Abstract

Reuse and recycling of retired electric vehicle (EV) batteries offer a sustainable waste management approach but face decision-making challenges. Based on the process-based life cycle assessment method, we present a strategy to optimize pathways of retired battery treatments economically and environmentally. The strategy is applied to various reuse scenarios with capacity configurations, including energy storage systems, communication base stations, and low-speed vehicles. Hydrometallurgical, pyrometallurgical, and direct recycling considering battery residual values are evaluated at the end-of-life stage. For the optimized pathway, lithium iron phosphate (LFP) batteries improve profits by 58% and reduce emissions by 18% compared to hydrometallurgical recycling without reuse. Lithium nickel manganese cobalt oxide (NMC) batteries boost profit by 19% and reduce emissions by 18%. Despite NMC batteries exhibiting higher immediate recycling returns, LFP batteries provide superior long-term benefits through reuse before recycling. Our strategy features an accessible evaluation framework for pinpointing optimal pathways of retired EV batteries.

Similar content being viewed by others

Introduction

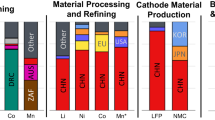

Climate change is one of the key bottlenecks for human society towards sustainable development goals (SDGs)1. To address the climate challenge, it is essential to accelerate the transition to clean energy, where the lithium-ion battery (LIB) plays a significant role2,3,4. LIBs currently serve as the dominant power source of electrified mobility and the fastest-growing stationary energy storage5. Their predominant applications in the electric vehicle (EV) sector have not only spurred a market revolution but also presented new challenges in managing retired LIBs6. Global EV sales have surged from 0.7 million in 2015 to 10 million in 20227, with projections anticipating a reach of 30 million by 20308. This rapid growth has led to the critical need for properly managing retired batteries9. Inappropriate handling of retired batteries may lead to environmental pollution, resource losses, increased waste management pressures, reduced energy security, and intensified supply chain risks10.

To mitigate these risks, scientific and industrial communities advocate for the reuse and recycling of retired batteries11,12. Reuse aims to extend the useful lifetime of batteries, lower the investment and operational costs of energy systems, and minimize the demand for raw materials. Recycling involves dismantling retired batteries to recover and repurpose valuable materials. Wang et al.13 and Yang et al.14 have taken a holistic approach, considering the entire life cycle of the battery itself, while others15,16,17 have focused on the reuse of energy storage systems (ESSs) within the power grid to analyse the effects of the energy system. Besides ESSs, retired batteries possess a diverse range of potential applications18, spanning various fields, such as communication base stations (CBSs)14,17 and low-speed vehicles (LSVs)19,20. Zhu et al.18 offered a comprehensive overview of second-life batteries (SLBs), highlighting the need for comprehensive evaluations of the remaining service life for proper performance assessment. Recent research has focused on improving inconsistency detection21,22, state of health (SOH) estimation23,24, and cathode material sorting25 to allocate these batteries appropriately for reuse and recycling applications. Many studies have investigated the application of ESSs to retired batteries for solar and wind power generation, primarily by examining environmental13,26, economic27, and comprehensive sustainability assessments28,29,30. Life cycle assessment (LCA) is important for evaluating the environmental impacts of LIBs throughout their lifecycle, from production to end-of-life (EOL) management. The prevailing consensus is that battery reuse reduces life cycle environmental impacts compared to immediate recycling31, while there is a study presenting contrasting evidence32. In addition, the battery system capacity configuration, a factor that influences economic performance33 and environmental benefits34, is often overlooked regardless of its decisive role in practical deployment. Larger capacities can increase costs and maintenance, whereas optimal alignment with application needs enhances efficiency and economic returns18,35. Variations in battery capacity impact electricity load patterns and environmental emissions34. A unified assessment methodology is currently lacking, which highlights a significant research gap in the rational reuse of SLBs in different applications with different requirements.

When retired batteries are no longer suitable for reuse, recycling has economic and environmental advantages at the EOL stage. Recycling effectively manages waste resources but faces challenges concerning profit and resource conversion36. Aiming at extracting valuable metals, recycling utilizes pyrometallurgical, hydrometallurgical, direct26, other retirement options20 and integration of these technologies37. A key overlooked factor is the impact of SOH on the outcomes of different recycling technologies38, which is essential for optimizing the recycling pathway. The influence of technological innovation on the trade-off between various reuse and recycling scenarios has not been explored31,39. Selecting appropriate reuse and recycling combinations using LCA methods could be promising for establishing both economic and environmental pathways for retired LIBs. However, generally applicable and strategic pathway decisions for retired LIBs are currently lacking, leading to suboptimal scenario selection, compromised economic performance, and increased greenhouse gas (GHG) emissions.

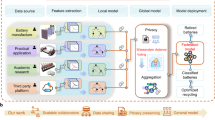

In this study, we present a reuse and recycling pathway decision strategy for retired EV batteries, demonstrating its effectiveness through an accessible analysis of the economic and environmental benefits spanning the entire lifecycle, namely, cradle-to-grave (CTG), as illustrated in Fig. 1. We focus on two prominent cathode chemistry types, i.e., lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP), with various retired SOHs (70%, 80%, and 90%) and diverse reuse scenarios (ESS, CBS, and LSV) considering capacity configurations. We also assess the implications of three recycling technologies (hydrometallurgical, direct, and pyrometallurgical recycling) for batteries with different SOH levels (40%, 50%, 60%, 70%, 80%, and 90%) at EOL stage. Ultimately, we developed an optimized pathway for the reuse and recycling of retired LIBs for sustainable waste management. Our work has useful implications for making economic and environmental pathway decisions for retired LIBs.

Our method encompasses the system boundaries of the lithium-ion battery life cycle, namely, cradle-to-grave, incorporating new battery production, first use, refurbishment, reuse, and end-of-life (EOL) stages. The life cycle of a battery begins with material extraction, refinement, component (cell) production, and assembly into modules and packs. These packs are used in electric vehicles (EVs) during the first use stage, after which the battery packs are disassembled, tested for viability, and reassembled for further use during the refurbishment stage. Applications in the reuse phase include energy storage systems (ESSs), communication base stations (CBSs), and low-speed vehicles (LSVs). When the batteries are subjected to the EOL stage, pretreatment and three recycling technologies are considered, including hydrometallurgical, direct, and pyrometallurgical recycling. Pink and teal icons illustrate the economic and environmental functions of each stage. The second-life battery (SLB) costs are related to the state of health, residual capacity potential, resourcing, repurposing, amount of retired batteries, refurbishment technology efficiency, and reuse rate. The operation cost comprises daily maintenance costs and operational costs.

Results

Economic and environmental performance for reuse scenarios

We focus on economic performance and the carbon footprint as analytical indicators across various scenarios considering the profitability of users and recyclers. Positive economic performance values denote a profit, and negative values indicate a financial loss. Economic performance is composed of the cost of battery purchase (negative), the cost of battery maintenance (negative), and the revenue of system operation (positive). The carbon footprint is selected to demonstrate and compare the life cycle environmental impact. A description of the pricing models for both new batteries and SLBs, the maintenance model, the operation model considering battery degradation, and the carbon footprint calculation can be found in the “Methods” section. Figure 2 illustrates the economic performance of NMC and LFP SLBs across different initial SOH levels in the ESS, CBS, and LSV scenarios at the reuse stage. The aging curves of the NMC and LFP batteries can be found in Supplementary Fig. 1. Eight distinct scenarios are examined, as detailed in Fig. 2a, including different load profiles for the ESS (large industries/government, light industries, and commercial areas)40,41, CBS (commercial, high-speed railways, urban residential, and rural areas)42, and LSV (sightseeing car for tourism and recreation)43. The government, light industry, commercial, railway, urban, rural, and sightseeing car scenarios are abbreviated as Gov, Lig, Com, Rai, Urb, Rur, and Sig, respectively. For example, ESS-Gov is the government load profile of the ESS application. Supplementary Figs. 2 and 3 provide detailed load profile data.

a Eight scenarios in the reuse stage involving three energy storage system (ESS) profiles, four communication base station (CBS) profiles, and one low-speed vehicle (LSV) profile. b The total profit, unit battery profit, and average daily profit of lithium nickel manganese cobalt oxide (NMC) battery configurations across distinct scenarios under varying initial states of health (SOHs) and 40% ended SOHs in the reuse stage. c The economic performance of lithium iron phosphate (LFP) batteries. d–f Changes in total profit concerning the capacity of NMC and LFP second-life batteries (SLBs) under the ESS-Lig, CBS-Rur, and LSV-Sig scenarios and other scenarios are shown in Supplementary Figs. 4–10. g–i The daily cumulative profit of NMC and LFP SLBs with different initial SOHs over time in the optimal configuration. The government, light industry, commercial, railway, urban, rural, and sightseeing car are abbreviated as Gov, Lig, Com, Rai, Urb, Rur, and Sig, respectively. For example, ESS-Lig is the light industry load profile of ESS application. Source data are provided as a Source Data file.

Economic performance measures the profitability of an operation or investment. It encompasses metrics such as total profit, which assesses the entire profit earned during the operation period; unit battery profit, which gauges the profit per kWh battery; and average daily profit, which tracks the daily operational profitability. The configuration and operation of the system considering battery degradation across various scenarios are determined by optimizing the total profit (for the ESS and CBS) and daily average profit (for the LSV) in the use stage. Figure 2b, c shows the results of the total profit, the profit per kWh battery, and the daily average profit for the NMC and LFP batteries. The total profit is calculated according to Eq. (2). The unit profit is the ratio of the total profit to the battery system capacity. The daily average profit is calculated by dividing the total profit by the number of operating days. LFP batteries generally perform better than NMC batteries due to their longer lifespan44,45,46 and higher efficiency40. Both the ESS and CBS scenarios are profitable, with the former outperforming the latter due to having larger photovoltaic (PV) systems. In the ESS, the light industry scenario with more renewable energy is the most profitable, while in the CBS, total profit is linked to load size. The unit battery profit shows that the ESS is losing its edge over the CBS. In the ESS, the unit battery profit aligns with the total profit, whereas in the CBS, it decreases from the rural, railway, and commercial scenarios to the urban scenario. Batteries with higher SOHs yield better unit battery profit in the ESS and CBS because of their longer lifespans. However, in some cases, such as in the ESS-Gov and ESS-Com scenarios, using a 70% SOH LFP battery can be more profitable daily than using an 80% SOH battery due to lower purchase costs and increased profits of $0.13/day and $0.32/day, respectively. In the LSV-Sig scenarios, both NMC and LFP SLBs have negative total profit, unit battery profit, and average daily profit due to the lack of renewable energy integration and reliance on grid electricity. Decision-making for the reuse pathway should prioritize the ESS and CBS, with surplus batteries allocated to the LSV.

Due to similar performances in the ESS and CBS scenarios, this study focuses on the ESS-Lig and CBS-Rur scenarios for detailed analysis, with other cases displayed in Supplementary Figs. 4–10. Figure 2d–f shows how the total profit varies with battery type, SOH, and capacity during the reuse stage. The ranking for total profit in the ESS and CBS is LFP batteries (90%, 80%, 70% SOH), followed by NMC batteries (90%, 80%, 70% SOH), with the best performance occurring at the allowable maximum battery capacity (scale). A higher initial SOH results in longer use for LFP batteries than for NMC batteries. The CBS experiences diminishing economic returns as the battery capacity increases due to a 3-h operational limit. In contrast, LSV prioritizes configurations with the lowest daily average cost, leading to different capacity configurations. LFP batteries, due to their longer lifespan, have lower capacity configuration results than NMC batteries. These results stem from a balance between investment and operational costs. Figure 2g–i illustrates the daily cumulative profit of the system under optimal configurations, starting with the initial purchase prices of the SLBs. In the ESS and CBS, daily profits decrease over time because of declining SOH and efficiency, and in the LSV, daily costs increase progressively. For the ESS and CBS scenarios, the time required to transition from a loss to a profit ranges from a minimum of 64 days to a maximum of 628 days. Initially, batteries with lower SOHs are more economical due to their reduced purchase prices. However, over the long run, batteries with a higher initial SOH yield greater returns due to their higher usable capacity and efficiency. For LSV scenarios, LFP SLBs with 70% SOH have the longest operational lifetimes and offer superior long-term benefits compared to those of other SLBs. In contrast, NMC SLBs with 70% SOH deliver better short-term benefits. Therefore, users should select batteries based on their application requirements and reuse durations.

To evaluate the economic performance of the SLBs, optimal operations are compared between the SLBs and new batteries. Supplementary Figs. 4–6 show that while new batteries often have a higher total income, SLBs have a greater advantage under the same usage duration due to lower purchase costs. Supplementary Fig. 7 demonstrates the economic performance in the LSV-Sig scenario using internal combustion engine vehicles for comparison, showing a shift from negative to positive economic viability for LSV with the use of retired batteries compared to the conventional fossil-based paradigm.

The above covers the economic performance during the use phase, here we show the environmental impact analysis. Supplementary Fig. 11 presents a carbon footprint analysis for the NMC and LFP battery modules and pack assembly. As a result of the recycling of waste generated during the refurbishment stage, the carbon footprint associated with module/pack assembly for SLBs is partially offset. This leads to the assembly process for new batteries having a higher carbon footprint per kWh battery compared to SLBs. Additionally, the carbon footprint per kWh decreases slightly as the SOH of the batteries decreases. This is because a lower initial SOH requires more batteries to meet user demands, thereby increasing the battery amount. However, components such as the battery pack casing and battery management system do not scale linearly with the number of batteries, leading to scenarios such as the small-scale rural area with the highest carbon footprint per kWh, while larger capacity ESS scenarios have lower values. Due to the lower energy density of LFP batteries, more materials are required for pack/module assembly, resulting in an increase in the carbon footprint per kWh, which is 124.36%–146.82% greater than that of NMC batteries. The carbon footprint for batteries with different cathode chemistries and SOH levels under various reuse scenarios can be observed in Supplementary Figs. 12 and 13.

For reuse, SLBs are both economically beneficial and environmentally friendly. Users can make choices based on factors such as total profit, unit battery profit, average daily profit, and carbon footprint when meeting load demand. These factors can be highly dependent on the capacity degradation, efficiency fade, electricity mix, and operation model31.

Economic and environmental performance of various recycling technologies

The economic performance resulting from the three battery recycling technologies for LFP and NMC batteries is presented in Fig. 3. Figure 3a–d indicates that for all methods, the unit battery profit improves with increasing SOH due to decreased active material loss, leading to either fewer inputs (direct recycling) or more valuable outputs (hydrometallurgical and pyrometallurgical recycling). For NMC batteries, direct recycling is the most profitable, as the SOH increases from 40% to 90%, due to its simplicity and the high value of the recovered NMC material. Profits range from $11.01 to $22.99/kWh battery for direct recycling, while pyrometallurgical and hydrometallurgical recycling yields range from −$8.59 to $2.41 and −$8.31.08 to $2.66/kWh battery, respectively. For LFP batteries, hydrometallurgical recycling is the most profitable, followed by direct and pyrometallurgical recycling. LFP recycling profits fluctuate less with SOH changes than those of the NMC counterpart, with both costs and revenues for LFP being smaller than those for NMC. Therefore, selecting a recycling technology in the EOL stage should consider the battery type and SOH.

a, b Unit battery profit of lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP) batteries with 40%–90% state of health (SOH) using different recycling technologies at the EOL stage. c, d Unit battery costs and revenues of NMC and LFP batteries with 40%–90% SOH using different recycling technologies. e, f The cost and revenue proportions associated with using the optimal recycling technology (direct recycling) for NMC batteries with 40% and 90% SOH. g, h The cost and revenue proportion of using the optimal recycling technology (hydrometallurgical recycling) for LFP batteries with 40% and 90% SOH. The proportions of other recycling technologies are provided in Supplementary Figs. 15 and 16. Hydrometallurgical, direct, and pyrometallurgical recycling technologies are referred to as hydro-, direct, and pyro-, respectively. The black triangles in (a) and (b) may overlap, forming black hexagons. Source data are provided as a Source Data file.

The economic performance of recycling varies with the price of lithium salt (Li2CO3). Figure 3a–d also illustrates the sensitivity analysis of recycling based on lithium salt price fluctuations. As shown in Fig. 3a, as the price of lithium salt increases from its lowest to highest, the advantage of direct recycling for NMC batteries gradually decreases. Eventually, pyrometallurgical recycling marginally becomes the most favourable option. The priority order for recycling technologies shifts from direct, pyrometallurgical, and hydrometallurgical to pyrometallurgical, direct, and hydrometallurgical. For LFP batteries (Fig. 3b), when lithium salt is inexpensive, the order of preference is direct, hydrometallurgical, and pyrometallurgical recycling. At the highest lithium salt price, the order changes to hydrometallurgical, pyrometallurgical, and direct recycling. The reason for these changes in both NMC and LFP batteries is that lithium salt is an output material in hydrometallurgical and pyrometallurgical recycling but an input material in direct recycling. As the price of lithium salt increases, the profitability of hydrometallurgical and pyrometallurgical recycling increases, while the profitability of direct recycling decreases.

The SOH at which batteries are recycled significantly affects their economic performance and carbon footprint during both their reuse and EOL stages. For LFP batteries, a higher SOH at the EOL slightly increases profits, indicating that extended use before recycling is more beneficial than early recycling. For instance, recycling (hydrometallurgical technology) a one kWh LFP battery after its SOH drops from 90% to 40% decreases profit by $9.58/kWh, while its value in the reuse stage changes significantly by at least $55/kWh (as shown in Fig. 2b). Supplementary Fig. 14 reveals that recycling profits are only slightly affected by changes in the battery system accessories. The profits from CBS configurations are slightly greater than those from ESS and LSV due to more efficient setups and reduced material waste. Therefore, prolonging the reuse phase and delaying recycling is advantageous for increasing economic performance.

To gain a deeper understanding of the recycling phase, Fig. 3e–h details the proportions of the optimal recycling tachnologies for NMC and LFP batteries at 40% and 90% SOH, respectively, with the proportions of other recycling technologies in Supplementary Figs. 15 and 16. The proportions of costs and revenues vary, but the ranking is consistent across different SOH levels for each method. For NMC batteries with 40% and 90% SOH, the cost-to-revenue ratio in direct recycling decreases from 0.80 to 0.58. The major costs include those of degraded NMC (25.5%–29.1%), Li2CO3 (14.7%–2.8%), and labour (1.0%–1.1%), while the main revenues come from NMC (47.4%–54.0%), graphite (4.5%–5.1%), and copper (3.0%–3.4%). A higher SOH reduces the amount of Li2CO3 and thus impacts other cost and revenue factors. In hydrometallurgical recycling for LFP batteries with 40% and 90% SOH, the cost-to-revenue ratio decreases from 0.92 to 0.60. Significant costs are incurred for degraded LFP (27.3%–22.2%), labour (4.7%–3.8%), and water (3.5%–2.9%). The major revenues are derived from FePO4 (23.6%–19.3%), Li2CO3 (17.7%–32.4%), and copper (10.5%–8.6%). As with NMC, a higher SOH increases the share of Li2CO3, affecting the proportions of other components. These shifts illustrate the impact of recycling processes and the market price of materials, highlighting the importance of high-value materials for profit enhancement.

We have also analysed the carbon footprint of various recycling technologies at the EOL stage for NMC and LFP batteries with 40%–90% SOH, as shown in Supplementary Figs. 17–19. The carbon footprint per kWh battery decreases with increasing SOH during recycling. Batteries with higher initial SOHs in their reuse stage slightly increase the carbon footprint per kWh during recycling due to the increased average amount of casing materials per kWh battery. NMC batteries offer significant environmental benefits when recycled, especially due to the carbon footprint of the positive electrode material, while the carbon footprint benefit of recycling LFP batteries is relatively low. Consequently, direct recycling stands out due to its comparable profitability, lower energy consumption, and reduced carbon footprint, indicating that direct recycling is a promising alternative to conventional, energy-intensive pyrometallurgical and hydrometallurgical technologies38,47.

Recyclers can gain insights into the economic and carbon footprint benefits of different recycling technologies. A profitability-based ranking is suggested for different SOH levels when recovering batteries. This facilitates the establishment of a mutually beneficial relationship between recyclers looking for higher SOH retired batteries and users seeking to prolong the battery lifetime.

Economic and environmental performance for reuse and recycling

The preceding analyses independently explored the economic and carbon footprint benefits of the reuse and recycling stages, respectively. Given their consecutive placement in the battery retirement pathway, holistic analysis is necessary to secure a comprehensive understanding by jointly considering reuse and recycling. Figure 4 shows the unit battery profit and carbon footprint during the lifecycle, including the refurbishment, reuse, and EOL stages. The recycling phase adopts the most economical technology, direct recycling for NMC and hydrometallurgical recycling for LFP. Supplementary Figs. 20–23 present the results of other ESS and CBS scenarios. In Fig. 4a, the economic benefits of NMC SLBs are greater for ESSs and CBSs with wider SOH reuse intervals, indicating that delayed recycling maximizes profit, while LSV shows negative performance. For NMC batteries, the highest life cycle benefit is $66.67/kWh battery, which is achieved through direct recycling after CBS use from 90% to 40% SOH. The least profitable is the −$59.26/kWh battery using direct recycling of LSV-used batteries with 90% to 40% SOH.

a The unit battery profit of lithium nickel manganese cobalt oxide (NMC) second-life batteries (SLBs) during the repurposing pathway, including the refurbishment (at 70%–90% state of health (SOH)), reuse (energy storage system (ESS), communication base station (CBS), and low-speed vehicle (LSV)) and end-of-life (EOL) (direct recycling at 40%–80% SOH) stages. The results of the other ESS and CBS scenarios are shown in Supplementary Figs. 20–23. b Carbon footprint per life cycle electricity delivery and per kWh battery of NMC batteries for traditional pathways. c Carbon footprint per life cycle electricity delivery and per kWh battery of NMC SLBs for repurposing pathways. The compositions of the other scenarios are shown in Supplementary Figs. 24–27. d–f Lithium iron phosphate (LFP) battery cases with hydrometallurgical recycling. Traditional pathways include the cell, module, pack, first use in electric vehicle (EV), and EOL (hydrometallurgical recycling) stages. Repurposing pathways, including the refurbishment, reuse, and EOL stages. Light industry, rural, and sightseeing cars are abbreviated as Lig, Rur, and Sig, respectively. For example, ESS-Lig is the light industry load profile of ESS application. Source data are provided as a Source Data file.

The carbon footprint for NMC batteries is illustrated in Fig. 4b, c. In Fig. 4b, when a battery is first used in an EV, the carbon footprint increases as the SOH decreases in the use stage, with the impact in the EOL stage being slight. However, for the carbon footprint per kWh life cycle of electricity delivery, extending the EV battery life reduces the carbon footprint, from 0.83 to 0.79 kg CO2-eq/kWh life cycle electricity delivery, due to a larger manufacturing carbon footprint than decreased efficiency or recycling delays. Supplementary Figs. 24–27 show the proportions of cost and carbon footprint during cell, module, and pack manufacturing. In Fig. 4c, in all the scenarios, the carbon footprint per kWh battery increases with a larger initial SOH when recycling at 40% SOH. This suggests that a high initial SOH increases the use stage carbon footprint more than does refurbishment, and charge‒discharge efficiency improvements can reduce the carbon footprint. The trends of the carbon footprint per kWh life cycle of electricity delivery for the ESS, CBS, and LSV are different from those of the carbon footprint per kWh battery. As the initial SOH decreases, the carbon footprint of the ESS and CBS first increases and then decreases, while the carbon footprint of the LSV monotonically increases, reaching a 0.56 kg CO2-eq/kWh life cycle electricity delivery. The NMC SLBs with 70% SOH used in the ESS-Lig scenario resulted in a minimum carbon footprint of 0.23 kg CO2-eq/kWh life cycle electricity delivery. For LFP batteries, Fig. 4d–f presents the unit battery profit and carbon footprint results. Compared to NMC batteries, LFP batteries appear to amplify economic outcomes. LFP batteries consistently have a greater carbon footprint than NMC batteries during the first use and reuse stage. Unlike that of NMC SLBs, the carbon footprint per kWh life cycle electricity delivery capacity of LFP SLBs follows a different trend, increasing due to extended battery life amplifying the charging–discharging efficiency-induced carbon footprint. For SLBs, the order of carbon footprint, from low to high, is ESS, CBS, and LSV, while the unit of battery profit ranks as CBS, ESS, and LSV.

Different battery types and SOHs yield distinct rankings in economic and carbon footprint analyses, highlighting the need for a pathway design. Considering the entire SLB life cycle, including selecting reuse scenarios and recycling technologies, our strategy can maximize economic and environmental benefits for both users and recyclers.

Evaluation of traditional and optimized pathways

The entire life cycle is crucial for sustainability and cost-effectiveness. Here, we design a prioritized pathway for different battery types and SOH levels. Figure 5 illustrates the optimal pathway, which we compare to the traditional pathway (direct retirement after EV use) to assess its effectiveness. Other pathways can be found in Supplementary Tables 1 and 2. In Fig. 5a, the traditional pathway for NMC batteries involves a new battery, EV use, and hydrometallurgical recycling at the EOL. Figure 5b provides the details, starting with a $97/kWh new battery cost. The first use in EVs increases user costs to $157/kWh battery. Finally, the battery is retired at 90% SOH and recycled using hydrometallurgical recycling. In contrast, the optimized pathway diverges after the first use stage. The process includes refurbishment, reuse, and recycling. Users need to purchase SLBs with 90% SOH, increasing costs to $176/kWh in the refurbishment stage. SLBs are then used in the CBS-Rur area, where they perform well until they degrade to 40% of the SOH, reducing the cost to the $103/kWh battery. Finally, the battery reaches the EOL stage and is recycled via direct recycling, resulting in a final life cycle cost of $91/kWh for the battery, which is $43/kWh lower than that of a traditional pathway.

a Life cycle pathways considered in this work, from the new battery to the end-of-life (EOL) stages, taking lithium nickel manganese cobalt oxide (NMC) as an example. b–d Comparison of traditional and optimized pathways of NMC batteries retired from electric vehicles at 90%, 80%, and 70% SOH. e–g Comparison of traditional and optimized pathways for lithium iron phosphate (LFP) batteries retired from EVs at 90%, 80%, and 70% SOH. The pathway details based on the unit battery profit and the carbon footprint are listed in Supplementary Tables 1–16. Applications in the reuse phase include energy storage systems (ESSs), communication base stations (CBSs), and low-speed vehicles (LSVs). Recycling technologies in the EOL stage include hydrometallurgical, direct, and pyrometallurgical recycling. The government, light industry, commercial, railway, urban, rural, and sightseeing car are abbreviated as Gov, Lig, Com, Rai, Urb, Rur, and Sig, respectively. For example, ESS-Lig is the light industry load profile of ESS application. Source data are provided as a Source Data file.

For NMC SLBs retired from EVs at 80% SOH in Fig. 5c, the processes are similar, but their unit battery profit is not as good as that at 90% SOH. Late retirement in EVs means that these batteries consume more electricity in the first use stage and have a lower price. A comparison of NMC batteries retired at 70% SOH in Fig. 5d confirmed this, with different reuse alternatives (CBS-Rai scenario). Different conditions of retired batteries yield different pathway recommendations. The comparison also emphasizes that early recycling benefits for recyclers are not as good as extended use benefits for users. For the LFP batteries shown in Fig. 5e–g, the profit margin expands due to their longer lifetime and higher charge‒discharge efficiency. The gap between traditional and optimized pathways narrows for low-SOH batteries retired from EVs. Regardless of battery chemistries, batteries with higher SOHs retired from EVs yield higher profits, even after eliminating purchase costs. The carbon footprint corresponding to the traditional and optimized pathways in Fig. 5b–g shows in Supplementary Fig. 28. In contrast to the repurposing pathway shown in Fig. 4, this life cycle pathway includes cell, module, first use, refurbishment, reuse, and EOL stages. A sensitivity analysis has been conducted on the carbon footprint of electricity ranging from 0.3140 to 0.7488 kg CO2-eq/kWh based on changes in the proportion of electricity sources in China from 2020 to 205048. Supplementary Tables 3–16 list the pathways chosen based on the carbon footprint from the policy-making perspective. The carbon footprint of electricity will significantly change in the future and thus may significantly affect the results26. Thus, the optimized pathway is contingent on the choice of indicators (unit battery profit and carbon footprint) or their assigned weights, with governments generally favouring the carbon footprint and users leaning towards economic performance.

The proposed pathway decisions for retired EV batteries support a suitable strategy for reuse scenarios and recycling technologies. It involves a comprehensive analysis of economic performance and carbon footprint considerations, contributing to the sustainable battery industry by promoting responsible waste management and efficient resource utilization. This aligns with a broader goal of fostering a sustainability-conscious strategy for battery lifecycle management.

Discussion

In conclusion, we show that the ESS is the best choice for reuse in terms of total profit, while the CBS leads in terms of average daily profit. Direct recycling is the most economical for NMC batteries, and hydrometallurgical recycling is the most economical for LFP batteries. Both chemical types have a minimal carbon footprint when using direct recycling technology. The optimized pathway for retired EV LFP batteries with 80% SOH yields economic profits of $156/kWh and reduces the carbon footprint by 0.15 kg CO2-eq/kWh life cycle electricity delivery, achieved through CBS reuse and hydrometallurgical recycling. NMC batteries with an 80% SOH result in a profit of $38/kWh battery and a decrease of 0.14 kg CO2-eq/kWh for life cycle electricity delivery for CBS reuse and direct recycling. With a global retirement scale of 150 GWh in 202549, the maximum reuse and recycling profit will reach $13.6 billion, assuming a market share of 45% LFP and 55% NMC batteries50. Our strategy is a universally applicable evaluation framework for pinpointing optimal retirement pathways for SLBs across various types, utilization scenarios, and recycling options, advancing the sustainable industry in the foreseeable future.

We have demonstrated the effectiveness of the battery retirement pathway in serving the dual purposes of economic and environmental viability. Such success can be rationalized by reasonably managing retired EV batteries through economic and environmental evaluations throughout the whole life cycle, considering various reuse applications and recycling technologies for different batteries with different SOHs when retired from EVs. We stress that our evaluation strategy improves traditional LCA calculations by streamlining data management, reducing computational costs, and enhancing standardization. It simplifies sensitivity analysis and uncertainty evaluations while improving representatives of the results. Here, we further discuss the general applicability of the retirement pathway decision strategy, its implications for battery reuse and recycling decision-making, and future considerations for potential methodological improvements.

The pathway decisions for retired EV batteries address the lifecycles of battery research, manufacturing, reuse, recycling, and third-party services. Multiple parties can be associated with different interest concerns, forming a complex decision model. For research and manufacturing, this study is crucial for technology advancement and planning, thus indicating potential revenue growth through high-performance materials. For reuse, this study explores the potential for SLBs to enhance circular economy practices and assess residual values. For recycling, this study suggests ways to decrease energy and material costs, minimize environmental impact, and boost industry scalability. There are many new direct recycling technologies51,52,53 that can be evaluated using our model. A lack of data impedes the positive effects mentioned above. Third-party platforms, such as China’s National BEV Monitoring and Management-Traction, Europe’s Battery Pass, and the USA’s Everledger, use technologies such as blockchain and artificial intelligence for lifecycle transparency, hinting at future developments in a global battery passport system. It is urgent to jointly consider multiparty interests, ensuring the feasibility of the designed pathway in real cases. However, current studies often overlook the interconnectedness of these different stakeholders and constraints. Therefore, deploying a unified battery retirement pathway helps bridge these gaps, creating a more cohesive and unified approach to battery lifecycle management and significantly enhancing the total economic and environmental benefits by simultaneously optimizing multiparty interests.

Here, we discuss the impact of different battery chemistries on the results. The LFP and NMC622 studied in this paper are among the current leading battery types dominating EV sales globally (~50% in 2023), with other prevalent types including NMC811, NMC721, NMC532, NMC111, and lithium nickel cobalt aluminium (NCA)54,55. While chemistries with higher cobalt contents degrade slightly faster due to reduced cycling stability, lifespan variations are minimal; thus, carbon emissions and economic benefits during the use stage remain similar across battery chemistries56. Manufacturing adjustments from NMC111 to NMC811, with decreased cobalt levels and increased nickel levels, have led to a 7.5% reduction in GHG emissions but a 104% increase in sulfur oxide emissions, primarily from nickel production31,57. The manufacturing of low-cobalt chemistries results in comparable environmental impacts to those of high-cobalt chemistries, mainly from energy consumption and the use of nickel31. Economic considerations, such as rising cobalt prices and ethical concerns about cobalt mining, have prompted a shift towards lower cobalt ratios, such as those of NMC622 and NMC811, which are, however, more challenging in manufacturing58. As the nickel content increases, battery manufacturing costs are projected to decline from $110/kWh (NMC111) to $98/kWh (NMC811) by 2025 under base mineral cost scenarios59. In the repurposing pathway, which encompasses the refurbishment, reuse, and EOL stages, NMC622 has a 7% lower carbon footprint than NMC11131. Kastanaki et al.55 suggest that the future attractiveness of NCA batteries, which are similar to NMC in terms of lifespan and energy density and contain high levels of cobalt and nickel, might decrease due to cost, ethical, and supply issues. Future research could consider the pathway decisions of different battery chemistries for sustainability considerations.

The development of a generally applicable battery retirement pathway, especially under heterogeneous battery retirement conditions, remains a challenge and is intensively coupled with many topics and disciplines. First, there are safety issues, including the risk of fires and chemical leaks. The integration of SOH estimation and remaining useful life (RUL) prediction into future pathway decisions should be studied and holds potential value60. Second, the disassembly process of battery packs is complex due to the variety and intricate interconnections of components, making it labour intensive and energy consuming61. According to Blömeke et al.62, the disassembly stage significantly contributes to the overall recycling process by separating more than 30% of the battery’s total mass, highlighting its potential impact on energy consumption. Automation and modern human–robot collaboration in production processes offer opportunities to reduce the time and costs of disassembly. These technological advancements could streamline the disassembly process, making it more efficient and less energy intensive. Third, human behaviours significantly influence battery lifespan and disposal patterns. Factors such as charging habits, use frequency, and operation conditions affect the longevity and efficiency of batteries and are promising aspects for designing a human-in-the-loop battery retirement scheme. Fourth, government incentives play a pivotal role in promoting sustainable practices in the battery industry, including subsidies for battery reuse, recycling, and regulations for eco-friendly disposal. Despite these challenges, our battery retirement pathway decisions still present promise for facilitating a more sustainable battery ecosystem by reshaping disordered retired battery management in an organized manner. Future work will integrate considerations such as battery safety, labour cost, complex user behaviours, extended reuse scenarios, advanced recycling processes, business models and government considerations.

Methods

Goal and scope definition

We propose a pathway decision strategy for retired EV batteries through economic and environmental evaluation. The intended field and audience include battery research and development, manufacturing, reuse, recycling, and third-party services. Two battery chemistries, LFP and NMC, which dominate the market, are studied. The evaluation examines diverse reuse scenarios and recycling technologies. The entire battery system life cycle, namely, that of CTG, is analysed from two perspectives: one including reuse and the other not including reuse. The latter serves as a baseline for comparison. In the first case, the life cycle encompasses cell production, assembly of modules and packs, use in EVs, refurbishment, reuse in ESS/CBS/LSV, and finally, recycling. In the second case, the life cycle includes cell production, assembly of modules and packs, EV/ESS/CBS/LSV use, and recycling. Pathway decisions involve the new battery production stage because cell/module/pack design affects both inputs and outputs in the refurbishment stage, while the cell composition impacts the recycling stage. The first use stage is compared with the beneficial pathway.

The unit battery profit per kWh battery (economic perspective) and carbon footprint per kWh life cycle electricity delivery (environmental perspective) are the functional units. These two indicators aim to maximize benefits by assessing the optimal battery reuse and recycling decision. The configuration of the system battery capacity across various scenarios is guided by optimizing total profit in the reuse stage. The pricing models for new and retired batteries are introduced, along with the system configuration and operation model considering battery degradation geared toward economic optimization. Afterwards, the analysis of the carbon footprint is conducted. The failure rate of LIB cells during the refurbishment stage is not considered63. Three technologies, hydrometallurgical, direct, and pyrometallurgical recycling, are analysed in the EOL stage. The recycling output qualities, namely, the battery grade, are not considered. Economic and environmental metrics are used to evaluate pathways, considering that the closed-loop process of recycling retired batteries into new LIBs is still in the design stage51,53. This model offers immediate insights into the variations in economic performance and carbon footprint resulting from changes in specific parameters within battery systems, which facilitates future confirmation of scenarios and optimization of capacity configurations.

Economic performance indicators

The traditional pathway involves battery manufacturing, use in EVs, and EOL. The price of new batteries designed for EVs is denoted as the investment cost \({C}_{{inv}}\), and their power consumption during the use stage is considered without accounting for interactions (ancillary services) with the power grid. Therefore, the economic performance \({C}_{{EV}}\) during the first use stage of a battery is based on the electricity consumption and its price, which is calculated according to Eq. (1):

where \({Q}_{{EV},\, {ini}}\) is the initial capacity of the EV. \( {{{\rm{SOH}}}}\left({{{\rm{Cycle}}}}\right)\) denotes the SOH of the battery, which varies with the cycle number. \({c}_{{buy}}^{{ele}}\) is the price of electricity purchased from the grid. \({\sum }_{{Cycle}=1}^{{{Cycle}}\; {{after}}\; {{first}}\; {{use}}}{{SOH}}\left({{Cycle}}\right)\cdot {Q}_{{EV},\, ini}\) defines the total throughput capacity of the battery, encompassing cycles from the first (100% SOH) to the last (70%–90% SOH) during the first use stage50. In some studies, battery electricity consumption in EVs has often been assumed based on values such as daily running kilometres and running years26,64. However, we consider the total throughput of battery electricity consumption to assess battery aging, a method widely acknowledged in the industry.

This research delves into the analysis of the reuse stage span across three distinct applications, three ESS working profiles, four CBS working profiles, and one LSV working profile. Particular emphasis is placed on the purchase cost of retired batteries and economic performance during the reuse stage40. Our work includes the optimal configuration and operation models of the ESS, CBS, and LSV considering battery degradation. The economic performance objective function maximizes the total profit by changing the battery configuration capacity, as shown in Eq. (2):

where \({C}_{{inv}}\) is the investment cost (the price of SLBs, including resourcing and refurbishment), \({C}_{{mai}}\) is the maintenance cost, and \({C}_{{ope}}\) is the operation cost. The investment cost \({C}_{{inv}}\) of both the new battery and the SLB is defined as Eq. (3):

where \({c}_{{u}}\) is the cost of the unit battery (cell or module). N is the number of batteries in the system. Typically, within a battery pack, a fully serial or hybrid connection configuration can be applied, resulting in a relatively large number of cells, and a hybrid packet can be composed of m modules in series with n units (mPnS)65. An increase in the number of series will reduce the inconsistency of the current distribution caused by parallel66, while for the parallel module, the difference in currents between cells inside the module increases with the discharge rate67. In addition, Chang et al.65 reported that the capacity of a battery system increased as the number of series or parallel increases, but the growth rate gradually slowed. In this study, a nonlinear correlation between the battery system capacity and total number of batteries is introduced by fitting Fig. 9 in ref. 65. The initial capacity of ESS/CBS/LSV \({Q}_{{ini}}\) can be expressed as Eq. (4):

where \({q}_{{u}}\) is the initial capacity of unit SLB, and \({\gamma }_{{c}}\) is the capacity difference rate.

For the new battery, \({c}_{{u}}\) is selected from ref. 68. When the battery is in reuse mode40, \({c}_{{u}}\) is defined as Eq. (5):

where \({AC}\) is the average SLB cost per kWh, \({AC}=\left({\omega }_{1}{q}_{{r}}+{\omega }_{2}{q}_{{r}}^{a}{T}^{b}\right)/{q}_{{r}}\). \({q}_{{r}}\) is the capacity of all retired batteries available from EVs. \({\omega }_{1}\) and \({\omega }_{2}\) are the unit prices for resourcing and repurposing, respectively. a and b are the elasticity parameters accounting for the number of retired batteries and the refurbishment technology efficiency, respectively. \(T\in \left[{{\mathrm{0,\, 1}}}\right]\) is the reuse rate. \({\alpha }_{{dc}}\) is the degradation curve indicator, which measures the relative capability SLB during its reuse stage to that of the market average, and a large \({\alpha }_{{dc}}\) indicates that the battery can release more capacity. Supplementary Table 18 lists the \({\alpha }_{{dc}}\) values. More details about Eq. (5) can be found in Supplementary Note 1 and ref. 40.

The daily maintenance cost \({C}_{{mai}}\) is calculated as Eq. (6):

where \({c}_{{mai}}\) is the maintenance cost per kWh battery. \({P}_{\max }\) is the maximum power of the battery system. \({i}_{{r}}\) and \({i}_{{d}}\) are the inflation rate and discount rate, respectively35. \(d\) and \(y\) represent the operation day and year, respectively. \({Day\; after\; use}\) indicates the operation day number of the battery system when it reaches the EOL stage or the end of the use stage.

The daily operation cost \({C}_{{ope}}\) is calculated as Eq. (7):

where \({c}_{{buy}}\left(d,\, \, t\right)\) and \({c}_{{sel}}\left(d,\, \, t\right)\) are the electricity prices for buying from and selling to the grid, respectively, on the \({d}{{{\rm{th}}}}\) day and at the \({t}{{{\rm{th}}}}\) hour. \({P}_{{buy}}\left(d,\, t\right)\) and \({P}_{{sel}}\left(d,\, t\right)\) are the electricity bought from and sold to the grid, respectively. In this study, \({c}_{{buy}}\left(d,\, t\right)\) and \({c}_{{sel}}\left(d,\, t\right)\) are set to be the same, as illustrated in Supplementary Fig. 3 for electricity prices in Shenzhen, China. The constraints of the ESS, CBS, and LSV can be found in Supplementary Note 1.

Mature recycling technologies can be divided into two primary categories, pyrometallurgical and hydrometallurgical recycling, the latter of which is associated with lower environmental impacts and is more practical51. Thus, this study adopts hydrometallurgical recycling via a traditional pathway. Direct recycling, recognized as a promising green technology, is notable for its environmental efficiency26. Although direct recycling is currently in its infancy51,52, it is developing very rapidly, and insights have already been proposed to facilitate the transition from laboratory research to industrial production53. In comparison to hydrometallurgical recycling, direct recycling has significant advantages, consuming only ~15% of the energy, generating ~25% less of the carbon footprint, and reducing costs by ~50%11. Direct landfill disposal or other coarse treatments of batteries are not analysed here due to legal constraints69,70, poor economic benefits, and environmental impacts. The economic performance during the recycling phase is calculated with reference to the environmental impact of this stage and is provided in Supplementary Note 3.

Environment impact indicator

The environmental impact in this paper is evaluated using the carbon footprint as the metric. The carbon footprint, defined as the total amount of GHG emitted during the life cycle of the LIB, is utilized to quantify and compare environmental impacts. At the beginning of the life cycle, batteries undergo a sequential process of assembling raw materials into cells, followed by the formation of modules and ultimately packs. This process encompasses the inputs of materials, electricity, and heat, with a more detailed description available in Supplementary Note 2. Subsequently, the transition to the first use stage occurs, where the SOH in EVs ranges from 100% to 70%–90%. The carbon footprint in the first use stage \({{CO}}_{2_{{EV}}}\) is based on electricity consumption and the carbon intensity of the mixed electricity used, as illustrated in Eq. (8):

where \({{CO}}_{2_{{ele}}}\) represents the carbon footprint per kWh of power grid electricity.

After the first use stage, the battery pack enters the refurbishment phase, which involves collection, SOH and RUL testing, and physical breakdown and repacking of the battery system18. Initially, the cost of battery collection is driven primarily by geography, where collection costs are kept lower by keeping transportation requirements low. Subsequently, the SOH and RUL of the battery are assessed to determine whether the battery is suitable for reuse. Successful refurbishment involves evaluating the suitability of the used battery for a reuse scenario20. Due to the decreases in the SOH and RUL, retired batteries may find applications in the same scenario as new batteries, but with larger amounts. Finally, disassembly is performed at the module level26, considering the substantial energy consumption, labour intensity, and potential hazards associated with thermal runaway and toxic chemicals26,71. This phase encompasses material output and energy input. During the assembly process, the quantity of related components is determined based on the requirements, involving the inputs of materials and electricity. A more in-depth understanding of the refurbishment process can be found in ref. 20. The capacity configuration illustrated in the previous sections determines the carbon footprint associated with raw materials, manufacturing processes, and electricity consumption during the refurbishment and reuse stages. The carbon footprint in the reuse phase \({{CO}}_{2_{{ope}}}\) is given by Eq. (9):

where \({{CO}}_{2_{{PV}}}\) represents the carbon footprint per kWh of renewable energy generation. \({P}_{{PV}}\left(d,\, t\right)\) is the power output from renewable sources on the \({d}{{{\rm{th}}}}\) day and at the \({t}{{{\rm{th}}}}\) hour.

The EOL phase consists of pretreatment and recycling. The allocation of recovered materials from recycling is performed assuming an open-loop process with no market disequilibrium31. A description of the recycling cost model and carbon footprint calculations, incorporating different recycling methods during the EOL stage, is provided in Supplementary Note 3.

The life cycle inventory, excluding the EOL stage, is available in Supplementary Note 2. The carbon footprint analysis is based on the LCA method, and the carbon footprint factor data are sourced from Ecoinvent version 3.972. We employ GWP100 indicators, which measure the impact of GHGs over a 100-year period. The life cycle is examined within the context of Guangdong, China, in 2023, representing our baseline case. In this baseline scenario, we do not account for temporal or spatial variations in the power grid. Consequently, the environmental impacts associated with electricity consumption are considered constant throughout the study period.

Sensitivity analysis

Sensitivity analysis is performed to evaluate the key assumptions of lithium salt price, electricity generation, the SOH range in the reuse stage and the SOH in the EOL stage. Lithium salt prices have experienced significant fluctuations73; thus, the impact of lithium salt price fluctuations (ranging from the minimum value of $5496 on October 26, 2020, to the maximum value of $84,942 on November 7, 2022) on profit, cost, and revenue during the recycling stage is examined, and the results are shown in Fig. 3. The carbon footprint of electricity will significantly change in the future26, and the effect of emissions from electricity (ranging from 0.3140 to 0.7488 kg CO2-eq/kWh) on the pathway results is detailed in Supplementary Tables 3–16. Due to the different conditions of the battery when it is retired and recycled, the SOH is projected to range from 70% to 90% at the end of the first use stage in EVs, while it is estimated to be within the 40%–80% range at the end of the reuse stage. This broader SOH range at the EOL stage, spanning from 40% to 90%, accommodates the diverse conditions of practical batteries. Additionally, batteries characterized by distinct SOH ranges have different RULs, degradation curves, throughput capacities, and charging–discharging efficiency impacts and thus yield varying operational outcomes. In this paper, the SOH of retired EV batteries is set at 70%, 80%, and 90%, while the SOH at the EOL stage is set at 90%, 80%, 70%, 60%, 50%, and 40%. This stratification by 10% intervals allows for a detailed observation of aging processes, enhances the clarity of the data, and aids in the visual representation of findings. Through sensitivity analysis, we can obtain more information on pathway decisions and enhance reliability.

Data availability

The authors declare that the data supporting the findings of this study are available within the paper and its Supplementary Information files. Source data are provided with this paper.

Code availability

The code for the pathway decisions model generated in this study is available at https://github.com/RuifeiMa/Reuse-and-recycling-pathway-of-retired-batteries.

References

Sagar, A. D. et al. Mission Energy Access for a just and sustainable future for all. Nat. Energy 8, 1171–1173 (2023).

Gutsch, M. & Leker, J. Costs, carbon footprint, and environmental impacts of lithium-ion batteries—from cathode active material synthesis to cell manufacturing and recycling. Appl. Energy 353, 122132 (2024).

Moraski, J. W., Popovich, N. D. & Phadke, A. A. Leveraging rail-based mobile energy storage to increase grid reliability in the face of climate uncertainty. Nat. Energy 8, 736–746 (2023).

Peng, L., Mauzerall, D. L., Zhong, Y. D. & He, G. Heterogeneous effects of battery storage deployment strategies on decarbonization of provincial power systems in China. Nat. Commun. 14, 4858 (2023).

Aguilar Lopez, F., Lauinger, D., Vuille, F. & Müller, D. B. On the potential of vehicle-to-grid and second-life batteries to provide energy and material security. Nat. Commun. 15, 4179 (2024).

Degen, F., Winter, M., Bendig, D. & Tübke, J. Energy consumption of current and future production of lithium-ion and post lithium-ion battery cells. Nat. Energy 8, 1284–1295 (2023).

IEA. Global EV Data Explorer (IEA, Paris, 2023).

IEA. Global EV Outlook 2022 (IEA, 2022).

Xu, C. et al. Electric vehicle batteries alone could satisfy short-term grid storage demand by as early as 2030. Nat. Commun. 14, 119 (2023).

Zeng, A. et al. Battery technology and recycling alone will not save the electric mobility transition from future cobalt shortages. Nat. Commun. 13, 1341 (2022).

Huang, Y. & Li, J. Key challenges for grid-scale lithium-ion battery energy storage. Adv. Energy Mater. 2202197 https://doi.org/10.1002/aenm.202202197 (2022).

Canals Casals, L., Amante García, B. & González Benítez, M. M. in Project Management and Engineering Research, 2014: Selected Papers from the 18th International AEIPRO Congress held in Alcañiz, Spain, in 2014 (eds Muñoz, J. L. A., Blanco, J. L. Y. & Capuz-Rizo, S. F.) 129–141 (Springer International Publishing, 2016).

Wang, Y. et al. Environmental impact assessment of second life and recycling for LiFePO4 power batteries in China. J. Environ. Manag. 314, 115083 (2022).

Yang, J., Gu, F. & Guo, J. Environmental feasibility of secondary use of electric vehicle lithium-ion batteries in communication base stations. Resour. Conserv. Recycl. 156, 104713 (2020).

Kamath, D., Shukla, S., Arsenault, R., Kim, H. C. & Anctil, A. Evaluating the cost and carbon footprint of second-life electric vehicle batteries in residential and utility-level applications. Waste Manag. 113, 497–507 (2020).

Bhatt, A., Ongsakul, W. & Madhu M, M. Optimal techno-economic feasibility study of net-zero carbon emission microgrid integrating second-life battery energy storage system. Energy Convers. Manag. 266, 115825 (2022).

Yang, J., Weil, M. & Gu, F. Environmental-economic analysis of the secondary use of electric vehicle batteries in the load shifting of communication base stations: a case study in China. J. Energy Storage 55, 105823 (2022).

Zhu, J. et al. End-of-life or second-life options for retired electric vehicle batteries. Cell Rep. Phys. Sci. 2, 100537 (2021).

Hossain, E. et al. A comprehensive review on second-life batteries: current state, manufacturing considerations, applications, impacts, barriers & potential solutions, business strategies, and policies. IEEE Access 7, 73215–73252 (2019).

Borner, M. F. et al. Challenges of second-life concepts for retired electric vehicle batteries. Cell Rep. Phys. Sci. 3, 101095 (2022).

Wang, Q., Wang, Z., Zhang, L., Liu, P. & Zhang, Z. A novel consistency evaluation method for series-connected battery systems based on real-world operation data. In IEEE Transactions on Transportation Electrification Vol. 7, 437–451 (IEEE, 2021).

He, K. et al. A novel quick screening method for the second usage of parallel-connected lithium-ion cells based on the current distribution. J. Electrochem. Soc. 170, 030514 (2023).

Zhang, J. et al. Realistic fault detection of li-ion battery via dynamical deep learning. Nat. Commun. 14, 5940 (2023).

Roman, D., Saxena, S., Robu, V., Pecht, M. & Flynn, D. Machine learning pipeline for battery state-of-health estimation. Nat. Mach. Intell. 3, 447–456 (2021).

Tao, S. et al. Collaborative and privacy-preserving retired battery sorting for profitable direct recycling via federated machine learning. Nat. Commun. 14, 8032 (2023).

Yanqiu, T., Rahn, C. D., Archer, L. A. & You, F. Second life and recycling: energy and environmental sustainability perspectives for high-performance lithium-ion batteries. Sci. Adv. 7, eabi7633 (2021).

Wu, W., Lin, B., Xie, C., Elliott, R. J. R. & Radcliffe, J. Does energy storage provide a profitable second life for electric vehicle batteries? Energy Econ. 92, 105010 (2020).

Cheng, M., Sun, H., Wei, G., Zhou, G. & Zhang, X. A sustainable framework for the second-life battery ecosystem based on blockchain. eTransportation 14, 100206 (2022).

Hannan, M. A. et al. Impact assessment of battery energy storage systems towards achieving sustainable development goals. J. Energy Storage 42, 103040 (2021).

Wewer, A., Bilge, P. & Dietrich, F. Advances of 2nd life applications for lithium ion batteries from electric vehicles based on energy demand. Sustainability 13 https://doi.org/10.3390/su13105726 (2021).

Dunn, J., Ritter, K., Velázquez, J. M. & Kendall, A. Should high-cobalt EV batteries be repurposed? Using LCA to assess the impact of technological innovation on the waste hierarchy. J. Ind. Ecol. 27, 1277–1290 (2023).

Steckel, T., Kendall, A. & Ambrose, H. Applying levelized cost of storage methodology to utility-scale second-life lithium-ion battery energy storage systems. Appl. Energy 300, 117309 (2021).

Jiang, Y., Kang, L. & Liu, Y. Optimal configuration of battery energy storage system with multiple types of batteries based on supply-demand characteristics. Energy 206, 118093 (2020).

Liang, Y., Cai, H. & Zou, G. Configuration and system operation for battery swapping stations in Beijing. Energy 214, 118883 (2021).

Tang, R., Xu, Q., Fang, J., Xia, Y. & Shi, Y. Optimal configuration strategy of hybrid energy storage system on industrial load side based on frequency division algorithm. J. Energy Storage 50, 104645 (2022).

Kang, Z. et al. Recycling technologies, policies, prospects, and challenges for spent batteries. iScience 26, 108072 (2023).

Sommerville, R. et al. A qualitative assessment of lithium ion battery recycling processes. Resour. Conserv. Recycl. 165, 105219 (2021).

Ji, G. et al. Direct regeneration of degraded lithium-ion battery cathodes with a multifunctional organic lithium salt. Nat. Commun. 14, 584 (2023).

Kamath, D., Arsenault, R., Kim, H. C. & Anctil, A. Economic and environmental feasibility of second-life lithium-ion batteries as fast-charging energy storage. Environ. Sci. Technol. 54, 6878–6887 (2020).

Cheng, M. et al. Sustainability evaluation of second-life battery applications in grid-connected PV-battery systems. J. Power Sources 550, 232132 (2022).

Ning, L., Si, L., Nian, L. & Fei, Z. Network reconfiguration based on an edge-cloud-coordinate framework and load forecasting. Front. Energy Res. 9, 679275 (2021).

Zhong, L. et al. Double-layer K-means++ clustering method for evaluation of dispatchable potential of massive regional 5G base stations. IEEE Access 10, 82870–82882 (2022).

Wang, T. et al. An optimized energy management strategy for fuel cell hybrid power system based on maximum efficiency range identification. J. Power Sources 445, 227333 (2020).

Baumhöfer, T., Brühl, M., Rothgang, S. & Sauer, D. U. Production caused variation in capacity aging trend and correlation to initial cell performance. J. Power Sources 247, 332–338 (2014).

Xiong, W., Mo, Y. & Yan, C. Online state-of-health estimation for second-use lithium-ion batteries based on weighted least squares support vector machine. IEEE Access 9, 1870–1881 (2021).

Cook, R., Swan, L. & Plucknett, K. Impact of test conditions while screening lithium-ion batteries for capacity degradation in low earth orbit cubesat space applications. Batteries 7 https://doi.org/10.3390/batteries7010020 (2021).

Zhou, Q. et al. A closed-loop regeneration of LiNi0.6Co0.2Mn0.2O2 and graphite from spent batteries via efficient lithium supplementation and structural remodelling. Sustain. Energy Fuels 5, 4981–4991 (2021).

Šimaitis, J., Allen, S. & Vagg, C. Are future recycling benefits misleading? Prospective life cycle assessment of lithium-ion batteries. J. Ind. Ecol. 27, 1291–1303 (2023).

Stringer, D. & Ma, J. in Bloomberg Businesswee (Bloomberg, New York, 2018).

Geng, J. et al. Potential of electric vehicle batteries second use in energy storage systems: the case of China. Energy 253, 124159 (2022).

Mao, J. et al. Toward practical lithium-ion battery recycling: adding value, tackling circularity and recycling-oriented design. Energy Environ. Sci. 15, 2732–2752 (2022).

Xu, P. et al. A materials perspective on direct recycling of lithium-ion batteries: principles, challenges and opportunities. Adv. Funct. Mater. 33, 2213168 (2023).

Shan, M. et al. Recycling of LiFePO4 cathode materials: from laboratory scale to industrial production. Mater. Today 73, 130–150 (2024).

IEA. Batteries and Secure Energy Transition (IEA, Paris, 2024).

Kastanaki, E. & Giannis, A. Dynamic estimation of end-of-life electric vehicle batteries in the EU-27 considering reuse, remanufacturing and recycling options. J. Clean. Prod. 393, 136349 (2023).

Jung, R. et al. Effect of ambient storage on the degradation of Ni-rich positive electrode materials (NMC811) for Li-ion batteries. J. Electrochem. Soc. 165, A132 (2018).

Winjobi, O., Kelly, J. C. & Dai, Q. Life-cycle analysis, by global region, of automotive lithium-ion nickel manganese cobalt batteries of varying nickel content. Sustain. Mater. Technol. 32, e00415 (2022).

IEA. Global EV Outlook 2023 (IEA, Paris, 2023).

Chen, W.-H. & Hsieh, I. Y. L. Techno-economic analysis of lithium-ion battery price reduction considering carbon footprint based on life cycle assessment. J. Clean. Prod. 425, 139045 (2023).

Tao, S. et al. Rapid and sustainable battery health diagnosis for recycling pretreatment using fast pulse test and random forest machine learning. J. Power Sources 597, 234156 (2024).

Cerdas, F., Andrew, S., Thiede, S. & Herrmann, C. in Recycling of Lithium-Ion Batteries: The LithoRec Way (eds Kwade, A. & Diekmann, J.) 267–288 (Springer International Publishing, 2018).

Blömeke, S. et al. Material and energy flow analysis for environmental and economic impact assessment of industrial recycling routes for lithium-ion traction batteries. J. Clean. Prod. 377, 134344 (2022).

Ahmadi, L. et al. Energy efficiency of Li-ion battery packs re-used in stationary power applications. Sustain. Energy Technol. Assess. 8, 9–17 (2014).

Philippot, M. et al. Environmental impact of the second life of an automotive battery: reuse and repurpose based on ageing tests. J. Clean. Prod. 366, 132872 (2022).

Chang, L. et al. Correlations of lithium-ion battery parameter variations and connected configurations on pack statistics. Appl. Energy 329, 120275 (2023).

Fan, X. et al. Simplified battery pack modeling considering inconsistency and evolution of current distribution. In IEEE Transactions on Intelligent Transportation Systems Vol. 22, 630–639 (IEEE, 2021).

Wang, B. et al. Study of non-uniform temperature and discharging distribution for lithium-ion battery modules in series and parallel connection. Appl. Therm. Eng. 168, 114831 (2020).

Fallahifar, R. & Kalantar, M. Optimal planning of lithium ion battery energy storage for microgrid applications: considering capacity degradation. J. Energy Storage 57, 106103 (2023).

Ministry of Industry and Information Technology of the Peopleʼs Republic of China. Interim Provisions of the Traceability Management of the Recovery and Utilization of New Energy Vehicle Power Battery (2018). Available at: https://www.gov.cn/zhengce/zhengceku/2018-12/31/content_5439636.htm.

Council of the European Union, European Parliament. Regulation (EU) 2023/1542 concerning batteries and waste batteries, amending Directive 2008/98/EC and Regulation (EU) 2019/1020 and repealing Directive 2006/66/EC (2023). Available at: https://eur-lex.europa.eu/eli/reg/2023/1542/oj.

Harper, G. et al. Recycling lithium-ion batteries from electric vehicles. Nature 575, 75–86 (2019).

Wernet, G. et al. The ecoinvent database version 3 (part I): overview and methodology. Int. J. Life Cycle Assess. 21, 1218–1230 (2016).

Sun, X., Ouyang, M. & Hao, H. Surging lithium price will not impede the electric vehicle boom. Joule 6, 1738–1742 (2022).

Acknowledgements

This work was supported by Shenzhen Science and Technology Program (Grant No. KQTD20170810150821146) [X.Z.], Tsinghua Shenzhen International Graduate School Interdisciplinary Innovative Fund (Grant No. JC2021006) [X.Z., G.Z.], Shenzhen Ubiquitous Data Enabling Key Lab (Grant No. ZDSYS20220527171406015) [X.Z.], Tsinghua-Berkeley Shenzhen Institute Phase II Research Funding [X.Z.], the Tsinghua Shenzhen International Graduate School-Shenzhen Pengrui Young Faculty Program of Shenzhen Pengrui Foundation (Grant No. SZPR2023007) [G.Z.], and the Guangdong Basic and Applied Basic Research Foundation (Grant No. 2023B1515120099) [G.Z.].

Author information

Authors and Affiliations

Contributions

R.M. conceptualized, designed, and implemented the numerical experiments and prepared the manuscript draft; S.T. conceptualized, reviewed, discussed, and supervised this work; X.S. reviewed, discussed, and supervised this work; Y.R. contributed to the optimal configuration analysis during the use stage; C.S. and G.J. contributed to the recycling analysis; J.X. and X.W. reviewed and discussed this work; and X.Z., Q.W., and G.Z. conceptualized, reviewed, discussed, supervised this work and retrieved funding.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Communications thanks Eleni Kastanaki, Shizhang Qiao and the other, anonymous, reviewer(s) for their contribution to the peer review of this work. A peer review file is available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Source data

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Ma, R., Tao, S., Sun, X. et al. Pathway decisions for reuse and recycling of retired lithium-ion batteries considering economic and environmental functions. Nat Commun 15, 7641 (2024). https://doi.org/10.1038/s41467-024-52030-0

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1038/s41467-024-52030-0

This article is cited by

-

Recycling power semiconductor devices

Nature Reviews Electrical Engineering (2026)

-

State evaluation of lithium-ion batteries in energy storage stations based on adaptive noise updating AEKF algorithm

Ionics (2026)

-

Advanced direct recycling enables upcycling of spent lithium-ion batteries

Science China Chemistry (2026)

-

Recycling of High-Purity Lithium Metal from Waste Battery by Photoelectrochemical Extraction at Ultralow Overall Potential

Nano-Micro Letters (2026)

-

Forecasting NMC and LFP battery retirement in China: a novel TFS-SVR-Weibull approach

Journal of Material Cycles and Waste Management (2026)