Abstract

In this paper, we investigate the relationship between the indicators for COVID-19 monitoring and the dynamic of jumps across six major financial markets including China, France, Italy, Germany, the UK, and the US. First, this paper finds that jumps occurred more frequently in the index returns during the COVID-19 pandemic. Second, the empirical findings suggest that the anxiety stemming from potential future control measures, which were prompted by updates in COVID-19 briefings, plays a significant role in explaining the jumps in index returns within financial markets. The strategies of ‘zero tolerance for COVID-19’, ‘maximum healthcare capacity’, and ‘less tolerance for restriction’ were carried out by China, European countries, and the US respectively. These diverse approaches to managing COVID-19 have a significant and varied impact on the market’s sudden price movements.

Similar content being viewed by others

Introduction

A jump in financial markets typically denotes a sudden and substantial price movement. Jumps have a profound impact on financial markets as they do not only escalate volatility but often signal a shift in investor sentiment or expectations, potentially indicating a pivotal point in the market’s trajectory. As a jump is a unique phenomenon, distinct from regular market fluctuations, it has drawn significant attention in academic research, particularly in relation to market crashes. Moreover, comprehending jumps is valuable for safeguarding investments against substantial losses, as risk management takes precedence during periods of market fluctuation.

The COVID-19 pandemic, as one of the latest global health crises to affect the modern financial system, offers us a unique opportunity to examine the impact of a pandemic on the world capital markets. In contrast to the majority of studies that have concentrated on market volatilities, this paper delves into the relationship between abrupt price jumps and the progression of pandemics, with a particular emphasis on the role of government responses to the pandemic in shaping market dynamics, whether they serve to exacerbate or mitigate market sentiment.

Based on economic intuition, jumps in the financial market are more likely to occur during the pandemic due to heightened uncertainty. With limited knowledge about a novel virus like COVID-19, the speed of spread and the fatality of cases from COVID-19 across the countries go beyond most people’s knowledge. To suppress the virus, countries implement measures such as quarantine and lockdowns, which dampen economic activities and severely impact market confidence. Particularly, in the face of unpredictable COVID-19 trends, the market sentiment swings between optimism and pessimism with each update on the pandemic’s progress.

As we all know, relevant news and announcements relating to the pandemic brief every day and have an impact on investors’ sentiment. When updated information suggests either an escalation or mitigation of the future economic situation, investors frequently revise their asset allocations, influenced by their occasionally inaccurate expectations and susceptible to sentiment. This phenomenon is a source of overreaction and can result in the price straying from the asset’s intrinsic value. An intriguing question arises: What specific statistical information and to what degree does it have an impact on market prices, potentially resulting in fallings or surges? Furthermore, does such a mechanism function universally across all countries?

In this paper, we examine the influence of both the type and extent of pandemic-related information on the magnitude of abrupt market movements or jumps. Our study not only examines how jump intensity has changed from the pre- and post-COVID period to the COVID period but also assesses the influence of pandemic development monitoring indicators on jumps.

Furthermore, we have conducted a comparative analysis of the magnitude of market reactions to pandemic information across six representative global financial markets. Our objective is to determine whether investors’ responses to pandemic-related information are consistent or divergent among these countries. If disparities are identified, we aim to identify the underlying factors contributing to these variations.

After the COVID-19 outbreak, financial studies linked with the pandemic have increased rapidly. The literature involve in the area of COVID-19 and the stock markets (Ahmad et al., 2021; Apergis and Apergis, 2020; Baker et al., 2020; Chatjuthamard et al., 2021; Lee et al., 2021; Mazur et al., 2021; Narayan et al., 2020, 2022; Rahman et al., 2021, ?; Uddin et al., 2022; Xu, 2022).

Some literature has focused on analyzing the impact of COVID-19 on market volatility (Albulescu, 2021; Bora and Basistha, 2021; Chowdhury, 2022; Chowdhury et al., 2022a, b; John and Li, 2021; Uddin et al., 2021). Chowdhury et al. (2022a, b) conducted a study to measure the influence of COVID-19 on US stock market volatility. Additionally, in Chowdhury’s (2022c) research, they expanded their investigation to include 12 selective countries across four continents, employing daily panel data to examine the global influence of COVID-19 on stock markets and economic activities. Their findings suggest that all pandemic-related variables exert a negative impact on stock markets. Furthermore, they observed that lockdown measures and movement restrictions have adverse effects on economic activities. While these literature pieces delve into the concept of uncertainty, they primarily view it as a driver of instability and do not emphasize independent, sharp price movements. Instead, their focus is on the fluctuation in price movements.

Recently, there are several literatures have also explored the relationship between COVID-19 and market jumps (Alqahtani et al., 2021; Baker et al., 2020; Kunjal and Peerbhai, 2021; Liu et al., 2022; Zeng et al., 2022; Zhang et al., 2022). Alqahtani et al. (2021) studied impacts of jump processes in the crude oil price. Zeng et al. (2022) investigated the roles of jump components in forecasting the volatility of international equity markets. Liu et al. (2022) examined the change of jumps in equity markets after the outbreak of COVID-19. These studies have identified that COVID-19 heightened risk and uncertainty in the financial market, leading to an increase in abrupt market movements during the pandemic, which in turn contributed to overall market volatility. Up to now, the literature concerning jumps in a period of the COVID-19 pandemic has not yet discussed the effect of COVID-19 related information on the jump occurrence in the stock market.

As far as we know, the closest literature about the information of COVID-19 on stock returns is (Al-Awadhi et al., 2020; Ashraf, 2020; Ftiti et al., 2021; Iqbal et al., 2021; Lee et al., 2021; Salisu and Vo, 2020; Tripathi and Pandey, 2021). Among a series of variables used to evaluate the development of COVID-19, the daily growth of confirmed cases and the death cases are two key indicators widely quoted by the press to report the scale and the severity of COVID-19. Most findings in related literature confirm that these two variables impact negatively stock returns. Besides, some literature extends to the theme of control measures and stock market reaction (Bannigidadmath et al., 2022; Narayan et al., 2021; Phan and Narayan, 2020). They figured out that the announcement of control measures did have a short-term effect on the stock returns.

Notice that jumps are the phenomenon of market overreaction to the arrival of unexpected information (Chan and Maheu, 2002; Fu and Shen, 2020; Lahaye et al., 2011; Lee and Mykland, 2008). The information that leads to a decrease in index returns is not doomed to trigger a negative jump in the index returns. Therefore, hardly we can conclude the similar effect of COVID-19 on jumps based on the findings of the relation between the indicators for pandemic monitoring and the index returns. Especially, the government’s response to pandemics can significantly influence investor expectations, potentially exacerbating or alleviating panic in the financial markets. Consequently, the market tends to respond to this new information with relatively subdued price fluctuations rather than sudden and dramatic price jumps.

In this paper, we employ the ARJI model proposed by Chan and Maheu (2002) to filter out the market jumps and explore the potential impact of COVID-19 on these jumps by analyzing the dynamic of annual jump frequencies. Furthermore, we also extend the ARJI model by incorporating the external variables, as proxies for COVID-19, into the time-varying jump intensity equation. This extension allows us to investigate how the development of pandemics, particularly the COVID-19 pandemic, impacts the occurrence of market jumps. We apply our extended ARJI model to examine the relationship between pandemic monitoring indicators and jump dynamics in six major financial markets: China, France, Italy, Germany, the UK, and the US.

In our empirical research, we uncover several key findings. First, we observe a higher jump intensity during the pandemic period compared to both the pre-pandemic and post-pandemic period in most of the countries studied. Second, we identify three distinct scenarios among the six countries. For China, we find that the daily confirmed cases of COVID-19, rather than the death cases, significantly influence jump intensity. In the case of the US stock market, none of the pandemic proxies exhibit a significant effect on jump intensity. In European countries and the UK, a noteworthy commonality is the statistical significance of daily death cases in relation to jump intensity across all countries. These empirical findings suggest that market reactions are driven by concerns about potential future control measures triggered by updates in COVID-19 briefings. This information sheds light on the dynamics of jumps in index returns during pandemic periods.

What distinguishes our study from the prior literature and contributes to the current literature is as follows: First, we pioneer to investigate the relationship between the indicators for pandemic monitoring and the occurrence of jumps in capital markets. It is well-established that the development of COVID-19 has been a significant source of uncertainty for financial markets. Our primary inquiry is to determine whether the scale or severity of COVID-19 plays a more pivotal role in driving these market jumps. By delving into this aspect, our research endeavors to shed light on the origins of market overreactions and enhance our understanding of the pandemic’s influence on financial markets.

Second, we discover the effect of investor responses to pandemics on financial markets varying with the countries. It’s essential to recognize that government actions primarily aim at controlling the virus, but their impact can extend to the financial markets. The design principles and the level of stringency in implementing these measures can lead to varying market reactions. In this paper, we evaluate how countries’ strategies to influence social mobility and business activities can indirectly shape investor expectations, a dimension that can be assessed through an investigation into the occurrences of jumps in financial markets. The findings can provide useful insights for rethinking public policymaking.

Our paper is organized as follows. “Model” introduces the methodology employed in the empirical research, including the specification details of the extended ARJI model. “Monte Carlo experiment” outlines a Monte Carlo experiment and compares the estimated parameters of the proposed models with the true values. “Data and descriptive statistics” presents the data and provides descriptive statistics. In “Empirical results”, we report and discuss the main empirical findings, presenting implications for policy formulation. Finally, “Conclusion and further directions” comes to the conclusions.

Model

How to examine the effect of the COVID-19 indicators on jump occurrence is the key step for the study. It is hard to model a sample of jumps in daily frequency as jumps are rare and discrete. To overcome this challenge, we employ a model centered around jump intensity since this approach allows us to work with continuous variables, transforming the problem into one focused on estimating the probability of jump occurrence. In this section, we discuss the autoregressive jump intensity model (ARJI) at first and then extend to our specification of including the COVID-19 indicators into the jump intensity equation of the ARJI model.

ARJI Model

Chan and Maheu (2002) proposed an autoregressive jump intensity model, which allows for the time-varying of jump intensity. In their model, the returns are governed by a simple diffusion model, a source of volatility, and a Poisson jump component. The model for the stock returns Rt is given by

where Rt is the return of a equity, ht is the conditional variance. In GARCH specification, α0, α1, and β are conventional GARCH parameters and obey the basic restrictions, α0 > 0, α1 > 0, and β > 0, to guarantee positive ht. The distinct specification is its innovation et, which combines a normal diffusion component e1t and a jump component e2t. The inclusion of jump component e2t allows the jumps to take effect on volatility through the innovation et−1 in the volatility equation. For specification of e2t, Jk is a random jump size variable governed by a normal distribution with the mean θj and the variance \({\sigma }_{j}^{2}\). Here nt is defined as the discrete counting process that governs the number of arrival jumps between t − 1 and t. nt follows a Poisson distribution. Distinguished from the conventional GARCH-jump model which fixes the jump intensity as a constant, the ARJI model employs an autoregressive process of λt to allow the dynamic of jump intensity. The equation of jump intensity is

where λt represents the conditional jump intensity at time t. λt associates with its pasted lags of the conditional jump intensity λt and the lags of innovation ξt. As the number of jumps is governed by a Poisson process, the jump intensity is the average jump in a given period. Hence, let λt = E(nt∣Φt−1) be the conditional expectation of the counting process. The jump intensity residual can be written as

The jump intensity residual ξt−1 is the difference between the expectation of number of jumps at time t − 1 based on the information at time t − 1 and the λt−1 computed at the prior iteration.

The ARJI model exhibited in Eq. (1) to (3) is applied to to filter out index return jumps for comparative analysis across different periods and countries.

The specification of ARJI model with COVID-19 impact

In our study, we specify the conventional ARJI(1,1) in terms of incorporating the external variable Nt−k into the equation. Here Nt−k is the current (k = 0) or the k lags (k > 0) of indicators for pandemic monitoring.

In our specification, we add the external variable Nt−k into equation (2).

We employ two indicators, the daily confirmed cases NCt and the daily death cases NDt, as the external variables in Eqs. (5) and (7). Considering the possible lag effect of information on the capital market and for robustness, we also introduce the one-day lag of the daily confirmed cases NCt−1 and the daily death cases NDt−1 in Eqs. (6) and (8). In total, we have four specifications for the extended ARJI model as

Furthermore, the extended ARJI model, depicted from Eq. (1) to (4), is employed to investigate the impact of pandemic-related information on the jump dynamics of index returns during the COVID-19 period.

Parameter estimation

The maximum likelihood estimation method is applied to estimate the parameters. For our specification, the parameters vector θ is (μ, α0, α1, β, θj, σj, λ0, ρ, γ, η) and the likelihood function is

where Rt is the index returns and Nt−k is the proxy of COVID-19 embedded in one of the time-varying jump intensity equations from Eq. (4). Φt−1 is the recent information set. The detail of f(Rt∣Nt−k, Φt−1; θ) is given by

where Eq. (10) shows that the conditional density returns at time t is completed by summing up the joint density of the conditional density returns at j jumps and the probability of j jumps at t which is driven by a time-varying Poisson distribution. Notice that λt is time-varying and determined by Eqs. (3) and (4). Furtherly, the distribution of returns conditional on the most recent information set and j jumps is normally distributed as the maximum likelihood estimation method is applied to estimate the parameters. For our specification, the parameters vector θ is (μ, α0, α1, β, θj, σj, λ0, ρ, γ, η) and the likelihood function is

Finally, we estimate the parameters by maximizing the likelihood function (9).

Monte Carlo experiment

Simulation process

We perform a Monte Carlo simulation to evaluate the model’s performance. The setting values for parameters {μ, α0, α1, β, θj, σj, λ0, ρ, γ, η} are {0.01, 0.01, 0.2, 0.75, -3, 0.01, 0.01, 0.6, 0.2, 1}.

Two sample series are created to assess parameter estimation for the ARJI model and the extended ARJI model respectively. For ARJI model testing, a sample series of 3000 observations, which represent the returns governed by the ARJI process, is generated based on the equations from (1) through (4). In particular, we introduce jumps into 5% of the total observations (150 occurrences). Firstly, a jump series is yielded from a normal distribution \(N({\theta }_{j},{\sigma }_{j}^{2})\). Subsequently, we randomly sample the positions of these jumps without replacement and add them to the simulated series at the corresponding positions.

For testing the extended ARJI model, we generate an additional series from a standard normal distribution to represent the external variable. To introduce shocks, we randomly select 14 positions within the entire sample and amplify the values at these positions by multiplying them by 10. Finally, the additional series is incorporated into the returns series based on Eq. (4).

Estimation of the simulated series

We conduct a two-step estimation for the simulated series. Parameters μ, α0, α1, β are estimated by conventional GARCH(1,1) model at the first step. Then the estimates obtained in the first step serve as the initial values for the subsequent model estimation to ensure the finding of global optimization.

As shown in the third column of Table 1, statistically significant at 1%, the estimation of key parameters in the dynamic jump intensity equation results in 0.615 and 0.203 respectively. These estimates closely approximate the true values of 0.6 and 0.2. Moreover, the estimate for the properties of jumps θj is −2.698 while the estimate for \({\sigma }_{j}^{2}\) is 0.0001. Both deviate slightly from the true value of 3 and 0.01. The result is in the range of expectation, given the infrequent occurrence of jumps.

Turning to the extended ARJI model, the estimated coefficient of the external variable is 1.023. The estimate not only accurately approximates the true value of 1 but also demonstrates statistical significance. Additionally, the remaining estimates of the interested parameters in the extended ARJI model closely align with their true values and exhibit statistical significance. The result of parameter estimation for the simulated series confirms that the significance of the interested parameters provides a reliable measure to assess the impact of external shocks.

After estimating the model parameters, we can infer the dynamic of jump intensity at each data point using Eq. (4). Notably, in the ARJI model, the probability of jumps is governed by a Poisson process, determined solely by the parameter of jump intensity λt. As the likelihood of a jump increases with λt, spikes in the jump intensity series can facilitate us to locate the position of possible jumps.

To investigate the jump detection based on the dynamic jump intensity, we examine the location of spikes in the jump intensity series yield by the ARJI model with the recorded position of jumps in the simulation. Figure 1 displays actual jump locations on the series. The upper and bottom two graphs highlight jumps in the simulated series and jump intensity series, respectively. The graphs on the left depict the results of the full sample, while those on the right extract a section of the original sample to emphasize details.

Validation of model’s jump detection through simulated sample. The results of the full sample and magnified details are displayed on the left and right sides, respectively. The green dots and blue squares indicate the positions where jumps are inserted in the simulated returns and the simulated external variable, respectively. The values of dynamic jump intensities inferred after model fitting are depicted in the lower two subgraphs. It is noteworthy that in the simulation, all jump positions align with peaks, particularly noticeable for jumps resulting from external shocks.

As illustrated in the right upper subgraph (simulated returns), it’s important to note that not all extremes represent jumps. Some are influenced by the persistence of volatility following a jump. In the lower right subgraph, all jump positions coincide with peaks, particularly evident for jumps resulting from external shocks (marked in blue). These findings underscore the ARJI model’s sensitivity to actual jumps.

Data and descriptive statistics

Data

The data utilized in this research paper comprises daily closing prices of stock indexes representing six different countries’ stock markets, along with daily confirmed COVID-19 cases and daily COVID-19 related deaths for monitoring the pandemic’s impact. The daily closing prices of these market indexes, namely SSE (China), CAC 40 (France), DAX 30 (Germany), MIB (Italy), FTSE 100 (UK), and S&P 500 (US), are sourced from the Wind Database, covering the period from January 2, 2013, to December 31, 2023. The selection of these specific market indexes is based on two primary criteria: the severity of COVID-19’s impact on the country and the global prominence of the country’s capital market.

To establish the pre- and post-COVID periods for comparison, we center the COVID period, spanning from January 3, 2020, to December 31, 2021. We then extend 2 years before and after this period. Consequently, the pre-COVID period ranged from January 2, 2018, to December 30, 2019, while the post-COVID period covers January 3, 2022, to December 31, 2023. Each period spans an equal length of 2 years, ensuring balanced data representation. The five years prior to the pre-COVID period are utilized to calculate the long-term jump intensity for various stock markets, serving as the baseline.

Additionally, we gather data on daily confirmed COVID-19 cases and daily COVID-19-related deaths for these countries during the COVID period, sourced from the World Health Organization (WHO) database, covering the timeframe from January 3, 2020, to December 31, 2021.

To gauge the stringency of COVID-19 measures implemented by these countries, we employ the stringency index developed by Oxford University. This index is accessed from The Oxford Covid-19 Government Response Tracker website.

Descriptive statistics

The daily index returns are calculated as follows:

where Pt and Pt are the closing prices of index returns on day t and t − 1, respectively.

Figures 2, 3, and 4 present the dynamic of the daily closing prices and the daily returns of the six indexes in the full sample period. The plots of the daily closing prices focus on illustrating the index movement trend while the plots of the daily returns address the distinguished extreme price movement between the pre-COVID period, the COVID period, and the post-COVID period.

The dynamics of the daily closing prices (upper) and the daily returns (bottom) of indexes from 2018 to 2023. Specifically, the SSE of China and CAC40 of France are positioned on the left and right sides, respectively. The background area shaded in sky blue distinguishes the situation during the COVID period from the pre-COVID and post-COVID periods. Notably, a significant plunge in the index can be observed at the beginning of 2020.

The dynamics of the daily closing prices (upper) and the daily returns (bottom) of indexes from 2018 to 2023. Specifically, the DAX30 of Germany and MIB of Italy are positioned on the left and right sides, respectively. The background area shaded in sky blue distinguishes the situation during the COVID period from the pre-COVID and post-COVID periods. Notably, a significant plunge in the index can be observed at the beginning of 2020.

The dynamics of the daily closing prices (upper) and the daily returns (bottom) of indexes from 2018 to 2023. Specifically, the FTSE100 of UK and SP500 of USA are positioned on the left and right sides, respectively. The background area shaded in sky blue distinguishes the situation during the COVID period from the pre-COVID and post-COVID periods. Notably, a significant plunge in the index can be observed at the beginning of 2020.

No matter how they had performed in the pre-COVID period, all six indexes fell sharply at the beginning of the outbreak of COVID-19 and then experienced a long recovery period. Due to the effect of the most stringent mandatory policies on the economy, the index returns in China remained weak until July 2020, whereas the index returns in the US had rebounded quickly after the plunge regardless of the grave COVID-19 development. The indexes’ returns in European countries and the UK moved in a similar trend. Their recoveries started slowly at the beginning and then sped up after the turning point in November 2020. As for the plots of daily returns, we notice that all indexes illustrate more extreme ups and downs during the COVID period.

Table 2 presents the summary statistics for the daily index returns during the COVID period. There is no doubt that the impact of COVID-19 on the market is negative in general since we observe that the index returns exhibit lower skewness in the COVID period. In addition, the kurtosis of index returns for all countries is higher in the COVID period.

Following the previous literature, we employ daily confirmed cases NCt and daily cases of death NDt as two indicators for COVID-19 monitoring. Here, NCt is the number of daily confirmed cases of a given country on day t, and NDt is the daily cases of death of a given country on day t.

Figures 5 and 6 display the daily confirmed cases and death cases of six countries to show the development trend and scale of daily confirmed cases and daily cases of death from COVID-19 for six countries respectively. There are three waves of COVID-19 through Jan 2020 to Dec 2021. The wave peaked in the winter season and fell in the summer season. Except for China, the rest five countries are affected by three round outbreaks of COVID-19 variants. The US recorded both the highest confirmed cases and the highest death cases.

The development trend and scale of daily confirmed cases from COVID-19 for six countries respectively. There are three waves of COVID-19 from Jan 2020 to Dec 2021. The wave peaked in the winter season and fell in the summer season. Except for China, the rest five countries are affected by three round outbreaks of COVID-19 variants. The US recorded the highest confirmed cases.

The development trend and scale of daily cases of death from COVID-19 for six countries respectively. There are three waves of COVID-19 from Jan 2020 to Dec 2021. The wave peaked in the winter season and fell in the summer season. Except for China, the rest five countries are affected by three round outbreaks of COVID-19 variants. The US recorded the highest death cases.

Table 3 exhibits the summary statistics of the daily confirmed cases and death cases for six countries. Although China encountered the first round of attack from COVID-19, the average daily confirmed cases and death cases, which are 140.71 and 6.33 respectively in the sample period, suggest that China controlled COVID-19 successfully by imposing the stringent lockdown and quarantine at the emergence of confirmed cases. On the contrary, the average daily confirmed cases and death cases for the US recorded 74877.08 and 1131, the highest among six countries. The fact implies that the US struggled to suppress the spread of the virus and backlashed during the COVID-19 outbreak due to the lagged response and the haste mandates lifting. The European countries and the UK experienced a hard moment during the outbreak of COVID-19 and mitigated the pandemic through more efficient mandatory measures. Italy recorded 203.04, the highest daily death cases among 4 countries because of the fatality in the older population while Germany displayed 153.32, the lowest daily death cases due to its leading healthcare capacity.

Empirical results

Impact of COVID-19 on market jumps

In this section, our objective is to utilize multiple methods to examine the significance of COVID-19 in jump dynamics. We not only compare jump frequencies between the COVID period and the pre-COVID and post-COVID periods but also conduct a DID experiment to cross-validate the assumption.

As the frequency of jumps over a given time span serves as an empirical measure of jump intensities, by comparing the counts of jumps during and outside the COVID period, we can analyze whether there is a noticeable effect on the dynamics of jumps, namely the market reaction to the uncertainty.

To obtain the frequency of jumps, we use the full sample ranging from 2013 through the end of 2023 to estimate the coefficients of the ARJI model. Then we infer the series of dynamic jump intensities and focus on the period of interest from 2018 to 2023. Considering data balance, we designate the timeframe from January 1, 2020, to December 31, 2021, as the COVID period, while the periods from January 1, 2018 to December 31, 2019 and January 1, 2022 to December 31, 2023, are designated as the pre-COVID and post-COVID periods, respectively, for comparison.

Table 4 presents parameter estimations. All coefficients, except for ρ, are statistically significant. Notably, across six indexes, the consistent pattern emerges where γ approaches 1 while ρ tends towards 0. This pattern is deemed highly effective for pinpointing the location of jumps at each peak of the jump intensity series, primarily attributed to its characteristic of swift responsiveness and minimal persistence.

Next, we standardize the original jump intensity series and filter out the values of jump intensity greater than 3. The annual frequency of jumps is then calculated by counting the detected jumps per year. Figures 7 and 8 depict the results of this process applied to all six indexes. The left subplot demonstrates the identification of jumps, with values surpassing the threshold marked by a dashed green line recognized as jumps. The right subplot showcases the counts of annual jumps across three periods: pre-COVID, COVID, and post-COVID.

The annual jumps detected by model for Italy, France, and Germany. The left subplot demonstrates the identification of jumps, with values surpassing the threshold marked by a dashed green line recognized as jumps. The right subplot showcases the counts of annual jumps across three periods: pre-COVID, COVID, and post-COVID. The pattern of jumps' dynamics across European countries follows a similar trajectory.

Two important findings can be concluded from the analysis of Figs. 7 and 8. First, the pattern of jumps’ dynamics across European countries follows a similar trajectory: starting from a baseline level prior to the COVID period, escalating to its peak during the pandemic’s outbreak in 2020, and subsequently returning to pre-pandemic levels.

The annual jumps detected by model for China, USA, and UK. The left subplot demonstrates the identification of jumps, with values surpassing the threshold marked by a dashed green line recognized as jumps. The right subplot showcases the counts of annual jumps across three periods: pre-COVID, COVID, and post-COVID. Distinguished from others, the annual jump frequency of the Chinese index is low in 2021 but high in 2022.

Secondly, the annual jump frequency of the Chinese index exhibits a distinct dynamic compared to the other indexes. Unlike the others, its jump frequency is low in 2021 but high in 2022. This discrepancy provides evidence to support the impact of COVID-19 on market uncertainty, as it aligns with the dramatic U-turn experienced by China. In 2021, the Chinese economy benefited, while in 2022, it suffered due to its adherence to a zero-COVID policy while disregarding the evolution of the virus.

Table 5 displays a summary of the annual frequency of jumps across six indexes. The average represents the mean value of the annual frequency of jumps spanning ten years from 2013 to 2023. Let us focus on the average value of annual jump frequency shown in the last row of Panel B. During the COVID period, there is a notable and typical peak in jump frequency. The average annual jump frequency across six indexes reached the highest at 7.8 during the COVID period, while 6.8 at the pre-COVID period and 5.9 at the post-COVID period.

The box plot in Fig. 9 provides additional visualization of this distinctive pattern. Besides the difference in mean value, the interquartile range of jump frequency during the COVID period is evidently smaller compared to the other two periods across indexes. This underscores the consistency of market reactions across different countries to the same source of uncertainty-the evolution of the pandemic.

The box plot of annual jump frequencies for six indexes in three periods. The box plot during the COVID period is highlighted in red, indicating a higher mean value. It is evident that the interquartile range of jump frequency during the COVID period is smaller compared to the other two periods across indexes.

Next, we undertake a Difference-in-Differences (DID) experiment to gather more robust statistical evidence regarding the impact of COVID-19 on the dynamics of jumps in financial markets. The divergent development of COVID-19 between China and the rest countries offers an opportunity to examine the contrasting jump intensities of indexes between the groups of countries. For the experiment design, China is selected as the treatment group which effectively controlled the spread of COVID-19 during the second wave while control groups consist of Italy, France, Germany, the USA, and the UK, which experienced a significant spread of COVID-19 during the second wave. To distinguish between groups, we introduce two dummy variables. The treatment dummy, labeled as ‘Treat_dum’, takes the value of 1 for observations belonging to the Chinese group, and 0 otherwise. Similarly, the event dummy, denoted as ‘Event_dum’, is set to 1 for observations falling between August 1, 2020, and August 1, 2021, and 0 otherwise. The DID variable is then calculated as the interaction term of Treat_dum × Event_dum.

where JFit represents the monthly jump frequency, which is the number of jumps detected by the ARJI model within each month. Treat_dumi and Event_dumt denote the treatment and event dummies, respectively, while DIDit represents the DID variable.

We attempt to test whether the coefficient of the interaction term is statistically significant. A significant coefficient indicates that the treatment (China’s effective control of COVID-19 during the second global wave) had a differential impact on jump frequency compared to the control group.

Table 6 presents the results. The DID estimator is −0.0218, which is statistically significant at the 5% level. Additionally, both Event_dum and Treat_dum are statistically significant. Specifically, all signs of variables in the DID regression align with the underlying assumptions. The positive sign of Event_dum indicates a higher jump frequency during the second wave of COVID-19 spread, while the negative signs of Treat_dum and DID signify the contrasting situation in the Chinese stock market. The lower jump frequency is not incidental when considering China’s successful control of COVID-19 during the same period.

Panel B of Table 6 illustrates the diverging trends in jump frequency between the treatment and control groups from the outside event period to the event period. Specifically, the jump frequency decreases in the group of China, while it increases in the group of rest countries, as observed from the first to the second column.

Overall, multiple pieces of evidence strongly support the causal relationship between COVID-19 and the dynamic of market jumps. The surge in annual jump frequency during the COVID period, compared to both the pre-COVID and post-COVID periods, along with the DID test, provides cross-validation for this conclusion.

The role of COVID-19 information in market jumps

When delving into how COVID-19 impacts market jumps, our focus shifts to pandemic tracking indicators, aiming to investigate their role in the variation of market jumps. However, examining the relationship between pandemic tracking indicators and monthly jump frequency proves infeasible due to data frequency mismatch. Pandemic tracking indicators are recorded daily, resulting in information loss if aggregated into monthly frequencies. Additionally, averaging indicator values by month could obscure crucial details, such as rare yet significant surges or drops in pandemic tracking indicators. Consequently, we employ an extended ARJI model to evaluate the significance of coefficients of pandemic tracking indicators on jump intensity within the model.

Parameter estimation for extended ARJI models across six countries

In our empirical study, we estimate four extended ARJI models which include the daily confirmed cases (NCt), the one-day lag of daily confirmed cases (NCt−1), the daily death cases (NDt) and the one-day lag of daily death cases (NDt−1) respectively for the COVID period. The introduction of various indicator’s formulation in the model aims to maximize the probability of detecting potential influences on market jumps.

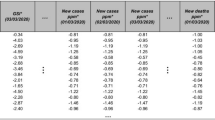

Tables 7, 8, and 9 report the results of model estimation for six index returns during the COVID period respectively. For instance, as shown in panel A of Table 7, the result for the index returns of China (SSE) consists of four specified ARJI model estimations for the COVID period. For our study, we are interested in the estimated parameter of η, namely the coefficient of the COVID-19 development on the jump intensity.

Focus on the estimated parameter η from the extended ARJI model for the COVID period across different countries, we notice that all the estimated parameters η for six countries are positive. It is more possible to see a jump in index returns when the daily confirmed cases or death cases grow. Further, the findings can be classified into three categories, China, the US and the rest (European countries and the UK). For China, as shown in panel A of Table 7, the estimated parameters for NCt and NCt−1 are 0.538 and 0.537, significant at 1% level respectively while the estimated parameters for NDt and NDt−1 are statistically insignificant. The results are in line with the findings (Al-Awadhi et al., 2020) that the impact of the total number of deaths is smaller than the total number of confirmed cases in China’s stock market. On the contrary, as shown in panel F of Table 5, none of the estimated parameters is statistically significant in the index returns of the US market.

For the category of European countries and the UK, the results seem to be complicated. Reported in panel B of Table 7, panels C and D of Table 8, and panel E of Table 9, the estimated parameter NDt−1 (the one-day lag of death cases) for France, Germany, Italy, and the UK are 0.549, 0.554, 0.488 and 0.508, all statistically significant at 1% respectively. Different from China and the US, the effectiveness of the daily death cases from COVID-19 on the jump intensity is a unique feature shared by European countries and the UK. We also notice that the jump occurrence in the French stock market is the most sensitive to the development of the COVID-19 pandemic. Both the instantaneous and the lags of pandemic information affect the jump intensity. The estimated parameters of NCt, NCt−1, NDt and NDt−1 are 0.546, 0.549, 0.526, and 0.549, significant at 1% level respectively. In contrast, the fact that only the parameter NDt−1 is estimated statistically for the UK illustrates that the British stock market is the least sensitive to the pandemic. The estimated parameters of NCt−1, NDt and NDt−1 are significant for Germany, while NCt and NDt−1 are significant for Italy.

Robustness test

To assess robustness, we employ a basic regression analysis to explore the relationship between weekly occurrences of extreme events and pandemic tracking indicators. Given the challenge of identifying daily fluctuations, we opt to aggregate the data into weekly extremes and examine whether there is any compelling evidence suggesting that pandemic tracking indicators influence the frequency of these extreme events. Extreme values are detected when the daily index returns surpass a threshold of twice the standard deviation of the index returns. Subsequently, these extreme values are tallied on a weekly basis. Weekly aggregates are computed for the daily confirmed cases and deaths to align their frequency with that of the weekly extreme values. To enhance the analysis, we then compute the differences in weekly confirmed cases and deaths to ensure the stationarity of the series, thus preventing spurious regressions.

Table 10 displays the results of a regression analysis conducted across six countries, assessing the relationship between cases and deaths and their impact on the frequency of weekly extremes. Panels A and B respectively illustrate the effects of cases and deaths on the frequency of weekly extremes. These findings align with the findings from the extended ARJI model.

For China, the coefficient associated with cases is statistically significant, while the coefficient for deaths is not. In the case of the United States, none of the variables exhibit statistical significance. In the EU and UK groups, with the exception of Germany, we have observed that the coefficient for the variable daily deaths is statistically significant. This constitutes an important distinguishing feature when compared to other groups.

Insights into the varying effective indicators across countries

Using the extended ARJI model, we have successfully observed that investors tend to exhibit overreactions in response to the progress of the pandemic in different countries. What’s even more intriguing is that we have found variations in investor responses to pandemic tracking indicators across different countries. This phenomenon suggests the existence of a spillover effect of government responses to COVID-19 on financial markets.

What distinguishes COVID-19 from other pandemics like MERS and H1N1 is the implementation of measures such as quarantine and lockdowns by countries to control the virus’s spread, which dampens economic activities and severely impacts market confidence. It’s essential to recognize that government actions primarily aim at controlling the virus, but their impact can extend to the financial markets. The design principles and the level of stringency in implementing these measures can lead to varying market reactions.

Table 11 provides a comprehensive overview of the stringency index for six countries, while Fig. 10 serves as a visual representation of these results. The stringency index proposed by the University of Oxford is a widely used composite score ranging from 0 to 100 (100 = strictest), to evaluate the degree of measures by the major countries during the COVID-19. From January 3, 2020, to December 31, 2021, China exhibited the highest average stringency index of 69.73, while the United States showed the lowest at 56.94. European countries, having faced severe waves of COVID-19 during the winter period, recorded maximum stringency index values ranging from 85.19 to 93.52, surpassing the values of 81.94 and 75.46 observed for China and the US, respectively.

By implementing restrictive measures, a country engages in a trade-off between its economy and the mitigation of COVID-19 transmission. Therefore, we propose a “stringency cases ratio" as a means to compare this trade-off across countries. This ratio is calculated by dividing the stringency value by the daily confirmed cases (expressed per 1000 persons).

As shown in the last row of Table 11, we notice that countries can be categorized into three groups: China, the US, and European countries including the UK. China and the US represent the extremes with stringency case ratios of 495.56 and 0.76, respectively. These findings indicate that China initially imposed stricter measures early in the COVID-19 transmission, maintaining them for an extended period, while the US exhibited a slower response, intensifying efforts later due to its decentralized political system and economic considerations. For European countries and the UK, the stringency cases ratio ranged from a minimum of 3.26 to a maximum of 8.16. These results suggest that European countries endured the COVID-19 outbreak waves but were able to curtail the scale of the outbreak through the implementation of effective measures.

Moreover, for a comprehensive examination of the divergent developments and interactions of COVID-19 across nations, we have chosen four key variables for hierarchical clustering analysis. These variables encompass daily confirmed cases, daily death cases, the stringency index, and the stringency cases ratio, serving as metrics for assessing the pandemic’s scale, severity, policy stringency, and policy effectiveness.

Before performing the agglomerative analysis using the Ward method, we standardized each variable. Figure 11 displays the dendrogram, illustrating the relative similarities among six countries. Based on the hierarchical clustering distance, we observe that France, Germany, the UK, and Italy form one distinct group, indicating a higher degree of similarity among these countries. On the other hand, China and the US form two separate, independent groups, each exhibiting distinct features and characteristics.

Figure 12 provides a more detailed illustration of the diversification observed among the three cluster groups. The cluster center associated with China is distinguished by the highest values in stringent ratio and stringency, coupled with low values in deaths and cases. This feature highlights that China stands out for its stringent policies and effective virus containment measures, resulting in an outstanding performance in metrics of scale and severity. Conversely, the cluster center representing the United States reveals lower scores in metrics of stringent ratio and stringency, resulting in a dismal performance in metrics associated with deaths and cases. These outcomes suggest that the United States followed a different approach, characterized by less stringent control measures and a faster initial spread of the virus.

Radar chart of the cluster centers for three groups. The areas shadowed in sky-blue represent China, red represents the USA, and yellow represents the group of the rest countries. It is evident that several European Union countries exhibit a more balanced set of values across the four metrics while China and USA are two extremes.

A more balanced set of values across the four metrics is observed among several European Union countries, including the UK, placing them within the same group. This outcome emphasizes that these countries, beyond their geographical proximity, have adopted a similar strategy that relies on implementing public control policies to effectively curb the spread of COVID-19.

Overall, our findings strongly support the idea that the nature and extent of pandemic-related information significantly influence fluctuations in index returns and are closely tied to a country’s strategies for addressing the COVID-19 pandemic. It is evident that government actions aimed at suppressing the virus have a critical impact on the market, as these measures often involve business closures and restrictions on mobility. Consequently, investor reactions to pandemic developments are largely shaped by their assessment of potential government policies, which, in turn, depend on the country’s overall strategy and previous implementations.

Among the six countries examined, China stands out for its zero tolerance for COVID-19 policy, which involves strict restrictions implemented early in the pandemic. Therefore, it is not surprising that our empirical studies show the significance of daily confirmed cases, rather than daily death cases, as a key factor. This is because the stringent measures were already activated once a small number of confirmed cases were detected, before the onset of deaths.

In contrast, European countries have balanced the negative economic impact with COVID-19 control, particularly after achieving primary vaccination coverage. Their focus has shifted to the capacity of the healthcare system as a critical threshold for implementing measures. The significance of the estimated parameter for daily death cases provides compelling evidence that healthcare system overload increases investor anxiety and the likelihood of stock market fluctuations.

Regarding the United States, neither the proxy for the scale of the pandemic (daily confirmed cases) nor the proxy for its severity (daily death cases) shows significance in our parameter estimation. These findings align with the decentralized nature of the US federalist system, where strict nationwide lockdown measures were challenging to implement. Additionally, the US has shown greater tolerance for surges in COVID-19 cases following the introduction of vaccines.

Implications for policy formulation

The findings regarding variations in investor responses to pandemic tracking indicators across different countries are indeed intriguing. This observation underscores the complex challenge of policy-making, where the spillover effects of policies can often lead to unintended consequences. Sometimes, even well-intentioned policies may not yield the desired outcomes due to unforeseen side effects caused by the singular focus of the policy.

Our findings underscore the importance of adopting a comprehensive approach when crafting policies in response to a new public health emergency. This approach must carefully weigh virus control measures against the need to sustain economic activities. Achieving the right equilibrium is essential to ensure that the policy not only efficiently addresses the health crisis but also preserves the stability of the economy.

Another crucial aspect to consider is the role of market crashes, which are often triggered by sudden, sharp price fluctuations. These abrupt changes in asset prices can have a profound impact on investor sentiment, leading to panic and herding behavior in the market. Our empirical analysis has identified that anxiety stemming from the anticipation of future control measures plays a central role in these market jumps.

To mitigate market volatility during a pandemic, it is essential to address investor anxiety. Implementing measures to soothe investor concerns and uncertainty can be an effective solution. This could involve providing transparent and timely information regarding policy intentions and control measures. Additionally, clear communication from regulatory authorities and central banks can help reassure investors and prevent them from making hasty, emotional decisions.

Conclusion and further directions

In this paper, we delve into the intricate relationship between pandemic monitoring indicators and the dynamics of jumps in six major financial markets, namely China, France, Italy, Germany, the UK, and the US. Specifically, we utilize daily confirmed COVID-19 cases and daily COVID-19 death cases as proxies for assessing the development of the pandemic. These proxies are then integrated into the time-varying jump intensity equation of the ARJI model, as originally proposed by Chen et al., (2002). This extension allows us to investigate how jump intensity responds to changes in the indicators of COVID-19 development.

To gauge the impact of the COVID-19 pandemic on global capital markets, we compare the average jump intensity observed before and during the pandemic. Our analysis reveals that during the COVID period, there were notably higher jump intensities in the six index returns when contrasted with the pre- and post-COVID periods. These findings indicate that jumps occurred with greater frequency in the index returns following the outbreak of the COVID-19 pandemic.

Next, we investigate the impact of proxies for COVID-19 monitoring on the time-varying jump intensity over six index returns. We have identified three distinct scenarios pertaining to six different countries in relation to the impact of COVID-19. In the case of China, it is observed that the daily confirmed cases, as opposed to the death cases, exert a notable influence on the jump intensity. However, it is noteworthy that none of the pandemic proxies seem to have any discernible effect on the US stock market. Conversely, when examining European countries and the UK, a consistent and statistically significant relationship emerges between daily death cases and jump intensity in all of these nations. Particularly noteworthy is the variation in the sensitivity of market jumps to pandemic-related information, with France exhibiting the highest sensitivity and the UK displaying the lowest sensitivity among these countries.

It is evident that government actions aimed at suppressing the virus have a critical impact on the market, as these measures often involve business closures and restrictions on mobility. Consequently, investor reactions to pandemic developments are largely shaped by their assessment of potential government policies, which, in turn, depend on the country’s overall strategy and previous implementations.

Furthermore, our findings reveal a novel fact that the type and the extent of pandemic information on jumps in the index returns are associated with the country’s strategies to tackle the COVID-19 pandemic. The results reflect the divergence of strategies for COVID-19 across countries. The strategies of zero tolerance for COVID-19, maximum healthcare capacity, and less tolerance for restriction are implemented by China, European countries, and the US, respectively.

These findings can serve as a valuable source of inspiration for policymakers when formulating public policies during the pandemic. By incorporating considerations of economic impact and leveraging both economic activities and public healthcare, policymakers can minimize the unintended adverse consequences of pandemics on financial markets.

However, our study has several limitations that need to be addressed. Firstly, our research is based on data from only six financial market indices. While we made efforts to select representative financial markets from major continents, there are numerous other markets that were not included in our analysis. This may introduce bias into our results. Secondly, we relied on data from the World Trade Organization (WTO), which is widely used in most COVID-19 related literature. However, there have been debates and concerns about the accuracy of the reported number of COVID-19-related deaths in China during the pandemic. This underestimation could potentially impact some of our conclusions. In future research, we intend to mitigate these limitations by expanding our sample of countries and including more emerging financial markets in our analysis. This will allow us to draw more robust and comprehensive conclusions about the relationship between financial markets and the COVID-19 pandemic.

Data availability

The dataset for the empirical analysis can be derived from Wind database. Daily confirmed COVID-19 cases and daily COVID-19-related deaths for these countries during the COVID period, sourced from the World Health Organization (WHO) database. The stringency index is accessed from The Oxford Covid-19 Government Response Tracker website. We have uploaded these data as supplementary information, which can be obtained.

References

Ahmad W, Kutan AM, Gupta S (2021) Black swan events and covid-19 outbreak: sector level evidence from the US, UK, and European stock markets. Int Rev Econ Finance 75:546–557

Al-Awadhi AM, Alsaifi K, Al-Awadhi A, Alhammadi S (2020) Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. J Behav Exp Finance 27:100326

Albulescu CT(2021) Covid-19 and the United States financial markets’ volatility Finance Res Lett 38:101699

Apergis N, Apergis E (2022) The role of COVID-19 for chinese stock returns: evidence from a garchx model. Asia-Pac J Acc Econ 29:1175–1183

Alqahtani ASS, Selmi R, Hongbing O(2021) The financial impacts of jump processes in the crude oil price: evidence from g20 countries in the pre- and post-covid-19 Resour Policy 72:102075

Ashraf BN(2020) Stock markets’ reaction to covid-19: Cases or fatalities? Res Int Bus Finance 54:101249

Baker SR, Bloom N, Davis SJ, Kost KJ, Sammon MC, Viratyosin T (2020) The unprecedented stock market impact of COVID-19. Technical report, National Bureau of Economic Research

Bannigidadmath D, Narayan PK, Phan DHB, Gong Q(2022) How stock markets reacted to COVID-19? evidence from 25 countries Finance Res Lett 45:102161

Bora D, Basistha D (2021) The outbreak of COVID-19 pandemic and its impact on stock market volatility: evidence from a worst-affected economy. J Public Affairs 21:e2623

Chan WH, Maheu JM (2002) Conditional jump dynamics in stock market returns. J Bus Econ Stat 20:377–389

Chatjuthamard P, Jindahra P, Sarajoti P, Treepongkaruna S (2021) The effect of COVID-19 on the global stock market. Acc Finance 61:4923–4953

Chowdhury EK(2022) Strategic approach to analyze the effect of COVID-19 on the stock market volatility and uncertainty: a first and second wave perspective J Capital Markets Stud 6:225–241

Chowdhury EK, Dhar BK, Stasi A(2022) Volatility of the us stock market and business strategy during covid-19 Bus Strat Dev 5:350–360

Chowdhury EK, Khan II, Dhar BK(2022) Catastrophic impact of COVID-19 on the global stock markets and economic activities Bus Soc Rev 127:437–460

Ftiti Z, Ameur HachmiBen, Louhichi Waël (2021) Does non-fundamental news related to COVID-19 matter for stock returns? evidence from Shanghai stock market. Econ Modell 99:105484

Fu M, Shen H (2020) Covid-19 and corporate performance in the energy industry. Energy Res Lett 1:12967

Iqbal N, Manzoor MuhammadSaqib, Bhatti MuhammadIshaq (2021) Asymmetry and leverage with news impact curve perspective in Australian stock returns’ volatility during COVID-19. J Risk Financial Manag 14:314

John K, Li J (2021) Covid-19, volatility dynamics, and sentiment trading. J Banking Finance 133:106162

Kunjal D, Peerbhai F (2021) Investor herding during COVID-19: evidence from the South African exchange traded fund market. Afr Rev Econ Finance 13:168–185

Lahaye Jérôme, Laurent Sébastien, Neely CJ (2011) Jumps, cojumps and macro announcements. J Appl Econom 26:893–921

Lee C-C, Lee C-C, Wu Y (2021) The impact of COVID-19 pandemic on hospitality stock returns in China. Int J Finance Econ 28:1787–1800

Lee SS, Mykland PA (2008) Jumps in financial markets: a new nonparametric test and jump dynamics. Rev Financial Stud 21:2535–2563

Liu W, Gui Y, Qiao G (2022) Dynamics lead-lag relationship of jumps among chinese stock index and futures market during the Covid-19 epidemic. Res Int Bus Finance 61:101669

Mazur M, Dang M, Vega M (2021) Covid-19 and the march 2020 stock market crash. evidence from s&p1500. Finance Res Lett 38:101690

Narayan PK, Devpura N, Wang H(2020) Japanese currency and stock market-what happened during the Covid-19 pandemic? Econ Anal Policy 68:191–198

Narayan PK, Gong Q, Joher Ali Ahmed H(2022) Is there a pattern in how COVID-19 has affected Australia’s stock returns? App Econ Lett 29:179–182

Narayan PK, Phan DHB, Liu G(2021) Covid-19 lockdowns, stimulus packages, travel bans, and stock returns Finance Res Lett 38:101732

Phan DHB, Narayan PK(2020) Country responses and the reaction of the stock market to covid-19-a preliminary exposition Emerg Mark Finance Trade 56:2138–2150

Rahman MdLutfur, Amin A, Al Mamun MohammedAbdullah (2021) The covid-19 outbreak and stock market reactions: evidence from Australia. Finance Res Lett 38:101832

Salisu AA, Vo XuanVinh (2020) Predicting stock returns in the presence of covid-19 pandemic: the role of health news. Int Rev Financial Anal 71:101546

Tripathi A, Pandey A (2021) Information dissemination across global markets during the spread of covid-19 pandemic. Int Rev Econ Finance 74:103–115

Uddin M, Chowdhury A, Anderson K, Chaudhuri K (2021) The effect of COVID-19 pandemic on global stock market volatility: can economic strength help to manage the uncertainty? J Bus Res 128:31–44

Uddin GS, Yahya M, Goswami GG, Lucey B, Ahmed A(2022) Stock market contagion during the COVID-19 pandemic in emerging economies Int Rev Econ Finance 79:302–309

Xu D (2022) Canadian stock market volatility under covid-19. Int Rev Econ Finance 77:159–169

Zeng Q, Lu X, Li T, Wu L (2022) Jumps and stock market variance during the covid-19 pandemic: evidence from international stock markets. Finance Res Lett 48:102896

Zhang Y, Zhou L, Chen Y, Liu F (2022) The contagion effect of jump risk across Asian stock markets during the covid-19 pandemic. N Am J Econ Finance 61:101688

Author information

Authors and Affiliations

Contributions

Conceptualization and methodology: Min Zhu; Data collection and emprical study: Shan Wen and Min Zhu ; Writing - Original Draft Preparation: Min Zhu; Writing - Review and Editing: Min Zhu and Yuping Song.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zhu, M., Wen, S. & Song, Y. Impact of COVID-19 on jump occurrence in capital markets. Humanit Soc Sci Commun 11, 820 (2024). https://doi.org/10.1057/s41599-024-03357-y

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-03357-y

This article is cited by

-

A New Fractal Method for the Modelling and Analysis of Financial Time Series

Computational Economics (2025)