The demand for sophisticated biologics is soaring, but discovery pipelines often lag. Many biopharmaceutical companies struggle to discover and optimize next-generation biologics such as bispecific antibodies, antibody–drug conjugates (ADCs), and chimeric antigen receptor (CAR) T-cell therapies quickly, cost-effectively, and with minimal risk. Multiple companies have tried and failed to solve the challenges, without much progress.

Some of the most successful approaches utilize heavy-chain-only antibody (HCAb) technologies, which offer several advantages. One example is the absence of light chains which eliminates the complexities and restrictions associated with light-chain pairing, offering unparalleled flexibility in designing intricate molecular structures. HCAbs are also significantly smaller than conventional antibodies—approximately one-tenth the size for VH—facilitating better cell penetration and blood–brain barrier crossing, making them well-suited for applications such as Alzheimer’s disease, Parkinson’s disease, and solid tumors. Fully human HCAbs are ideal building blocks for advanced biologics, exhibiting excellent safety profiles and low immunogenicity.

However, technology platforms can be slow and difficult to scale, while contract research organizations (CROs) often lack the proprietary innovation needed to develop cutting-edge therapies from the ground up. Harbour BioMed and Nona Biosciences are addressing both challenges through a unique business model that leverages their fully human HCAb platform.

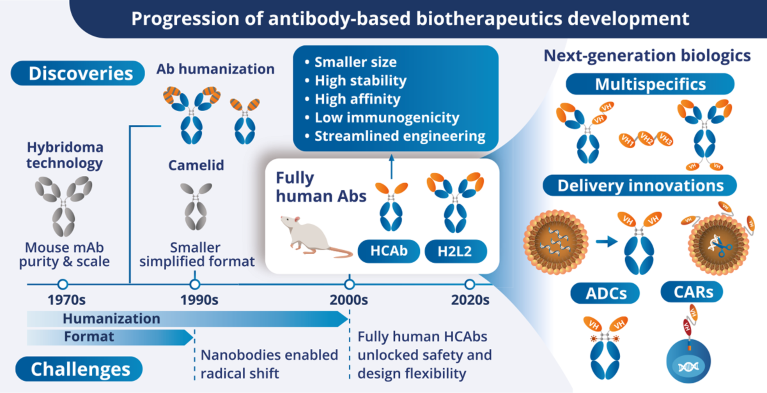

The progress of antibody-based therapeutics through the ages. Ab, antibody; ADC, antibody–drug conjugate; CAR, chimeric antigen receptor; HCAb, heavy-chain-only antibody; mAb, monoclonal antibody.

Harbour is a global pharmaceutical company founded in 2016 by chairman and CEO Jingsong Wang to build on the work of Frank Grosveld, scientific founder of predecessor company Harbour Antibodies and professor of cell biology at the Erasmus Medical Center in Rotterdam.

To maximize its HCAb capabilities, Harbour launched Nona in 2022, a wholly owned subsidiary focused on technology innovation. Nona offers access to its platform alongside licensing and other CRO-type services. This dual-pillar business model leverages the technology platform across two complementary divisions.

Nona: the discovery powerhouse

Nona’s core mission is to empower global therapeutic innovation by providing one-stop solutions—from antibody discovery to investigational new drug (IND)-enabling studies—for biotech and pharmaceutical companies.

“Our proprietary platform is a powerful engine for generating the sophisticated molecules required for next-generation biologics,” explained Yiping Rong, Harbour’s CSO. “We have been continuously upgrading our fully human HCAb technology for nearly a decade, ultimately leading us to HCAb Plus for complex modalities like multispecifics and ADCs.”

Nona’s discovery capabilities are anchored by its proprietary Harbour Mice platform, which includes two transgenic mouse models that produce fully human antibodies. These enable the production of complex modalities, including highly targeted bispecifics and multispecifics capable of binding multiple antigens. ADCs are another key focus, with Nona’s platform producing antibodies that facilitate precise delivery of potent therapeutic agents to target cells.

The platform also supports emerging modalities including radiotherapy, and cell and gene therapies. Its HCAbs can be essential components in CAR-T cells. “Our HCAbs are human-derived alternatives to the llama antibodies that have traditionally been used in CAR-T constructs, demonstrating superior efficacy and safety,” said Rong. This is especially important for emerging in vivo CAR-T-cell therapies. Last year, Nona partnered with Umoja Biopharma to discover antibodies for its next-generation CAR-T-cell therapeutic pipeline. Additionally, Nona’s platform can discover antibodies for messenger RNA (mRNA)–lipid nanoparticle (LNP) therapeutics, potentially integrating antibodies into gene-based therapies.

Partners can license Nona’s HCAb mice and H2L2 mice (which generate fully human regular antibodies comprising two light and two heavy chains) for their own discovery programs, along with Nona’s breeding service and shipment support. Alternatively, they can engage Nona’s experienced team through a fee-for-service model for highly efficient discovery services with higher success rates. “We deliver antibody discovery at half the cost and twice the speed, leveraging our cutting-edge technology, high operational efficiency, and integrated capabilities and resource ecosystem,” said Rong. The company also licenses de-risked preclinical candidates based on antibody assets it has developed.

Nona’s flexible business model allows tailored collaborations—from simple technology licensing to full discovery services (from target identification to IND-enabling studies) or multi-year, multi-target partnerships spanning preclinical development.

“We’re not just a typical CRO, but a new kind of infrastructure for antibody discovery for the whole industry,” Rong explained. “Our goal is to be a true strategic partner, leveraging our platforms and efficiencies to accelerate our clients’ pipelines.” Recent ADC deals with industry leaders such as Pfizer underscore this ambition.

Notably, in May 2024, Nona announced a global license and option agreement with AstraZeneca to develop tumor-targeted antibodies. “We oversee the entire discovery process, from target nomination to IND submission and even early clinical development,” said Rong. “Long-term partnerships like these are sustainable and highly productive. We’re establishing ourselves as a critical infrastructure for antibody discovery within the industry.”

Looking ahead, Nona is continuing to invest in its technology, including the integration of advanced artificial intelligence (AI) capabilities to further enhance its antibody-discovery engine. Earlier this year, it announced a partnership with Insilico Medicine to jointly develop AI-driven systems and platforms for biologics and drug discovery.

“AI promises to accelerate timelines and open new therapeutic frontiers, including hard-to-drug targets and novel antigens,” said Rong. “We’re eager to leverage algorithms to mine our extensive antibody data and sequence-function relationships to optimize target selection, tackle difficult antigens, and expand existing technological horizons. Our goal is to empower our partners to push the boundaries of innovation.”

Harbour BioMed: capitalizing on Nona’s tech to drive next-gen therapies to the clinic

Nona’s business model offers both stable revenue and high-value out-licensing returns, a combination not typically seen in the biotech or CRO sectors. It also functions as an innovation engine that can support its parent company’s clinical portfolio.

Harbour leverages the transgenic mouse antibody technology platforms—including both H2L2 and HCAb formats—with a focus on advancing innovative antibody therapeutics through clinical development in oncology, immunology, and autoimmune diseases, as well as out-licensing. A strict firewall separates the two entities, with Nona providing discovery services for Harbour’s internal pipeline, effectively making Harbour one of Nona’s clients.

“In the era of ‘antibody plus (Ab+)’—where bispecifics, multispecifics, ADCs, and CAR-T-cell therapies define the frontier of innovation—our HCAb platform provides a common foundation for the entire field,” said Wang. “We are not only enabling a global ecosystem to innovate faster, safer, and smarter, but also building our own therapeutic pipeline.”

Harbour’s portfolio began in oncology, with a particular focus on T-cell engagers, bispecifics, and ADCs for solid tumors. From there, it rapidly expanded into immunology, especially T-cell engagers for autoimmune disease and type 2 T-cell pathways for immune modulation. This led to the development of HBM9378, a fully human monoclonal antibody targeting thymic stromal lymphopoietin (TSLP), which is a cytokine linked to allergic inflammation. Harbour partnered with Windward Bio in January 2025 to progress the asset, and has just initiated a global phase 2 study for asthma.

Another key asset is HBM7020, a B-cell maturation protein (BCMA)×cluster of differentiation 3 (CD3) bispecific T-cell engager developed from the Harbour Mice platform, originally to treat cancer. The program has since pivoted to autoimmune diseases. In June 2025, Harbour licensed HBM7020 to Otsuka Pharmaceutical Co. “This is a good example of our two-pronged strategy, showcasing our ability to successfully out-license assets derived from our internal platforms,” said Wang.

Harbour’s most advanced autoimmune candidate is batoclimab (HBM9161), an anti-neonatal fragment crystallizable receptor (FcRn) antibody for myasthenia gravis that is currently under biologics license application (BLA) review in China.

In oncology, Harbour’s lead asset is Porustobart (HBM4003), a next-generation anti-cytotoxic T-lymphocyte protein 4 (CTLA-4) antibody. Approximately 200 patients have now been treated with Porustobart in clinical studies, and Harbour is preparing for a phase 3 trial in melanoma. Harbour has also out-licensed HBM7022/AZD5863, a claudin-18.2 (CLDN18.2)×CD3 bispecific antibody for solid tumors, which AstraZeneca is currently evaluating in a phase 1/2 trial. And in June 2025, Harbour out-licensed HBM7020, a BCMA×CD3 bispecific T-cell engager, to Otsuka Pharmaceutical Co.

“We’re also expanding into additional therapeutic areas. Our technology is well-suited for metabolic diseases, where we’re applying novel approaches to develop next-generation obesity therapeutics,” said Wang. To that end, Harbour launched Élancé Therapeutics in March 2025 to leverage Nona’s Hu-mAtrIx AI platform for bispecific antibody discovery. Its pipeline includes multiple preclinical bispecific antibodies designed to promote weight loss while maintaining lean muscle mass.

The company is also exploring neurology indications, given the innate ability of HCAbs to cross the blood–brain barrier.

Beyond its out-licensing program and Nona’s partnership strategy, Harbour is actively pursuing additional strategic collaborations. In March 2025, Harbour and AstraZeneca announced a multi-project collaboration agreement for 5–10 years across multiple therapeutic areas. As part of the deal, which was one of the highest-value of the year, AstraZeneca invested more than $100 million in Harbour, and the partners are building a joint innovation center in Beijing, China. “This is creating a new benchmark for how major multinational companies can fully leverage the core technology platform of a biotech partner,” Wang said. “It also allows both of us to access regional innovation through the partnership.”

This serves as another example of how Harbour and Nona are operating beyond traditional expectations for either a biotech or a CRO—innovating not only in platform technology but also in collaboration. “Especially in the US, investors and the market do not really recognize the service-focused technology-platform companies like CROs, due to their low valuations. And on the other side, investors always feel the attrition rate is very high and success rate is low for biotechs—even for those that successfully out-license their own pipeline. It’s not a sustainable model for value generation,” said Wang.

“Harbour and Nona are pursuing a differentiated approach,” he added. “We integrate a technology services platform that delivers a stable, long-term cash flow alongside high-value asset generation through our intellectual property (IP)-rich discovery arm, with products spanning from preclinical to clinical stages. Together, this creates greater value and significantly higher returns for investors.”

With two consecutive years of profitability, Harbour and Nona are demonstrating a new model for sustainable growth—in a sector where that’s hard to find.