Abstract

Aging is accompanied by changes in multiple cognitive domains, which can impact older adults’ ability to maintain independence. The ability to manage one’s personal finances is an activity of daily living most often studied in the context of Mild Cognitive Impairment and dementia. However, it is critical that we also understand the nature and sources of variation in financial capacity in cognitively unimpaired populations. This study aimed to establish meaningful individual differences in financial capacity in this population and to define those primary behavioral predictors of individual differences. Applying a partial least squares correlation approach, we found significant associations between financial capacity, as assessed by the Financial Capacity-Short Form, and a battery of neuropsychological and self-report measures in normal aging (r = .56, p < .001). Key predictors of financial capacity included fluid reasoning, crystallized intelligence, working memory updating, visual memory, and self-reported sleep duration (|rs| = 0.29−0.56, ps = 0.02− 0.001). These findings indicate that financial capacity is supported by multiple cognitive domains in aging. Further, associations with fluid reasoning and crystallized intelligence suggest some individuals may be more protected against clinically-relevant impairment in financial capacity through cognitive reserve mechanisms.

Similar content being viewed by others

Introduction

Aging is accompanied by cognitive changes in multiple domains including executive function and memory1,2. Reduced cognitive function in aging can impair older adults’ ability to successfully maintain independence by impacting performance on instrumental activities of daily living (IADLs). IADLs have been characterized by their high cognitive demand3 and include activities such as financial management, medical decision-making, medication management, meal planning, shopping, and cooking. IADLs and “functional cognition” are a focus of research in aging and neurological disorders4,5,6, in acquired brain injury7, and in psychiatric8 and developmental disorders9. There are clear interpersonal, societal, and financial motivations for helping these populations strengthen and maintain functional cognition for as long as possible. To support the detection of impairment in IADLs, a number of standardized self-report and instrumental laboratory tasks have been developed to inform clinically relevant decision-making about patient care10.

In aging and dementia research, there has been a specific focus on assessing individuals’ ability to maintain their finances. With retirement, older adults are often faced with complex problems related to budgeting and financial planning. Indeed, for many, there is an unfortunate co-occurrence of increased complexity of financial decisions and reductions in performance in multiple cognitive domains. General financial literacy goes down with older age11,12. Older adults are more likely to accept loans at higher interest rates13 and are more susceptible to fraud14,15. The Financial Capacity Instrument-Short Form (FCI-SF) was developed to optimize detection of reduced financial capacity16, and is sensitive to clinically relevant impairment in MCI and Alzheimer’s disease (AD) clinical syndrome17,18. Recent findings from the Alzheimer’s Disease Neuroimaging Initiative link poorer financial capacity with disease severity as indexed by higher levels of beta-amyloid and tau pathology18,19,20. Moreover, financial capacity is often severely impaired when altered mood (e.g., depression, apathy) and sleep disturbances co-occur in MCI and AD patients21,22,23,24. These factors have been identified as key predictors in financial decision-making, emphasizing the complex interaction between pathological cognitive decline and psychological factors.

There is increasing interest in identifying behavioral measures which may forecast pathological aging trajectories and future cognitive impairment25,26. Financial capacity is purported to be one of the earliest IADLs to be impacted in pathological aging27, though there has been little investigation into the use of FCI-SF as a meaningful individual differences measure in cognitively unimpaired populations. Most previous studies have treated cognitively normal older adults as a control group from which to evaluate the effects of MCI and AD without evaluating the nature and sources of variation among those controls28,29,30. Notable exceptions pursuing ancillary analyses focused on unimpaired controls find consistent associations between financial capacity and arithmetic and reasoning ability31,32,33.

To address gaps in our understanding of the behavioral correlates of financial capacity in aging, we collected the FCI-SF in addition to neuropsychological assessments and self-report measures in the same individuals (59–86 years old). A strength of our approach is both the breadth of cognitive domains we evaluate and the depth we achieve through a rich sampling of multiple memory and executive function subdomains. In addition, we include self-report assessments of metamemory, affect, motivation, physical activity, and sleep quality, which may provide unique insight into sources of variation in IADL. To capitalize on the variety of data in this deeply phenotypic sample, we used an exploratory, data-driven partial least squares correlation (PLSC) approach. By identifying the cognitive domains most closely related to financial capacity, our findings may give insight into the cognitive profiles of those older adults most resilient or vulnerable to impairment in IADLs, and may reveal possible targets for therapeutic intervention.

Results

Seventy-three participants underwent a battery of neuropsychological tests and self-report questionnaires in this study (Table 1). Because the Keep Track, Spatial N-back, and Stroop tasks were adapted from previous literature34,35, we calculated internal reliability by adjusting split-half correlations with the Spearman-Brown prophecy formula and found acceptable reliability for each measure (Keep Track = 0.72; Spatial N-back = 0.88; Stroop = 0.78).

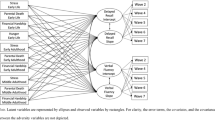

To test the association between financial capacity and cognitive function, a PLSC analysis was applied to the correlation matrix between FCI-SF scores and neuropsychological and self-report measures (Fig. 1). We extracted the latent variables (first component p < .001) that optimally expressed the multivariate association between participants’ financial capacity and cognitive performance (r = .56, p < .001; Fig. 2A). Participants who showed higher financial capacity exhibited better neuropsychological performance after partialling out chronological age and years of education. Of the FCI-SF scores, mental calculation, simple and complex checkbook/check register, total score, and total time components were the reliable contributors to the latent variable (Bootstrap ratios > 1.96 Fig. 2B). These primary contributors were positively correlated with neuropsychological performance related to general intelligence as measured by vocabulary in Wechsler Abbreviated Scale of Intelligence II (WASI-II: r = .38, p = .001) and matrix reasoning in WASI-II (r = .31, p = .01), executive function (Spatial N-back: rs > 0.34, ps = 0.001; Keep Track: r = .29, p = .02), and visual memory (visual reproduction recognition in WMS-IV: r = .29, p = .02; Table 2) and negatively correlated with repetitions of verbal memory (California Verbal Learning Test-II [CVLT-II] repetitions: r = − .25, p = .03) and sleep duration (Pittsburgh Sleep Quality Index [PSQI] duration: r = − .40, p = .001; Table 2). No self-report measures related to affect, motivation, metamemory, or intellectual or physical activity showed significant associations with FCI-SF performance.

Schematic representation of partial least squares correlation analysis (PLSC). The correlation matrix between the financial capacity assessments and neuropsychological tests was subjected to singular vector decomposition. The association between the two latent variables after partialling out chronological age represents the pattern of interindividual differences in financial skill ability that shares the largest amount of variance with interindividual differences in overall neuropsychological performance. Note WASI-II = Wechsler Abbreviated Scale of Intelligence II; WMS-IV = Wechsler Memory Scale IV; CVLT = California Verbal Learning Test; FNAME = Face-Name Associative Memory Exam; MMQ = Multifactorial Memory Questionnaire; BAI = Behavioral Activation and Behavioral Inhibition Scales; GDS = Geriatric Depression Scale; PSWQ = Penn State Worry Questionnaire; MASQ = Mood and Anxiety Symptom Questionnaire; LEQ = Lifetime of Experiences Questionnaire; PSQI = Pittsburgh Sleep Quality Index.

Better financial skill abilities are associated with better cognitive functions. (A) Scatter plot depicting the association between latent FCI scores and latent neuropsychological scores after partialling out chronological age and years of education. (B) Contribution of individual FCI components to a PLSC latent variable (bootstrap ratios > 1.96 represented in red is considered reliable). FCI = financial capacity instrument; MC = mental calculation; FCK = financial conceptual knowledge; SCR = simple checkbook/check register; CCR = complex checkbook/check register; BSM = bank statement management.

Discussion

This study suggests there is variation in financial capacity in cognitively unimpaired older adults as measured by the FCI-SF, which is associated with individual differences in standard neuropsychological assessments. The measures which contributed to the significant association included measures of crystalized and fluid intelligence (WASI-II Vocabulary and Matrix Reasoning), working memory updating (Spatial N-back, Keep Track), episodic memory (WMS-IV Visual Reproduction, CVLT-II repetitions), and self-reported sleep (PSQI sleep duration). Together, these findings provide empirical support for the view that financial capacity as an IADL is supported by multiple cognitive domains.

We found associations between financial capacity and cognitive measures that are highly reliant on prefrontal cortex function including fluid intelligence and multiple working memory measures. These findings are in line with previous research linking working memory performance with math and problem-solving skills, which represent core features of financial capacity assessment36,37. The heavy weighting of this IADL on executive function has been previously demonstrated in empirical studies of MCI28,29,31,38 and meta-analysis investigating cognitive correlates of functional status in MCI6. Relevant to financial capacity, intact memory may be critical for supporting experience-guided financial decision making and for maintaining financial literacy. Thus, optimal financial capacity is likely supported by multiple systems including the prefrontal cortex and medial temporal lobe. Notably, these systems are particularly impacted in both aging39 and across the AD continuum40. It is possible that financial capacity’s reliance on the integrity of the prefrontal cortex and medial temporal lobe structures underlies its sensitive prediction of AD conversion.

In the fields of aging and AD research, there is significant attention focused on identifying factors that allow some individuals to maintain high levels of cognitive function despite the accumulation of beta-amyloid pathology, tau pathology, and accompanying neurodegeneration. These factors have been discussed in terms of “cognitive reserve” or “cognitive resilience” and support the ability of some people to maintain normal cognition and independence for decades after significant neural insult41,42. Common cognitive reserve proxies include years of education and IQ. For example, Rentz and colleagues (2010) demonstrated that higher years of education and IQ reduce or eliminate the association between beta-amyloid and poorer neuropsychological performance43. Relevant to financial capacity, Han and colleagues (2015) found that the association between MCI diagnosis and poorer financial literacy is offset by higher years of education44. In the current study, we found better financial capacity performance was associated with measures of fluid and crystallized intelligence, which are commonly used to estimate IQ. The close association between financial capacity and IQ suggests that those older adults with low financial capacity are likely also to have low cognitive reserve. Specific attention should be paid to these individuals because they are not likely to be able to endure substantial age or AD-related brain changes before showing cognitive decline and significant impairment in financial capacity.

One motivation of this exploratory study was to identify possible targets for intervention to improve financial capacity in older age. However, the majority of those neuropsychological factors we identified as correlates of financial capacity are not highly modifiable. For example, executive function and fluid reasoning have proven notoriously difficult to train44,45,46. Sleep is considered a modifiable factor and was associated with financial capacity in the current study. Specifically, longer sleep durations were associated with poorer performance, which is consistent with a significant body of research linking an inverted-U association between sleep duration and cognitive decline in aging47. However, long sleep durations in aging may be considered a proxy for poor health and may therefore not be an optimal intervention target for causally improving cognition. Future sleep intervention studies may consider examining how improvements in empirically measured sleep quality, rather than duration per se, improve financial capacity in aging.

There are limitations in our study, which include a relatively small sample size and cross-sectional design. Despite bootstrapped PLSC analyses (see Methods), it is possible the small sample impacted our ability to detect real associations between financial capacity and other cognitive or self-report measures, or led to false positives. Future analyses would benefit from larger and more diverse samples including samples with a broader range in educational attainment, financial literacy or numeracy, and affective health. It is unclear to what extent our findings apply to older adults with a history of psychiatric disorders, which is of particular interest given associations between disordered mood and financial capacity across the dementia spectrum21,22,48. While our neuropsychological battery is notable for its breadth and depth relative to previous studies, it did not include measures of value-based decision-making or reinforcement learning, which may be particularly sensitive to age-related alterations in catecholamine neuromodulator systems49,50.

Future research should focus on continuing to develop our understanding of the neural mechanisms underlying the successful maintenance of financial capacity in older age. Since the FCI-SF was added to the longitudinal Alzheimer’s Disease Neuroimaging Initiative, we have learned that both higher beta-amyloid and tau pathology are associated with poorer financial capacity18,19,51. These lines of biomarker research would benefit from integration with ongoing work aimed at identifying candidate brain mechanisms of cognitive reserve and resilience. For example, the dorsal anterior cingulate cortex has emerged as a brain region central to optimal cognition and resilience in aging52,53 and is a site of high-level integration between the prefrontal cortex and the medial temporal lobe54 relevant to financial capacity. Complementary research on ascending neuromodulator systems suggests the role of catecholamine systems in financial decision-making55 and cognitive resilience in aging56. Together, this study lays critical groundwork supporting the investigation of sources of individual differences in financial capacity in cognitively unimpaired older adults.

Methods

Participants

Ninety-five participants from the greater Boston area (mean age ± standard deviation [SD] = 71.22 ± 5.78, age range = 59–86 years) with normal or corrected-to-normal vision participated in this study from 2020 to 2022. Data from 22 participants were excluded due to incomplete neuropsychological batteries or omissions in responding to self-report questionnaires, leaving a total of 73 older adult participants available for analysis (33 men, 40 women, mean age ± SD = 70.68 ± 5.92, age range = 59–86 years). The racial information was self-reported with 94.52% identifying as White, 2.74% as Black or African American, and 2.74% as Asian. Participants were part of a longitudinal study that aims to understand age-related changes in multiple cognitive domains. History of neurological or psychiatric disorders by self-reports was exclusionary. All participants scored at least 27 on the Mini-Mental State Exam57 (MMSE; mean ± SD = 29.1 ± 0.91) and 13 or less on the Geriatric Depression Scale (GDS; 3.37 ± 3.43). While we frequently use GDS cut-offs of 10 or less, our research since the COVID-19 pandemic has adopted a higher GDS cut-off following global trends in the frequency of depression symptoms and our interest in studying a representative sample of older adults.

This study was approved by the Brandeis University Human Research Protection Program (Approval Number: 22218R). All experiments were conducted in accordance with the relevant guidelines and regulations, including the Declaration of Helsinki (2008). Informed consent was obtained from all participants, and they were fully informed about the study’s objectives, procedures, and their right to withdraw at any time. Participants also consented to the use of their de-identified data for publication.

Financial skill assessments

All participants completed the FCI-SF16, which was developed by Gerstenecker and colleagues (2016) to assess financial understanding and skills. The FCI-SF is a performance-based test that consists of 37 items to evaluate a range of financial skills related to coin/currency knowledge, financial conceptual knowledge and problem-solving, understanding/using a checkbook, and understanding/using a bank statement. Scores were summed to establish five sub-scores and a total score, whereby higher scores reflect better financial capacity. Total completion time was also included in our analyses (Table 1).

Neuropsychological tests

To evaluate basic cognitive function, participants underwent a battery of neuropsychological tests including the WASI-II58, WMS-IV59, CVLT-II60, Face-Name Associative Memory Exam (FNAME)61, Digit Span (Forward/Backward), Keep Track Working Memory Updating task, Spatial N-back task, and Stroop task. Table 2 depicts the details of each neuropsychological test and scoring. Because the Keep Track, Spatial N-back, and Stroop tasks were adapted from previous literature34,35, we provide additional detail about their task design below. These tasks have been found to have good internal reliability and validity35,62 and were programmed using E-prime software (version 3.0).

Keep track

For each trial, participants were presented with a series of 14–21 words. Words were presented on a computer screen sequentially for 2000 ms each. Words belonged to one of four categories: animals, colors, relatives, and countries. We adapted the original task for use in older adults by using three categories rather than six. For each trial, participants were instructed to “keep track” of the most recently presented word from specific target categories. For example, if they were asked to remember ANIMALS and COLORS and they saw the words “Blue,” “Cat,” “Mother,” “Cow,” and “Uncle,” then they would report the words Cow and Blue. Participants were tested under conditions in which they were asked to track two, three, and four categories. Participants completed four trials for each condition (12 trials total). We calculated the sum of the correct words across all conditions.

Spatial N-back

The Spatial N-back task consisted of 1-back and 2-back conditions, each with three blocks of 24 trials (72 total trials per condition). Participants viewed a computer screen with twelve white boxes distributed across the screen. On each trial, one box became black for 500 ms, followed by a 1500 ms inter-trial interval. In the 1-back condition, participants used a button box to indicate whether the black box was in the same location as the black box in the previous trial. For the 2-back condition, participants indicated whether the black box was in the same location as it appeared in two trials previously. Each trial was scored as correct or incorrect, and percentages were calculated as the number of correct trials divided by the number of total trials, with separate scores for 1- and 2-back conditions.

Stroop

In the Stroop task, a word written in one of three different font colors (green, red, or blue) was presented at the center of the computer screen. Participants were instructed to indicate the font color as quickly as possible while verbal responses were recorded (Chronos for Biopac). Each trial had no time limit, and the word remained on the screen until the participant responded. An experimenter recorded whether each response was correct or incorrect. A fixation cross appeared in the center of the screen for 500 ms between each trial. Before beginning the word blocks, participants familiarized themselves with the task format by completing 44 trials in which asterisks were presented (green, red, or blue). Participants were instructed to name the color of the asterisks. The asterisk block was followed by two word blocks: one block of 44 congruent word trials in which the word matched the font color (e.g., participants are presented with the word RED in red ink) and the other of 62 incongruent word trials in which the word did not match the font (e.g., participants are presented with the word RED in blue ink). We computed the difference between the average reaction time in the incongruent trials and that in the congruent trials, where higher values reflect greater interference and poorer cognitive performance. Before calculating the difference in reaction times, we excluded incorrect response trials, trials in which microphone errors occurred, trials with reaction times below 200 ms or above 2000 ms, and trials in which the reaction time was above or below 3 standard deviations from the median.

Self-report questionnaires

To assess a range of psychological factors that may influence financial capacity, participants completed self-report questionnaires that provided insights into their mood, affect, motivation, lifestyle habits, sleep quality, and self-reported cognitive functioning. We included such measures in the current analysis because they may identify affective or lifestyle factors associated with FCI-SF performance, which may be feasible targets for intervention to bolster financial capacity. Further, these are standard questionnaires commonly collected in neuropsychological batteries in aging studies and in clinical settings, and thus any positive findings relating questionnaire data to financial capacity would be easily translatable. These questionnaires included the GDS63, Penn State Worry Questionnaire (PSWQ)64, the Mood and Anxiety Symptom Questionnaire (MASQ)65, the Lifetime Experiences Questionnaire (LEQ)66, PSQI67, the Multifactorial Memory Questionnaire (MMQ)68, and the Behavioral Activation and Behavioral Inhibition Scales (BAI)69. Table 2 depicts the details of each self-report questionnaire and scoring.

Statistical analysis

To investigate the multivariate association between financial capacity and neuropsychological performance, we applied a PLSC analysis, which is a powerful tool for detecting latent associations and handling collinearity among variables70,71. PLSC works by reducing the dimensionality of the data and extracting latent components that capture the most relevant variance in both the predictors and the outcome. This approach is particularly well-suited for small sample sizes, as it allows for reliable estimation even with fewer observations72,73. In this analysis, the correlation matrix (Eq. 1a) was constructed from the FCI-SF scores (7 scores × 73 participants) and neuropsychological and self-report questionnaire scores (54 scores × 73 participants). The matrix was then decomposed into three matrices using singular value decomposition (SVD), facilitating the extraction of the latent components associated with financial capacity and neuropsychological performance. The SVD can be denoted as follows:

where X and Y denote the datasets of FCI-SF scores and neuropsychological/self-report measures, respectively, and R indicates Pearson’s correlation matrix between FCI-SF and LC neuropsychological scores subjected to SVD. All the datasets (i.e., XFCI or YNeuropsy) were z-scored across all participants before applying SVD. U and V are the singular vectors (the saliences) that represent the profiles of neuropsychological performance and financial capacity, respectively, to best characterize R. S is a diagonal matrix of singular values. Based on this matrix decomposition, a pair of latent variables (LV) was extracted to denote a linear combination of each original dataset (i.e., XFCI or YNeuropsy) and its correspondingly singular vector (i.e., VFCI or UNeuropsy in Eq. 1c or 1d). The association between the two latent variables optimally expresses (in the least squares sense) the pattern of interindividual differences in financial skill ability that shares the largest amount of variance with interindividual differences in overall neuropsychological performance (Fig. 1).

The associations between the extracted latent variables were examined across all participants after partialling out chronological age and years of education. The reliability of the singular vectors to the latent variables was evaluated using bootstrapping (n = 10,000 iterations). Bootstrapping helps estimate the variability in model performance by resampling the data with replacement, which provides more robust estimates of the stability and significance, particularly in the context of a smaller sample size. A ratio of the singular vectors and their corresponding bootstrapped standard errors provided bootstrap ratios that can be interpreted akin to Z-scores. Thus, bootstrap ratios < − 1.96 and > 1.96 (akin to Z-scores; p < .05) were considered reliable and indicated as reliable contributions to the latent variable.

Data availability

All de-identified data and analytic code are publicly available on Open Science Framework (https://osf.io/yf5tj/?view_only=7de5645c1b1c430c9e4d58d5acd1867a).

References

Park, D. C. et al. Models of visuospatial and verbal memory across the adult life span. Psychol. Aging. 17, 299–320 (2002).

Treitz, F. H., Heyder, K. & Daum, I. Differential course of executive control changes during normal aging. Aging Neuropsychol. Cogn. 14, 370–393 (2007).

Lawton, M. P. & Brody, E. M. Assessment of older people: Self-maintaining and instrumental activities of daily Living1. Gerontol 9, 179–186 (1969).

Foster, E. R. & Doty, T. Cognitive correlates of instrumental activities of daily living performance in Parkinson disease without dementia. Arch. Rehabil. Res. Clin. Transl. 3, 100138 (2021).

Jekel, K. et al. Mild cognitive impairment and deficits in instrumental activities of daily living: A systematic review. Alzheimer’s Res. Ther. 7, 17 (2015).

McAlister, C. & Schmitter-Edgecombe, M. Everyday functioning and cognitive correlates in healthy older adults with subjective cognitive concerns. Clin. Neuropsychol. 30, 1087–1103 (2016).

McCrea, M. A. et al. Functional outcomes over the first year after moderate to severe traumatic brain injury in the prospective, longitudinal TRACK-TBI study. JAMA Neurol. 78, 982–992 (2021).

Harvey, P. D. & Bellack, A. S. Toward a terminology for functional recovery in schizophrenia: Is functional remission a viable concept? Schizophr Bull. 35, 300–306 (2009).

Bal, V. H., Kim, S. H., Cheong, D. & Lord, C. Daily living skills in individuals with autism spectrum disorder from 2 to 21 years of age. Autism 19, 774–784 (2015).

Pashmdarfard, M. & Azad, A. Assessment tools to evaluate activities of daily living (ADL) and instrumental activities of daily living (IADL) in older adults: A systematic review. Méd J. Islam Repub. Iran. 34, 33–33 (2020).

Finke, M. S., Howe, J. S. & Huston, S. J. Old age and the decline in financial literacy. SSRN Electron. J. https://doi.org/10.2139/ssrn.1948627 (2011).

Giannouli, V. & Tsolaki, M. Financial capacity and illiteracy: Does education matter in amnestic mild cognitive impairment? J. Alzheimer’s Dis. Rep. 5, 715–719 (2021).

Agarwal, S., Driscoll, J. C., Gabaix, X. & Laibson, D. The age of reason: Financial decisions over the Life-Cycle with implications for regulation. SSRN Electron. J. https://doi.org/10.2139/ssrn.973790 (2009).

DeLiema, M., Deevy, M., Lusardi, A. & Mitchell, O. S. Financial fraud among older Americans: Evidence and implications. J. Gerontol. Ser. B. 75, 861–868 (2020).

Burnes, D. et al. Prevalence of financial fraud and scams among older adults in the United States: A systematic review and Meta-Analysis. Am. J. Public. Heal. 107, e13–e21 (2017).

Gerstenecker, A. et al. Age and education corrected older adult normative data for a short form version of the financial capacity instrument. Psychol. Assess. 28, 737–749 (2016).

Sudo, F. K. & Laks, J. Financial capacity in dementia: A systematic review. Aging Ment Heal. 21, 677–683 (2017).

Tolbert, S. et al. Financial management skills in aging, MCI and dementia: Cross sectional relationship to 18F-Florbetapir PET cortical β-amyloid deposition. J. Prev. Alzheimer’s Dis. 6, 274–282 (2019).

Vassilaki, M. et al. Association of performance on the financial capacity Instrument–Short form with brain amyloid load and cortical thickness in older adults. Neurol. Clin. Pr. 12, 113–124 (2022).

Gonzalez, C. et al. Financial capacity and regional cerebral Tau in cognitively normal older adults, mild cognitive impairment, and Alzheimer’s disease dementia. J. Alzheimer’s Dis. JAD. 79, 1133–1142 (2021).

Giannouli, V., Stamovlasis, D. & Tsolaki, M. Exploring the role of cognitive factors in a new instrument for elders’ financial capacity assessment. J. Alzheimer’s Dis. 62, 1579–1594 (2018).

Giannouli, V. & Tsolaki, M. In the hands of Hypnos: Associations between sleep, cognitive performance and financial capacity in aMCI and mild AD. Sleep. Sci. 16, 231–236 (2023).

Armendariz, J. R., Han, S. D. & Fung, C. H. A scoping review and conceptual framework examining the role of sleep disturbance in financial exploitation in older adults. Gerontol. Geriatr. Med. 8, 23337214221116230 (2022).

Morin, R. T. et al. Impaired financial capacity in Late-Life depression: Revisiting associations with cognitive functioning. J. Int. Neuropsychol. Soc. 25, 1088–1093 (2019).

Schaeverbeke, J. M. et al. Baseline cognition is the best predictor of 4-year cognitive change in cognitively intact older adults. Alzheimer’s Res. Ther. 13, 75 (2021).

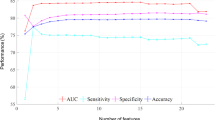

Giannouli, V. & Kampakis, S. Can machine learning assist Us in the classification of older patients suffering from dementia based on classic neuropsychological tests and a new financial capacity test performance? J. Neuropsychol. https://doi.org/10.1111/jnp.12409 (2024).

Goldberg, T. E. et al. Performance-based measures of everyday function in mild cognitive impairment. Am. J. Psychiatry. 167, 845–853 (2010).

Griffith, H. R. et al. Magnetic resonance imaging volume of the angular gyri predicts financial skill deficits in people with amnestic mild cognitive impairment. J. Am. Geriatr. Soc. 58, 265–274 (2010).

Han, S. D., Boyle, P. A., James, B. D., Yu, L. & Bennett, D. A. Mild cognitive impairment is associated with poorer Decision-Making in Community‐Based older persons. J. Am. Geriatr. Soc. 63, 676–683 (2015).

Marson, D. C. et al. Assessing financial capacity in patients with alzheimer disease: A conceptual model and prototype instrument. Arch. Neurol. 57, 877–884 (2000).

Bassett, S. S. Attention: Neuropsychological predictor of competency in Alzheimer’s disease. J. Geriatr. Psychiatry Neurol. 12, 200–205 (1999).

Kershaw, M. M. & Webber, L. S. Assessment of financial competence. Psychiatry Psychol. Law. 15, 40–55 (2008).

Sherod, M. G. et al. Neurocognitive predictors of financial capacity across the dementia spectrum: Normal aging, mild cognitive impairment, and Alzheimer’s disease. J. Int. Neuropsychol. Soc. 15, 258–267 (2008).

Snyder, H. R., Friedman, N. P. & Hankin, B. L. Transdiagnostic mechanisms of psychopathology in youth: Executive functions, dependent stress, and rumination. Cogn. Ther. Res. 43, 834–851 (2019).

Friedman, N. P. et al. Stability and change in executive function abilities from late adolescence to early adulthood: A longitudinal twin study. Dev. Psychol. 52, 326–340 (2016).

Bangma, D. F., Fuermaier, A. B. M., Tucha, L., Tucha, O. & Koerts, J. The effects of normal aging on multiple aspects of financial decision-making. PLoS ONE. 12, e0182620 (2017).

Raghubar, K. P., Barnes, M. A. & Hecht, S. A. Working memory and mathematics: A review of developmental, individual difference, and cognitive approaches. Learn. Individ Differ. 20, 110–122 (2010).

Niccolai, L. M. et al. Neurocognitive predictors of declining financial capacity in persons with mild cognitive impairment. Clin. Gerontol. 40, 14–23 (2017).

Raz, N. & Rodrigue, K. M. Differential aging of the brain: Patterns, cognitive correlates and modifiers. Neurosci. Biobehav. Rev. 30, 730–748 (2006).

Berron, D., van Westen, D., Ossenkoppele, R., Strandberg, O. & Hansson, O. Corrigendum to: Medial Temporal lobe connectivity and its associations with cognition in early Alzheimer’s disease. Brain 144, e84–e84 (2021).

Arenaza-Urquijo, E. M. & Vemuri, P. Resistance vs resilience to alzheimer disease. Neurology 90, 695–703 (2018).

Stern, Y. et al. Whitepaper: Defining and investigating cognitive reserve, brain reserve, and brain maintenance. Alzheimer’s Dement. 16, 1305–1311 (2020). Whitepaper.

Rentz, D. M. et al. Cognition, reserve, and amyloid deposition in normal aging. Ann. Neurol. 67, 353–364 (2010).

Kassai, R., Futo, J., Demetrovics, Z. & Takacs, Z. K. A meta-analysis of the experimental evidence on the Near- and Far-Transfer effects among children’s executive function skills. Psychol. Bull. 145, 165–188 (2019).

Jaeggi, S. M., Buschkuehl, M., Jonides, J. & Perrig, W. J. Improving fluid intelligence with training on working memory. Proc. Natl. Acad. Sci. 105, 6829–6833 (2008).

Stephenson, C. L. & Halpern, D. F. Improved matrix reasoning is limited to training on tasks with a visuospatial component. Intelligence 41, 341–357 (2013).

Lo, J. C., Groeger, J. A., Cheng, G. H., Dijk, D. J. & Chee, M. W. L. Self-reported sleep duration and cognitive performance in older adults: A systematic review and meta-analysis. Sleep. Med. 17, 87–98 (2016).

Giannouli, V. & Tsolaki, M. Beneath the top of the iceberg: Financial capacity deficits in mixed dementia with and without depression. Healthcare 11, 505 (2023).

Chen, H. Y., Marxen, M., Dahl, M. J. & Glöckner, F. Effects of adult age and functioning of the locus coeruleus norepinephrinergic system on reward-based learning. J. Neurosci. 43, 6185–6196 (2023).

Eppinger, B., Hammerer, D. & Shu-Chen, L. Neuromodulation of reward based learning and decision making in human aging. Ann. N Y Acad. Sci. 1235, 1–17 (2011).

Initiative & for the Alzheimer’s Disease Neuroimaging, et al. Financial capacity and regional cerebral Tau in cognitively normal older adults, mild cognitive impairment, and Alzheimer’s disease dementia. JAD 79, 1133–1142 (2021).

Arenaza-Urquijo, E. M. et al. The metabolic brain signature of cognitive resilience in the 80+: Beyond alzheimer pathologies. Brain 142, 1134–1147 (2019).

Pezzoli, S. et al. Successful cognitive aging is associated with thicker anterior cingulate cortex and lower Tau deposition compared to typical aging. Alzheimer’s Dement. 20, 341–355 (2024).

Minxha, J., Adolphs, R., Fusi, S., Mamelak, A. N. & Rutishauser, U. Flexible recruitment of memory-based choice representations by the human medial frontal cortex. Science 368, 6498 (2020).

Zaghloul, K. A. et al. Human substantia Nigra neurons encode unexpected financial rewards. Science 323, 1496–1499 (2009).

Engels-Domínguez, N. et al. State-of-the-art imaging of neuromodulatory subcortical systems in aging and Alzheimer’s disease: Challenges and opportunities. Neurosci. Biobehav. Rev. 144, 104998 (2023).

Folstein, M. F., Folstein, S. E. & McHugh, P. R. Mini-Mental State Examination https://doi.org/10.1037/t07757-000. (1975).

Wechsler, D. Wechsler Abbreviated Scale of Intelligence–Second Edition. (2011). https://doi.org/10.1037/t15171-000

Wechsler, D. Wechsler Memory Scale–Fourth Edition. (2012). https://doi.org/10.1037/t15175-000

Delis, D. C., Kramer, J. H., Kaplan, E. & Ober, B. A. Calif. Verbal Learn. Test–Second Ed. https://doi.org/10.1037/t15072-000

Rentz, D. M. et al. Face-name associative memory performance is related to amyloid burden in normal elderly. Neuropsychologia 49, 2776–2783 (2011).

Friedman, N. P. et al. Individual differences in executive functions are almost entirely genetic in origin. J. Exp. Psychol. Gen. 137, 201–225 (2008).

Yesavage, J. A. et al. Development and validation of a geriatric depression screening scale: A preliminary report. J. Psychiatr Res. 17, 37–49 (1983).

Meyer, T. J., Miller, M. L., Metzger, R. L. & Borkovec, T. D. Development and validation of the Penn state worry questionnaire. Behav. Res. Ther. 28, 487–495 (1990).

Watson, D. & Clark, L. A. Mood and Anxiety Symptom Questionnaire. (1991).

Valenzuela, M. J. & Sachdev, P. Life Experiences Questionnaire (2007).

Buysse, D. J., Reynolds, C. F., Monk, T. H., Berman, S. R. & Kupfer, D. J. The Pittsburgh sleep quality index: A new instrument for psychiatric practice and research. Psychiatry Res. 28, 193–213 (1989).

Troyer, A. K. & Rich, J. B. Psychometric properties of a new metamemory questionnaire for older adults. J. Gerontol. Ser. B Psychol. Sci. Soc. Sci. 57, P19–P27 (2002).

Carver, C. S. & White, T. L. Behavioral Inhibition Behavioral activation, and affective responses to impending reward and punishment: The BIS/BAS scales. J. Pers. Soc. Psychol. 67, 319–333 (1994).

Krishnan, A., Williams, L. J., McIntosh, A. R. & Abdi, H. Partial least squares (PLS) methods for neuroimaging: A tutorial and review. NeuroImage 56, 455–475 (2011).

McIntosh, A. R. & Lobaugh, N. J. Partial least squares analysis of neuroimaging data: Applications and advances. NeuroImage 23, S250–S263 (2004).

Willaby, H. W., Costa, D. S. J., Burns, B. D., MacCann, C. & Roberts, R. D. Testing complex models with small sample sizes: A historical overview and empirical demonstration of what partial least squares (PLS) can offer differential psychology. Pers. Individ. Differ. 84, 73–78 (2015).

Pirouz, D. M. An overview of partial least squares. SSRN Electron. J. https://doi.org/10.2139/ssrn.1631359 (2006).

Acknowledgements

We thank all participants for taking part in the study. This work was supported by R00AG058748 (ASB); R01AG074330 (ASB); T32GM132498 (CJC); Scientific Research Network on Decision Neuroscience & Aging – Pilot grant (HYC). The F-CAP Financial Capacity Instrument was developed at the University of Alabama at Birmingham, and all rights therein are owned by the UAB Research Foundation.

Author information

Authors and Affiliations

Contributions

A.S. Berry and H.R. Snyder conceived the research idea and designed the study. B.C. Gold, A.A. Adornato, J.L. Cowan, K. E. O’Malley, C.J. Ciampa contributed to data collection, H.-Y. Chen, B.C. Gold, and J. L. Crawford made contributions to the analysis and interpretation of data. A.S. Berry and H.-Y. Chen drafted the manuscript. A.S. Berry, H.-Y. Chen, and H.R. Snyder performed the writing review and editing, and all authors read and approved the final version of the manuscript. A.S. Berry supervised the study.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Chen, HY., Gold, B.C., Ciampa, C.J. et al. Understanding the cognitive factors which contribute to individual differences in financial capacity in aging. Sci Rep 15, 15398 (2025). https://doi.org/10.1038/s41598-025-00120-4

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1038/s41598-025-00120-4