Abstract

The electric automotive transition is crucial for achieving carbon neutrality, especially in emerging economies like China. However, the scarcity of critical materials in lithium-ion batteries (LIBs) challenges electric vehicle (EV) deployment targets. Our work delivers a comprehensive framework of EV battery recycling, considering resource compensation, environmental performance, geospatial optimization, and cost feasibility of closed-loop LIB recycling under China’s carbon neutrality. Our findings show that meeting EV deployment targets will widen the supply-demand gap, with cobalt and manganese demand exceeding 2022 production levels by 54-fold and 116-fold, respectively. Battery recycling is crucial for mitigating material scarcity, necessitating a minimum 84% collection rate to stabilize supply by 2060. Battery recycling remains economically viable in most scenarios, generating a net profit of US$58 billion in the optimal scenario. Here, our work underscores inherent trade-offs among integrated metrics, informing battery recycling strategies to strengthen supply chain resilience and advance automotive electrification under decarbonization goals.

Similar content being viewed by others

Introduction

Circular economy strategies, including recycling, are promising to lead the world onto a resilient and renewable path aligned with Sustainable Development Goals1,2,3,4,5. Lithium-ion battery (LIB) recycling, a key component of recycling frameworks in major jurisdictions, mitigates environmental impacts by reducing or offsetting emissions associated with battery raw material production and landfill disposal at end-of-life6,7. China issued extended producer responsibility mandates, urging power battery enterprises and automobile manufacturers to establish a waste LIBs recycling system8. Besides, recycling LIBs using closed-loop recycling technology could alleviate the supply-side scarcity of critical materials (e.g., cobalt, lithium, nickel, manganese) to a varying degree9,10. Therefore, LIB recycling has shown promise in the context of electric vehicles (EVs)11,12,13.

The EV sales volume has been booming amidst China’s carbon neutrality (CN60) target being put forward14,15. The number of EVs is estimated to exceed 10 million (with over 70% market penetration), potentially reducing cumulative passenger car sector emissions in 2050 by half16,17. Such a huge rise in EV demand, particularly related to LIBs manufacturing, raises a concern about the availability of critical materials18,19. EV batteries accounted for ~60% of lithium demand, 30% of cobalt demand, and 10% of nickel demand in 202220, increasing two- to four-fold in just five years. More seriously, nickel, lithium, and cobalt had over 80% of import reliance in China21,22,23. Thus, we pose the imperative questions: To what extent can LIB recycling assist China’s EV deployment ambition under China’s CN60 target? Further, what are the corresponding implications of LIB recycling in terms of environmental performance, spatial configuration, and economic feasibility? Finally, what is the optimal recycling strategy when considering a multidimensional assessment?

Two practical challenges should be considered while answering these questions. First, unclear recycling responsibilities and inadequate infrastructure lead to low battery collection rates24. Informal market entities with poor technical capabilities compete to purchase scrapped batteries as the upstream materials price increases25. Consequently, only 20% of scrapped LIBs flow into formal recycling channels, enlarging the gap between demand and supply of the critical material. Second, the uncertainty of a secondary supply of critical material stems from uncertainty in the technical evolution of batteries26. Valuable cathode materials like nickel manganese cobalt (NMC) and lithium nickel cobalt aluminum (NCA) are favored in LIBs recycling, while EV manufacturing stakeholders, including giants like Tesla, are increasingly focused on lithium iron phosphate (LFP) batteries with the potential risk of soaring prices and unstable supply of critical materials27. Therefore, the lack of long-term insights into battery technology evolution and recycling process could strain EV deployment efforts, creating resource constraints and supply chain vulnerability in the domestic battery industry. To address uncertainty, we devise a scenario-based strategy for LIB recycling (See Methods section for details of scenarios).

With reference to the environmental impacts, the recycling strategy portfolio for LIBs can help reduce the life-cycle carbon emission by partially offsetting the energy consumption and emissions from battery manufacturing and logistics28. However, as emissions from battery manufacturing decrease due to the expected cleaner energy mix, the environmental gains from recycling could also diminish. To account for changes in energy sources, we consider a CN60 electricity mix and incorporate a scenario-based strategy into the life-cycle assessment (LCA), creating a dynamic model to reflect decreasing carbon intensity due to the renewable energy transition.

Economic feasibility is also crucial in determining whether battery recycling is an efficient and versatile industry pillar and must be evaluated across multiple dimensions29. First, process-based cost evaluation, which decomposes the cost produced in the recycling process into discrete analysis units, reveals granular cost differences across various recycling technologies30. Second, financial returns evolve over time owing to the economies of scale driven by technological progress and improved resource allocation. Third, considering the capital-intensive nature of LIB recycling, the optimized spatial configuration can reduce logistics costs, a factor that is often overlooked. To consider all these dimensions, we geographically optimize location-based cost factors and embed them within the process-based cost assessment, providing insight into how the spatiotemporal evolution of LIB recycling configuration affects the supply chain financial costs.

Here, our study evaluates how economically feasible strategies of closed-loop LIB recycling could meet the future LIB material demand and identify the optimal pathway to achieve EV diffusion targets. A lack of deep understanding of this issue could result in delayed EV transition, hindering the process of decarbonization under China’s CN60 target 31,32,33. Here, we develop a dynamic and systemic assessment framework of LIB recycling, elucidating the holistic view of resource compensation, environmental performance, geospatial optimization, and cost feasibility. This customized integrated model incorporates modules to forecast vehicle-specific demand and cathode-specific battery scrappage, explorative scenario-based materials flow simulation, life-cycle environmental assessment, and optimal layout cost modeling. The overview of the model integrating all modules is shown in Supplementary Fig. 1. We find the optimal pathway for the LIB closed-loop recycling system by simulating a range of pessimistic to optimistic situations, considering various LIB retirement patterns, changing cathode chemistries, recycling processes, critical material recycling technologies, and battery collection strategies. Our findings demonstrate that the supply-demand gap for cobalt and manganese is projected to reach 54 and 116 times their 2022 production capacities when EVs are sufficiently deployed under China’s climate goal. The latest direct cathode recycling technologies create synergistic benefits, achieving self-sufficiency in critical materials, offsetting 1550 Mt of cumulative carbon emissions, and generating US$58 billion in recycling profit by 2060.

Results

Historical flows and the demand-supply imbalance of critical materials

Integrated lifetime distribution modeling and dynamic material flow analysis (dMFA), the historical-critical material (including cobalt, lithium, nickel and manganese) flows from EV manufacturing to LIB scrappage in China during 2010–2020 are illustrated in Fig. 1. We assume most of the waste batteries are recycled after echelon reuse for extending the battery lifespan and enhancing resource efficiency. In detail, if the service life of the battery is longer than its warranty period (normal failure battery), 80% percent of the end-of-life battery would be repurposed for echelon applications, and the remaining part would enter the recycling market27. Based on the battery’s state of health (SOH), the option for direct reuse (SOH exceeds 85%; used for the low-speed EVs) or indirect reuse (SOH falls within the range of 80% to 85%; used for the energy storage systems) could be identified. When the SOH is below 80%, the end-of-life batteries would be transferred from the reuse application to the recycling process (See details of battery recycling roadmap from Methods, Supplementary note 4 and Supplementary Fig. 2).

a Cobalt cycle, b Lithium cycle, c Nickel cycle, d Manganese cycle. LIBs lithium-ion batteries, EV electric vehicle, EV-LIBs lithium-ion battery for EVs, Car BEV compact battery electric car, Car PHEV compact plug-in hybrid electric car, Large Car BEV battery electric large car and sport utility vehicle, Large Car PHEV plug-in hybrid electric large car and sport utility vehicle, Mini Car BEV mini-sized battery electric car, Mini Car PHEV mini-sized plug-in hybrid electric car, NCA nickel cobalt aluminum, LFP lithium iron phosphate, NMC nickel manganese cobalt. In the secondary use process, the waste batteries are initially used for the direct application (low-speed EVs) and then used for indirect application (energy storage systems).

The LIB recycling roadmap reveals that the total demand for cobalt, lithium, nickel, and manganese in EV production surged to 204, 222, 602, and 195 hundred tons, respectively, in 2020, a 900-fold increase over 2010 levels (Fig. 1). However, the supply of these materials from recycled sources remains marginal, covering only 1.3% of the demand for cobalt, nickel, and manganese, and an even lower 1.1% for lithium. A huge demand-supply imbalance exists in the closed-loop LIB recycling due to a low battery collection rate. Consequently, the limited recovery of these critical materials intensifies supply risk concerns for the EV industry.

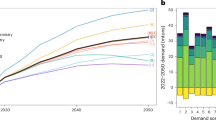

The future adoption trajectory of EVs under China’s CN60 pathway (see details in the Methods and Supplementary note 3) is shown in Fig. 2a. The overall EV adoption will experience rapid growth in the coming years and reach 34 million in 2030, and thereafter, the development of EV will tend to stabilize relatively until 2060. Based on the projected EV demand, trends in scrapped LIBs are illustrated (Fig. 2b–d). There will be 46 Mt waste batteries generated by 2060, 38% of which will come from electrified compact cars and 60% from electric large cars and sport utility vehicles (SUVs) (Fig. 2b). According to the current cathode chemistry market, retired batteries equipped with LFP cathode will account for nearly half in 2060 (Fig. 2c). In terms of battery recycling and cascade utilization, 43% of overall waste batteries in 2060 will be recycled, and 58% will undergo cascade utilization. Among the cascaded batteries, 44% will be used in energy storage systems, and 35% will eventually be recycled (Fig. 2d).

a EV adoption trajectory. b The mass of LIB scrapages. c Scrappage of cathode-specific LIB. d The structure of LIB cascading and recycling use. e The demand and secondary supply gap of critical materials under China’s CN60 target. The black dashed lines denote the overall volumes of EV adoption and LIB scrappage in a, b, respectively. e The left bar represents the demand for critical materials, while the right bar represents the supply from closed-loop recycling; the noted number denotes the cumulative difference between the demand and secondary supply. Car BEV compact battery electric car, Car PHEV compact plug-in hybrid electric car, Large Car BEV battery electric large car and sport utility vehicle, Large Car PHEV plug-in hybrid electric large car and sport utility vehicle, Mini Car BEV mini-sized battery electric car, Mini Car PHEV mini-sized plug-in hybrid electric car, RE replaced battery, NF normal failure battery, ESS energy storage system, Co cobalt, Li lithium, Ni nickel, Mn manganese.

Based on the annual pathway of LIB scrappage and prospective dMFA, Fig. 2e shows that the large-scale demand-supply strain for critical materials will arise when EVs are sufficiently deployed toward China’s CN60 target. The cumulative imbalance (the gap between materials demand and self-sufficiency by closed-loop recycling) will increase substantially over the next four decades to 4638 kt for cobalt, 5226 kt for lithium, 4434 kt for manganese, and 13665 kt for nickel. Notably, the closed-loop supply and demand imbalance for these critical materials exceeds the production capacity. By 2060, the imbalance volumes of cobalt and manganese are projected to reach 54 and 116 times their 2022 production capacities, respectively, exacerbating fragility and interruptions across supply chains34,35,36. In the case of cobalt (its price now looming larger), tied with the low battery collection rate and nascent material recycling infrastructure, its demand and self-sufficiency imbalance is projected to increase to 120 kt by 2060 in China, requiring the equivalent of 60 new average-sized mines to bridge this supply-demand gap37. Such enormous scarcity means that critical material consumption is heavily import-dependent, threatening road transport electrification under China’s climate target.

Demand for critical materials and the corresponding supply from battery recycling

In this work, we develop a scenario combination approach to evaluate EV material demand and recovery in the process of LIB recycling (Fig. 3a). Nine selected scenarios (Table 1) are presented to explore the demand and self-sufficiency imbalance from LIBs and the annual material circularity of cobalt, lithium, nickel, and manganese, considering changing cathode chemistries (CC-LFP, CC-NMC, and CC-NCA), recycling processes (RP-PYR and RP-DIR), LIB service life (SL-HIGH), and material recycling rate (MRR-PRO). The optimal technology scenario (OPT) means that the battery and its recycling technology successfully realize the best technology evolution pathway. The reference scenario (RS) illustrates the current LIB technology and recycling process in China, where the 2020 market share is maintained until 2060 (48% LFP, 6% NMC111, 9% NMC523, 24% NMC622, 7% NMC811, and 6% NCA cathode). Since the waste batteries are likely to end up in regulated and informal recycling channels, the real-world collection rate is uncertain26. To capture its uncertainty and variability, we design three baseline collection rates (65%, 85%, and 100%), reflecting the recycling infrastructure evolution from moderate to ideal assumption over the next 4 decades9,12,38.

a Demand and potential secondary supply from recycling under nine selected scenarios. b Vehicle-specific demand and potential secondary supply in 2060. c Cathode-specific demand and potential secondary supply in 2060. The SP across nine recycling strategies based on three battery collection rates is displayed from the lower to the upper bound. The light red dashed line denotes the breakeven between the demand and secondary supply from battery recycling. The white square indicates the average SP displayed on the secondary axis between 2021 and 2060. RS refers to the baseline scenario in which the cathode chemistry, battery lifespan, recycling technology, and critical material rate develop according to current trends. CC-LFP, CC-NMC,, and CC-NCA represent the LFP-dominated, NMC-dominated, and NCA-dominated cathode evolution scenario,s respectively. SL-HIGH is the high battery service life scenario. Under the RP-PYR and RP-DIR scenarios, the batteries are adopted pyrometallurgical recycling and direct cathode recycling technology, respectively. MRR-PRO refers to the progressive critical material recycling rate. And the OPT scenario denotes the optimal battery technology and recycling technology transition. The scenarios are detailed in Table 1. Co cobalt, Li lithium, Ni nickel, Mn manganese, Car BEV compact battery electric car, Car PHEV compact plug-in hybrid electric car, Large Car BEV battery electric large car and sport utility vehicle, Large Car PHEV plug-in hybrid electric large car and sport utility vehicle, Mini Car BEV mini-sized battery electric car, Mini Car PHEV mini-sized plug-in hybrid electric car, NCA nickel cobalt aluminum, LFP lithium iron phosphate, NMC nickel manganese cobalt.

LIB technology variability will substantially affect the critical material demand and supply in the future. In terms of LIB cathode chemistry, the cobalt demand will reach 164 kt in 2060 for the RS scenario, while the demand would reach 132 kt with the evolution of low-cobalt and high-nickel battery cathode (CC-NMC scenario; NMC cathode with the greatest potential to reach dominant adoption). As long as the cathode chemistry market tends to develop advanced, cheap and cobalt-free materials (CC-LFP scenario; the most common cathode today), the estimated cobalt demand will stand at approximately 35 kt in 2060, as LFP cathode does not contain this high-value material39. In the CC-NCA scenario, the cobalt demand for EVs would peak at 184 kt in 2060; however, closed-loop recycling could yield 87–134% self-sufficiency potential (SP, the percentage of material supply via closed-loop recycling could make up for demand). Although the CC-NMC scenario requires high nickel and manganese, it is not concerning provided that the collection rate of these materials exceeds 84%. The extended battery lifespan in the SL-HIGH scenario dwarfs the SP of each critical material relative to the RS scenario due to the decline of retired batteries (the reduction ranges from 22–34% for cobalt, nickel, and manganese, and 17–26% for lithium).

The recycling technology contributes substantially to the prospective material supplement embodied in LIBs. Direct cathode recycling technology (in the RP-DIR scenario) would achieve 80–123% self-sufficiency in cobalt, nickel, and manganese materials, and 67–104% for lithium specifically, lower than those in the RS scenario in 2060. This technology is at the laboratory stage and has not yet been commercialized, resulting in lower material recovery rates. Pyrometallurgical recycling technology (in the RP-PYR scenario) has the lowest material recovery due to the high-temperature processing and the loss of lithium and manganese in the slag. Additionally, in the best optimal technology practice (OPT scenario), critical materials could be on the verge of reaching a demand-supply balance by 2060 with the theoretically best-case collection rate. Moreover, assuming improved collection practices, the battery collection rate for cobalt, nickel, and manganese in 2060 should rise to 84% and 90% for lithium to exactly achieve the demand-supply balance. Therefore, critical material circularity for LIBs will be vital in the transition to electrifying and decarbonizing the automotive sector along China’s CN60 pathway.

The vehicle-specific contribution analysis in Fig. 3b shows that over 85% of the material recycling is from the battery electric vehicle (BEV) sector, especially electrified large cars and SUVs account for 59%. However, the cumulative secondary supply is difficult to keep up with the cumulative demand in 2060 (accounting for 47–65%). The cathode-specific contribution analysis in Fig. 3c illustrates that under CC-NMC and CC-NCA scenarios, the SP of cobalt, lithium, nickel, and manganese embodied in LIB recycled from dominant cathode chemistry in each scenario ranges from 46–52%, 31–34%, 54–61%, and 0–58%, indicating the closed association of demand and recycling configuration of future critical material with cathode chemistry market.

Life-cycle CO2 emission in LIB

We assess the life-cycle CO2 emissions under nine developed recycling scenarios with medium battery collection rate and emphasize the role of battery recycling in mitigating emissions, considering two energy mixes in electricity grid (Fig. 4). Figure 4a shows the cumulative LIB life-cycle CO2 emission and the shares involving the battery manufacturing, collection, transportation, and recycling under CN60 electricity mix and baseline electricity mix40,41,42. A higher penetration of renewable energy is linked to relatively lower life-cycle emissions from batteries.

a LIB life-cycle CO2 emissions under China’s carbon neutrality electricity mix (CN60 electricity mix) and baseline electricity mix (BAU electricity mix) in 2060. b Battery recycling process CO2 emissions under CN60 electricity mix. c CO2 emissions of vehicle/cathode-specific battery recycling process under CN60 electricity mix. a The bars illustrate the specific material inputs involved in the battery manufacturing process, including steel, aluminum, copper wire, cathode materials, graphite, polyvinylidene fluoride (PVDF), lithium hexafluorophosphate (LiPF₆), electrolyte, and polypropylene. In the circular chart of (a), recycling emissions are shown on the right side of the origin to represent an increase in emissions resulting from the recycling process, indicating their contribution to the lifecycle total. Conversely, recycling emissions are shown on the left side of the origin to represent a reduction in emissions, highlighting the avoided emissions that offset those from battery manufacturing, transportation, and collection. BAU - CN60 value displayed in the secondary axis denotes the difference in cumulative life-cycle carbon emissions between BAU electricity mix and CN60 electricity mix. b The output is the annual avoided carbon emissions from battery recycling. RS refers to the baseline scenario in which the cathode chemistry, battery lifespan, recycling technology, and critical material rate develop according to current trends. CC-LFP, CC-NMC and CC-NCA represent the LFP-dominated, NMC-dominated, and NCA-dominated cathode evolution scenarios, respectively. SL-HIGH is the high battery service life scenario. Under RP-PYR and RP-DIR scenarios, the batteries are adopted pyrometallurgical recycling and direct cathode recycling technology, respectively. MRR-PRO refers to the progressive critical material recycling rate. And the OPT scenario denotes the optimal battery technology and recycling technology transition. Car BEV compact battery electric car, Car PHEV compact plug-in hybrid electric car, Large Car BEV battery electric large car and sport utility vehicle, Large Car PHEV plug-in hybrid electric large car and sport utility vehicle, Mini Car BEV mini-sized battery electric car, Mini Car PHEV mini-sized plug-in hybrid electric car, NCA nickel cobalt aluminum, LFP lithium iron phosphate, NMC nickel manganese cobalt.

Battery manufacturing is a substantial contributor to battery life-cycle emissions, especially in the process of cathode material, accounting for 42–56% of CO2 emissions in the CN60 electricity mix. In addition, CO2 emissions in transportation and scrapped LIB collection have a negligible effect on the life-cycle emissions of batteries (~1–3%). Recycling technology plays an imperative role in the battery’s life-cycle emissions. Especially, the transition to direct cathode recycling in the RP-DIR scenario could cumulatively mitigate 1671 Mt CO2-eq emissions in 2060, equivalently offsetting 55% emissions from other processes.

Figure 4b presents the detailed carbon emissions of battery recycling under the considered scenarios for two electricity mixes. In 2060, cumulative net CO₂ emissions could be reduced by 192–346 Mt in the RS, CC-NMC, and CC-NCA scenarios through battery recycling. The extended lifetime of LIB would help avoid emissions (140 or 147 Mt CO2-eq reduction in 2060 in the SL-HIGH scenario), but slightly lower than the RS scenario. While comparing the emission impact of different recycling processes, we estimate that carbon mitigation with direct cathode recycling over the next 40 years (in the RP-DIR scenario) is ninefold greater for hydrometallurgical recycling (in the RS scenario). Given the optimal battery and its recycling technology (OPT scenario), cumulative CO2 emissions of approximately 1550 Mt CO2-eq will be avoided by LIB recycling in 2060 with CN60 electricity mix, which is equivalent to twice the annual carbon emission of China’s passenger car sector16.

The vehicle-specific breakdown of cumulative CO2 mitigation under the CN60 electricity mix in Fig. 4c indicates that over 85% of the reduction is from BEVs: ~30% from compact cars and ~55% from large cars and SUVs. The cathode-based breakdown reflects that the use of LFP cathodes may increase emissions during the recycling process, potentially adding up to 137 Mt of cumulative carbon emissions. However, if it is linked with advanced recycling technologies, specifically direct cathode recycling in the RP-DIR scenario, considerable emissions (−430 Mt) could be avoided.

Economically feasible LIB recycling considering the synergy of optimizing geospatial configuration

Battery recycling offers significant benefits for resource conservation and emission reduction, but the cost feasibility of different recycling strategies requires further investigation, as it determines the potential for the commercial deployment of the industry. Using a process-based cost evaluation approach, this study evaluates the costs associated with recycling, considering phases such as transportation and collection, disassembly, and the recycling process. Our breakdown model incorporates multiple cost components, including materials and energy costs, direct labor, capital investment, variable overhead, and research and development. Furthermore, the effects of economies of scale are embedded in the analysis, indicating that during the early stages of the recycling process, fixed and operational costs decline as recycling scales up, driven by technological progress and improved resource allocation. This cost-reduction mechanism plays a crucial role in enhancing economic feasibility.

Our cost model incorporates the optimal spatial layout of battery recycling facilities to minimize long-distance transportation and collection costs, enhancing resource recovery efficiency and regional supply chain resilience to support the circular economy. Given China’s vast geography and the dispersed distribution of retired batteries, a well-structured recycling network (and cascading use facilities; the Chinese government has approved 156 retired LIB recycling operators, including those focused on recycling and cascading use) is essential to avoid increased transportation costs and risks, such as fire or explosion during the transport of hazardous materials. The spatial layout also interacts with economies of scale. In areas with high battery supply, centralized recycling hubs promote industrial clustering through shared logistics, technology, and supply chains, driving down costs. In remote regions with lower battery availability, distributed facilities help reduce logistics costs. Our results of optimizing geospatial configuration suggest that large-scale recycling hubs and cascading use facilities should be established in battery-rich regions such as Guangdong, Henan, and Chongqing, as well as in areas connecting remote locations like Jilin, Guizhou, and Shanxi.

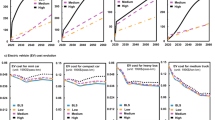

We analyze the unit costs associated with battery recycling under focused recycling strategies (Fig. 5a). Based on the spatial distribution of battery recycling facilities, the unit costs for the collection and transportation of end-of-life LIBs are optimized and remain stable over time. Across different battery cathode chemistries, transportation and collection costs range from $0.98 kg−1 to $1.05 kg−1 between 2030 and 2060. When aggregating costs and revenues across transportation and collection, disassembly, and recycling processes, we observe that unit recycling costs (or revenues) are shaped by economies of scale, driven by recycling expansion and technological progress. Although LFP batteries, made from inexpensive materials, are not economically suited for hydrometallurgical recycling, they still benefit from economies of scale, with unit recycling losses narrowing from $2.05 kg−1 in 2030 to $2.00 kg−1 in 2060 under the RS scenario. Conversely, the unit profit for NCA battery recycling rises from $0.74 kg−1 in 2030 to $0.89 kg−1 in 2060; the unit profit of NMC111 battery recycling increases from $1.67 kg−1 in 2030 to $1.81 kg−1 in 2060. Among the various recycling processes, direct cathode recycling stands out as the most cost-effective, yielding positive revenues even for LFP batteries. Under the OPT scenario, the unit profit of LFP battery recycling grows from $1.30 kg−1 in 2030 to $1.32 kg−1 in 2060. Other cathode chemistries achieve even higher unit profits over this period: NCA from $4.10 kg−1 to $4.18 kg−1, NMC111 from $4.01 kg−1 to $4.06 kg−1, NMC532 from $4.17 kg−1 to $4.21 kg−1, NMC622 from $4.35 kg−1 to $4.37 kg−1, and NMC811 from $4.16 kg−1 to $4.22 kg−1 (See more details of the unit costs in Supplementary Data 1–6).

a Unit battery recycling costs and profits in 2030 and 2060. b Recycling cost assessment of LIBs at the industry level across nine recycling scenarios. RS refers to the baseline scenario in which the cathode chemistry, battery lifespan, recycling technology, and critical material rate develop according to current trends. CC-LFP, CC-NMC, and CC-NCA represent the LFP-dominated, NMC-dominated, and NCA-dominated cathode evolution scenarios, respectively. SL-HIGH is the high battery service life scenario. Under RP-PYR and RP-DIR scenarios, the batteries are adopted pyrometallurgical recycling and direct cathode recycling technology, respectively. MRR-PRO refers to the progressive critical material recycling rate. And the OPT scenario denotes the optimal battery technology and recycling technology transition. In each scenario of (a), the left dot denotes the unit battery recycling costs/profits in 2030, while the right dot indicates the unit battery recycling costs/profits in 2060, reflecting the impact of economies of scale. The battery recycling net profits aggregate the cost and revenue of disassembly and recycling processes, and the cost of transportation and collection related to LIB recycling.

The costs associated with battery recycling at the industry level are compared across nine recycling scenarios, as illustrated in Fig. 5b. The results indicate that the CC-LFP scenarios incur the highest recycling costs, reaching a total loss of $3 billion by 2060. In contrast, the OPT scenario yields the highest recycling profit, primarily due to the adoption of direct cathode recycling technologies and advanced infrastructure, which maximize the material recycling rate for high-value materials, generating a net profit of $58 billion. Overall, battery recycling remains economically feasible under most scenarios, emphasizing the significant influence of recycling technologies on financial outcomes. Furthermore, the material recycling rate plays a crucial role in determining economic feasibility across different battery chemistries.

Discussion

Shifting to EVs is a compelling strategy to decarbonize the transport sector, but the scarcity of critical materials embodied in LIBs may delay the EV deployment schedule to achieve China’s climate target. When EVs are fully deployed on China’s CN60 path, the closed-loop supply of critical materials remains insufficient to meet demand, far surpassing mining production capacities. By 2060, shortages of cobalt and manganese are expected to reach 54 and 116 times their 2022 production levels. The cobalt shortage in China in 2060 will reach 120 kt, ninefold that in 2021, requiring the equivalent of 60 new average-sized mines. According to official data, China’s cobalt reserves only constitute 1.1% of the global total43, partly because the cobalt concentration in domestic deposits is very low (~0.02%)44; however, this emerging economy is responsible for 39.7% of cobalt consumption45, a large portion for LIB manufacturing. Subjected to price volatility, diverse geopolitical influence, supply uncertainties, and globally intensifying trade frictions, cobalt, regarded as more insecure than oil, may incur dramatic supply risk in the medium and long run46,47,48. Thus, China may be obliged to slow its EV action plan because of the deficient supply of critical materials, affecting its climate target.

LIB recycling has the potential to handle critical material shortages to support fleet electrification and bring substantial environmental co-benefits. Our scenario-based simulations suggest that critical materials, except lithium, could achieve a demand-supply balance under the optimal direct cathode recycling technology, while also offsetting 55% emissions from other processes in the LIB supply chain. Battery collection rate advancement driven by relevant regulations to construct an efficient recovery system is a vital strategy to achieve self-sufficiency of critical materials. To achieve a balanced supply and demand for cobalt, nickel, and manganese in 2060, the required battery collection rate is up to 84%, which is 90% for lithium. Generally, most batteries go missing at the end of their lifecycle rather than being available to recyclers. Since there is no clear pricing mechanism for power battery recycling in China, many LIBs flow to irregular market participants, such as small workshops and second-hand car markets, by means of bidding on scrapped cars installed with spent batteries, resulting in few batteries being obtained by officially certified battery recyclers49,50. Policymakers concerned with resources and the environment should pay attention to establishing sound regulations and standards to propel the battery recycling industry. For example, an extended producer responsibility system and design for remanufacturing, reuse, and recycling should be promoted to stimulate closed-loop recycling among manufacturers51,52.

The cathode chemistry development of LIBs affects critical material recovery and environmental performance. Cathode market structure has a critical influence on the absolute volume of demand and recycling of critical materials; for example, the demand for cobalt and manganese can vary significantly, depending on the different cathode chemistries used. NCA, with cathode chemistry beneficial not only for the circularity potential of critical materials but also for environmental improvement, represents a technology challenge for many LIB producers due to its delayed research. Although inexpensive-material cathode technology (LFP currently) could help reduce China’s dependence on critical materials like cobalt, manganese, and nickel, it fails to address the lithium shortage as long as LIBs remain the mainstream technology. Moreover, this cathode type is the least effective in mitigating emissions. As EV adoption accelerates under China’s CN60 target, lithium will play an increasingly vital role in the national economic system17,53. Therefore, greater research efforts should be directed toward advancing battery cathode technology, such as sodium batteries, which serve as a low-cost alternative to LIBs and are crucial for alleviating the burden on the critical materials supply chain caused by LIBs54,55.

Techno-economic evaluation determines whether resource-efficient and environmentally friendly battery recycling strategies can achieve commercial viability, supporting EV deployment under climate targets. Our analysis indicates that while NMC and NCA battery recycling are financially advantageous, LFP battery recycling is economically viable only when direct cathode recycling technology is applied. This finding highlights the importance of integrating advancements in cathode chemistry, recycling technologies, and infrastructure improvements to enhance cost efficiency. The transition to optimized battery compositions and recycling strategies presents the most effective solution, as direct cathode recycling combined with high material recovery rates maximizes resource utilization and enhances economic returns. Furthermore, economies of scale are evident across all recycling scenarios as the recycling scale expands.

Our cost assessment model accounts for the impact of spatial configuration on the recycling supply chain, showing that a well-planned layout improves system efficiency and financial sustainability, and lowers environmental burdens. Ideally, optimizing logistics pathways can reduce the unit transportation cost of end-of-life EV batteries to $0.98–1.05 km−1. Policymakers must consider the spatial deployment of recycling facilities to balance economies of scale with logistics efficiency, ensuring an optimal distribution of resources and enhancing battery recycling industrial clustering benefits.

In summary, it is imperative to account for multiple factors to select the most suitable and well-founded battery recycling strategy due to trade-offs between critical material supply and demand, environmental impacts, and technological cost (Supplementary Tables 27–29 and Supplementary Fig. 31). Cutting-edge cathode direct recycling technology brings potential benefits to resource availability, environmental performance, and economic gain. Therefore, advancing toward commercial-scale application is crucial for the technology’s future trajectory. LIB recycling performance with the state-of-the-art facility presented in a best-case material recovery condition would achieve a 30%–41% material surplus after satisfying the material demand of EV deployment. In terms of strategy involving extending battery lifespan, although a reduced quantity of batteries would lead to lower emissions, it inevitably results in the lowest self-sufficiency potential of critical materials. Moreover, despite closed-loop recycling supplying lower critical materials for EV deployment at the material level when shifting towards the direct cathode recycling technology, it helps with the preservation of structure and composition of LIBs, the improvement of material reuse, and the maximization of environmental benefit and economic revenue. By integrating optimal battery and recycling technology, secondary supply through recycling could basically balance the supply and demand of critical materials, and achieve decreased life-cycle CO2 emission and maximum yields. To better support EV deployment under China’s emission mitigation pledge, the balanced and tailored selection between the resource, environment, and economic benefits is urgently required.

There are some limitations in this study. The impacts and contributions of our findings are limited to the domestic market of China, while the international products trade (such as EVs, LIBs, and critical materials) could potentially impact the demand-supply structure. Future studies can investigate optimal pathways for LIB recycling, considering geopolitical dynamics in a global economy. Moreover, while we consider three different cathode chemistries (LFP, NCA, and NMC), there is an uncertainty in the required resources and the environment of the battery recycling process due to evolving battery technology. For example, if the adoption of lithium-air, lithium-sulfur, sodium batteries, and solid-state batteries becomes more predictable, the future supply chain of LIBs and critical materials will be substantially altered. Future studies could consider broader cathode chemistry while modeling the battery market dynamics.

Methods

Modeling overview

We develop a unified, system-level model for analysis of the demand-supply dynamic of critical materials, carbon environmental impacts, optimal geographic layout, and economic prospects associated with LIBs embodied in EVs under China’s CN60 target. Our integrated model contains six major modules related to future EV uptake, battery scrappage dynamics, critical materials cycle, life-cycle CO2 emissions, recycling layout optimization, and cost-effectiveness quantification. The modeling framework can be found in Supplementary Note 1 and Supplementary Fig. 1.

In detail, we first construct China’s CN60 target using the Global Change Assessment Model (GCAM; https://github.com/JGCRI/gcam-core), which simulates the future climate scenarios through the combination of the Shared Socioeconomic Pathways (SSPs) and Representative Concentration Pathways (RCPs)56. We then couple the GCAM model with the bottom-up strategy, such as the technologically rich Bass model, predicting the EV adoption trajectory under China’s CN60 target. Then, based on retirement patterns (estimated by a Weibull distribution) of various EV types, including compact car, large car and SUV, mini car, light truck, medium truck, and heavy truck, the vehicle-specific end-of-life LIB generation is simulated using dMFA27. The battery’s secondary and recycling use, based on battery service lifespan and its SOH distribution, are modeled. Further, we examine the retrospective and prospective material demand and recovery of cobalt, lithium, nickel, and manganese at the pack level based on stock-driven dMFA. Note that our nested dMFA covers three layers, ensuring that flows from EVs to LIBs to materials3. The vehicle stock determines the waste battery stock and thus determines its inflow and outflow. The LIB flow is a determining factor for the critical material requirement. Subsequently, estimates of co-benefits with CO2 reduction are also considered by LCA57. The processes, including battery manufacture, transportation, collection, and recycling, are considered in LCA. Since the traditional LCA is static and may amplify the environmental benefits in the long term, we obtain the electricity mix by the GCAM model under China’s CN60 scenario and update the carbon emission factor every 5 years from 2020 to 2060 to capture the dynamic electricity emission in the battery manufacturing and recycling process. Next, the location-optimized logistics model is refined by minimizing transportation distance and cost, generating an optimal configuration for the flow of end-of-life batteries from potential collection sites to recycling facilities. Finally, leveraging the process-driven EverBatt model, we assess the recycling cost composition of LIBs, and the effect of economies of scale stemming from recovery activities is considered. The optimal spatial and temporal configuration of recycling facilities, derived from the recycling geospatial optimization model, is input into the cost evaluation process to minimize transportation and logistics expenses along the LIB supply chain.

The forecasting of EV adoption under China’s carbon neutrality target

We construct an integrated top-down and bottom-up model to simulate the EV deployment trajectory under China’s CN60 target, which directly determines the demand for critical materials (See details in Supplementary Note 3). In the top-down module, we use the GCAM model to assess the interaction between socioeconomic, energy, and climate systems, simulating the outlook for future sustainable mitigation. Through converging SSP1 (Sustainability-Taking the Green Road) with regional-level RCP pathway (China’s net-zero emission objective), China will achieve net-zero carbon dioxide emissions by the year 206058. We then link this macroeconomic model to the bottom-up strategy for the passenger car sector and truck sector modeling.

Two different bottom-up models are employed for the car and truck sectors, owing to delayed levels of electrification and insufficient historical data on trucks. For the passenger car, we consider the Bass model to capture the role of influential elements59, e.g., vehicle ownership costs, infrastructure factor, and user’s driving behavior, in the electrified passenger car adoption. By inputting the parameters such as socioeconomic development, population, vehicle share, energy, and carbon price obtained from the GCAM to the Bass model, we couple these two forecasting models, outputting the long-term S-shaped growing trend of EVs. The methodological framework of the truck is based on the stock-driven dMFA model27. We calculate the vehicle-specific (e.g., light truck, medium truck, and heavy truck) stock associated with the vehicle traveled kilometer, transportation demand, and load factor (obtained from GCAM). The inflow and outflow of the truck sector can be identified once its stock is determined. Therefore, truck adoption and scrappage trajectories are simulated.

LIB scrappage roadmap

The wasted batteries could be recycled from three sources27: i) Battery replaced by early failure. When the battery failure occurs during its warranty period (8 years)27,60, some of the batteries (70%) could be repaired and reused in the EV. However, the rest of the parts (30%) are replaced and then enter the recycling market. ii) Recycling from the echelon. In terms of normal failure batteries (the service life of LIBs exceeds their warranty period), there are two end-of-life pathways available: recycling and cascading use. To extend the battery lifespan and maximize flexibility in applications, most part of the battery is prioritized for second-life use before recycling. The batteries enter into the echelon accounting for 80% proportion from the overall normal failure batteries. Battery SOH above 85% would be reused directly in low-speed EV applications (Direct reuse). SOH between 80% and 85% would be reused in the energy storage systems (Indirect reuse)12. Until the condition of SOH below 80% is satisfied, eventually, the batteries are collected into the recycling market61. iii) Direct recycling. Except for the cascaded utilization of normal failure batteries, the remaining part (20%) of normal failure batteries is directly recycled. The stages of the battery pack calendar and cycle lifetime for LIBs are illustrated in Supplementary Figs. 2 and 3. See more details in Supplementary Note 4.

Scenario settings

To evaluate the integrated influence of technical, economic, environmental, and spatial factors, we adopt the explorative scenario-based analysis. Given the uncertainty of forecasts of markets and technologies, we take diverse aspects of potential scenarios, involving LIB retirement patterns, cathode chemistries, recycling processes, and recycling advancement, into consideration, as listed below and detailed in Table 1. We define two LIB retirement patterns (low and high battery service life), four changing cathode chemistries (business-as-usual, LFP-dominated, NMC-dominated and NCA-dominated cathode), three recycling processes (pyrometallurgical recycling process, hydrometallurgical recycling process and direct cathode recycling process), two critical material recycling technologies, and three battery collection rates driven by the assumption of recycling infrastructure advancement (low, medium, and high battery collection rate). See detailed scenario and parameter settings in Table 1, Supplementary Note 2 and Supplementary Table 1.

Simulation of critical material flows

We use a dMFA method to quantify the retrospective flows of critical materials embedded in China EV batteries from 2010 to 2020. We consider the material lifecycle, including EV manufacturing, EV use, LIB use, LIB secondary use, and LIB waste management and recovery. The stocks in use and waste flow generation are simulated by historical EV consumption and retirement curves (e.g., waste stream in LIBs from battery use to waste management and recovery)62. Here, we assume that the EV stock in use before 2010 is marginal due to its limited consumption. Meanwhile, we deduce the other upper- and lower-stream flows by the mass balance principle and transfer coefficients (e.g., recycling rate) from statistics and literature.

Based on a prospective product-specific stock-driven model, the expected material demand and recovery of cobalt, lithium, nickel, and manganese under different scenario settings are quantified63. Specifically, we model the demand for these critical materials in terms of EV use, as well as upstream and downstream flows on the basis of the current use situation and development potential for technological transition. These critical materials are simulated by the battery capacity and density, material intensity, fleet type, fleet lifespan, LIB capacity, battery cathode chemistry market shares, and material recycling level.

Calculating the future life-cycle CO2 emissions of a battery

In our work, the research boundary covers the life-cycle stage of LIBs (see details in Supplementary Note 6). Specifically, LCA is employed to evaluate an environmental load, Global Warming Potential, from battery manufacturing, transportation, collection, and recycling64,65. In relation to battery manufacturing, the primary emissions originate from the production of battery cathodes. Thus, we model the battery cathodes first by the LCA method and then incorporate them as a vital material input in the cathode-specific battery manufacturing process. In reference to battery recycling, the carbon emissions of 1 kg of batteries in recycling technology, including pyrometallurgical, hydrometallurgical, and direct cathode recycling technologies, under different recycling and cathode chemistry scenarios are computed. Note that there are two elements considerably affecting the battery emissions in these stages. One is the battery capacity or density, which profoundly affects the material and energy input and output in the assessment process. The other is the future electricity mix. Ignorance of the electricity decarbonization would result in the biased estimation of carbon emission as the penetration of renewable energy increases. Therefore, we also explore carbon emissions in the extended battery capacity (density) and grid-cleaner transition scenarios. We obtain the future electricity generation structure under China’s CN60 scenario, simulated by the GCAM model as well. The input of energy and feedstock, and output of carbon emissions in manufacturing and recycling processes are determined by Simpro 9 software66 (with ecoinvent 3.8 database, updated in September 2021 for up-to-date battery data module).

In addition, the GREET 2023 model (https://www.anl.gov/topic/greet) was developed for vehicle- and fuel-technology-related energy and environmental assessment67,68, which is employed in our work to evaluate carbon emissions in transportation and the collection of LIBs. First and foremost, we need to ascertain the transportation and collection distance. We use ArcGIS to calculate the distance of transportation and collection, comprehensively considering multiple factors such as road networks, population distribution, automotive service facilities, energy infrastructure, etc. The average distance from the LIB manufacturer to the EV manufacturer is 301 km; the average distance from the EV manufacturer to the EV dealers is 392 km. Nowadays, the extended producer responsibility is complemented, and thus EV manufacturers are collaborating with their EV dealers to recycle scrapped batteries69. For this reason, we assume the average collection distance is obtained between EV dealers and authorized waste LIB recycling operators. The average distance to collect the LIBs from EV dealers to LIB recycling operators is 231 km. The detailed distance information of LIB manufacturers, EV makers, EV dealers, and LIB recycling operators is shown in Supplementary Data 1–6.

Optimizing the geospatial configuration of battery recycling

We employ Location-Allocation analysis in ArcGIS to optimize the spatial distribution of battery recycling facilities by identifying optimal locations and minimizing transportation costs between collection points and recycling sites70 (See more details in Supplementary Note 7). The analysis integrates high-resolution road networks, candidate facilities, collection points, and transportation infrastructure to reflect real-world connectivity. Economic-technical and geospatial factors such as demographics, automotive service facilities, and energy infrastructure are incorporated to enhance site suitability assessment. In alignment with national policies on battery recycling, EV manufacturers’ sales networks are used as proxies for collection points, and authorized operators are identified as potential recycling or second-life facilities. Battery waste volumes are allocated across collection points based on population distribution.

The Location-Allocation analysis defines recycling sites as facilities and collection points as demand nodes, minimizing total travel distances and logistics costs71. Facility layouts are re-optimized every decade, offering dynamic insights into the evolution of LIB recycling and second-life utilization networks from 2020 to 2060.

Cost assessment associated with battery recycling

We assess the costs associated with battery recycling using the EverBatt model, a process-based, modular techno-economic analysis tool developed by Argonne National Laboratory72,73 (See more details in Supplementary Note 8). EverBatt divides closed-loop battery recycling into submodules, including logistics and collection, disassembly and preprocessing, and recycling process74. The model incorporates economies of scale, simulating how costs evolve as production scales up or down. Inputs for the recycling process include material costs, direct labor, capital equipment, and building costs. EverBatt supports customized parameter inputs, enabling tailored scenario analysis. We further integrate the model with a spatial location optimization model to link optimal recycling logistics routes to EverBatt’s transportation and collection module70. This combined approach allows us to evaluate cost-effectiveness under various recycling strategies while minimizing transportation routes, ensuring efficient economic performance and environmental sustainability across the battery recycling network.

Data availability

All data used in this study are publicly available. The energy input and carbon emissions in the battery manufacturing and recycling process are obtained from the ecoinvent 3.8 database (updated in September 2021 for up-to-date battery data module) at https://simapro.com/. The data supporting and generated in this study are provided in the Supplementary Information, Supplementary Data 1–6 and Source Data file. Source data are provided with this paper.

Code availability

The simulation of China’s carbon neutrality target is based on the GCAM model. GCAM model is an open-source integrated assessment model, available at: https://github.com/JGCRI/gcam-core. Projections on future EV adoption and battery scrappage, and the critical material inflow and outflow, are conducted using MATLAB. The energy input and CO2 emissions in the battery manufacturing and recycling process were determined by the Simpro 9 software. The emissions in battery transportation and collection are computed by ArcGIS and GREET 2023 (https://www.anl.gov/topic/greet). The geospatial configuration of the battery recycling facility is optimized by ArcGIS. The cost feasibility analysis is determined by EverBatt 2023 (https://www.anl.gov/amd/everbatt). Code is available with this paper, which is deposited in the Zenodo database under the accession code https://zenodo.org/records/15342229.

References

Govindan, K. How digitalization transforms the traditional circular economy to a smart circular economy for achieving SDGs and net zero. Transport. Res. Part E: Logist. Transport. Rev. 177, 103147 (2023).

Song, L. et al. China’s bulk material loops can be closed but deep decarbonization requires demand reduction. Nat. Clim. Change 13, 1136–1143 (2023).

Aguilar Lopez, F., Lauinger, D., Vuille, F. & Müller, D. B. On the potential of vehicle-to-grid and second-life batteries to provide energy and material security. Nat. Commun. 15, 4179 (2024).

Franks, D. M., Keenan, J. & Hailu, D. Mineral security essential to achieving the sustainable development goals. Nat. Sustain.6, 21–27 (2023).

Morseletto, P. Targets for a circular economy. Resour. Conserv. Recycl. 153, 104553 (2020).

Vaccari, M. et al. Assessing performance in lithium-ion batteries recycling processes: a quantitative modeling perspective. Resour. Conserv. Recycl. 206, 107643 (2024).

Harper, G. et al. Recycling lithium-ion batteries from electric vehicles. Nature 575, 75–86 (2019).

Li, K., Qin, Y., Zhu, D. & Zhang, S. Upgrading waste electrical and electronic equipment recycling through extended producer responsibility: a case study. Circ. Econ. 2, 100025 (2023).

Liu, M., Liu, W., Liu, W., Chen, Z. & Cui, Z. To what extent can recycling batteries help alleviate metal supply shortages and environmental pressures in China?. Sustain. Prod. Consum. 36, 139–147 (2023).

Dunn, J., Kendall, A. & Slattery, M. Electric vehicle lithium-ion battery recycled content standards for the US – targets, costs, and environmental impacts. Resour. Conserv. Recycl. 185, 106488 (2022).

Richter, J. L. A circular economy approach is needed for electric vehicles. Nat. Electron. 5, 5–7 (2022).

Baars, J., Domenech, T., Bleischwitz, R., Melin, H. E. & Heidrich, O. Circular economy strategies for electric vehicle batteries reduce reliance on raw materials. Nat. Sustain. 4, 71–79 (2021).

Xu, C. et al. Electric vehicle batteries alone could satisfy short-term grid storage demand by as early as 2030. Nat. Commun. 14, 119 (2023).

Liang, X. et al. Air quality and health benefits from fleet electrification in China. Nat. Sustain. 2, 962–971 (2019).

Yu, Y. et al. Which type of electric vehicle is worth promoting mostly in the context of carbon peaking and carbon neutrality? A case study for a metropolis in China. Sci. Total Environ. 837, 155626 (2022).

Chen, W. et al. Carbon neutrality of China’s passenger car sector requires coordinated short-term behavioral changes and long-term technological solutions. One Earth 5, 875–891 (2022).

Sun, X., Hao, H., Zhao, F. & Liu, Z. The dynamic equilibrium mechanism of regional lithium flow for transportation electrification. Environ. Sci. Technol. 53, 743–751 (2019).

Zhang, C., Zhao, X., Sacchi, R. & You, F. Trade-off between critical metal requirement and transportation decarbonization in automotive electrification. Nat. Commun. 14, 1616 (2023).

Woodley, L. et al. Climate impacts of critical mineral supply chain bottlenecks for electric vehicle deployment. Nat. Commun. 15, 6813 (2024).

IEA. Global EV Outlook 2023. https://www.ieaorg/reports/global-ev-outlook-2023 (2023).

MINING.COM. China faces risks due to high chrome, manganese, nickel import reliance — report. https://www.miningcom/china-faces-risks-due-to-high-chrome-manganese-nickel-import-reliance-report/ (2021).

Hao, H., Liu, Z., Zhao, F., Geng, Y. & Sarkis, J. Material flow analysis of lithium in China. Resour. Policy 51, 100–106 (2017).

Liu, W., Li, X., Liu, C., Wang, M. & Liu, L. Resilience assessment of the cobalt supply chain in China under the impact of electric vehicles and geopolitical supply risks. Resour. Policy 80, 103183 (2023).

Chen, J., Zhang, W., Gong, B., Zhang, X. & Li, H. Optimal policy for the recycling of electric vehicle retired power batteries. Technol. Forecast. Soc. Change 183, 121930 (2022).

Li, J., Wang, Z., Li, H. & Jiao, J. Which policy can effectively promote the formal recycling of power batteries in China?. Energy 299, 131445 (2024).

Dunn, J., Slattery, M., Kendall, A., Ambrose, H. & Shen, S. Circularity of lithium-ion battery materials in electric vehicles. Environ. Sci. Technol. 55, 5189–5198 (2021).

Wang, H. et al. China’s electric vehicle and climate ambitions jeopardized by surging critical material prices. Nat. Commun. 14, 1246 (2023).

Qiao, D. et al. Exploring the potential impact of electric passenger vehicle battery recycling on China’s cobalt supply and demand under the goals of carbon peaking and carbon neutrality during 2010–2060. J. Clean. Prod. 444, 141139 (2024).

Ma, R. et al. Pathway decisions for reuse and recycling of retired lithium-ion batteries considering economic and environmental functions. Nat. Commun. 15, 7641 (2024).

Ciez, R. E. & Whitacre, J. F. Examining different recycling processes for lithium-ion batteries. Nat. Sustain. 2, 148–156 (2019).

Liu, B. et al. The impacts of critical metal shortage on China’s electric vehicle industry development and countermeasure policies. Energy 248, 123646 (2022).

Watari, T. et al. Integrating circular economy strategies with low-carbon scenarios: lithium use in electric vehicles. Environ. Sci. Technol. 53, 11657–11665 (2019).

Hao, H., Liu, F., Sun, X., Liu, Z. & Zhao, F. Quantifying the energy, environmental, economic, resource Co-benefits and risks of GHG emissions abatement: the case of passenger vehicles in China. Sustainability 11, 1344 (2019).

Cheng, A. L., Fuchs, E. R. H., Karplus, V. J. & Michalek, J. J. Electric vehicle battery chemistry affects supply chain disruption vulnerabilities. Nat. Commun. 15, 2143 (2024).

United States Geological Survey. Mineral commodity summaries 2023. https://www.usgs.gov/publications/mineral-commodity-summaries-2023 (2023).

IEA. Global Supply Chains of EV Batteries, https://www.ieaorg/reports/global-supply-chains-of-ev-batteries (2022).

National Energy Administration of China. Classification standards for the scale of mineral resource reserves. https://www.neagovcn/2011-08/19/c_131059659htm (2011).

Xu, C. et al. Future material demand for automotive lithium-based batteries. Commun. Mater. 1, 99 (2020).

Olivetti, E. A., Ceder, G., Gaustad, G. G. & Fu, X. Lithium-ion battery supply chain considerations: analysis of potential bottlenecks in critical. Met. Joule 1, 229–243 (2017).

Fan, J.-L. et al. Co-firing plants with retrofitted carbon capture and storage for power-sector emissions mitigation. Nat. Clim. Change 13, 807–815 (2023).

Wang, Y. et al. Accelerating the energy transition towards photovoltaic and wind in China. Nature 619, 761–767 (2023).

Zhuo, Z. et al. Cost increase in the electricity supply to achieve carbon neutrality in China. Nat. Commun. 13, 3172 (2022).

Zhang, T. et al. Cradle-to-gate life cycle assessment of cobalt sulfate production derived from a nickel–copper–cobalt mine in China. Int. J. Life Cycle Assess. 26, 1198–1210 (2021).

Chen, Z., Zhang, L. & Xu, Z. Analysis of cobalt flows in mainland China: Exploring the potential opportunities for improving resource efficiency and supply security. J. Clean. Prod. 275, 122841 (2020).

Qiao, D. et al. Exploring potential opportunities for the efficient development of the cobalt industry in China by quantitatively tracking cobalt flows during the entire life cycle from 2000 to 2021. J. Environ. Manag. 318, 115599 (2022).

Zeng, A. et al. Battery technology and recycling alone will not save the electric mobility transition from future cobalt shortages. Nat. Commun. 13, 1341 (2022).

Becker, J. M. General equilibrium impacts on the U.S. economy of a disruption to Chinese cobalt supply. Resour. Policy 71, 102005 (2021).

Rachidi, N. R., Nwaila, G. T., Zhang, S. E., Bourdeau, J. E. & Ghorbani, Y. Assessing cobalt supply sustainability through production forecasting and implications for green energy policies. Resour. Policy 74, 102423 (2021).

He, L. & Sun, B. Exploring the EPR system for power battery recycling from a supply-side perspective: an evolutionary game analysis. Waste Manag. 140, 204–212 (2022).

Jiang, S. et al. Assessment of end-of-life electric vehicle batteries in China: future scenarios and economic benefits. Waste Manag. 135, 70–78 (2021).

Woodard, R. Waste management in small and medium enterprises (SMEs) – a barrier to developing circular cities. Waste Manag. 118, 369–379 (2020).

Peng, B., Tu, Y., Elahi, E. & Wei, G. Extended producer responsibility and corporate performance: effects of environmental regulation and environmental strategy. J. Environ. Manag. 218, 181–189 (2018).

Sun, X., Hao, H., Geng, Y., Liu, Z. & Zhao, F. Exploring the potential for improving material utilization efficiency to secure lithium supply for China’s battery supply chain. Fundam. Res. 4, 167–177 (2024).

Vaalma, C., Buchholz, D., Weil, M. & Passerini, S. A cost and resource analysis of sodium-ion batteries. Nat. Rev. Mater. 3, 18013 (2018).

Yao, A., Benson, S. M. & Chueh, W. C. Critically assessing sodium-ion technology roadmaps and scenarios for techno-economic competitiveness against lithium-ion batteries. Nat. Energy 10, 404–416 (2025).

Milovanoff, A., Posen, I. D. & MacLean, H. L. Electrification of light-duty vehicle fleet alone will not meet mitigation targets. Nat. Clim. Change 10, 1102–1107 (2020).

Martínez-Hernando, M.-P., Bolonio, D., Ortega, M. F., Llamas, J. F. & García-Martínez, M.-J. Material flow analysis and regional greenhouse gas emissions associated to permanent magnets and batteries used in electric vehicles. Sci. Total Environ. 904, 166368 (2023).

Wang, Z. et al. Unequal residential heating burden caused by combined heat and power phase-out under climate goals. Nat. Energy 8, 881–890 (2023).

Kumar, R. R., Guha, P. & Chakraborty, A. Comparative assessment and selection of electric vehicle diffusion models: A global outlook. Energy 238, 121932 (2022).

Zubi, G., Dufo-López, R., Carvalho, M. & Pasaoglu, G. The lithium-ion battery: state of the art and future perspectives. Renew. Sustain. Energy Rev. 89, 292–308 (2018).

Tao, Y., Rahn, C. D., Archer, L. A. & You, F. Second life and recycling: energy and environmental sustainability perspectives for high-performance lithium-ion batteries. Sci. Adv. 7, eabi7633 (2021).

Rasmussen, K. D., Wenzel, H., Bangs, C., Petavratzi, E. & Liu, G. Platinum demand and potential bottlenecks in the global green transition: a dynamic material flow analysis. Environ. Sci. Technol. 53, 11541–11551 (2019).

Dong, Z. et al. Projecting future critical material demand and recycling from China’s electric passenger vehicles considering vehicle segment heterogeneity. Resour. Conserv. Recycl. 207, 107691 (2024).

Rosenberg, S. et al. Combining dynamic material flow analysis and life cycle assessment to evaluate environmental benefits of recycling – a case study for direct and hydrometallurgical closed-loop recycling of electric vehicle battery systems. Resour. Conserv. Recycl. 198, 107145 (2023).

Feng, T. et al. Energy transition in the new era: The impact of renewable electric power on the life cycle assessment of automotive power batteries. Renew. Energy 236, 121365 (2024).

Yang, H. et al. Life cycle assessment of secondary use and physical recycling of lithium-ion batteries retired from electric vehicles in China. Waste Manag. 178, 168–175 (2024).

Machala, M. L. et al. Life cycle comparison of industrial-scale lithium-ion battery recycling and mining supply chains. Nat. Commun. 16, 988 (2025).

Cheng, A. L., Fuchs, E. R. H. & Michalek, J. J. US industrial policy may reduce electric vehicle battery supply chain vulnerabilities and influence technology choice. Nat. Energy 9, 1561–1570 (2024).

Qi, X., Liu, Z. & Li, T. Design incentives of extended producer responsibility for electric vehicle producers with competition and cooperation. Omega 133, 103266 (2025).

Nguyen-Tien, V., Dai, Q., Harper, G. D. J., Anderson, P. A. & Elliott, R. J. R. Optimising the geospatial configuration of a future lithium ion battery recycling industry in the transition to electric vehicles and a circular economy. Appl. Energy 321, 119230 (2022).

Gonzales-Calienes, G., Yu, B. & Bensebaa, F. Development of a reverse logistics modeling for end-of-life lithium-ion batteries and its impact on recycling viability—a case study to support end-of-life electric vehicle battery strategy in Canada. Sustainability 14, 15321 (2022).

Lander, L. et al. Financial viability of electric vehicle lithium-ion battery recycling. iScience 24, 102787 (2021).

Xiong, S., Ji, J. & Ma, X. Environmental and economic evaluation of remanufacturing lithium-ion batteries from electric vehicles. Waste Manag. 102, 579–586 (2020).

Dai Q. et al. EverBAtt: a closed-loop battery recycling cost and environmental impacts model. Argonne National Laboratory https://publications.anl.gov/anlpubs/2019/07/153050.pdf (2019).

Acknowledgements

This study is supported by the National Natural Science Foundation of China (Grant No. 72222017, 72174023) [B.Z.], (Grant No. 72321002, 72141302, 72140002) [Z.W.], (Grant No. 72104021) [S.C.], and (Grant No. 72243001) [B.W.]; the Beijing Natural Science Foundation (Grant No. 9232017) [B.Z.]; the Key Research Project of Philosophy and Social Sciences of the Ministry of Education of China (Grant No. 21JZD027) [Z.W.]; and the Science and Technology Innovation Program for Innovative Talents in Beijing Institute of Technology (Grant No. 2024CX01017) [B.Z.].

Author information

Authors and Affiliations

Contributions

B.Z., Q.X., and Z.W. conceptualized the study and designed the methodology. S.C. and B.W. collected the data. Q.X. and H.L. conducted data analysis and contributed to the result interpretation. B.Z., Q.X., and P.B. drafted the manuscript. Z.W. and P.B. provided supervision, project administration, and critical revisions. B.Z., Q.X., S.C., B.W., H.L, Z.W., and P.B. contributed to discussions, reviewed the manuscript, and approved the final submission.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Communications thanks Wei Liu, Viet Nguyen-Tien, and the other, anonymous, reviewer(s) for their contribution to the peer review of this work. A peer review file is available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Source data

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Zhang, B., Xin, Q., Chen, S. et al. Lithium-ion battery recycling relieves the threat to material scarcity amid China’s electric vehicle ambitions. Nat Commun 16, 6661 (2025). https://doi.org/10.1038/s41467-025-61481-y

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1038/s41467-025-61481-y

This article is cited by

-

High-power temperature resilient ionic liquid-driven graphene supercapacitor for an effective solar-powered energy backup system

Advanced Composites and Hybrid Materials (2026)

-

Lignin-derived hierarchical porous carbons enabling high-voltage electrochemical capacitors with low self-discharge

Carbon Research (2026)

-

Lithium-ion battery recycling: a perspective on key challenges and opportunities

npj Materials Sustainability (2025)