Abstract

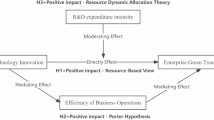

With the growing emphasis on sustainable finance and the increasing influence of green technologies on market dynamics, understanding how green technology innovations affect financial volatility has become crucial for accurate financial cycle forecasting. This study investigates how green technology innovation, proxied by green energy patents across upstream, midstream, and downstream stages in the oil production chain, affects the forecasting of the financial cycle. Based on causal analysis, a threshold interval decomposition ensemble (TIDE) model is introduced to predict the interval-valued Chicago Board Options Exchange Volatility Index (VIX) series with non-linear behaviors, with bivariate empirical mode decomposition employed to analyze daily VIX data and forecast lower/upper bounds across short-, medium-, and long-term horizons. Interval predictions are derived from equally weighted component forecasts, and model efficacy is assessed through root mean square error and Diebold-Mariano tests. The main findings are as follows: (1) The green energy patents across different stages of production processes are closely related to the financial cycle both from a causal perspective and in predictions, which enhances the prediction of the medium- and long-term VIX, while having no significant effect in the short term, underscoring the influence of time-compression diseconomies on the financial cycle. (2) There are asymmetrical impacts of green innovation on the financial cycle across the industrial chain, with varying effects observed in upstream crude oil sectors, midstream and downstream diesel operations, and upstream-to-midstream liquefied petroleum gas (LPG) segments, demonstrating that green technology innovations affect VIX differently depending on the specific position within each energy sector’s value chain. (3) Causal analysis shows that green technology innovation increases industrial exposure to the financial cycle in both the short and medium term but has a reducing effect in the long term. However, the external uncertainties brought by climate change, economic policy, and geopolitical risk weaken this linkage, presenting a significant weakening effect in the short term for both climate change and geopolitical risk, and gradually becoming insignificant for the mid- and long-term horizons. This study provides insights for policymakers as well as investors, raising attention regarding the asymmetrical impacts of green innovation on the financial cycle over different time horizons, and the downstream and upstream of the industrial chain, especially in this era of the aforementioned external uncertainties.

Similar content being viewed by others

Data availability

The datasets generated and/or analyzed during the current study are available from the corresponding author upon reasonable request.

References

Abraham-Dukuma MC (2021) Dirty to clean energy: exploring ‘oil and gas majors transitioning’. Extr Ind Soc 8:100936

Acemoglu D, Akcigit U, Hanley D, Kerr W (2016) Transition to clean technology. J Polit Econ 124(1):52–104

Andersson FNG (2020) Effects on the manufacturing, utility and construction industries of decarbonization of the energy-intensive and natural resource-based industries. Sustain Prod Consum 21:1–13

Atems B, Kapper D, Lam E (2015) Do exchange rates respond asymmetrically to shocks in the crude oil market?. Energy Econ 49:227–238

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636

Battiston S, Mandel A, Monasterolo I, Schütze F, Visentin G (2017) A climate stress-test of the financial system. Nat Clim Chang 7(4):283–288

Berger S, Kilchenmann A, Lenz O, Ockenfels A, Schlöder F, Wyss AM (2022) Large but diminishing effects of climate action nudges under rising costs. Nat Hum Behav 6(10):1381–1385

Bi Q, Feng S, Qu T, Ye P, Liu Z (2024) Is the green innovation under the pressure of new environmental protection law of PRC substantive green innovation. Energy Policy 192: 114227

Brutschin E, Fleig A (2016) Innovation in the energy sector–The role of fossil fuels and developing economies. Energy Policy 97:27–38

Caldara D, Iacoviello M (2022) Measuring geopolitical risk. Am Econ Rev 112(4):1194–1225

Cao Q, Hong Q, Yu W (2025) Oil price shocks, policy uncertainty, and China’s carbon emissions trading market price. Humanit Soc Sci Commun 12:426

Chatziantoniou I, Degiannakis S, Filis G (2019) Futures-based forecasts: How useful are they for oil price volatility forecasting?. Energy Econ 81:639–649

Chen Y, Ni L, Liu K (2022a) Innovation efficiency and technology heterogeneity within China’s new energy vehicle industry: a two-stage NSBM approach embedded in a three-hierarchy meta-frontier framework. Energy Policy 161: 112708

Chen Y, Qiao G, Zhang F (2022b) Oil price volatility forecasting: threshold effect from stock market volatility. Technol Forecast Soc Chang 180: 121704

Chizaryfard A, Karakaya E (2022) The value chain dilemma of navigating sustainability transitions: a case study of an upstream incumbent company. Environ Innov Soc Transitions 45:114–131

Dai Z, Zhang X, Liang C (2024) Efficient predictability of oil price: the role of VIX-based panic index shadow line difference. Energy Econ 129: 107234

Dierickx I, Cool K (1989) Asset stock accumulation and sustainability of competitive advantage. Manag Sci 35(12):1504–1511

Ewing BT, Malik F, Payne JE (2024) Volatility transmission between upstream and midstream energy sectors. Int Rev Econ Finance 92:1191–1199

Fama EF, MacBeth JD (1973) Risk, return, and equilibrium: Empirical tests. J Polit Econ 81(3):607–636

Forster PM, Forster HI, Evans MJ, Gidden MJ, Jones CD, Keller CA, Lamboll RD, Le Quéré C, Rogelj J, Rosen D, Schleussner CF, Richardson TB, Smith CJ, Turnock ST (2020) Current and future global climate impacts resulting from COVID-19. Nat Clim Chang 10(10):913–919

Ghaithan AM, Attia A, Duffuaa SO (2017) Multi-objective optimization model for a downstream oil and gas supply chain. Appl Math Model 52:689–708

Gong H, Zou Y, Yang Q, Fan J, Sun F, Goehlich D (2018) Generation of a driving cycle for battery electric vehicles: a case study of Beijing. Energy 150:901–912

Gozgor G, Lau CKM, Lu Z (2018) Energy consumption and economic growth: new evidence from the OECD countries. Energy 153:27–34

Gravert C, Shreedhar G (2022) Effective carbon taxes need green nudges. Nat Clim Chang 12(11):1073–1074

Hammond GP, O’Grady Á (2017) The life cycle greenhouse gas implications of a UK gas supply transformation on a future low carbon electricity sector. Energy 118:937–949

Hingley P, Park WG (2017) Do business cycles affect patenting? Evidence from European Patent Office filings. Technol Forecast Soc Chang 116:76–86

Huang HH, Lin Y-R (2023) Forecasting VIX with stock and oil prices. Finance Uver: Czech J Econ Finance 73(1):24–55

Huszár ZR, Kotró BB, Tan RSK (2023) Dynamic volatility transfer in the European oil and gas industry. Energy Econ 127: 107052

Khorasani M, Sarker S, Kabir G, Ali SM (2022) Evaluating strategies to decarbonize oil and gas supply chain: Implications for energy policies in emerging economies. Energy 258: 124805

Lau CK, Gozgor G, Mahalik MK, Patel G, Li J (2023) Introducing a new measure of energy transition: Green quality of energy mix and its impact on CO2 emissions. Energy Econ 122: 106702

Li MC, Liu X, Lv K, Sun J, Dai C, Liao B, Liu C, Mei C, Wu Q, Hubbe M (2023) Cellulose nanomaterials in oil and gas industry: current status and future perspectives. Prog Mater Sci 139:101187

Li Y, Huang J, Zhang H (2022) The impact of country risks on cobalt trade patterns from the perspective of the industrial chain. Resour Policy 77: 102641

Lima C, Relvas S, Barbosa-Póvoa APFD (2016) Downstream oil supply chain management: a critical review and future directions. Comput Chem Eng 92:78–92

Liu Y, Liu S, Xu X, Failler P (2020) Does energy price induce China’s green technology innovation?. Energies 13(15):4034

McGrattan ER, Prescott EC (2014) A reassessment of real business cycle theory. Am Econ Rev 104(5):177–182

Meckling J, Allan BB (2020) The evolution of ideas in global climate policy. Nat Clim Chang 10(5):434–438

Mewes L, Broekel T (2022) Technological complexity and economic growth of regions. Res Policy 51(8):104156

Mirza N, Naqvi B, Rizvi SKA, Boubaker S (2023) Exchange rate pass-through and inflation targeting regime under energy price shocks. Energy Econ 124: 106761

Moghaddam MB (2023) The relationship between oil price changes and economic growth in Canadian provinces: evidence from a quantile-on-quantile approach. Energy Econ 125: 106789

Nordgaard CL, Jaeger JM, Goldman JSW, Shonkoff SBC, Michanowicz DR (2022) Hazardous air pollutants in transmission pipeline natural gas: An analytic assessment. Environ Res Lett 17(10):104032

Oluklulu S, Kasal S (2025) What is the role of fiscal policy in reducing CO₂ emissions? Evidence from different income groups. Humanit Soc Sci Commun 12:591

Pástor Ľ, Veronesi P (2013) Political uncertainty and risk premia. J Financial Econ 110(3):520–545

Regnier E (2007) Oil and energy price volatility. Energy Econ 29(3):405–427

Rey H (2015) Dilemma not trilemma: the global financial cycle and monetary policy independence. National Bureau of Economic Research

Rilling G, Flandrin P, Gonçalves P (2007) Bivariate empirical mode decomposition. IEEE Signal Process Lett 14(12):936–939

Shen CH, Ren JY, Huang YL, Shi JG, Wang AQ (2018) Creating financial cycle in China and interaction with business cycles on the Chinese economy. Emerg Mark Finance Trade 54(13):2897–2908

Shen M, Ma N, Chen Q (2024) Has green finance policy promoted ecologically sustainable development under the constraints of government environmental attention?. J Clean Prod 450: 141854

Shi X, Sun S (2017) Energy price, regulatory price distortion and economic growth: a case study of China. Energy Econ 63:261–271

Sun S, Sun Y, Wang S (2018a) Interval decomposition ensemble approach for crude oil price forecasting. Energy Econ 76:274–287

Sun Y, Han A, Hong Y (2018b) Threshold autoregressive models for interval-valued time series data. J Econom 206(2):414–446

Tol RSJ (2021) Do climate dynamics matter for economics?. Nat Clim Chang 11(10):802–803

Wang S, Li B, Zhao X, Hu Q, Liu D (2024) Assessing fossil energy supply security in China using ecological network analysis from a supply chain perspective. Energy 288: 129772

Wang X, Qin C, Liu Y, Tanasescu C, Bao J (2023) Emerging enablers of green low-carbon development: Do digital economy and open innovation matter?. Energy Econ 127: 107065

Wang X, Wang K, Xu B, Jin W (2025) Digitalisation and technological innovation: Panaceas for sustainability?. Int J Prod Research 63(16):6071–6088

Wang Y, Zhou R (2024) Can carbon emission trading policies promote the withdrawal of government subsidies and the green development of enterprises? Empirical evidence from China’s A-share market. Humanit Soc Sci Commun 11:1723

Wu X, He Q, Xie H (2023) Forecasting VIX with time-varying risk aversion. Int Rev Econ Finance 88:458–475

Yan Z, Tian F, Sun Y, Wang SL (2024) A time-frequency-based interval decomposition ensemble method for forecasting gasoil prices under the trend of low-carbon development. Energy Econ 134: 107609

Yang X, Tao Y, Tao Y, Wang X, Zhao G, Lee CT, Yang D, Wang B (2024a) City-scale methane emissions from the midstream oil and gas industry: A satellite survey of the Zhoushan archipelago. J Clean Prod 449: 141673

Yang Y, Zheng T, Wu J (2024b) Green taxation, regional green development and innovation: Mechanisms of influence and policy optimization. Humanit Soc Sci Commun 11:810

You J, Zhang W (2022) How heterogeneous technological progress promotes industrial structure upgrading and industrial carbon efficiency? Evidence from China’s industries. Energy 247: 123386

Yuan M, Zhang H, Wang B, Zhang Y, Zhou X, Liang Y (2020) Future scenario of China’s downstream oil reform: Improving the energy-environmental efficiency of the pipeline networks through interconnectivity. Energy Policy 140: 111403

Acknowledgements

The authors thank anonymous referees and gratefully acknowledge research support from the following funding sources. The first author received support from the National Natural Science Foundation of China (No. 72374032). The third author is supported by the Planning Fund Project of the Ministry of Education (25YJA630108). The second author is supported by the Major Program of the National Natural Science Foundation of China (Grant No. 72495155) and the Major Projects of the Ministry of Education Humanities and Social Sciences Key Research Bases (25JJD790005).

Author information

Authors and Affiliations

Contributions

Zichun Yan (First Author): Conceptualization, Supervision, Investigation, Funding Acquisition, Writing—Original Draft, Writing—Review & Editing; Zehan Wang (Co-first Authors): Supervision, Investigation, Methodology, Software, Visualization, Writing—Original Draft, Writing—Review & Editing; Jingjia Zhang (Corresponding Author): Supervision, Investigation, Funding Acquisition, Writing—Original Draft, Writing—Review & Editing; Yuwei Huang (Co-first Authors): Writing—Original Draft, Writing—Review & Editing, Validation; Shengtai Zhang: Supervision, Writing—Review & Editing, Validation; Mohammad Zoynul Abedin: Supervision, Writing—Review & Editing, Validation.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This study does not involve human participants or their data. Therefore, ethics approval was not required for this research. The analysis uses secondary data from existing sources, and the study complies with all relevant ethical guidelines and regulations.

Informed consent

This study does not involve human participants or their data. As a result, informed consent was not obtained or required. The research relies on secondary data from existing sources and does not engage with any personal or identifiable information, ensuring compliance with all relevant ethical guidelines and regulations.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Yan, Z., Wang, Z., Zhang, J. et al. Navigating through green policies: how green technology innovation affects the financial cycle. Humanit Soc Sci Commun (2026). https://doi.org/10.1057/s41599-026-06620-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-026-06620-6