Abstract

Global climate change and the collection of environmental protection taxes are accelerating the green transformation of thermal power enterprises. This study selected Chinese thermal power listed companies as samples and used a dynamic three-stage (operational, green transformation, and market performance) network DEA model to evaluate their transformation efficiency and corporate performance. This paper incorporates targeted indicators such as ESG (environment, society, governance) and stock prices into the model and conducts a comparative study on the basis of macro policies and the geographical location of the enterprise. A comparative analysis was conducted on the efficiency of enterprises before and after the adjustment of the environmental tax burden, using the environmental tax burden as an exogenous variable. Thus, the following conclusions can be drawn: there is a certain positive correlation between the collaborative efficiency of the two links of thermal power enterprises and the economic development of their respective regions. Moreover, the green transformation efficiency of most thermal power enterprises is superior to the market performance efficiency. The environmental tax burden mainly improves the overall efficiency of thermal power enterprises by improving their operational efficiency and efficiency in the green transformation stage without affecting market performance. To further improve efficiency, thermal power enterprises should actively communicate with stakeholders to strive for more financial relief.

Similar content being viewed by others

The World Meteorological Organization (WMO) released its 2022 WMO Global Climate Statement in early 2023, indicating that global warming is still accelerating. In 2022, the global average temperature was 1.15 °C higher than before industrialization (1850–1900). Despite the cooling effects of the La Niña event over the past three years, the period from 2015 to 2022 remains the warmest eight years recorded by instruments since 1850. Liu et al.1 noted that the most direct consequence of an increase in carbon dioxide concentration is global warming. Carbon emissions have also become a hot topic around the world. In 2022, China's carbon dioxide emissions reached 11.48 billion tons, a decrease of 23 million tons from 2021, accounting for 0.2% of total emissions.

According to the CO2 Emissions in 2022 report released by the International Energy Agency (IEA), the largest industry emission growth in 2022 came from electricity and thermal power generation, with their emissions increasing by 1.8%, or 261 million tons. Global coal-fired and thermal power generation emissions, led by emerging Asian economies, increased by 224 million tons or 2.1%. In China, the power generation industry is fundamental for the development of the national economy and the main body of carbon market trading, bearing significant responsibility for carbon reduction. After years of development, China’s installed capacity and power generation both rank first in the world. Although economic benefits are the foundation for the survival and development of enterprises, environmental benefits are becoming increasingly important for their development. Zhang et al.2 noted that, when formulating development strategies, enterprises should consider environmental benefits, which are conducive to achieving a win‒win situation between economic and environmental benefits. At the same time, thermal power enterprises are often seen as not being conducive to environmental protection, but their transformation in the field of new energy has become a new growth direction for traditional thermal power enterprises. In 2023, the installed capacity of new energy (wind power, photovoltaic, hydropower, biomass power, and nuclear power) in China exceeded 50% for the first time, indicating that it has made significant progress in the field of new energy and made important contributions to addressing climate change and environmental protection.

In response to the increasingly serious environmental pollution problem, the Chinese government began levying environmental protection taxes in 2018. The collection of environmental taxes undoubtedly accelerates the green transformation and development process of heavily polluting enterprises, represented by thermal power enterprises, forcing them to incorporate environmental performance into their corporate performance. The ESG rating of a company integrates evaluation values from environmental, social responsibility, and governance dimensions, and the ESG score has financial relevance because it can comprehensively denote the sustainable transformation and development of a company. For listed thermal power companies, ESG ratings not only reflect their own progress in green transformation but also have a significant effect on their market performance.

Analysis of green transformation efficiency and performance efficiency of thermal power enterprises has always been an important issue for scholars in related fields. Most of the literature analyses the efficiency of sustainable transformation and development in the thermal power industry at the regional and industry levels, while relatively scant research has been conducted at the microlevel. Moreover, the understanding of corporate performance is only at the level of financial performance, without considering the capital market value of listed thermal power companies. This study uses the dynamic three-stage network DEA method to link the daily operations, green transformation, and market performance of thermal power enterprises, comprehensively evaluates the overall efficiency of the sustainable development of enterprises, and horizontally compares the efficiency of each substage.

The main contributions of this study are as follows. (1) Considering that factors such as the ESG scores of listed companies are output attributes of thermal power enterprises in the green transformation stage and input attributes in the subsequent market performance stage, ESG scores and related indicators are introduced into the evaluation index system for the synergistic efficiency of the green transformation and market performance of thermal power enterprises. (2) This study adopts a dynamic three-stage network DEA method to divide the collaborative efficiency evaluation process of the green transformation and market performance of thermal power enterprises into three progressive stages (operation, green transformation, and market performance), making it more in line with the actual operation of the enterprise. (3) Most other studies on the efficiency of green transformation focus on macro levels, such as regions, and relatively little research has been conducted on the efficiency of green transformation at the micro level of enterprises. Moreover, the only research at the enterprise level has failed to link the transformation effect of enterprises with market performance. This study selected the annual report data disclosed by 21 A-share listed thermal power companies from 2018 to 2022 for the evaluation and analysis of green transformation and market performance synergy efficiency. The model results are more in line with the actual efficiency evaluation needs of listed thermal power enterprises, providing reference value for their actual green transformation process.

Literature review

ESG score and the green transformation efficiency of enterprises

As the concept of green development gradually integrates into the strategies of listed companies, ESG ratings are highly important in characterizing their green transformation efficiency. The introduction of ESG ratings has forced thermal power companies to strike a balance between financial performance and green transformation efficiency3. Under the goal of balancing the efficiency of green transformation, green investment must be made, which is inevitably related to the financial pressure4 and management attitudes of the enterprise5.

First, many scholars suggest that ESG ratings can alleviate financial pressure on companies, thereby incentivizing the efficiency of their green transformation6. However, there is significant controversy over the mechanism by which ESG ratings alleviate financial pressure on companies and improve the efficiency of their green transformation. There are two mechanisms of action: internal and external to the company. From the external perspective of the enterprise, on the one hand, issuing higher ESG ratings can attract investors to invest by enhancing their confidence in improving the efficiency of the enterprise's green transformation, thereby alleviating the financial difficulties of the enterprise7. On the other hand, ESG ratings can better disclose nonfinancial information, such as the impact of green transformation on financial institutions. Even if a company's current financial performance is not ideal due to improvements in its green transformation efficiency, nonfinancial information can still gain the favour of institutional investors by demonstrating the company's future green development capabilities8. However, from an internal perspective, the release of ESG ratings enables companies to reduce internal costs caused by high pollution and emissions by improving the efficiency of their green transformation, thereby alleviating financial pressures in actual operations9. Moreover, with the popularization of ESG ratings, the green transformation effect of enterprises has reduced potential operational risk and attracted investors with hedging needs10. In short, good ESG rating performance alleviates financial pressure on enterprises, and sufficient capital turnover space helps enterprises improve the efficiency of green transformation, further enhances ESG rating performance, and forms a virtuous cycle of green development for enterprises.

Second, some scholars argue that the release of ESG ratings has increased environmental awareness among business managers, thereby encouraging them to improve the efficiency of their green transformation. The impact of ESG ratings on managers' awareness of green transformation can be divided into two directions: passive acceptance and active guidance. From the perspective of passive acceptance, increasingly strict environmental and emission-related policies and regulations have increased reputation and litigation risk for enterprise managers. To avoid these risks, enterprise managers must improve the efficiency of their green transformation11. Moreover, business managers must consider and respond to stakeholders' concerns about the prospects of green development to improve the efficiency of green reduction in enterprises12. From a positive guidance perspective, companies can improve their ESG performance by enhancing the efficiency of green transformation, thereby improving market performance. This will encourage managers to increase their awareness of green transformation, promote technological innovation under the green development strategy, and enhance the core competitiveness of the company13. In addition, stakeholders' positive attitudes towards ESG ratings and green transformation can enable them to allocate more resources to support management's green decisions. Managers can utilize these additional resources to achieve business goals while improving the efficiency of a company's green transformation14. In any direction, disclosing ESG ratings can increase managers' awareness of green transformation, enabling them to integrate green transformation goals into business objectives and thus improve the efficiency of a company's green transformation.

Environmental tax burden and the green transformation efficiency of enterprises

The core goal of the government's collection of environmental taxes is to increase the cost of pollutant emissions, force heavily polluting enterprises to improve their green transformation efficiency and reduce pollution expenditures15. The Chinese government has also introduced a national environmental tax collection bill by integrating local policies from various provinces16. Scholars generally believe that China's environmental tax can improve the efficiency of enterprises' green transformation17. Environmental taxes improve the efficiency of corporate green transformation through four main mechanisms: green technology innovation, environmental governance investment, the product market, and the labour market.

First, from the perspective of green technology innovation, the environmental tax burden can promote green technology innovation only in the short term; however, it may not necessarily improve the efficiency of corporate green transformation18. This is because, although companies are incentivized by environmental tax burdens to engage in green innovation activities, they may abandon additional green investments because of their own financial pressures and the possibility that green innovation activities may not be able to offset the costs of environmental tax burdens. Moreover, early investment also leads to the waste of enterprise resources, resulting in low efficiency in the green transformation of enterprises. Second, from the perspective of environmental governance investment19, low environmental tax burdens decrease the willingness of enterprises to invest in environmental governance. In addition, by increasing the burden of environmental taxes, enterprises can significantly increase their investment in environmental governance, thereby improving the efficiency of their green transformation from the end of production. Third, from the perspective of the product market20, consumers are more inclined to choose clean and environmentally friendly products to avoid the risks of product use, and this tendency also forces distributors to choose manufacturers with better environmental reputations for supply. Improving the efficiency of green transformation has become the only way for enterprises to form new market competitive advantages under environmental regulations. Finally, from the perspective of the labour market, the changes in business models brought about by environmental taxes can guide companies to invest in more professional green innovation talent21. In the long run, professional employees who focus on green innovation can better support the green transformation effect of enterprises22.

Application of the DEA method in the efficiency measurement of green transformation

In previous studies, DEA methods have focused mainly on the regional research perspective and the overall industry perspective when measuring the efficiency of green transformation. The perspective of regional studies can be divided into provincial studies and specific types of urban studies. For example, Tao et al.23 adopted the DEA model to measure the efficiency of green transformation at the provincial level in China. Yin et al.24 adopted a three-stage DEA method to evaluate the green transformation efficiency of mineral resource-based cities in China. However, some scholars have summarized the special geographical units in which cities are located and compared them with other regions. For example, Fu et al.25 used the DEA method to measure the efficiency of green transformation in northeast China and performed a comparative analysis with that of the other three typical provinces. The overall perspective of the industry is mostly concentrated in heavily polluting industries. For example, Li et al.26 measured the efficiency of green transformation in China's metal industry.

Moreover, many scholars have used more traditional DEA methods to measure the efficiency of green transformation in the past, which can be divided into single-stage DEA methods and multistage DEA methods according to the number of stages of the DEA model. With respect to single-stage DEA methods, the most common method is the adoption, for example, by Chen & Liu27 of the slack-based measure (SBM-DEA) method, which considers the unexpected output to measure the green transformation efficiency of coal mine areas. Moreover, multiple single-stage DEA methods can also be combined for comprehensive evaluation. For example, Chen et al.28 adopted the SBM-DEA model and EBM-DEA (epsilon-based measure) model to measure the green transformation efficiency of industrial enterprises. In addition, to further study the dynamic change in the efficiency value, other scholars have also combined the DEA method with the Malmquist index. For example, Yang et al.29 measured and analysed the efficiency of green transformation in various provinces in China through the superefficiency DEA and Malmquist index methods. In terms of the multistage DEA method, Chen et al.30 adopted the traditional three-stage DEA model to measure the efficiency of the green transformation of Chinese agriculture and eliminated the influence of environmental factors and random errors to a certain extent through the stochastic frontier method.

Summary

In summary, there are currently some gaps in the literature.

-

1.

Although the literature has confirmed the role of ESG score disclosure and the environmental tax burden in improving the efficiency of corporate green transformation, the specific impact mechanism of both in improving corporate green transformation efficiency is not yet clear.

-

2.

Currently, most studies combine the green transformation efficiency of enterprises with their financial performance but do not directly link the green transformation efficiency of enterprises with their capital market performance (such as stock price).

-

3.

When the DEA method is used to evaluate the efficiency of green transformation, most of the literature focuses only on the regional level, ignoring individual differences in enterprises and their actual business processes.

-

4.

In terms of research methods, most of the literature uses only relatively simple single-stage traditional DEA methods. Even if multistage methods are used, they exclude only the influence of environmental variables on the entire mathematical model and cannot describe the actual process of the green transformation of thermal power enterprises and their gradual relationship with market performance. Similarly, they cannot clarify the specific target of environmental variables.

Therefore, this study takes the environmental tax burden as an exogenous variable and evaluates the synergistic efficiency of the green transformation and market performance of 21 listed thermal power companies in China through a dynamic three-stage network DEA model. By selecting ESG indices and stock prices as indicators with feedback from the capital market and through the progressive relationship between the green transformation stage and the market performance stage in model design, the transformation results of enterprises are linked to market performance, better reproducing the actual business processes of enterprises. The application of the environmental tax burden as an exogenous variable also more intuitively demonstrates its impact on the efficiency of thermal power enterprises at different stages of operation.

Methodology and data

Methodology

Because the evaluation performance of the DDF nonray distance function is better and provides more accurate estimation results, this study extends the traditional DDF model, combines the dynamic DEA model of Tone & Tsutsui31, and considers the exogenous problem to solve the deficiencies of one-, two-, and three-stage dynamic DDF under an exogenous DEA model. In addition, traditional DEA models are "black boxes" that cannot intuitively reflect the process from input to output. In contrast, relevant scholars simply classify what enters the box and what leaves the box, and it is almost impossible to clarify the mechanism of action between variables. In contrast, multilevel network DEA is not a simple repetition of the traditional DEA model but allows for the gradual measurement of efficiency values on the basis of the chain structure. This study effectively simulates the process of thermal power enterprises carrying out green transformation through profit and obtaining feedback from the capital market by measuring the actual operational profit, green transformation process, and market feedback of thermal power enterprises. This can reveal the internal mechanism of the green transformation of thermal power enterprises in depth. In addition, unlike the traditional three-stage DEA model, which uses stochastic frontier analysis to eliminate the influence of external factors on the entire mathematical model, the network DEA model, which is based on exogenous variables, can analyse the target of exogenous variables more flexibly by observing the changes in efficiency values before and after the application of exogenous variables in each stage. Therefore, from the perspective of the actual process of green transformation and market feedback in thermal power enterprises, the multistage network DEA model is more suitable for this study. The formula is as follows.

Assume that a decision-making unit (\({DMU}_{j},j=1,\dots ,J\)) has \(t (t=1,\dots ,T)\) time periods. Within each time period, there are three stages: Stage 1, Stage 2, and Stage 3.

In Stage 1, there are D inputs \({x}_{ij}^{t}\left(i=1,\dots ,m\right)\) that produce P intermediate products \({z}_{Pj}^{t}\left(p=1,\dots ,P\right)\) and Q desired outputs \({o}_{qj}^{t}\left(q=1,\dots ,Q\right)\). Stage 2 uses P intermediate products \({z}_{Pj}^{t}\left(p=1,\dots ,P\right)\) and F inputs \({a}_{fj}^{t}\left(f=1,\dots ,F\right)\) to create R desired outputs \({y}_{rj}^{t}\left(r=1,\dots ,R\right)\) and S intermediate products \({u}_{sj}^{t}\left(s=1,\dots ,S\right)\). Stage 3 uses S intermediate products \({u}_{sj}^{t}\left(s=1,\dots ,S\right)\) and G inputs \({f}_{gj}^{t}\left(g=1,\dots ,G\right)\) to create L desired outputs \({n}_{lj}^{t}\left(l=1,\dots ,L\right)\).

Stage 1 (operation stage) inputs are total employees, new energy installed capacity, and thermal power installed capacity. The output is the annual total revenue. Stage 1 links to Stage 2 via R&D expenses. The inputs of Stage 2 (the green transformation stage) are the employee responsibility rate and the environmental improvement rate. The outputs are CO2 emissions and energy substitution benefits. Stage 2 links to Stage 3 via the ESG index. Stage 3 (market performance stage) inputs are operating costs and highly educated employees. The output is the stock price. The exogenous variable \(={A}_{vj}\left(v=1\dots V\right)\) is the environmental tax burden, and carry-over \({= c}_{hj}^{t}\left(h=1,\dots ,H\right)\) is the fixed asset balance. Figure 1 shows the research framework and related indicators of a dynamic three-stage network DEA model based on exogenous variables. The specific explanations for each variable are presented in Table 1.

We note that \(j\) represents the number of each DMU (i.e., the 30 thermal power enterprises in this paper), \(t\) represents the stage, and \(i,p,q,f,r,s,g,v,h,l\) represents the order of each variable. For example, \({x}_{ij}^{t}\) represents the ith input of enterprise \(j\) in stage \(t\).

Objective function

If there is an n dimension \(DMU\) set denoted as j, where \({DMU}_{o}\) represents the \(DMU\) under evaluation and \({DMU}_{o}\in j,\), then the mathematical model is formulated as follows.

Formula (1) calculates the efficiency of \({DMU}_{o}\). Formula (1) is primarily referenced from Chiu et al.32.

S.T.

Stage 1 (Operation stage) | Stage 2 (Green transformation stage) | Stage 3 (Market performance stage) |

|---|---|---|

\(\sum_{j}^{n}{\lambda }_{j}^{t}{X}_{ij}^{t}\le {x}_{io}^{t}-{\theta }_{1o}^{t}{q}_{io}^{t} \forall i, \forall t\) \(\sum_{j}^{n}{\lambda }_{j}^{t}{z}_{Pj}^{t}\le {z}_{Po}^{t}-{\theta }_{1o}^{t}{q}_{Po}^{t} \forall d,\forall t\) \(\sum_{j}^{n}{\lambda }_{j}^{t}{o}_{qj}^{t}\ge {o}_{qo}^{t}-{\theta }_{1o}^{t}{q}_{qo}^{t} \forall k, \forall t\) | \(\sum_{j}^{n}{\mu }_{j}^{t}{Z}_{pj}^{t}\le {z}_{po}^{t}-{\theta }_{2o}^{t}{q}_{po}^{t} \forall d, \forall t\) \(\sum_{j}^{n}{\mu }_{j}^{t}{y}_{ri}^{t}\ge {y}_{ro}^{t}-{\theta }_{2o}^{t}{q}_{ro}^{t} \forall s, \forall t\) \(\sum_{j}^{n}{\mu }_{j}^{t}{u}_{sj}^{t}\le {u}_{so}^{t}-{\theta }_{2o}^{t}{q}_{so}^{t} \forall g, \forall t\) | \(\sum_{j}^{n}{\rho }_{j}^{t}{u}_{sj}^{t}\le {u}_{so}^{t}-{\theta }_{3o}^{t}{q}_{so}^{t} \forall e, \forall t\) |

\(\sum_{j}^{n}{\rho }_{j}^{t}{f}_{gj}^{t}\le {f}_{go}^{t}-{\theta }_{3o}^{t}{q}_{go}^{t} \forall b, \forall t\) | ||

\(\sum_{j}^{n}{\rho }_{j}^{t}{n}_{lj}^{t}\le {n}_{lo}^{t}-{\theta }_{3o}^{t}{q}_{lo}^{t} \forall l, \forall t\) | ||

\(\sum_{j}^{n}{\mu }_{j}^{t}{u}_{sj}^{t}\le {u}_{so}^{t}-{\theta }_{2o}^{t}{q}_{so}^{t} \forall e, \forall t\) |

There is an n dimension \(DMU\) set denoted as \(j\), where \({DMU}_{o}\) represents the \(DMU\) under evaluation and \({DMU}_{o}\in j.\)

We note that the GFE represents the global factor efficiency, where \({\gamma }_{t}\) is the weight assigned to period t and \({w}_{1}^{t}\), \({w}_{2}^{t}\), and \({w}_{3}^{t}\) are the weights assigned to Stage 1 efficiency, Stage 2 efficiency, and Stage 3 efficiency, respectively. Therefore, \({w}_{1}^{t}\), \({w}_{2}^{t}\), and \({w}_{3}^{t}\) and \(\sum_{t=1}^{T}{\gamma }_{t}=1\).

Exogenous variables and links of stages

The exogenous variable is Formula (2). Formula (2) is primarily referenced from Li et al.33.

Here, \({\lambda }_{j}^{t}, {\mu }_{j}^{t},\text{ and }{\rho }_{j}^{t}\) denote the weights of the benchmarking for \({DMU}_{o}\) in the first, second and third stages, respectively.

The Stage 1 and Stage 2 links are expressed in Formula (3). The Stage 2 and Stage 3 links are expressed in Formula (4). The two periods of links are expressed in Formula (5). Formulas (3), (4), and (5) are primarily referenced from Lu et al.34.

Overall efficiency, period efficiency, stage efficiency, and period stage efficiency can be obtained from the above results.

Subefficiency values

The subefficiency values of the variables in this study are calculated in accordance with the total-factor efficiency (TFE) indicator published by Hu & Wang35 via the following equation.

The input variables and good output variables are Formulas (6) and (7), respectively.

If the value of total factor efficiency is 1, then the efficiency target has been achieved. Conversely, this means that there is an excess of inputs or a shortage of outputs, indicating that there is room for improvement.

Data description

This study selects data from 21 listed thermal power enterprises in China from 2018 to 2022, mainly based on the top 30 listed enterprises in terms of market value as ranked on the Tonghuashun Financial Data Platform at the end of 2022. The specific names and locations of the sample companies studied are in Appendix A of the supplementary material file. We have determined the geographical locations of the thermal power companies and new energy subsidiaries listed in the 2022 annual reports of these 21 listed thermal power companies in Fig. 2.

Regional distribution of thermal power enterprises. *Generated with ArcGIS 10.2 (URL: http://xdc.at/map/wmts). (a) Regional distribution of thermal power subsidiary companies, (b) Regional distribution of new energy subsidiary companies.

Descriptive statistics

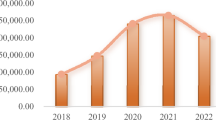

Figures 3, 4 and 5 show the descriptive statistics of the average, maximum, and standard deviation of some typical input‒output indicators. During the operation stage, the statistical data of the thermal power installed capacity, new energy installed capacity, total number of employees, and annual total revenue tend to increase annually. This may be because, with the continuous development of China’s economy and the increasing demand for electricity in society, the scale of thermal power enterprises has expanded.

In the green transformation stage, with increasing R&D expenses, employee responsibility rates, and environmental improvement rates annually, the energy substitution benefits of thermal power enterprises also increase. However, the ESG index of thermal power enterprises is decreasing annually, and their CO2 emission reductions are experiencing significant fluctuations. The annual increase in the standard deviation of R&D expenses indicates that the uncertainty of R&D input and output in thermal power enterprises has increased and that there are significant differences among different enterprises, which continue to increase over time.

During the market performance stage, the operating costs as input variables and the average number of highly educated employees continue to increase. The average stock price as an output variable also increases annually. The standard deviation of the above three indicators continues to increase, indicating that the gap between input and output in the development process of the sample thermal power enterprises is also increasing annually.

Empirical analysis

Total efficiency analysis

Figure 6 reflects the total efficiency value and ranking of the sample enterprises. Without considering the environmental tax burden, the average total efficiency of all enterprises from 2018 to 2022 is 0.5995. After this burden is considered, the average total efficiency increases to 0.6063, indicating a relatively average overall situation. Regardless of whether this tax burden is considered, there are 6 enterprises with an average total efficiency of 0.8 or above, accounting for 28.57% of overall efficiency. These enterprises, with the exception of TFEC, are all located in the economically developed eastern and southern regions of China, indicating a possible positive correlation between the economic level of their respective regions and their transformation efficiency. Economically developed regions provide certain policy support to their affiliated enterprises and have sufficient electricity demand to support their transformation financially.

Regardless of whether an environmental tax burden is considered, there are 10 companies with an average total efficiency below 0.6, of which 3 are below 0.3: JNPC, JEIC, and SNPC. JNPC and JEIC are both located in the northern coal-rich region. Their traditional coal price advantage due to their proximity to coal-producing areas may be the fundamental reason for their unwillingness to actively engage in clean energy transformation. The SNPC, as the smallest of these 21 thermal power enterprises, has limited enterprise resources, relies excessively on thermal power for its main business, and is clearly unwilling and unable to carry out clean energy transformation.

Notably, an environmental tax burden, as an exogenous variable, has little effect on the overall efficiency value. After considering the environmental tax burden, only 6 companies experienced changes in their total efficiency values, and their total efficiency values all showed an increasing trend. Among them, the GEPC has the largest change at 0.076, which may be due to the developed economy, dense population, and high level of urbanization in its southern region, along with the high environmental tax burden that enterprises need to bear. After considering the environmental tax burden for all enterprises, the true transformation efficiency of the GEPC has greatly improved.

Stage efficiency analysis

Efficiency analysis of the operation stage (S1)

In the operation stage, most enterprises have better efficiency values. Without considering the environmental tax burden (Fig. 7a), 71.43% of enterprises have an efficiency value of 1, with an average efficiency value of 0.9396. When the environmental tax burden (Fig. 7b) is considered, 85.71% of enterprises have an efficiency value of 1, and the average efficiency value increases to 0.9580. From the perspective of the location of enterprise ownership, regardless of whether the environmental tax burden is considered, the average efficiency of central China, as a region with a relatively weak economy, is the lowest.

As shown in Fig. 7a and b, from the perspective of some typical enterprises, the impact of the environmental tax burden can lead to changes in the operational efficiency values of six enterprises. Without exception, after the environmental tax burden is considered, the operational efficiency values of these six enterprises all improve. Overall, except for the developed coastal east and south regions of China, where the operating efficiency value of enterprises remains almost 1, the inland north and central regions of China show a U-shaped trend around 2020. Among them, JKPC has the lowest operating efficiency value, which may be due to its preparation and improvement of major asset restructuring around 2020 to reverse the decline of its operations. However, the improvement of its operating efficiency was not immediately achieved after asset restructuring.

Efficiency analysis of the green transformation stage (S2)

In the green transformation stage, the efficiency values of each enterprise decrease compared with the operation stage efficiency values. Without considering the environmental tax burden, the average efficiency value is 0.7626, whereas, after considering the environmental tax burden, the average efficiency value increases to 0.7773. As shown in Fig. 8a, from the perspective of enterprise ownership, regardless of whether the environmental tax burden is considered, the transformation efficiency of the eastern and southern regions, as the most developed areas in China’s economy, is second only to that of the northwestern region, which has transformed resource endowments. On the basis of the geographical distribution of its subsidiaries, as shown in Fig. 1, the reason for this situation may be that thermal power enterprises located in the east and south regions choose to invest in building new energy units in other areas with natural advantages, such as the northwest region.

As shown in Fig. 8b, from the trend of efficiency value changes in some typical enterprises, the transformation efficiency values in the eastern and northern regions mostly exhibit an inverted U-shaped trend, reaching their peak in 2020. This may be due to the prominent supply‒demand contradiction in China’s coal market in 2020, with a significant increase in coal prices forcing thermal power enterprises to accelerate their transformation pace and reduce operating costs. In addition, in 2020, the Chinese government introduced multiple policies to encourage thermal power enterprises to cooperate in the construction of new power systems with new energy as the main body. For enterprises in South China, their efficiency value is lower than that in East China because they are located along the coast of the South China Sea and have obvious advantages in commodity transportation, which is enough to obtain a low-priced coal supply. This also makes local enterprises unwilling to carry out costly new energy reforms.

Efficiency analysis of the market performance stage (S3)

In the market performance stage, the average efficiency value of a company is the lowest among the three stages. Notably, the environmental tax burden has almost no effect on the average efficiency value of a company’s market performance. The average efficiency value of enterprises in southern China exceeds that of enterprises in eastern China at this stage, indicating that southern China has the highest efficiency value. This may be because South China is home to the Shenzhen Stock Exchange and adjacent to Hong Kong, a global financial centre, which brings more advanced market management concepts and more convenient financial operation channels to enterprises in this region.

As shown in Fig. 9, based on the change trend, almost all enterprises were at their lowest market performance efficiency in 2019. This is due to the administrative intervention of the Chinese government in electricity prices caused by the decline in coal prices in 2019, as well as the outbreak of the COVID-19 epidemic in China at the end of 2019, which led to negative market expectations for future electricity demand. However, SEGCs are different from those of other enterprises. Its market efficiency has been steadily improving since 2018, and it was not until 2021 that it reached its peak efficiency. The key to achieving this situation lies in the significant increase in sales of its gas turbine projects overseas, as well as its early investment in new energy units in China. Since 2018, its current sales have been increasing annually, and by 2021, its new energy sales have reached 60% of those of the overall enterprise.

Subindex efficiency analysis

First, in the operation stage, we select the thermal power installed capacity, new energy installed capacity, and annual total revenue as key indicators for sample analysis. Among them, the efficiency value of thermal power installed capacity shows a relatively smooth and excellent level among all enterprises without considering the environmental tax burden. After this burden is considered, although the efficiency value still remains excellent, it slowly decreases over time. This finding indicates that the existence of an environmental tax burden can reduce the efficiency value of thermal power installed capacity to some extent, thereby reducing the dependence of enterprises on thermal power units and accelerating the pace of enterprise transformation. The efficiency value of new energy installed capacity has fluctuated greatly over the past five years. Although the environmental tax burden can improve the overall efficiency level to a certain extent, there is still a significant gap between it and the efficiency value of own thermal power installed capacity. In terms of the efficiency value of annual total revenue, the negative impact of the environmental tax burden is not significant and can almost be ignored. However, owing to the decrease in electricity demand and increase in coal prices during the COVID-19 pandemic, the efficiency values of all enterprises have declined to varying degrees since 2020. Among them, enterprises in economically developed areas have seen a significant decline compared with those in other inland areas.

Second, in the green transformation stage, key indicators for sample analysis include R&D expenses, energy substitution benefits, the ESG index, and CO2 emissions. In terms of R&D expenses, nearly 80% of enterprises achieved an efficiency value of 1 between 2018 and 2022, whereas a small number of enterprises represented by the CEPC peaked in 2020. This is due to their self-built new energy units achieving grid-connected power generation and commercial operation within the year and completing the clean technology transformation of traditional coal-fired units. In terms of the efficiency value of energy substitution benefits, there has been a significant fluctuation among enterprises from 2018 to 2022, but the average has always maintained an excellent level of 0.75 or above. The ESG index efficiency values show an inverted U-shaped pattern over the past five years, with almost all reaching their peak in 2020. Among them, Shanghai Electric Power has the largest fluctuation range because it has vigorously promoted the production of new energy projects in the past five years, but losses occurred in 2021. The variation in CO2 emission efficiency is similar to the variation in energy substitution efficiency. Compared with not considering the environmental tax burden, considering this burden improves the efficiency values of various green transformation stage indicators to varying degrees, with the efficiency value of R&D expenses increasing the most.

Finally, in the market performance stage, we selected operating costs and stock prices as key indicators for sample analysis. From the perspective of changes in operating cost efficiency values, except for GDGI and HEHL, which have almost always maintained excellent performance with an efficiency value of 1, all other enterprises have a U-shaped structure with the lowest value around 2019. Both GDGI and HEHL are located in the Guangdong Hong Kong Macao Greater Bay Area, which was heavily developed by the Chinese government. They can use coal hedging tools to reduce fuel costs. With respect to changes in the efficiency value of stock prices, except for a few companies located in South China and East China, all other companies have a U-shaped trend, such as changes in the efficiency value of operating costs. Notably, the impact of the environmental tax burden on the two market performance indicators mentioned above is almost negligible.

Figures 10a and b illustrate the efficiency clustering heatmaps divided by the indices. Overall, regardless of whether the environmental tax burden is considered, the ESG index efficiency of most enterprises from 2018 to 2022 is in the optimal range, indicating an obvious clustering state. The relevant efficiency in the market performance stage is relatively weak, concentrated in the middle range of 0.4 to 0.6. Considering this tax burden, the efficiency of the annual total revenue indicator of thermal power enterprises has improved.

In the clustering situation, regardless of whether the environmental tax burden is considered, CO2 emissions and energy substitution benefits are significantly correlated. The carbon reduction and green transformation development of thermal power enterprises are conducive to achieving good energy substitution benefits. However, the efficiency of the green transformation indicators and the market performance indicators in this study sample are not strongly correlated. One possible reason is that the green transformation indicator benefits mainly from noncapitalized expenditures that directly increase operating costs, whereas market performance mostly depends on expected profitability, which conflicts to some extent between the two. In addition, owing to the multiple influences of administrative intervention and public welfare factors, the green transformation and market performance of thermal power enterprises have not reached a relatively optimal state of coordinated development. It is necessary to focus on the correlation effect between the green transformation process and market performance in the future and take various measures to improve business performance and market competitiveness while promoting green transformation.

Conclusions and suggestions

Conclusions

By evaluating the transformation process of 21 thermal power enterprises in China from 2018 to 2022, the following conclusions can be drawn.

1. The overall efficiency value of thermal power enterprises is good, and enterprises that engage only in thermal power business have the best overall efficiency performance. Regardless of whether the environmental tax burden is considered or not, it reaches 0.78 or above, and there is a certain positive correlation with the economic development status of an enterprise’s region. The existence of an environmental tax burden can improve the overall efficiency of the transformation process to some extent. The efficiency performance of the sample enterprises at each stage is basically consistent with the economic development level of their respective regions. This finding indicates that the transformation process of thermal power enterprises requires strong support from local governments and that the industrial structure and market environment in the jurisdiction also have a significant effect on the transformation process of thermal power enterprises. By sorting out the distribution of thermal electronics companies and new energy subsidiaries of these 21 thermal power enterprises, we find that thermal power enterprises in economically developed areas can achieve their green transformation process by establishing new energy subsidiaries in areas with natural advantages.

The conclusion that the collaborative efficiency value is positively correlated with the economic development status of the region where the enterprise is located is consistent with the views of many mathematicians, such as Xiao et al.36; that is, the efficiency of power enterprises in provinces with higher economic levels is better than that in provinces with lower economic levels. These findings indicate that good government financial support and high electricity demand promote the overall efficiency of thermal power enterprises. In addition, Dai37 believes that the common feature of the decline in performance of thermal power enterprises is the single production and operation mode and the lack of business expansion. This is completely different from the results of this study. Among the sample enterprises, companies that only engage in thermal power business, such as Tianfu Energy, rank among the top in the industry in terms of overall efficiency values at all stages and even rank first. This may be because, during Dai's research period, China's electricity demand was strong, and the power grid facilities were sufficient to absorb the early stage of new energy generation. However, China's power grid is currently unable to adapt and does not need to adapt to unstable new energy generation. Excessive expansion of the new energy business by thermal power enterprises can lead to inefficient phenomena such as electricity waste.

2. In terms of stage efficiency, the green transformation stage efficiency of thermal power enterprises is better than the market performance stage efficiency but lower than their own operational stage efficiency. Among them, operation stage efficiency is on average 23% higher than green transformation stage efficiency, whereas green transformation stage efficiency is 18% higher than market performance stage efficiency. The impact of the environmental tax burden improves the operational efficiency and green transformation efficiency of enterprises, but it does not impact their market performance. Notably, the environmental tax burden has the same effect on improving efficiency in these two stages at 2%. This means that a listed company’s operational efficiency is naturally excellent, while its green transformation efficiency and market performance efficiency are lower than the overall efficiency level. The government improves the operational efficiency and green transformation efficiency of thermal power enterprises by increasing the environmental tax burden, thereby optimizing overall efficiency.

The impact of the environmental tax burden on the green transformation process of thermal power enterprises is consistent with the conclusion drawn by Huang et al.38 but contrary to that of Tu & Chen39. The environmental tax burden can increase the green innovation level and efficiency of heavily polluting industry enterprises, thereby improving the green transformation efficiency of heavily polluting industry enterprises (such as thermal power enterprises). This may be due to excessive emphasis on the effectiveness of financial performance in the transformation and development of thermal power enterprises while neglecting the level of green transformation that enterprises have already achieved.

3. In terms of subindicator efficiency, the efficiency values of the input‒output indicators in various stages of thermal power enterprises are mostly in a stable improvement state and only slowly decrease around 2022. Owing to China’s difficulties in electricity consumption in 2021, the government adopted administrative intervention measures to require thermal power enterprises to restore a stable and large-scale supply of thermal power. Therefore, green transformation indicators such as energy substitution efficiency are prone to significant fluctuations, but overall, they are still relatively good. This indicates that, despite being negatively affected by individual business factors and external environmental factors, the transformation process of China’s thermal power enterprises is still steadily advancing over time.

4. There is no good correlation between the efficiency of indicators in the green transformation stage and the market performance stage. This is reflected mainly in the lack of a good linkage effect between the efficiency of ESG indicators and the efficiency of stock price indicators. This finding also indicates that there is no progressive relationship between the green transformation and market performance goals of thermal power enterprises. This requires the management of an enterprise to better coordinate the possible contradictions between the two and take various measures to improve business performance and market competitiveness while promoting green transformation as much as possible.

However, this study also has shortcomings in the following aspects. First, owing to the limited availability of enterprise data, the sample size selected in this study is relatively small, which to some extent affects the quasi reliability of the DEA evaluation method. Second, this study only classifies thermal power enterprises on the basis of their geographical location, and the classification criteria are simple, ignoring the impact of other differences between thermal power enterprises on efficiency values. Third, this study analyses the trend of efficiency values, which inevitably involves a certain degree of randomness. Therefore, future research needs to collect sample enterprise data more widely to address the accuracy issues faced by dynamic multistage network DEA models. In addition, we refine the classification method for thermal power enterprises while introducing a benchmark regression method to verify the factors affecting the transformation and performance synergy efficiency of thermal power enterprises.

Implications

Implications for thermal power enterprises

Thermal power enterprises need to strengthen their connections with government departments, financial institutions, and other stakeholders. Financial institutions can alleviate the difficulties in capital turnover caused by carrying out green transformation through endorsement from local government departments and granting credit. At the same time, thermal power enterprises need to focus on their own market performance while carrying out green transformation. For example, the timely disclosure of one’s own environmental performance to the public can enable investors to see the good development prospects of the enterprise, thereby attracting and obtaining more equity investment and credit limits. Doing so can help form a virtuous cycle between transformation and development.

Implications for government departments

In addition to continuing to collect environmental taxes, government departments should also introduce a series of policy combinations on the basis of the situation of different enterprises. For example, for some thermal power enterprises that clearly deliberately evade environmental taxes, bureaus should increase their law enforcement and supervision efforts and appropriately increase relevant taxes and fees. When facing financial difficulties for some thermal power enterprises due to green transformation, the government should actively help them establish communication channels with banks and other financial institutions and provide certain financial subsidies to help them overcome the painful business period caused by transformation.

Data availability

The data are provided within the manuscript files.

Abbreviations

- ESG:

-

Environment, society, and governance

- DEA:

-

Data envelopment analysis

- SBM:

-

Slacks-based measure

- EBM:

-

Epsilon-based measure

- DMU:

-

Decision-making unit

- S1:

-

Operation stage

- S2:

-

Green transformation stage

- S3:

-

Market performance stage

- R&D:

-

Research and development

- MW:

-

Megawatt

- CO2ER:

-

CO2 emission reduction

- OC:

-

Operating costs

- ESB:

-

Energy substation benefits

- SP:

-

Stock price

References

Liu, Z. et al. Targeted opportunities to address the climate–trade dilemma in China. Nat. Clim. Change 6, 201–206. https://doi.org/10.1038/nclimate2800 (2015).

Zhang, L., Long, R., Chen, H. & Huang, X. Performance changes analysis of industrial enterprises under energy constraints. Resour. Conserv. Recycl. 136, 248–256. https://doi.org/10.1016/j.resconrec.2018.04.032 (2018).

Rim, E. K., Nohade, N., Etienne, H. & Khaled, H. Exploring the performance of responsible companies in G20 during the COVID-19 outbreak. J. Clean. Prod. 354, 131693. https://doi.org/10.1016/j.jclepro.2022.131693 (2022).

Eliwa, Y., Aboud, A. & Saleh, A. ESG practices and the cost of debt: Evidence from EU countries. Crit. Perspect. Account. 79, 102097. https://doi.org/10.1016/j.cpa.2019.102097 (2021).

Capelli, P., Ielasi, F. & Russo, A. Forecasting volatility by integrating financial risk with environmental, social, and governance risk. Corp. Soc. Responsib. Environ. Manag. 28(5), 1483–1495. https://doi.org/10.1002/csr.2180 (2021).

Jiao, J., Zhang, X. & Tang, Y. What factors determine the survival of green innovative enterprises in China?—A method based on fsQCA. Technol. Soc. 62, 101314. https://doi.org/10.1016/j.techsoc.2020.101314 (2020).

Deng, X., Li, W. & Ren, X. More sustainable, more productive: Evidence from ESG ratings and total factor productivity among listed Chinese firms. Finance Res. Lett. 51, 1544–6123. https://doi.org/10.1016/j.frl.2022.103439 (2023).

Huang, Z., Liao, G. & Li, Z. Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Change 144, 148–156. https://doi.org/10.1016/j.techfore.2019.04.023 (2019).

Reber, B., Gold, A. & Gold, S. ESG disclosure and idiosyncratic risk in initial public offerings. Journey Bus. Ethics 179, 867–886. https://doi.org/10.1007/s10551-021-04847-8 (2022).

Li, W., Hu, H. & Hong, Z. Green finance policy, ESG rating, and cost of debt-Evidence from China. Int. Rev. Financ. Anal. 92, 103051. https://doi.org/10.1016/j.irfa.2023.103051 (2024).

Samad, S. et al. Green Supply Chain Management practices and impact on firm performance: The moderating effect of collaborative capability. Technol. Soc. 67, 101766. https://doi.org/10.1016/j.techsoc.2021.101766 (2021).

Zhang, B., Wang, Z. & Lai, K. Mediating effect of managers’ environmental concern: bridge between external pressures and firms’ practices of energy conservation in China. J. Environ. Psychol. 43, 203–215. https://doi.org/10.1016/j.jenvp.2015.07.002 (2015).

Zumente, I. & Bistrova, J. ESG importance for long-term shareholder value creation: Literature vs. practice. J. Open Innov. Technol. Mark. Complex. 7(2), 127. https://doi.org/10.3390/joitmc7020127 (2021).

Huang, S., Lu, J., Chau, K. Y. & Zeng, H. Influence of ambidextrous learning on eco-innovation performance of startups: Moderating effect of top management’s environmental awareness. Front. Psychol. 11, 1976. https://doi.org/10.3389/fpsyg.2020.01976 (2020).

Shen, Y. & Zhang, X. Study on the impact of environmental tax on industrial green transformation. Int. J. Environ. Res. Public Health 19(24), 16749. https://doi.org/10.3390/ijerph192416749 (2022).

Cheng, Z. H. & Li, X. Do raising environmental costs promote industrial green growth? A Quasi-natural experiment based on the policy of raising standard sewage charges. J. Clean. Prod. 343, 131004. https://doi.org/10.1016/j.jclepro.2022.131004 (2022).

Yu, Y., Liu, J. & Wang, Q. Has environmental protection tax reform promoted green transformation of enterprises? Evidence from China. Environ. Sci. Pollut. Res. 1, 25. https://doi.org/10.1007/s11356-024-32844-7 (2024).

Jie, M. H., Wang, J. & Liu, D. M. Environment regulation, technological innovation and corporate performance. Nankai Bus. Rev. 17, 106–113 (2014).

Tang, G. P., Li, L. H. & Wu, D. J. Environmental regulation, industry attributes and corporate environmental investment. Account. Res. 6, 83–88 (2013).

Menguc, B., Auh, S. & Ozanne, L. The interactive effect of internal and external factors on a proactive environmental strategy and its influence on a firm’s performance. J. Bus. Ethics 94, 279–298. https://doi.org/10.1007/s10551-009-0264-0 (2010).

Yip, C. M. On the labor market consequences of environmental taxes. J. Environ. Econ. Manag. 89, 136–152. https://doi.org/10.1016/j.jeem.2018.03.004 (2018).

Karydas, C. & Zhang, L. Green tax reform, endogenous innovation and the growth dividend. J. Environ. Econ. Manag. 97, 158–181. https://doi.org/10.1016/j.jeem.2017.09.005 (2019).

Tao, X., Wang, P. & Zhu, B. Provincial green economic efficiency of China: A non-separable input–output SBM approach. Appl. Energy 171, 58–66. https://doi.org/10.1016/j.apenergy.2016.02.133 (2016).

Yin, Q., Wang, Y., Wan, K. & Wang, D. Evaluation of green transformation efficiency in Chinese mineral resource-based cities based on a three-stage DEA method. Sustainability 12(22), 9455. https://doi.org/10.3390/su12229455 (2020).

Fu, J., Xiao, G. & Wu, C. Urban green transformation in Northeast China: A comparative study with Jiangsu, Zhejiang and Guangdong provinces. J. Clean. Prod. 273, 122551. https://doi.org/10.1016/j.jclepro.2020.122551 (2020).

Li, S., Zhu, X. & Zhang, T. Optimum combination of heterogeneous environmental policy instruments and market for green transformation: Empirical evidence from China’s metal sector. Energy Econ. 123, 106735. https://doi.org/10.1016/j.eneco.2023.106735 (2023).

Chen, Y. & Liu, L. Improving eco-efficiency in coal mining area for sustainability development: An emergy and super-efficiency SBM-DEA with undesirable output. J. Clean. Prod. 339, 130701. https://doi.org/10.1016/j.jclepro.2022.130701 (2022).

Chen, W., Pan, L. & Zhao, M. Efficiency evaluation of green technology innovation of China’s Industrial enterprises based on SBM model and EBM model. Math. Problems Eng. 11, 6653474. https://doi.org/10.1155/2021/6653474 (2021).

Yang, Q., Wan, X. & Ma, H. Assessing green development efficiency of municipalities and provinces in China integrating models of super-efficiency DEA and Malmquist index. Sustainability 7, 4492–4510. https://doi.org/10.3390/su7044492 (2015).

Chen, Y., Miao, J. & Zhu, Z. Measuring green total factor productivity of China’s agricultural sector: A three-stage SBM-DEA model with non-point source pollution and CO2 emissions. J. Clean. Prod. 318, 128543. https://doi.org/10.1016/j.jclepro.2021.128543 (2021).

Tone, K. & Tsutsui, M. Network DEA: A slacks-based measure approach. Eur. J. Oper. Res. 197(1), 243–252. https://doi.org/10.1016/j.ejor.2008.05.027 (2009).

Chiu, Y., Huang, C. & Ma, C. M. Assessment of China transit and economic efficiencies in a modified value-chains DEA model. Eur. J. Oper. Res. 209(2), 95–103. https://doi.org/10.1016/j.ejor.2010.05.010 (2011).

Li, L., Liu, B., Liu, W. & Chiu, Y. Efficiency evaluation of the regional high-tech industry in China: A new framework based on meta-frontier dynamic DEA analysis. Socio-Econ. Plann. Sci. 60, 24–33. https://doi.org/10.1016/j.seps.2017.02.001 (2017).

Lu, L. C., Chiu, S. Y., Chiu, Y. & Chang, T. H. Three-stage circular efficiency evaluation of agricultural food production, food consumption, and food waste recycling in EU countries. J. Clean. Prod. 343, 130870. https://doi.org/10.1016/j.jclepro.2022.130870 (2022).

Hu, J. & Wang, S. Total-factor energy efficiency of regions in China. Energy Policy 34(17), 3206–3217. https://doi.org/10.1016/j.enpol.2005.06.015 (2006).

Xiao, Q. W., Tian, Z. & Ren, F. R. Efficiency assessment of electricity generation in China using meta-frontier data envelopment analysis: Cross-regional comparison based on different electricity generation energy sources. Energy Strategy Rev. 39, 100767. https://doi.org/10.1016/j.esr.2021.100767 (2022).

Dai, L. & Wang, M. Study on the influence of carbon emission constraints on the performance of thermal power enterprises. Environ. Sci. Pollut. Res. 27, 30875–30884. https://doi.org/10.1007/s11356-020-09604-4 (2020).

Huang, S., Lin, H., Zhou, Y., Ji, H. & Zhu, N. The influence of the policy of replacing environmental protection fees with taxes on enterprise green innovation—Evidence from China’s heavily polluting industries. Sustainability 14, 6850. https://doi.org/10.3390/su14116850 (2022).

Tu, Z. G. & Zhan, R. J. Can the Emission trading system achieve the Porter Effect in China?. Econ. Res. J. 50, 160–173 (2015).

Funding

This study was supported by the Jiangsu Province Social Science Foundation Project (22GLD019), the Major Project of Philosophy and Social Science Research in Universities of Jiangsu Province (2022SJZD053) and Soft science project of Science and Technology Department of Shaanxi Province (2023-CX-RKX-009).

Author information

Authors and Affiliations

Contributions

X-yL: formal analysis and writing—original draft preparation. F-rR: conceptualization, methodology and software resources. F-yS: data and visualization curation. X-mY: investigation and project administration. All the authors read and contributed to the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Liu, Xy., Ren, Fr., Sun, Fy. et al. Green transformation and performance synergy efficiency of china’s thermal power enterprises on the basis of the environmental tax burden. Sci Rep 14, 19358 (2024). https://doi.org/10.1038/s41598-024-70465-9

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1038/s41598-024-70465-9

Keywords

This article is cited by

-

Evaluating energy efficiency in Turkish electric distribution using network DEA and GA models

Scientific Reports (2025)

-

Enterprise Tax Assessment and Risk Avoidance Based on Deep Learning

International Journal of Computational Intelligence Systems (2025)