Abstract

The interaction between the government’s carbon reduction policy and a firm’s product strategy has not been well studied in the literature. This paper considers the government’s two different carbon quota allocation policies for the cap-and-trade scheme and the firm’s two product strategies and investigates the interaction between them by establishing a theoretical model and deriving the optimal decisions. This paper first examines the firms’ selection of low-carbon products or ordinary product strategies under the government’s two carbon quota allocation policies and then studies the government’s optimal carbon quota allocation policy for overall social welfare, which is based on the firm’s two product strategies. Our analysis reveals that (i) when the government allocates carbon quotas aimed at reducing the firm’s total carbon emissions, the firm will choose the low-carbon product strategy. When the government allocates a carbon quota aimed at optimal total social welfare, the firm’s decision depends on the impact of total carbon emissions. (ii) To achieve optimal social welfare, the government will formulate different carbon quota allocation policies on the basis of firms’ different product strategies.

Similar content being viewed by others

Introduction

With the rapid development of the global economy, the environmental problems caused by excessive emission of greenhouse gases, mainly carbon dioxide, have gradually attracted the attention of all sectors of society. It is estimated that a 1% rise in economic growth will increase carbon emissions by 0.97%19. According to the “Emissions Gap Reports 2023” released by the United Nations Environment Programme, global greenhouse gas emissions increased by 1.2% between 2021 and 2022, setting a new record of 57.4 billion tons of carbon dioxide. By 2030, global carbon emissions must decrease by 28% to 42% to achieve the goal of limiting global warming by 1.5 to 2 degrees 5.

To limit and reduce the excessive emissions of greenhouse gases such as carbon dioxide, various countries have successively launched a series of policies, among which cap-and-trade is considered effective 21,24. According to statistics, more than 46 countries and 32 regions have implemented or planned to implement 61 carbon emission reduction policies, 31 of which are cap-and-trade systems 7. Under this policy, firms can obtain a certain amount of free carbon emissions from the government. If the actual carbon emissions in the production process exceed this quota, the firm must purchase the remainder in the carbon trading market. If the firm’s actual carbon emissions are lower than the carbon quota allocated by the government, unused carbon credits can be sold in the trading market.

To address the environmental problems caused by excessive carbon dioxide emissions, especially under government environmental policies such as cap-and-trade, firms have adopted carbon emission reduction measures and started to produce low-carbon products. On the one hand, producing low-carbon products can reduce carbon dioxide emissions in the production process, which could relieve the pressure of government policies on these firms. On the other hand, consumers’ demand for low-carbon and environmentally friendly products can be met, which also allows firms to increase consumer surplus. However, producing low-carbon products requires the firm to adopt carbon emission reduction technology, which will incur additional technology improvement costs. As a result, for cost reasons, some firms continue to produce ordinary products, whereas others choose to produce low-carbon products. For example, Oceano Company, a well-known Chinese ceramic tile manufacturer, improved the low-carbon technology of kilns for firing ceramic tiles and began to produce low-carbon ceramic tiles, annually reducing carbon emissions by 11,800 tons 20.

The government has implemented a cap-and-trade policy aimed at forcing firms to reduce carbon emissions in production by assigning carbon quotas to them. Under the government’s policies, firms reduce carbon emissions during production and protect the environment. However, society as a whole includes firms, consumers, and other groups. The firm’s carbon emission reduction measures must pay a certain cost, which will inevitably reduce some groups’ interests. Therefore, a carbon quota allocation policy designed solely to reduce carbon emissions may not be optimal for total social welfare. It is necessary to rethink the formulation of the government’s policy while considering a firm’s profits, consumer surplus, environmental benefits, and other factors.

As mentioned earlier, firms choose a product strategy that is beneficial to them according to government policies. Therefore, when formulating policies, the government should also consider the firm’s selection mechanism for product strategy. That is, the government and the firm, as the two sides of the game, take the influence of the other side into account when making decisions. Therefore, it is highly important for both governments and firms to study the interaction between product strategy selection and the carbon quota allocation policy. In other words, the government’s carbon quota allocation policy should be studied on the basis of the firm’s product strategy, and the firm’s product strategy should be studied on the basis of the government’s carbon quota allocation policy. This is beneficial to the firm’s product strategy selection and formulation of government’s carbon quota allocation policy.

Although scholars have studied cap-and-trade policies, most of them have used comparative methods to analyze their effects on firms’ carbon emission reduction and environmental benefits 3,9,10,14,24,29,31, they have neither drawn specific carbon quota allocation policies for optimal social welfare nor considered interactions with firms’ product strategy selection. Some scholars have also studied firms’ product strategy selection under cap-and-trade regulation 4,15,27,28, but most of them have only studied firms’ product strategy selection under one carbon quota allocation policy and have not considered the situation under multiple carbon quota policies. Research using theoretical models to study the government’s carbon quota allocation policy aimed at optimal social welfare, the firm’s product strategy selection under two different carbon quota allocation policies, and the interaction between them remains sparse.

To fill this gap, we develop a theoretical model to address the interaction effect between a government’s carbon quota allocation policy and a firm’s selection of two-product strategies. This paper considers the government’s two carbon quota allocation policies, the policy aimed only at reducing the firm’s carbon emissions (Policy I) and the policy aimed at optimal social welfare (Policy II), and considers the firm’s two product strategies: the ordinary product strategy and the low-carbon product strategy.

Specifically, this article answers the following main questions:

(i). When the government adopts a carbon quota allocation policy aimed only at reducing the firm’s carbon emissions, will the firm choose the ordinary product strategy or the low-carbon product strategy?

(ii). When the government adopts a carbon quota allocation policy aimed at optimal social welfare, will the firm choose the ordinary product strategy or the low-carbon product strategy?

(iii). When a firm adopts an ordinary product strategy or a low-carbon product strategy, what carbon quota allocation policy should the government formulate to achieve optimal social welfare?

The remainder of the paper proceeds as follows. We review the related literature in Section "Literature review", and then we set up the model in Section "Model Description". In Section "Firm’s product strategy selection under Policy I", we examine the firm’s selection on two product strategies under Policy I. In Section "Firm product strategy selection and the government’s optimal carbon quota under Policy II.", we examine the firm’s selection on product strategies under Policy II and the formulation of this policy. Section "Numerical example" provides the numerical example for the findings. Section "Discussion" is the discussion. In Section "Conclusion" we conclude the paper.

Literature review

There are three streams of literature related to the research in this paper, and we review them separately.

The first stream is concerned with research on cap-and-trade policy. To limit and constrain firms’ carbon dioxide emissions, many governments have implemented various carbon emission reduction policies, such as cap-and-trade mechanisms, carbon taxes, and subsidy policies. Among them, cap-and-trade policies are regarded as the most effective and have attracted the attention of many scholars. For example, Hu et al.9 compared the effects of carbon taxes and cap-and-trade policy on China’s remanufacturing industry and showed that cap-and-trade policy is more suitable for China’s remanufacturing industry. Chen et al.3 established a static optimal model to compare the impact of cap-and-trade policy and carbon tax on the effects of firm’s clean innovation and showed that cap-and-trade policy is more effective in promoting firm’s clean innovation. Li.16 studied the government’s specific carbon tax policy, considering the firm’s different product distribution channels. Yang et al. 24 compared the effects of cap-and-trade policy and government subsidy policy on carbon emission reduction of firms in Electric Logistics Vehicles Leasing System And concluded that cap-and-trade policy can better encourage firms to reduce carbon emissions. Zhang et al. 29 analyzed the effect of a hybrid carbon policy of carbon tax and cap-and-trade, on the manufacturer’s carbon abatement activities and social welfare.

Li et al.14compared the effect of cap-and-trade and hybrid subsidy policies on remanufacturers and environmental benefit. Huang et al.10 compared mixed carbon policy with single tax and cap-and-trade policies for economic and environmental benefits.

These studies used the comparative method to study the effects of cap-and-trade policy on firms’ decisions, profits, and social welfare. Initially, scholars conducted comparative studies on individual carbon reduction policies such as cap-and-trade, carbon tax, and subsidies. Recently, scholars have begun to study the effects of mixed policies on firms’ carbon emission reduction decisions and social welfare. However, most of these studies did not propose specific carbon emission reduction policy parameters for optimal social welfare, which is also a direction that scholars need to study in the future. This paper, along with this direction, provides specific carbon quota allocation policy recommendations.

We made a comparative analysis on some relevant literatures, as shown in Table 1.

The second stream focuses on the firm’s decision-making under cap-and-trade regulation. The cap-and-trade policy is used to restrict and limit a firm’s excessive carbon emission, but the firm’s aim is to pursue the maximum profit, which often deviates from this policy’s target. To verify the effectiveness of cap-and-trade policy and formulate a more effective carbon quota allocation mechanism, it is necessary to study a firm’s specific decision-making mechanism under cap-and-trade regulation. Therefore, many scholars have studied the impact of cap-and-trade policies on firms’ decisions on product selection, price, and carbon emission reduction. For instance, Du et al.4 believes that even if the additional cost involved in producing low-carbon products is high, firms are likely to adopt low-carbon product strategy if consumer preference for low-carbon product is high enough. Li et al.13 established a Stackelberg game model to study the impact of government’s two subsidy strategies on the firm’s carbon emission reduction under cap-and-trade policy and give specific recommendations for developed and high-emission and emerging industries. Zhang et al. 27 established a Stackelberg game model to study whether firms in a competitive supply chain would choose low-carbon production strategy under cap-and-trade regulation and concluded that the selection of low-carbon production strategy of downstream firms is mainly affected by the market competition degree. Liu et al.17 mainly studied the firm’s selection on different carbon emission reduction modes under the carbon cap-and-trade policy. Cai and Jiang.1 studied a firm’s price decisions and carbon emission reduction decisions in the low-carbon supply chain under cap-and-trade policy and showed that consumer environmental awareness always improves the performance of the supply chain. Xu et al.22 studied a firm’s selection on manufacturer-led reselling and platform-led reselling modes. considering the impact of cap-and-trade policy and green production technology. Chen et al.2 examined a firm’s choice of green technology under the influence of cap-and-trade scheme, considering the impact of insurer green finance. Yang et al. 25 analyzed the reasons why some firms would rather face penalty than take carbon emission reduction measures under cap-and-trade mechanism. Zou et al. 32 studied a firm’s Equilibrium pricing mechanism under cap-and-trade regulation in a low-carbon supply chain and showed that the improvement of the risk aversion coefficient can improve the firm’s sales price and profit.

Most of the above studies have investigated the impact of cap-and-trade policies on firms’ decision-making under different circumstances. However, few studies have focused on the interaction between the government’s carbon quota allocation quantity and the firm’s product strategy selection, combining the government’s carbon quota allocation policy with the firm’s product strategy.

We made a comparative analysis on some relevant literature, as shown in Table 2.

The third stream concerns the heterogeneity of consumer environmental awareness. Owing to the impact of environmental pollution, as well as the publicity and advocacy of the government and environmental protection agencies, many consumers have significantly increased their environmental awareness. One of the manifestations is that they have a clear purchase preference for environmentally friendly and low-carbon products. However, because of the influence of education level, age, region and other factors, consumers’ environmental awareness and preferences for low-carbon products differ. Many scholars have also paid attention to the heterogeneity of consumer environmental awareness and incorporated it into research on government environmental policies and firms’ decision-making. For example, Meng et al.18 studied the government’s green innovation subsidy strategy, considering the heterogeneity of consumers’ environmental awareness and showed that as the proportion of green consumers increases, governments are more willing to subsidize the firm. Gong et al. 6 divided consumers into green consumers and ordinary consumers, when studying the coordination of new energy vehicles supply chain. Their conclusion showed that an increase in the proportion of green consumers under centralized decisions would reduce the total profit of the supply chain. He et al.8 also considered the heterogeneity of consumers’ environmental awareness, when studying consumers’ selection on new energy vehicles and showed that green consumers boost the unit profit of electric vehicles. Yang et al. 26 considered the heterogeneity of farmers’ preference for farmland environment and biodiversity, when conducting evaluation on farmland ecological service in Jianghan Plain of China. The above studies all consider the heterogeneity of consumers’ environmental awareness when studying firms’ different decisions. However, few studies consider the heterogeneity of consumers when studying government environmental policies, especially the specific carbon quota allocation in cap-and-trade policies.

This paper makes the following contributions:

First, we propose a specific carbon quota allocation policy for governments that can affect firms’ decisions when they adopt an ordinary product strategy or a low-carbon product strategy to achieve optimal social welfare. Our research provides a reference for the formulation of the government’s optimal cap-and-trade policy and enriches the literature on carbon emission reduction.

Second, this paper studies a firm’s selection of the ordinary product strategy and the low-carbon product strategy under two carbon quota allocation policies and conducts a comparative analysis of the firm’s selection mechanism for these two product strategies.

Third, this paper establishes a Stackelberg game model between the government and the firm and studies the interaction between the firm’s selection of a product strategy and the government’s optimal carbon quota allocation policy.

Model Description

Assumptions. To establish the model, we make the following assumption:

Assumption 1:

The additional cost of low-carbon technology improvement for producing low-carbon products is assumed to be a quadratic function \({{ke^{2} } \mathord{\left/ {\vphantom {{ke^{2} } 2}} \right. \kern-0pt} 2}\). This assumption considers the diseconomy of the scale of technological improvement, so it is often applied in similar studies 12,23.

Assumption 2:

We assume that the carbon emissions of the low-carbon product are lower than those of the ordinary product. In other words, in equilibrium, the carbon emission reduction level of the low-carbon product should be greater than zero.

Assumption 3:

We assume that when the firm adopts the ordinary product strategy or low-carbon product strategy, in equilibrium, product demand and the firm’s profit are greater than zero.

Assumption 4:

Total social welfare includes the firm’s profits, consumer surplus and the impact of total carbon emissions. This assumption has been widely adopted in many studies 11,30.

Government policy

Consider a traditional high-carbon emission industry in which a firm has a monopoly position in the market. The government has implemented a cap-and-trade policy to encourage firms to reduce carbon dioxide emissions during production. The government first allocates a carbon quota \(Q\) per unit of product to the firm free of charge. If the actual carbon emissions per unit of product exceed \(Q\), the firm needs to purchase the required carbon credits in the market according to the carbon trading price \(t\). If the actual carbon emissions per unit of product are lower than \(Q\), the firm can sell the unused carbon credits in the market at price \(t\).

This paper considers the government’s two carbon quota allocation policies in cap-and-trade.

First, the government only allocates carbon quotas to firms aimed at reducing carbon emissions (Policy I); second, the government allocates carbon quotas to firms aimed at maximizing social welfare (Policy II).

Firm’s product strategy

Under the influence of a cap-and-trade policy, a firm has two product strategies to choose: the ordinary product strategy and the low-carbon product strategy. When a firm chooses the low-carbon product strategy, it should adopt low-carbon production technology to reduce carbon emissions during the production process. The improvement in its low-carbon technology will incur additional costs \({{ke^{2} } \mathord{\left/ {\vphantom {{ke^{2} } 2}} \right. \kern-0pt} 2}\), where \(k\) is the cost coefficient. We define \(e_{O}\) as the carbon emissions per unit of ordinary product in the production process and \(e\) as the carbon emission reduction level \((e_{O} > e)\) in the low-carbon product production process. Therefore, the actual carbon emissions per unit of low-carbon products are \(e_{O} - e\), where \(e\) is the firm’s decision-making variable. We assume that the impact coefficient of total carbon emissions on social welfare is \(v\).

Under Policy I, to maximize profit, the firm selects two product strategies. Under Policy II, we set up a Stackelberg game model with the government as the leader and the firm as the follower. The government incorporates firm decisions into its own decision-making mechanism. To maximize total social welfare, the government first determines the carbon quota allocation policy, and then, the firm makes decisions to maximize profits.

Consumer utility

This paper divides consumers into two categories according to their preference for low-carbon products. The first is consumers with low-carbon preferences, who have strong environmental awareness, have certain purchase preferences for low-carbon products and are willing to pay higher prices for them. The second is regular consumers, who have no obvious purchase preference for low-carbon products. We normalize the entire market as 1, assuming that the proportion of consumers with low-carbon preferences in the market is \(r\); then, the proportion of regular consumers in the market is \(1 - r\). \(V\) denotes the valuation of consumers with low-carbon preferences for the ordinary product, and \(V\) is uniformly distributed between 0 and 1. Because they have a certain preference for low-carbon products, they will obtain additional utility when purchasing such products. Therefore, we assume that their total utility from low-carbon products is \(V + ae\), where \(ae\) is the additional utility they obtain. \(a\) is the sensitivity coefficient of the carbon emission reduction level of low-carbon products \((0 < a < 1)\).

Assume that \(p_{L}\) is the sales price of low-carbon products, \(p_{O}\) is the sales price of ordinary products, \(D_{O}\) is the market demand for ordinary products, and \(D_{L}\) is the market demand for low-carbon products. Then, consumers with low-carbon preferences can obtain net utility \(V - p_{L} + ae\) when purchasing low-carbon products and can obtain net utility \(V - p_{O}\) when purchasing ordinary products. Regular consumers can obtain net utility \(V - p_{L} + ae\) when purchasing low-carbon products and can obtain net utility \(V - p_{O}\) when purchasing ordinary products. (In this paper, the subscript “\(O\)” is used to represent the relevant variables of ordinary products, and the subscript “\(L\)” is used to represent the relevant variables of low-carbon products). All notations used in this paper are summarized in Table 3.

Firm’s product strategy selection under Policy I

Under the influence of Policy I, a firm can choose between two product strategies: an ordinary product strategy and a low-carbon product strategy.

Ordinary product strategy

When choosing the ordinary product strategy, the firm produces only ordinary products, and both consumers with low-carbon preferences and regular consumers in the market choose to buy only ordinary products. If the consumer’s valuation \(v\) equals or exceeds the offered product price \(p_{O}\), the consumer will choose to purchase the product; otherwise, he or she will not buy anything. Moreover, we assume that each consumer purchases at most one unit of product. Since consumers’ valuations are uniformly distributed from 0 to 1 with a density of 1, which implies that \(1 - p_{O}\) consumers will purchase the product, the demand function of the ordinary product can be obtained as \(D_{O} = 1 - p_{O}\). The firm’s profit function can be obtained as follows:

The first item on the right of Eq. (1) is the firm’s benefit from ordinary products. The second item is the increased cost or benefit under cap-and-trade regulation, where \(e_{O}\) is the carbon emissions per unit of ordinary product; if \(e_{O}\) is greater than the carbon quota \(Q\), \(t(e_{O} - Q)D_{O}\) is the increased cost of purchasing carbon quotas; otherwise, \(t(e_{O} - Q)D_{O}\) is the benefit of selling the unused carbon quota. The firm makes decisions on the product price \(p_{O}\) to maximize its profit.

We present the sequence of events in Fig. 1.

Then, we can derive the optimal product price, demand, and firm profit under an ordinary product strategy, as shown in Lemma 1:

Lemma 1

The product price \(p_{O} *\), product demand \(D_{O} *\) and profit \(\pi_{O} *\) are as follows:

Low-carbon product strategy

When choosing the low-carbon product strategy, the firm produces only low-carbon products. Consumers with low-carbon preferences have a valuation \(V + ae\) of low-carbon products, and the net utility they obtain is \(V + ae - p_{L}\) when purchasing low-carbon products, whereas regular consumers’ valuation of low-carbon products is still \(V\), and the net utility they obtain is \(V - p_{L}\) when purchasing low-carbon products. Because we normalize the entire market to 1, the proportion of consumers with low-carbon preferences in the market is \(r\).

Therefore, under the low-carbon product strategy, the product demand function can be expressed as \(D_{L} = r(1 - p_{L} + ae) + (1 - r)(1 - p_{L} )\), where the first item represents the demand from consumers with low-carbon preferences, and the second item represents the demand from regular consumers. The firm’s profit function can be obtained as follows:

The first item on the right side of Eq. (3) is the firm’s benefit from low-carbon products; the second item is the increased income or cost under the influence of a cap-and-trade policy. The third item is the additional cost of producing low-carbon products. The firm makes decisions on the price \(p_{L}\) and carbon emissions reduction level of low-carbon products \(e\).

We present the sequence of events in Fig. 2.

Then, we can derive the optimal emission reduction level, the optimal product price, demand, and firm profit under a low-carbon product strategy, as shown in Lemma 2.

Lemma 2

The optimal emission reduction level \(e_{L} *\), product price \(p_{L} *\), product demand \(D_{L} *\) and profit \(\pi_{L} *\) are as follows:

Under the influence of Policy I, we obtained the firm’s optimal decisions and profit from adopting each product strategy and then carried out a comparative analysis.

By comparing the product demands under the low-carbon product strategy and the ordinary product strategy, we obtain Lemma 3.

Lemma 3

The relationship between the product demands under the low-carbon product strategy and that under the ordinary product strategy is as follows:\(D_{L} * > D_{O} *\).

Under the ordinary product strategy, although consumers with low-carbon preferences preferentially choose to buy low-carbon products, the firm only produces ordinary products, so these consumers can only buy ordinary products together with regular consumers. Under the low-carbon product strategy, the firm only produces low-carbon products, and the low-carbon preferences of these consumers will be transformed into the demand for low-carbon products. As a result, the demand for low-carbon products will increase. Therefore, the product demand under the low-carbon product strategy will be greater than that under the ordinary product strategy.

By comparing the product prices under the low-carbon product strategy and the ordinary product strategy, we obtain Lemma 4.

Lemma 4

The relationship between the product price under the low-carbon product strategy and that under the ordinary product strategy is as follows: If \(a > a_{1}\),\(p_{L} * > p_{O} *\); If \(a < a_{1}\), \(p_{L} * < p_{O} *\).

Under the low-carbon product strategy, consumers with low-carbon preferences will preferentially buy low-carbon products because of their greater perceived value of low-carbon products, and they become the main source of the firm’s profit. When \(a\) is large, it indicates that they have a greater preference for low-carbon products. To increase consumer surplus, the firm will increase the product price; therefore, compared with that under the ordinary product strategy, the product price under the low-carbon product strategy is greater. A small an indicates that they have a low preference for low-carbon products. To ensure the product sales quantity and maximize profits from these consumers, the firm will reduce the product price. Therefore, compared with that under the ordinary product strategy, the product price under the low-carbon product strategy is lower.

By comparing the firm’s profit under the low-carbon product strategy and the ordinary product strategy, we obtain Proposition 1.

Proposition 1

The relationship between the firm’s profit under the low-carbon product strategy and that under the ordinary product strategy is as follows:\(\pi_{L} * > \pi_{O} *\)

When a firm adopts a low-carbon product strategy, consumers with low-carbon preferences for low-carbon products will shift to demand for products, and an increase in product demand will contribute to an increase in profits. In addition, under the influence of the carbon quota policy, producing low-carbon products can reduce carbon emissions per unit of product, and the firm will have more carbon quotas to sell, which can increase profits. Although the firm will pay extra costs for producing low-carbon products, the total profits will increase.

Firm product strategy selection and the government’s optimal carbon quota under Policy II

Under the influence of Policy II, a firm can choose between two product strategies. To achieve optimal social welfare, the government, as the social manager, incorporates firm decisions on product strategy into the decision-making mechanism of cap-and-trade policy and formulates the optimal carbon quota allocation policy according to the different product strategies chosen by firms.

Ordinary product strategy and the government’s optimal carbon quota

Under the ordinary product strategy, the firm only produces ordinary products, and the demand function of the products is \(D_{O} = 1 - p_{O}\). As the leader of the game, the government incorporates the firm’s decision-making mechanism into its own and makes decisions on the carbon quota \(Q\) per unit of product allocated to the firm to optimize social welfare. After the government’s decision, the firm makes decisions on the product price to maximize its profit. We obtain the firm’s profit function as follows:

The government optimization question is as follows:

The first item on the right side of the formula above represents the consumer surplus from ordinary products. The second item represents the firm’s profits from producing ordinary products. The third item is the cost or revenue added to society for selling or purchasing a carbon quota, which should also be added to social welfare. The fourth item represents the environmental impact of the firm’s total carbon emissions. By backward induction, we can obtain the optimal decisions of the government and the firm in equilibrium, which we list in Lemma 5. (The superscript “\(A\)” indicates the relevant variable under the ordinary product strategy).

We present the sequence of events in Fig. 3.

Lemma 5

When the firm chooses the ordinary product strategy, the government’s optimal carbon quota allocation policy, product selling price, product sales quantity, firm profit and total social welfare are as follows:

The following lemma can be obtained by studying the impact of coefficient \(v\) on the product sales quantity, the firm’s profit and social welfare under the ordinary product strategy.

Lemma 6

The impacts of coefficient \(v\) on sales quantity, a firm’s profit, and social welfare under the ordinary product strategy are as follows:

Impact | |

|---|---|

Product sales quantity | \({{\partial D_{O}^{A} *} \mathord{\left/ {\vphantom {{\partial D_{O}^{A} *} {\partial v < 0}}} \right. \kern-0pt} {\partial v < 0}}\) |

Firm’s profit | \({{\partial \pi_{O}^{A} *} \mathord{\left/ {\vphantom {{\partial \pi_{O}^{A} *} {\partial v}}} \right. \kern-0pt} {\partial v}} < 0\) |

Social welfare | \({{\partial SW^{A} *} \mathord{\left/ {\vphantom {{\partial SW^{A} *} {\partial v}}} \right. \kern-0pt} {\partial v}} < 0\) |

Low-carbon product strategy and government optimal carbon quota

Under the low-carbon product strategy, the firm chooses to produce only low-carbon products. To achieve optimal social welfare, the government first determines the carbon quota \(Q\) allocated to the firm and then determines the carbon emission reduction level \(e\) per unit of low-carbon product and product price \(p_{L}\). We obtain the firm’s profit function as follows:

The government optimization question is as follows:

The first item on the right side of the above equation represents the consumer surplus from buying low-carbon products. The second item represents the firm’s profits from low-carbon products. The third item is the cost or revenue added to society for selling or purchasing a carbon quota, which should also be added to total social welfare. The fourth item represents the impact of total carbon emissions on social welfare. By backward induction, we can obtain the optimal decisions of the government and the firm in equilibrium, which we list in Lemma 6. (The superscript “\(B\)” indicates the relevant variable under the low-carbon product strategy).

We present the sequence of events in Fig. 4.

Lemma 7

When the firm chooses the low-carbon product strategy, the government’s optimal carbon quota allocation policy, product price, product sales quantity, firm profit, and total social welfare are as follows:

The following lemma can be obtained by studying the impact of coefficient \(v\) on sales quantity, the carbon emission reduction level of low-carbon products, a firm’s profit, and social welfare under the low-carbon product strategy.

Lemma 8

The coefficient \(v\) on sales quantity, the carbon emission reduction level of low-carbon products, firm’s profit, and social welfare under the low-carbon product strategy are as follows( In Table 4):

For firm, the purpose of choosing different product strategies is to maximize its profit. Under the influence of policy II, we first obtain the firm’s maximum profit when choosing ordinary product strategy and low-carbon product strategy, and then compare and analyze the firm’s optimal decisions and profits.

For government, the carbon quota allocation policy is designed to maximize social welfare. Based on firm’s two product strategies, we obtained the optimal carbon quota allocation policy and total social welfare, and then carried out a comparative analysis.

By comparing product sales quantity under the low-carbon product strategy and that under the ordinary product strategy, the following propositions can be obtained:

Lemma 9

The relationship between the product sales quantity under the low-carbon product strategy and that under the ordinary product strategy is as follows: \(D_{L}^{B} * < D_{O}^{A} *\) if \(v < v_{1}\); \(D_{L}^{B} * > D_{O}^{A} *\) if \(v > v_{1}\).

This lemma shows that when \(v\) is less than \(v_{1}\), the sales quantity of products under the low-carbon product strategy is greater than that under the ordinary product strategy; when \(v\) is greater than \(v_{1}\), the opposite is true. When \(v\) is large, the firm’s total carbon emissions have a greater impact on total social welfare, while the cost of reducing total carbon emissions has a relatively low impact on social welfare. Therefore, reducing total carbon emissions can increase social welfare. A firm’s total carbon emissions are affected by two factors: its carbon emissions per unit of product and its sales quantity. Under the low-carbon product strategy, the firm reduces its carbon emissions per unit of product, while under the ordinary product strategy, the firm does not change its carbon emissions per unit of product. Therefore, compared with those of ordinary products, the carbon emission levels per unit of low-carbon products are lower. When \(v\) is large, to achieve optimal social welfare, the firm must reduce total carbon emissions. Under the low-carbon product strategy, the firm can still maintain its product quantity at a high level because the carbon emissions per unit of product are reduced. Under the ordinary product strategy, the firm does not change its carbon emissions per unit of product. To reduce total carbon emissions, the firm can only reduce product quantity. Therefore, the quantity of ordinary products is relatively low. When \(v\) is small, the firm’s total carbon emissions have a small impact on social welfare, and the cost of reducing total carbon emissions has a high impact on social welfare. Therefore, to achieve optimal social welfare, the firm must reduce the cost of reducing total carbon emissions, and correspondingly, the firm’s total carbon emissions increase. Under the low-carbon product strategy, the firm reduces its carbon emissions per unit of product but also must pay the cost of improving its low-carbon technology. Therefore, when \(v\) is small, to optimize social welfare, the firm must reduce the cost of total carbon emission reduction; therefore, the quantity of low-carbon products must be kept at a low level. Under the ordinary product strategy, without reducing the cost of carbon emission reduction per unit of product, the firm can maintain a high quantity of ordinary products.

By comparing the optimal carbon quota per unit of product allocated by government to the firm under these two product strategies, the following proposition can be obtained:

Proposition 2

When the firm choose the low-carbon product strategy and the ordinary product strategy, the relationship between the optimal carbon quota per unit of product allocated by the government is as follows:\(Q^{B} * < Q^{A} *\), if \(v < v_{2}\); \(Q^{B} * > Q^{A} *\), if \(v > v_{2}\).

This proposition shows that when coefficient \(v\) is less than \(v_{2}\), the optimal carbon quota allocated by the government to the firm under the low-carbon product strategy is smaller than that under the ordinary product strategy. When \(v\) is greater than \(v_{2}\), the opposite conclusion is true. It has been previously stated that when the coefficient \(v\) is large, the firm’s total carbon emission has a greater impact on social welfare, while the cost of reducing the total carbon emission has a lower impact on social welfare. Therefore, to achieve the optimal social welfare, the firm must reduce its total carbon emission. Under the ordinary product strategy, the firm does not reduce carbon emission per unit of product, but only reduce total carbon emission by reducing the product quantity. To improve total social welfare, the government will impose strict carbon quota on the firm, and then allocate less carbon quota. While, under the low-carbon product strategy, the firm improves low-carbon technology and reduces carbon emissions per unit of product. Additionally, the firm can reduce total carbon emissions by adjusting carbon emissions reduction per unit of product and the product quantity. Therefore, compared with the ordinary product strategy, the government does not need to impose a more severe carbon quota policy, and accordingly allocates relatively more carbon quotas to the firm. The previous proposition has also proved that when the coefficient \(v\) is small, the firm’s total carbon emissions have a small impact on social welfare, while the cost of reducing total carbon emissions has a larger impact on social welfare. Therefore, to achieve the optimal social welfare, the firm will reduce the cost of reducing its total carbon emissions, and correspondingly the firm’s total carbon emission will increase. Under the ordinary product strategy, the firm can only reduce total carbon emissions by reducing product quantity, so the cost of reducing total carbon emission is higher, the firm’s profits are reduced by more, and social welfare is also reduced by more. Therefore, to achieve the optimal social welfare and reduce the cost, the government must allocate more carbon quotas to the firm.

While, under the low-carbon product strategy, to reduce total carbon emission, the firm can reduce both carbon emissions per unit of product and the product quantity. Therefore, the total cost of reducing total carbon emissions is lower, the profit is reduced by less, and social welfare is also decreased by less. Therefore, to achieve the optimal social welfare, compared with that under the ordinary product strategy, the government should allocate less carbon quota to the firm.

By comparing the firm’s profit under the low-carbon product strategy and that under the ordinary product strategy, the following proposition can be obtained:

Proposition 3

The relationship between the firm’s profit under the low-carbon product strategy and that under the ordinary product strategy is as follows: \(\pi_{L}^{B} * > \pi_{O}^{A} *\) if \(v < v_{3}\); \(\pi_{L}^{B} * < \pi_{O}^{A} *\) if \(v > v_{3}\).

This proposition shows that when the coefficient \(v\) is less than \(v_{3}\), the firm’s profit under the low-carbon product strategy is greater than that under the ordinary product strategy; when \(v\) is greater than \(v_{3}\), the opposite conclusion holds. When the coefficient \(v\) is large, reducing total carbon emissions can increase social welfare. To achieve optimal social welfare, the government encourages firms to reduce total carbon emissions. Under the low-carbon product strategy, the firm reduces its carbon emissions per unit of product, but it also must pay the cost of low-carbon technology improvement, which will lead to a large decline or a smaller increase in profits. Under the framework of optimal social welfare, a firm’s decisions are constrained by the carbon quota, and profits may not be maximized. Under the ordinary product strategy, the firm does not need to pay the cost for low-carbon technology improvement and can reduce total carbon emissions only by reducing the product quantity, which will lead to a small decline or larger increase in profits. Therefore, the firm’s profit under the ordinary product strategy is greater than that under the low-carbon product strategy. In contrast, if \(v\) is small, increasing the firm’s total carbon emissions can increase social welfare, and the government will appropriately relax the incentive measures for the firm to reduce carbon emissions. Under the low-carbon product strategy, because the cost of carbon emission reduction is not high, the firm’s profit will decrease less or increase by more. However, under the ordinary product strategy, the firm’s profit declines more or increases by less. Therefore, the profit under the low-carbon product strategy is greater than that under the ordinary product strategy.

By comparing total social welfare under low-carbon product strategy and ordinary product strategy, the following proposition can be obtained:

Proposition 4

The relationship between social welfare under the low-carbon product strategy and that under the ordinary product strategy is as follows:\(SW^{B} * < SW^{A} *\) if \(v < v_{1}\); \(SW^{B} * > SW^{A} *\) if \(v > v_{1}\).

This proposition shows that when \(v\) is less than \(v_{1}\), total social welfare under the low-carbon product strategy is less than that under the ordinary product strategy, and when \(v\) is greater than \(v_{1}\), the opposite is true. Under the ordinary product strategy, the firm only produces ordinary products. Under cap-and-trade regulation, firms can reduce total carbon emissions only by reducing product quantity, which can increase social welfare. However, a decrease in product quantity can reduce firm profit and consumer surplus, which can reduce social welfare. Under the low-carbon product strategy, the firm can reduce its carbon emissions per unit of product and reduce its product quantity, which can reduce total carbon emissions. Low-carbon products can better meet the needs of consumers with low-carbon preferences and increase the firm’s profits and consumer surplus, which increases total social welfare; however, producing low-carbon products requires paying for improvements in low-carbon technologies, which can reduce firm profits and social welfare. When \(v\) is large, the firm’s total carbon emissions have a greater impact on social welfare, and reducing total carbon emissions can increase social welfare. Under the low-carbon product strategy, the firm has made improvements in its low-carbon technology, thus increasing social welfare by more. However, under the general product strategy, the firm does not improve its low-carbon technology or increase social welfare. Therefore, total social welfare is greater under the low-carbon product strategy than under the ordinary product strategy.

In contrast, when the coefficient \(v\) is small, the firm’s total carbon emissions have little impact on social welfare. To achieve optimal social welfare, a firm should relax its carbon emission reduction measures, and accordingly, the firm’s total carbon emissions will increase. Under the low-carbon product strategy, the firm increases social welfare less when it improves low-carbon technology; however, the firm also must pay the corresponding cost, and the cost reduces social welfare more. However, under the ordinary product strategy, the firm does not improve its low-carbon technology and does not need to pay for technology improvement. Therefore, total social welfare is greater under the ordinary product strategy than under the low-carbon product strategy.

Numerical example

This section provides numerical examples to illustrate above analytical results and gain managerial insights. We give some estimated parameters. The parameter values used in this section are as follows: \(a = 0.3\),\(e_{O} = 0.4\),\(r = 0.3\),\(t = 0.2\),\(k = 1/1.5\), and \(c = 0.3\).

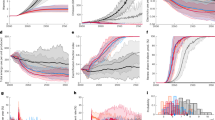

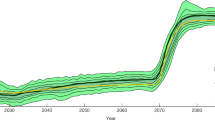

Figure 5 is to verify the results in Lemma 9. We let the values of some parameters remain unchanged and vary \(v\) to study the impact of \(v\) on the product sales quantity under the ordinary product strategy and the low-carbon product strategy. Figure 5\((a)\) is the case where \(k\) is small \((k = 1)\), and Fig. 5\((b)\) is the case where \(k\) is large \((k = 1.5)\). As can be seen from Fig. 5\((a)\), curve \(D_{L}^{B} *\) gradually increases with an increase in parameter \(v\), indicating that when the cost of low-carbon technology improvement is relatively low, the products sales quantity under the low-carbon product strategy gradually increases with an increase in \(v\). As can be seen from Fig. 5\((b)\), curve \(D_{L}^{B} *\) gradually decreases with an increase in \(v\), indicating that when the cost of low-carbon technology is relatively high, the products sales quantity under the low-carbon product strategy will gradually decrease with an increase in \(v\). However, it can be seen from both figures that under the ordinary product strategy, the curve \(D_{O}^{A} *\) of product sales quantity declines with an increase in \(v\). From both figures, we can see the intersection of these two curves, which is \(v_{1}\). In the interval where \(v\) is less than \(v_{1}\), the product sales quantity under the low-carbon product strategy is lower than that under the ordinary product strategy, while in the interval where \(v\) is greater than \(v_{1}\), the opposite is true. As can be seen from the figure, the result of data verification is consistent with the conclusion in Lemma 9.

Figure 6 describes the comparison of the firm’s profits when choosing the ordinary product strategy and the low-carbon product strategy under cap-and-trade regulation. With some other parameters remaining unchanged, we study the impact of the change of \(v\) on firm’s profits under these two product strategies. Again, we consider two cases where \(k\) is large \((k = 1.5)\) in Fig. 6\((b)\) and small \((k = 1)\) in Fig. 6\((a)\). As can be seen from Fig. 6\((a)\), curve \(\pi_{L}^{B} *\) gradually increases with the an increase in \(v\), indicating that when the cost of low-carbon technology is relatively low, the firm’s profit under the low-carbon product strategy will increase with an increase in parameter \(v\). As can be seen from Fig. 6\((b)\), curve \(\pi_{L}^{B} *\) decreases with an increase in \(v\), indicating that when the cost of low-carbon technology improvement is relatively high, the firm’s profit under the low-carbon product strategy will decrease with an increase in \(v\). From Fig. 6\((a)\) and Fig. 6\((b)\), we can see the intersection of these two curves. When \(v\) is less than \(v_{3}\), the firm’s profit under the low-carbon product strategy is lower than that under the ordinary product strategy, while the opposite is true in the interval where \(v\) is greater than \(v_{3}\).The conclusion verified in Fig. 2 is consistent with the conclusion Proposition 3.

Figure 7 studies the influence of parameter \(v\) on the carbon quota allocated by the government under these two product strategies by varying parameter \(v\). Figure 7\((a)\) describes the situation when \(k\) is small, while Fig. 7\((b)\) describes the situation when \(k\) is large. From Fig. 7\((a)\) and Fig. 7\((b)\), we can see the intersection point \(v_{2}\) of these two curves. In the interval where \(v\) is less than \(v_{2}\), the value of curve \(Q^{A} *\) is higher than that of curve \(Q^{B} *\), indicating that when \(v\) is less than the critical value \(v_{2}\), the optimal carbon quota allocated by the government to the firm is smaller than that when the firm chooses the low-carbon product strategy. In the interval where \(v\) is higher than \(v_{2}\), the situation opposite occurs.

Figure 8 is used to verify the conclusion of Proposition 4, the influence of the change of parameter \(v\) on total social welfare when the firm choose each product strategy. The parameter settings are the same as those in Fig. 5 and Fig. 6. Figure 8\((a)\) verifies the impact of parameter \(v\) on total social welfare in the case where \(k\) is small \((k = 1)\), and Fig. 8\((b)\) is the case where \(k\) is large \((k = 1.5)\). It can also be seen from Fig. 8\((a)\) and Fig. 8\((b)\) that when \(v\) is less than \(v_{1}\), total social welfare under the low-carbon product strategy is lower than that under the ordinary product strategy, while the opposite is true when \(v\) is greater than \(v_{1}\). As can be seen from Fig. 8\((b)\), when the cost of low-carbon technology is relatively high, curve \(SW_{O}^{B} *\) decreases with an increase in parameter \(v\), indicating that under the low-carbon product strategy, total social welfare decreases with an increase in parameter \(v\). It can also be seen from these two figures that under the ordinary product strategy, total social welfare decreases with an increase in \(v\).

Discussion

This paper studies the interaction between the government’s carbon quota allocation policy and the firm’s product strategy selection. First, the firm makes decisions on product strategies according to the government’s different carbon quota allocation policies. Second, the government formulates the carbon quota allocation policies on the basis of the firm’s different product strategies.

In terms of the firm’s product strategy selection, this paper concludes that if the government’s carbon quota allocation policy aims only to reduce the firm’s carbon emissions, under certain conditions, choosing a low-carbon product strategy is superior to choosing an ordinary product strategy. Du et al.4 also studied whether firms choose low-carbon production under the influence of cap-and-trade policy. These two papers’ conclusions are consistent in some way; they both believe that, under certain conditions, choosing to produce low-carbon products is beneficial. The difference between them is that Du et al.4 believe that even if the additional cost involved in producing low-carbon products is high, firms are likely to adopt a low-carbon product strategy if consumer preference for low-carbon products is high enough, whereas this paper believes that it is enough to meet the quantity of product demand. The reason is that the influence factors considered in the model are different. For example, Du et al.4 consider only one type of consumer with a low-carbon preference, whereas this paper considers two types. In addition, Zhang et al. 27 studied a product manufacturer’s selection of a low-carbon product strategy within a supply chain and suggested that under cap-and-trade policies, the manufacturer tends to choose to produce low-carbon products. However, Zhang et al.27 suggested that the conditions under which firms choose to produce low-carbon products are related to the intensity of competition in the market. In addition, this paper studies a firm’s selection of product strategies under the government’s carbon quota allocation policy aimed at maximizing social welfare and concludes that a firm’s selection depends on the impact of total carbon emissions on social welfare. At present, there are relatively few studies on this issue in the literature. For research on the carbon quota allocation policy in cap-and-trade, this paper takes government policy as an endogenous variable and deduces the specific carbon quota allocated for firms for optimal social welfare on the basis of firms’ different product strategies. At present, most studies on cap-and-trade policies focus on the effectiveness of these policies by using comparative methods, whereas few studies have focused on specific government carbon emission reduction policies based on firms’ decision-making. For example, Li 15 studied the government’s specific carbon tax policy, considering the firm’s different product distribution channels. For research methods and concepts, Li 15 is consistent with this paper, both of which regard the government’s carbon emission reduction policy as a decision-making tool to achieve optimal social welfare and draw specific policy suggestions. However, Li 15 studies the carbon tax policy, whereas this paper studies the carbon quota allocation policy in cap-and-trade.

This study also has certain practical implications. First, this paper provides a reference for firms to choose a product strategy under a cap-and-trade policy. Cap-and-trade policies are carbon reduction policies adopted by many countries. After a period of implementation, governments have accumulated some experience. Moreover, the government’s design concept for this type of policy is constantly changing. For firms, it is necessary to identify and study the relevant factors according to different carbon quota allocation policies and choose the proper product strategy. This paper provides suggestions for firms in this respect. Second, as mentioned above, the government’s understanding of cap-and-trade policy is deepening, the factors considered are gradually increasing, and the concept is constantly updated. For example, at the beginning, the government’s carbon quota allocation policy is to force the firm to reduce carbon emissions, but it will gradually realize that, in some cases, such policies will also reduce the firm’s profits and the consumers’ interests, which is not conducive to improving total social welfare. Therefore, the government should formulate a more effective carbon quota allocation policy that considers more factors. This paper provides suggestions for the government in this respect.

Conclusion

This paper considers the government’s two carbon quota allocation policies and the firm’s two product strategies and studies the interaction between the government’s optimal carbon quota allocation policy formulation and the firm’s product strategy selection. First, we study the firm’s selection of the ordinary product strategy and low-carbon product strategy under the government’s carbon quota allocation policy aimed at reducing the firm’s carbon emissions. Next, we study the firm’s selection of the ordinary product strategy and low-carbon product strategy under the policy aimed at optimal total social welfare, as well as the formulation of this policy on the basis of each firm’s product strategy.

Our analysis reveals that (i) a firm’s selection of product strategies will be contingent upon the government’s carbon quota allocation policies. When the government allocates carbon quotas for the purpose of reducing the firm’s total carbon emissions, the firm will choose the low-carbon product strategy. When the government allocates a carbon quota for the purpose of optimal total social welfare, the firm will choose the product strategy according to the impact of total carbon emissions on social welfare. That is, when the impact of a firm’s total carbon emissions on social welfare is relatively small, the firm will choose the low-carbon product strategy; otherwise, the firm will choose the ordinary product strategy. (ii) To achieve optimal social welfare, the government will formulate different carbon quota allocation policies on the basis of firms’ different product strategies. That is, when the impact of a firm’s total carbon emissions on social welfare is relatively small, under the low-carbon product strategy, the government will allocate fewer carbon quotas to the firm than under the ordinary product strategy; otherwise, the opposite conclusion holds.

This paper provides a reference for the government’s formulation of cap-and-trade policies and expands the understanding of firms’ operations and management. Although some results have been obtained, there are still some limitations in this research. First, this paper assumes that the firm sells products directly to consumers without considering retailers in the research framework. Second, this paper considers only the ability of the firm to sell products through the offline channel without considering the online channel. Third, this paper draws conclusions from mathematical reasoning on the basis of the game model, which lacks empirical data support. All the issues above should be investigated in future research.

Data availability

All data generated or analysed during this study are included in this published article .

References

Cai, J. & Jiang, F. Decision models of pricing and carbon emission reduction for low-carbon supply chain under cap-and-trade regulation. Int. J. Prod. Econ.264, 108964 (2023).

Chen, S., Huang, F. & Lin, J. Green technology choices under the cap-and-trade mechanism with insurer green finance in a dragon-king environment. Energ Econ.117, 106490 (2023).

Chen, Y., Wang, C., Nie, Pu. & Chen, Z. A clean innovation comparison between carbon tax and cap-and-trade system. Energy. Strateg. Rev.29, 100483 (2020).

Du, S. F., Tang, W. Z. & Song, M. L. Low-carbon production with low-carbon premium in cap-and-trade regulation. J. Clean. Prod.2, 1–11 (2016).

Emissions Gap Reports 2023. UNEP (2023) https://www.unep.org/publications-data

Gong, B., Xia, X. & Cheng, J. Supply-Chain Pricing and Coordination for New Energy Vehicles Considering Heterogeneity in Consumers’ Low-Carbon Preference. Sustain.12, 1306 (2020).

Haites, E. Carbon taxes and greenhouse gas emissions trading systems: what have we learned?. Clim. Pol.18, 955–966 (2018).

He, H., Wang, C., Wang, S., Ma, F. & Sun, Q. Does environmental concern promote EV sales? Duopoly pricing analysis considering consumer heterogeneity. Transport. Res. D.91, 102695 (2021).

Hu, X., Yang, Z. & Sun, J. Carbon tax or cap-and-trade: which is more viable for Chinese remanufacturing industry. J. Clean. Prod.2431, 18606 (2020).

Huang, Y., He, P. & Cheng, T. Optimal strategies for carbon emissions policies in competitive closed-loop supply chains: A comparative analysis of carbon tax and cap-and-trade policies. Comput. Ind. Eng.195, 110423 (2024).

Ji, J., Li, T. & Yang, L. Pricing and carbon reduction strategies for vertically differentiated firms under Cap-and-Trade regulation. Transp. Res. Part E.171, 103064 (2023).

Ji, J., Zhang, Z. & Yang, L. Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J. Clean. Prod.141, 852–867 (2017).

Li, A., Pan, Y., Yang, W., Ma, J. & Zhou, M. Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energ. Econ.101, 105426 (2021).

Li, P., Wang, W. & Xia, X. Assessing the effectiveness of carbon cap-and-trade and hybrid subsidy policies: The perspective of production, environment, and consumer. J. Clean. Prod.468, 143074 (2024).

Li, X., Tang, Y., & Tang, Y. Production Strategy Selection and Carbon Emission Reduction with Consumer Heterogeneity under Cap-and-Trade Regulation. Complexity. 8602997 (2022). https://doi.org/10.1155/2022/8602997

Li, X. Carbon tax policy analysis based on distribution channel strategy. Environ. Sci. Pollut. Res.29, 26385–26395 (2022).

Liu, H., Kou, X., Xu, G., Qiu, X. & Liu, H. Which emission reduction mode is the best under the carbon cap-and-trade mechanism?. J. Clean. Prod.314, 128053 (2022).

Meng, Q., Wang, Y., Zhang, Z. & He, Y. Supply chain green innovation subsidy strategy considering consumer heterogeneity. J. Clean. Prod.281, 125199 (2020).

Raihan, A. et al. Dynamic linkages between environmental factors and carbon emissions in Thailand. Environ. Processes.10(1), 5 (2023).

Tong, J. J., Meng, Z. & Zhang, L. China Low-carbon product certification and case analysis. Resou Infor. Eng.3(35), 123–128 (2020).

Wang, Z. & Wang, C. How carbon offsetting scheme impacts the duopoly output in production and abatement: analysis in the context of carbon cap-and-trade. J. Clean. Prod.103, 715–723 (2015).

Xu, X., Guo, S., Cheng, T. C. E. & Du, P. The choice between the agency and reselling modes considering green technology with the cap-and-trade scheme. Int. J. Prod. Econ.260, 108839 (2023).

Yang, L., Zhang, Q. & Ji, J. Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int. J. Prod. Econ.191, 286–297 (2017).

Yang, W., Zhu, T., Zhu, Y. & Fan, A. Comparison between Subsidy and Cap-and-Trade Policy on Electric Logistics Vehicles Leasing System. Adv Eco Man Res.6, 390–396 (2023).

Yang, Y., Goodarizi, S., Bozorgi, A. & Fahimnia, B. Carbon cap-and-trade schemes in closed-loop supply chains: Why firms do not comply?. Transport. Res. Part. E-Log.156, 102486 (2021).

Yang, Xin., Zhou, X., Shang, G. & Zhang, A. An evaluation on farmland ecological service in Jianghan Plain, China --from farmers’ heterogeneous preference perspective. Ecol. Indic. 136, 108665 (2022).

Zhang, H., Zhang, Y., Li, P., Zheng, H. & Li, Z. Low-carbon production or not? Co-opetition supply chain manufacturers’ production strategy under carbon cap-and-trade policy. Environ Dev Sustain.https://doi.org/10.1007/s10668-022-02342-2 (2022).

Zhang, S., Wang, C., Yu, C. & Ren, Y. Governmental cap regulation and manufacturer’s low carbon strategy in a supply chain with different power structures. Comput. Ind. Eng.134, 27–36 (2019).

Zhang, L., Ren, J. & Zhang, G. Optimal dynamic strategy for emission reduction and operation considering hybrid carbon policy with carbon tax and cap-and-trade. Comput. Ind. Eng.187, 109820 (2024).

Zhang, X., Li, Z. & Li, G. Grandfather-based or benchmark-based: Strategy choice for carbon quota allocation methods in the carbon neutrality era. Renew. Sustain. Energy Revs.192, 114195 (2024).

Zhang, Y., Zeng, C. & Chi, N. Analyzing the influence of government policy on building carbon emission reduction based on differential game. Sci. Rep.14, 17309 (2024).

Zou, H., Qin, J. & Zheng, H. Equilibrium pricing mechanism of low-carbon supply chain considering carbon cap-and-trade policy. J. Clean. Prod.407, 137107 (2023).

Funding

The funding was provided by China Post Group Training Center Doctor Pre-research Foundation (Grant No. G99993088).

Author information

Authors and Affiliations

Contributions

Xuzhao Li: Writing – original draft, formal analysis. Xiangying Lan: Writing – Review and formal analysis. Yongbo Jin: Writing – review and editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethics approval

Neither the manuscript nor any parts of its content are currently under consideration or published in another journal.

Consent to participate

Informed consent was obtained from all individual participants included in the study.

Consent to publish

The participant has consented to the submission of the manuscript to the journal.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Lemma 1

We can get that \(\frac{{\partial \pi_{O} (p_{O} )}}{{\partial p_{O}^{2} }} = - 2\),and we know that \(\pi_{O} (p_{O} )\) is jointly concave in \(p_{O}\), set \(\frac{{\partial \pi_{O} (p_{O} )}}{{\partial p_{O} }} = 0\), then we can solve them to get \(p_{O} * = \frac{1}{2}( - tQ + te_{O} + c + 1)\).

By substituting into \(\pi_{O} (p_{O} )\), we can get \(D_{O} *\) and \(\pi_{O} *\).

Proof of Lemma 2

The process of obtaining the optimal solutions is similar to that in lemma 1, thus we omit them.

Proof of Lemma 3

(i) Calculate \(D_{L} * - D_{O} *\), which equals \(- \frac{1}{2}\frac{{(ar + t)^{2} (Q - e_{O} t - c + 1)}}{{a^{2} r^{2} + 2art + t^{2} - 2k}}\). From assumption , we obtain \(Qt - e_{O} t - c + 1 > 0\) and \(a^{2} r^{2} + 2art + t^{2} - 2k < 0\). Therefore, we have \(D_{L} * > D_{O} *\).

Proof of Lemma 4

Calculate \(p_{L} * - p_{O} *\), which equals \(- \frac{1}{2}\frac{{(ar + t)(ar - t)(Q - e_{O} t - c + 1)}}{{a^{2} r^{2} + 2art + t^{2} - 2k}}\). Since we have \(Qt - e_{O} t - c + 1 > 0\), and \(ar + t > 0\), and \(a^{2} r^{2} + 2art + t^{2} - 2k < 0\), then \(ar - t\) is a linear increasing function in \(a\). Solve \(ar - t = 0\) and obtain \(a_{1} = \frac{t}{r}\); therefore, we have \(p_{L} * > p_{O} *\) for \(a > a_{1}\) and \(p_{L} * < p_{O} *\) otherwise.

Proof of Proposition 1

Calculate \(\pi_{L} * - \pi_{O} *\), which equals \(- \frac{1}{4}\frac{{(Qt - e_{O} t - c + 1)^{2} (ar + t)^{2} }}{{a^{2} r^{2} + 2art + t^{2} - 2k}}\). By assumption, we obtain \(a^{2} r^{2} + 2art + t^{2} - 2k < 0\). Then, we can conclude \(\pi_{L} * > \pi_{O} *\).

Proof of Lemma 5

Under the ordinary product strategy, the firm can only make decision on the product price \(p_{O}\). Since \({{\partial \pi } \mathord{\left/ {\vphantom {{\partial \pi } {\partial p_{O} = }}} \right. \kern-0pt} {\partial p_{O} = }} - 2\), we know \(\pi\) is a concave function with respect to \(p_{O}\). Therefore, let \({{\partial \pi^{A} } \mathord{\left/ {\vphantom {{\partial \pi^{A} } {\partial p_{O}^{A} = }}} \right. \kern-0pt} {\partial p_{O}^{A} = }}0\), solve for \(p_{O}\), then we have \(p_{O}^{A} * = ( - tQ + te_{O} + c + 1)/2\). By substituting \(p_{O}^{A} * = ( - tQ + te_{O} + c + 1)/2\) into the firm’s profit function, then we can obtain \(D_{O}^{A} * = (1 + tQ - te_{O} - c)/2\) and \(\pi^{A} * = (Qt - e_{O} t - c + 1)^{2} /4\), which is reaction function of parameter \(Q\). By substituting them into social welfare function \(\mathop {\max }\limits_{Q} SW = CS + \pi + t(e_{O} - Q)D_{O} - ve_{O} D_{O}\). Since \({{\partial^{2} \pi^{A} } \mathord{\left/ {\vphantom {{\partial^{2} \pi^{A} } {\partial (Q^{A} )^{2} = }}} \right. \kern-0pt} {\partial (Q^{A} )^{2} = }} - t^{2} /4 < 0\), then we know \(SW^{A}\) is a concave function with respect to \(Q^{A}\). Let \({{\partial SW^{A} } \mathord{\left/ {\vphantom {{\partial SW^{A} } {\partial Q^{A} = 0}}} \right. \kern-0pt} {\partial Q^{A} = 0}}\), and solve for \(Q^{A}\). We can obtain \(Q^{A} * = - \frac{{e_{O} t + 2e_{O} v + c - 1}}{t}\). By substituting it into social welfare function, we can get \(SW^{A} * = (e_{O} v + c - 1)^{2} /2\),\(p_{O}^{A} * = e_{O} v + c\),\(D_{O}^{A} * = - e_{O} v - c + 1\) and \(\pi^{A} * = (e_{O} v + c - 1)^{2}\).

Proof of Lemma 6

(1) Calculate \({{\partial D_{O}^{A} *} \mathord{\left/ {\vphantom {{\partial D_{O}^{A} *} {\partial v}}} \right. \kern-0pt} {\partial v}}\), which equals \(- e_{O}\), since we have \(e_{O} > 0\), therefore we have \({{\partial D_{O}^{A} *} \mathord{\left/ {\vphantom {{\partial D_{O}^{A} *} {\partial v < 0}}} \right. \kern-0pt} {\partial v < 0}}\). (2) Calculate \({{\partial \pi^{A} *} \mathord{\left/ {\vphantom {{\partial \pi^{A} *} {\partial v}}} \right. \kern-0pt} {\partial v}}\), which equals \(2(e_{O} v + c - 1)e_{O}\), since we have \(e_{O} v + c - 1 < 0\) by assumption, therefore we have \({{\partial \pi^{A} *} \mathord{\left/ {\vphantom {{\partial \pi^{A} *} {\partial v}}} \right. \kern-0pt} {\partial v}} < 0\). (3) Calculate \({{\partial SW^{A} *} \mathord{\left/ {\vphantom {{\partial SW^{A} *} {\partial v}}} \right. \kern-0pt} {\partial v}}\), which equals \((e_{O} v + c - 1)e_{O}\), similarly, we can prove \({{\partial SW^{A} *} \mathord{\left/ {\vphantom {{\partial SW^{A} *} {\partial v}}} \right. \kern-0pt} {\partial v}} < 0\).

Proof of Lemma 7

Under the low-carbon product strategy, the firm makes decisions on the product price \(p_{L}\) and carbon emission reduction level product \(e\). Since \({{\partial^{2} \pi } \mathord{\left/ {\vphantom {{\partial^{2} \pi } {\partial (p_{L} )^{2} = }}} \right. \kern-0pt} {\partial (p_{L} )^{2} = }} - 2\),\({{\partial^{2} \pi } \mathord{\left/ {\vphantom {{\partial^{2} \pi } {\partial (e)^{2} = }}} \right. \kern-0pt} {\partial (e)^{2} = }}2art - k\), and \({{\partial^{2} \pi } \mathord{\left/ {\vphantom {{\partial^{2} \pi } {\partial p_{L} \partial e = }}} \right. \kern-0pt} {\partial p_{L} \partial e = }}ar - t\), we built a Hesse matrix and know that it is negative definite, therefore we know \(\pi\) is a concave function with respect to \(p_{L}\) and \(e\). Let \({{\partial \pi } \mathord{\left/ {\vphantom {{\partial \pi } {\partial p_{L} = }}} \right. \kern-0pt} {\partial p_{L} = }}0\) and \({{\partial \pi } \mathord{\left/ {\vphantom {{\partial \pi } {\partial e = }}} \right. \kern-0pt} {\partial e = }}0\), we can obtain \(p_{L} (Q) = - \frac{{(a^{2} r^{2} t + art^{2} - kt)Q - a^{2} e_{O} r^{2} t - a^{2} cr^{2} - ae_{O} rt^{2} - acrt - art + e_{O} kt + ck - t^{2} + k}}{{a^{2} r^{2} + 2art + t^{2} - 2k}}\) and \(e(Q) = - \frac{{Qart - ae_{O} rt + Qt^{2} - acr - e_{O} t^{2} + ar - ct + t}}{{a^{2} r^{2} + 2art + t^{2} - 2k}}\). Accordingly, we can get \(D_{L} (Q) = - \frac{{k(Qt - e_{O} t - c + 1)}}{{a^{2} r^{2} + 2art + t^{2} - 2k}}\) and \(\pi (Q) = - \frac{1}{2}\frac{{k(Qt - e_{O} t - c + 1)^{2} }}{{a^{2} r^{2} + 2art + t^{2} - 2k}}\). By substituting the results above into the social welfare function \(\mathop {\max }\limits_{Q} SW = CS + \pi + t(e_{O} - e - Q)D_{L} - v(e_{O} - e)D_{L}\), since we can prove that \({{\partial^{2} \pi } \mathord{\left/ {\vphantom {{\partial^{2} \pi } {\partial (Q)^{2} = }}} \right. \kern-0pt} {\partial (Q)^{2} = }}\frac{{kt^{2} (a^{2} r^{2} + 2arv - t^{2} + 2tv - k)}}{{(a^{2} r^{2} + 2art + t^{2} - 2k)^{2} }} < 0\), therefore we can know the social welfare function \(SW\) is concave with respect to \(Q\). Let \({{\partial SW} \mathord{\left/ {\vphantom {{\partial SW} {\partial Q = 0}}} \right. \kern-0pt} {\partial Q = 0}}\) and solve for \(Q\), then we can get \(Q^{B} * = \frac{{(e_{O} t - 2e_{O} v - c + 1)k^{2} - (t - v)(ar + t)(ae_{O} r - e_{O} t - 2c + 2)k + a^{2} r(r - 1)(ar + t)^{2} (e_{O} t + c - 1)}}{{t[k^{2} - (ar + t)(ar - t + 2v)k + a^{2} r(r - 1)(ar + t)^{2} ]}}\) By substituting the result above into the social welfare function, we can obtain \(SW^{B} * = - \frac{1}{2}\frac{{k^{2} (e_{O} v + c - 1)^{2} }}{{[k^{2} - (ar + t)(ar - t + 2v)k + a^{2} r(r - 1)(ar + t)^{2} ]}}\), accordingly we can get \(e_{L}^{B} *\), \(D_{L}^{B} *\), \(p_{L}^{B} *\), \(\pi_{L}^{B} *\)。

Proof of Lemma 8

(1) Calculate \({{\partial D_{L}^{B} *} \mathord{\left/ {\vphantom {{\partial D_{L}^{B} *} {\partial v}}} \right. \kern-0pt} {\partial v}}\), which equals \(- \frac{{k^{2} [e_{O} k^{2} - (ar + t)(ae_{O} r - e_{O} t - 2c + 2)k + a^{2} e_{O} r(r - 1)(ar + t)^{2} ]}}{{[k^{2} - (ar + t)(ar - t + 2v)k + a^{2} r(r - 1)(ar + t)^{2} ]^{2} }}\). As can be seen that, the denominator is positive. The numerator is a quadratic function in \(k\), and the coefficient is \(e_{O}\), which is positive by assumption. Let this function equals 0 and solve for \(k\) , then we can obtain one real solution \(k_{1}\).

\(k_{1} = \frac{1}{{2e_{O} }}\Bigg[(ae_{O} r - e_{O} t - 2c + 2 +\sqrt{\begin{array}{ll}- 3a^{2} e_{O}^{2} r^{2} + 4a^{2} e_{O}^{2} r - 2ae_{O}^{2} rt - 4ace_{O} r \\ + e_{O}^{2} t^{2} + 4ae_{O} r + 4ce_{O} t + 4c^{2} - 4e_{O} t - 8c + 4\end{array}} (ar + t)\Bigg]\)。Therefore, we have \({{\partial D_{L}^{B} *} \mathord{\left/ {\vphantom {{\partial D_{L}^{B} *} {\partial v > 0}}} \right. \kern-0pt} {\partial v > 0}}\) for \(k < k_{1}\) and \({{\partial D_{L}^{B} *} \mathord{\left/ {\vphantom {{\partial D_{L}^{B} *} {\partial v < 0}}} \right. \kern-0pt} {\partial v < 0}}\), otherwise. (2) Calculate \({{\partial e^{B} *} \mathord{\left/ {\vphantom {{\partial e^{B} *} {\partial v}}} \right. \kern-0pt} {\partial v}}\), which equals \(- \frac{{k(ar + t)[e_{O} k^{2} - (ar + t)(ae_{O} r - e_{O} t - 2c + 2)k + a^{2} e_{O} r(r - 1)(ar + t)^{2} ]}}{{[k^{2} - (ar + t)(ar - t + 2v)k + a^{2} r(r - 1)(ar + t)^{2} ]^{2} }}\). From the result above, we know the denominator is positive, and in the nominator \(e_{O} k^{2} - (ar + t)(ae_{O} r - e_{O} t - 2c + 2)k + a^{2} e_{O} r(r - 1)(ar + t)^{2}\) is a quadratic function in k, and the coefficient of \(k^{2}\) is \(e_{O}\), which is positive by assumption. Let this function equals 0 and solve for \(k\), then we can obtain one real solution \(k_{1}\).

\(k_{1} = \frac{1}{{2e_{O} }}\Bigg[(ae_{O} r - e_{O} t - 2c + 2 +\sqrt{\begin{array}{ll}- 3a^{2} e_{O}^{2} r^{2} + 4a^{2} e_{O}^{2} r - 2ae_{O}^{2} rt - 4ace_{O} r \\ + e_{O}^{2} t^{2} + 4ae_{O} r + 4ce_{O} t + 4c^{2} - 4e_{O} t - 8c + 4\end{array}} (ar + t)\Bigg]\).

Therefore, we have \({{\partial e^{B} *} \mathord{\left/ {\vphantom {{\partial e^{B} *} {\partial v > 0}}} \right. \kern-0pt} {\partial v > 0}}\) for \(k < k_{1}\) and \({{\partial e^{B} *} \mathord{\left/ {\vphantom {{\partial e^{B} *} {\partial v < 0}}} \right. \kern-0pt} {\partial v < 0}}\), otherwise. (4) Similarly, we can prove \({{\partial \pi_{L}^{B} *} \mathord{\left/ {\vphantom {{\partial \pi_{L}^{B} *} {\partial v > 0}}} \right. \kern-0pt} {\partial v > 0}}\) for \(k < k_{1}\) and \({{\partial \pi_{L}^{B} *} \mathord{\left/ {\vphantom {{\partial \pi_{L}^{B} *} {\partial v < 0}}} \right. \kern-0pt} {\partial v < 0}}\), otherwise. (5)Similarly, we can prove \({{\partial SW^{B} *} \mathord{\left/ {\vphantom {{\partial SW^{B} *} {\partial v > 0}}} \right. \kern-0pt} {\partial v > 0}}\) for \(k < k_{2}\) and \({{\partial SW^{B} *} \mathord{\left/ {\vphantom {{\partial SW^{B} *} {\partial v < 0}}} \right. \kern-0pt} {\partial v < 0}}\), otherwise.

\(k_{2} = - \frac{1}{2}\frac{{ - (ar + t)(ae_{O} r - e_{O} t + e_{O} v - c + 1) -\sqrt{\begin{gathered} \,[ - (ar + t)(ae_{O} r - e_{O} t + e_{O} v - c + 1)]^{2} \hfill \\ - 4a^{2} e_{O}^{2} r(r - 1)(ar + t)^{2} \hfill \\ \end{gathered}} }}{{e_{O} }}\)

Proof of Lemma 9

Calculate \(D_{L}^{B} * - D_{O}^{A} *\), which equals \(\frac{{(ar + t)(a^{3} r^{3} - a^{3} r^{2} + a^{2} r^{2} t - a^{2} rt - akr + kt - 2kv)(e_{O} v + c - 1)}}{{k^{2} - (ar + t)(ar - t + 2v)k + a^{2} r(r - 1)(ar + t)^{2} }}\). From the assumption, we know that denominator is positive. For the nominator, \(e_{O} v + c - 1\) is negative, \(ar + t\) is positive,\(a^{3} r^{3} - a^{3} r^{2} + a^{2} r^{2} t - a^{2} rt - akr + kt - 2kv\) is a linear increasing function in \(v\), and the coefficient of \(v\) is \(- 2k\). Let this function equals 0, and solve for \(v\) to get \(v_{1} = \frac{1}{2}\frac{{a^{3} r^{3} - a^{3} r^{2} + a^{2} r^{2} t - a^{2} rt - art + kt}}{k}\). Therefore, we have \(D_{L}^{B} * < D_{O}^{A} *\) for \(v < v_{1}\), and \(D_{L}^{B} * > D_{O}^{A} *\), otherwise.

Proof of Proposition 2

Calculate \(Q_{L}^{B} * - Q_{O}^{A} *\), which equals \(\frac{{(ar + t)(2a^{3} r^{3} - 2a^{3} r^{2} + 2a^{2} r^{2} t - 2a^{2} rt - akr + 3kt - 4kv)(e_{O} v + c - 1)}}{{k^{2} - (ar + t)(ar - t + 2v)k + a^{2} r(r - 1)(ar + t)^{2} }}\). For the denominator, we know that \(k^{2} - (ar + t)(ar - t + 2v)k + a^{2} r(r - 1)(ar + t)^{2}\) is positive by assumption. For the nominator, \(e_{O} v + c - 1\) is negative,\(ar + t\) is positive, \(2a^{3} r^{3} - 2a^{3} r^{2} + 2a^{2} r^{2} t - 2a^{2} rt - akr + 3kt - 4kv\) is a linear increasing function in \(v\), and the coefficient of \(v\) is \(- 4k\). Let this function equals 0,and solve for \(v\), we can obtain \(v_{2} = \frac{1}{4}\frac{{2a^{3} r^{3} - 2a^{3} r^{2} + 2a^{2} r^{2} t - 2a^{2} rt - art + 3kt}}{k}\). Therefore, we have \(Q_{L}^{B} * < Q_{O}^{A} *\) for \(v < v_{2}\) and \(Q_{L}^{B} * > Q_{O}^{A} *\) otherwise.

Proof of Proposition 3

Similarly, we can prove \(\pi_{L}^{B} * < \pi_{O}^{A} *\) for \(v < v_{3}\) and \(\pi_{L}^{B} * > \pi_{O}^{A} *\) for \(v > v_{3}\).\(v_{3} = \frac{1}{4}\frac{{\sqrt { - (2ar + 2t)(M + N)} }}{(ar + t)k}\)

Proof of Proposition 4

Calculate \(SW^{B} * - SW^{A} *\), we can get.

\(- \frac{1}{2}\frac{{(ar + t)(a^{3} r^{3} - a^{3} r^{2} + a^{2} r^{2} t - a^{2} rt - akr + kt - 2kv)(e_{O} v + c - 1)^{2} }}{{k^{2} - (ar + t)(ar - t + 2v)k + a^{2} r(r - 1)(ar + t)^{2} }}\). By assumption, we know the denominator is positive. For the nominator,\((e_{O} v + c - 1)^{2}\) is positive , \(ar + t\) is positive and \(a^{3} r^{3} - a^{3} r^{2} + a^{2} r^{2} t - a^{2} rt - akr + kt - 2kv\) is a linear increasing function in \(v\). Let \(a^{3} r^{3} - a^{3} r^{2} + a^{2} r^{2} t - a^{2} rt - akr + kt - 2kv = 0\), and solve for \(v\), we can obtain \(v_{1} = \frac{1}{2}\frac{{a^{3} r^{3} - a^{3} r^{2} + a^{2} r^{2} t - a^{2} rt - art + kt}}{k}\). Therefore, we have \(SW^{B} * < SW^{A} *\) for \(v < v_{1}\) and \(SW^{B} * > SW^{A} *\) for \(v > v_{1}\).

Rights and permissions