Abstract

The quick response (QR) code-enabled mobile payment has gained large attention from academicians and policymakers due to its fast, convenience, and usefulness. However, acceptance of this technology among consumers is limited and rare in a few cases. Therefore, current research attempts to gain insight into factors that influence consumer behavior to adopt QR code-enabled mobile payment. This research has developed an integrated research framework that combines the technology acceptance model, theory of reasoned action, transaction speed, convenience, and innovativeness to investigate consumer behavior to adopt QR code mobile payment. In addition to that moderating effect of transaction speed is tested between consumer attitude and intention to adopt QR code-driven mobile payment. This study empirically investigates consumer attitudes and intention to adopt the QR mobile payment system with 216 responses. Findings of the statistical analysis have revealed that perceived usefulness, perceived ease of use, convenience, subjective norms, and innovativeness explained a substantial variance \({R}^{2}\) 52.3% in measuring user attitude to adopt QR code-enabled mobile payment. Practically, this study suggests that policymakers should pay attention to perceived convenience, transaction speed, subjective norm, and perceived usefulness to boost consumer attitude and intention to adopt QR-enabled mobile payment. This study is unique as it integrates the technology acceptance model and theory of reasoned action to investigate consumer behavior towards the adoption of QR code mobile payment. This study is also valuable as it examines the moderating effect of transaction speed between consumer attitude to accept QR code and their intention to adopt QR code-driven mobile payment and adds a new dimension to information system literature.

Similar content being viewed by others

Introduction

The rapid acceptance of mobile phone devices has transformed individual personal and professional lives. Aside from communication tools mobile devices are now being used in the fintech industry for mobile payments. Mobile payment denotes to payment process wherein business transactions are performed through mobile devices (Liu and Zheng, 2023; Nicoletti et al., 2017). A recent development in mobile payment systems is the advent of QR code technology, which has gained large attention from academicians and policymakers due to its fast, convenient, and useful service (N. Singh et al., 2020a). The QR code is a storage system that comprises a dot matrix kind of bar code and can be shown or printed on the screen, interpreted by a special reader, and reveals extensive information that could not be explained by traditional bar code (Denso, 2000). Although the QR code-enabled mobile payment method is easy, convenient, and enjoyable (Chang et al., 2021) however, the acceptance of quick response payment system is at its initial stage (Bhat et al., 2023; Boden et al., 2020; Yan et al., 2021). Consistently, the focus of this research is to understand factors that influence user behavior to adopt quick response (QR) codes for mobile payments.

Authors like Tew et al. (2021) asserted that QR code mobile payment systems have gained less attention when compared to other mobile-empowered financial services like Internet or mobile banking. Nevertheless, current research fills the research gap in this context and integrates the technology acceptance model with the theory of reasoned action to investigate consumer attitudes and behavioral intention to adopt the QR code mobile payment system in Saudi Arabia. This study is significant as it integrates the technology acceptance model and theory of reasoned action toward consumer adoption of the QR code mobile payment system in Saudi Arabia. In addition to that this research examines how perceived enjoyment, convenience, and innovativeness impact consumer behavior to accept QR code-enabled payment systems in the Saudi region. This study is unique as it conceptualizes the moderating effect of transaction speed between consumer attitude to accept QR code and their intention to adopt a QR code-based mobile payment system. The following section demonstrates the definition of the constructs and supporting literature to generate hypotheses.

Research model and hypotheses development

QR code-enabled mobile payment

With the emergence of 4th industrial revolution fintech industry has evolved several fintech services including the Internet of things (IOT), artificial intelligence, near-field communication, smartphone applications, and quick response code payment systems (Liu and Zheng, 2023; Mi Alnaser et al., 2023; Nicoletti et al., 2017; Shang et al., 2023). Similarly, the mobile payment system is also updated with the latest innovative applications and software. Traditionally, mobile payments have been done with mobile banking applications or web-based internet banking also known as e-banking (Rahi et al., 2023; Rahi et al., 2021b). Nevertheless, the use of these applications for payments was found complex when compared with the quick response (QR) payment system. Therefore, an alternative service namely a quick response (QR) payment system has gained consumer attention in a cashless society (Alamoudi, 2022). With the advent of quick response (QR)-enabled payment systems consumers are no longer constrained to credit/debit card services (Chang et al., 2021). The use of QR codes is easy and enjoyable. For instance, the consumer just needs to scan a QR code with their mobile phone camera and payment will be completed quickly (Gutiérrez et al., 2013). In the context of Saudi Arabia, the Saudi payment authority has recently made a contract with the High-tech payment systems authority to introduce a QR code scheme. Nevertheless, consumers are reluctant to adopt QR code-enabled mobile payment systems in the Saudi retail industry. Therefore, it is essential to understand factors that impact consumer behavioral intention to adopt a QR code-enabled mobile payment system.

Technology acceptance model

The technology acceptance model was invented by Davis (1993) and investigated consumer attitudes and behavior toward adopting technology. The technology acceptance framework comprises two main exogenous constructs namely usefulness and ease of use. The perceived usefulness is the degree to wherein individuals perceive technology as useful and improves task performance (Ahn and Park, 2023; S. Singh et al., 2020b). Therefore, ease of use is identified as the extent to wherein technology is perceived by users as easy and simple to use and enhances individual task performance (Davis et al., 1989). It is assumed that QR code mobile payment is new technology and hence usefulness and ease of use would encourage users to adopt mobile payment driven by QR code. Prior literature on information systems has long established that usefulness and ease of use influence consumer intention to adopt QR code-enabled payment systems (Cao et al., 2016; de Luna et al., 2019; Kaatz, 2020; Ooi and Tan, 2016; Shankar and Datta, 2018). Therefore, the following hypotheses are proposed:

H1: Perceived usefulness impacts consumer attitude towards QR code mobile payment.

H2: Perceived ease of use impacts consumer attitude towards QR code mobile payment.

Theory of reasoned action

The theory of reasoned action was introduced by Ajzen and Fishbein and has been widely used in information system studies (Ajzen and Fishbein, 1977). TRA determines consumer attitudes and subjective norms to adopt a specific technology (Flavian et al., 2020). Subjective norm is the extent that measures individual values and beliefs whether important people encourage or discourage them from adopting technology (Flavian et al., 2020). Nevertheless, the subjective norm in the QR code context is conceptualized as the degree wherein individual belief is affected by surrounding people’s opinions including family and peers, and brings the feeling that QR code-based payment is attractive and must be used for financial activities (Flavian et al., 2020; Shang et al., 2023; Wu and Gong, 2023). Prior studies have established the positive impact of the subjective norm in measuring consumer attitudes toward adopting mobile payment (Al Nawayseh, 2020; Baptista and Oliveira, 2015; Liu and Zheng, 2023). Therefore, the subjective norm is hypothesized as:

H3: Subjective norm is related to consumer attitude towards QR code-based mobile payment.

Perceived convenience and innovativeness

The role of perceived convenience and innovation is found critical in determining consumer behavior to adopt QR codes (Boden et al., 2020; Nguyen and Dao, 2024). Perceived convenience is the extent to wherein users believe that payment through a QR code is easy and convenient (Boden et al., 2020; Chen, 2008). It is argued that digital consumers expect the use of technology to be time-saving and convenient and hence they prefer to use innovative technology (Boden et al., 2020). The term innovativeness is the degree to wherein consumer perceives that technology is new and amusing (Liu and Zheng, 2023; Rahi and Abd Ghani, 2021). Therefore, it is assumed that innovation will motivate consumers to try new mobile technology which is QR code-enabled mobile payment (Boden et al., 2020; Kim et al., 2010). Both convenience and innovativeness have substantial support from literature to predict consumer behavior to adopt QR code-based mobile payment (Chen and Nath, 2008; Cowart et al., 2008; De Kerviler et al., 2016; Kim et al., 2010; Makki et al., 2016; Ooi and Tan, 2016; Rampton, 2017; Slade et al., 2015; Zhang et al., 2018). Therefore, convenience and innovativeness are hypothesized as:

H4: Convenience determines consumer attitude towards QR code mobile payment.

H5: Perceived innovativeness positively determines consumer attitude towards QR code-based mobile payment.

The main attractiveness of QR codes is speed during financial transactions. For instance, users do not need to login and they just scan and pay their bills by using a QR code (Yan et al., 2021). Therefore, the importance of transaction speed cannot be neglected in measuring user attitude and intention to adopt QR code-based payment. The term transaction speed is the extent to wherein consumer feels that the use of QR code mobile payment increases transaction speed that is not possible in traditional mobile payment methods (Chen, 2008; Yan et al., 2021). Therefore, it is assumed that transaction speed will boost consumer confidence resulting higher acceptance rate of QR code-enabled mobile payment. In literature prior studies have established that transaction speed is the core factor that influences consumer behavior and encourages to adoption of QR code mobile payment systems (Chen, 2008; Norton and Hall, 2006; Teo et al., 2015b; Yang, 2009). Nevertheless, this study advances the body of knowledge and conceptualizes transaction speed as a moderating factor in the relationship between consumer attitude and intention to adopt QR code-enabled mobile payment. Therefore, the following hypotheses are proposed:

H6: Attitude towards QR code influences consumer intention to adopt QR code mobile payment.

H7: Transaction speed has a moderating effect on consumer attitude and intention to adopt QR code-based mobile payment.

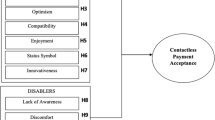

After reviewing detailed literature this study has summarized that perceived usefulness, ease of use, subjective norm, transaction convenience, enjoyment, and innovativeness have a positive impact on consumer attitude and intention to adopt QR code-enabled mobile payment. In addition to that transaction speed has been conceptualized as a moderating factor in the relationship between consumer attitude and intention to adopt QR code-enabled mobile payment. The theoretical framework is exhibited in Fig. 1.

Methodology

Scale measurement

Scale development is the process of retaining relevant research items for construct assessment (Rahi et al., 2019). Rahi et al. (2019) asserted that developing a new scale is not essential if theory exists. Therefore, in the current study scale exists and hence scale items are adopted from past studies and then adapted into the current research setting. Construct items of usefulness and ease of use were adopted from Yan et al. (2021) and Rahi et al. (2018). Scale items for subjective norms were adopted from Liébana-Cabanillas et al. (2015). Perceived convenience items were adopted from Teo et al. (2015a). Moving further innovativeness items were adopted from Slade et al. (2015) and Rahi and Abd. Ghani (2018). Scale items for attitude were adopted from Rahi, Khan, et al. (2021a). Scale items for intention to adopt QR code mobile payment were adopted from Yan et al. (2021) and (Rahi, 2022). Next to this transaction speed items were adopted from Yan et al. (2021) and Teo et al. (2015a). Scale items are presented in Table 1. Concerning with Likert scale type researchers have found substantial support against the 7-point Likert scale (Rahi et al., 2019; Rowley, 2014). Therefore, 7 point Likert scale is used wherein 7 indicates strongly agree and 1 represents strongly disagree.

Research approach, sample size calculation, and data collection

The current research investigates user behavior towards the adoption of quick response code-enabled mobile payment. Consequently, an integrated research framework is established and empirically investigated with numerical data. Nevertheless, before data collection, it is essential to select a population and adequate sample size. The population of this study is smart mobile phone users all around Saudi Arabia. Therefore, sample computation is done with the prior power method (Rahi, 2018; Rahi, 2023). The priori power method estimates sample size through predictors. There are seven predictors in the research framework and requires a sample of 153 respondents for empirical analysis. The face validity issue is addressed through a pilot study (Hair et al., 2015). For the pilot survey, 20 smart mobile phone users were approached physically and requested to fill out the questionnaire. Overall, respondents have faced no difficulty in filling out the questionnaire, however, they have suggested adding preliminary questions to screen out relevant respondents. Thus, a preliminary question is added to the main research questionnaire having contents that whether respondents are smartphone users or not. The purpose of this preliminary question is to identify relevant respondents. Thus, respondents having smart mobile phones were allowed to participate in the research survey.

Concerning with sampling approach researcher has selected a purposive sampling approach for data collection (Hair et al., 2015). According to Samar Rahi (2017a, 2017b) purposive sampling approach could be selected if the objective of the research is to collect data only from selective respondents. As the population of this study is smartphone mobile banking users therefore purposive sampling approach was most appropriate. For data collection, a research questionnaire was distributed among 243 mobile banking users who requested to fill out the survey questionnaire. These respondents were approached by visiting different retail stores located in Jeddah city of Saudi Arabia. As the research design of this study is based on cross-sectional thus data were collected at once. In addition to that participation in this research survey was voluntary instead of mandatory. Among 243 respondents 216 respondents participated in the QR code mobile payment research survey with an attractive response rate of 88%. Thus, these numerical responses were further analyzed with a structural equation model.

A descriptive analysis is conducted to disclose the respondent’s characteristics. In the data set, there are 69% male therefore 31% of respondents are counted as female participants. Respondent’s age is measured and descriptive analysis has revealed that a total of 135 respondents are aged between 21 to 30 years. Therefore, a total of 35 respondents were found aged between 31 to 40 years. Next 36 respondents are found aged between 41 to 50 years. Therefore, only 10 respondents are found aged between 51 to 60 years. Aside from age comparison education level of the respondents is measured following three categories including high school education, i.e., equivalent to 10th grade, graduation level, i.e., equivalent to 14th years of education and master level of education, i.e., equivalent to 16 years of education. Results indicate that 42 respondents have a high school education. Therefore, 78 respondents have shown graduation level of study. Similarly, 96 respondents have shown master-level education and participated in the research survey.

Data analysis

Addressing common method biases issue

The quantitative research that is based on a research survey may be affected due to common method issues. In addition to that in this study structured survey questionnaire has been used for data collection. Nevertheless, authors like Hair et al. (2015) have stated that common method variance issues could arise if data have been collected at one point in time against all predictor and criterion variables. Thus, the CMV issue is addressed through procedural and statistical remedies. Following procedural remedies questionnaires were jumbled up and then distributed among respondents. Therefore, among statistical remedies common method variance bias is assessed through Harman’s single-factor solution (Fornell and Larcker, 1981; Rahi, 2022). Harman’s single-factor solution suggests that the value of the first un-rotated factor must be less than 40% (Fornell and Larcker, 1981). Result of the Harman’s single-factor solution suggests that the value of the first un-rotated factor was 11% less than 40% and hence confirmed the validity of the data.

Structural equation modeling

The structural equation modeling approach is incorporated for data estimation. This approach is based on two stages namely structural model and measurement model. Initially, data were analyzed with a measurement model and established factors reliability, indicator reliability, discriminant, and convergent validity of the instruments. Therefore, in the second stage hypotheses were tested. For data estimation, Smart-PLS software v.3.39 has been used (Rahi et al., 2022).

Measurement model

In measurement model estimation indicator reliability was assessed first following the criterion that the loading of the indicator must be higher than 0.60 (Rahi, 2018; Rahi et al., 2022). Therefore, factor reliability was tested with composite reliability and Cronbach alpha following the criterion that the value of CR and CA must be greater than 0.70 (Podsakoff et al., 2003; Rahi et al., 2022). Similarly, convergent validity is assessed with average variance extracted following a threshold value of 0.50 (S. Rahi, 2017a, 2017b; Rahi et al., 2022). Table 1 exhibits the results of the measurement model.

Another analysis in the measurement model is identified by Fornell and Larcker which measures the discriminant validity of the factors (Podsakoff et al., 2003; M. Yamin, 2020a). Discriminant validity is established that constructs measure distinct concepts and discriminant. Therefore, the Fornell and Larcker analysis is employed to test discriminant validity (Fornell and Larcker, 1981; M. Yamin, 2020a). It is suggested that for adequate discriminant validity square root of AVE must be higher in the correlation table (Fornell and Larcker, 1981; M. A. Y. Yamin, 2020b). Results of the Fornell and Larcker analysis are shown in Table 2 indicating satisfactory discriminant validity of the factors.

The cross-loading method is an alternative method to measure the discriminant validity of the constructs. This method has suggested that the loading of the indicator must be higher when comparing corresponding construct indicator loadings (Fornell, 1992; Yamin, 2019). Table 3 depicts that cross-loadings are higher and demonstrates that constructs are discriminant and measure distinct concepts.

Measuring the discriminant validity of the constructs is critical and therefore Heterotrait-Monotrait ratio analysis is recommended to measure the discriminant validity of the constructs (Kline, 2011). According to Kline (2011), cross-loading and Fornell and Larcker analysis have shown some deficiencies and hence HTMT is the most appropriate analysis to be taken into consideration. This analysis suggests that values of HTMT ratios must be ≤0.90 indicating adequate discriminant validity of the constructs (Gold et al., 2001; Kline, 2011). The results of the HTMT ratio are shown in Table 4.

Structural assessment

The structural model tests the hypotheses relationship using the bootstrapping method (Hair Jr et al., 2016). Nevertheless, prior to structural model assessment multi-collinearity issue is addressed through the variance inflation factor (VIF). Results of the VIF analysis indicate that values of the VIF were lower than the threshold value, i.e., 3.3 hence confirming that multi-collinearity is not likely an issue in this study. Finally, data were bootstrapped for structural assessment. Results of the bootstrapping have revealed values of path coefficient, t-statistics, standard error, and significance level. The findings of the hypotheses analysis are shown in Table 5.

Table 5 demonstrates that perceived usefulness has a positive impact on user attitude and statistically confirmed H1: β = 0.158 path, significance p = 0.005 and t-statistics of 2.901. Therefore, perceived ease of use has a positive impact on user attitude and is supported by β = 0.059 path, significance p = 0.046, and t-statistics of = 1.790, and hence H2 is confirmed. Concerning subjective norms results have shown that subjective norms have a positive impact on user attitude and are statistically backed by β = 0.149 path coefficient, significance level p = 0.000, and t-statistics of 4.969. Perceived convenience has shown a positive impact on user attitude to adopt QR code-enabled payment and is supported by H4: β = 0.493 path, significance p = 0.000, and t-statistics of 15.306. Innovativeness has shown a significant influence on user attitude and hence confirmed H5: β = 0.104 path coefficient, significance level p = 0.002, and t-values of 3.236. Consumer attitude has shown a positive influence on user behavioral intention to adopt QR code mobile payment and is supported by H6: β = 0.668 path, significance p = 0.000, and t-statistics of 18.515. These results are shown in Appendix 1 with path coefficient and significance level. Overall, results have shown a positive influence of exogenous factors in measuring endogenous factors. The variance explained by exogenous factors in measuring endogenous factors and the effect size of the factors is given in the following section.

Factors affect size, predictive power, and R 2

The structural model assessment has established the impact of exogenous factors in determining endogenous variables. Nevertheless, the variance explained by these factors was assessed with the coefficient of determination R2. Results indicate that user attitude is jointly measured by perceived usefulness, perceived ease of use, convenience, subjective norms, and innovativeness and explained substantial variance R2 52.3% in measuring user attitude to adopt QR code-enabled mobile payment. Therefore, user intention to adopt QR code-enabled mobile payment is measured by transaction speed and attitude and explains a large variance in user intention R2 55% hence confirming the validity of the research model. Next to this effect size analysis is incorporated to disclose the impact of each factor in measuring user attitude and intention. Results indicate that perceived convenience has a substantial effect size in measuring user attitude when compared with other exogenous factors. On the flip side, the attitude has shown a large effect size in measuring user intention to adopt QR-enabled mobile payment. Nevertheless, transaction speed has shown a small effect size when compared with attitude. Finally, predictive power was tested with Q2 as recommended by earlier studies (Rahi and Abd Ghani, 2021; M. Yamin, 2020a). Results as depicted in Table 6 revealed substantial predictive power to measure consumer attitude Q2 37.3% and intention to adopt QR-enabled mobile payment Q2 41.4%. Therefore, it is confirmed that the research model is theoretically and statistically valid to measure consumer attitude and intention to adopt QR-enabled mobile payment.

Importance-performance analysis

The current study has analyzed data with importance-performance analysis to reveal the importance and performance of the factors. Rahi (2022) stated that before incorporating IPMA analysis it is essential to select a single outcome variable. Consistently user intention to adopt QR mobile payment is selected as an outcome variable. Results of the IPMA analysis revealed that user attitude has the highest importance in determining mobile banking users’ intention to adopt QR-enabled payment. Therefore, perceived convenience is found second most important factor in measuring user intention. Moving further transaction speed is found third most important factor to determine user intention. In addition to that the importance of perceived usefulness and subjective norm was also notable. However, factors like ease of use and innovativeness have shown less importance and hence weak influence on user intention to adopt QR-enabled mobile payment. Table 7 comprises the outcome of the IPMA analysis.

Aside from statistical values trend of the importance and performance is tested with an importance-performance map. IPMA map as shown in Fig. 2 indicates that factors like perceived convenience, transaction speed, subjective norm, and perceived usefulness are the most influential factors in determining user attitude and intention to adopt QR-enabled mobile payment. Therefore, policymakers should pay attention to perceived convenience, transaction speed, subjective norm, and perceived usefulness to boost user attitude which in turn will enhance consumer intention to adopt QR-enabled payment.

Transaction speed

As this study discusses QR code-enabled mobile payment consequently, speed is being considered as the main factor that influences user attitude and intention to adopt mobile payment derived by quick response code. As a result, the moderating effect of transaction speed is tested between consumer attitude and intention to adopt QR code-enabled payment. The moderating analysis is calculated with a product indicator approach (Rahi, 2022). Findings of the moderating analysis are exhibited in Fig. 3 demonstrating significant values of path coefficient β = 0.138, adequate significance p < 0.05, and t-statistics 3.995 and hence established H7.

Although statistical findings have established that transaction speed positively moderates the relationship between user attitude and intention to adopt QR code-enabled mobile payment nevertheless, the power of the moderating effect is analyzed with a simple slope graph. A simple slope graph basically displays the trend of the relationship at positive and negative gradients. A simple slope graph given in Fig. 4 illustrates that TRS at +1 SD is sharply moving upwards when compared with a negative trend at TRS at -1SD. This trend explains that with transaction speed user attitude and intention will be higher towards the adoption of QR code-enabled mobile payment.

Discussion

The quick response code-enabled mobile payments have revolutionized the fintech industry around the globe (Yuan et al., 2023). Now consumers don’t need to remember long passwords and they can pay by scanning a QR code anywhere in the world. Despite the widespread use of mobile devices, the adoption of QR code-enabled mobile payment systems is limited among the Saudi population (Bhat et al., 2023). Therefore, factors underpinned theory of reasoned action and the technology acceptance model were conceptualized to investigate user attitudes and intentions to adopt QR code-enabled mobile payment. Underpinned factors have shown a positive impact in predicting consumer attitude and behavioral intention to adopt QR code-enabled payment. Refereeing to technology acceptance model results have confirmed that both perceived usefulness and ease of use have a positive influence on user attitude and are consistent with prior studies (de Luna et al., 2019; Shankar and Jebarajakirthy, 2019). Concerning with factors underpinned theory of reasoned action results have confirmed that the positive impact of subjective norms in determining consumer attitude and consistent with prior studies (Al Nawayseh, 2020; Baptista and Oliveira, 2015). This study has added some additional factors namely convenience and innovativeness to determine consumer attitude and behavioral intention. Therefore, statistical findings have confirmed that perceived convenience positively impacts consumer attitude and is consistent with prior studies (Boden et al., 2020; Chen, 2008). Likewise, innovativeness is positively related to consumer attitude and is similar to prior research findings (Boden et al., 2020; Kim et al., 2010). Aside from predicting consumer attitude, this research has tested the impact of consumer attitude toward behavioral intention to adopt QR code-enabled mobile payment. Findings have confirmed that consumer attitude positively impacts consumer behavioral intention to adopt QR code-driven mobile payment hence supporting to argument developed by prior studies (Chen, 2008; Yan et al., 2021).

Although the newly developed integrative model has confirmed statistical validity to measure consumer attitude however the impact of underpinned factors was tested with a coefficient of determination and effect size analysis. Overall, the research framework demonstrates that consumer attitude is jointly measured by perceived usefulness, perceived ease of use, convenience, subjective norms, and innovativeness and explained substantial variance R2 52.3% in measuring user attitude to adopt QR code-enabled mobile payment which is higher than previous study (Yan et al., 2021). In the extended model consumer intention to adopt QR code-enabled mobile payment is measured by transaction speed and attitude and explained by a large variance in consumer intention R2 55%, i.e., greater than prior studies (Chang et al., 2021; Yan et al., 2021). Similarly, effect size f2 analysis has revealed a substantial impact of perceived convenience in measuring consumer attitude. These findings indicate that convenience is the most important factor behind the selection of a QR code-based payment option. Nevertheless, this study has also revealed that if the objective is to determine consumer behavioral intention to adopt QR code payment it is mandatory to have a positive attitude. This is also confirmed with effect size analysis wherein results have revealed that consumer attitude has a substantial impact in measuring consumer intention to adopt a QR code payment system. The following sub-section demonstrates the theoretical and practical contributions of this study.

Contribution to theory and method

In terms of theoretical contributions this study has developed an integrative research model with the help of the theory of reasoned action and technology acceptance model and hence contributes to information system literature. In addition to that this study has outlined innovativeness as exogenous factor in the research model and examined consumer attitudes to adopt QR codes and hence enrich information systems in the context of innovativeness. Similarly, examining perceived convenience impact to investigate consumer attitude also contributes to the literature. Aside from the direct relationship, this study has confirmed the moderating impact of transaction speed between consumer attitude and intention to adopt QR code-enabled payment and added a new dimension to the research model. This study widely contributes to methods. For instance, the research methodology is designed under the positivist paradigm. Additionally, a survey was administered at a large scale, and over 216 respondents participated in this research. These responses were analyzed with the structural equation modeling approach which is the latest statistical approach for financial analysis.

Contribution to practice

Practically this study directs that policymakers should pay attention to factors underpinned theory of reasoned action, the technology acceptance model, perceived convenience, and innovativeness. More precisely this study recommends that perceived convenience is the most important factor in determining consumer attitude to accept QR-based payment. Nevertheless, a unified perspective is taken from the importance-performance analysis. Results of the importance-performance analysis indicate that factors like perceived convenience, transaction speed, subjective norm, and perceived usefulness are the most influential factors in determining user attitude and intention to adopt QR-enabled mobile payment. Consequently, policymakers should pay attention to perceived convenience, transaction speed, subjective norm, and perceived usefulness to boost user attitude and intention to adopt QR-enabled mobile payment. This study has also concluded that transaction speed moderates the relationship between consumer attitude and behavioral intention to adopt QR code-enabled mobile payment. Therefore, if policymakers highlight the transaction speed character of the QR code it will impact positively both consumer attitude and intention to adopt a QR code-based payment system.

Conclusion

The current research develops an integrated research framework that combines the technology acceptance model, theory of reasoned action, transaction speed, convenience, and innovativeness to investigate consumer behavior toward the adoption of a QR code mobile payment system. For empirical investigation, responses were collected through a research survey that was administered to smart mobile phone users. Results of this study have concluded that perceived usefulness, perceived ease of use, convenience, subjective norms, and innovativeness positively impact consumer attitude and explained a substantial variance \({R}^{2}\) 52.3% in determining user attitude to adopt QR code-enabled mobile payment. Moreover, consumer intention to adopt QR code-enabled mobile payment is predicted by transaction speed and consumer attitude and disclosed a large variance \({R}^{2}\)55% in consumer behavioral intention to adopt QR code mobile payment. Aside from the overall impact of exogenous factors in predicting endogenous factor effect size analysis was conducted. Similarly, effect size f2 analysis has revealed the substantial effect of perceived convenience in determining consumer attitude to adopt QR code-driven payment. The model is further extended with the moderating effect of transaction speed and reveals a significant moderating effect between consumer attitude and intention to adopt QR code-driven mobile payment. Theoretically, this study has developed an integrative research model with the help of the theory of reasoned action and technology acceptance model and hence contributes to information system literature. Therefore, for practitioners, this study suggests that policymakers should pay attention to perceived convenience, transaction speed, subjective norm, and perceived usefulness to boost consumer attitude and intention to adopt QR-enabled mobile payment. Moreover, this study has suggested if policymakers visualize the transaction speed character of QR codes it will impact positively on consumer attitude and behavior to adopt QR code-based payment. To conclude this research provides useful findings to policymakers to understand factors that influence consumer behavior to adopt quick response code mobile payment systems. Quick response code is an emerging technology and hence it will bring transformation in the Saudi fintech industry.

Limitations and future research directions

This research has some limitations and therefore it is important to acknowledge these limitations for future research directions. First, the integrative research model has combined the theory of reasoned action and the technology acceptance model altogether to investigate consumer intention to adopt QR code-based mobile payment. However, this study has not claimed to include all factors that impact consumer attitudes and behavioral intention to adopt QR code-enabled mobile payment. Therefore, future researchers are suggested to extend the current research model with service quality factors such as system quality, and information quality. Second, this study has outlined innovativeness as a single factor to investigate consumer attitudes toward adopting QR code-based payment. Aside from innovativeness diffusion of innovation theory also comprises compatibility. Therefore, future researchers may add compatibility in the current research framework to understand how it impacts consumer attitudes and intention to adopt QR code-based payment. Similarly, the perceived convenience factor has been extracted from self-determination theory. Nevertheless adding some other factors underpinned by self-determination could strengthen the research framework. Moreover, security is identified as an important concern for technology users. Therefore, future researchers are suggested to extend the current research model with perceived security to get deep insight into consumer behavior toward the adoption of QR codes. Another limitation of this study is that it collects data at one point in time and is based on a cross-sectional research design. Nevertheless, future researchers may investigate consumer adoption behavior under a longitudinal research design. “Descriptive analysis has shown that the majority of the respondents were young and expected that young people would have more incline towards adoption of innovative technology when compared with old age people. Thus, future researchers are suggested to examine the behavior of old age people and observe their attitude towards the adoption of QR code-enabled mobile payment. Another limitation of this research is to assess data biases through Harman’s single-factor analysis. However, testing common method bias through marker variables could reveal robust results. Finally, this study is conducted in a developing country context like Saudi Arabia. Nevertheless, a comparative study may be conducted to reveal how consumer attitudes and behavior toward the adoption of QR codes vary in different regions.

Data availability

Data used for this study are publicly available at the following link: https://github.com/mohammadyamin1978/data.

References

Ahn H, Park E (2023) Motivations for user satisfaction of mobile fitness applications: an analysis of user experience based on online review comments. Humanit Soc Sci Commun 10(1):3. https://doi.org/10.1057/s41599-022-01452-6

Ajzen I, Fishbein M (1977) Attitude-behavior relations: a theoretical analysis and review of empirical research. Psychol Bull 84(5):888

Al Nawayseh M (2020) Fintech in COVID-19 and beyond: what factors are affecting customers’ choice of fintech applications? J Open Innov Technol Mark Complex 6:153

Alamoudi H (2022) Examining retailing sustainability in the QR code-enabled mobile payments context during the COVID-19 pandemic. Int J Customer Relatsh Mark Manag (IJCRMM) 13(1):1–22

Baptista G, Oliveira T (2015) Understanding mobile banking: the unified theory of acceptance and use of technology combined with cultural moderators. Comput Hum Behav. 50:418–430

Bhat JR, AlQahtani SA, Nekovee M (2023) FinTech enablers, use cases, and role of future internet of things. J King Saud Univ-Comput Inf Sci 35(1):87–101

Boden J, Maier E, Wilken R (2020) The effect of credit card versus mobile payment on convenience and consumers’ willingness to pay. J Retail Consum Serv 52:101910

Cao TK, Dang PL, Nguyen HA (2016) Predicting consumer intention to use mobile payment services: empirical evidence from Vietnam. Int J Mark Stud 8(1):117–124

Chang V, Chen W, Xu QA, Xiong C (2021) Towards the customers’ intention to use QR codes in mobile payments. J Glob Inf Manag (JGIM) 29(6):1–21

Chen L-D (2008) A model of consumer acceptance of mobile payment. Int J Mob Commun 6(1):32–52

Chen L, Nath R (2008) Determinants of mobile payments: an empirical analysis. J Int Technol Inf Manag 17:9–21

Cowart KO, Fox GL, Wilson AE (2008) A structural look at consumer innovativeness and self‐congruence in new product purchases. Psychol Mark 25(12):1111–1130

Davis FD (1993) User acceptance of information technology: system characteristics, user perceptions and behavioral impacts. Int J Man-Mach Stud 38(3):475–487

Davis FD, Bagozzi RP, Warshaw PR (1989) User acceptance of computer technology: a comparison of two theoretical models. Manag Sci 35(8):982–1003

De Kerviler G, Demoulin NT, Zidda P (2016) Adoption of in-store mobile payment: are perceived risk and convenience the only drivers? J Retail Consum Serv 31:334–344

de Luna IR, Liébana-Cabanillas F, Sánchez-Fernández J, Munoz-Leiva F (2019) Mobile payment is not all the same: the adoption of mobile payment systems depending on the technology applied. Technol Forecast Soc Change 146:931–944

Denso W (2000) QR code features. J Barcode Tech 25(3):123–135

Flavian C, Guinaliu M, Lu Y (2020) Mobile payments adoption – introducing mindfulness to better understand consumer behavior. Int J Bank Market 38(7):1386–1401

Fornell C (1992) A national customer satisfaction barometer: The Swedish experience. J Market 56:6–21

Fornell C, Larcker DF (1981) Structural equation models with unobservable variables and measurement error: algebra and statistics. J Mark Res 18(3):382

Gold AH, Malhotra A, Segars AH (2001) Knowledge management: an organizational capabilities perspective. J Manag Inf Syst 18(1):185–214

Gutiérrez F, Abud MA, Vera F, Sánchez JA (2013, 11–13 March 2013) Application of contextual QR codes to augmented reality technologies. CONIELECOMP 2013, 23rd International Conference on Electronics, Communications and Computing

Hair JF, Wolfinbarger M, Money AH, Samouel P, Page MJ (2015). Essentials of business research methods. Taylor & Francis. https://books.google.com.pk/books?id=qvjqBgAAQBAJ

Hair Jr JF, Hult GTM, Ringle C, Sarstedt M (2016). A primer on partial least squares structural equation modeling (PLS-SEM). Sage Publications

Kaatz C (2020) Retail in my pocket–replicating and extending the construct of service quality into the mobile commerce context. J Retail Consum Serv 53:101983

Kim C, Mirusmonov M, Lee I (2010) An empirical examination of factors influencing the intention to use mobile payment. Comput Hum Behav 26(3):310–322

Kline R (2011) Principles and practice of structural equation modeling, 3rd edn. Guilford Press, New York

Liébana-Cabanillas F, Ramos de Luna I, Montoro-Ríos FJ (2015) User behaviour in QR mobile payment system: the QR Payment Acceptance Model. Technol Anal Strateg Manag 27(9):1031–1049

Liu S, Zheng D (2023) Impacts of tourists’ trust, perception and acceptance of health quick response technology on responsible pandemic travel behaviours. J Hospit Tour Technol 14(2):278–294. https://doi.org/10.1108/jhtt-11-2021-0330

Makki AM, Ozturk AB, Singh D (2016) Role of risk, self-efficacy, and innovativeness on behavioral intentions for mobile payment systems in the restaurant industry. J Foodserv Bus Res 19(5):454–473

Mi Alnaser F, Rahi S, Alghizzawi M, Ngah AH (2023) Does artificial intelligence (AI) boost digital banking user satisfaction? Integration of expectation confirmation model and antecedents of artificial intelligence enabled digital banking. Heliyon 9(8):e18930. https://doi.org/10.1016/j.heliyon.2023.e18930

Nguyen G-D, Dao T-HT (2024) Factors influencing continuance intention to use mobile banking: an extended expectation-confirmation model with moderating role of trust. Humanit Soc Sci Commun 11(1):276. https://doi.org/10.1057/s41599-024-02778-z

Nicoletti B, Nicoletti W, Weis (2017) Future of FinTech. Springer

Norton K, Hall K (2006) Contactless payment comes to cell phones. Bus Week Online 11:22–25

Ooi K-B, Tan GW-H (2016) Mobile technology acceptance model: an investigation using mobile users to explore smartphone credit card. Expert Syst Appl 59:33–46

Podsakoff PM, MacKenzie SB, Lee J-Y, Podsakoff NP (2003) Common method biases in behavioral research: a critical review of the literature and recommended remedies. J Appl Psychol 88(5):879

Rahi S (2017a) Research design and methods: a systematic review of research paradigms, sampling issues and instruments development. Int J Econ Manag Sci 6(2):1–5

Rahi S (2017b) Structural Equation Modeling Using SmartPLS. CreateSpace Independent Publishing Platform. https://books.google.com.my/books?id=XwF6tgEACAAJ

Rahi S (2018) Research design and methods. CreateSpace Independent Publishing Platform. https://books.google.com.pk/books?id=FlGktgEACAAJ

Rahi S (2022) Assessing individual behavior towards adoption of telemedicine application during COVID-19 pandemic: evidence from emerging market. Libr Hi Tech 40(2):394–420. https://doi.org/10.1108/lht-01-2021-0030

Rahi S (2023) What drives citizens to get the COVID-19 vaccine? The integration of protection motivation theory and theory of planned behavior. J Soc Market (ahead-of-print). https://doi.org/10.1108/jsocm-05-2022-0100

Rahi S, Abd Ghani M (2021) Examining internet banking user’s continuance intention through the lens of technology continuance theory and task technology fit model. Digit Policy Regul Gov 23(5):456–474. https://doi.org/10.1108/dprg-11-2020-0168

Rahi S, Abd. Ghani M (2018) The role of UTAUT, DOI, perceived technology security and game elements in Internet banking adoption. World J Sci Technol Sustain Dev 15(4):338–356. https://doi.org/10.1108/wjstsd-05-2018-0040

Rahi S, Alghizzawi M, Ngah AH (2022) Factors influence user’s intention to continue use of e-banking during COVID-19 pandemic: the nexus between self-determination and expectation confirmation model. EuroMed J Bus (ahead-of-print). https://doi.org/10.1108/emjb-12-2021-0194

Rahi S, Alghizzawi M, Ngah AH (2023) Factors influence user’s intention to continue use of e-banking during COVID-19 pandemic: the nexus between self-determination and expectation confirmation model. EuroMed J Bus 18(3):380–396. https://doi.org/10.1108/emjb-12-2021-0194

Rahi S, Alnaser FM, Abd Ghani M (2019) Designing survey research: recommendation for questionnaire development, calculating sample size and selecting research paradigms. Economic and Social Development: Book of Proceedings, Scientific Research Publishing (SCIRP), pp. 1157–1169

Rahi S, Ghani M, Ngah A (2018) A structural equation model for evaluating user’s intention to adopt Internet banking and intention to recommend technology. Accounting 4(4):139–152

Rahi S, Khan MM, Alghizzawi M (2021a) Factors influencing the adoption of telemedicine health services during COVID-19 pandemic crisis: an integrative research model. Enterp Inf Syst 15(6):769–793. https://doi.org/10.1080/17517575.2020.1850872

Rahi S, Othman Mansour MM, Alharafsheh M, Alghizzawi M (2021b) The post-adoption behavior of internet banking users through the eyes of self-determination theory and expectation confirmation model. J Enterp Inf Manag 34(6):1874–1892. https://doi.org/10.1108/jeim-04-2020-0156

Rampton J (2017) How digital wallets and mobile payments are evolving and what it means for you. Entrepreneur. Retrieved from https://www.entrepreneur.com/article/287590

Rowley J (2014) Designing and using research questionnaires. Manag Res Rev 37(3):308–330

Shang D, Wu W, Schroeder D (2023) Exploring determinants of the green smart technology product adoption from a sustainability adapted value-belief-norm perspective. J Retail Consum Serv 70:103169

Shankar A, Datta B (2018) Factors affecting mobile payment adoption intention: an Indian perspective. Glob Bus Rev 19(3_suppl):S72–S89

Shankar A, Jebarajakirthy C (2019) The influence of e-banking service quality on customer loyalty: A moderated mediation approach. Int J Bank Market 37(5):1119–1142. https://doi.org/10.1108/IJBM-03-2018-0063

Singh N, Sinha N, Liébana-Cabanillas FJ (2020a) Determining factors in the adoption and recommendation of mobile wallet services in India: analysis of the effect of innovativeness, stress to use and social influence. Int J Inf Manag 50:191–205

Singh S, Sahni MM, Kovid RK (2020b) What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Manag Decis 58(8):1675–1697. https://doi.org/10.1108/md-09-2019-1318

Slade EL, Dwivedi YK, Piercy NC, Williams MD (2015) Modeling consumers’ adoption intentions of remote mobile payments in the United Kingdom: extending UTAUT with innovativeness, risk, and trust. Psychol Mark 32(8):860–873

Teo A-C, Tan GW-H, Ooi K-B, Hew T-S, Yew K-T (2015a) The effects of convenience and speed in m-payment. Ind Manag Data Syst 115(2):311–331. https://doi.org/10.1108/imds-08-2014-0231

Teo A-C, Tan GW-H, Ooi K-B, Hew T-S, Yew K-T (2015b) The effects of convenience and speed in m-payment. J Retail and Consum Serv 27:111–117. https://doi.org/10.1016/j.jretconser.2015.07.002

Tew H-T, Tan GW-H, Loh X-M, Lee V-H, Lim W-L, Ooi K-B (2021) Tapping the next purchase: embracing the wave of mobile payment. J Comput Inf Syst 61(6):491–502. https://doi.org/10.1080/08874417.2020.1858731

Wu YQ, Gong J (2023) Mobile social media as a vehicle of health communication: a multimodal discourse analysis of WeChat official account posts during the COVID-19 crisis. Humanit Soc Sci Commun 10(1):787. https://doi.org/10.1057/s41599-023-02259-9

Yamin M (2020a) Examining the role of transformational leadership and entrepreneurial orientation on employee retention with moderating role of competitive advantage. Manag Sci Lett 10(2):313–326

Yamin MAY (2019) The mediating role of ethical organisational climate between HRM practices and HR outcomes in public sector of Saudi Arabia. Int J Bus Excell 19(4):557–573

Yamin MAY (2020b) Examining the effect of organisational innovation on employee creativity and firm performance: moderating role of knowledge sharing between employee creativity and employee performance. Int J Bus Innov Res 22(3):447–467

Yan L-Y, Tan GW-H, Loh X-M, Hew J-J, Ooi K-B (2021) QR code and mobile payment: the disruptive forces in retail. J Retail Consum Serv 58:102300

Yang AS (2009) Exploring adoption difficulties in mobile banking services. Can J Adm Sci/Rev Canadienne des Sci de l’Administration 26(2):136–149

Yuan K, Li W, Zhang W (2023) Your next bank is not necessarily a bank: FinTech expansion and bank branch closures. Econ Lett 222:110948

Zhang Y, Sun J, Yang Z, Wang Y (2018) What makes people actually embrace or shun mobile payment: a cross-culture study. Mobile Inf Syst 2018:1–13. https://doi.org/10.1155/2018/1965704

Acknowledgements

This work was funded by the University of Jeddah, Jeddah, Saudi Arabia under grant No. (UJ-23-SHR-65). Therefore, the authors thank the University of Jeddah for its technical and financial support.

Author information

Authors and Affiliations

Contributions

Yamin MAY and Abdalatif OAA: conceived and designed the study. Abdalatif OAA: conducted the experiments and collected the data. Yamin MAY: analyzed and interpreted the data. All authors critically revised the manuscript for important intellectual content and approved the final version for publication.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

The questionnaire and methodology for this study were approved by the Human Research Ethics Committee of the University of Jeddah (Ethics approval number: HAP-02-J-094).

Informed consent

informed consent was obtained from all participants and/or their legal guardians.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Yamin, M.A.Y., Abdalatif, O.A.A. Examining consumer behavior towards adoption of quick response code mobile payment systems: transforming mobile payment in the fintech industry. Humanit Soc Sci Commun 11, 675 (2024). https://doi.org/10.1057/s41599-024-03189-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03189-w

This article is cited by

-

Sustaining engagement with digital finance: mobile payment adoption among marginalized women street vendors in an emerging market

Discover Sustainability (2025)

-

Human-centric barriers and enablers to FinTech use in SMEs: cognitive and organizational insights from smart payment systems

Cognition, Technology & Work (2025)