Abstract

As Solís-Baltodano et al. (2021) figure out, almost a third of the total European Union budget was set aside for the Cohesion Policy during the 2014–2020 period. The distribution of this budget is made through three main structural and investment funds, trying to promote convergence in the level of development of EU countries. Specifically, the current approach, by analysing this situation as a claims problem (O’Neill, 1982), finds the claims solution that performs better than the others by reducing inequality and promoting convergence to a greater degree (the Constrained Equal Losses rule). Nonetheless, when using this egalitarian division of losses, regions may not receive any funds. This paper defines a new way to distribute the limited resources of the European Regional Development Fund (ERDF). It proposes a compromise between the egalitarian approaches, i.e., a combination of the egalitarian division of the funds with an egalitarian division of the losses (what regions do not get). In doing so, the proposal applies the constrained equal losses solution while ensuring a minimum amount is allocated to each region (sustainable bound). Finally, the new solution is axiomatically analysed, and it is applied to the ERDF problem.

Similar content being viewed by others

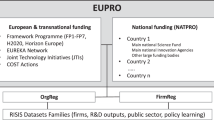

Introduction

The European Regional Development Fund (ERDF) is part of the European structural and investment fund, which has been designed under the EU cohesion policy. With the aim of reducing inequalities in the level of development among regions throughout the EU and compensating for the backwardness of less developed regions, the ERDF is invested in supporting small and medium-sized enterprises, improving the health system, developing the digital infrastructure, enforcing non-polluting transportation and diminish greenhouse gas emissions to achieve the target of being carbon neutral by 2050.

The European Commission together with member states are responsible for allocating the ERDF budget to regions. To allocate the ERDF, each member state is classified into three regions according to their Gross Domestic Product (GDP) per capita: less developed, transitioned, and more developed regions; and the ERDF is distributed to cover the needs of the regions according to the so-called Berlin method. However, we can consider the ERDF budget as the limited endowment to be allocated, and the funds that the regions need to develop some projects (mainly in infrastructures: airports, universities, hospitals, etc.) that they could not afford individually, can be defined as claims. The available ERDF budget is not enough to satisfy all the claims that the regions have on it, thus, we have a claims problem (O’Neill, 1982).

Within this context, the current approach complements Fragnelli and Kiryluk-Dryjska (2019) and Solís-Baltodano et al. (2021), by defining a new way of distributing the ERDF. As Fragnelli and Kiryluk-Dryjska (2019) mention “this approach has the great advantage that solutions may be obtained with a fast computation." Particularly, Solís-Baltodano et al. (2021) identify the agents (the EU NUTS level 2 regions) and the endowment (the ERDF budget to be allocated) and, then, use four solutions to claims problems: the Proportional rule, the Constrained Equal Awards rule, the Constrained Equal Losses rule, and the \({\alpha }_{\min }\)-Egalitarian rule. Among the analysed rules, the one that performs best (promoting convergence) is the one that proposes the most unequal (per capita) distribution of the ERDF budget: the Constrained Equal Losses rule.

It is noteworthy that there are other related economic and social problems where the claims approach is implemented: in the education sector, Pulido et al. (2002) use this approach to obtain an efficient allocation of university funds; in the fishing sector, it is a useful tool for seeking possible solutions to address fish shortages, by proposing fishing quotas among a number of agents within an established perimeter (Iñarra and Prellezo, 2008; Iñarra and Skonhoft, 2008; Kampas, 2015); Kiryluk-Dryjska (2014, 2018) propose a formal framework for rural development budget allocation by using fair division techniques; or, in the negotiations on CO2 emissions, a relevant issue nowadays, Giménez-Gómez et al. (2016) and Duro et al. (2020) propose an appealing distribution by analyzing this situation as a conflicting claims problem.Footnote 1

To solve claims problems, we have several division rules that propose a unique way to divide the endowment among agents. As aforementioned, Solís-Baltodano et al. (2021) study the allocation of ERDF as a claims problem by investigating different division rules. The authors show that the Constrained Equal Losses (CEL) solution, an egalitarian rule that divides the difference between the aggregate claims and the endowment (the part that cannot be honoured, i.e., the losses) equally among the agents is the best proposal to achieve the EU convergence target. The CEL gives priority to agents with larger claims per capita, that is, the less developed regions.

Nonetheless, the CEL assigns no funds to some regions, hence, it is usually not applied in real situations (no region will accept not receiving any amount).Footnote 2 Therefore, it seems clear that, in any real situation, smaller claimants should be protected.

Following Giménez-Gómez and Peris (2014), we propose to guarantee a minimal amount for all the claimants, and, then, divide the remainder by applying the CEL rule. To determine this minimum amount, we use the concept of Min lower bound which was introduced by Dominguez and Thomson (2006). Prior to introducing our new solution, we would like to define two perspectives of claims problems regarding significantly small claims. On the one hand, if the region i’s claim is as small as when we truncate the claims of other regions to the agent i’s claim, then we do not have a claims problem anymore, as this claim is sustainable. Sustainability states that these types of claims should be completely satisfied. On the other hand, we should take into account the excess of the claims, i.e., the losses. Preeminence, which is the dual concept of sustainability, establishes that if a claim is removed from the problem, and we still have a claims problem, then this so-called residual claim should not be satisfied. Hence, preeminence, which is satisfied by the CEL rule, gives priority to larger claims, the claims that can change the situation of the claims problem.

Our proposed solution, called CELmin, keeps a balance between the egalitarian distribution of the endowment and the CEL rule. The rule proposes that: if the smallest claim is sustainable, CELmin assigns a minimal guarantee equal to the minimum of the smallest claim (c1) and the endowment (E) divided by the number of the agents (n) to all agents, and revises down the claims and the endowment to implement CEL rule and distribute the remaining. It is noteworthy that this rule may propose an equal division of the endowment when the smallest claim is sufficiently large.

The definition of CELmin naturally arises as a need for an unequal allocation of the resources between the agents in favour of the larger claimants, while simultaneously ensuring a minimal amount to all agents. The CELmin utilises the power of the CEL in an unfair allocation of endowment by giving priority to larger claimants. But, prior to applying CEL, the rule guarantees a minimal portion of the endowment to all agents. In this way, CELmin adjusts the problem of zero allocation that CEL imposes on small (residual) claims. Therefore, CELmin performs better than the classical solutions in claims problems where the claims represent needs (see Proposition 2), such as in the ERDF context, ensuring convergence like CEL, but guaranteeing a minimum amount of the endowment to each region.

The rest of the paper is organised as follows. In Section 2 we formally present the notion of claims problems and some of the main solutions in the literature. In Section 3 we define our new solution, the CELmin. In Section 4 we conduct an axiomatic analysis for the proposed solution. Section 5 analyses and compares the proposed allocations from a convergence point of view, and in Section 6 we apply the previous analysis to the ERDF problem. Some final comments in Section 7 conclude the paper.

Preliminaries: claims problems

The agents are defined as a set of \(N=\left\{1,2,...,n\right\}\). Each agent is identified by her claim, ci ∈ R+, i ∈ N, on the endowment E ∈ R+. A claims problem occurs when the endowment is not sufficient to cover all the claims, that means \({\mathop{\sum}\limits_{i=1}^n} c_i > {E}.\) Without loss of generality, we order agents according to their claims: c1 ≤ c2 ≤ ⋯ ≤ cn. The pair \(\left(E,c\right)\) represents the claims problem and \({{{\mathcal{B}}}}\) is the set of all claims problems. A claim rule (solution) is a single value function \(\varphi :{{{\mathcal{B}}}}\to {{\mathbb{R}}}_{+}^{n}\) such that, for each i ∈ N, \(0\le {\varphi }_{i}\left(E,c\right)\le {c}_{i}\), (non-negativity and claim-boundedness) and \(\mathop{\sum}\limits_{i=1}^n{\varphi }_{i}\left(E,c\right)=E\), (efficiency).

Next, we define three well-known classic solutions to claims problems (see Thomson, 2003).

Definition 1

Proportional (P) divides the endowment proportionally according to the agents’ claims.

For each \(\left(E,c\right)\in {{{\mathcal{B}}}}\) and each i ∈ N, \({P}_{i}\left(E,c\right)=\lambda {c}_{i},\) where \(\lambda =\frac{E}{\mathop{\sum}\limits_{i\in N}{c}_{i}}.\)

Definition 2

Constrained Equal Awards (CEA) assign the endowment equally by imposing a constraint on the allocation, such that no agent receives more than her claim.

For each \(\left(E,c\right)\in {{{\mathcal{B}}}}\) and each i ∈ N, \(CE{A}_{i}\left(E,c\right)\equiv \min \left\{{c}_{i},\mu \right\},\) where μ is chosen so that \(\mathop{\sum}\limits_{i\in N}\min \left\{{c}_{i},\mu \right\}=E.\)

Note that the CEA solution is based on the Equal Awards division (EA). This method assigns the endowment equally among all members, i.e., for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\) and each i ∈ N, \(E{A}_{i}\left(E,c\right)=\frac{E}{n}.\) However, it is easy to see that in some situations with the equal distribution an agent may receive more than her claim, violating the claim-boundedness condition of a rule.

Definition 3

Constrained Equal Losses (CEL) allocates the loss which is the difference between aggregate claims and the endowment. This measure is divided equally, such that no agent receives a negative amount.

For each \(\left(E,c\right)\) \(\in {{{\mathcal{B}}}}\) and each i ∈ N, \(CE{L}_{i}\left(E,c\right)\equiv \max \left\{0,{c}_{i}-\mu \right\},\) where μ is such that \(\mathop{\sum}\limits_{i\in N}\max \{0,{c}_{i}-\mu \}=E.\)

In addition, we mention \({\alpha }_{\min }\)-Egalitarian rule (Giménez-Gómez and Peris, 2014), which is a compromise of the Equal Awards division and the Proportional.

Definition 4

\({{{{\boldsymbol{\alpha }}}}}_{\min }\)-Egalitarian (\({\alpha }_{\min }\)) guarantees a minimal right equal to the smallest claim to all agents, and if the endowment is sufficient it distributes the remaining endowment proportionally to the agents’ revised claims. If the endowment is not enough, it is divided equally.

For each \(\left(E,c\right)\) \(\in {{{\mathcal{B}}}}\) and each i ∈ N, if \({c}_{1}\ge \frac{E}{n}\) then \({\alpha }_{mi{n}_{i}}\left(E,c\right)=\frac{E}{n}\) and if \({c}_{1} < \frac{E}{n}\) then \({\alpha }_{mi{n}_{i}}\left(E,c\right)={c}_{1}+{P}_{i}\left(E-n{c}_{1},c-{c}^{1}\right)\), where \({c}^{1}={\left({c}_{1},\ldots ,{c}_{1}\right)}_{1\times n}\).

The CELmin solution

Note that the goal of the present paper is to define a solution that proposes larger allocations to larger claimants, but ensures a lower bound on awards to everyone, i.e. that guarantees a minimal positive allocation to all agents and distributes the remaining endowment by implementing the CEL.

In doing so, we propose to use the Min lower bound (Dominguez and Thomson, 2006) as the lower bound, since it proposes that each agent should receive at least 1/n of the smallest claim truncated by the endowment. So it considers the idea of an egalitarian distribution of the endowment, coming from the CEA solution.

Min lower bound (min): for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\), each i ∈ N, \({\varphi }_{i}\left(E,c\right)\ge min\left(E,c\right)\equiv \frac{1}{n}\min \{{c}_{1},E\}.\)

By combining the Min lower bound and the CEL we define a solution that, if possible, assigns the minimal positive amount to all agents and distributes the remaining endowment \({E}^{{\prime} }=E-n\cdot min\left(E,c\right)\) by implementing the CEL rule among the agents with respect to the remaining claims \({c}_{i}^{{\prime} }={c}_{i}-min\left(E,c\right)\). Note that if the endowment is not enough to assign this lower bound to all agents, then we assign the equal division of the endowment to all agents.

Definition 5

For each \(\left(E,c\right)\)\(\in {{{\mathcal{B}}}}\),

where \(mi{n}^{1}\left(E,c\right)={\left(min\left(E,c\right),\ldots ,min\left(E,c\right)\right)}_{1\times n}\) and MIN(E, c) ≡ n ⋅ min(E, c).Footnote 3

The following example shows how the rule proceeds.

Example 1

Consider \(\left(E,c\right)=\left(2000;\left(500,2000,2400\right)\right)\). \(CELmin\left(E,c\right)=\left(\frac{500}{3},\frac{500}{3},\frac{500}{3}\right)+CEL\left(1500,\left(\frac{1000}{3},\frac{5500}{3},\frac{6700}{3}\right)\right)=\left(\frac{500}{3},\frac{500}{3},\frac{500}{3}\right)+\left(0,\frac{1650}{3},\frac{2850}{3}\right)=\left(\frac{500}{3},\frac{2150}{3},\frac{3350}{3}\right)\). Note that with the CEL we have \(CEL\left(E,c\right)=\left(0,800,1200\right)\), agent one receives nothing and with the CELmin everyone receives at least a minimal amount of \(\frac{500}{3}\). Compared with the Proportional rule, which allocates \(P\left(E,c\right)=\left(204.08,816.33,979.59\right)\), in this example larger claimants receive larger amounts than by applying CELmin (in section 6 we see that this is not always the case). Although CELmin and αmin assign equal minimal right, the allocation of \({\alpha }_{min}\left(E,c\right)=\left(500,750.59,779.41\right)\) shows CELmin protects larger claimants more than αmin. CEA is the rule which allocates the smallest share to larger claimants, \(CEA\left(E,c\right)=\left(500,750,750\right)\).

In line with the concept of achieving a compromise between equal distribution of awards and equal distribution of losses, while ensuring a minimal allocation to all agents, Hougaard et al. (2013a) and Alcalde and Peris (2022) provide valuable insights on combining the principles of equal sharing. Specifically, Hougaard et al. (2013a) introduce a mechanism that guarantees each claimant a minimal amount, referred to as the baseline (b), which depends on the individual claims and the available resources.

For each \(\left(b,E,c\right)\), let \({t}_{i}\left(b,c\right)=\min \left({b}_{i},{c}_{i}\right)\) for each i ∈ N and \(t\left(b,c\right)={\{{t}_{i}\left(b,c\right)\}}_{i\in N}\) denotes the truncated baseline-claim vector and \(T=\mathop{\sum}\nolimits_{i\in N}{t}_{i}\left(b,c\right)\). In this context, the authors define a family of rules, Sb, through a composition operator (Hougaard et al., 2012 and Hougaard et al., 2013b) as \({S}^{b}\left(b,E,c\right)=S\left(E,t\left(b,c\right)\right)\), if \(E\le T\left(b,c\right)\), or \({S}^{b}\left(b,E,c\right)=t\left(b,c\right)+S\left(E-T\left(b,c\right),c-t\left(b,c\right)\right)\), if \(E\ge T\left(b,c\right)\).

It is noteworthy that if we define the baseline as the smallest claimant and take CEL as the starting rule then, the CELmin is retrieved,

with bi = c1 for each i.

Axiomatic analysis

In this section, we analyse the CELmin rule from an axiomatic point of view and we compare it with CEL, which is the rule that is most related to it. At the end of the section, there is a table with a summary of the comparison of the axioms satisfied by these two rules. Next, we propose some properties considered by the literature as a minimal requirement and some additional principles.Footnote 4

Equal treatment of equals considers that agents with equal claims must receive equal allocations.

Equal treatment of equals: for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\), and each i, j ∈ N, such that ci = cj, then \({\varphi }_{i}\left(E,c\right)={\varphi }_{j}\left(E,c\right)\).

Anonymity requires invariance under permutations of agents; the names of the agents should not matter. Denoting by ΠN the class of bijections from N into itself, the requirement is the following:

Anonymity: for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\), such that π ∈ ΠN, and each i ∈ N, then \({\varphi }_{\pi \left(i\right)}\left(E,{c}^{{\prime} }\right)={\varphi }_{i}\left(E,c\right),\) where \({c}^{{\prime} }\equiv {({c}_{\pi \left(j\right)})}_{j\in N}\).

Order preservation (Auman and Maschler, 1985) considers that the order of the claims must be respected. If agent i’s claim is at least as large as agent j’s claim, the awards and losses allocated to agent i must be at least as much as the ones allocated to agent j.

Order preservation: for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\), and each i, j ∈ N, such that ci ≥ cj, then \({\varphi }_{i}\left(E,c\right)\ge {\varphi }_{j}\left(E,c\right),\) and \({c}_{i}-{\varphi }_{i}\left(E,c\right)\ge {c}_{j}-{\varphi }_{j}\left(E,c\right).\)

Resource monotonicity (Curiel et al., 1987) indicates that if the endowment increases, all agents should receive at least the amount of the endowment that was allocated to them before the increase.

Resource monotonicity: for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\) and each \({E}^{{\prime} }\in {{\mathbb{R}}}_{+}\) such that \(C \,>\, {E}^{{\prime} } \,>\, E,\) then \({\varphi }_{i}\left({E}^{{\prime} },c\right)\ge {\varphi }_{i}\left(E,c\right),\) for each i ∈ N.

Super-modularity (Dagan et al., 1997) requires that if the endowment increases, given two agents, the one with the greater claim should receive a greater portion of the increment.

Super-modularity: for each \(\left(E,c\right)\in {{{\mathcal{B}}}},\) all \({E}^{{\prime} }\in {{\mathbb{R}}}_{+}\) and each i, j ∈ N such that \(C \,>\, {E}^{{\prime} } \,>\, E\) and ci ≥ cj, then \({\varphi }_{i}\left({E}^{{\prime} },c\right)-{\varphi }_{i}\left(E,c\right)\ge {\varphi }_{j}\left({E}^{{\prime} },c\right)-{\varphi }_{j}\left(E,c\right).\)

Order preservation under claims variations(Thomson, 2019) demands that if the claim of one agent decreases, given two other agents, the one with the greater claim receives more than the other.

Order preservation under claims variations: for each k ∈ N, each pair \(\left(E,c\right)\) and \(\left(E,{c}^{{\prime} }\right)\in {{{\mathcal{B}}}},\) with \({c}^{{\prime} }=\left({c}_{k}^{{\prime} },{c}_{-k}\right)\) and \({c}_{k}^{{\prime} } < {c}_{k}\) and each pair i and j ∈ N⧹k with ci≤cj, \({\varphi }_{i}\left(E,{c}^{{\prime} }\right)-{\varphi }_{i}\left(E,c\right)\le {\varphi }_{j}\left(E,{c}^{{\prime} }\right)-{\varphi }_{j}\left(E,c\right)\).Footnote 5

In the next proposition, we show that the CELmin solution satisfies all the axioms mentioned above and the Min lower bound mentioned in Section 3.

Proposition 1

The CELmin solution satisfies Equal treatment of equals, Anonymity, Order preservation, Resource monotonicity, Super modularity, Order preservation under claims variation and Min lower bound.

Proof

For each \(\left(E,c\right)\in {{{\mathcal{B}}}}\), we have

Since the CEL satisfies Equal treatment of equals, Anonymity and Order preservation it is straightforward that the CELmin also satisfies these properties.

Regarding Resource monotonicity, let \(C \,>\, {E}^{{\prime} } \,>\, E\). We consider three cases.Footnote 6

Case 1. If \(\frac{{c}_{1}}{n}\ge \frac{{E}^{{\prime} }}{n}\ge \frac{E}{n}\),

Case 2. If \(\frac{{E}^{{\prime} }}{n}\ge \frac{{c}_{1}}{n}\ge \frac{E}{n}\),

Case 3. If \(\frac{{E}^{{\prime} }}{n}\ge \frac{E}{n}\ge \frac{{c}_{1}}{n}\), in this case, since the CEL satisfies resource monotonicity we have:

Similarly, we can prove that the rule satisfies Super modularity.

Let \(C \,>\, {E}^{{\prime} } \,>\, E\) and i, j ∈ N such that ci ≥ cj. We consider three cases:

Case 1. If \(\frac{{c}_{1}}{n}\ge \frac{{E}^{{\prime} }}{n}\ge \frac{E}{n}\). In this case, \(CELmin\left({E}^{{\prime} },c\right)={\left(\frac{{E}^{{\prime} }}{n}\right)}_{1\times n}\) and \(CELmin\left(E,c\right)={\left(\frac{E}{n}\right)}_{1\times n}\). Therefore,

Case 2. If \(\frac{{E}^{{\prime} }}{n}\ge \frac{{c}_{1}}{n}\ge \frac{E}{n}\), since the CEL satisfies Order preservation we have:

Case 3. If \(\frac{{E}^{{\prime} }}{n}\ge \frac{E}{n}\ge \frac{{c}_{1}}{n}\), since the CEL satisfies Super modularity we have:

To show that Order preservation under claims variations is satisfied, let k ∈ N,\({c}^{{\prime} }=\left({c}_{k}^{{\prime} },{c}_{-k}\right)\) with \({c}_{k}^{{\prime} } \,<\, {c}_{k}\) and a pair i, j ∈ N⧹k with ci ≤ cj.

We must distinguish three cases:

Case 1. If \(\frac{{c}_{1}}{n}\ge \frac{{c}_{1}^{{\prime} }}{n}\ge \frac{E}{n}\), in this case k = 1. Then,

Case 2. If \(\frac{{c}_{1}}{n}\ge \frac{E}{n}\ge \frac{{c}_{1}^{{\prime} }}{n}\), in this case k = 1. Then, since the CEL satisfies order preservation we have:

Case 3. If \(\frac{{c}_{1}}{n}\le \frac{E}{n}\). In this case we must distinguish k = 1 and k ≠ 1. Therefore,

Case 3.1. If k = 1. since the CEL satisfies order preservation under claims variation we have:

Case 3.2. If k ≠ 1. since the CEL satisfies order preservation under claims variation we have:

It is straightforward to check that CELmin fulfils Min lower bound since, by Definition 5, each agent receives either an equal division of the endowment or the smallest claim.■

Although CELmin and CEL have shown similar behaviour in axiomatic analysis so far, Limited consistency, Composition down, and Composition up are satisfied by CEL but not fulfilled by CELmin. On the other hand, CELmin fulfils Min lower bound but the CEL does not.

Limited consistency states that adding an agent with a zero claim does not affect the award of other agents.Footnote 7

Limited consistency: for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\) and each i ∈ N, \({\varphi }_{i}\left(E,c\right)={\varphi }_{i}\left(E,\left(0,{c}_{1},...,{c}_{n}\right)\right).\)

Example 2

Consider \(\left(E,c\right)=\left(100,\left(10,200\right)\right)\). Then, \(CELmin\left(100,\left(10,200\right)\right)=\left(5,95\right)\) and \(CELmin\left(100,\left(0,10,200\right)\right)=\left(0,0,0\right)\)\(+CEL\left(100,\left(0,10,200\right)\right)=\left(0,0,100\right)\). According to the definition of Limited consistency, the previous results should coincide for all i ∈ N. Since this is not the case, Limited consistency is not satisfied.

Composition down requires that, if after distributing the endowment, the endowment decreases, two options are available: first, cancel the initial allocation and apply the rule for the revised endowment. Second, consider the agents’ initial awards as their claims and apply the rule to allocate the revised endowment in this situation. Both ways should lead to the same award vector.

Composition down: for each \(\left(E,c\right)\in {{{\mathcal{B}}}},\) each i ∈ N, and each \(0\le {E}^{{\prime} }\le E,\)\({\varphi }_{i}\left({E}^{{\prime} },c\right)={\varphi }_{i}\left({E}^{{\prime} },\varphi \left(E,c\right)\right).\)

Consider Example 2, where \(\left(E,c\right)=\left(100,\left(10,200\right)\right)\) and \(CELmin\left(E,c\right)=\left(5,95\right)\). If the endowment decreases to \({E}^{{\prime} }=50\), according to the definition of Composition down, the below results should coincide:

and

Therefore, Composition down is not satisfied.

Composition up demonstrates the opposite situation of Composition down in which after distributing the endowment, re-evaluation shows the endowment has increased. Again, two options are available: First, cancel the initial distribution and apply the rule for revised endowment. Second, the claims of agents are revised down by their initial gains. The rule divides the increment part of the endowment into revised claims. The results of both options should coincide.

Composition up: for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\), and each \({E}^{{\prime} } \,>\, E,\)\(\varphi \left({E}^{{\prime} },c\right)=\varphi \left(E,c\right)+\varphi \left({E}^{{\prime} }-E,c-\varphi \left(E,c\right)\right).\)

Example 3

Consider \(\left(E,c\right)=\left(30,\left(30,40,50\right)\right)\). Then, \(CELmin\left(E,c\right)=\left(10,10,10\right)\). If the endowment increases to \({E}^{{\prime} }=50\), according to the definition of Composition up, the below results should coincide:

and

Therefore Composition up is not satisfied.

Next, we define some axioms that the CELmin does not satisfy and are not met by CEL either.

Reasonable lower bounds on awards: ensures that each individual receives at least the minimum of her claim and the endowment divided by the number of individuals.

Reasonable lower bounds on awards for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\), and each i ∈ N, then \({\varphi }_{i}\left(E,c\right)\ge \frac{\min \{{c}_{i},E\}}{n}\).

Invariance under claims truncation requires that the part of the claim of agent i that exceeds the endowment should be ignored. Indeed, agent i cannot ask for more than the available resource.Footnote 8

Invariance under claims truncation: for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\), \(\varphi \left(E,c\right)=\varphi \left(E,t\left(E,c\right)\right).\)

Self duality: requires the solution to recommend the same allocation when dividing gains and losses, where losses are defined as the difference between the sum of the claims and the estate.

Self duality for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\), and each i ∈ N, \({\varphi }_{i}\left(E,c\right)={c}_{i}-{\varphi }_{i}\left(L,c\right).\)

Midpoint property ensures to each agent half of her claim when the estate is equal to half of the aggregate claim.

Midpoint property: for each \(\left(E,c\right)\in {{{\mathcal{B}}}}\), and each i ∈ N, if E = C/2, then \({\varphi }_{i}\left(E,c\right)={c}_{i}/2\).

Note that, for instance, \(\left(E,c\right)=\left(100,\left(8,20,30,200\right)\right)\) shows that Reasonable lower bounds on awards is not satisfied by the CELmin. Example 1 shows that neither invariance under claims truncation, nor self-duality, is satisfied by CELmin. To show that Midpoint property is not satisfied take \(\left(E,c\right)=\left(2000,\left(500,1500,2000\right)\right)\).

Finally, Table 1 depicts which of the axioms are satisfied by the CELmin and the CEL.

Convergence

It is noteworthy to re-emphasise that the objective of the European Union through assigning the ERDF is to elevate the growth rate of less developed regions to achieve economic convergence in the EU territory. Supporting the less developed regions requires detecting the division rules that distribute the ERDF in a way that is more favourable for larger claimants.

Lorenz dominance is an appropriate criterion that explores how the rules treat smaller claimants relative to larger claimants. A Lorenz dominant rule is an equitable rule which is favourable for smaller claimants.

Let \({{\mathbb{R}}}_{+}^{n}\) be the set of positive n-dimensional vectors \(x=\left({x}_{1},{x}_{2},\ldots ,{x}_{n}\right)\) ordered from small to large, i.e., 0 < x1≤x2≤…≤xn. Let x and y be in \({{\mathbb{R}}}_{+}^{n}\). We say that x Lorenz dominates y, x ≻ Ly, if for each k = 1, 2, …, n − 1: x1 + x2 + ⋯ + xk ≥ y1 + y2 + … + yk and x1 + x2 + … + xn = y1 + y2 + … + yn. If x Lorenz dominates y and x ≠ y, then at least one of these n − 1 inequalities is a strict inequality. The following definition extends Lorenz dominance to claims problem situations.

Definition 6

Given two solutions φ and ψ it is said that φ Lorenz dominates ψ, φ ≻ Lψ, if for any claims problem \(\left(E,c\right)\) the vector \(\varphi \left(E,c\right)\) Lorenz dominates \(\psi \left(E,c\right).\) Indeed, it states that \(\varphi \left(E,c\right)\) is more equitable and more supportive of smaller claims.

Bosmans and Lauwers (2011) proved that the CEA is the most equitable rule, since this rule Lorenz dominates all other rules. Their comparison shows that the CEL is the most inequitable rule: \(CEA{\succ }_{L}{\alpha }_{\min }{\succ }_{L}P{\succ }_{L}CEL\).

The following result shows the Lorenz relationships between our solution and the main ones.

Proposition 2

(a) \(CEA{\succ }_{L}{\alpha }_{\min }{\succ }_{L}CELmin{\succ }_{L}CEL\).

(b) There is no Lorenz dominance relation between CELmin and P.

Proof

Part (a) is easily obtained by definition and previous results. By definition, the CELmin rule has an egalitarian part that makes the rule more equitable than the CEL.

Part (b) is directly obtained from the case analysis. If c1 is unsustainable, CELmin corresponds to CEA. Therefore, the rule Lorenz dominates P. If c1 is sustainable, the result of Table 2 shows that P Lorenz dominates CELmin.■

In line with the Lorenz dominance, we performed an additional computation designed to assess the effectiveness of the different rules in achieving convergence targets within the EU. For this purpose, we employed a metric known as the Divergence Ratio (Solís-Baltodano et al., 2021). By allocating the ERDF to different regions using the rules defined in our study, we anticipate an increase in the level of convergence in the EU. However, the extent of convergence would inevitably vary depending on the rule applied.

The ERDF allocation contributes to the growth of the GDP and overall economic development in the EU as it is invested in various projects. The Divergence Ratio serves as a criterion for evaluating which allocation rule can expedite convergence in the EU more effectively than others. It measures the ability of each rule to reduce the disparity between the GDP per capita of less developed regions and that of the most developed regions.

The ratio assumes that the regions’ new GDP per capita (\({\widehat{GD{P}^{h}}}\)) equals their initial GDP per capita (GDPh) plus the allocation amount (x). The Divergence Ratio is as follows:

where \(GD{P}_{\alpha }^{h}\) is the GDP per capita of the less developed region α and \(GD{P}_{\beta }^{h}\) is the GDP per capita of the most developed region β. The divergence ratio is always greater than 0 and the amount close to 0 reflects convergence.

Distribution of the European regional development funds

The ERDF budget of the European Council and Parliament determined for the 2014–2020 programming period is approximately 182,150 million euros, which corresponds to almost 44% of the total budget. This budget is intended for the second level of the EU nomenclature of territorial units for statistics (NUTS2) which involves regions with populations between 800,000 and 3,000.000 inhabitants.

According to this division, the regional eligibility for the ERDF is calculated by taking into account the regional per capita GDP. Regions in NUTS level 2 are split and classified into three different categories according to their GDP per capita measured in purchasing power standards, as follows:

-

More developed regions (R1): with GDP per capita above 100% of the average GDP per capita of the EU-27.

-

Transition regions (R2): with GDP per capita between 75% and 100% of the average GDP per capita of the EU-27.

-

Less developed regions (R3): with GDP per capita less than 75% of the average GDP per capita of the EU-27.

According to this classification, there were 265 regions in NUTS 2 for the 2014–2020 programming period. This number declines to 47 if the regions of the same category are considered together (Solís-Baltodano et al., 2021). From the claims problems perspective, these 47 regions form the claimants who have a claim on the ERDF budget. We use the same claims that Solís-Baltodano et al. (2021) offer in their study. In their method, each agent claims a fixed amount which is equal for all regions, the allocation per inhabitant obtained for the region with the highest GDP per inhabitant (it can be interpreted as a minimal allocation), plus an amount that depends on the gap between the specific region GDP per capita and the highest GDP per capita. The attribute of this method is that the less developed regions claim more than the others. The claims of the regions are depicted in Table 2. Moreover, the table illustrates a comparison between the regional allocation of our proposed rule and the rules that have been already studied.

The CEA rule distributes the funds as equally as possible to all regions without taking into account the measure of their demands. In contrast, the CEL imposes equal losses to all regions. Therefore, it helps regions with larger claims, which are regions in R3 to obtain more ERDF. But, in this case, the rule causes some more developed regions (R1) to receive nothing. In particular, as Table 2 illustrates, the total ERDF that CELmin allocates to R3 regions is equal to the allocation of the CEL with a slight difference. Nonetheless, CELmin supports some regions in R1 that are ignored by the CEL (e.g. Czechia R1). Our main objective is to propose a new rule to distribute the ERDF budget that solves this situation. With the CELmin every region receives the minimal right that CELmin guarantees for all regions.

It is noteworthy that the solutions provided by the claims problem approach satisfy a number of minimal requirements (properties). One of them is order preservation. As aforementioned, this property states that larger claimants receive larger awards and incur in larger losses. The current distribution violates this statement. For instance, comparing Greece R3 with France R2, the latter region incurs larger losses than the former. However, France R2 claims less than Greece R3.

Finally, to compute the Divergence Ratio of the rules, we consider the GDP per capita of the least developed region (Bulgaria R3) and the GDP per capita of the most developed region (Luxembourg R1). Then, the initial Divergence Ratio before any allocation is 0.8054. To calculate the Divergence Ratio after the ERDF allocation, we add the assignment of each rule to the GDP per capita of the aforementioned regions and compute the ratio for each rule. The Divergence Ratio of CEA is 0.8003. It is expected that this rule has the largest ratio. Since this rule distributes the budget in the most egalitarian manner possible, maintaining the existing differences before the budget was allocated. On the contrary, the CEL provides a less egalitarian distribution of funds. The ratio for CEL is 0.7957. Therefore, CEL may be most appropriate to achieve the convergence goal of the ERDF. However, this rule does not allocate funds to some regions, which makes it difficult to implement in real life. The ratio for the \({\alpha }_{\min }\) and P are 0.7989 and 0.7987 respectively. The Divergence Ratio for the CELmin is about 0.7957 which is almost equal to the CEL’s ratio. It is significant to consider that, since all the rules satisfy order preservation, they increase the convergence in the European Union, since they allocate more assignments to poor regions. However, the Divergence Ratio results confirm that CELmin is the most appropriate rule to meet the convergence target.

Conclusions

We conclude this study by highlighting the findings. The aim of the ERDF allocation is to help less developed regions in the European Union achieve a welfare level like that experienced by developed regions. Therefore, it can be inferred that the fair allocation of ERDF lies in the unequal division of the fund and assigning more to less developed regions.

The claims problem approach contributes to allocating this fund as unequally as possible. The pillar of the claims problem approach is the region’s demand for money needed to boost its development level. These demands are estimated in such a way that the well-developed regions require smaller funds (Solís-Baltodano et al., 2021). First, the four division rules are applied in this study and the results prove that they are not able to serve the objective of the ERDF allocation. The Constrained Equal Awards (CEA) assigns an equal portion of the ERDF (408.073 M€) to all regions. The only exception is Luxembourg R1 which receives her claim due to the claims-boundedness assumption and the sustainability properties. In addition, the result of the Lorenz dominance illustrates that CEA is the most equitable rule between the rules we apply. Thus, CEA is not an appropriate solution for the ERDF allocation. The Proportional (P) rule considers the claims of the regions in the fund allocation process. Therefore, the portion it assigns to less developed regions is larger than what the more developed regions receive. The \({\alpha }_{\min }\)-Egalitarian (\({\alpha }_{\min }\)) has two phases, egalitarian allocation and proportional allocation, which makes it more equitable than Proportional and not appropriate for the ERDF allocation. The Constrained Equal Losses (CEL) completely neglect the well-developed regions (e.g. Czechia R1 or Ireland R1) and support the less developed ones. Although the degree of inequality of CEL (which is more than P) suggests it would be the best choice for the ERDF fund, zero allocation to developed regions is a noticeable obstacle to using this rule in a real situation.

To adjust this problem and simultaneously support larger claimants, we propose CELmin, which guarantees a fixed allocation right to all agents by reaching a compromise between Equal Awards (EA) allocation and CEL. The results in Table 2 confirm that CELmin supports less developed regions, compared with CEA and \({\alpha }_{\min }\). Moreover, the Lorenz dominance of CELmin is less than these rules. To compare CELmin with P, we compute the Divergence Ratio for them. The results depict that CELmin with a ratio equal to 0.7957 is able to reach convergence in the European Union much faster than P (with a ratio equal to 0.7987).

Finally, it is noteworthy that previous results induce that our new proposal should be implemented in context with similar features, such as the environmental negotiations (for instance, the distribution of CO2 emissions rights).

Data availability

The present research does not involve the generation of any data.

Notes

Note that for each claims problem (E, c), min(E, c) is a constant and therefore MIN(E, c) is also constant.

Notice that \(\left({c}_{k}^{{\prime} },{c}_{-k}\right)\) is the claims vector obtained from c by replacing ck by \({c}_{k}^{{\prime} }\).

For the sake of simplicity we denote by \({\left(A\right)}_{1\times n}={\left(A,\ldots ,A\right)}_{1\times n}\), where A denotes either min(E, c), \(\frac{E}{n}\), c1 or any other argument, in each specific case.

Clearly if \(\left(E,\left({c}_{1},\ldots ,{c}_{n}\right)\right)\) is a claims problem with n agents, then \(\left(E,\left(0,{c}_{1},\ldots ,{c}_{n}\right)\right)\) is a claims problem with n+1 agents.

Note that, as aforementioned, \(t\left(E,c\right)={\left({t}_{i}\left(E,c\right)\right)}_{i\in N}\) and \({t}_{i}\left(E,c\right)=min\{{c}_{i},E\}\) for all i ∈ N.

References

Alcalde J, Peris JE (2022) Mixing solutions for claims problems. Math Soc Sci 115:78–87

Auman R, Maschler M (1985) Game theoretic analysis of a bankruptcy problem from the talmud. J Econ Theory 36:195–213

Bosmans K, Lauwers L (2011) Lorenz comparisons of nine rules for the adjudication of conflicting claims. Int J Game Theory 40:791–807

Curiel IJ, Maschler M, Tijs SH (1987) Bankruptcy games. Zeitschrift für Oper Res 31:A143–A159

Dagan N, Serrano R, Volij O (1997) A noncooperative view of consistent bankruptcy rules. Games Econ Behav 18:55–72

Dominguez D, Thomson W (2006) A new solution to the problem of adjudicating conflicting claims. Econ Theory 28:283–307

Duro JA, Giménez-Gómez JM, Vilella C (2020) The allocation of co2 emissions as a claims problem. Energy Economics 104652

Fragnelli V, Kiryluk-Dryjska E (2019) Rationing methods for allocating the European Union’s rural development funds in Poland. Economia Politica 36:295–322

Giménez-Gómez J-M, Peris JE (2014) A proportional approach to claims problems with a guaranteed minimum. Euro J Oper Res 232:109–116

Giménez-Gómez JM, Teixidó-Figueras J, Vilella C (2016) The global carbon budget: a conflicting claims problem. Climatic Change 1–11

Hougaard JL, Moreno-Ternero JD, Østerdal LP (2012) A unifying framework for the problem of adjudicating conflicting claims. J Math Econ 48:107–114

Hougaard JL, Moreno-Ternero JD, Østerdal LP (2013) Rationing in the presence of baselines. Soc Choice Welfare 40:1047–1066

Hougaard JL, Moreno-Ternero JD, Østerdal LP (2013) Rationing with baselines: the composition extension operator. Ann Oper Res 211:179–191

Iñarra E, Prellezo R (2008) Bankruptcy of fishing resources: the Northern European Anglerfish Fishery. Marine Res Econ 17:291–307

Iñarra E, Skonhoft A (2008) Restoring a fish stock: a dynamic bankruptcy problem. Land Econ 84:327–339

Kampas A (2015) Combining fairness and stability concerns for global commons: the case of East Atlantic and Mediterranean tuna. Ocean Coast Manag 116:414–422

Kiryluk-Dryjska E (2014) Fair division approach for the European Union’s structural policy budget allocation: an application study. Group Decis Negot 23:597–615

Kiryluk-Dryjska E (2018) Application of a fair-division algorithm to EU rural development funds allocation in Poland. Intercathedra 34:21–28

O’Neill B (1982) A problem of rights arbitration from the Talmud. Math Soc Sci 2:345–371

Pulido M, Sánchez-Soriano J, Llorca, N (2002) Game theory techniques for university management. Ann Oper Res 129–142

Rose A, Stevens B, Edmonds J, Wise M (1998) International equity and differentiation in global warming policy. Environ Res Econ 12:25–51

Solís-Baltodano MJ, Giménez-Gómez JM, Peris JE (2021) Distributing the european structural and investment funds from a conflicting claims approach. Rev Reg Res 1–25

Thomson W (2003) Axiomatic and game-theoretic analysis of bankruptcy and taxation problems: a survey. Math Soc Sci 45:249–297

Thomson, W. How to divide when there isn’t enough. 62 (Cambridge University Press, 2019)

Young HP (1987) On dividing an amount according to individual claims or liabilities. Math Oper Res 12:398–414

Acknowledgements

Usual caveat applies. Financial support from Universitat Rovira i Virgili and Generalitat de Catalunya (ECO Next SGR2021-00729) and Grant PID2020-119152GB-I00 funded by MCIN/AEI/ 10.13039/501100011033 is acknowledged.

Author information

Authors and Affiliations

Contributions

FS and CV – Substantial contributions to the conception and design of the work. FS, CV, J-MG-G – Final approval of the version to be published, agreement to be accountable for all aspects of the work in ensuring that questions related to the accuracy or integrity of any part of the work are appropriately investigated and resolved. FS – interpretation of data for the work, drafting the work. CV – Revising the work critically for important intellectual content. J-MG-G – Substantial contributions to the acquisition, analysis, and interpretation of data for the work, and revising it critically for important intellectual content.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Giménez-Gómez, JM., Salekpay, F. & Vilella, C. How to distribute the European regional development funds through a combination of egalitarian allocations: the constrained equal losses min. Humanit Soc Sci Commun 10, 594 (2023). https://doi.org/10.1057/s41599-023-02114-x

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-023-02114-x