Abstract

Digital technology drives high-quality development in manufacturing while serving as a critical enabler for advancing the digital economy. Using data from the Chinese list of manufacturing enterprises from 2012 to 2023, this study empirically analyzes the impact of digital technology on total factor productivity (TFP) in manufacturing and its mechanism of action and further explores its heterogeneity. The results show that digital technology has significantly promoted total factor productivity in manufacturing; this effect was still valid after a series of robustness tests and endogeneity tests were conducted. The mechanism analysis indicated that digital technology enhances total factor productivity in the manufacturing enterprises through the enhancement of the innovation ability of enterprises and the reduction in the operation and management costs. The heterogeneity analysis showed that digital technology has a more significant effect on the total factor productivity enhancement of enterprises in the eastern region, state-owned enterprises, and small and medium-sized enterprises. The conclusions provide clear policy implications for the promotion of the digital transformation of enterprises, accelerating the formation of high-quality productivity in enterprises, and promoting the high-quality development of the manufacturing industry.

Similar content being viewed by others

Introduction

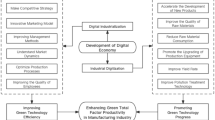

In the context of the current global economic transition, the manufacturing industry’s development model is significantly impacted by the rapid development of digital technologies; consequently, there is great potential for improvement in total factor productivity. The application of digital technologies not only optimizes production processes but also drives industrial upgrading and enhances the competitiveness of enterprises. With the continuous iteration of cutting-edge technologies, such as 5G, artificial intelligence, cloud computing, and blockchain, digital technologies have brought new opportunities for productivity enhancement in the manufacturing industry, providing significant momentum for the achievement of high-quality development1. The Chinese government has explicitly emphasized the need to cultivate growth momentum for the next generation of information technologies to promote the deep integration of the digital economy with the real economy. This highlights the critical role of digital technologies in improving economic efficiency and driving industrial transformation.

As the cornerstone of the national economy, the improvement of total factor productivity in the manufacturing industry is of critical significance for overall economic growth. The widespread application of digital technologies has enabled the manufacturing industry to achieve more efficient resource allocation and production process optimization, thereby enhancing productivity2. For example, the application of smart manufacturing and automation technologies has efficiently utilized human and material resources in the production process, reduced operational costs, and in-creased flexibility. Meanwhile, the combination of data analytics and artificial intelligence enables enterprises to monitor production status in real time, forecast market demand, and optimize inventory management, further enhancing total factor productivity. However, continuous investment in information technology does not always translate into total factor productivity growth, as evidenced by the mismatch between IT investment and productivity in some regions, which is known as the “Solow Paradox”3. This paradox is particularly pronounced in China’s economic transformation, where the manufacturing industry urgently needs to leverage digital technologies to enhance production efficiency and optimize the industrial structure to address the increasingly severe competitive challenges, thereby achieving the goals of sustain-able development and innovation-driven growth.China’s manufacturing sector exemplifies the Solow Paradox resolution through policy-driven digital transformation. By leveraging state-backed industrial ecosystems, digital technologies enable cross-firm knowledge diffusion and organizational agility via cloud platforms and flattened hierarchies, while provincial talent hubs align workforce upskilling with technological adoption. Initiatives like “Made in China 2025” systematically integrate infrastructure investment with institutional reforms, transforming fragmented capabilities into systemic productivity gains through three synergies: innovation spillovers from SOEs to SMEs, data-driven market responsiveness, and complementary human capital development.

Therefore, studying the impact of digital technologies on the total factor productivity of the manufacturing industry helps to create an understanding of their enabling role and provides theoretical support and policy insights that promote the deep integration of the digital economy with the real economy. This research not only holds significant theoretical value but also offers new perspectives and directions for China’s manufacturing industry to achieve high-quality development under the new economic conditions. By exploring how digital technologies enhance enterprise productivity, this research supports China’s economic transition and upgrade toward higher quality.

This study’s possible contributions to the existing literature focus on several aspects of digitalization. First, from a theoretical perspective, this study enriches and ex-tends the understanding of the internal mechanisms through which digitalization influences manufacturing development. By employing microlevel data from listed manufacturing firms and conducting empirical analyses, it provides a novel perspective on how digital technologies empower the manufacturing industry. Second, this study examines the direct impact of digital technology on total factor productivity in manufacturing and explores the mediating roles of corporate innovation capabilities and operational management costs. It reveals how digital technology indirectly enhances productivity by fostering innovation and optimizing cost management and provides targeted references for policy making and corporate practices. Finally, this study further examines how firm size, ownership characteristics, and regional economic development levels moderate the impact of digital technology on total factor productivity. By revealing the heterogeneity in its application effects, this research provides detailed empirical evidence to support the promotion of digital technology and the development of targeted regional policies.

Literature review

The impact of digital technologies on manufacturing productivity has been examined through three dominant theoretical lenses in existing literature: factor synergy, productivity enhancement, and productivity paradox. These perspectives reflect both the transformative potential and implementation challenges of digitalization.

Scholars framing digitalization through factor synergy emphasize its role in reconfiguring traditional production systems. Acemoglu and Restrepo4 posit that digital technologies primarily function as labor-substitutive tools, enabling intelligent production while reshaping labor markets. This structural transformation is further nuanced by Hammershøj5 who observes that digital tools optimize capital-labor ratios without necessarily altering market competitiveness—a finding corroborated by Bai et al.6. Their work highlights that digital efficiency gains depend critically on interactions with existing factors. Cheng et al.7 extend this argument by identifying a “digital dividend effect,” where technology integration enhances resource allocation efficiency, creating systemic advantages for both firms and manufacturing ecosystems. Collectively, these studies underscore that successful digital adoption requires deliberate factor recombination rather than mere technological insertion. A second strand of research documents digital technologies’ capacity to elevate productivity metrics. At the micro level, Liu and Zuo8 empirically demonstrate that smart manufacturing significantly boosts total factor productivity (TFP), while Baratta et al.9 attribute productivity gains to industrial robots’ labor-intensivity reduction. Predictive analytics further amplify these effects: Makridakis10 shows how anticipatory bottleneck identification preempts operational losses, whereas Lokuge et al.11 link automation to improved capital productivity through process optimization. Macro-level enhancements emerge from AI-driven resource management; as Kromann et al.12 illustrate, machine learning applications in demand forecasting and inventory control simultaneously raise labor productivity and managerial efficacy. These studies converge on digitalization’s dual role—augmenting both input efficiency and output quality. Contrasting with optimistic assessments, the productivity paradox literature reveals contextual limitations. Torrent-Sellens13 warns that digital-techno mismatch with local infrastructure can induce economic hollowing-out, negating growth potential. Xin et al.14 similarly note subdued GDP/TFP impacts despite digital economy expansions, suggesting implementation gaps between theoretical models and real-world adoption. Bonsay et al.15 identify AI’s nonlinear TFP effects, where overreliance on automation may depress productivity—a phenomenon compounded by measurement challenges16. Siddik et al.17. temporal analysis adds nuance, revealing that digital benefits often materialize with lags due to organizational learning curves. Together, these critiques highlight that productivity outcomes depend on complementary investments in institutional readiness and performance metrics.

In recent years, the Chinese government has placed great emphasis on the development of the digital economy; it has continuously promoted the deep integration of digital technologies with the real economy, and the construction of a digital China has been elevated to a national strategic goal. Zhao et al. point out that digital technologies are not only new engines driving the growth of total factor productivity in the manufacturing industry but also core drivers of high-quality development in the sector18. Therefore, leveraging digital technologies to enhance total factor productivity in manufacturing enterprises has become a significant trend for future development. The exploratory studies by domestic and international scholars provide important insights for this study; however, some limitations remain. Currently, the intrinsic connection between digital technologies and the growth of total factor productivity in the manufacturing industry remains unclear, and the specific pathways through which digital technologies enhance total factor productivity have not been thoroughly explored. To address this, this study uses panel data from A-share listed manufacturing firms in China from 2010 to 2022; text analysis is employed to measure the digital technology level of manufacturing enterprises, and the impact of digital technology on total factor productivity in the manufacturing industry is empirically tested. The study also examines the mechanisms through which corporate innovation capacity and operational management costs affect total factor productivity, and it further explores the heterogeneity of digital technology’s impact. It aims to gain a deeper understanding of the critical role and complexity of digital technology in enhancing productivity in the manufacturing industry.

Theoretical analysis and hypotheses

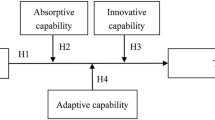

The impact of digital technology on total factor productivity in manufacturing

Digital technologies revolutionize manufacturing productivity through knowledge-driven mechanisms central to endogenous growth theory. As codified knowledge capital, digital tools amplify total factor productivity (TFP) by enabling perpetual knowledge accumulation and spillover effects19. Romer’s framework manifests in three dimensions: First, digital platforms reduce knowledge replication costs through AI-enhanced R&D systems, transforming enterprise data into reusable intellectual assets that generate increasing returns across production networks20. Second, big data analytics dismantle innovation barriers by converting market signals and operational data into actionable intelligence, enabling precision resource allocation and accelerated product iteration cycles21. This digital codification of tacit knowledge creates self-reinforcing learning loops that elevate industry-wide technical capabilities22. Third, cloud-based collaboration ecosystems transcend geographical constraints, facilitating global recombination of specialized expertise through digital twins and blockchain networks23. Such intra-product division of labor expands knowledge diffusion channels while maintaining cumulative innovation momentum, effectively counteracting diminishing returns from traditional factors24. Crucially, digitalization transforms data into endogenous growth fuel—its near-zero marginal cost in application and infinite recombinatory potential establish perpetual productivity gains.Therefore, this study proposes the following hypothesis:

Hypothesis H1: Digital technology can promote total factor productivity improvement in the manufacturing industry.

Analysis of the impact mechanism of digital technologies on total factor productivity in the manufacturing industry

Enterprise innovation capacity

Drawing on dynamic capability theory, digital technology strengthens manufacturing innovation capabilities by synergizing organizational learning and resource reconfiguration to drive total factor productivity growth. Through embedded digital platforms spanning R&D, production, and supply chains, enterprises establish real-time data symbiosis that fuels continuous organizational learning. Big data analytics and AI tools convert fragmented market signals into structured knowledge capital, enabling agile responses to consumer demands through personalized product innovation25while cloud collaboration systems dismantle functional silos, allowing cross-departmental teams to co-interpret market feedback and prototype solutions within IoT-enhanced ecosystems26. Concurrently, digital infrastructure enables dynamic resource orchestration through modular architectures like digital twins and blockchain networks, which virtualize R&D assets for low-risk experimentation and facilitate global recombination of innovation resources27. This transforms static operations into adaptive innovation ecosystems, where crowdsourced user insights from digital platforms are systematically integrated into product pipelines, enhancing both solution relevance and user engagement28. The convergence of AI and human capital further amplifies adaptive capabilities: machine learning algorithms identify latent opportunities across multi-source data streams to optimize resource allocation, while digital upskilling cultivates workforces capable of balancing predictive process optimization with AI-driven exploration of disruptive scenarios. These interconnected mechanisms institutionalize dynamic capabilities-enabling enterprises to systematically sense market shifts through data-driven learning, seize opportunities via hybrid intelligence systems, and reconfigure assets through digital-physical integration. The resulting innovation ecosystem accelerates development cycles, reduces time-to-market, and enhances resource efficiency, ultimately driving measurable productivity gains through continuous capability renewal and sustained market responsiveness in volatile environments29.Therefore, this study proposes the following hypothesis:

Hypothesis H2: Digital technology can promote the total factor productivity of the manufacturing industry.

Operational management costs

Digital technology can promote the improvement of total factor productivity in the manufacturing industry by reducing operational and management costs, which can be explored in terms of both operational efficiency and management costs. In terms of operational efficiency, digital technologies have significantly enhanced the production and operational capabilities of enterprises. By intelligently upgrading existing production equipment, enterprises can achieve real-time monitoring of equipment performance and conduct in-depth analyses of production data, which result in reduced maintenance costs and significantly improved operational efficiency30. The application of digital management systems enables the rapid flow of information, allowing real-time coordination across various stages and preventing the resource waste caused by information delays. Through a series of intelligent and digital measures, the operational management model of enterprises has become more efficient, thereby reducing overall operational costs and improving total factor productivity31. In terms of management costs, digital technologies also play a crucial role. By leveraging cutting-edge digital technologies such as artificial intelligence, big data, and the Internet of Things, enterprises can achieve refined management of the entire product lifecycle, from design to disposal, ensuring high transparency and traceability of information, thereby greatly enhancing management accuracy and efficiency32. This precise management not only reduces the complexity of internal control but also lowers labor and time costs. The application of digital technologies has facilitated the flattening of internal management structures, making information transmission faster and more efficient and reducing coordination costs between organizations33. The new management model improves decision-making efficiency, allowing enterprises to maintain flexibility and adaptability in a rapidly changing market environment. In addition, digital technologies optimize supply chain management through the integration and consolidation of resources, ensuring precise alignment between production and market demand and effectively avoiding inventory buildup and resource wastage34. Therefore, the application of digital technologies not only reduces operational management costs but also provides strong support for the improvement of total factor productivity in the manufacturing industry. By enhancing operational and management efficiency, digital technologies enable enterprises to gain a competitive edge in the intense market competition and to achieve sustainable development. Therefore, this study proposes the following hypothesis:

Hypothesis H3: Digital technology can promote the total factor productivity of the manufacturing industry by reducing operation and management costs.

Research design

Variable definition

Total factor productivity

There are various methods for calculating an enterprise’s total factor productivity (TFP). This study follows the approaches of Chen35 and Liu et al.36 by using the OP to calculate TFP at the microlevel. Compared to other methods, the OP method can better mitigate the sample selection and endogeneity problems in traditional measures, thus improving the accuracy of firm productivity measurement.

Digital technology

With reference to Yu et al.37 and Luo et al.38this study takes the frequency of specific keywords in the annual reports of listed companies as a proxy variable for the degree of digital technology (Dig) of the listed companies. We use Python to capture 10 keywords concerning digital technology, such as big data, blockchain, artificial intelligence, and cloud computing, as proposed by Luo, et al.38who investigated word frequency statistics in the texts of the annual reports of A share listed companies. The keyword frequencies are processed by adding 1 and taking the natural logarithm to obtain an index of the digital technology of enterprises.

Mediating variables

-

(1)

Enterprise innovation capability (Rd), with reference to the study by Li et al.39: this study adopts the logarithmic value of the R&D capital investment of manufacturing firms to measure corporate innovation capability.

-

(2)

Operation and management cost (Cost), with reference to the study by Chen et al.34: this study adopts the cost/expense ratio to measure the operation and management cost of manufacturing enterprises. The larger this indicator, the higher the operation and management cost of the enterprise.

Control variables

According to the existing research, the factors influencing total factor productivity in the manufacturing industry are diverse. Following the studies by Qi et al.40Wei et al.41and Zhang & Zhang42this study selects the following control variables: enterprise age (Age), enterprise size (Size), leverage ratio (Leve), return on assets (Roa), level of cash holdings (Cash), board size (Board), equity concentration (Fist), and combined title of board chair and CEO (Dual). The variables involved in this paper are shown in Table 1.

Model specification

Based on the theoretical analysis above, this study examines the direct impact of digital technology on the total factor productivity of the manufacturing enterprises. The benchmark model was established as follows:

To further examine the mechanism through which digital technology impacts the total factor productivity of manufacturing enterprises, we constructed the following mediating effects models:

where the subscripts i, j, k, and t represent enterprises, industries, provinces, and years, respectively.\(TF{P_{it}}\)is the total factor productivity of the manufacturing enterprises, \(Di{g_{it}}\)is the level of digital technology of the enterprises, and \(Controls\) is a series of control variables. \(M{V_{it}}\)is the mediating variable, which is the innovation capacity of the enterprises and the operation and management costs. \(In{d_j}\),\(Pr{o_k}\), and\(Yea{r_t}\)represent industry fixed effects, province fixed effects, and year fixed effects, respectively. \({\varepsilon _{it}}\)is a random error term.

Data sources and descriptive statistics

The data of China’s A share listed manufacturing companies from 2012 to 2023 were selected as the research sample; the relevant data were primarily sourced from the Wind database and the CSMAR database. In addition, to ensure the accuracy and timeliness of the information, annual report data of the relevant companies were obtained from the official websites of the Shenzhen Stock Exchange and the Shanghai Stock Exchange. To reduce the impact of anomalous samples on the results of the study, ST companies and those that were demoted during the period were excluded, and samples with missing key indicators were excluded; the samples were subjected to 1% and 99% trimming. After a series of screenings, a total of 15,310 listed company sample data points meeting the research criteria were obtained.

Analysis of empirical results

Descriptive statistics

Table 2 shows the results for descriptive statistics of the variables, including the mean, the standard deviation, the minimum value the maximum value, and the median value. The mean value of Dig is 1.266, the minimum value is 0, and the maximum value is 6.140. It indicates that the digitalization levels of manufacturing enterprises are significant differences. Meanwhile, the median of Dig is 1.099, which indicates that half of the firms in the sample hold relatively small digital transformation capabilities, and the digitization of firms has not been a uniform trend. The mean value of the TFP of manufacturing enterprises is 6.172, which is roughly comparable to the TFP of firms calculated in the previous works in the literature, and obviously less than the median (8.000). This value indicates that the overall distribution of enterprises’ TFP is left skewed.

Benchmark regression results

The results are summarized in Table 3, which presents the benchmark regression findings on the effect of digital technology on factor productivity in manufacturing. Column (1) presents the regression results with only the explanatory variables included. Column (2) further incorporates a series of control variables, such as firm age, firm size, asset/liability ratio, and return on assets. Column (3) controls for the firm, industry, province, and year fixed effects based on the aforementioned model. The regression results indicate that under different models, the regression coefficients of digital technology (Dig) are significantly positive at the 1% level, suggesting that digital technology has a significant promoting effect on the improvement of total factor productivity in the manufacturing industry. After fully considering other influencing factors and strictly incorporating the fixed effects, a 1% increase in the level of digital technology leads to a significant 2.3% improvement in the total factor productivity of the manufacturing industry. This conclusion not only reveals the tremendous potential of digital technology in enhancing manufacturing productivity but also provides strong empirical support for the resolution of the “Solow Paradox” in the digital age; thus, research hypothesis H1 proposed above is validated.

Robustness tests

Change the TFP measurement method

The differences in the total factor productivity measurement methods of the manufacturing enterprises may affect the empirical results; in order to test the robustness of the results, this study addresses this issue by replacing the measurement methods used for the explanatory variables. The total factor productivity of the manufacturing industry is recalculated using four different methods: the semi-parametric method (LP), ordinary least squares (OLS), the fixed effects method (FE), and the generalized method of moments (GMM). The regression results presented in Column (1) to Column (4) of Table 4 demonstrate that regardless of the calculation method employed, the regression coefficients of the core explanatory variable, digital technology (Dig), are significantly positive, confirming that the conclusion that digital technology significantly enhances the total factor productivity of the manufacturing industry is robust.

Substitution core explanatory variable

The differences in the selection of digital technology indicators may affect the empirical results; this study attempts to address this issue by replacing the core explanatory variable. Considering that the productivity effects of digital technology may have a certain time lag, this study lags the core explanatory variable—digital technology—by one period and conducts the regression analysis again. The regression results are presented in Table 5, Column (1). Secondly, considering the differences in the length of digitally related text in annual reports, this study draws on the research method of Gu et al.43 and uses the total frequency of the digitally related terms divided by the length of the digitally related segments in the annual reports (Dcg) as a proxy variable for the level of digital technology. The regression is re-estimated, and the results are presented in Table 5, Column (2). Thirdly, considering that the digital technology keyword information in the listed companies’ annual reports only reflects anticipated tasks, this study draws on the research method of Manita et al.44and uses the proportion of intangible assets related to the digital economy at year end and the total intangible assets (Digi) as an alternative indicator of the digital technology level of the manufacturing enterprises. The regression analysis is re-conducted, and the results are presented in Table 5, Column (3). The above results show that the regression coefficient of Dig is positive at different significance levels, indicating that the productivity-enhancing effect of digital technology persists. This confirms that the baseline conclusions of this study are robust and reliable.

Adjustment of the sample size

Considering that specific types of samples may interfere with the estimation results, this study re-examines the baseline conclusions by excluding different types of samples. (1) Excluded research samples: Due to the high level of economic development in the municipalities (Beijing, Shanghai, Tianjin, and Chongqing), the firms located in the areas under the municipalities tend to have a higher level of digital technology, and the impact on their total factor productivity may be inconsistent with other industry samples. Thus, manufacturing enterprises located in municipalities are excluded from the re-estimation, and the regression results are shown in Column (1) of Table 6. (2) Reduced research time: In 2013, the State Council of China issued the “Broadband China” Strategy and Implementation Plan, promoting the development of digital infrastructure and supporting the digital transformation of enterprises. Therefore, this study excludes data from 2013 and earlier, re-estimating the sample for the period from 2014 to 2023. The regression results are presented in Column (2) of Table 6. After adjusting the research sample, the regression coefficient of digital technology (Dig) remains significantly positive at the 1% level, indicating that the baseline regression conclusions are still robust.

Higher dimensional fixed effect

To rigorously control for potential omitted variables at the industry and regional levels and to avoid spurious associations between digital technology and total factor productivity, this study further adopts a high-dimensional fixed effects model for robustness testing. During the regression sample period, a series of industry- and provincial-level industrial policies were implemented, such as the “14th Five-Year Plan for Intelligent Manufacturing Development” and the “Digital Implementation Guidelines for Quality Management in Manufacturing (Trial).” These policies may influence the total factor productivity of enterprises by promoting industrial structure upgrading, enhancing investment and consumption attractiveness, optimizing resource allocation, fostering innovation-driven growth, and improving innovation capabilities. At the same time, industry and provincial characteristics, such as industry innovation capability, regional economic vitality, digital infrastructure development, and policy support intensity, may also impact the total factor productivity of enterprises. If these factors are not controlled for, it may be difficult to accurately identify the net effect of digital technology on the total factor productivity of the manufacturing industry. To address this, the study introduces province–year fixed effects and industry–year fixed effects in the regression analysis for re-estimation. The regression results are presented in Table 6, Column (3). The results show that the regression coefficient of digital technology (Dig) is significantly positive at the 1% level, confirming that the baseline conclusion of this study remains valid.

Endogeneity tests

Instrumental variable method

When analyzing the impact of digital technology on the total factor productivity of the manufacturing industry, there may be endogeneity issues. On one hand, total factor productivity is influenced by a variety of complex factors, and some unobservable factors may play a role. On the other hand, total factor productivity is not only affected by the digital transformation of enterprises; the regional level of digital technology development also depends on factor inputs, which may lead to reverse causality. Therefore, drawing on the identification strategies of Nunn & Qian45 and Peng & Tao46this study employs two instrumental variables to address potential endogeneity concerns. The first instrument (IV1) constructs an interaction term between urban terrain ruggedness and time trend, following Nunn and Qian’s approach where geographic features influence infrastructure deployment while remaining exogenous to productivity. The second instrument (IV2) interacts spherical distance to Hangzhou with time, recognizing Hangzhou’s pivotal role as China’s digital hub (hosting Alibaba’s headquarters) - where proximity affects technology diffusion yet maintains exogeneity to firm-level productivity. The estimation results are presented in Table 7. The results in Columns (1) and (3) of Table 7 indicate that the regression coefficients of the selected instrumental variables are significantly positive at the 1% level, suggesting a positive correlation between the instrumental variables and the endogenous explanatory variables. The results in Columns (2) and (4) of Table 7 show that the regression coefficients of digital technology (Dig) are significantly positive at the 1% level, indicating that even after accounting for endogeneity, digital technology still enhances the total factor productivity (TFP) of the manufacturing industry. This confirms the robustness of the baseline conclusion in this study. In addition, the instrumental variables pass the relevance test.

In addition, for the test of the original hypothesis that the instrumental variables are under-identified, the p-values of the Kleibergen-Paap rk LM statistic are all 0.000, significantly rejecting the original hypothesis. The Kleibergen-Paap rk Ward F statistic was all greater than 16.38, indicating that the hypothesis of weak instrumental variables could be rejected, even at the strictest critical value. Therefore, the instrumental variables pass the relevance test.

System GMM method

To mitigate the endogeneity issues in the model estimation, this study uses the one-period lag of total factor productivity (TFP) as an instrumental variable and applies the system GMM estimation to address the endogeneity problem in dynamic panel data. The test results in Column (1) of Table 8 show that the p-value of the AR (1) test is significant at the 1% level, the p-value of the AR (2) test is greater than 0.1, and the p-value of the Hansen test is 0.147, which is also greater than 0.1. These results indicate that the chosen instrumental variable, the one-period lag of TFP, is appropriate. Column (1) presents the regression results, including the one-period lag of the dependent variable (L.TFP) and the core explanatory variable (Dig). The regression coefficient of L.TFP is 0.441 and is significant at the 1% level, indicating that a 1% increase in the previous period’s total factor productivity (TFP) leads to a 0.441% increase in the current period’s productivity. The regression coefficient of Dig is significantly positive at the 10% level, suggesting that digital technology enhances the total factor productivity of the manufacturing industry. These findings confirm the robustness of the study’s conclusions.

Multiperiod DID method

This study further treats exogenous policy shocks as a quasi-natural experiment and constructs a difference-in-differences (DID) model with multiple periods to mitigate potential endogeneity issues. In August 2013, the State Council issued the “Broadband China” strategy and implementation plan, gradually advancing the construction of digital infrastructure. The Ministry of Industry and Information Technology (MIIT) and the National Development and Reform Commission (NDRC) selected a total of 120 cities as demonstration points in 2014, 2015, and 2016. Based on this, this study treats the “Broadband China” strategy as an exogenous policy shock and constructs a multiple-period difference-in-differences (DID) model. The model is as follows:

where, \(trea{t_{it}} \times pos{t_{it}}\) is a dummy variable for the “Broadband China” strategy. The variable \(trea{t_{it}}\) represents a dummy variable indicating whether the city where the enterprise is located has implemented the “Broadband China” strategy. If the strategy was implemented, the value is set to 1; otherwise, it is set to 0. \(pos{t_{it}}\) is a dummy variable for the policy implementation year. If the city where the enterprise is located started the “Broadband China” strategy pilot in that year, the value is set to 1 for that year and the subsequent years; otherwise, it is set to 0. The settings for the other variables are consistent with those in the baseline regression. The results in Column (2) of Table 8 show that the regression coefficient of the “Broadband China” strategy policy is significantly positive at the 1% level, indicating that the “Broadband China” strategy policy contributes to the enhancement of the total factor productivity of the manufacturing industry, further supporting hypothesis H1.

Further analysis

Mechanism analysis

Enterprise innovation capacity

Columns (1) and (2) of Table 9 present the results of the analysis of the mechanism of corporate innovation capability. Column (1) reports the impact of digital technology on corporate innovation capability. The results show that the regression coefficient of digital technology (Dig) is significantly positive at the 1% level, indicating that digital technology promotes corporate innovation. Column (2) reports that the regression coefficient of corporate innovation capability (Rd) is significantly positive at the 1% level, and the regression coefficient of Dig is also significantly positive at the 1% level. This suggests that both corporate innovation capability and digital technology have a significant positive impact on corporate total factor productivity. This indicates that digital technology can enhance corporate innovation capability, thereby promoting the improvement of total factor productivity in the manufacturing industry. Thus, hypothesis H2 of this study is validated.

Operational management costs

Columns (3) and (4) of Table 9 present the results of the analysis of the operational management cost mechanism. Column (3) examines the impact of digital technology on corporate operational management costs. The results show that the regression coefficient of digital technology (Dig) is significantly negative at the 5% level, indicating that digital technology significantly reduces corporate operational management costs. Column (4) reports that the regression coefficient of operational management costs (Cost) is significantly negative at the 10% level, and the regression coefficient of Dig is significantly positive at the 1% level. This suggests that reducing corporate operational management costs and the development of digital technology can both promote the improvement of total factor productivity. This indicates that digital technology can promote the improvement of total factor productivity in the manufacturing industry by reducing operational management costs. Thus, hypothesis H3 of this study is validated.

Heterogeneity analysis

Region heterogeneity

To explore regional heterogeneity, this study classifies the provinces where the sample enterprises are located into eastern and central-western regions based on the macro-geographical environment. Columns (1) and (2) of Table 10 report the regression results of regional heterogeneity for enterprises in different regions. The results show that the regression coefficient of digital technology (Dig) in the eastern region is significantly positive at the 1% level, while the regression coefficient of Dig in the central and western regions is not significant. The eastern region’s advantages stem not only from superior infrastructure but also from its industrial cluster ecosystems—dense networks of suppliers, tech firms, and skilled labor pools that amplify digital spillovers. For instance, provinces like Guangdong and Zhejiang exhibit strong synergies between advanced manufacturing hubs and digital service platforms, fostering rapid technology diffusion. Conversely, central-western regions face fragmented industrial chains and weaker institutional support, limiting scalability. Additionally, the eastern region’s higher R&D intensity ensures complementary investments in data analytics and IoT, whereas central-western firms often prioritize basic digitization due to resource constraints.

Property rights heterogeneity

This study classifies the sample enterprises based on the nature of ownership into state-owned enterprises and non-state-owned enterprises. Columns (3) and (4) of Table 10 report the regression results of heterogeneity by ownership of the enterprise. The results show that the regression coefficients of digital technology (Dig) are significantly positive at the 1% level for both state-owned and non-state-owned enterprises, indicating that digital technology can enhance total factor productivity in the manufacturing industry. However, the regression coefficient of Dig is relatively larger for state-owned enterprises, suggesting that the improvement effect is significantly higher for state-owned enterprises compared to non-state-owned enterprises. This reflects institutional disparities in digital investment logic. SOEs benefit from policy-driven digitalization: soft budget constraints enable large-scale, long-cycle investments backed by state subsidies and procurement mandates. In contrast, non-SOEs adopt market-driven digitization, prioritizing short-term ROI. For example, private firms in Jiangsu often adopt modular SaaS tools to reduce upfront costs, but face financing bottlenecks for systemic upgrades. Moreover, SOEs’ monopolistic positions in sectors like telecoms grant exclusive access to infrastructure projects, whereas non-SOEs rely on competitive markets, incurring higher adaptation risks. These dynamics explain the TFP gap, underscoring the interplay between ownership structure and institutional environments.

Size heterogeneity

This study classifies the sample enterprises into large enterprises and small and medium-sized enterprises (SMEs) based on the industry annual median of total assets. Columns (5) and (6) of Table 10 report the regression results of heterogeneity by enterprise size. The results show that the regression coefficients of digital technology (Dig) are significantly positive at the 5% level for large enterprises and at the 1% level for small and medium-sized enterprises, indicating that, regardless of enterprise size, digital technology can promote the improvement of total factor productivity in the manufacturing industry. The regression coefficient of Dig for small and medium-sized enterprises is larger than that for large enterprises, indicating that the effect of digital technology in promoting total factor productivity improvement is greater for small and medium-sized enterprises than for large enterprises. The underlying reason is that small and medium-sized enterprises typically respond more quickly in decision making and implementation, enabling them to rapidly adopt new technologies to enhance production efficiency. In addition, small and medium-sized enterprises place more emphasis on the application of digital technology in resource allocation to enhance their competitiveness, which results in more outstanding performance in technology application and innovation. In contrast, although large enterprises possess abundant resources, they may face organizational inertia and higher coordination costs, which can result in relatively lower effectiveness in the application of digital technology.

Conclusions

Main conclusions and insights

This study empirically demonstrates that digital technology serves as a pivotal driver of total factor productivity (TFP) enhancement in China’s manufacturing sector, offering critical theoretical and policy implications for resolving the “Solow Paradox” and advancing endogenous growth frameworks. The key findings are threefold.First, digital technology exerts a robust, statistically significant positive impact on manufacturing TFP, a conclusion validated through rigorous robustness checks and endogeneity mitigation strategies. These results resolve the paradox by highlighting how complementary institutional reforms and human capital alignment amplify digital spillovers, transforming fragmented capabilities into systemic productivity gains. This advances endogenous growth theory by formalizing digitalization as a knowledge-codification mechanism that fuels perpetual innovation cycles and resource reconfiguration. Second, the mechanisms underlying this relationship are dual-faceted. Digital technologies enhance TFP by strengthening corporate innovation capabilities through dynamic resource orchestration and reducing operational and management costs via intelligent automation and data-driven decision-making. These pathways validate the synergistic role of technological adoption and organizational adaptability in sustaining productivity growth. Third, significant heterogeneity exists across regions, ownership types, and firm sizes. The TFP-enhancing effects are most pronounced in eastern China, state-owned enterprises, and small and medium-sized enterprises. Conversely, central-western regions and non-SOEs face structural barriers, such as fragmented supply chains and market-driven constraints, limiting scalability.

Additionally, this study offers the following practical insights for promoting high quality development of manufacturing firms and the digital economy in the current era:

-

(1)

For regional development, Eastern China should prioritize establishing national R&D hubs to accelerate the adoption of advanced technologies like AI and IoT, fostering collaboration between tech leaders and SMEs to amplify innovation diffusion47. Strengthening infrastructure to sustain industrial clusters and knowledge spillovers will further consolidate the region’s competitive edge48. In Central-Western China, bridging digital divides requires creating cross-regionally funded “Digital Enclaves” focused on connectivity upgrades such as 5G networks and subsidized IoT deployment. Leveraging Eastern expertise through partnerships can enhance technology absorption, enabling these regions to overcome structural barriers like fragmented supply chains and limited institutional support.

-

(2)

For SMEs, targeted empowerment is critical. Introducing a dedicated fund to subsidize cloud computing, analytics tools, and modular SaaS solutions would reduce entry barriers to digital transformation49. Collaboration with technology providers to design cost-effective digital toolkits, coupled with fintech solutions to ease financing constraints, can incentivize scalable transitions. This approach aligns with SMEs’ agility in adopting technologies, enabling them to optimize resource allocation and compete effectively despite resource limitations.

-

(3)

Ownership-specific interventions must also be emphasized. State-owned enterprises (SOEs) should undergo comprehensive digital overhauls—integrating blockchain and smart manufacturing—supported by state subsidies and policy mandates. Their monopolistic access to infrastructure projects positions them as ideal pilots for systemic upgrades50. Conversely, non-SOEs require tax incentives for SaaS adoption and streamlined regulatory processes to encourage agile digitization51. Enhancing access to venture capital and public-private innovation platforms can mitigate market-driven risks, ensuring equitable participation in the digital economy. These strategies collectively address heterogeneity in regional capacities, ownership structures, and firm sizes, fostering inclusive and sustainable productivity growth.

Limitations and future prospects

Future studies should adopt mixed-method approaches, integrating qualitative case studies to uncover firm-level dynamics in innovation and cost management. Cross-national comparisons could elucidate how institutional contexts shape digital productivity outcomes, while incorporating environmental metrics would align efficiency gains with sustainability goals. Additionally, exploring the role of workforce upskilling and data governance frameworks in sustaining digital dividends could further refine policy design. Addressing these gaps will deepen the understanding of digital transformation’s role in achieving equitable and sustainable industrial development globally.

Data availability

Data will be made available on request. (Please contact: tujian0727@163.com).

References

Skare, M. & Riberio Soriano, D. How globalization is changing digital technology adoption: an international perspective [J]. J. Innov. Knowl. 6 (4), 222–233. https://doi.org/10.1016/j.jik.2021.04.001 (2021).

Chen, B., Lin, H., Shan, B. & Xiao, Y. Government investment in science and technology, digital transformation, and innovation in manufacturing enterprises [J]. Finance Res. Lett. 69, 106299. https://doi.org/10.1016/j.frl.2024.106299 (2024).

Brynjolfsson, E., Rock, D. & Syverson, C. The Economics of Artificial Intelligence Artificial Intelligence and the Modern Productivity Paradox: A Clash of Expectations and Statistics [J]. The economics of artificial intelligence: An agenda, 23: 23–57. (2019). https://doi.org/10.7208/9780226613475-003

Acemoglu, D. & Restrepo, P. The race between man and machine: implications of technology for growth, factor shares, and employment [J]. Am. Econ. Rev. 108 (6), 1488–1542. https://doi.org/10.1257/aer.20160696 (2018).

Hammershøj, L. G. The new division of labor between human and machine and its educational implications [J]. Technol. Soc., 59: 101142doi :https://doi.org/10.1016/j.techsoc.2019.05.006 (2019).

Bai, K. et al. How does digitalization promote productivity growth in china?? [J]. J. Innov. Knowl. 9 (4), 100586. https://doi.org/10.1016/j.jik.2024.100586 (2024).

Cheng, Y., Zhou, X. & Li, Y. The effect of digital transformation on real economy enterprises’ total factor productivity [J]. Int. Rev. Econ. Finance. 85, 488–501. https://doi.org/10.1016/j.iref.2023.02.007 (2023).

Liu, Y. & Zuo, Y. Implementing intelligent manufacturing policies to increase the total factor productivity in manufacturing: transmission mechanisms through construction of industrial chains [J]. Int. J. Prod. Econ. 279, 109468. https://doi.org/10.1016/j.ijpe.2024.109468 (2025).

Baratta, A., Cimino, A., Longo, F. & Nicoletti, L. Digital twin for human-robot collaboration enhancement in manufacturing systems: Literature review and. Comput. Ind. Eng. 187, 109764. https://doi.org/10.1016/j.cie.2023.109764 (2024). direction for future developments [J].

Makridakis, S. The forthcoming artificial intelligence (AI) revolution: its impact on society and firms [J]. Futures 90, 46–60. https://doi.org/10.1016/j.futures.2017.03.006 (2017).

Lokuge, S., Sedera, D., Grover, V. & Sarker, S. Orchestrating digital technologies with incumbent enterprise systems for attaining innovation [J]. Inf. Manag. 62 (1), 104066. https://doi.org/10.1016/j.im.2024.104066 (2025).

Kromann, L., Malchow-Møller, N., Skaksen, J. R. & Sørensen, A. Automation and productivity—a cross-country, cross-industry comparison [J]. Ind. Corp. Change. 29 (2), 265–287. https://doi.org/10.1093/icc/dtz039 (2020).

Torrent-Sellens, J. Digital transition, data-and-tasks crowd-based economy, and the shared social progress: Unveiling a new political economy from a European perspective [J]. Technology in Society, 79: 102739. (2024). https://doi.org/10.1016/j.techsoc.2024.102739

Xin, Y., Song, H., Shen, Z. & Wang, J. Measurement of the integration level between the digital economy and industry and its impact on energy consumption [J]. Energy Econ. 126, 106988. https://doi.org/10.1016/j.eneco.2023.106988 (2023).

Bonsay, J. O., Cruz, A. P., Firozi, H. C. & Camaro P J C J J o E, Finance, Studies, A. Artificial intelligence and labor productivity paradox: the economic impact of AI in china, india, japan, and Singapore [J]. J. Econ. Finance Acc. Stud. 3 (2), 120–139. https://doi.org/10.32996/jefas.2021.3.2.13 (2021).

Brynjolfsson, E., Hitt, L. & Yang, S. J. I. P. Intangible assets: how the interaction of computers and organizational structure affects stock market valuations [C]. International conference on information systems 8–29. https://aisel.aisnet.org/icis1998/3 (1988).

Siddik, A. B., Forid, M. S., Yong, L., Du, A. M. & Goodell, J. W. Artificial intelligence as a catalyst for sustainable tourism growth and economic cycles [J]. Technol. Forecast. Soc. Chang., 210: 123875. doi:https://doi.org/10.1016/j.techfore.2024.123875 (2025).

Zhao, S., Zhang, L., Peng, L., Zhou, H. & Hu, F. Enterprise pollution reduction through digital transformation? Evidence from Chinese manufacturing enterprises [J]. Technol. Soc. 77, 102520. https://doi.org/10.1016/j.techsoc.2024.102520 (2024).

Qiu, L. et al. Impact of digital empowerment on labor employment in manufacturing enterprises: evidence from China [J]. Heliyon 10 (8). https://doi.org/10.1016/j.heliyon.2024.e29040 (2024).

Ma, S., Ding, W., Liu, Y., Ren, S. & Yang, H. Digital twin and big data-driven sustainable smart manufacturing based on information management systems for energy-intensive industries [J]. Appl. Energy, 326: 119986. doi:https://doi.org/10.1016/j.apenergy.2022.119986 (2022).

Xue, T. & Xi, X. Empirical study on the synergistic effects of the composite system of technological finance in the technology industry, technological innovation, and technological funding [J]. : 1–28 (2024). https://doi.org/10.1007/s13132-024-02242-y

Ma, Y., Wu, X. & Shui, J. The impact of the digital economy on the cost of living of the population: evidence from 160 cities in China [J]. 11(2): 2246007 (2023). https://doi.org/10.1080/23322039.2023.2246007

Wang, J., Liu, Y., Wang, W. & Wu, H. How does digital transformation drive green total factor productivity? Evidence from Chinese listed enterprises [J]. J. Clean. Prod. 406, 136954. https://doi.org/10.1016/j.jclepro.2023.136954 (2023).

Wu, Y., Li, H., Luo, R. & Yu, Y. How digital transformation helps enterprises achieve high-quality development? Empirical evidence from Chinese listed companies [J]. Eur. J. Innov. Manage. 27 (8), 2753–2779. https://doi.org/10.1108/EJIM-11-2022-0610 (2024).

Lai, X., Quan, L., Guo, C. & Gao, X. Exploring the digital era: has digital technology innovation reshaped investment efficiency in Chinese enterprises? [J]. Res. Int. Bus. Finance. 75, 102729. https://doi.org/10.1016/j.ribaf.2024.102729 (2025).

Zhang, X., Yang, X. & Fu, Q. Digital economy, dynamic capabilities, and corporate innovation boundary [J]. Finance Res. Lett. 73, 106675. https://doi.org/10.1016/j.frl.2024.106675 (2025).

Jia, Y. et al. Digital servitization in digital enterprise: leveraging digital platform capabilities to unlock data value [J]. Int. J. Prod. Econ. 278, 109434. https://doi.org/10.1016/j.ijpe.2024.109434 (2024).

Abiri, R., Rizan, N., Balasundram, S. K., Shahbazi, A. B. & Abdul-Hamid, H. Application of digital technologies for ensuring agricultural productivity [J]. Heliyon, 9(12): e22601. doi:https://doi.org/10.1016/j.heliyon.2023.e22601 (2023).

Zhai, S. & Liu, Z. Artificial intelligence technology innovation and firm productivity: evidence from China [J]. Finance Res. Lett. 58, 104437. https://doi.org/10.1016/j.frl.2023.104437 (2023).

Zhu, H. & Chao, Y. Impact of corporate governance level on enterprise total factor productivity from the perspective of supply chain digitization [J]. Finance Res. Lett. 73, 106549. https://doi.org/10.1016/j.frl.2024.106549 (2025).

Fang, X. & Liu, M. How does the digital transformation drive digital technology innovation of enterprises? Evidence from enterprise’s digital patents [J]. Technol. Forecast. Soc. Chang. 204, 123428. https://doi.org/10.1016/j.techfore.2024.123428 (2024).

Suuronen, S., Ukko, J., Eskola, R., Semken, R. S. & Rantanen, H. A systematic literature review for digital business ecosystems in the manufacturing industry: prerequisites, challenges, and benefits [J]. CIRP J. Manufact. Sci. Technol. 37, 414–426. https://doi.org/10.1016/j.cirpj.2022.02.016 (2022).

Mohsen, B. M. Developments of digital technologies related to supply chain management [J]. Procedia Comput. Sci. 220, 788–795. https://doi.org/10.1016/j.procs.2023.03.105 (2023).

Chen, Y., Pan, X., Liu, P. & Vanhaverbeke, W. How does digital transformation empower knowledge creation? Evidence from Chinese manufacturing enterprises [J]. J. Innov. Knowl. 9 (2), 100481. https://doi.org/10.1016/j.jik.2024.100481 (2024).

Chen, Q. Impact of sentiment tendency of media coverage on corporate green total factor productivity: the moderating role of environmental uncertainty [J]. Finance Res. Lett. 65, 105637. https://doi.org/10.1016/j.frl.2024.105637 (2024).

Liu, M., Tao, Q., Wang, X. & Zhou, H. Build resilience to overcome panic? Examining the global capital market during the COVID-19 pandemic [J]. Int. Rev. Econ. Finance. 88, 670–682. https://doi.org/10.1016/j.iref.2023.07.015 (2023).

Yu, J., Xu, Y., Zhou, J. & Chen, W. Digital transformation, total factor productivity, and firm innovation investment [J]. J. Innov. Knowl. 9 (2), 100487. https://doi.org/10.1016/j.jik.2024.100487 (2024).

Luo, Q., Deng, L., Zhang, Z. & Wang, H. The impact of digital transformation on green innovation: novel evidence from firm resilience perspective [J]. Finance Res. Lett. 74, 106767. https://doi.org/10.1016/j.frl.2025.106767 (2025).

Li, R., Rao, J., Wan, L. J. M. & Economics, D. The digital economy, enterprise digital transformation, and enterprise innovation [J]. 43(7): 2875–2886 (2022). https://doi.org/10.1002/mde.3569

Qi, R., Ma, G., Liu, C., Zhang, Q. & Wang, Q. Enterprise digital transformation and supply chain resilience [J]. Finance Res. Lett. 66, 105564. https://doi.org/10.1016/j.frl.2024.105564 (2024).

Wei, J., Zhang, X. & Tamamine, T. Digital transformation in supply chains: assessing the spillover effects on midstream firm innovation [J]. J. Innov. Knowl. 9 (2), 100483. https://doi.org/10.1016/j.jik.2024.100483 (2024).

Zhang, L. & Zhang, X. Impact of digital government construction on the intelligent transformation of enterprises: evidence from China [J]. Technol. Forecast. Soc. Chang. 210, 123787. https://doi.org/10.1016/j.techfore.2024.123787 (2025).

Gu, R., Li, C., Yang, Y. & Zhang, J. The impact of industrial digital transformation on green development efficiency considering the threshold effect of regional collaborative innovation: evidence from the Beijing-Tianjin-Hebei urban agglomeration in China [J]. J. Clean. Prod. 420, 138345. https://doi.org/10.1016/j.jclepro.2023.138345 (2023).

Manita, R., Elommal, N., Baudier, P. & Hikkerova, L. The digital transformation of external audit and its impact on corporate governance [J]. Technol. Forecast. Soc. Chang. 150, 119751. https://doi.org/10.1016/j.techfore.2019.119751 (2020).

Nunn, N. & Qian, N. US Food Aid and Civil Conflict [J]. Am. Econ. Rev., 104(6): 1630–1666. doi:https://doi.org/10.1257/aer.104.6.1630 (2014).

Peng, Y. & Tao, C. Can digital transformation promote enterprise performance? —From the perspective of public policy and innovation [J]. J. Innov. Knowl. 7 (3), 100198. https://doi.org/10.1016/j.jik.2022.100198 (2022).

Zhang, C., Gu, G., Zhu, H. & Guo, L. Has the digital transformation promoted enterprise innovation? – Evidence from China [J]. Transnatl. Corporations Rev. 200109. https://doi.org/10.1016/j.tncr.2025.200109 (2025).

Song, C., Han, M. & Yuan, H. The impact of digital transformation on firm productivity: from the perspective of sustainable development [J]. Finance Res. Lett. 75, 106912. https://doi.org/10.1016/j.frl.2025.106912 (2025).

Wang, W., Cao, Q., Li, Z. & Zhu, J. Digital transformation and corporate environmental performance [J]. Finance Res. Lett. 106936. https://doi.org/10.1016/j.frl.2025.106936 (2025).

Meng, T., Li, Q., He, C. & Dong, Z. Research on the configuration path of manufacturing enterprises’ digital servitization transformation [J]. Int. Rev. Econ. Finance. 98, 103952. https://doi.org/10.1016/j.iref.2025.103952 (2025).

Seppänen, S., Ukko, J. & Saunila, M. Understanding determinants of digital transformation and digitizing management functions in incumbent SMEs [J]. Digit. Bus. 5 (1), 100106. https://doi.org/10.1016/j.digbus.2025.100106 (2025).

Funding

The research is supported by National Social Science Fund of China (Grant No. 19ZDA048), Science and Science Project Founded by the Education Department of Jiangxi Province (Grant No. GJJ2202813), Humanities and Social Sciences Projects in Jiangxi Province’s Universities (Grant No. JJ24216) and Social Science Planning Project of Nanchang City (Grant No. YJ202409). All authors have read and agreed to the published version of the manuscript.

Author information

Authors and Affiliations

Contributions

Conceptualization, M.R.; methodology, J.T. and X.W.; formal analysis, J.T. and M.R.; data collection, J.T. and X.W.; writing—original draft, J.T. and M.R.; writing—review and editing, J.T., X.W. and M.R. All authors reviewed the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Tu, J., Wei, X. & Razik, M.A.B. The impact of digital technology on total factor productivity in manufacturing enterprises. Sci Rep 15, 23543 (2025). https://doi.org/10.1038/s41598-025-05811-6

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1038/s41598-025-05811-6