Abstract

The remaining carbon budget for limiting global warming to 1.5 degrees Celsius will probably be exhausted within this decade1,2. Carbon debt3 generated thereafter will need to be compensated by net-negative emissions4. However, economic policy instruments to guarantee potentially very costly net carbon dioxide removal (CDR) have not yet been devised. Here we propose intertemporal instruments to provide the basis for widely applied carbon taxes and emission trading systems to finance a net-negative carbon economy5. We investigate an idealized market approach to incentivize the repayment of previously accrued carbon debt by establishing the responsibility of emitters for the net removal of carbon dioxide through ‘carbon removal obligations’ (CROs). Inherent risks, such as the risk of default by carbon debtors, are addressed by pricing atmospheric CO2 storage through interest on carbon debt. In contrast to the prevailing literature on emission pathways, we find that interest payments for CROs induce substantially more-ambitious near-term decarbonization that is complemented by earlier and less-aggressive deployment of CDR. We conclude that CROs will need to become an integral part of the global climate policy mix if we are to ensure the viability of ambitious climate targets and an equitable distribution of mitigation efforts across generations.

This is a preview of subscription content, access via your institution

Access options

Access Nature and 54 other Nature Portfolio journals

Get Nature+, our best-value online-access subscription

$32.99 / 30 days

cancel any time

Subscribe to this journal

Receive 51 print issues and online access

$199.00 per year

only $3.90 per issue

Buy this article

- Purchase on SpringerLink

- Instant access to full article PDF

Prices may be subject to local taxes which are calculated during checkout

Similar content being viewed by others

Data availability

All data generated or analysed during this study are included in this published Article and its Supplementary Information.

Code availability

The source code of the numerical model used for generating the data used in this study is available at https://github.com/jobednar/CROmodel. The numerical model was calibrated using scenarios from the SSP scenario database hosted by IIASA (https://tntcat.iiasa.ac.at/SspDb/).

References

Masson-Delmotte, V. et al. Global warming of 1.5 °C. An IPCC Special Report (IPCC, 2018).

Gasser, T. et al. Path-dependent reductions in CO2 emission budgets caused by permafrost carbon release. Nat. Geosci. 11, 830–835 (2018).

Geden, O. The Paris Agreement and the inherent inconsistency of climate policymaking. Wiley Interdiscip. Rev. Clim. Change 7, 790–797 (2016).

Peters, G. P. & Geden, O. Catalysing a political shift from low to negative carbon. Nat. Clim. Change 7, 619–621 (2017).

Bednar, J., Obersteiner, M. & Wagner, F. On the financial viability of negative emissions. Nat. Commun. 10, 1783 (2019).

Black, R. et al. Taking Stock: A Global Assessment of Net Zero Targets https://eciu.net/analysis/reports/2021/taking-stock-assessment-net-zero-targets (ECIU, 2021).

Rogelj, J., Geden, O., Cowie, A. & Reisinger, A. Three ways to improve net-zero emissions targets. Nature 591, 365–368 (2021).

McLaren, D. P., Tyfield, D. P., Willis, R., Szerszynski, B. & Markusson, N. O. Beyond “net-zero”: a case for separate targets for emissions reduction and negative emissions. Front. Clim. 1, 4 (2019).

Clarke, L. et al. Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change (eds Edenhofer, O. et al.) Ch. 6, 413–510 (Cambridge Univ. Press, 2014).

Rogelj, J., Forster, P. M., Kriegler, E., Smith, C. J. & Séférian, R. Estimating and tracking the remaining carbon budget for stringent climate targets. Nature 571, 335–342 (2019).

Rogelj, J. et al. Differences between carbon budget estimates unravelled. Nat. Clim. Change 6, 245–252 (2016).

van Vuuren, D. P., Hof, A. F., van Sluisveld, M. A. E. & Riahi, K. Open discussion of negative emissions is urgently needed. Nat. Energy 2, 902–904 (2017).

Honegger, M. & Reiner, D. The political economy of negative emissions technologies: consequences for international policy design. Clim. Policy 18, 306–321 (2018).

Anderson, K. & Peters, G. The trouble with negative emissions. Science 354, 182–183 (2016).

Fuss, S. et al. Betting on negative emissions. Nat. Clim. Change 4, 850–853 (2014).

Lawrence, M. G. et al. Evaluating climate geoengineering proposals in the context of the Paris Agreement temperature goals. Nat. Commun. 9, 3734 (2018).

Lenzi, D., Lamb, W. F., Hilaire, J., Kowarsch, M. & Minx, J. C. Don’t deploy negative emissions technologies without ethical analysis. Nature 561, 303–305 (2018).

Fuss, S. et al. Negative emissions—part 2: costs, potentials and side effects. Environ. Res. Lett. 13, 063002 (2018).

Obersteiner, M. et al. How to spend a dwindling greenhouse gas budget. Nat. Clim. Change 8, 7–10 (2018).

Rogelj, J. et al. A new scenario logic for the Paris Agreement long-term temperature goal. Nature 573, 357–363 (2019).

United Nations Environment Programme. The Emissions Gap Report 2019, Annex B (UN, 2019).

Hotelling, H. The economics of exhaustible resources. J. Polit. Econ. 39, 137–175 (1931).

Mattauch, L. et al. Steering The Climate System: An Extended Comment Centre for Climate Change Economics and Policy Working Paper 347/Grantham Research Institute on Climate Change and the Environment Working Paper 315 (London School of Economics and Political Science, 2018).

Rogelj, J. et al. Scenarios towards limiting global mean temperature increase below 1.5 °C. Nat. Clim. Change 8, 325–332 (2018).

Norges Bank Investment Management. Investing with a Mandate. https://www.nbim.no/contentassets/cd563b586fe34ce2bfea30df4c0a75db/investing-with-a-mandate_government-pension-fund-global_web.pdf (2020).

OECD. OECD Sovereign Borrowing Outlook 2020 (2020).

Steitz, C. & Lewis, B. EU short of 118 billion euros in nuclear decommissioning funds - draft. Reuters (16 February 2016).

Fankhauser, S. & Hepburn, C. Designing carbon markets. Part I: carbon markets in time. Energy Policy 38, 4363–4370 (2010).

Murray, B., Newell, R. & Pizer, W. Balancing Cost and Emissions Certainty: An Allowance Reserve for Cap-and-Trade. NBER Working Paper 14258 http://www.nber.org/papers/w14258.pdf (National Bureau Of Economic Research, 2008).

Goulder, L. & Schein, A. Carbon Taxes vs. Cap and Trade: A Critical Review. NBER Working Paper 19338 http://www.nber.org/papers/w19338.pdf (National Bureau Of Economic Research, 2013).

Coffman, D. & Lockley, A. Carbon dioxide removal and the futures market. Environ. Res. Lett. 12, 015003 (2017).

Emmerling, J. et al. The role of the discount rate for emission pathways and negative emissions. Environ. Res. Lett. 14, 104008 (2019).

Hilaire, J. et al. Negative emissions and international climate goals—learning from and about mitigation scenarios. Clim. Change 157, 189–219 (2019).

Parson, E. A. & Buck, H. J. Large-scale carbon dioxide removal: the problem of phasedown. Glob. Environ. Polit. 20, 70–92 (2020).

Meinshausen, M. et al. The shared socio-economic pathway (SSP) greenhouse gas concentrations and their extensions to 2500. Geosci. Model Dev. 13, 3571–3605 (2020).

Workman, M., Dooley, K., Lomax, G., Maltby, J. & Darch, G. Decision making in contexts of deep uncertainty - an alternative approach for long-term climate policy. Environ. Sci. Policy 103, 77–84 (2020).

Butnar, I. et al. A deep dive into the modelling assumptions for biomass with carbon capture and storage (BECCS): a transparency exercise. Environ. Res. Lett. 15, 084008 (2020).

Gough, C. et al. Challenges to the use of BECCS as a keystone technology in pursuit of 1.5 °C. Glob. Sustain. 1, e5 (2018).

Friedlingstein, P. et al. Global carbon budget 2019. Earth Syst. Sci. Data 11, 1783–1838 (2019).

Capros, P. et al. Energy-system modelling of the EU strategy towards climate-neutrality. Energy Policy 134, 110960 (2019).

European Commission. A Clean Planet for All. A European Strategic Long-term Vision for a Prosperous, Modern, Competitive and Climate-neutral Economy (EC, 2018).

European Environment Agency. EEA Greenhouse Gas - Data Viewer. https://www.eea.europa.eu/data-and-maps/data/data-viewers/greenhouse-gases-viewer (EEA, 2021).

Geden, O. & Schenuit, F. Unconventional Mitigation: Carbon Dioxide Removal as a New Approach in EU Climate Policy. SWP Research Paper 2020/RP08 https://www.swp-berlin.org/10.18449/2020RP08/ (SWP, 2020).

Rickels, W., Proelß, A., Geden, O., Burhenne, J. & Fridahl, M. Integrating carbon dioxide removal into European emissions trading. Front. Clim. 3, 62 (2021).

Davis, S. J. et al. Net-zero emissions energy systems. Science 360, eaas9793 (2018).

Luderer, G. et al. Residual fossil CO2 emissions in 1.5–2 °C pathways. Nat. Clim. Change 8, 626–633 (2018).

Allen, M. R., Frame, D. J. & Mason, C. F. The case for mandatory sequestration. Nat. Geosci. 2, 813–814 (2009).

Friedmann, S. J. Engineered CO2 removal, climate restoration, and humility. Front. Clim. 1, 3 (2019).

Beuttler, C., Charles, L. & Wurzbacher, J. The role of direct air capture in mitigation of anthropogenic greenhouse gas emissions. Front. Clim. 1, 10 (2019).

Levihn, F., Linde, L., Gustafsson, K. & Dahlen, E. Introducing BECCS through HPC to the research agenda: the case of combined heat and power in Stockholm. Energy Rep. 5, 1381–1389 (2019).

The World Bank. Carbon Pricing Dashboard. https://carbonpricingdashboard.worldbank.org/ (accessed 11 March 2020).

Newman, A. L. & Posner, E. Putting the EU in its place: policy strategies and the global regulatory context. J. Eur. Public Policy 22, 1316–1335 (2015).

Santikarn, M., Li, L., Theuer, S. L. H. & Haug, C. A Guide to Linking Emissions Trading Systems (ICAP, 2018).

Riahi, K. et al. The Shared Socioeconomic Pathways and their energy, land use, and greenhouse gas emissions implications: an overview. Glob. Environ. Change 42, 153–168 (2017).

Richards, F. J. A flexible growth function for empirical use. J. Exp. Bot. 10, 290–301 (1959).

Fujimori, S. et al. SSP3: AIM implementation of Shared Socioeconomic Pathways. Glob. Environ. Change 42, 268–283 (2017).

Calvin, K. et al. The SSP4: a world of deepening inequality. Glob. Environ. Change 42, 284–296 (2017).

Strefler, J. et al. Between Scylla and Charybdis: delayed mitigation narrows the passage between large-scale CDR and high costs. Environ. Res. Lett. 13, 044015 (2018).

Marcucci, A., Kypreos, S. & Panos, E. The road to achieving the long-term Paris targets: energy transition and the role of direct air capture. Clim. Change 144, 181–193 (2017).

Sanz-Pérez, E. S., Murdock, C. R., Didas, S. A. & Jones, C. W. Direct capture of CO2 from ambient air. Chem. Rev. 116, 11840–11876 (2016).

Smith, P. et al. Biophysical and economic limits to negative CO2 emissions. Nat. Clim. Change 6, 42–50 (2016).

Clarke, L., Weyant, J. & Birky, A. On the sources of technological change: assessing the evidence. Energy Econ. 28, 579–595 (2006).

Drud, A. S. CONOPT—a large-scale GRG code. ORSA J. Comput. 6, 207–216 (1994).

Acknowledgements

We acknowledge financial support from the European Research Council Synergy grant ERC-SyG-2013-610028 IMBALANCE-P as well as from the FWF grant P-31796 Medium Complexity Earth System Risk Management (ERM) and support from the HSE University Basic Research Program for A.B.

Author information

Authors and Affiliations

Contributions

M.O., F.W., M.T. and J.B. have contributed equally to identifying the knowledge gaps and main ideas of this Article, as well as sharpening the field of interest. J.B. acted as lead author and was primarily involved in formalizing and quantifying the ideas of the Article, as well as in drafting the main paper and developing the analytical and numerical methods. J.W.H. and M.O. supervised the development of the paper from the first draft throughout the review process. J.W.H., O.G., M.A., F.W. and M.T. contributed to the framing, conception and design of the work, as well as to the interpretation of the results. A.B. provided quality control of methods and the presentation of the results and contributed the mathematical proof of the equations derived in the Methods. O.G. contributed by markedly improving the policy relevance of the Article (for instance, by developing the EU implementation scenario). All authors were equally involved in the revision process and have approved the submitted version of the Article.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Peer review information Nature thanks David Stainforth and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Extended data figures and tables

Extended Data Fig. 1 Schematic supply of emission allowances and CROs at a fixed point in time.

The supply of allowances is completely inelastic (emission cap), whereas the supply elasticity of CROs is determined by discounted future abatement costs, which increase as the demand for CROs increases, as well as interest costs, which can be controlled by managing authorities and financial institutions (dashed blue CRO supply curves). If CROs are traded on a market, they clear at the same price as allowances and thereby reduce the price of allowances. The larger the elasticity of the CRO supply curve, the lower the potential for price volatility (red arrows), as—for example—induced by a demand shock (dashed orange line). The sum of allowances and CROs issued equals net emissions. Abated emissions equal the difference between baseline emissions (green) and net emissions and consist of emission reductions and/or carbon removal.

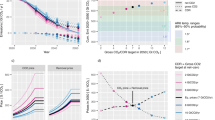

Extended Data Fig. 2 Abatement costs and carbon debt of 1.5 °C (RCP 1.9) scenarios for six different MACCs of DACS and interest rates on carbon debt rd = 0 and rd = 0.08.

A definition of D is provided in the Methods. Abatement costs are discounted and expressed as a percentage of the GDP. Abatement costs are exclusive of interest costs. For each rate rd, 78 scenarios (13 scenarios as for the RCP 2.6 analysis times 6 DACS parameters) are grouped by DACS costs (low to high, that is, ‘LoCost’, ‘MedCost’ and ‘HiCost’) and DACS capacity limits (10% and 30% of baseline emissions, that is, ‘LoCap’ and ‘HiCap’). a, b, Median abatement costs as a function of median carbon debt D for rd = 0 (a) and rd = 0.08 (b). For rd = 0, we observe an inverse relation between the level of carbon debt and abatement costs; and the capacity limit is a stronger determinant of abatement costs than DACS deployment costs. This ‘discounting effect’ is reversed when rd = 0.08 and high levels of \(D\) are penalized. In this case, lower abatement costs are realized by lower carbon debt (and vice versa). For both rates rd ‘LoCost_HiCap’ DACS scenarios are characterized by the lowest abatement costs, however, at very different levels of D. When interest is invoked, DACS deployments costs become an increasingly important determinant of total abatement costs. c, d, Distribution of total carbon debt D (c) and abatement costs (d) for the median values shown in a, b. Boxes indicate the 25–75% interquartile ranges around medians (bold solid line), whiskers indicate minimum to maximum ranges, black dots mark outliers.

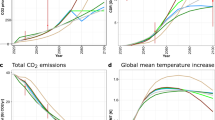

Extended Data Fig. 3 The 1.5 °C (RCP 1.9) pathways under a conventional ETS or a CRO-ETS.

a, b, A conventional ETS is used. c, d, A CRO-ETS is used. The underlying set of scenarios was filtered for those scenarios that achieved at least a 5% reduction in total carbon debt compared with their baselines (see Methods). a, c, Geometric median net emissions (solid line) and gross emissions from FFI, BECCS, LUC and DACS. Net emissions from a are also displayed in c (dashed line) and vice versa. The total carbon debt D is shown as a box-and-whiskers plot. Boxes indicate the 25–75% interquartile range around the median values (bold line), whiskers indicate minimum to maximum ranges, points mark the outliers. b, d, Annual mitigation costs as a percentage of GDP, including the share of average abatement costs attributed to emission reductions (ABM), to the compensation of residual emissions by CDR (RES) and to net-negative emissions (NNE) as well as expenditures for allowances (ETS) and interest costs (INT). Total mitigation costs (that is, ABM + RES + NNE + ETS + INT) from d are also displayed in b (dashed line) and vice versa. Box-and-whiskers plots show the total discounted abatement costs (that is, ABM + RES + NNE) as a percentage of GDP, the number above the chart indicates out-of-range outliers. Pie charts in d summarize the properties of the underlying set of scenarios (see Methods). The distribution of rd in CRO-ETS scenarios is depicted in c.

Extended Data Fig. 4 The 1.5 °C (RCP 1.9) pathways under a conventional ETS or a CRO-ETS.

a, b, A conventional ETS is used. c, d, A CRO-ETS is used. The underlying set of scenarios was filtered for those scenarios that achieve at least a 15% reduction in total carbon debt compared with their baselines (see Methods). a, c, Geometric median net emissions (solid line) and gross emissions from FFI, BECCS, LUC and DACS. Net emissions from a are also displayed in c (dashed line) and vice versa. The total carbon debt D is shown as a box-and-whiskers plot. Boxes indicate the 25–75% interquartile range around the median values (bold line), whiskers indicate minimum to maximum ranges, points mark the outliers. b, d, Annual mitigation costs as a percentage of GDP, including the share of average abatement costs attributed to emission reductions (ABM), to the compensation of residual emissions by CDR (RES) and to net-negative emissions (NNE) as well as expenditures for allowances (ETS) and interest costs (INT). Total mitigation costs (that is, ABM + RES + NNE + ETS + INT) from d are also displayed in b (dashed line) and vice versa. Box-and-whiskers plots show the total discounted abatement costs (that is, ABM + RES + NNE) as a percentage of GDP, the number above the chart indicates out-of-range outliers. Pie charts in d summarize the properties of the underlying set of scenarios (see Methods). The distribution of rd in CRO-ETS scenarios is depicted in c.

Extended Data Fig. 5 The 1.5 °C (RCP1.9) pathways under a conventional ETS or a CRO-ETS.

a, b, A conventional ETS is used. c, d, A CRO-ETS is used. The underlying set of scenarios was filtered for those scenarios that achieve at least a 45% reduction in total carbon debt compared with their baselines (see Methods). a, c, Geometric median net emissions (solid line) and gross emissions from FFI, BECCS, LUC and DACS. Net emissions from a are also displayed in c (dashed line) and vice versa. The total carbon debt D is shown as a box-and-whiskers plot. Boxes indicate the 25–75% interquartile range around the median values (bold line), whiskers indicate minimum to maximum ranges, points mark the outliers. b, d, Annual mitigation costs as a percentage of GDP, including the share of average abatement costs attributed to emission reductions (ABM), to the compensation of residual emissions by CDR (RES) and to net-negative emissions (NNE) as well as expenditures for allowances (ETS) and interest costs (INT). Total mitigation costs (that is, ABM + RES + NNE + ETS + INT) from d are also displayed in b (dashed line) and vice versa. Box-and-whiskers plots show the total discounted abatement costs (that is, ABM + RES + NNE) as a percentage of GDP, the number above the chart indicates out-of-range outliers. Pie charts in d summarize the properties of the underlying set of scenarios (see Methods). The distribution of rd in CRO-ETS scenarios is depicted in c.

Extended Data Fig. 6 The abatement costs and interest costs of the 1.5 °C (RCP 1.9) scenarios as function of the percentage of carbon debt reduction compared with the baseline scenario.

a, b, The abatement costs (a) and interest costs (b) of the 1.5 °C (RCP 1.9) scenarios is compared with the baseline scenario (in which rd = 0) for all 468 RCP 1.9 scenarios, grouped by the carbon debt interest rate (rd) and the cost and capacity parameters of DACS. DACS cost parameters range from low to high (that is, LoCost, MedCost and HiCost); capacity limits include 10% and 30% of baseline emissions (that is, LoCap and HiCap). a, Total discounted abatement costs excluding interest costs (that is, ABM + RES + NNE as in Fig. 4 and Extended Data Figs. 3–5). b, Total discounted interest costs (that is, INT as in Fig. 4 and Extended Data Figs. 3–5).

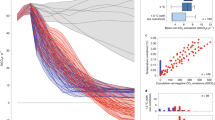

Extended Data Fig. 7 Schematic overview and illustrative repayment terms of RCP 1.9 scenarios.

a, Schematic overview of the CRO-ETS. The physical overshoot of a cumulative emission target, potentially amplified by outgassing of CO2 from the Earth’s stocks, subsequently necessitates carbon sequestration for returning to the target. For accrued carbon debt, CROs are issued, obliging emitters to compensate for a tonne of CO2 before a specified maturity—for example, by physically removing atmospheric CO2 or by acquiring an adequate quantity of allowances in the future. Similar to financial debt, CROs require debtors to pay interest to hedge physical and financial risks associated with carbon debt. Three earmarked financial resources are created under a CRO-ETS. (1) Revenues from auctioning allowances are recycled into the economy to the benefit of society. (2) Revenues from interest on carbon debt are targeted at managing risks—that is, by enabling additional carbon sequestration when Earth system risks (for example, permafrost thaw) and financial risks (for example, default risk of debtors) materialize. (3) Funds for repayment of the carbon debt are individually managed by debtors. b–e, The repayment term function TR(t) for the scenarios illustrated in Extended Data Fig. 3 (b), Extended Data Fig. 4 (c), Fig. 4 (d) and Extended Data Fig. 5 (e). Interest on carbon debt rd reflects the mean values of the distributions shown in Fig. 4c and Extended Data Figs. 3c, 4c, 5c. Bold lines indicate geometric median repayment terms derived from the scenarios presented in Fig. 4 and Extended Data Figs. 3–5. TR(t) maps the timing of carbon debt accrual to the time of its compensation (see Methods). For instance, in c, the carbon debt accrued in 2020 is compensated approximately 40 years later in scenarios with interest (rd = 0.058, yellow lines) and roughly 50 years later in scenarios for which rd = 0 (turquoise lines). As rd is increased, the net-zero year moves closer, indicating that carbon debt in 2020 is compensated earlier, whereas, in general, TR extends over longer periods. The increasingly flat net-negative emissions profile (when rd is increased) suggests that TR increases more rapidly in the beginning than when rd = 0 because the cumulative carbon debt at t grows faster than the cumulative net-negative emissions at t + TR(t). The point of inflection indicates where cumulative carbon debt begins to grow more slowly than cumulative net-negative emissions that compensate for that carbon debt. For instance, in d (yellow line), the cumulative carbon debt from 2030 onwards grows at a slower pace than the cumulative net-negative emissions approximately 63 years later.

Extended Data Fig. 8 MACCs.

a, The functional form of MACs,\(\,{\rm{MAC}}(a)=b[\tfrac{1}{\nu }((\tfrac{L-A}{a-A}{)}^{\nu }-1){]}^{c}\), is derived from the inverse generalized logistic function. It is relatively flexible with respect to replicating a wide range of MACCs derived from the SSP database. Here A = 1 and L = 0 are upper and lower asymptotes along the y axis. Notably, MAC(a = A) = ∞; therefore, A is a maximum abatement rate built into the MAC curve. b defines the y position of the pivot point. The x position of the pivot point is determined by ν and for ν = 1 it is exactly the middle of the interval (L, A), (L + A)/2. c defines the level of rotation with respect to the pivot point. b, Six stylized MACCs for DACS covering the literature range for costs from US$20 to US$1,000 per t CO2 (orange area). Low-cost MACCs (dotted lines) start at approximately US$50 per t CO2 and reach US$1,000 per t CO2 at abatement rates aDACS = 0.07 (low capacity, blue line) and aDACS = 0.27 (high capacity, red line) equivalent to approximately 3 and 12 Gt CO2 yr−1 at current emission levels, respectively. Medium-cost MACCs (dashed lines) start at US$250 per t CO2 and reach US$1,000 t CO2 at aDACS = 0.05 (low capacity, blue line) and aDACS = 0.22 (high capacity, red line), that is, roughly 2 and 10 Gt CO2 yr−1 at current emission levels, respectively. High-cost MACCs (solid lines) start at approximately US$500 per t CO2 and reach US$1,000 per t CO2 at aDACS = 0.03 (low capacity, blue line) and aDACS = 0.12 (high capacity, red line), amounting to roughly 1 and 5 Gt CO2 yr−1 at current emission levels, respectively.

Supplementary information

Supplementary Information

This file contains a graphical representation of all 2 °C (RCP2.6) emission pathways discussed in the Results (specifically in Figure 3).

Supplementary Data

This file contains the data of all 2 °C (RCP2.6) pathways discussed in the Results as an Excel sheet.

Supplementary Information

SI1.3 contains a graphical representation of all 1.5 °C (RCP1.9) emission pathways discussed in the Results (specifically in Figure 4 and Extended Data Figures 7–9).

Supplementary Data

This file contains the data of all 1.5 °C (RCP1.9) pathways discussed in the Results as an Excel sheet.

Supplementary Information

This file contains a graphical representation of the marginal abatement cost (MAC) curves used in the numerical model of this study. The parameters of the MAC curves can be retrieved with the R package provided for using the numerical model.

Supplementary Information

This file illustrates carbon prices from the SSP scenarios compared to carbon prices and MAC from the numerical model of this study.

Supplementary Information

This file illustrates consumption loss and GDP loss from the SSP scenarios compared to abatement costs from the numerical model of this study.

Supplementary Information

This file illustrates net emissions from the SSP scenarios compared to net emissions from the numerical model of this study.

Supplementary Information

This file contains the analytical methods necessary to derive equation [16] in the Methods section.

Rights and permissions

About this article

Cite this article

Bednar, J., Obersteiner, M., Baklanov, A. et al. Operationalizing the net-negative carbon economy. Nature 596, 377–383 (2021). https://doi.org/10.1038/s41586-021-03723-9

Received:

Accepted:

Published:

Issue date:

DOI: https://doi.org/10.1038/s41586-021-03723-9

This article is cited by

-

Separating CO2 emission from removal targets comes with limited cost impacts

Nature Communications (2025)

-

Optimizing afforestation pathways through economic cost mitigates China’s financial challenge of carbon neutrality

Communications Earth & Environment (2025)

-

Defect Engineering: Can it Mitigate Strong Coulomb Effect of Mg2+ in Cathode Materials for Rechargeable Magnesium Batteries?

Nano-Micro Letters (2025)

-

Inequality repercussions of financing negative emissions

Nature Climate Change (2024)

-

Prudent carbon dioxide removal strategies hedge against high climate sensitivity

Communications Earth & Environment (2024)