Abstract

The integration of Renewable Energy Sources (RESs) into modern power grids is critical for reducing carbon emissions and enhancing energy sustainability. However, the intermittent nature of RESs poses challenges to grid reliability and operational efficiency. This study addresses these challenges by proposing a novel approach to optimize the reliable efficiency index (REI), a key performance metric for grid operations. Through the deployment of Energy Storage Systems (ESS) and leveraging advanced optimization techniques, this research explores the combined effects of RES and ESS on grid reliability, profitability, and environmental impact. The epsilon-constrained method was employed to optimize system operations, incorporating uncertainty in RES outputs and market conditions. Results from simulations on the IEEE 33-bus distribution system demonstrate significant improvements in REI, system availability, and profitability after incorporating RESs and ESSs. Additionally, hidden revenues, including reduced carbon emissions and fuel savings, were quantified, highlighting the economic and environmental benefits. The integration of Renewable Energy Sources (RESs) into modern power grids is critical for reducing carbon emissions and enhancing energy sustainability. Results from simulations on the IEEE 33-bus distribution system demonstrate significant improvements, including a 171% increase in the reliable efficiency index (REI), a 38% rise in profitability, and a reduction in carbon emissions and fuel costs. These findings highlight the economic and environmental viability of the proposed approach.

Similar content being viewed by others

Introduction

The ever-growing global demand for energy, coupled with the imperative need to mitigate environmental concerns, has driven a significant paradigm shift in the power generation landscape. The establishment of a sustainable and robust energy infrastructure has been markedly shaped by the inclusion of renewable energy sources (RESs) such as solar and wind, in conjunction with the assimilation of energy storage systems (ESSs). These factors play a crucial role in the advancement of a durable energy framework. As we navigate through the complexities of integrating these technologies into existing power systems, it becomes apparent that a holistic approach is indispensable. This paper endeavors to address the pressing challenges of enhancing both reliability and profitability in presence of renewable energies.

The motivation behind this research stems from the realization that the intermittent nature of RESs poses a unique set of challenges to the conventional power grid. These challenges, ranging from variability in power generation to the inherent unpredictability of renewable resources, demand innovative solutions that extend beyond traditional power system design. Additionally, the inclusion of ESSs introduces a dynamic element that holds great promise in addressing the intermittency issues and optimizing the utilization of renewable energy.

Furthermore, as the energy landscape undergoes this transformative shift, there is an inherent need to strike a balance between the reliability and the economic viability. The interplay between reliability and profitability is a complex dynamic that requires a comprehensive understanding and strategic integration of various elements within the power system.

This paper aims to contribute to the existing body of knowledge by presenting a holistic approach that considers the synergistic interactions between RESs, ESSs, and the power grid. Through a thorough exploration of system reliability enhancement strategies and economic considerations, we seek to provide valuable insights that can guide decision-makers, policymakers, and researchers in navigating the complexities of modern energy systems.

Literature review

A number of studies have discussed the multifaceted domain of energy systems, emphasizing the intersection of profitability, reliability, and sustainability. Zhou et al.1 explore the profitability of fast-charging stations in the context of vehicle-to-grid (V2G) technology. Their data-driven framework, integrating analytics, optimization, and behavioral theory, addresses the challenges posed by the uncertainty in electric vehicle (EV) charging behavior. The study’s findings underscore the potential for monthly bill curtailment of 20–30% under a coordinated charging scheme, fostering efficient and profitable V2G operations. Shabani et al.2 focus on lithium-ion battery storage and scheduling strategy. These strategies, tailored for residential grid-connected applications, seek to maximize both profitability and longevity. Notably, the study highlights the intricate balance required to achieve impressive profit, a short payback period, and a commendable lifespan. The findings emphasize the importance of optimizing charging/discharging actions to ensure sustained profitability while considering degradation costs. Alsirhani et al.3 present new methods for forecasting the stability of power systems using the machine learning techniques. The study addresses the essential need to evaluate and predict stability of power systems, considering factors such as the incorporation of green energy and the involvement of consumers and producers. The proposed MLP-ELM approach outperforms traditional machine learning techniques, achieving high accuracy and demonstrating its potential for assessing smart grid stability under varying conditions. Agajie and Fanuel4 contribute to the reliability improvement of distribution systems within smart grids, focusing on distributed generation. The study employs a smart grid system environment to enhance reliability, incorporating sectional switches and distributed generation sources. The proposed solution optimally isolates failures, resulting in improved reliability indices. This research highlights the shift towards smart methods for reliability improvement in distribution systems. Janhunen, Vimpari, and Junnila5 investigate the benefit of a heat-pump pool. The study evaluates the economic and environmental implications of demand response (DR) in the electricity markets. Despite minor benefits in the current market, the study emphasizes the potential importance of prosumers consumption control in the energy landscape. Taherian et al.6 delve into profit maximization for an electricity retailer in a smart grid environment, focusing on DR programs. The proposed model utilizes analytic hierarchy process and deep learning algorithms to learn customer behavior and formulate a profit maximization problem for the retailer. The results showcase the effectiveness of the approach in improving the profitability of the retailer. A comprehensive analysis of the reliability implications arising from the integration of ESS with smart grid technologies is presented by Ayesha, Numan, Baig, and Yousif7. The research addresses the growing challenge of maintaining equilibrium in power systems, attributed to the intermittent characteristics of RESs. The study delves into the potential of ESS, in conjunction with technologies like dynamic thermal rating, optimal transmission switching, and demand response, to augment both the flexibility and reliability of the grid. The examination underscores the importance of effectively coordinating ESS with these technologies and briefly explores the significance of incorporating cyber layer modeling to ensure reliability and security.

The integration of RESs in smart grids has raised many challenges due to the inherent uncertainty in their production. Azimi Nasab et al.8 address this challenge by proposing a coordinated control strategy for electric vehicles (EVs) and distributed energy resources (DER) systems. The study employs the CPLEX solver to plan the flexibility of EV charging and discharging in coordination with wind and solar production, aiming to compensate for the uncertainty in these RES. The optimization considers different scenarios related to loading, wind, and solar production, with a focus on minimizing the operating cost of the microgrid. Results indicate a reduction in costs through optimal planning for EVs, making the approach not only effective in handling uncertainties but also economically viable for the microgrid operator. In the context of ESSs in smart grids, Rezaeimozafar et al.9 provide a comprehensive review of ESSs. The work explores the increasing installed capacity of ESSs, emphasizing their role in optimizing energy management for both system operators and end-users. The review delves into associated technologies, billing/pricing policies, and optimization solutions for energy management problems. This reference offered valuable insights into the potential capabilities of ESSs and identifying research areas for future studies. Lamnatou et al.10 exptend the discussion to smart systems and intelligent devices concerning photovoltaic (PV) system, storages, and structures. The research underscores the pivotal role of intelligent utilities, emphasizing the advancement of buildings configuration. Additionally, the research explores the evolution of building sectors, concentrating on aspects like net-zero building, indoor quality. The authors pinpoint challenges such as residential microgeneration and the imperative for active user involvement, underscoring the need to strike a balance between sustainability and profitability.

Contributing to the existing body of knowledge, Ahmad et al.11 undertake a study on probabilistic techniques tailored for intelligent systems and networks. This study addresses energy consumption and price forecasting, consumer lifetime value, and cybersecurity concerns.

The work underscores the urgency of research in data-driven ML techniques to optimize decision-making in energy distribution operations. In scrutinizing smart grids and EV integration, Mohanty et al.12 delve into DR, exposing novel strategies and navigating challenges in modeling and optimization. Beyond the ordinary, their review unveils the dynamic interplay between EVs and the grid, spotlighting the transformative power of cutting-edge vehicle-to-grid (V2G) infrastructures. The article comprehensively addresses issues and challenges in EV-DR programs, providing insights into modeling charging infrastructure and optimizing EV-DR operations.

The evolution of smart grid technology is explored through a series of comprehensive reviews in recent literature. Ben Slama13 focuses on the Prosumer concept within smart grids, examining the role of intelligent edge computing and Artificial Intelligence (AI) scheduling techniques. The integration of IoT technology is highlighted as critical for the digitization of power grids, enhancing real-time data analysis and decision-making. The study delves into edge computing solutions, emphasizing the importance of information technologies and AI scheduling techniques in facilitating energy sharing among prosumers. Saini et al.14 conduct a thorough examination of short-term wind speed forecasting models for smart grid applications, emphasizing learning-based approaches. Evaluating 41 models with data from Jodhpur, India, the study considers diverse features and highlights varying model performance, suggesting insights for energy storage planning, market strategies, and reliability. Tiwari and Pindoriya15 shift focus to automated DR in smart distribution grids, proposing an ICT-driven framework and optimization models for efficient program implementation. Pandiyan et al.16 broaden the perspective, exploring technological advancements for smart energy management in smart cities, categorizing them into smart grids, buildings, and transportation. Elsir et al.17 contribute a novel day-ahead operation scheduling strategy for demand response and hybrid ESSs in smart grids, integrating cleaner energy sources. Chen et al.18 delve into profitability optimization of virtual power plants with residential and industrial microgrids, proposing an adaptive scheduling mechanism. Jayachandran et al.19 provide insights into operational concerns and solutions in smart electricity distribution systems, reviewing issues and discussing emerging technologies. Allehyani et al.20 explore the demand response scheme for EV charging in smart power systems with 100% renewable energy, emphasizing its role in grid performance and sustainability. The study addresses various EV charging options and assesses the impact of uncoordinated charging on the distribution grid. The study provides a comprehensive overview of DR schemes, smart charging, and the challenges associated with widespread EV adoption. These references contribute to a deeper understanding of diverse aspects within the domain of smart grids, ranging from Prosumer integration and wind speed forecasting to automated demand response, energy management in smart cities, novel scheduling strategies, operational concerns, and demand response for electric vehicle charging. The reviews collectively underscore the significance of technological advancements, data analytics, and optimization techniques in enhancing the efficiency, reliability, and sustainability of smart grids.

The recent surge in research on smart grids has led to an extensive body of literature examining various aspects of these intelligent energy systems. Khare and Chaturvedi21 thoroughly analyze microgrids, emphasizing the intricate balance between control and reliability. Their focus on fine-tuned strategies to optimize operations, integrate RESs and ESSs, and explore innovative trends like artificial intelligence, data analysis, and blockchain sets their assessment apart, showcasing tangible enhancements in reliability and resilience through numerical results. In a different realm of smart grid research, Moafi et al.22 delve into cooperative game theory for optimal profit allocation among DERs. Their three-level intelligent structure utilizes particle swarm optimization (PSO) and fuzzy logic algorithms for optimizing DER power, achieving fairness between participants, and maximizing coalition profits. The study demonstrates the feasibility of engaging a large number of buyers and producers, presenting a novel approach for effective collaboration among electricity manufacturers. Moving towards residential applications, Ghazimirsaeid et al.23 perform the optimal energy management for multiple grid-connected green buildings. The study addresses the challenges of controlling DERs and consumers in a home microgrid, presenting an energy management system based on multi-agent systems. The proposed model enhances overall energy efficiency, profitability of individual buildings, and optimal device management, encouraging demand response programs and reducing market clearing prices. Fotopoulou et al.24 contribute to the field by assessing the operation of smart grids under emergency situations, utilizing innovative optimization algorithms and artificial neural networks. Their study evaluates the impact of emergencies on smart grid autonomy and sustainability, considering disruptions to RESs and ESSs. The proposed algorithm prioritizes RESs and demonstrates varying reductions in autonomy and increased curtailments based on the nature of emergencies. Shamsini Ghiasvand et al.25 present a distributed energy procurement model for retailers in smart grids, emphasizing the collaboration among multiple retailers. The proposed model uses a Mayfly optimization algorithm to determine the best energy exchange prices between retailers, demonstrating increased total profits in the presence of ESSs. Addressing the economic perspective, Alaqeel and Suryanarayanan26 conduct a thorough economic evaluation concerning the implementation of state-of-the-art technologies within an electrical infrastructure. Their work provides a comprehensive economical approach, assessing the feasibility and profitability of various smart grid technologies. De Kinderen et al.27 examine existing valuation methods for smart grid initiatives, identifying gaps and deficiencies in addressing key concerns. In the context of enhanced solutions for smart grids, Douiri Leila et al.28 explore the potential of leveraging blockchain technology. Their article emphasizes the urgent need for a transparent, secure, and scalable framework for smart grid management, and blockchain emerges as a promising solution with features such as a distributed ledger, immutability, consensus, security, and automation. In summary, recent literature on smart grids spans a wide range of topics, including microgrid optimization, cooperative game theory for DER collaboration, multi-agent systems for residential energy management, emergency response strategies, distributed energy procurement, economic assessments, valuation methods, and the integration of blockchain technology.

Recent studies have explored various aspects of renewable energy integration and grid management under uncertainty. In29, a data-driven framework is proposed to address the vulnerabilities in renewable energy networks caused by false data injection attacks, emphasizing the importance of robust decision-making in energy market participation under uncertain condition. In30, a robust multi-objective joint scheduling framework for integrated electricity and gas grids, incorporating flexible loads and renewable energy uncertainty is developed to achieve sustainable operations while balancing costs and robustness. Additionally, In31, the multi-stage expansion of renewable resources and storage systems in distribution networks is investigated, employing a risk-averse scenario-based approach to reduce costs and environmental impact while addressing the challenges posed by responsive loads and high-rate energy consumers.

Research gap

The existing body of literature reveals several notable limitations in prior research efforts. Firstly, although numerous studies have extensively examined the impacts of RESs on microgrids’ cost and profit, there remains a gap in research addressing their effects on hidden revenues associated with smart grids. These hidden revenues encompass aspects such as the non-generation of environmental emissions and the non-payment of fuel cost resulting from RESs utilization.

Secondly, while previous studies have introduced different indexes for smart microgrids, a noticeable deficiency exists in the availability of a model capable of demonstrating the microgrid efficiency based on its reliability and availability. This gap highlights the need for a comprehensive modeling for assessing the microgrid efficiency with respect to its reliability and availability.

To address these identified research gaps, this paper undertakes a techno-economic study driven by the development of a novel efficiency index. The primary objective is to optimize the microgrid energy management while considering all aforementioned limitations.

Contributions

This study presents an innovative efficiency metric designed to optimize the profitability, accessibility, and reliability of power grids. The computation of the total system profit takes into consideration feed-in tariffs for all power plants, along with a thorough analysis of costs linked to carbon emissions, revenue generated from the absence of carbon production, and savings on fuel costs resulting from the integration of renewable energies.

The epsilon-constrained method is proposed as an effective means to optimize smart grid operation, with a specific focus on elevating a reliability-based index and overall profitability. The application of this method is demonstrated using the IEEE standard 33-bus radial distribution system, with results compared across scenarios both prior to and following the integration of renewable power plants, considering various uncertainties.

The key contributions of this paper include:

-

Defining a new Reliable Efficiency Index (REI).

-

Examination of potential revenue streams resulting from the absence of carbon emissions and the reduction of fuel cost by the utilization of RESs.

-

In-depth analysis of smart grid availability and reliability, incorporating RESs and ESSs across diverse scenarios.

Therefore, this study not only introduces the Reliable Efficiency Index (REI) but also presents a comprehensive optimization framework addressing both economic and environmental objectives. The inclusion of hidden revenues from reduced carbon emissions and fuel savings provides actionable insights for policymakers and grid operators.

Table 1 shows the comparison of current study with selected references from literature review.

Problem formulation

Clarification of parameters, cost, and revenue

Maximum active power value is observed in a purely resistive state, where active power remains resistive. The computation of active power loss is expressed in Eq. (1)32.

Ik represents the current and Rk denotes the resistance of the line.

The computation of reactive power loss is established using Eq. (2)32.

Xk denotes the impedance of the line. The calculation of energy not supplied is expressed in Eq. (3)32.

Ikp represents the peak load line current, λk signifies the failure rate, Vrated represents the system’s rated voltage, α represents load factor, and d represents repair duration. System reliability is contingent on the ENS and system load, and it could be calculated using Eq. (4)32.

\(P_{D}\) represents the system load.

This study determines overall smart grid cost through the utilization of Eq. (5).

where \(C_{ENS}\), \(C_{Loss}\), \(C_{Generation}^{{Fossil\;units}}\), and \(C_{Carbon}^{Fossil \, units}\) signify the expenses related to energy unavailability, energy loss, conventional power plants’ generation, and emission costs, respectively. The determination of the ENS cost is formulated using Eq. (6)32.

ci signifies the value of ENS in i-kh line.

Computation of costs attributed to power loss can be performed using Eq. (7)32.

Here, cl denotes the uniform cost applicable to all lines, while β represents the line’s loss factor, and Ik and Rk stand for the current and resistance of line k, respectively. The determination of the value for β follows a specific process.

In this context, α symbolizes the load factor.

The computation of the cost associated with fossil power plant generations can be carried out through the following method.

In this equation, where a, b, and c are coefficients, and \(P_{fossil}\) represents the power generation from the fossil power plants.

The determination of the penalty cost related to carbon production from fossil power plant is conducted through the following calculation.

where \(P_{g}^{{{Fossil\;units}}}\), \(FIT_{{{per\;ton}}}^{Carbon}\), and \(E_{{{per\;MW}}}^{Carbon}\) are represent the power generations of fossil units, the feed-in tariff for carbon emissions cost per ton of carbon production and the quantity of emissions per kilowatt-hour of energy production.

This study computes the overall revenue of the system through the utilization of Eq. (11).

In this equation, \(HR_{{{Carbon\;saving}}}^{{{{Renewable}}}}\) and \(HR_{{{Fuel\;saving}}}^{{{{Renewable}}}}\) denote the concealed revenue resulting from the non-production of carbon emissions from RESs and the concealed revenue from fuel savings due to the non-utilization of fossil fuels, respectively. \(R_{Solar}\), \(R_{{{{Wind}}}}\), and \(R_{{{{Hydro}}}}\) represent the revenues generated from the sale of power from the solar system, wind turbine, and pumped-storage hydropower, respectively. Lastly, \(R_{{{{Fossil}}}}\) stands for the revenue generated from the sale of power from fossil power plants.

The computation of the concealed revenue arising from the non-production of carbon emissions from RESs is determined using Eq. (12).

In this equation, PSolar, PWind, and PHydro denote the power generations of the solar system, wind turbine, and pumped-storage hydropower, respectively.

The concealed revenue from fuel savings resulting from the non-utilization of fossil fuels and the adoption of RESs can be determined using Eq. (13).

where \(FC_{{{{fuel}}}}^{{{fossil\;units}}}\) is the fuel cost of fossil units.

The computation of the revenue generated from the sale of power generation from the solar system is conducted using Eq. (14).

In this equation, \(FIT_{Solar}\) represents the feed-in tariff for the solar power price per kilowatt-hour of solar power generation.

The income from selling the power produced from the wind turbine can be computed using Eq. (15).

In this equation, \(FIT_{{{{Wind}}}}\) signifies the feed-in tariff associated with the wind energy price per kilowatt-hour of wind energy production.

The calculation of revenue derived from marketing the energy produced by pumped-storage hydropower is specified by Eq. (16).

\(FIT_{{{{Hydro}}}}\) denotes the feed-in tariff for the hydropower price per kilowatt-hour of hydropower generation. The computation of revenue from selling the power generation from fossil power plants is determined using Eq. (17).

\(FIT_{{{{Fossil}}}}\) represents the feed-in tariff for the fossil unit power price per kilowatt-hour of fossil unit power generation.

The overall profit of the system is determined through the application of Eq. (18).

The reliable efficiency index (REI)

This study presents a novel reliable efficiency index (REI), defined as follows.

where \(P_{{{{Solar}}_{{{U}}} }}\) and \(P_{{{{wind}}_{{{U}}} }}\) denote the active power generation of solar and wind resources with uncertainty, respectively. \(P_{{{{D}}_{{{U}}} }}\) represents the total load with uncertainty.

ESS operation constraints

The constraints for both charging and discharging of the ESS are outlined in Eqs. (20) and (21), respectively.

where \(CH_{t}^{ESS}\) and \(DCH_{t}^{ESS}\) represent the charge and discharge of the ESS at hour t. \(CH^{\max }\) and \(DCH^{\max }\) denote the maximum charge and discharge capacities of the ESS.

The state of charge constraint for the ESS is as follows:

In this equation, \(SoC_{t}\) represents the state-of-charge of the ESS at hour t. \(E_{ESS}^{\max }\) is the maximum total charging energy of the ESS at hour t. \(\eta_{CH}^{ESS}\) and \(\eta_{DCH}^{ESS}\) denote the charge and discharge efficiency of the ESS, respectively.

Modeling the load uncertainty

The utilization of the AutoRegressive Integrated Moving Average (ARIMA) model for scenario generation, rooted in a time series model33, distinguishes this study’s approach. Through the integration of this framework with scenario reduction approaches like the K-Means method, the anticipation of forthcoming data based on historical records of stochastic variables is streamlined. The ARIMA model unfolds through three consecutive phases: system modeling, parameter prognosis, and performance assessment. In this study, the focal point lies in the collaboration between the ARIMA model and the K-Means scenario reduction technique for modeling load uncertainty. The overarching structure of the ARIMA model, identified as ARIMA(p, d, q), is encapsulated in Eq. (23).

In this equation, \(Z_{t}\) and \(a_{t}\) represent the time series and random error at time t, respectively. The parameters p, q, and d denote the orders of autoregressive, moving average, and differencing. c is a constant, \(\phi_{p} {(}B{)} = 1 - \sum\nolimits_{i = 1}^{p} {\phi_{i} B^{i}},\) \(\theta_{q} {(}B{)} = 1 - \sum\nolimits_{j = 1}^{q} {\theta_{j} B^{j} \, }\), and B represents the periodicity operator expressed as \(B^{i} y_{t} = y_{t - i}\). \(\phi_{i}\) and \(\theta_{j}\) are the autoregressive and moving average parameters, respectively.

Methodology

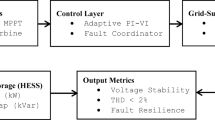

Figure 1 illustrates the step-by-step methodology framework employed in this study. The flowchart begins with the data input, including system parameters and renewable resource data. Following this, the uncertainty modeling technique integrates the ARIMA model with the K-Means clustering method for scenario reduction. The next step, model development, involves defining the REI and formulating cost/revenue equations. Subsequently, the optimization method applies epsilon-constrained optimization for optimal scheduling of resources. The simulation phase compares system performance before and after the integration of RESs and ESSs. Finally, the results section highlights improvements in system availability, reliability, REI, and quantifies hidden revenues from reduced emissions and fuel cost savings.

Case study

The analyzed system comprises conventional units located at nodes 3 and 22, each with a 2 MW capacity. Additionally, there is a 1 MW solar installation, paired with a 2 ESS featuring a 90% efficiency, positioned at node 4. Furthermore, a 1 MW wind turbine is placed at node 10, and a hydropower power system with a 1 MW capacity and a reservoir of 0.5 MW capacity is positioned at node 20.

The configuration of the system is depicted in Fig. 2.

The system parameters utilized are chosen in accordance with the specifications outlined in reference34, and are detailed in Table 2.

The wind speed and solar irradiance data are sourced from Milwaukee city35. Hourly data spanning a complete year, encompassing an average of 365 days with 24 h per day, is at our disposal. The Monte Carlo method tactically leverages a subset of these 365 days in random computations, enhancing computational efficiency. Variability is observed in wind speeds and solar radiations across all nodes.

Table 3 furnishes details on specific parameters of wind turbine. Likewise, Table 4 delineates parameters of solar array.

Table 5 provides the parameters associated with the charging/discharging/SoC of the storage.

Table 6 delineates the feed-in tariff values encompassing the cost per ton of carbon production, the price per kWh for solar energy production, the price per kWh for wind energy production, the price per kWh for hydropower production, and the price per kWh for conventional units’ energy production. The feed-in tariff information for various generations is extracted from references26,37,38.

In Table 7, you’ll find details on the carbon emission levels from conventional units per kWh of energy production, along with information on fuel costs and cost function for 2 conventional units, each sharing identical fuel costs.

Figure 3 illustrates average annual solar irradiance.

The average annual solar irradiance for Milwaukee city35.

Figure 4 visually depicts the average yearly wind velocity at each hour throughout the day.

The ARIMA model parameters are precisely defined as p = 1, q = 1, and d = 1. Figure 5 graphically portrays the system load, skillfully modeled by intertwining the ARIMA scenario generation model with the K-Means scenario reduction method.

Numerical results

Table 8 provides a detailed overview of the location and capacity of the fossil fuel and renewable power plants39.

Figures 6, 7, 8, 9 and 10 offer a comprehensive overview of the system’s performance and the interplay of Fig. 6 shows the power generation profiles of the two conventional fossil fuel power plants over a 24-h period. The operation adapts dynamically to fluctuations in energy demand and renewable energy production. During off-peak hours, the fossil plants operate at minimal levels, conserving fuel and reducing emissions. As demand increases, particularly during peak hours (18:00–22:00), the plants ramp up their output to compensate for the reduced generation from renewable energy sources. This figure highlights the crucial role of conventional units in maintaining grid stability, especially during times of reduced renewable energy availability or heightened demand.

Figure 7 illustrates the solar power system’s daily generation profile, which follows a diurnal pattern corresponding to sunlight availability. Solar energy generation begins around sunrise, peaks at noon when sunlight intensity is highest, and tapers off toward sunset. This figure underscores the intermittent nature of solar energy and the importance of integrating storage systems to manage excess generation during midday and provide energy during non-sunny periods. The clear peak at midday emphasizes the potential for solar energy to contribute significantly to meeting daytime electricity demand.

Figure 8 reveals the power output of the wind turbine across a 24-h period, showing its variability due to fluctuating wind speeds. The wind turbine complements the solar PV system by often generating power at times when solar energy is unavailable, such as during the evening or early morning hours. The figure demonstrates the dynamic nature of wind energy production, with some hours showing high generation due to favorable wind conditions and others with minimal or no generation. This variability highlights the need for balancing mechanisms, such as ESS or hydropower, to stabilize the grid.

Figure 9 presents the charging and discharging patterns of the Energy Storage System (ESS) throughout the day. The ESS charges during periods of low demand and high renewable energy generation, such as midday when solar output is at its peak. During peak demand hours (18:00–22:00), the ESS discharges to reduce reliance on fossil fuel generation, flattening the load curve and supporting grid reliability. This figure demonstrates the critical role of ESS in mitigating the variability of renewable energy sources and ensuring a more stable and efficient energy system.

Figure 10 visualizes the energy output of the hydropower plant, which combines a constant base output of 1 MW with flexible generation from a 0.5 MW reservoir. The reservoir allows the hydropower plant to adjust its output to meet peak demand, providing a valuable buffer for the variability of renewable energy sources. During off-peak periods, the plant operates steadily at 1 MW, while the reservoir is used strategically to enhance generation during high-demand hours. This figure emphasizes the role of hydropower as both a renewable energy source and a storage solution, crucial for balancing the grid.

Table 9 provides a comparison of various system indicators before and after the incorporation of RESs, including solar systems, wind turbines, and pumped-storage hydropower. Furthermore, Table 10 outlines the expenditures, income, and the system’s net profit.

The outputs from the solar and wind renewable generation, functioning as backup capacities, exhibits a degree of uncertainty. It is noteworthy that the peak production from the PV system occurs at hour 12, while the wind turbine attains its maximum production at hour 14.

According to Table 10, the integration of RESs leads to improvements in the system’s availability, reliability, and REI. Furthermore, there is a reduction in daily active losses within the system. Consequently, the inclusion of RESs as backup capacities plays a pivotal role in augmenting both the availability and reliability of the overall smart grid infrastructure.

As indicated in Table 10, concealed revenue, encompassing benefits from reduced carbon emissions and the avoidance of fuel costs through utilization of RES, exert a substantial influence on augmenting the overall profitability of the system.

The REI increased from 24.69 to 66.88 after the integration of RESs, demonstrating a 171% improvement. System availability increased from 0.13 to 0.33, while reliability improved from 0.41 to 0.42. Financial welfare was significantly enhanced, with hidden revenues from reduced carbon emissions ($112,622 per day) and fuel cost savings ($69,248 per day) driving a 38% increase in net profit. These findings underscore the practical benefits of the proposed model for improving grid operations and achieving sustainable energy goals.

The proposed approach demonstrates significant improvements in REI, system availability, and profitability compared to similar methods in the literature. For example,10 reported reliability improvements of 40–50% through ESS and RES integration, while our model achieved a 171% REI increase, reflecting a more robust grid design. Our model incorporates hidden revenues from reduced emissions and fuel savings, broadening its scope and utility.

To evaluate the robustness of the proposed approach, a sensitivity analysis was conducted on key parameters affecting the REI and system profitability. Table 11 presents the impact of variations in renewable energy penetration, energy storage efficiency, carbon emission cost, and load variability. The results highlight the critical role of renewable energy integration and energy storage systems in improving REI and profitability, while also emphasizing the importance of accurate forecasting and carbon cost policies. These findings provide a deeper understanding of the proposed model’s performance under different operational scenarios.

Conclusion

This paper introduces an innovative REI model meticulously refined to amplify the effectiveness, accessibility, and reliability of intelligent grids. The core inquiry delves into the intricate dynamics of how RESs and ESSs shape the dependability, efficiency, and both explicit and concealed financial gains of smart grids. This study comprehensively explores the impact of RESs on hidden revenues within smart grids, particularly emphasizing the nuanced considerations of reduced carbon emissions and the elimination of fuel costs resulting from RES utilization. The proposed REI model, coupled with an in-depth evaluation of concealed revenues derived from RESs, holds relevance across a spectrum of smart grid scenarios, albeit with limitations tied to arrangement and and accessibility of generations aligning with smart grid needs. Addressing the unpredictability in load, this approach combines the ARIMA model with the K-Means scenario reduction technique. This paper goes beyond by meticulously factoring in feed-in tariffs for all power plants, computing the cost of carbon emissions, and scrutinizing hidden revenue stemming from the integration of renewable energy. Furthermore, this investigation extends into probing the influence of ESSs on smart grids. This study demonstrates significant improvements in grid reliability, efficiency, and profitability through the integration of RESs and ESSs, with the REI increasing by 171%, system availability improving by 154%, and hidden revenues from reduced emissions and fuel savings exceeding $1.28 million per day. Despite these promising results, the study assumes ideal market conditions, fixed RES locations, and excludes long-term ESS degradation effects. The proposed model can be scaled for larger systems with higher DG penetration by incorporating additional distributed generator types, such as waste-to-energy plants and tidal power. Future work should address these limitations by incorporating regulatory and market constraints, optimizing RES and ESS placement, considering battery degradation, and expanding to include additional renewable sources and demand-side management strategies, enabling a more scalable and robust approach for modern power systems. Future work will validate the model on larger systems to assess its robustness and adaptability under high-penetration scenarios.

Data availability

Upon reasonable request, the corresponding author will make the datasets used in this study available.

Abbreviations

- \(PL\) :

-

Active power loss (MW)

- \(QL\) :

-

Reactive power loss (MVAR)

- \(I_{k}\) :

-

Current of k-th line (A)

- \(R_{k}\) :

-

Resistance of k-th line (Ohm)

- \(N_{br}\) :

-

Total number of branches

- \(X_{k}\) :

-

Reactance of k-th line (Ohm)

- V reff :

-

Reference voltage of the system (kV)

- \(ENS\) :

-

Energy not supplied (kWh)

- R :

-

Reliability of the system

- I kp :

-

Peak load branch current (A)

- \({\lambda }_{{{k}}}\) :

-

Failure rate of k-th line (Failures/year)

- V rated :

-

Rated voltage of system (kV)

- \(\alpha\) :

-

Load factor

- d k :

-

Repair duration of k-th line (hours)

- \(C_{Generation}^{{{Fossil\;units}}}\) :

-

Cost of fossil power plants generations ($)

- \(C_{Carbon}^{{{{Fossil\;unit}}s}}\) :

-

Penalty cost of carbon production from fossil power plants ($/ton)

- \(Cost_{total}\) :

-

Total cost of the system ($)

- \(P_{fossil}\) :

-

Generation power of fossil power plant (MW)

- \(P_{g}^{{{Fossil\;units}}}\) :

-

Power generations of fossil units (MW)

- \(FIT_{{{per\;ton}}}^{Carbon}\) :

-

Feed-in tariff of carbon emissions cost per ton of carbon production ($/ton)

- \(E_{{{per\;kW}}}^{Carbon}\) :

-

Amount of carbon emission per kilowatt-hour of power generation (kg/kWh)

- C k :

-

Cost of line k of the main feeder ($)

- \(C_{ENS}\) :

-

Cost of energy not supplied ($)

- \(C_{Loss}\) :

-

Cost of energy losses ($)

- β :

-

Loss factor

- P Solar :

-

Power generation of solar system (MW)

- P Wind :

-

Power generation of wind turbine (MW)

- P Hydro :

-

Power generation of pumped-storage hydropower (MW)

- \({{Revenue}}_{{{{total}}}}\) :

-

Total revenue of the system ($)

- \(HR_{{{Carbon\;saving}}}^{{{{Renewable}}}}\) :

-

Hidden revenue of non-production of carbon from renewable energy resources ($)

- \(HR_{{{Fuel\;saving}}}^{{{{Renewable}}}}\) :

-

Hidden revenue of fuel saving from non-use of fossil fuels ($)

- \(R_{Solar}\) :

-

Revenue from the sale of the power generation of the solar system ($)

- \(R_{{{{Wind}}}}\) :

-

Revenue from the sale of the power generation of the wind turbine ($)

- \(R_{{{{Hydro}}}}\) :

-

Revenue from the sale of the power generation of the pumped-storage hydropower ($)

- \(R_{{{{Fossil}}}}\) :

-

Revenue from the sale of the power generation of the fossil power plants ($)

- \(FC_{{{{fuel}}}}^{{{fossil\;units}}}\) :

-

Fuel cost of fossil units ($)

- \(FIT_{Solar}\) :

-

Feed-in tariff of solar power price ($)

- \(FIT_{{{{Wind}}}}\) :

-

Feed-in tariff of wind power price ($)

- \(FIT_{{{{Hydro}}}}\) :

-

Feed-in tariff of hydropower price ($)

- \(FIT_{{{{Fossil}}}}\) :

-

Feed-in tariff of fossil unit power price ($)

- \({{Profit}}_{total}\) :

-

Total profit of the system ($)

- \(P_{{{\text{wind}}_{{\text{U}}} }}\) :

-

Power generation of wind turbine with uncertainty (MW)

- \(P_{{{\text{solar}}_{{\text{U}}} }}\) :

-

Power generation of solar system with uncertainty (MW)

- \(P_{{{{D}}_{{{U}}} }}\) :

-

Total load with uncertainty (MW)

- \({{P}}_{{{w}}}\) :

-

Output power generation of wind turbine (MW)

- \({{v}}_{{{cut{\text{-}}in}}}\) :

-

Cut-in speed of wind turbine (m/s)

- \({{v}}_{{{cut{\text{-}}out}}}\) :

-

Cut-out speed of wind turbine (m/s)

- \({{v}}_{{{N}}}\) :

-

Nominal speed of wind turbine (m/s)

- \({{v}}_{{{w}}}\) :

-

Wind speed (m/s)

- \({{P}}_{{{{rated}}}}\) :

-

Rated output power of wind turbine (MW)

- \(A\) :

-

Swept area of rotor (m2)

- \(\rho\) :

-

Density of air (kg/m3)

- \(C_{p}\) :

-

Power coefficient

- \(P_{pv}\) :

-

Maximum output power of photovoltaic array (W)

- \(N_{S}\) :

-

Number of series modules

- \(N_{P}\) :

-

Number of parallel modules

- \(P_{md}\) :

-

Maximum power generated by photovoltaic module (W)

- \(V_{oc}\) :

-

Open circuit voltage (V)

- \(I_{sc}\) :

-

Short circuit current (A)

- \(FF\) :

-

Fill factor of photovoltaic module

- \(G_{N}\) :

-

Rated solar radiation on photovoltaic module (W/m2)

- \(G_{a}\) :

-

Actual solar radiation on photovoltaic module (W/m2)

- \(T_{N}\) :

-

Rated temperature of photovoltaic module (°C)

- \(T_{a}\) :

-

Actual temperature of photovoltaic module (°C)

- \(V_{Noc}\) :

-

Rated open circuit voltage of photovoltaic module (V)

- \(I_{Nsc}\) :

-

Rated short circuit current of photovoltaic module (A)

- \(R_{s}\) :

-

Series resistance of photovoltaic module (Ohm)

- \(T\) :

-

Photovoltaic module temperature (°C)

- \(K\) :

-

Boltzmann constant (J/K)

- \(q\) :

-

Elementary charge (C)

- \(f(S_{Wind} )\) :

-

Probability density function of Weibull distribution for wind speed

- \({\beta }_{w}\) :

-

Shape parameter of Weibull distribution for wind speed

- \({\eta }_{w}\) :

-

Scale parameter of Weibull distribution for wind speed

- \(S_{Wind}\) :

-

Weibull distribution function of wind speed

- \(F(S_{Wind} )\) :

-

Cumulative distribution function of Weibull distribution for wind speed

- \(f(I_{Solar} )\) :

-

Probability density function of Beta distribution for solar radiation

- \(I_{Solar}\) :

-

Beta distribution function of solar radiation

- \(F(I_{Solar} )\) :

-

Cumulative distribution function of Beta distribution for solar radiation

- \({\beta }_{s}\) :

-

Shape parameter of Beta distribution for solar radiation

- \(\alpha_{s}\) :

-

Scale parameter of Beta distribution for solar radiation

- \(\phi_{i}\) :

-

Autoregressive parameter of ARIMA model

- \(\theta_{j}\) :

-

Moving average parameter of ARIMA model

- \(d_{eu}\) :

-

Euclidean distance

- q :

-

Cluster quality

- \(S_{p}\) :

-

A set of population members are dominated by p

- \(n_{p}\) :

-

The number of times that member p is dominated by others

- \(I_{i}^{k}\) :

-

Current of bus i at k-th iteration (A)

- \({{J}}_{i}^{k}\) :

-

Current of line i at k-th iteration (A)

- \(V_{i}^{k}\) :

-

Voltage of bus i at k-th iteration (V)

- \({{iter}}\) :

-

Iteration

- \(iter_{\max }\) :

-

Maximum iteration

- \(r_{i}\) :

-

A random number with a uniform distribution between 0 and 1 is specific to the crow i

- \(fl^{i,iter}\) :

-

The flight length of the crow i at iteration iter

- \(fl_{\max }\) :

-

Maximum flight length

- \(fl_{\min }\) :

-

Minimum flight length

- \(AP^{j,iter}\) :

-

Awareness probability of crow j at iteration iter

- \(AP_{\max }\) :

-

Maximum awareness probability

- \(AP_{\min }\) :

-

Minimum awareness probability

- \(N\) :

-

The number of crows

- \(x^{i,iter}\) :

-

The position of crow i at iteration iter

- \(m^{i,iter}\) :

-

The memory of crow i at iteration iter

- \(CH^{\max }\) :

-

Maximum charge of ESS (MWh)

- \(DCH^{\max }\) :

-

Maximum discharge of ESS (MWh)

- \(\eta_{CH}^{ESS}\) :

-

Charge efficiency of ESS (%)

- \(\eta_{DCH}^{ESS}\) :

-

Discharge efficiency of ESS (%)

- \(E_{ESS}^{\max }\) :

-

Capacity of ESS (MWh)

- \(CH_{t,w}^{ESS}\) :

-

ESS charge at hour t (MWh)

- \(DCH_{t,w}^{ESS}\) :

-

ESS discharge at hour t (MWh)

- \(SoC_{t,w}^{ESS}\) :

-

State-of-charge of ESS at hour t (MWh)

References

Zhou, G., Zhao, Y., Lai, C. S. & Jia, Y. A profitability assessment of fast-charging stations under vehicle-to-grid smart charging operation. J. Clean. Prod. 20(428), 139014 (2023).

Shabani, M., Shabani, M., Wallin, F., Dahlquist, E. & Yan, J. Smart and optimization-based operation scheduling strategies for maximizing battery profitability and longevity in grid-connected application. Energy Convers. Manag. X 1(21), 100519 (2024).

Alsirhani, A. et al. A novel approach to predicting the stability of the smart grid utilizing MLP-ELM technique. Alex. Eng. J. 1(74), 495–508 (2023).

Agajie, T. F. & Fanuel, M. Reliability improvement of distribution using distributed generation in smart grid: A case study. In Active Electrical Distribution Network 305–326 (Academic Press, 2022).

Janhunen, E., Vimpari, J. & Junnila, S. Evaluation of the financial benefits of a ground-source heat pump pool with demand side management: Is smart profitable for real estate?. Sustain. Cities Soc. 1(78), 103604 (2022).

Taherian, H., Aghaebrahimi, M. R. & Baringo, L. Profit maximization for an electricity retailer using a novel customers’ behavior leaning in a smart grid environment. Energy Rep. 1(8), 908–915 (2022).

Numan, M., Baig, M. F. & Yousif, M. Reliability evaluation of energy storage systems combined with other grid flexibility options: A review. J. Energy Storage 1(63), 107022 (2023).

Nasab, M. A. et al. Uncertainty compensation with coordinated control of EVs and DER systems in smart grids. Sol. Energy 1(263), 111920 (2023).

Rezaeimozafar, M., Monaghan, R. F., Barrett, E. & Duffy, M. A review of behind-the-meter energy storage systems in smart grids. Renew. Sustain. Energy Rev. 1(164), 112573 (2022).

Lamnatou, C., Chemisana, D. & Cristofari, C. Smart grids and smart technologies in relation to photovoltaics, storage systems, buildings and the environment. Renew. Energy 1(185), 1376–1391 (2022).

Ahmad, T., Madonski, R., Zhang, D., Huang, C. & Mujeeb, A. Data-driven probabilistic machine learning in sustainable smart energy/smart energy systems: Key developments, challenges, and future research opportunities in the context of smart grid paradigm. Renew. Sustain. Energy Rev. 1(160), 112128 (2022).

Mohanty, S. et al. Demand side management of electric vehicles in smart grids: A survey on strategies, challenges, modelling, modeling, and optimization. Energy Rep. 1(8), 12466–12490 (2022).

Slama, S. B. Prosumer in smart grids based on intelligent edge computing: A review on Artificial Intelligence Scheduling Techniques. Ain Shams Eng. J. 13(1), 101504 (2022).

Saini, V. K., Kumar, R., Al-Sumaiti, A. S., Sujil, A. & Heydarian-Forushani, E. Learning based short term wind speed forecasting models for smart grid applications: An extensive review and case study. Electr. Power Syst. Res. 1(222), 109502 (2023).

Tiwari, A. & Pindoriya, N. M. Automated demand response in smart distribution grid: a review on metering Infrastructure, communication technology and optimization models. Electr. Power Syst. Res. 1(206), 107835 (2022).

Pandiyan, P. et al. Technological advancements toward smart energy management in smart cities. Energy Rep. 1(10), 648–677 (2023).

Elsir, M., Al-Sumaiti, A. S. & El Moursi, M. S. Towards energy transition: A novel day-ahead operation scheduling strategy for demand response and hybrid energy storage systems in smart grid. Energy 5, 130623 (2024).

Chen, Y., Li, Z., Samson, S. Y., Liu, B. & Chen, X. A profitability optimization approach of virtual power plants comprised of residential and industrial microgrids for demand-side ancillary services. Sustain. Energy Grids Netw. 28, 101289 (2024).

Jayachandran, M. et al. Operational concerns and solutions in smart electricity distribution systems. Utilities Policy 1(74), 101329 (2022).

Allehyani, A., Ajabnoor, A. & Alharbi, M. Demand response scheme for electric vehicles charging in smart power systems with 100% of renewable energy. In Power Systems Operation with 100% Renewable Energy Sources 247–268 (2024).

Khare, V. & Chaturvedi, P. Design, control, reliability, economic and energy management of microgrid: A review. e-Prime-Adv. Electr. Eng. Electron. Energy 5, 100239 (2023).

Moafi, M. et al. Optimal coalition formation and maximum profit allocation for distributed energy resources in smart grids based on cooperative game theory. Int. J. Electr. Power Energy Syst. 1(144), 108492 (2023).

Ghazimirsaeid, S. S. et al. Multi-agent-based energy management of multiple grid-connected green buildings. J. Build. Eng. 1(74), 106866 (2023).

Fotopoulou, M., Rakopoulos, D., Petridis, S. & Drosatos, P. Assessment of smart grid operation under emergency situations. Energy 15(287), 129661 (2024).

de Kinderen, S., Kaczmarek-Heß, M., Ma, Q. & Razo-Zapata, I. S. Model-based valuation of smart grid initiatives: Foundations, open issues, requirements, and a research outlook. Data Knowl. Eng. 1(141), 102052 (2022).

Ghiasvand, F. S., Afshar, K. & Bigdeli, N. Multi-retailer energy procurement in smart grid environment with the presence of renewable energy resources and energy storage system. J. Energy Storage 25(55), 105585 (2022).

Alaqeel, T. A. & Suryanarayanan, S. A comprehensive cost-benefit analysis of the penetration of Smart Grid technologies in the Saudi Arabian electricity infrastructure. Utilities Policy 1(60), 100933 (2019).

Leila, D., Ouchani, S., Kordoghli, S., Fethi, Z. & Karim, B. Energy management, control, and operations in smart grids: Leveraging blockchain technology for enhanced solutions. Procedia Comput. Sci. 1(224), 306–313 (2023).

Sabzevari, K. et al. Energy market trading in green microgrids under information vulnerability of renewable energies: A data-driven approach. Energy Rep. 11, 4467–4484 (2024).

Tabar, V. S., Jirdehi, M. A. & Jordehi, A. R. A robust multi-objective joint scheduling of integrated electricity and gas grids considering high penetration of wind and solar units and flexible loads towards achieving a sustainable operation. Int. J. Hydrog. Energy 48, 4613–4630 (2023).

Tabar, V. S. et al. Stochastic multi-stage multi-objective expansion of renewable resources and electrical energy storage units in distribution systems considering crypto-currency miners and responsive loads. Renew. Energy 198, 1131–1147 (2022).

Bohre, A. K., Agnihotri, G. & Dubey, M. Optimal sizing and sitting of DG with load models using soft computing techniques in practical distribution system. IET Gener. Transm. Distrib. 10(11), 2606–2621 (2016).

Pannakkong, W., Pham, V.-H. & Huynh, V.-N. A novel hybridization of ARIMA, ANN, and K-means for time series forecasting. Int. J. Knowl. Syst. Sci. 8(4), 30–53 (2017).

Kayal, P. & Chanda, C. Placement of wind and solar based DGs in distribution system for power loss minimization and voltage stability improvement. Int. J. Electr. Power Energy Syst. 53, 795–809 (2013).

Weather history download Milwaukee. meteoblue. [Online]. https://www.meteoblue.com/en/weather/archive/export/milwaukee_united-states-of-america_5263045. Accessed 03 Apr 2019.

Aien, M., Ramezani, R. & Ghavami, S. M. Probabilistic load flow considering wind generation uncertainty. Eng. Technol. Appl. Sci. Res. 1(5), 126–132 (2011).

Feed-in tariff (FIT) rates, Ofgem (2020). https://www.ofgem.gov.uk/environmental-programmes/fit/fit-tariff-rates. Accessed 25 Aug 2020.

Legal sources on renewable energy—Feed-in tariff. (2019). http://www.res-legal.eu/search-by-country/macedonia/single/s/res-e/t/promotion/aid/feed-in-tariff-12/lastp/486/. Accessed 25 Aug 2020.

Afzali, P., Anjom Shoa, N., Rashidinejad, M. & Bakhshai, A. Techno-economic study driven based on available efficiency index for optimal operation of a smart grid in the presence of energy storage system. J. Energy Storage 32, 101853 (2020).

Author information

Authors and Affiliations

Contributions

H. Alizadeh: Investigation, Visualization, Writing– Original Draft Preparation A. Khajehzadeh: Conceptualization, Reviewing and editing original draft, Formal Analysis M. Eslami: Supervision, Software, Data curation, Resources, Validation, Formal Analysis, Software, Project administration, funding acquisition M. Jafari Shahbazzadeh: Reviewing and editing original draft, Formal Analysis.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Alizadeh, H., Khajehzadeh, A., Eslami, M. et al. A holistic approach to enhance reliability and profitability through reliable efficiency index optimization and renewable energy integration. Sci Rep 15, 11853 (2025). https://doi.org/10.1038/s41598-025-96142-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41598-025-96142-z