Abstract

As a popular non-market strategy, corporate political activity (CPA) benefits a firm’s risk management and competitive advantage. However, the mechanism of promoting firms to engage in corporate political activity remains obscure. Based on the behavioral theory of the firm, this research develops a mediation model containing organization slack, entrepreneurial orientation, and corporate political activity to investigate the prediction effect of different types of slack, as well as the mediation effect of different dimensions of entrepreneurial orientation. Based on the multiple informant data from 303 firms in China, this research conducted ordinary least-squares estimation with SPSS and post hoc analysis with PROCESS. The results support the main and key hypotheses. First, entrepreneurial orientation plays a mediation effect between slack and corporate political activity. Second, financial slack provides stronger support to develop certain capabilities than operational slack. Third, two sub-dimensions of entrepreneurial orientation play heterogeneous mediation effects according to their different emphasis. Managerial attitude also mediates the effect of entrepreneurial behavior effect toward CPA. This research enriches the antecedent research of CPA, deepens our understanding of the CPA engagement mechanism, and extends the behavioral theory of the firm.

Similar content being viewed by others

Introduction

Corporate political activity (CPA) drew considerable attention in recent years for its benefit in understanding the environment (Lawton et al., 2013), managing external environmental risk (Abdurakhmonov et al., 2022; Eesley and Lenox, 2006; Choi et al., 2021; Schuler et al., 2019), and facilitating favorable policy (Brown et al., 2022; Sun et al., 2012; Liedong et al., 2020) and building strategic advantage (Hadani et al., 2017a; Yan et al., 2018; Shirodkar et al., 2022; Kingsley et al., 2012). Evidence indicated that firms are expending ever-increasing resources to CPA (Brown et al., 2018, 2022; Hadani et al., 2017a, 2015; McDonnell and Werner, 2016), and there is no sign that this trend is likely to slow down in the future (Evers-Hillstrom et al., 2020; Brown et al., 2022).

Following this trend are massive researches on the predictors of CPA. While researchers have examined antecedents of CPA, these were often looked at from firm, industry, or broader environmental factors but with much less attention to factors internal to the firm (Brown et al., 2022). Existing studies frame the external antecedents of CPA from the political environment (Brown et al., 2020; Werner, 2017; Abdurakhmonov et al., 2022) and social environment (Hadani et al., 2019, 2018), in which the firm operates in a different level.

Some prior internal predictors research focused on the firm’s subjective elements, such as ownership structure and firm size (Hadani et al., 2015; Wöcke and Moodley, 2015), which investigated the effect of a firm’s resources on CPA engagement. However, there remain inconsistent findings related to the effect of firm resources (Lux et al., 2011). What’s more, the role of business representatives’ behavior in conducting political endeavors has been overlooked (Scherer, 2018). Despite previous calls to examine the relationship between corporate political actions and individual behavior (Hillman et al., 2004), a wider focus has been put on the macro-level of firms (Maak et al., 2016; Scherer, 2018), leading the micro-level predictors being heavily neglected. While their role is pivotal to understanding corporate political behavior. Some scholars noticed the importance of micro-level managerial factors in the CPA engagement field and found CEO characteristics (Johnson, 2019; Rudy and Johnson, 2019) and managerial discretion (Minefee et al., 2021; Nalick et al., 2023; Greiner and Lee, 2020) matters. However, the process and mechanism remain an enigma, as reflected in inconsistent arguments, limited explanatory power, and ambiguous functional mechanism.

The behavioral theory of the firm asserts that political engagement can be understood from the willingness and ability to engage in CPA (Rehbein and Schuler, 1999). Although existing research indicated that willingness and ability both matter, limited empirical evidence exists. Thus, the ignorance of the subjective willingness to engage in CPA is a prominent gap in the prior research on the antecedents of CPA, the role of business representatives’ behavior in conducting political endeavors has been overlooked (Scherer, 2018).

As the surrogate of the firm’s political ability, the firm’s resources presented numerous foci, among which organizational slack was deemed important. Investigations on the relationship between organizational slack and CPA hold opposite views: the school of positive relationship posits that firms with high levels of slack will more actively conduct CPA because they can afford to do so (Hadani et al., 2015), whereas the other schools postulate that because of low levels of slack, CPA may be the only way to rectify their resource woes (Hillman et al., 2004). However, these arguments take slack as a uni-dimensional variable, while it could be further distinguished by flexibility and scarceness (Bradley et al., 2011), thereby might generating different effects on the firms’ engagement in CPA. Extant research failed in tapping such differences and was incapable of probing their diversified effects, which might also be the reason for the inconsistent findings.

In terms of the firms’ willingness, the decision to engage in CPA is related to the firm’s orientation and the manager’s preference. As an important strategic orientation, entrepreneurial orientation (EO) not only decides the firms’ behavior tendency toward innovativeness and proactiveness (Wales, 2016), based on which firms’ need and possibility of engagement could be evaluated; but also reflects the firms’ managerial attitude toward risk (Anderson et al., 2015), which influences the managers’ decision-making process in relation to CPA engagement. In other words, investing in CPA involves great risks, and firms with a favorable managerial attitude toward risk are more likely to engage in CPA (Greiner and Lee, 2020; Den Hond et al., 2014). Unfortunately, after Hillman et al. (2004) called for more effort to study the influence of top management on the firm’s CPA, some scholars investigated the importance of managerial factors in the CPA engagement field and found CEO characteristics (Johnson, 2019; Rudy and Johnson, 2019), and managerial discretion (Minefee et al., 2021; Nalick et al., 2023; Greiner and Lee, 2020), but the research still minimally focused on the influence of the firm’s orientation and managerial attitude.

Moreover, Lux et al. (2011) indicated that antecedent variables drawn from traditional theories that explain why firms engage in CPA have limited explanatory ability (accounting for 2–4% of the variance in CPA on average), thereby verifying that the existing objective factors may not directly influence CPA. As many scholars suggested, EO may affect the firm’s decision to engage in CPA (Den Hond et al., 2014; Covin and Lumpkin, 2011), thereby implying a potential mediation mechanism between objective antecedents and CPA engagement. However, the mechanism containing objective resource ability and subjective willingness towards CPA engagement is yet to be validated theoretically and empirically.

To complement these knowledge inadequacies, we propose a conceptual model that contains the factors of the firms’ objective ability and subjective willingness to engage in CPA, and we investigate how firms’ resource foundation and willingness to engage in CPA may affect their CPA activities. In particular, we consider resource slack as the indicator of the firm’s ability to engage in CPA and specify the diversified effects of two different types of slack on the firms’ engagement in CPA. Given the importance of EO during the decision process, we also examine the mediating effect of EO in the slack–CPA path to better interpret the firms’ engagement in CPA. Unlike the widely used three-dimension paradigm (innovativeness, proactiveness, and risk-taking attitude) of EO (Brettel et al., 2015; Wales et al., 2013), we adopt a two-dimension definition (entrepreneur behavior preference and managerial attitude toward risk) from Anderson et al. (2015) for three reasons. First, the three-dimension paradigm has long suffered from the issue that the “covariation between proactiveness and innovativeness is independent of variations in risk taking” (Lomberg et al., 2017), a condition that would be complemented by our two-dimension paradigm. Second, our paradigm delineates the two key attributes—behavioral and attitudinal—of the behavior preference of entrepreneurs. Third, the firm’s orientation toward risky projects and the manager’s attitude in the decision-making process, as our research focuses, would be better aligned with the two sub-dimension paradigms.

Our research would thus add to the CPA literature in the following ways. First, our research unfolds and empirically tests the heterogeneous effect of different kinds of slack (i.e., financial slack and operational slack) due to their different scarceness and flexibility in affecting the firm’s engagement in CPA, thereby enriching the knowledge of the antecedents of CPA. Second, we probe into the black box of the decision-making process to engage in CPA by investigating how firms’ willingness and ability may function to affect the firms’ engagement in CPA, and we identify a slack–EO–CPA route to interpret such engagement, which not only calls back the advocate of more research on the role of managerial orientation on CPA, but also extend the understanding of CPA engagement mechanism. In addition, we deepen the behavioral theory of the firm by examining the mediating effect of willingness between ability and decision-making and portray the nature of the organizational decision-making behavior.

Theory foundation and hypotheses development

Behavioral theory of the firm and CPA engagement

CPA is a firm’s attempt to shape government policy to advance private ends (Hillman et al., 2004). The overall objective of political behavior is to produce public policy outcomes that are favorable for the firm’s continued economic survival and success. To accomplish their goals, firms must respond to the external political environment by organizing their resource. Whether firms decide to engage in CPA or not is closely related to the organization’s resource and strategic orientation. The behavioral theory of the firm posits that corporate strategists have limited information about the political environment and are rationally bounded in decision-making. Accordingly, Schuler and Rehbein (1997) proposed a filter model to investigate the firms’ engagement in CPA and stated that the firms’ structures, procedures, experiences, and resources mediate the relations between the firms’ external political environment and political engagement. On the basis of the filter model, a firm’s resource status is the most robust factor, because a firm’s slack resource affects its search for political solutions to environmental problems (Schuler and Rehbein, 1997; Quan et al., 2020). Specifically, slack is a cushion of resources that companies can utilize both to tackle threats (e.g. regulatory influences, Islam et al., 2021) and exploit opportunities (e.g. maintaining relationships with the government, Uddin et al., 2018). Slack resource affects the firms’ interpretation of the political environment and endows firms with the ability and confidence to pursue political goals.

Aside from slack resources, firms’ subjective preference also plays a significant role in affecting their political engagement. In particular, the standing groups, such as the top management teams or the boards of directors, and loose collections of individuals, such as Cyert and March’s dominant coalition (Argote and Greve, 2007), are responsible for much of a firm’s decision making, including the decision of engage in CPA. As a result, the strategic orientation of managers matters in CPA engagement because successful firms tend to view their external political environments as opportunity sets, within which they face choices about what objectives to pursue and how to pursue them to serve their interests (Oliver and Holzinger, 2008). EO, as a typical preference, represents the firm’s inclination toward innovative and risky projects and the attitude toward taking action. In other words, EO represents the values of the enterprise and the decision-making style of managers, and it could be a key indicator of whether firms will engage in CPA. Unfortunately, the relationship between EO and CPA received limited attention in existing research.

As mentioned above, ability and willingness are critical in CPA engagement. Existing entrepreneurship and innovation studies confirmed that slack can improve the level of EO (Hughes et al., 2015; Bradley et al., 2011). For example, Hughes et al. (2015) posited that the availability of slack resources is an enabler of EO according to resource orchestration theory. On the basis of the filter model, slack resources might induce firms to participate in political affairs, and specifically, the firms’ willingness (EO) could organize resources for the purpose of engaging in CPA.

Organizational slack and CPA

Organizational slack refers to the stock of excess resources available to an organization during a given planning cycle (Li et al., 2017; Iyer and Miller, 2008). Organizational slack has been treated as a positive antecedent of political strategy because it represents a firm’s controlled resources that could be leveraged to implement its political strategy (Hadani et al., 2015; Tan and Peng, 2003). Hadani et al. (2017b) found that the more resources firms spend on political activities, the more the value of political contacts would increase.

Organizational slack has different types, such as financial and operational slack (Chu et al., 2021) and absorbed and unabsorbed slack (Argilés-Bosch et al., 2016). We focus on financial and operational slack for their clear distinction in terms of flexibility and scarcity, which are key features related to the function of slack. Financial slack refers to the level of available liquid assets the firm possesses above what it needs for its current operations (e.g., cash on hand, Kiss et al., 2018). It is valuable, less scarce, and easier to reallocate to multiple activities (Voss et al., 2008; Chu et al., 2021). While operational slack is generally tied to a specific purpose within an organization because it derives from unused or underutilized operational resources, such as excess production capacity (Tan and Peng, 2003). Thus, operational slack is relatively difficult to reallocate to alternative uses in the near term (Chu et al., 2021). In this case, the different characteristics of these two types of slack could respond differently to external political situations (Oliver and Holzinger, 2008), and endow them with heterogeneous abilities for supporting CPA engagement activities.

In particular, because conducting CPA is costly, firms with sufficient financial slack would be more capable of investing in CPA (Quan et al., 2020). Financial slack allows a firm to engage in CPA without putting itself at high risk by increasing debt and financially overextending (Hewa Wellalage et al., 2020), which increases the tolerance of failure; moreover, only those who have financial slack are able to engage in networking activities necessary to connect with elite ties (Adomako et al., 2021). Thus, firms could gain enough exposure in the political field and engage in CPA more easily. Conversely, operational slack may not be able to provide immediate relief for a crisis when firms face environmental challenges (Tan and Peng, 2003). However, such resources could be utilized as a buffer or cushion (Huang and Chen, 2010). What’s more, it could increase the firm’s capacity to interpret valuable political information and guide the policy-making process because of its historical knowledge accumulation (Lee et al., 2021). Furthermore, well-organized operational slack smoothens daily operations and would establish a relatively stress-free organizational atmosphere that facilitates firm engagement in CPA (Lee et al., 2021).

However, relative to the support of financial slack, the effects of operational slack on CPA would be less obvious for the following reasons. Financial slack could be quickly deployed to a specific activity; therefore, the political activity could use financial slack promptly and directly. Conversely, operational slack is history and routine dependent and hard to redeploy. Thus, the support for CPA is reflected by interpreting external political information and maintaining routine activities. Therefore, the influence of operational slack on CPA will not obtain instant results, and financial slack could generate a significant effect on a supporting firm’s CPA activity. Thus, we propose the following:

H1a: Financial slack and operation slack are positively related to CPA; and

H1b: The positive relationship between financial slack and CPA is stronger than that of operational slack.

Organizational slack and EO

A firm’s degree of entrepreneurship is the extent to which it innovates, acts proactively, and takes risks (Huang and Wang, 2011; Miller, 1983). As discussed above, we define EO as a firm-level construct composed of two dimensions based on Anderson et al. (2015): entrepreneurial behaviors (encompassing innovativeness and proactiveness) and managerial attitude toward risk (risk-taking). Firms with a high level of entrepreneurial behaviors will pursue new products, processes, or business models (e.g., innovativeness), and then commercialize those innovations in new product/market domains (e.g., proactiveness). The managerial attitude toward risk refers to the inherent managerial inclination which showed by senior managers when they were dealing with developing and implementing firm-level strategies, thereby favoring strategic actions that have uncertain outcomes. This definition clearly encompasses the two attributes of behavior and attitude of EO and is consistent with that of Miller (1983), who posited that EO is the joint exhibition of observed entrepreneurial behaviors and a managerial inclination. The definition also gets empirically validated by following research (e.g. Ling et al., 2020).

As a strategic orientation, a firm’s EO is influenced by its resource base (Hughes et al., 2015; Bradley et al., 2011; Patel et al., 2015). Wales et al. (2021) observed that EO captures how organizations orchestrate, configure, and put their resources to work in new combinations (Miao et al., 2017), essentially consuming resources in the process of opportunity exploration and pursuit of new value creation (Wales et al., 2020). Compared with operational slack, financial slack is more flexible and easily redeployed. Companies with surplus financial resources have less concern “to make painful trade-offs than those that have to pursue multiple objectives with rather limited slack resources” (Xiao et al., 2018, p. 140), thus it can provide sufficient research funds for expensive innovative trials and supports many innovative projects to enhance the success rate of innovative and proactive trials (Liu et al., 2014). Second, financial slack enables organizations to divert attention away from “firefighting” to focus instead on expansive thinking and risky, innovative ventures with potentially high payoffs (Nohria and Gulati, 1996). In keeping with previous research (Marlin and Geiger, 2015), we expect that higher financial slack will be associated with increased innovation disposition, which entails unpredictable investments and uncertain near-term returns.

As for operational slack, its support is always hidden deeply. Given historic accumulation, operational slack not only ensures adequate function but also implies scarce valuable support for the efficient deployment of resources (Huang and Chen, 2010). Operational slack can support entrepreneurial activities by equipping them with professional staff and facilities and by offering reasonable innovative ideas for better exploring the external environment (Uddin et al., 2018).

A comparison of the effect of different slack types on CPA shows that financial slack also presents a stronger effect on entrepreneur behavior because of the difference in flexibility and the requirement of entrepreneur behavior. Entrepreneur behavior relies heavily on trial and error and should be supported by flexible and instant financial resources. Although operational slack provides solid backing, its promotion effect is not as obvious as that of financial slack. Thus, we propose the following:

H2a: Financial slack and operational slack are positively related to entrepreneurial behavior.

H2b: Financial slack shows a stronger positive relationship toward entrepreneurial behavior.

The managerial attitude toward risk could also be enhanced by financial slack and operational slack. With a high level of financial slack, firms could tolerate more failures (Wieczorek-Kosmala and Błach, 2019), and managers would be more capable of searching for new opportunities in their environments (Bradley et al., 2011; Jang et al., 2019), experimenting with new strategies, and pursuing goals to a greater degree without consideration of risk, thereby causing the firm to engage in risky management and high-risk projects (Wieczorek-Kosmala and Błach, 2019). Overall, financial slack promotes a manager’s confidence and capability to take risks.

Operational slack involves expensive facilities and skilled staff, which can ensure the firm’s implementation of bold ideas and thus increase the managers’ confidence in conducting innovation and their orientation toward risk-taking. Second, operational slack removes trouble at home for the firm’s risk-taking behavior, and such a situation offers space for managers to focus on external exploration behavior and future strategy (Lee et al., 2021). George (2005) found that a high level of operational slack can make managers more aggressive in market competition. Thus, we proposed that a high level of operational slack could encourage a risk-taking managerial attitude.

Compared with the effects of financial slack, the encouraging effect of operational slack on managerial attitude toward risk is more silent because of its low flexibility and historically accumulated characteristics. While financial slack could offer timely and conspicuous support. Thus, the supportive effects of financial slack will be more prominent in conducting risky projects. Consequently, we propose the following:

H2c: Financial slack and operational slack are positively related to managerial attitude toward risk.

H2d: Financial slack shows a stronger positive effect toward managerial attitude toward risk.

EO and CPA

EO captures how organizations orchestrate, configure, and put their resources into opportunity exploration and future strategy (Miao et al., 2017; Wales et al., 2020), it decides the firm’s resource arrangement and strategy behavior. Brown et al. (2022) found that a firm’s future plans might influence its engagement in CPA. Thus, we argue that a firm’s EO could act as the firm’s willingness toward CPA, and firms with high-level EO prefer to allocate resources to activities that are aggressive, and risky but with higher returns, which is in accordance with the characteristics of CPA.

First, the firm’s entrepreneurial activity highlights R&D and product innovation behavior. In this situation, CPA would likely be pursued because it provides firms with necessary government/policy support to protect intelligent property and ensure fair competition (Kotabe et al., 2017). Entrepreneurial behavior needs protection from related policies (e.g., intellectual protection) and would be effectively enforced when firms are actively engaged in CPA. Furthermore, pursuing CPA may bring government procurement or promotion, which benefits the firm’s innovation strategy (Xin and Pearce, 1994). Thus, firms with high EO are more likely to engage in CPA to seize the possible innovation opportunities associated with those government-related benefits. Empirical evidence has also suggested that firms make complementary investments between R&D and CPA (Ozer, 2010).

Second, compared with conservative enterprises, firms with a high managerial attitude toward risk have a greater tendency to invest in risky projects with a higher return. Engaging in CPA is thus more likely to be treated as a rational investment decision. Existing research has found that engaging in CPA might be a profit-maximizing approach (Rudy and Cavich, 2020; Brown et al., 2022). Firms with a high risk-taking managerial attitude can screen opportunities in CPA and predict the potential strategic influence of CPA on firms (e.g., policy advantage and domain defense, Lawton et al., 2013). Thus, we propose the following:

H3a: Entrepreneurial behavior is positively related to CPA.

H3b: Managerial attitude toward risk is positively related to CPA.

The mediating effect of EO

Thus far, organizational slack (financial slack and operational slack) has been hypothesized to positively impact firms’ EO (entrepreneurial behavior and managerial attitude toward risk) which, in turn, have positive effects on CPA. A meaningful idea we now propose is that EO mediates the relationships between organizational slack and CPA in two ways. First, as the stock of excessive available resources, organizational slack always draws the managers’ attention toward the maximization of such resources. It encourages and supports firms to pursue opportunities, engage in trial and error, and take risks (Wieczorek-Kosmala and Błach, 2019). In other words, organizational slack cultivates the firm’s EO. Meanwhile, the opportunities to engage in CPA should be sensed by managers in the first place, followed by the willingness to seize them by using organizational resources (Penrose and Penrose, 2009). In this consideration, a manager’s EO depends heavily on slack foundations to sense CPA opportunities and arrange resources to take action. Existing evidence found that the alignment of a firm’s strategy and structure leads to better political engagement (Brown et al., 2022), thus firms could engage in CPA when the firm’s resource structure could be aligned with EO. Second, because a firm’s strategic orientation for organizing its resources greatly affects its value creation potential (Hitt et al., 2011), the firm’s attitude toward entrepreneurial activity and risky projects could change the direction of the firm’s resource deployment. Organization slack lays the foundation for a firm’s engagement in CPA, but the realization of such engagement relies on the firms’ allocation and redeployment, which are decided by the firms’ decision-making process. As a risk-taking decisive preference, EO could thus function as the enabler to leverage the firm’s slack resource to support costly and risky CPA. In general, the firm’s slack will influence EO and through it affect CPA engagement, and the EO must depend on slack resources to play a role during the process of CPA engagement. Thus, we propose hypotheses H4a and H4b.

H4a: Entrepreneurial behavior mediates the positive effect between financial/operational slack and CPA.

H4b: Managerial attitude toward risk mediates the positive effect between financial/operational slack and CPA.

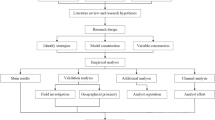

The research framework is shown in Fig. 1.

Methodology

Sampling and data collection

This study used a questionnaire survey to collect data from 303 firms located in 23 provinces of mainland China. The survey process was undertaken between 2010 and 2011, nearly three years after ‘stimulus packages issued by Chinese governments since the 2008 economic crisis have strengthened government influences’ (Li et al., 2013, p. 207), which cultivate a relatively consistent external environment, under which firms realized the importance of government comprehensively and made decisions on whether engage in CPA mainly based on their internal heterogeneity. It’s a proper empirical context to investigate the internal mechanism of a firm’s engagement in CPA.

The research uses techniques like translation and back translation, employing local researchers, and using face-to-face interviews as key methods to obtain reliable and valid data. Ten senior managers from top or middle-level positions within their organizations were interviewed for a pilot survey. These interviewees were requested not only to answer all the questionnaire items but also to provide feedback about the design and wording of the survey instrument, then the questionnaire was refined according to these interviews.

Generally, the formal survey process was conducted with three processes. First, as China’s 31 provinces have varying levels of institutional development, we divided them into three regions: region A (10 eastern and coastal provinces), region B (10 middle provinces), and region C (11 northwestern provinces). We randomly selected 500 firms from the published industry directories in each region. Second, we hired and trained eight experienced interviewers to contact the selected firms via email and telephone to solicit cooperation. The interviewers visited the firms that agreed to participate and conducted face-to-face interviews (1–1.5 h). We collected 980 responses from 490 firms, dropped the responses with missing data on key constructs, and finally get 606 questionnaires from 303 firms (two respondents and corresponding questionnaires were required from every firm), the response rate was 10.1% (303/1500).

Among the sample, 42.90% of firms are from region A, 25.75% of firms are from region B, and 31.40% of firms are from region C. These firms cover different ownership structures, including state-owned and controlled enterprises (36.3%), privately owned and controlled enterprises (28.7%), joint ventures (9.9%), foreign direct investments (10.9%), and other types (14.2%). Regards to the firm size, based on the criteria of annual sales, 38.94% of firms are below ¥5 million; 29.04% of firms are between ¥5 million to ¥5 billionaire; and 21.12% of firms are over ¥5 billionaire. Moreover, the respondents (36.63% middle managers, 9.41% CEOs, and 40.26% non-CEO top managers, the remaining 13.70% didn’t provide position information, but were at least middle-level managers) had an average of 8.75 years of work experience in their current firms and an average of 5.76 years of experience in their current positions.

We used t-tests for nonresponse bias by comparing the participating and nonparticipating firms in terms of size, age, and ownership. The results indicated no significant differences (P > 0.05).

Measurements

The variables were all measured with multi-item scales, and all items were randomly ordered to minimize the bias from the survey method. Each of the scale items used a Likert-type response format ranging from 1, “strongly disagree” to 7, “strongly agree”. The CPA scale was designed based on the research of Hillman and Wan (2005) and Wei (2006). We deleted unsuitable items in China such as campaign contributions. The measurement of organization slack was adopted from Tan and Peng (2003) and Voss et al. (2008), and their scale has been widely used in the literature (e.g., Su et al., 2009). EO was measured by following the insights of Wang (2008) and Anderson et al. (2015) by asking the respondents about the level of the firm’s innovative and proactive activity, the propensity to engage in risky projects, and the managers’ preference for bold versus cautious acts to achieve firm objectives. These items can be seen in Table 1.

Several factors that might influence the organizational slack–CPA relationship are controlled. Different industry development stages indicate different policy demands, and guide firms to identify and react to the environment (Maylín-Aguilar and Montoro-Sánchez, 2021). Thus, we controlled the industry development stage. It was measured by a four-point scale with 1, “start-up stage,” 2, “growth stage,” 3, “mature stage,” and 4, “decline stage.” Industry competitiveness has been examined as the antecedent of CPA (Hillman et al., 2004). Then we controlled competitiveness by evaluating the degree of competition in their industry with a five-point Likert scale (adapted from Gao et al., 2008). By asking the respondents to report the firm’s average market share in three years and calculating the corresponding logarithms, we controlled for the firm’s market share, which also has been treated as antecedents (Lawton et al., 2013; Liedong et al., 2020). We also controlled marketization to rule out the possible influence of heterogeneous institutional and market environments, and the composite index of marketization followed the research results of Fan et al. (2003). Finally, we controlled two industry sector variables: high-tech industry with 1 representing the high-tech industry firms and 0 for otherwise, and manufacturing sector with 1 representing the manufacturing firms and 0 for otherwise (Peng and Luo, 2000).

Data analysis

This research used SPSS 19.0 software with ordinary least-squares (OLS) estimation. All variables were randomly selected from the two sample databases.

First, confirmatory factor analysis (CFA) was conducted by using Amos 17.0 software to determine the uni-dimensionality, discriminant validity, and convergent validity of the variables. A five-factor model was examined in which the indicators of the five variables were loaded distinctively on their corresponding latent variables. This hypothetical model revealed adequate fit with the data (χ2 = 262.648, d.f. = 94, P < 0.001; NFI = 0.910, CFI = 0.939, TLI = 0.923, RMSEA = 0.077, AIC = 378.648). In addition, in the five-factor model, the measures possessed convergent validity because all items were significantly loaded on their respective latent variables (the smallest critical value is 8.941 with the largest P-value of 0.000). The construct reliability values as measured by Cronbach’s α all exceeded 0.80 (see Table 2), thereby suggesting that these measures have good internal consistency. These results assured the validity and reliability of the measures in this research.

To further examine the discriminant validity of the measurement, we compare the variance shared between the constructs with the average variance extracted (AVE) for each individual construct. Table 3 includes the square roots of the AVE for each latent variable along the diagonal and the correlation coefficients among all theoretically related constructs in the off-diagonal elements. The discriminant validity of a construct is adequate when the diagonal element is greater than each of the off-diagonal elements in the corresponding rows and columns. Results in Tables 2 and 3 satisfied those requirements. Evidence from the results of CFA and AVE analysis indicated that each construct in this study is more closely related to its own reflective indicators than to those of other constructs.

Table 3 reports the descriptive statistics, correlations, standard deviations, and the square roots of AVE values for each latent variable in this study.

Results

Regression results

To test the hypotheses, we used a hierarchical regression model. To assess the explanatory power of each set of variables, we include only the control variables in the first step, and subsequently added organization slack and EO to the model. We summarize the results in Table 4.

H1 involves examining the effect of slack on CPA. As Model 2 showed, both financial slack (β = 0.322, P < 0.001) and operational slack (β = 0.151, P < 0.01) promote the firm’s engagement in CPA. To compare the different effects of financial slack and operational slack, we developed a Z test. The result of the Z test (Z = 1.60 > 1.58) significantly supports H1a and H1b.

Mediating effect

Following Baron and Kenny (1986), the mediating effects in H4 were tested through four steps. The first step (Models 2) shows the main effect of financial/operational slack. The second step (Model 3) tested the effect of mediators on CPA, as entrepreneurial behavior (β = 0.071, P > 0.1)/managerial attitude toward risk (β = 0.192, P < 0.01). Entrepreneurial behavior does not show a positive effect on CPA, whereas managerial attitude toward risk has a significant positive effect on CPA. Therefore, H3a does not hold, but H3b does. Third, we investigated the relationship of organizational slack and EO (Models 4 and 5). Both financial slack (β = 0.196, P < 0.01) and operational slack (β = 0.204, P < 0.01) promote entrepreneurial behavior. As to the managerial attitude toward risk, both financial slack (β = 0.233, P < 0.01) and operational slack (β = 0.239, P < 0.01) have positive and significant effects; thus, H2a and H2c hold. This study also compared the different effects of financial and operational slack on EO, but the results of the Z test reveal no significant difference. Fourth, we tested the mediating effect of entrepreneurial behavior and managerial attitude toward risk (Models 6–9). Models 6 and 7 indicate that entrepreneurial behavior does not significantly mediate financial slack or operational slack’s positive effect on CPA. Thus, H4a is not supported. Models 8 and 9 present the mediating effect of managerial attitude toward risk. Managerial attitude toward risk significantly and partly mediates financial slack or operational slack. Thus, H4b holds.

Post hoc analysis

As the OLS regression’s results showed, entrepreneurial behavior’s mediating effect is not significant. Moreover, entrepreneurial behavior’s direct effect on CPA is not significant when taken together with managerial attitude toward risk. To further rule out a potential relationship between entrepreneurial behavior and managerial attitude toward risk, an additional PROCESS model was proposed. We used PROCESS to test the mediation linkage effect. As Table 5 shows, entrepreneurial behavior’s effect can be transferred by managerial attitude toward risk. The firm’s managerial attitude toward risk exerts a solid and strong mediating effect on promoting engagement in CPA.

Both financial slack and operational slack have a positive effect on CPA. The mediating effect of entrepreneurial behavior is not significant, whereas that of managerial attitude toward risk is significant. Such outcomes are consistent with the analysis of hierarchical regression. Interestingly, the managerial attitude toward risk mediates the effect of entrepreneurial behavior on CPA.

Discussion and conclusions

Conclusions

As shown in Table 6, this study proposed four group hypotheses (for a total of ten separate hypotheses), of which six gained support. Specifically, the empirical results indicated that both financial and operational slack promote CPA, and financial slack shows a stronger effect (H1). Both financial and operational slack promote EO (H2a and H2c), but the effects have no significant difference, thereby failing to support H2b and H2d. The effects of the two dimensions of EO are heterogeneous; entrepreneurial behavior’s effect toward CPA was not significant, and thus, H3a was not supported, whereas managerial attitude toward risk promotes CPA significantly (H3b). Moreover, the mediating effect of entrepreneurial behavior was not significant (H4a), whereas managerial attitude toward risk plays a mediating role between organizational slack and CPA (H4b) and mediates the effect of entrepreneurial behavior’s effect toward CPA.

Theoretical contributions

In response to the call for more research into the micro mechanism of CPA and the influence of managerial factors (Hillman et al., 2004; Lawton et al., 2013; Brown et al., 2022), our research investigated the mechanism by which firms’ slack resource could promote CPA engagement through EO according to the behavioral theory of the firm. Our theoretical discussion and empirical results add to previous research in the following aspects.

First, the heterogeneous effect of financial slack and operational slack on the firm’s CPA that we discovered helps resolve the ongoing debate regarding the basic issue of whether slack facilitates or inhibits CPA. Unlike research that focused exclusively on whether slack as a whole has a positive or negative effect on CPA (Meznar and Nigh, 1995; Quan et al., 2020), we explored the heterogeneous effects of different types of organizational slack on CPA. In particular, we proposed that financial slack facilitates CPA by offering flexible supporting resources and enables firms to execute new political strategies and develop political ties (Quan et al., 2020; Hewa Wellalage et al., 2020; Adomako et al., 2021), which is prominent and easily be observed. Given its internal accumulated nature, operational slack acts as the “solid backyard” that smoothens internal operations and has a useful but conservative effect on CPA. Empirical findings that indicate that financial slack has a stronger positive effect on CPA than operational slack confirm these theoretical predictions.

More importantly, this research addresses the missing link between organizational slack and firms’ engagement in CPA. In particular, prior studies have sought to explain the determinants of CPA but largely overlooked the managerial factors and decision mechanisms within the firm (Scherer, 2018; Borges and Ramalho, 2022). According to the behavioral theory of the firm, we tackled this knowledge inadequacy by investigating the mediating effect of EO between slack and CPA. Specifically, we proposed that organization slack could improve the firm’s ability to engage in CPA, yet such potential per se could not guarantee the firms’ engagement in CPA as those slack resources are not always allocated to political activity. In this situation, EO, as a risk-taking decisive preference, could motivate managers to allocate slack resources to support costly and risky CPA (Rudy and Cavich, 2020; Brown et al., 2022). In this way, we delineate the mediating role of EO between a firm’s ability (slack) and engagement in CPA. Our empirical findings confirm the suggested mediation path, but entrepreneurial behavior reveals no mediating effects between organizational slack and CPA. The possible reason could be that entrepreneurial behavior focuses on the firm’s product innovation and commercialization, which is related to a market strategy more closely. Firms with a high level of entrepreneurial behavior may focus exclusively on their internal innovation and thus overlook the exploration of external political opportunities. Conversely, managerial attitude toward risk makes firms decisive and executive with CPA. The post hoc analysis also revealed that the mediating effect of EO actually functions via managerial attitude toward risk. Therefore, the firm’s CPA engagement results from both the objective resource base and the managerial attitude. These findings not only enrich the antecedent research of CPA but also deepen our understanding of the CPA engagement mechanism. Moreover, it extends and validates the behavioral theory of the firm in the CPA research field.

Managerial implications

As a risky investment, engaging in CPA needs the firm’s support from slack resources and managerial preference. Both financial slack and operational slack can promote CPA engagement but through different mechanisms. Managers need to accumulate operational slack to ensure a safe backyard and financial slack for sufficient and flexible support. What’s more, this research proposed that EO, especially the managerial attitude towards risk, plays a key mediating role in the relationship between slack and CPA. Managers should cultivate a managerial attitude towards risk to make more decisive CPA engagement decisions when they want to engage in CPA activities. For firms that are eager to obtain favorable government supports from CPA activity, they should first fully mobilize financial slack resources in firms to provide cost support and incentives for CPA engagement. At the same time, managers should also be “bold and cautious” to find opportunities in the external environment and rationally allocate resources to provide information, manpower, financial and other support for CPA engagement. For firms with sufficient resources but with the poor performance of CPA engagement, it is necessary to check whether the managerial decision-making style is too conservative. And then these firms should cultivate managers with entrepreneurship orientation, and provide a moderately easy decision-making environment towards risky projects, which is conducive to the engagement of CPAs.

Limitations and future research directions

Our study also has several limitations. First, the subjective measure of constructs and the cross-sectional data limit the ability to make strong causal inferences from the findings (Rindfleisch et al., 2008). To inspect the causality between organizational slack, EO, and CPA, we can conduct a tracking survey for longitudinal research. Moreover, the self-report data may have biases due to different backgrounds and experiences, in future research, we can conduct the research with list companies’ data to test the robustness of our research.

Second, our empirical setting focuses on a particular transitional context, which demands caution for the generalization of the findings. Although transitional economies share some commonalities in the economic and political reforms and the economic development patterns, the stages, the extent, and the content of reforms are heterogeneous. Further studies that conducted across different contexts are needed to test the generalizability of our research findings.

Data availability

The datasets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Abdurakhmonov M, Ridge JW, Hill AD et al. (2022) Strategic risk and lobbying: investigating lobbying breadth as risk management. J Manag 48(5):1103–1130

Adomako S, Ahsan M, Amankwah-Amoah J et al. (2021) Corruption and SME growth: the roles of institutional networking and financial slack. J Inst Econ 17(4):607–624

Anderson BS, Kreiser PM, Kuratko DF et al. (2015) Reconceptualizing entrepreneurial orientation. Strateg Manag J 36(10):1579–1596

Argilés-Bosch JM, Garcia-Blandon J, Martinez-Blasco M (2016) The impact of absorbed and unabsorbed slack on firm profitability: implications for resource redeployment. In: Timothy BF, Constance EH, Samina K (eds) Resource redeployment and corporate strategy, vol 35. Emerald Group Publishing Limited, pp. 371–395

Argote L, Greve HR (2007) A behavioral theory of the firm—40 years and counting: introduction and impact. Organ Sci 18(3):337–349

Baron RM, Kenny DA (1986) The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173

Borges A, Ramalho N (2022) Building political capital through corporate social responsibility: a microlevel focus on the role of business leaders. Soc Responsib J. https://doi.org/10.1108/SRJ-10-2021-0450

Bradley SW, Shepherd DA, Wiklund J (2011) The importance of slack for new organizations facing ‘tough’ environments. J Manag Stud 48(5):1071–1097

Brettel M, Chomik C, Flatten TC (2015) How organizational culture influences innovativeness, proactiveness, and risk‐taking: fostering entrepreneurial orientation in SMEs. J Small Bus Manag 53(4):868–885

Brown LW, Manegold JG, Marquardt DJ (2020) The effects of CEO activism on employees person‐organization ideological misfit: a conceptual model and research agenda. Bus Soc Rev 125(1):119–141

Brown LW, Rasheed AA, Bell RG (2022) How and why? A review of corporate political activity predictors and actions. Group Organ Manag 47(2):440–484

Brown LW, Yaşar M, Rasheed AA (2018) Predictors of foreign corporate political activities in United States politics. Glob Strateg J 8(3):503–514

Choi S-J, Liu H, Yin J et al. (2021) The effect of political turnover on firms’ strategic change in the emerging economies: the moderating role of political connections and financial resources. J Bus Res 137:255–266

Chu S-H, Ren Y, Cai H et al (2021) Financial slack, operational slack and firm performance during episodes of financial crises: a panel data analysis. In: 2021 PMIS. IEEE, pp. 144–148

Covin JG, Lumpkin GT (2011) Entrepreneurial orientation theory and research: reflections on a needed construct. Entrep Theory Pract 35(5):855–872

Den Hond F, Rehbein KA, de Bakker FG et al. (2014) Playing on two chessboards: reputation effects between corporate social responsibility (CSR) and corporate political activity (CPA). J Manag Stud 51(5):790–813

Eesley C, Lenox MJ (2006) Firm responses to secondary stakeholder action. Strateg Manag J 27(8):765–781

Evers-Hillstrom K, Weber D, Massoglia A et al (2020) More money, less transparency: a decade under citizens united. Center for Responsive Politics. https://www.opensecrets.org/news/reports/a-decade-under-citizens-united Accessed 14 Jan 2020

Fan G, Wang X, Zhu H (2003) NERI index of marketization of China’s provinces. National Economic Research Institute, Beijing

Gao S, Xu K, Yang J (2008) Managerial ties, absorptive capacity, and innovation. Asia Pac J Manag 25(3):395–412

George G (2005) Slack resources and the performance of privately held firms. Acad Manag J 48(4):661–676

Greiner M, Lee J (2020) A supply-side approach to corporate political activity: performance consequences of ideologically driven CPA. J Bus Res 115:25–37

Hadani M, Bonardi J-P, Dahan NM (2017a) Corporate political activity, public policy uncertainty, and firm outcomes: a meta-analysis. Strateg organ 15(3):338–366

Hadani M, Dahan NM, Doh JP (2015) The CEO as chief political officer: managerial discretion and corporate political activity. J Bus Res 68(11):2330–2337

Hadani M, Doh JP, Schneider M (2019) Social movements and corporate political activity: managerial responses to socially oriented shareholder activism. J Bus Res 95:156–170

Hadani M, Doh JP, Schneider MA (2018) Corporate political activity and regulatory capture: how some companies blunt the knife of socially oriented investor activism. J Manag 44(5):2064–2093

Hadani M, Munshi N, Clark K (2017b) The more you give, the more you get? The impact of corporate political activity on the value of government contracts. Bus Soc Rev 122(3):421–448

Hewa Wellalage N, Locke S, Samujh H (2020) Firm bribery and credit access: evidence from Indian SMEs. Small Bus Econ 55(1):283–304

Hillman AJ, Keim GD, Schuler D (2004) Corporate political activity: a review and research agenda. J Manag 30(6):837–857

Hillman AJ, Wan WP (2005) The determinants of MNE subsidiaries’ political strategies: evidence of institutional duality. J Int Bus Stud 36(3):322–340

Hitt MA, Ireland RD, Sirmon DG et al. (2011) Strategic entrepreneurship: creating value for individuals, organizations, and society. Acad Manag Perspect 25(2):57–75

Huang SK, Wang Y-L (2011) Entrepreneurial orientation, learning orientation, and innovation in small and medium enterprises. Procedia-Soc Behav Sci 24:563–570

Huang Y-F, Chen C-J (2010) The impact of technological diversity and organizational slack on innovation. Technovation 30(7–8):420–428

Hughes M, Eggers F, Kraus S et al. (2015) The relevance of slack resource availability and networking effectiveness for entrepreneurial orientation. Int J Entrep Small Bus 26(1):116–138

Islam SMT, Ghosh R, Khatun A (2021) Slack resources, free cash flow and corporate social responsibility expenditure: evidence from an emerging economy. J Account Emerg Econ 11(4):533–551

Iyer DN, Miller KD (2008) Performance feedback, slack, and the timing of acquisitions. Acad Manag J 51(4):808–822

Jang Y, Hadley B, Lee WJ (2019) Inward technology licensing, financial slack, and internal innovation in new technology-based firms located in isolated areas. J Asian Financ Econ Bus 6(2):173–181

Johnson A (2019) Board of director independence, CEO duality, and corporate political activity. SAM Adv Manag J 84(4):67–80

Kingsley AF, Vanden Bergh RG, Bonardi J-P (2012) Political markets and regulatory uncertainty: insights and implications for integrated strategy. Acad Manag Persp 26(3):52–67

Kiss AN, Fernhaber S, McDougall–Covin PP (2018) Slack, innovation, and export intensity: implications for small- and medium-sized enterprises. Entrep Theory Pract 42(5):671–697

Kotabe M, Jiang CX, Murray JY (2017) Examining the complementary effect of political networking capability with absorptive capacity on the innovative performance of emerging-market firms. J Manag 43(4):1131–1156

Lawton T, McGuire S, Rajwani T (2013) Corporate political activity: a literature review and research agenda. Int J Manag Rev 15(1):86–105

Lee T, Liu WT, Yu JX (2021) Does TMT composition matter to environmental policy and firm performance? The role of organizational slack. Corp Soc Responsib Environ Manag 28(1):196–213

Li D, Cao C, Zhang L et al. (2017) Effects of corporate environmental responsibility on financial performance: the moderating role of government regulation and organizational slack. J Clean Prod 166:1323–1334

Li Y, Peng MW, Macaulay CD (2013) Market–political ambidexterity during institutional transitions. Sage Publications Sage UK, London, England, pp. 205–213

Liedong TA, Aghanya D, Rajwani T (2020) Corporate political strategies in weak institutional environments: a break from conventions. J Bus Eth 161(4):855–876

Ling Y, López-Fernández MC, Serrano-Bedia AM et al. (2020) Organizational culture and entrepreneurial orientation: examination through a new conceptualization lens. Int Entrep Manag J 16(2):709–737

Liu H, Ding X-H, Guo H et al. (2014) How does slack affect product innovation in high-tech Chinese firms: the contingent value of entrepreneurial orientation. Asia Pac J Manag 31(1):47–68

Lomberg C, Urbig D, Stöckmann C et al. (2017) Entrepreneurial orientation: the dimensions’ shared effects in explaining firm performance. Entrep Theory Pract 41(6):973–998

Lux S, Crook TR, Woehr DJ (2011) Mixing business with politics: a meta-analysis of the antecedents and outcomes of corporate political activity. J Manag 37(1):223–247

Maak T, Pless NM, Voegtlin C (2016) Business statesman or shareholder advocate? CEO responsible leadership styles and the micro‐foundations of political CSR. J Manag Stud 53(3):463–493

Marlin D, Geiger SW (2015) A reexamination of the organizational slack and innovation relationship. J Bus Res 68(12):2683–2690

Maylín-Aguilar C, Montoro-Sánchez Á (2021) The industry life cycle in an economic downturn: lessons from firm’s behavior in Spain 2007–2012. J Bus Cycle Res 17(2):185–214

McDonnell M-H, Werner T (2016) Blacklisted businesses: social activists’ challenges and the disruption of corporate political activity. Admin Sci Q 61(4):584–620

Meznar MB, Nigh D (1995) Buffer or bridge? Environmental and organizational determinants of public affairs activities in American firms. Acad Manag J 38(4):975–996

Miao C, Coombs JE, Qian S et al. (2017) The mediating role of entrepreneurial orientation: a meta-analysis of resource orchestration and cultural contingencies. J Bus Res 77:68–80

Miller D (1983) The correlates of entrepreneurship in three types of firms. Manage Sci 29(7):770–791

Minefee I, McDonnell MH, Werner T (2021) Reexamining investor reaction to covert corporate political activity: a replication and extension of Werner (2017). Strateg Manag J 42(6):1139–1158

Nalick M, Kuban S, Ridge JW et al. (2023) When not one of the crowd: the effects of CEO ideological divergence on lobbying strategy. J Manag 49(3):1106–1139

Nohria N, Gulati R (1996) Is slack good or bad for innovation? Acad Manag J 39(5):1245–1264

Oliver C, Holzinger I (2008) The effectiveness of strategic political management: a dynamic capabilities framework. Acad Manag Rev 33(2):496–520

Ozer M (2010) Top management teams and corporate political activity: do top management teams have influence on corporate political activity? J Bus Res 63(11):1196–1201

Patel PC, Kohtamäki M, Parida V et al. (2015) Entrepreneurial orientation-as-experimentation and firm performance: the enabling role of absorptive capacity. Strateg Manag J 36(11):1739–1749

Peng MW, Luo Y (2000) Managerial ties and firm performance in a transition economy: the nature of a micro-macro link. Acad Manag J 43(3):486–501

Penrose E, Penrose ET (2009) The theory of the growth of the firm. Oxford university press, Oxford

Quan Z, Renyan M, Yue H et al. (2020) The influence mechanism of organizational slack on CSR from the perspective of property heterogeneity: evidence from China’s intelligent manufacturing. J Intell Fuzzy Syst 38(6):7041–7052

Rehbein KA, Schuler DA (1999) Testing the firm as a filter of corporate political action. Bus Soc 38(2):144–166

Rindfleisch A, Malter AJ, Ganesan S et al. (2008) Cross-sectional versus longitudinal survey research: concepts, findings, and guidelines. J Mark Res 45(3):261–279

Rudy BC, Cavich J (2020) Nonmarket signals: investment in corporate political activity and the performance of initial public offerings. Bus Soc 59(3):419–438

Rudy BC, Johnson AF (2019) The chief political officer: CEO characteristics and firm investment in corporate political activity. Bus Soc 58(3):612–643

Scherer AG (2018) Theory assessment and agenda setting in political CSR: a critical theory perspective. Int J Manag Rev 20(2):387–410

Schuler DA, Rehbein K (1997) The filtering role of the firm in corporate political involvement. Bus Soc 36(2):116–139

Schuler DA, Rehbein K, Green CD (2019) Is corporate political activity a field? Bus Soc 58(7):1376–1405

Shirodkar V, Batsakis G, Konara P et al. (2022) Disentangling the effects of domestic corporate political activity and political connections on firms’ internationalisation: evidence from US retail MNEs. Int Bus Rev 31(1):101889

Su Z, Xie E, Li Y (2009) Organizational slack and firm performance during institutional transitions. Asia Pac J Manage 26(1):75–91

Sun P, Mellahi K, Wright M (2012) The contingent value of corporate political ties. Acad Manag Persp 26(3):68–82

Tan J, Peng MW (2003) Organizational slack and firm performance during economic transitions: two studies from an emerging economy. Strateg Manag J 24(13):1249–1263

Uddin S, Siddiqui J, Islam MA (2018) Corporate social responsibility disclosures, traditionalism and politics: a story from a traditional setting. J Bus Eth 151(2):409–428

Voss GB, Sirdeshmukh D, Voss ZG (2008) The effects of slack resources and environmentalthreat on product exploration and exploitation. Acad Manag J 51(1):147–164

Wales WJ (2016) Entrepreneurial orientation: a review and synthesis of promising research directions. Int Small Bus J 34(1):3–15

Wales WJ, Covin JG, Monsen E (2020) Entrepreneurial orientation: the necessity of a multilevel conceptualization. Strateg Entrep J 14(4):639–660

Wales WJ, Gupta VK, Mousa F-T (2013) Empirical research on entrepreneurial orientation: an assessment and suggestions for future research. Int Small Bus J 31(4):357–383

Wales WJ, Kraus S, Filser M et al. (2021) The status quo of research on entrepreneurial orientation: conversational landmarks and theoretical scaffolding. J Bus Res 128:564–577

Wang CL (2008) Entrepreneurial orientation, learning orientation, and firm performance. Entrep Theory Pract 32(4):635–657

Wei W (2006) The relationship among corporate political resources, political strategies, and political benefits of firms in China: based on resource dependency theory. Singap Manag Rev 28(2):85–101

Werner T (2017) Investor reaction to covert corporate political activity. Strateg Manag J 38(12):2424–2443

Wieczorek-Kosmala M, Błach J (2019) Financial slack and company’s risk retention capacity. In: Multiple perspectives in risk and risk management: ERRN 8th European Risk Conference 2018. Springer, Berlin, pp. 145–168

Wöcke A, Moodley T (2015) Corporate political strategy and liability of foreignness: similarities and differences between local and foreign firms in the South African Health Sector. Int Bus Rev 24(4):700–709

Xiao C, Wang Q, van Donk DP et al. (2018) When are stakeholder pressures effective? An extension of slack resources theory. Int J Prod Econ 199:138–149

Xin K, Pearce JL (1994) Guanxi_ Good connections as substitutes for institutional support. In: Academy of management proceedings. Academy of Management Briarcliff Manor, New York, pp. 163–167

Yan ZJ, Zhu JC, Fan D et al. (2018) An institutional work view toward the internationalization of emerging market firms. J World Bus 53(5):682–694

Acknowledgements

The authors are extremely grateful to the National Nature Science Foundation of China (72272119/71972151/72102022), the Soft Science Project of Shaanxi Province (2022KRM105), the Philosophy and Social Science Research Project of Shaanxi Province (2023QN0034), and the Fundamental Research Funds for the Central Universities [300102112603].

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

Approval was obtained from the ethics committee of University Xi’an Jiaotong University. The survey process and procedures used in this study adhere to the tenets of the Declaration of Helsinki.

Informed consent

The informed consent was obtained from all participants and/or their legal guardians for participation in the study. We contact the participants via email and telephone to solicit cooperation, and then the interviewers visited the firms that agreed to participate. Before the face-to-face interviews began, we read out the possible uses of their information and asked for their consent again. Thus, informed consent was obtained from all participants before we conducted the survey.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Li, Y., Gao, Y. & Gao, S. Organizational slack, entrepreneurial orientation, and corporate political activity: From the behavioral theory of the firm. Humanit Soc Sci Commun 10, 117 (2023). https://doi.org/10.1057/s41599-023-01605-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-01605-1