Abstract

The clean energy transition centered on photovoltaic solar and wind power is widely regarded as the fundamental way to achieve the Paris Agreement’s pledges. The development of clean energies, however, relies much more on critical minerals than that of conventional ones. It is therefore vital to incorporate mineral constraints into integrated assessment modeling and designing of energy transition pathways. To this end, we reexamine the feasibility of China’s energy transition evaluated by 5 typical integrated assessment models, then reconfigure the pathways and assess possible trade and warming risks by designing primary mineral supply, recovery and technological progress scenarios. The results indicate that the contribution of solar and wind power to achieve the Paris Agreement goals may far below our expectation due to critical mineral constraints, and the installed capacity of the targeted two renewables will averagely decline by over 56.7% and 68.9%, respectively, by 2060 under the 1.5 °C warming limit. This may lead to an emission gap of carbon reduction by up to 2.35 GtCO2, which will greatly challenge China’s attainment of carbon neutrality.

Similar content being viewed by others

Introduction

The global average temperature has rose by around 1.1 °C compared with pre-industrialization levels1, posing a great challenge to the achievement of the warming limits of the Paris Agreement2,3,4. The attainment of these goals heavily depends on the large-scale substitution of traditional energy with clean energy such as solar and wind power5. The latest International Energy Agency (IEA) report shows that to achieve the net-zero target, nearly 90% of global electricity generation will come from renewables in 2050, of which solar and wind power account for nearly 70%6. The accelerated deployment of solar and wind power is expected to become an important part of the energy system transition7. This is particularly true for China, who consumed 145 exajoules of energy in 2020, accounting for 26.1% of the world’s total primary energy consumption (TPEC), and makes renewables’ development as the core of its proposed “dual carbon” strategic goals8. In fact, China’s cumulative installed capacity of photovoltaic solar and wind power has reached 253.83 gigawatt (GW) and 281.99 GW, respectively, in 2020, accounting for 35.9% and 38.5% of the world’s total installed capacity9. Thus, it is of importance to examine the feasibility of China’s energy transition pathways centered on the large-scale deployment of renewables like solar and wind power.

Compared with the traditional fossil energy system, the renewable energy system, dominated by solar and wind power, is highly mineral-intensive10. For example, the demand of onshore wind power plants for critical minerals such as chromium, molybdenum, and zinc is 9 times that of gas-fired power plants10; solar power plants require 4000 tonnes of cuprum per gigawatt of installed capacity, which is 4 times the demand of traditional power plants11. These minerals are often labeled “critical” because of their high risk of supply disruption12. Critical minerals have not been uniformly defined because the criticality of minerals is different across countries or regions. Based on the criticality assessment on minerals with special consideration of China’s industrial conditions13, around 20 kinds of critical minerals are defined for China (See Supplementary Table 1 for mineral names and their abbreviations). Mineral demand varies widely across clean energy technologies. Generally, aluminum (Al) and cuprum (Cu) are the cornerstones of all power-related technologies; photovoltaic solar panels mainly rely on argentum (Ag), silicon (Si), cadmium (Cd), tellurium (Te), indium (In), gallium (Ga), selenium (Se), germanium (Ge); onshore and offshore wind power plants require similar types of minerals, mainly boron (B), chromium (Cr), manganese (Mn), molybdenum (Mo), niobium (Nb), nickel (Ni), rare earth (RE), tin (Sn), vanadium (V) and zinc (Zn). In recent years, the link between the energy system and critical mineral resources is becoming increasingly strong14,15, and the clean transition of the energy system will significantly increase the demand for these mineral resources16,17.

In this regard, the estimation of mineral demand18 and the assessment of mineral supply risks19 are attracting wide research and political attentions20. Several studies believe that the supply of critical minerals will restrict the development of green energy technologies21,22 and even hinder the transition to a low-carbon economy23,24, despite that the possible technological advances are expected to reduce the demand intensity for some minerals25. This concern could be especially strict when considering the mismatch between supply and demand in geographical locations and the associated trade risks. To address this concern, this work aims to resolve the mismatch from the perspective of minerals’ trade, and explores the role of trade-contributed mineral’s constraints in energy transition toward carbon neutrality.

Further, considering the resource supply of minerals such as Ag, Te, In and Dy, the pathway of renewables’ development designed in the Fifth Assessment Report (AR6) of Intergovernmental Panel on Climate Change (IPCC) may not be feasible26; and resource shortages of Dy, In, Te, Ga and Nd will also limit the implementation of energy technology strategy in European Union27 and the United States28. While infeasible pathway planning will mislead energy investment and carbon reduction strategy formulation, thereby missing the time window for controlling the global warming rise beyond 1.5 °C and 2 °C, and resulting in irreversible climate damage29,30. Although there are increasing attentions on the constraining of minerals to energy transition, scarcity of them yield results from the robustness perspective, which relies on at least three aspects of modeling works. First, a resource-constrained mechanism has to be proposed in the integrated model framework so as to capture the dynamics of minerals’ demand from non-energy sectors. Second, an integrated assessment model (IAM)-based multi-model framework needs to be built to examine the impact of model uncertainty on the feasibility assessment of pathways, which greatly helps yielding robust results. Third, a coupling optimization model has to be developed by linking the resource-constrained mechanism with the IAMs’ output to reliably reconfigure the pathways of energy transition under the minerals’ constraints. Such modeling works substantially feature this research.

In summary, we conducted a comprehensive assessment of China’s energy transition pathways under the Paris Agreement goals by constructing a reserves-production-demand integrated framework at both the Chinese and global scales. The pathways were generated by 5 representative IAMs, namely, AIM/CGE, IMAGE, MESSAGE, REMIND, and WITCH. As the main result, this study provides timelines and quantities of supply and demand gaps for scarce minerals under several well-set scenarios. To meet the mineral constraints, the capacity of solar and wind power in 2060 expected by the typical IAMs, has to decline by over 56.7%. We then reconfigure the energy transition pathways by developing a coupling optimization model, subject to the mineral shortages, and estimate the resulting emission gaps of carbon reduction. The risks of mineral trade associated with China’s energy transition are also explored in terms of the quantity and timeline of imports and exports. This work underscores the importance of including mineral constraints in the policy-making of long-term energy investment and strategic energy transition toward carbon neutrality.

Results

Mineral demand driven by clean energy transition

In this work, we design four technology combination scenarios under two climate goals (see Table 1 for details). The Paris Agreement targets have created a strong reliance on critical minerals for the development of renewable energy, such as solar and wind. Our cross-model results show that under the 1.5 °C climate target, China’s photovoltaic solar and wind power installed capacity in 2060 will reach 3193 GW and 1986 GW, respectively, accounting for approximately 22.7% and 21.5% of global capacity (Supplementary Fig. 1), which is higher than those under the 2 °C goal. The installed capacity of photovoltaic solar energy in China under the REMIND model is the largest of all models, reaching 9257 GW in 2060, 67 times that in 2020. The same applies to the growth of the mineral demand. However, this situation can be changed in the presence of technological progress that causes a significant decrease in material intensity31 (see Supplementary Note 1 and Supplementary Fig. 2), and this is also true for other models. On average, the total demand of wind and solar technologies in China for 20 minerals under climate targets accounts for about one-fourth of global demand over time (Supplementary Figs. 4 and 5). Due to improvements in material intensity, however, the demand for most minerals shows a slow upward or even inverted U-shaped trend, such as for Ag, B, Cd, Cr, Ge, and Mn. See Supplementary Note 2 for a more detailed analysis.

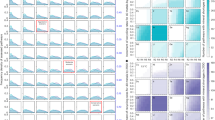

Material recycling is another critical measure to ease the pressure on mineral supply32,33. We considered two mineral recycling scenarios, namely the low recycling rate (LRR) and high recycling rate (HRR) scenarios (Supplementary Fig. 5). Compared to the LRR scenario, recovering more mineral materials from decommissioned equipment will significantly reduce net demand. Take Ag and RE for instances, the cross-model results show that a 35.9% and 38.6% increase in recycling rate is associated with a 296.7% and 47.1% reduction of net demand, respectively (details in Supplementary Note 3). The net demand curve shows an obvious inverted U-shape even though the net demand for some minerals is negative (e.g., Ga, Ge in the LRR scenario and Cr, Ga, Ge, Mn, Ni in the HRR scenario), and it is true for both warming-control scenarios (Fig. 1 and Supplementary Fig. 6). Given the slow deployment of photovoltaic solar and wind power in China before 2020 and their long service lifetime of approximately 20–25 years, the excess demand for these minerals will mostly appear after 2040 (details in Supplementary Note 4).

Net demand of (a) Ag, (b) Al, (c) B, (d) Cd, (e) Cr, (f) Cu, (g) Ga, (h) Ge, (i) In, (j) Mn, (k) Mo, (l) Nb, (m) Ni, (n) RE, (o) Se, (p) Si, (q) Sn, (r) Te, (s) V, (t) Zn under the 1.5 °C + LRR, 1.5 °C + HRR, 2 °C + LRR and 2 °C + HRR scenarios, respectively. Here, LRR and HRR denote the scenarios of low and high recycling rate, respectively. Source data are provided as a Source Data file.

To accurately assess the supply-demand relation of the critical minerals required for China’s clean energy transition, we further consider the net mineral demand for critical minerals in other industries. The net demand curves for critical minerals in other industries also show an inverted U shape, generally peaking in 2049, under both 1.5 °C and 2 °C goals (Supplementary Fig. 7). The net demand for minerals across all industries in China and the world are shown in Supplementary Fig. 8. For most minerals, such as Ag, Ga, Ge, In, Mo, Nb, Se, Si, Te and V, China’s net mineral demand for solar and wind power will account for more than 50% of the net demand for the entire industry in China after 2030, even under the HRR scenario (Supplementary Fig. 9). We also observe differences in results across models and over time. For example, under the 1.5 °C warming limit and LRR scenario, the Ag demand of photovoltaic solar accounts for only 22.9% (AIM/CGE model) and 34.5% (REMIND model) of China’s industry-wide demand in 2020, while when the demand peaks in 2035, this proportion will increase to 49.4% and 66.4%, respectively.

Re-assessment of China’s clean energy transition pathways

Through re-evaluating China’s clean energy transition pathways under the 8 combined scenarios (see Table 1 for details), we find that the constraints of primary mineral supply on the expansion of photovoltaic solar and wind are likely to prevent the realization of China’s clean energy transition under all scenarios. The results identify the minerals that constrain the development of photovoltaic, namely Ag, Cd, In, Se, Te and Cu, and those restricting the development of wind power, namely Sn, Zn and Cu under both 1.5 °C and 2 °C climate targets, from the perspective of both China and global reserves (Supplementary Table 9). This underscores the importance of incentivizing a diversified clean energy system34 that relies less on critical minerals compared to solar and wind power35. The demand for other minerals can be met due to either sufficient domestic reserves or dependence on overseas imports, which will not pose a threat to China’s clean energy transition. Specifically, for photovoltaic solar, the demand for Ga, Ge, Si and Al can be met in all scenarios and all pathways, so they will not constrain its future large-scale development; when moving to the expansion of wind power, the unconstrained minerals are B, Cr, Mn, Mo, Nb, Ni, RE, V and Al instead.

The constrained minerals for different transition pathways are different (Fig. 2). The pathway generated by the IMAGE model is relatively less constrained by critical minerals. For instance, under the LRR + HRV scenario, only Sn could be restricting to achieve the 1.5 °C climate targets, with a global reserve shortage of 1874 kilotonnes. While for the REMIND model, 5 more minerals, i.e., Ag, Cd, Cu, Te, and Zn, will be restrictive for the transition pathways, with the greater shortage in reserve than that of other models, i.e., 5820 kilotonnes. There are also significant cross-model differences in the restrictive mineral types along the same pathway (Fig. 2). For the MESSAGE model, under the 1.5 °C and LRR + LRV scenario, there are 6 constrained minerals. When moving to the LRR + HRV case, the number of mineral types is reduced to 3 (Fig. 2). The stricter the climate target is, the more restrictive the minerals are in the transition pathway. Under the 2 °C and LRR + LRV scenario, there are 4 minerals that constrict the MESSAGE-generated pathway (Supplementary Fig. 10).

Further, Fig. 3 presents the timing of supply-demand imbalance for 8 types of minerals that will be in shortage. For example, Ag faces different resource shortage risks across scenarios and pathways (Fig. 3a). Under the 1.5 °C and LRR + LRV scenario, China’s reserves of Ag will be in short supply from 2032, and the timeline could be extended only to 2044, even considering the limited global mineral reserves. While under the 2 °C and HRR + HRV scenario, the timing of the reserve shortage is shifted back to 2038, despite the mineral demand under some model pathways (e.g., IMAGE, MESSAGE, WITCH) can be met by global reserves. The evaluation results also identify 12 types of minerals that will not constrain energy transition, including Al, B, Cr, Ga, Ge, Mn, Mo, Nb, Ni, RE, Si, and V, as distributed in the top right and top left quadrant (Fig. 3). Actually, China has abundant reserves of Ga, Mo, RE, Si and V (located in top right quadrant), while the reserves of Al, B, Cr, Ge, Mn, Nb, Ni are insufficient (top left quadrant), implying that China’s demand will have to be supported by global reserves since then.

a Ag, Al, B. b Cd, Cu. c Cr, Ga. d In, Ge, Mo. e Ni. f Zn, Mn. g Se, RE. h Nb, Sn, Si. i Te, V. For minerals located in the top right quadrant, the potential spply capacity of China and the world is both sufficient to meet the mineral demand by 2060; for minerals located in the top left quadrant, China’s reserves are not enough to meet its demand in some years, but the global reserves are not in shortage; for minerals located in the bottom left quadrant, neither Chinese nor global reserves are sufficient to meet their mineral demand. Source data are provided as a Source Data file.

It is observable that the pathway given by the IMAGE model is constrained the least by minerals and thus could be the most likely one to follow; and the 1.5 °C and LRR + LRV scenario performs to be in line with current policy expectations and technological development most. The risks of mineral supply and demand imbalance in those contexts are therefore more representative. We found that Sn faces the most severe shortage risk, followed by Cd; the global reserves of Sn and Cd can only support China’s energy transition plan until 2031 and 2037, respectively. The shortage risk of Ag is relatively small, and their global reserves can support China’s transition plan until 2044. For China, the reserves of Zn will face depletion risks before 2030, the global reserves, however, may meet China’s import demand up to 2042. For these minerals, discovering more recoverable reserves by strengthening exploration techniques is an important way of relieving constraints36,37. Compared to the current situation, reserves of Sn, Cd, Zn, and Ag in 2060 need to increase by 300%, 151%, 91%, and 62%, respectively, to meet the demand resulting from the expansion of the solar and wind industry. The results also explore the formidable role of resource recycling in relieving mineral constraints, and this is particularly true for the minerals with lower recovery rates. For minerals with limited recycling potential, such as Ag, Cd, Cu, Sn, and Zn, seeking alternative materials may be more effective to ensure supply.

International trade risks for unconstrained minerals

Throughout the period to achieve the carbon neutrality goal, China will be a net exporter of Ga, and a net exporter of Mo, RE, Si, and V in most years, under the two warming limits. As for Ga, even under the strict 1.5 °C and LRR + LRV scenario, China still has considerable Ga to export before 2060, and this is consistent across all models (Fig. 4a). While for Mo, RE, Si and V, China needs to import these minerals in a certain short period of time.

a China’s industry-wide trade (timing and volume) in unconstrained minerals under the 1.5 °C climate target, and (b) under the 2 °C climate target. The blue and red band represent net mineral exports and imports, respectively. The darker the color, the greater the net export or import volume. Scenarios here are defined as in Table 1. Source data are provided as a Source Data file.

Cross-model results show that the net exports of minerals associated with photovoltaic and wind expansion will account for 0.5% of China’s total Ga exports, with a volume of 14.01 tonnes in 2060. For Mo, RE, Si and V, the proportions are as high as 52.2%, 19.3%, 49.4% and 62.8%, respectively (Supplementary Fig. 11). When moving to a more optimistic scenario, namely the 2 °C and HRR + HRV scenario, China will be able to export more Ga, Mo, RE, Si and V, also with longer export period. From trade policy perspective, China should work on alleviating the phase-by-phase import pressure by increasing storage of Mo (model-averagely from 2041 to 2053), RE (around 2028), Si (model-averagely from 2036 to 2052), and V (before 2045); meanwhile, more attention should be paid to the environmental and ecological damage caused by excess mining exploitation38.

Seen from import, China will be a net importer of Cr, Mn, Nb, Ni throughout the targeted period, and a net importer of Ge, Al, and B in most years, under both 1.5 °C and 2 °C goals. As of 2060, China’s net import demand for these minerals will increase by an average of 149%-754% compared to 2020, under the 1.5 °C and LRR + LRV scenario. According to the cross-model results, the net import demand for Al and Nb in photovoltaic and wind industry will account for 23.5% and 49.7% of the country’s total imports, versus relative smaller import shares for Ni, Cr, Ge, Mn and B, i.e., 6.2%, 2.2%, 0.9%, 0.6% and 0.1%, respectively (Supplementary Fig. 11). This emphasizes the strategic position of Al and Nb in China’s energy transition toward carbon neutrality. The import pressure of these minerals will release to some extent when moving to the 2 °C and HRR + HRV scenario (Fig. 4b). Nevertheless, China still faces tremendous risks in accessing those resources, given the abnormal fluctuations in mineral prices associated with the increasing fierce global competition for mineral resources. Trade data of the United Nations show that, 80% of China’s Cr and 44% of its Mn import are from South Africa in 2020; Ni and Al are mainly imported from the Philippines, Guinea, and Australia, while 40% of China’s Nb are imported from Nigeria. In this context, diversifying the sources of imports, including establishing long-term partnerships or investing in overseas mineral supply chains, could be important ways of risk aversion.

Reconfiguring China’s clean energy transition pathways

The above evaluation results show that China’s clean energy transition pathways generated by targeted models are largely infeasible, if considering the constraints of mineral resources. We thus reconfigure the pathways by constructing a dynamic optimization model coupled with the IAMs. Overall, the inclusion of mineral constraints will greatly suppress the installed capacity of solar and wind power, and cut the expected contribution to controlling the warming limits.

Cross-model results reveal that under the 1.5 °C and HRR + HRV scenarios, the installed capacity of solar and wind power will decrease by 13.5% and 19.0%, respectively, in 2060 (Supplementary Fig. 12a, b). When turning to the conservative 1.5 °C and LRR + LRV scenarios, their decline of installed capacity will expand to 56.7% and 68.9%, respectively (Fig. 5a, b). Material substitution can reduce the decline in installed capacity associated with mineral constraints to some extent (e.g., Cd and Sn are of high probabilities to be replaced, according to existing studies39), still, the installed capacity of the two technologies will decrease by 11.5% and 8.7% respectively, under the most optimistic scenario, that is, 2 °C and HRR + HRV scenario (Supplementary Figs. 14a, b and 15a, b).

a Dynamic comparison of China’s solar installed capacity before and after pathway reconfiguring, corresponding to the solid line and dotted line, respectively. b Carbon emissions before and after pathway reconfiguration. Dynamic comparison of China’s installed capacity of (c) total wind, (d) onshore wind, and (e) offshore wind before and after pathway reconfiguration. The proportions of (f) solar and (g) wind power in TPEC before and after pathway reconfiguration, the colored bars show the corresponding proportions for different models, and the shortened bars indicate a dramatic decrease in values. Source data are provided as a Source Data file.

The decline in installed capacity indicates that the roles of solar and wind power in future energy transition could be greatly weakened (Fig. 5d). Specifically, under the 1.5 °C and HRR + HRV scenario, cross-model results reveal that the proportion of solar and wind power in China’s TPEC in 2060 will drop averagely from 21.3% and 19.8% to 16.1% and 14.8%, respectively in the presence of mineral constraints (Supplementary Fig. 12d and Fig. 5d). Even considering the possible material substitution of Cd and Sn, the corresponding proportions in TPEC still shows a significant decline to 13.3% and 12.5% under the 2 °C and HRR + HRV scenario, and 10.5% and 8.1% under the 1.5 °C and LRR + LRV scenario (Supplementary Figs. 14d and 15d). It is therefore vital to diversify clean energy sources, such as advanced nuclear energy40, or fossil fuels equipped with carbon capture and storage (CCS), to circumvent the constraints of mineral shortages in China’s carbon-neutral vision41.

Emission gaps resulting from mineral-constrained energy transition

The energy demand gap caused by the decline of solar and wind power in energy supply will also hinder the achievement of China’s carbon neutrality and the Paris Agreement pledges, without aggressive energy substitution and conservation measures. Given the limited potential of China’s clean energy, such as hydro and geothermal power, and uncertainties nuclear energy faces due to safety risks, fossil fuels, especially coal, natural gas, and oil, are likely to continue to play an important role in the energy structure. Assuming that the energy demand gap caused by the decline of solar and wind power is supplemented by fossil fuels (with and without CCS, as shown in Supplementary Figs. 16 and 17), then the resulting carbon emissions will increase, causing emission gap of carbon reduction toward carbon neutrality (called the emission gap hereafter for short). The results reveal that the emission gap in 2060 reaches 2351 megatons of CO2 (MtCO2) under the 1.5 °C and LRR + LRV scenario (REMIND model, Fig. 5c), with the model-average value to be 1051 MtCO2; even under HRR + HRV scenario, this model-average gap could still be 466 MtCO2 under both climate goals (Supplementary Fig. 12c). By considering possible mineral substitution, the corresponding average emission gap could be reduced to 894 MtCO2 under the 1.5 °C and LRR + LRV scenario (Supplementary Fig. 13c), and to 399 MtCO2 under the 2 °C and HRR + HRV scenario (Supplementary Fig. 14c).

Uncertainty analysis

Changes in critical parameters such as market share and material intensity may affect the assessment to some extent. To test the uncertainty of our results to key assumptions, we analyzed the results of the 5 IAMs under the LRR + LRV and HRR + HRV scenarios.

We first set a 10% reduction in the market share of photovoltaic solar and wind sub-technologies. Given this change in market shares, the evaluation results indicate that the development pathways of solar and wind power are still constrained by the 8 minerals pointed out in the basic results, but the degree of constraint has decreased. The model-average results show that, under the 1.5 °C and LRR + LRV scenario, the installed capacity, carbon emission gaps, and energy structure of the two renewables have changed by − 2.2%, 0.1%, and − 2.5%, respectively, versus − 2.6%, 0.8%, and − 3.3%, respectively, under the 2 °C and HRR + HRV scenario (Supplementary Fig. 19).

We further set a 10% reduction in the material intensity of the 8 constrained minerals (Ag, Cd, Cu, Te, In, Se, Sn, Zn) based on the basic results, and conclude that these minerals will still limit the large-scale deployment of solar and wind power in China. From the perspective of model average, the installed capacity, carbon emission gaps, and shares of solar and wind power in TPEC under the 1.5 °C and LRR + LRV scenario will also fluctuate within an acceptable range, by − 2.2%, 0.1%, and − 2.5%, respectively compared to the original results, versus − 2.6%, 0.8%, and − 3.3%, respectively the 2 °C and HRR + HRV scenario (Supplementary Fig. 20). The uncertain analysis therefore well verifies the reliability of our basic results.

Discussion

China’s clean energy transition under the carbon neutrality vision will significantly boost the demand for relevant mineral resources. Given the expansion of photovoltaic solar and wind power, China’s total demand for minerals in 2060 will be 12 times higher than that in 2020, accounting for approximately 1/4 of the world’s associated mineral demand. Such enormous growth in critical mineral demand will impose strict constraints on clean energy development from the perspective of global reserves and the potential risk of mineral trade. Specifically, the potential supply of Ag, Cd, In, Se, Te, and Cu cannot support the expansion of China’s solar industry, while the large-scale deployment of wind power will also be severely restricted by Sn, Zn, and Cu. Even for the least constrained pathways that are generated by the IMAGE model, mineral reserves are only sufficient to support China’s energy transition by 2031, which may guarantee the attainment of China’s carbon peaking goal, while not its carbon neutrality vision by 2060.

This study also identified nonrestrictive minerals for China’s clean energy transition, namely, Al, B, Cr, Ga, Ge, Mn, Mo, Nb, Ni, RE, Si and V, due to the sufficient global resource reserves, but several of them, such as Al, B, Cr, Ge, Mn, Nb and Ni, will largely depend on import trade. The fact is that since 2009, export restrictions on critical raw materials have increased fivefold42. For example, Indonesia has banned the export of nickel ore and is considering implementing potential export bans on bauxite, which is a microcosm of increasingly keen competition for mineral resources. Price fluctuations, supply security, and trade frictions may also intensify the potential risks of mineral resource shortages43.

Under the mineral constraints, we reconfigure the energy transition pathways and find that the deployment scale of the wind and solar industry needs to be greatly reduced under the warming limits, even considering the possible material substitutions. In the current scenario (LRR + LRV), the installed capacity of solar and wind power will averagely decline by up to 56.7% and 68.9% respectively by 2060, for reaching the 1.5 °C climate goal. It means that the highly anticipated solar and wind technologies will contribute far less than expected to achieve the warming limits. This could lead to a delayed retirement of fossil-fueled power plants44. By 2060, an accumulate emission gap of up to 54.8 gigatons of CO2 (GtCO2) may emerge, far exceeding the world’s total carbon emissions of 33.6 GtCO2 in 2020, which will cause global temperatures to rise far beyond the agreed thresholds. The results emphasize the significance of including mineral constraints in integrated assessment modeling and policy making of long-term energy development strategies.

The transition to clean energy should prioritize the following aspects. First, it is imperative to enhance the utilization efficiency and recycling of mineral resources, while simultaneously improving technological progress in resource exploration and material substitution, which helps maximizing the potential contribution of solar and wind power to future energy restructuring45,46. It is worth noting that Cu, as a low-cost and relatively abundant material, works on alleviating the constraints of Ag on futures’ deployment of photovoltaic solar power. Second, the government may need to rethink the pace of fossil-fueled power decommissioning, gradually deploying CCS to balance energy safety and carbon mitigation47,48, and strengthening the role of other clean energies, such as biomass, advanced nuclear, and hydrogen49. Third, more attention should be paid on the potential risks of mineral shortages and trade frictions, and the stability of the mineral supply chain should be the focus of energy and climate policy50. Specifically, it is of necessity of establishing a strategic mineral reserve system at both government or enterprise scales, especially for the minerals of Te, In, Sn, Ag, Cd, and Zn, and building a solid trade network with major mineral producing countries by signing long-term supply agreements or participate in development projects of critical mineral resources. In addition, exploring potential international partnerships, especially in geopolitically stable regions, is also important to reduce the risk of supply crises. Further, clean energy equipment manufacturers should be encouraged to participate in the whole supply chain of critical minerals and cooperate in investment, information sharing, and technological innovation to enhance their resilience.

Methods

Installed capacity data for PV solar and wind power

In the CD-LINKs project, a series of IAMs designed energy transition pathways for the world and China under the Paris Agreement climate goals. According to the data requirements of this study, we selected the results of 5 representative models, including AIM/CGE, IMAGE, MESSAGE, REMIND, and WITCH (For a brief introduction to these models, please refer to Supplementary Note 7). Overall, China’s photovoltaic solar installed capacity accounts for nearly a quarter of the world’s total, peaking at 35% in 2060 under the 2 °C climate target. The installed capacity of photovoltaic solar energy in China generated by the REMIND model is the largest, versus the smallest result for the IMAGE model. In terms of wind power development, China’s installed capacity accounts for nearly one-fourth of the global total, but the installed scale of future wind energy is generally lower than that of photovoltaic solar. Onshore wind power accounts for more than 90% of China’s total wind power generation, and the proportion calculated by models like the AIM/CGE model is close to 100% (Supplementary Fig. 1).

Compared with the 2 °C climate target, the more stringent 1.5 °C target requires a much higher degree of energy cleanliness, and the total installed capacity of wind and solar power, the main forces of clean energy, is also larger. This is reflected in the results of most models, including AIM/CGE, MESSAGE, and WITCH. However, we can observe nonlinear fluctuations of results for some models, due to the crowding effect of other technologies in the clean energy system. For example, in the IMAGE and REMIND models, there is a situation in which the installed capacity of wind and solar power under the 2 °C climate target is greater than that under the 1.5 °C target from 2030–2035 and 2045–2060.

Material intensity of minerals

We determine the material intensity of minerals in photovoltaic solar and wind power based on the extant research. The data sources are detailed in Supplementary Table 2, 3, and 4. We assume that technological progress will lead to a continuous decline in material intensity. In general, for minerals required for photovoltaic solar power, the data on material intensity covers the period 2020–2050. We use the trend extrapolation method to obtain data for 2050–2060, while for minerals needed for wind power, most researchers assumed a constant material intensity. We take this data as the initial value in 2020. The dynamic trend of material intensity of minerals required for wind power is obtained according to the average change rate of material intensity of minerals in photovoltaic (Supplementary Fig. 2).

Market share of solar and wind sub-technologies

We consider four representative photovoltaic solar technologies, namely, crystalline silicon (c-Si), cadmium telluride (CdTe), copper indium gallium selenide (CIGS), and amorphous silicon (a-Si)51,52. The global photovoltaic solar market is currently dominated by c-Si technology, with continuous improvement in performance and price advantages, the market share of silicon-based technology will continue to grow18,52. While thin film technologies (i.e., CdTe, CIGS, and a-Si) will gradually disappear from the market by 206018,52. For wind power, there are mainly four technology branches, namely, direct-drive turbines based on electrically excited synchronous generator (DD-EESG), direct-drive turbines based on permanent magnet synchronous generator (DD-PMSG), gearbox turbines based on permanent magnet synchronous generator (GB-PMSG), and gearbox turbines based on double-fed induction generator (GB-DFIG)52. Given its advantages of easy installation, high energy efficiency, and low maintenance costs, PMSG technology remains a key factor for current and next-generation wind turbines52,53. GB-DFIG will still hold a place in the future, while DD-EESG may gradually exit market52. See Supplementary Table 5, 6, and 7 for details of the sub-technologies market shares before 2060.

Calculation of total mineral demands

Given\(\,{{TD\_PV}}_{i}\) and \({{TD\_Wd}}_{i}\) the total demand of photovoltaic solar and wind power (including onshore and offshore), they can then be calculated by Eqs. (1) and (2):

where \({{Cap}}_{i}\) is the installed capacity of photovoltaic solar or wind power in the \(i\)-th year; \({{Int}}_{i}\) is the material intensity of the mineral; and \({{Share}}_{i}\) is the market share of photovoltaic solar or wind sub-technologies. The total mineral demand for photovoltaic solar and wind power in China and the world by 2060 is detailed in Supplementary Figs. 4 and 5, respectively.

Scenario setting for recycling rates

The level of resource recycling is an important manifestation of technological progress and a critical parameter affecting mineral supply and demand. We set the recycling rate scenarios according to the general method of the technological progress pathway, and the specific calculation is presented by Eqs. (3) and (4):

where \({A}_{i}\) refers to the recycling rate of minerals in year i; \({g}_{i}\) is the growth rate of the recycling rate; and \({\delta }_{i}^{m}\) is the growth rate of \({g}_{i}\), with \({\delta }_{i}^{1}\) corresponding to the LRR scenario and \({\delta }_{i}^{2}\) corresponding to the HRR scenario. To a large extent, these parameters are determined by the improvement potential of recycling technology, similar to the approach of Valero et al32.

Specifically, we set two scenarios, namely the low recycling rate (LRR) scenario and the high recycling rate (HRR) scenario. In the LRR scenario, the improvement space for recycling technology is limited, that is, the initial growth rate of the recycling rate (\({g}_{0}\)) will decrease at a relatively large rate (\({\delta }_{i}^{1}\)), then recycling rate (\({A}_{i}\)) will show a slow growth trend, as shown in Supplementary Fig. 5a. While in the HRR scenario, there is much room for improvement in recycling technology, \({g}_{0}\) will decrease at a relatively small rate (\({\delta }_{i}^{2}\)), then \({A}_{i}\) will show a rapid growth trend, as shown in Supplementary Fig. 5b. We also consider the technical differences in recycling rate of different minerals, assuming that the greater the initial recycling rate of a mineral, the slower its technological progress, that is, the smaller the initial growth rate (\({g}_{0}\)). See Supplementary Table 8 for details. The range of the initial recycling rate (\({A}_{0}\)) mainly refers to the United Nations Environment Program (UNEP) report54.

Calculation of net mineral demands

To calculate the net demand for mineral raw materials in the development of photovoltaic solar and wind energy, we consider the service life of the technology in addition to technological advances in recycling. Studies have shown that the life cycle of photovoltaic solar energy is approximately 25 years55, while that of wind power is approximately 20 years56. Accordingly, this paper designs Eqs. (5) and (6) to estimate the net demand.

where \({{Cap}}_{i-25}\) and \({{Cap}}_{i-20}\) are the installed capacity of photovoltaic solar and wind power (covering data from 1995 to 2060), respectively; \({{Int}}_{i-25}\) and \({{Int}}_{i-20}\) are the material intensity of the two technologies (covering data from 1995 to 2060); \({{Share}}_{i-25}\) and \({{Share}}_{i-20}\) are the market share of photovoltaic solar and wind sub-technologies (covering data from 1995 to 2060); and \({{RR}}_{i}\) is the recycling rate of minerals in year \(i\). The historical installed capacity data for photovoltaic solar and wind power in China and the world are from BP, IEA, and GWEC. Since the development of photovoltaic solar and wind technology in the past 25 years has been slower than it is expected to be after 2020, we assume that the market share and material intensity data before 2020 are the same as those in 2020. The net mineral demand in China and the world is shown in Fig. 1 and Supplementary Fig. 6.

Calculation of mineral demand for other industries

This study also determines the net mineral demand in other industries (OI) except wind and solar power generation by 2060, as shown in Supplementary Fig. 7, and its calculation is given by Eq. (7):

where \({{GDP}}_{i}\) refers to the gross domestic product of China or the world in year \(i\) and \({{NMDf}}_{{i}}\) refers to the net mineral demand per unit of GDP in China or the world. This method reflects changes in the usage efficiency of minerals in other industries, and it is helpful to calculate the net demand for minerals in different industries in the process of a country’s development. GDP scenarios are abstracted from the International Monetary Fund (IMF).

Limited by data availability, we estimate the net demand for other minerals based on their initial net demand \({{ND\_OI}}_{2020}\) and the net demand for Ag in other industries. Specifically, the net demand for Ag in other industries is given by Eq. (8):

Due to the improvement of utilization efficiency and recycling technology, the future demand for Ag per unit of GDP is on a downward trend, and its volatility is denoted f. Assuming that the fluctuation trend of \({{NMDf}}_{{i}}\) is the same as for Ag, the unit GDP net demand for other minerals from 2021 to 2060 can be given by Eq. (9):

The initial value of the net mineral demand in other industries \({{ND\_OI}}_{2020}\) is calculated by subtracting the mineral demand in solar and wind power from the demand in the whole industry57. The industry-wide net demand for minerals \({{ND\_AI}}_{i}\) is given by Eq. (10):

We also show changes in the proportion of China’s mineral demand in photovoltaic solar energy and wind energy within the demand in the whole industry from 2020 to 2060 (See Supplementary Figs. 9 and 10).

Scenario design of mineral reserves

Resource reserves mainly depend on resource endowment and progress in exploration technology, including stock and taste of traditional natural mines, supply potential of urban mines, i.e., mineral recovery, ocean mines, and space mines. Given that the current technology cannot support ocean and space mining, the future mineral reserves should be contingent on the first two aspects. We have excluded recoverable mineral volumes from total mineral demand, so assumptions are primarily based on the possible status of conventional natural mines. This paper designs two scenarios, namely, the low reserve volume scenario (LRV) and the high reserve volume scenario (HRV). The LRV scenario assumes that mineral reserves will grow slightly after 2020, and the average annual increment is determined by the general historical trend, considering both its growth and its decline. While the HRV scenario is more optimistic, its average annual increment is only determined by the growing portion of the historical trend. Results of LRV and HRV are presented in Supplementary Fig. 17 and Supplementary Note 5. The reserve data are from the United States Geological Survey (USGS)58.

Forecasting on mineral production

Assuming that the production of minerals follows Hubbert’s peak model, the predicted production curve is characterized by slow growth in production in the short term. The growth tends to increase exponentially over time and then gradually declines after reaching a peak (inflection point), forming a normal distribution curve59. This method has been used to forecast copper60 and iron ore61 production. We thus use this model to determine China’s mineral production by 2060 according to the current mineral constraints (Supplementary Fig. 18). The specific formula is given by Eq. (11):

where \({P}_{M}\left(t\right)\) refers to the production of mineral M in year t, R refers to the resource volume of the mineral, and b0 and t0 are unknown parameters that can be given by fitting them to historical yield data. When \(t={t}_{0}\), the numerical value of the equation reaches the maximum, as shown in Eq. (12):

Assessment criteria for energy transition pathways

Based on the resource exploration technology and recycling rate assumptions given earlier, we design four combined scenarios, namely, LRR + LRV, LRR + HRV, HRR + LRV, and HRR + HRV. The LRR + LRV combines a low recycling rate and low newly added reserves, while HRR + HRV combines a high recycling rate and high newly added reserves; these two scenarios correspond to pessimistic and optimistic technical combination scenarios, respectively. Using these scenarios, we systematically evaluate the feasibility of clean energy transition pathways under mineral constraints. It is assumed that the production and demand balance of each mineral can be achieved at the global scale; that is, global production is equal to global demand. To evaluate the feasibility of China’s transition pathways, we design the following evaluation criteria considering different situations. First, if the remaining reserves in China and the world are both negative from 2020 to 2060, China’s demand cannot be met through domestic production or imports, then the development pathway of clean energy is not feasible. Second, during the inspection period, if China’s remaining reserves are negative but with positive global reserves, the mineral resources required for China’s energy transformation can still be met through imports, making transition pathways feasible. Finally, if the remaining reserves in China and the world are both positive, China’s demand can be met by domestic supply and imports, then the transition pathway is also feasible. The pathway assessment results are shown in Supplementary Table 9 and Figs. 2 and 3.

Calculation of mineral trade volumes

Here, we focus on the international trade of unconstrained minerals that do not strictly affect the expansion of China’s wind energy and photovoltaic solar energy. Denote the mineral trade volume \({MTV}\) and production \({MPV}\), then the specific trade volume can be calculated by Eq. (13):

Obviously, if the trade volume is negative, the trade situation is recognized as a net import; otherwise, it is recognized as a net export. The international trade situation of China’s industry-wide mineral demand is shown in Fig. 4, and the mineral trade demand for wind and solar energy are depicted in Supplementary Fig. 11.

Reconfiguration of clean energy transition pathways

We reconfigure the infeasible energy transition pathway by establishing a dynamic linear optimization model under critical mineral constraints. The objective function and constraints of the model are shown in Eq. (14):

where \(i\in {{\rm{I}}}=\left\{2020,\,2025,\cdots,2060\right\}\); \({x}_{i}\in \left(0,\right.\left.1\right]\) is the reconfiguration coefficient; \({a}_{i}\) gives the installed capacity of the original pathway; \(y\) is the installed capacity of the new pathway; \({{Int}}_{i}\) is the material intensity of minerals; \({{Share}}_{i}\) is the market share of solar segment technologies; \({Q}_{{RM}}\) refers to the recoverable mineral quantity; \({{ND\_OI}}_{i}\) is the mineral demand of other industries; and \({{AS}}_{{Ag}}\) is the available supply of Ag for China. The objective function needs to meet two sets of constraints at the same time, namely, the critical mineral constraints from the deployment of photovoltaic solar and wind energy. The minerals involved in photovoltaic solar and wind technology are shown in Supplementary Table 1.

Identification of carbon reduction gaps

Given the reconstructed pathways under mineral constraints, the development scale of wind and photovoltaic solar power will be greatly reduced, if there are no alternative technical options, the energy supply is still bound to rely on fossil fuels (Supplementary Figs. 16 and 17). Accordingly, we can calculate the resulting emission gaps of carbon reduction (Fig. 5 and Supplementary Fig. 12). Specifically, define the total emission gap \({Gap}\) (Eq. (15)), which is resulting from reduced capacity of solar and wind power \({GapP}\) (Eq. (16)) and \({GapW}\) (Eq. (17)), respectively.

where

\({ty}\) represents a specific fossil-fueled technology with CCS, \({TY}\) is the corresponding technology set, i.e., \({TY}= \left\{{Coal\; with\; CCS},{Oil\; with\; CCS},{Gas\; with\; CCS}\right\}\); similarly, \({tn}\) represents a specific fossil-fueled technology without CCS, and the technology set \({TN}=\left\{{Coal\; without\; CCS},{Oil\; without\; CCS},{Gas\; without\; CCS}\right\}\). Further, \({GapP}\) and \({GapW}\) calculate the emission gaps yielded by supplementing the reduced capacity of solar and wind power with fossil fuels. For example, \({{GapP}}_{{ty}}\) and \({{GapP}}_{{tn}}\) can be calculated via Eqs. (18) and (19), respectively:

\(\alpha\) and \(\beta\) denote the average annual power generation hours of photovoltaic solar and wind power in China; \({\omega }_{{ty}}\) and \({\omega }_{{tn}}\) present proportions the specific fossil fuel with and without CCS, respectively in the total fossil energy (see Supplementary Figs. 16 and 17 for details); \({\gamma }_{{ty}}\) and \({\gamma }_{{tn}}\) give the emission factors of fossil fuels with and without CCS, here the emission factors of coal, nature gas and oil without equipped with CCS are valued at 0.0840, 0.0560, 0.0732 respectively; we can then obtain the corresponding emission factors by considering the different carbon capture rate of CCS (83% for coal, 86% for natural gas and 90% for oil)62; \(\rho=3.6\times {10}^{12}\) is the conversion factor between gigawatt (GW) and joule per hour (J h−1), namely, 1 \({{\rm{GW}}}=3.6\times {10}^{12}\)J h−1; and \(\eta=1.0\times {10}^{15}\) is the conversion coefficient between peta-joule (PJ) and joule (J). By conducting similar calculation to Eqs. (18) and (19), we can obtain \({{GapW}}_{{ty}}\) and \({{GapW}}_{{tn}}\).

Data availability

All data used or generated in this study are provided in the Source Data file and the Supplementary Information file. To be specific, the data of the main results are provided in the Source Data file; the resting data, including the data used in the Supplementary Figs, have been deposited in a GitHub repository: https://github.com/JaelHLee/Zero-Carbon-data/tree/master. The data of sub-technology market shares, the material intensity, and recycling rates used in this study are provided in the Supplementary Information file. The IAMs outputs data used in this study are accessible through https://data.ene.iiasa.ac.at/cd-links/#/workspaces. Source data are provided in this paper.

Code availability

All codes used in this work can be obtained from https://github.com/JaelHLee/Zero-Carbon-code/tree/master.

References

IPCC. Climate Change 2021: The Physical Science Basis. (2021).

Rogelj, J., Geden, O., Cowie, A. & Reisinger, A. Three ways to improve net-zero emissions targets. Nature 591, 365–3 (2021).

UNFCCC. The Paris Agreement. (2015).

Duan, H. et al. Assessing China’s efforts to pursue the 1.5 °C warming limit. Science 372, 378–385 (2021).

Victoria, M. et al. Solar photovoltaics is ready to power a sustainable future. Joule 5, 1041–1056 (2021).

IEA. Net Zero by 2050-A Roadmap for the Global Energy Sector (2021).

Zhang, S. & Chen, W. Y. Assessing the energy transition in China towards carbon neutrality with a probabilistic framework. Nat. Commun. 13, 87 (2022).

Liu, L. B. et al. Potential contributions of wind and solar power to China’s carbon neutrality. Resour. Conserv. Recycl. 180, 106155 (2022).

BP. Statistical Review of World Energy 2021 (2021).

IEA. The Role of Critical Minerals in Clean Energy Transitions. (2021).

Villena, J. Nuevos horizontes para los minerales. Prof. del. cobre. 69–71 (2019).

Mudd G. M. The Resources Cycle: Key Sustainability Issues for the Mining of Metals and Minerals. (2021).

Yan, W., Wang, Z., Cao, H., Zhang, Y. & Sun, Z. Criticality assessment of metal resources in China. iScience 24, 102524 (2021).

Capellán-Pérez, I. et al. MEDEAS: A new modeling framework integrating global biophysical and socioeconomic constraints. Energy Environ. Sci. 13, 986–1017 (2020).

Nassar, N. T., Wilburn, D. R. & Goonan, T. G. Byproduct metal requirements for U.S. wind and solar photovoltaic electricity generation up to the year 2040 under various Clean Power Plan scenarios. Appl. Energy 183, 1209–1226 (2016).

Cherry, C., Scott, K., Barrett, J. & Pidgeon, N. Public acceptance of resource-efficiency strategies to mitigate climate change. Nat. Clim. Chang. 8, 1007–1012 (2018).

Greim, P., Solomon, A. A. & Breyer, C. Assessment of lithium criticality in the global energy transition and addressing policy gaps in transportation. Nat. Commun. 11, 4570 (2020).

Gervais, E., Shammugam, S., Friedrich, L. & Schlegl, T. Raw material needs for the large-scale deployment of photovoltaics - Effects of innovation-driven roadmaps on material constraints until 2050. Renew. Sustain. Energy Rev. 137, 110589 (2021).

Nassar, N. T. et al. Evaluating the mineral commodity supply risk of the U.S. manufacturing sector. Sci. Adv. 6, eaay8647 (2020).

Gulley, A. L., Nassar, N. T. & Xun, S. China, the United States, and competition for resources that enable emerging technologies. Proc. Natl. Acad. Sci. USA 115, 4111–4115 (2018).

Wang, P., Chen, L. Y., Ge, J. P., Cai, W. & Chen, W. Q. Incorporating critical material cycles into metal-energy nexus of China’s 2050 renewable transition. Appl. Energy 253, 113612 (2019).

Li, J. et al. Critical rare-earth elements mismatch global wind-power ambitions. One Earth 3, 116–125 (2020).

Alonso, E. et al. Evaluating rare earth element availability: A case with revolutionary demand from clean technologies. Environ. Sci. Technol. 46, 3406–3414 (2012).

De Koning, A. et al. Metal supply constraints for a low-carbon economy? Resour. Conserv. Recycl. 129, 202–208 (2018).

Elshkaki, A. & Shen, L. Energy-material nexus: The impacts of national and international energy scenarios on critical metals use in China up to 2050 and their global implications. Energy 180, 903–917 (2019).

Grandell, L. et al. Role of critical metals in the future markets of clean energy technologies. Renew. Energy 95, 53–62 (2016).

Moss, R. L., Tzimas, E., Kara, H., Willis, P. & Kooroshy, J. The potential risks from metals bottlenecks to the deployment of strategic energy technologies. Energy Policy 55, 556–564 (2013).

Fishman, T. & Graedel, T. E. Impact of the establishment of US offshore wind power on neodymium flows. Nat. Sustain. 2, 332–338 (2019).

Peters, G. P. et al. Carbon dioxide emissions continue to grow amidst slowly emerging climate policies. Nat. Clim. Chang. 10, 3–6 (2020).

Galán-Martín, Á. et al. Delaying carbon dioxide removal in the European Union puts climate targets at risk. Nat. Commun. 12, 6490 (2021).

Yang, J. et al. Understanding the material efficiency of the wind power sector in China: A spatial-temporal assessment. Resour. Conserv. Recycl. 155, 104668 (2020).

Valero, A., Valero, A., Calvo, G. & Ortego, A. Material bottlenecks in the future development of green technologies. Renew. Sustain. Energy Rev. 93, 178–200 (2018).

Ali, S. H. et al. Mineral supply for sustainable development requires resource governance. Nature 543, 367–372 (2017).

Millot, A., Krook-Riekkola, A. & Maïzi, N. Guiding the future energy transition to net-zero emissions: Lessons from exploring the differences between France and Sweden. Energy Policy 139, 111358 (2020).

Moss, R. L., Tzimas, E., Kara, H., Willis, P. & Kooroshy, J. Critical Metals in Strategic Energy Technologies. (European Commission, Joint Research Center, Institute for Energy and Transport, 2011).

Toro, N., Robles, P. & Jeldres, R. I. Seabed mineral resources, an alternative for the future of renewable energy: A critical review. Ore. Geol. Rev. 126, 103699 (2020).

Larcher, D. & Tarascon, J. M. Towards greener and more sustainable batteries for electrical energy storage. Nat. Chem. 7, 19–29 (2014).

Lèbre, É. et al. The social and environmental complexities of extracting energy transition metals. Nat. Commun. 11, 4823 (2020).

Graedel, T. E., Harper, E. M., Nassar, N. T. & Reck, B. K. On the materials basis of modern society. Proc. Natl. Acad. Sci. 112, 6295–6300 (2013).

Duan, L., Petroski, R., Wood, L. & Caldeira, K. Stylized least-cost analysis of flexible nuclear power in deeply decarbonized electricity systems considering wind and solar resources worldwide. Nat. Energy 7, 260–269 (2022).

Liu, Z. et al. Challenges and opportunities for carbon neutrality in China. Nat. Rev. Earth. Environ. 3, 141–155 (2021).

Kowalski, P. & C. Legendre. Raw materials critical for the green transition: Production, international trade and export restrictions. OECD Trade Policy Papers, No. 269, OECD Publishing, Paris (2023).

Han, L., Chen, X. H., Wang, Y. & Hoang, Y. H. Examining the impact of mineral export controls on sustainable energy transition in the global south. Resour. Policy 98, 105289 (2024).

Achakulwisut, P. et al. Global fossil fuel reduction pathways under different climate mitigation strategies and ambitions. Nat. Commun. 14, 5425 (2023).

Wang, P. et al. Regional rare-earth element supply and demand balanced with circular economy strategies. Nat. Geosci. 17, 94–102 (2024).

Bao, Z., Ptacek, C. J. & Blowes, D. W. Extracting resources from abandoned mines. Science 381, 731–732 (2023).

Fan, J. L. et al. Carbon reduction potential of China’s coal-fired power plants based on a CCUS source-sink matching model. Resour. Conserv. Recycl. 168, 105320 (2021).

Wei, Y. M. et al. A proposed global layout of carbon capture and storage in line with a 2 °C climate target. Nat. Clim. Chang. 11, 112–118 (2021).

Yang, X., Nielsen, C. P., Song, S. & McElroy, M. B. Breaking the hard-to-abate bottleneck in China’s path to carbon neutrality with clean hydrogen. Nat. Energy 7, 955–965 (2022).

Yuan, P. et al. Assessing the supply risks of critical metals in China’s low-carbon energy transition. Glob. Environ. Chang. 86, 102825 (2024).

Elshkaki, A. & Graedel, T. E. Solar cell metals and their hosts: A tale of oversupply and undersupply. Appl. Energy 158, 167–177 (2015).

Carrara, S., Dias, P. A., Plazzotta, B. & Pavel, C. Raw Materials Demand for Wind and Solar PV Technologies in the Transition Towards a Decarbonised Energy System (Publication Office of the European Union, 2020).

GWEC. Global Offshore Wind Report. (2022).

Graedel, T. E. et al. Recycling Rates of Metals: A Status Report (United Nations Environment Programme, 2011).

Stamp, A., Wäger, P. A. & Hellweg, S. Linking energy scenarios with metal demand modeling–The case of indium in CIGS solar cells. Resour. Conserv. Recycl. 93, 156–167 (2014).

Kleijn, R. & van der Voet, E. Resource constraints in a hydrogen economy based on renewable energy sources: An exploration. Renew. Sustain. Energy Rev. 14, 2784–2795 (2010).

Global Mineral Resources Situation Report 2021 [in Chinese] (Global Mineral Resources Strategic Research Center, Chinese Academy of Geological Sciences, 2021).

USGS. Mineral Commodity Summaries 2020 (2020).

Hubbert, M. K. Nuclear energy and the fossil fuel. Drill. Prod. Pract. 95, 1–57 (1956).

Northey, S., Mohr, S., Mudd, G. M., Weng, Z. & Giurco, D. Modelling future copper ore grade decline based on a detailed assessment of copper resources and mining. Resour. Conserv. Recycl. 83, 190–201 (2014).

Mohr, S., Giurco, D., Yellishetty, M., Ward, J. & Mudd, G. Projection of iron ore production. Nat. Resour. Res. 24, 317–327 (2015).

Golombek, R., Greaker, M., Kittelsen, S. A., Røgeberg, O. & Aune, F. R. Carbon capture and storage technologies in the European power market. Energ. J. 32, 209–238 (2011).

Acknowledgements

The authors would like to thank the seminar participants at the University of Chinese Academy of Science, and the referees of its two-round of review in Nature from February to November, 2022, for their helpful comments and suggestions on this paper. All errors and omissions remain the sole responsibility of the authors. Financial supports, the National Natural Science Foundation of China (72274188 to H.D., 72325008 to H.D., 71988101 to S.W., H.L., 72173119, and 72342002 to H.D.), the National Key Research and Development Program of China (2020YFA0608603 to H.D.), and the MOE Philosophy and Social Sciences Innovative Group on “Complex Systems Modeling in Economic Management in the Era of Digital Intelligence, are gratefully acknowledged.

Author information

Authors and Affiliations

Contributions

H.D., W.C., and S.W. designed the study. H.S. and H.D. constructed the methodologies and performed the analysis. H.S., J.H., H.L., P.W., and L.C. interpreted data and model verification. H.S., J.H., and H.D. contributed to visualization. H.S., J.H., and H.D. prepared the first draft. S.W., W.C., and H.D. supervised the study. H.S., J.H., H.D., H.L., W.C., P.W., L.C., and S.W. contributed to revise the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Communications thanks the anonymous reviewer(s) for their contribution to the peer review of this work. A peer review file is available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Source data

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Shi, H., Heng, J., Duan, H. et al. Critical mineral constraints pressure energy transition and trade toward the Paris Agreement climate goals. Nat Commun 16, 4496 (2025). https://doi.org/10.1038/s41467-025-59741-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41467-025-59741-y