Abstract

ESG uncertainty refers to the discrepancies in ratings by multiple third-party ESG rating agencies, challenging investors in assessing a company’s true ESG status. This study integrates ESG rating data from six major Chinese agencies to construct an ESG Uncertainty Index. Using a PVAR model, it explores the bidirectional relationships among ESG uncertainty, investor attention, and stock price crash risk in the Chinese capital market. The findings reveal no direct causal relationship between ESG uncertainty and stock price crash risk. However, there is a bidirectional Granger causality between ESG uncertainty and investor attention, as well as between stock price crash risk and investor attention. This suggests that increased ESG uncertainty and stock price crash risk attract more investor attention, which in turn amplifies these issues. The study implies that investor attention mediates the relationship between ESG uncertainty and stock price crash risk, indirectly affecting the latter. These findings highlight the importance of enhancing information disclosure regarding ESG factors to improve market transparency and stability.

Similar content being viewed by others

Introduction

Stock price crash risk refers to the risk of a sharp decline in a company’s stock price in a short period, which not only causes substantial losses to investors’ assets, especially for those who are highly leveraged (Xu et al., 2022). At the same time, a sharp decline in stock prices may also trigger market panic, affecting broader market stability and the economic environment (Rao et al., 2024). Therefore, regulatory bodies usually monitor the market and take necessary measures to stabilize it when needed. Academic research by He et al. (2021) has demonstrated that company management often conceals negative information within the company due to motives such as engaging in insider trading, optimizing the timing of option exercises, and securing promotions. These practices aim to manipulate market perceptions and safeguard personal or organizational gains. Over time, as negative news accumulates, it approaches a critical point. Eventually, the negative events hidden by the company are exposed to investors, sparking panic and causing a significant decrease in stock prices, triggering a crash crisis (Y. Kim et al., 2014). As important participants in the secondary market, the psychology and behavior of investors are considered one of the significant causes of stock price crash risk (Naseem et al., 2021).

As the most prominent concept in the global investment community at present, ESG emphasizes a new philosophy and company evaluation standard that focuses on a target company’s environmental performance, social responsibility performance, and internal governance performance, beyond traditional financial performance (Meng et al., 2023). The Chinese government is vigorously promoting the development of ESG in the investment sector and mandates that listed companies in certain industries proactively disclose investor information, including ESG dataFootnote 1. These measures are conducive to the green transformation of Chinese listed companies and support the development of China’s “carbon neutrality”Footnote 2 goals. ESG information not only conveys value information to investors, enhancing corporate transparency and alleviating information asymmetryFootnote 3 and agency problems; it can also serve as a risk measurement indicator, helping investors identify and avoid investment risks, thereby reducing the risk of stock price crashes (Rao et al., 2024).

In the Chinese capital market, investors primarily access listed companies’ ESG information through voluntary disclosures (not mandated by regulatory bodies) and assessments from domestic third-party ESG rating agenciesFootnote 4 such as Hua Zheng, Syn Tao Green Finance, and Wind. These reports, which reference the GRI framework and SDGs targets, vary significantly in quality. Different rating agencies have significant differences in their ESG rating results for the target company (Zhu et al., 2023). This condition frequently subjects investors to uncertainty when gauging the authentic ESG standing of target firms. Owing to variances in the emphasis of indicator systems and evaluation methodologies among different ESG rating agencies, there are often substantial divergences in the rating outcomes for the same entity (Avramov et al., 2022), ESG uncertainty arises from this. Such inconsistency in ratings can pose a considerable barrier to ESG investing (Wang et al., 2024). Nevertheless, despite the significant influence of this uncertainty on investment choices, research exploring the impact of ESG uncertainty on secondary market pricing or risk remains markedly sparse in the Chinese context.

From empirical observations and theoretical analysis, the uncertainty of ESG information may attract investors’ attention, who might undertake further research and analysis to decipher a company’s actual ESG performance, leading to increased attention towards the company (Zhao et al., 2023). This heightened investor interest could result in greater market participation and discussion (Zhang & Zhang, 2024), further magnifying the market impact of ESG information uncertainty. Given that ESG information is considered a crucial indicator of a company’s future risks and opportunities, companies with high ESG uncertainty may prompt investors to adopt a cautious stance regarding their future prospects (Avramov et al., 2022). Any negative ESG news or events could lead to rapid divestment by investors, thereby causing significant stock price volatility. Moreover, when a company garners high investor attention, the speed and breadth of information dissemination also increase, potentially influencing the risk of stock price crashes (Wen et al., 2019a). However, if investor attention is primarily focused on seeking short-term gains while neglecting a company’s long-term ESG performance and risks, it could paradoxically increase the risk of stock price crashes (Xiang et al., 2020).

Compared to existing research, the incremental contributions of this paper include, first and foremost, innovations in perspective and methodology. This study employs the Panel Vector Autoregression (PVAR) model to investigate the bidirectional relationships among ESG uncertainty, stock price crash risk, and investor attention. While other studies have explored the links between ESG divergence and stock price crash risk, their focus has been on unidirectional impacts and static analyses (Dong et al., 2024). This paper offers new insights on how ESG uncertainty can increase stock price crash risk by influencing investor behavior and market expectations, and also examines how stock price crash risk, in turn, heightens market focus on and perception of ESG performance uncertainty. Secondly, there are differences in data and variable construction. This paper defines a new “ESG Uncertainty Index,” integrating data from six major Chinese ESG rating agencies. Compared to similar studies that only consider ratings from two or three Chinese agencies to construct an “ESG divergence” indicator (Bi & Qu, 2023; Dong et al., 2024), this comprehensive index design not only increases the breadth of data but also enhances the accuracy and representativeness of assessing ESG uncertainty in the Chinese market. Finally, the contributions to policy implications and practical significance are noteworthy. The findings of this study offer important strategic recommendations for policymakers, corporate management, and market participants on how to understand and respond to ESG uncertainty. For instance, reducing discrepancies in rating standards and improving the quality of information disclosure may help decrease market volatility and the risk of stock price crashes. Moreover, for investors, a better understanding of the sources of ESG uncertainty and its mechanisms impacting the market can aid in developing more scientifically informed investment strategies.

The remaining chapters are structured as follows: The second section includes literature review and theoretical analysis; the third section details the research design; the fourth section presents the empirical analysis; and the final section concludes with implications and insights.

Literature review and theorical analysis

ESG and stock price crash risk

In the academic community, the causes of stock price crash risk are attributed to two main factors: principal-agent conflicts and information asymmetry (Xiao, 2023; Zhang, 2024). Specifically, management may choose to hide or delay the disclosure of bad news in pursuit of personal benefits, leading to a continuous accumulation of negative internal information within a company. When this accumulated negative information reaches a certain threshold and becomes public, it can cause a sharp decline in the company’s stock price in the short term, ultimately triggering a stock price crash (Chen et al., 2001; Hutton et al., 2009). ESG performance serves as a crucial indicator for assessing a company’s sustainability. It builds upon previous research in corporate social responsibility and sustainable development (Brooks & Oikonomou, 2018). The academic community has already begun to analyze the relationship between ESG performance and stock price crash risk. Generally, the majority of studies indicate that companies with strong ESG performance tend to have a lower risk of stock price crashes, demonstrating a negative correlation (Feng et al., 2022; Wang et al., 2023). However, the strength and consistency of this relationship vary across different regions and conditions (Luo et al., 2023), as well as among different ESG assessment standards (Murata & Hamori, 2021). In the Chinese market, where ESG development is not mature, listed companies voluntarily disclose ESG performance. Improving ESG performance could both reflect shareholder value, reduce principal-agent costs, enhance transparency (Gelb & Strawser, 2001), mitigate stock price crash risk (Feng et al., 2022), and be used by management as a means to conceal bad news. Enhancing ESG performance is seen as reflecting shareholder interests, increasing long-term value, reducing principal-agent conflicts and information asymmetry, thereby lowering stock price crash risk (Luo et al., 2023). One of the subjects this paper explores—ESG uncertainty (the inconsistency in ratings by ESG rating agencies)—has an uncertain correlation with ESG performance because different rating agencies may assess a company’s ESG performance based on different standards and information (Gibson Brandon et al., 2021). If a company’s disclosure of ESG-related information is insufficient or not transparent, it could lead to significant differences in ratings by different agencies, thus increasing ESG uncertainty. What is the relationship between ESG uncertainty and stock price crash risk? The academic community has not yet explored the relationship between the two.

Theoretically, ESG uncertainty could exacerbate the problem of information asymmetry. According to the theory of information asymmetry, when different rating agencies give inconsistent evaluations of the same company’s ESG performance, investors may find it difficult to determine which ratings reflect the true situation of the company, thereby increasing the uncertainty of investment decisions. This uncertainty could make it harder for investors to identify potential risks, including those that could lead to a stock price crash (Li et al., 2022). Moreover, according to signaling theory, ESG uncertainty could weaken investor confidence in a company. If there is a significant divergence in the market’s evaluation of a company’s ESG performance, investors may be skeptical about the true level of ESG risks. This skepticism could lead to a more sensitive and severe reaction to negative news, thereby increasing the magnitude of stock price declines and the possibility of a crash. Lastly, ESG uncertainty could also affect the interpretation of management behavior. According to agency theory, if a company has high ESG uncertainty, even if management takes steps to improve its ESG performance, these efforts might be perceived by the market as a means to mask potential issues (Murata & Hamori, 2021). Therefore, even if a company makes efforts to improve transparency and social responsibility, it may not fully win market trust, making it difficult to effectively reduce the risk of a stock price crash. In summary, theoretically, ESG uncertainty is positively correlated with stock price crash risk. In the Chinese market, the relationship between ESG uncertainty and stock price crash risk may not always be direct and positive. This relationship could be influenced by various factors, making it non-significant or even negative under certain conditions. For instance, Chinese market investors may not pay as much attention to ESG issues as those in Western markets, especially among retail investors (Li et al., 2023). If investors lack awareness of ESG, they may not consider ESG uncertainty as a crucial factor in investment decisions, thus weakening the impact of ESG uncertainty on stock price crash risk (Deng et al., 2023). Additionally, the influence of the Chinese government and regulatory bodies on the market is significant. Policy directions and regulatory environments could affect the relationship between ESG uncertainty and stock price crash risk to some extent (Zhang & Feng, 2023). For example, government-led environmental policies and social responsibility initiatives could encourage companies to increase transparency and improve ESG performance. Even if there is ESG uncertainty, policy support might mitigate its negative impact on stock price crash risk. Furthermore, the habits and quality of information disclosure among companies in the Chinese market vary widely. Companies that actively disclose ESG information and strive to improve the quality of disclosure, even facing inconsistencies in ESG ratings, might reduce potential stock price crash risks due to high transparency. In contrast, companies with poor information disclosure, even if their ESG ratings are consistent, may face higher stock price crash risks due to other poor risk management practices. Additionally, stock price crash risk could, in turn, influence ESG uncertainty. Although this research might not be as intuitive or widely discussed as the impact of ESG uncertainty on stock price crash risk, companies with high stock price crash risk indeed may take actions to reduce ESG uncertainty as part of their comprehensive risk management and market trust rebuilding strategy.

ESG and investor attention

In recent years, with the rise of sustainable investment and increasing societal emphasis on corporate responsibility, ESG factors are increasingly considered key dimensions for assessing long-term value and risk management of companies (Schoenmaker & Schramade, 2019; Zumente & Bistrova, 2021). Research on the relationship between ESG performance and investor attention has become a significant topic. Studies indicate that companies with high ESG performance tend to attract more investor attention. Investors are placing greater emphasis on ESG information because it is closely related to long-term investment performance. This attention stems not only from the pursuit of financial returns but also from the push towards ethical investment and socially responsible investment strategies (Amir & Serafeim, 2018). Some research has particularly highlighted the greater impact of social and governance factors over environmental factors in attracting investor interest. Zhao et al. (2023) found that the impact of social and governance factors on company value is especially significant when ESG ratings decline, suggesting that investors may be more sensitive to changes in these areas. Additionally, Zhang & Zhang (2024) proposed that improved ESG disclosures could enhance investor relations management and attract more investor attention by reducing information asymmetry. This suggests that transparency and high-quality ESG reporting are crucial for building investor confidence and attracting long-term investments. Regarding the impact of investor attention on ESG, Xie & Cao (2023) demonstrated that online attention could significantly enhance a firm’s ESG practices. This external monitoring effect promotes companies to improve their ESG performance, particularly in environments with a higher degree of marketization and in competitive industries, indicating the significant role of social and online media in driving corporate ESG improvement. Long-term investors prefer companies with high ESG scores and show more patience towards these companies (Gillan et al., 2021). In summary, existing literature emphasizes the importance of ESG performance in enhancing investor attention and also mentions the positive role of investor attention in improving corporate ESG performance.

The paper aims to study the relationship between ESG uncertainty and investor attention, a topic with limited existing research. Theoretically, according to information asymmetry theory, inconsistent ESG ratings from different agencies can increase market information asymmetry. This inconsistency makes it harder for investors to accurately assess a company’s sustainability performance (Kim & Koo, 2023). Faced with such uncertainty, investors might intensify their search and analysis of company information, thereby heightening investor attention. This increased attention could lead to more sensitive market reactions, further affecting stock price volatility. Additionally, from the perspective of signaling theory, consistent high ESG ratings are typically viewed as a positive signal of company quality. Conversely, inconsistent ratings could be interpreted by the market as a negative signal, suggesting uncertainty about the company’s ESG performance. Investors might therefore heighten their focus on these companies, seeking confirmation from other information sources to assess the impact of this uncertainty on investment value. Voluntary disclosure theory further explains the strategies companies might employ to address this uncertainty. By proactively disclosing more ESG information, companies can reduce information asymmetry and enhance transparency (Ferri et al., 2023), thereby helping investors to more accurately evaluate their sustainability performance (Ellili, 2022). Such voluntary disclosure can not only alleviate investor concerns but also enhance the company’s reputation and image in the market. In cases of inconsistent ESG ratings, a company’s voluntary disclosure of additional ESG information can attract more investor attention, as investors seek additional data to determine the company’s true performance. Therefore, voluntary disclosure can mitigate investor uncertainty while simultaneously increasing investor attention to the company. Finally, behavioral finance suggests that investor decisions are influenced by cognitive biases and emotions (Raheja & Dhiman, 2020). High ESG uncertainty could trigger investor overreactions or emotional trading, leading to fluctuations in attention towards relevant stocks. Compared to the more mature markets of Europe and America, Chinese investors may have a more basic understanding and application of ESG information, hence high ESG uncertainty could cause greater confusion and attention in the Chinese market (PingAn, 2020). It is also worth noting that the investor structure in the Chinese market is predominantly individual investors, who may be more susceptible to information asymmetry and market sentiment. Therefore, ESG rating uncertainty could lead to more intense market reactions and changes in investor attention, necessitating further research for a detailed analysis.

Investor attention and stock price crash risk

The relationship between investor attention and stock price crash risk is a significant topic in financial research, exploring how market participants’ information processing behavior and market sentiment fluctuations collectively impact extreme negative movements in stock prices. Da et al. (2011) measured investor attention through media coverage and internet search data, finding that investor attention significantly affects stock returns and trading volume. Their research lays the groundwork for understanding how investor attention can indirectly influence stock price volatility by affecting market participants’ behavior and market dynamics. Directly addressing the topic, Wen et al. (2019) discovered a positive correlation between high levels of investor attention and stock price crash risk. Their study indicates that when investors concentrate their attention on a particular stock, the market’s reaction to information can be amplified, thereby increasing the risk of a stock price crash. Andreou, Andrei & Hasler (2015) explored how investor attention could indirectly increase stock price crash risk by affecting the processing and dissemination of information. They found that investor attention could lead to friction in the price discovery process, increasing the likelihood of a stock price crash. Existing research conclusions broadly categorize the relationship as positively correlated, providing a clear consensus.

Regarding the Chinese market, the relationship between investor attention and stock price crash risk might be influenced by specific market structures, investor behavior, and regulatory environments, leading to different conclusions. It was previously mentioned that the Chinese stock market has a high proportion of retail investors, whose investment decisions are often more driven by emotion than by in-depth financial analysis. Therefore, when certain stocks or sectors receive high levels of attention, it might lead to speculative behavior, increasing the volatility and crash risk of stock prices (Wen et al., 2019b). The rapid response of retail investors to market rumors, hot news, or even the tone of internet reports can exacerbate this phenomenon (Zhao et al., 2023). Moreover, there have historically been issues with information disclosure and transparency in the Chinese market, though there have been improvements in recent years (Chen & Wang, 2021). Information asymmetry could lead investors to make irrational decisions under high attention, due to a lack of accurate information, ultimately increasing the risk of a stock price crash. Finally, regulatory bodies like the China Securities Regulatory Commission (CSRC) strictly regulate the market, including cracking down on insider trading, market manipulation, and misleading informationFootnote 5. Changes in the regulatory environment, such as new information disclosure requirements and investor protection measures, might also affect the relationship between investor attention and stock price crash risk (Jin et al., 2021).

The academic discourse surrounding the nexus among ESG performance, investor attention, and stock price crash risk has unfolded, yet most studies have examined the relationships between pairs of these variables in a unidirectional manner. However, there appears to be a lack of comprehensive research integrating all three variables in a bidirectional framework—especially considering the unique characteristics of the Chinese market, such as its higher proportion of retail investors and an evolving regulatory environment. Furthermore, the aspect of ESG uncertainty’s impact on investor attention and stock price stability in China remains underexplored. This paper will demonstrate how ESG uncertainty, investor attention, and stock price crash risk interact with each other in a market where information flows rapidly and retail investor participation is significant.

Research design

Research sample

This study selects the data of companies listed on the main board and Growth Enterprise Market (GEM) of Shanghai and Shenzhen stock exchanges in Chinese A-share securities market as our research sample. The time window of the study is from 2011– 2021. To ensure a balanced sample and to avoid the impact of outliers or special cases in the data on the study results, we references Meng et al. (2023) for the sample data processing method, excluding companies labeled as ST and *STFootnote 6, companies in the financial industryFootnote 7, and companies with missing data from the sample. In addition, we winsorize the data at the 1% and 99% quantiles. Data were obtained from the China Securities Market and Accounting Research (CSMAR) database and the China Wind database.

Model

In order to study the relationship between ESG uncertainty, investor attention, and stock price crash risk, this paper constructs a Panel Vector Autoregression (PVAR) model for analysis. The PVAR model extends the VAR (Vector Autoregression) model to the domain of panel data (Love & Zicchino, 2006). The PVAR model treats all variables as endogenous, meaning that each variable is influenced not only by its own past values but also by the past values of other variables (Abrigo & Love, 2016). This framework allows for a more comprehensive capture of the interdependencies and dynamic feedback effects among the variables. By using the lagged terms of the variables as explanatory variables, the PVAR model can effectively mitigate endogeneity issues (Holtz-Eakin et al., 1988). Lagged terms are generally considered exogenous, as current shocks do not affect past values. Furthermore, the PVAR model can identify and estimate dynamic causal relationships between variables (Love & Zicchino, 2006). This systematic approach aids in understanding the complex interaction mechanisms among variables, thereby reducing potential biases that might arise in single-equation models. The PVAR model has shown considerable applicability in the fields of economics and finance. The formula of PVAR model can be found below:

Wherein, i denotes the firm, and t represents time, indicating different years; \({y}_{{it}}\) is the m×1 vector of m observable random variables for firm i at time t; \({\alpha }_{0}\) is the vector of intercepts; \({\alpha }_{j}\) is the m×m coefficient matrix for the lagged variables; \({y}_{i.t-j}\) is the jth order lag of the endogenous variables; \({\gamma }_{i}\) represents the individual fixed effects; \({\theta }_{t}\) is the time effects; and \({\varepsilon }_{i,t}\) is the random disturbance term.

In Model (1), this paper incorporates three variables: ESG uncertainty (Uncertainty), investor attention (Attention), and stock price crash risk (NCSKEW), as 3 observable random variables (m = 3), allowing for causal interactions among them and examining their dynamic impacts on each other. The use of this model primarily focuses on the analysis of Granger causality tests, impulse responses, and forecast variance decomposition among the variables. Due to the presence of fixed effects in Model (1), the assumption of strict exogeneity in the classical linear regression model, where explanatory variables (i.e., lagged variables of the dependent variable) are considered, no longer holds. Consequently, the within-group mean differencing method, typically employed to handle fixed effects, becomes infeasible. In such cases, the “forward mean differencing” technique is utilized to eliminate the mean of future observations for each individual, ensuring that the explanatory variables are uncorrelated with the model’s error term, thereby guaranteeing effective regression results. In the estimation process, the PVAR method employs lagged variables as instrumental variables for system GMM estimation, thus eliminating endogeneity issues and enhancing the efficiency of the results (T. Chen & Da, 2022).

Variables

This study adopts an innovative approach to the uncertainty data of ESG performance for Chinese listed companies, based on the research framework of Avramov et al. (2022), with further innovations made upon it. By integrating ESG rating data from China’s six major domestic ESG rating agencies—Hua Zheng, Bloomberg, Syn Tao Green Finance, Wind, FTSE Russell, and MSCI—this research constructs a composite index, namely the Listed Company ESG Uncertainty Index (Uncertainty). The calculation of this index is based on the comparison of ESG scores given by different rating agencies for the same listed company in the same year. First, the scores from each rating agency are ranked according to their original scoring scales, and then a normalized percentile ranking (ranging from 0 to 1) is calculated for each listed company. By comparing the standard deviation of the score rankings across different rating agencies, the final uncertainty index of the listed company’s ESG rating (Uncertainty) is obtained.

In measuring the level of investor attention for Chinese listed companies used in this study, early academic research predominantly utilized trading data of the company’s stock, such as trading volume and liquidity (Barber & Odean, 2008; Gervais et al., 2001), or internal metrics like the number of shares and shareholders (D’Aveni & Finkelstein, 1994). Nowadays, the academic community has shifted towards employing indicators such as social media attention and search engine query volumes to gauge investor interest. For instance, Hahn &Tetlock (2007) used the number of mentions in The Wall Street Journal as a measure of investor attention, while Sprenger et al. (2014) utilized the volume of relevant tweets on Twitter. Da et al., (2011) adopted Google search volumes as a proxy for investor attention. Following the measurement approach of Meng et al. (2023), this study constructs an investor attention index (Attention) for Chinese listed companies based on data from Baidu, China’s largest search engine. Specifically, we use the sum of search volumes for the company’s stock code, its short name, and its full name on Baidu. To address heteroscedasticity and manage the impact of outliers, we add one to this sum and then apply a natural logarithmic transformation.

Finally, this paper needs to measure the stock price crash risk of Chinese listed companies. The commonly used metrics in the academic community are the Negative Coefficient of Skewness (NCSKEW) and Down-to-Up Volatility (DUVOL) (Hutton et al., 2009), along with the approach by Jin & Myers (2006), which define crash weeks and measure stock price crash risk through the setting of dummy variables. This paper employs the Negative Coefficient of Skewness (NCSKEW) to measure stock price crash risk.

The calculation formula for the Negative Coefficient of Skewness (NCSKEW) is shown as in Model (2):

Wherein, n represents the number of trading weeks per year for company i. \({W}_{i,t}\) denotes the specific weekly return rate for company i’s stock, calculated through the formula \({W}_{i,t}={Ln}(1+{\varepsilon }_{i.t})\), where \({\varepsilon }_{i.t}\) represents the portion of stock i’s return rate that cannot be explained by market return rate fluctuations, which can be represented by the residuals of Model (3).

\({R}_{i,t}\) represents the return rate of listed company i in week t, while \({R}_{m,t}\) is the average return rate of all A-share listed companies in week t, calculated through market value-weighted average. In model (3), the market return rate’s two lead terms and two lag terms are included to adjust for the impact of non-synchronous trading.

According to the information hiding hypothesis, stock price crash risk is typically due to management concealing bad news about the company. When the accumulated bad news reaches a certain threshold and suddenly erupts, it causes a crash. In a perfect market, where information is complete and symmetric, the probability of a specific weekly return rate for a stock, \({W}_{i,t}\) being above or below the annual average return rate \({W}_{i}\), should be equal. However, in reality, due to irrational behavior by managers, the distribution of \({W}_{i,t}\) exhibits skewness, meaning when management hides bad news, the probability of \({W}_{i,t}\) being greater than the annual average return rate \({W}_{i}\) is higher. Therefore, NCSKEW (or DUVOL) can be used to measure stock price crash risk, with a higher value indicating a higher risk of stock price crash.

The symbols and definitions of the variables are presented in Table 1, while Table 2 showcases the descriptive statistics of the variables. From the results in Table 2, it is observed that the standard deviations for the three main variables—Uncertainty, NCSKEW, and Attention—are all <1, indicating minor differences among the observations. The distribution of Uncertainty is relatively concentrated, with a narrow range between its maximum and minimum values, suggesting that most data points closely cluster around the mean value. NCSKEW exhibits a broader distribution, marked by significant positive and negative skewness values. In contrast, Attention is relatively concentrated around a higher mean value, with the range between its maximum and minimum values being comparatively small. This indicates that the investor attention values for most sample companies are closely aligned. Table 3 showcases the correlations among variables. The correlation coefficient between variables ranges from −1 to +1.

To mitigate endogeneity caused by omitted variable bias and enhance the accuracy and reliability of the model’s estimation results, the PVAR model in this paper incorporates a series of firm-level control variables. These include the company’s profitability (calculated as Net profit for the current year / Average net assets), asset structure (Fixed Assets / Total Assets), debt ratio (Total liabilities / Total assets), and age (Natural logarithm of the number of years the company has been listed + 1). Due to space constraints, the detailed results of the control variables are not presented in the following sections.

Empirical results and discussion

Data stability and PVAR regression results

This paper proceeds to utilize Stata 17 software for processing and analyzing the Panel Vector Autoregression (PVAR) model. Before constructing the model, it is necessary to test the panel data for stability to avoid the issue of spurious regression. This paper employs two common methods for testing unit roots in panel data—the Augmented Dickey–Fuller test and the Phillips–Perron test, to examine the stability of the data. The results are presented in Table 4, with both tests having the null hypothesis that all variables have a unit root process (i.e., the data are non- stable).

Based on the data from Table 4, it is evident that all the statistics from the two stability testing methods significantly pass the test, rejecting the presence of a unit root process in the variables. This indicates that the data for the three variables—ESG uncertainty (Uncertainty), stock price crash risk (NCSKEW), and investor attention (Attention)—are stationary and can proceed to the next phase of analysis.

Before proceeding with the PVAR regression, it is necessary to determine the optimal lag order. The determination of the optimal lag order typically follows three criteria: the Akaike Information Criterion (AIC), the Bayesian Information Criterion (BIC), and the Hannan-Quinn Information Criterion (HQIC), selecting the model with the lowest values of AIC, BIC, and HQIC. The analysis results for the optimal lag order are presented in Table 5, where the AIC, BIC, and HQIC criteria all indicate that the optimal order is one lag. Therefore, in this paper, choosing a first-order lag for the PVAR model is the optimal choice.

Due to the presence of fixed effects in Model (1), and since the explanatory variables (i.e., the lagged variables of the dependent variable) in the VAR structure do not uphold the strict exogeneity assumption of classical linear regression models, the commonly used method of within-group mean differencing to handle fixed effects becomes infeasible. In such cases, the method of “forward mean differencing” (Helmert transformation) can be adopted to eliminate the mean of future observations for each individual, ensuring that there is no correlation between explanatory variables and the error term of the model, thereby safeguarding the validity of the regression results (Yang, 2017). In the subsequent estimation process, the PVAR method utilizes lagged variables as instrumental variables for system GMM estimation, thus addressing the issue of endogeneity. The GMM estimation results are presented in Table 6.

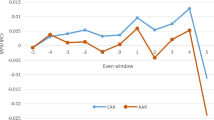

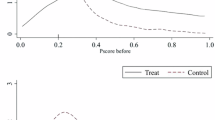

From the results presented in Table 6, for the equation of ESG uncertainty, the lagged one-period coefficient of stock price crash risk (NCSKEW) is not significant, while the lagged two-period coefficient of stock price crash risk (NCSKEW) is significantly positive. The coefficients for both the lagged one and two periods of investor attention (Attention) are significantly positive. For the equation of stock price crash risk (NCSKEW), the coefficients for both lagged one and two periods of ESG uncertainty (Uncertainty) are not significant; the coefficient for the lagged one period of investor attention (Attention) is significantly negative, while for the lagged two periods, it is significantly positive. Lastly, for the equation of investor attention (Attention), the coefficients for both the lagged one and two periods of ESG uncertainty (Uncertainty) are significantly positive; whereas, the coefficient for the lagged one period of stock price crash risk (NCSKEW) is significantly negative, and the coefficient for the lagged two periods is not significant. Figure 1 presents the results of the stability test for the PVAR model, verifying the model’s stability by calculating the unit root eigenvalues of the regression model to see if they all fall inside the unit circle (<1), indicating a long-term stable relationship between the variables. From Fig. 1, it can be observed that all three estimated points of the PVAR model fall inside the unit circle, confirming the stability of the constructed PVAR model and the existence of a long-term stable relationship among the variables.

According to the PVAR regression results, in the nexus between ESG uncertainty (Uncertainty) and stock price crash risk (NCSKEW), the regression coefficient of ESG uncertainty on stock price crash risk is not significant. The lagged one-period effect of stock price crash risk on ESG uncertainty is not significant, while the lagged two-period effect of stock price crash risk on ESG uncertainty is significantly positive. This suggests that the impact of stock price crash risk on ESG uncertainty may not manifest immediately in the short term, but over a longer timeframe, an increase in stock price crash risk leads to an increase in ESG uncertainty. This may be due to market participants paying greater attention to a company’s ESG performance and related uncertainties when faced with the risk of drastic declines in stock prices.

In the nexus between ESG uncertainty (Uncertainty) and investor attention (Attention), both the lagged one-period and two-period effects of ESG uncertainty on investor attention have a significantly positive impact. This implies that as ESG uncertainty escalates, so does investors’ attention to the relevant companies. This could be attributed to investors believing that high ESG uncertainty may affect the long-term performance and risk profile of a company, thereby more actively seeking information about the company’s ESG performance. The lagged one-period and two-period effects of investor attention on ESG uncertainty also exhibit a significantly positive impact, suggesting that as investors try to comprehend a company’s ESG performance, they may discover more uncertainty factors, thus increasing the perception of ESG uncertainty.

The nexus between stock price crash risk (NCSKEW) and investor attention (Attention) is comparatively complex. The lagged one-period effect of investor attention on stock price crash risk has a significantly negative impact, while the lagged two-period effect of investor attention on stock price crash risk has a significantly positive impact! The significantly negative impact of the lagged one-period investor attention on stock price crash risk may reflect an information effect in the short term. When investor attention increases, it could lead to quicker and broader dissemination of information in the market. This enhanced transparency helps to reduce information asymmetry, thereby lowering the likelihood of a stock price crash. In the short term, the regulatory function of the market is more effective, and investors’ attention could lead to the swift identification and correction of potential risks. However, the significantly positive impact of the lagged two-period investor attention on stock price crash risk may indicate that, over a longer timeframe, high levels of attention could precipitate market overreaction. This overreaction could increase stock price volatility, thereby elevating the risk of a stock price crash. Over time, investors might react excessively to certain information or events, especially in situations of uncertainty or adverse news, thereby increasing market instability. The significantly negative impact of the lagged one-period stock price crash risk on investor attention could suggest that when stock price crash risk intensifies, investors tend to shy away from risk, reducing their attention to that stock. This behavior reflects investors’ risk sensitivity and their inclination to avoid high-risk investments. The non-significant impact of the lagged two-period stock price crash risk on investor attention may suggest that the influence of stock price crash risk on investor attention diminishes over the long term. As time progresses, other factors (such as company fundamentals, macroeconomic conditions) may start to exert a more significant influence on investor attention.

To test the causal relationships and their directions among ESG Uncertainty (Uncertainty), Investor Attention (Attention), and Stock Price Crash Risk (NCSKEW), this study further conducts Granger causality tests on these three variables, with the results presented in Table 7.

From the outcomes depicted in Table 7, it is observed that only the tests examining if Stock Price Crash Risk (NCSKEW) Granger-causes ESG Uncertainty (Uncertainty) and if ESG Uncertainty (Uncertainty) Granger-causes Stock Price Crash Risk (NCSKEW) fail to reject the null hypothesis. For all other tests, the null hypotheses are rejected. This indicates that, within the Chinese market, there is no causal relationship between ESG Uncertainty (Uncertainty) and Stock Price Crash Risk (NCSKEW). Conversely, there exist mutual causal relationships between Stock Price Crash Risk (NCSKEW) and Investor Attention (Attention), as well as between ESG Uncertainty (Uncertainty) and Investor Attention (Attention).

Impulse response analysis and variance decomposition

To further analyze the interrelationships among ESG Uncertainty (Uncertainty), Investor Attention (Attention), and Stock Price Crash Risk (NCSKEW), this study proceeds with impulse response tests and variance decomposition analysis. First, the impulse response test is conducted. Through the impulse response function, it is possible to analyze the impact of a one standard deviation shock in the random disturbance terms on the variables within the VAR system over the current and future specific periods (Li et al., 2023). This can effectively reflect the dynamic relationships among variables. This study employs the Monte Carlo method to simulate 200 times, depicting the impact of each variable’s shock on the changes in other variables over 0 to 10 periods in Fig. 2. The horizontal axis in Fig. 1 represents the response periods, and the vertical axis represents the degree of response, with the lines above and below indicating the 95% confidence interval.

In the impulse response function graph, Fig. 2, each subplot represents the impact of a one standard deviation shock to one variable (such as Uncertainty, NCSKEW, or Attention) on another variable within the system, including itself. Given that the PVAR model regression results have already demonstrated the absence of a causal relationship between Uncertainty and NCSKEW (and their impulse response graphs are not statistically significant as their confidence intervals include the zero axis), and also excluding the relationships of variables to themselves, the analysis results of Fig. 2 are as follows:

Impact of ESG Uncertainty (Uncertainty) on Investor Attention (Attention): When the company’s ESG performance Uncertainty receives a positive shock (i.e., an increase in Uncertainty), investor Attention initially increases correspondingly. The graph shows that this shock causes a rise in investor Attention which is strongest at period 0 and progressively intensifies over time. This suggests that if a company’s ESG performance is ambiguous, investors may pay closer Attention to the company to gather more information and assess potential ESG risks.

Impact of Investor Attention (Attention) on Stock Price Crash Risk (NCSKEW): An increase in investor Attention appears to have an initial negative shock on stock price crash risk (i.e., reducing the risk). This effect becomes apparent at period 0 and remains relatively stable in subsequent periods. This might indicate that increased market oversight and transparency can reduce information asymmetry and thereby lower the likelihood of a sudden, significant drop in stock prices.

Impact of Investor Attention (Attention) on ESG Uncertainty (Uncertainty): An increase in investor Attention leads to a rise in the company’s ESG performance Uncertainty. This relationship is represented in the graph as a positive shock, which strengthens over time. This could reflect that heightened investor scrutiny triggers more in-depth discussions and analyses of a company’s ESG practices, thus revealing more Uncertainty factors previously unknown to the market.

Impact of Stock Price Crash Risk (NCSKEW) on Investor Attention (Attention): An increase in stock price crash risk seems to initially exert a negative shock on investor Attention, with this adverse effect gradually intensifying over time. This indicates that if the market perceives an increased risk of a sudden and significant decline in stock prices, investors might opt to steer clear, reducing their focus on the affected company.

Variance decomposition results can measure the contribution of different disturbance terms to the fluctuation of a specific variable (Chen & Da, 2022), and more accurately examine the degree of interplay between ESG Uncertainty (Uncertainty), Investor Attention (Attention), and Stock Price Crash Risk (NCSKEW). The results of the variance decomposition can also be obtained during the impulse response analysis process, with the analysis period set for 10 periods. The results of the variance decomposition are presented in Table 8.

From the variance decomposition results, several observations can be made: Firstly, throughout all periods, the fluctuation of ESG Uncertainty (Uncertainty) is primarily explained by its own shocks, indicating that the company’s ESG uncertainty is largely influenced by its own factors. Moreover, the fluctuation of Stock Price Crash Risk (NCSKEW) is also predominantly explained by its own shocks for the majority of the time. Over time, the influence of Investor Attention (Attention) and Uncertainty on NCSKEW has increased slightly, but overall remains small. The cumulative variance contribution of Attention to NCSKEW is higher than that of Uncertainty to NCSKEW. Lastly, the fluctuation of Investor Attention (Attention) is mainly explained by its own shocks in the short term (within 10 periods), and as time progresses, the influence of Uncertainty on Attention gradually increases, while the impact of stock price NCSKEW remains small and stable. Specifically, the data provided in Table 8 shows that at the 10th period, 27.2% of the variation in Uncertainty can be explained by its own shock in the 1st period, while the contributions of NCSKEW and Attention to the fluctuation of Uncertainty are relatively minor. For NCSKEW, the degree to which its own shocks explain its variation slightly decreases from 99.8% in the 1st period to 93.1% by the 10th period, with the effects of Uncertainty and Attention gradually increasing, particularly the impact of Uncertainty. The fluctuation of Attention is initially almost entirely explained by its own shocks (94.8% in the 1st period), and over time, the impact of Uncertainty increases, contributing to 10.3% by the 10th period, while the influence of NCSKEW is relatively stable but small.

Conclusions and implications

Research conclusions

This paper constructs a PVAR model with data from listed companies on the Chinese capital market between 2011 and 2021, innovatively examining the interrelationships among corporate ESG uncertainty, investor attention, and stock price crash risk. The primary findings are as follows:

Granger causality test results reveal that in the Chinese market, there is no causal nexus between ESG uncertainty and stock price crash risk. However, bidirectional Granger causality nexuses exist between ESG uncertainty and investor attention, and between stock price crash risk and investor attention. The absence of a causal nexus between ESG uncertainty and stock price crash risk suggests that the uncertainty of ESG factors does not directly predict sudden, significant drops in stock prices (crash risk). Although ESG factors are considered crucial for the long-term value of companies(Xu et al., 2022), their uncertainty does not lead directly to short-term drastic fluctuations in stock prices. The bidirectional Granger causality nexus between ESG uncertainty and investor attention indicates that an increase in ESG uncertainty attracts investor attention, possibly because investors are seeking to understand the potential impacts of ESG uncertainty on their investment decisions (Kim & Koo, 2023). Similarly, increased investor attention may result in further exploration and discussion of ESG information, thereby amplifying ESG uncertainty (Avramov et al., 2022). The bidirectional Granger causality nexus between stock price crash risk and investor attention signifies that an elevation in stock price crash risk garners more investor attention, as investors may enhance their monitoring and analysis of a company due to concerns about sudden stock price declines. Concurrently, heightened investor attention could magnify the market’s reaction to specific information, thus escalating the risk of stock price crashes.

Integrating the insights from GMM regression and impulse response analysis, we observe, firstly, the nexus between ESG uncertainty and stock price crash risk: GMM regression outcomes demonstrate that the direct impact of stock price crash risk on ESG uncertainty is not significant in the lagged first period, supporting the Granger test conclusion that there is no Granger causal nexus between ESG uncertainty and stock price crash risk. Nonetheless, it turns significantly positive in the lagged second period, implying that the increase in stock price crash risk might not immediately reflect on ESG uncertainty, but as time progresses, this influence becomes significant and exhibits a positive nexus.

The impact of ESG uncertainty on investor attention: Impulse response analysis shows that an upsurge in ESG uncertainty leads to an increase in investor attention (Zhang & Zhang, 2024), which is most intense at the initial stage and intensifies over time. This indicates that investors heighten their monitoring and analysis of companies with uncertain ESG performance to evaluate potential ESG risks (Li et al., 2022). The interaction between investor attention and ESG uncertainty: An increase in investor attention results in heightened ESG uncertainty, reflecting that more profound discussions and analyses of a company’s ESG practices by investors may uncover previously unknown uncertainty factors to the market.

The impact of investor attention on stock price crash risk: Both GMM regression and impulse response analysis highlight that an initial increase in investor attention adversely affects stock price crash risk (Wen et al., 2019b; Xiang et al., 2020), i.e., mitigating the risk. This could be attributed to increased market oversight and transparency reducing information asymmetry, thereby diminishing the likelihood of sudden, significant drops in stock prices. The impact of stock price crash risk on investor attention: An escalation in stock price crash risk might initially negatively impact investor attention, with this detrimental effect potentially worsening over time. This suggests that an increase in stock price crash risk might prompt investors to distance themselves from affected companies, lessening their focus on them.

The results of the variance decomposition indicate that the fluctuations in ESG uncertainty are primarily explained by its own shocks, suggesting that a company’s ESG uncertainty is predominantly influenced by internal factors. Similarly, the volatility of stock price crash risk is mainly accounted for by its own shocks. Although the impact of investor attention and ESG uncertainty on this risk slightly increases over time, the overall influence remains minimal. In the short term, the variation in investor attention is predominantly explained by its own shocks. In the long term, however, the effect of ESG uncertainty on investor attention gradually grows, while the impact of stock price crash risk remains small and stable. Notably, the variance contribution of investor attention to stock price crash risk exceeds that of ESG uncertainty to stock price crash risk. This analysis underscores the nuanced interplay between ESG uncertainty, investor attention, and stock price crash risk, highlighting the predominant role of intrinsic factors in shaping these dynamics.

In summary, this analysis emphasizes the complex interplay among ESG uncertainty, investor attention, and stock price crash risk: In the Chinese market, there is no direct causal relationship between ESG uncertainty and stock price crash risk. This indicates that although ESG factors are crucial for the long-term value of companies (Chang & Lee, 2022; Zumente & Bistrova, 2021), their uncertainty does not directly lead to short-term drastic fluctuations in stock prices. There is a bidirectional causal relationship between ESG uncertainty and investor attention. Increased ESG uncertainty attracts investor attention (Xiang et al., 2020), while heightened investor attention further amplifies ESG uncertainty. This interaction reflects the close monitoring and in-depth discussion by investors in response to ESG uncertainty. Similarly, a bidirectional causal relationship exists between stock price crash risk and investor attention. An increase in stock price crash risk draws more investor attention (Wen et al., 2019b), and increased investor attention may intensify the market’s reaction to specific information, thereby elevating the risk of stock price crashes (Han, 2022). This study may imply that investor attention mediates the relationship between ESG uncertainty and stock price crash risk. Although ESG uncertainty itself does not directly cause stock price crash risk, it can indirectly affect this risk by increasing investor attention. When investors focus more on ESG uncertainty, they enhance their monitoring and analysis of the company, which influences the market’s reaction to the company’s information, ultimately affecting the magnitude and frequency of stock price fluctuations.

Theoretical implications

The conclusions of this article offer a variety of theoretical implications, including: firstly, the findings of this study redefine the nexus between ESG uncertainty, investor attention, and stock price crash risk. By demonstrating the absence of a direct causal link between ESG uncertainty and stock price crash risk, this paper fills a gap in existing research and extends the body of literature. It challenges the traditional notion that ESG factors, due to their implications for long-term value (Shen et al., 2023), might have an immediate effect on stock price stability. Instead, the results suggest that the impact of ESG uncertainty unfolds over time rather than directly precipitating stock price crashes. Secondly, the identified bidirectional Granger causality nexus between ESG uncertainty and investor attention highlights the dynamic interplay between the two, where ESG uncertainty not only draws investor attention but is also amplified by it. This underscores the importance of investor behavior within the ESG ecosystem, indicating that investors play a crucial role in shaping the market’s perception of ESG uncertainty. This finding enriches the dialogue on how capital markets process and act upon ESG information. Lastly, the study addresses the temporal dynamics of market reactions. The impact of ESG uncertainty and investor attention on stock price crash risk does not occur instantaneously but evolves over time. This underscores the importance of considering the temporal dynamics of market reactions, indicating that the effects of ESG factors and investor behavior on market stability unfold over various time horizons. Furthermore, the conclusions of this study suggest the potential mediating role of investor attention, where initial investor focus can mitigate the risk of stock price crashes, indicating that enhanced market oversight and transparency could serve as protective mechanisms against sudden market downturns. This positions investor attention as a potential mediator that could influence the trajectory of stock price crash risk, offering a new perspective on mechanisms that could stabilize the market.

Practical implications

Based on the conclusions and theoretical insights of this study, practical recommendations are provided for corporate management, investors, and policymakers:

Companies are encouraged to prioritize enhancing the transparency and quality of their ESG reporting as a means to mitigate ESG uncertainty (de Souza Barbosa et al. (2023)). Such efforts not only captivate and maintain investor interest but also facilitate a more precise evaluation of a company’s ESG performance by investors, which, in turn, could diminish the potential for stock price volatility. At the same time, it is crucial for companies to recognize the risk of inducing uncertainty through excessive disclosure and to seek a balanced approach. In addition, proactive management of investor relations is essential for deepening investors’ comprehension of a company’s ESG practices (Hoepner et al., 2017). Regular investor briefings, detailed ESG performance reports, and engaging investor dialogues are strategies that enhance transparency and foster trust (Meng et al., 2023). These measures enable companies to effectively align investor expectations and reduce the potential risks linked to ESG uncertainty.

While ESG factors are crucial for a company’s long-term value (Chang & Lee, 2022; Gillan et al., 2021), their uncertainty does not directly cause short-term drastic stock price fluctuations. Investors need to balance their assessment of a company’s long-term value with attention to short-term market volatility, avoiding overreacting to short-term uncertainties in their investment decisions. Considering the influence of investor attention on the risk of stock price crashes, the adoption of advanced risk management tools and strategies for monitoring and managing ESG-related risks is advisable. Utilizing big data and artificial intelligence to identify and assess possible ESG risks and formulating appropriate mitigation strategies are among the recommended approaches (Park & Jang, 2021). Active participation in domestic and international ESG initiatives and standard-setting showcases a company’s dedication to sustainable development. Such engagement not only bolsters ESG performance but also cultivates a positive image among investors, which can attract more long-term investment. The mutual influence between investor attention and ESG uncertainty necessitates collaborative efforts by companies and regulatory bodies to elevate public and investor awareness regarding ESG matters (Zhao et al., 2023). Educational and outreach activities, along with providing guidance and tools for evaluating ESG performance, can empower investors to make well-informed decisions and minimize market overreactions to ESG uncertainty (Meng et al., 2023).

Policy makers are advised to enhance laws and regulations concerning ESG reporting and transparency to ensure uniform disclosure standards across the marketplace (Lavin & Montecinos-Pearce, 2021). The introduction and enforcement of more rigorous ESG-related regulations would increase market transparency, lessen uncertainty, and consequently, reduce the risk of stock price crashes. In essence, by adopting these recommendations, companies, investors, and policymakers can more effectively address and mitigate the risks associated with ESG uncertainty, thereby fostering a healthy and sustainable development of the capital market.

Limitations

This study primarily relies on data from companies listed on the Chinese capital market from 2011 to 2021, which may not fully capture the latest trends in market dynamics and ESG practices. Additionally, as it focuses on the capital market in mainland China, the generalizability of its conclusions and their applicability to other regions may be limited. Although the PVAR model is scientifically robust, it may not reveal the entirety of potential causal relationships and dynamic interactions between ESG uncertainty, investor attention, and stock price crash risk. Limitations in model assumptions and parameter settings could impact the interpretation of the research findings. While the ESG uncertainty indicators are original, the reliance on specific databases and metrics for investor attention and stock price crash risk may introduce biases that affect the accuracy and reliability of the results. Therefore, future research could consider using more recent data and a broader sample, including listed companies from different countries and regions, to enhance the universality and applicability of the research conclusions. Exploring differences between industries and companies of various sizes may provide deeper insights into ESG practices. Alternatively, adopting more diversified methods, such as case studies and in-depth interviews, could further explore the complex relationships and inherent mechanisms between ESG uncertainty, investor attention, and stock price crash risk.

Moreover, Due to data accessibility limitations, this paper does not distinguish between investors’ attention to ESG information and their attention to other fundamental factors of the company. Future research can enhance the conclusions of this study by characterizing investors’ attention to a company’s ESG information through the following methods: observing investors’ behavior patterns, trading activities, and their responses to different types of information. For instance, investors focusing on ESG might participate more frequently in ESG-related discussions and activities and pay closer attention to the company’s social responsibility reports and sustainability indicators. Additionally, utilizing survey data, investor questionnaires, or market research to analyze different investors’ preferences and focus areas can help to more accurately determine the specific content of their attention. These approaches would provide a more nuanced understanding of investors’ attention and expand the conclusions of this research.

Data availability

The dataset used in this study can be obtained from the corresponding author upon reasonable request.

Notes

Source from https://msadvisory.com/china-esg/.

China has committed to achieving carbon neutrality by 2060, meaning that by 2060, China will achieve net-zero carbon emissions, i.e., the amount of carbon emitted by China will be balanced by the amount of carbon that can be absorbed.

The information asymmetry addressed by ESG information differs from the “traditional” information asymmetry issues (such as low financial transparency). Traditional information asymmetry typically involves a company’s financial performance and operational data, whereas ESG uncertainty pertains to the opacity of a company’s environmental, social, and governance practices.

Companies marked as ST (Special Treatment) and ST in the Chinese stock market are usually in financial distress or have lost money for two consecutive years. These companies may have abnormal financial data and may be at risk of delisting themselves.

The operating models, financial structures, and risk exposures of companies in the financial industry, such as banks and insurance companies, are significantly different from those of non-financial companies. Therefore, directly analyzing financial companies together with non-financial companies may lead to biased results.

References

Abrigo MRM, Love I (2016) Estimation of panel vector autoregression in Stata. Stata J 16(3):778–804. https://doi.org/10.1177/1536867x1601600314

Amir AZ, Serafeim G (2018) Why and how investors use ESG information: evidence from a global survey. Financ Anal J 74(3):87–103. https://doi.org/10.2469/faj.v74.n3.2

Andrei D, Hasler M (2015) Investor attention and stock market volatility. Rev Financ Stud 28(1):33–72. https://doi.org/10.1093/rfs/hhu059

Avramov D, Cheng S, Lioui A, Tarelli A (2022) Sustainable investing with ESG rating uncertainty. J Financ Econ 145(2):642–664. https://doi.org/10.1016/j.jfineco.2021.09.009

Barber BM, Odean T (2008) All that glitters: the effect of attention and news on the buying behavior of individual and institutional investors. Rev Financial Stud 21(2):785–818. https://doi.org/10.1093/rfs/hhm079

Bi, Q, & Qu, T (2023). ESG rating disagreement and stock price crash risk. SSRN https://doi.org/10.2139/ssrn.4578456

Brooks C, Oikonomou I (2018) The effects of environmental, social and governance disclosures and performance on firm value: a review of the literature in accounting and finance. Br Account Rev 50(1):1–15. https://doi.org/10.1016/j.bar.2017.11.005

Chang, YJ, & Lee, BH (2022). The impact of ESG activities on firm value: multi-level analysis of industrial characteristics. Sustainability (Switzerland), 14(21):14444. https://doi.org/10.3390/su142114444

Chen J, Hong H, Stein JC (2001) Forecasting crashes: trading volume, past returns, and conditional skewness in stock prices. J Financ Econ 61(3):345–381. https://doi.org/10.1016/S0304-405X(01)00066-6

Chen T, Da Y (2022) Income balance, carbon emissions and economic growth. Soft Sci 36(03):68–74. https://doi.org/10.13956/j.ss.1001-8409.2022.03.10

Chen, X, & Wang, C (2021). Information disclosure in china’s rising securitization market. Int J Financial Stud 9(4):66. https://doi.org/10.3390/ijfs9040066

D’Aveni RA, Finkelstein S (1994) CEO duality as a double-edged sword: how boards of directors balance entrenchment avoidance and unity of command. Acad Manag J 37(5):1079–1108

Da Z, Engelberg J, Gao P (2011) In search of attention. J Financ 66(5):1461–1499. https://doi.org/10.1111/j.1540-6261.2011.01679.x

de Souza Barbosa A, da Silva MCBC, da Silva LB, Morioka SN, de Souza VF (2023) Integration of environmental, social, and governance (ESG) criteria: their impacts on corporate sustainability performance. Hum Soc Sci Commun 10(1):1–18. https://doi.org/10.1057/s41599-023-01919-0

Deng J, Jiao R, Qin Y (2023) Can good ESG performance reduce the stock price crash risk? Sci Technol Manag Land Resour 40:91–105. CNKI:SUN:DZKG.0.2023-06-008

Dong, M, Li, M, Wang, H, & Pang, Y (2024). ESG disagreement and stock price crash risk: evidence from China. Asia Pacific Financial Markets https://doi.org/10.1007/s10690-024-09453-y

Ellili NOD (2022) Impact of ESG disclosure and financial reporting quality on investment efficiency. Corp Gov (Bingley) 22(5):1094–1111. https://doi.org/10.1108/CG-06-2021-0209

Feng J, Goodell JW, Shen D (2022) ESG rating and stock price crash risk: evidence from China. Financ Res Lett 46(PB):102476. https://doi.org/10.1016/j.frl.2021.102476

Ferri S, Tron A, Colantoni F, Savio R (2023) Sustainability disclosure and IPO performance: exploring the impact of ESG reporting. Sustainability (Switz.) 15(6):1–15. https://doi.org/10.3390/su15065144

Gelb DS, Strawser JA (2001) Corporate social responsibility and financial disclosures: an alternative explanation for increased disclosure. J Bus Ethics 33(1):1–13. https://doi.org/10.1023/A:1011941212444

Gervais S, Kaniel R, Mingelgrin DH (2001) The high-volume return premium. J Financ 56(3):877–919. https://doi.org/10.1111/0022-1082.00349

Gibson Brandon R, Krueger P, Schmidt PS (2021) ESG rating disagreement and stock returns. Financ Anal J 77(4):104–127. https://doi.org/10.1080/0015198X.2021.1963186

Gillan SL, Koch A, Starks LT (2021) Firms and social responsibility: a review of ESG and CSR research in corporate finance. J Corp Financ 66(January):101889. https://doi.org/10.1016/j.jcorpfin.2021.101889

Hahn R, T P (2007) When gambling is good. Wall Str J MAY(11):A10

Han J (2022) Advertising, investor attention and stock price crash risk. BCP Bus Manag 19:181–193. https://doi.org/10.54691/bcpbm.v19i.740

He, G, Ren, HM, & Taffler, R (2021). Do corporate insiders trade on future stock price crash risk? In Review of Quantitative Finance and Accounting (Vol. 56, Issue 4). Springer US. https://doi.org/10.1007/s11156-020-00936-3

Hoepner, AGF, Oikonomou, I, Sautner, Z, Starks, LT, & Zhou, X (2017). ESG shareholder engagement and downside risk. SSRN Electron J https://doi.org/10.2139/ssrn.2874252

Holtz-Eakin D, Newey W, Rosen HS (1988) Estimating vector autoregressions with panel data. Econom J Econom Soc 56(6):1371–1395. https://doi.org/10.2307/1913103

Hutton AP, Marcus AJ, Tehranian H (2009) Opaque financial reports, R2, and crash risk. J Financ Econ 94(1):67–86. https://doi.org/10.1016/j.jfineco.2008.10.003

Jin L, Liu W, Wang X, Yu J, Zhao P (2021) Analyzing information disclosure in the Chinese electricity market. Front Energy Res 9(March):1–8. https://doi.org/10.3389/fenrg.2021.655006

Jin L, Myers SC (2006) R2 around the world: new theory and new tests. J Financ Econ 79(2):257–292. https://doi.org/10.1016/j.jfineco.2004.11.003

Kim R, Koo B (2023) The impact of ESG rating disagreement on corporate value. J Deriv Quant Stud 31(3):219–241. https://doi.org/10.1108/JDQS-01-2023-0001

Kim Y, Li H, Li S (2014) Corporate social responsibility and stock price crash risk. J Bank Financ 43(1):1–13. https://doi.org/10.1016/j.jbankfin.2014.02.013

Lavin JF, Montecinos-Pearce AA (2021) Esg disclosure in an emerging market: an empirical analysis of the influence of board characteristics and ownership structure. Sustainability (Switz.) 13(19):1–25. https://doi.org/10.3390/su131910498

Li C, Wu M, Huang W (2023) Environmental, social, and governance performance and enterprise dynamic financial behavior: evidence from panel vector autoregression. Emerg Mark Financ Trade 59(2):281–295. https://doi.org/10.1080/1540496X.2022.2096435

Li, Q, Watts, E, & Zhu, C (2023). Retail investors and ESG news. SSRN Electron J. https://doi.org/10.2139/ssrn.4384675

Li Z, Feng L, Pan Z, Sohail HM (2022) ESG performance and stock prices: evidence from the COVID-19 outbreak in China. Hum Soc Sci Commun 9(1):1–10. https://doi.org/10.1057/s41599-022-01259-5

Love I, Zicchino L (2006) Financial development and dynamic investment behavior: evidence from panel VAR. Q Rev Econ Financ 46(2):190–210. https://doi.org/10.1016/j.qref.2005.11.007

Luo D, Yan J, Yan Q (2023) The duality of ESG: impact of ratings and disagreement on stock crash risk in China. Financ Res Lett 58(PB):104479. https://doi.org/10.1016/j.frl.2023.104479

Meng T, Dato Haji Yahya MH, Ashhari ZM, Yu D (2023) ESG performance, investor attention, and company reputation: threshold model analysis based on panel data from listed companies in China. Heliyon 9(10):e20974. https://doi.org/10.1016/j.heliyon.2023.e20974

Murata, R, & Hamori, S (2021). ESG disclosures and stock price crash risk. J Risk Financial Manag14(2):70. https://doi.org/10.3390/jrfm14020070

Naseem S, Mohsin M, Hui W, Liyan G, Penglai K (2021) The investor psychology and stock market behavior during the initial era of COVID-19: a study of China, Japan, and the United States. Front Psychol 12(February):1–10. https://doi.org/10.3389/fpsyg.2021.626934

Park, SR, & Jang, JY (2021). The impact of ESG management on investment decision: Institutional investors’ perceptions of country-specific ESG criteria. Int J Financial Stud 9(3):48. https://doi.org/10.3390/ijfs9030048

PingAn. (2020). ESG in China current state and challenges in disclosures and integration. Ping an digital economic research center. http://www.pingan.com/app_upload/images/info/upload/2c615b3f-c891-475b-9e5e-8c0bff24e549.pdf. Accessed 15 June 2020

Raheja S, Dhiman B (2020) How do emotional intelligence and behavioral biases of investors determine their investment decisions? Rajagiri Manag J 14(1):35–47. https://doi.org/10.1108/ramj-12-2019-0027

Rao J, Jin P, Zeng W (2024) How the ESG performance of listed companies affects stock price crash risk —— an empirical study based on information and confidence pathways. Commun Financ Account 2:35–40. https://doi.org/10.16144/j.cnki.issn1002-8072.2024.02.014

Schoenmaker D, Schramade W (2019) Investing for long-term value creation. J Sustain Financ Invest 9(4):356–377. https://doi.org/10.1080/20430795.2019.1625012

Shen H, Lin H, Han W, Wu H (2023) ESG in China: a review of practice and research, and future research avenues. China J Account Res 16(4):100325. https://doi.org/10.1016/j.cjar.2023.100325

Sprenger TO, Tumasjan A, Sandner PG, Welpe IM (2014) Tweets and trades: the information content of stock microblogs. Eur Financ Manag 20(5):926–957. https://doi.org/10.1111/j.1468-036X.2013.12007.x

Wang H, Jiao S, Ge C, Sun G (2024) Corporate ESG rating divergence and excess stock returns. Energy Econ129(October 2023):107276. https://doi.org/10.1016/j.eneco.2023.107276

Wang L, Ji Y, Ni Z (2023) Spillover of stock price crash risk: Do environmental, social and governance (ESG) matter? Int Rev Financ Anal 89(99):102768. https://doi.org/10.1016/j.irfa.2023.102768

Wen F, Xu L, Ouyang G, Kou G (2019a) Retail investor attention and stock price crash risk: evidence from China. Int Rev Financ Anal 65(March):101376. https://doi.org/10.1016/j.irfa.2019.101376

Wen F, Xu L, Ouyang G, Kou G (2019b) Retail investor attention and stock price crash risk: evidence from China. Int Rev Financ Anal 65(July):101376. https://doi.org/10.1016/j.irfa.2019.101376

Xiang C, Chen F, Wang Q (2020) Institutional investor inattention and stock price crash risk. Financial Res Lett 33(February 2019):1–10. https://doi.org/10.1016/j.frl.2019.05.002

Xiao D (2023) A literature review of stock price crash risk: Evidence from its influencing factors. SHS Web Conf. 169:01072. https://doi.org/10.1051/shsconf/202316901072

Xie E, Cao S (2023) Can network attention effectively stimulate corporate ESG practices?-evidence from China. PLoS ONE 18(12 December):1–16. https://doi.org/10.1371/journal.pone.0290993

Xu N, Liu J, Dou H (2022) Environmental, social, and governance information disclosure and stock price crash risk: evidence from Chinese listed companies. Front Psychol 13(September):1–15. https://doi.org/10.3389/fpsyg.2022.977369

Yang J (2017) Research on the relationship between new urbanization and the scale and specialization of agricultural industry: based on PVAR method. Financ Econ 04:65–76

Zhang, S (2024). The driving factors of stock price crash risk. Finance Econ 1:4. https://doi.org/10.61173/ydmskt22

Zhang Z, Feng Y (2023) Can green governance(ESG) of listed companies curb the stock price crash risk? Humanit Soc Sci 1(12):85–102. https://doi.org/10.15886/j.cnki.hnus.202303.0257

Zhang Z, Zhang L (2024) Investor attention and corporate ESG performance. Financ Res Lett 60(October 2023):104887. https://doi.org/10.1016/j.frl.2023.104887

Zhao R, Fan R, Xiong X, Wang J, Hilliard J (2023) Media tone and stock price crash risk: evidence from China. Mathematics 11(17):1–14. https://doi.org/10.3390/math11173675

Zhao X, Fang L, Zhang K (2023) Online search attention, firms’ ESG and operating performance. Int Rev Econ Financ 88(April 2022):223–236. https://doi.org/10.1016/j.iref.2023.06.025

Zhu, Y, Yang, H, & Zhong, M (2023). Do ESG ratings of Chinese firms converge or diverge? a comparative analysis based on multiple domestic and international ratings. Sustainability (Switzerland), 15(16):12573. https://doi.org/10.3390/su151612573

Zumente, I, & Bistrova, J (2021). Esg importance for long-term shareholder value creation: literature vs. practice. J Open Innov Technol Mark Complex 7(2):127. https://doi.org/10.3390/joitmc7020127

Funding

This research received no funding.

Author information

Authors and Affiliations

Contributions

The creation of this article was conducted by Tiantian Meng, with significant assistance from Danni Yu, who also helped with the review and revision of the manuscript. Minyu Zheng and Rongyi Ma offered guidance throughout the development of this paper.

Corresponding author

Ethics declarations

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions