Abstract

This paper proposes to forecast an important cognitive phenomenon called the Loss Aversion Bias via Hybrid Machine Learning Models. One of the unique aspects of this study is using the reaction time (milliseconds), psychological factors (self-confidence scale, Beck’s hopelessness scale, loss-aversion), and personality traits (financial literacy scales, socio-demographic features) as features in classification and regression methods. We found that Random Forest was superior to other algorithms, and when the positive spread ratio (between gain and loss) converged to default loss aversion level, decision-makers minimize their decision duration while gambling, we named this phenomenon as “irresistible impulse of gambling”.

Similar content being viewed by others

Introduction

The most intriguing topics of behavioral economics, “Prospect Theory” and “Cumulative Prospect Theory” by Kahneman and Tversky (1979) and Tversky and Kahneman (1992), which is shaped by the major anomalies and biases (such as Allais paradox, reflection effect, loss aversion, St. Petersburg paradox, endowment effect, fourfold pattern, etc.) is examined by cognitive theories that include mixed gambles (both loss and gain associated with a decision under risk) (Kahneman and Tversky, 1979; Kahneman et al., 1991; Gächter et al., 2007; Plott and Zeiler, 2005).

In this context, loss aversion has been widely studied and has been the subject of numerous research articles, books, and review papers. One of the most influential studies on loss aversion is written by psychologists Daniel Kahneman and Amos Tversky (1979), “Prospect theory: an analysis of decision under risk”. It introduces the concept of loss aversion and presents evidence to support the idea that people experience a greater emotional impact from losses than from gains of equivalent value. Since the publication of this seminal study, loss aversion has been widely studied and has been found to play a role in a variety of decision-making contexts, including financial decision-making, risk-taking, and consumer behavior. The other notable study on loss aversion is Kahneman and Tversky (1992) “Advances in prospect theory: cumulative representation of uncertainty,” which elaborated the concept of loss aversion further, and introduced the idea of ‘reference dependence’, or the idea that people’s decisions are influenced by their perception of their current situation relative to a reference point. Other studies have examined the neural basis of loss aversion, using brain imaging techniques to examine the neural mechanisms underlying the phenomenon. Overall, the related literature on loss aversion suggests that it is a robust and influential phenomenon, playing a significant role in decision-making and behavior.

Therefore, loss aversion refers to the idea that people experience a greater emotional impact from losing something than they do from gaining something of equivalent value. This concept was first introduced by psychologists Kahneman and Tversky’s (1979) paper. It has become a widely studied phenomenon in the field of behavioral economics. Loss aversion is believed to be a result of the human brain’s tendency to assign greater value to things that we already possess. When we stand to lose something that we already have, it can trigger feelings of fear, anxiety, and sadness, leading us to make decisions driven more by emotion than by rational thought. Kahneman and Tversky’s other well-known study in 1992 elaborated on the concept of loss aversion. Moreover, loss aversion can have significant implications for decision-making, as it can influence how we approach risks and uncertainties. For example, people who are more loss averse may be more likely to avoid taking risks or making changes in their lives, even if doing so might bring potential benefits because they are fearful of the potential losses that could result. In conclusion, loss aversion is an important concept to understand as it can help us to better understand and predict human behavior and decision-making, particularly when it comes to matters involving risk and uncertainty.

Regarding the above explanations, empirical findings in the fields of behavioral economics and neuroeconomics enable us to understand (1) the implementation of social engineering tools and increasing the efficiency of the policies, (2) consumer tendencies (e.g. survey and social media-based research), (3) risk tendencies and investors’ risk appetite in financial markets, (4) the trade-off between inflation and unemployment (for the short and long run), (5) determination of tax and penalty rates [analyzed by Willingness to Pay (WTP) and Willingness to Accept (WTA) in the theory of the consumer, and The Nudge Theory et al.], and (6) the prediction of a general election. The empirical findings help policymakers to develop “Foresight Theories” and update the parameters of existing theories and models. Machine learning methods are compatible more to solve complex problem sets (Hutchison, 1981; Sokol-Hessner et al., 2009; Thaler and Sunstein, 2009; Kube et al., 2013; Canessa et al., 2013; Alm, 2014; Kim and Han, 2016; Basu and Dulleck, 2020; Wiafe et al., 2020).

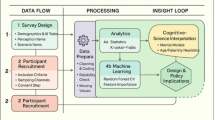

Figure 1 indicates an impact that policymakers want to evoke across the population or in a particular part of the society that has some difficulties. Policymakers can benefit from machine learning methods to improve their behavior models and parameters’ efficiency. The model parameters require fine tunings because of

-

the complexity of the raw data,

-

the correct determination of variables and their weights,

-

the complexity of the transmission mechanism,

-

and the exact dependence of the system output on the human factor.

Particularly, it is only probable with the knowledge of the economic sentiments of decision makers’ risk lovers, risk-averse (e.g., loss averse, etc.) under uncertainty and risk. By means of the risk profile of the decision maker, it is probable to understand (1) the expenditure profiles of the decision maker’s income, (2) the effectiveness of monetary, fiscal, and income policies and pension plans, and (3) international trade policies against business cycles. In this sense, the trends of individuals’ and societies’ consumption, one of the most featured components of economic growth, are included in various foresight and insight analyses in the related literature. For instance, Tversky and Kahneman (1991) stated that depending on the loss aversion behavior, especially for a given time, the consumer is a risk-taker if the consumption expectation results in a gain, while in case of an expected loss in consumption, the consumer exhibits more risk-avoiding behavior. Freund and Özden (2008) demonstrated how loss aversion and reference dependence are important in shaping people’s perception of trade policy. Freund and Özden (2008) highlighted that people’s trade policy preferences are not only dependent on their income but also on some biases like loss aversion and reference dependence which are modeled under their utility functions. That’s why government protective trade policy and object function are more shaped by loss aversion behaviors under negative shock. Rosenblatt-Wisch (2008) showed that people cannot be assumed as homo-economicus as indicated in Cass, Koopmans, and Ramsey. They highlighted that loss aversion functionalizes in this kind of aggregate macroeconomic time series model. Other important results are that the discount factor and updating horizon period are negatively related to loss aversion.

Santoro et al. (2014) demonstrated that loss aversion behavior integrated into general equilibrium models could be a way out to vaste debate on the asymmetric effect of monetary policy on output and inflation. They showed that loss aversion causes many types of non-linearities and asymmetric shocks on macroeconomic variables during contractionary and expansionary phases of the business cycle, and how to renovate monetary policies to cope with these asymmetries. Foellmi et al. (2019) incorporated prospect theory into the neoclassical growth model. They stated that the reluctance of loss-averse individuals in the economy reduces the level of current consumption in order to achieve a higher steady state in the future. They also came up with that stochastic growth (real business cycle) with loss-averse agents relaxing the assumption and requirements with less negative technology shocks to explain macroeconomic aggregates. Sirven and Barnay (2017) investigated the reasons what are motivational factors behind the increasing number of job retention of older workers in European countries since 2000. European Countries—micro data level-2006–2011—survey. For older workers who remain on the market and prefer job retention the effect of the “bad surprise” looms larger than the “good surprise”. These preferences indicate loss aversion behavior and resistance against losing wealthier life conditions changing in consumption utility. Another important result indicates that loss aversion is more common among males, and risk-averse individuals (Tversky and Kahneman, 1991; Grossman and Helpman, 1994; Freund and Ozden, 2008; Rosenblatt-Wisch, 2008; Santoro et al., 2014; Sirven and Barnay; 2017; Foellmi et al., 2019; Clancy and Ricci, 2019). In a nutshell, the main aim of the study is to highlight the loss aversion behavior, and similar tendencies under the phenomenon of consumption smoothing, tax evasion, tax avoidance, market volatility, bubbles, frauds, and crashes, and trade protectionism (Morduch, 1995; Dhami and Al-Nowaihi, 2007; Freund and Özden, 2008; Bouteska and Regaieg, 2018; Yang, 2019; Reiter-Gavish et al., 2022).

Besides the above explanation, machine learning prediction with loss aversion bias as output has become an increasingly popular research topic in recent years. This study aims to investigate how demographic and psychological factors affect loss aversion bias in the context of Hybrid Machine Learning Models prediction (Fig. 2). By utilizing demographic information such as age, income, and gender, as well as psychological factors such as overconfidence, hopelessness, and financial literacy scale. Therefore, it hopes to gain a better understanding of how these factors contribute to loss aversion bias in Hybrid Machine Learning Models prediction. The results of this study will have important implications for the design and implementation of Hybrid Machine Learning Models in a variety of fields.

The study is finally structured as follows. The next section is the model and methodology used in the study, including any relevant variables, equations, and data sources. The literature section enables enough amount of the existing literature on the topic, highlighting the gap in knowledge that the current study aims to fill. The results and discussion section presents the results of the study, including any relevant data or figures, in addition to the implications of the results and how they contribute to the understanding of the topic. Lastly, the conclusion and policy implications section has the main findings of the study and discusses their policy implications for decision-makers along with recommendations for future research.

Model and methodology

Kahneman and Tversky (1979) showed that people are about twice as sensitive to the pain of loss than to the pleasure of gains. In other words, subjective value functions can be more convex and steeper in the lost region. They proposed to use the median value of the index created with U(−x)/U(x) by ordering the decisions of acceptance or/and rejection with a series of mixed gambles to determine the loss aversion coefficient λ (lambda) (Kahneman and Tversky, 1979).

Boulding (1983) emphasizes the importance of understanding of loss aversion concept with the following words:

… the perception of potential threats to survival may be much more important in determining behavior than the perceptions of potential profits so profit maximization is not really the driving force. It is fear of loss rather than the hope of gain that limits our behavior (Boulding (1983).

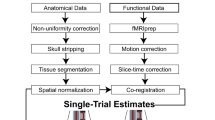

Kahneman and Tversky (1991) found the loss aversion coefficient λ = 2.25 as the median value (between 2 and 2.5) (Tversky and Kahneman, 1991). Tom et al. (2007), used fMRI (functional magnetic resonance Imaging) brain imaging technique and 16 participants involved in their study, and λ was found as a median value of 1.93 (Tom et al., 2007). In this study, we found λ = 3.1 as the median value (range between 0.5 and 6). It is seen that the pain of losing is three times as powerful as the pleasure of gaining.

The size of the sample in behavioral and neurological experiments is limited because of the time, cost, human factors, and ethical issues. Since model coefficients are not reasonably effective for quantitative and qualitative analysis, deeper analysis of Insight Theories and more reliable predictions of Forecasting Theories enabled relatively weak results. The development of hybrid models began with the integration of behavioral theories into machine learning rules for predicting human decisions. While pioneer studies in the field of behavioral economics and neuroeconomics contain qualitative behavioral insights (loss aversion, endowment effect, etc.), quantitative behavioral foresight models obtained from functional descriptive models such as (Cumulative) Prospect Theory have enabled us to develop hybrid models (Ivanov et al., 2009; Plonsky et al., 2019).

Literature review

Loss aversion is a concept in behavioral economics that describes an individual’s tendency to prefer avoiding losses over acquiring gains. The concept of loss aversion has been studied by researchers for over 40 years, and its implications for consumer behavior and decision-making have been widely explored. Since the publication of Kahneman and Tversky (1979) “Prospect theory: An analysis of decision under risk”, loss aversion has been widely studied and has been found to play a role in a variety of decision-making contexts, including financial decision-making, risk-taking, and consumer behavior. This literature review provides various research studies conducted to explore the concept of loss aversion, its impact on consumer decision-making, and how it can be applied in various settings.

Loss aversion and overconfidence, hopelessness, level of financial literacy, gender, age, and income are multiple directly and indirectly related concepts that have been studied in the field of behavioral economics. Overconfidence, on the other hand, refers to the tendency of people to be overly optimistic or to overestimate their abilities, knowledge, or chances of success. There is evidence to suggest that loss aversion and overconfidence may be related, as overconfidence can lead people to take risks that they might not otherwise take, and these risks can sometimes result in losses. For example, people who are overconfident in their ability to make investment decisions might be more likely to take on risky investments, which could lead to losses if those investments do not perform as expected. At the same time, loss aversion can also influence overconfidence, as people who are more loss averse may be more conservative in their decision-making and less likely to take risks. This can lead to a self-reinforcing cycle, as people who are more loss averse may be less likely to take risks, which could in turn lead to fewer opportunities for losses, and this could further reinforce their loss-averse tendencies. Overall, the relationship between loss aversion and overconfidence is complex and multifaceted, and further research is needed to fully understand the ways in which these two phenomena interact and influence decision-making.

Moreover, hopelessness refers to a negative emotional state characterized by a lack of hope or expectation for the future. While loss aversion and hopelessness are not directly related, it is possible that loss aversion could contribute to feelings of hopelessness in some cases. For instance, if someone experiences a significant loss, such as the loss of a loved one or the loss of a job, they may feel a sense of hopelessness about their future prospects. Similarly, if someone is faced with repeated losses or disappointments, they may begin to feel a sense of hopelessness about their ability to achieve their goals or to improve their circumstances. Concurrently, feelings of hopelessness can also lead to a greater sense of loss aversion, as people who feel hopeless may be more fearful of taking risks or making changes in their lives, even if doing so might bring potential benefits because they do not believe that things will work out for them in the end.

Loss aversion and financial literacy are two related concepts that have been studied in the field of behavioral economics, as well. Financial literacy refers to the ability to understand and effectively manage financial matters. There is evidence to suggest that loss aversion can influence financial literacy, as people who are more loss averse may be more conservative in their financial decision-making and less likely to take risks. This can lead to a self-reinforcing cycle, as people who are more loss averse may be less likely to take risks with their finances, which could in turn lead to fewer opportunities for losses, and this could further reinforce their loss-averse tendencies. Simultaneously, financial literacy can also influence loss aversion, as people who are more financially literate may be better able to understand and manage financial risks, which could help them to make more informed and rational decisions about their finances.

Some studies have explored whether there are gender differences in loss aversion. Some have found that men and women do not differ significantly in their levels of loss aversion when making decisions about financial investments. On the opposite, some have found that men and women may differ in their levels of loss aversion in certain contexts. Women were more loss averse than men when making decisions about work-related risks, but men were more loss averse than women when making decisions about personal financial risks. Overall, the evidence on gender differences in loss aversion is mixed, and more research is needed to fully understand any potential differences and the factors that may contribute to them. It is important to note that individual differences in loss aversion are likely to be influenced by a range of factors, including cultural and personal experiences, and that it is not appropriate to make generalizations about loss aversion based on gender alone.

Further, some research has explored whether there are age differences in loss aversion. Some have found that older adults may be more loss averse than younger adults. Some studies found that older adults were more loss averse than younger adults when making decisions about work-related risks. Some other studies have found that age may not be a significant predictor of loss aversion. Overall, the evidence on age differences in loss aversion is mixed. It is important to note that individual differences in loss aversion are likely to be influenced by a range of factors, including cultural and personal experiences, and that it is not appropriate to generalize about loss aversion based on age alone.

There are other studies that have found that people with higher incomes may be less loss averse than those with lower incomes. People with higher incomes were less loss averse than those with lower incomes when making decisions about financial investments. Some other studies have found that income may not be a significant predictor of loss aversion. Income may not significantly predict loss aversion when making decisions about work-related risks. Overall, the evidence on income differences in loss aversion is mixed, and more research is needed to fully understand any potential differences and the factors that may contribute to them. It is important to note that individual differences in loss aversion are likely to be influenced by a range of factors, including cultural and personal experiences, and that it is not appropriate to generalize about loss aversion based on income alone. Other studies have found that people may be more loss averse when making decisions that involve longer durations. People were more loss averse when making decisions about long-term financial investments than when making decisions about short-term investments.

Molins et al. (2022) examined whether ambiguity and at-risk negativity bias lead to irrational choices, such as loss-aversion bias, by increasing or decreasing reinforcement learning with 69 participants. In order to determine the relationship between the negative at-risk bias and loss aversion behavior, the participants were asked to make a decision under the Lottery Choice Task (LCT), which includes six claims. Under ambiguity, they made 100 consecutive decisions with the Iowa Gambling Task (IGT) to examine participants’ negativity bias and karma avoidance bias. In addition to the facial expressions of the participants in risky and ambiguous decisions, mouse movements were also included in the model as an explanatory variable. The loss aversion coefficient was found to be between 2 and 2.5. They showed that the participants exhibited a negative bias towards the presented images, and this bias was associated with loss aversion behavior in risky decisions. It was found that when faces with ambiguous expressions were classified as positive, the greater the attractiveness of the opposing option, the greater the loss aversion. It is among the findings that the negativity bias automatically evaluates ambiguous faces as negative in the second, third, and fourth blocks, and this situation supports reinforcement learning through faster learning and higher performance, leading to an increase in the performance of IGT.

Liu and Fan (2022) investigated the effects of stock price fluctuations on investors’ psychological health and, accordingly, their physical health. The Truven Health MarketScan Claims and Encounters Database, a national dataset covering more than 13.3 million inpatient, outpatient, and pharmaceutical claims in the United States on a comprehensive individual level on physical well-being and mental health, allows for empirical identification of the effects of stock market downturns on the psychological health of investors. MarketScan) was used. The fact that the MarketScan data set is intended for employees increases the possibility that the use of antidepressants caused by stock market fluctuations is due to portfolio erosion rather than job loss. In the study, it was seen that the findings were compatible with the loss aversion phenomenon presented in the “Theory of Hope”, and that the increase in stock prices did not affect the use of antidepressants. On the other hand, it was observed that a standard deviation decrease in stock returns increased the use of antidepressants by about 0.42%.

He (2022) investigated the effects of overconfidence and loss aversion biases in investors on market performance. They argued that the normative and descriptive explanations offered by Kahneman and Tversky’s (1979, 1991) Expectation Theory and the expected value theory can only provide static and fragmentary explanations of the anomalies of the market that show changes over time. In the agent-based models they have developed, they have shown that overconfidence and loss aversion in the informed and uninformed trades of experienced and inexperienced investors are part of the natural functioning of the market in the period until experience is gained in order to avoid the necessary emergence dynamics within the scope of evolutionary theory in adaptive markets and to close the trades with a loss. They have accepted that investors who want to act with their own knowledge in the market communicate their actions to each other through prices, under limited rationality, in election uncertainty, and that information exchange and coordination in the market progress in this way. Individuals have provided an evolutionary explanation for the gaps between their willingness to accept (WTA: Willing to accept) and their willingness to pay (Willing To pay) from their own experiences combined with market knowledge, overconfidence, and loss aversion behaviors. In this sense, inexperienced agents exhibited overconfidence because they were willing to pay a premium to learn the dominant strategies of informed experienced agents, whereas the stability motive demanded a reward for making risky choices. At the end of the market experience, the law of diminishing marginal utility removes behavioral biases, allowing intermediaries to act as if they were purely rational. Inexperienced traders will incur more losses than gains on their first trades in uncertain market conditions. In this case, he will need overconfidence or optimism to get his long-term expectations from the market. As one becomes a more experienced trader, he will be able to identify dominant strategies, such as loss aversion, to stabilize his targets. Although the limits of his rationality are debatable, it is assumed that the trader develops or develops a system that provides protection from irrational choices with limited rationality, with the contribution of diminishing marginal utility.

Yiwen (2021) investigated how the stock price performances of 100 nonfinancial publicly listed firms in the Chinese stock market were affected by potential investor biases such as loss aversion and overconfidence between 2000 and 2020. The hypotheses of it showed that men and women tend to have more overconfidence in their investments than women because of the differences in their manner of thinking and investment preferences. Another explanation for the effects of overconfidence in the market is that the overconfidence tendencies of investors with private and public information in the market are due to their excessive reaction to the correct information. Investors who use private information give overconfidence and overestimation of accurate information, which causes overreaction. The investor profile that bases transactions on public information is accepted as that of a rational investor. The risk-taking profile of overconfident investors leads them to expect higher profits than rational investors. These investors admitted that in the long run, portfolios that lose money can outperform portfolios that make a profit by 25%. Therefore, Yiwen (2021) acknowledged the existence of a transitional mechanism between overconfidence and loss aversion. Loss aversion behavior was represented by the percentage changes in the trading volume, and overconfidence was measured by the percentage change in the shares owned by the shareholders. They showed that the feeling of pessimism may reflect the loss aversion behavior of investors and cause negative effects on the prices of publicly traded firms.

Baek et al. (2017) investigated the relationship of suicidal behavior with risk and loss aversion, which may produce negative predictions about uncertain future events, examined 45 depressed patients with a history of suicide attempts, 47 depressed patients without a history of suicide attempts, and 75 healthy individuals. All participants were included in monetary decision-making tasks evaluating risk and loss aversion. Risk and loss aversion was found to be increased in depressed patients with a history of suicide attempts compared to depressed patients who had not attempted suicide before and healthy participants who were not depressed. In addition, in these patients, risk aversion manifests itself especially in the area of loss, in other words, suicide attempters who choose between a certain loss and a gamble that will not lead to a greater loss or no loss, compared with other groups, was more likely to be against both risk and loss in gambling with potential loss. It was observed that they exhibited excessive reluctance. Risk avoidance and loss avoidance were found to be correlated in depressed patients. Risk and loss aversion biases are thought to be caused by a common pathophysiological mechanism. It is among the findings that emotion regulation through suppression, which is a harmful emotional control strategy, is positively associated with loss avoidance in depressive patients, which indicates deterioration in emotion regulation processes. In fMRI findings, it was observed that the subgenual anterior cingulate cortex, insula cortex, and left amygdala exhibit impaired neural responses to potential gains and losses in brain regions related to valuation, emotion reactivity, and emotion regulation. Impaired neural responses indicate impaired emotion regulation in depressed patients with a history of suicidal attempts and are prone to increase negative evaluation in decision-making at risk.

Gächter et al. (2007) indicated the loss aversion bias in 660 randomly selected customers of a German car manufacturer, using risk-free and risky choices. As a result of risk-free and risky loss aversion experiments, significant heterogeneities were found depending on the socioeconomic components of the participants. Loss aversion in risk-free choices and loss aversion in risky choices have a strong positive correlation. However, on average, risk-free loss aversion was higher than risk-free loss aversion. It has been determined that loss aversion in both selection tasks increases with age, income, and wealth and decreases with education level. On both measures, women exhibited, on average, more loss avoidance behavior than men. Older people tend to be more loss-averse, both in their risk-free assessments and their risky choices. Loss aversion behavior increases with household income and welfare. Higher education reduces loss aversion in cases of risky loss aversion. The findings also show that the endowment effect is caused by more than just the status quo bias; loss aversion is also a factor in the endowment effect.

Following up on the relationship between the variables in the model and the loss aversion concept, Plonsky et al. (2017) adopted the Psychological Forest algorithm as a synthetic machine learning model within six behavioral mechanisms (such as sensitivity to expected values; minimization of immediate regret; outcomes equally likely; max. prob. of gain and min. prob. of losing; pessimism; dominance) and Best Estimate and Simulation (BEAST) as the behavioral and the baseline model. They investigated the power of the algorithms and the models mentioned above to predict human behavior in Choice Prediction Competition 2015 (CPC 2015) data involving 14 cognitive theories (Plonsky et al., 2017). Psychological Forest algorithm outperforms as an integrative approach of psychological insights into Random Forests for combined data and social science analyses.

Plonsky et al. (2019) also used Choice Prediction Competition 2015 (CPC 2015) and Choice Prediction Competition 2018 (CPC 2018) data, and benefited from 14 cognitive theories, behavioral theoretical models, and machine learning rules to estimate the performance of human behavior. Mean squared error results of the models revealed that hybrid models and certain behavioral theories included as a feature in the machine learning algorithms performed better than the descriptive models. in addition, among machine learning (ML) algorithms, the gradient-boosted decision tree model outperformed the other models (Plonsky et al., 2019).

Bourgin et al. (2019) developed the “ML + Raw Data”, “Theoretical Models”, “ML + Feature Engineering” and “ML + Cognitive Prior” prediction models using BEAST15 as input and explain changes in individual and interindividual gamble preferences by using CPC15 and CPC18 data. Among these models, Random Forest algorithms resulted in the lowest mean square error value (Bourgin et al., 2019).

The choice tasks and experimental design

The purpose of the study is to investigate the mostly cited qualitative behavioral analysis model “Loss Aversion” as the foremost cognitive bias model of a functional descriptive model, “Cumulative Prospect Theory”. Loss aversion measures the sensitivity of risk aversion or risk-taking tendencies for individuals under gains and losses in the case of mixed gambles.

For this reason, the research group consisted of 28 volunteer studentsFootnote 1. In a mixed gamble simulation, participants were asked to make decisions among only four alternatives: “Reject”, “Strictly Reject”, “Accept” or “Strictly Accept” options along with a 50% chance to gain, and 50% chance to lose. Participants are not allowed to stay out of trials. If the participant does not accept this gamble, it is assumed that the participant confirms a 100% chance for no gain (i.e., zero gain). The term “Strictly” is added to prevent participants from having difficulties with “reject” or “accept” decisions in gambles where the number of rewards and penalties are close to each other. The gamble matrix is set as 10 TLFootnote 2 for lower bound limits and 40 TL for upper bound for gains and the increment steps can increase by 2 TL for each gamble. The lower bound for the loss gambles are set to be 5 TL, and the upper bound is set to be 20 TL, decreasing steps can decrease by 1 TL for each gamble. In this sense, the study is a pioneer for other behavioral economic research in terms of the sample size of loss aversion-centric design and methods by benefiting from the hybrid model (machine learning algorithms plus qualitative behavioral insight model) to estimate individual’s decision. The Visual Basic programming language is used to design gamble simulations in Microsoft Excel 2016. During the sessions, the screen was recorded and so the reaction time for each gamble of each participant was calculated in milliseconds when the stimulus appeared on the screen (Fig. 3).

One of the particular aspects of the study was the calculation of the difference between milliseconds and the inclusion of psychological and individual factors and self-confidence, hopelessness, and financial literacy scales (Durak and Palabiyikoğlu, 1994; Akın, 2007; Sarıgül, 2015). Milliseconds were used as a feature in algorithms to enhance the prediction power of models. In the study, instead of putting the λ coefficient directly as a feature, the ratio of the gain and loss amounts of each gamble is added with the name diff among the features (Table 1).

Data, variables, and machine learning methods

Recently, experimental studies in the field of neuroscience and behavioral economics make it possible to determine more efficient parameters by dint of machine learning algorithms. These algorithms have more sophisticated and statistically reliable resampling methods for the detection of bias and anomalies under decision mechanisms (e.g., bagging, bootstrap, and Monte Carlo). Machine learning algorithms and descriptive theories (e.g., prospect theory) combined under hybrid models contribute to the development of specific and reliable foresight theories. The FORLEARN project is one of the crucial studies on the development of foresight theories in Europe. Under the FORLEARN project, the importance of six functions that can help policymakers to develop predictive theories was emphasized. These are considered symbolic functions, informing policy, facilitating policy implementation, supporting policy definition, reconfiguring the policy system, and embedding participation in policymaking. Advances in multi-agent, multi-layer, and hybrid model analysis, combined with increased processing speeds, have granted population tendencies and fine-tuning hyperparameters to be taken into account in policy making and implementation phases (Da Costa et al., 2008; Lian et al., 2017; Rosenfeld and Kraus, 2018).

This study employed hybrid machine learning algorithms. The main objective in the application of machine learning classification and regression models is to resolve the probability of an individual preferring a gamble rather than calculating the “Aggregate Probability” of all individuals involved in a gamble. In the first stage, machine learning classification algorithms were used to analyze the data and features of individuals’ decisions. On that occasion, it classifies predictions under a binary system “0 (reject) or “1 (accept)” as an updated feature. These classification results are included in another analysis as an input/feature for regression machine learning algorithms. In the next step, the data were split, respectively, into 80% and 20% train and test, and the probability of everyone to accept or reject each gamble was predicted as a continuous variable.

The raw data was divided into five different datasets (1–50; 51–100; 101–150; 151–200; 201–256). These observations were prepared for the use of machine learning algorithms including test and train split format. Accuracy score and mean square error (MSE) values of the classification and regression procedures of machine learning algorithms were reported in the results of the study. Machine learning procedures were performed using Python 3.6 Compiler and Keras, Pandas, Numpy, Matplotlib, and Plotly libraries. 2016b MATLAB curve fitting tools also benefited from graph features of the most powerful techniques: Random Forest Regression and Kernel SVR (Pal and Mather, 2003; Akbilgic, 2015; Lakshmi et al., 2013; Rodriguez-Galiano et al., 2012; Lee and Kim, 2016; Amari and Wu, 1999; Smits and Jordaan, 2002; Fix and Hodges, 1989; Cunningham and Delany, 2007; Xu et al., 2005; Breiman, 1996; Breiman, 2001; Liaw and Wiener, 2002; Cherkassky and Ma, 2004; Devroye et al., 1994; Chomboon et al., 2015) (Tables 2 and 3).

Murphy (2012) defines machine learning as

… a set of methods that can automatically detect patterns in data, and then use the uncovered patterns to predict future data, or to perform other kinds of decision-making under uncertainty (Murphy, 2012).

In terms of policy recommendation, the estimation of the loss aversion coefficient based on the participant’s behavior in the laboratory experiment done within the scope of the study is essential, but insufficient. In this regard, it is essential that feature importance analyses in machine learning models highlight the demographic and psychological components behind the loss aversion bias. Both econometric and machine learning techniques are used to analyze and predict data. While econometric methods are based on the causal connection between these biases and explanatory variables, machine learning algorithms permit estimations with training and testing. However, there are some key differences between the two:

Data type: Econometric techniques are typically used to analyze quantitative data, such as economic data, while machine learning methods can be used to analyze both quantitative and qualitative data.

Focus: Econometric techniques are primarily used to understand the relationships between economic variables and to make predictions about future economic outcomes. Machine learning methods, on the other hand, are focused on building models that can learn patterns in data and make predictions or decisions based on those patterns.

Approach: Econometric techniques follow a more formal and structured approach to data analysis, with a clear set of assumptions and methods for estimating relationships between variables. Machine learning methods are more flexible and adaptable, allowing the model to learn from the data and adjust itself as new data becomes available.

Complexity: Econometric techniques can be used to analyze relatively simple relationships between variables but can become more complex as the number of variables increases. Machine learning methods can handle very large and complex datasets and are often used to analyze very large and complex datasets.

The sample size (28 volunteer students) has been determined by a biostatistics expert using the G-Power program and with the approval of the Ethics Committee.

Results and discussion

Beyond the main goal of behavioral science to explain and understand the way of individuals behavior, the main goal is to predict multiple mechanisms integrated into behavioral insight features. By the virtue of behavioral foresight, the study can focus on interactions and the relative importance of objective, naïve, sociodemographic, and psychological features. In Fig. 4, the nearest neighbor interpolant curve fitting graphs generated in the Matlab program for the diff feature representing the ratio between the amount of gain and loss of the gambles, the aggregate probabilities (prob), and the individual probability (probpred) target feature estimated by the Random Forest algorithm are presented. Random Forest algorithm has performed very effective predictions in low and high values of diff feature, especially when this ratio is <0 and close to 8. Acceptance of gambles is low at low diff levels. In the cases where the loss aversion is coefficient, which is determined as the median value of the participants is 3.1 when the prob and probpred values are around 50%, acceptance of gambles is low, and the duration of decision differs significantly. When the diff feature is close to 1 and the value of the probpred target features is around 50%, there is a significant increase in the duration of the decision. The decision-making process is longer in milliseconds (1681 ms) when diff (close to 0) and probpred (10–20%) are low. In the cases where acceptance of gambles is at moderate probability (50–60%), the duration of decision times is higher than the average decision-making time (1618 ms). Duration of decision (1536 ms) is very short when diff (between 6 and 8) and probpred are high (between 90% and 100%) (Fig. 4).

Throughout the experiment, the average duration of the decision is 1600 ms. 4702 gambles are accepted and the average duration of decision for gambles is 1564 ms. In 2466 certain gain amount (0 TL with %100 probability) was chosen. The average duration of decision for certain gain choice decisions is 1670 ms. On that account, decision-makers were quicker to accept gambles. This situation strengthens the possibility that the participants have strong beliefs in their levels of self-confidence, prospect, heuristic, and financial literacy, and it also shows the use of related features as psychological factors to support the baseline model in the machine learning rules. This situation has been named as the “irresistible impulse of gambling” when decision-makers minimize the duration of their decisions for gambling. When the diff is between 3.1 and 0, which is the median value of loss aversion, participants decrease the probability of acceptance of gambles and the duration of the decisions increases. Where the diff is between 2.9 and 3.1, 364 decisions have been made, and the average duration of the decision is 1560 ms (ranging from 100 to 2900 ms). In the cases where the diff is between 2.1 and 1.1, 2660 decisions have been made. The average duration of the decision is 1639 seconds (ranging from 200 to 3600 ms). In Fig. 4, it is observed that the tendency to accept gamble increases where the diff is between 2 and 1 and probpred is around 50%. In the cases where the diff is between 0 and −2, 840 decisions have been made. The average duration of the decision was 1623 s (ranging from 200 to 3200 ms).

In such loss-resulting gambles where zero gain is an alternative, it is observed that the duration of the decision is higher than the values of the average duration of the decision and other diff values where the decision makers accepted gambles. This is consistent with the Kahneman and Tversky (1991) “losses loom larger than gains” statements in terms of the duration of the decision as well as the quantity. This seems that decision-makers extend the duration of their decision directly in proportion to the pain that they will suffer in case of loss (Dong et al., 2014). In the cases where diff is between 3 and 8, 1652 decisions have been made. The average duration of the decision is 1506 s (ranging from 100 to 3900 ms). These results have led to a distinction that the duration of the decision of gambles is higher than certain amounts, but the duration of the decision for losses is slower than earnings (Table 4).

The average duration of the decision is 1600 ms. The average duration of decision for Acceptance Gambles is 1564 ms, for Certain Amount (Rejection of Gambles) it was 1670 ms. Decision-makers were quicker to accept gambles. These results seem compatible with Kahneman (2011) theory of “Fast and Slow Thinking” which brings an explanation to the system of thinking in simple and complex decisions during daily life (Kahneman, 2011). The empirical findings of the study support the perception that individuals make faster decisions to end their painful results of decisions such as risk-taking, early payment discount of the penalties and taxes, and consumption smoothing. As the probability and probability prediction of the gambles and the differences increase, the duration of the decision increases. These findings are also coherent with the duration of the decision for the Acceptance and Rejection explanations discussed above.

Table 5 presents the accuracy scores of the classifications and the mean error-squared results of the regression results. The table shows that the Random Forest algorithm is the best-performing algorithm in hybrid machine learning which is considered the loss aversion baseline model. This result is like previous studies by Plonsky and Bourgin (Plonsky et al., 2019; Bourgin et al., 2019).

In line with the earlier literature, it was found that the Random Forest algorithm is superior to other algorithms. The results are consistent with the literature’s conclusion that this algorithm is superior at predicting human biases. λ = 3.1 was determined to be the median value of the participants’ loss aversion coefficient (range between 0.5 and 6). In the literature, the loss aversion coefficient is commonly between 2 and 2.5, however, it has been observed that it is higher than in earlier studies. It is believed that this outcome is closely related to the experimental design and participant scale values. The results are believed to be validated by the use of the scale values in additional investigations and at various sample levels. It was observed that the placement of “strictly reject” and “strictly accept” options in the experimental design, similar to the results obtained from facial expressions that support reinforcement learning (\), caused an increase in the average times in the acceptance and rejection rates of the gambles.

When the issue comes to the limitations of the study, there are several potential limitations of experimental research on loss aversion as followings:

Ecological validity: loss aversion experiments are often conducted in laboratory settings, which may not accurately reflect real-world decision-making. This limits the generalizability of the findings to real-world scenarios.

Simplicity: loss aversion experiments often involve simple decision-making tasks, such as choosing between a sure gain and a gamble, which may not capture the complexity of real-world decision-making.

Self-reported measures: Many experiments rely on self-reported measures of loss aversion, which can be affected by social desirability biases and may not accurately reflect actual decision-making.

Data issues: The research may have missing data or outliers which can have a significant effect on the results.

Sample size: experiments may have a small sample size which can affect their power and the generalization of the findings.

Confounds: The research may have uncontrolled variables that can confound the results and not allow for a clear causal relationship between the independent and dependent variables.

Conclusion and policy implications

This study focused on individual human choice behavior in different amounts of money choice problems. It compares the MSE value of different hybrid machine-learning algorithms using some features. It has 28 participants from Toros University who were briefly informed about the gambles. The gambles include 256 decisions, all the gambles were choices with 50–50% risky gain and loss amounts and 100% 0-zero gain. Participants had 3 s to prefer alternatives, gambling or not on a given amount of money. Thus, the analysis consisted of 7168 (28 × 256) data. All data were split into train and test data. The train and test data were scaled with quantile scaler metrics via the scikit_learn. Preprocessing scaler library and made ready for regression. After completing the ML classification forecasting of each participant’s “accept” or “reject” gamble decision, the continuous value of the probability of each state was predicted with ML regression methods.

Loss aversion was measured statically in a controlled experimental context by simulating risky mixed gambles. It is possible to dynamically quantify loss aversion in market transactions using proxy transactions for certain time periods; however, this is not possible in an experimental environment. The concept of loss aversion is essential for recovering the trust of investors who have sustained significant losses because of the increasing volatility of financial markets. ETFs are one of the market participants that can generate contagion effects and magnify the impact of market movements. Numerous employees invest their retirement funds in capital and money markets to guard against inflation throughout their golden years. Depending on their financial knowledge and socioeconomic standing, investors may develop gloomy perceptions of the market and grow anxious about losses to their retirement funds. During periods of sharp declines, for instance, excessive volatility induced by excessively anxious and risk-averse investors or excessively risk-loving investors during bull markets may contribute to market volatility due to timing disparities and changes in investment appetite. The process of restoring confidence may not take as long as the time it takes for investors to flee markets owing to decline-induced losses. The restoration of market trust will not be compensated as quickly as the damage itself. This discrepancy in time will result in supply and demand imbalances, delaying the dynamic balancing process. In the study, the phenomenon of loss aversion, which contributes to the degradation of equilibrium, was analyzed statistically under the influence of specific demographic and psychological variables. Examining the equilibrium path under various experimental conditions that also account for other biases, such as the ownership effect and negativity bias, will aid in the development of time-based policy suggestions.

In Graph 1 (see Appendix), it is observed that the Random Forest algorithm is effectively determined with the continuous values of the predictions of the medium probabilities as well as the high and low probabilities of the probability prediction as target features. In Graph 2 (see Appendix), the difference feature was highly correlated with all other variables. Decision Tree Feature Selection operation confirmed that the difference (diff) feature had a very important place among the inputs. This indicates that the choice of the loss aversion factor as a baseline model within the machine learning rules provides an important input in increasing the prediction power of the algorithms. Random forest algorithm has shown the effectiveness of iteration methods (e.g., bagging) in modeling human behaviors as the regression model which gives the lowest MSE value by generating additional trees and nodes. This study concerns that hybrid machine learning algorithms are vital to model complex structures of human behavior. These models integrate data-driven machine learning systems and theoretical elements of decision theories. Hybrid machine learning algorithms allow policymakers to include fine-tuning model parameters such as loss aversion coefficient in macroeconomic models and hence, enable them to develop relatively large samples and implement policies using based on such predictive methods.

Loss aversion is a psychological phenomenon in which individuals are more likely to take action to avoid losses than to pursue gains. This phenomenon has implications for gender relations policy, particularly in areas such as pay equity, workplace harassment, and other gender-based issues. For example, when it comes to pay equity, loss aversion can lead to gender-based wage gaps. This is because employers may be more likely to offer lower wages to female employees in order to avoid the potential “loss” of having to pay female employees the same wage as male employees. Loss aversion can also lead to workplace harassment as employers may be more likely to take action to avoid potential losses associated with complaints or lawsuits. This could include allowing harassment to occur or punishing employees who report harassment. Finally, loss aversion can lead to gender-based discrimination in hiring and promotion decisions. In particular, employers may be more likely to choose male applicants over female applicants in order to avoid potential losses associated with hiring a female employee. To address these issues, policymakers should consider implementing policies that reduce the potential losses associated with gender-based issues. For example, employers could be required to pay a minimum wage and/or provide anti-harassment training to all employees, regardless of gender. Additionally, employers could be incentivized to hire and promote female employees by offering tax credits or other benefits for doing so.

Loss aversion has a number of implications for policy-makers, particularly when it comes to age-related issues. Here are some of the implications:

Older adults and retirement savings: Loss aversion can lead to older adults being overly conservative with their retirement savings, as they are more likely to focus on avoiding losses than on maximizing gains. This can lead to older adults not taking enough risks with their retirement savings, which can negatively affect their financial security in retirement. Policy-makers should consider ways to encourage older adults to take more risks with their retirement savings, such as providing educational resources and incentives.

Elder financial abuse: Loss aversion can lead to older adults being more vulnerable to financial exploitation, as they may be more likely to make decisions that minimize losses rather than maximize gains. Policy-makers should consider ways to protect older adults from financial exploitation, such as providing educational resources and monitoring financial transactions.

Elder care: Loss aversion can lead older adults to be overly focused on avoiding losses, even when such losses may be necessary for their overall well-being. Policy-makers should consider ways to encourage older adults to take risks that may be beneficial for their overall well-being, such as providing educational resources and incentives.

Loss aversion phenomenon has been found to have a strong relationship with income, with those from lower-income households exhibiting greater loss aversion than those from higher-income households. Therefore, there are potentially important policy implications to consider when attempting to influence the behavior of individuals from different economic backgrounds. One policy implication of this research is that when attempting to influence the behavior of individuals from lower-income households, it may be more effective to focus on reducing the potential losses that could be incurred as opposed to emphasizing potential gains. For example, when attempting to encourage individuals to save money, it may be more effective to emphasize the potential losses that could be incurred by not saving (e.g. missed opportunities to invest, or inflation eroding the value of money) as opposed to emphasizing the potential gains that could be earned. Another policy implication is that when attempting to influence the behavior of individuals from higher-income households, it may be more effective to emphasize potential gains rather than potential losses. For example, when attempting to encourage individuals to invest, it may be more effective to emphasize the potential gains that could be earned (e.g. returns on investments, or the potential to increase wealth) as opposed to emphasizing the potential losses that could be incurred (e.g. risk of losing money, or the potential to incur debt). Overall, this research suggests that when attempting to influence the behavior of individuals from different economic backgrounds, it may be beneficial to consider the potential losses and gains that could be incurred, as well as the individual’s income level. This could help ensure that policies are tailored to the needs and preferences of the target population, and potentially lead to better outcomes.

The relationship between loss aversion and hopelessness is significant and has important policy implications. Loss aversion, or the tendency to strongly prefer avoiding losses to acquiring gains, is a common cognitive bias that can lead to feelings of hopelessness and helplessness. When people experience loss aversion, they are more likely to feel that the future is out of their control and that they are unable to make positive changes in their lives. This can lead to a sense of despair and can prevent people from taking meaningful action. Policy makers should take the relationship between loss aversion and hopelessness into account when designing programs and policies. For example, they should consider ways to reduce the feeling of helplessness that comes with loss aversion, such as providing opportunities for meaningful action or offering support to those who are feeling hopeless. Additionally, policy makers should aim to reduce the likelihood of people experiencing loss aversion by providing clear information on the risks and rewards associated with various actions and by making sure that people have access to resources to help them make informed decisions.

Financial literacy, on the other hand, is the ability to understand and make informed decisions about financial matters. Given the link between loss aversion and financial literacy, there is a need to develop policies that promote financial literacy and reduce the risk of loss aversion. This could include initiatives such as:

Education: Developing and implementing financial education programs in schools to increase financial literacy and reduce the risk of loss aversion.

Regulation: Establishing regulations that require financial institutions to provide clear, concise and accurate information to consumers.

Incentives: Introducing incentives to encourage the use of financial products and services that reduce the risk of loss aversion.

Financial counseling: Establishing financial counseling services to assist people in understanding the risks and rewards of financial decisions.

By implementing these policies, governments can help to reduce the risk of loss aversion and promote financial literacy, which will ultimately lead to better financial decisions and improved financial outcomes.

Loss aversion and overconfidence are two common biases that have important implications for policymaking.

First, policy makers should be aware of the effects of loss aversion and overconfidence when designing policies. Policy makers can take steps to account for these biases, such as providing clear information and setting reasonable expectations. Additionally, policy makers should consider how the public will respond to potential losses and should structure policies in ways that minimize the potential impact of losses.

Second, policy makers should consider how to mitigate the effects of these biases. This may include providing additional resources to help people understand the risks involved in a policy and how to make wise decisions. Additionally, policy makers should consider how to reward those who take the time to properly assess the risks and rewards of a policy, and how to discourage those who take excessive risks.

Finally, policy makers should consider how to ensure that individuals and organizations are held accountable for their decisions. This may include introducing more stringent regulations on investment decisions or introducing penalties for those who take excessive risks. Additionally, policy makers should consider how to encourage individuals and organizations to seek independent advice before making decisions, which can help mitigate the effects of these biases.

Loss aversion is a cognitive bias that can have significant implications for decision-making, as it can lead to decisions being made too quickly, without considering all potential outcomes. To address this issue, policymakers should consider implementing policies that encourage decision-makers to take their time when making decisions. Such policies might include:

Allowing sufficient time for decision-making: Policies that establish reasonable time frames for decision-making, such as allowing at least one week or two weeks for decisions instead of rushing to make them in a matter of days or hours.

Providing decision-makers with sufficient information: Policies that require decision-makers to have access to all relevant information before making a decision, such as requiring them to consult with experts or do research on the issue.

Ensuring that decisions are based on evidence: Policies that require decision makers to base decisions on evidence, such as requiring them to consider different scenarios or outcomes and weigh the pros and cons of each.

These policies can help to ensure that decisions are made in a manner that takes into account loss aversion and avoids the negative consequences of making decisions too quickly.

Loss aversion can influence how individuals and organizations make decisions, particularly when it comes to matters involving risk and uncertainty. For example, policymakers may need to consider loss aversion when designing policies that aim to encourage individuals to engage in certain behaviors, such as saving for retirement or making healthier lifestyle choices. Loss aversion can make it difficult for people to make changes that involve short-term sacrifices or losses, even if those changes may lead to long-term benefits. Policymakers may also need to consider loss aversion when designing policies that involve the distribution of resources or the allocation of risks. For example, policies that involve redistributing resources from one group to another may be met with resistance if the group that stands to lose resources is more loss averse than the group that stands to gain. Overall, understanding loss aversion can help policymakers to design policies that are more effective and that are better able to address the needs and concerns of the individuals and groups that they are intended to benefit.

Finally, further research can address other types of human biases (such as herding behavior, overconfidence, endowment effect, anchoring, adjustment biases, etc.) and neuropsychologic signature analysis via hybrid machine learning models.

There are many possible approaches that could be taken in a research paper on loss aversion. Some possible approaches such as new moderators and mediators that could be considered “novel” might include:

Examining the neural basis of loss aversion: Using brain imaging techniques such as fMRI, researchers could study the neural mechanisms underlying loss aversion and explore how these mechanisms might influence decision-making and behavior.

Investigating the role of loss aversion in group decision-making: Research could examine how loss aversion might influence group dynamics and decision-making, and how group-level factors such as group size and composition might affect loss aversion.

Examining the impact of loss aversion on policy decisions: Researchers could study how loss aversion might influence policymakers’ decision-making and how policymakers might be able to design policies that take loss aversion into account.

Exploring the role of loss aversion in intertemporal choice: Research could examine how loss aversion might influence people’s choices between smaller immediate rewards and larger future rewards, and how this might vary across different cultural and demographic groups.

Investigating the role of loss aversion in social comparisons: Research could explore how people’s perceptions of their own losses and gains might be influenced by their comparison to others, and how this might impact their decision-making.

Overall, a novel approach to a research paper on loss aversion would involve bringing a fresh perspective to the study of this phenomenon and exploring new and understudied areas of inquiry.

Data availability

The data set used in this study is available from the corresponding author at a reasonable request. The data are not publicly available due to privacy or ethical restrictions.

Notes

The number of participants was determined under professional biostatistician consultancy, and the approval of clinical and experiment was received from XXX University Clinical Research Ethics Committee.

TL = Turkish Lira

References

Akbilgic O (2015) Classification trees aided mixed regression model. J Appl Stat 42(8):1773–1781. https://doi.org/10.1080/02664763.2015.1006394

Akın A (2007) Öz-Güven Ölçeği’nin Geliştirlmesi ve Psikometrik Özellikleri Abant İzzet Baysal Üniversitesi. Eğitim Fakültesi Dergisi 7(2):167–176

Alm J (2014) Does an uncertain tax system encourage “aggressive tax planning”? Econ Anal Policy 44(1):30–38. https://doi.org/10.1016/j.eap.2014.01.004

Amari SI, Wu S (1999) Improving support vector machine classifiers by modifying kernel functions. Neural Netw 12(6):783–789. https://doi.org/10.1016/s0893-6080(99)00032-5

Baek K, Kwon J, Chae JH, Chung YA, Kralik JD, Min JA, Jeong J (2017) Heightened aversion to risk and loss in depressed patients with a suicide attempt history. Sci Rep 7(1):1–13

Basu AK, Dulleck U (2020) Why do (some) consumers purchase complex financial products? An experimental study on investment in hybrid securities. Econ Anal Policy 67:203–220. https://doi.org/10.1016/j.eap.2020.07.005

Boulding KE (1983) Evolutionary economics. J Bus Eth 2(2). https://www.jstor.org/stable/i25071376

Bourgin DD, Peterson JC, Reichman D, Russell SJ, Griffiths TL (2019) Cognitive model priors for predicting human decisions. In: Chaudhuri K, Salakhutdinov R (Eds). International conference on machine learning. PMLR, pp. 5133–5141

Bouteska A, Regaieg B (2018) Investor characteristics and the effect of disposition bias on the Tunisian stock market. Borsa Istanbul Rev 18(4):282–299. https://doi.org/10.1016/j.bir.2018.05.004

Breiman L (1996) Bagging predictors. Mach Learn 24(2):123–140. https://doi.org/10.1007/BF00058655

Breiman L (2001) Random forests. Mach Learn 45(1):5–32. https://doi.org/10.1023/A:1010933404324

Canessa N, Crespi C, Motterlini M, Baud-Bovy G, Chierchia G, Pantaleo G, Tettamanti M, Cappa SF (2013) The functional and structural neural basis of individual differences in loss aversion. J Neurosci 33(36):14307–14317. https://doi.org/10.1523/JNEUROSCI.0497-13.2013

Cherkassky V, Ma Y (2004) Practical selection of SVM parameters and noise estimation for SVM regression. Neural Netw 17(1):113–126. https://doi.org/10.1016/S0893-6080(03)00169-2

Chomboon K, Chujai P, Teerarassamee P, Kerdprasop K, Kerdprasop N (2015) An empirical study of distance metrics for k-nearest neighbor algorithm. In: Maode Ma (ed.). Proceedings of the 3rd international conference on industrial application engineering. The Association for Computing Machinery (ACM) New York. pp. 280–285

Clancy D, Ricci L (2019) Loss aversion, economic sentiments and international consumption smoothing. European Stability Mechanism Working Paper 35. pp. 1–61

Da Costa O, Warnke P, Cagnin C, Scapolo F (2008) The impact of foresight on policy-making: insights from the FORLEARN mutual learning process. Technol Anal Strateg Manag 20(3):369–387. https://doi.org/10.1080/09537320802000146

Cunningham P, Delany SJ (2007) k-Nearest neighbour classifiers. Mult Classif Syst 34(8):1–17. https://doi.org/10.48550/arXiv.2004.04523

Devroye L, Gyorfi L, Krzyzak A, Lugosi G (1994) On the strong universal consistency of nearest neighbor regression function estimates. Ann Stat 22(3):1371–1385. https://doi.org/10.1214/aos/1176325633

Dhami S, Al-Nowaihi A (2007) Why do people pay taxes? Prospect theory versus expected utility theory. J Econ Behav Organ 64(1):171–192. https://doi.org/10.1016/j.jebo.2006.08.006

Dong G, Lin X, Zhou H, Du X (2014) Decision-making after continuous wins or losses in a randomized guessing task: implications for how the prior selection results affect subsequent decision-making. Behav Brain Funct 10(1):1–11. https://doi.org/10.1186/1744-9081-10-11

Durak A, Palabiyikoğlu R (1994) Beck Umutsuzluk Ölçeği Geçerlilik Çalışmasi. Kriz dergisi 2(2):311–319. https://doi.org/10.1501/Kriz_0000000071

Fix E, Hodges JL (1989) Discriminatory analysis Nonparametric discrimination: consistency properties. Int Stat Rev/Rev Int Stat 57(3):238–247

Foellmi R, Jaeggi A, Rosenblatt-Wisch R (2019) Loss aversion at the aggregate level across countries and its relation to economic fundamentals. J Macroecon 61:103136. https://doi.org/10.1016/j.jmacro.2019.103136

Freund C, Ozden C (2008) Trade policy and loss aversion. Am Econ Rev 98(4):1675–91. https://doi.org/10.1257/aer.98.4.1675

Gächter S, Johnson EJ, Herrmann A (2007) Individual-level loss aversion in riskless and risky choices. CeDEx Discussion Paper No. 2007-02. Retrieved from University of Nottingham Centre for Decision Research and Experimental Economics http://www.nottingham.ac.uk/cedex/documents/papers/2007-02.pdf

Grossman GM, Helpman E (1994) Protection for sale. Am Econ Rev 84(4):833–850

Hutchison D (1981) The use of statistics in government decision-making with particular reference to the Reports of Royal Commissions. J Appl Stat 8(2):179–223. https://doi.org/10.1080/02664768100000015

He ZL (2022) An evolutionary theory of overconfidence and loss aversion in adaptive markets Sage Open. Available at SSRN 4115680 https://doi.org/10.1080/02664768100000015/10.1177/2158244021106849

Ivanov A, Levin D, Peck J (2009) Hindsight, foresight, and insight: an experimental study of a small-market investment game with common and private values. Am Econ Rev 99(4):1484–1507. https://doi.org/10.1257/aer.99.4.1484

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):363–391. 0012-9682(197903)

Kahneman D, Knetsch JL, Thaler RH (1991) Anomalies: the endowment effect, loss aversion, and status quo bias. J Econ Perspect 5(1):193–206. https://doi.org/10.1257/jep.5.1.193

Kahneman D (2011) Hızlı ve Yavaş Düşünme Çev. OÇ Deniztekin and F. Deniztekin Varlık Yayınları

Kim M, Han S (2016) Cognitive social network analysis for supporting the reliable decision-making process. J Supercomput 74(8):3654–3665

Kube S, Maréchal MA, Puppe C (2013) Do wage cuts damage work morale? Evidence from a natural field experiment. J Eur Econ Assoc 11(4):853–870. https://doi.org/10.1111/jeea.12022

Lakshmi TM, Martin A, Begum RM, Venkatesan VP (2013) An analysis on performance of decision tree algorithms using student’s qualitative data. Int J Mod Educ Comput Sci 5(5):18–27. https://doi.org/10.5815/ijmecs.2013.05.03

Lee H, Kim S (2016) Black-box classifier interpretation using decision tree and fuzzy logic-based classifier implementation. Int J Fuzzy Logic Intell Syst 16(1):27–35. https://doi.org/10.5391/IJFIS.2016.16.1.27

Lian T, Yu C, Wang Z, Hou Z (2017) The evaluation study on tourism websites: from the perspective of triangular intuitionistic fuzzy multiple attribute group decision making. J Appl Stat 44(16):2877–2889. https://doi.org/10.1080/02664763.2016.1266466

Liaw A, Wiener M (2002) Classification and regression by random. Forest R news 2(3):18–22. ISSN 1609-3631

Liu C, Fan M (2022) Stock market and the psychological health of investors. Available at SSRN https://ssrn.com/abstract=4295619

Molins F, Martínez-Tomás C, Serrano MÁ (2022) Implicit negativity bias leads to greater loss aversion and learning during decision-making. Int J Environ Res Public Health 19(24):17037

Morduch J (1995) Income smoothing and consumption smoothing. J Econ Perspect 9(3):103–114. https://doi.org/10.1257/jep.9.3.103

Murphy KP (2012) Machine learning: a probabilistic perspective. MIT Press

Pal M, Mather PM (2003) An assessment of the effectiveness of decision tree methods for land cover classification. Remote Sens Environ 86(4):554–565. https://doi.org/10.1016/S0034-4257(03)00132-9

Plonsky O, Erev I, Hazan T, Tennenholtz M (2017) Psychological forest: predicting human behavior. In: Thirty-first AAAI conference on artificial intelligence, San Francisco, CA

Plonsky O, Apel R, Ert E, Tennenholtz M, Bourgin D, Peterson JC (2019) Predicting human decisions with behavioral theories and machine learning. ArXiv preprint arXiv:1904.06866

Plott CR, Zeiler K (2005) The willingness to pay-willingness to accept gap, the endowment effect, subject misconceptions, and experimental procedures for eliciting valuations. Am Econ Rev 95(3):530–545. https://doi.org/10.1257/0002828054201387

Reiter-Gavish L, Qadan M, Yagil J (2022) Investors’ personal characteristics and trading decisions under distressed market conditions. Borsa Istanb Rev 22(2):240–247. https://doi.org/10.1016/j.bir.2021.04.005

Rodriguez-Galiano VF, Ghimire B, Rogan J, Chica-Olmo M, Rigol-Sanchez JP (2012) An assessment of the effectiveness of a random forest classifier for land-cover classification. ISPRS J Photogramm Remote Sens 67:93–104. https://doi.org/10.1016/j.isprsjprs.2011.11.002

Rosenblatt-Wisch R (2008) Loss aversion in aggregate macroeconomic time series. Eur Econ Rev 52(7):1140–1159

Rosenfeld A, Kraus S (2018) Predicting human decision-making: From prediction to action. Synth Lect Artif Intell Mach Learn 12(1):1–150. https://doi.org/10.2200/S00820ED1V01Y201712AIM036

Santoro E, Petrella I, Pfajfar D, Gaffeo E (2014) Loss aversion and the asymmetric transmission of monetary policy. J Monet Econ 68:19–36. https://doi.org/10.1016/j.jmoneco.2014.07.009

Sarıgül H (2015) Finansal okuryazarlik tutum ve davraniş ölçeği: geliştirme, geçerlik ve güvenirlik. Yönetim Ekon Araştırmaları Derg 13(1):200–218

Smits GF, Jordaan EM (2002) Improved SVM regression using mixtures of kernels. In: Proceedings of the 2002 International Joint Conference on Neural Networks IJCNN'02, Cat. No. 02CH37290, vol 3. IEEE, pp. 2785–2790

Sirven N, Barnay T (2017) Expectations, loss aversion and retirement decisions in the context of the 2009 crisis in Europe. Int J Manpow 38(1):25–44. https://doi.org/10.13140/RG.2.1.2229.7203

Sokol-Hessner P, Hsu M, Curley NG, Delgado MR, Camerer CF, Phelps EA (2009) Thinking like a trader selectively reduces individuals’ loss aversion. Proc Natl Acad Sci USA 106(13):5035–5040. https://doi.org/10.1073/pnas.0806761106

Thaler RH, Sunstein CR (2009) Nudge: improving decisions about health, wealth, and happiness. Penguin

Tom SM, Fox CR, Trepel C, Poldrack RA (2007) The neural basis of loss aversion in decision-making under risk. Science 315(5811):515–518. https://doi.org/10.1126/science.1134239

Tversky A, Kahneman D (1991) Loss aversion in riskless choice: a reference-dependent model. Q J Econ 106(4):1039–1061. https://doi.org/10.2307/2937956

Tversky A, Kahneman D (1992) Advances in prospect theory: cumulative representation of uncertainty. J Risk Uncertain 5(4):297–323

Wiafe OK, Basu AK, Chen ET (2020) Portfolio choice after retirement: should self-annuitisation strategies hold more equities? Econ Anal Policy 65:241–255. https://doi.org/10.1016/j.eap.2020.02.012

Yang L (2019) Loss aversion in financial markets. J Mech Inst Design 4(1):119–137. 10.22574/jmid.2019.11.005

Yiwen H (2021) Impact of investors’ loss aversion and overconfidence on market performance evidence from China Stock Markets. In: Thurasamy R, Majid IA, Rahman NABA, Zulkafli AH (Eds). 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021). Atlantis Press, pp. 2022–2025

Xu M, Watanachaturaporn P, Varshney PK, Arora MK (2005) Decision tree regression for soft classification of remote sensing data. Remote Sens Environ 97(3):322–336. 10.22574/jmid.2019.11.005

Acknowledgements

Mersin University Scientific Research Project Unit-Project Number: 2016-2-AP3-1906. Mersin University SCR Unit founded this study to collect the EEG and experimental data.

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Ethical approval

The conducted research clinical permissions were established with the approval of the Mersin University Clinical Research Ethics Board of Committee. We certify that the study was performed in accordance with the ethical standards as laid down in the 1964 Declaration of Helsinki and its later amendments or comparable ethical standards.

Informed consent

Written informed consent was obtained from all subjects before the study.

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Saltık, Ö., Rehman, W.u., Söyü, R. et al. Predicting loss aversion behavior with machine-learning methods. Humanit Soc Sci Commun 10, 183 (2023). https://doi.org/10.1057/s41599-023-01620-2

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-023-01620-2