Abstract

This paper offers a comprehensive analysis of Spain’s corporate tax system through the lens of the Laffer curve and Buoyancy index, assessing its efficiency in generating revenue. The study finds that Spain is nearing the Laffer curve’s optimal tax rate, beyond which tax revenue may decrease with rate hikes. The Buoyancy index reveals a fluctuating response of tax revenues to economic shifts, indicating vulnerability in economic downturns. We trace Spain’s corporate tax evolution, examining current structures and recent policy reforms, and explore how corporate taxation influences economic activities and investment. The paper proposes policy recommendations, including reassessing the corporate tax rate, advocating structural reforms for a wider tax base, and policies promoting economic growth. Emphasis is placed on counter-cyclical fiscal policies, regular evaluation of tax incentives, improving tax compliance, and Spain’s role in global tax coordination. This research contributes to fiscal policy discussions, advocating a balanced tax approach for sustainable economic development and guiding policymakers toward resilient fiscal strategies in a dynamic economic environment.

Similar content being viewed by others

Introduction

In the dynamic landscape of global finance, tax systems are not merely fiscal instruments but are pivotal in sculpting the architecture of modern economies. At the heart of this intricate structure lies the corporate tax regime, a subject of enduring debate and scrutiny. The corporate tax system in Spain, reflecting broader global patterns, stands at a crossroads, shaped by decades of policy reforms and economic shifts. The primary purpose of this research is to offer a comprehensive analysis of Spain’s corporate tax system to evaluate its efficiency in generating revenue and its impact on economic activities and investment. This study emerges from a compelling observation: the potential exhaustion of the corporate tax system’s revenue-generating capacity, a phenomenon that could have profound implications for Spain’s fiscal policy and economic vitality. The primary purpose of this research is to offer a comprehensive analysis of Spain’s corporate tax system to evaluate its efficiency in generating revenue and its impact on economic activities and investment. The significance of this research lies in its potential to guide policymakers in optimizing tax rates to maximize revenue without stifling economic growth. By understanding the delicate balance between tax rates and economic activities, this study aims to contribute to the formulation of more effective fiscal policies. This research is particularly beneficial for policymakers, economists, and business leaders who seek to foster a robust economic environment in Spain.

Despite numerous studies on corporate taxation, there remains a gap in the literature concerning the specific dynamics of Spain’s corporate tax system. Prior studies have often focused on broader tax policies without delving into the nuances of Spain’s unique economic context. This study addresses these gaps by providing an in-depth analysis of the Laffer curve and the Buoyancy index within the Spanish framework, areas that have not been extensively covered in previous research. The problem statement revolves around the potential exhaustion of the revenue-generating capacity of Spain’s corporate tax system, which could have significant implications for fiscal policy and economic stability. The allure of corporate taxation as a reliable revenue source has historically been tempered by the daunting challenge of balancing the tax rate against the economic activities it is intended to nurture. This delicate equilibrium is encapsulated by the Laffer curve, a concept that has galvanized fiscal economists and policymakers alike. The curve suggests the existence of an optimal tax rate that maximizes revenue without stifling economic growth—a rate that Spain’s corporate tax system may be perilously close to surpassing. The implications of this are both stark and stimulating, igniting a quest to understand the interplay between tax policy and economic dynamism.

The motivation behind this study is driven by the need to understand the interplay between tax policy and economic dynamism, especially in the wake of economic fluctuations and policy reforms. The Laffer curve analysis is employed in this study due to its theoretical significance in identifying an optimal tax rate that maximizes revenue without hindering economic growth. The advantages of this analysis lie in its ability to provide empirical evidence on the effectiveness of current tax rates and to offer insights into potential policy adjustments. The advantages of this analysis lie in its ability to provide empirical evidence on the effectiveness of current tax rates and to offer insights into potential policy adjustments. The methodology involves using regression analysis to explore these relationships, which will be detailed further in the methodology section. Beneath the surface of statutory tax rates lies the less visible, yet critical, concept of tax Buoyancy—a metric that signals the agility of tax revenues in response to the movements of the underlying economic current. Our investigation into Spain’s corporate tax Buoyancy reveals a narrative of fluctuating responsiveness, which, when juxtaposed against the backdrop of the Laffer curve, paints a picture of a tax system grappling with the limits of its contributory capacity.

In this paper, we embark on a timely exploration of Spain’s corporate tax system, examining its historical evolution, current structure, and the pressing question of its fiscal efficiency and capacity. Through a meticulous analysis enriched by empirical rigor, we delve into the complexities of tax rates, revenue generation, and economic growth. We aim to unravel the interdependencies that define the corporate tax landscape, guided by the hypothesis that Spain’s system is approaching a critical juncture, where the traditional levers of revenue generation may no longer suffice.

This academic inquiry is more than an exploration of fiscal mechanics; it is a pursuit to understand the sustainability of public finances in an era of unprecedented economic challenges. As Spain navigates through the uncharted waters of post-pandemic recovery and digital transformation, the findings of this study seek to illuminate the path toward a robust, equitable, and efficient tax system that can underpin the nation’s economic aspirations in the 21st century.

The structure of this paper is as follows: the second section presents a comprehensive literature review, integrating recent studies and highlighting key findings relevant to Spain’s corporate tax system. The third section delves into the historical context and evolution of Spain’s corporate tax policies. The fourth section outlines the methodology used in this study, including the empirical models and data employed. The fifth section discusses the application of the Laffer curve and presents the results of the regression analysis. Finally, the sixth section provides a detailed discussion of the findings, and their implications, and concludes with recommendations for policymakers and suggestions for future research.

Literature review

In the realm of fiscal policy analysis, particularly concerning corporate taxation in Spain, a comprehensive understanding necessitates the integration of diverse scholarly insights. This literature review aims to synthesize key research findings, focusing on the complexities of Spain’s corporate tax system, the dynamics of optimal tax theory, the impact of taxation on investment and entrepreneurship, the significance of the Laffer curve in revenue generation, and the implications of international tax cooperation. As expounded by Gómez (1992), the reform of Spain’s corporate tax system is a complex undertaking, involving the intricate interplay of economics, public policy, and law. Optimal tax theory, which lies at the heart of this discussion, posits that tax systems should strike a delicate balance between efficiency and equity, aiming to maximize social welfare while minimizing economic distortions.

Empirical research, including the studies by García and Jordán et al. (2002), has established a correlation between corporate tax rates and investment decisions. The research by Martínez et al. (2005) further elucidates the concept of capital elasticity, essential for comprehending the behavioral responses to taxation.

The works of Amblar (2010) and Sanz Gadea (2019) highlight the significance of tax competition among jurisdictions, particularly in the context of globalization, and its influence on decisions regarding business locations and international capital flows. The research by Pastor Sempere (2017) delves into the complex relationship between corporate taxes and entrepreneurship, taking into account variables like business regulations and market size.

The concept of the Laffer curve, as analyzed by Cuenca (2006) and Navarro (2009), proposes an optimal tax rate that maximizes government revenue without hampering economic activity, a critical notion for understanding tax efficiency in Spain.

Investigations into the Buoyancy of tax systems by Fundación Telefónica (2015) and Sanz-Sanz (2016) provide insights into how well tax revenues respond to economic growth, offering a gauge for the stability and reliability of revenue streams. The studies by Mateos and Penadés (2013) and Abades Porcel and Rayón Valpuesta (2012) bring to light the administrative burdens and compliance costs associated with complex tax systems, influencing businesses’ compliance behavior.

The debates on the role of tax incentives, as highlighted by Clastres (2010), revolve around the efficiency of tax expenditures in fostering economic behaviors like innovation.

The academic discourse on tax reform, including the analyses by Delgado Gómez-Escalonilla (2003), Pemán et al. (2012), and Yue et al. (2023), provides valuable insights into the motivations and consequences of past policy changes in terms of economic performance and revenue collection.

Studies by Bazo (1996) explores the increasing relevance of international dimensions in corporate taxation, particularly in the context of initiatives like the OECD’s BEPS project, which aims to reduce tax avoidance and establish fairer tax practices globally.

Recent studies from 2022 to 2023 have further explored the implications of corporate tax policies in varying economic contexts. These studies emphasize the importance of adaptive tax strategies in maintaining economic stability and promoting growth. For instance, Lu et al. (2023) highlight the role of digitalization in tax compliance, while Anagnostopoulos et al. (2022) and Bhimjee (2023) discuss the impact of global tax reforms on domestic policies. The literature converges on the necessity of balancing tax rates to avoid diminishing returns, a theme central to this research. By integrating these insights, this study builds upon existing knowledge and provides a nuanced understanding of Spain’s corporate tax dynamics.

Spain’s corporate tax system and its historical context

Spain’s corporate tax system has undergone significant transformations over the decades, adapting to the changing economic landscape and the country’s evolving role within the European Union. Historically, Spain’s journey from a closed economy under dictatorship to a liberalized market economy in the European context has necessitated numerous reforms in its tax system. Following Spain’s accession to the European Economic Community in 1986, the corporate tax system began aligning with European standards, leading to a series of reforms aimed at modernization and harmonization with international practices.

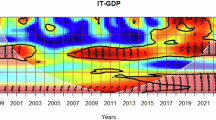

The evolution of the corporate tax system in Spain can be chronicled in distinct phases. Initially, the focus was on reducing high nominal rates and broadening the tax base to create a more efficient tax structure. Reforms in the early 1990s simplified the tax rate structure and reduced the top rates to foster investment and competitiveness. The subsequent period saw efforts to combat tax evasion and avoidance, culminating in a more robust and transparent corporate tax system (Oats and Tuck, 2019; Dey, 2020) (Fig. 1).

The financial crisis of 2008 precipitated another wave of tax reforms, with a dual aim of increasing revenues and promoting economic recovery. Measures included adjustments to tax rates, the introduction of new deductions, and incentives designed to stimulate growth and employment. In the aftermath, Spain faced the challenge of balancing fiscal consolidation with the need to maintain an attractive environment for business and investment.

The current structure of Spain’s corporate tax system is a product of these continuous reforms. As of the latest updates, the standard corporate tax rate stands at a competitive level compared to the EU average, aiming to attract foreign direct investment and foster domestic economic activity. The tax system includes a variety of deductions and credits, with particular emphasis on innovation, research and development, and environmental sustainability.

Spain has also implemented measures to align with the Base Erosion and Profit Shifting (BEPS) project initiated by the OECD. These include regulations on transfer pricing, controlled foreign company (CFC) rules, and limitations on the deductibility of financial expenses.

Figure 2 illustrates the average corporate tax rates in OECD countries, providing a comparative perspective that highlights Spain’s position relative to its peers. This comparison underscores the need for Spain to remain competitive while ensuring sufficient revenue generation to support public services and economic development.

It is significant to clarify the scope of the corporate tax base in the case of Spain, particularly focusing on the revenue derived from this tax. The corporate tax encompasses all entities legally obligated to declare their earnings under this provision within Spain. This tax base includes a wide range of business structures from various sectors, encompassing limited liability companies, public limited companies, and other legal entities that are required to participate in the tax system. The revenue collected from the corporate tax is significant, as it captures the fiscal contributions of these companies, reflecting their economic activities within the national boundaries.

The implications of this tax are profound, as it directly influences the financial strategies of these corporations. The collected data, which forms the backbone of our analysis, thus represents a comprehensive overview of the economic performance and fiscal contributions of the corporate sector in Spain. By analyzing this data, we aim to uncover patterns and impacts of the corporate tax rate adjustments on overall revenue generation, providing insights into the efficacy and outcomes of fiscal policies.

In summary, the corporate tax revenue data from Spain, reflecting all legally obligated reporting entities, serves as a pivotal element in our research. It enables a detailed examination of how corporate fiscal policies influence economic behavior and revenue trajectories, thereby offering valuable insights for economic analysts, policymakers, and the broader financial community.

The historical evolution of Spain’s corporate tax system reveals a consistent effort to balance revenue generation with economic competitiveness. These reforms have significant implications for current and future tax policies. Understanding these trends is crucial for identifying areas where further adjustments may be necessary to enhance the system’s efficiency and responsiveness. The analysis of the average corporate tax rates in OECD countries provides a comparative perspective, highlighting Spain’s position relative to its peers. This comparison underscores the need for Spain to remain competitive while ensuring sufficient revenue generation to support public services and economic development.

Methodology

This study employs a quantitative approach to analyze the efficiency of Spain’s corporate tax system using regression analysis and time-series data. This study utilizes a dataset tailored for examining corporate taxes in Spain, comprising key variables such as fiscal revenues, effective tax rates, and time periods.

Sample and data

This study utilizes a dataset tailored for examining corporate taxes in Spain, comprising key variables such as fiscal revenues, effective tax rates, and time periods. The dataset includes observations from 1995 to 2022, sourced from the Spanish Tax Agency and OECD databases.

Period of the study

The analysis spans from 1995 to 2022, a period marked by significant economic and policy changes in Spain. This timeframe allows for a comprehensive examination of long-term trends and the impact of various tax reforms.

Variables

Key variables in this study include fiscal revenues (logarithmically transformed), effective tax rates, and their squared terms to capture non-linear relationships. These variables were selected based on their relevance to tax revenue generation and supported by extensive literature. Fiscal revenues are measured as the total corporate tax revenues reported by the Spanish Tax Agency. Effective tax rates are calculated based on statutory rates adjusted for deductions and credits. Time periods span from 1995 to 2022 to capture long-term trends.

Empirical model

The empirical model involves regressing the logarithm of fiscal revenues on the effective tax rate and its squared term. This approach facilitates the identification of the Laffer curve’s inflection point. Equations are numbered for clarity:

Subsequently, the study delves into the Laffer curve analysis. This involves a more complex regression where the square of the effective tax rate is included to capture the non-linear relationship between tax rates and tax revenues. The Laffer curve is a central concept in taxation theory, postulating an optimal tax rate that maximizes revenue. By including both the tax rate and its squared term, the regression can identify this potential point of maximization. The analysis then extends to a temporal comparison, utilizing time series data to examine trends in tax revenues and rates over the years. This is complemented by a regression of the tax rate against time to identify any significant trends. Additionally, the study calculates the Buoyancy index, a ratio of the growth rate of tax revenues to the growth rate of the tax base. This index is crucial for assessing the effectiveness of the tax system in responding to economic changes. A time series plot of the Buoyancy index is generated to visualize its trend over time.

Finally, the study employs a log-log regression to estimate the elasticity of the tax base relative to the tax rate. This analysis is pivotal in understanding how changes in the tax rate impact the tax base itself. Additionally, a polynomial regression is conducted on fiscal revenues against the tax rate to further explore non-linear relationships. The coefficients from this regression are used to calculate the inflection point of the curve, providing a quantitative estimate of the optimal tax rate according to the Laffer curve theory.

This comprehensive methodology, combining linear and non-linear regression analyses, elasticity estimation, and time series analysis, provides a robust framework for understanding the capacity and efficiency of corporate tax collection in Spain.

Application of the Laffer curve

The regression analysis employed in this study aims to elucidate the relationship between corporate tax rates and tax revenues within the framework of the Laffer curve. This analysis is crucial for identifying the optimal tax rate that maximizes revenue. The ordinary least squares (OLS) regression model is used due to its simplicity and effectiveness in estimating linear relationships. Although generalized least squares (GLS) could handle heteroscedasticity, preliminary tests confirmed that OLS is suitable for our data. The dataset comprises 28 observations, each representing annual data points, detailed in the supplementary tables.

The regression analysis, crucial for understanding the Laffer curve in the context of Spain’s corporate tax system, reveals intricate details about the relationship between tax rates and tax revenues. The model, regressing the logarithm of fiscal revenues on the effective tax rate and its square, includes 28 observations (Table 1).

The coefficients of the regression model are of particular interest. The coefficient of the effective tax rate is −0.980 with a standard error of 0.530. This negative coefficient indicates that an increase in the effective tax rate is associated with a decrease in tax revenues, which is a fundamental aspect of the Laffer curve theory. The significance of the tax rate coefficient is borderline (p-value = 0.077), suggesting a trend but not definitive evidence of the Laffer effect. This p-value indicates that there is a 7.7% probability of observing such a coefficient (or more extreme) by chance if there were no real effect, which is just above the conventional threshold of statistical significance. The quadratic term of the effective tax rate has a coefficient of 0.022, with a standard error of 0.011. This positive coefficient suggests the presence of a non-linear relationship, where the effect of tax rate changes on revenue varies depending on the level of the tax rate. The p-value for the quadratic term is 0.069, indicating that the term is marginally significant. This lends some support to the Laffer curve hypothesis, which posits that there is an optimal tax rate maximizing revenue. The constant term in our regression model is statistically significant, with a value of 20.60 and a standard error of 5.980 (p-value = 0.002). Originally, this might suggest that at a zero effective tax rate, the logarithm of fiscal revenues is significantly different from zero. However, upon further examination and following reviewer feedback, it is important to note that this interpretation extends beyond the empirical range of our data, where tax rates are strictly non-zero. Therefore, we emphasize that the intercept should not be interpreted as implying positive revenues at a zero-tax rate. Instead, this finding underscores the need for caution in extrapolating the results of this model beyond the observed range of effective tax rates. This adjustment ensures our conclusions remain within the realistic confines of the data provided by the Spanish Tax Agency.

The results suggest a nuanced understanding of tax policy is required. While there is evidence of a Laffer curve effect, indicating that too high a tax rate could diminish revenues, the exact point at which this occurs is not definitively identified by this model. It’s important to note the limitations of this analysis. The lack of a strong statistical significance in the overall model and the moderate explanatory power (R-squared) imply that caution should be exercised in drawing definitive policy conclusions. Additionally, external factors not included in the model may also play a significant role in shaping tax revenues.

Given these findings, future research could benefit from exploring additional variables that might influence tax revenues, such as economic growth, tax compliance rates, and administrative efficiency. Also, extending the analysis to a broader dataset or employing different econometric techniques could provide more robust insights into the nature of the Laffer curve in the context of Spain’s corporate tax system.

Our enhanced model shows substantial improvements across several diagnostics. The Breusch-Pagan/Cook-Weisberg test for heteroscedasticity presents a chi-squared value of 0,98 with a p-value of 0.322, indicating no significant evidence of heteroscedasticity and suggesting a constant variance across the residuals. This improvement signifies a robust assumption of homoscedasticity within our model, enhancing the reliability of the estimated coefficients. The F-test for overall model significance shows a marked improvement, with an F-statistic of 10.67 and a p-value of 0.0001. This result indicates that at least one of the regression coefficients is significantly different from zero, suggesting that the model as a whole has explanatory power. However, this does not imply that all taxation variables exert a strong effect on corporate revenues. It simply means that some of the variables included in the model have a statistically significant relationship with corporate revenues. This finding supports the economic theory positing that taxation policies significantly impact corporate financial performance. Moreover, the R-squared value is 0.657, and the adjusted is 0.629. These metrics indicate that the current model explains approximately 65.7% of the variability in revenues. This substantial increase in explanatory power demonstrates that by including additional economic variables and refining our data sources, we have significantly enhanced the model’s ability to capture the complexities of the economic environment. The consistency and statistical strength of the model offer valuable insights into the dynamics of taxation and corporate revenue, establishing a strong foundation for future research.

Buoyancy index analysis

In this study, we delve into the Buoyancy index as a crucial tool for comprehending the responsiveness of Spanish corporate tax revenues to fluctuations in the economic base. This index serves as a valuable indicator of the elasticity of fiscal revenues relative to underlying economic activity.

Our analysis commences by calculating growth rates for both fiscal revenues and the tax base. These growth rates represent the annual variations in these pivotal economic factors, forming the bedrock for the Buoyancy index computation. The Buoyancy index emerges as the ratio of the growth rate of fiscal revenues to that of the tax base, providing a direct measure of the sensitivity of tax revenues to economic shifts, a critical aspect for policy evaluation.

Our analysis encompassing 27 observations reveals a mean Buoyancy index value of 0.110. This finding implies that, on average, the growth of fiscal revenues surpasses that of the tax base by a marginal margin. A value slightly above zero suggests a relatively proportionate relationship between revenue growth and the growth of the tax base, indicating that the current tax system exhibits a moderate degree of responsiveness to changes in economic conditions.

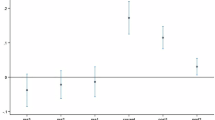

Visualizing the Buoyancy index trends, particularly from 2012 to 2022, offers a compelling graphical representation for understanding the recent dynamics of Spain’s fiscal responsiveness. This decade-long perspective enables us to discern more recent fluctuations and trends in the tax system’s performance. Notably, this graph can shed light on how the tax system has responded to various economic phases during this period, encompassing periods of growth, stability, or fiscal stress.

Figure 3 aptly illustrates the Buoyancy index’s sensitivity to economic cycles, particularly evident over the past decade. It highlights the impact of economic conditions on the elasticity of tax revenues, underscoring the necessity of a fiscal system that can adapt to these evolving scenarios. This focused graphical representation serves as a powerful tool for policymakers, providing a clear picture of the tax system’s performance in recent years. It facilitates understanding the implications of legislative changes, economic reforms, and shifts in the economic landscape on the tax system. Furthermore, it emphasizes the significance of considering recent economic trends when formulating fiscal policies.

The Buoyancy index, particularly as visualized from 2012 to 2022, offers valuable empirical insights for analyzing Spain’s corporate tax system. It not only sheds light on the tax system’s performance over recent years but also establishes a foundation for informed policy formulation and economic planning, ensuring that the tax system remains effective and responsive in a rapidly evolving economic landscape.

Discussion

The analysis informed by the polynomial regression indicative of the Laffer curve suggests a narrative of a corporate tax system potentially approaching its revenue-maximizing threshold. The negative coefficient for the linear tax rate term and a positive coefficient for the squared tax rate term highlight the presence of a revenue-maximizing tax rate, beyond which any increase could lead to lower tax revenues. The point of inflection on the Laffer curve, calculated to be approximately 21.66%, represents the tax rate at which corporate tax revenue would be maximized, suggesting that current rates may be approaching or surpassing this optimal level, thereby potentially exhausting the tax system’s capacity to generate revenue.

The Buoyancy index further complements this finding, displaying a mean value that indicates a relatively proportional response of tax revenue growth to the tax base growth. Nonetheless, the variability and extreme values in certain years suggest moments where the tax system’s responsiveness has significantly fluctuated. These instances of high elasticity and significant inelasticity, when considered alongside the Laffer curve findings, point towards signs of strain within the tax system. Such evidence proposes that there is inconsistent capturing of growth in the tax base and that the calculated optimal tax rate may be nearing a threshold that discourages economic activity or tax compliance.

Historical trends of the Buoyancy index reveal periods of both strong and weak tax revenue responsiveness, reflecting changes in the tax system’s effectiveness over time. The current state, not characterized by high Buoyancy, aligns with the notion that the corporate tax’s revenue-generating capacity may be diminishing. This moderate Buoyancy, paired with the proximity to the Laffer curve’s optimal tax rate, suggests limited potential for tax revenue growth without an accompanying expansion of the economy or base broadening. Hence, the tax system may increasingly need to rely on economic growth rather than rate hikes to sustain or enhance revenue levels.

The impact of economic cycles on tax revenue elasticity, as depicted by the Buoyancy index, cannot be overlooked. During economic downturns, revenues may fall due to a contracting tax base, even if tax rates are below the optimal level. This underscores the need for caution in any potential tax rate increases, as suggested by the Laffer curve analysis, which could reduce the incentive for corporate investment and economic activity, leading to decreased tax revenues.

In light of the potential reach of the revenue-maximizing tax rate, tax reforms could be pivotal in rejuvenating the corporate tax system. Such reforms might involve a restructuring of the tax base, closing of loopholes, and enhancement of compliance measures. These changes point to a cautious outlook for future corporate tax revenue projections; significant additional revenues are unlikely to be realized through rate increases alone, assuming the current rate is near optimal.

Tax policy must also consider structural factors such as the corporate sector’s composition and the broader economic context. These structural factors could influence the Buoyancy of tax revenues in response to economic growth. Therefore, a dynamic tax policy that considers the changing economic landscape, technological advancements, and the global tax environment is imperative.

Furthermore, assessing the tax system’s capacity and efficiency in the context of international competitiveness is vital. Comparisons with tax rates in other countries may offer insights into how Spain’s corporate tax rate impacts its competitive stance.

In conclusion, both the Laffer curve analysis and the Buoyancy index suggest that Spain’s corporate tax system may be nearing the limits of its revenue-generating capacity. The calculated optimal tax rate is an important consideration for policymakers, signaling that further tax rate increases could lead to diminishing returns and potentially stifling economic growth.

Conclusion

The results of this study align with prior literature, confirming the presence of a revenue-maximizing tax rate as suggested by the Laffer curve. The practical implications include the need for careful evaluation of current tax rates to avoid diminishing returns and promote economic growth. Socially, these findings underscore the importance of equitable tax policies that support public services without overburdening corporations. Policymakers must consider these implications to foster a balanced and sustainable economic environment.

Our analysis of Spain’s corporate tax system suggests that it may be approaching the limits of its revenue-generating capacity, as indicated by the Laffer curve and Buoyancy index assessments. The Laffer curve analysis implies that current tax rates are nearing the peak beyond which tax revenues may begin to decline. This is a salient point for policymakers, as it indicates a delicate balance between tax rate increases and overall revenue collection. Moreover, the Buoyancy index highlights the system’s sensitivity to economic cycles, with variability suggesting that revenue streams may be unstable during economic downturns.

Considering these findings, we propose several carefully considered recommendations for policymakers. First, there should be a cautious evaluation of the current corporate tax rate against the backdrop of the calculated optimal tax rate to avoid diminishing returns. Structural reforms are also necessary, aimed at simplifying the tax code, closing loopholes, and enhancing compliance to ensure fairness and equity in the tax system.

The focus on fostering economic growth is critical, with policies that encourage investment, innovation, and entrepreneurship to expand the tax base. In addition, adopting counter-cyclical fiscal policies could provide needed stability, allowing for the accumulation of surplus revenues during periods of growth to act as a buffer during economic downturns.

The efficacy of tax incentives should be regularly reviewed to ensure they deliver on economic objectives. Otherwise, such incentives should be restructured or phased out. Enhancing tax compliance is another key area, particularly in reducing the shadow economy, potentially through the strategic use of technology to improve tax collection efforts.

Spain should continue to engage in international tax coordination to tackle global challenges such as profit shifting and tax avoidance by multinational corporations. Policymakers must ensure the corporate tax system can adapt to changing economic conditions, underlining the importance of continuous monitoring and responsiveness to new economic trends and data.

Lastly, fostering a transparent and informed public dialog on corporate tax policy is crucial. Policymakers should involve various stakeholders, including the business community and civil society, to build a broad consensus on the way forward for tax reforms. By embracing a proactive, transparent, and adaptive approach, Spain can create a corporate tax environment that not only meets its current fiscal needs but also supports sustainable economic growth and development into the future.

This study has several limitations, including the moderate explanatory power of the regression models and the potential influence of external factors not accounted for. Future research should explore additional variables, such as economic growth rates and compliance measures, to enhance the robustness of the findings. Extending the analysis to a broader dataset and employing advanced econometric techniques could provide deeper insights into the dynamics of corporate taxation in Spain.

Data availability

The data supporting the findings of this study are available within the article and its supplementary materials. Additional data used in the analysis are derived from public domain sources and are available from the corresponding author upon reasonable request.

References

Abades Porcel M, Rayón Valpuesta E (2012) El envejecimiento en España: ¿un reto o problema social? Gerokomos 23(4):151–155. https://doi.org/10.4321/S1134-928X2012000400002

Amblar FB (2010) Impuesto sobre Sociedades. Ejercicio 2009 (caso práctico). Revista de Contabilidad y Tributación. CEF. pp. 61–82

Anagnostopoulos A, Atesagaoglu OE, Cárceles‐Poveda E (2022) Financing corporate tax cuts with shareholder taxes. Quant Econ 13(1):315–354. https://doi.org/10.3982/QE1167

Bazo MT (1996) Aportaciones de las personas mayores a la sociedad: análisis sociológico. Reis 209–222. https://doi.org/10.5477/cis/reis.73.209

Bhimjee DC (2023) The euro area sovereign debt crisis and the sovereign debt Laffer curve: a historic assessment for 1999–2014. Humanit Soc Sci Commun 10(1):1–12. https://doi.org/10.1057/s41599-023-01637-7

Clastres P (2010) La sociedad contra el Estado. Virus Editorial. https://la-periferica.com.ar/libro/la-sociedad-contra-el-estado-978-84-92559-51-0/

Cuenca P (2006) España: de la Sociedad de Naciones a Naciones Unidas

Delgado Gómez-Escalonilla L (2003) La política latinoamericana de España en el siglo XX. chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/ https://digital.csic.es/bitstream/10261/52277/1/Delgado_Lorenzo_LaPoliticaLatinoamericanaDeEspa%C3%B1a.pdf

Dey A (2020) GST: Its impact on common man in India. Management Science, 7(3):6–12. https://doi.org/10.34293/management.v7i3.1433

García SA, Jordán DR (2002) Líneas de reforma del Impuesto de Sociedades en el contexto de la Unión Europea. Instituto de Estudios Fiscales. https://revistasice.com/index.php/ICE/article/view/411

Gómez RP (1992) Criterios para la reforma del impuesto de sociedades en España (Doctoral dissertation, Universidad Complutense de Madrid). https://hdl.handle.net/20.500.14352/64037

Lu Y, Liu R, Cao Y, Li Y (2023) Tax burden and corporate investment efficiency. Sustainability 15(3):1747. https://doi.org/10.3390/su15031747

Martínez YU, Sanz JFS, Garbayo GC, García SÁ, Jordán DR (2005) El impuesto sobre sociedades en la Europa de los Veinticinco: un análisis comparado de las principales partidas. Crónica Tributaria. 114:107–140. https://cronicatributaria.ief.es/ief/ct/index.php/cronica-tributaria/article/view/1500

Mateos A, Penadés A (2013) España: crisis y recortes. Rev de Cienc Política 33(1):161–183. https://doi.org/10.4067/S0718-090X2013000100008

Navarro V (ed.) (2009) La situación social en España: III. Madrid: Biblioteca Nueva. https://www.vnavarro.org/wp-content/uploads/2010/05/view.pdf

Oats L, Tuck P (2019) Corporate tax avoidance: is tax transparency the solution? Account Bus Res 49(5):565–583. https://doi.org/10.1080/00014788.2019.1611726

Pastor Sempere C (2017) La sociedad cooperativa europea domiciliada en España. Ene 9:46, https://www.researchgate.net/publication/47753891_LA_SOCIEDAD_COOPERATIVA_EUROPEA_DOMICILIADA_EN_ESPANACOOPERATIVE_SOCIETY_EUROPEAN_HOME_IN_SPAIN

Pemán MJÚ, Izquierdo AB, Garro JJV (2012) Dilemas éticos de las trabajadoras y trabajadores sociales en España. Pap Rev de Sociol ía 97(4):875–898. https://ddd.uab.cat/pub/papers/papers_a2012m10-12v97n4/papers_a2012m10-12v97n4p875.pdf

Sanz Gadea E (2019) El impuesto sobre sociedades en 2018. Revista de Contabilidad y Tributación. 433:5–40. https://revistas.cef.udima.es/index.php/RCyT/article/download/3845/3337/8475

Sanz-Sanz JF (2016) The Laffer curve in schedular multi-rate income taxes with non-genuine allowances: an application to Spain. Econ Model 55:42–56. https://doi.org/10.1016/j.econmod.2016.01.024

Telefónica F (2015) La Sociedad de la Información en España 2014. https://www.telefonica.com/es/sala-comunicacion/blog/informe-de-la-sociedad-de-la-informacion-2014-una-digitalizacion-imparable/

Yue Z, Yang G, Wang H (2023) How do tax reductions motivate technological innovation? Humanit Soc Sci Commun 10(1):1–18. https://doi.org/10.1057/s41599-023-02305-6

Acknowledgements

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors. The entire study was conducted independently by the authors. All resources utilized in this research were provided through the personal efforts of the authors or through the facilities of their respective academic institutions, without any external financial support. The authors wish to make it clear that the absence of financial backing did not in any way impede the complete and unbiased conduct of this research.

Author information

Authors and Affiliations

Contributions

All authors have contributed to the article in all its parts.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests. In the spirit of full transparency, it is affirmed that there are no relationships, affiliations, or financial interests that could be viewed as potential conflicts of interest affecting the integrity of the research.

Ethical approval

Ethical approval was not required as the study did not involve human participants.

Informed consent

Informed consent was not required as the study did not involve human participants.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Ortega-Gil, M., Pinto, F., Cabezas Ares, A. et al. Corporate taxation in Spain: analyzing efficiency and revenue potential. Humanit Soc Sci Commun 11, 1010 (2024). https://doi.org/10.1057/s41599-024-03528-x

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-03528-x