Abstract

Intelligent transformation has become a key driver of enterprise development. It enables firms to improve operational efficiency, enhance innovation capabilities, and maintain long-term competitiveness. This study investigates the impact of environmental performance on the intelligent transformation of manufacturing firms in China. It uses the panel data from A-share listed manufacturing companies covering the period from 2010 to 2023. Environmental performance is measured using the environmental sub-score from the CNRDS ESG rating system. The analysis investigates both the direct impact of environmental performance on firms’ intelligent upgrading and the mediating effects of external market environments, including product market, policy environment, and capital market. The empirical findings reveal that higher environmental performance significantly enhances the level of intelligent transformation, highlighting its increasingly key role in promoting technological progress and smart development in the manufacturing sector. This study contributes to the theoretical integration of environmental governance and digital transformation, offering practical implications for manufacturing firms seeking to align sustainability with innovation strategies under China’s dual transformation framework.

Similar content being viewed by others

Introduction

China’s manufacturing sector is undergoing a critical transition driven by global trends in green and digital transformation. In response to growing pressure to enhance competitiveness while meeting sustainability goals, the Chinese government has launched strategic initiatives, including the 14th Five-Year Plan for the Development of the Digital Economy and the Guiding Opinions on Accelerating the Green and Low-carbon Transformation of Manufacturing. These policies emphasize the integration of environmental performance (EP) and digital upgrading, positioning EP not only as a regulatory requirement but also as a strategic enabler of high-quality development. Intelligent transformation (IT), a key aspect of digitalization, reflects a firm’s ability to embed digital technologies into production processes while improving environmental efficiency and reducing carbon emissions1. The alignment between EP and IT is thus central to sustainable, innovation-driven growth in the manufacturing sector.

Several Chinese firms illustrate this synergy. Gree Electric has improved energy efficiency and built green factories while advancing smart production lines2. BYD has expanded its new energy vehicle segment and invested in environmental technologies, leveraging green financing to develop intelligent factories3. Similarly, SANY Heavy Industry has incorporated green design and energy monitoring system into its “Lighthouse Factory” initiative, optimizing both smart management and carbon reduction4. These cases suggest that firms with strong EP are more likely to acquire key resources and policy support, thereby enabling intelligent upgrading.

Both national policy frameworks and firm-level practices emphasize EP as a crucial driver of IT1,5,6. Prior research has shown that strong EP enhances reputation, reduces regulatory risk, and improves access to external resources7. The stakeholder theory and Resource-Based View (RBV) suggest that environmentally responsible firms are better positioned to respond to external pressures7,8,9 and gain competitive advantage10. However, most studies have treated environmental practices and digital technologies as separate domains, often overlooking potential synergies between them. Empirical evidence on how EP enables firms to overcome resource constraints and adapt to digital-intelligent transformation remains limited, especially in the policy-driven and transformation-intensive context of China7,11.

To address this gap, this study examines the effect of EP on IT among Chinese manufacturing firms. Using panel data from A-share listed companies between 2010 and 2023, this study uses environmental scores from the CNRDS ESG database as the core explanatory variable. A system GMM model is applied to assess the relationship between EP and IT. In addition, we examine the mechanisms through which EP may influence IT—namely, through supply chain coordination, institutional support, and capital market access. Theoretically, the study extends RBV by conceptualizing EP as a dynamic capability that enables resource acquisition and digital readiness. This provides a new lens to explain how firms convert environmental responsibility into internal transformation. Practically, these findings are relevant to other transition economies or emerging markets that face similar dual demands of environmental sustainability and technological modernization. By demonstrating the link between EP and digital upgrading in China’s manufacturing sector, the study offers a transferable analytical framework that can guide policy and strategy in broader international contexts.

The structure of the paper is as follows: Sect. 2 reviews related literature and the theoretical framework. Section 3 introduces data, variables, and methodology. Section 4 presents empirical results, robustness tests, heterogeneity analysis, and mechanism verification. Section 5 concludes with key findings, policy implications, limitations, and future research directions.

Literature review and theoretical hypothesis

Literature review

EP has attracted widespread academic attention. Existing literature generally suggests that strong EP not only enhances a firm’s reputation5,6,12 and public image13,14,15 but also strengthens the capacity to respond to external regulatory and market pressures7,16,17,18. This enables firms to obtain greater policy support19 capital resources20,21,22 and market recognition20,23. Based on the resource-based view, EP can be regarded as a strategic resource that is valuable, rare, and difficult to imitate. As such, EP contributes to a firm’s sustainable competitive advantage by supporting both internal capability building and external resource acquisition. Prior studies have demonstrated that EP exerts significant influence on firms’ innovation capabilities24,25 financial performance22,26,27 and risk control28,29,30.

The IT of enterprises has emerged as a critical pathway for achieving high-quality development in the manufacturing sector31 encompassing both the application of digital technologies such as automation, informatization32 and upgrading traditional production and manufacturing processes33. Existing studies have explored the roles of digital infrastructure34,35 government subsidies36,37,38 and R&D investment39,40 in advancing IT. However, little attention has been given to how EP, as a strategic intangible asset, influences IT at the firm level—especially in emerging market contexts like China.

Based on the Resource-Based View, existing studies have preliminarily revealed the resource-attracting effect of EP. Firms with stronger EP are more likely to access green finance41 government incentives42 and supply chain advantages43. These findings suggest that EP generates positive externalities, which help firms acquire more diverse resource endowments and external support for their digital and IT. Although the RBV acknowledges the supportive role of environmental reputation as a valuable resource5,44,45 existing studies have paid limited attention to how EP contributes to resource integration and capability reconfiguration during digital transformation. This gap is particularly evident in emerging markets such as China. Incorporating EP into the RBV framework and examining its influence on IT can extend the theoretical application of RBV. It also helps to address the current research gap in the context of intelligent upgrading in the manufacturing sector of emerging economies.

Theoretical hypothesis

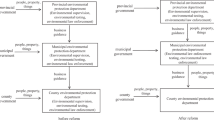

From the perspective of RBV, EP can be regarded as a strategic resource. It may possess key attributes such as value, rarity, inimitability, and organizational embeddedness, thereby providing sustained competitive advantages46. Meanwhile, Stakeholder Theory emphasizes that strong EP enables firms to better meet the expectations of key stakeholders such as regulators, investors, and consumers, and thus access critical external support7. These theoretical frameworks offer a foundation for understanding how EP influences the IT of manufacturing firms, particularly mechanisms related to internal capability enhancement and external resource acquisition. The theoretical framework is illustrated in Fig. 1.

According to RBV, EP reflects the firm’s long-term commitment to environmental protection. It embodies the accumulation of strategic resources and capabilities, including governance strength47 forward-looking technological investments48,49 and organizational execution capacity50. These characteristics form both the technical and institutional foundation required for intelligent production, automation, and digital management. As far as the perspective of resource heterogeneity, firms with superior EP tend to have more established green governance systems, including green production technologies44,51 mechanisms for environmental information disclosure52 and organizational culture oriented toward sustainability53. Institutional arrangements not only enhance resilience to external shocks but also lay a solid foundation for IT. For instance, digital production systems often demand higher energy efficiency and lower carbon emissions—requirements more readily met by firms with advanced environmental capabilities54.

In terms of resource acquisition capacity, effective IT involves more than deploying digital tools. It requires a fundamental restructuring of a firm’s organizational design, management practices, and operational routines, often under significant uncertainty and technological complexity. This transformation depends on a firm’s ability to devise strategic responses, coordinate internal resources, and adapt continuously through organizational learning55. Empirical studies have shown that firms with strong EP are more likely to exhibit these capabilities. They respond more effectively to policy signals and market trends56,57,58 and allocate resources more efficiently to support intelligent initiatives22. Moreover, firms with superior EP tend to emphasize long-term value creation and risk management by embedding sustainability principles into their organizational structures and everyday operations22,59. This sustainability-oriented flexibility improves their adaptability to systemic changes and facilitates a smoother transition toward intelligent upgrading. Accordingly, this study proposes the following hypothesis:

H1: EP positively influences the IT of manufacturing enterprises.

Stakeholder theory suggests that firms should address both shareholder interests and the expectations of various external stakeholders, including customers, suppliers, and strategic partners60. By absorbing and utilizing resources embedded in stakeholders, firms can improve their ability to integrate and expand resources. This will support the advancement of IT.

Strong EP sends a signal of commitment to sustainability and responsible conduct. This helps enterprises build trust and legitimacy with key market participants61. Firms with superior EP are more likely to gain customer loyalty and supplier recognition, which enables the formation of stable green supply chain partnerships31,62. These partnerships, in turn, help firms acquire critical resources, reduce transaction uncertainty, and enhance supply chain resilience. Furthermore, a strong environmental reputation boosts brand value and market competitiveness. Close supplier collaboration also facilitates the integration of intelligent technologies at various points along the supply chain63,64. Green-aligned networks promote coordinated deployment of smart production systems, real-time data sharing, and digital logistics solutions. In areas such as green procurement, traceable production, and intelligent logistics, firms with strong EP lead in adopting advanced technologies, thereby accelerating IT. Therefore, this study proposes the following hypothesis:

H2: EP promotes IT by strengthening supply chain linkages.

The government, as a key external stakeholder, exercises regulatory authority while exerting substantial influence on corporate strategic decisions via policy incentives, fiscal subsidies, and the distribution of resources65. As green and low-carbon transformation becomes a national priority, firms with strong EP are increasingly favored by policy agendas. Due to their compliance and best practices in environmental governance, these firms are more likely to gain government trust and support. This allows them to access institutional resources such as green financing22 technical assistance66 and industrial support67 during their intelligent upgrading processes. Pursuing IT often involves high investment costs and considerable risk. Firms with superior EP, supported by their positive public image and responsiveness to policy signals, are more likely to be selected for government-led pilot programs in intelligent manufacturing or to be certified as green factories. These firms may receive preferential access to financial instruments, targeted subsidies, or digital capability enhancement services67. Such institutional advantages help reduce external uncertainties during the technology upgrading process and improve firms’ integration into innovation-driven manufacturing ecosystems68. Thus, this study proposes the following hypothesis:

H3: EP facilitates IT by enabling firms to secure institutional support.

Enterprises with superior EP could imply stronger compliance awareness and organizational transparency. This signals their long-term commitment to sustainable development61,69. This enhances investor confidence and improves the firm’s reputation in capital markets. These reputation effects place firms in a favorable position in financing negotiations, allowing access to lower-cost or larger-scale capital70. Alleviating financial constraints increases liquidity and supports sustained investment in IT. Intelligent systems, automation technologies, and industrial software require significant and continuous financial input. Firms with strong EP are more likely to win the trust of financial institutions and policymakers, enabling access to green loans, public funds, and long-term capital22. This reduces financing pressure and accelerates digital and intelligent upgrading. The following hypothesis is proposed:

H4: EP promotes IT by alleviating financial constraints.

The theoretical framework is shown in Fig. 1.

Methodology adopted

Data collection and sample selection

To test the proposed framework, this study utilizes a sample of 3,048 A-share manufacturing firms listed on the Shanghai and Shenzhen stock exchanges from 2010 to 2023. The time frame is chosen for several reasons. First, it covers key policy milestones in China’s transition toward green and intelligent manufacturing. These include the launch of the “Made in China 2025” initiative in 2015 and the emphasis on green transformation introduced in the 12th Five-Year Plan. Second, ESG-related data have become more accessible and standardized since 2010, allowing for greater consistency and comparability in variable measurements. Third, 2023 is the most recent year with relatively complete and reliable financial and ESG data. To ensure data quality, To ensure data quality, the sample excludes firms designated as ST or *ST, as well as those with financial leverage above 0.8. Control variables related to firms’ financial and governance characteristics are obtained from the CSMAR and CNRDS databases. Data on the use of industrial intelligent robots by listed manufacturing firms are sourced from the International Federation of Robotics (IFR). The complete dataset used for the empirical analyses is provided in the supplementary material to facilitate transparency and reproducibility.

Definition and measurement of variables

Environment performance (EP)

CNRDS database offers the ESG rating for listed firms in China which is a key measurement for evaluating ESG performance. The index consists of three parts: environmental rating, social rating and governance rating. Therefore, the environmental rating can be considered as a good factor to show the EP21. This study selects the environmental rating from ESG index from CNRDS.

Intelligent transformation (IT)

Acemoglu and Restrepo (2020) estimated the industrial robot penetration rate among the U.S71,72. firms. This method has been widely applied to measure the level of intelligent manufacturing in China at both the macro and micro levels73. Drawing on the approaches of studies Du et al. (2024)74 and Zhang et al.75 the study construct a robot penetration index at the firm level to capture firm-level exposure to industrial automation, defined as follows.

Which \(\:\frac{{PWP}_{i,f,t=2010}}{{MedianPWP}_{i,t=2010}}\:\)represents the ratio of production-line workers in firm f within manufacturing industry i in 2010 to the median ratio of production-line workers across all firms in industry i in the same year. \(\:{IR}_{i,t}\) refers to the increment of industrial robots in manufacturing industry i in year t, and \(\:{L}_{i,t=2009}\) denotes the number of employees in industry i in 2009.

Control variables

To rigorously evaluate the influence of EP on IT this study incorporates controls for macroeconomic factors and firm-specific characteristics that could affect enterprise innovation. At the macroeconomic level, industry characteristics (Industry) and temporal trends (Year) are controlled to account for their potential impacts.

Based on the existing research, to control the typical firm-level characteristics including development stage, ownership structure, capital accumulation capacity, and overall financial performance, the study includes the following variables at the enterprise level: (1) Size: Firm size, measured by the natural logarithm of total assets. (2)lnAge: Firm age, measured by the natural logarithm of years of corporate existence. (3) ROA: Total asset profit ratio, measured by net income divided by total assets, reflecting a firm’s profitability and operational efficiency, which may affect its ability and willingness to invest in intelligent technologies. (4) Leverage: it measured by the ratio of total liabilities to total assets. High leverage may limit financial flexibility. (5) TobinQ: Tobin’s Q ratio, measured by total market value divided by total asset value, reflecting market expectations of future growth and investment opportunities. (6) Growth: Total asset growth rate used to reflect a firm’s expansion capacity. (7) Top1: The shareholding ratio of the largest shareholder, measured by the number of shares held by the largest shareholder divided by the total number of shares. A higher concentration of ownership may lead to more effective corporate governance or influence strategic priorities, including investments in sustainability or smart transformation. (8) Board: Number of independent directors, measured by the natural logarithm of the number of independent directors. A well-structured board improves oversight and may promote long-term innovation strategies. (9) Duality: Duality takes a value of 1 if the chairperson and CEO roles are held by a single individual and 0 otherwise. Leadership duality may reduce internal checks and balances, potentially leading to biased or risk-averse decisions regarding long-term investments in IT and sustainability.(10)SOE: State-owned enterprises are assigned a value of 1and non-state-owned enterprises are assigned a value of 0. SOEs may respond more strongly to government policy signals or environmental regulations, affecting their transformation strategies.༈11༉HHI: The squared sum of the ratio of each firm’s total assets to the total assets of each industry. This measures industry concentration, which may influence competition intensity and innovation pressure.

Model design

The impact of EP on IT may exhibit a temporal lag, wherein the current period of IT will be influenced by its previous level. To account for this dynamic effect, the lagged term should be included in the model as an explanatory variable. In case of the issues which is caused by the lagged term of IT, the study adopts the GMM model and constructs a dynamic panel model, where IT serves as the dependent variable and EP is the core explanatory variable. Model 1 is as follows:

In the regression equation, \(\:i\) denotes the firm, and \(\:t\) denotes the year. The variable, \(\:{\varvec{I}\varvec{T}}_{\varvec{i}\varvec{t}}\) represents the IT level for company \(\:i\) in year \(\:t\), while \(\:{\varvec{I}\varvec{T}}_{\varvec{i}\varvec{t}-1}\:\) is its lagged term. \(\:{EP}_{it}\) indicates the EP of firm \(\:i\) in year \(\:t\). \(\:{Controls}_{it}\) denotes a set of control variables. The terms, \(\:{\gamma\:}_{i}\) and \(\:{\mu\:}_{t}\) capture firm-specific and time-fixed effects, respectively, while \(\:{\epsilon\:}_{it}\) is the random disturbance term, and \(\:{a}_{0}\) is the constant term. The key coefficient is \(\:{a}_{1}\), which captures the impact of EP on IT. A significantly positive \(\:{\alpha\:}_{1}\) indicates a better EP is associated with higher IT level, thereby providing empirical support for study’s theoretical framework.

In dynamic panel data models, potential endogeneity issues may lead to biased estimates when using panel OLS or fixed effects (FE) methods. To address this, the difference GMM estimator employs lagged variables as instruments to improve estimation accuracy. However, the difference GMM approach may suffer from weak instrument problems. Therefore, this study adopts the system GMM estimator, which simultaneously estimates equations in both levels and first differences. By incorporating lagged differences as instruments for the level equation and lagged levels as instruments for the differenced equation, system GMM reduces bias and enhances estimation efficiency. To ensure the validity of the instruments and the robustness of the estimation results, the Hansen test and Arellano–Bond test for autocorrelation (AR test) are employed.

In dynamic panel data models, potential endogeneity issues, including omitted variable bias, simultaneity, and particularly reverse causality between EP and IT, may lead to biased estimates when using traditional panel OLS or fixed effects (FE) methods. To address these concerns, this study adopts the system GMM estimator, which is well suited for handling dynamic relationships and internal endogeneity. Specifically, system GMM uses lagged first-differences of the variables as instruments for the level equations, and lagged levels as instruments for the differenced equations. This dual-equation approach enhances estimation efficiency while mitigating bias caused by endogeneity. The possibility of reverse causality—where firms that already exhibit higher levels of IT may invest more in environmental practices to meet regulatory or reputational demands—is a particular concern in this context. By using lagged values of EP as instruments, system GMM addresses this potential feedback effect and improves the credibility of causal inference.

To ensure the robustness of the estimation results and the validity of the instrumental variables, the Hansen test for over-identifying restrictions and the Arellano–Bond AR(2), Arellano–Bond AR(1) test for second-order autocorrelation and first-order autocorrelation in the residuals are conducted. These diagnostic checks confirm the reliability of the instruments and the appropriateness of the dynamic panel specification.

Furthermore, the study establishes a regression equation to ascertain the mediating effect of EP and IT. Based on the H2- H4, this study adopts Model 2 and Model 3 to test the mediating effect.

In this model, \(\:{Mechanism}_{it}\) encompasses three categories of mediating variables: Supplychain, Policy and SA. All other parameters are aligned with those used in the baseline regression model.

Empirical results

The impact of the explanatory variable on the dependent variable is the primary focus of the section. A descriptive analysis and regression analysis are included.

Analysis of the descriptive statistics

The descriptive statistics in Table 1 provide an overview of the main variables used in this study. The dependent variable, IT has a mean of 6.672 and a median of 7.019, with values ranging from 4.762 to 8.119. The standard deviation of 1.032 indicates moderate variation in the level of industrial robot penetration across firms. The key explanatory variable, EP, has a mean of 20.907 and a standard deviation of 20.323, with a wide range between 0 and 97.564, reflecting substantial differences in EP implementation among firms. Control variables such as firm size, return on assets, leverage, firm age, growth, Tobin’s Q, ownership concentration, board independence, CEO duality, and state ownership all show relatively low standard deviations. This suggests that the data are stable and free from significant outliers, supporting the robustness of subsequent regression analysis.

Benchmark regression results

To address potential endogeneity arising from the inclusion of the lagged dependent variable IT in the baseline regression, this study employs the system GMM estimator for Model (1). Before estimation, diagnostic tests confirm the absence of first-order autocorrelation and the presence of second-order autocorrelation, consistent with GMM assumptions. In the model, IT and its lag are treated as endogenous variables, EP as a predetermined variable, and all control variables as exogenous.

To further validate the robustness of the system GMM estimation, this study also employs both fixed effects (FE) and ordinary least squares (OLS) models. Table 2 reports the regression results across three approaches. Column (1) displays the OLS estimation without the lagged IT term, respectively, while Column (2) presents the corresponding FE estimates. Column (3) provides the result from the system GMM estimation. As shown in Column (3), the coefficient of EP on IT is 0.420 and statistically significant at the 5% level. Across all models, EP exhibits a consistently positive effect on IT. Notably, the coefficient obtained from the system GMM estimation is more than those from the OLS and FE models, and the direction of the effect remains consistent. These results collectively suggest that the system GMM estimates are more robust and reliable. Overall, the findings support the conclusion that EP positively influences firms’ IT.

Furthermore, the Arellano-Bond test results for autocorrelation show a p-value of 0.009 for AR(1) and 0.110 for AR(2), indicating the presence of first-order autocorrelation and the absence of second-order autocorrelation in the residuals, which aligns with the assumptions of the system GMM estimator. In addition, the Hansen test yields a p-value of 0.579, exceeding the conventional threshold of 0.1, thereby confirming the validity of the instrumental variables used in the model. These results provide further support for the reliability of the system GMM estimation.

Regarding the lagged term of IT, the results for the two-period lag show a significant positive effect at the 1% level. This suggests a favorable relationship between IT in the preceding two periods and the current period, indicating the inertia of innovation over time, which implies that IT increases are cumulative on an annual basis. In other words, there are driven effects of intelligent technology and knowledge among activities.

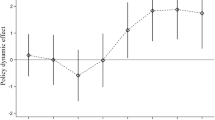

Robustness test

To ensure the scientific rigor and accuracy of the test results, the following procedures are implemented, whose results are shown in Table 3:

First, replace the explanatory variable. As the original EP indicator is result-oriented and does not adequately capture the process of green governance, this robustness test substitutes it with the logarithm of corporate green governance expenditure. Model (1) is re-estimated using this alternative measure. As shown in Column (1), the results are consistent with the main regression findings, further confirming the positive effect of EP on IT.

Then, extreme values are removed. Bilateral 1% trimming and bilateral 5% trimming are applied to the primary continuous variables in the case of outliers. Equation (1) is re-estimated via the system GMM approach. The estimation results, presented in Column (2–3), closely align with the main regression outcomes, thereby confirming the robustness of the initial findings. Overall, the comprehensive approach ensures that the conclusions drawn from the analysis are robust and reliable, effectively addressing potential concerns related to extreme values, bias in data selection, and variations in EP evaluation criteria.

Mediating effect analysis

To identify the channels through which EP affects IT, this study examines the significance of the regression coefficient of EP in Eq. (2) and the mechanism variables in Eq. (3). The underlying theoretical framework is elaborated in the research section. The statistical significance of these core variables provides empirical support for the transmission pathways of EP’s influence on IT across different market environment in Table 4.

Product market

To examine the mediating role of the product market, this study introduces Supplychain as the mediating variable. The logarithmic transformation of firms’ inventory turnover ratio is used as a proxy variable to measure the level of supply chain linkage, denoted as Supplychain. A higher value of this indicator suggests more frequent interactions between the firm and its upstream and downstream partners in the supply chain. In the first-stage regression, the coefficient of EP on the supply chain variable is significantly positive, indicating that firms with better EP tend to maintain stable supply chain relationship. In the second stage, Supplychain also exhibits a significant positive effect on IT, confirming its role as a mediating channel.

These results confirm the presence of a mediating effect, suggesting that EP promotes IT in manufacturing firms partly by improving their position in the product market through stronger supply chain relationships. Firms with high environmental standards are more likely to earn trust and collaboration from upstream and downstream partners, which in turn facilitates IT and technological upgrading in the manufacturing sector.

Institutional environment

To examine the mediating role of the institutional environment, this study introduces the Policy variable as a mediator. This study uses the natural logarithm of the annual amount of government subsidies received by a firm as a proxy for institutional policy support, denoted as Policy. This variable reflects the extent of government involvement in and support for the firm’s operations and strategic transformation.

The first-stage regression results show that EP has a positive effect on the institutional environment variable, with a coefficient of 0.001 at the 5% significance level. In the second stage, Policy is positively associated with IT, yielding a coefficient of 1.014, also significant at the 5% level. This suggests that i that a more favorable institutional environment substantially facilitates firms’ IT. Notably, the direct effect of EP on IT becomes statistically insignificant when Policy is included, implying the presence of a full mediating effect through institutional support.

These findings indicate that EP promotes IT in manufacturing firms indirectly through improvements in the institutional environment, thereby confirming the mediating role of institutional factors. This result also reflects the growing tendency of the government to incentivize environmentally responsible firms through policies related to digitalization and smart manufacturing, accelerating their intelligent upgrading process.

Capital market

To examine the mediating role of the capital market, this study introduces the SA index to reflect the degree of financing constraints, as a mediating variable. A higher value of SA implies stronger financing constraints faced by the firm. In the first-stage regression, EP has a significantly negative effect on SA, indicating that firms with better EP tend to experience fewer financing constraints. In the second-stage regression, SA shows a significantly negative effect on IT, suggesting that stronger financing constraints hinder firms’ IT. Meanwhile, the direct effect of EP on IT remains significant, considering the inverse nature of the SA index, this indicates an effective mediation effect, where EP promotes IT partly by alleviating capital constraints.

These findings confirm the mediating role of capital market conditions in the EP–IT relationship. Firms with stronger EP are more likely to earn investor trust and gain access to external financing, enabling them to overcome capital limitations and invest in digital technologies and smart transformation initiatives.

In summary, the basic hypotheses H2 to H4 are supported by the results. Together with the findings of H1, the hypothesis results are summarized in (Fig. 2).

Heterogeneity test

In practice, firms exhibit significant heterogeneity in EP due to differences in industry affiliation, regulatory context, and modes of technology acquisition. As China enters a critical stage of high-quality economic transformation, the institutional and policy environments that shape industrial development and corporate sustainability remain uneven. This institutional heterogeneity is primarily reflected in the following aspects:

Concern on environment

As China enters a critical phase of high-quality economic transformation, both internal environmental commitment and external regulatory pressure have become essential components of the broader societal concern for sustainable development. Firms’ responses to EP expectations are shaped not only by policy environments but also by their environmental investing, which influence their strategic orientations and resource allocation efficiency.

To capture the heterogeneity in regional governmental attention to environmental issues, the study constructs two classification indicators. Encost reflects the intensity of environmental protection expenditure at the regional level, operationalized by calculating the annual median of environmental spending across 31 provinces in mainland China. Regions with expenditures exceeding the median are assigned a value of 1, and those below are assigned 0. Similarly, Reguflag captures the salience of environmental concerns in official discourse, measured by the frequency of environmental references in provincial government work reports. An annual median threshold is applied, with values above the median coded as 1, and those below as 0. Based on these classifications, a heterogeneity analysis of environmental attention is conducted, as reported in Table 5.

Columns (1–2) present the regression results grouped by whether firms’ Encost is over the median. For firms in the area with high environmental expenditure (Encost = 1), EP shows a significantly positive impact on IT, aligning with the baseline regression. This suggests that when firms actively invest in environmental practices, their ESG efforts are more likely to support digital technology innovation, possibly through improved stakeholder communication or internal sustainability culture. In contrast, for firms in the area with low environmental expenditure (Encost = 0), the coefficient of EP is positive but statistically insignificant. This implies that environmental practices without sufficient environmental investment may fail to generate effective intelligence spillovers.

Columns (3–4) report results grouped by the level of environmental regulatory pressure. In regions with stronger environmental regulations (Reguflag = 1), EP has a significantly positive effect on IT, indicating that external policy pressure may strengthen firms’ motivation to engage in innovation-driven EP implementation. Similarly, in regions with weaker environmental regulations (Reguflag = 0), EP still exerts a significantly positive impact on IT, though with slightly reduced magnitude. This suggests that while policy context matters, firms may still voluntarily leverage EP to promote technological upgrading, especially if such practices align with profit-driven the level of intelligence.

Heterogeneity in regional marketization level

Higher marketization levels promote more efficient resource allocation, stronger property rights protection, and a competitive business environment, all of which attract innovation factors such as capital, talent, and technology. This fosters greater innovation resource agglomeration and supports technological upgrading. However, in regions with lower marketization, institutional frictions may hinder resource mobility and weaken the effectiveness of innovation policies. As a result, the impact of EP on IT may significantly across regions with different levels of market development.

To examine the heterogeneity of the effect of EP on IT under different levels of factor market development, the sample is divided into two subgroups: regions with high factor market development (Market = 1) and those with low development (Market = 0). The regression results are reported in Columns (1) and (2) of Table 6. The data on marketization level used in this study are derived from The China Marketization Index by Province: 2009 Report by Fan Gang and his colleagues. Based on the indicators and methodology provided in the report, the marketization level of each Chinese province is measured. A binary variable is then constructed using the median value as the threshold: provinces with marketization levels above the median are assigned a value of 1, and those below the median are assigned a value of 0.

In regions with higher marketization levels in Column 1, the coefficient of EP is 0.017 and statistically significant at the 10% level, suggesting that EP has a positive impact on IT under well-functioning factor markets. In contrast, in regions with lower marketization levels in Column 2, the coefficient of EP remains positive (0.017) but is not statistically significant. These results imply that the facilitating role of EP in promoting IT is more pronounced in regions where factor markets are better developed. This suggests that institutional environment characterized by more efficient resource allocation mechanisms may amplify the effectiveness of environmental governance in driving digital-intelligent upgrading.

Heterogeneity in technology acquisition

To test the heterogeneity of the impact of EP on IT under different modes of technology acquisition, the sample is divided into two groups: firms primarily engaged in independent innovation (Techway = 1) and those relying on external technologies (Techway = 0). The regression results are reported in Columns (3) and (4) of Table 6.

In the group characterized by independent innovation in Column 3, the coefficient of EP is 0.058 and statistically significant at the 1% level, suggesting a strong positive effect of IT on EP when firms invest in internal R&D and innovation capacity building. In contrast, for firms dependent on external technology in Column 4, the coefficient is negative but statistically insignificant, indicating that EP does not significantly promote IT in this context.

These results imply that the effectiveness of EP in driving intelligent upgrading is more prominent when firms pursue endogenous innovation pathways.

Conclusions and discussion

This study investigates the relationship between EP and IT based on panel data from A-share listed manufacturing firms in China from 2010 to 2023. The results indicate that EP significantly promotes IT at the firm level. This finding highlights the complementarity and synergy between environmental sustainability and digital upgrading in the manufacturing sector. This highlights the complementarity between environmental sustainability and digital upgrading in the manufacturing sector, suggesting that green development and technological progress can be mutually reinforced67. It also aligns with conclusions drawn from related studies in the tourism industry14,39.

Mechanism analysis further reveals that EP enables firms to acquire key resources required for IT from product markets, institutional environments, and capital markets. Specifically, there are three main channels. First, strong EP enhances supply chain coordination and facilitates more efficient cooperation and information sharing between upstream and downstream firms. This promotes the effective deployment of intelligent technologies across the value chain. Second, firms with outstanding EP are more likely to receive government support, which reduces institutional uncertainty during the process of technological upgrading. Third, environmental reputation improves a firm’s image in capital markets, easing financial constraints and supporting investment in capital-intensive intelligent initiatives, such as automation and industrial software. These results confirm the value of EP in enhancing firms’ resource capabilities19,31 and reconfiguring external resource networks12,18,23.

Heterogeneity analysis provides further insights. The positive impact of EP on IT is more pronounced in regions with higher levels of marketization and stricter environmental regulations. At the firm level, this effect is stronger among enterprises with greater environmental awareness and higher levels of independent innovation. In such contexts, environmental achievements are more likely to be recognized by consumers, partners, and investors. This recognition enhances firms’ reputation and commercial value, providing reasonable expectations for future technological investments7,19. Moreover, IT helps improve resource allocation efficiency and reduce environmental input4,31. This also supports the view that digital transformation depends not only on policy incentives35,76 but also on the accumulation of internal absorptive capacity24.

In summary, this study draws on the Resource-Based View to conceptualize EP as a heterogeneous strategic resource. Existing literature presents two contrasting perspectives on their relationship: one considers EP and IT as independent dimensions20,23 while the other acknowledges their interdependence which is supported by this study. Additionally, prior research emphasizes EP as an external reputational signal under signaling theory13 whereas this study addresses certain limitations by framing EP within the Resource-Based View as a heterogeneous strategic resource. EP reflects firms’ ability to integrate resources and acquire critical assets, thereby improving adaptability and facilitating digital transformation64. This perspective also contributes to addressing the limitation of the traditional Resource-Based View, which tends to prioritize tangible assets while overlooking the strategic importance of institutional and reputational resources. By conceptualizing EP as a source of dynamic capabilities, this study extends the theoretical applicability of the RBV to environments characterized by rapid technological change and policy-driven transformation43. Accordingly, EP should be positioned not merely as an external reputational signal, but as a strategic resource essential to supporting firms’ transformation and upgrading.

While this study focuses on the Chinese manufacturing sector, the mechanisms identified may also apply to other capital- and energy-intensive industries, such as construction, transportation, where EP and digital upgrading are closely intertwined. Future research could test whether similar EP–IT relationships hold across different sectors, institutional contexts, and international markets, thereby further assessing the generalizability of these findings.

Based on the empirical findings, this study proposes the following policy recommendations to support the coordinated advancement of EP and IT in the manufacturing sector:

Firstly, regulatory enforcement and incentive mechanisms should be jointly enhanced. The empirical results indicate that EP significantly promotes firms’ IT. It suggests that strong EP functions as a strategic enabler, facilitating firms’ resource integration, access to key assets, and advancement in IT. Therefore, policymakers should enforce environmental standards while expanding the coverage of positive incentive tools, such as green subsidies, tax breaks, and preferential green credit, especially for firms with strong EP. Combining strict regulation with market-based incentives can encourage firms to align environmental objectives with technological upgrading. This helps promote both green development and high-quality industrial growth.

Secondly, regional and sectoral heterogeneity should be fully considered in policy design. This study reveals regional and sectoral heterogeneity in the effect of EP on IT. The positive impact is more significant in regions with higher marketization and stronger digital bases. This finding suggests that policy design should account for regional and sectoral differences. A stratified and differentiated policy framework is needed. In developed regions, policies should focus on enhancing market-based mechanisms to support innovation and technological upgrading. In less-developed areas, particularly in western China, governments should increase investment in digital infrastructure and green capabilities to address existing resource and capacity gaps.

Thirdly, the strategic value of EP should be further emphasized to cultivate firms’ endogenous momentum toward IT. Empirical evidence shows that EP enhances firms’ capacity to integrate internal and external resources and to secure critical assets, thereby significantly advancing IT. Accordingly, policy interventions should aim to transform EP into a sustained internal driver of innovation and technological upgrading. This can be achieved through institutional and market-based mechanisms. For instance, governments may establish targeted funds to support green–intelligent upgrading, provide subsidies for technical capacity building, or implement pilot programs that incentivize digital adoption among environmentally leading firms. In parallel, financial institutions and capital markets should improve access to low-cost financing and offer risk-mitigation instruments to facilitate intelligent upgrading in firms with strong environmental records.

Theoretically, this study extends the Resource-Based View by framing EP as an external reputational signal under signaling theory and strategic resource that underpins firms’ dynamic capabilities. This perspective highlights EP’s dual role in supporting both organizational signaling and internal capability development. Practically, the findings indicate that policymakers should strengthen regulatory enforcement alongside incentive mechanisms. Policy design should account for regional and sectoral heterogeneity. Differentiated support is needed for digital infrastructure development, green capacity enhancement, and the application of market-based mechanisms. Despite providing valuable insights, this study has limitations. The sample is restricted to listed manufacturing firms, which may limit the generalizability of the findings to small- and medium-sized enterprises (SMEs) or non-listed firms. Future research could explore whether the mechanisms identified in this study apply across different industries, firm sizes, and regional contexts, especially under varying levels of marketization and environmental regulation. Such research would strengthen both the theoretical robustness and the practical relevance of the EP–IT relationship.

Data availability

Due to not being accessed for free, data is provided within the manuscript and supplementary files. The corresponding author Sun Jiamin (zhiyeniu1224@163.com) could be contacted in case of any queries or requirement of data.

References

Lucke, D., Constantinescu, C. & Westkämper, E. Smart Factory - A step towards the next generation of manufacturing. in Manufacturing Systems and Technologies for the New Frontier (eds Mitsuishi, M., Ueda, K. & Kimura, F.) 115–118 https://doi.org/10.1007/978-1-84800-267-8_23. ((Springer, 2008).

Guo, Y. & Zheng, G. How do firms upgrade capabilities for systemic catch-up in the open innovation context? A multiple-case study of three leading home appliance companies in China. Technol. Forecast. Soc. Change. 144, 36–48 (2019).

Liu, J. & Meng, Z. Innovation model analysis of new energy vehicles: taking toyota, Tesla and BYD as an example. Procedia Eng. 174, 965–972 (2017).

Shan, S., Wen, X., Wei, Y., Wang, Z. & Chen, Y. Intelligent manufacturing in industry 4.0: A case study of Sany heavy industry. Syst. Res. Behav. Sci. 37, 679–690 (2020).

Cho, C. H., Guidry, R. P., Hageman, A. M. & Patten, D. M. Do actions speak louder than words? An empirical investigation of corporate environmental reputation. Acc. Organ. Soc. 37, 14–25 (2012).

Khanifah, K., Udin, U., Hadi, N. & Alfiana, F. Firm value: testing the role of firm reputation in emerging countries. Int. J. Energy Econ. Policy. 10, 96–103 (2020).

Russo, M. V., Fouts, P. A., A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 40, 534–559 (1997).

Kassinis, G. & Vafeas, N. Stakeholder pressures and environmental performance. Acad. Manage. J. 49, 145–159 (2006).

Rashid, A., Rasheed, R. & Altay, N. Greening manufacturing: the role of institutional pressure and collaboration in operational performance. J. Manuf. Technol. Manag. 36, 455–478 (2025).

Walker, M. & Mercado, H. The Resource-worthiness of environmental responsibility: A Resource‐based perspective. Corp. Soc. Responsib. Environ. Manag. 22, 208–221 (2015).

Danso, A., Adomako, S., Lartey, T., Amankwah-Amoah, J. & Owusu-Yirenkyi, D. Stakeholder integration, environmental sustainability orientation and financial performance. J. Bus. Res. 119, 652–662 (2020).

Yigitcanlar, T. et al. Artificial intelligence and the local government: A five-decade scientometric analysis on the evolution, state-of-the-art, and emerging trends. Cities 152, 105151 (2024).

De Miguel, M. Impact of environmental performance and policy on firm environmental reputation. Manag Decis. 59, 190–204 (2020).

Hossain, M. M., Wang, L. & Yu, J. The reputational costs of corporate environmental underperformance: evidence from China. Bus. Strategy Environ. 33, 930–948 (2024).

Hu, W., Wall, G. E. & Management Environmental image and the competitive tourist attraction. J. Sustain. Tour. 13, 617–635 (2005).

Luo, H. & Qu, X. Impact of environmental CSR on firm’s environmental performance, mediating role of corporate image and pro-environmental behavior. Curr. Psychol. 42, 32255–32269 (2023).

Ali, A., Ma, L., Shahzad, M., Musonda, J. & Hussain, S. How various stakeholder pressure influences mega-project sustainable performance through corporate social responsibility and green competitive advantage. Environ. Sci. Pollut Res. 31, 67244–67258 (2023).

Tyler, B. B. et al. Environmental practice adoption in smes: the effects of firm proactive orientation and regulatory pressure. J. Small Bus. Manag. 62, 2211–2246 (2024).

Xie, J., Abbass, K. & Li, D. Advancing eco-excellence: integrating stakeholders’ pressures, environmental awareness, and ethics for green innovation and performance. J. Environ. Manage. 352, 120027 (2024).

Zhang, W., Luo, Q. & Liu, S. Is government regulation a push for corporate environmental performance? Evidence from China. Econ. Anal. Policy. 74, 105–121 (2022).

Nagiah, G. R. Mohd suki, N. Linking environmental sustainability, social sustainability, corporate reputation and the business performance of energy companies: insights from an emerging market. Int. J. Energy Sect. Manag. 18, 1905–1922 (2024).

Velte, P. Environmental performance, carbon performance and earnings management: empirical evidence for the European capital market. Corp. Soc. Responsib. Environ. Manag. 28, 42–53 (2021).

Wang, Q. J., Wang, H. J. & Chang, C. P. Environmental performance, green finance and green innovation: what’s the long-run relationships among variables? Energy Econ. 110, 106004 (2022).

Jacobs, B. W., Singhal, V. R. & Subramanian, R. An empirical investigation of environmental performance and the market value of the firm. J. Oper. Manag. 28, 430–441 (2010).

Kraus, S., Rehman, S. U. & García, F. J. S. Corporate social responsibility and environmental performance: the mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Change. 160, 120262 (2020).

Liang, Z., Zhang, Q., Wu, W. & Liu, X. The synergistic effect of corporate environmental responsibility and technological base on firm performance: from the perspective of knowledge recombination. Corp. Soc. Responsib. Environ. Manag. 31, 4384–4397 (2024).

Azeem, A., Naseem, M. A., Ali, R. & Ali, S. How does environmental performance contribute to firm financial performance in a Multi-country study?? Mediating role of competitive advantage and moderating role of voluntary environmental initiatives. J. Knowl. Econ. 16, 7688–7721 (2024).

Nguyen, T. H. H., Elmagrhi, M. H., Ntim, C. G. & Wu, Y. Environmental performance, sustainability, governance and financial performance: evidence from heavily polluting industries in China. Bus. Strategy Environ. 30, 2313–2331 (2021).

Cai, L., Cui, J. & Jo, H. Corporate environmental responsibility and firm risk. J. Bus. Ethics. 139, 563–594 (2016).

Gangi, F., Daniele, L. M. & Varrone, N. How do corporate environmental policy and corporate reputation affect risk-adjusted financial performance? Bus. Strategy Environ. 29, 1975–1991 (2020).

Xue, B., Zhang, Z. & Li, P. Corporate environmental performance, environmental management and firm risk. Bus. Strategy Environ. 29, 1074–1096 (2020).

Yu, Y., Zhang, J. Z., Cao, Y. & Kazancoglu, Y. Intelligent transformation of the manufacturing industry for industry 4.0: seizing financial benefits from supply chain relationship capital through enterprise green management. Technol. Forecast. Soc. Change. 172, 120999 (2021).

Eboigbe, E. O., Farayola, O. A. & Olatoye, F. O. Obiageli Chinwe nnabugwu, & Chibuike daraojimba. BUSINESS INTELLIGENCE TRANSFORMATION THROUGH AI AND DATA ANALYTICS. Eng. Sci. Technol. J. 4, 285–307 (2023).

Qu, F., Tang, Q., Li, C. M. & Liu, J. Exploring the impact of digital transformation on productivity: the role of artificial intelligence technology, green technology, and energy technology. Technol. Econ. Dev. Econ. 0, 1–32 (2025).

Li, H., Yang, Z., Jin, C. & Wang, J. How an industrial internet platform empowers the digital transformation of smes: theoretical mechanism and business model. J. Knowl. Manag. 27, 105–120 (2023).

Zhang, W., Li, H., Wang, S. & Zhang, T. Impact of digital infrastructure inputs on industrial carbon emission intensity: evidence from china’s manufacturing panel data. Environ. Sci. Pollut Res. 30, 65296–65313 (2023).

Ding, Q., He, W. & Deng, Y. Can tax reduction incentive policy promote corporate digital and intelligent transformation? Int. Rev. Financ Anal. 99, 103932 (2025).

Tian, Y., Mao, K., Yang, J. & Pan, L. Coordination mechanism of financial subsidies and tax incentives for intelligent transformation of manufacturing enterprises in China. Eng. Constr. Archit. Manag. https://doi.org/10.1108/ECAM-10-2024-1351 (2025).

Yu, F., Wang, L. & Li, X. The effects of government subsidies on new energy vehicle enterprises: the moderating role of intelligent transformation. Energy Policy. 141, 111463 (2020).

Li, Z., Zhu, J. & Wang, S. Environmental regulation, intelligent manufacturing and corporate investment & financing: evidence from industrial robot investment. Pac. -Basin Finance J. 87, 102477 (2024).

Qin, Z., Lu, Q. & Yao, Z. The impact of R&D investment and policy support on intelligent manufacturing level: Based on the fsQCA method. Math. Probl. Eng. 4265155 (2023).

Kwilinski, A., Lyulyov, O. & Pimonenko, T. Unlocking sustainable value through digital transformation: an examination of ESG performance. Information 14, 444 (2023).

Wang, J. Digital transformation, environmental regulation and enterprises’ ESG performance: evidence from China. Corp. Soc. Responsib. Environ. Manag.. 32, 1567–1582 (2025).

Zhang, M. & Huang, Z. The impact of digital transformation on ESG performance: the role of supply chain resilience. Sustainability 16, 7621 (2024).

Chuang, S. P. & Huang, S. J. The effect of environmental corporate social responsibility on environmental performance and business competitiveness: the mediation of green information technology capital. J. Bus. Ethics. 150, 991–1009 (2018).

Morales-Raya, M. & Martín-Tapia, I. Ortiz-de-Mandojana, N. To be or to seem: the role of environmental practices in corporate environmental reputation. Organ. Environ. 32, 309–330 (2019).

Wernerfelt, B. A resource-based view of the firm. Strateg Manag J. 5, 171–180 (1984).

Walls, J. L., Berrone, P. & Phan, P. H. Corporate governance and environmental performance: is there really a link? Strateg Manag J. 33, 885–913 (2012).

Klassen, R. D. Exploring the linkage between investment in manufacturing and environmental technologies. Int. J. Oper. Prod. Manag. 20, 127–147 (2000).

Sabherwal, R. et al. How does strategic alignment affect firm performance?? The roles of information technology investment and environmental uncertainty. MIS Q. 43, 453–474 (2019).

Wen, H., Lee, C. C. & Song, Z. Digitalization and environment: how does ICT affect enterprise environmental performance? Environ. Sci. Pollut Res. 28, 54826–54841 (2021).

Li, D., Zhao, Y., Sun, Y. & Yin, D. Corporate environmental performance, environmental information disclosure, and financial performance: evidence from China. Hum. Ecol. Risk Assess. Int. J. 23, 323–339 (2017).

Ameer, F. & Khan, N. R. Green entrepreneurial orientation and corporate environmental performance: A systematic literature review. Eur. Manag J. 41, 755–778 (2023).

Wang, L. & Shao, J. Digital economy, entrepreneurship and energy efficiency. Energy 269, 126801 (2023).

Wang, Z. & Liu, H. Can intelligent transformation enhance corporate green innovation performance? Finance Res. Lett. 81, 107426 (2025).

Chiarini, A. Industry 4.0 technologies in the manufacturing sector: are we sure they are all relevant for environmental performance? Bus. Strategy Environ. 30, 3194–3207 (2021).

Fosso Wamba, S., Queiroz, M. M. & Trinchera, L. The role of artificial intelligence-enabled dynamic capability on environmental performance: the mediation effect of a data-driven culture in France and the USA. Int. J. Prod. Econ. 268, 109131 (2024).

Khan, S. A. R., Yu, Z. & Farooq, K. Green capabilities, green purchasing, and triple bottom line performance: leading toward environmental sustainability. Bus. Strategy Environ. 32, 2022–2034 (2023).

Soedjatmiko, S., Tjahjadi, B. & Soewarno, N. Do environmental performance and environmental management have a direct effect on firm value?? J. Asian Finance Econ. Bus. 8, 687–696 (2021).

Donaldson, T. & Preston, L. E. The stakeholder theory of the corporation: concepts, evidence, and implications. Acad. Manage. Rev. 20, 65 (1995).

Özparlak, G. & Gürol, B. The role of diversity on the environmental performance and transparency. Environ. Dev. Sustain. 27, 483–507 (2023).

Wei, S., Liu, H., Xu, W. & Chen, X. The impact of supply chain digitalization on supply chain performance: a moderated mediation model. Inf. Technol. Manag. https://doi.org/10.1007/s10799-024-00431-4 (2024).

Baah, C. et al. Examining the correlations between stakeholder pressures, green production practices, firm reputation, environmental and financial performance: evidence from manufacturing SMEs. Sustain. Prod. Consum. 27, 100–114 (2021).

Shahzad, M. F., Xu, S., An, X., Asif, M. & Haider Jafri, M. A. Effect of stakeholder pressure on environmental performance: do virtual CSR, green credit, environmental and social reputation matter? J. Environ. Manage. 368, 122223 (2024).

Wang, H., Rispens, S. & Demerouti, E. Boosting firm environmental performance: the roles of top management team functional diversity, environmental disclosures, and government subsidy. Group. Organ. Manag. 10596011241257029 https://doi.org/10.1177/10596011241257029 (2024).

Wu, R. & Lin, B. Environmental regulation and its influence on energy-environmental performance: evidence on the Porter hypothesis from china’s iron and steel industry. Resour. Conserv. Recycl. 176, 105954 (2022).

Wei, L., Liu, Z., Cao, P. & Zhang, H. Environmental subsidies and green innovation: the role of environmental regulation and chief executive officer green background. Clean. Technol. Environ. Policy. 27, 389–402 (2025).

Siswanti, I., Riyadh, H. A., Cahaya, Y. F., Prowanta, E. & Beshr, B. A. H. Unlocking sustainability: exploring the nexus of green banking, digital transformation, and financial performance with foreign ownership moderation. Discov Sustain. 5, 379 (2024).

Shvarts, E., Pakhalov, A., Knizhnikov, A. & Ametistova, L. Environmental rating of oil and gas companies in russia: how assessment affects environmental transparency and performance. Bus. Strategy Environ. 27, 1023–1038 (2018).

Zhang, D. How environmental performance affects firms’ access to credit: evidence from EU countries. J. Clean. Prod. 315, 128294 (2021).

Acemoglu, D. & Restrepo, P. The race between man and machine: implications of technology for growth, factor shares, and employment. Am. Econ. Rev. 108, 1488–1542 (2018).

Acemoglu, D. & Restrepo, P. Robots and jobs: evidence from US labor markets. J. Polit Econ. 128, 2188–2244 (2020).

Yu, L., Wang, Y., Wei, X. & Zeng, C. Towards low-carbon development: the role of industrial robots in decarbonization in Chinese cities. J. Environ. Manag. 330, 117216 (2023).

Du, J., He, J., Yang, J. & Chen, X. How industrial robots affect labor income share in task model: evidence from Chinese A-share listed companies. Technol. Forecast. Soc. Change. 208, 123655 (2024).

Zhang, L., Gan, T. & Fan, J. Do industrial robots affect the labour market? Evidence from China. Econ. Transit. Institutional Change. 31, 787–817 (2023).

Wu, Y., Ivashkovskaya, I., Besstremyannaya, G. & Liu, C. Unlocking green innovation potential amidst digital transformation Challenges—The evidence from ESG transformation in China. Sustainability 17, 309 (2025).

Acknowledgements

Authors sincerely thank the China Scholarship Council (CSC) for funding this research.

Author information

Authors and Affiliations

Contributions

ZQ was responsible for writing funding proposals or securing the funds for the study. SJ wrote the first draft of the manuscript and worked for the manuscript’s revision, final version and analysis of the data. RL and QY handled the data collection. The datasets generated during the current study are available in the CSMAR and CNRDS databases repository, (https://data.csmar.com/https://www.cnrds.com/Home/Login).

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Qingjie, Z., Jiamin, S., Lijun, R. et al. Impact of environmental performance on intelligent transformation in Chinese manufacturing enterprises. Sci Rep 15, 33337 (2025). https://doi.org/10.1038/s41598-025-17897-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41598-025-17897-z