Abstract

The quantity of recognized National Sports Industry Bases (NSIBs) serves as a robust indicator for measuring the level of agglomeration of sports enterprises and sports-related projects, collectively termed as sports brand resources, within a given region. This paper utilizes various methodologies, including the nearest neighbor index, kernel density estimation, standard deviation ellipse analysis, and GeoDetector, to examine the spatial evolution characteristics of NSIBs in Chinese urban agglomerations. The study focuses on four primary aspects: distribution pattern, distribution density, spatial orientation, and influencing factors. The findings uncover several significant trends: Firstly, during the initial phase of sports brand resource development in Chinese urban agglomerations, the spatial distribution exhibited random dispersion characteristics, which subsequently evolved into a statistically significant clustering pattern. Secondly, sports brand resources in Chinese urban agglomerations have transitioned from a dispersed distribution to a more concentrated structure overall, although spatial distribution remains highly uneven. Thirdly, the center of gravity of NSIBs has shown a dynamic migration pattern, shifting from “northwest-northeast-southwest,” with the development disparity between eastern and western regions, as well as between southern and northern regions, gradually narrowing. Fourthly, factors such as the economic foundation, potential market, and policy environment significantly interact with other variables to drive the development of sports brand resources.

Similar content being viewed by others

Introduction

With a lengthy industrial chain, high added value, and a significant driving force on related industries, the sports industry plays a pivotal role in bolstering regional economic development1. The global shift towards clean energy transition and sustainable development is emerging as a catalyst for reducing carbon emissions in manufacturing. Given the sports industry’s low resource consumption and minimal pollution emissions, a strategic increase in the sector’s share can enhance the allocation of production resources and facilitate industrial structural upgrades. This, in turn, can mitigate the region’s climate vulnerability2. The sports industry demonstrates robust development resilience and promising prospects3. Despite ongoing local regional conflicts, global economic downturns, and inflation dampening consumer confidence, the global sporting goods industry managed to achieve a 6% growth in annual revenue in 20234. Furthermore, a global sports industry research report released in 2023 foresees the global sports market growing at an annualized rate of around 6.6% over the next 2–4 years, with the Asian market expanding at a rate of 6.4% annually. Sports executives surveyed displayed particular optimism towards the Middle East and North America markets, anticipating annualized growth rates of 13.5% and 9.5% respectively.

The sustainable growth of the sports industry hinges on the continuous provision of resources relevant to the sports sector5. Existing research exhibits three main shortcomings: Firstly, most traditional economic perspectives in sports industry research concentrate on areas such as the business model of sports enterprises, the economic and social benefits of the sports industry, among others. For instance, Chenchen Lv et al. utilized 200 innovation indicators from 50 listed sports companies as a research sample, illustrating that the implementation of a blockchain business model can improve the innovation efficiency of sports enterprises6. Michael B. Edwards advocates for the positive impact of sports in enhancing community capacity-building, thereby contributing to public health and disease prevention7. However, there remains limited exploration into the underlying drivers of regional sports industry growth, particularly concerning sports resources.

Secondly, according to the Resource-Based View (RBV), the competitive advantage of a region’s industries stems from its possession of scarce, valuable, non-substitutable, and inimitable resources. This theoretical framework suggests that the heterogeneous distribution of these strategic resources across regions creates sustainable competitive advantages that are difficult for competitors to replicate or substitute. Previous literature on sports resources has primarily emphasized the importance of traditional industrial components, such as human capital8 and social capital inputs9,10while neglecting the role of high-quality sports enterprises, brands, and projects in propelling regional sports industry development11. High-quality enterprise resources, exemplified by industry leaders such as Nike, which possess efficient management teams, significant brand equity, and proprietary technologies, constitute the core competitive advantage of regional sports industries. These resources enable regions to maintain dominant market shares in the sports equipment sector over the long term. Meanwhile, premium project resources, including internationally renowned sports event IPs and highly participatory sports programs, are characterized by their scarcity and high value-added potential. Global sporting events such as the Olympics and the NBA, with their extensive worldwide attention and substantial commercial value, provide invaluable opportunities for the development and maturation of regional sports industry chains.

Thirdly, existing literature on sports resources predominantly focuses on development planning, management strategies, institutional frameworks, and related topics. For instance, Gustavo Bergantinos and Juan D Moreno-Ternero discuss the equitable distribution of revenues from televised sports events among participating teams12. Russell Hoye et al. investigate methods to enhance the design and operational management of national sports organizations13. Nevertheless, limited research has been conducted on the spatial heterogeneity of sports resources and the underlying factors shaping such disparities. Therefore, in light of the practical requirements for the development of the sports industry and the limitations inherent in existing scholarly investigations, this study aims to address a significant gap in the academic literature by focusing on sports brand resources, a critically underexplored dimension. By systematically analyzing the spatial evolution patterns of sports brand resources, as well as investigating the underlying determinants of these spatial dynamics, this research seeks to make a substantive contribution to the advancement of knowledge in this field. Such an inquiry not only enriches the theoretical framework of sports economics but also provides actionable insights and strategic recommendations for both academic researchers and industry practitioners.

The establishment of National Sports Industry Bases (NSIBs) represents a crucial initiative within the Chinese sports industry. These bases, comprising sports complexes, enterprises, and projects showcasing outstanding performance in terms of overall competitiveness and benefits, are designated as NSIBs. They are intended to serve as testbeds for innovation in the sports sector, continuously generating new experiences, setting new benchmarks, and energizing the industry. In recent years, NSIBs, as flagship entities in China’s sports industry development strategy, have played a pivotal role in exemplifying best practices and spearheading the creation of a conducive environment for industrial clustering. They have facilitated the transformation and modernization of local economies and stimulated consumer demand. The progressive accumulation of sports resources has significantly propelled regional sports industry growth. Conversely, the advancement of the sports industry has contributed to the recognition of local sports bases, enterprises, and projects as NSIBs. It is crucial to emphasize that being designated as a NSIB does not necessarily imply the entity is a physical “industrial base.” Rather, as stipulated in the “Notice on Strengthening the Construction of National Sports Industry Bases” (refer to Sect. “Policy background and key milestones”), NSIB accreditation may be granted to three distinct categories: demonstration bases, exemplary enterprises, or model projects. Consequently, the quantity of recognized NSIBs serves as a robust indicator for measuring the level of agglomeration of sports enterprises and sports-related projects, collectively termed as sports brand resources, within a given region. To this end, this study adopts comprehensive GIS spatial measurement techniques, focusing on the analysis of 19 urban agglomerations in China. It seeks to uncover the spatial distribution and evolution patterns of NSIBs in these urban agglomerations, identify key factors influencing their spatial evolution characteristics, and speculate on the mechanisms underlying these influences.

Compared to existing studies, this paper aims to make three distinct contributions. Firstly, it seeks to enhance and refine the conventional conceptualization of sports resources. Chinese NSIBs comprise three key categories: demonstration bases, enterprises, and projects. Consequently, the measurement of sports brand resources through the number of NSIBs not only acknowledges the conventional inputs like manpower, capital, and infrastructure resources but also underscores the contribution of scarce high-quality sports enterprises and projects in enriching the overall understanding of sports resources.

Secondly, this paper delves deeper into the influencing factors and their underlying mechanisms that impact the spatial evolution of sports brand resources. Beyond simply characterizing the spatial distribution evolution of sports brand resources in Chinese urban agglomerations, this study also considers various perspectives such as distribution coupling, distribution type, density, and orientation. It consolidates the factors that may influence this evolution into an indicator system. By employing GeoDetector’s factor detector and interaction detector tools, the aim is to identify the drivers behind the rapid accumulation of sports brand resources in a region. This approach seeks to uncover the root causes contributing to the prosperity of the sports industry.

Thirdly, this study offers an empirical sample that is more relevant to the sports industry in developing countries. Conventional sports industry theories have predominantly originated from Europe and the United States, with scholarly works from these regions dominating the discourse on sports industry and resources. The sports industry in Europe and the United States has a long-standing history and has established a mature industry chain encompassing various sectors such as sports event organization, sports goods manufacturing, training institutions, media, event operations, brokerage firms, retailing, stadiums, clubs, and sports tourism14. However, research founded on this framework may not always yield reliable and applicable recommendations for underdeveloped countries or regions with nascent sports industry chains. Similarly, akin to other developing countries in the sports industry, China’s commercialization of the sports sector commenced relatively late and is currently transitioning from a stage of rapid growth to becoming a sports powerhouse. Therefore, this study, based on Chinese data, may offer more compelling empirical evidence for guiding the development of the sports industry in less developed nations.

Policy background and theoretical analysis

Policy background and key milestones

Although the first group of National Sports Industry Bases (NSIBs) was evaluated and announced in 2006, and the initial regulatory document on NSIBs was issued towards the end of 2011, the establishment of NSIBs in China has long been in the nascent pilot phase characterized by a limited scale of the sports industry, a lack of factor agglomeration capabilities, evident homogenization of categories, and significant institutional constraints. By 2014, the State General Administration of Sport of China had identified and acknowledged only seven NSIBs, with the full potential of these bases in terms of radiation effect and demonstration value yet to be fully realized. In October of the same year, the “Several Opinions on Accelerating the Development of Sports Industry and Promoting Sports Consumption” explicitly advocated for the promotion of sports industry bases that adhere to market principles and exhibit market competitiveness. Seizing this opportunity, seven new demonstration bases and eleven demonstration units were added in 2015, marking a pivotal juncture in the evolution of NSIBs.

From 2016 to 2018, the Chinese government issued a series of directives to provide direct guidance and strategic planning for the development of NSIBs, thereby expanding the scope of cultivating sports brand resources. Notably, the “Notice on Strengthening the Construction of National Sports Industry Bases” outlined the strategic positioning of these bases, categorizing them into demonstration bases, demonstration units, and demonstration projects. The “13th Five-Year Plan for Sports Industry Development” set forth incremental construction targets, aiming to bolster the presence of key players in the sports market, establish 50 demonstration bases, 100 demonstration units, and 100 demonstration projects. Consequently, this period marked a phase of rapid advancement in the construction of Chinese NSIBs.

From 2019 to 2021, the “Outline for Building a Leading Sports Nation” released by the General Office of the State Council of China advocated for the promotion of the sports industry as a key pillar of the national economy. The “14th Five-Year Plan for Sports Industry Development” emphasized the importance of enhancing both the quality of construction and the economic benefits of NSIBs, while underscoring the pivotal role of completed bases in driving demonstration and radiation effects. This period heralded a strategic opportunity for the development of Chinese NSIBs, with the annual number of accolades awarded to such bases witnessing rapid growth, culminating in a peak in 2021.

Subsequently, the State General Administration of Sport of China undertook revisions and enhancements to the Measures for the Administration of National Sports Industry Bases. While the expansion of NSIBs experienced a temporary slowdown, the operation and management of these bases became more refined, with standardized procedures for declaration, evaluation, naming, and recognition. In March 2022, the State General Administration of Sport of China revoked the qualification of the demonstration unit in Anda, Qinhuangdao, and the qualification of the demonstration project in Hongshan, Jiangsu Province, marking the first instance of qualification revocation in the history of Chinese NSIBs development. This shift ushered in a development pattern characterized by comprehensive categories, prominent functions, and demonstrative effects, signaling the transition of NSIBs towards a stage of high-quality transformation. The detailed development milestones and key policy initiatives in the evolution of China’s NSIBs are summarized in Table 1. For a comprehensive understanding of the development trajectory and annual list of designated NSIBs in China, please refer to the official website of the General Administration of Sport of China, which provides detailed authoritative information on this matter.

Based on the number of Chinese NSIBs awarded in previous years, the developmental trajectory can be segmented into four distinct stages: initial pilot phase (2006–2015), initial expansion phase (2016–2018), rapid growth phase (2019–2021), and high-quality transformation phase (2022-present). Consequently, the years 2015, 2018, 2021, and 2023 have been identified as pivotal time nodes for the subsequent empirical research to be conducted.

Influencing factors of Spatial evolution characteristics

What factors contribute to the heterogeneity in the spatial distribution of Chinese NSIBs, or sports brand resources? In order to address this question, this study first categorizes the factors that may influence the spatial evolution of sports brand resources into three main groups: factor inputs, market conditions, and policy environment. Subsequently, this study selects key indicators from these three categories of influencing factors and constructs a comprehensive system of influencing factor indexes that capture the spatial evolution characteristics of NSIBs. The rationale for selecting factor inputs, market conditions, and policy environment as drivers of spatial heterogeneity in the distribution of sports brand resources will now be expounded upon, along with speculation on the potential mechanisms underlying these influencing factors.

Factor inputs represent the foundational requisites for nurturing sports brand resources. Inspired by Say’s trinity formula, the decomposition of input factors into labor, land, and capital can be applied to the modern sports industry as human capital and talent pool in the sports sector, sports venue resources, and investment in the sports industry. The high input characteristic in the initial stages necessitates the availability of ample labor and venue resources for the establishment of Chinese NSIBs: labor input supports the growth of the regional sports industry through its human capital and innovative talent dividends15,16; venue resources, serving as spatial anchors, play a complementary role in sustaining sports brand resources, with city governments often making substantial financial investments in stadium construction and refurbishment to enhance services and potential revenue streams associated with the sports industry17. Adequate provision of resources, capital, and human talent facilitates deeper industrial integration and sets the stage for extending the sports sector and its associated value chain.

With the onset of the era of consumption upgrading in China, regional market conditions have emerged as a significant catalyst for the spatial evolution of sports brand resources. According to marketing theory, a healthy market requires the presence of three fundamental elements: population, purchasing power, and buying desire, none of which can be lacking. Applied to the sports industry, the cultivation of sports brand resources relies on the population size within a region to constitute the potential market for the continuous expansion of the sports market. The purchasing power and capacity of the sports industry are measured by the regional economic foundation, existing market size, and transportation conditions. Additionally, residents must demonstrate sufficient consumption demand for sports products. The economic underpinnings of a city serve as a driving force for the agglomeration of the sports industry, fostering a conducive business environment and public service infrastructure to nurture sports brand resources18. This, in turn, bolsters the foundation of sports manufacturing and service sectors, catalyzes regional consumption vitality, and attracts a greater influx of enterprises into the market. Consumption demand and existing market dynamics ensure the profitability of sports enterprises in terms of unit profit and overall sales: regions exhibiting a strong inclination towards sports and entertainment demonstrate robust consumption potential, thereby facilitating market expansion; meanwhile, existing market demand serves as a key factor in ensuring the profitability of sports enterprises, serving as a driver for regional sports industry agglomeration. The potential market characterizes the quality of sports brand resources cultivation through the lens of sustainability. The synergistic relationship between regional population size and the distribution of NSIBs is evident, particularly in the correlation between the presence of elderly and tertiary-educated populations and the sports industry, as demonstrated in the research by Yuping Duan et al.19. Strong transportation infrastructure is crucial for overcoming logistical constraints on the movement of production factors and consumer groups, serving as a vital conduit for connecting event tourism source markets. Analyzing urban transportation data for 25 metropolitan areas hosting Major League Baseball (MLB) teams from 1990 to 2014, Brad R Humphreys and Hyunwoong Pyun emphasized the impact of urban transportation conditions on hosting sporting events20.

Government policies, as macro-control and planning regulators, play a pivotal role in supporting and regulating the cultivation of sports brand resources21. Since the 18th National Congress of the Communist Party of China, the State Council, the Development and Reform Commission, and the General Administration of Sport have issued a series of favorable policies aimed at enhancing the development of NSIBs, streamlining management practices, expanding opportunities, and charting the course for future growth. The accelerated drive towards establishing a robust sports nation has become a consensus across society, leading to a heightened proactive stance by local governments in China towards exploring new avenues for development. Most provinces and municipalities have introduced specific policies tailored to support various segments of the sports industry based on local development characteristics, encompassing industry-led funding initiatives and incentives for private capital investment. These policy measures serve as a robust support platform and guarantee for the construction of Chinese NSIBs.

Study area, methodology and data sources

Study area

Given its vast geographic expanse and diverse terrain, China displays a pronounced spatial disparity in its sports industry landscape. Urban agglomerations play a pivotal role in fostering the development of a comprehensive sports industry ecosystem, driven by conducive conditions for material production that facilitate the accumulation of mature sports resources. This study posits a significant correlation between the spatial distribution of sports brand resources and the advancement of urban agglomerations in China. The primary empirical objective is to evaluate the level of this correlation to validate the hypothesis.

In order to pinpoint regions rich in sports brand resources and derive meaningful empirical findings, this research concentrates on five national-level urban agglomerations earmarked for concentrated development: the Yangtze River Delta, Pearl River Delta, Jing-Jin-Ji, the Middle Reaches of the Yangtze River, and the Chengdu-Chongqing region. Furthermore, eight regional-level urban agglomerations, targeted for balanced development (Mid-Southern Liaoning, Shandong Peninsula, Guangdong-Fujian-Zhejiang Coastal, Harbin-Changchun, Zhongyuan, Guanzhong Plain, Beibu Gulf, and the Northern Slope of the Tianshan Mountains), and six regional-level urban agglomerations designated for guided cultivation (Jinzhong, Hubao, Hohhot-Baotou-Ordos-Yulin, Yunnan Central, Central Guizhou, Lanxi, and Ningxia Along the Yellow River) by the State Council of China, the National Development and Reform Commission (NDRC), and relevant provincial governments, are chosen as the focal points of this study. This selection aims to delve into the spatial disparities in the distribution of sports brand resources across these regions and analyze the underlying factors shaping these patterns.

Methodology

Distribution type characterization: nearest neighbor index

In this study, the National Sports Industry Bases (NSIBs) in Chinese urban agglomerations are treated as point entities. The average Euclidean distance from each point to its nearest neighbor is denoted as \(\overline{r}_1\). For comparison, the expected mean distance to the nearest neighbor under a random distribution is represented by \(\overline{r_E}\). The spatial distribution of the NSIBs is then characterized using the nearest-neighbor index, as proposed by Dutta and Das22:

In the formula: n represents the number of NSIBs, A denotes the area of the urban agglomeration, and D refers to the density of the NSIBs. The value of R—when less than, equal to, or greater than 1—corresponds to the spatial distribution characteristics of the NSIBs: a random distribution, agglomerated distribution, and uniform distribution, respectively. For the specific steps of the research methodology, which are omitted here, please refer to the relevant literature.

istributional density characterization: kernel density estimation

Kernel Density Estimation (KDE) constitutes a nonparametric estimation technique that characterizes probability density distributions through scatter point analysis. This method offers three distinctive advantages: It requires no a priori assumptions about data distribution, it derives estimates directly from empirical observations, and it only necessitates the specification of input variables, kernel functions, and bandwidth parameters to generate robust density functions23. The methodology’s foundation lies in constructing symmetric kernel functions centered on observed data points. The two-dimensional KDE formulation is expressed in Eq. (2)24:

In the formula: K\((\bullet)\geq\:\:0\), \(\int_{}^{}K(\bullet)dx\:= 1\). n is the total number of samples; h is the bandwidth; \(d_{i,(x,y)}\) is the distance between sample object i and the point (x,y), and \(K(\bullet)\) is the kernel function.

The Thumb Rule represents the most widely adopted benchmark criterion for determining optimal bandwidth parameters in nonparametric estimation, with its computational formulation given by Eq. (4):

In this spatial econometric specification, \(\sigma_s\) denotes the standard deviation of the sample data, while d represents the dimensionality parameter in kernel density estimation. Given that the spatial evolution of sports brand resources across geographical coordinates constitutes a two-dimensional spatial problem, we accordingly set d = 2 for our analysis.

Distributional orientation characterization: standard deviation ellipse

The standard deviation ellipse (SDE) is used to capture the spatial directional distribution characteristics of sports brand resources within Chinese urban agglomerations, as well as the internal changes in equilibrium states from multiple perspectives. The center of the ellipse represents the centroid of the spatial distribution of NSIBs within the urban agglomeration. The standard deviation along the major axis indicates the degree of dispersion of these bases in the direction of the principal trend, while the orientation of the minor axis reflects the direction of lower concentration in the spatial distribution. The difference between the lengths of the major and minor axes is positively correlated with the directional concentration of sports brand resources25.

Driving effects test: geodetector

GeoDetector represents a robust spatial statistical methodology designed to identify geographical heterogeneity and uncover its underlying determinants. This analytical framework enables rigorous examination of the covariance between multivariate factors and the spatial distribution of sports brand resources, thereby identifying key determinants that exert significant influence on regional spatial patterns of sports brand allocation. This study employs GeoDetector to objectively assess whether each influencing factor contributes to the spatial differentiation of sports brand resources across Chinese urban agglomerations. The methodology is as follows26:

In the formula: h is the number of NSIBs in the urban agglomeration (Y), L is the number of layers divided according to independent variable X; Nh and N are the number of units of h and the number of cells in the whole region; and are the variance of cells of h and the variance of cells in the whole region; \(\sigma^2_h\) and \(\sigma^2\) the values of SSW and SST are the sum of the intra-stratum variance and the total region-wide variance, respectively. The magnitude of the q-statistic is positively correlated with the degree of spatial heterogeneity in the dependent variable Y. When the stratification is derived from independent variable X, a higher q-value denotes greater explanatory power of X over the spatial distribution of Y, and conversely, a lower q-value indicates weaker explanatory capacity.

Interaction detectors were then used to assess whether the interaction of any 2 non-independent factors could enhance or weaken their respective interpretations of the\(\:Y\) the explanatory power of each factor.

Data sources

The empirical analysis in this paper uses several key datasets of 227 cities in 19 urban agglomerations at four time points, 2015, 2018, 2021, and 2023, as mentioned earlier, including a comprehensive compilation of Chinese NSIBs, spatial coordinate data, and panel data on urban agglomerations, which capture the factors influencing the spatial evolution of these bases. The list of NSIBs is derived from the annex of the notice issued by the State General Administration of Sports concerning the declaration of NSIBs in 2023. It is important to note that the qualification of these bases may be automatically revoked upon expiration in 2023. This is primarily attributed to the diminishing demonstration effect and representativeness of the previous evaluations, rather than a depletion of sports resources. Therefore, this paper characterizes the accumulated level of sports brand resources based on the total number of NSIBs, rather than their immediate stock.

Spatial coordinates for the NSIBs were gathered using Baidu Maps and other geographic information tools. Panel data on urban agglomerations and the factors affecting the spatial evolution of the NSIBs were sourced mainly from the China Urban Statistical Yearbook and policy research platforms such as Beida Faber. This comprehensive dataset allows for a thorough analysis of the spatial dynamics and structural characteristics of China’s sports industry.

Characteristics of Spatial evolution

Validation of the coupling

The spatial relationships between National Sports Industry Bases (NSIBs) and urban agglomerations were analyzed in detail using ArcGIS. The analysis reveals that a significant proportion of NSIBs are located within the 19 urban agglomerations identified across the country. This observation highlights a substantial overlap in the spatial distribution of these two elements, thereby validating the rationale for focusing on urban agglomerations in China as the key area for analyzing sports brand resources.

The coupling between NSIBs and urban agglomerations can be explained by several key factors. Urban agglomerations generally possess greater financial capacity to invest in and maintain sports infrastructure, including stadiums, swimming pools, and other facilities. These areas also attract a larger pool of athletes, coaches, referees, and other sports professionals. Additionally, urban agglomerations are home to a higher concentration of sports museums, cultural districts, and other sports-related cultural resources. The demand for sports events, fitness services, health offerings, and the retail of sporting goods is also more pronounced in these regions. Furthermore, urban agglomerations typically feature well-developed industrial value chains, encompassing event organization, sports training, equipment manufacturing, and media communication, all of which contribute to the growth of the sports industry. With advanced infrastructure and the capacity to host large-scale sporting events, these agglomerations enhance their visibility and influence, which in turn supports further growth and development within the sports sector.

Statistics on the distribution of NSIBs across urban agglomerations (as shown in Table 2) highlight a significant imbalance in the spatial allocation of sports brand resources in China. The cumulative number of NSIBs in each urban agglomeration region consistently accounts for over 83% of the total number of NSIBs nationwide. Furthermore, disparities are apparent even among different urban agglomerations. The top five regions in terms of cumulative NSIBs—the Yangtze River Delta, Jing-Jin-Ji, the Middle Reaches of the Yangtze River, Shandong Peninsula, and Guangdong-Fujian-Zhejiang Coastal—together account for 75.76% of all NSIBs within urban agglomerations.

Evolutionary characteristics of Spatial distribution types

Urban agglomerations in China with a cumulative total of more than five NSIBs were selected for analysis. The regional nearest-neighbor indices of NSIBs at different time points were then calculated for each agglomeration jurisdiction, as presented in Table 3.

As of 2015, the accumulation of sports brand resources across Chinese urban agglomerations was relatively limited. However, from that point onward, certain urban agglomerations experienced rapid growth in the number of NSIBs. Between 2016 and 2018, the Yangtze River Delta urban agglomeration was the first to exhibit a clear clustering trend, while the Pearl River Delta, the Middle Reaches of the Yangtze River, and the Shandong Peninsula urban agglomerations saw a more dispersed and random distribution of NSIBs. Other urban agglomerations experienced only slow growth.

From 2019 to 2021, the Yangtze River Delta continued to expand and entered a phase of significant clustering, while the Jing-Jin-Ji urban agglomeration also showed some clustering, albeit to a lesser extent. The Guangdong-Fujian-Zhejiang Coastal urban agglomeration shifted from a more dispersed distribution to a random pattern, while the Harbin-Changchun and Guanzhong Plains agglomerations experienced moderate accumulation. The Chengdu-Chongqing and Zhongyuan urban agglomerations showed substantial growth, entering a phase of random distribution. Between 2022 and 2023, the Middle Reaches of the Yangtze River urban agglomeration developed into a notable cluster, while the Guanzhong Plains agglomeration transitioned to a more dispersed distribution.

Overall, the nearest-neighbor index and z-scores for NSIBs in each urban agglomeration declined to varying degrees, particularly between 2019 and 2021. This trend indicates that the spatial distribution of sports brand resources in Chinese urban agglomerations has gradually shifted from a dispersed and random arrangement toward clustering. This progression reflects the early stages of sports brand resources development, where NSIBs were initially few and scattered, resulting in a generally dispersed and random distribution. As the accumulation of sports brand resources increased and the construction of NSIBs accelerated, clustering patterns began to emerge more clearly.

Evolutionary characteristics of Spatial distribution density

For urban agglomerations in China with a cumulative number of NSIBs exceeding five, the ArcGIS kernel density estimation tool was employed to examine the spatial distribution density at various time points. The results are summarized as follows:

Leading role

As of 2015, the Yangtze River Delta urban agglomeration exhibited relatively few high-density zones for sports brand resources, with the primary concentration located northeast of Hangzhou, while the rest of the region showed lower density levels.

However, between 2017 and 2018, a marked transformation occurred, characterized by the rapid emergence of high-density primary centers in the eastern and northern parts of Shanghai-Suzhou. During this period, secondary centers began to develop in cities such as Nanjing, northeast Hangzhou, and southern regions of Jiangsu, while the overall number of NSIBs across the entire agglomeration also grew.

From 2019 to 2021, the clustering and development of NSIBs continued in Shanghai, Nanjing, and northeast Hangzhou. Additionally, new high-density zones emerged in East Changzhou, northeast Wuxi, and northwest Suzhou, which became interconnected, forming a larger concentration of NSIBs. The rapid expansion of NSIBs in southern Jinhua and Ningbo further contributed to the overall growth of the region.

By 2022–2023, the Yangtze River Delta had developed a distinct spatial distribution pattern for NSIBs. This included a primary high-density center encompassing Shanghai-Suzhou East, northeast Hangzhou-Huzhou South-Jiaxing Southwest; a secondary center in Nanjing-Maanshan North, Changzhou East-Wuxi North-Suzhou North; and tertiary centers in Yancheng West-Yangzhou North, Jinhua South, and Ningbo. This evolution reflects the region’s increasingly concentrated and diversified development of the national sports industry.

Stable growth

(i) Jing-Jin-Ji Urban Agglomeration: As of 2015, Beijing and Tianjin each had one National Sports Industry Base (NSIB). Between 2016 and 2018, a clear spatial pattern began to emerge, with Beijing evolving into a primary center and Tianjin forming a secondary center for sports industry development. From 2019 to 2021, the number of NSIBs in Beijing continued to grow rapidly, while the construction of NSIBs in Tianjin slowed. Concurrently, cities such as Zhangjiakou, Baoding South, and Shijiazhuang North began to form a sub-center for NSIBs. This pattern remained largely stable thereafter.

(ii) Middle Reaches of the Yangtze River Urban Agglomeration: By 2015, Wuhan and Jingmen West each hosted one NSIB. Between 2016 and 2018, the development of NSIBs in this region exhibited a decentralized distribution, with several high-density clusters emerging in Wuhan, Changsha, Jingmen West-Yichang East, Changde South, and Shangrao North. From 2019 to 2021, the trend toward clustering became more pronounced, with Wuhan-Xiaogan, Changsha, and Jingzhou South emerging as key centers, while the rest of the region also saw notable growth in NSIBs. By 2022–2023, Wuhan had solidified its position as the primary core for NSIBs, with Changsha serving as a secondary core. Jingzhou and Nanchang evolved into secondary centers, while the remaining cities and municipalities exhibited more scattered patterns of development.

(iii) Guangdong-Fujian-Zhejiang Coastal Urban Agglomeration: Prior to 2016, the southeastern coast, particularly around Quanzhou, experienced rapid accumulation of NSIBs. From 2016 to 2018, a high-density center formed in the southeastern part of Quanzhou, extending eastward to Xiamen and Zhangzhou, while Fuzhou emerged as a secondary center for NSIBs. The northeastern region of Ningde also saw notable development, a trend that continued through the following years.

(iv) Shandong Peninsula Urban Agglomeration: In 2015, only one NSIB was located in northeast Dezhou. Between 2016 and 2018, southeast Qingdao was awarded two NSIBs, forming a high-density cluster with Dezhou in the northeast. From 2019 to 2021, sports resources continued to concentrate in Qingdao’s central areas. The development of NSIBs in the northeast, including regions such as Binzhou West, grew at a slower pace. Meanwhile, other cities, including Jinan-Tai’an North, Heze North, Linyi, Rizhao East, Weifang, Zibo North, Dongying, Yantai West, and Weihai North, saw a steady accumulation of NSIBs, a trend that persisted in the following years.

Strong presence but insufficient driving force

(i) Pearl River Delta Urban Agglomeration: As of 2015, the primary center of NSIBs (NSIBs) was located in southwest Guangzhou, with a secondary center in Shenzhen. Between 2016 and 2018, the NSIB cluster in southwest Guangzhou expanded, forming a high-density zone extending to east Foshan. During this period, the overall development of NSIBs in the Pearl River Delta was concentrated in the southwest Guangzhou-Foshan East area and Shenzhen, while the number of NSIBs in East Zhuhai also saw some growth.

(ii) Chengdu-Chongqing Urban Agglomeration: By 2015, Chengdu hosted a single NSIB. From 2016 to 2018, two additional NSIBs were established in southwest Chongqing, laying the foundation for a dual-core spatial distribution pattern centered on Chengdu and southwest Chongqing. Subsequently, NSIBs continued to develop primarily in these two locations, while Mianyang also saw moderate growth in its number of NSIBs.

Slow development

(i) Harbin-Changchun Urban Agglomeration: As of 2015, the Harbin-Changchun urban agglomeration contained only one National Sports Industry Base (NSIB), located in southeast Harbin. Between 2016 and 2018, additional NSIBs were established in Changchun South and southwest Yanbian Korean Autonomous Prefecture. The development of sports resources in Jilin Province showed notable progress from 2019 to 2021, with the Ha-Chang agglomeration forming a primary center in Changchun South and Jilin, alongside a sub-center pattern in Qiqihar, southeast Harbin, and southwest Yanbian. However, after this period, the development of NSIBs in the Ha-Chang agglomeration remained slow, with the total number of NSIBs continuing to be relatively low.

(ii) Zhongyuan Urban Agglomeration: By 2015, only one NSIB existed in southwest Zhengzhou. Between 2016 and 2018, sports brand resources in this area continued to accumulate, and from 2019 to 2021, a primary center emerged in southeast Zhengzhou and northern Luoyang, with Shangqiu serving as a secondary center for NSIBs. However, the growth of NSIBs in the Zhongyuan agglomeration stagnated after this period, with the overall number of bases experiencing only minimal increase.

(iii) Guanzhong Plains Urban Agglomeration: In 2018, a single NSIB was established in Weinan. From 2019 to 2021, a dual-core pattern emerged with Weinan and northern Xi’an as the key centers for NSIBs. By 2022–2023, there was some progress in the construction of NSIBs in northwest Yuncheng, though the pace of development remained relatively slow.

To summarize, the spatial distribution of sports brand resources in Chinese urban agglomerations has shifted from a scattered structure to a more concentrated, clustered pattern. High-density areas of NSIBs have largely expanded based on the cultivation of existing resources. Furthermore, most NSIBs are concentrated along the eastern coast and in the middle reaches of the Yangtze River, while the northeastern and western regions remain sparsely populated with NSIBs.

The Yangtze River Delta, Jing-Jin-Ji, the Middle Reaches of the Yangtze River, Guangdong-Fujian-Zhejiang Coastal areas, and the Shandong Peninsula have relatively robust socio-economic foundations, abundant human and talent resources, and have therefore established favorable conditions for the large-scale cultivation of NSIBs at an early stage. The development of sports resources, products, brands, and industrial chains in these regions has matured over time, providing a solid foundation for these areas to secure dominant positions in pricing, bargaining power, and the formulation of industry rules and standards27. And a favorable market environment facilitates the accumulation of human capital, which is a crucial condition for the prosperity of the regional sports economy28.

In contrast, later entrants into the NSIB development face significant challenges, including high market entry barriers, limited market share, weak product competitiveness, and poor industrial clustering effects. These factors make it difficult for latecomers to overcome the initial advantages of established regions and achieve significant progress in industry development.

Evolutionary characteristics of Spatial distribution orientation

Using ArcGIS, the center of gravity coordinates, as well as the lengths of the long and short axes and other relevant parameters of the standard deviation ellipse for NSIBs, were calculated (as detailed in Table 4). Notable changes in these parameters were observed from 2015 to 2023.

The short axis exhibited a dynamic “N-shaped” trend, characterized by phases of growth, contraction, and subsequent expansion. In contrast, the long axis followed an inverted “N” pattern, with initial contraction, followed by expansion, and then a subsequent reduction. The spatial movement of the center of gravity followed a dynamic trajectory, shifting from northwest to northeast, and ultimately to the southwest. This indicates a gradual reduction in the development gap in sports brand resources between the eastern and western, as well as the northern and southern regions of China.

This spatial shift can be attributed to the ongoing implementation of policies aimed at the development of China’s sports industry and sports poverty alleviation29. The development of NSIBs has increasingly prioritized balanced spatial planning, with a particular emphasis on leveraging the natural environment and cultural resources of central and western China30. Key initiatives have focused on enhancing policy support, improving the availability of sports venues and facilities, stimulating consumer demand, and optimizing the industrial layout. These efforts are aligned with the broader rural revitalization strategy for central and western regions of the country, promoting a more equitable and comprehensive distribution of sports brand resources across China’s urban agglomerations31. Ultimately, these initiatives aim to foster inclusive and sustainable development within the sports industry.

Validation of influencing factors

Selection of influencing factors indicators

Building upon the previously proposed mechanisms underlying the spatial evolution of sports resources, this section uses panel data from 10 Chinese urban agglomerations, each with a cumulative number of National Sports Industry Bases (NSIBs) exceeding five as of 2015, 2018, 2021, and 2023. The analysis focuses on three primary factors: factor inputs, market conditions, and the policy environment, employing the GeoDetector method for this purpose.

(i) Factor inputs: These are assessed through two key indicators: labor inputs \({X_1}\), measured by the number of employees in the culture, sports, and entertainment sectors, and venue resource inputs \({X_2}\), quantified by the number of sports stadiums available in each agglomeration.

(ii) Market conditions: Market conditions are examined from five perspectives:

Economic base \({X_3}\), measured by the Gross Domestic Product (GDP) of the region;

Consumer demand \({X_4}\), measured by per capita consumer spending;

Existing market \({X_5}\), quantified by the value-added index of the tertiary industry;

Potential market \({X_6}\), gauged by the household population size;

Traffic support \({X_7}\), measured by highway passenger volume.

(iii) Policy environment: The policy environment \({X_8}\) is evaluated based on the number of regulations, policy documents, working papers, and licensing approvals issued by local governments that specifically address “sports.”

Validation of the driving effects of influential factors

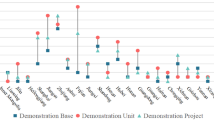

Utilizing the natural breakpoint method, influential factors were discretized through a five-point scale, and the strength of their impacts, as well as their interactions, were evaluated using the GeoDetector technique (as shown in Fig. 1). The values within the squares represent the magnitude of influence that pairs of factors exert on the spatial evolution of NSIBs in Chinese urban agglomerations. The results indicate that:

-

(i)

Factor inputs: In terms of factor inputs, the influence ratios of labor and venue resource inputs remained relatively stable in 2015 and 2018, with the dominance of venue resource input gradually increasing post-2018. The explanatory power of both factors with respect to the evolutionary characteristics of sports brand resources increased between 2015 and 2018 but has significantly declined since 2019. This decline is likely attributed to a shift in the growth dynamics of the sports industry in Chinese urban agglomerations around 2018. Initially, the development of NSIBs was driven by investments in human capital, venue resources, and policy incentives, which helped establish a foundational industrial chain and improve market conditions. However, this phase has since evolved into a more stable development stage, primarily driven by market supply and demand, pricing mechanisms, and competitive forces32.

-

(ii)

Market conditions: The explanatory power of various market condition factors exhibits notable variations. The influence of the economic base declined between 2015 and 2018 and remained low thereafter. In contrast, the impact of consumption demand has consistently increased since 2015. Both the existing and potential markets have experienced steady growth, albeit at a slightly slower rate than consumption demand. Traffic support has maintained a relatively high and stable influence. As of 2021, the ranking of market condition factors, excluding the economic base, was as follows: consumption demand (1), traffic support (2), existing market (3), and potential market (4). The key drivers of these trends include: Firstly, the continuous development of the Chinese economy and rising income levels, which have increased demand for entertainment, health, and quality of life services, thus prompting the sports industry to expand beyond professional events to include fitness clubs, equipment sales, and sports training to meet diverse consumer needs; secondly, rapid advancements in digital media technology, enabling real-time viewing of sports events through multiple channels, which has sparked interest among younger consumers and increased engagement with sports; thirdly, a series of supportive policies guiding the sports industry’s consumer-oriented transformation, alongside intensified market competition that has pushed sports enterprises to adapt to shifting consumer preferences; and forth, a shift in the public perception of sports, from competitive performance to a broader focus on national fitness, recreation, and socialization, which has led to greater integration of industries such as sports and culture, as well as sports and tourism, while raising demands on infrastructure and government adaptability. Several studies have provided empirical evidence supporting this perspective and have analyzed the specific transmission mechanisms through which market dynamics (including consumer demand, transportation infrastructure, existing markets, and potential markets) facilitate the agglomeration of sports resources. For instance, Rute Martins et al. argue that sustainable and accessible transportation conditions for spectators are critical constraints in international sports tourism activities33. Meanwhile, Joris Drayer et al. have attempted to identify latent consumer demand and shifts in preferences by analyzing secondary ticket market prices34.

-

(iii)

Policy environment: The influence of the policy environment has remained low after gradually weakening since 2015. This trend suggests that Chinese government policies have successfully utilized their supportive and regulatory roles to foster a cohort of enterprises capable of achieving independent profitability. Furthermore, a series of legal frameworks have been established to maintain competitive market order, reflecting the gradual maturation of China’s sports industry.

-

(iv)

Joint effects of influential factors: Among the 28 interaction terms examined, 17 demonstrated nonlinear enhancement effects in certain years. Notably, the q-values for combinations of the economic base, potential market, and policy environment factors with all other variables—excluding the interactions between the other two—were significantly higher than the sum of the q-values for each factor acting independently. The economic base, in particular, exhibited a cumulative nonlinear enhancement effect, highlighting its critical role in the development of sports brand resources when combined with other factors. However, the individual explanatory power of these three factors remained relatively weak, and their synergistic effects were not particularly pronounced. Labor inputs and venue resources did not exhibit nonlinear enhancement effects until 2021. In terms of market conditions, consumption demand showed one nonlinear enhancement effect in 2015 and three in 2018; the existing market demonstrated two nonlinear enhancements in 2015, two in 2018, and three in 2021; and traffic support displayed one, two, and three enhancements, respectively, across these years. Notably, with the exception of consumption demand, which did not demonstrate synergistic effects with other factors in 2021, all other factors showed increasing trends in the frequency of nonlinear enhancement effects over time. This suggests that the coupling effects of factor inputs, market conditions, and the policy environment on the spatial evolution of sports brand resources have become more pronounced as time has progressed.

Conclusions and discussion

Main conclusions

(i) Spatial distribution patterns: Both the nearest-neighbor index and the z-score for National Sports Industry Bases (NSIBs) in China’s urban agglomerations show a declining trend over time. In the early stages of development, the number of NSIBs was limited, and their distribution was relatively random across cities. However, with the accumulation of resources, a distinct trend toward agglomeration and clustering of these bases emerged.

(ii) Spatial distribution density: The Yangtze River Delta urban agglomeration remains the leading region in terms of the number of NSIBs. Other regions such as the Beijing-Tianjin-Hebei urban agglomeration, the urban agglomeration along the middle reaches of the Yangtze River, and the coastal urban agglomerations of Guangdong, Fujian, and Zhejiang exhibit stable growth. Additionally, a dual-core pattern is evident in the Pearl River Delta and Chengdu-Chongqing regions, although the driving forces behind this development appear relatively weak. In contrast, the development of NSIBs in regions such as the Ha-Chang, Central Plain, and Guanzhong Plain urban agglomerations remains slow. Overall, there is a shift from a scattered to a more concentrated spatial structure, although spatial distribution remains highly uneven.

(iii) Spatial distribution orientation: The spatial center of gravity for NSIBs has migrated in a “northwest-northeast-southwest” direction, with a gradual narrowing of the development gap between eastern and western, as well as southern and northern regions.

(iv) Driving factors of distribution: Factor input serves as the fundamental prerequisite for the development of NSIBs, while market conditions are the primary driving force, and the policy environment plays a supportive and regulatory role. Over time, the influence of factor input and the policy environment on the spatial evolution of these bases has diminished, whereas the importance of market conditions has increased. The economic foundation, market potential, and policy environment interact with other factors to foster the development of sports brand resources. Additionally, the non-linear enhancement effect of the interactions among these factors has become more pronounced over time, amplifying their collective influence.

Policy implications

The policy implications of our study for less-developed countries in the sports industry are as follows:

(i) Balanced spatial distribution and localized sports branding.

The standard deviation ellipse analysis indicates that, while China’s sports industry has made efforts to achieve spatial balance in the distribution of sports brand resources, the underlying issue of uneven resource allocation persists. Developing distinctive sports programs based on the geographical features, climatic conditions, and cultural characteristics of different urban clusters represents an effective pathway to promote localized sports brand development and avoid homogenized competition. From an economic perspective, this approach leverages regional comparative advantages to create differentiated sports industry clusters35. Three specialized strategies can be proposed: Firstly, sports project development based on geographical endowments. Mountainous/high-altitude regions (e.g., Yunnan-Guizhou-Sichuan and Tibetan areas in China) possess comparative advantages in developing extreme sports such as mountaineering, rock climbing, mountain marathons, trail running, and paragliding. These regions can establish themselves as “international mountain sports destinations” through vertical integration of the value chain, including co-developing high-altitude equipment with outdoor brands and creating certification systems for mountain sports training. Representative cases include Liupanshui’s “Cool Capital Trail Running” leveraging karst topography and Shangri-La’s high-altitude trekking events. Coastal/archipelago regions (e.g., Yangtze River Delta, Pearl River Delta, and Hainan) should capitalize on their marine resources to develop water sports clusters encompassing sailing, surfing, diving, beach volleyball, and sea fishing. This involves building marine sports tourism belts, hosting international aquatic events, and fostering domestic water sports equipment brands (e.g., diving suits, surfboards). Successful implementations include Wanning’s “Surfing Town” development and Qingdao’s sailing industry centered around the Olympic Sailing Center. Plain/river network areas (e.g., middle-lower Yangtze and North China Plain) can optimize their flat terrain to develop mass-participation sports like cycling, dragon boat racing, and urban marathons. Noteworthy examples include Suzhou’s “Ancient Town Dragon Boat Race” incorporating Jiangnan water town culture and Wuhan’s lakeside cycling routes along East Lake Greenway.

Secondly, climate-conditioned differential development. Northern regions (e.g., Northeast China and Beijing-Tianjin-Hebei) can exploit their cold winters to cultivate winter sports economies (ice hockey, skiing, ice sculpture marathons) and construct winter sports theme parks. Heilongjiang’s strategy to establish itself as “China’s Winter Sports Equipment R&D Hub” and Jilin’s utilization of Winter Olympics legacy to develop training IPs demonstrate effective cluster development. Subtropical urban clusters (e.g., Guangdong-Hong Kong-Macao and Fujian) should focus on climate-adapted indoor sports (badminton, table tennis, indoor climbing) and develop winter training bases. Dongguan’s basketball industry cluster and Jinjiang’s “Sports Footwear and Apparel Brand Capital” exemplify specialized industrial development. Arid/desert regions (e.g., Northwest China) can create unique desert sports products (desert trekking, camel riding, sand motorcycles) and develop event IPs incorporating Silk Road culture. Case studies include Zhongwei’s “Silk Road Desert Marathon” and Dunhuang’s “Gobi Challenge.”

Thirdly, cultural-embedded sports IP development. Ethnic minority regions (e.g., Inner Mongolia, Xinjiang, Tibet) can modernize traditional sports (Mongolian wrestling, Tibetan Gyagya, Xinjiang tightrope walking) into competitive events. The modernization of Inner Mongolia’s Nadam Fair and Xinjiang’s “Tianshan Trail Race” integrating nomadic culture demonstrate cultural value addition. Historical cities (e.g., Xi’an, Luoyang, Chengdu) can develop “ancient capital-themed sports tourism,” such as Xi’an’s City Wall Marathon and Chengdu’s “Three Kingdoms” orienteering, coupled with cultural-creative sports merchandise (e.g., Han-style sportswear, cultural medals). Through the aforementioned measures, urban agglomerations can establish a “one-region-one-brand” sports industry matrix, which simultaneously stimulates local economic development and reinforces cultural identity, ultimately achieving sustainable growth in the sports sector.

(ii) Integration of culture, sports, and tourism.

The nearest-neighbor index results suggest that the development of sports brand resources in Chinese urban agglomerations has not yet reached a critical mass, and the integration of culture, sports, and tourism—particularly sports culture, creative tourism, and niche sports tourism—is still underdeveloped. Urban agglomerations should be encouraged to promote collaboration between the sports industry, technology enterprises, universities, and research institutions to drive innovation in areas such as sports data analytics, virtual reality, and wearable technology. This would provide the necessary technical support for advancing sports resource development36. These objectives can be achieved through the following approaches:

Firstly, create distinctive “sports + cultural tourism” event IPs to enhance brand influence. On one hand, enhance competitive differentiation by infusing cultural elements into sports events. For instance, host “ancient capital-themed sports events” (such as city wall marathons or Han-style cycling competitions) in historical cities like Xi’an and Luoyang, while developing cultural derivative products (custom medals, themed equipment) to increase the cultural added value of events. On the other hand, integrate sports content into tourism scenarios to create composite consumption models. Develop “premium sports tourism routes” (such as coastal cycling or karst rock climbing) in popular tourist destinations like Sanya and Guilin, promoting the “spectator sports + tourism” model, as exemplified by Hainan’s around-the-island sailing competitions combined with vacation consumption. Repurpose industrial heritage sites (such as Chongqing Steel Plant or Northeast China’s old industrial bases) into “industrial-style sports parks” hosting parkour and street basketball events, forming new “industrial tourism + sports” formats.

Secondly, build a “sports + technology + culture” industrial chain to cultivate local sports enterprises. On one hand, combine sports equipment with cultural creativity to enhance brand added value. Encourage partnerships between sports companies (like Anta and Li-Ning) and cultural institutions to develop “national trend sports gear” (such as Dunhuang-themed running shoes or Sanxingdui co-branded sportswear), strengthening brands’ cultural recognition. Support technology companies (like Huawei and DJI) in developing smart sports equipment (VR ski simulators, AI motion analysis systems) to drive cross-industry innovation in “sports + technology.” On the other hand, establish sports industry innovation parks to promote enterprise clustering. Set up “sports technology incubators” in cities rich in sports resources (like Jinjiang and Qingdao), attracting innovative enterprises in sports big data, sports rehabilitation, and esports to form industrial clusters. Support collaborations between universities (like Beijing Sport University and Shanghai University of Sport) and sports enterprises to build “sports and health laboratories,” facilitating the commercialization of research outcomes (such as smart wearable devices and sports nutrition products).

(iii) Regional collaboration and high-density urban synergies.

The kernel density estimation reveals that sports brand resources in China are concentrated in key regions such as the Yangtze River Delta, Jing-Jin-Ji, the Middle Reaches of the Yangtze River, the Guangdong-Fujian-Zhejiang Coastal Area, and the Shandong Peninsula. Within these regions, resources tend to cluster around core cities such as Shanghai, Hangzhou, Wuhan, and Qingdao. However, the radiating influence of these high-density cities on their surrounding areas remains limited. To cultivate sports brand resources by strengthening regional collaboration and leveraging the driving role of high-density cities, it is necessary to build a multi-level coordinated development system that integrates regional resource endowments, industrial foundations, and market potential. The following are specific recommendations for measures: Firstly, establishing regional collaboration mechanisms. Form a cross-regional sports industry alliance led by key regions such as the Yangtze River Delta and Beijing-Tianjin-Hebei, in collaboration with industry associations, leading enterprises, universities, and research institutions to establish a sports brand development alliance that coordinates resource integration and standard setting. Regularly hold regional sports brand summits to promote technology sharing, talent mobility, and joint R&D (for example, the Yangtze River Delta could focus on smart sports equipment, while Beijing-Tianjin-Hebei emphasizes event IP incubation). Create a differentiated division of labor system: The Yangtze River Delta can leverage its advantages in digital economy to develop sports technology, esports, and high-end equipment manufacturing (e.g., Shanghai, Hangzhou); the Guangdong-Fujian-Zhejiang coastal area can utilize its foreign trade and manufacturing foundation to strengthen the transformation from sports footwear and apparel OEM to independent brands (e.g., Quanzhou, Jinjiang); Shandong Peninsula/Beijing-Tianjin-Hebei can combine cultural tourism resources to cultivate outdoor sports and winter sports industries (e.g., Qingdao, Zhangjiakou).

Secondly, strengthening the core driving role of high-density cities. Build “sports industry corridors” with central cities as hubs, leveraging the radiating effects of cities like Shanghai, Beijing, Guangzhou, and Shenzhen to develop comprehensive sports service complexes (including high-end formats such as event operations, sports media, and training), driving surrounding cities to form supporting industrial chains. For example: The Shanghai Hongqiao sports economic circle can collaborate with manufacturing in Suzhou and Jiaxing to form an integrated “R&D-production-marketing” network. Establish national-level sports industry innovation platforms and set up sports brand incubation centers in high-density cities to provide one-stop services including design, intellectual property, and marketing, lowering the entry barriers for small and medium brands. Support technology parks like Beijing’s Zhongguancun and Shenzhen’s Nanshan to expand “sports + technology” application scenarios (e.g., wearable devices, virtual events).

Thirdly, optimizing the flow of resource factors. Promote mutual recognition of sports professional qualifications across regions and establish expert databases and flexible introduction mechanisms (e.g., joint training of sports management masters by universities in Beijing-Tianjin-Hebei). Build a big data platform for the sports industry to integrate consumption data and supply chain information to support precision marketing (e.g., regional sub-centers of Alibaba Sports and Tencent Sports). Establish cross-regional sports industry funds to focus on investing in potential brands (e.g., extending the Yangtze River Delta G60 Science and Technology Innovation Corridor Fund to the sports sector); encourage high-density cities to issue sports consumption vouchers and expand their inter-regional applicability (e.g., Chengdu and Hangzhou jointly promoting “event tourism packages”).

Forthly, policy support and infrastructure coordination. To foster the cultivation of sports brand resources, it is essential to establish unified regional policy standards, harmonizing differences in land use, taxation, and subsidies across regions to prevent detrimental competition (e.g., standardizing subsidies for sports venue construction). Pilot policies such as “Sports Free Trade Zones” could be implemented to streamline customs clearance for cross-border sports goods (particularly applicable to coastal regions like Guangdong, Fujian, and Zhejiang). Additionally, joint infrastructure development should be promoted, including the establishment of regional sports logistics hubs (e.g., leveraging Zhengzhou as a distribution center for sports goods in Central China) and the integration of intercity sports facilities through shared digital platforms (e.g., a unified booking system for stadiums in the Beijing-Tianjin-Hebei region). It should be noted that these policy recommendations are primarily formulated within the Chinese context. When applied to other developing countries, adaptations should be made based on local socioeconomic, cultural, and climatic conditions, with selective referencing of the most relevant case studies.

Research limitations and future prospects

This study is motivated by existing gaps in the sports industry literature, particularly the insufficient attention given to the spatial evolution of sports brand resources and the factors that influence this evolution. By focusing on a sample of Chinese urban agglomerations with relatively underdeveloped sports industries, this empirical research seeks to provide valuable insights for other countries aiming to develop a mature sports industry value chain, with a particular emphasis on optimizing the cultivation of sports brand resources. The findings of this study highlight the evolving roles of factors such as resource inputs, market conditions, and the policy environment. Furthermore, the research demonstrates that the economic base, market potential, and policy framework interact with other factors to positively influence the development of regional sports brand resources.

However, it should be noted that this study still has several notable limitations: Firstly, there are inherent flaws in the dataset. We rely on the number of NSIBs to measure the agglomeration level of sports brand resources in a given region, but this approach implicitly assumes that all NSIBs—whether they are bases, enterprises, or projects—contribute equally to regional sports industry development. In reality, this assumption may be overly simplistic. Research on China’s sports industry often entails a trade-off between data accessibility and dataset reliability, given the frequent challenges in obtaining high-quality data.

Secondly, while we categorize the influencing factors of spatial evolution characteristics of sports brand resources into three dimensions based on existing literature and our own conceptual framework, the selection of specific evaluation indicators remains somewhat rudimentary. A more nuanced and comprehensive set of metrics could enhance the robustness of our analysis.

Thirdly, the mechanisms through which these factors shape the spatial distribution and development of sports brand resources have primarily been discussed through literature review and theoretical reasoning. The proposed transmission pathways have yet to be empirically validated, necessitating further research to test and refine these causal relationships.

Data availability

The source of the original data used in the study is stated in the text; if in doubt, please contact the corresponding author for access.

References

Acquah-Sam, E. Developing sports for economic growth and development in developing countries. Eur. Sci. J. 17, 172–216 (2021).

Zhao, C., Guo, Q., Jia, R., Dong, K. & Wang, K. How does clean energy transition promote original design manufacturers? A three-party evolutionary game analysis. Energy Econ. 126, 106965 (2023).

Abbiasov, T. & Sedov, D. Do local businesses benefit from sports facilities? The case of major league sports stadiums and Arenas. Reg. Sci. Urban Econ. 98, 103853 (2023).

Becker, S., Berg, A., Kohli, S. & Thiel, A. Sporting goods 2024: time to move. McKinsey & Company (2024).

Savić, Z., Ranđelović, N., Stojanović, N., Stanković, V. & Šiljak, V. The sports industry and achieving top sports results. Facta Universitatis Series: Phys. Educ. Sport. 15, 513–522 (2018).

Lv, C., Wang, Y. & Jin, C. The possibility of sports industry business model innovation based on blockchain technology: evaluation of the innovation efficiency of listed sports companies. Plos One. 17, e0262035 (2022).

Edwards, M. The role of sport in community capacity building: an examination of sport for development research and practice. Sport Manage. Rev. 18, 6–19 (2015).

Doherty, A. J. Managing our human resources: A review of organisational behaviour in sport. Sport Manage. Rev. 1, 1–24 (1998).

Widdop, P., Cutts, D. & Jarvie, G. Omnivorousness in sport: the importance of social capital and networks. Int. Rev. Sociol. Sport. 51, 596–616 (2016).

Zhou, R. & Kaplanidou, K. Building social capital from sport event participation: an exploration of the social impacts of participatory sport events on the community. Sport Manage. Rev. 21, 491–503 (2018).

Pianese, T. Interpreting sports events from a resource-based view perspective. Int. J. Sports Mark. Spons. 22, 240–261 (2021).

Bergantinos, G. & Moreno-Ternero, J. D. Sharing the revenues from broadcasting sport events. Manage. Sci. 66, 2417–2431 (2020).

Hoye, R. et al. Design archetype utility for Understanding and analyzing the governance of contemporary National sport organizations. Sport Manage. Rev. 23, 576–587 (2020).

Rönkkö, J. The Sports Industry’s marketing Strategies in the United States: Case: How the National Football League is Going to Maintain their Status as a Leader of the Sports Market Industry in North America. (2019).

Brannagan, P. M. & Grix, J. Nation-state strategies for human capital development: the case of sports mega-events in Qatar. Third World Q. 44, 1807–1824 (2023).

Liu, L., Si, S. & Li, J. Research on the effect of regional talent allocation on high-quality economic development—Based on the perspective of innovation-driven growth. Sustainability 15, 6315 (2023).

Ramos, R. F., Biscaia, R., Moro, S. & Kunkel, T. Understanding the importance of sport stadium visits to teams and cities through the eyes of online reviewers. Leisure Stud. 42, 693–708 (2023).

Paddison, R. & Miles, S. Culture-led Urban Regeneration (Routledge, 2020).

Duan, Y. et al. The effects of demographic trends on the high-quality development of the Chinese sports industry. Sustainability 14, 1039 (2022).

Humphreys, B. R. & Pyun, H. Professional sporting events and traffic: evidence from US cities. J. Reg. Sci. 58, 869–886 (2018).

Teixeira, M. R. & Ribeiro, T. M. Sport policy and sports development: study of demographic, organizational, financial and political dimensions to the local level in Portugal. The Open. Sports Sci. J. 9, 26–34 (2016).

Dutta, I. & Das, A. Exploring the Spatio-temporal pattern of regional heat Island (RHI) in an urban agglomeration of secondary cities in Eastern India. Urban Clim. 34, 100679 (2020).

Niu, W., Cai, F. & Fu, J. Load extrapolation method based on adaptive bandwidth kernel density Estimation. Trans. Chin. Soc. Agricultural Mach. 52, 375–384 (2021).

Guo, Q., Ren, W. & Lu, W. New classification method of coal spontaneous combustion three zones in the Goaf based on non-parametric kernel density Estimation. Environ. Sci. Pollut. Res. 30, 4733–4743 (2023).

Zhao, Y. et al. Explore the mitigation mechanism of urban thermal environment by integrating geographic detector and standard deviation ellipse (SDE). Remote Sens. 14, 3411 (2022).

Zheng, X. et al. Equity analysis of the green space allocation in china’s eight urban agglomerations based on the theil index and geodetector. Land 12, 795 (2023).

Rascher, D. A., Maxcy, J. G. & Schwarz, A. The unique economic aspects of sports. J. Global Sport Manage. 6, 111–138 (2021).

Yu, M. & Deng, X. The inheritance of marketization level and regional human capital accumulation: evidence from China. Finance Res. Lett. 43, 102268 (2021).

Dai, J. & Menhas, R. J. R. M. & policy, h. Sustainable development goals, sports and physical activity: the localization of health-related sustainable development goals through sports in china: a narrative review. Risk Manag. Healthc. Policy 13, 1419–1430 (2020).

Hong-Min, A., Xiao, C. D., Tong, Y. & Fan, J. Ice-and-snow tourism and its sustainable development in china: A new perspective of poverty alleviation. Adv. Clim. Change Res. 12, 881–893 (2021).

Ye, J., Guo, G., Yu, K. & Lu, Y. Allocation efficiency of public sports resources based on the DEA model in the top 100 economic counties of China in Zhejiang Province. Sustainability 15, 9585 (2023).

Filo, K., Lock, D. & Karg, A. Sport and social media research: A review. Sport Manage. Rev. 18, 166–181 (2015).

Martins, R. et al. Understanding spectator sustainable transportation intentions in international sport tourism events. J. Sustainable Tourism. 30, 1972–1991 (2022).

Drayer, J., Rascher, D. A. & McEvoy, C. D. An examination of underlying consumer demand and sport pricing using secondary market data. Sport Manage. Rev. 15, 448–460 (2012).

Dubinsky, Y. Branding a City as a sports town: A conceptual model based on ‘track town USA’. J. Global Sport Manage. 9, 1–17 (2024).

Lu, H. F. Enhancing university student employability through practical experiential learning in the sport industry: an industry-academia Cooperation case from Taiwan. J. Hospitality Leisure Sport Tourism Educ. 28, 100301 (2021).

Author information

Authors and Affiliations

Contributions

Conceptualization, X.Z. and J.W.; investigation, data collection, J.W. and Z.Z.; software implementation, analysis of results, visualization, and writing of the original manuscript, J.W.; review and editing, X.Z. and J.W.; project management and access to funding, X.Z. All authors have read and agreed to the publication of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Zhong, X., Wang, J. & Zhong, Z. Spatial evolution characteristics and influencing factors of sports brand resources in Chinese urban agglomerations. Sci Rep 15, 22138 (2025). https://doi.org/10.1038/s41598-025-09706-4

Received:

Accepted:

Published:

Version of record: