Abstract

To achieve the triple goals of digesting excess capacity, making effective investments, and accelerating green governance, it is important and necessary to comprehensively examine the intrinsic relationship between media reports, environmental regulation, and enterprise investment inefficiency. To this end, this study employs multiple econometric models to investigate the intrinsic relationship between them by using the data of listed companies in China’s A-share heavy-polluting industries between 2010 and 2020. The results of the study are as follows. Firstly, media reports can encourage heavy-polluting enterprises to pay attention to stakeholder demands and significantly ameliorate the enterprise investment inefficiency. In addition, environmental regulation can ameliorate the enterprise investment inefficiency through the “push-back effect” and “compensation effect”. Moreover, pollution fees can positively moderate the amelioration effect of media reports on the investment inefficiency of heavy-polluting enterprises, while it fails in terms of environmental protection subsidies. Finally, conclusions and policy implications are provided.

Similar content being viewed by others

Introduction

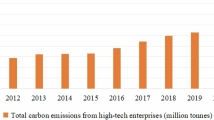

Since the reform and opening up, China’s industrial GDP has grown at an average annual rate of 11.5%. However, industry, which accounts for only about 40% of GDP, consumes nearly 70% of the country’s energy and emits about 85% of the country’s carbon dioxide. Rapid industrial growth is characterized by high investment, high energy consumption, and high emissions (Lin and Xie 2023). The extensive industrial growth model has resulted in massive resource consumption and severe environmental pollution, close to the environmental carrying limit. In the Global Environmental Performance Index released by Yale University in 2022, China’s environmental performance score is only 28.4 points, a drop of 40 ranking positions compared with the 2018 release. In addition, in recent years, sudden environmental accidents caused by heavy metals and chemical pollution have occurred frequently, pollution emissions in some areas have greatly exceeded environmental capacity, and heavy-polluting enterprises are incredibly harmful to the ecological environment. Against this backdrop, to realize the construction of a resource-saving and environmentally friendly society and to assume the responsibility of a significant international country, the environmental regulation of heavy-polluting enterprises has become the focus of China’s environmental pollution prevention and control. However, there is still a black box regarding the relationship between media reports, environmental regulation, and enterprise investment inefficiency. Therefore, this study aims to fill this research gap by exploring the intrinsic links between these three.

In the digital age, the rapid development and spread of new media have made the dissemination of information more accessible, broader, and faster. Understanding media coverage is crucial for enterprises to achieve sustainable development goals. For enterprises, on the one hand, the rapid development of the new media can promote administrative forces’ attention, constrain enterprise managers’ behavior, and reduce the information asymmetry between shareholders and managers (Jiang et al., 2021). On the other hand, enterprises can learn about and provide feedback on the public concerns and expectations about the environment and sustainable development through social media, online news, and professional websites, which can help them better understand the market demand and trends and pay more attention to environmental protection and sustainable development in the design, production, and sales of their products and services. In addition, media reports can prompt enterprises to strengthen interaction and cooperation with stakeholders such as government, non-governmental organizations, academia, and social organizations. Through the new media platform, enterprises can exchange information and cooperate with these stakeholders in a win-win manner, forming a synergy of multi-party participation and joint promotion of sustainable development.

Environmental regulation refers to the process by which the government regulates and manages the behavior of enterprises and individuals in environmental protection and resource utilization through laws, policies, and standards. It plays a vital role in guiding and supervising enterprises in fulfilling their environmental protection and social responsibilities. Reasonable, strict, and effective environmental regulation can prompt enterprises to comply with environmental laws and regulations, reduce environmental pollution and resource waste, and thus promote sustainable development strategies. In addition, environmental regulation can also guide enterprises to consider environmental factors in their investment and emissions trading, promote the transformation of enterprises from high energy consumption and pollution to low-carbon environmental protection, accelerate the transformation and upgrading of industrial structure, and ultimately achieve the purpose of promoting the development of green economy (Cheng et al., 2017).

Enterprise investment efficiency refers to the efficiency of capital allocation and resource utilization, including the rationality of capital investment decisions, the efficiency of resource utilization in the production process, the efficiency of resource utilization in products, and the innovation capacity of enterprises. Against the background of increasing global challenges such as resource pressure, environmental pollution, and climate change, ameliorating the inefficiency of enterprise investment is crucial to promoting sustainable economic growth, social prosperity, and environmental protection. On the one hand, efficient investment can increase the productivity and competitiveness of enterprises (Du et al., 2021). On the other hand, as a part of society, the investment activities of enterprises not only have a broad influence on enterprises themselves but also can create employment opportunities and promote social stability and harmonious development. In addition, it is worth noting that enterprises need to consider environmental factors in their investment decisions and adopt environmental protection measures to achieve sustainable operation. Efficient investment can help enterprises reduce resource consumption and environmental pollution and lower environmental risks and costs. By promoting cleaner production, circular economy, and low-carbon development, enterprises can reduce the negative influence and promote sustainable environmental development. At the same time, efficient enterprise investment can also promote the development and application of environmental protection technologies, promote environmental technology innovation, and provide feasible solutions to global environmental problems.

At the beginning of the 21st century, some scholars began studying the impact of media public opinion on corporate governance. They proposed that media public opinion mainly affects the investment efficiency of enterprise operation and development by promoting government supervision mechanisms, spreading reputation mechanisms, and reducing information asymmetry mechanisms. After this, with the continuous deepening of the research on this topic, some scholars have put forward new hypotheses on the corporate governance mechanism of media public opinion, arguing that the mechanism of network public opinion’s influence on corporate investment efficiency in the new period has changed and that its influence is more substantial, extensive and profound. However, there are fewer existing studies on the impact of online public opinion on the investment inefficiency of heavily polluted enterprises, and even fewer that include environmental regulation in the scope of research. It is difficult to explain the new trend of fully integrating the internet into social interaction and daily life in the new era. The continuous integration of internet public opinion has dramatically impacted social production and living order. While promoting the continuous development of society, the requirements for enterprise management have become more stringent, posing new challenges to the regulatory authorities. Therefore, further research is needed.

Derived from the data of listed companies in China’s A-share heavy-polluting industries between 2010 and 2020, this paper investigates the internal link between media reports, environmental regulation, and enterprise investment inefficiency. The possible marginal contributions of this paper are the following four. (1) Our study focuses on the micro-enterprise level. It explores the impact of media reports on investment inefficiency of heavily polluting firms in the digital context of the new era, which gives a new meaning to the study of online public opinion. (2) Incorporating media reports, environmental regulation, and enterprise investment inefficiency into one framework for research, which fills up the literature gap of environmental regulation in regulating media reports on investment inefficiency of heavy-polluting enterprises. (3) The different impacts of the heterogeneity of environmental regulation instruments and the heterogeneity of heavy-polluting enterprises on this issue are further explored. (4) Applying the IV-2SLS and PSM methods effectively eliminates the influence of endogeneity problems.

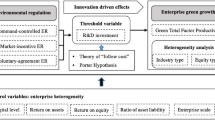

The rest of this article is arranged as follows (Fig. 1): Part 2 is the literature review and hypothesis development; Part 3 is the research framework, i.e., the research methodology; Part 4 is the in-depth analysis; Part 5 is the research results and policy recommendations.

Literature review and hypothesis development

Media report

The critical influencing factors of enterprise investment inefficiency are information asymmetry and agency problems. In the digital age, the dissemination of information is more immediate and adequate than ever before (Suarez and Vicente, 2023). As an intermediary of information dissemination, new media has the characteristics of fast, convenient, and diversified dissemination. In particular, its public opinion monitoring function has received extensive attention from the public and academia (Antweiler and Frank, 2004; Tetlock, 2007; Graf-Vlachy et al., 2020; Wang and Zhang, 2021; Gooch et al., 2022; You et al., 2023). Existing research has shown that media reports effectively reduce information asymmetry and opacity of firms in the capital market and improve their investment behavior (Wu, 2004; Engelberg and Parsons, 2011; Baloria and Heese, 2018). Managers are more inclined to consider voices outside the firms than internal opinions (Yaniv, 2004). Media coverage is an essential social supervision force that exposes internal events and “hidden contracts” (Chen et al., 2014). Therefore, as a crucial non-legal external governance tool, the media report is vital in improving enterprise governance (Liu and Mcconnell, 2013; Yang et al., 2014; Rogers et al., 2016). Meanwhile, some scholars also pointed out that enterprise governance is positively correlated with enterprise investment efficiency, i.e., the better the enterprise governance, the higher the efficiency of enterprise investment (Richardson, 2006; Chen et al., 2011; Zhang and Su, 2015).

Regarding how media coverage achieves the monitoring effect on corporate governance, previous literature has mainly described two implementation mechanisms. The first mechanism is government intervention (Zhang and Su, 2015). In this case, the events reported by the new media or the social repercussions they cause must catch the government’s “attention” and “intervention”, which is a crucial step for the new media to realize the monitoring effect on enterprise governance through government intervention. Another mechanism is achieved by influencing the reputation of executives (Liu and Mcconnell, 2013; Zhu et al., 2022). In this case, the events reported by new media or the social repercussions they cause attract the attention of enterprise executives. Subsequently, to maintain personal reputation and eliminate the managerial risks associated with media coverage, enterprise executives will transform this “attention” into a “driving force” to improve the company’s internal governance, thus achieving the monitoring effect of enterprise governance.

In addition, the influence of media coverage on enterprise governance also depends on the choice of media coverage tendencies, i.e., positive and hostile media reports may have differential impacts on enterprise governance. Affective tendency information in media reports affects investors’ emotions and expectations, affecting investors’ decision-making (Sun et al., 2020). The more optimistic the coverage, the more attention investors pay. An increase in a company’s share price triggered by investor sentiment can increase investor returns, make external financing relatively easy, increase new investment, and improve the inefficiency of corporate investment. For example, Bhattacharya et al., (2009) state that positive media reports can improve a firm’s ability to raise capital in the capital market. On the contrary, adverse reports can reduce investor attention and investment enthusiasm (Liu and Mcconnell, 2013), increase the cost of external financing, increase financing constraints, reduce new investment, and further reduce enterprise investment efficiency. However, adverse media reports can also expose enterprises’ problems and urge them to improve. For instance, Jia et al. (2016) pointed out that negative media coverage effectively improves enterprises’ lousy business behavior, especially in China.

In conclusion, according to the existing literature, the media report has an influence on the investment inefficiency of heavy-polluting enterprises. Therefore, we put forth the following hypothesis:

H1: Media reports can ameliorate the investment inefficiency of heavy-polluting enterprises;

H2a: Positive media reports can ameliorate the investment inefficiency of heavy-polluting enterprises;

H2b: Negative media reports can ameliorate the investment inefficiency of heavy-polluting enterprises.

Environmental regulation and heterogeneity

Environmental regulation governmental agencies’ intervention, guidance, and monitoring activities on economic entities to address negative environmental externalities. Studies have found that environmental regulation can significantly impact firms’ production and business performance (Kathuria, 2007; Langpap and Shimshack, 2010; Huang and Lei, 2021). For the classification of environmental regulation in China, existing studies mainly classify it into three categories, recognized by most researchers, namely, command environmental regulation, market environmental regulation, and public participation environmental regulation (Huang et al., 2014; Ren et al., 2018). Mandatory and strict administrative orders and controls characterize command environmental regulation. It usually stipulates environmental protection provisions and pollution penalties through laws or regulations. Its primary forms include emission standards, emission permits, as well as emission quotas. Market environmental regulation encourages enterprises to reduce pollution emissions through market incentives. Its primary forms include pollution fees, taxes, subsidies, and emission trading. Many studies suggest that compared with command environmental regulation, market environmental regulation has the advantages of low cost, high efficiency, high flexibility, and sound implementation effect because it allows enterprises to make the best choice freely according to their economic interests (Jung et al., 1996; Montero, 2002; Requate and Unold, 2003). Compared with command environmental regulation, public participation is mainly characterized by participation rather than coercion and promotes the reduction of pollution emissions by enterprises mainly through public opinion and social-moral pressure.

Existing studies have shown that different environmental regulations can solve different environmental problems (Stavins, 1996), such as air pollution (Xu, 2023), health problems of the population due to environmental degradation, and even affect energy and education (Niu et al., 2023a; Niu et al., 2023b) and that different kinds of environmental regulations have different costs and effects (Malueg, 1989). Guo et al. (2023) empirically examined the effect of environmental regulation on firms’ green innovation. They found that environmental regulation mainly influences the green innovation of heavy-polluting enterprises with poor internal and external governance. Zheng et al. (2023) empirically analyzed the effect of informal environmental regulation on the green lifestyles of Chinese residents. They found that informal environmental regulation can positively affect residents’ green lifestyles by raising public awareness of environmental protection and further play a role in controlling environmental pollution. Arimura et al. (2008) empirically find that voluntary regulation effectively reduces pollutant emissions. Blackman and Kildegaard (2010) argued that formal environmental regulation is unrealistic because empirical evidence suggests that, although Mexican environmental protection agencies routinely implement environmental monitoring, they cannot encourage companies to adopt “clean” technologies. Ye et al. (2022) constructed a model to measure the strength of environmental policies by categorizing them into command, market, and public participation types and found that local governments preferred command environmental policy instruments. However, Zhao et al. (2015) found that among these three types of environmental regulation tools, market-based environmental regulation has a more significant impact on improving productivity and reducing CO2 emissions.

Therefore, according to the research conclusions of the existing literature, we put forward the following hypothesis:

H3: Environmental regulation can ameliorate the investment inefficiency of heavy-polluting enterprises.

Some studies have shown that under a concentrated ownership structure, due to the dominant interests of controlling shareholders, firms’ investment decisions prioritize control gains over maximizing firm value, leading to inefficient enterprise investment (Yan et al. 2022). However, in enterprises with high equity balances, due to the constraints of other shareholders, the largest shareholder cannot control all substantial decisions of the enterprise. Therefore, enterprises with high equity balance are more likely to be affected by environmental regulation, adjust investment strategies, and then ameliorate investment inefficiency.

In addition, some studies suggest that Chinese institutional investors are more inclined to short-term investment behavior (Jiang and Kim, 2015). However, Cao et al. (2020) found that long-term investment behavior more effectively alleviates enterprise over-investment or under-investment. Institutional investors in China’s capital market frequently need help to achieve practical constraints in their managerial agency behavior. Yan et al. (2022) argue that, in addition to management’s institutional oversight, high shareholding of institutional investors can lead to short-sighted managerial behaviors and wrong value-investment philosophies on the part of investors, which can deteriorate the inefficiency of enterprise investment.

Compared with non-state-owned enterprises, the internal management of state-owned enterprises is more stringent, and problems such as information asymmetry and opacity are relatively more straightforward to resolve (Ling et al., 2023). Moreover, state-owned enterprises also have the inherent advantage of relatively stable capital flow, as they do not need to consider financing constraints. Therefore, under the constraints of environmental regulations, state-owned enterprises have a better internal supervision mechanism, and they can adjust their investment strategies more effectively and reduce non-essential investment, thus improving investment inefficiency.

Therefore, we put forward the following hypothesis:

H4: Environmental regulation is more likely to ameliorate the investment inefficiency of enterprises with higher equity balance, non-state-owned enterprises, and enterprises with lower shareholding ratios of institutional investors.

The moderating effect of environmental regulation

Recently, many studies have focused on the impact of environmental regulations on various aspects of enterprise performance, such as enterprise innovation, enterprise marketing, and enterprise productivity. However, the impact of environmental regulation on enterprise investment inefficiency is under-researched, and the literature on the level of heavy-polluting enterprises is scarce. Moreover, while the transmission of social attitudes toward firms is at the center of the impact of media coverage on corporate investment inefficiency, internal corporate governance and external market pressures continue to play a crucial role (Shen et al., 2023a, b). However, the dominance of these two types of roles can change, given that differences in the external environments faced by enterprises often lead to systematic or disruptive changes in the effectiveness and efficiency of new media in transmitting social attitudes. Thus, the moderating role of environmental management instruments requires further study.

In recent years, as the government has put forward environmental protection concepts such as “carbon peak” and “carbon neutrality”, more and more environmental protection policies have been introduced one after another, and the state environmental supervision of enterprises has also significantly been promoted (Liu et al., 2022; Gao et al., 2024). For local governments, how to effectively use environmental regulation to achieve ecological modernization and transformation has become particularly important, and local governments have thus become the most critical stakeholders of heavy-polluting enterprises. Through environmental regulation, local governments hope to support the ecological transformation of heavy-polluting enterprises in the new media era. At the same time, heavy-polluting enterprises are bound to adjust their decision-making according to the level of government environmental regulation they face (Cai and Li, 2018; Li et al., 2023). However, environmental regulation also has a divergent effect.

On the one hand, effective environmental regulation can facilitate a synergistic “win-win” for government and firms, i.e., it satisfies the sustainable development goal of environmentally inclusive growth that the government wishes to achieve and enhances the ability of enterprises to cope with the crisis of public opinion. Buysse and Verbeke (2003) argue that in order to comply with environmental regulations, heavy-polluting enterprises seek to amass and invest large amounts of resources and opportunities. However, due to information asymmetries and agency problems, these savings and investments sometimes fail to ameliorate the inefficiencies of firms’ investments, which can be helped by the role of media coverage in providing information. On the other hand, Li et al. (2020) point out that local governments continue to adopt a universal approach to implementing environmental management policies, focusing on the short-term target and ignoring the long-term requirements of environmental modernization, which will exacerbate the negative influence of new media attention and undermine the effectiveness of heavy-polluting enterprises. Fan et al. (2020) point out that enterprises will adopt short-sighted strategies, such as “greenwashing”, to address the problem of public authorities if their relationship with public authorities deteriorates and productivity loses due to media attention.

In China, the behavior of enterprises chasing short-term profits is prevalent, and China is a socialist system country; the government has a powerful governance authority. As a result, the punitive policies tend to be more effective. In contrast, compensatory subsidies tend to be the private property of large enterprises and are not readily demonstrable. In addition, under the influence of local protection, subsidies may also promote inertia among subsidized firms, and thus, the effects of subsidies tend to be less pronounced.

Therefore, based on the above theoretical analysis, we put forward the following hypothesis:

H5a: Pollution fee effectively moderates the amelioration effect of the media report of the investment inefficiency of heavy-polluting enterprises.

H5b: Environmental protection subsidy fails to moderate the amelioration effect of the media report of the investment inefficiency of heavy-polluting enterprises.

Research structure

Data sources and variable definitions

Explained variable: enterprise investment inefficiency

According to the study of Richardson (2006) and Chen et al. (2011), this paper estimate enterprises’ average capital investment level and then use the absolute value of the model’s residual as the proxy variable of investment inefficiency. The specific regression model is as follows:

Among them, Investi,t is the amount of capital investment of company i in year t. We define Investi,t as the cash expenditure of fixed assets, intangible assets, and other long-term assets minus the cash income from the sale of assets and divided by the total assets at the beginning of the year t. Growthi,t is the company’s growth opportunities, measured by the operating income growth rate. Levi,t is the asset-liability ratio of the enterprise. Cashi,t is the company’s cash holdings, defined as the year-end monetary funds divided by total assets. Agei,t is the company’s listing age, which is calculated by the natural logarithm of the difference between the year of listing and the year of listing. Sizei,t represents the size of the enterprise, measured by the natural logarithm of total assets. Returni,t is the company’s annual return on the stock market. Industry represents the industry fixed effect, Year represents the annual fixed effect, and the industry classification is obtained based on the industry classification standard of the China Securities Regulatory Commissionchina. All explanatory variables in the Model (1) lag one period.

A more considerable value of Invest indicates a less efficient investment for the company. In addition, we use TobinQ as a proxy variable for Growth and use a similar method to obtain another measure of investment inefficiency (Invest1) for robustness testing in this paper.

Explanatory variable: media report

In the digital age, media-based information dissemination is faster, more convenient, and more diverse and is receiving widespread attention from enterprises and academia (Graf-Vlachy et al., 2020; Burke, 2022; Wang and Zhang, 2021). One of the primary functions of the media is to report and disclose events within the company, reducing the opacity and information asymmetry in the company’s actions. Some scholars believe that the media provide social and cultural explanations to the public by reporting on enterprise behaviors that would otherwise be ignored (Graffin et al., 2013). Therefore, based on previous studies, we estimate the natural logarithm of the number of online news per year plus 1 for each company as a proxy variable for the media report. In addition, we distinguish positive and negative news in new media and deeply analyze the influence of media reports with diverse emotional trends.

Moderating variables: environmental regulation

Concerning the measurement of environmental regulation, existing research tends to use regional indicators, for instance, the definition of environmental regulation as the intensity of application of environmental legislation, the contribution of regions to environmental governance, comprehensive weighted indicators, etc. In contrast, the various mechanisms by which heterogeneous environmental monitoring instruments play a role and the different reactions that may be made to environmental pollutants are ignored (Li et al., 2023). Therefore, in our work, we manually collected and compared the pollution fees and environmental protection subsidies in the yearly environmental report prepared by the listed enterprise. We calculated the natural logarithm of pollution fees and environmental protection subsidies as a proxy variable for environmental regulation.

Control variables

Furthermore, in order to avoid bias in the absence of variables and motivated by previous research (e.g., Yan et al., 2022; Wu et al., 2022; Benlemlih and Bitar, 2018; Dai and Kong, 2017; Chen et al., 2011; Biddle et al., 2009; Richardson, 2006), we have created a series of control variables from three aspects: company characteristics, management characteristics, and financial performance. In addition, Appendix 1 gives the symbols and definitions of all control variables. At the same time, the definitions and characteristics of the explained variables and explanatory variables are also explained in Appendix 1.

Sample and data

Our work analyzes the link between the media report, environmental regulation, and enterprise investment inefficiency by taking A-share listed companies in heavy-polluting industries in Shanghai and Shenzhen stock markets between 2010 and 2020 as the study object. At the same time, the samples were screened as follows: (1) ST and *ST listed companies were excluded; (2) Remove fragmented and missing sample data; (3) Excluding newly registered companies in 2010 and 2020; (4) Excluding the samples of zero-emission fees and environmental subsidies; (5) Considering the lack of environmental index data in Tibet, the intensity of environmental regulation cannot be calculated, so the sample of enterprises in Tibet Autonomous Region is eliminated; (6)To alleviate the influence of outliers on model estimation, Winsorize processing was performed on all variables at 1% and 99% quantiles. After the above screening, we obtained 5170 observations of 470 listed companies. It is worth noting that the sources of all the data used in this paper are shown in Appendix 1.

Furthermore, it cannot be ignored that China implemented the “Environmental Protection Tax Law of the People’s Republic of China” in 2018 and abolished the “Regulations on the Collection and Use of Sewage Charges” implemented in 2003. The introduction of this law means that the previous “pollution fee” has been changed to “environmental tax”. At the same time, the “environmental tax” is more stringent than the previous “pollution fee” regarding collection management measures and standards (Li et al., 2023). However, “environmental tax” and “pollution fee” are both negative externalities of economic activity fees levied on enterprises, so this change will not affect this paper’s main research conclusions and relevant policy recommendations.

Data description

We present the descriptive and statistical results of the empirical variables in Table 1. For each variable, we give the observed value (N), mean (Mean), standard deviation (SD), minimum (Min), and maximum (Max). As we can see from Table 1, the maximum value of enterprise investment inefficiency is −1.357, the Mean value is −3.683, and the SD is 1.094. These figures show that the investment efficiency level of sample enterprises is generally low. The Max and Min values of the media report are 7.927 and 0, respectively, with an average of 5.110, which indicates that the new media is paying more and more attention to heavy-polluting enterprises.

The average values of the positive and hostile media reports are 4.339 and 4.040, respectively, which shows that the media report is more balanced regarding emotional tendency and the sample enterprises have good representativeness. The average values of pollution fees and environmental subsidies are 14.208 and 13.725, respectively, which implies that the sample enterprises’ pollution fees and environmental protection subsidies are relatively high. In addition, as shown in Table 2, we also calculated the Pearson Correlation Coefficient Matrix among the main variables. Since the values among all independent variables are lower than 0.6, the problem of multicollinearity can be neglected in our work. At the same time, the correlation coefficient and significance coefficient in Table 2 show that there may be a negative relationship between the dependent variables and the independent variables.

Models

The following models are used in this research to explore the effect of the media report and environmental regulation on enterprise investment inefficiency. Moreover, the specific econometric models are:

Here, Investi,t stands for the investment inefficiency of enterprise i in year t; Mediai,t stands for the media report of enterprise i in year t, as well as P_Mediai,t and N_Mediai,t stand for positive and negative media report of enterprise i in year t, respectively. What is more, Feei,t and Subsidyi,t are the proxy variables of environmental regulation, and Feei,t stands for the pollution fees of enterprise i in year t, Subsidyi,t stands for the environmental protection subsidies of enterprise i in year t, respectively. Ci,t denotes control variables, and their definitions are illustrated in Appendix 1. δk represents the fixed industry effect, and μt stands for the fixed year effect. εi,t is the error term; γ0 denotes the constant parameter, γ1 denotes the coefficient of such core variables (e.g., Mediai,t; P_Mediai,t; N_Mediai,t; Feei,t and Chargei,t), and γ2 denotes the coefficient of the control variables.

After that, we construct six cross-terms of the media report and environmental regulation to examine the moderating effect. The specific econometric models are:

Here, MFi,t (MSi,t) is obtained by building cross-term of Mediai,t × Feei,t (Subsidyi,t), MPFi,t (MPSi,t) is obtained by building cross-term of P_Mediai,t × Feei,t (Subsidyi,t), and MNFi,t (MNSi,t) is the cross-term of N_Mediai,t × Feei,t (Subsidyi,t). α3 is the crucial coefficient of the moderating effect test, and other variables align with the previous variables’ definitions.

Empirical results and analysis

Results of baseline estimation

Effect of media report on enterprise investment inefficiency

Firstly, this paper tests hypotheses H1, H2a, and H2b based on total sample estimation and examines the impact of media coverage on the investment inefficiency of heavy-polluting enterprises. Table 3 documents the regression outcomes. Columns (1), (3), and (5) are double fixed-effect models controlling for industry and year, reporting the effects of full, positive, and negative media coverage on firms’ investment inefficiency, respectively, with no other control variables included. However, Columns (2), (4), and (6) added 12 control variables to Columns (1), (3), and (5) for the regressions.

As shown in Table 3, the coefficients on the characteristic variables are significantly negative regardless of whether the explanatory variables are total media coverage, positive coverage, or negative coverage, suggesting that media coverage ameliorates the investment inefficiency of heavy-polluting enterprises. The regression outcomes in Column (1) indicate that media coverage directly affects firms’ investment inefficiency when controlling only for year and industry-fixed effects. The Media coefficient is −0.092, which is dramatically negative at the 1% level, suggesting that more media coverage significantly ameliorates firms’ inefficient investment. In order to further confirm whether this relationship is robust, we added 12 control variables to the regression of Column (2). The Media coefficient remains at −0.092 and is still dramatically negative at the 1% statistical level, which proves that the results of Column (1) are robust. These findings suggest that media coverage influences the governance of heavily polluting firms so that they can positively improve investment inefficiency. In addition, the findings of Gao et al. (2021) also show that media coverage can significantly reduce underinvestment by firms, which is similar to the findings of this paper. Therefore, hypothesis H1 is supported.

Then, to verify the hypotheses H2a and H2b, we categorize the total media report into positive and negative. In Columns (3) and (4), the P_Media coefficients are −0.096 and −0.106, respectively, dramatically negative at the 1% statistical level, implying that more positive media coverage has a more significant ameliorating effect on firms’ ineffective investment. In Columns (5) and (6), the N_Media coefficients are −0.077 and −0.067, respectively, dramatically negative at the 1% statistical level, suggesting that more negative media coverage has a more significant ameliorating effect on ineffective corporate investment. By comparing the effect of negative and positive media reports on the investment inefficiency of heavy-polluting enterprises, it is not difficult to see that regardless of whether the emotional tendency of the media report is positive or adverse, they can play a similar role in enterprise governance and ameliorate the investment inefficiency of enterprises (Jia et al., 2016; Bhattacharya et al., 2009). Therefore, the hypotheses H2a and H2b are supported.

In summary, whether the media report is positive or adverse, it can ameliorate enterprise investment inefficiency through its enterprise governance role. Media coverage is a direct reflection of public opinion, as well as a side reaction to enterprise visibility (Hu et al., 2023). Fan et al. (2020) point out that as heavy-polluting enterprises are more sensitive to public opinion and environmental policies, they are more likely to understand the connotations and needs of ecological modernization and its benefits. Therefore, enterprises with high enthusiasm for new media tend to improve investment efficiency more effectively. However, it is worth worrying that too much new media enthusiasm may also lead to behaviors such as overestimating enterprise value and overconfidence of enterprise managers, which may lead to over-investment or under-investment of enterprises and worsening investment inefficiency (So, 2022).

Effect of environmental regulation on enterprise investment inefficiency

Secondly, to verify Hypothesis H3, the paper examines the impact of environmental regulations on investment inefficiency of heavily polluting firms based on the estimation of the total sample. Table 4 reports the regression outcomes. Columns (1) and (3) are double fixed effects controlling for the industry and year, and pollution fees and environmental protection subsidies are regressed on firm investment inefficiency, respectively, with other control variables not added. However, Columns (2) and (4) add 12 control variables according to Columns (1) and (3).

As shown in Table 4, in Columns (1) and (2), the Fee coefficients are −0.014 and −0.013, respectively, which are both dramatically negative with passing the 10% statistical level. In Columns (3) and (4), Subsidy coefficients are −0.044 and −0.041, respectively, dramatically negative at the 1% level. These outcomes indicate that the coefficients of the environmental regulation characteristic variables are significantly negative regardless of whether the explanatory variables are pollution fees or environmental protection subsidies, indicating that environmental regulation can ameliorate the investment inefficiency of heavy-polluting enterprises. Therefore, hypothesis H3 is supported.

These results suggest that appropriate environmental regulatory instruments incentivize managers to ameliorate the inefficient behavior of business investment. On the one hand, appropriate pollution fees can have a dual impact of external pressure and internal incentives on heavy-polluting enterprises, forcing them to reduce their dependence on polluting production methods. At the same time, it also forces heavy polluters to some extent to make a green transition in their production methods (Wang et al., 2023). The option increases investment in green innovation, which aligns with the national green development strategy and achieves the optimal allocation of resources, thus improving the enterprise investment inefficiency and helping enterprise managers solve some long-standing and challenging problems (Du et al., 2022; Liu et al., 2022; Li et al., 2023). On the other hand, effective environmental protection subsidies can provide heavy-polluting enterprises with the necessary financial security, reduce the cost of green transformation (Li et al., 2023), and help improve the risk tolerance of enterprise managers for green transformation, thus enhancing their long-term investment capacity (Zhang and Zhao, 2022). To sum up, pollution fees and environmental protection subsidies can force enterprises to carry out green transformation to improve pollution prevention and control capabilities and the technological content of their products, thus ameliorating their investment’s inefficiency.

Heterogeneity test

To verify hypothesis H4, we use the heterogeneity test to analyze whether environmental regulations have a differential influence on the investment inefficiency of heavy-polluting enterprises.

Firstly, we divide the sample firms into two sub-samples, high (Balance = 1) and low (Balance = 0), according to the degree of equity balance, i.e., whether the ratio of the total shareholding of the second to the fifth major shareholders to the shareholding of the first significant shareholder is higher than the median of the enterprises in the same year. As shown in Tables 5 and 6, pollution fees and environmental protection subsidies are significantly negative for firms with high equity ratios at the 5% and 1% statistical levels, respectively. In contrast, these two coefficients are insignificant for firms with low equity balances. Therefore, environmental regulation can ameliorate the investment inefficiency of enterprises with high equity balance compared with enterprises with low equity balance, which is consistent with hypothesis H4. Similarly, Yan et al. (2022) find that green finance reforms improve investment efficiency more significantly for firms with high equity checks and balances, which supports this paper’s argument.

In addition, we also categorize the sample enterprises into high (INST = 1) and low (INST = 0) sub-samples based on whether the institutional investor shareholding is higher than the industry median of the year. As reported in Tables 5 and 6, we find that the coefficients of the core explanatory variables are not significant among enterprises with low institutional investor shareholdings. However, the pollution fee and environmental protection subsidy coefficients are statistically significantly negative at 5% and 1%, respectively, among firms with higher institutional investor shareholdings. This contradicts the hypothesis H4 of this paper. There are two possible reasons for this result. First, environmental regulation can force heavy-polluting enterprises to carry out green transformation, but this requires substantial financial support. However, institutional investors are the vane of market funds. Their investment decisions send a positive signal to the outside world, and their solid financial advantages escort enterprises to achieve green transformation (Xiao, 2023). Second, institutional investors are shareholders who aim to maximize their interests. Previous studies have shown that the involvement of institutional investors can reduce information asymmetry, effectively alleviate agency problems, and inhibit enterprise “short-sighted” behavior (Shleifer and Vishny, 1986; Carleton et al., 1998; Liu and Wu, 2023), so institutional investors are willing to actively participate in enterprise governance and supervise management in order to alleviate financing constraints. In summary, we conclude that environmental regulation can ameliorate the investment inefficiency of enterprises with a high institutional investment shareholding ratio compared with enterprises with a low institutional investor shareholding ratio.

Finally, we categorize the sample enterprises into state-owned (SOE = 1) and non-state-owned (SOE = 0) sub-samples based on the nature of enterprise ownership. As shown in Tables 5 and 6, the coefficients of pollution fees and environmental protection subsidies are dramatically negative at the 1% level among state-owned firms. In contrast, the coefficients for non-state-owned enterprises are insignificant. Therefore, environmental regulations can improve the investment inefficiency of equity state-owned enterprises compared to non-state-owned enterprises, which is consistent with hypothesis H4.

Endogeneity estimation

Plenty of literature points to the endogeneity of environmental regulation (Copeland and Taylor, 2004; Jiang et al., 2018). Meanwhile, due to the increasing breadth and depth of environmental regulation, heavy-polluting enterprises may receive more attention from media reports. Therefore, our findings may need to be revised due to endogeneity problems. The endogeneity problem is mainly caused by missing variables and reverse causality. In the previous regression, we added 12 control variables to eliminate the potential endogeneity problem caused by missing variables as much as possible. Therefore, this paper will focus on the endogeneity problem caused by causality. Then, we use the two-stage least squares regression (IV-2SLS) and propensity score matching (PSM) to exclude the impact of endogeneity on the baseline results as much as possible.

First, referring to the extensive literature and considering the practicability, we selected the lags of the core explanatory variables as the instrumental variables. Tables 7 and 8 report the regression results of the IV-2SLS method. We find that the estimated coefficients of the media report, positive media report, hostile media report, pollution fee, and environmental protection subsidy are still dramatically negative, which implies that the previous findings are robust. In addition, the F-values of the first stage of all regressions are significant, suggesting that all instrumental variables exhibit a high correlation with the endogenous explanatory variables, satisfying the correlation criterion for instrumental variables. However, only the instrumental variables of environmental regulation passed the under-identification and weak identification. In contrast, the instrumental variables for the media report did not pass, indicating that second-order serial correlation may exist. However, even so, the test results of the IV-2SLS method can still support our benchmark estimation to some extent.

In addition, we conducted an additional endogeneity test, the PSM test, which can effectively solve the endogeneity problem caused by sample selection bias. We use the investment inefficiency of heavy-polluting enterprises as the output variable and 12 control variables as the covariates for nearest-neighbor matching. Table 9 records the regression outcomes of PSM, which shows that the equilibrium assumption holds. After selecting the appropriate control group through PSM, this paper conducts regression according to the new samples. Table 10 illustrates the results of regression using the PSM samples. Except for hostile media report, the estimated coefficients of the media report, positive media report, pollution fees, and environmental protection subsidies are still significantly negative, indicating that the above assumptions are still valid.

Finally, to ensure the credibility of the above findings, we conduct another robustness test, where we use the TobinQ value as a proxy variable for growth opportunity (Choi et al., 2020), and use a similar Eq. (1) to obtain another measure of investment efficiency (Invest2). Table 11 reports the robustness estimation results, which are consistent with the findings of the previous benchmark regressions, suggesting that our results are robust to the fact that media reports and environmental regulations can effectively ameliorate the investment inefficiency of heavy-polluting enterprises.

Results of moderating effect estimation

In order to further verify hypotheses H5a and H5b, we next explore the regulatory role of environmental regulation. Tables 12 and 13 record the moderating effects of pollution fees and environmental protection subsidies, respectively.

Firstly, as shown in Table 12, we examine the regulatory role of pollution fees. Columns (1), (3), and (5) control the effects of industry and year, and generate interaction terms between pollution fees and media report, positive media report and negative media report, respectively, and then substitute them into formulas (7), (8), and (9) for the regressions. However, it should be noted that Columns (2), (4), and (6) in Table 12 add 12 control variables based on Columns (1), (3), and (5). According to the results in Table 12, the regression coefficients of MF, MPF, and MNF are all dramatically negative at the 1% statistical level, indicating that pollution fees can positively moderate the relationship between media report with different emotional tendencies and the investment inefficiency of heavy-polluting enterprises, and Hypothesis 5a is verified. Secondly, as shown in Table 13, we examine the moderating effect of environmental protection subsidies, and the treatment process in Table 13 is similar to that in Table 12. As reported in Table 13, it presents that the regression coefficients of the interaction items MS, MPS, and MNS did not pass the 10% significance test, suggesting that environmental protection subsidies cannot effectively moderate the relationship between the media report with different emotional tendencies and the investment inefficiency of heavy-polluting enterprises, and Hypothesis 5b is verified.

For the differentiated outcomes shown in Tables 12 and 13, i.e., pollution fees can positively moderate the relationship between the media report and the investment inefficiency of heavy-polluting enterprises. However, environmental protection subsidies are ineffective in moderating the relationship between the media report and the investment inefficiency of heavy-polluting enterprises. The main reason for this phenomenon is that compared with environmental protection subsidies, the implementation of pollution fees is more significant and has certain punitiveness (Feng et al., 2021a). As a result, in the media report, pollution fees have more significant results in shaping enterprise behavior, which is reflected in the improvement of investment inefficiency of heavy-polluting enterprises. In other words, the stricter the environmental regulations, the more likely enterprises will ameliorate their investment inefficiency when they gain new media attention. With the increasing national emphasis on achieving the goals of “carbon peak” and “carbon neutrality”, more and more environmental protection policies have been introduced, and government supervision of heavy-polluting enterprises has increased dramatically (Feng et al., 2021b). Faced with government environmental regulation, heavy-polluting enterprises must make favorable decisions for enterprises under the premise of fully considering media reports (Li et al., 2023). In addition, effective environmental regulation can strengthen the interest link between the government and enterprises (Shen et al., 2023a), improve the resource base and dynamic ability of heavy-polluting enterprises to cope with new media crisis (Wang and Feng, 2018), and thus help enterprises to ameliorate their investment inefficiency in the media coverage.

Conclusion and implications

Based on the background of China’s strong advocacy of “peak carbon” and “carbon neutral” carbon emission reduction targets and its emphasis on sustainable development, this paper integrates the media report, environmental regulation, and investment inefficiency of enterprises into a single framework and critically examines the linkages between them by taking a sample of listed companies in China’s A-share heavy polluting industries from 2010 to 2020, and draws some noteworthy conclusions.

Firstly, the results of the study show that media coverage, positive and negative reports contribute to the improvement of investment inefficiency in heavy-polluting enterprises. Second, environmental regulation, i.e., pollution fees and environmental protection subsidies, help to promote the improvement of investment inefficiency in heavy-polluting enterprises through the superposition of punitive and compensatory effects. Third, the application of the IV-2SLS method and PSM method effectively addresses the endogeneity problem and proves that our empirical findings are robust and reliable. In addition, environmental regulation can better ameliorate the investment inefficiency of heavy-polluting enterprises with the nature of state-owned enterprises, a high equity balance, and a high proportion of institutional investor shareholdings. Finally, we further investigate the moderating effect of environmental regulation and show that pollution fees can positively moderate the relationship between media report and investment inefficiency of heavy-polluting enterprises. However, environmental protection subsidies have no moderating effect.

These findings have specific theoretical and practical significance as follows.

-

(1)

For heavy-polluting enterprises, managers must strengthen enterprise governance, effectively solve the problem of information asymmetry and principal-agent conflicts, and improve information transparency. Managers cannot disregard media reports. In addition, managers should be cautious about various reports on the market with obvious emotional tendencies towards the enterprise itself, and make investment decisions based on the actual situation of the enterprise, so as to avoid being swayed by public opinion, which will lead to a reduction in the efficiency of the investment.

-

(2)

For the government, it is necessary to strengthen the supervision of new media and improve the effectiveness of new media governance. In particular, it is necessary to strengthen the supervision of media reports with obvious emotional tendencies, end malicious attacks and exaggerated false media reports, and promote the media to win credibility through objective reporting of facts.

-

(3)

To achieve a win-win situation for improving the inefficiency of corporate investment and environmental protection, the government should rationally formulate various environmental protection policies, select environmental regulation tools according to the local conditions, and further give full play to the roles of market incentives and government supervision. In addition, the government should also consider introducing more public participation in environmental regulatory policies, broadening the channels for public participation in environmental supervision, and raising public awareness of environmental protection.

-

(4)

According to the empirical results, the role of media reports in corporate governance is more prominent under the punitive environmental regulatory tool (pollution fee) than the compensatory environmental regulatory tool (environmental protection subsidy). This reminds policymakers that, on the one hand, it is vital to adequately link media coverage with environmental regulation to achieve the effect of 1 + 1 being more significant than 2. On the other hand, it is wise to introduce more punitive environmental regulatory instruments as soon as possible to improve firms’ investment inefficiency.

This study has the following limitations. (1) The samples we focus on are heavy-polluting enterprises. Our sample should be more comprehensive in further research than heavy-polluting enterprises. It should be expanded to more types of enterprises to increase the generalisability of this paper’s findings. (2) The heterogeneity of media reports is also a factor we should consider in the follow-up study. In addition to the emotional tendency of media reports, media reports from different sources can impact companies differently. (3) In terms of research methodology, more excellent empirical methods should be applied, such as machine learning, neural networks, functional parameters, etc.

Data availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

References

Antweiler W, Frank MZ (2004) Is all that talk just noise? The information content of internet stock message boards. J Financ 59:1259–1294

Arimura TH, Hibiki A, Katayama H (2008) Is a voluntary approach an effective environmental policy instrument? A case for environmental management systems. J Environ Econ Manag 55:281–295

Baloria VP, Heese J (2018) The effects of media slant on firm behavior. J Financ Econ 129:184–202

Benlemlih M, Bitar M (2018) Corporate social responsibility and investment efficiency. J Bus Ethics 148:647–671

Bhattacharya U, Galpin N, Ray R, Yu X (2009) The role of the media in the internet IPO bubble. J Financ Quant Anal 44:657–682

Biddle GC, Hilary G, Verdi RS (2009) How does financial reporting quality relate to investment efficiency? J Acc Econ 48:112–131

Blackman A, Kildegaard A (2010) Clean technological change in developing country industrial clusters: mexican leather tanning. Environ Econ Policy Stud 12:115–132

Burke JJ (2022) Do boards take environmental, social, and governance issues seriously? Evidence from media coverage and CEO dismissals. J Bus Ethics 176:647–671

Buysse K, Verbeke A (2003) Proactive environmental strategies: a stakeholder management perspective. Strateg Manag J 24:453–470

Cai W, Li G (2018) The drivers of eco-innovation and its impact on performance: evidence from China. J Clean Prod 176:110–118

Cao Y, Dong Y, Lu Y, Ma D (2020) Does institutional ownership improve firm investment efficiency? Emerg Mark Financ Trade 56:2772–2792

Carleton WT, Nelson JM, Weisbach MS (1998) The influence of institutions on corporate governance through private negotiations: evidence from TIAA-CREF. J Financ 53:1335–1362

Chen F, Hope O, Li Q, Wang X (2011) Financial reporting quality and investment efficiency of private firms in emerging markets. Acc Rev 86:1255–1288

Cheng Z, Li L, Liu J (2017) Identifying the spatial effects and driving factors of urban PM2.5 pollution in China. Ecol Indic 82:61–75

Chen S, Sun Z, Tang S (2011) Government intervention and investment efficiency: evidence from China. J Corp Financ 17:259–271

Chen Y, Wang Y, Lin L (2014) Independent directors’ board networks and controlling shareholders’ tunnelling behaviour. China J Acc Res 7:101–118

Choi JK, Hann RN, Subasi M, Zheng Y (2020) An empirical analysis of analysts’ capital expenditure forecasts: evidence from corporate investment efficiency. Contemp Account Res 37:2615–2648

Copeland BR, Taylor MS (2004) Trade, growth, and the environment. J Econ Lit 42:7–71

Dai LD, Kong DM (2017) Can executives with overseas experience improve corporate investment efficiency? J World Econ 1:168–192

Du G, Yu M, Sun C, Han Z (2021) Green innovation effect of emission trading policy on pilot areas and neighboring areas: an analysis based on the spatial econometric model. Energy Policy 156:112431

Du M, Chai S, Li S, Sun Z (2022) How environmental regulation affects green investment of heavily polluting enterprises: evidence from steel and chemical industries in China. Sustainability 14:11971

Engelberg JE, Parsons CA (2011) The causal impact of media in financial markets. J Financ 66:67–97

Feng Y, Geng Y, Liang Z, Shen Q, Xia X (2021a) Research on the impacts of heterogeneous environmental regulations on green productivity in China: the moderating roles of technical change and efficiency change. Int J Environ Res Public Health 18:11449

Feng Y, Wang X, Liang Z, Hu S, Xie Y, Wu G (2021b) Effects of emission trading system on green total factor productivity in China: empirical evidence from a quasi-natural experiment. J Clean Prod 294:126262

Fan L, Yang K, Liu L (2020) New media environment, environmental information disclosure and firm valuation: evidence from high-polluting enterprises in China. J Clean Prod 277:123253

Gao X, Xu W, Li D, Xing L (2021) Media coverage and investment efficiency. J Empir Financ 63:270–293

Gao X, Zhang G, Zhang Z, Wei Y, Liu D, Chen Y (2024) How does new energy demonstration city pilot policy affect carbon dioxide emissions? Evidence from a quasi-natural experiment in China, Environ Res 117912

Gooch E, Goethe S, Sobrepena N, Eckstrand E (2022) Measuring competition between the great powers across Africa and Asia using a measure of relative dispersion in media coverage bias. Humanit Soc Sci Commun 9:393

Graffin SD, Bundy J, Porac JF, Wade JB, Quinn DP (2013) Falls from Grace and the Hazards of High Status: The 2009 British MP Expense Scandal and Its Impact on Parliamentary Elites. Adm Sci Q 58:313–345

Graf-Vlachy L, Oliver AG, Banfield R, Konig A, Bundy J (2020) Media coverage of firms: background, integration, and directions for future research. J Manag 46:36–69

Guo M, Wang H, Kuai Y (2023) Environmental regulation and green innovation: Evidence from heavily polluting firms in China. Financ Res Lett 53:103624

Huang JH, Yang XG, Cheng G, Wang SY (2014) A comprehensive eco-efficiency model and dynamics of regional eco-efficiency in China. J Clean Prod 67:228–238

Huang L, Lei Z (2021) How environmental regulation affect corporate green investment: evidence from China. J Clean Prod 279:123560

Hu Y, Chen S, Liu R, Dai Y (2023) Managers’ aspirations and quality of CSR reports: evidence from China. Humanit Soc Sci Commun 10:293

Jia M, Tong L, Viswanath PV, Zhang Z (2016) Word Power: the impact of negative media coverage on disciplining corporate pollution. J Bus Ethics 138:437–458

Jiang F, Kim KA (2015) Corporate governance in China: a modern perspective. J Corp Finan 32:190–216

Jiang Z, Wang Z, Li Z (2018) The effect of mandatory environmental regulation on innovation performance: evidence from China. J Clean Prod 203:482–491

Jiang Z, Zhao X, Zhou J (2021) Does the supervision mechanism promote the incentive effects of government innovation support on the R&D input of agricultural enterprises? IEEE Access 9:3339–3359

Jung C, Krutilla K, Boyd R (1996) Incentives for advanced pollution abatement technology at the industry level: an evaluation of policy alternatives. J Environ Econ Manag 30:95–111

Kathuria V (2007) Informal regulation of pollution in a developing country: evidence from India. Ecol Econ 63:403–417

Langpap C, Shimshack JP (2010) Private citizen suits and public enforcement: substitutes or complements? J Environ Econ Man 59:235–249

Li J, Shi X, Wu H, Liu L (2020) Trade-off Between economic development and environmental governance in China: an analysis based on the effect of river chief system. China Econ Rev 60:101403

Lin B, Xie Y (2023) Positive or negative? R&D subsidies and green technology innovation: evidence from China’s renewable energy industry. Renew Energy 213:148–156

Ling X, Luo Z, Feng Y, Liu X, Gao Y (2023) How does digital transformation relieve the employment pressure in China? Empirical evidence from the national smart city pilot policy. Humanit Soc Sci Commun 10:617

Liu B, Mcconnell JJ (2013) The role of the media in corporate governance: do the media influence managers’ capital allocation decisions. J Financ Econ 110:1–17

Liu G, Yang Z, Zhang F, Zhang N (2022) Environmental tax reform and environmental investment: a quasi-natural experiment based on China’s Environmental Protection Tax Law. Energy Econ 109:106000

Liu Y, Wu X (2023) How does shareholder governance affect the cost of borrowing? Evidence from the passage of anti-takeover provisions. J Acc Econ 7:101569

Li Z, Huang Z, Su Y (2023) New media environment, environmental regulation and corporate green technology innovation: evidence from China. Energy Econ 119:106545

Malueg DA (1989) Emission credit trading and the incentive to adopt new pollution abatement technology. J Environ Econ Manag 16:52–57

Montero JP (2002) Permits, standards, and technology innovation. J Environ Econ Manag 44:23–44

Niu S, Chen Y, Zhang R, Feng Y (2023a) How does the air pollution prevention and control action plan affect sulfur dioxide intensity in China? Front Public Health 11:1119710

Niu S, Chen Y, Zhang R, Luo R, Feng Y (2023b) Identifying and assessing the global causality among energy poverty, educational development, and public health from a novel perspective of natural resource policy optimization. Resour Policy 83:103770

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: will the true ranking please stand up? Eur Econ Rev 47:125–146

Ren S, Li X, Yuan B, Li D, Chen X (2018) The effects of three types of environmental regulation on eco-efficiency: a cross-region analysis in China. J Clean Prod 173:245–255

Richardson S (2006) Over-investment of free cash flow. Rev Acc Stud 11:159–189

Rogers JL, Skinner DJ, Zechman SLC (2016) The role of the media in disseminating insider-trading news. Rev Acc Stud 21:1–29

Shen Q, Pan Y, Feng Y (2023a) Identifying and assessing the multiple effects of informal environmental regulation on carbon emissions in China. Environ Res 237:116931

Shen Q, Pan Y, Feng Y (2023b) The impacts of high-speed railway on environmental sustainability: quasi-experimental evidence from China. Humanit Soc Sci Commun 10:719

Shleifer A, Vishny RW (1986) Large shareholders and corporate control. J Polit Econ 94:461–488

So M (2022) Analysis of the influence of enterprise managers’ overconfidence on the overinvestment behavior of listed companies under the media reports. Front Psychol 13:1018189

Stavins RN (1996) Correlated uncertainty and policy instrument choice. J Environ Econ Manag 30:218–232

Suarez AA, Vicente MR (2023) Going “beyond the GDP” in the digital economy: exploring the relationship between internet use and well-being in Spain. Humanit Soc Sci Commun 10:582

Sun J, Zhou Y, Wang JG, Guo J (2020) Influence of media coverage and sentiment on seasoned equity offerings. Acc Financ 60:557–585

Tetlock PC (2007) Giving content to investor sentiment: the role of media in the stock market. J Financ 62:1139–1168

Wang K, Zhang X (2021) The effect of media coverage on disciplining firms’ pollution behaviors: evidence from Chinese heavy polluting listed companies. J Clean Prod 280:123035

Wang W, Wen J, Luo ZG, Luo WY (2023) How does environmental punishment affect regional green technology innovation?-Evidence from Chinese Provinces. PLoS ONE 18:e0288080

Wang X, Feng Y (2018) The influence of environmental regulation on China’s circular economy performance. China Popul Resour Environ 28:136–147

Wu Y, Lee CC, Lee CC, Peng D (2022) Geographic proximity and corporate investment efficiency: evidence from high-speed rail construction in China. J Bank Financ 140:106510

Wu Y (2004) The impact of public opinion on board structure changes, director career progression, and CEO turnover: evidence from CalPERS’ corporate governance program. J Corp Financ 10:199–227

Xiao H (2023) Institutional investors’ corporate site visits and corporate investment efficiency. Int Rev Financ 23:359–392

Xu S (2023) China’s climate governance for carbon neutrality: regulatory gaps and the ways forward. Humanit Soc Sci Commun 10:853

Yan C, Mao Z, Ho KC (2022) Effect of green financial reform and innovation pilot zones on corporate investment efficiency. Energy Econ 113:106185

Yang D, Lu Z, Luo D (2014) Political connections, media monitoring and long-term loans. China J Acc Res 7:165–177

Yaniv I (2004) Receiving other people’s advice: influence and benefit. Organ Behav Hum Decis Process 93:1–13

Ye K, Guo Z, Zhang W, Liang Y (2022) Heterogeneous environmental policy tools for expressway construction projects: a cross regional analysis in China. Environ Impact Assess Rev 97:106907

You Z, Wang M, Shamu Y (2023) The impact of network social presence on live streaming viewers’ social support willingness: a moderated mediation model. Humanit Soc Sci Commun 10:385

Zhang B, Zhao S (2022) Research on the impact of government subsidies on green innovation of enterprises - The moderating effect of political connection and environmental regulation. Sci Res Manag 43:154–162

Zhang H, Su Z (2015) Does media governance restrict corporate overinvestment behavior? Evidence from Chinese listed firms. China J Acc Res 8:41–57

Zhao X, Yin H, Zhao Y (2015) Impact of environmental regulations on the efficiency and CO2 emissions of power plants in China. Appl Energy 149:238–247

Zheng QQ, Wan L, Wang SY, Chen ZX, Li J, Wu J, Song ML (2023) Will informal environmental regulation induce residents to form a green lifestyle? Evidence from China. Energy Econ 125:106835

Zhu X, Wang Y, Li J (2022) What drives reputational risk? Evidence from textual risk disclosures in financial statements. Humanit Soc Sci Commun 9:318

Acknowledgements

This work was supported by Postdoctoral Science Foundation of China (2022M720131).

Author information

Authors and Affiliations

Contributions

Writing—original draft preparation, Yanchao Feng and Yidong Chen; conceptualization, Rongbing Huang; methodology, Yidong Chen; software, Yanchao Feng; validation, Guoshuo Sui; formal analysis, Yidong Chen; data curation, Guoshuo Sui; writing—review and editing, Yanchao Feng; visualization, Yidong Chen; supervision, Yanchao Feng; funding acquisition, Yanchao Feng.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Feng, Y., Huang, R., Chen, Y. et al. Assessing the moderating effect of environmental regulation on the process of media reports affecting enterprise investment inefficiency in China. Humanit Soc Sci Commun 11, 171 (2024). https://doi.org/10.1057/s41599-024-02677-3

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-02677-3

This article is cited by

-

Green Supplier Selection in the Iraqi Food Industry: Criteria Analysis and Barriers to Implementation

Circular Economy and Sustainability (2025)

-

Exacerbate or alleviate? The new environmental protection law and corporate over-financialization

Economic Change and Restructuring (2025)

-

Does green technology innovation improve carbon emission efficiency? Evidence from energy-intensive enterprises in China

Environment, Development and Sustainability (2024)