Abstract

As the severity of global climate change escalates, carbon peak and carbon neutrality have emerged as international imperatives. Green taxation, a crucial fiscal strategy promoting the transition to a green low-carbon economy, demands thorough investigation regarding its efficacy and operational mechanisms. Predominantly, existing research has concentrated on the macroeconomic implications of green taxes, while their influence on regional green growth and innovation remains underexplored. This paper delineates green taxation in both a broad and narrow sense, elucidating its essence and potential in stimulating regional green progress and innovation. Utilizing panel data from 30 provinces in China spanning 2004 to 2021, a bidirectional fixed-effects model was developed for empirical analysis. Moreover, an impact mechanism model was constructed to delve into how green taxation specifically affects regional green development and innovation. Findings reveal that green taxation significantly fosters regional green growth and markedly enhances green innovation. Nonetheless, due to the resource crowding-out effect, it adversely impacts the comprehensive innovation capabilities of regional enterprises. This insight offers a fresh perspective on the paradoxical effects of green taxation, underscoring the necessity for a balanced approach in policy design and implementation. Drawing on these conclusions, the paper presents tailored policy recommendations.

Similar content being viewed by others

Introduction

In the era of transformative economics, the global shift towards green low-carbon, and circular development is gaining momentum, positioning itself as a crucial trajectory and trend for economic growth. This paradigm shift in economic development not only fosters the evolution of environmental management but also catalyzes the green tax systems. Green taxation, targeting polluters, seeks to internalize external costs, remediate market resource allocation flaws, and boost economic efficiency. During the 14th Five-Year Plan of China, the pivot from rapid to high-quality green economic growth has placed the effective application of green taxation at the forefront of academic and policy-making circles, both domestically and internationally. Despite the recognized significance of green taxation, there is a notable dearth of theoretical research on its adverse effects on regional green development and innovation. Current literature predominantly focuses on its macroeconomic impact and environmental quality, with less emphasis on the detailed mechanisms by which it influences regional innovation, particularly through the allocation of corporate resources and the crowding out of limited assets.

The existing theoretical gap hinders a full evaluation of green taxation, subsequently affecting the related policy efficiency. According to the Resource-Based View (RBV), the reallocation of resources could diminish a firm’s innovation and competitiveness in non-green sectors (Zahra, 2021). The innovation system indicates that while green taxation may incentivize green technological innovation, it could also divert resources away from other areas of innovation, impacting the overall innovation capacity (Kooreman and Mot, 2021). Additionally, the technological lock-in theory points out that once a specific technology is adopted, it becomes challenging for the system to shift from the established trajectory due to scale economies and learning effects (Foxon, 2002; Cecere et al., 2014). Therefore, the study investigates the negative aspects of green taxation in fostering regional green development and innovation. By conducting an in-depth analysis of how green taxation affects corporate behavior towards green innovation, this research introduces the innovative concept that green taxation may negatively influence regional innovation capacity. Utilizing a novel approach to heterogeneity analysis, it examines the effects of green taxation across regions with differing innovation capabilities, probing potential innovation capacity declines caused by resource imbalances. This approach fills a crucial theoretical void in existing literature and offers more precise and practical advice for policymakers. This study aims to underpin the design of green taxation, facilitating high-quality green economic development.

Literature review

In defining green taxes, Marshall identified them as environmental taxes, a term first introduced in 1932 by welfare economist Pigou (Marshall, 1920). Researchers such as Norouzi have harmonized on the definition and nuances of green taxes, which have matured from a singular special green tax to an extensive assortment of tax varieties and strategies pertinent to resource employment and environmental safeguarding (Norouzi et al., 2022; Shi et al., 2023; Saad and Ariffin, 2019). Deng and Huang (2020a) offer a refined distinction of green taxes, differentiating them into narrow and broad categories. The narrow perspective of green theory concentrates on pollutant emissions, whereas the broad view encompasses the synergistic progression of the economy, ecology, and society. Mohammed (2020) embraced this division, regarding environmental protection taxes as narrow green taxes and other environment-related taxes as broad green taxes. His conclusion was that although green taxes bolster reliance on renewable resources and diminish consumption of non-renewable counterparts, they do not markedly stifle economic growth. Researchers concur that green innovation can be characterized as the modification of processes, technologies, systems, and products aimed at mitigating or circumventing environmental problems (Franceschini et al., 2016; Kemp and Oltra, 2011; Rennings, 2000). This innovation is bifurcated into two streams: green process innovation and green product innovation (Zhou and Xie, 2019), propelled by the strict governmental regulations, the pressures of external stakeholders, and cost-efficiency, which are instrumental in competitive edges and performance (Díaz-García et al., 2015). Green development, a strategy rooted in sustainable growth, strives to balance economic expansion and societal well-being with the preservation of natural resources. It encompasses a suite of initiatives, including efficient policy, technological advancements, behavioral shifts, and resource management, all targeted at safeguarding ecosystems and biodiversity and rising to the challenges posed by climate change (Hussain et al., 2022). The ambit of green development extends across various sectors such as the green economy, green energy, green transportation, green construction, and green living, fostering resource efficiency, pollution, and waste reduction, enhanced adaptability to climate variations, and a shift towards the utilization of clean and renewable energy sources.

Existing research has focused on green taxation as a driving force of regional green development. In the discourse on ecological progress, researchers have predominantly explored this from the angles of green tax intensity, environmental regulatory impacts, and green tax frameworks. Pourkarimi and Hojjat (2019) pointed out that green taxes are an important tool for environmental technology and sustainable development by reducing production costs and encouraging participation from environmentally friendly businesses and the public. Chien et al. (2021) observed that green taxes exert a considerable negative effect on curbing carbon emissions and haze pollution within the U.S. economy, thereby playing an important role in environmental protection and sustainable development. Hu and Chen (2023) suggested that an expansion in the scope of environmental protection taxes coupled with the application of differentiated tax rates could mitigate pollution emissions and enhance green development. Sun (2013) asserted the green tax system’s vital role as an economic instrument, particularly in fostering the refinement of such systems in pilot regions like the Qinghai Qaidam Circular Economy Experimental Zone. László (2021) emphasized that green taxes, via tax policy overhauls, rectify climate-damaging activities and shift consumer and producer patterns to fulfill the green policy. Wang et al. (2022) observed that adopting differentiated green tax policies regionally will advance local ecological progress. Hafi et al. (2023) underscored the need for enhanced coordination within and between tax and environmental regulatory frameworks, advocating for the optimization of green tax strategies to foster regional ecological advancement. Saad and Ariffin (2019) provided empirical insights into Malaysia’s green tax mechanism, assessing its effectiveness in meeting environmental goals and noting its primary focus on incentive taxes with moderate success. Labandeira et al. (2019) highlighted that green tax reforms are designed for the versatile utilization of tax revenues, imposing levies on energy-related environmental damage to influence energy demand, emissions, public finances, and income distribution. These funds are also earmarked for fiscal consolidation and subsidizing renewable energy initiatives. Rodríguez et al. (2019) identified the potential of green tax reforms to yield a dual benefit, notably improving the energy trade balance and mitigating energy intensity. Su et al. (2023) observe that green taxation significantly influences the green transformation of heavily polluting industries in China. Deng and Huang (2020b) recognized green taxes as a potent tool for energy regulation via taxation, essential for diminishing consumption and augmenting efficiency, with differentiation into narrow and broad categories. Accordingly, it is evident that a prevalent view among scholars is the effectiveness of green taxes in fostering ecological progress. Fotis and Polemis (2018), utilizing a dynamic GMM model analysis of data from 34 European countries (2005–2013), advocated for the early taxation of polluting sectors as a strategy to enhance air quality and sustainability. However, regional green development cannot be separated from green innovation. Shen and Zhang (2022) discovered that specific green taxes (like those on vehicles, vessels, resources and urban land use) significantly bolster industrial ecological transformation, marking a critical tool for environmental safeguarding and sustainable progress. Cheng et al. (2022) observed a favorable influence of green tax policies on the environmental investments made by major polluting firms, notably within larger entities. Liu et al. (2022) noted that the adoption of recycling carbon taxes and policies promoting clean electricity technology could facilitate economic growth, emission reduction, and an enhancement in social welfare. Grounded in the research mechanisms of green development, the study posits that green taxation emerges as a key driver for green innovation within enterprises and across regions.

Consequently, green taxation should be viewed as an effective approach to enhancing green innovation. Porter Hypothesis asserts that judicious environmental regulation has a beneficial impact on green innovation (Porter, 1996). In 2020, Song et al. (2020) highlighted green taxes as a vital tool for fostering green product innovation, noting the necessity for further examination of environmental regulations alongside R&D tax incentives. Wang et al. (2022) revealed that resource tax reforms significantly bolster green innovation in resource-intensive industries with corporate profitability acting as a reinforcing mediator, and executive compensation amplifying this effect. Yu et al. (2021) demonstrate a unit-based progressive carbon tax encourages firms to engage in green innovation more effectively than a fixed rate. Jiang et al. (2023) identified a dual influence of green taxes on corporate green innovation: environmental subsidies exert a positive impetus, whereas environmental taxes demonstrate a U-shaped dynamic—initially inhibitory but subsequently stimulatory. China’s implementation of an environmental protection tax in 2018, which targets corporate pollution emissions, has been pivotal in improving corporate ESG (Environmental, Social, and Governance) performance, thereby stimulating green technology innovation and facilitating sustainable development. Li’s study (2022) demonstrates that the environmental protection tax not only significantly boosts ESG performance, but also enhances green technological innovation, with the former playing a mediating role in the latter’s enhancement. The study also notes variations in this effect based on corporate ownership and regional factors (Li and Li, 2022). Zhang et al. (2020), using a game-theoretic model, find that carbon taxes incentivize firms to adopt aggressive green innovation strategies. Pourkarimi and Hojjat (2019) underscore green taxes as crucial instruments within green economic policies for deploying sustainable technology. They argue that these taxes promote the adoption of environmental technologies by lowering production costs and the expense associated with non-environmental goods. Zheng et al. (2023) argue that environmental and R&D taxes enhance corporate green innovation, exhibiting a synergistic effect. Wang and Yu (2021) observed that mineral resource development often results in externality issues. They found that the rate of environmental tax directly influences pollution reduction and green production. His results indicate that environmental externalities negatively affect green technology innovation, advocating for a gradual increase in environmental tax rates. Deng et al. (2023) report that environmental taxes have heightened green innovation in heavily polluting industries, with increased management costs compelling firms to increase their R&D investment, thus boosting green technological innovation. The influence of green taxation on environmental protection and green technology innovation is substantial, and it is essential to account for the nonlinear effects of tax competition to enhance the efficacy of environmental regulation and the advancement of green technology innovation (Deng et al., 2022). Johan (2006) argued that green taxation opens wider market opportunities for the development of pollution-free environmental technologies. In 2021, Yu explored the effects of green taxes and technology subsidies on the intelligent transformation of manufacturing enterprises. He discovered that adjustments in government taxation policies could encourage the production of intelligent products and boost corporate competitiveness (Yu et al., 2021). Lastly, Chen et al. (2022) emphasized the critical role of green taxation in driving environmental technology innovation, with significant implications for the manufacturing industry’s development. In the context of China, the enactment of environmental tax laws has been a catalyst for green technology innovation, though further incentives are necessary to foster green development.

However, the investigation into the negative impacts of green taxation remains limited. Extensive research in the realm of green innovation and development has scrutinized knowledge-based factors (such as intellectual property rights) that stimulate green performance, including R&D expenditures, patent registrations and applications (Guo and Huang, 2022; Wang et al., 2022). Yet, there is a notable scarcity of research addressing the adverse effects resulting from the mandatory channeling of these knowledge-based and material resources into green investments, leading to a depletion of resources available for other innovative activities. Zahra (2021), from the Resource-Based View (RBV), argues that for resource-constrained firms, managing limited resources to reach an optimal state is a slow and challenging process, highlighting the criticality of optimal resource allocation. Kooreman and Mot (2021), utilizing innovation system theory, review the literature and policies surrounding green innovation. This body of work underscores the intricacies involved in formulating and executing green innovation policies, including green taxation. It highlights how these policies influence the alteration of incentive structures and the redirection of resource flows. Foxon (2002) and Cecere et al. (2014), grounded in technological lock-in and path dependency theories, observe that entrenchment in existing technological paths can restrict the scope and trajectory of innovation, making shifts toward more sustainable pathways arduous. This is particularly relevant in understanding how green taxation may engender an over-reliance on existing technologies in firms and regions, thus constraining the exploration of novel and disruptive technological avenues. Empirical studies focusing on how to reduce the time and costs of green innovations, minimize pollutant emissions and diminish impact are scant, particularly those examining the negative repercussions of extensive resource reallocation due to green taxation. This oversight and potential misinterpretation of policy lag by governments can further hinder the effectiveness of green taxation and lead to outcomes that contradict initial expectations.

As illustrated in Table 1, substantial research has been conducted on the positive impacts of green taxation and the critical role of resource allocation. However, when green taxes are effective, studies on the potential negative consequences that may arise from resource reallocation remain sparse. This research, therefore, seeks to assess whether green taxation can facilitate regional green development and innovation, considering both its resource allocation effects and the associated negative impacts. Drawing the China Innovation Report, assesses innovation capacity through a systematic framework encompassing knowledge creation, acquisition, corporate innovation, the innovation environment and performance. The paper argues that while green taxation can indeed propel regional green development and innovation, this necessitates the reallocation of corresponding resources to achieve such promotional effects (Shi et al., 2023). Green taxation in a region should encourage investments in green resources, crucial for advancing green technological development and reducing pollution emissions (Arshian et al., 2023). However, this implies that in the context of overall limited resources, there could be not only a significant shift in resource allocation towards green initiatives but also substantial changes in overall resource distribution, which could inadvertently impede development in other sectors.

By analyzing panel data from 30 Chinese provinces spanning 2004–2021, this study unveils the positive influence of green taxation on regional green development and innovation, while also delving into the mechanisms of its potential negative effects. Anchored in disciplines such as environmental economics, the Resource-Based View (RBV) theory, and innovation systems, this research probes how green taxation steers the behavioral choices of businesses and individuals towards regional green growth and innovation. This exploration sheds light on the economic merits of green taxation, especially in terms of its latent role in promoting regional green technological innovation and sustainable development. Our approach, which refines existing research, employs meticulous data, including the two-way fixed effects model and mediation effect analysis. It integrates an empirical analysis of varying innovation capacities into heterogeneity analysis, offering deeper and more precise insights. This work endeavors to bridge the gaps in theoretical and empirical research about the workings of green taxation across diverse economic and environmental backdrops found in the existing literature.

Research hypotheses and data measurement

Research hypotheses

Impact on green development and green innovation

Green taxation, as a strategic policy instrument, plays a pivotal role in promoting sustainable practices. By offering reduced taxes on environmental equipment and technologies, it motivates enterprises to invest in and adopt eco-friendly technologies, including clean production and resource-efficient technologies. This strategy leads to reduced resource consumption and environmental pollution, thereby contributing to an enhanced level of regional green development. Additionally, green tax policies encourage the adoption of energy-saving and emission-reduction measures. These practices not only improve energy efficiency but also decrease emissions during the production process, further augmenting productivity (Yasmeen et al., 2023). In a similar vein, the imposition of higher taxes on sources of pollution compels enterprises to escalate investments in environmental research and development. This shift fosters the innovation and application of green technologies, catalyzing the growth and transformation of green industries. However, it is noteworthy that the application of innovative technologies often exhibits a certain degree of latency. Additionally, the implementation of green taxation may increase the operational costs for businesses to some extent. Consequently, green taxation might exhibit a lagging effect on regional green development and innovation. In light of these considerations, the following hypotheses are posited:

Hypothesis H1: Green taxation exerts a delayed promotional effect on regional green development.

Hypothesis H2: Green taxation positively influences regional green innovation.

Mechanism and impact on regional innovation capacity

The introduction of green tax policies, while increasing costs for businesses, also steers them towards investing in the green sector, owing to the incentives and reductions these policies offer. This shift may inadvertently result in decreased investment in research and development (R&D) and innovation in other vital areas. From the Resource-Based View (RBV), a firm’s competitive advantage and capacity for innovation are derived from its unique resources and capabilities. Green taxation encourages businesses to redirect their finite resources toward green technologies in pursuit of tax benefits. This reallocation could potentially compromise R&D and innovation in non-green sectors, thereby impacting the firm’s competitiveness and innovative potential in these areas. Innovation system theory highlights that innovation is a systemic process involving multiple stakeholders, including enterprises, governments, and research institutions. These entities collectively foster the generation and application of new knowledge through diverse interactions. Green taxation, by reshaping incentive structures and resource distribution, may bolster innovation in green technologies within the system. Yet, this could also lead to a diversion of resources from other potential areas of innovation, influencing a region’s overall innovative capacity. The technological lock-in and path dependency indicate that once a specific technological path is embraced, the system may become excessively dependent on it due to factors like scale economies, and synergistic and learning effects, potentially hindering the transition to alternative technological paths. Green taxation, therefore, might cause enterprises and regions to rely too heavily on established technologies, restricting exploration into novel and disruptive technological trajectories. In light of this, the paper proposes the following two hypotheses:

Hypothesis H3: Green taxation exerts an inhibitory influence on regional comprehensive innovation capacity.

Hypothesis H4: Green taxation, while advancing regional green development and reallocating corporate resources, impedes the enhancement of regional innovation capacity.

Data measurement

Measurement of green taxation

In this study, green taxes are delineated into two distinct categories: narrow green taxes and broad green taxes. Narrow green taxes specifically target pollutant emissions, aiming to foster environmental protection and sustainable development. These are essentially environmental protection taxes, marking a transition from a pollution fee system to a formal taxation framework. Prior to the adoption of environmental protection taxes, pollution fees served as an effective interim measure.

Broad green taxes, on the other hand, are more encompassing, considering the synergistic development of ecological and economic systems. These taxes focus on post-event regulation as well as preemptive guidance and control (OECD, 2010). Broad green taxes encompass a range of fiscal measures including environmental protection taxes, pollution fees and specific environmental provisions within certain tax categories. Given the challenges in acquiring data on tax incentives for environmental protection and energy conservation within value-added tax and corporate income tax, this study has chosen to use a composite measure for broad green taxes. This measure defined broad green taxation as the proportion of the total sum of environmental protection tax, domestic consumption tax, resource tax, urban maintenance and construction tax, farmland occupation tax, and vehicle and vessel tax to the total regional tax revenue. This approach allows for a nuanced and comprehensive evaluation of both narrow and broad green tax policies on regional green development and innovation capacity. This comprehensive analysis is visualized in Fig. 1, which presents a timeline of national green tax intensity:

Measurement of green development indicators

In assessing green development, the scholarly community has yet to agree upon uniform measurement indicators. Predominant methods for evaluation include comprehensive assessment systems that address environmental pollution and green total factor productivity (Li et al., 2022; Fang, 2021). Green total factor productivity, particularly in the production process, encompasses a holistic consideration of resource utilization efficiency, environmental impact, and economic benefits. This approach integrates both the outputs and inputs of the production process, while also emphasizing the sustainable use of resources and minimizing environmental degradation. An increase in green total factor productivity signifies enhanced output with equal or reduced resource consumption and a diminished environmental footprint, aligning with the principles of sustainable development. Consequently, this paper adopts green total factor productivity as the representative metric for regional green development. This is quantified using the sbm-ddf model. The model’s parameters are outlined in Table 2, and the data have been subjected to logarithmic transformation for analysis.

Assessment of Regional Comprehensive Innovation Capability

The evaluation of regional comprehensive innovation capability draws upon the aggregated utility values of China’s regional innovation capabilities, as reported in the China Regional Innovation Capability Report spanning from 2004 to 2021. This index system is structured around five primary indicators, further divided into 20 secondary indicators. A detailed breakdown of these indicators is provided in Table 3:

Based on the index construction system and the corresponding weight assignments detailed in the China Regional Innovation Capability Report, the weights assigned to various indicators are as follows: knowledge acquisition holds a weight of 0.15, knowledge creation also has a weight of 0.15, enterprise innovation is weighted at 0.25, the innovation environment carries a weight of 0.25, and the innovation performance effect value is given a weight of 0.20. This weighting scheme culminates in a comprehensive utility value for regional innovation capabilities. The partial results, which have undergone logarithmic processing, are presented in Table 4:

Research design

Development of the econometric model

This study establishes a dual fixed effects panel model to examine the influence of green tax policies on both green development and innovation. In this analysis, green taxes are categorized into narrow and broad types, serving as explanatory variables. Given that green taxes impact green development and innovation through technology research and development, a lag effect is inherent. Furthermore, numerous scholars incorporate the squared term of environmental regulation in their analyses of environmental regulatory issues. Hence, following the methodologies used by Song and Wang (2013) and Wang (2011), this study accounts for both one-period and two-period lags, as well as the squared term of green taxes in the model, leading to the construction of the following specific dynamic panel model:

In this framework, \({LNGTTP}\) signifies the green development within a region. \({LNGTC}\) represents regional green innovation, \({LNTCC}\) denotes the comprehensive capability of regional bed innovation, and\(\,{LNXYGTAX}\) and \({LNGYGTAX}\) for narrow and broad green taxes respectively; \({LNXYG}{{TAX}}_{i,{\rm{t}}-1}\) and \({LNXYG}{{TAX}}_{i,{\rm{t}}-2}\) for the one-period and two-period lags of narrow green taxes; \({LNXYG}{{TAX}}^{2}\) for the squared term of narrow green taxes; \({LNGYG}{{TAX}}_{i,{\rm{t}}-1}\) and \({LNGYG}{{TAX}}_{i,{\rm{t}}-2}\) for the one-period and two-period lags of broad green taxes; and \({LNGYG}{{TAX}}^{2}\) for the squared term of broad green taxes. \({LNGTTP}\) for green development and \({LNGTC}\) for green innovation; \({LNTCC}\) for comprehensive innovation capability; \({LNEDU}\) for educational level; \({LNOP}\) for openness degree; \({LNGDP}\) for economic development; \({LNFDL}\) for foreign investment;\(\,{LNL}\) for labor; \({LNTC}\) for technological level; and \({LN}{\rm{IS}}\) for industrial level. \({\epsilon }_{i,t}\) represents the random error term in the model. To mitigate the effects of heteroscedasticity and multicollinearity, all data have been logarithmically processed.

Data overview and indicator selection

In light of the data’s availability and the need for stability in pandemic-era data, this study utilizes panel data from 30 provinces and municipalities in China. The time frame for the data spans from 2004 to 2021. The information regarding pollution charges within green taxes is sourced from the China Environment Yearbook, whereas other necessary data are obtained from the China Statistical Yearbook and various provincial statistical yearbooks. For instances of data missing, the regression imputation method is applied to estimate the missing values. The chosen indicators for this study are outlined below:

Dependent variables

The research considers three dependent variables: \({LNGTTP}\), \({LNGTC}\) and \({LNTCC}\). The green development index is measured by the SBM-DDF method, with GDP as the desired output. The undesired outputs include industrial sulfur dioxide, industrial wastewater, and Industrial Particulate Matter, with fixed assets (perpetual inventory method), average number of employees, and energy consumption as input factors. The data derived from this method undergoes logarithmic transformation. LNTCC is determined based on the China Regional Innovation Capability Report, with assigned index weights and final data also subject to logarithmic transformation, as detailed earlier. \({LNGTC}\) is quantified through the ratio of regional green patent grants to the total number of patent grants. The resultant data are then transformed by removing the percentage and applying logarithmic processing.

Explanatory variables

This paper divides green taxation into narrow (\({LNXYGTAX}\)) and broad (\({LNGYGTAX}\)) categories. Narrow green taxation refers to the proportion of environmental fees within the total regional tax. In contrast, broad green taxation encompasses the aggregate of environmental protection taxes, domestic consumption taxes, resource taxes, urban maintenance and construction taxes, farmland occupation taxes, and vehicle and vessel taxes as a percentage of the total regional tax.

Control variables

-

a.

Education Level (\({LNEDU}\)): This is gauged by the ratio of regional educational expenditure to the total regional expenditure. Regions with higher education levels typically demonstrate greater environmental awareness and a stronger commitment to green development, often showing more recognition and support for green tax policies.

-

b.

Openness Degree (\({LNOP}\)): Measured by the ratio of the total value of goods imported and exported by operating units in each region to the regional GDP. This value is calculated using the average annual exchange rate of the RMB to the US dollar. A higher degree of openness in a region usually correlates with increased opportunities for green development and innovation.

-

c.

Economic Development (\({LNGDP}\)): Determined by the per capita GDP of each region. Regions with higher economic development are generally more responsive and contributive to green tax policies, thereby facilitating green development and innovation.

-

d.

Technological Innovation (\({LNTC}\)): This is assessed by the proportion of regional fiscal R&D expenditure to total regional expenditure. The level of regional technological innovation plays a significant role in the region’s developmental capacity.

-

e.

Foreign Direct Investment (\({LNFDL}\)): A high level of foreign direct investment can introduce more green technology and industries. It also aids in the implementation and effectiveness of green tax policies.

-

f.

Labor Force (\({LNL}\)): Represented by the number of people employed at the end of the year in each region. An inadequately skilled or environmentally unaware labor force can impede the implementation of green tax policies and hinder green development.

-

g.

Industrial Structure (\({LN}{\rm{IS}}\)): Measured by the proportion of tertiary industry output to the regional GDP. A higher tertiary industry output percentage often indicates a more developed and diverse regional economic structure, which tends to have a higher demand for environmental protection and green development.

Descriptive statistical analysis

The analysis of Table 5 reveals a substantial variation in the minimum and maximum values for the degree of green development, green innovation, both broad and narrow green taxes, foreign investment, and technological innovation. This variation underscores a notable disparity in green development, innovation, green tax application, and other related variables across various regions in China. The relatively smaller standard deviation observed in the degree of green development and the level of green innovation suggests a more cohesive distribution of data pertaining to these indicators. Conversely, the larger standard deviations associated with green taxes, technological innovation, foreign investment, and openness to external engagement reflect a broader dispersion of data. These disparities indicate significant regional differences in green taxes, technological innovation, and openness.

Correlation analysis

Table 6 reveals a pronounced negative correlation between narrow green taxation and regional green development, yet with a positive coefficient for its squared term. This suggests that as narrow green taxation increases, its negative impact on regional green development diminishes and may potentially transform into a positive influence. This suggests a nonlinear relationship in which an increase in narrow green taxation might initially hinder green development but becomes beneficial after surpassing a certain threshold. The analysis of Table 7 indicates a significant negative link between broad green taxation and overall regional innovation capacity, and this relationship is further accentuated by a significantly negative squared term. This indicates that an increase in broad green taxation not only initially exerts a negative impact on regional innovation capacity but also that this adverse effect intensifies with further increases in taxation. Such a trend could suggest that excessively high broad green taxation dampens corporate innovation drive, thereby adversely affecting regional comprehensive innovation capacity. These analyses lead to the conclusion that there is a notable correlation between green taxation (both narrow and broad) and the chosen dependent variables (regional green development and comprehensive innovation capacity). Additionally, the robust significance of the control variables underscores their validity. These insights provide a deeper understanding of the effects of green taxation on regional development and innovation capacity, underscoring the significance of continued research in this area.

Empirical analysis

The dataset employed in this study comprises unbalanced panel data, encompassing 30 samples over an 18-year period. When selecting regression models, F-tests strongly reject the null hypothesis “H0: all ui = 0”, indicating a preference for fixed effects over mixed regression. Further, the Hausman test decisively refutes the null hypothesis, demonstrating that the fixed utility model of this study markedly outperforms the random effects model. Consequently, this paper adopts a fixed effects model for the empirical analysis. To enhance the model’s robustness, it accounts for both time and regional variations, constructing a two-way fixed effects model and employing clustered robust standard errors to address potential heteroskedasticity. The empirical analysis presented in this paper is conducted using Stata16 software.

Fundamental regression analysis

(1) Regression Analysis: The Impact of Narrow Green Taxes on China’s Green Development and Innovation

In the first column of Table 8, the influence of narrow green taxes exhibits a lag effect at a 1% significance level. Specifically, the first lag of narrow green taxes shows a significant and positive impact on green development. This lag effect indicates that the imposition of environmental protection taxes can motivate enterprises and individuals to adopt production methods that are more environmentally sustainable and resource-efficient. Such a shift enhances resource utilization and boosts production efficiency, thus facilitating the green transformation of enterprise equipment (Luo and Wu, 2023; Sun et al., 2023). As a result, there is an observed increase in green total factor productivity. The implementation of new equipment and the resultant improvements in enterprise efficiency take time to materialize, which explains the positive impact of the one-period lag of narrow green taxes on green development.

In the second column of Table 7, narrow green taxes positively influence green innovation at a 10% significance level. This effect arises because green tax policies elevate corporate environmental consciousness and costs, thereby fostering green innovation and green technologies (Feng et al., 2022). However, a first-order negative effect is observed at a 10% significance level, suggesting that narrow green taxes boost green innovation in the short term. In the longer term, due to the delayed application of new technologies, the distribution of new equipment, and the limited scope of direct taxation on emissions under narrow green taxes, the cost effect tends to surpass the compensatory effect. Consequently, this dampens corporate green innovation, resulting in a less pronounced impact of the one-period lag of narrow green taxes on green innovation.

Moreover, in the third column, while facilitating green development and innovation, narrow green taxes adversely affect the overall innovative capacity of enterprises with a one-period lag at a 5% confidence level. On the one hand, the imposition of narrow green taxes causes enterprises to redirect their research resources towards green initiatives, which may be inadequate for supporting innovation in other areas, thus impeding the overall innovative progress of the enterprise (Zhao et al., 2022). On the other hand, narrow green taxes generally elevate the comprehensive costs for enterprises, leading to a decrease in their overall innovative capabilities. (2) Regression Analysis: The Influence of Broad Green Taxes on China’s Green Development and Innovation

In the fourth and fifth columns of Table 7, this section examines the influence of broad green taxes through a national-level empirical analysis. The findings suggest that these taxes do not exert a substantial impact on green development and innovation. The implementation of these green tax policies appears to be hindered by several institutional and operational challenges, leading to their limited effectiveness. Initially, it is important to note that broad green taxes include a spectrum of fiscal measures beyond just environmental protection taxes. This diversity can give rise to complications in tax design and administration. For instance, exorbitant tax rates or impractical collection methods can impose undue burdens on businesses, thus potentially stifling their innovative drive. Moreover, the effectiveness of broad green taxes is further complicated by issues like market failure and information asymmetry. Enterprises depend on precise and comprehensive information regarding environmental costs and benefits to make informed investment choices. A lack of accessible, accurate information or the presence of information asymmetry can result in inadequate investment in green innovation. Furthermore, for broad green taxes to be truly effective, there must be a harmonious integration with other environmental policies and strategies. In cases where these policies are not well-aligned or are flawed, the potency of green tax initiatives can be significantly weakened. This situation is exacerbated when environmental standards are lenient or when regulatory oversight is insufficient, as companies may sidestep environmental obligations to cut costs. Such behavior inevitably leads to a reduction in investments in green innovation.

In the sixth column in Table 7, regarding the influence on enterprises’ overall innovative capacity, the study identifies negative effects at a 10% significance level for both the first and second lag periods. This finding is particularly noteworthy due to the significant negative coefficient of the quadratic term. It implies that an increase in broad green taxes corresponds with a further decline in the innovative capacity of enterprises. The underlying reasons are akin to those observed with narrow green taxes. However, the broader scope of taxation intensifies their impact on the innovative prowess of enterprises.

Drawing from the detailed analysis of the effects of narrow and broad green taxes on green development and innovation, it can be inferred that hypotheses H1 and H2 are substantiated to a certain degree.

In examining the control variables, it becomes evident that regional labor positively influences green innovation, as evidenced by the 1% significance level. An increase in employment not only boosts labor participation in green innovation but also catalyzes the development and application of eco-friendly technologies and products. This shift enhances both the efficiency and quality of innovation, thereby nurturing the green industry’s growth. Concurrently, increased employment bolsters the dissemination and exchange of knowledge and technology, thereby enriching the collective capacity for innovation and accelerating regional progress in green innovation. Conversely, foreign investment appears to adversely affect green innovation, observable at both 5 and 1% significance levels. Typically characterized by a short-term orientation and a focus on profit maximization, such investment often resorts to environmentally detrimental and energy-intensive production practices. This approach not only curtails regional green innovation opportunities but also impedes environmental betterment. Furthermore, foreign technology transfer predominantly involves outdated technologies, thereby constraining the regional development of green innovation and the transformation of green industries. The degree of regional openness to foreign markets positively correlates with green development, as indicated at the 10% significance level. This openness facilitates resource and technology flows, thereby bolstering green innovation capabilities and production efficiency. Inter-regional exchange and collaboration enable the adaptation of cutting-edge technologies, expansion of market share, and improvement in product value. Such dynamics stimulate corporate green innovation and enhance the environmental performance and benefits of products. In terms of economic development and workforce size, these factors markedly bolster comprehensive innovation capacity in enterprises. However, openness, at the 10% confidence level, presents a paradoxical effect. While economic development and an expanded labor force can invigorate corporate innovation activities—fueled by increased capital investment, technological advancement, and market growth—an escalation in openness may introduce heightened competition and market pressures, potentially curtailing innovation efforts. Enterprises, in the face of rivalry, might prioritize cost reduction and efficiency over innovation. Moreover, increased openness could facilitate technology and knowledge outflows, thereby diminishing the innovative capacities of enterprises.

Assessing the impact of innovation capacity and underlying mechanisms

This section delves deeper into the nexus between green development and regional innovation capacity. It particularly examines the hypothesis that green taxes, while fostering regional green development, adversely affect regional innovation capacity. To this end, mechanism tests are employed for both narrow and broad green taxes, utilizing Wen’s three-step regression method (Wen and Ye, 2014). The initial two steps are already addressed in the baseline regression analysis, and the results from the third step are presented in Table 9.

Firstly, drawing upon the baseline regression results and the mechanism test outcomes in Table 8, the study observes a nuanced impact of green taxes on enterprise innovation. Specifically, narrow green taxes, while conducive to green development and innovation, adversely affect the comprehensive innovation capacity of enterprises at a 5% confidence level with a one-period lag. This form of taxation generally increases the total costs for enterprises, leading to a reduction in their overall innovation capacity. In contrast, broad green taxes demonstrate a negative influence on this capacity at a 10% significance level, observable in both first-order and second-order lags. Notably, the significant negative coefficient of the quadratic term suggests a progressive decline in enterprise innovation capacity with increasing broad green taxes. The underlying causes mirror those of narrow green taxes. However, due to their wider range of taxes, broad green taxes exert a more pronounced impediment to enterprise innovation capacity.

Consequently, Hypothesis H3 finds robust validation through these findings.

Secondly, upon integrating the variable of green total factor productivity in Tables 9 and 10, notable shifts are observed in the impacts of both broad and narrow green taxes on regional comprehensive innovation capacity. Focusing on narrow green taxes and the baseline regression results, these taxes demonstrate a dual effect: they promote regional green development with a first-order lag at a 1% significance level, yet concurrently exert a first-order lagged inhibitory impact on regional innovation capacity at a 5% significance level. The mediation test outcomes reveal that when green development is introduced as a mediating variable in the innovation capacity regression, the significance of the inhibitory effect of narrow green taxes on innovation capacity is attenuated, falling to the 10% significance level. Concurrently, green development itself presents an inhibitory effect on regional innovation capacity at a 5% significance level.

From the perspective of broad green taxes, and in reference to the previous regression results in Table 8, a marked first-order and second-order lagged inhibitory effect on regional innovation capacity is evident. Although broad green taxes initially do not show a discernible impact on regional green development, this changes when green development is incorporated as a variable in the innovation capacity regression in Table 10. Subsequently, the second-order lagged inhibitory effect of broad green taxes on innovation capacity dissipates, leaving only the first-order lagged effect. Moreover, the previously significant negative quadratic term loses its significance. This indicates that some impacts were mitigated through the influence of narrow green taxes on green development, thereby altering the overall significance of their effects.

The promotion of regional green development can inadvertently lead to a decrease in regional innovation capacity. This outcome is partly due to resource reallocation and economic structure adjustments that can disrupt the existing innovation system. In the quest for green development, substantial investments and resources are often channeled into environmental protection and sustainable development initiatives, potentially detracting from investments in other innovation sectors (Li et al., 2022). Compliance with environmental standards and regulations may also constrain the growth potential of certain traditional industries, thus impacting regional economic progression and innovation capacity. Moreover, green development can trigger shifts in the regional industrial landscape. While this shift may temporarily hinder traditional industries, the burgeoning green sectors require time to mature, which could transiently affect regional innovation capacity during this transitional phase.

Thus, Hypothesis H4 is validated to a certain extent.

Heterogeneity analysis based on the regional level

Narrow green taxes

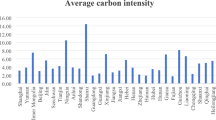

Acknowledging the notable disparities among various regions in China, this study segments provincial data into three geographical categories: Eastern, Central, and Western. This segmentation aims to conduct a heterogeneity analysis that accurately reflects regional variations. Figure 2 provides a visual depiction of these differences, focusing on the intensity of green taxes, quantified as their proportion in the overall tax structure. Complementing this, Table 10 offers detailed regression results, examining the influence of narrow green taxes on aspects such as green development, green innovation, and comprehensive innovation capacity across these distinct regions.

The horizontal axis represents various provinces, while the vertical axis depicts the average green tax intensity, expressed as the percentage of green taxes as a proportion of total tax revenue from 2004 to 2021. This illustrates the differences in average green tax intensity across different provinces.

According to the top three columns in Table 11, in the Eastern region, the narrow green taxes significantly bolster green development, demonstrating a positive impact at the 5% significance level. Notably, an increasing trend in this positive effect is evident with the escalation of these taxes, as suggested by the positive coefficient of the quadratic term. The Eastern region, in comparison to others, is better poised for green development due to its superior conditions and solid foundational support. Characterized by an advanced economy with heightened awareness of green industries and environmental protection, this region offers an ideal backdrop for the effective enactment of green taxes, thereby facilitating enhanced green development (Lu and Zhou, 2023). However, these taxes also exhibit a first-order lagged negative impact on green innovation, noticeable at the 10% significance level. As the Eastern region nears the saturation point in green technology, further innovation demands significant investments in both funds and human resources. The increased operational costs for businesses, stemming from narrow green taxes, pose challenges to ongoing technological advancements. Interestingly, narrow green taxes appear to exert negligible influence on the comprehensive innovation capacity of businesses in the Eastern region. This is largely attributed to the region’s advanced state, marked by a smaller presence of heavy and pollution-intensive industries, which significantly diminishes the impact of these taxes. The study also reveals that certain factors like foreign investment, labor, and technological innovation serve as impediments to regional green development, evident at the 1%, 5%, and 10% significance levels, respectively. Conversely, regional economic development is found to be a significant catalyst for green development, underscoring its importance at the 1% significance level.

According to the fourth to sixth column in Table 11, in the Central region, the impact of narrow green taxes on green development is not pronounced, yet these taxes notably impede regional green innovation, as evidenced by a 5% significance level. This region, characterized by a well-developed industrial sector, is home to major industrial enterprises. Notable areas include Heilongjiang and Jilin in the Northeast, predominantly engaged in heavy industries like petroleum, and the central and southern regions focusing on metallurgy, with provinces such as Shanxi, Hunan, and Hubei specializing in machinery manufacturing. Despite this industrial robustness, the Central region’s economic development remains comparatively modest. This situation has led the region to absorb pollution-intensive industries relocated from the Eastern region, in a bid to stimulate economic growth. Consequently, there is a pressing need for the Central region to impose higher environmental protection taxes and to intensify regulatory measures. However, the region’s reliance on heavy-pollution industries and manufacturing enterprises presents significant challenges in leveraging environmental protection taxes to influence regional green development and innovation (Rao et al., 2023). This situation also adversely affects the capability of enterprises to innovate, with a significant negative impact at the 10% significance level, as indicated by the negative coefficient for the quadratic term. The research further identifies that the regional economic development and the scale of foreign investment each positively influence regional green development, at the 10 and 5% significance levels, respectively. Conversely, the level of technological innovation and the industrial structure are found to impede regional green development, at the 5 and 10% significance levels, respectively. Moreover, factors such as regional economic development, industrial structure, and the degree of openness to foreign markets collectively promote the enhancement of comprehensive enterprise innovation capacity, with significant positive impacts at the 1 and 5% significance levels, respectively.

According to the last three columns in Table 11, in the Western region, the influence of narrow green taxes on green development is not substantial; however, they positively affect green innovation, albeit with a first-order lagged negative effect, at the 10% significance level. There is also a notable negative impact on the comprehensive innovation capacity of enterprises, evidenced at the 5% significance level, with the quadratic term showing significant negativity. The region’s industrial structure is relatively uniform, predominantly centered around resource exploitation and traditional heavy industries (Zhang et al., 2022). As a result, enterprises in the Western region are encountering increased burdens and challenges under the influence of narrow green taxes. While the escalation in costs and policy support might stimulate green innovation in the Western region, the absence of advanced technology and green innovation capabilities could hinder enterprises from effectively mitigating environmental pollution and resource waste. This limitation impacts the potential for both green development and innovation. Moreover, these escalated costs contribute to an increased comprehensive innovation burden for enterprises (Nan et al., 2022). Regarding regional influences, economic development and technological innovation each play a supportive role in promoting regional green development, marked at the 5 and 10% significance levels, respectively. Conversely, the level of foreign investment is observed to impede regional green innovation at the 10% significance level. Additionally, both regional economic development and technological innovation are instrumental in enhancing the comprehensive innovation capacity of enterprises, as indicated at the 10% confidence level. In contrast, the degree of openness to foreign markets presents an obstacle to this enhancement, as evidenced by the 5% confidence level.

Broad green taxes

According to the top three columns in Table 12, in the Eastern region, broad green taxes demonstrate a more subdued impact on green development compared to narrow green taxes, manifesting only as a first-order lagged positive effect at the 1% significance level. This muted impact can be attributed to the region’s advanced economic development and industrial structure, which stand out relative to the Central and Western regions. Additionally, the Eastern region levies fewer environmental-related taxes, such as resource taxes and cultivated land occupation taxes, in comparison to the Central and Western regions. However, the Eastern region excels in technological strength, boasting superior environmental technology and innovative capabilities. The introduction of green taxes in this context serves as an incentive for enterprises to augment their R&D investments. Consequently, this leads to a first-order lagged positive effect and a favorable impact on green innovation at the 10% significance level. The presence of a negative quadratic term, however, suggests an inverted U-shaped relationship. At the 10% confidence level, broad green taxes are observed to impede the comprehensive innovation capacity of enterprises, with a significantly negative impact noted in the quadratic term. Owing to their broader tax base, broad green taxes exert a more pronounced influence on the comprehensive innovation capacity of enterprises than narrow green taxes, and this influence is notably adverse in the Eastern region. Furthermore, the labor and technological innovation are found to significantly hinder green development. In contrast, the level of regional economic development plays a crucial role in promoting regional green innovation. Additionally, the labor, regional education, and economic development are significant drivers in enhancing the comprehensive innovation capacity of enterprises.

According to the fourth to sixth column in Table 12, in the Central region, broad green taxes reveal a nuanced impact on green development and innovation. These taxes enhance regional green innovation notably at the 1% significance level. However, the analysis of the quadratic term of these taxes shows a negative effect at the 10% significance level. This suggests an inverted U-shaped relationship between the broad green taxes and green innovation in this region. The influence of these taxes on the comprehensive innovation capacity of enterprises is complex, exhibiting both promotional and first-order lagged inhibitory effects. The presence of a significant negative quadratic term further underscores the inverted U-shaped dynamic in this relationship. This pattern can be attributed to the Central region’s industrial landscape, which is skewed towards pollution-intensive manufacturing sectors. Higher broad green taxes in this context incentivize enterprises to pursue green innovation as a strategy to mitigate tax burdens (Wang et al., 2022). Although the push for innovation spurred by these taxes markedly boosts the comprehensive innovation capacity of enterprises, the entrenched nature of the heavy industry sector limits rapid shifts, thus not yielding a substantial impact on green development. This situation has also precipitated a first-order lagged negative effect on the enterprises’ comprehensive innovation capacity. Furthermore, an excessive tax burden dampens the momentum for regional green innovation, culminating in an inverted U-shaped trend for the comprehensive innovation capacity of enterprises. Factors like technological innovation and industrial structure pose significant challenges to regional green development. Conversely, the regional economic development acts as a catalyst for green progress. Additionally, elements such as openness to foreign markets, industrial structure, and regional economic development level each play a significant role in bolstering the comprehensive innovation capacity of enterprises, as evidenced by their impact at the 5 and 1% significance levels.

According to the last three columns in Table 12, in the Western region, the effects of broad green taxes on regional green development and innovation are less distinct compared to the Eastern and Central regions. These taxes appear to impede green development and the comprehensive innovation capacity of enterprises, both at the 10% significance level. The Western region is characterized by slower economic growth, a relatively simple industrial makeup, and a delicate ecological system (Dai et al., 2022). As a result, the region exhibits a subdued demand for green development and a weaker response to green tax initiatives. Additionally, the technical capabilities in the Western region are underdeveloped, lacking the necessary infrastructure for green innovation. The imposition of green taxes in this context may escalate cost pressures on businesses. Lacking the means to mitigate these costs through green innovation, enterprises in the Western region face a limited impact on green innovation, coupled with a negative influence on their comprehensive innovation capacity. Furthermore, the study highlights that factors such as openness to foreign markets and technological innovation are significant promoters of green development in the region. In contrast, the industrial structure and the level of foreign investment are notable impediments to both green development and innovation. The degree of openness to foreign markets and regional labor poses challenges to enhancing the comprehensive innovation capacity of enterprises, as evidenced at the 5% significance level. On the other hand, foreign investment and regional innovation capabilities have a promotional effect.

Temporal heterogeneity analysis

Narrow green taxes

Table 13 reveals a dynamic change in the impact of narrow green taxes over time. Prior to 2016, these taxes did not significantly influence green development. After 2016, however, their effect became notably promotional at the 1% significance level. In terms of green innovation, the impact remained non-significant across all periods. The influence on enterprise innovation capacity varied, presenting as a deterrent at the 5%, 10%, and 1% significance levels, particularly with a significantly negative quadratic term post-2006. The evolution of these effects mirrors broader shifts in China’s environmental policy and economic priorities. Before 2006, and extending to 2016, the country’s focus was predominantly on economic growth, with less emphasis on environmental protection and green development. During this period, green development concepts had not been deeply integrated into national strategies, and governmental support for green taxes was comparatively limited (Lin et al., 2023), leading to a subdued impact of these policies. Furthermore, the initial design of green tax policies encountered several challenges. China’s green tax framework primarily comprised resource taxes and environmental protection taxes, characterized by low rates, restricted scope, and operational issues like vague collection standards and complex procedures. These factors collectively diminished the influence of green taxes. Moreover, the corporate acceptance of green tax policies was relatively minimal during this phase. However, there was a significant shift after 2016. The Chinese government began to prioritize green development, incorporating it as a key component of the national agenda. This shift was accompanied by the introduction of various supportive policies and measures, including the enhancement and expansion of green tax initiatives. Subsequent adjustments to the green tax policy involved increasing tax rates, broadening coverage, and streamlining collection processes, thereby augmenting the efficacy of these policies. Despite these advancements, the overall effect of narrow green taxes on enterprise innovation capacity remained consistently negative throughout the three periods, primarily due to the increased operational costs imposed on businesses.

Broad green taxes

An analysis of Table 14 provides insights into the varying impacts of broad green taxes over time. Prior to 2006, these taxes had a dual effect: they were promotive for green development and inhibitory for green innovation at the 1% significance level. The quadratic term for green innovation before 2006, as well as for green development from 2006 to 2016, was positive, suggesting a U-shaped impact. Regarding enterprise innovation capacity, a promotional influence was noted at the 10% significance level, whereas an inhibitory impact was observed at both the 1 and 5% levels. Notably, the quadratic term was significantly negative before 2006 and turned significantly positive post-2016. These fluctuations may be attributed to changes in the environmental policy landscape. Following 2006, the Chinese government introduced a suite of environmental policies, including the Environmental Protection Law and the Air Pollution Control Law. These initiatives heightened the focus on environmental protection, potentially diminishing the independent effect of broad green taxes (Wang and Lin, 2010). Conversely, prior to 2006, moderate green tax lower impacts on corporate profitability contributed to a positive effect on comprehensive innovation capacity. However, this positive influence waned as tax efforts intensified. From 2006 to 2016, the diversification of environmental policies likely altered the impact of green taxes (Fang et al., 2023). The various environmental strategies from the government, such as carbon emission trading markets, renewable energy development, and environmental monitoring, may have lessened the influence of green taxes on green development. Despite ongoing enhancements in the green tax system and tax efforts during this period, a pronounced negative impact on the comprehensive innovation capacity of enterprises was observed. Post-2016, in the context of sustained economic growth and employment under broader economic pressures, the influence of green taxes on green development and innovation further diminished. Although the significant negative impact on enterprises’ comprehensive innovation capacity continued, it gradually lessened due to supportive related policies, even as tax efforts were amplified.

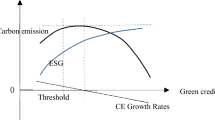

Analysis of heterogeneity in relation to innovation levels

This section delves into the varying effects of green taxes across regions characterized by disparate levels of corporate innovation capabilities. For this analysis, regions are categorized into two distinct groups: those with high innovation capacity and those with low. Figure 3 illustrates the disparate outcomes linked to these innovation capacities. The detailed findings of this analysis are presented below:

Narrow green taxes

In Table 15, the impact of narrow green taxes on green development is discernible, exhibiting a significant but delayed promotional effect in both high and low-innovation capacity regions. Specifically, at a 5% significance level, these taxes influence green development in a first-order and second-order lagged manner in high-innovation regions, and in a first-order lagged manner in low-innovation regions. For green innovation, however, narrow green taxes impede progress in high innovation areas at the 5% significance level, while fostering it in low innovation regions at a more significant 1% level. In high innovation areas, mature technology often encounters a bottleneck in green innovation, and the influence of narrow green taxes is minimal, leading to no observed promotional effect. Conversely, in low innovation regions, where technology is less developed, there remains considerable potential for green technological advancements. Here, the impact of narrow green taxes is more pronounced, resulting in a clear promotional effect. Furthermore, regarding regional enterprise innovation capacity, a hindering effect of narrow green taxes is observed only in low innovation regions at the 5% significance level. This phenomenon can be attributed to the heavier tax burden imposed by narrow green taxes in these regions, which escalates the cost pressures on enterprises compared to their high innovation counterparts, thus leading to an inhibitory impact.

Broad green taxes

In Table 16, the analysis reveals that broad green taxes do not exert a significant promotional effect on green development and innovation in either high or low-innovation capacity regions. Instead, these taxes present a hindering effect, particularly in regions with low innovation capacity, noticeable at the 10% significance level. Broad green taxes, encompassing a more extensive array of tax types than narrow green taxes, impose a greater tax burden on enterprises across both regions. This heightened financial pressure increases operational costs, consequently impeding the growth of regional green total productivity and innovation (Hong and Cords, 2019). The influence on regional enterprise innovation capacity differs between high and low-innovation regions. In high innovation regions, these taxes exhibit a first-order and second-order inhibitory effect at the 1% significance level. However, in regions with lower innovation capacity, the impact is not statistically significant. The increased tax burden generally leads to a reduction in enterprise innovation capacity. Nonetheless, state-initiated support policies for underdeveloped regions partially offset the cost challenges posed by broad green taxes, mitigating their adverse effects in regions with lower innovation capacity.

Robustness test

To ascertain the dependability of the estimated results, this study adopts a substitution model method, incorporating data into both random effect models and linear regression models for validation. The findings confirm that the primary regression outcomes are stable and consistent. Additionally, to further mitigate any potential measurement errors in the independent variables, this paper alters the metric for green taxes from regional tax intensity to the aggregate amount of green taxes within a region, subsequently reapplying this modified metric to the fixed effect model for regression analysis. Typically, the discussion around green taxes centers on regional green tax intensity, defined as the ratio of green taxes to the total regional economic output. Nonetheless, this metric might not wholly capture the actual dynamics of green taxes in a region. By shifting the focus from regional green tax intensity to the total amount of green taxes, the study offers a more precise evaluation of the effectiveness of regional green taxes. The total amount accounts for the influence of the regional economic scale, thereby providing a more accurate reflection of the region’s contribution to environmental protection. The results, even with this modification, uphold the main regression findings to a considerable degree, suggesting that the empirical results of this paper possess a notable level of robustness.

Conclusion and policy implications

This study’s empirical analysis yields several key findings:

Firstly, it establishes that both narrow and broad green taxes significantly hinder the overall innovation capacity of enterprises. Secondly, the influence of green taxes on regional green innovation and development is region-specific. In eastern regions, green taxes tend to bolster green development, whereas in central and western regions, their impact is either subdued or negative. Narrow green taxes impede green innovation in the east and central regions, yet foster it in the west. Conversely, broad green taxes enhance green innovation in the east and central areas without notable effects in the west. Thirdly, narrow green taxes exhibit a delayed yet markedly positive effect on regional green development and provide a stimulative influence on green innovation, evident both immediately and in a first-order lagged context. Fourthly, a U-shaped nonlinear relationship is observed between green taxes and green innovation, green development, and the aggregate innovation capacity of enterprises. Nationally, narrow green taxes correlate in a U-shaped manner with green innovation, while broad green taxes demonstrate an inverted U-shaped relationship with comprehensive enterprise innovation capacity. Regionally, a U-shaped pattern is apparent in the relationship between narrow green taxes and green development. Fifthly, as the green taxes and their associated policies progressively evolve, their impact on enterprise innovation capacity, regional development and innovation becomes increasingly rationalized, exhibiting an ascending trend nationally over time. Lastly, although green taxes facilitate green development, they risk diverting other innovative resources, potentially leading to resource imbalances in enterprises and diminishing the collective innovation capacity of regional businesses.

Most existing research predominantly concentrates on the economic impact of green taxation on enterprises, with a lesser focus on its effects on innovation capacity. The study’s findings, consistent with prior research, suggest that green taxation acts as a potential catalyst for green development and innovation. However, both the narrow and broad green taxation negatively influence the overall innovation capacity of enterprises. This outcome stands in contrast to some literature that posits a positive effect on innovation, hinting that green taxation might initially impose a burden on corporate innovation, mainly due to the redistribution of resources and resulting imbalances. The long-term effects, however, remain an area for further study. Furthermore, this research highlights significant regional disparities in the impact of green taxation on green development and innovation, a facet that has not received adequate attention in previous studies. It demonstrates a promotional effect in Eastern regions, whereas, in Central and Western regions, the impact is either negligible or negative. This variation could be associated with differences in regional economic development, industrial structures, and innovation capacities, emphasizing the need for region-specific green tax policies. Another key contribution of the study is the identification of a nonlinear relationship between green taxation and both green innovation and development. This insight offers a novel perspective on the complex effects of green taxation, challenging the linear assumptions found in some existing literature. It suggests that the influence of green taxation may vary with the level of taxation, calling for future research to explore the optimal tax level that balances the promotion of green innovation against potential negative impacts on corporate innovation capacity. Ultimately, the study enriches traditional heterogeneity analysis by examining regions with diverse innovation capabilities. The results highlight the varied effects of green taxation across areas with different levels of corporate innovation. In regions with high corporate innovation capacity, narrow green taxation exhibits a delayed effect in fostering green development, potentially due to enterprises needing time to adjust their innovation strategies to new tax policies initially. In contrast, in regions with lower innovation capacities, narrow green taxation prompts a quicker uptake of green measures, suggesting that modest incentives may be sufficient to spur action among businesses in these areas. The influence emphasizes the necessity of regional innovation capacities in policy-making. This differentiation in impact indicates that identical policies might require varied approaches across different regions. Broad green taxation has not demonstrated significant promotional effects on green development and innovation in either type of region. This finding points to a more detailed approach to designing green taxation, ensuring it effectively encourages green innovation and sustainable development.

China’s 20th National Congress has distinctly marked green development as a pivotal trajectory for future growth. The green development and innovation become focal points for regional enterprises, particularly those with substantial environmental resource consumption and high pollution emissions. This need is most pressing in the less developed central and western regions, where the stark challenge lies in balancing environmental protection with swift developmental progress. To more effectively leverage the beneficial aspects of green taxes for regional green development and innovation, while simultaneously diminishing their detrimental effects on enterprise innovation capacity and regional green progress, this paper offers the policy recommendations and research trends:

Firstly, the governments should strengthen the direction of green tax policy. It is essential to implement more effective optimization measures for enterprises that are heavy consumers of environmental resources and major polluters. These measures are aimed at motivating such enterprises to expedite their shift towards advanced green development levels. The green tax relief for enterprises proactively engaging in green technologies and practices is recommended. Businesses that adopt practices like clean energy use, resource recycling and low-carbon production could benefit from tax reductions or preferential policies, fostering their ongoing progress in green development.