Abstract

This study focuses on how recent global crises such as the COVID-19 pandemic and the Russia–Ukraine war have affected the relationship between the U.S. and Chinese agricultural futures markets. By applying wavelet coherence analysis (WCA) and time-varying parameter vector autoregression (TVP-VAR), we obtain the following findings. First, both events have changed the correlation and lead–lag comovement between U.S. and Chinese soybean and corn futures returns but have little impact on the comovement between the two cotton futures returns. Second, U.S. agricultural markets transmit more volatility risk to Chinese markets than the risk spillover from the reverse direction. Third, the risk spillover enhancement effect from the war is stronger than that from the pandemic, which is obvious in both the soybean and corn futures markets but not in the cotton market. Our paper has implications for policy makers seeking to stabilize agricultural commodity prices during global crisis episodes and for designing strategies for cross-market hedging of spillover risks among commodity markets for international investors.

Similar content being viewed by others

Introduction

The rise of international trade and financial market globalization has heightened the connectedness of different commodity markets within the global context (Yang and Zhou, 2020). Facing strong external shocks, the interconnectedness between international commodity markets can increase the spillover of risks (Melvin and Sultan, 1990; Silvennoinen and Thorp, 2013; Webb et al., 2016; Junttila et al., 2018; Song et al., 2018; Mensi et al., 2019; Alquist et al., 2020), potentially resulting in extreme events such as negative oil futures prices and supply chain disruptions caused by the coronavirus disease 2019 (COVID-19) pandemic. Therefore, regulators must be aware of the international connections of commodity futures markets to implement market supervision policies that stabilize these markets and the global supply chain. Additionally, investors can benefit from understanding and predicting the relationships and risk transmission among international commodity futures markets, as doing so helps them develop effective strategies for international portfolio investment and hedging strategies (Fernandez-Perez et al., 2020, 2022).

As the global financial crisis occurred in 2008, numerous studies have endeavored to scrutinize how external events or crises affect the relationships between developed and emerging markets (Yue et al., 2020; Li and Majerowska, 2008; Wu et al., 2017; Wang et al., 2020). However, there has been scarce research on the interconnectedness of international commodity markets during global crises such as the COVID-19 pandemic and the Russia–Ukraine conflict. Although previous studies have examined the price movements between the U.S. and Canadian wheat futures markets (Booth et al., 1998), as well as the price cointegration between the London and Shanghai copper futures markets (Li and Zhang, 2008), there has been a lack of exploration into international commodity market connections during recent global crises. Recently, scholars have concentrated on the effect of the COVID-19 pandemic, which has increased the interdependence between the U.S. and Chinese stock and oil futures markets (Zhang and Mao, 2022; Zhang et al., 2022). Furthermore, COVID-19 and the Russia–Ukraine war have different effects on the linkage between the U.S. and Chinese stock markets (Zhang and Sun, 2023). This paper thereby aims to investigate how COVID-19 and the Russia–Ukraine conflict impact the causal and correlation relationships between the U.S. and Chinese agricultural futures markets.

The motivations of this paper are fourfold. First, agricultural futures price movements can affect other futures prices in different commodity families, including energy and metal families (Batten et al., 2015; Bonato, 2019; Byrne et al., 2013; Pindyck and Rotemberg, 1990; Zhang and Ding, 2018, 2021; Zhang et al., 2018, 2019; Ding and Zhang, 2020). Second, agricultural commodities are important to both the U.S. and China. The U.S. is the largest agricultural producer and exporter, while China is the largest agricultural consumer and importer. Therefore, understanding the linkage between the U.S. and Chinese agricultural futures markets is important not only for cross-market risk hedging but also for the agricultural economy in both countries. Third, the global economy and fluctuations in commodity prices have been significantly impacted by the COVID-19 pandemic, which is a public health emergency (Zhang and Wang, 2022). The pandemic strongly affected agricultural commodity production due to worldwide lockdowns. Many agricultural exporting countries in Southeast Asia and India have restricted agricultural commodity exports due to severe supply shortages to meet domestic food needs. The pandemic has also made Chinese agricultural consumption more dependent on imports from the U.S. market than before. Finally, Ukraine is a major agricultural commodity exporter. The war in Ukraine has dramatically affected worldwide agricultural trading and has significantly increased food prices in most parts of the world.

Contagion theory can provide a valuable framework for underpinning agricultural futures market connectivity between the U.S. and China by elaborating that the spread of market shocks in one country’s agricultural futures market can be transmitted to the other, affecting both futures prices and futures market dynamics (Pericoli and Sbracia, 2003). A contagion event can occur through various channels, such as information flows and financial linkages.

Information flows play a crucial role in financial market contagion. Globalization and advancements in technology have facilitated the rapid dissemination of information, making futures markets more interconnected than before. News regarding a shock in one country can quickly spread to other countries, influencing market sentiments and triggering financial contagion effects in futures markets (Yarovaya et al., 2022). In the context of the soybean and corn futures markets, the release of key agricultural reports or trading policies by either country can have a significant impact on agricultural futures market dynamics. If negative news regarding soybean and corn production or trade restrictions emerges in one country, it can create panic in the other country’s market, leading to price volatility and contagion effects.

Furthermore, financial linkages between the U.S. and China also contribute to potential contagion in the agricultural futures market. Financial institutions, investors, and speculators from both countries participate in commodity futures markets, creating interconnections between the futures markets in the two countries. These linkages can amplify the transmission of shocks and risks through various investment instruments, including commodity futures contracts, allowing risk to be exposed to the agricultural futures market (Caramazza et al., 2004). The transmission of cross-border risks in futures markets typically occurs through capital and investor sentiment channels based on financial linkages. In an episode of global financial integration, a country experiencing a liquidity crash in its futures market can lead to similar challenges for its trading partners, thereby spreading risks in futures markets (Patel et al., 2022). Additionally, international investor sentiment also serves as an important risk-spreading channel for risk contagion in the futures market. For instance, when a country’s agricultural futures market becomes risky, global investors tend to adopt a pessimistic outlook toward investing in that country’s agricultural futures market. This negative sentiment may also extend to other countries’ agricultural futures markets, leading to reduced investments in agricultural futures markets such as the soybean futures market (Akyildirim et al., 2022).

Our study was carried out for three major agricultural futures, soybean, corn, and cotton, which are most actively traded in both the U.S. and Chinese futures markets. We first apply the Johansen cointegration test to examine the presence of a long-term association between U.S. and Chinese agricultural futures returns. We further employ wavelet coherence analysis (WCA) to examine the comovement and lead–lag (causal) relationships among U.S. and Chinese agricultural futures markets at varying time scales and time locations. The WCA method is a powerful tool for detecting localized comovements between different time series with multiscale structures and has been successfully applied in recent economic research (Marobhe and Kansheba, 2023, Umar and Gubareva, 2021). Then, we apply the time-varying parameter vector autoregression (TVP-VAR) connectedness approach (Cagli et al., 2023) to investigate the impact of the COVID-19 pandemic and the Russia–Ukraine war on the dynamic volatility spillovers between the U.S. and Chinese markets. Finally, we analyze the impact of exogenous shocks during the pure-COVID-19 period and the Russia–Ukraine war period on risk transmission across the U.S. and Chinese soybean futures markets using the impulse response function and the variance decomposition method under the vector autoregression (VAR) model framework.

Our paper contributes to the literature on commodity market research in the following way. First, the outbreak of COVID-19 at the beginning of 2020 and the Russia–Ukraine war around the spring of 2022 have changed both the correlation relationship and the causal relation between the U.S. and Chinese soybean futures markets in short-term investment periods. Second, the Russia–Ukraine war has changed from a positive to a negative correlation without altering the causal relation (lead–lag relation) between U.S. and Chinese corn futures returns on a short time scale of up to 12 days, while COVID-19 has had little impact on the connectedness of two corn futures markets. Third, both COVID-19 and the Russia–Ukraine war had little impact on the causal relationships led by U.S. cotton futures returns on short time scales and had positive correlation relationships on longer time scales. Fourth, the pandemic lockdown has had a transient effect on preventing risk spillover across the U.S. and Chinese soybean and corn futures markets, while the Russia–Ukraine war has dramatically increased risk spillover across the U.S. and Chinese soybean and corn futures markets on a short time scale. However, these two exogenous events have little impact on risk spillovers across the U.S. and Chinese cotton markets. Finally, the impulse response from the Chinese soybean market to U.S. shock is much stronger than the U.S. market response to Chinese shock. The cross-market responses are much more persistent during the Russia–Ukraine war period than during the COVID-19 period. The variance contribution from the U.S. soybean market to Chinese market fluctuations is much stronger than that from the U.S. market during both the COVID-19 period and the war period, while the war has enhanced such cross-market variance contributions from China more significantly than U.S. contributions.

The remainder of this paper is organized as follows: Section “Data and descriptive statistics” presents the data and descriptive statistics. Section “Return comovements between the U.S. and Chinese agricultural futures markets” presents a wavelet coherence analysis (WCA) to examine the comovement and lead–lag causal relationships among the U.S. and Chinese agricultural futures markets at varying time scales and time intervals under the influence of COVID-19 and the Russia–Ukraine war. Section “Dynamic volatility connectedness between the U.S. and Chinese agricultural futures markets” applies the TVP-VAR method to investigate the impact of these external events on the dynamic volatility spillovers between the U.S. and Chinese agricultural futures markets. Section “The causal and risk transmission relationships between the U.S. and Chinese soybean futures markets during crisis periods” adopts VAR models to investigate the causal and shock transmission relations across the two soybean futures markets during crisis periods. Section “Conclusions, discussions, and implications” concludes our paper with discussions and research implications.

Data and descriptive statistics

We collected daily NYMEX closing prices for soybean, corn, and cotton futures in the U.S. and for soybean, corn, and cotton futures on the Dalian Futures Exchange (DFE) in China from March 26, 2018, on which date Chinese oil futures started to trade in the Shanghai Futures Exchange, through November 28, 2023. Soybean, corn, and cotton are the three major agricultural commodities that are most actively traded in both the U.S. and Chinese futures markets. We choose this starting date for data selection to exclude the impact of the oil futures launch event on agricultural futures.

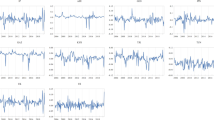

We denote the U.S. soybean price and return as PUsoy and RUsoy, and we denote the Chinese soybean price and return as PCsoy and RCsoy. Similar notations can be used for corn and cotton futures prices and returns. Figures 1–3 show the price and return time series for U.S. and Chinese soybean, corn, and cotton futures, respectively. Tables 1 and 2 present the descriptive statistics for prices and returns, respectively, from which we find that all three Chinese futures prices and standard deviations are greater than those of U.S. futures, while the standard deviations for all three U.S. futures returns are greater than those of Chinese futures returns.

Return comovements between the U.S. and Chinese agricultural futures markets

We first carry out the Johansen cointegration test to examine the presence of long-term associations between U.S. and Chinese agricultural futures returns (Johansen, 1991). Table 3 shows the absence of any cointegration between the U.S. and Chinese markets for all three futures.

We further employ wavelet coherence analysis (WCA) to examine the comovements and lead–lag relations among U.S. and Chinese agricultural futures markets at varying time scales and time locations. WCA is based on a bivariate framework established on a continuous wavelet transformation and is able to examine the interdependence between two time series in both the time and frequency domains (for a detailed description of wavelet coherence analysis, see Marobhe and Kansheba, 2023, Umar and Gubareva, 2021).

Figures 4–6 show the wavelet coherence structures for the interdependence between the U.S. and Chinese soybean, corn, and cotton futures returns, respectively. The legends on the right-hand sides show the keys for reading the heatmaps. The horizontal axis represents time, and the vertical axis represents frequency, which is displayed as the duration of the study period in days. Smaller periods correspond to shorter time scales or higher frequencies. The coherence magnitude is displayed as the color for any day and frequency. The warmer the color (yellow) is, the greater the interdependence (coherence) between the two series. A cooler color (blue) indicates less coherence. The black arrows in the coherence heatmaps indicate the causal relationships (lead–lag relations) between two time series. The directions of the arrows indicate the phase differences. A perfect correlation corresponds to zero phase differences. If an arrow points to the right (left), the correlation is positive (negative) or in-phase (out of phase) comovement. If an arrow points upward (downward), the first series leads (lags) the second. Now, we can summarize the four types of arrows as follows: (1) a right-upward arrow indicates that the first time series leads the second with in-phase comovement or a positive correlation; (2) a right-downward arrow indicates that the second time series leads the first with in-phase comovement or a positive correlation; (3) a left-upward arrow indicates that the first time series leads the second with out-of-phase comovement or a negative correlation; and (4) a left-downward arrow indicates that the second time series leads the first with out-of-phase comovement or a negative correlation. Therefore, wavelet coherence analysis provides a much richer interdependence structure with both correlation relationships and causal relationships between two time series in dynamic time and at various frequencies (periods). For futures return time series, periods are regarded as time scales or investment time horizons.

From Fig. 4, we observe (1) the right upward arrows starting at the 5-to-12-day investment horizons around October-November of 2019, which indicate the in-phase comovements led by U.S. soybean futures returns; (2) the right downward arrows starting at the 16-to-32-day investment horizons around January-February of 2020, which indicate the in-phase comovements led by Chinese soybean futures returns; (3) the left upward arrows starting at the 6-to-8-day investment horizons around April-August of 2020, which indicate the out-phase comovements led by U.S. soybean futures returns; (4) the right upward arrows starting at the 1-to-8-day investment horizons around January-February of 2022, which indicate the in-phase comovements led by U.S. soybean futures returns; and (5) the left downward arrows starting at the 1-to-3-day investment horizons around March-April of 2020, which indicate the out-phase comovements led by Chinese soybean futures returns. Based on the above findings, we can conclude that the outbreak of COVID-19 at the beginning of 2020 and the Russia–Ukraine war around the spring of 2022 have changed both the correlation relationship and the causal relation between the U.S. and Chinese soybean futures markets in short-term investment periods.

From Fig. 5, we observe the following: (1) no significant change in the directions of arrows around the beginning of 2020 when COVID-19 became a pandemic; (2) right downward arrows from 6 to 8 days of investment horizons around January-February of 2022, which indicate the in-phase comovements led by Chinese corn futures returns; and (3) left downward arrows from 8 to 12 days of investment horizons around March-April 2020, which indicate the out-of-phase comovements led by Chinese corn futures returns. Therefore, the Russia–Ukraine war has changed the correlation relation (from in-phase to out-of-phase comovement) without altering the causal relation (lead–lag relation) between U.S. and Chinese corn futures returns on a short time scale of up to 12 days, while COVID-19 has had little impact on the connectedness of two corn futures markets.

From Fig. 6, we find that the arrows mostly remain upward or right upward from 1- to 10-day investment horizons and point straight rightward throughout the two crisis periods beyond 16-day investment horizons. This finding indicates that both COVID-19 and the Russia–Ukraine War had little impact on the causal relationships led by U.S. cotton futures returns on short time scales and had positive correlation relationships on longer time scales.

Dynamic volatility connectedness between the U.S. and Chinese agricultural futures markets

We employ the TVP-VAR connectedness approach (Cagli et al., 2023) to investigate the dynamic volatility spillovers between the U.S. and Chinese agricultural futures markets.

Tables 4–6 summarize the average dynamic connectedness of futures volatilities for the U.S. and the Chinese soybean, corn, and cotton markets, respectively. Table 4 shows that the U.S. soybean futures market transmits an average of 3.1% volatility risk to China, while the Chinese soybean market transmits only 0.8% risk to the U.S. market. Table 5 shows that the U.S. corn futures market transmits an average of 4.6% volatility risk to China, while the Chinese corn market transmits 1.9% risk to the U.S. market. Table 6 shows that the average amount of cotton volatility spillover from the U.S. to China is 14.7%, while only 5.7% of cotton volatility spillover from the other direction occurs. Thus, all three U.S. agricultural futures markets dominate Chinese markets in terms of volatility spillover. Furthermore, from Tables 4–6, we find that the total connectedness index (TCI) is 3.9% for soybean, 6.5% for corn, and 20.5% for cotton, which indicates a relatively strong risk contagion effect across the two cotton markets.

To demonstrate the effects of COVID-19 and the Russia–Ukraine war on volatility connectedness across the U.S. and Chinese agricultural futures markets, Figs. 7–9 present the dynamic risk spillovers over time for soybeans, corn, and cotton, respectively. From the TCI evolution series in Fig. 7, we find that the TCI for two soybean volatilities decreased to near zero around the start of the COVID-19 pandemic in March–April 2020, gradually increased to close to 6% in early 2021, and then steeply increased from 1% to 4% at the start of the Russia–Ukraine war in early 2022. From the one-directional spillover series in Fig. 7, we find similar effects of the pandemic and the war on the spillover direction from the U.S. to China but not so significant from the other direction. From Fig. 8, we find the same story for corn futures markets: COVID-19 reduces risk spillover and gradually increases to the peak spillover, but the Russia–Ukraine war has made a large jump in risk spillover on a very short time scale. However, interestingly, such impacts from both exogenous events on risk spillover across the U.S. and Chinese cotton futures markets are absent, which can be inferred from Fig. 9.

Based on the above findings from the TVP-VAR analysis, we can conclude the following: (1) The pandemic lockdown had a transient effect on preventing risk spillover across the U.S. and Chinese soybean and corn futures markets; (2) the Russia–Ukraine war dramatically increased the risk spillover across the U.S. and Chinese soybean and corn futures markets on a short time scale, possibly because the war disrupted the transport of food products to the world from Ukraine, which is a major agricultural producer and exporter of global food consumption; and (3) the small effects of the two exogenous events on the risk spillover across the U.S. and Chinese cotton markets could be because the use of cotton as a raw material in the textile industry was not an urgent necessity during the two crisis periods.

The causal and risk transmission relationships between the U.S. and Chinese soybean futures markets during crisis periods

From the WCA results in Section 3, we find that crisis events have similar impacts on the interdependence of two soybean futures returns and the interdependence of two corn futures returns but have little impact on the interdependence of two cotton futures returns. In this section, we employ VAR models to explore the effects of COVID-19 and the Russia–Ukraine conflict on the causal and risk transmission relationships between the U.S. and Chinese soybean futures markets only. The outbreak of COVID-19 was announced on January 17, 2020, and the Russia–Ukraine war started on February 24, 2022. We thereby define the pre-COVID-19 period as March 26, 2018 to January 17, 2020; the pure COVID-19 period as January 18, 2020 to February 23, 2021; and the war period as February 24, 2021 to November 28, 2023.

VAR models

The daily returns can be found as follows:

where \({P}_{t}\) and \({P}_{t-1}\) are the soybean prices on days t and t−1, respectively. We denote \({R}_{t}^{{\rm{u}}}\) and \({R}_{t}^{{\rm{c}}}\) as the U.S. and Chinese soybean futures returns, respectively, on day t.

The optimal number of VAR lags can be determined by the likelihood ratio (LR) statistics, final prediction error (FPE) and Akaike, Hannan–Quinn, and Schwarz information criteria (AIC, HQIC, and SBIC, respectively). The above five measures for different lags for the pre-COVID-19 period, pure-COVID-19 period and war period are presented in Tables 7–9, respectively, from which we find that the optimal lag number is 0 for the pre-COVID-19 period, 1 for the pure-COVID-19 period, and 4 for the war period. Since the VAR lag before COVID-19 was zero, the U.S. and Chinese soybean futures markets were not significantly connected. Thus, we need to establish VAR models only for the pure-COVID-19 period and the war period, with the model fitting results presented in Tables 10 and 11.

Figures 10 and 11 show that the roots of the VAR comparison matrix are within the unit circle for the pure-COVID-19 and war periods, respectively. Therefore, our VAR systems are stable for both periods.

Impulse response analysis

We undertake impulse response analyses on the U.S. and Chinese soybean futures returns under our VAR models to examine the response of one market return when the other market return experiences a one standard deviation shock during the COVID-19 and Russia–Ukraine war periods. Figures 12 and 13 illustrate the impulse response functions for the U.S. and Chinese soybean futures returns for the two periods.

According to Fig. 12, during the pure-COVID-19 period, a one standard deviation shock occurred in 0.014 for the U.S. market and 0.013 for Chinese soybean futures. However, the response of U.S. soybean futures returns is close to zero when the Chinese market experiences a one standard deviation shock, while the Chinese futures returns jump to 0.002 in response to a U.S. shock. Additionally, the Chinese market response to the U.S. shock lasted for 2 days. Thus, COVID-19 caused a much stronger response of Chinese soybean futures to the U.S. market shock than to the other way around.

In Fig. 13, during the Russia–Ukraine conflict period, a one standard deviation shock is 0.015 for the U.S. market and 0.009 for the Chinese market. We find that the Chinese futures return jumps to 0.002 in response to a U.S. shock that lasts for 6 days and that the U.S. futures return jumps to 0.001 in response to a Chinese shock that lasts for 5 days. Therefore, the impulse response from the Chinese market to U.S. shock was much stronger than that to the U.S. market, and it was much more persistent during the Russian war period than during the COVID-19 period.

Variance decomposition

To further analyze the relationship between the U.S. and Chinese soybean futures markets, we use variance decomposition of the standard errors based on our two soybean futures VAR systems. This decomposition allows us to assess the percentage contributions of variations in the two futures returns to the standard error of each soybean return, providing a quantitative comparison of the impact of the U.S. market on the Chinese market and vice versa.

The results of the variance decompositions are presented in Tables 12 and 13 for the COVID-19 and Russia–Ukraine war periods, respectively. During the COVID-19 period, the standard errors of U.S. soybean market returns are influenced by variations in the Chinese market, with contributions of 0.05%. This contribution significantly increases to 0.3%–0.5% in the Russia–Ukraine war period. In contrast, the standard errors of Chinese soybean returns are more strongly influenced by variations in the U.S. markets. In the COVID-19 period, U.S. variations contributed 2% to the standard errors, which significantly increased to 4.5% in the Russia–Ukraine war period. The variance contribution from the U.S. soybean market to Chinese market fluctuations is much stronger than that from the U.S. market during both the COVID-19 period and the war period, while the war has enhanced such cross-market variance contributions from China more significantly than U.S. contributions.

Conclusions, discussions, and implications

Our paper attempts to analyze the impact of the COVID-19 pandemic and the Russia–Ukraine conflict on the connectedness between the U.S. and Chinese agricultural futures markets. We first analyze the impact of the pandemic and the war on the correlation and lead–lag comovement across U.S. and Chinese futures return series through wavelet coherence analysis (WCA) for varying investment horizons. Furthermore, we apply the TVP-VAR method to study the impact of these two crisis events on the dynamic volatility spillovers between the U.S. and Chinese markets. Finally, based on the VAR framework, impulse response functions and variance decomposition methods were employed to study the shock transmission intensity and persistence across the U.S. and Chinese soybean futures markets during the two crisis periods.

We summarize the main conclusions of our paper as follows. First, both the pandemic and war have changed the correlation and lead–lag comovement between U.S. and Chinese soybean and corn futures returns in short time investment horizons. However, these two events seem to have little impact on the comovement between the two cotton futures returns. Second, all three U.S. agricultural markets transmit more volatility risk to Chinese markets than does risk spillover from the reverse direction. Third, the risk spillover enhancement effect from the Russia–Ukraine war is increasingly stronger than that from the COVID-19 pandemic and has been more pronounced in both the soybean and corn futures markets, not in the cotton market. The small effects of these two exogenous events on the risk spillover across the U.S. and Chinese cotton markets could be because the use of cotton as a raw material in the textile industry was not an urgent necessity during these two crisis periods.

Our findings contribute to the literature on the impact of crisis events on connectedness and risk spillover across different markets, such as the impact of the global financial crisis and COVID-19 on volatility spillover between oil and other commodities (Marobhe and Kansheba, 2023), the impact of COVID-19 and the Russia–Ukraine war on different stock markets’ connectedness (Zhang and Sun, 2023), and the nonlinear nexus between cryptocurrency returns and COVID-19 news sentiment (Banerjee et al., 2022). Our findings also corroborate contagion theory on financial market linkages and further enrich this theory by considering risk transmission at multiple scales and different investment horizons.

Our paper has significant implications for policymakers and investors. By understanding the transmission of price shocks and volatility spillovers between the U.S. and Chinese agricultural futures markets, policymakers can assess the potential contagion risks and the impact of their policies on future market stability. Policymakers can thereby formulate policies to mitigate the market risk propagated from other countries’ futures markets. For example, policymakers can monitor the impact of trade quotas or tariffs on soybean prices in both countries and take appropriate measures to manage potential price volatility. They can also analyze the effectiveness of policy interventions, such as subsidies or import-export regulations, in mitigating market risks and stabilizing soybean prices. This understanding can help policymakers develop strategies to enhance soybean market resilience and maintain a conducive environment for the soybean trade.

Investors, particularly those engaged in commodities or agricultural investments, can benefit from understanding the price shocks and volatility spillovers between agricultural futures markets. By analyzing the connectivity between the U.S. and Chinese markets, investors can diversify their portfolios and reduce risk exposure in futures markets. This approach can help them reduce the impact of market-specific shocks to their investment portfolios by diversifying their portfolios in different agricultural futures markets. Our paper can also help investors strengthen the risk management practices embedded in agricultural futures markets. By understanding the connectivity between the U.S. and Chinese markets, investors can assess potential contagion risks and determine appropriate risk limits and trading positions. With this insight, they can develop risk management strategies to monitor and mitigate the spillover effects between two markets and stress test their portfolios under different market scenarios. Future research can also use the methodologies employed in this research, such as WAC and TVP-VAR, to further investigate the connectedness among more international markets, such as the G20 and BRICS countries, for more commodity classes.

Data availability

The data has been sent to the journal.

References

Akyildirim E, Cepni O, Pham L, Uddin GS (2022) How connected is the agricultural commodity market to the news-based investor sentiment? Energy Econ 113:106174

Alquist R, Ellwanger R, Jin J (2020) The effect of oil price shocks on asset markets: evidence from oil inventory news. J Futures Mark 40(8):1212–1230

Banerjee A, Akhtaruzzaman M, Dionisio A, Almeida D, Sensoy A (2022) Nonlinear nexus between cryptocurrency returns and COVID-19 news sentiment. J Behav Exp Financ. https://doi.org/10.1016/j.jbef.2022.100747

Batten JA, Szilagyi PG, Wagner NF (2015) Should emerging market investors buy commodities? Appl Econ 47(39):4228–4246

Bonato M (2019) Realized correlations, betas and volatility spillover in the agricultural commodity market: what has changed? J Int Financ Mark Inst Money 62:184–202

Booth G, Brockman P, Tse Y (1998) The relationship between US and Canadian wheat futures. Appl Financ Econ 8(1):73–80

Byrne JP, Fazio G, Fiess N (2013) Primary commodity prices: co-movements, common factors and fundamentals. J Dev Econ 101:16–26

Cagli E, Mandaci P, Taskin D (2023) The volatility connectedness between agricultural commodity and agri businesses: evidence from time-varying extended joint approach. Financ Res Lett. https://doi.org/10.1016/j.frl.2022.103555

Caramazza F, Ricci L, Salgado R (2004) International financial contagion in currency crises. J Int Money Financ 23(1):51–70

Ding S, Zhang Y (2020) Cross market predictions for commodity prices. Econ Model 91:455–462

Fernandez-Perez A, Frijns B, Gafiatullina I, Tourani-Rad A (2022) Profit margin hedging in the New Zealand dairy farming industry. J Commod Mark 26:100197

Fernandez-Perez A, Frijns B, Indriawan I, Tse Y (2020) Pairs trading of Chinese and international commodities. Appl Econ 52(48):5203–5217

Johansen S (1991) Estimation and hypothesis testing of co-integration vectors in Gaussian vector autoregressive models. Econ Econ Soc 59(6):1551–1580

Junttila J, Pesonen J, Raatikainen J (2018) Commodity market based hedging against stock market risk in times of financial crisis: the case of crude oil and gold. J Int Financ Mark Inst Money 56:255–280

Li H, Majerowska E (2008) Testing stock market linkages for Poland and Hungary: a multivariate GARCH approach. Res Int Bus Financ 22:247–266

Li X, Zhang B (2008) Price linkages between Chinese and world copper futures markets. Front Econ China 3(3):451–461

Marobhe MI, Kansheba JMP (2023) High frequency volatility spillover between oil and non-energy commodities during crisis and tranquil periods. SN Bus Econ. https://doi.org/10.1007/s43546-023-00463-y

Melvin M, Sultan J (1990) South African political unrest, oil prices, and the time varying risk premium in the gold futures market. J Futures Mark 10:103–111

Mensi W, Hammoudeh S, Al-Jarrah IMW, Al-Yahyaee KH, Kang SH (2019) Risk spillovers and hedging effectiveness between major commodities, and Islamic and conventional GCC banks. J Int Financ Mark Inst Money 60:68–88

Patel R, Goodell JW, Oriani ME, Paltrinieri A, Yarovaya L (2022) A bibliometric review of financial market integration literature. Int Rev Financ Anal 80:102035

Pericoli M, Sbracia M (2003) A primer on financial contagion. J Econ Surv 17(4):571–608

Pindyck RS, Rotemberg JJ (1990) The excess co-movement of commodity prices. Econ J 100:1173–1189

Song W, Ryu D, Webb RI (2018) Volatility dynamics under an endogenous Markov-switching framework: a cross-market approach. Quant Financ 18(9):1559–1571

Silvennoinen A, Thorp S (2013) Financialization, crisis and commodity correlation dynamics. J Int Financ Mark Inst Money 24:42–65

Umar Z, Gubareva M (2021) The relationship between the Covid-19 media coverage and the environmental, social and governance leaders equity volatility: a time-frequency wavelet analysis, Appl Econ. https://doi.org/10.1080/00036846.2021.1877252

Wang Z, Li Y, He F (2020) Asymmetric volatility spillovers between economic policy uncertainty and stock markets: evidence from China. Res Int Bus Financ 53:101233

Webb RI, Ryu D, Ryu D, Han J (2016) The price impact of futures trades and their intraday seasonality. Emerg Mark Rev 26:80–98

Wu W, Lau MCK, Vigne SA (2017) Modelling asymmetric conditional dependence between Shanghai and Hong Kong stock markets. Res Int Bus Financ 42:1137–1149

Yang J, Zhou Y (2020) Return and volatility transmission between China’s and international crude oil futures markets: a first look. J Futures Mark 40(6):860–884

Yarovaya L, Brzeszczyński J, Goodell JW, Lucey B, Lau CKM (2022) Rethinking financial contagion: information transmission mechanism during the COVID-19 pandemic. J Int Financ Mark Inst Money 79:101589

Yue P, Fan Y, Batten JA, Zhou WX (2020) Information transfer between stock market sectors: a comparison between the USA and China. Entropy 22(2):194

Zhang Y, Ding S (2018) The return and volatility co-movement in commodity futures markets: the effects of liquidity risk. Quant Financ 18(9):1471–148

Zhang Y, Ding S, Scheffel E (2018) Policy impact on volatility dynamics in commodity futures markets: evidence from China. J Futures Mark 38(10):1227–1245

Zhang Y, Ding S (2021) Liquidity effects on price and return co-movements in commodity futures markets. Int Rev Financ Anal 76:101796

Zhang Y, Ding S, Scheffel E (2019) A key determinant of commodity price co-movement: the role of daily market liquidity. Econ Model 81:170–180

Zhang Y, Wang R (2022) COVID-19 impact on commodity futures volatilities. Financ Res Lett 47(Part A):102624

Zhang Y, Mao J (2022) COVID-19’s impact on the spillover effect across the Chinese and U.S. stock markets. Financ Res Lett 47(Part B):102648

Zhang Y, Ding S, Shi H (2022) The impact of COVID-19 on the interdependence between US and Chinese oil futures markets. J Futures Mark 42:2041–2205

Zhang Y, Sun Y (2023) Did U.S. and Chinese investors respond differently to the exogenous shocks from COVID-19 and the war in Ukraine? Int Rev Financ Anal 88:102710

Acknowledgements

This paper is supported by the grant (LYZDA2301) from Academy of Longyuan Construction Finance Research, the Special Research Project for the 15th Zhejiang CCP Congress, “Digital Technologies for Financial Risk Management and Regulation,” 2022, Zhejiang Philosophy and Social Sciences grant (21NDJC058YB) and grant (24NDJC240YBM).

Author information

Authors and Affiliations

Contributions

Yongmin Zhang has contributed to conceptional design, model setting up, analysis of the results, and writing of the whole paper. Yiru Sun has contributed to data analysis in sections “Data and descriptive statistics”, “Dynamic volatility connectedness between the U.S. and Chinese agricultural futures markets” and “The causal and risk transmission relationships between the U.S. and Chinese soybean futures markets during crisis periods.” Haili Shi has provided the data set and contributed data analysis in section “The causal and risk transmission relationships between the U.S. and Chinese soybean futures markets during crisis periods.” Shusheng Ding has written theoretical support and practical implication of this study in sections “Introduction” and “Conclusions, discussions, and implications.” Yingxue Zhao has contributed the data analysis for section “Return comovements between the U.S. and Chinese agricultural futures markets.”

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical Approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zhang, Y., Sun, Y., Shi, H. et al. COVID-19, the Russia–Ukraine war and the connectedness between the U.S. and Chinese agricultural futures markets. Humanit Soc Sci Commun 11, 477 (2024). https://doi.org/10.1057/s41599-024-02852-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-02852-6

This article is cited by

-

Two forecasting model selection methods based on time series image feature augmentation

Scientific Reports (2025)