Abstract

As society continues to develop, a growing body of research is focusing on how informal institutions, such as culture, influence corporate behavior and economic outcomes. The aim of this study is to explore the impact of cultural inclusiveness, as a non-formal institution, on firm performance. Using Chinese A-share listed firms as our sample, we employ econometric methods to analyze the relationship between cultural inclusiveness and firm performance. Our findings reveal that cultural inclusiveness enhances firm performance, particularly evident in regions with higher levels of cultural inclusiveness, where firms tend to exhibit higher return on equity. To address concerns of endogeneity, instrumental variable regression using regional topographical changes is employed. Mechanism testing indicates that cultural inclusiveness primarily improves firm performance by reducing financial constraints and optimizing employee structure. Additionally, the study finds that cultural inclusiveness has a more pronounced impact on firms with higher corporate social responsibility (CSR) performance as well as those with greater investment in research and development (R&D). This study provides a comprehensive empirical explanation of how cultural inclusiveness influences the sustainable operation of businesses.

Similar content being viewed by others

Introduction

Informal institutions refer to a range of norms, practices, values, and social customs that exist within an organization or society but are not codified as formal laws or regulations (Lei et al. 2022; Guiso et al. 2006; Mao et al. 2024a). Despite their informal nature, these institutions exert significant influence on individual behavior and organizational functioning (Chen et al. 2014; Sun et al. 2023a). Among these informal systems, regional culture stands out as a crucial factor with profound effects on individuals, organizations, and societies (Li et al. 2024; Mao et al. 2024a). According to institutional economics theory, local culture shapes internal operations and interpersonal relationships within a firm, thereby impacting management practices and corporate governance styles (Chen et al. 2014; Lei et al. 2022; North, 1991; Sun et al. 2023a). This influence becomes particularly noteworthy in developing countries where legal frameworks are weak, as informal institutions such as culture often play a more prominent role in regulating corporate behavior and business activities (Allen et al. 2005; Griffin et al. 2021; Mao et al. 2024b; Li et al. 2013). Understanding how local culture affects sustained firm performance in such environments can provide valuable insights into specific contexts, including operational methods and decision-making orientation. Conducting in-depth research on the impact of regional culture on firm performance enables business decision-makers to access comprehensive and accurate information, facilitating optimized business management and improved operational efficiency (Abbasi et al. 2021; Sun et al. 2023b).

Our research aims to investigate the impact of regional cultural inclusiveness on firm performance and the mechanisms underlying this relationship. Cultural inclusiveness at the local level refers to the degree to which individuals from diverse backgrounds are accepted and respected within the community, with an emphasis on understanding and equal treatment (Shore et al. 2011; Sun et al. 2023a; Sun et al. 2023b). The cultural environment can have a dual effect on firm performance (Guiso et al. 2009; Leslie and Flynn 2022; Leung and Wang 2015; Mao et al. 2024a). On the one hand, regional cultural inclusiveness may help firms to overcome cultural barriers, enhancing their competitiveness and adaptability in the market (Sun et al. 2023a; Wang et al. 2022). In a relatively inclusive environment, firms are exposed to diverse cultural factors, providing a more varied perspective and approach to business decision-making (Shore et al. 2011; Shore et al. 2018; Sun et al. 2023b), thereby exerting a positive influence on firm performance.

However, it is important to note that cultural inclusiveness may have negative impacts on firm performance. On the one hand, inclusive culture may lead to reduced efficiency in team collaboration (Shore et al. 2011; Xie and Zhu 2022). The presence of diverse cultural backgrounds within a firm’s workforce can make communication and understanding between employees more challenging, despite the attractive nature of local inclusive cultural traits that can draw in a wider range of individuals (Audretsch et al. 2010; Faccio et al. 2016; Khan and Kalra 2022; Lei et al. 2022; Liu et al. 2011). If the firm fails to implement effective communication and training strategies, these cultural differences could result in internal conflicts and reduced cooperation among team members (Arbatli et al. 2020; Johnson et al. 2018).

Therefore, it is important to empirically examine how cultural inclusiveness affects the sustainable operation of firms. This has implications for whether the government should promote inclusive policies and whether cities need to engage in inclusive cultural construction. At a more micro level, this can also provide comprehensive and accurate information for business decision-makers in the process of formulating corporate strategies and creating corporate culture, which can help optimize business management and improve operational efficiency.

To explore this issue, we took Chinese A-share listed firms as a sample and conducted a more in-depth study on the relationship between cultural inclusiveness and firm performance. Initially, we employed linear regression to examine the basic correlation between cultural inclusiveness and firm performance. We found that local cultural inclusiveness significantly promotes enhanced firm performance. Subsequently, we utilized topographical changes at the local level as instrumental variables to mitigate potential endogeneity concerns associated with the study of cultural inclusiveness. Furthermore, we conducted a mechanism analysis of cultural inclusiveness. We discovered that cultural inclusiveness has effects on both financial and employee structure dimensions. Specifically, cultural inclusiveness promotes firm performance by alleviating financing constraints and improving employee structure. Additionally, we examined the heterogeneity effects brought about by cultural inclusiveness through the dimensions of corporate social responsibility performance and firm research and development investment. This further aids in understanding the potential economic consequences of cultural inclusiveness.

The remaining sections of this paper are as follows. In section two, we reviewed the literature on the antecedents of firm performance and identified how our study fills gaps in the existing field. Moreover, we conducted a more profound exploration of the connotation of cultural inclusiveness and proposed the related mechanism hypotheses that affect firm performance. In section three, we disclosed the data sources used in this study and how we constructed our initial sample. In section four, we reported the primary empirical results of the paper, including the main regression analysis, endogeneity handling, and various robustness checks. In section five, we further analyzed the mechanisms and heterogeneity effects of cultural inclusiveness. Finally, we discussed our research in the context of relevant literature, highlighting the potential theoretical contributions and practical implications. Additionally, we summarized the limitations of our study and future research directions and concluded the entire paper.

Literature review and theoretical analysis

Literature review

Firm performance is the result of strategic decision-making and operational activities within a firm. Current research on the antecedents of firm performance primarily focuses on formal institutions and firm characteristics. Exploring firm performance from the perspective of informal institutions is also a highly regarded topic, yet such studies predominantly address how internal cultural features within firms influence performance.

Formal institutions have a significant impact on firm performance in several ways. Increased policy uncertainty and legal environments affect decision-making difficulties for managers (Gulen and Ion 2016; Julio and Yook 2012). When faced with high levels of external institutional uncertainty, firms tend to adopt conservative strategic decisions, such as reducing investment activities, cutting back on research and development expenditures, and increasing cash holdings, thereby negatively affecting their operational performance (Jens 2017; Phan et al. 2019; Xu 2020). The legal environment is an important component of formal institutions. Sound legal systems not only safeguard economic growth but also contribute to enhancing corporate governance (LaPorta et al. 1997; LaPorta et al. 1998). Strengthening intellectual property rights protection is a direct manifestation of an improved legal system. Enhanced protection discourages patent infringement, reduces the possibility of intellectual property theft and counterfeiting, stimulates research and development confidence and investment, and positively influences firm performance (Fang et al. 2017; Kafouros et al. 2015). Furthermore, government subsidies and policy support also contribute to the generation of innovative outcomes, which enhance a firm’s competitive advantage and subsequently improve its performance (Bronzini and Piselli 2016; Qi et al. 2022; Ren et al. 2021). However, some firms may become excessively reliant on government support, leading to the misuse of funds and potentially undermining performance (Li and Atuahene-Gima 2001; Lim et al. 2018).

At the firm level, research on the impact of firm performance focuses on dimensions such as ownership structure and executive characteristics. Shareholders, who possess decision-making and monitoring rights within corporate governance structures, can directly participate in management and influence strategic planning and operational decisions, thus impacting firm performance (Hwang and Kim 2016; Jia et al. 2018). In general, a more dispersed distribution of equity ownership within a firm is less conducive to improving firm performance (Rashid 2020; Sanchez-Ballesta and Garcia-Meca 2007). Executives play a crucial role in driving decision-making and implementation within a firm, exerting a significant influence on its operations. On one hand, executive compensation and personal characteristics such as gender, age, and personal experiences directly shape the managerial style in a firm’s strategic development, thereby affecting firm performance (Aboody et al. 2010; Chang et al. 2023; Custodio et al. 2013; Nanda et al. 2023; Serfling 2014; Yu et al. 2014). On the other hand, executives’ social relationships help firms obtain resource support, playing a critical role in major financial activities such as financing and mergers and acquisitions, thereby influencing firm performance (Ishii and Xuan 2014; Mertzanis 2019; Shane and Cable 2002). Moreover, when there is a significant cultural distance within the executive team, conflicts in values and cognition may arise, inhibiting decision-making efficiency and negatively impacting firm performance(Beugelsdijk et al. 2018; Burns et al. 2017).

The relationship between organizational culture and firm performance is a hot topic of academic research. Shin et al. (2018) conducted a study on 104 teams and found that both process-oriented culture and relationship-oriented culture within an organization are significantly associated with team task performance. Chatman et al. 2023, from the perspective of organizational cultural constraints, discovered that normative organizational culture content and guiding employees to consensus can help enhance a firm’s financial performance. Affes and Affes (2022) pointed out that organizational culture can effectively guide business model transformation and further shape high-quality strategic decisions to improve firm performance. Jacobs et al. (2013) indicated that executive teams can shape a competitive organizational culture and transmit these cultural traits to organizational operational decisions, thereby influencing organizational performance. Fiordelisi and Ricci (2014) found through text analysis that a firm’s competitive culture and innovative culture are closely related to CEO turnover and further impact firm performance.

In summary, prior research has primarily focused on the impact of formal institutions and organizational characteristics on firm performance. A significant body of literature has also examined the influence of internal organizational culture on performance outcomes. However, there remains a gap in understanding how external institutional environments affect firm performance. In reality, firm operations are complex and multifaceted, resulting from the interaction of multiple factors. In countries such as China, with a rich cultural heritage, informal institutions also play a crucial role in social development. Merely considering the roles of formal institutions and firm characteristics is insufficient for gaining a complete understanding of firm performance formation. Therefore, studying the influence of cultural characteristics on firm performance from the perspective of informal institutions will provide valuable supplementary insights to existing academic achievements.

Theoretical analysis

Food culture and cultural inclusiveness

Cultural inclusiveness is a complex notion, determined by a variety of factors such as the natural environment, social practices and cultural identification. The fundamental question addressed in this paper is how to accurately assess cultural inclusiveness. At the theoretical level, fractal theory provides a useful framework for selecting proxy variables for cultural inclusiveness. Fractal theory suggests that the characteristics of a specific part of a system are similar to those of the whole, exhibiting self-similarity (Mandelbrot 1967; Plowman et al. 2007; Stevenson 1998; Zhao and Wu 2016). This means that the features of the entire system can be inferred from a local part of the system (Batty 1996; Mandelbrot 1998; Ni et al. 2003). In the context of culture, food culture as a part of the system also exhibits this self-similarity. For example, whether at a family dining table or in international restaurants, people adhere to specific dining etiquettes and norms. These norms may vary across different cultures, but they share similar characteristics overall, such as respect for food and social interactions. This self-similarity reflects the correlation and consistency between a specific part (food culture) and the entire cultural system. Therefore, according to fractal theory, food culture, as a subsystem of culture, may share highly similar features with the overall cultural system.

In addition, Sun et al. (2023a) and Sun et al. (2023b) have identified food culture as a good proxy variable for measuring cultural inclusiveness. This is because food is a necessity in human society and plays a significant role in maintaining interpersonal relationships, depicting local cultural meanings, and promoting local economic sustainability (Cook 2006; Cook 2008; Cook et al. 2011). From a natural perspective, food can be viewed as a result of human interaction with the environment. As a natural commodity, food is largely influenced by geographic factors such as weather conditions, waterways and mountains, resulting in a distinctive regional gastronomic and cultural identity (Li et al. 2021). Socially, food is perfectly integrated into the fabric of human relationships. From diplomatic gatherings between nations to dining protocols, food acts as a unifying force that fortifies connections. In ancient China, communal dining was a customary practice among those in authority to bolster their relationships with subordinates. Presently, Chinese individuals continue to foster bonds with relatives and friends through shared meals and social events. In numerous societies, sharing meals and dining together are also viewed as romantic encounters, particularly within diverse ethnic cultures where food can serve as an intermediary (Chesters 2007; Sun et al. 2022a). Regarding cultural characteristics, food serves as a significant conduit for local sentiments. Various studies have demonstrated that food culture impacts local identity and the sense of belonging to a place in diverse ways (Cappellini and Yen 2013; Chuck et al. 2017; Cross and Gilly 2014; Kikon 2021). Over time, specific flavors become emblematic representations of local culture. For instance, piquant tastes are often considered vital culinary symbols in regions such as Hunan and Jiangxi, while sweetness embodies the food culture of Shanghai and Zhejiang. This process of constructing local identity through flavor memory is also shaped by geographical connections, underscoring the role of geography in deeply ingrained human emotional experiences. In conclusion, food culture is a result of human interaction with nature, a bond within social relationships, and a bearer of local culture and emotions (Cappellini and Yen 2013; Chang et al. 2010; Lo Monaco and Bonetto 2019). Drawing on fractal theory and contemporary empirical research, it can be deduced that the inclusiveness of food culture may effectively represent cultural inclusiveness (Cook 2006; Cook 2008; Cook et al. 2011).

Cultural inclusiveness and firm performance

According to institutional economics theory, local cultural characteristics can have a homogeneous normative effect on the behavior of businesses, further influencing their economic outcomes (Chen et al. 2014; Guiso et al. 2004; Guiso et al. 2006). Therefore, cultural inclusiveness, which emphasizes full understanding and equal treatment of individuals from different backgrounds, may significantly impact the operational performance of local firms.

On one hand, cultural inclusiveness may help establish a positive corporate reputation. When the cultural environment in which a firm operates encourages inclusiveness and respect for people from diverse cultural backgrounds, the firm is more likely to gain social acceptance and respect (Nishii 2013; Shore et al. 2018). This favorable reputation attracts more consumers, investors, and stakeholders, thereby increasing the business’s influence, market share, and overall performance (Borghesi et al. 2014; Kim 2019).

On the other hand, cultural inclusiveness may expand the customer base of a firm. People from different cultural backgrounds have different needs and preferences, and their demands for products and services vary (Chu and Wu 2023; Franke et al. 2009; Wagner et al. 2009). When businesses can understand and respect the differences between cultures and adjust their product design, service strategies, and marketing accordingly, they can better meet the diverse needs of different customer segments (Sun et al. 2023a). This leads to a broader customer base, higher sales, and increased market share.

Furthermore, local cultural inclusiveness can facilitate better communication and collaboration among individuals from diverse cultural backgrounds, creating more business and investment opportunities (Laursen and Salter 2014; Maietta 2015; Shore et al. 2011). In this environment, diversified business partnerships provide firms with broader opportunities for development, promoting sustainable economic and industrial growth (Sun et al. 2023b). The prosperity of the local economy and industry can also provide firms with additional sources of financing and contribute to improved firm performance (Terjesen et al. 2016; Xu 2020). Based on the discussion above regarding the potential positive effects of cultural inclusiveness, we propose the following assumption:

Assumption 1: Cultural inclusiveness at the local level enhances firm performance.

Mechanism analysis

In the current fiercely competitive economic landscape, firms must distinguish themselves in market competition and secure adequate financial support. However, financing limitations have emerged as a significant obstacle to sustainable business expansion. Local cultural inclusiveness has the potential to mitigate these financing constraints and enhance firm performance.

On one hand, regional cultural inclusiveness can promote cooperative relationships between firms and stakeholders. The development of a firm relies on support from various social actors, such as the community, government, suppliers, customers, and shareholders (Gillan et al. 2021). Under the influence of local cultural inclusiveness, firms can gain a greater sense of social identification and support. This sense of identification and support extends not only to internal employees and management but also encompasses the range of stakeholders including the community, government, suppliers, customers, and shareholders (Farooq et al. 2014). These stakeholders can provide resources and funding to firms through various forms of collaboration and support, thus alleviating their financing pressures (Cheng et al. 2014).

On the other hand, in regions with higher levels of cultural inclusiveness, firms are likely to experience less discrimination and unfair treatment (Shore et al. 2018; Sun et al. 2023a). When dealing with financing or government agencies, they are more likely to be treated and evaluated fairly. The elimination of cultural barriers between firms also facilitates the establishment of strong connections and cooperative relationships, gaining trust and support (Shore et al. 2011; Sun et al. 2023b). Therefore, regional cultural inclusiveness may help firms mitigate financing constraints, allowing them to fully utilize resources for more efficient development and improved firm performance. Based on the discussion above, we propose the following assumption:

Assumption 2: Local cultural inclusiveness promotes firm performance by helping firms alleviate financing constraints.

The indispensability of talent to businesses cannot be overstated, as they serve as the primary catalyst for the development, innovation, and competitive advantage of firms (Chen et al. 2021). Exceptional talent brings forth the latest knowledge, skills, and creativity that are crucial for survival and growth in a rapidly evolving market environment (Agrawal and Matsa 2013; Paillé et al. 2014). They possess the ability to effectively address challenges, enhance work efficiency, and propel firms towards their objectives (Chi 2008). Moreover, talent plays a pivotal role in fostering and cultivating firm culture by disseminating positive values and work attitudes, strengthening team cohesion, and boosting motivation (Helfat and Martin 2015; Newman et al. 2014). In today’s increasingly fierce global competition, the presence of a diverse and highly skilled workforce is paramount for firms to seize market opportunities, engage in technological innovation, improve service quality, and expand market share (Bornay-Barrachina et al. 2017; Kianto et al. 2017). In summary, talent represents the most invaluable resource for firms, serving as the core driver of continuous progress and success (Chen et al. 2021; Hancock et al. 2013; Paillé et al. 2014).

The degree of cultural inclusiveness in a local area has a profound impact on recruiting high-quality talent and improving firm performance (Eikhof, 2020; Sun et al. 2023b). Regions with high levels of cultural inclusiveness typically have a broader acceptance of values, respect for diversity and individual differences, creating a favorable environment for attracting talents from different cultural backgrounds (Conti, 2007; Shore et al. 2011; Sun et al. 2023b). A multicultural team can bring different ways of thinking, innovative ideas, and problem-solving abilities, thereby promoting internal innovation and development within the firm (Alexandra et al. 2020; Li et al. 2017). Moreover, communities with high levels of cultural inclusiveness are often more open and tolerant, attracting talents from around the world (Deng et al. 2022; Shore et al. 2018). These talents bring different experiences and skills, enriching the firm’s talent pool and enhancing its competitiveness in the global market (Sumo et al. 2021; Sun et al. 2023b; Weerakkody et al. 2012). Additionally, regions with high levels of cultural inclusiveness are usually better able to attract and retain talents because individuals feel valued and accepted, thus being more motivated to contribute to the firm’s development (Mao et al. 2024a; Sun et al. 2023a). Lastly, a diverse work environment helps break traditional thinking patterns and work styles, unleashing employee potential and improving team cohesion and execution (Mousa, 2021; Zhan et al. 2015). Therefore, regions with higher levels of cultural inclusiveness are more likely to attract high-quality talent, thus enhancing firm performance and achieving sustained growth and success. Based on the discussion above, we propose the following assumption:

Assumption 3: Local cultural inclusiveness promotes firm performance by helping firms attract talents.

Data and variables description

Data source

In this study, we obtained corporate and governance-related data from CSMAR and supplemented it with regional development index data from the National Bureau of Statistics. Our test period spans from 2010 to 2019, utilizing A-share data from the Chinese capital market, while excluding ST, PT, financial, and real-estate industry data. Given the significant adverse impacts of the financial crisis and COVID-19, we excluded sample data prior to 2010 and after 2019 in the main regression. However, to ensure the robustness of our results, we further extended the sample period in the robustness checks. In order to avoid extreme values, we winsorized all continuous variables at the 1% level (our results are very robust to using this threshold). Our final sample consists of 12,466 annual firm observations and includes 2354 firms in China.

Variable description

Our dependent variable is firm performance, with \({ROE}\) used as a proxy. We have also expanded the set of proxy variables for firm performance in the robustness check section, aiming to verify the robustness of our results. We utilized the work of Sun et al. (2023a) and Sun et al. (2023b) as a foundation for developing a cultural inclusiveness index (\({Inclu}\)) centered on food culture. Through their research, Sun et al. (2023a) and Sun et al. (2023b) quantified the taste data of Chinese cuisine at the provincial level and established a local cultural inclusiveness index by evaluating the deviation of food flavor. Specifically, they employed mathematical methodologies to standardize variables commonly used in measuring cultural inclusiveness based on the extent of divergence between local food tastes and local cuisine.

Furthermore, the local population demonstrates significant resistance to external food cultures to safeguard against cultural assimilation (Chang et al. 2010; Sun et al. 2023a; Sun et al. 2023b). Thus, we drew on the work of Sun et al. (2023a) and Sun et al. (2023b) to utilize the proportion of non-local cuisines (e.g., in Fujian Province, the proportion of cuisines other than “Fujian cuisine”) as an alternative variable (\({Inclu\_alter}\)) for assessing cultural inclusiveness.

In selecting control variables, we drew upon the research of Chen et al. (2014), Lei et al. (2022), Sun et al. (2023a) and Sun et al. (2023b), opting for indicators at the firm, corporate governance, and regional levels to mitigate potential endogeneity resulting from omitted variables. The specific definitions of our variables are outlined in Table 1.

Main results

Summary statistics

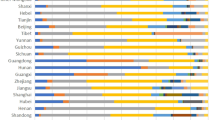

Table 2 gives the summary statistical data of our sample and lists the distribution of main variables. The average value of cultural inclusiveness index is 0.683 and the standard deviation is 0.324, indicating that there are significant differences among regions. In fact, the regional inclusion index of 75% quantile (0.930) is 125.73% higher than that of 25% quantile (0.412). In addition, the main dependent variable \({ROE}\) shows significant cross-sectional changes (standard deviation of 8.689). The \({ROE}\) of firms in the 75% quantile (11.030) is 244.47% higher than that of firms in the 25% quantile (3.202), indicating that there are significant differences in the performance of various firms.

Basic regression

We now examine the relationship between cultural inclusiveness and firm performance. We rely on the following model as the main regression for our multivariate analysis:

Where, \({{ROE}}_{i,p,t}\) is the return on net assets of firm \(i\) located in province \(p\) in year \(t\), \({{Inclu}}_{p,t}\) is the cultural inclusiveness index in province \(p\). \({{Control}}_{i,p,t-1}\) are control variables with a lag of one year. We also control the industry and year fixed effects to further solve the endogenous problems, and we use the double clustering robust standard errors at the firm and year levels.

Our results are shown in Table 3. The baseline regression results for the control variables that encompass the firm-level aspects of all firms in the sample are provided in column (1). Column (2) builds upon column (1) by introducing additional control variables related to corporate governance, including variables such as \({TOP\_}1\), \({Boardsize}\), \({Independent}\), \({Income}\) and \({CO\_CEO}\). Column (3) goes a step further by incorporating control variables related to regional development, including variables such as \({GDP\_per}\), \({GDP\_growth}\), \({Pop\_growth}\) and \({Consume\_per}\), in addition to the variables already included in column (2). We can see that in all columns, there is a significant positive correlation between cultural inclusiveness and firm performance.

Columns (4)–(6) of Table 3 examine the association between cultural inclusiveness and firm performance using alternative proxy variables of cultural inclusiveness (\({Inclu\_alter}\)). The use of \({Inclu\_alter}\), which represents the proportion of non-native cuisines, as a proxy variable for cultural inclusiveness does not alter our main finding: greater cultural inclusiveness is consistently linked to higher firm performance. Overall, the regression results above provide evidence supporting the significant role of cultural inclusiveness in the business context, thus confirming assumption 1.

Endogenous treatment

Although we explicitly control for as many variables as possible in the main regression, there is still the possible problem of endogeneity and spurious correlation. To address this issue, we adopt the topographical changes of the region (\({TGC}\)) measured by Feng et al. (2008) as an instrumental variable for cultural inclusiveness, following the approach suggested by Lei et al. (2022), Sun et al. (2023a) and Sun et al. (2023b). \({TGC}\) is highly correlated with cultural inclusiveness because complex interlocking mountainous terrain makes human interactions more difficult at the geographic level, and the precondition for inclusiveness is deeper human interactions (Feng et al. 2008; Sun et al. 2023a; Sun et al. 2023b). Second, more complex topography makes it easier for regions to be historically divided into small, relatively enclosed areas, which makes migration more difficult and the population more divided, thus making cross-regional cultural transmission difficult, and thus closed areas are more likely to develop xenophobic ideas (Sun et al. 2023a; Sun et al. 2023b). In general, higher regional topographical changes may inhibit the formation of cultural inclusiveness, but regional topographical changes is a purely geographic natural shock that has evolved over thousands of years and is not influenced by firm performance; therefore, it is an exogenous enough instrumental variable for cultural inclusiveness (Lei et al. 2022; Sun et al. 2023a; Sun et al. 2023b).

Based on the topographical changes as an instrumental variable, we used 2SLS method:

\({Fit}\) is the predicted value of cultural inclusiveness obtained from the first stage regression, and the other variables are as described above. The results of IV regression are given in Table 4. We found that on the first stage, higher regional topographical changes \({TGC}\) significantly reduces cultural inclusiveness, while on the second stage, we found that the cultural inclusiveness index fitted with regional topographical changes significantly enhances firm performance. In columns (3) to (4), we used the alternative variable of cultural inclusiveness \({Inclu\_alter}\) to test the robustness of IV regression. Combined with the results of columns (1) and (2), our results support the explanation of the causal relationship between cultural inclusiveness and firm performance.

Robustness test: expanding time samples

In our primary regression analysis, we accounted for the adverse impacts of the financial crisis and COVID-19 by excluding the corresponding periods from the sample. To ensure the robustness of our empirical regression, we further expanded the study sample to cover the period from 2005 to 2022. The regression results based on the extended sample period, as shown in Table 5, reveal that cultural inclusiveness continues to exert a significant positive effect on firm performance.

Robustness test: substitution of variable

In this section, we conducted a robustness test to examine the relationship between cultural inclusiveness and firm performance, utilizing the number of regional art-performance groups as a proxy variable. Previous research suggests that art-performance work necessitates acceptance, respect, and inclusion of individuals and their surroundings (Mellander and Florida 2011), indicating higher cultural inclusiveness in regions with a greater number of artists (Sun et al. 2023a). Therefore, we employed the number of regional art-performance groups (referred to as \({Art}{\rm{\_}}{group}\)) as a measure of cultural inclusiveness. Given that this variable has a much larger magnitude than ROE, we divided it by 10 to enhance visibility of the coefficient value in Table 6. The empirical results are presented in column (1) of Table 6, accounting for industry fixed effects and year fixed effects. The findings reveal a statistically significant positive correlation between cultural inclusiveness, represented by \({Art}{\rm{\_}}{group}\), and firm performance.

To further test the robustness of our findings, we replaced the dependent variable \({ROE}\) with return on assets (\({ROA}\)) and the Tobin’s Q (\(Q\)), serving as proxies for firm performance. We explored the correlation between \({ROA}\) and cultural inclusiveness in column (2) of Table 6, while we explored the correlation between \(Q\) and cultural inclusiveness in column (3). Across all these different specifications, we consistently found a significantly positive relationship between cultural inclusiveness and firm performance. These results suggest a robust and general association between cultural inclusiveness and firm performance. Overall, the regressions conducted in this study provide strong evidence supporting our findings.

Further analysis

Mechanism of cultural inclusiveness: mediating effect of financial constraints

To test assumption 2, we employed corporate financing constraints as the mediating variable. The estimation of firm financing constraints in this study is based on the research of Fee et al. (2009), Hadlock and Pierce (2010). Compared to other indicators measuring the level of corporate financial constraints, the FC index stands out for its advantage in comprehensively considering multiple variables such as firm size, age, and cash dividend payout ratio (Fee et al. 2009; Hadlock and Pierce 2010; Kurt et al. 2022). This comprehensive approach enables the FC index to provide a more accurate and comprehensive reflection of the extent of corporate financial constraints, and it has shown superior performance in empirical studies (Brown et al. 2017; Hadlock and Pierce 2010; Yu et al. 2021). Firstly, three variables, namely firm size, years since going public, and cash dividend payout ratio, are standardized annually. The sample firms are then ranked based on the mean values of the standardized variables, and a virtual variable \({FC\_dummy}\) is constructed using the third quartile as the threshold for financing constraints. Firms above the two-thirds quartile are considered to have lower levels of financing constraints (\({FC\_dummy}=0\)), while firms below the one-third quartile are considered to have higher levels of financing constraints (\({FC\_dummy}=\,0\)).

Next, model (5) is used to fit the probability P (also known as the financing constraint index \({FC}\), ranging from 0 to 1) of firms facing financing constraints in each year. A larger \({FC}\) indicates higher levels of financing constraints. In model (5), \({Size}\) represents the logarithm of total assets, \({Leverage}\) represents the ratio of total debt to total assets, \({Div}\) represents the ratio of cash dividends to total assets, \({MB}\) represents the ratio of market value to book value, \({NO}\) represents the ratio of net operating working capital to total assets, and \({EBIT}\) represents the ratio of earnings before interest and taxes to total assets.

We employed the 2SLS method of mechanism test, as suggested by Griffin et al. (2021), to examine the mechanism of corporate financial constraints (Griffin et al. 2021). In the first stage, we regressed the regional inclusive proxy variables mentioned above on the intermediary variable (\({FC}\)) and compute the fitted values of financing constraints using the regression coefficients. In the second stage, we regressed the explained variable (\({ROE}\)) on the fitted values of financing constraints (\({FC}\_{fit}\)). The empirical results are presented in Table 7.

The mechanism test results of the impact of cultural inclusiveness on firm performance are presented in columns (1) to (4) of Table 7. In the first stage (i.e., columns (1) and (3)), we observed a significant alleviation of corporate financial constraints with higher cultural inclusiveness. However, in the second stage (i.e., columns (2) and (4)), we found that firms facing more pronounced financing constraints tend to experience a decline in operational performance. These findings indicate that cultural inclusiveness can indeed enhance firm performance by mitigating corporate financing constraints.

To test assumption 3, we used the structure of employees recruited by the organization as a mediating variable. We focused on the educational level of employees in the organization. Specifically, we used the increment of employees with a bachelor’s degree or higher as the mediating variable (\({Bachelor}\)) and run 2SLS regressions.

The mechanism test results regarding the composition of employees are presented in columns (1) to (2) of Table 8. In the first stage (i.e., column (1)), we observed a significant increase in the corporate proportions of employees with bachelor’s or higher degrees with higher cultural inclusiveness. Subsequently, in the second stage (i.e., column (2)), we found that firms with higher proportions of employees possessing bachelor’s or higher degrees tend to experience an improvement in firm performance. Additionally, in columns (3) and (4), we employed the alternative variable of cultural inclusiveness, \({Inclu\_alter}\), to verify the mechanism, which yields similar results. These findings indicate that cultural inclusiveness can indeed enhance firm performance by enhancing the composition of employees.

Heterogeneity analysis

Different types of firms may be affected differently by cultural inclusiveness, and the costs of corporate governance are also different. This part discusses the heterogeneity of the impact of cultural inclusiveness on firm performance from the perspectives of CSR performance and R&D investment.

In the process of undertaking social responsibilities, firms often require significant financial support (Gillan et al. 2021). This necessitates a balance between fulfilling social responsibilities and maintaining operational performance (Carmine and De Marchi 2023; Smith and Besharov 2019). However, the cultural inclusiveness of a firm’s location can play a positive role in alleviating financing constraints and helping firms secure more funding. This enables firms to sustain their operations while undertaking social responsibilities (Hahn et al. 2014; Sun et al. 2023a).

Regions with higher cultural inclusiveness may attract more investors and stakeholders, providing firms with greater financing opportunities. By establishing a stable stakeholder relationship, firms can further expand their financing channels (Borghesi et al. 2014; Vishwanathan et al. 2019). This additional financial support empowers firms to better fulfill their social responsibilities while maintaining operational performance.

Furthermore, the positive reputation effects resulting from undertaking social responsibilities also contribute to a firm’s performance (Kim 2019; Shane and Cable 2002). Consumers, investors, and stakeholders are inclined to collaborate with firms that demonstrate good social responsibility practices. This favorable reputation enhances a firm’s competitiveness, improves market position, and positively influences performance. Therefore, we inferred that the cultural inclusiveness of a firm’s location plays a more significant role in promoting the firm performance that exhibit strong social responsibility practices.

We constructed the dummy variable \({CSR}\) using the median number of corporate social responsibility (data from Hexun.com) as a bound (\({CSR}\) is 1 if the corporate social responsibility is greater than the median number in the sample, and 0 otherwise). \({CSR}\) is then interacted with the cultural inclusiveness index, resulting in the cross-term \({Inclu\_CSR}\), which is included in the main regression. The regression results are shown in columns (1) of Table 9, where the coefficient of cross-term \({Inclu\_CSR}\) is significantly positive, indicating that cultural inclusiveness has a heterogeneous effect on firms with different CSR performance. We conducted a similar test using \({Inclu\_alter}\) as an alternative explanatory variable for cultural inclusiveness in column (2) and obtained consistent results. Specifically, the effect of cultural inclusiveness is stronger for firms with higher CSR performance, and the positive effect on firm performance is more pronounced.

Undertaking research and development is a capital-intensive process for businesses (Ahuja and Katila 2001; Chen et al. 2014; Sun et al. 2022b), and the cultural inclusiveness of a firm location may help alleviate funding constraints and have a more substantial impact on the performance of innovative firms. In regions with higher cultural inclusiveness, innovative firms are more likely to gain the trust and support of investors, thereby obtaining greater funding for their R&D projects (Sun et al. 2023b; Wan et al. 2022). These investors are more open-minded and receptive to the firm’s innovative concepts and are willing to provide financial backing. Conversely, in areas with lower cultural inclusiveness, firms may face more funding difficulties, which may limit their ability to conduct R&D and realize their innovative potential.

In addition, cultural inclusiveness also helps attract high-quality talent to join the firm and stimulate employee creativity as well as innovative thinking (Shore et al. 2011). In an environment with high cultural inclusiveness, employees are more likely to come up with new ideas, try new methods, and receive support as well as encouragement (Shore et al. 2018). This positive innovation atmosphere will help firms continuously drive the R&D process, improve efficiency, and enhance the quality of outcomes. Therefore, cultural inclusiveness may have a more significant role in promoting the performance of innovative firms.

Thus, this paper argues that cultural inclusiveness has heterogeneous effects on firms with different levels of R&D. We constructed the dummy variable \({RD}\) using the median number of corporate R&D investment as a bound (\({RD}\) is 1 if the corporate R&D investment is greater than the median number in the sample, and 0 otherwise). \({RD}\) is then interacted with the cultural inclusiveness index, resulting in the cross-term \({Inclu\_RD}\), which is included in the main regression. The regression results are shown in columns (3) of Table 9, where the coefficient of cross-term \({Inclu\_RD}\) is significantly positive, indicating that cultural inclusiveness has a heterogeneous effect on firms with different R&D investment. We conducted a similar test using \({Inclu\_alter}\) as an alternative explanatory variable for cultural inclusiveness in column (4) and obtained consistent results. Specifically, the effect of cultural inclusiveness is stronger for firms with higher R&D investment, and the positive effect on firm performance is more pronounced.

Discussion and conclusion

Discussion

This paper explores the impact of informal institutions on firm performance, mainly from the perspective of cultural inclusiveness. Our study is directly related to Sun et al. (2023a) and Sun et al. (2023b). In terms of research content, existing studies on the behavioral and economic consequences of cultural inclusiveness on firms have mainly explored the dimensions of firms’ total factor productivity (TFP) and CSR. Specifically, Sun et al. (2023a) illustrated that cultural inclusiveness can lead firms to be more socially responsible, the mechanism of which is that cultural inclusiveness promotes local perceptions of gender equality and inhibits local perceptions of power disparity. Sun et al. (2023b) also pointed out that cultural inclusiveness positively contributes to the TFP of local firms, and suggested that executives played a role in the important role in the transmission of cultural perceptions. Our study brings new findings that further enrich the research on the impact of cultural inclusiveness on firms.

First, in terms of the economic consequences for firms, our study reveals that cultural inclusiveness plays a role in contributing to firm performance, and this main result is reflected in the fact that cultural inclusiveness positively affects ROE, ROA, and Tobin Q of firms. In addition, we further extend the mechanisms by which cultural inclusiveness affects firm performance. To the best of our knowledge, we validate the impact of cultural inclusiveness from a financial perspective for the first time. Specifically, we find that cultural inclusiveness exerts a significant effect on alleviating firms’ financing constraints. This finding is significant because it reveals that cultural inclusiveness becomes a substantial strategic advantage in business operations. The promotion and practice of cultural inclusiveness can break down the financing constraints of firms, expand financing channels, and reduce financing costs, thus enhancing the financial health and competitiveness of firms. This not only helps firms achieve a more favorable position in the market, but also makes a positive contribution to their long-term sustainable development.

Secondly, we extend the understanding of the mechanisms through which cultural inclusiveness affects firm performance from a human resource perspective. We find that more inclusive regions attract higher-quality talent to serve local firms. This finding deepens the understanding of the impact of cultural inclusiveness from a human resources perspective and highlights its critical role in talent retention. A more inclusive region not only attracts high-quality talent from diverse cultural backgrounds but also provides a broader talent pool for firms. Moreover, it enhances the innovative capacity and competitive advantage of firms. This phenomenon not only facilitates the performance of local firms but also promotes the economic development and social progress of the entire region. Therefore, our study is of significant value in guiding the development strategy formulation and human resource management of firms and regions. It helps firms and regions to better leverage cultural inclusiveness to achieve long-term sustainable talent strategy goals.

Theoretical contribution

The construction of indicators of cultural inclusiveness in our study is informed by Sun et al. (2023a) and Sun et al. (2023b). They argued the natural, social and cultural attributes embedded in food culture and elaborated that food culture is a good proxy variable for cultural inclusiveness. We further introduced fractal theory on the basis of their study and used fractal theory to elaborate the rationality of using food culture as a proxy for cultural inclusiveness, which in turn provided more theoretical foundations for the construction of the cultural inclusiveness index. Applying fractal theory to the field of cultural studies also enriches the theoretical framework of cultural studies by providing new ways to understand the multidimensionality and complexity of culture. In addition, our study also has some relevance to Lei et al. (2022) and Zhang (2018). Based on the social and cognitive characteristics of language, they argued that the number of dialects in a region can be used to measure the local cultural diversity characteristics, which is another supporting evidence in terms of the application of fractal theory to the construction of culture class indices.

Our study makes an important contribution to the theory of institutional economics. Specifically, we provide additional empirical evidence that strengthens the application of institutional economics in the field of corporate finance. In the institutional economics framework, culture is considered an important institutional factor that can shape firms’ decisions and behaviors. By examining the impact of local cultural inclusiveness on firm performance, we empirically support this view and consolidate the academic understanding of the role of culture in economic activities. In addition, this study expands the academic understanding of how the institutional environment affects firm performance. While institutional economics emphasizes the importance of a region’s institutional environment on firm behavior and performance, cultural inclusiveness, as part of the institutional environment, has a profound impact on firms is further validated in our study. These findings not only deepen the academic understanding of how firm behavior and performance are affected by the institutional environment, but also provide theoretical guidance for policy makers and contribute positively to the development of institutional economics theory.

In addition, our study strengthens the academic understanding of the antecedent conditions of firm performance. Current research on the antecedents of firm performance focuses on firm characteristics and formal institutions. Although examining the antecedent conditions of firm performance from the perspective of informal institutions has also received more discussion, these studies have focused more on cultural characteristics within firms. However, our study examines how cultural inclusiveness, as a social norm originating from external informal systems, affects firm performance. Studying the impact of informal institutions based on an external perspective has natural advantages. On the one hand, interpreting the external institutional environment can provide new perspectives on the causes of cross-geographical imbalances in firms’ development and help identify the characteristics of firms’ development in different institutional environments. On the other hand, it can also provide policymakers with more specific and targeted practical guidance, which can help formulate more effective policy measures to promote better firm development.

Practical contribution

Based on the empirical findings presented in this study, several practical implications can be drawn. Firstly, firms should actively create a diverse and inclusive work environment that encourages communication and collaboration among employees from different cultural backgrounds. This can be achieved through recruiting employees from various cultural backgrounds, providing cross-cultural training, and advocating fair promotion mechanisms. Additionally, firms should respect and appreciate the values and customs of different cultures, avoiding biases or discrimination towards specific cultures. By respecting and understanding the differences between cultures, firms can create an open and inclusive working environment that stimulates employees’ creativity and innovation.

Furthermore, the government can establish and enforce inclusive regulations that encourage firms to focus on cultural inclusiveness in employment, training, and promotion. These policies can provide guidance and support to firms, ensuring the fair distribution of opportunities and breaking down cultural barriers. The government can also establish an inclusive financial system that encourages financial institutions to prioritize a firm’s innovation capabilities, development potential, and social responsibility in the financing process, rather than relying excessively on collateral or traditional indicators. This will encourage financial institutions to provide financing support to a wider range of firms, promoting sustainable business operations and high-quality economic development. Moreover, the government can provide funding and resources to support cross-cultural exchange and cooperation projects. This includes funding cultural activities, organizing cross-cultural training and seminars, and facilitating international cultural exchanges. Finally, the government can strengthen the promotion and education of cultural inclusiveness through the education system and media channels. This helps improve public awareness and understanding of cultural diversity, encouraging people to respect and appreciate the differences between cultures.

Limitation and future prospect

We recognize that there are limitations to our study of cultural inclusiveness and firm performance. Constrained by data characteristics, the data for our cultural inclusiveness index are based on the provincial level. While extensive research has validated the feasibility of this approach (Lei et al. 2022; Mao et al. 2024a; Zhang 2018), further disaggregation of the cultural index to the municipal level may yield richer findings. Future research could explore more precise indicators that capture the impact of cultural inclusiveness on firms at a finer geographic level, leading to more accurate characterization and richer empirical results. In addition, while this study has revealed the significant impact of local cultural inclusiveness on firm performance, there are many related issues that need to be further explored. Future research could further explore how cultural inclusiveness interacts with other institutional factors, and analyze in more detail how cultural inclusiveness affects business development, including the specific mechanisms of its impact in the areas of business management, innovation and sustainability.

Conclusion

This study investigates the impact of cultural inclusiveness on firm performance and uncovers that regions with more pronounced inclusiveness characteristics have a positive impact on firms, including alleviating firms’ financial constraints and enhancing operational performance. Even after controlling for industry and year fixed effects as well as employing a double-cluster robust standard error at the firm-year levels, the empirical results consistently demonstrate a significant and meaningful relationship between cultural inclusiveness and firm performance. Moreover, the influence of cultural inclusiveness strengthens in firms that exhibit better social responsibility performance and higher R&D investments. Additionally, this study employs regional topographical changes as an instrumental variable to address potential endogeneity concerns, further validating the causal connection between cultural inclusiveness and firm performance.

Broadly speaking, this study is rooted in the distinctive regional culture with Chinese characteristics and offers fresh insights into the influence of non-formal institutional cultural factors on real economic activities within corporate settings, carrying substantial normative implications. The research affirms that cultural inclusiveness plays a pivotal role in corporate operational activities, thereby indirectly highlighting the foundational significance of culture in the business.

Data availability

The basic data presented in this study are available in supplementary information.

References

Abbasi K, Alam A, Du M, Huynh T (2021) FinTech, SME efficiency and national culture: Evidence from OECD countries. Technol Forecasting Soc Change 163. https://doi.org/10.1016/j.techfore.2020.120454

Aboody D, Johnson NB, Kasznik R (2010) Employee stock options and future firm performance: Evidence from option repricings. J Account Econ 50(1):74–92. https://doi.org/10.1016/j.jacceco.2009.12.003

Affes W, Affes H (2022) Business Model and Firm Performance in Tunisian Firms: a Mediated Moderation Analysis. J Knowl Econ 13(4):2822–2839. https://doi.org/10.1007/s13132-021-00836-4

Agrawal AK, Matsa DA (2013) Labor unemployment risk and corporate financing decisions. J Financial Econ 108(2):449–470. https://doi.org/10.1016/j.jfineco.2012.11.006

Ahuja G, Katila R (2001) Technological Acquisitions and the Innovation Performance of Acquiring Firms: A Longitudinal Study. Strategic Manag J 22(3):197–220. https://doi.org/10.1002/smj.157

Alexandra V, Ehrhart KH, Randel AE (2020) Cultural intelligence, perceived inclusion, and cultural diversity in workgroups. Personal Ind Differ 168. https://doi.org/10.1016/j.paid.2020.110285

Allen F, Qian J, Qian M (2005) Law, Finance, and Economic Growth in China. J Financial Econ 77(1):57–116. https://doi.org/10.1016/j.jfineco.2004.06.010

Arbatli CE, Ashraf QH, Galor O, Klemp M (2020) Diversity and Conflict. Econometrica 88(2):727–797. https://doi.org/10.3982/ECTA13734

Audretsch D, Dohse D, Niebuhr A (2010) Cultural Diversity and Entrepreneurship: A Regional Analysis for Germany. Ann Regional Sci 45(1):55–85. https://doi.org/10.1007/s00168-009-0291-x

Batty M (1996) Chaos, fractals and dynamics in geography - French - Dauphine,A. Ann Assoc Am Geographers 86(1):182–183. https://doi.org/10.1177/0149206317729027

Beugelsdijk S, Kostova T, Kunst VE, Spadafora E, van Essen M (2018) Cultural Distance and Firm Internationalization: A Meta-Analytical Review and Theoretical Implications. J Manag 44(1):89–130. https://doi.org/10.1177/0149206317729027

Borghesi R, Houston JF, Naranjo A (2014) Corporate Socially Responsible Investments: CEO Altruism, Reputation, and Shareholder Interests. J Corp Financ 26:164–181. https://doi.org/10.1016/j.jcorpfin.2014.03.008

Bornay-Barrachina M, Lopez-Cabrales A, Valle-Cabrera R (2017) How do employment relationships enhance firm innovation? The role of human and social capital. Int J Hum Resour Manag 28(9):1363–1391. https://doi.org/10.1080/09585192.2016.1155166

Bronzini R, Piselli P (2016) The impact of R&D subsidies on firm innovation. Res Policy 45(2):442–457. https://doi.org/10.1016/j.respol.2015.10.008

Brown JR, Martinsson G, Petersen BC (2017) Do financing constraints matter for R&D? Eur Economic Rev 56(8):1512–1529. https://doi.org/10.1016/j.euroecorev.2012.07.007

Burns N, Minnick K, Starks L (2017) CEO Tournaments: A Cross-Country Analysis of Causes, Cultural Influences, and Consequences. J Financial Quant Anal 52(2):519–551. https://doi.org/10.1017/S0022109017000163

Cappellini B, Yen DAW (2013) Little emperors in the UK: acculturation and food over time. J Bus Res 66(6):968–974. https://doi.org/10.1016/j.jbusres.2011.12.019

Carmine S, De Marchi V (2023) Reviewing Paradox Theory in Corporate Sustainability Toward a Systems Perspective. J Bus Ethics 184(1):139–158. https://doi.org/10.1007/s10551-022-05112-2

Chang R, Kivela J, Mak A (2010) Food preferences of Chinese tourists. Ann Tour Res 37(4):989–1011. https://doi.org/10.1016/j.annals.2010.03.007

Chang S-J, Kim Y-C, Park S (2023) Inter-Unit Executive Redeployment in Multiunit Firms: Evidence from Korean Business Groups. Organ Stud, https://doi.org/10.1287/orsc.20.14525

Chatman JA, Caldwell DF, O’Reilly CA, Doerr B (2023) Parsing organizational culture: How the norm for adaptability influences the relationship between culture consensus and financial performance in high-technology firms. J Organ Behav 35(6), 785–808. https://doi.org/10.1002/job.1928

Chen D, Gao H, Ma Y (2021) Human capital-driven acquisition: evidence from the inevitable disclosure doctrine. Manag Sci 64(8):4643–4664. https://doi.org/10.1287/mnsc.2020.3707

Chen Y, Podolski EJ, Rhee SG, Veeraraghavan M (2014) Local Gambling Preferences and Corporate Innovative Success. J Financial Quant Anal 49(1):77–106. https://doi.org/10.1017/S0022109014000246

Cheng B, Ioannou I, Serafeim G (2014) Corporate Social Responsibility and Access to Finance. Strat Manag J 35(1):1–23. https://doi.org/10.1002/smj.2131

Chesters J (2007) Dispossession, dreams and diversity: issues in Australian studies. J Sociol 43(1):110–111. https://doi.org/10.1177/144078330704300110

Chi W (2008) The role of human capital in China’s economic development: Review and new evidence. China Economic Rev 19(3):421–436. https://doi.org/10.1016/j.chieco.2007.12.001

Chu LY, Wu B (2023) Designing Online Platforms for Customized Goods and Services: A Market Frictions-Based Perspective. Acad Manag Rev 48(1):78–99. https://doi.org/10.5465/amr.2020.0247

Chuck C, Fernandes SA, Hyers LL (2017) Awakening to the politics of food: politicized diet as social identity. Appetite 107:425–436. https://doi.org/10.1016/j.appet.2016.08.106

Conti F (2007) Migration and cultural inclusion in the European city. J Ethn Migr Stud 33(8):1389–1390. https://doi.org/10.1080/13691830701614296

Cook I (2006) Geographies of food: following. Prog Hum Geogr 30(5):655–666. https://doi.org/10.1177/0309132506070183

Cook I (2008) Geographies of food: mixing. Prog Hum Geogr 32(6):821–833. https://doi.org/10.1177/0309132508090979

Cook I, Hobson K, Hallett L, Guthman J, Henderson H (2011) Geographies of food: ‘Afters. Prog Hum Geogr 35(1):104–120. https://doi.org/10.1177/0309132510369035

Cross SNN, Gilly MC (2014) Consumption compromises: negotiation and unification within contemporary families. J Bus Res 67(4):449–456. https://doi.org/10.1016/j.jbusres.2013.03.031

Custodio C, Ferreira MA, Matos P (2013) Generalists versus specialists: Lifetime work experience and chief executive officer pay. J Financial Econ 108(2):471–492. https://doi.org/10.1016/j.jfineco.2013.01.001

Deng X, Huang N, Yu M (2022) Cultural inclusion and social trust: Evidence from China. Asian J Soc Sci 50(1):16–26. https://doi.org/10.1016/j.ajss.2021.07.001

Eikhof DR (2020) COVID-19, inclusion and workforce diversity in the cultural economy: what now, what next? Cultural Trends 29(3):234–250. https://doi.org/10.1080/09548963.2020.1802202

Faccio M, Marchica M-T, Mura R (2016) CEO gender, corporate risk-taking, and the efficiency of capital allocation. J Corp Financ 39:193–209. https://doi.org/10.1016/j.jcorpfin.2016.02.008

Fang LH, Lerner J, Wu C (2017) Intellectual Property Rights Protection, Ownership, and Innovation: Evidence from China. Rev Financial Stud 30(7):2446–2477. https://doi.org/10.1093/rfs/hhx023

Farooq O, Payaud M, Merunka D, Valette-Florence P (2014) The Impact of Corporate Social Responsibility on Organizational Commitment: Exploring Multiple Mediation Mechanisms. J Bus Ethics 125(4):563–580. https://doi.org/10.1007/s10551-013-1928-3

Fee CE, Hadlock CJ, Pierce JR (2009) Investment, Financing Constraints, and Internal Capital Markets: Evidence from the Advertising Expenditures of Multinational Firms. Rev Financial Stud 22(6):2361–2392. https://doi.org/10.1093/rfs/hhn059

Feng Z, Tang Y, Yang Y (2008) Relief Degree of Land Surface and Its Influence on Population Distribution in China. J Geographical Sci 18(2):237–246. https://doi.org/10.1007/s11442-008-0237-8

Fiordelisi F, Ricci O (2014) Corporate culture and CEO turnover. J Corp Financ 28:66–82. https://doi.org/10.1016/j.jcorpfin.2013.11.009

Franke N, Keinz P, Steger CJ (2009) Testing the Value of Customization: When Do Customers Really Prefer Products Tailored to Their Preferences? J Mark 73(5):103–121. https://doi.org/10.1509/jmkg.73.5.103

Gillan SL, Koch A, Starks LT (2021) Firms and Social Responsibility: A Review of ESG and CSR Research in Corporate Finance. J Corporate Finance 66(3)):101889. https://doi.org/10.1016/j.jcorpfin.2021.101889

Griffin D, Guedhami O, Li K, Lu G (2021) National Culture and the Value to Implications of Corporate Environmental and Social Performance. J Corporate Finance, 71, https://doi.org/10.1016/j.jcorpfin.2021.102123

Guiso L, Sapienza P, Zingales L (2004) The Role of Social Capital in Financial Development. Am Economic Rev 94(3):526–556. https://doi.org/10.1257/0002828041464498

Guiso L, Sapienza P, Zingales L (2006) Does Culture Affect Economic Outcomes? J Economic Perspect 20(2):23–48. https://doi.org/10.1257/jep.20.2.23

Guiso L, Sapienza P, Zingales L (2009) Cultural Biases in Economic Exchange? Q J Econ 124(3):1095–1131. https://doi.org/10.1162/qjec.2009.124.3.1095

Gulen H, Ion M (2016) Policy Uncertainty and Corporate Investment. Rev Financial Stud 29(3):523–564. https://doi.org/10.1093/rfs/hhv050

Hadlock CJ, Pierce JR (2010) New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev Financial Stud 23(5):1909–1940. https://doi.org/10.1093/rfs/hhq009

Hahn T, Preuss L, Pinkse J, Figge F (2014) Cognitive Frames in Corporate Sustainability: Managerial Sensemaking with Paradoxical and Business Case Frames. Acad Manag Rev 39(4):463–487. https://doi.org/10.5465/amr.2012.0341

Hancock JI, Allen DG, Bosco FA, Mcdaniel KR, Pierce CA (2013) Meta-analytic review of employee turnover as a predictor of firm performance. J Manag 39(3):573–603. https://doi.org/10.1177/0149206311424943

Helfat CE, Martin JA (2015) Dynamic Managerial Capabilities: Review and Assessment of Managerial Impact on Strategic Change. J Manag 41(5):1281–1312. https://doi.org/10.1177/0149206314561301

Hwang S, Kim W (2016) When heirs become major shareholders: Evidence on pyramiding financed by related-party sales. J Corp Financ 41:23–42. https://doi.org/10.1016/j.jcorpfin.2016.08.013

Ishii J, Xuan Y (2014) Acquirer-target social ties and merger outcomes. J Financial Econ 112(3):344–363. https://doi.org/10.1016/j.jfineco.2014.02.007

Jacobs R, Mannion R, Davies HTO, Harrison S, Konteh F, Walshe K (2013) The relationship between organizational culture and performance in acute hospitals. Soc Sci Med 76:115–125. https://doi.org/10.1016/j.socscimed.2012.10.014

Jens CE (2017) Political uncertainty and investment: Causal evidence from US gubernatorial elections. J Financial Econ 124(3):563–579. https://doi.org/10.1016/j.jfineco.2016.01.034

Jia N, Shi J, Wang Y (2018) Value creation and value capture in governing shareholder relationships: Evidence from a policy experiment in an emerging market. Strat Manag J 39(9):2466–2488. https://doi.org/10.1002/smj.2921

Johnson A, Nguyen H, Groth M, White L (2018) Reaping the Rewards of Functional Diversity in Healthcare Teams: Why Team Processes Improve Performance. Group Organ Manag 43(3):440–474. https://doi.org/10.1177/1059601118769192

Julio B, Yook Y (2012) Political Uncertainty and Corporate Investment Cycles. J Financ 67(1):45–83. https://doi.org/10.1111/j.1540-6261.2011.01707.x

Kafouros M, Wang C, Piperopoulos P, Zhang M (2015) Academic collaborations and firm innovation performance in China: The role of region-specific institutions. Res Policy 44(3):803–817. https://doi.org/10.1016/j.respol.2014.11.002

Kianto A, Saenz J, Aramburu N (2017) Knowledge-based human resource management practices, intellectual capital and innovation. J Bus Res 81:11–22. https://doi.org/10.1016/j.jbusres.2017.07.018

Kikon D (2021) Bamboo shoot in our blood fermenting flavors and identities in northeast India. Curr Anthropol 62:S376–S387. https://doi.org/10.1086/715830

Khan U, Kalra A (2022) It’s Good to Be Different: How Diversity Impacts Judgments of Moral Behavior. J Consum Res 49(2):177–201. https://doi.org/10.1093/jcr/ucab061

Kim S (2019) The Process Model of Corporate Social Responsibility (CSR) Communication: CSR Communication and its Relationship with Consumers’ CSR Knowledge, Trust, and Corporate Reputation Perception. J Bus Ethics 154(4):1143–1159. https://doi.org/10.1007/s10551-017-3433-6

Kurt AC, Becker MJ, Hoitash R, Hoitash U (2022) Financial Constraints, Auditing, and External Financing. Eur Account Rev, https://doi.org/10.1080/09638180.2022.2159471

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (1998) Law and finance. J Political Econ 106(6):1113–1155. https://doi.org/10.1086/250042

LaPorta R, LopezDeSilanes F, Shleifer A, Vishny R (1997) Legal determinants of external finance. J Financ 52(3):1131–1150. https://doi.org/10.1111/j.1540-6261.1997.tb02727.x

Laursen K, Salter AJ (2014) The paradox of openness: Appropriability, external search and collaboration. Res Policy 43(5):867–878. https://doi.org/10.1016/j.respol.2013.10.004

Lei G, Wang W, Yu J, Chan KC (2022) Cultural Diversity and Corporate Tax Avoidance: Evidence from Chinese Private Enterprises. J Bus Ethics 176(2):357–379. https://doi.org/10.1007/s10551-020-04683-2

Leslie LM, Flynn E (2022) Diversity Ideologies, Beliefs, and Climates: A Review, Integration, and Set of Recommendations. J Manag, https://doi.org/10.1177/01492063221086238

Leung K, Wang J (2015) Social processes and team creativity in multicultural teams: a socio-technical framework. J Organ Behav 36(7):1008–1025. https://doi.org/10.1002/job.2021

Li B, Li H, Sun G, Tao J, Lu C, Guo C (2024) Speculative culture and corporate high-quality development in China: mediating effect of corporate innovation. Humanit Soc Sci Commun 11:870. https://doi.org/10.1057/s41599-024-03404-8

Li C, Lin C, Tien Y, Chen C (2017) A Multilevel Model of Team Cultural Diversity and Creativity: The Role of Climate for Inclusion. J Creative Behav 51(2):163–179. https://doi.org/10.1002/jocb.93

Li H, Atuahene-Gima K (2001) Product innovation strategy and the performance of new technology ventures in China. Acad Manag J 44(6):1123–1134. https://doi.org/10.5465/3069392

Li H, Jia P, Fei T (2021) Associations Between Taste Preferences and Chronic Diseases: A Population-Based Exploratory Study in China. Public Health Nutr 24(8):2021–2032. https://doi.org/10.1017/S136898002000035X

Li K, Griffin D, Yue H, Zhao L (2013) How Does Culture Influence Corporate Risk-Taking? J Corp Financ 23:1–22. https://doi.org/10.1016/j.jcorpfin.2013.07.008

Lim CY, Wang J, Zeng CC (2018) China’s “Mercantilist” Government Subsidies, the Cost of Debt and Firm Performance. J Bank Financ 86:37–52. https://doi.org/10.1016/j.jbankfin.2017.09.004

Liu JY-C, Chen H-G, Chen CC, Sheu TS (2011) Relationships among interpersonal conflict, requirements uncertainty, and software project performance. Int J Proj Manag 29(5):547–556. https://doi.org/10.1016/j.ijproman.2010.04.007

Lo Monaco G, Bonetto E (2019) Social representations and culture in food studies. Food Res Int 115:474–479. https://doi.org/10.1016/j.foodres.2018.10.029

Mao L, Lu C, Sun G, Zhang C, Guo C (2024a) Regional Culture and Corporate Finance: A Literature Review. Humanit Soc Sci Commun 11:59. https://doi.org/10.1057/s41599-023-02551-8

Mao L, Sun G, He Y, Chen H, Guo C (2024b) Culture and Sustainability: Evidence from Tea Culture and Corporate Social Responsibility in China. Sustainability 16:10. https://doi.org/10.3390/su16104054

Maietta OW (2015) Determinants of university-firm R&D collaboration and its impact on innovation: A perspective from a low-tech industry. Res Policy 44(7):1341–1359. https://doi.org/10.1016/j.respol.2015.03.006

Mandelbrot BB (1967) How long is the coast of Britain? Statisticalself - simility and fractional dimension. Science 150(3775):636–638

Mandelbrot BB (1998) The Fractal Geometry of Nature. Am J Phys 51(3), https://doi.org/10.1119/1.13295

Mellander C, Florida R (2011) Creativity, Talent, and Regional Wages in Sweden. Ann Regional Sci 46(3):637–660. https://doi.org/10.1007/s00168-009-0354-z

Mertzanis C (2019) Family ties, institutions and financing constraints in developing countries. J Bank Finance 108, https://doi.org/10.1016/j.jbankfin.2019.105650

Mousa M (2021) Does Gender Diversity Affect Workplace Happiness for Academics? The Role of Diversity Management and Organizational Inclusion. Public Organ Rev 21(1):119–135. https://doi.org/10.1007/s11115-020-00479-0

Nanda V, Silveri S, Wang K, Zhao L (2023) Executive Compensation Limits and Executive Turnover. Manag Sci, https://doi.org/10.1287/mnsc.2023.4812

Newman A, Ucbasaran D, Zhu F, Hirst G (2014) Psychological capital: A review and synthesis. J Organ Behav 35:S120–S138. https://doi.org/10.1002/job.1916

Ni S, Chen J, Zhang L (2003) The application of fractal theory to supply chain management. J Huazhong Univ Sci Technol. https://doi.org/10.13245/j.hust.2003.11.039

Nishii LH (2013) The Benefits of Climate for Inclusion for Gender-Diverse Groups. Acad Manag J 56(6):1754–1774. https://doi.org/10.5465/amj.2009.0823

North DC (1991) Institutions. J Economic Perspect 5(1):97–112. https://doi.org/10.1257/jep.5.1.97

Paillé P, Yang C, Boiral O, Jin J (2014) The impact of human resource management on environmental performance: an employee-level study. J Bus Ethics 121(3):451–466. https://doi.org/10.1007/s10551-013-1732-0

Phan HV, Nguyen NH, Nguyen HT, Hegde S (2019) Policy uncertainty and firm cash holdings. J Bus Res 95:71–82. https://doi.org/10.1016/j.jbusres.2018.10.001

Plowman DA, Baker LT, Beck TE, Kulkarni M, Solansky ST, Travis DV (2007) Radical change accidentally: The emergence and amplification of small change. Acad Manag J 50(3):515–543. https://doi.org/10.1016/j.jbusres.2018.10.001

Qi X, Guo Y, Guo P, Yao X, Liu X (2022) Do subsidies and R&D investment boost energy transition performance? Evidence from Chinese renewable energy firms. Energy Policy 164, https://doi.org/10.1016/j.enpol.2022.112909

Rashid MM (2020) Ownership structure and firm performance: the mediating role of board characteristics. Corp Gov- Int Rev 20(4):719–737. https://doi.org/10.1108/CG-02-2019-0056

Ren S, Sun H, Zhang T (2021) Do environmental subsidies spur environmental innovation? Empirical evidence from Chinese listed firms. Technol Forecasting Soc Change 173, https://doi.org/10.1016/j.techfore.2021.121123

Sanchez-Ballesta JP, Garcia-Meca E (2007) A meta-analytic vision of the effect of ownership structure on firm performance. Corp Gov Int Rev 15(5):879–893. https://doi.org/10.1111/j.1467-8683.2007.00604.x

Serfling MA (2014) CEO age and the riskiness of corporate policies. J Corp Financ 25:251–273. https://doi.org/10.1016/j.jcorpfin.2013.12.013

Shane S, Cable D (2002) Network ties, reputation, and the financing of new ventures. Manag Sci 48(3):364–381. https://doi.org/10.1287/mnsc.48.3.364.7731

Shin Y, Kim M, Choi JN, Lee SH (2018) Does Team Culture Matter? Roles of Team Culture and Collective Regulatory Focus in Team Task and Creative Performance. Group Organ Manag 41(2):232–265. https://doi.org/10.1177/1059601115584998

Shore LM, Cleveland JN, Sanchez D (2018) Inclusive Workplaces A Review and Model. Hum Resour Manag Rev 28(2):176–189. https://doi.org/10.1016/j.hrmr.2017.07.003

Shore LM, Randel AE, Chung BG, Dean MA, Ehrhart KH, Singh G (2011) Inclusion and Diversity in Work Groups: A Review and Model for Future Research. J Manag 37(4):1262–1289. https://doi.org/10.1177/0149206310385943

Smith WK, Besharov ML (2019) Bowing before Dual Gods: How Structured Flexibility Sustains Organizational Hybridity. Adm Sci Q 64(1):1–44. https://doi.org/10.1177/0001839217750826

Stevenson MJ (1998) Fractal market analysis: Applying chaos theory to investment and economics. J Economic Behav Organ 34(2):343–345

Sumo J, Staffileno BA, Warner K, Arrieta M, Salinas I (2021) The development of an online diversity and inclusion community: Promoting a culture of inclusion within a college of nursing. J Professional Nurs 37(1):18–23. https://doi.org/10.1016/j.profnurs.2020.10.002

Sun G, Cao X, Chen J, Li H (2022a) Food Culture and Sustainable Development: Evidence from Firm-Level Sustainable Total Factor Productivity in China. Sustainability 14(14):8835. https://doi.org/10.3390/su14148835

Sun G, Guo C, Li B, Li H (2023a) Cultural inclusivity and corporate social responsibility in China. Humanit Soc Sci Commun 10(1):670. https://doi.org/10.1057/s41599-023-02193-w

Sun G, Guo C, Ye J, Ji C, Xu N, Li H (2022b) How ESG Contribute to the High-Quality Development of State-Owned Enterprise in China: A Multi-Stage fsQCA Method. Sustainability 14(23):15993. https://doi.org/10.3390/su142315993

Sun G, Lin X, Chen J, Xu N, Xiong P, Li H (2023b) Cultural inclusion and corporate sustainability: evidence from food culture and corporate total factor productivity in China. Humanit Soc Sci Commun 10(1):159. https://doi.org/10.1057/s41599-023-01649-3

Terjesen S, Hessels J, Li D (2016) Comparative International Entrepreneurship: A Review and Research Agenda. J Manag 42(1):299–344. https://doi.org/10.1177/0149206313486259

Vishwanathan P, van Oosterhout HJ, Heugens PPMAR, Duran P, van Essen M (2019) Strategic CSR: A Concept Building Meta-Analysis. J Manag Stud 57(2):314–350. https://doi.org/10.1111/joms.12514

Wagner T, Hennig-Thurau T, Rudolph T (2009) Does Customer Demotion Jeopardize Loyalty? J Mark 73(3):69–85. https://doi.org/10.1509/jmkg.73.3.69

Wan Y, Gao Y, Hu Y (2022) Blockchain application and collaborative innovation in the manufacturing industry: Based on the perspective of social trust. Technol Forecasting Soc Change, 177, https://doi.org/10.1016/j.techfore.2022.121540

Wang L, Wang Y, Sun Y, Han K, Chen Y (2022) Financial inclusion and green economic efficiency: evidence from China. J Environ Plan Manag 65(2):240–271. https://doi.org/10.1080/09640568.2021.1881459