Abstract

This study examines whether and how corporate digitalization affects labor investment practices. Using a sample of Chinese listed companies from 2007 to 2023, we find that corporate digital development is positively associated with labor investment efficiency. Mechanism tests show that corporate digitalization can facilitate precise judgment of labor input scales, accelerate employment adjustment responsiveness, recruit high-quality potential workforce, and improve management oversight, thus contributing to making efficient labor investment decisions. Cross-sectional tests indicate that the positive impact of corporate digital development is more prominent for firms located in regions with stronger labor protection systems, industries with higher competition levels and those non-state-owned enterprises. Moreover, corporate digitalization can curb both over- and underinvestment in labor resources, and this effect is primarily manifested in firm’s hiring practices. Our findings contribute to the literature on the determinants of corporate labor investment efficiency and provide practice insight into the role of corporate digitalization in firm’s decision-making.

Similar content being viewed by others

Introduction

Labor force, as a crucial input element in production, plays a pivotal role in facilitating economic development (Hamermesh, 1996). According to Jung et al. (2014), more than half of worldwide value creation comes from labor costs. For China, a significant factor for its swift economic expansion in the past 40 years can be attributed to demographic dividend, which continues to provide low-cost labor to support economic activities. However, due to the diminishing demographic bonus and disappearing competitive advantage caused by increased labor costs, it is vital to utilize human capital as the major driver of enterprise value creation, aimed at maintaining sustained economic growthFootnote 1. On this basis, improving the allocation efficiency of the labor force serves as a microeconomic foundation for optimizing human capital allocation, which has become an essential task for all levels of the Chinese government (Kong et al., 2018). For micro-level enterprises, labor investment constitutes the essential component of corporate decision-making (Khedmati et al., 2020). Efficient labor investment serves as a fundamental guarantee for shaping corporate competitiveness and improving their productivity and value (Becker, 1962). Therefore, studying the factors that affect the efficiency of corporate labor investment is crucial.

An increasing body of research has documented the impact of institutional environment (Luo et al., 2020; Ding et al., 2021; Yan et al., 2024), external supervisors (Do and Le, 2021), accounting information quality (Pinnuck and Lillis, 2007; Jung et al., 2014), corporate employee policy (Cao and Rees, 2020), and CEO attributes (Khedmati et al., 2020; Lai et al., 2021) on the efficiency of corporate labor investment. However, based on the available literature, we find relatively little empirical evidence to explore how corporate digital development influences corporate labor investment efficiency. With the innovation of digital technology, contemporary society has transitioned into the age of digital economy. An increasing number of enterprises are utilizing these advanced information technologies to actively innovate data processing methods and carry out digital transformation, so as to serve their daily management operations and optimize business decisionsFootnote 2 (Zhang et al., 2021; Zhai et al., 2021). Substantial studies have highlighted that corporate digitalization makes critical contributions to improving business models, stimulating entrepreneurship activities, fostering technological innovation, and enhancing enterprise marketing capabilities (Liu et al., 2011; Loebbecke and Picot, 2015; Viete and Erdsiek, 2015; Goldfarb and Tucker, 2019; Wu et al., 2019; Shah and Murthi, 2021; Usai et al., 2021). In this study, we primarily focus on firms’ investment practices in labor force, aiming to examine whether corporate digital development is linked to lower deviations from the ideal investment level based on economic basics, i.e., higher labor investment efficiencyFootnote 3.

Based on an extensive dataset of publicly traded Chinese companies spanning from 2007 to 2023, we assess the level of corporate digital development by text information and empirically examine its impact on labor investment efficiency within firms. The outcomes indicate that corporates with advanced digital technology are more efficient in labor investment. Digital involvement equips companies with more timely and accurate information about labor investment and then enables them to adjust their employment decisions more efficiently, thus getting closer to the optimal investment level determined by fundamental economic conditions. Moreover, the mechanism tests show that corporate digitalization contributes to the precise distribution of labor, the recruitment of high-quality labor, and the improvement of management oversight, ultimately leading to efficient labor investment. Further, cross-sectional tests reveal that corporate digitalization has a more pronounced positive impact on labor investment efficiency among corporates located in regions with stronger labor protection systems, industries with higher competition levels, and those non-state-owned enterprises. Additionally, corporate digitalization alleviates the problem of over- and underinvestment in labor resources primarily by influencing enterprise recruitment. The outcomes are robust after implementing alternative method to calculate corporate digitalization and labor investment efficiency and still remain solid after addressing possible endogeneity problems with two-stage regression model, differences-in-differences tests, and propensity score matching procedures.

This study makes great contributions to the existing research. First, our paper provides novel facts to the growing literature on the economic consequences of corporate digital transformation. With the advancements in information technology, the in-depth mining and utilization of data is becoming increasingly crucial in enterprise operations and management (Fernandez-Rovira et al., 2021). A slew of studies give emphasis to the importance of corporate digital development in resource exploitation (Liu et al., 2011), business model optimization (Loebbecke and Picot, 2015), consumer value creation (Matarazzo et al., 2021; Shah and Murthi, 2021), and technological innovation (Wu et al., 2019; Usai et al., 2021). In contrast, this study extends this stream of literature to corporate labor investment decisions and empirically indicates that corporate digital transformation improves the efficiency of labor investment, that is, leading to a lower deviation from the ideal investment level of the labor force associated with economic basics. This deepens our understanding of the economic value of corporate digitalization.

Second, this study also enriches and supplements studies on the factors of enterprise labor investment efficiency. Previous research examining the driving forces behind labor investment efficiency has primarily focused on the institutional environment, external supervisors, accounting information disclosure, corporate employee policies and CEOs’ characteristics (Jung et al., 2014; Kong et al., 2018; Cao and Rees, 2020; Lee and Mo, 2020; Ding et al., 2021; Lai et al., 2021). However, in the digital economy era, digitalization has permeated various aspects of production and operation activities, exerting an increasingly important impetus in corporate behavior and decisions. Particularly in China, a rapidly expanding market for digital technology, the government has regarded digitalization as the driving force that motivates the development of society and economy. In this reality, it is very necessary to examine the role of corporate digitalization. This study utilizes textual analysis to assess the extent of corporate digital development. The empirical outcomes indicate that corporate digitalization contributes to the precise distribution of labor resources, the recruitment of high-quality labor, and the improvement of management oversight, which results in higher labor investment efficiency and deepens our understanding of the factors influencing corporate labor investment efficiency.

This paper also imparts some enlightenment for practical application. First, when labor investment efficiency is suboptimal, particularly with China’s aging population, it becomes critical to improve labor investment efficiency through the use of digital technology because labor efficiency underpins micro-level technology. This study provides a viable idea for firms to improve labor investment efficiency from the angle of digital technology empowerment. Specifically, for one thing, digitalization offers diverse employment methods, thereby enhancing the efficiency of corporate recruitment. Beyond optimizing institutional design, technological transformation has become a critical focus for improving labor investment efficiency. Through digital transformation, firms can more effectively match labor supply and demand, enhance employee skills, and increase productivity, ultimately achieving higher employment levels and broader career development opportunities. For another thing, in the digital economy era, digitalization has permeated various aspects of production and operation activities. Firms must comprehensively explore and leverage the advantages of digital management, to optimize management processes, enhance decision-making efficiency, and strengthen market competitiveness. Additionally, digital economy has become a critical strategic deployment for national economic progress and a key driver of high-quality economic growth. Using an extensive dataset of publicly traded Chinese companies, this study examines the effect of corporate digital development on labor investment efficiency within firms and thus provides policymakers with micro-level empirical evidence and decision-making references for formulating digital development strategies.

We have arranged the rest of this manuscript as follows. Our testable hypothesis is developed in Segment 2. Segment 3 presents the research sample, data source, variable measures, and empirical model. The main regressions outcomes are reported in Segment 4. Moreover, Segment 5 further carries out robustness checks. Segment 6 provides the results of further analysis. The conclusions of our study are presented in Segment 7.

Hypothesis development

Information asymmetry theory spotlights the salience of information in economic actors’ decision-making processes (Leland and Pyle, 1977; Myers and Majluf, 1984). In many cases, economic actors not only suffer from a shortage of complete information but also lack the corresponding capabilities to actively mine data, which leads to their business decisions riddled with uncertainties. The limitation of information makes corporate investment practices unable to reach the optimal level and often manifests as overinvestment or underinvestment. In line with this viewpoint, Richardson (2006) reveals that incomplete information escalates monitoring costs for corporate managers and induces moral hazard. Consequently, managers are more inclined to engage in overinvestment driven by their self-interest, such as the pursuit of empire-building. Jung et al. (2014) exhibit that the disclosure of high-quality financial reports is conducive to alleviating information asymmetry, thus narrowing the divergence from the ideal level of labor investment, ultimately leading to higher labor investment efficiency.

Corporate digitalization stands as a pivotal business practice in which enterprises use advanced digital technologies such as artificial intelligence, cloud computing and big data analytics to fully mine and utilize valuable data and information to serve their operations and managementFootnote 4. Digital transformation serves as an effective approach to integrate and transform intricate business information into more intuitive and detailed datasets (Zhai et al., 2021; Li et al., 2022), empowering enterprises with a heightened ability to discern and navigate the internal operational landscape with greater precision. Concurrently, digital development also aids firms in capturing a wider spectrum of external market demands, fostering a holistic comprehension and cognizance of the external business milieu (Wen et al., 2022). Armed with a comprehensive grasp of both internal and external business conditions, enterprises can more accurately judge and recognize what scale of labor is appropriate for their current development stage, and contribute to making more optimal employment decisions that are compatible with the actual situation. That is to say, corporate digitalization contributes to facilitating precise judgment of labor input scales, which lays the groundwork for precise labor allocation decisions, thereby reducing the occurrence of resource underutilization or wastage due to staffing inadequacies or redundancies.

Second, digitalization within enterprises contributes significantly to enhancing the timeliness of labor investment adjustments. The amalgamation of emerging digital technologies such as artificial intelligence, cloud computing and big data with corporate management processes facilitates rapid aggregation of pertinent decision-making information across three distinct phases, pre-adjustment, during adjustment, and post-adjustment (Lim et al., 2011; Li et al., 2022; Luo et al., 2022). This integration substantially reduces the response time of enterprises, ensuring robust support to guarantee timely adjustments. Pre-adjustment, the collection and integration of more effective employment information serve to augment enterprises’ predictive capabilities regarding labor investment, enabling them to anticipate labor needs earlier and prepare for adjustments in advance. During the adjustment phase, the digital advantage aids in the swift alignment of personnel with roles, effectively leveraging employee productivity and enhancing the adaptability of labor adjustments. In the post-adjustment phase, employing digital technology in employee management and assessment assists firms in gathering more job performance output information. This allows for a timely evaluation and feedback on the rationality of labor investment adjustment decisions, facilitating the swift formulation of effective response strategies. In summary, digital development endows enterprises with stronger capabilities for timely adjustments in labor investments, reducing the response time for workforce adjustments and enabling labor investments to converge more rapidly toward the optimal level determined by economic fundamentals, thereby achieving heightened efficiency.

Third, corporate digitalization facilitates firms to hunt for superior labor investment projects, particularly those involving highly qualified employees, which is also a potential pathway to improve labor investment efficiency. On one hand, digital development facilitates enterprises’ information dissemination channels and enhances their information propagation capability (Liu et al., 2011; Nigam et al., 2020), thereby extending the reach of job postings to a wider pool of labor supply. As a result, recruitment information and employment opportunities can reach a wider pool of potential candidates, allowing companies to attract more attention from high-quality employees. Moreover, enterprises with advanced digital development also have an edge in collecting and processing applicant information (Goldfarb and Tucker, 2019; Zhang et al., 2021). Through the use of detailed and abundant data, they can accurately screen and select from a vast array of job seekers, making it easier to find high-quality employees that meet their specific business development needs. In other words, digitalization enables enterprises to acquire more high-quality labor resources, build a more advanced human capital base and thus improve their workforce structure. This advancement is conducive to unleashing labor productivity and realizing its greater value-creation potential, which ultimately enhances the effectiveness of labor investment.

Fourth, corporate digital development also provides convenience and support for supervising their managers. The agency theory suggests that enterprises need to establish sound corporate governance mechanisms and continuously enhance management oversight to alleviate conflicts of interest between owners and managers. Otherwise, managers are prone to engage in self-serving behaviors, such as making investment decisions that favor their private interests but harm the enterprise’s value, leading to inefficient investment (Jensen and Meckling, 1976; Richardson, 2006). Digitalization practices can greatly expand and enrich the dimensions and quantities of enterprise data, providing more support for improving management oversight. In contrast to traditional financial indicators, digital technologies generate more diverse and richer metrics, such as images, recordings and videos, which can serve as effective references for management supervision. Moreover, corporate digitalization provides stronger data information tracing capabilities, facilitating the tracking and evaluation of past management decisions (Bloom et al., 2014; Goldfarb and Tucker, 2019). This capability improves the quality of monitoring historical decisions and optimizing management oversight. Additionally, the deep embedding and integration of digital technology in corporate decision-making processes can promote standardization and intelligence in managerial decisions, reducing excessive reliance on individual managers and thus mitigate the possibility of managers manipulating corporate decisions to serve private interests. Overall, corporate digitalization plays a crucial role in optimizing management oversight and improving corporate governance, which is conducive to curbing the occurrence of overinvestment or underinvestment in the labor force resulting from managers’ self-interest motives (e.g., “building a business empire” or “seeking comfort”), thus promoting corporate labor investment efficiency.

Based on the above analysis, we conjecture that corporate digitalization is correlated with lower discrepancies of labor investment from the optimum level substantiated by economic basics, namely higher labor investment efficiency. We thus obtain the following hypothesis:

H1: Corporate digital development is positively associated with labor investment efficiency.

Research design

Sample and data sources

We select Chinese listed enterprises on the Shenzhen and Shanghai Stock Exchanges from 2007 to 2023 as our initial sample. The financial and corporate governance data are derived from the China Stock Market & Accounting Research Database (CSMAR). We collect information on corporate digital development by searching for the textual data of the “Management Discussion and Analysis” (MD&A) section in the company’s annual report during the period 2007–2023. Following prior literature (Fang et al., 2023; Naidu and Ranjeeni, 2024), due to special differences in financial statement structures and related accounting items between the financial or utility industries and other sectors, the sample data is processed as followsFootnote 5. (1) The samples of companies in the financial or utility industries are eliminated. (2) The samples with missing data are eliminated. Finally, we obtain 27,238 firm-year observations representing 2872 listed firms. To avoid the interference of data extremes on the robustness of the study findings, all the continuous variables are winsorized at the 1% and 99% levels.

Measure of labor investment efficiency

To estimate labor investments, we adopt net hiring to indicate the adjustment in the firm’s workforce size (Pinnuck and Lillis, 2007; Jung et al., 2014). Abnormal net hiring is described as the distinction between the practical alteration in firm’s labor force and the predicted alteration associated with corporate economic basics. Following previous literature (Ha and Feng, 2018; Cao and Rees, 2020; Fan et al., 2021), we first calculate abnormal net hiring by performing a regression analysis of net hiring (percentage adjustment in firm’s workforce size) on a set of fundamental corporate economic variables. Abnormal net hiring is measured as the residuals from Eq. (1), representing inefficient labor investment. Given that the residuals contain both positive and negative values, for simplicity of interpretation, we take the absolute value of the residuals as our dependent variable (Ablabor), which represents an inverse measure of corporate labor investment efficiency. The lower the value of Ablabor, the higher the efficiency of corporate workforce investment.

Where i refers to a company and t stands for a year. Net_Hireit is defined as the percentage alteration in the number of employees for company i from year t-1 to t; Sale_Growthit-1 represents the percentage alteration in sales revenue for company i from year t-2 to t-1; ΔRoait-1 refers to the growth in return on assets for company i from year t-2 to t-1; Roait refers to the return on assets for company i in year t; Returnit is the annual stock return for company i in year t; Size_Rit-1 represents the percentile rank of the natural logarithm of the market value of equity for company i in year t-1; Quick it-1 is measured as cash and short-term investment plus receivables divided by current liabilities for company i in year t-1; ΔQuickit-1 refers to the growth in cash and short-term investment plus receivables divided by current liabilities for company i from year t-2 to t-1; Levit-1 is calculated as long-term debt divided by total assets for company i in year t-1. Lossinsit-1 are five indicator variables for company i in year t-1, representing each 0.05 interval of prior-year Roa from 0 to −0.025. For example, Lossin1it-1 takes the value of 1 if the prior-year Roa is between −0.005 and 0, and 0 otherwise. Industryi is the industry dummy variable.

Measure of corporate digital development

Corporate digitization is a complex and comprehensive process, resulting in significant problems in precisely measuring the extent of digitization at micro-enterprise level. Previous studies emphasize that the textual content from the MD&A section in an enterprise’s annual report contains a large amount of company-specific business information, so it is a good choice to conduct a textual analysis to fully explore and utilize these texts to define the research variables (Bochkay and Levine, 2019; Durnev and Mangen, 2020; Wang, 2020; Cho and Muslu, 2021). Therefore, drawing on existing literature (Yuan et al., 2021; Zhao, 2021; Zhai et al., 2021), we apply Python software to capture textual information on the frequency of digitalization-related phrases in firms’ MD&A section to measure the level of corporate digitalization development. Several rigorous steps are involved in our methodology. First, we construct a Chinese thesaurus about digital terms. Using Python software to segment the official government policy documents and authoritative reports related to digitalization, we thus screen out the digitalization-related terms with a high frequency and then supplement the above-mentioned terms in combination with the existing literature on corporate digitalization. Then, we form a high-frequency digital dictionary containing 157 terms. Second, we conduct a textual analysis of the annual reports of each listed company to count the frequency of digitalization-related words in their MD&A part. The more frequently digital-related words appear in the MD&A part, the deeper the firm’s digital involvement. Based on the above, we define two independent variables to measure the intensity of corporate digital development: (1) Digital1 is the natural logarithm of the frequency of digital terms in the MD&A section; (2) Digital2 is the frequency of digital terms divided by the total number of sentences in the MD&A part.

Empirical model

To examine the effect of corporate digital development on labor investment efficiency, we formulate the following regression model:

Where i refers to a firm and t means a year. The dependent variable of Ablabor is an inverse indicator of corporate labor investment efficiency. Digital is corporate digital development, measured as Digital1 and Digital2. Following prior literature (Jung et al., 2014; Cao and Rees, 2020; Khedmati et al., 2020), a series of control variables are also included in the regression model. Mtbit-1 represents the ratio of market value to book value for company i in year t-1; Sizeit-1 represents the natural logarithm of total assets for firm i in year t-1; Quickit-1 represents measured as cash and short-term investment plus receivables divided by current liabilities for company i in year t-1; Levit-1 represents measured as long-term debt divided by total assets for company i in year t-1; Divdit-1 represents a dummy variable, taking the value of one if the company i pays dividends in year t-1, and zero otherwise; Sdcfoit-1 represents the standard deviation of cash flow for company i from year t-5 to t-1; Sdsaleit-1 represents the standard deviation of sales revenue for company i from year t-5 to t-1; Tangibit-1 is calculated as the property, factory and equipment divided by total assets for firm i in year t-1; Lossit-1 is a dummy variable, coded as one if the value of company’s Roa is negative in year t-1, and zero otherwise; Instit-1 is calculated as the ratio of institutional investors’ shareholding in the company’s outstanding shares in year t-1; Sdhireit-1 represents the standard deviation of the percentage alteration in the quantity of company’s employees over year t-5 to t-1; Laborit-1 is measured as the number of employees divided by company’s total assets in year t-1; Abinvit refers to the abnormal other (non-labor) investments for company i in year t, which is measured as the absolute magnitude of the residual from the model Investit = β0 + β1Sale_Growthit-1 + εitFootnote 6 (Biddle et al., 2009). Moreover, this paper also controls year fixed effects and industry fixed effects.

Empirical results

Descriptive statistics

The descriptive statistics of our main variables is shown in Table 1. The mean values of the independent variables Digital1 and Digital2 are 1.4502 and 0.0683, respectively. In addition, the mean and median values of the dependent variable (Ablabor) are 0.1635 and 0.0982, respectively, with a standard deviation of 0.2152. This is similar to Kong et al. (2018), which has a mean (median) of 0.193 (0.111) and a standard deviation of 0.296 for inefficient net hiring.

Correlation analysis

Table 2 shows the results of the Pearson correlation analysis. The correlation coefficients between the dependent variable (Ablabor) and explanatory variables (Digital1, Digital2) are significantly negative, indicating that firms with deeper digital involvement have less inefficient labor investment, which initially supports our expectation. Moreover, as envisaged, the pairwise correlation coefficients between control variables are generally low, indicating that there is no severe multicollinearity issue when these variables are included in the regression concurrently.

The effect of corporate digital development on labor investment efficiency

Through showing the baseline regression outcomes of Eq. (2), the relationship between inefficient labor investment (Ablabor) and business digital development (Digital1, Digital2) is presented in Table 3. Specifically, Columns (2) and (4) add control variables, while Columns (1) and (3) solely contain independent variables. The coefficients of Digital1 and Digital2 are all significantly negative with a statistical level of 1% (−0.0187 with t = −15.41, −0.0070 with t = −4.27, −0.1301 with t = −10.60, −0.0498 with t = −3.31), indicating that corporate digital development is adversely related to labor investment that is not efficient. Economically speaking, this means that a one standard deviation rise in Digital1 (Digital2) corresponds to a 5.49% (3.48%) decrease in inefficient labor investment. The findings suggest that corporate digital development is positively associated with firm’s labor investment efficiency, which provide empirical support for Hypothesis 1.

Concerning control variables, the coefficients of Mtb, Sdsale, Loss, Sdhire and Abinv are all significantly positive, indicating that companies possessing a higher market-to-book ratio, more volatile sales revenue and staff numbers, worse profitability, and higher abnormal non-labor investments are more susceptible to poor labor investment, which is consistent with the existing literature (Ha and Feng, 2018; Khedmati et al., 2020; Sun and Zhang, 2021; Li et al., 2023). In addition, the results also show that firms with a larger quick ratio, better dividend performance, greater cash flow volatility, higher proportion of tangible assets, and larger staff size exhibit higher labor investment efficiency, which echoes previous studies (Chu and Fang, 2021; Gu et al., 2022; Wang et al., 2022).

Mechanism tests

As stated in the “Hypothesis development” section, digital development empowers enterprises with a heightened ability to discern and navigate their internal and external business conditions with greater precision. This is conducive to laying the groundwork for precise labor allocation decisions, thereby reducing the occurrence of resource underutilization or wastage due to staffing inadequacies or redundancies. If this mechanism holds, we are able to conjecture that the beneficial impact of digitalization on improving the accuracy of labor investment will be more pronounced in contexts where judging the appropriate employment scale is particularly challenging. Under such a setting, firms face greater uncertainty and complexity, necessitating more stringent precision in labor allocation. Consequently, the efficiency gains and decision optimization advantages brought about by digitalization become more pronounced. In this study, we aim to delineate the complexity inherent in enterprises’ precise judgment of labor inputs by measuring the degree of business diversification. Divers represents the degree of business diversification, quantified by the number of industries in which the enterprise’s core operations are involved. As organizations engage in a broader spectrum of industries, there emerges a need for a more diversified workforce to address the practical demands of operating across diverse business segments. The necessity for diverse staffing amplifies the difficulty enterprises encounter in precisely evaluating labor inputs. To empirically test this mechanism, we introduced business diversification (Divers) and the interaction term (Digital × Divers) in regression Model (2). The coefficients involved in interaction terms (Digital1 × Divers, Digital2 × Divers) are all significantly negative, suggesting that business diversification reinforces the link between corporate digital development and labor investment efficiency. That is, when enterprises encounter higher levels of business diversification (posing challenges in judging accurate labor investment decisions), the effect of corporate digitalization will be more prominent, supporting the proposed channel of facilitating precise judgment of labor inputs.

Second, corporate digitalization contributes significantly to accelerating employment adjustment responsiveness. We characterize the urgency of timely labor adjustments in firms based on the intensity of operational uncertainty they face. Giving the operational uncertainty directly impacts a firm’s market adaptability and strategic flexibility, making timely labor adjustments a crucial strategy for responding to market changes and internal demands. As operational uncertainty increases, there is a greater need for timely adjustments in labor investments by companies to better adapt and align with their survival environment. This study utilizes the Economic Policy Uncertainty Index for China (EPU), to assess the extent of operational uncertainty encountered by publicly listed firms. As the Economic Policy Uncertainty Index rises, companies experience higher levels of external changes and environmental instability during their operational processes, resulting in increased levels of operational uncertainty. We introduced EPU and the interaction term (Digital × EPU) in regression Model (2) to test the above mechanism. As shown in Columns (3) and (4), the coefficients of the interaction terms (Digital1 × EPU, Digital2 × EPU) are both significantly negative, at least at the 10% level, signifying that operational uncertainty reinforces the link between corporate digital development and labor investment efficiency. The above results imply that as enterprises encounter heightened uncertainty (requiring increased employment adjustments), the impact of corporate digitalization will be more pronounced, which provides empirical evidence supporting mechanisms for the digital elevation of enterprises’ responsiveness in labor adjustment.

Moreover, corporate digitalization can facilitate the discovery of more efficient labor resource investment projects (highly qualified employees). The availability of such a high-quality workforce can lead to higher productivity and greater potential for value creation, thereby supporting the company in achieving an efficient state of labor investment. If the mechanism for seeking high-quality labor projects is effective, we can surmise that the baseline effect of corporate digitalization on labor investment efficiency will be more pronounced in companies operating at the knowledge-intensive or technological frontier with a greater reliance on high-quality human capital with specialized skills. That is to say, the stringent demands for precision and efficiency in their labor investments suggest they are likely to benefit more from the impacts of corporate digitalization on labor investment efficiency. We employ the proportion of highly educated employees within a firm (Quality), specifically the percentage of employees holding bachelor’s degrees or higher to the aggregate number of employees, to measure the extent of a firm’s reliance on a high-quality workforce. In this study, the interaction term (Digital × Quality) is introduced into the regression Model (2) to test whether the aforementioned mechanism holds. Columns (5) and (6) of Table 4 show the regression results. The coefficients involved in interaction terms (Digital1 × Quality, Digital2 × Quality) are both adverse and statistically significant, demonstrating that corporate digital development improves labor investment efficiency in enterprises that depend more heavily on a high-quality workforce. These results provide empirical evidence to support our above-expected mechanism of “discovering high-quality labor investment projects”.

Fourth, corporate digital development also provides convenience and support for supervising managers’ labor investment decisions and thus curbs the occurrence of overinvestment or underinvestment in the labor force stemming from managers’ self-interest motives (e.g., “building a business empire” or “seeking comfort”). This section aims to examine this mechanism of “management supervision” for digital development to improve the efficiency of corporate labor investment. Previous studies indicate that the weaker a company’s internal controls, the more susceptible it is to management self-interest and thus the more prone to inefficient labor investment (Johnstone et al., 2011; Jung et al., 2014; Khedmati et al., 2020). Therefore, in situations where internal controls are weaker, managers’ decisions may be driven more by personal interests than by the maximization of the firm’s overall interests, resulting in a deviation from the optimal path in the allocation of labor resources. On this basis, if the proposed mechanism of digital development actually works, its contribution to improving labor investment efficiency will be more apparent in companies with poor internal controls. Building on prior literature (Wang et al., 2018; Liu et al., 2022), we select the IC index released by the DIB database in order to evaluate the quality of corporate internal control. A higher value of IC indicates more effective internal control. We then introduce the interaction term between corporate digitalization and internal control (Digital × IC) in the benchmark model to examine whether the “management supervision” mechanism is valid. Columns (7) and (8) in Table 4 present the regression outcomes. The coefficients involved in interaction terms (Digital1 × IC, Digital2 × IC) are all significantly positive, which suggests that the impact of corporate digital development on labor investment efficiency is more prominent in companies under weaker internal control, providing evidence to support the “management supervision” mechanism.

Robustness checks

Alternative measures of corporate digital development and labor investment efficiency

To strengthen the robustness of the findings, this section first chooses alternative measures of corporate digital development to carry out robustness checks. Specifically, we define four new independent variables, Digital_Money1, Digital_Money2, Digital_Patents1 and Digital_Patents2 to re-estimate the impact of corporate digital development on the efficiency of labor investment. To mitigate the potential difference between stated intentions and actual practices and accurately reflect the true state of digitalization within enterprises, our study also employs digital investment amounts and digital patent applications as direct indicators of the extent of digital development. Specifically, we manually extracted detailed data on digital investments in both software (intangible assets) and hardware (fixed assets) from the annual financial statement notes. Then, we aggregated these amounts to obtain the total annual digital investment for each enterprise. Digital_Money1 is the natural logarithm of the total digital investment amount. Digital_Money2 is the ratio of the total digital investment amount to the sum of intangible and fixed assets for the year. Additionally, we judged the information on applications for digital patents to ascertain whether each patent pertained to digital technology, subsequently calculating the quantity of applications for digital patents filed by listed companies within a year. Digital_Patents1 is the natural logarithm of the quantity of applications for digital patents plus one. Digital_Patents2 is the ratio of the quantity of applications for digital patents to the total number of applications for digital patents. Moreover, following the existing studies (Cella, 2020; Cao and Rees, 2020; Chu and Fang, 2021), we perform robustness checks by changing the measuring method of labor investment efficiency. Ablabor2 is the extent of inefficient labor investment recalculated by adopting a company’s industry median level of net hiring as a substitute for the ideal level. Ablabor3 is the recalculated residual from Model (1) that uses the increasing rate in employees’ overall compensation (excluding executive compensation) as a proxy measure for net labor investment.

Table 5 provides the regression outcomes of alternative variables. In Panel A, the coefficients on Digital_Money1, Digital_Money2, Digital_Patents1 and Digital_Patents2 are all negative and statistically significant at a level of 1% (−0.0007 with t = −3.60, −0.2738 with t = −2.89, −0.0090 with t = −4.20, −0.0678 with t = −3.17), demonstrating that corporate digital development contributes positively to improving labor investment efficiency, which aligns with our earlier findings. Table 5 of Panel B shows the outcomes obtained from utilizing the alternative measure of labor investment efficiency. The coefficients on Digital1 and Digital2 are all significantly negative (−0.0063 with t = −2.44, −0.0486 with t = −2.04, −0.0056 with t = −5.07, −0.0366 with t = −3.63), providing empirical support for the impact of corporate digital development on improving labor investment efficiency. The above findings imply that our findings are robust to regression tests using alternative variables.

Two-stage instrumental variable regressions

The problems of endogeneity, especially from omitted factors, may influence our regression results when investigating the relationship between corporate digital development and labor investment efficiency. To address the above concerns, this section employs two-stage instrumental variable estimation to carry out robustness tests. Referring to relevant research (Nunn and Qian, 2014; Liu et al., 2023), it is advisable to apply historical data of landlines at the city level as exogenous variables for digitalization, and we thus employ the landlines data of the city in which the company is located in 2000 to set our instrumental variable. First, the telecommunications infrastructure used in past regional development will influence the subsequent adoption and approval of information technology by local enterprises, so it is relevant to corporate digitalization. Therefore, the chosen variable meets the prerequisite for relevance. Additionally, with the rise of the Internet and mobile phones, the fixed telephone, as a traditional telecommunications tool, is gradually being eliminated by history, which cannot directly affect the current company’s labor investment efficiency. Hence, this variable meets the exclusivity requirement. During China’s Ninth Five-Year Plan period, there was a rapid enhancement in telecommunications infrastructure and service levels. In the year 2000, the final year of the plan, the state strategically formulated a series of policies aimed at advancing the telecommunications industry, and thus, China’s telecommunications sector achieved significant development with a high penetration rate of fixed telephonesFootnote 7. Moreover, given that the 2000 landlines data of each city is cross-sectional, this may not be suitable for direct use in two-stage regression analysis of panel data. Based on previous research (Yuan et al., 2021; Luo et al., 2022; Liu et al., 2023), we define our panel instrumental variable IV_Digital with a time-varying interaction term between the lagged one-period quantity of national Internet subscribers and the quantity of 2000 landlines in each city in which the company operates.

Table 6 displays the findings of two-stage instrumental variable analysis. In Columns (1) and (2), the instrumental variable’s coefficients (IV_Digital) are positive and statistically significant at a level of 1% (0.0112 with t = 6.19, 0.0015 with t = 8.28), indicating that the spread of historical telecommunication tools has contributed to the subsequent digital development of local enterprises. More importantly, according to the results of second-stage regressions, which are shown in Columns (3) and (4), we can infer that the coefficients of independent variables (Digital1, Digital2) are all significantly negative (−0.0857 with t = −2.22, −0.6557 with t = −2.27), providing empirical support for the beneficial impact of corporate digital development on labor investment efficiency. In addition, the Anderson LM statistics are all significant at the 1% level, rejecting the null hypothesis of underidentified instrumental variable. The Cragg-Donald Wald F statistics both exceed the critical value at the 10% level of weak identification test (16.38), indicating a rejection of weak instrumental variable. The above indicates that the employment of instrumental variables in this study is valid. Overall, our results imply that the findings remain robust following the implementation of two-stage instrumental variable estimation to mitigate endogeneity concerns.

Differences-in-differences (DID) tests

In the month of February, 2016, Guizhou Province’s National Big Data Comprehensive Pilot Zone (NBDCPZ) was established with the approval of the National Development and Reform Commission, the Ministry of Industry and Information Technology, and the Central Internet Information Office. Subsequently, in October 2016, these three departments concerned reached an agreement to promote the construction of pilot zones across nine regions, ranging from Beijing, Tianjin, Hebei, the Pearl River Delta, Shanghai, Henan, Chongqing, Shenyang and Inner Mongolia.

Drawing on existing studies (Fang et al., 2023), the NBDCPZ will provide substantial support to the digital development of enterprises within their jurisdictions through the following three mechanisms. First, the policy can optimize the digital development environment in the region by strengthening the construction of digital economy infrastructure and improving relevant rules and regulations, hence promoting the digital transformation of companies. Second, the establishment of pilot zones gives companies access to favorable policies and financial subsidies from the local governments, thereby accelerating their digital transformation. Third, the establishment of pilot zones facilitates the aggregation of digital enterprises and human capital, generating spillover effects of digital knowledge, thereby further promoting enterprises’ digital transformation and development. Consequently, NBDCPZ provides an ideal quasi-natural experimental setting to examine the link of causality between corporate digitalization and labor investment efficiency. On this basis, we then proceed to formulate the following Difference-in-Differences (DID) model:

The core explanatory variable Cityi*Postt indicates whether the NBDCPZ is implemented in the city in which firm i is located in year t. Cityi is equivalent to one for the treatment group, which comprises firms located in Guizhou, Beijing, Tianjin, Hebei, the Pearl River Delta Shanghai, Henan, Chongqing, Shenyang and Inner Mongolia, and for other firms, Cityi is equivalent to zero. Additionally, the policy year is 2017; therefore, Postt is equivalent to one in the case where the year t is greater than or equal to 2017, and zero otherwise. That is to say, if the policy is implemented, Cityi*Postt takes the value of one, and zero otherwise. The coefficient β1 represents the average policy impacts of the NBDCPZ on Ablaborit within companies. ΣControls is composed of a vector of control variables that are similar to those included in the regression Model (2), Firmi and Yeart show the fixed effects of firm and year, respectively. εit represents the residual term. Table 7 presents the DID regression findings. Without taking the control variables into account, Column (1)’s results indicate that the coefficient of City*Post is for is −0.0155 which is statistically significant at a level of 1%. The calculated coefficient of City*Post in Column (2), which includes the control variables, is −0.0114 and statistically significant at a level of 5%. The results suggest that there is a significant causal link between corporate digital development and labor investment efficiency under the exogenous policy intervention of NBDCPZ, providing empirical support for our expectation.

Propensity score matching (PSM) approach

In this section, aimed at mitigating some of the observable sources of endogeneity, we further implement a propensity score matching (PSM) procedure. A control group composed of companies that have not participated in digital involvement, which do not exhibit distinctions in their features compared to corporates with digital involvement, needs to be identified. First, we employ the probit model to calculate the likelihood of a company engaging in digitalization (propensity score), which is determined by considering a series of control variables employed in the preceding regression analyses. Based on the “nearest neighbor matching” principle, we perform matching from the sample firms without digital involvement to constitute a control group. Thus, we finally obtain 19,784 valid observations.

The outcomes of PSM procedure are presented in Table 8. It is clear from Panel A that the balancing test outcomes indicate that the treatment and control groups exhibit greater similarity in the observable attributes after implementing propensity score matching, which provides support for the validity of our PSM strategy. In Panel B, we conduct a univariate difference test for the dependent variable between these two groups. The findings demonstrate that enterprises without digital participation have a greater average of ineffective labor investment (Ablabor), and the distinctions are of statistical significance. The regression results concerning the matched sample are illustrated in Panel C. The coefficients of Digital1 and Digital2 are both significantly negative (−0.0077 with t = −4.10, −0.0503 with t = −3.00), indicating that corporate digital development contributes positively to improving efficiency of labor investment, which aligns with our earlier findings.

Controlling for regional characteristics and firm fixed effects

Considering that regional factors, such as regional population density, economic development and government intervention, may also affect firms’ employment decisions, we further control for regional characteristics in the main regressions. Specifically, Popint is regional population density, measured as regional population divided by area; Gdp denotes regional economic development, measured as provincial gross domestic product; Finance is regional financial development level, which is measured by taking the natural logarithm of the aggregate quantity of commercial bank outlets within each province; Govern represents government intervention level, measured as the provincial government corruption perception index, which is compiled by China’s Urban Political-business Relations Ranking Report released by the National Academy of Development and Strategy. In addition, given that the regional digital economy may exert an impact on both enterprise digital transformation and labor investment, we also control for the level of regional digital economy development in this section. Digieco denotes the level of digital economy in the city where the firm is located. Drawing on previous research (Luo et al., 2022; Li et al., 2022), to measure Digieco, by principal component analysis, we establish a composite index of regional digital economy development with five indicators: Internet penetration rate, proportion of computer software employees, total telecommunication services per capita, cell phone subscriber ratio, and digital financial inclusionFootnote 8.

Based on Panel A in Table 9, the coefficients of Gdp as well as Finance are significantly negative, indicating that enterprises’ labor investment is more efficient in regions featuring highly developed economics and finance. The coefficients of Digieco are positive and statistically significant at a level of 10%, suggesting that the digital economy serves a beneficial role in promoting decision-making related to firms’ labor investment. More importantly, the coefficients of independent variables (Digital1, Digital2) are still significantly negative, suggesting that the positive impact of corporate digital development on the effectiveness of labor investment remains robust after controlling for regional characteristics. Furthermore, aimed at reinforcing our results’ robustness, our research also controls for firm fixed effects in the regression analysis. As revealed in Panel B of Table 9, both Digital1 and Digital2 have significantly negative coefficients, providing empirical support for our previous findings again.

Excluding the sample without undergoing digitalization

Considering that the difference of whether firms undergo digitalization or not may affect the causal relationship in this study, we further exclude the observations that have not engaged in digitalization and retain only the digitized sample to re-examine the association between the level of corporate digital development and efficiency of investment in labor force. Table 10 shows the regression outcomes after excluding the sample without undergoing digitalization. Both Digital1 and Digital2 have negative coefficients and are statistically significant at a level of 1% (−0.0089 with t = −3.93, −0.0526 with t = −2.82), supporting a promoting role for digital development of corporations in the efficiency of investment in labor force, which aligns with our earlier findings.

Further analysis

Cross-sectional tests

Influence of regional labor protection systems

Labor protection-related laws constitute the fundamental formal system for safeguarding labor rights and exert a significant influence on corporate employment practices. With the progressive refinement of the Chinese legal system, the enactment of pivotal laws and regulations, such as the “Labor Law of China,” the “Regulations on Unemployment Insurance,” and the “Labor Contract Law of China” provides essential institutional support and legal underpinnings for the protection of labor rights. However, the extent of the labor legal system’s refinement is closely related to the constraint of firm’s labor investment adjustments. Under a more stringent labor legal framework, corporate employment practices are subject to confront more rigorous institutional constraints and higher adjustment costs, thereby increasing the difficulty of achieving an optimal level of labor investment. Leverage cross-country data on labor protection legislation to find that stringent legislation significantly increases the difficulty of downward adjustments in corporate labor investments, resulting in workforce redundancy issues. Digital transformation empowers firms with enhanced capabilities for searching, integrating, and utilizing labor information data (Goldfarb and Tucker 2019), thereby fostering a convergence of labor investment towards an optimal state. As the intensity of labor law protection increases, which implies more constrain of labor investment adjustments, firms need to rely more on the advantages of corporate digitalization in labor investment to achieve higher efficiency. For example, a more accurate prediction of the number of hires beforehand can reduce the number of subsequent unnecessary employee dismissals. Thus, we can conject that the influence of corporate digital development on the efficiency of investment in labor force will be more pronounced for companies situated in those regions with stronger labor protection systems.

This study employs the settlement rate of labor dispute cases to measure the intensity of labor law protection in a region. A robust local labor protection system correlates with more efficient handling of labor dispute cases, indicating a higher level of binding force and intensity of labor law protection. After comparing the regional settlement rate of labor dispute cases with the median value, our sample firms are divided into two subsamples, “strong labor protection systems” and “weak labor protection systems”. Then, we test the moderating role of regional labor protection systems on the link between corporate digital development and efficiency of investment in labor force by regressing different subsamples with Eq. (2). Table 11 shows the regression results. In the “strong labor protection systems” subsample, the coefficients of independent variables (Digital1, Digital2) are all significantly negative (−0.0099 with t = −4.79, −0.0735 with t = −4.29), whereas these coefficients for the “weak labor protection systems” subsample are of smaller magnitude and not of statistical significance. The above outcomes indicate that the positive influence of corporate digital development on efficiency of investment in labor force takes on greater significance for firms situated in areas with stronger labor protection systems, which aligns with our prediction.

Influence of industry competition

In this segment, our research explores the role of industry competition affects the relationship between corporate digital development and the efficiency of investment in labor force. When firms are in an industry with intense competition, they may incur a greater risk of losing outstanding staff and confidential information to their rivals (Cao and Rees 2020). Moreover, the fierce external competition environment also brings more business turbulence and information asymmetry to firms, which hinders the formulation of optimal labor investment decisions. Corporate digital development can help firms accurately and timely capture more information to serve their employment decisions, and thus improve their labor investment efficiency. That is, in order to respond to high competitive pressures, firms have to rely more on the information integration advantages fostered by their own digital development to improve labor investment decisions and optimize resource allocation efficiency. Hence, we predict that the advantageous influence of corporate digital development on the efficiency of investment in labor force will be more prominent for firms in industries with intense competition. Following prior literature (Bharath and Michael 2019), we employ the total number of square market shares of all firms within an industry, which is known as the Herfindahl-Hirschman Index (HHI), to measure the extent of competition in each industryFootnote 9. A lower HHI value means higher intensity of industry competition. After comparing the HHI value of the firm’s industry with the sample median value, we split the sample firms into two subsamples, “high industry competition” and “low industry competition”. Then, we run regressions with Eq. (2) on different subsamples to verify the moderating role of industry competition.

Table 12 displays the regression results. In the “high industry competition” subsample, the coefficients of independent variables (Digital1, Digital2) are all prominently negative (−0.0110 with t = −5.10, −0.0841 with t = −4.88), whereas these coefficients for the “low industry competition” subsample are of smaller magnitude and not of statistical significance. By considering the above outcomes, we can infer that corporate digital development makes a positive contribution to the efficiency of investment in labor force, particularly for corporates in highly competitive industries.

Influence of state ownership

In China, state-owned firms and privately owned enterprises exhibit substantial distinctions in functional roles and operating characteristics (Lin et al., 2020). Compared with private enterprises, economic performance is often not the primary business goal of state-owned enterprises. They tend to be more active and perform better in fulfilling government goals and social responsibilities, such as promoting regional employment and ensuring social stability, even at the expense of their investment efficiency. In contrast, given the natural disadvantages of the private sector in terms of capital scale and access to financing, private enterprises have to devote more energy and effort to improving investment efficiency to gain competitive advantages and achieve sustainable growth. Thus, we speculate that the positive role of corporate digital development in the efficiency of investment in labor force is more prominent for privately owned firms. According to whether the firm is state-owned, we split the sample into two groups, “state-owned enterprises (SOEs)” and “non-state-owned enterprises (NSOEs)”. We then use different subsamples to conduct regression analysis with Eq. (2) to verify the moderating role of state ownership.

Table 13 presents the regression results. In the NSOEs subsample, the coefficients of independent variables (Digital1, Digital2) are all prominently negative (−0.0113 with t = −5.19, −0.0667 with t = −3.28), while these coefficients for the SOEs subsample are of smaller magnitude and not of statistical significance. These results provide empirical support that the advantageous influence of corporate digital development on the efficiency of investment in labor force is more prominent for privately owned corporates.

Overinvestment versus underinvestment

Drawing on the existing literature (Jung et al., 2014; Khedmati et al., 2020), this section further investigates the effect of digital development on enterprises in the context of over- and underinvestment in labor resources. Besides, in terms of overinvestment, this study separates the sample into subsamples of over-hiring and under-firing. As for underinvestment, we subdivide the sample into subsamples of under-hiring and over-firing. Then, based on these different subsamples, this paper provides comprehensive analyses of digital transformation and further deepens our comprehension of its impact on the efficiency of investment in labor force.

Table 14 displays the empirical regression results. The coefficients of Digital1 and Digital2 are negative and of statistical significance at least at a level of 5% (−0.0145 with t = −4.37, −0.1134 with t = −4.25, −0.0053 with t = −3.87, −0.0318 with t = −2.39). This suggests that corporate digital development has an advantageous impact on the efficiency of investment in labor force, which aligns with our earlier findings. Additionally, in the overinvestment in labor resources subsample, compared with under-hiring, the coefficients of independent variables (Digital1, Digital2) belonging to the subsample of over-hiring are all prominently negative (−0.0230 with t = −4.37, −0.1530 with t = −3.42). As for the underinvestment in labor resources subsample, compared with under-hiring, the coefficients of independent variables (Digital1, Digital2) belonging to the subsample of over-hiring are all prominently negative (−0.0057 with t = −3.71, −0.0350 with t = −2.24). In light of this, we can conjecture that corporate digitalization primarily alleviates the issues of over- and underinvestment in labor resources by influencing recruiting behavior rather than dismissing behavior. In practice, the constraints imposed by relevant labor laws make it difficult for enterprises to fire employees, thereby the impact of digitalization on labor investment is not prominent through firing behavior, which is in line with our regression results. In general, corporate digital development negatively affects both over- and underinvestment in labor resources by influencing the company’s hiring behavior.

Conclusions

With the advent of artificial intelligence, cloud computing and big data analytics, digital development has been playing a substantial role in business behaviors and management decision-making. Using an extensive dataset of publicly traded Chinese companies spanning from 2007 to 2023, we examine whether and how corporate digitalization affects firms’ labor investment practices. The results indicate that corporate digital development has an advantageous effect on the efficiency of investment in labor force. Firms with in-depth digital transformation can obtain more timely and accurate data regarding labor investment, which exerts an important role in making their employment decisions closer to the ideal investment level justified by fundamental economic conditions. Furthermore, mechanism tests indicate that corporate digitalization serves to promote the precise allocation of labor resources, the recruitment of high-quality labor, the improvement of management oversight, and ultimately improve the efficiency of investment in labor force. In addition, we reveal that the impact of corporate digitalization is more prominent for firms situated in regions with stronger labor protection systems, industries with higher competition levels, and those non-state-owned enterprises. Moreover, corporate digitalization can curb both over- and underinvestment in labor resources, and this impact primarily embodies in firm’s hiring practices. The findings expand the growing literature concerning the determinants of corporate investment efficiency in labor force and provide practice insight on the role of corporate digitalization in business decision-making as well.

Data availability

Correspondence and requests for materials should be addressed to Youliang Yan. The database contains firm-level microdata and macro-level data. We have deposited all our data in an open repository: Youliang Yan, 2024, “Replication Data for: Does corporate digitalization promote labor investment efficiency? Evidence from Chinese listed companies”, https://doi.org/10.7910/DVN/MSLTAS.

Notes

According to the National Bureau of Statistics, China’s labor force population has declined for seven consecutive years since 2012, with a decrease of more than 26 million. By the end of 2018, the labor force population had decreased by 4.7 million over the previous year, with its share of the population dropping to 64.3%.

According to the data released by the China Academy of Information and Communications Technology (CAICT), from 2005 to 2022, enterprise digitalization has witnessed vigorous development in China, with the scale of the national digital economy expanding from 2.6 trillion to 50.2 trillion, accounting for 41.5% of GDP.

Corporate labor investment efficiency should be consistent with percentage change in sales revenue (Sale_Growthit-1), return on assets (Roait), annual stock return for firm (Returnit), percentile rank of the natural logarithm of the market value of equity (Size_Rit-1), cash and short-term investment plus receivables divided by current liabilities (Quickit-1) and long-term debt divided by total assets (Levit-1), which constitute the main components of economic fundamentals and economic basics.

For example: NVIDIA’s artificial intelligence and simulation solutions have brought unprecedented efficiency and intelligence to supply chains, ensuring retailers can consistently meet customer expectations. Using intelligent video analytics, robotics and automate management, operations are streamlined, processing times accelerated. At the same time, the accuracy of order picking, packaging, and shipping has been enhanced. JINGDONG’s big data cluster comprises over 15,000 servers with a total data capacity exceeding 200 petabytes. Approximately 200,000 jobs run daily, serving nearly 200 million active users generating millions of orders. JINGDONG’s big data covers the entire process of user interactions from browsing, ordering, delivery to after-sales service, establishing a closed-loop for data circulation, which plays a vital role in processing massive datasets, discovering patterns within data and leveraging data insights to create value for enterprises and industries.

According to the listed company industry classification guidelines formulated by China securities regulatory commission in 2012, the listed company industries are divided into 19 sectors and 90 categories. Sectors include mining, manufacturing, construction, education, and finance, etc. Manufacturing encompasses categories such as food manufacturing, furniture manufacturing, textiles, pharmaceutical manufacturing, etc.

According to Statistical Bulletin of the Telecommunications Industry released by Ministry of Industry and Information Technology of the People’s Republic of China, in the year 2000, China had an average of 20.1 telephones per hundred people, an average of 11.45 telephone mainlines per hundred people, and 82.9% of administrative villages had telephone service.

The data on internet penetration rate, proportion of computer software employees, total telecommunication services per capita, and cell phone subscriber ratio are from the China City Statistical Yearbook, and the data on digital financial inclusion come from the official index for 2011–2020 released by the Digital Finance Research Center of Peking University. Due to the narrowed sample period involved in the data on regional characteristics, the number of firm observations is reduced to 15,081 in this section when controlling for regional factors.

Taking 2020 as an example: In 2020, there were 2732 observations in the sample, and the median Herfindahl-Hirschman Index (HHI) was 0.15324. Among these, there were 1289 observations with HHI values higher than 0.15324, which are categorized as low competition industries such as electricity and gas supply industry, transportation and postal industry, information transmission industry, tobacco manufacturing industry and metal smelting industry. At the same time, there were 1443 observations with HHI values lower than 0.15324, indicating that they belong to high competition industries.

References

Becker GS (1962) Investment in human capital: a theoretical analysis. J Political Econ 70(5):9–49. https://doi.org/10.1086/258724

Bharath ST, Michael H (2019) External governance and debt structure. Rev Financ Stud 32(9):3335–3365. https://doi.org/10.1093/rfs/hhy112

Biddle GC, Hilary G, Verdi RS (2009) How does financial reporting quality relate to investment efficiency? J Account Econ 48(2–3):112–131. https://doi.org/10.1016/j.jacceco.2009.09.001

Bloom N, Garicano L, Sadun R (2014) The distinct effects of information technology and communication technology on firm organization. Manag Sci 60(12):2859–2885. https://doi.org/10.1287/mnsc.2014.2013

Bochkay K, Levine CB (2019) Using MD&A to improve earnings forecasts. J Account Audit Financ 34(3):458–482. https://doi.org/10.1177/0148558X17722919

Cao Z, Rees W (2020) Do employee-friendly firms invest more efficiently? Evidence from labor investment efficiency. J Corp Financ 65:101744. https://doi.org/10.1016/j.jcorpfin.2020.101744

Cella C (2020) Institutional investors and corporate investment. Financ Res Lett 32:101169. https://doi.org/10.1016/j.frl.2019.04.026

Cho H, Muslu V (2021) How do firms change investments based on MD&A disclosures of peer firms? Account Rev 96(2):177–204. https://doi.org/10.2308/TAR-2017-0646

Chu J, Fang J (2021) Economic policy uncertainty and firms’ labor investment decision. China Financ Rev Int 11(1):73–91. https://doi.org/10.1108/CFRI-02-2020-0013

Ding H, Ni X, Xu H (2021) Short selling and labor investment efficiency: evidence from the Chinese stock market. Account Financ 61:2451–2476. https://doi.org/10.1111/acfi.12671

Do TK, Le AT (2021) Shareholder litigation rights and labor investment efficiency. Financ Res Lett 46:102296. https://doi.org/10.1016/j.frl.2021.102296

Durnev A, Mangen C (2020) The spillover effects of MD&A disclosures for real investment: the role of industry competition. J Account Econ 70(1):101299. https://doi.org/10.1016/j.jacceco.2020.101299

Fan R, Weng R, Pan J (2021) How property rights affect firm’s labor investment efficiency? Evidence from a property law enactment in China. Emerg Mark Financ Tr 58:381–397. https://doi.org/10.1080/1540496X.2021.1987215

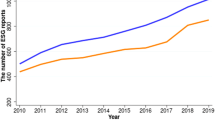

Fang H, Nie X, Shen (2023) Can enterprise digitization improve ESG performance? Econ Model 118:106101. https://doi.org/10.1016/j.econmod.2022.106101

Fernandez-Rovira C, Alvarez J, Bortolo GM (2021) The digital transformation of business. Towards the datafication of the relationship with customers. Technol Forecast Soc Change 162:120339. https://doi.org/10.1016/j.techfore.2020.120339

Goldfarb A, Tucker C (2019) Digital economics. J Econ Lit 57(1):3–43. https://doi.org/10.1257/jel.20171452

Gu L, Ni X, Tian G (2022) Controlling shareholder expropriation and labor investment efficiency. Int Rev Econ Financ 82:261–274. https://doi.org/10.1016/j.iref.2022.06.006

Ha J, Feng M (2018) Conditional conservatism and labor investment efficiency. J Contemp Account Econ 14(2):143–163. https://doi.org/10.1016/j.jcae.2018.05.002

Hamermesh DS (1996) Labor demand. Princeton University Press, Princeton, New Jersey. https://press.princeton.edu/books/paperback/9780691025872/labor-demand

Jensen M, Meckling W (1976) The theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 3(4):305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Johnstone K, Li C, Rupley KH (2011) Changes in corporate governance associated with the revelation of internal control material weaknesses and their subsequent remediation. Contemp Account Res 28(1):331–383. https://doi.org/10.1111/j.1911-3846.2010.01037.x

Jung B, Lee WJ, Weber DP (2014) Financial reporting quality and labor investment efficiency. Contemp Account Res 31(4):1047–1076. https://doi.org/10.1111/1911-3846.12053

Khedmati M, Sualihu MA, Yawson A (2020) CEO-director ties and labor investment efficiency. J Corp Financ 65:101492. https://doi.org/10.1016/j.jcorpfin.2019.101492

Kong D, Liu S, Xiang J (2018) Political promotion and labor investment efficiency. China Econ Rev 50:273–293. https://doi.org/10.1016/j.chieco.2018.05.002

Lai S, Li X, Chan KC (2021) CEO overconfidence and labor investment efficiency. North Am J Econ Financ 55:101319. https://doi.org/10.1016/j.najef.2020.101319

Lee KYK, Mo K (2020) Do analysts improve labor investment efficiency? J Contemp Account Econ 16(3):100213. https://doi.org/10.1016/j.jcae.2020.100213

Leland HE, Pyle DH (1977) Informational asymmetries, financial structure, and financial intermediation. J Financ 32(2):371–387. https://doi.org/10.1111/j.1540-6261.1977.tb03277.x

Li B, Zhao Q, Shahab Y, Kumar S (2023) High-speed rail construction and labor investment efficiency: evidence from an emerging market. Res Int Bus Financ 64:101848. https://doi.org/10.1016/j.ribaf.2022.101848

Li R, Rao J, Wan L (2022) The digital economy, enterprise digital transformation, and enterprise innovation. Manag Decis Econ 43(7):2875–2886. https://doi.org/10.1002/mde.3569

Lim JH, Stratopoulos TC, Wirjanto TS (2011) Path dependence of dynamic information technology capability: an empirical investigation. J Manag Inf Syst 28(3):45–84. https://doi.org/10.2753/MIS0742-1222280302

Lin KJ, Lu X, Zhang J (2020) State-owned enterprises in China: a review of 40 years of research and practice. China J Account Res 13(1):31–55. https://doi.org/10.1016/j.cjar.2019.12.001

Liu B, Huang W, Chan KC, Chen T (2022) Social trust and internal control extensiveness: evidence from China. J Account Public Policy 41:106940. https://doi.org/10.1016/j.jaccpubpol.2022.106940

Liu DY, Chen SW, Chou TC (2011) Resource fit in digital transformation: lessons learned from the CBC Bank global e-banking project. Manag Decis 49(9–10):1728–1742. https://doi.org/10.1108/00251741111183852

Liu X, Liu F, Ren X (2023) Firms’ digitalization in manufacturing and the structure and direction of green innovation. J Environ Manag 335:117525. https://doi.org/10.1016/j.jenvman.2023.117525

Loebbecke C, Picot A (2015) Reflections on societal and business model transformation arising from digitalization and big data analytics: a research agenda. J Strategic Inf Syst 24(3):149–157. https://doi.org/10.1016/j.jsis.2015.08.002

Luo J, Li X, Chan KC (2020) Political uncertainty and labor investment efficiency. Appl Econ 52(43):4677–4697. https://doi.org/10.1080/00036846.2020.1739615

Luo S, Yimamu N, Li Y, Wu H, Irfan M, Hao Y (2022) Digitalization and sustainable development: how could digital economy development improve green innovation in China? Bus Strategy Environ 32(4):1847–1871. https://doi.org/10.1002/bse.3223

Matarazzo M, Penco L, Profumo G (2021) Digital transformation and customer value creation in Made in Italy SMEs: a dynamic capabilities perspective. J Bus Res 123:642–656. https://doi.org/10.1016/j.jbusres.2020.10.033

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13(2):187–221. https://doi.org/10.3386/w1396

Naidu D, Ranjeeni K (2024) Is customers’ financial reporting quality associated with suppliers’ decision to contract? Account Rev. https://doi.org/10.2308/TAR-2021-0652

Nigam N, Benetti C, Johan SA (2020) Digital start-up access to venture capital financing: what signals quality? Emerg Mark Rev 45:100743. https://doi.org/10.1016/j.ememar.2020.100743

Nunn N, Qian N (2014) US food aid and civil conflict. Am Econ Rev 104(6):1630–1666. https://doi.org/10.1257/aer.104.6.1630

Pan X, Tian GG (2020) Political connections and corporate investments: evidence from the recent anti-corruption campaign in China. J Bank Financ 119:105108. https://doi.org/10.1016/j.jbankfin.2017.03.005

Pinnuck M, Lillis AM (2007) Profits versus losses: does reporting an accounting loss act as a heuristic trigger to exercise the abandonment option and divest employees? Account Rev 82(4):1031–1053. https://doi.org/10.2308/accr.2007.82.4.1031

Richardson S (2006) Over-investment of free cash flow. Rev Account Stud 11(2–3):159–189. https://doi.org/10.1007/s11142-006-9012-1

Shah D, Murthi BPS (2021) Marketing in a data-driven digital world: implications for the role and scope of marketing. J Bus Res 125:772–779. https://doi.org/10.1016/j.jbusres.2020.06.062

Sun X, Zhang T (2021) Board gender diversity and corporate labor investment efficiency. Rev Financ Econ 39(3):290–313. https://doi.org/10.1002/rfe.1112

Usai A, Fian F, Petruzzelli AM (2021) Unveiling the impact of the adoption of digital technologies on firms’ innovation performance. J Bus Res 133(4):327–336. https://doi.org/10.1016/j.jbusres.2021.04.035

Viete S, Erdsiek D (2015) Mobile information and communication technologies, flexible work organization and labor productivity: firm-level evidence. ZEW Cent Eur Econ Res 12:15–087. https://doi.org/10.2139/ssrn.2766228

Wang FJ, Xu LY, Zhang JR, Shu W (2018) Political connections, internal control and firm value: evidence from China’s anti-corruption campaign. J Bus Res 86:53–67. https://doi.org/10.1016/j.jbusres.2018.01.045

Wang K (2020) Is the tone of risk disclosures in MD&As relevant to debt markets? Evidence from the pricing of credit default swaps. Contemp Account Res 38(2):1465–1501. https://doi.org/10.1111/1911-3846.12644

Wang QS, Lai S, Pi S, Anderson H (2022) Does directors’ and officers’ liability insurance induce empire building? Evidence from corporate labor investment. Pac Basin Financ J 73:101753. https://doi.org/10.1016/j.pacfin.2022.101753

Wen H, Zhong Q, Lee CC (2022) Digitalization, competition strategy and corporate innovation: evidence from Chinese manufacturing listed companies. Int Rev Financ Anal 82:102166. https://doi.org/10.1016/j.irfa.2022.102166

Wu L, Lou B, Hitt L (2019) Data analytics supports decentralized innovation. Manag Sci 65(10):4863–4877. https://doi.org/10.1287/mnsc.2019.3344

Yuan C, Xiao T, Geng C, Sheng Y (2021) Digital transformation and division of labor between enterprises: vertical specialization or vertical integration. China Ind Econ 9:137–155. https://doi.org/10.19581/j.cnki.ciejournal.2021.09.007

Yan Y, Wang M, Hu G, Jiang C (2024) Does Confucian culture affect shadow banking activities? Evidence from Chinese listed companies. Res Int Bus Financ 68:102191. https://doi.org/10.1016/j.ribaf.2023.102191