Abstract

Green finance plays a critical role in promoting regional green innovation. However, the precise influence of green finance on diverse facets of green innovation remains underexplored. This study empirically analyses the diverse effects of green finance on heterogeneous green innovation by applying the negative binomial model, the threshold model, andthe spatial error model using China’s regional data from 2010 to 2019. The results indicate that green finance has a positive impact on regional green innovation performance, primarily through significant contributions to fossil energy carbon reduction, energy conservation and recovery, and clean energy technology innovation. The effect of green finance is also influenced by the level of local environmental supervision, exhibiting a significant threshold effect. In addition, the development of green innovation in the region can have a siphoning effect on the resources of surrounding areas, hindering their innovation development. These findings highlight the necessity for strategic government policy-making, which should leverage the diverse impacts of green finance on various forms of green innovation. Customizing green financial instruments to suit regional environmental regulatory conditions and the green innovation levels of neighboring regions could significantly aid in promoting regional green transformation and growth.

Similar content being viewed by others

Introduction

In recent years, China’s economic development strategy has experienced a fundamental transformation, whereby the strategy’s focus has shifted from prioritizing rapid growth to emphasizing high-quality development. This change is marked by a new developmental ethos that advocates for green and low-carbon initiatives. The concept highlights the importance of environmental improvement, aims for ecological stability, and concentrates on the efficient utilization of resources, reflecting the nation’s commitment to harmonizing economic advancement with environmental protection, thereby fostering sustainable economic growth (Li et al. 2023b; Yan et al. 2023). While China is actively striving for a high-quality development path, emphasizing resource conservation and environmental sustainability, its dependence on fossil fuels persists, with coal still the predominant energy source (Du et al. 2019; Li et al. 2022c). In 2022, China’s carbon dioxide emissions reached approximately 12.1 billion tons, representing one-third of the world’s total emissions. To address the challenges of climate change, ecological damage, and resource shortages, an increasing number of nations and regions are prioritizing green development, including the development of unique green innovation systems and technological pathways (Liu et al. 2020). Moreover, green innovation (GI) is increasingly acknowledged as a crucial driver of the green transformation of industrial frameworks, attracting significant attention from the academic community (Qiu et al. 2020; Ma et al. 2024).

GI involves developing environmentally friendly and low-carbon technologies focused on achieving carbon reduction, neutrality, or potentially negative carbon impacts (Du and Li, 2019). Extensive studies have demonstrated the critical importance of GI in reducing carbon emissions and enhancing energy efficiency, effectively aligning with economic and environmental goals (Leoncini et al. 2016; Li et al. 2021). However, it has been noted that GI, particularly in areas such as renewable technology research, often involves longer investment cycles and higher costs than traditional innovation models. This characteristic can discourage active participation by financial institutions and limit the motivation of companies to engage in green transformation (Huang et al. 2022b; Yi et al. 2023). To address this challenge, the government has developed a series of strategies to alleviate the financial constraints faced by enterprises and to encourage financial institutions to participate in environmental protection projects, including the provision of financial subsidies for green and low-carbon technologies, together with incentives for financial institutions to participate in environmental projects, these strategies can alleviate the funding constraints faced by enterprises. This approach promotes GI, addresses the critical issue of resource and environmental constraints, and promotes the green restructuring of the industrial systems (Yu et al. 2021). Green finance (GF) in China transcends a mere economic strategy; it represents a comprehensive national strategy that has seen extensive promotion and application. The concept of “establishing a green financial system” was initially articulated in the 2015 Overall Plan for Ecological Civilization System Reform. Since then, China has introduced a series of policies encompassing green credit, green bonds, green insurance, and green trust. Key policy initiatives include the Guiding Opinions on Building a Green Financial System, the Green Credit Guidelines, and the Green Bond Support Project Catalogue. These efforts collectively contribute to the construction of a robust green financial system within the country.

Current research highlights the significant positive influence of GF on factors such as green factor productivity, GI, and corporate financing capabilities, suggesting a spatial spillover effect of GF on GI (Chen et al. 2022; Huang and Chen, 2022; Hung, 2023). However, there remains a gap in understanding the complex processes through which GF propels GI. The rich diversity of GI, which covers a wide range of pursuits, including carbon emission reduction in fossil fuels, energy efficiency, recycling of energy resources, development of clean energy, and energy storage solutions, has not been comprehensively analysed in terms of the effects and differences generated by GF. Moreover, the differential effects of green financial instruments need to be analysed. Given China’s vast geographical expansion and significant regional disparities in green development levels, innovation resource endowments, and industrial structures, it is imperative to devise region-specific strategies (Irfan et al. 2022). Therefore, analysing the effects of GF on GI should be tailored to regional developmental characteristics and green technology nuances. This approach is crucial for providing theoretical and empirical support for shaping China’s green transformation development strategy.

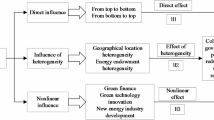

This study examines the varying effects of GF on regional GI by assessing how these impacts differ under diverse intensities of environmental supervision through a threshold model. Additionally, it investigates the spatial spillover effects associated with various types of GI by employing a spatial error model. Specifically, this study enhances the existing research on GI and finance from several novel perspectives. First, it deepens the research on GI by categorizing its types, thereby elucidating the various mechanisms by which GF influences regional GI. This not only augments the literature on the GF but also identifies key policy-driven areas for regional green development, offering comprehensive insights into corporate environmental transformations. Second, this study reveals the regional heterogeneity in the effects of GF on GI and determines the threshold effect of environmental supervision intensity (ESI). This provides new directions for policy-making, underscoring the critical role of regional differences in shaping the policies of the GF and highlighting the need for policymakers to consider the unique characteristics of different regions and the varying impacts of environmental supervision. Finally, the paper reveals a negative spatial spillover effect of regional GI, suggesting that advancing green development in one area could compromise environmental benefits in adjacent regions. Accordingly, it advocates for a holistic and systematic approach in governmental strategy formulation for green development, cautioning against myopic focuses that could result in unintended consequences.

The remainder of the paper is organized as follows. Section Literature review and hypotheses reviews the literature on GF and GI and formulates hypotheses. Section Methodology and Data details the study design, including the model configuration and variable descriptions. Section Empirical Results analyses the empirical results and related examination. Finally, Section discussion and Conclusion summarizes the conclusions, highlighting the theoretical contributions and policy implications.

Literature review and hypotheses

Green finance and regional heterogeneous green innovation

As the world faces increasing environmental disasters and climate change risks, GI has gained widespread attention in academia, which emphasizes ecological protection, environmental friendliness, and sustainable development goals (Nylund et al. 2022; Sun and Razzaq, 2022). Extensive research indicates that GI is a technological model that is more conducive to low-carbon development. It can directly or indirectly influence carbon emission intensity and promote sustainable economic growth by improving industrial and energy structures (Rehman et al. 2021; Jia et al. 2022).

In addition to assessing the environmental and economic benefits of GI, current studies have explored its complexity. Barbieri et al. (2020) noted that green technology is more complex and novel than non-green technology and has a broader and more significant impact on subsequent inventions. Li et al. (2022a), integrating Schumpeter’s theory of innovation, described the differential impact of regional integration policies on exploratory and exploitative GI through the paradigms of knowledge recombination and new knowledge introduction. Singh et al. (2022) classify GI into green product innovation and green process innovation from product and process perspectives, thereby establishing a linkage mechanism with high corporate performance. Moreover, the development of GI also faces numerous challenges. Low willingness to pay, high development costs, high commercial uncertainty, and a lack of favourable political frameworks are significant barriers to the advancement of GI (Stucki, 2019). Increasingly, many enterprises are constrained by capital limitations in GIs (Lai et al. 2022), making the alleviation of financial burdens for GI an urgent issue to address.

The development and innovation of green technology are inseparable from financial support. GF plays a positive role in GI by attracting capital and investment to technologies, projects, and enterprises that enhance environmental benefits (Qadri et al. 2024). On the one hand, GF can effectively mitigate financing constraints in the process of GI. This is particularly useful for small and medium-sized enterprises, whose long-term capital needs and high risks in GI make them more dependent on GF (Cowling and Liu, 2023). Yu et al. (2021) found that green credit can effectively alleviate the financing constraints of GI, although private enterprises often struggle to obtain such support. On the other hand, GF also helps offset the increased costs of environmental supervision. For example, external costs such as environmental taxes can reduce the resources available for innovation within companies (Tingbani et al. 2023). Fang and Shao (2022) introduced GF as a moderating variable and found that it can significantly alleviate the impact of environmental regulatory tools on GI. Additionally, the market mechanisms of GF incentivize companies to undertake higher-quality GI to secure more external financing (Huang et al. 2022a).

Although academia generally recognizes the positive impact of GF on GI, few studies systematically explain the heterogeneous effects between the two. In particular, whether the effectiveness of GF is consistent across different types of GI remains a topic for further discussion. By categorizing GI into quantity, quality, and diversity, Cheng et al. (2023) found that air pollution control action plans only enhanced the diversity of corporate GI without improving its quality. Zhang et al. (2023b) found that green creative technological innovation, compared to green improvement technological innovation, is more conducive to regional air quality improvement and economic development. The demand for GF may vary across different types of GI. For technology-intensive GI, such as clean energy, GF primarily lowers the barriers to innovation. In contrast, for structural transformation GI, such as carbon reduction in fossil energy, the role of GF lies in its impact on product market penetration.

Furthermore, considering the variations in resource reserves, environmental supervision, and industrial structures across regions, the same policy measures may not be equally effective everywhere (Grillitsch and Hansen, 2019). Economically developed regions with richer human resources often provide more substantial knowledge reserves and technical foundations for GI, leading to different performance outcomes (Li et al. 2024). Xu et al. (2023) found through a comparative analysis of clean production standards and pollution emission standards that different environmental standards have asymmetric impacts on GI. In China, renewable energy innovations are occurring mainly in the economically developed and industrially advanced eastern coastal regions, particularly in the Beijing-Tianjin-Hebei region and the middle and lower reaches of the Yangtze River (Ma et al. 2023). GF policies effective in promoting GI in the eastern regions may not successfully stimulate the development and utilization of renewable energy technologies in the northwestern regions.

Based on these insights, this study proposes the following hypothesis:

Hypothesis 1: There are significant differences in the influence of green finance on regional heterogeneous green innovation.

Threshold effect of environmental supervision

Environmental supervision is of pivotal importance in regional green transformation, exerting a significant influence on technological innovation, the redistribution of resources, and the development of skill premiums (Li et al. 2022b; Zhang and Zhao, 2023). Existing research on environmental supervision primarily focuses on the deconstruction of the Porter hypothesis and the assessment of compliance costs, thus forming both positive and negative views on the impact of environmental supervision on GI (Zhang et al. 2024). The positive perspective, derived from the Porter hypothesis, posits that appropriate environmental supervision pressure can incentivize firms to engage in more innovative activities in the long run, with improved innovation performance compensating for the costs of environmental supervision (Brunel, 2019). Behera and Sethi (2022) analysed the relationship between environmental supervision and GI in OECD countries, highlighting that well-designed environmental supervision can facilitate regional green technological innovation. Conversely, the negative perspective emphasizes the compliance cost burden that firms face in environmental governance, such as pollution permit fees and environmental taxes. Increased compliance costs ultimately result in a reduction in innovation motivation and activities (Du et al. 2021b). Tian and Yae (2024) demonstrated that in firms with greater product market competition, weaker financial foundations, and greater business development uncertainty, the implementation of stringent environmental supervision leads to the diversion of resources originally allocated to GI.

Although there is no consensus in academia on the effects of environmental supervision, both the Porter hypothesis and the compliance cost perspective agree on the recognition that stringent environmental supervision increases innovation costs. The key factor that may cause the divergence in research findings is whether firms can offset the increased costs of environmental supervision through the benefits gained from GI. Larger firms are more likely to be held accountable by the public for environmental protection responsibilities, and they can more easily enhance their core competitiveness by shaping a green image, thereby forming a positive relationship between environmental supervision and GI (Borsatto and Amui, 2019). Highly polluting firms are more likely to seek green transformation and development to avoid high environmental supervision costs (García-Marco et al. 2020). Environmental supervision imparts meaning and value to firms’ GI efforts, but it also raises the threshold for GI activities. When deciding to engage in GI, firms need to consider both internal resource reserves and external environmental supervision (Kiefer et al. 2019).

In this context, the relationships among environmental supervision, GF, and GI have been the subject of extensive academic debate. The extant literature indicates that environmental supervision can promote GF through short-term or long-term external financing channels (Xu et al. 2022b). Furthermore, external financing constraints can also moderate the relationship between environmental supervision and GI (Zhang et al. 2023a). Yang et al. (2022b), while clarifying the positive impact of GF and environmental supervision on GI, found that as the intensity of environmental supervision increases, the promotional effect of GF on regional GI significantly increases. Yin et al. (2023) analysed the pathways through which heterogeneous environmental supervision affects GI, supplemented by an exploration of the moderating role of GF. Existing research confirms the close connection between the three, but the exploration of the pathways through which environmental supervision and GF influence GI remains inconsistent.

This study suggests that, compared to the linear impact of GF on GI, environmental supervision may exhibit non-linear characteristics due to the influence of compliance costs and innovation compensation effects. Specifically, short-term compliance cost constraints reduce firms’ innovation investments to meet environmental supervision requirements. In the long term, however, the innovation compensation effect incentivizes firms to engage in GI activities to mitigate or compensate for the productivity losses caused by environmental supervision. This misalignment may result in the threshold effect of environmental supervision (Xu et al. 2022a). When the intensity of environmental supervision is low, firms are more inclined to meet regulatory requirements by purchasing pollution emission permits or paying environmental taxes rather than investing in GI, which typically has longer payback periods and greater risks. This leads to situations where GF fails to effectively promote GI (Popp, 2019). As the intensity of environmental supervision increases, stringent environmental policies reduce the risk of knowledge spillover from GI, thereby increasing the expected returns from innovation. Consequently, firms are more willing to invest in green technological innovation to drive the green transformation of industrial structures and avoid high compliance costs under strict environmental supervision. In such cases, the impact of GF on GI becomes significant (Kesidou and Wu, 2020).

Considering these effects, this study proposes the following hypothesis:

Hypothesis 2: The intensity of environmental supervision has a threshold effect on the relationship between green finance and regional heterogeneous green innovation.

Spatial effects of regional heterogeneous green innovation

The development of regional green transformation is influenced not only by internal factors such as economic conditions, technological capabilities, and policy frameworks but also by economic progression and resource availability in neighboring areas. A crucial element in assessing the impact of GF on GI is the spatial effect, which plays a dual role. First, as Peng et al. (2021) illustrate, the spatial spillover of GI is instrumental in improving the quality of economic development and aiding the transition and modernization of regional economies. Second, differences in GF, environmental supervision, industrial structures, and regional market demands significantly influence the development of GI. These factors not only promote GI within each region but also affect GI performance in neighboring areas (Huang et al. 2022b; Shao et al. 2022; Qiu et al. 2023). From the perspective of GF, Hu et al. (2023) attributed the spatial spillover effect of GI to factors such as economies of scale, efficient resource allocation, and the trickle-down effect.

Current studies on the spatial effects of GI mainly focus on individual innovation types, with limited exploration of the classification of GI and its varied spatial impacts across different categories. Diverse analytical perspectives have led to a range of interpretations of heterogeneous GI. Du et al. (2021a) categorized GI into green invention innovation and green utility model innovation based on China’s patent classification, examining the distinct impacts of emission trading policies. In contrast, Chen et al. (2023) explored the negative effects of digital financial development in neighboring cities on the GI of core cities using mixed qualitative and quantitative research methods. Extending Schumpeter’s innovation theory, Juo and Wang (2022) divided GI into green exploratory innovation and green exploitative innovation, delving into its regulatory effect on the relationship between green practices and competitive advantage.

However, these studies primarily concentrate on the types of innovation rather than the specific characteristics of green technologies. The heterogeneity of GI is more clearly reflected in different technological paradigms, such as renewable energy, energy-saving technology, and waste recycling. For example, Yang et al. (2022a) evaluated the effects of renewable energy policies on GI in sectors such as wind, hydropower, and solar energy, and found a minimal impact on geothermal GI. Zhang et al. (2022) observed that stringent environmental policies positively affected GI in geothermal, hydropower, and marine energy but not in wind and solar energy. Yang et al. (2017) argued that varied technological resources may be a key driver of innovation in energy-saving technologies in sectors such as electricity and heat energy. This heterogeneity implies significant regional variations in the effects of GI. Factors such as regional technical capacity, resource endowment, market demand, and policy orientation can result in diverse spatial spillover effects of GI, as noted by Zhou et al. (2023). These differences affect not only the nature and scope of GI but also its contribution to regional economies and environmental sustainability.

In summary, GI has a direct impact on their respective regions and influence neighboring areas through mechanisms such as knowledge spillover (Ben Arfi et al. 2018), cooperation networks (Wang et al. 2021), and industrial transfer (Luo et al. 2023). These spatial effects may exhibit varying characteristics and intensities in different regions, suggesting that heterogeneous GI has significant spatial effects across various regions. This observation leads to the formulation of the following hypothesis:

Hypothesis 3: The impact of green finance on regional heterogeneous green innovation exhibits spatial effects.

Methodology and Data

Model design

Baseline model

The impact of GF on regional GI may arise from mechanisms such as industrial structure transition, reduced financing burdens, and increased green R&D investment, potentially leading to varied effects. To capture the differentiated impact of GF on heterogeneous GI, this study uses the number of regionally authorized green invention patents as the dependent variable. Since this variable is a nonnegative integer, simple linear regression may produce estimates that deviate from the real-world scenario. Commonly used count models include the Poisson model and the negative binomial model. The Poisson model requires a variable distribution to meet the Poisson distribution condition, where the mean and variance are equal. However, for the variables involved in this study, the mean is less than the variance. For example, the mean regional GI is 541.410, while the variance is 487875.707, indicating overdispersion, which does not meet the requirements of the Poisson model. Referencing the viewpoints of Lisawadi et al. (2021) and Wu et al. (2024), the negative binomial model was chosen for data analysis. The specific model equation is as follows.

where \({{Gi\_x}}_{{it}}\) denotes the GI of type x, x = 1, 2, 3, 4, 5. \({{GF}}_{{it}}\) represents the development of GF in region i at time t. \({{Control}}_{{it}}\) encapsulates other variables in region i that may influence heterogeneous GI at time t, serving as the control variables in this study. \({\mu }_{i}\) indicates a provincial fixed effect, \({\upsilon }_{t}\) denotes a time fixed effect, and \({\varepsilon }_{{it}}\) is a random error term.

Threshold effect model

Existing research predominantly postulates a linear relationship between GF and GI. However, this perspective may oversimplify the dynamics due to regional disparities in industrial structures, environmental capacities, and resource endowments, which could engender a more intricate, nonlinear interplay between GF and heterogeneous GI. In light of this, the present study integrates the panel threshold effect model proposed by Hansen (1999) to investigate these nonlinear effects. Accordingly, the model is constructed as follows:

where \(I\left(\cdot \right)\) represents the indicator function, which assumes a value of 1 when the specified conditions within the parentheses are satisfied and 0 otherwise. \({{ESI}}_{{it}}\) denotes the intensity of regional environmental supervision and serves as the model’s threshold variable, with \(\theta\) being the corresponding threshold value.

Spatial effect model

The GF and GI may be affected by the regional natural resource endowment, economic development level, policy supervision intensity and other factors, resulting in spatial heterogeneity of the results. This paper tests the similarity degree of adjacent spatial attributes by measuring the Moran index of the geographical space weight matrix. The specific equation is as follows:

where \({x}_{i}\) and \({x}_{i}\) represent the performances of the heterogeneous GIs in region i and region j, respectively, \(\bar{x}\) is the mean value of the heterogeneous GI, \({S}^{2}\) denotes the sample variance, and \({\omega }_{{ij}}\) is the geospatial weight matrix.

The study then employs a spatial econometric model to capture potential spatial spillover effects associated with GF and GI. The mainstream spatial econometric models include the spatial lag model (SLM), the spatial error model (SEM), and the spatial Durbin model (SDM). After considering the results of the LM test and the characteristics of regional heterogeneity, the spatial error model is selected as the most appropriate model for this analysis. The construction of the model is as follows:

where \(\lambda\) is the coefficient of the spatial error term, and the spatial dependence degree of this parameter measures the spatial error term. The other variables are basically consistent with Eq. (2). When studying the impact of GF on heterogeneous GI, SEM helps to identify and explain the spatially related errors caused by geographical location, regional policy differences, and other factors and enhances the explanatory power of the model.

Data description

Dependent variable

Following the methodology of Sheng et al. (2024), this study measures regional GI using the number of regionally approved green invention patents. The criteria for defining green patents and their heterogeneity are based on the Green Low-Carbon Technology Patent Classification System issued by the China National Intellectual Property Administration in 2022. This document is aligned with the International Patent Classification (IPC) and addresses China’s energy resource endowment, which is characterized by abundant coal, limited oil, and scarce gas. It identified five key technology categories essential for China’s green economic development: fossil energy carbon reduction (GI_1), energy saving and recovery (GI_2), clean energy (GI_3), energy storage (GI_4), and greenhouse gas capture, utilization, and storage (GI_5). These categories are critical to achieving China’s carbon peaking and carbon neutrality goals. The detailed classifications of GI are shown in Table A2.

In China, patents are categorized into three types: invention, utility model, and design. Invention patents require a higher level of creativity, ensuring that the approved patents have high technical standards and innovation degrees. These patents often contain fundamental and disruptive technological innovations that play a significant role in industrial development and technological progress. Thus, using green invention patents effectively captures the real situation of regional GI. Additionally, following the approach of Doblinger et al. (2022), this study lags the dependent variable by one year to account for the period between the introduction of GF projects and the resulting substantive green patent applications. For instance, the number of green invention patents applied for and authorized in 2020 reflects the outcomes of GF development in 2019.

Independent variable

In contrast to the traditional financial system, which primarily focuses on economic benefits, the evaluation of GF requires a comprehensive approach that includes environmental and social dimensions. This broader scope of assessment encompasses risk management, transparency, responsibility, and innovation. Drawing inspiration from the GF index system developed by Lv et al. (2021), this study established 10 primary indicators and 26 secondary indicators. These indicators are constructed through policy promotion at the provincial-municipal-county level, market incentives, constraints, and government investment. The detailed indicators are listed in Table A3. To comprehensively evaluate the development of GF in China, this study uses the spatiotemporal entropy weighting method to synthesize these indicators. This method allows for an integrated assessment of the various dimensions of GF development over time and across different regions. The specific measurement approach is as follows.

First, the secondary indicators belonging to dimensions such as policy promotion and market mechanism construction are standardized using Eqs. (6) and (7) to eliminate the influence of different units among the indicators. The positive indicators are standardized using Eq. (6), while the negative indicators are standardized using Eq. (7). Here, \({{Indicator}}_{{ijt}}\) represents the variation in indicator i in region j at time t, while \({\rm{m}}{\rm{ax}}({{Indicator}}_{{ijt}})\) and \(\min ({{Indicator}}_{{ijt}})\) denote the maximum and minimum values of indicator i.

Next, based on the standardized data obtained, we construct a proportion matrix for each indicator and calculate the proportion of each indicator within its observation range using Eq. (8). If \({p}_{{ijt}}\) is 0, then \({p}_{{ijt}}{\mathrm{ln}}\,({p}_{{ijt}})\) is also defined as 0.

Then, we calculate the information entropy and the corresponding weight of each indicator according to Eqs. (9) and (10). \({D}_{i}\) represents the information entropy value of each indicator, and \({W}_{i}\) denotes the weight of each indicator.

Finally, the standardized indicators \({{Indicator\_i}}_{{jt}}^{s}\) and weights \({W\_i}\) are synthesized according to equation (11), resulting in a comprehensive indicator that evaluates the various developmental stages of GF across regions. This comprehensive indicator, referred to as GF, serves as the independent variable in this study.

Threshold variable

Numerous studies have shown that the degree to which local governments pay attention to environmental conditions is a crucial factor influencing the direction of regional GI (Krause et al. 2019; Bhatia and Jakhar, 2021). A higher ESI indicates a more urgent need for environmental innovation measures in the region. This urgency prompts firms to continuously advance eco-friendly innovation initiatives to offset or mitigate the increased costs associated with environmental supervision. Therefore, changes in the ESI affect regional firms’ demand for and perception of GF, leading to a threshold effect on the impact of GF on regional GI.

Currently, common methods for measuring ESI in academia include counting the frequency of environmental keywords (Chen et al. 2018), pollutant emissions (Li et al. 2023a), and environmental legislation data (Liu et al. 2024). Among these methods, counting environmental keywords primarily reflects the emphasis local governments place on environmental protection, which does not directly affect GI. Using pollutant emissions as a measure could overlap with the independent variables of this study, potentially leading to multicollinearity problems. Therefore, this study follows the approach of Tu et al. (2024) and uses the number of environment-related administrative penalties in different regions of China as a proxy variable to measure the intensity of environmental supervision in those regions. This method provides a more direct and tangible indicator of ESI that captures the regulatory pressure exerted on firms.

Control variables

To delve deeper into the influence of GF on heterogeneous GI, this paper methodically controls for several key variables, as guided by the extant literature, to mitigate potential interference from unobserved heterogeneity and ensure the accuracy and reliability of our findings.

First, to account for potential biases caused by differences in regional economic development levels and government support, this study controls for these factors. The regional economic development level is measured by per capita GDP (PGDP) (Pan et al. 2023), and government support intensity (GOV) is measured by the ratio of fiscal expenditure to GDP (Li et al. 2024). Second, regional investment levels and financial development may also influence the effect of GF on innovation. The regional investment level is measured by the amount of foreign direct investment (FDI), while financial development (FIN) is measured by the ratio of the balance of deposits and loans of financial institutions to GDP (Lu and Xia, 2024). Finally, this study also considers the potential impact of regional structural variables on the results, controlling for population density (PPL) and industrial structure (STR). The industrial structure is measured by the ratio of the secondary and tertiary industries to GDP (Feng et al. 2022).

Data selection

Considering the aspects of data availability and validity, this study constructed a balanced panel hybrid dataset encompassing 30 provinces in China spanning the years 2010 to 2019. The sources for this dataset include the China Statistical Yearbook, China Energy Statistical Yearbook, China Environmental Statistical Yearbook, China Urban Statistical Yearbook, the incoPat patent database, and the Peking University legal information database. The dependent variable, GI, is defined according to the level 1 index classification and IPC classification numbers found in the directory of the Green and Low-carbon Technology Patent Classification System, released by the State Intellectual Property Office of China in 2022. This variable quantifies GI through the number of invention patents authorized in the respective application locations, with all relevant data sourced from the incoPat patent database. The descriptive statistics for each variable are presented in Table 1.

Empirical results

Regional heterogeneous GI

The foundational premise of this study hinges on the substantial regional disparities in China regarding the performance of five distinct types of GI. These categories encompass carbon reduction in fossil energy, energy conservation and recovery, clean energy, energy storage, and greenhouse gas capture, utilization, and storage. To illustrate these disparities, this study delineates the regional distribution of these five types of GI across China from 2010 to 2019. The findings of this analysis are depicted in Fig. 1.

Figure 1 reveals that the performance of heterogeneous GI exhibits pronounced regional characteristics. Notably, GI in carbon reduction technologies based on fossil energy occurs mainly in North China, Northeast China, and Northwest China. In contrast, South China, East China, Southwest China, and Central China are more inclined to develop GI through energy conservation and recovery technologies. The three types of GI – clean energy, energy storage, and greenhouse gas capture, utilization, and storage – demonstrate more uniform development across all regions. These trends may be influenced by each region’s unique energy structure and industrial features.

North China, Northeast China, and Northwest China are crucial industrial and energy hubs of China and rely heavily on fossil energy such as coal and oil. Hence, fostering carbon reduction technologies in these fossil fuels is pivotal for reducing environmental pollution and greenhouse gas emissions in these areas. Conversely, regions such as South China, East China, Southwest China, and Central China have more diversified economic structures, with a significant presence of light industries and services alongside varied energy demands. Developing GI in energy conservation and recovery is vital for reducing energy consumption and enhancing energy efficiency, providing significant economic and environmental benefits.

Additionally, there are marked disparities in the distribution of green innovation resources across different regions. In North China, South China, and Northwest China, innovation resources are mainly concentrated in Beijing, Guangdong Province, and Shaanxi Province, respectively, with other provinces and cities lagging. The total number of GI in Beijing, Guangdong Province, and Shaanxi Province significantly surpassed that in their neighboring provinces and cities. On the other hand, the distribution of innovation resources in Northeast, East, Southwest, and Central China is relatively balanced, with a minimal gap in the development of GI among provinces and cities in these regions and a lack of a significant resource agglomeration effect.

Baseline results

Table 2 presents the regression results for the influence of GF on heterogeneous GI. The findings indicate that the regression coefficient of GF on GI is 0.119, which is statistically significant at the 1% level. These results suggest that with China’s approach to developing regional GI, GF significantly influences GI in fossil energy carbon reduction, energy conservation and recovery, and clean energy.

This finding suggests that, in the context of GI with Chinese characteristics, GF promotes the development of regional GI levels by driving technological advancements in fossil energy carbon reduction, energy savings and recovery, and clean energy. The reason may be that in the Chinese context, GF has specific preferences for different types of green project investments. As defined in the Guiding Opinions on Building a Green Finance System issued by the Chinese government in 2019, the GF encompasses economic activities supporting environmental improvement, climate change mitigation, and the efficient utilization of resources. It extends financial services to the investment and financing of projects, operations, and risk management in areas such as environmental protection, energy conservation, clean energy, green transportation, and green building.

Furthermore, the sustainability of GF depends on its ability to draw more social capital into the green industry, leveraging the reputation effect. This characteristic necessitates the selection of investment sectors that promise quicker returns on investment and significant innovation compensation. Among the five categories of green technology, fossil energy carbon reduction, energy saving and recovery, and clean energy technology are more advanced in the industrial chain and are directly related to product production and returns. As a result, changes in the GF will have a direct impact on their performance.

Threshold analysis

The above analysis confirms the positive impact of GF on GI. However, the question of whether this necessitates a uniform policy of GF across all cities requires further investigation. A substantial body of research indicates a strong correlation between the intensity of environmental supervision and the proliferation of GI. This raises an intriguing question: does the impact of GF on GI vary due to regional differences in the ESI?

To address this issue, this study, which leverages the panel threshold effect model, delves into the threshold effect of GF on GI. The threshold variable is regional environmental regulatory intensity in the number of administrative penalty letters in each region. This approach aims to elucidate whether the influence of GF on GI manifests differently across different regions, contingent on the varying degrees of environmental regulatory intensity.

Initially, tests were conducted to ascertain whether the regional ESI exhibits a threshold effect. To enhance the precision of the confidence interval, a bootstrap with 1000 replications was used. The results, shown in Table 3, indicate that when heterogeneous GI is used as the dependent variable, the ESI passes the single threshold test at least at the 10% significance level for all types of GI except for greenhouse gas capture and utilization technology innovation. This confirms the threshold effect of the ESI.

Subsequently, building on these findings, the study estimated a single threshold regression model using the ESI as the threshold variable. The results in Table 4 indicate that regional GF positively impacts heterogeneous GI, albeit with variations contingent on the intensity of regional environmental supervision. Specifically, when the ESI is below the threshold, GF has a significant positive effect only on the GI related to energy savings and recovery. The other coefficients did not pass the significance tests. This result means that in regions with low ESI, the development of GF only affects energy savings and recovery-related GI but not other types of GI. It is only when the regulatory intensity reaches a certain level that GF can have the expected impact.

The reason for this phenomenon may be that GF, as a product with both social and economic attributes, relies not only on public participation driven by rising regional environmental awareness but also on policy guidance. In heavily polluted areas, due to constraints from industrial structures and economic benefits, public environmental awareness tends to be weak. It is challenging for the government to achieve energy savings and emission reductions by issuing green bonds and implementing carbon emission trading. However, developing energy conservation and recovery technologies can directly reduce production costs. Therefore, even in regions with weaker ESI, enterprises may still promote the development of these technologies to pursue lower production costs. In conclusion, while the GF promotes heterogeneous regional GI, its effectiveness is influenced by the intensity of environmental supervision. The implementation of GF is more effective in regions where environmental protection efforts have reached a certain level.

Spatial spillover effect analysis

The extent of GI is influenced not only by internal factors such as environmental awareness, education level, and economic development within a region but also potentially influenced by the GI strategies of neighboring regions. This aspect is particularly pertinent in China, where regional development, propelled by integration policies, transcends isolated efforts, emphasizing interregional connectivity and enhanced resource utilization through resource exchanges with surrounding areas.

To test the spatial correlation of heterogeneous regional GI, this study employs a geographical proximity matrix to compute the global Moran’s I for Chinese provinces from 2010–2019. The findings in Table 5 reveal that most categories of GI, as well as the aggregate measure of total GI, are significantly positive at the 5% level. This indicates a high spatial correlation in the levels of heterogeneous GI. Specifically, the level of GI in a given region may be influenced by the GI levels in its neighboring regions, exhibiting characteristics of spatial agglomeration. Hence, it is imperative to consider this spatial effect in empirical analyses to fully understand the dynamics of GI.

Therefore, the study uses a spatial econometric model for regression analysis. The LM test is used to select the most appropriate model between the SEM and the SLM. The results in Table 6 indicate a better fit for the SEM than for the SLM. Consequently, this study adopts SEM for subsequent testing of spatial effects. The regression results derived from the SEM are presented in Table 7.

Table 7 reveals that the spatial error term λ is −0.165, which is statistically significant at the 1% level. This finding indicates a notable negative spatial spillover effect of heterogeneous GI in cities. Specifically, regions adjacent to areas with high levels of GI tend to exhibit lower innovation levels. This phenomenon may be influenced by the siphoning effect caused by the regional promotion of green innovation, which leads to the flow and transfer of innovative elements and resources between regions. On the one hand, the threshold model results indicate a correlation between high environmental regulation and high green innovation performance. As regional environmental regulation intensity increases, highly polluting and energy-intensive enterprises may relocate to surrounding areas to avoid higher compliance costs. This industrial structure shift could create pollution clusters in neighboring regions, thereby altering the innovation orientation of those areas (Cai and Ye, 2022).

On the other hand, the level of regional green innovation affects the mobility of human capital. Environmental factors such as air quality and climate conditions significantly increase the willingness of high-quality talent to move and settle, forming a one-way flow path of human capital from regions with low green innovation to those with high green innovation (He et al. 2023; Wang and Guo, 2023). Additionally, the development of green finance further exacerbates the impact of green innovation in surrounding areas. Zheng et al. (2023) found that the development of green credit has negative effects on neighboring regions. This finding suggests that the level of regional green innovation is influenced not only by internal factors but also by the green innovation levels of adjacent regions due to random disturbances.

Furthermore, the results from models (1) to (6) show that the regression coefficient of green finance on regional green innovation is positive at the 1% significance level, indicating that the more mature the development of green finance is, the greater the performance of green innovation in that region. This finding is consistent with the conclusions of the benchmark model.

Robustness tests

To verify the robustness of the above conclusions, this study employs several methods for robustness testing. First, we adjust the lag period of the dependent variable. The baseline model considers the time lag between project implementation and innovation outcomes by applying a one-year lag to the dependent variable. In this section, we examine the regression results for the dependent variable with no lag, a two-year lag, and a three-year lag, as presented in Tables A4 to A6.

Next, we change the econometric model. Given that the dependent variable is a count variable, our options include the Poisson model and the negative binomial model. While the baseline model uses the panel negative binomial model, we use the panel Poisson model for robustness testing in this section. Additionally, following the approach of Sheng et al. (2024), we log-transform the dependent variable and use the OLS model for analysis; the results are shown in Tables A7 and A8. Finally, we replace the threshold variable. In addition to using the number of environmental-related lawsuits to measure the regional ESI, we adopted the method of Li et al. (2023a) by using the inverse of industrial wastewater, industrial SO2, and industrial dust emissions to reflect the regional ESI. The re-estimated results are shown in Table A9. The results from these models are consistent with the baseline model, thus confirming the robustness of our conclusions.

Discussion and Conclusion

This study examines the differentiated impact of GF on regional GI by introducing heterogeneous GI and using provincial panel data from 30 provinces in China from 2010 to 2019. The results show that the development of regional GF enhances green innovation performance, primarily through its positive effects on fossil energy carbon reduction technology, energy savings and recovery, and clean energy. This phenomenon may be due to the government’s interpretation of GF, which emphasizes its role as an economic investment behavior that supports environmental improvement, climate change mitigation, and efficient resource utilization. Consequently, investments naturally focus on returns. Compared to more complex post-treatment green technology innovations such as energy storage and greenhouse gas capture and utilization, investments in fossil energy carbon reduction technology, energy savings and recovery, and clean energy development yield more immediate and tangible returns. Therefore, these areas have become the primary investment targets of GF.

Furthermore, this study integrates findings from a threshold model, revealing that the effectiveness of GF in promoting GI is contingent upon the intensity of regional environmental oversight, exhibiting a clear threshold effect. In areas with more pronounced government environmental awareness and stringent supervision, the role of GF in enhancing GI is significantly more substantial. These insights suggest that while GF is beneficial, it is not a blanket solution for elevating the level of GI. This implies that local governments need to customize the support policy of GF to suit their specific environmental context, with the understanding that significant returns in GI from GF are only achievable when the intensity of supervision is applied at a suitable level.

Finally, the study concludes that GI is influenced not only by internal dynamics but also by the green innovation strategies of neighboring regions. The interconnection and mutual reinforcement among regions mean that regions no longer function as isolated units. However, this interconnectedness is not wholly advantageous. Enhancing a region’s GI often necessitates substantial internal resource allocation and, to a certain degree, may entail the sacrifice of green resources in neighboring areas. When a region focuses on environmental protection and green development, significant resources are required for industrial upgrading and transformation. At the same time, strict environmental policies may prompt the relocation of high-pollution and high-energy-consuming industries to surrounding areas, thus avoiding potential environmental burdens. This dual effect can lead to a “Matthew effect” in GI. Thus, the study underscores that GF has diverse impacts on GI, influenced by the pre-existing level of environmental protection in the region. Moreover, it identifies a spatial negative correlation in the levels of GI across regions, highlighting the need for green finance development strategies to consider not only internal regional factors but also the broader context of adjacent areas.

Theoretical contributions

This study offers significant theoretical contributions to the understanding of GI. By leveraging the green technology classification list from the State Intellectual Property Office of China, we comprehensively described the development of GI across 30 provinces in China during 2010–2019. Our research reveals the different impacts of GF on various types of GI, including carbon reduction technology for fossil energy, energy conservation and recovery, clean energy, energy storage technology, and greenhouse gas capture, utilization, and storage. This exploration not only clarifies the internal mechanisms by which GF fosters GI but also enriches the theoretical framework surrounding GF.

Moreover, the study delves into how regional environmental development influences the effectiveness of GF in advancing GI. We found that the beneficial effects of GF are conditional on a region’s environmental awareness and regulatory intensity, becoming significant only when a region’s environmental regulatory intensity exceeds a certain threshold.

Finally, our systematic analysis of the spatial spillover effect of regional heterogeneity in GI reveals a substantial negative correlation between the green innovation performance of provinces and cities. This finding suggests a siphon effect, wherein regions with higher levels of GI draw resources from neighboring areas. Employing spatial econometric models in this context is both appropriate and crucial, highlighting the need to consider not only regional internal factors, such as levels of GF and ESI but also the impact of neighboring regions on the development of GI.

Policy implications

Based on the conclusions of this study, the following policy recommendations can be derived. First, the development of green finance significantly enhances GI at the regional level. Therefore, the government should establish and improve local green financial systems and formulate financial support policies to promote the development of green enterprises and the structural transformation of traditional high-pollution, high-energy consumption enterprises. Given the differentiated impact of green finance on various types of GI, policies should prioritize focusing green finance efforts on fossil energy carbon reduction technology, energy savings and recovery, and clean energy development. This approach will guide the coordinated development of regional GI.

Second, the findings regarding the threshold effect demonstrate that the strength of regional environmental supervision substantially affects the efficacy of GF. A GF, while beneficial, is not a universal solution for elevating green innovation levels regionally. Governmental strategies should not indiscriminately deploy GF policies but rather tailor these approaches to the specific environmental contexts of each region. The impactful deployment of green finance tools hinges on meeting fundamental prerequisites, such as attaining a defined level of environmental regulatory intensity.

Finally, this study analyses the spatial spillover effects of green innovation, revealing a significant negative siphoning effect. Specifically, areas surrounding cities with high levels of green innovation often exhibit lower levels of green innovation. This phenomenon may be due to the flow and transfer of innovative elements and resources driven by the dissemination of green innovation within the region. Therefore, when formulating relevant policies, governments need to consider not only how internal factors influence green innovation but also the potential ripple effects these policies may have on neighboring regions. To avoid negative impacts on the environmental health of adjacent areas, policy designs aimed at enhancing green innovation should emphasize sustainability, ensuring that the positive effects of green innovation are realized across a broader region.

Data availability

The datasets are available in the supplementary file.

References

Barbieri N, Marzucchi A, Rizzo U (2020) Knowledge sources and impacts on subsequent inventions: Do green technologies differ from non-green ones? Res Policy, 49(2)

Behera P, Sethi N (2022) Nexus between environment regulation, FDI, and green technology innovation in OECD countries. Environ Sci Pollut Res 29(35):52940–52953

Ben Arfi W, Hikkerova L, Sahut JM (2018) External knowledge sources, green innovation and performance. Technol Forecast Soc Change 129:210–220

Bhatia MS, Jakhar SK (2021) The effect of environmental regulations, top management commitment, and organizational learning on green product innovation: Evidence from automobile industry. Bus Strategy Environ 30(8):3907–3918

Borsatto JMLS, Amui LBL (2019) Green innovation: Unfolding the relation with environmental regulations and competitiveness. Resour Conserv Recycl 149:445–454

Brunel C (2019) Green innovation and green Imports:Links between environmental policies, innovation, and production. J Environ Manag 248:109290

Cai W, Ye P (2022) Local-neighborhood effects of different environmental regulations on green innovation: evidence from prefecture level cities of China. Environ, Dev Sustain 24(4):4810–4834

Chen JY, Zhu DD, Ren XH, Luo WJ (2023) Does digital finance promote the “quantity” and “quality” of green innovation? A dynamic spatial Durbin econometric analysis. Environ Sci Pollut Res 30(28):72588–72606

Chen Z, Kahn ME, Liu Y, Wang Z (2018) The consequences of spatially differentiated water pollution regulation in China. J Environ Econ Manag 88:468–485

Chen ZG, Zhang YQ, Wang HS, Ouyang X Xie YX (2022) Can green credit policy promote low-carbon technology innovation? J Clean Prod, 359

Cheng YY, Du KR, Yao X (2023) Stringent environmental regulation and inconsistent green innovation behavior: Evidence from air pollution prevention and control action plan in China. Energy Econ. 120

Cowling M, Liu W (2023) Access to Finance for Cleantech Innovation and Investment: Evidence from U.K. Small- and Medium-Sized Enterprises. Ieee Trans Eng Manag 70(3):963–978

Doblinger C, Surana K, Li D, Hultman N, Anadón LD (2022) How do global manufacturing shifts affect long-term clean energy innovation? A study of wind energy suppliers. Res Policy 51(7):104558

Du G, Yu M, Sun CW, Han Z (2021a) Green innovation effect of emission trading policy on pilot areas and neighboring areas: An analysis based on the spatial econometric model. Energy Policy 156

Du K, Cheng Y, Yao, X (2021b) Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ 98

Du K, Li J (2019) Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 131:240–250

Du KR, Li PZ, Yan ZM (2019) Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol Forecast Soc Change 146:297–303

Fang Y, Shao Z (2022) Whether green finance can effectively moderate the green technology innovation effect of heterogeneous environmental regulation. Int. J. Environ. Res. Public Health, 19(6)

Feng Z, Cai H, Chen Z, Zhou W (2022) Influence of an interurban innovation network on the innovation capacity of China: A multiplex network perspective. Technol Forecast Soc Change 180:121651

García-Marco T, Zouaghi F, Sánchez M (2020) Do firms with different levels of environmental regulatory pressure behave differently regarding complementarity among innovation practices? Bus Strategy Environ 29(4):1684–1694

Grillitsch M, Hansen T (2019) Green industry development in different types of regions. Eur Plan Stud 27(11):2163–2183

Hansen BE (1999) Threshold effects in non-dynamic panels: Estimation, testing, and inference. J Econ 93(2):345–368

He Z, Chen Z, Feng X (2023) How does high-speed railway affect green technology innovation? A perspective of high-quality human capital. Environ Sci Eur 35(1):97

Hu Y, Wang C, Zhang XK, Wan H, Jiang, D (2023) Financial agglomeration and regional green innovation efficiency from the perspective of spatial spillover. J Innov Knowl 8(4)

Huang HY, Mbanyele W, Wang FR, Song ML, Wang YZ (2022a) Climbing the quality ladder of green innovation: Does green finance matter? Technol Forecast Soc Change 184

Huang Y, Chen C, Lei L, Zhang Y (2022b) Impacts of green finance on green innovation: A spatial and nonlinear perspective. J Clean Prod 365:132548

Huang YM, Chen C (2022) The spatial spillover and threshold effect of green finance on environmental quality: evidence from China. Environ Sci Pollut Res 29(12):17487–17498

Hung NT (2023) Green investment, financial development, digitalization and economic sustainability in Vietnam: Evidence from a quantile-on-quantile regression and wavelet coherence. Technol Forecast Soc Change 186:122185

Irfan M, Razzaq A, Sharif A, Yang XD (2022) Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technol Forecast Soc Change 182

Jia W, Jia X, Wu L, Guo Y, Yang T, Wang E, Xiao P (2022) Research on regional differences of the impact of clean energy development on carbon dioxide emission and economic growth. Hum Soc Sci Commun 9(1):25

Juo WJ, Wang CH (2022) Does green innovation mediate the relationship between green relational view and competitive advantage? Bus Strategy Environ 31(5):2456–2468

Kesidou E, Wu L (2020) Stringency of environmental regulation and eco-innovation: Evidence from the eleventh Five-Year Plan and green patents. Econ Lett 190:109090

Kiefer CP, González PD, Carrillo-Hermosilla J (2019) Drivers and barriers of eco-innovation types for sustainable transitions: A quantitative perspective. Bus Strategy Environ 28(1):155–172

Krause RM, Hawkins V C, Park AYS, Feiock RC (2019) Drivers of Policy Instrument Selection for Environmental Management by Local Governments. Public Adm Rev 79(4):477–487

Lai Z, Lou G, Ma H, Chung S-H, Wen X, Fan T (2022) Optimal green supply chain financing strategy: Internal collaborative financing and external investments. Int J Prod Econ 253:108598

Leoncini R, Montresor S, Rentocchini F (2016) CO2-reducing innovations and outsourcing: Evidence from photovoltaics and green construction in North-East Italy. Res Policy 45(8):1649–1659

Li C, Wen M, Jiang S, Wang H (2024) Assessing the effect of urban digital infrastructure on green innovation: mechanism identification and spatial-temporal characteristics. Hum Soc Sci Commun 11(1):320

Li CJ, Razzaq A, Irfan M, Luqman, A (2023a) Green innovation, environmental governance and green investment in China: Exploring the intrinsic mechanisms under the framework of COP26. Technol. Forecast Soc Change 194

Li L, Yue C, Ma S, Ma X, Gao F, Zheng Y, Li X (2023b) Life cycle assessment of car energy transformation: evidence from China. Ann Oper Res, 1–20

Li L, Ma SJ, Zheng YL, Ma XY, Duan KF (2022a) Do regional integration policies matter? Evidence from a quasi-natural experiment on heterogeneous green innovation. Energy Econ, 116

Li L, Ma SJ, Zheng YL, Xiao XY (2022b) Integrated regional development: Comparison of urban agglomeration policies in China. Land Use Policy, 114

Li L, Zheng Y, Ma S Li M (2022c) Environmental infrastructure and urban residents’ well-being: A system dynamics approach. J Environ Plan Manage,1–27

Li W, Elheddad M, Doytch, N (2021) The impact of innovation on environmental quality: Evidence for the non-linear relationship of patents and CO2 emissions in China. J Environ Manage 292

Lisawadi S, Ahmed SE, Reangsephet O (2021) Post estimation and prediction strategies in negative binomial regression model. Int J Model Simul 41(6):463–477

Liu L, Ren R, Cui K, Song L (2024) A dynamic panel threshold model analysis on heterogeneous environmental regulation, R&D investment, and enterprise green total factor productivity. Sci Rep. 14(1):5208

Liu YQ, Zhu JL, Li EY, Meng ZY, Song Y (2020) Environmental regulation, green technological innovation, and eco-efficiency: The case of Yangtze river economic belt in China. Technol. Forecast. Soc. Change, 155

Lu Y, Xia Z (2024) Digital inclusive finance, green technological innovation, and carbon emissions from a spatial perspective. Sci Rep. 14(1):8454

Luo SY, Yimamu N, Li YR, Wu HT, Irfan M, Hao Y (2023) Digitalization and sustainable development: How could digital economy development improve green innovation in China? Bus Strategy Environ 32(4):1847–1871

Lv C, Bian B, Lee C-C, He Z (2021) Regional gap and the trend of green finance development in China. Energy Econ 102:105476

Ma S, Li L, Zuo J, Gao F, Ma X, Shen X, Zheng Y (2024) Regional integration policies and urban green innovation: Fresh evidence from urban agglomeration expansion. J Environ Manag 354:120485

Ma L, Wang Q, Shi D, Shao Q (2023) Spatiotemporal patterns and determinants of renewable energy innovation: Evidence from a province-level analysis in China. Hum Soc Sci Commun 10(1):357

Nylund PA, Brem A, Agarwal N (2022) Enabling technologies mitigating climate change: The role of dominant designs in environmental innovation ecosystems. Technovation 117:102271

Pan X, Wang M, Li M (2023) Low-carbon policy and industrial structure upgrading: Based on the perspective of strategic interaction among local governments. Energy Policy 183:113794

Peng W, Yin Y, Kuang C, Wen Z, Kuang J (2021) Spatial spillover effect of green innovation on economic development quality in China: Evidence from a panel data of 270 prefecture-level and above cities. Sustain Cities Soc 69:102863

Popp D (2019) Environmental policy and innovation: a decade of research. Int Rev Environ Resour Econ 13(3-4):265–337

Qadri HMuD, Ali H, Abideen ZU, Jafar A (2024) Mapping the evolution of green finance research and development in emerging green economies. Resour Policy 91:104943

Qiu L, Hu D, Wang Y (2020) How do firms achieve sustainability through green innovation under external pressures of environmental regulation and market turbulence? Bus Strategy Environ 29(6):2695–2714

Qiu Y, Wang HN, Wu JJ (2023) Impact of industrial structure upgrading on green innovation: evidence from Chinese cities. Environ Sci Pollut Res 30(2):3887–3900

Rehman SU, Kraus S, Shah SA, Khanin D, Mahto V R (2021) Analyzing the relationship between green innovation and environmental performance in large manufacturing firms. Technol Forecast Soc Change 163:120481

Shao XY, Liu S, Ran RP, Liu YQ (2022) Environmental regulation, market demand, and green innovation: spatial perspective evidence from China. Environ Sci Pollut Res 29(42):63859–63885

Sheng J, Ding R, Yang H (2024) Corporate green innovation in an aging population: Evidence from Chinese listed companies. Technol Forecast Soc Change 202:123307

Singh SK, Del Giudice M, Chiappetta Jabbour CJ, Latan H, Sohal AS (2022) Stakeholder pressure, green innovation, and performance in small and medium-sized enterprises: The role of green dynamic capabilities. Bus Strategy Environ 31(1):500–514

Stucki T (2019) What hampers green product innovation: the effect of experience. Ind Innov 26(10):1242–1270

Sun Y, Razzaq A (2022) Composite fiscal decentralisation and green innovation: Imperative strategy for institutional reforms and sustainable development in OECD countries. Sustain Dev 30(5):944–957

Tian GZ, Yae J (2024) Unintended consequences of punishment: Adverse effects of environmental penalties on green patents. Res Int Bus Finance 70

Tingbani I, Salia S, Hussain JG, Alhassan Y (2023) Environmental Tax, SME financing constraint, and innovation: evidence from OECD countries. IEEE Trans Eng Manag 70(3):1006–1025

Tu C, Liang Y, Fu Y (2024) How does the environmental attention of local governments affect regional green development? Empirical evidence from local governments in China. Hum Soc Sci Commun 11(1):371

Wang G, Li Y, Zuo J, Hu WB, Nie QW, Lei, HQ (2021) Who drives green innovations? Characteristics and policy implications for green building collaborative innovation networks in China. Renew. Sustain Energy Rev 143

Wang H, Guo F (2023) City-level socioeconomic divergence, air pollution differentials and internal migration in China: Migrants vs talent migrants. Cities 133:104116

Wu Y, Ding L, Li N, Yu X (2024) Unveiling the influence of global innovation networks on corporate innovation: evidence from the international semiconductor industry. Sci Rep 14(1):11007

Xu L, Yang LL, Li D, Shao S (2023) Asymmetric effects of heterogeneous environmental standards on green technology innovation: Evidence from China. Energy Econ 117

Xu X, Hou P, Liu Y (2022a) The impact of heterogeneous environmental regulations on the technology innovation of urban green energy: a study based on the panel threshold model. Green Financ 4(1):115–136

Xu Y, Li SS, Zhou XX, Shahzad U, Zhao X (2022b) How environmental regulations affect the development of green finance: Recent evidence from polluting firms in China. Renew Energy 189:917–926

Yan Z, Sun Z, Shi R, Zhao M (2023) Smart city and green development: Empirical evidence from the perspective of green technological innovation. Technol Forecast Soc Change 191:122507

Yang QC, Zheng MB, Chang CP (2022a) Energy policy and green innovation: A quantile investigation into renewable energy. Renew Energy 189:1166–1175

Yang YX, Su X, Yao SL (2022b) Can green finance promote green innovation? The moderating effect of environmental regulation. Environ Sci Pollut Res 29(49):74540–74553

Yang ZB, Shao S, Yang LL, Liu JH (2017) Differentiated effects of diversified technological sources on energy-saving technological progress: Empirical evidence from China’s industrial sectors. Renew Sustain Energy Rev 72:1379–1388

Yi H, Hao L, Liu A, Zhang Z (2023) Green finance development and resource efficiency: A financial structure perspective. Resour Policy 85:104068

Yin XM, Chen DD, Ji JY (2023) How does environmental regulation influence green technological innovation? Moderating effect of green finance. J Environ Manage 342

Yu C-H, Wu X, Zhang D, Chen S, Zhao J (2021) Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 153:112255

Zhang D, Zheng MB, Feng GF, Chang CP (2022) Does an environmental policy bring to green innovation in renewable energy? Renew Energy 195:1113–1124

Zhang W, Zhu B, Li Y, Yan D (2024) Revisiting the Porter hypothesis: a multi-country meta-analysis of the relationship between environmental regulation and green innovation. Hum Soc Sci Commun 11(1):232

Zhang Y, Hu HY, Zhu GJ, You DM (2023a) The impact of environmental regulation on enterprises’ green innovation under the constraint of external financing: evidence from China’s industrial firms. Environ Sci Pollut Res 30(15):42943–42964

Zhang YW, Zhao MJ (2023) Regulation and decarbonization: how can environmental regulations more effectively facilitate industrial low-carbon transitions? Environ Sci Pollut Res 30(40):93213–93226

Zhang Z, Zhou Z, Zeng Z, Zou Y (2023b) How does heterogeneous green technology innovation affect air quality and economic development in Chinese cities? Spatial and nonlinear perspective analysis. J Innov Knowl 8(4):100419

Zheng Y, Wang HM, Wang, SY (2023) Neighbourhood or beggar-thy-neighbour: the spatial effect of regional green credit development on green technology innovation. J Environ Plan Manage

Zhou FL, Si DG, Hai PP, Ma PP, Pratap S (2023) Spatial-temporal evolution and driving factors of regional green development: an empirical study in Yellow River Basin. Systems, 11(2)

Acknowledgements

This work is partially supported by the National Natural Science Foundation of China (No. 72174139; No. 71874120), the Humanity and Social Science Youth Foundation of the Ministry of Education of China (No. 23YJC630259), the Philosophical and Social Science Planning Project of Tianjin (No. TJGLQN23-006), the Independent Innovation Foundation of Tianjin University (2024XSC-0035), the Science and Technology Innovation Leaders Cultivation Program of Tianjin University (2024XQM-001), and the Graduate Arts and Science Excellence Innovation Award Program of Tianjin University (No. A2-2022-006).

Author information

Authors and Affiliations

Contributions

Lei Li: Conceptualization, Project administration, Supervision, Writing- original draft. Xiaoyu Ma: Conceptualization, Data collection, Formal analysis, Methodology, Writing- original draft, Writing- review & editing, Shaojun Ma: Conceptualization, Methodology, Writing- original draft. Feng Gao: Data collection, Formal analysis, Methodology.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Li, L., Ma, X., Ma, S. et al. Role of green finance in regional heterogeneous green innovation: Evidence from China. Humanit Soc Sci Commun 11, 1011 (2024). https://doi.org/10.1057/s41599-024-03517-0

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-03517-0

This article is cited by

-

Measurement and spatio-temporal evolution of high-quality industrial development level in China

Scientific Reports (2025)

-

Facilitating urban green innovative efficiency from intergovernmental perspective in China

Scientific Reports (2025)

-

China’s national image in the classroom: evidence of bicultural identity integration

Current Psychology (2025)

-

Assessing the impact of pilot free trade zones on urban land use efficiency in China

Clean Technologies and Environmental Policy (2025)