Abstract

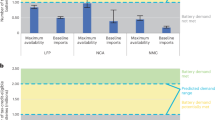

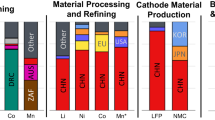

We analyse US Inflation Reduction Act (IRA) incentives for electric vehicle battery technology and supply chain decisions. We find that the total value of available credits exceeds estimated battery production costs, but qualifying for all available credits is difficult. IRA cell and module credits alone bring estimated US battery production costs in line with China. In contrast, IRA material extraction and processing credits are modest. IRA’s end-user purchase credits are restricted to electric vehicles whose battery supply chains exclude foreign entities of concern, including China. This incentivizes diversification of the entire supply chain, but leasing avoids these restrictions. Lithium iron phosphate batteries have potential to more easily reduce supply chain vulnerabilities and qualify for incentives, but they have smaller total available incentives than nickel/cobalt-based batteries. Overall, the IRA primarily incentivizes downstream battery manufacturing diversification, whereas upstream supply implications depend on automaker responses to foreign entities of concern and leasing rules.

This is a preview of subscription content, access via your institution

Access options

Access Nature and 54 other Nature Portfolio journals

Get Nature+, our best-value online-access subscription

$32.99 / 30 days

cancel any time

Subscribe to this journal

Receive 12 digital issues and online access to articles

$119.00 per year

only $9.92 per issue

Buy this article

- Purchase on SpringerLink

- Instant access to the full article PDF.

USD 39.95

Prices may be subject to local taxes which are calculated during checkout

Similar content being viewed by others

Data availability

The source and processed data generated in this study are attached as Supplementary Data. The model used in this study (BatPaC)41 is publicly available via the Argonne National Lab. We only use publicly available production and critical mineral price data for the production analysis, primarily from the BatPaC model and Trost and Dunn23. Estimates of production costs in China are estimated from Krishna42. Data used to generate supply chain data in Fig. 1 are from publicly available US Geological Survey60, Sun et al.58, Endo et al.59 and International Energy Agency31 datasets and a Frost and Sullivan report61 that is not in the public domain. Additionally, we have created an interactive tool to allow users to adjust model assumptions around mineral prices and see how they affect key results in Figs. 2 and 3 at https://acheng98.shinyapps.io/IRAMineralPriceEffectsSim/.

Code availability

The code that is used for this analysis and an interactive tool is freely available in the repository linked to this paper (https://doi.org/10.5281/zenodo.11182063). Additionally, the scripts used to automate some of the modelling are provided as a Supplementary Code zip file and in the repository.

Change history

19 May 2025

A Correction to this paper has been published: https://doi.org/10.1038/s41560-025-01799-5

References

H.R. 5376–Inflation Reduction Act of 2022 (117th Congress, 2022).

Internal Revenue Service. Section 30D new clean vehicle credit. Federal Register (17 April 2023); https://www.federalregister.gov/documents/2023/04/17/2023-06822/section-30d-new-clean-vehicle-credit

Fortuna, C. The IRA was shaped solely to achieve energy security, argues Joe Manchin. CleanTechnica (20 March 2023); https://cleantechnica.com/2023/03/20/the-ira-was-shaped-solely-to-achieve-energy-security-argues-joe-manchin/

Reynolds, E. B. U.S. industrial transformation and the ‘how’ of 21st century industrial strategy. J. Ind. Compet. Trade 24, 8 (2024).

Lee, J., Veloso, F. M., Hounshell, D. A. & Rubin, E. S. Forcing technological change: a case of automobile emissions control technology development in the US. Technovation 30, 249–264 (2010).

Whitefoot, K. S. & Skerlos, S. J. Design incentives to increase vehicle size created from the U.S. footprint-based fuel economy standards. Energy Policy 41, 402–411 (2012).

Jenn, A., Azevedo, I. M. L. & Michalek, J. J. Alternative fuel vehicle adoption increases fleet gasoline consumption and greenhouse gas emissions under United States corporate average fuel economy policy and greenhouse gas emissions standards. Environ. Sci. Technol. 50, 2165–2174 (2016).

Jenn, A., Azevedo, I. L. & Michalek, J. J. Alternative-fuel-vehicle policy interactions increase U.S. greenhouse gas emissions. Transp. Res. Part Policy Pract. 124, 396–407 (2019).

Veloso, F. Local Content Requirements and Industrial Development: Economic Analysis and Cost Modeling of the Automotive Supply Chain (Massachusetts Institute of Technology, 2001).

Kuntze, J.-C. & Moerenhout, T. Local content requirements and the renewable energy industry–a good match? Preprint at SSRN https://doi.org/10.2139/ssrn.2188607 (2012).

Cheng, F., Luo, H., Jenkins, J. D. & Larson, E. D. Impacts of the Inflation Reduction Act on the economics of clean hydrogen and synthetic liquid fuels. Environ. Sci. Technol. 57, 15336–15347 (2023).

Chyong, C. K., Italiani, E. & Kazantzis, N. Implications of the Inflation Reduction Act on deployment of low-carbon ammonia technologies. Preprint at Research Square https://doi.org/10.21203/rs.3.rs-3450127/v1 (2023).

Bracci, J. M., Sherwin, E. D., Boness, N. L. & Brandt, A. R. A cost comparison of various hourly-reliable and net-zero hydrogen production pathways in the United States. Nat. Commun. 14, 7391 (2023).

Cook, B. & Hagen, C. Techno-economic analysis of biomass gasification for hydrogen production in three US-based case studies. Int. J. Hydrog. Energy 49, 202–218 (2024).

Delgado, H. E. et al. Techno-economic analysis and life cycle analysis of e-fuel production using nuclear energy. J. CO2 Util. 72, 102481 (2023).

Grubert, E. & Sawyer, F. US power sector carbon capture and storage under the Inflation Reduction Act could be costly with limited or negative abatement potential. Environ. Res. Infrastruct. Sustain. 3, 015008 (2023).

Min, Y., Brinkerink, M., Jenkins, J. & Mayfield, E. Effects of renewable energy provisions of the Inflation Reduction Act on technology costs, materials demand, and labor (Version 3). Zenodo https://zenodo.org/doi/10.5281/zenodo.7942444 (2023).

Celsa, M. & Xydis, G. The Inflation Reduction Act versus the 1.5 cent/kWh and 30% investment tax credit proposal for wind power. SN Bus. Econ. 3, 68 (2023).

Bistline, J. et al. Emissions and energy impacts of the Inflation Reduction Act. Science 380, 1324–1327 (2023).

Larsen, J. et al. A turning point for US climate progress: assessing the climate and clean energy provisions in the Inflation Reduction Act. https://rhg.com/research/climate-clean-energy-inflation-reduction-act/ (Rhodium Group, 2022).

Jenn, A., Springel, K. & Gopal, A. R. Effectiveness of electric vehicle incentives in the United States. Energy Policy 119, 349–356 (2018).

Jenn, A., Azevedo, I. L. & Ferreira, P. The impact of federal incentives on the adoption of hybrid electric vehicles in the United States. Energy Econ. 40, 936–942 (2013).

Trost, J. N. & Dunn, J. B. Assessing the feasibility of the Inflation Reduction Act’s EV critical mineral targets. Nat. Sustain. https://doi.org/10.1038/s41893-023-01079-8 (2023).

Miao, Y., Hynan, P., von Jouanne, A. & Yokochi, A. Current Li-ion battery technologies in electric vehicles and opportunities for advancements. Energies 12, 1074 (2019).

Bruchon, M., Chen, Z. L. & Michalek, J. Cleaning up while changing gears: the role of battery design, fossil fuel power plants, and vehicle policy for reducing emissions in the transition to electric vehicles. Environ. Sci. Technol. 58, 3787–3799 (2024).

Houache, M. S. E., Yim, C.-H., Karkar, Z. & Abu-Lebdeh, Y. On the current and future outlook of battery chemistries for electric vehicles—mini review. Batteries 8, 70 (2022).

Walvekar, H., Beltran, H., Sripad, S. & Pecht, M. Implications of the electric vehicle manufacturers’ decision to mass adopt lithium-iron phosphate batteries. IEEE Access 10, 63834–63843 (2022).

Forsythe, C. R., Gillingham, K. T., Michalek, J. J. & Whitefoot, K. S. Technology advancement is driving electric vehicle adoption. Proc. Natl Acad. Sci. USA 120, e2219396120 (2023).

Helveston, J. P., Wang, Y., Karplus, V. J. & Fuchs, E. R. H. Institutional complementarities: the origins of experimentation in China’s plug-in electric vehicle industry. Res. Policy 48, 206–222 (2019).

Hao, H., Ou, X., Du, J., Wang, H. & Ouyang, M. China’s electric vehicle subsidy scheme: rationale and impacts. Energy Policy 73, 722–732 (2014).

Global Supply Chains of EV Batteries (IEA, 2022); https://iea.blob.core.windows.net/assets/4eb8c252-76b1-4710-8f5e-867e751c8dda/GlobalSupplyChainsofEVBatteries.pdf

Cheng, A. L., Fuchs, E. R. H., Karplus, V. J. & Michalek, J. J. Electric vehicle battery chemistry affects supply chain disruption vulnerabilities. Nat. Commun. 15, 2143 (2024).

Doll, S. China revises EV credits for automakers, reducing offset opportunities that have driven production. Electrek (6 July 2023); https://electrek.co/2023/07/06/china-revises-ev-credits-automakers-offset-opportunities-production/

Yang, Z. How China’s electric vehicle credits work. Protocol (6 September 2021); https://web.archive.org/web/20230328051719/https://www.protocol.com/china/dual-credit-policy

Wu, F., Li, P., Dong, X. & Lu, Y. Exploring the effectiveness of China’s dual credit policy in a differentiated automobile market when some consumers are environmentally aware. Energy Econ. 111, 106077 (2022).

How the federal electric vehicle (EV) tax credit works. EVAdoption https://evadoption.com/resources/federal-electric-vehicle-ev-tax-credit-works/ (2017).

Buffie, N. E. Foreign Entity of Concern Requirements in the Section 30D Clean Vehicle Credit (CRS, 2024); https://crsreports.congress.gov/product/pdf/IN/IN12322

Interpretation of foreign entity of concern. Federal Register 88 84082–84089 (2023).

Moerenhout, T. & Brunelli, K. Q&A—The Debate Over the 45X Tax Credit and Critical Minerals Mining (Center on Global Energy Policy at Columbia University SIPA, 2024); https://www.energypolicy.columbia.edu/qa-the-debate-over-the-45x-tax-credit-and-critical-minerals-mining/

Henry, J. Remember auto leasing? It’s rebounding in 2024, thanks in part to EVs. Forbes (27 February, 2024); https://www.forbes.com/sites/jimhenry/2024/01/26/remember-auto-leasing-its-rebounding-in-2024-thanks-in-part-to-evs/

Knehr, K., Kubal, J., Nelson, P. & Ahmed, S. Battery Performance and Cost Modeling for Electric-Drive Vehicles: A Manual for BatPaC v5.0 ANL/CSE-22/1, 1877590, 176234 (OSTI, 2022); https://doi.org/10.2172/1877590

Krishna, M. Right-sizing EV battery packs to reduce cost and BRM supply constraints. Fastmarkets https://www.fastmarkets.com/insights/smaller-battery-packs-answer-battery-material-supply/ (2023).

Wang, B. EV battery glut drives prices down to $70–75 per kWh. Next Big Future https://www.nextbigfuture.com/2023/10/ev-battery-glut-drives-prices-down-to-70-75-per-kwh.html (2023).

How much cheaper are Chinese lithium ion battery cells? Benchmark Source https://source.benchmarkminerals.com/article/how-much-cheaper-are-chinese-lithium-ion-battery-cells (2023).

Lithium-ion battery pack prices hit record low of $139/kWh. BloombergNEF (14 August 2023); https://about.bnef.com/blog/lithium-ion-battery-pack-prices-hit-record-low-of-139-kwh/

Wang, B. EV LFP battery price war at less than $56 per kWh within six months. Next Big Future https://www.nextbigfuture.com/2024/01/ev-lfp-battery-price-war-w-55-in-six-months.html (2024).

Du, Y., Guo, Z. & Bao, H. Smooth sailing ahead? Policy options for China’s new energy vehicle industry in the post-subsidy era. Energy Res. Social Sci. 107, 103359 (2024).

Liu, S. & Patton, D. China, world’s top graphite producer, tightens exports of key battery material. Reuters (20 October 2023); https://www.reuters.com/world/china/china-require-export-permits-some-graphite-products-dec-1-2023-10-20/

Holderness, A., Velazquez, N., Carroll, H. H. & Cook, C. Understanding China’s gallium sanctions. (Center for Strategic & International Studies, 2023); https://www.csis.org/analysis/understanding-chinas-gallium-sanctions

Lv, A., Liu, S., Nguyen, M. & Devitt, P. Explainer: what is antimony and why is China curbing its exports? Reuters (16 August 2024); https://www.reuters.com/markets/commodities/what-is-antimony-why-is-china-curbing-its-exports-2024-08-16/

What does the US Inflation Reduction Act mean for the EV battery supply chain? Benchmark Source https://source.benchmarkminerals.com/article/what-does-the-us-inflation-reduction-act-mean-for-the-ev-battery-supply-chain (2022).

The Role of Critical Minerals in Clean Energy Transitions 287 (IEA, 2021); https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

Morin, H., Whitacre, J. & Michalek, J. Electric vehicle battery replacement costs under realistic fast charging behaviors. ECS Meet. Abstr. MA2023-01, 2777 (2023).

Zhao, Y., Wang, Z., Shen, Z.-J. M. & Sun, F. Assessment of battery utilization and energy consumption in the large-scale development of urban electric vehicles. Proc. Natl Acad. Sci. USA 118, e2017318118 (2021).

Randall, T. Americans insist on 300 miles of EV range. They’re right. Bloomberg (4 May 2023); https://www.bloomberg.com/news/articles/2023-05-04/americans-insist-on-300-miles-of-ev-range-they-re-right

Ford taps Michigan for new LFP battery plant; new battery chemistry offers customers value, durability, fast charging, creates 2,500 more new American jobs. Ford Media Center https://media.ford.com/content/fordmedia/fna/us/en/news/2023/02/13/ford-taps-michigan-for-new-lfp-battery-plant–new-battery-chemis.html (2023).

Zhou, C. CATL says Ford project on track despite new U.S. battery rules. Nikkei Asia (7 December 2023); https://asia.nikkei.com/Business/Technology/CATL-says-Ford-project-on-track-despite-new-U.S.-battery-rules

Sun, X., Liu, Z., Zhao, F. & Hao, H. Global competition in the lithium-ion battery supply chain: a novel perspective for criticality analysis. Environ. Sci. Technol. 55, 12180–12190 (2021).

Endo, C., Kaufmann, T., Schmuch, R. & Thielmann, A. Benchmarking International Battery Policies (Fraunhofer, 2024); https://doi.org/10.24406/PUBLICA-2030

Mineral Commodity Summaries 2024 (USGS, 2024).

Global Lithium-ion Battery Materials Market Growth Opportunities (Frost & Sullivan, 2023).

Wang, M. et al. Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies Model (GREET) (Argonne National Laboratory, 2022); https://doi.org/10.11578/GREET-EXCEL-2022/DC.20220908.1

Brodd, R. J. & Helou, C. Cost comparison of producing high-performance Li-ion batteries in the U.S. and in China. J. Power Sources 231, 293–300 (2013).

Duffner, F., Wentker, M., Greenwood, M. & Leker, J. Battery cost modeling: a review and directions for future research. Renew. Sustain. Energy Rev. 127, 109872 (2020).

Wentker, M., Greenwood, M. & Leker, J. A bottom-up approach to lithium-ion battery cost modeling with a focus on cathode active materials. Energies 12, 504 (2019).

Berckmans, G. et al. Cost projection of state of the art lithium-ion batteries for electric vehicles up to 2030. Energies 10, 1314 (2017).

Sakti, A., Michalek, J. J., Fuchs, E. R. H. & Whitacre, J. F. A techno-economic analysis and optimization of li-ion batteries for light-duty passenger vehicle electrification. J. Power Sources 273, 966–980 (2015).

Orangi, S. & Strømman, A. H. A techno-economic model for benchmarking the production cost of lithium-ion battery cells. Batteries 8, 83 (2022).

Mauler, L., Duffner, F. & Leker, J. Economies of scale in battery cell manufacturing: the impact of material and process innovations. Appl. Energy 286, 116499 (2021).

Ciez, R. E. & Whitacre, J. F. Examining different recycling processes for lithium-ion batteries. Nat. Sustain. 2, 148–156 (2019).

Turner, J. US and Canada electric vehicle supply chain map. Charged https://www.charged-the-book.com/na-ev-supply-chain-map (2024).

Building America’s Clean Energy Future: Investment Announced Under Biden Administration (DOE, 2024).

Acknowledgements

This research was supported by the 2021 Carnegie Mellon University College of Engineering Moonshot Award for ‘Engineering Competitiveness: Critical Technologies, Supply Chains, and Infrastructure’ (A.L.C., E.R.H.F.) the National Science Foundation award number 2241237 (A.L.C., E.R.H.F., J.J.M.) and the National Science Foundation Graduate Research Fellowship under grant number DGE2140739 (A.L.C.). We would like to acknowledge J. P. Helveston, W. Cohen, V. Karplus and K. MacMahon for feedback that helped us improve initial drafts of this article; J. Axsen, D. Gohlke, A. Jenn, D. Mackenzie, A. Mohan, M. Ziegler, J. Jenkins, L. Reynolds, J. P. MacDuffie, S. Helper, A. Reamer, K. Bhuwalka, M. Davidson, H. Khan, J. Dunn, M. Mauter and C. Scown for their feedback and perspectives at various conferences and presentations; and the Fuchs, Karplus (LEO) and Michalek (VEG) research groups for their feedback throughout the development of this work. We would also like to acknowledge the use of large language models to edit and refine some of the text and code in this work.

Author information

Authors and Affiliations

Contributions

A.L.C.: conceptualization, methodology, software, formal analysis, writing–original draft, writing–review and editing, visualization. E.R.H.F.: conceptualization, methodology, writing–review and editing, visualization, supervision, funding acquisition. J.J.M.: conceptualization, methodology, writing–review and editing, visualization, supervision.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Energy thanks the anonymous reviewers for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary Notes 1–4, Tables 1–12 and Figs. 1 and 2.

Supplementary Data 1

Supplementary Data 0–9 and a cover sheet describing the contents of the file to process data to be used in and received from the model (BatPaC, developed by the Argonne National Lab).

Supplementary Code 1

The Microsoft Office scripts used in conjunction with the BatPaC model to make analysis easier.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Cheng, A.L., Fuchs, E.R.H. & Michalek, J.J. US industrial policy may reduce electric vehicle battery supply chain vulnerabilities and influence technology choice. Nat Energy 9, 1561–1570 (2024). https://doi.org/10.1038/s41560-024-01649-w

Received:

Accepted:

Published:

Version of record:

Issue date:

DOI: https://doi.org/10.1038/s41560-024-01649-w

This article is cited by

-

Trends and 2025 insights on the rise of electric vehicles in the USA

Nature Reviews Clean Technology (2025)

-

Lithium-ion battery recycling relieves the threat to material scarcity amid China’s electric vehicle ambitions

Nature Communications (2025)

-

Feasibility, cost and decarbonization potential of clean pathways for heavy-duty road transportation

Nature Reviews Clean Technology (2025)

-

Carbon footprint distributions of lithium-ion batteries and their materials

Nature Communications (2024)