Abstract

This paper offers a qualitative analysis of how higher education and green finance impact the promotion of sustainable energy within the Regional Comprehensive Economic Partnership (RCEP) region from 2000 to 2020. The analysis reveals that higher education has a positive effect on sustainable energy development, with a 1% increase in the higher education population associated with a 0.19% rise in short-term and a 0.29% rise in long-term sustainable energy progress. Green finance also plays a crucial role, significantly accelerating green energy development in the RCEP region—each 1% increase in green finance results in a 0.43% boost in short-term and a 0.38% boost in long-term sustainable energy advancement. In contrast, increased fossil fuel production hampers sustainable energy development. Enhanced internet access further supports green energy progress, contributing to a 0.43% increase in the short-term and a 0.53% increase in the long-term. Policy recommendations include expanding the green finance market, advancing sustainable education initiatives, reducing reliance on fossil fuels, and improving internet access to further sustainable energy development in the RCEP region.

Similar content being viewed by others

Research outline

Sustainable energy development represents a crucial opportunity to address the challenges associated with our dependence on fossil fuels. By investing in renewable energy sources such as solar, wind, hydro, and geothermal power, countries can drive a significant global economic transformation (Opeyemi, 2021; Nastasi et al., 2022; Ye and Rasoulinezhad, 2023). This transition not only reduces reliance on finite and environmentally harmful fossil fuels but also alleviates the negative impacts of climate change. Adopting sustainable energy solutions promotes innovation, generates employment, and enhances energy security, all while decreasing greenhouse gas emissions and protecting vulnerable ecosystems (Rasoulinezhad, 2020; Ostergaard et al., 2022; Shahbaz et al., 2023).

Promoting sustainable energy development requires overcoming various hurdles, chief among them being the scarcity of capital for such initiatives. Many nations grapple with the challenge of insufficient funds to kickstart sustainable energy projects. However, a promising solution has emerged in the form of green finance instruments. These innovative tools have gained popularity as efficient means to bolster capital accumulation for sustainable endeavors. Green bonds, investment funds focused on environmental sustainability, and other financial mechanisms channel funds towards renewable energy projects, offering attractive returns for investors while advancing the global transition towards cleaner energy sources.

The impact of higher education on sustainable energy development cannot be overstated. As individuals attain higher levels of education, they become increasingly aware of sustainability and environmental issues. Armed with knowledge and critical thinking skills, they are more likely to advocate for and support environmental policies aimed at promoting sustainable energy practices (Ruiz-Rivas et al., 2020). Higher education cultivates a deeper understanding of the intricate connections between human activities, energy consumption, and environmental degradation (Abad-Segura and Gonzalez- Zamar, 2021). Moreover, it empowers individuals to engage in research, innovation, and policymaking processes geared towards advancing renewable energy technologies and fostering a transition to a low-carbon economy (Leal et al., 2024).

The focus of this research is to investigate the short-term and long-term impacts of higher education and green finance on sustainable energy development within the Regional Comprehensive Economic Partnership (RCEP) countries. This emphasis on RCEP nations stems from their significant stature in the global economy, collectively representing ~30% of the world’s population and boasting a total gross domestic product (GDP) of around $38,813 billion, which also accounts for 30% of global GDP. Despite their economic prowess, RCEP countries face severe consequences from climate change, with their combined CO2 emissions from fuel combustion contributing a substantial 39.1% to the global total in 2018. Furthermore, these nations exhibit high levels of fossil fuel consumption, necessitating a swift transition towards sustainable energy consumption.

This paper advances the existing literature by offering a detailed analysis of sustainable energy development in RCEP countries, focusing specifically on the effects of educational attainment and green finance. While previous research has investigated various factors influencing sustainable energy adoption, there has been limited emphasis on the specific roles of higher education and green finance within the RCEP context. Our study addresses this gap, delivering important insights into the dynamics that drive sustainable energy transitions in some of the world’s largest economies. Through both empirical analysis and theoretical frameworks, we clarify the complex interactions between educational attainment, financial mechanisms, and sustainable energy development outcomes.

While this paper offers valuable insights into the relationship between higher education, green finance, and sustainable energy development in RCEP countries, it is essential to acknowledge certain research limitations. One such limitation is the lack of detailed data regarding the specific projects financed by green financial instruments within these countries. Without granular information about the nature, scale, and outcomes of such projects, our analysis may be somewhat constrained in providing precise recommendations for policymakers and stakeholders. However, despite this limitation, the broader insights gleaned from this study remain highly relevant and applicable to RCEP nations and other global economies.

The paper is structured to address the gap in the literature concerning the impacts of higher education and green finance on sustainable energy development in RCEP countries. Beginning with an elucidation of this research gap, the subsequent sections provide background information on sustainable energy project finance (“Background”), describe the data sources and methodology employed (“Methodology and material”), and present the findings of the analysis (“Discussion on estimations”). “Further discussion: Interconnections of higher education and green finance” represents a further discussion, while “Research summary and policies” synthesizes the main conclusions drawn from the study, discussing their implications for policy and offering recommendations for leveraging educational attainment and green finance to accelerate the transition towards renewable energy sources in RCEP countries.

Brief review of literature

Previous studies have explored the issue of sustainable energy project finance, with a multitude of scholars investigating the impacts of different variables on advancing green energy finance.

Literature on sustainable energy projects

Sustainable energy projects are crucial for addressing global energy challenges and mitigating the adverse impacts of climate change. A wealth of research highlights the necessity of shifting towards renewable energy sources to achieve long-term sustainability goals (Antwi and Ley, 2021; Jaiswal et al., 2022). These projects include a diverse range of technologies such as solar photovoltaic, wind turbines, hydroelectric dams, and geothermal systems, each offering distinct benefits related to resource availability, environmental impact, and scalability (Taghizadeh-Hesary et al., 2022; Phung et al., 2023; Shahbaz et al., 2023; Zhao and Rasoulinezhad, 2023; Mohagheghi and Mousavi, 2024). Evidence shows that sustainable energy projects not only cut greenhouse gas emissions but also drive economic growth, generate employment, and improve energy security (Yoshino et al., 2021; Ostergaard et al., 2022). Additionally, the increasing cost-competitiveness of renewable energy infrastructure makes it an appealing option for investors and policymakers aiming to move away from fossil fuels (Garrain and Lechon, 2023). However, challenges persist, including financing constraints, regulatory obstacles, and technological limitations (Li et al., 2023).

Literature on green finance

Green finance has emerged as a crucial catalyst in directing investments toward sustainable energy projects and addressing the impacts of climate change. Both scholars and practitioners now widely acknowledge the essential role of financial mechanisms in supporting the transition to a low-carbon economy (Rasoulinezhad and Taghizadeh-Hesary, 2022; Khan et al., 2022; Xiong and Dai, 2023). Financial instruments such as green bonds, carbon markets, and impact investing funds are specifically crafted to channel capital into environmentally beneficial projects while offering investors financial returns (Bhatnagar and Sharma, 2022). Research shows that green finance not only mobilizes private sector investments for renewable energy development but also promotes corporate sustainability practices and encourages responsible investing (Gafoor et al., 2024). Additionally, green finance initiatives are becoming increasingly integrated into both national and international policy frameworks, signaling a growing commitment to sustainability from governments and regulatory bodies (Bakry et al., 2023). Nevertheless, challenges remain, including the need for standardized metrics, transparent reporting, and improved collaboration among stakeholders (Ouyang et al., 2023).

Literature on higher education and sustainable economic concept

Higher education plays a vital role in fostering the understanding and implementation of sustainable economic concepts. Scholars and researchers have emphasized the significance of higher education in equipping individuals with the knowledge and skills needed to address complex sustainability challenges (Figueiro et al., 2022; Abo-Khalil, 2024). Through interdisciplinary programs and research initiatives, universities and educational institutions have become hubs for advancing sustainable economic theories and practices (McCowan, 2023). Higher education not only promotes awareness of environmental and social issues but also encourages critical thinking and innovation in developing solutions for sustainable development (Serafini et al., (2022)). Moreover, the integration of sustainability principles into curricula across disciplines prepares future professionals to contribute to sustainable economic growth in various sectors, including energy, finance, and policymaking (Vargas-Merino et al., 2024).

Gap and hypothesis

The research aims to address a notable gap in the literature by investigating the short-term and long-term impacts of higher education and green finance on sustainable energy development within the RCEP countries. While previous studies have explored the influence of various factors on sustainable energy adoption and financing mechanisms, few have specifically focused on the intersection of higher education, green finance, and sustainable energy development within the context of RCEP nations. The hypothesis posits that higher levels of education and increased availability of green finance instruments positively correlate with advancements in sustainable energy projects and contribute to the transition towards renewable energy sources in RCEP countries.

Background

The trends in sustainable energy finance worldwide depict a remarkable surge in investments towards energy transition technologies. In 2022, global investment in energy transition, encompassing initiatives such as energy efficiency enhancements, surged to a record high of USD 1.3 trillion. Notably, the momentum continued into 2023, with global new investments in renewable energy alone soaring to an impressive $358 billion within the first six months of the year. However, to achieve the ambitious goal of net zero emissions by 2050, further substantial investment is imperative. Projections suggest that annual clean energy investment worldwide will need to more than triple by 2030, totaling around $4 trillion, to effectively curb greenhouse gas emissions and mitigate climate change impacts.

Green finance acts as a powerful driver for advancing sustainable energy projects through several key mechanisms. Firstly, it provides financial incentives, such as green bonds and specialized investment funds, which direct capital towards renewable energy initiatives, thus supporting their development and implementation. Secondly, green finance tools allow investors to fund environmentally beneficial projects, aligning their investment portfolios with sustainability objectives while achieving financial returns. Thirdly, by offering favorable terms like reduced interest rates and extended repayment periods, green finance makes sustainable energy projects more financially viable and appealing to investors. Additionally, green finance initiatives frequently involve standards and certification processes that enhance transparency and accountability in project financing, fostering greater trust among investors and stakeholders.

Higher education plays a pivotal role in fostering social readiness and awareness leading to the promotion of sustainable energy development through several pathways. Firstly, higher education institutions serve as hubs for knowledge dissemination and critical thinking, equipping individuals with the necessary skills and understanding to comprehend the complexities of energy systems and environmental challenges. Through interdisciplinary programs and research initiatives, higher education fosters a holistic understanding of sustainability issues, including the importance of transitioning towards renewable energy sources. Secondly, higher education cultivates a culture of innovation and entrepreneurship, empowering students and researchers to develop cutting-edge technologies and solutions for sustainable energy production and consumption. By fostering collaboration between academia, industry, and government, higher education institutions drive research and development efforts aimed at advancing renewable energy technologies and promoting their adoption. Furthermore, higher education fosters a sense of social responsibility and global citizenship, instilling values of environmental stewardship and sustainable development in future leaders and decision-makers.

Methodology and material

This paper aims to provide a qualitative analysis of how higher education and green finance influence the promotion of sustainable energy, focusing on 15 countries within the RCEP from 2000 to 2020. The selected RCEP countries are China, Japan, South Korea, Australia, New Zealand, and the 10 ASEAN member states: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. The year 2000 is chosen as the starting point due to its relevance following the financial crises of the late 1990s. Sustainable energy generation, including solar, wind, hydro, and geothermal sources, is considered the dependent variable, with progress in these areas reflecting advancements in sustainable energy development. Higher education levels and green finance are treated as explanatory variables, while fossil fuel-based power plant production, automobile manufacturing, internet access, and inflation rate are included as control variables. Table 1 presents the research framework, detailing the descriptions of these variables.

The anticipated impacts of the explanatory variables, higher education population, and green finance, as well as the control variables, on sustainable energy development are expected as follows:

Higher education population plays a crucial role in positively influencing sustainable energy development through various mechanisms. Firstly, higher education institutions serve as hubs of knowledge and innovation, equipping individuals with the necessary skills and expertise to drive advancements in renewable energy technologies. By fostering a workforce that is well-versed in the latest developments and best practices in the field, higher education contributes to the efficient deployment and integration of sustainable energy solutions. Moreover, higher education fosters critical thinking and problem-solving skills, enabling graduates to address the complex challenges associated with transitioning to renewable energy sources. Secondly, higher education plays a vital role in raising awareness about sustainability issues and promoting a culture of environmental responsibility. Through academic programs, research initiatives, and outreach efforts, higher education institutions educate students and the broader community about the importance of sustainable energy and the urgent need to mitigate climate change. Additionally, higher education encourages interdisciplinary collaboration and engagement with stakeholders, facilitating the development of innovative solutions and strategies for sustainable energy development. On the other hand, green finance is anticipated to play a pivotal role in providing essential financial resources and incentives to bolster investments in sustainable energy projects. By offering innovative financing mechanisms and favorable investment conditions, green finance facilitates the deployment of renewable energy technologies and infrastructure on a larger scale. This support not only accelerates the development and deployment of sustainable energy solutions but also enhances their accessibility and affordability to a wider range of investors and stakeholders. Moreover, green finance initiatives often incorporate stringent environmental and social standards, ensuring that investments are directed towards projects that deliver tangible environmental and social benefits. By aligning financial interests with sustainability objectives, green finance contributes to the transition towards a low-carbon economy and fosters long-term resilience and prosperity. Regarding the control variables, it is expected that fossil fuel-based power plant production and automobile manufacturing will exert negative impacts on sustainable energy development. These industries are major contributors to greenhouse gas emissions and heavily rely on non-renewable energy sources such as coal, oil, and natural gas. The expansion of fossil fuel-based power plants and automobile manufacturing exacerbates environmental degradation and undermines efforts to transition towards cleaner and more sustainable energy alternatives. Moreover, the continued reliance on fossil fuels perpetuates resource depletion and increases the vulnerability of ecosystems to climate change impacts.

Conversely, internet access is believed to play a facilitating role in the dissemination of information and knowledge related to sustainable energy, thereby potentially exerting a positive impact on its development. Increased internet access enables individuals and communities to access a wealth of educational resources, research findings, and best practices in the field of renewable energy. This enhanced accessibility to information empowers stakeholders to make informed decisions, adopt sustainable energy solutions, and participate in advocacy efforts. Moreover, internet access facilitates communication and collaboration among stakeholders, fostering knowledge sharing, innovation, and the exchange of ideas. The inflation rate has the potential to influence investment decisions and project economics, although its precise impact on sustainable energy development requires further investigation. Fluctuations in the inflation rate can affect the cost of capital, construction materials, and operating expenses, thereby influencing the financial viability of renewable energy projects. High inflation rates may increase project costs and reduce investor confidence, leading to uncertainty and hesitation in committing capital to sustainable energy ventures. Conversely, low inflation rates may create a favorable investment environment and encourage greater investment in renewable energy projects. However, the specific dynamics of how inflation rates affect sustainable energy development may vary depending on various factors such as market conditions, regulatory frameworks, and technological advancements.

The method of estimating coefficients begins by investigating the relationship of cross-sectional dependency (CD) through the approach introduced by Pesaran (2021), as depicted in Eq. 1.

Furthermore, the stationarity of each variable in the model is assessed using the Cross-sectionally Augmented Dickey-Fuller (CADF) test, as proposed by Pesaran (2007). Following this, long-term relationships among the variables are analyzed using the panel co-integration test developed by Westerlund (2007). To evaluate the impacts of the independent variables, we employ both the Cross-sectional Distributed Lag (CS-DL) technique (Eq. 2) and the Error Correction Model (ECM) (Eq. 3).

Evaluating both the short-term and long-term effects of the independent variables on sustainable energy development within the RCEP region offers valuable insights for policymakers and environmentalists. These insights are essential for crafting more effective policies to accelerate the transition to sustainable energy sources and achieve faster progress in sustainable energy adoption.

Discussion on estimations

The initial stage of empirical estimation involves assessing cross-sectional dependency within the panel. To achieve this, the Pesaran (2021) test is utilized, with the null hypothesis of “no cross-section dependency,” to detect any associations of cross-sectional dependency (CD). The outcomes of this examination are showcased in Table 2, revealing the presence of cross-sectional dependency.

Furthermore, given the existence of cross-sectional dependency, the CADF approach is employed, as demonstrated in Table 3, to assess the integrated orders of all variables. As indicated in the table, certain variables exhibit stationarity at the level, while others attain stationarity after first differencing.

Next, the Westerlund (2007) cointegration test, comprising four statistics, is employed, and its outcomes are displayed in Table 4. The results suggest rejecting the null hypothesis, which proposes no cointegration, indicating that the series are indeed cointegrated in the long term.

Following that, the Cross-sectional Distributed Lag (CS-DL) panel framework technique is employed to evaluate the short and long-term effects of variables, as illustrated in Table 5.

The estimations reveal that a 1% increase in the higher education population results in a 0.19% increase in sustainable energy development in the short term and a 0.29% increase in the long term within the RCEP region. This indicates that higher education significantly contributes to sustainable energy development over both short and extended timeframes. Several factors may account for this effect. Firstly, individuals with higher education are more likely to have the expertise and skills needed to innovate and effectively implement renewable energy technologies. Secondly, higher education enhances awareness and understanding of environmental issues, which translates into greater support for policies and initiatives that promote sustainable energy. Additionally, higher education institutions often act as centers for research and development in renewable energy, generating new ideas and solutions to address energy-related challenges.

Additionally, the findings confirm that green finance significantly accelerates green energy development in the region. A 1% increase in green finance results in a 0.43% rise in short-term and a 0.38% rise in long-term sustainable energy development within the RCEP region. This impact can be attributed to several key factors. First, green finance provides essential financial resources and incentives, enhancing the attractiveness and viability of investments in renewable energy projects. Second, green finance initiatives typically include standards and certification processes that ensure transparency and accountability in project financing, thereby fostering trust among investors and stakeholders. Moreover, the availability of green finance can lower the cost of capital for renewable energy projects, making them more competitive compared to traditional fossil fuel-based energy sources.

Moreover, the results confirm that a 1% increase in fossil fuels power plant production and automobile production has negative impacts on sustainable energy development. There are several reasons behind these negative impacts. Firstly, increased production in fossil fuel-based power plants and automobiles signifies a greater reliance on non-renewable energy sources, such as coal and oil, which contributes to higher greenhouse gas emissions and environmental degradation. This reliance on fossil fuels hampers efforts to transition towards cleaner and more sustainable energy alternatives. Secondly, the expansion of fossil fuel-based power plants and automobiles may divert resources and investments away from renewable energy projects, hindering their development and deployment. Additionally, the continued reliance on fossil fuels perpetuates the extraction and consumption of finite resources, leading to long-term environmental and economic consequences.

Going towards greater internet access proves to be a beneficial way to improve sustainable energy development in RCEP. A 1% increase in the improvement of internet access accelerates green energy development by 0.43% and 0.53% in the short- and long-term, respectively. This result can be attributed to several factors. Firstly, enhanced internet access facilitates the dissemination of information and knowledge related to sustainable energy technologies and practices. It enables greater access to educational resources, allowing individuals and communities to learn about renewable energy solutions and their benefits. Secondly, internet access facilitates communication and collaboration among stakeholders in the renewable energy sector, including researchers, policymakers, investors, and industry professionals. This collaboration fosters innovation and the exchange of ideas, leading to the development and implementation of more effective and efficient sustainable energy projects. Additionally, internet access enables the monitoring and management of energy systems, allowing for greater efficiency and optimization of renewable energy resources.

Lastly, the coefficient of the inflation rate is estimated to be negative, indicating that it decelerates green energy development in RCEP. This result can be interpreted in several ways. Firstly, inflationary pressures may increase the cost of renewable energy technologies and infrastructure, making them less financially viable and accessible to investors and consumers. Higher inflation rates can lead to rising construction costs, equipment prices, and operating expenses, which may deter investment in renewable energy projects. Secondly, inflationary environments can undermine investor confidence and stability, leading to uncertainty and reluctance to commit capital to long-term renewable energy ventures. Additionally, high inflation rates may divert resources and attention away from sustainable energy development towards short-term economic stabilization measures.

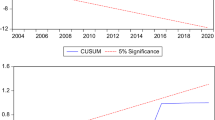

Following that, several diagnostic tests are undertaken to validate the robustness of the empirical model. The outcomes of these assessments are showcased in Table 6, confirming the credibility of the econometric model.

Further discussion: interconnections of higher education and green finance

The intersection of higher education and green finance holds significant promise for advancing sustainable energy progress. These two variables are deeply intertwined, their impacts reverberating across societal, economic, and environmental landscapes. At their core, they embody the essence of sustainability—the harmonious coexistence of human activity with the natural world.

Higher education plays a pivotal role in shaping the attitudes, knowledge, and skills of individuals who will drive forward the transition to sustainable energy. Through rigorous academic programs, research initiatives, and experiential learning opportunities, universities cultivate a generation of professionals equipped to tackle complex sustainability challenges. Students exposed to interdisciplinary curricula that integrate environmental science, economics, policy analysis, and finance are better prepared to navigate the intricacies of sustainable energy development.

Moreover, higher education institutions serve as hubs of innovation and collaboration, fostering partnerships between academia, industry, and government. These collaborations drive research and development in renewable energy technologies, energy efficiency solutions, and sustainable finance mechanisms. By nurturing a culture of innovation and entrepreneurship, universities catalyze the translation of cutting-edge research into real-world applications, accelerating the deployment of sustainable energy solutions.

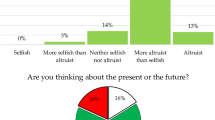

However, the impact of higher education on sustainable energy progress is contingent upon broader societal awareness and engagement with environmental issues. Sustainable literacy, encompassing an understanding of ecological principles, resource management, and the interconnectedness of human societies and the environment, is essential for driving demand for sustainable energy solutions. Without a populace that values environmental stewardship and recognizes the urgency of addressing climate change, the potential of higher education to drive sustainable energy progress remains untapped.

Conversely, the development of green finance markets is instrumental in overcoming barriers to sustainable energy deployment and scaling up renewable energy infrastructure. Green finance encompasses a range of financial instruments and mechanisms designed to mobilize capital towards environmentally sustainable projects and initiatives. These may include green bonds, sustainability-linked loans, carbon markets, and impact investing vehicles.

The emergence of green finance markets has the potential to unlock vast pools of capital for sustainable energy projects, providing the necessary funding to overcome upfront costs and incentivize investment in renewable energy infrastructure. Moreover, green finance mechanisms can help mitigate financial risks associated with renewable energy investments, thereby attracting a broader base of investors, including institutional investors, pension funds, and asset managers.

However, the effectiveness of green finance in driving sustainable energy progress hinges upon widespread awareness and understanding of its potential benefits and implications. In societies where environmental issues are not prioritized or where sustainable finance mechanisms are nascent or underdeveloped, the full potential of green finance to catalyze sustainable energy development may not be realized. Thus, there exists a symbiotic relationship between sustainable literacy and the development of green finance markets, with each reinforcing the other in a virtuous cycle of awareness, investment, and impact.

Research summary and policies

This paper offers a qualitative analysis of how higher education and green finance impact the promotion of sustainable energy, focusing on 15 countries within the RCEP from 2000 to 2020. The analysis reveals that a 1% increase in the higher education population results in a 0.19% increase in short-term and a 0.29% increase in long-term sustainable energy development within the RCEP region. Higher education significantly contributes to sustainable energy development by enhancing knowledge, skills, and environmental awareness.

Furthermore, the study confirms that green finance plays a crucial role in accelerating green energy development, with a 1% increase leading to a 0.43% rise in short-term and a 0.38% rise in long-term sustainable energy development in the RCEP. Green finance provides vital financial resources and incentives for renewable energy projects, while also ensuring transparency and accountability in project financing.

Conversely, a 1% increase in fossil fuel power plant production and automobile manufacturing negatively impacts sustainable energy development by increasing reliance on non-renewable energy sources and diverting resources away from sustainable alternatives. Additionally, greater internet access benefits sustainable energy development in the RCEP, with a 1% increase accelerating green energy development by 0.43% in the short term and 0.53% in the long term. Finally, the negative coefficient of the inflation rate hinders green energy development by raising costs and undermining investor confidence, thereby diverting resources from sustainable energy projects.

The findings of this paper hold significant policy implications for sustainable energy development in the RCEP region. Firstly, there is a clear need to develop and expand the green finance market to accelerate green energy development. Policymakers should focus on implementing measures to attract investment in renewable energy projects by offering financial incentives, reducing investment risks, and fostering transparency and accountability in project financing. Additionally, issuing national plans for sustainable education and promoting the establishment of green universities can play a crucial role in enhancing the level of education and awareness about sustainable energy among the population. By investing in education and research in the field of renewable energy, countries in the RCEP region can cultivate a skilled workforce and drive innovation in sustainable energy technologies. Moreover, policymakers should address the negative impacts of fossil fuel-based power plant and automobile production by implementing regulations and incentives to transition towards cleaner and more sustainable energy alternatives. Lastly, efforts should be made to improve internet access across the region to facilitate information dissemination, collaboration, and optimization of renewable energy resources, thereby further accelerating green energy development.

While this study provides valuable insights into the factors influencing sustainable energy development in the RCEP region, future research should focus on two key areas to further enhance our understanding and inform policy decisions. Firstly, there is a need to investigate the impacts of digitalization on green finance within the RCEP context. The growing role of digital technologies in financial markets has the potential to revolutionize the way green finance operates, offering new opportunities for efficiency, transparency, and accessibility. Understanding how digitalization influences the flow of green finance and its impact on sustainable energy development is essential for guiding policymakers and market participants. Secondly, future studies should explore the effects of green tax rates on sustainable energy development in the region. Implementing green tax policies can incentivize the adoption of renewable energy technologies and discourage reliance on fossil fuels. Assessing the effectiveness of green tax rates in promoting sustainable energy development and identifying potential challenges and opportunities associated with their implementation is crucial for designing effective policy measures to mitigate climate change and promote environmental sustainability in the RCEP region and beyond.

Data availability

For inquiries regarding access to the datasets generated or analyzed in the current study, please do not hesitate to reach out to the corresponding author.

References

Abad-Segura E, Gonzalez- Zamar M (2021) Sustainable economic development in higher education institutions: a global analysis within the SDGs framework. J Clean Prod 294:126133. https://doi.org/10.1016/j.jclepro.2021.126133

Abo-Khalil A (2024) Integrating sustainability into higher education challenges and opportunities for universities worldwide. Heliyon 10(9):e29946. https://doi.org/10.1016/j.heliyon.2024.e29946

Antwi S, Ley D (2021) Renewable energy project implementation in Africa: ensuring sustainability through community acceptability. Sci Afr 11:e00679. https://doi.org/10.1016/j.sciaf.2020.e00679

Bakry W, Mallik G, Nghiem X, Sinha A, Vo X (2023) Is green finance really “green”? Examining the long-run relationship between green finance, renewable energy and environmental performance in developing countries. Renew Energy 208:341–355

Bhatnagar S, Sharma D (2022) Evolution of green finance and its enablers: a bibliometric analysis. Renew Sustain Energy Rev 162:112405. https://doi.org/10.1016/j.rser.2022.112405

Figueiro P, Neutzling D, Lessa B (2022) Education for sustainability in higher education institutions: a multi-perspective proposal with a focus on management education. J Clean Prod 339:130539. https://doi.org/10.1016/j.jclepro.2022.130539

Gafoor C, Perumbalath S, Daimari P, Naheem K (2024) Trends and patterns in green finance research: a bibliometric study. Innov Green Dev 3(2):100119. https://doi.org/10.1016/j.igd.2023.100119

Garrain D, Lechon Y (2023) Sustainability assessments in solar energy projects: results of case studies. Sol Compass 6:100039. https://doi.org/10.1016/j.solcom.2023.100039

Jaiswal K, Chowdhury C, Yadav D, Verma R, Dutta S, Jaiswal K, SangmeshB, Karuppasamy K (2022) Renewable and sustainable clean energy development and impact on social, economic, and environmental health. Energy Nexus 7:100118. https://doi.org/10.1016/j.nexus.2022.100118

Khan M, Riaz H, Ahmed M, Saeed A (2022) Does green finance really deliver what is expected? An empirical perspective. Borsa Istanb Rev 22(3):586–593

Leal S, Azeiteiro U, Aleixo A (2024) Sustainable development in Portuguese higher education institutions from the faculty perspective. J Clean Prod 434:139863. https://doi.org/10.1016/j.jclepro.2023.139863

Li D, Guan X, Tang T, Zhao L, Tong W, Wang Z (2023) The clean energy development path and sustainable development of the ecological environment driven by big data for mining projects. J Environ Manag 348:119426. https://doi.org/10.1016/j.jenvman.2023.119426

Nastasi B, Markovska N, Puksec T, Duic N, Foley A (2022) Renewable and sustainable energy challenges to face for the achievement of Sustainable Development Goals. Renew Sustain Energy Rev 157:112071. https://doi.org/10.1016/j.rser.2022.112071

McCowan T (2023) The crosscutting impact of higher education on the Sustainable Development Goals. Int J Educ Dev 103:102945. https://doi.org/10.1016/j.ijedudev.2023.102945

Mohagheghi V, Mousavi S (2024) A new model for resilient-sustainable energy project portfolio with bi-level budgeting and project manager skill utilization under neutrosophic fuzzy uncertainty: a case study. Eng Appl Artif Intell 131:107821. https://doi.org/10.1016/j.engappai.2023.107821

Opeyemi B (2021) Path to sustainable energy consumption: The possibility of substituting renewable energy for non-renewable energy. Energy 228:120519. https://doi.org/10.1016/j.energy.2021.120519

Ostergaard P, Duic N, Noorollahi Y, Kalogirou S (2022) Renewable energy for sustainable development. Renew Energy 199:1145–1152

Ouyang H, Guan C, Yu B (2023) Green finance, natural resources, and economic growth: Theory analysis and empirical research. Resour Policy 83:103604. https://doi.org/10.1016/j.resourpol.2023.103604

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Pesaran MH (2021) General diagnostic tests for cross-sectional dependence in panels. Empir Econ 60(1):13–50

Phung T, Rasoulinezhad E, Thu H (2023) How are FDI and green recovery related in Southeast Asian economies? Econ Change Restruct 56:3735–3755

Rasoulinezhad E (2020) Environmental impact assessment analysis in the Kahak’s Wind Farm. J Environ Assess Policy Manag 22(01):2250006. https://doi.org/10.1142/S1464333222500065

Rasoulinezhad, E, and Taghizadeh-Hesary, F2022. Role of green finance in improving energy efficiency and renewable energy development. Energy Effic 15 (14), https://doi.org/10.1007/s12053-022-10021-4

Ruiz-Rivas U, Martinez-Crespo J, Venegas M, Chinchilla-Sanchez M (2020) Energy engineering curricula for sustainable development, considering underserved areas. J Clean Prod 258:120960. https://doi.org/10.1016/j.jclepro.2020.120960

Serafini P, Moura J, Almeida M, Rezende J (2022) Sustainable Development Goals in Higher Education Institutions: a systematic literature review. J Clean Prod 370:133473. https://doi.org/10.1016/j.jclepro.2022.133473

Shahbaz M, Siddique A, Siddiqui M, Jiao Z, Kautish P (2023) Exploring the growth of sustainable energy technologies: a review. Sustain Energy Technol Assess 57:103157. https://doi.org/10.1016/j.seta.2023.103157

Taghizadeh-Hesary F, Phoumin H, Rasoulinezhad E (2022) COVID-19 and regional solutions for mitigating the risk of SME finance in selected ASEAN member states. Econ Anal Policy 74:506–525

Vargas-Merino J, Rios-Lama C, Panez-Bendezu M (2024) Critical implications of education for sustainable development in HEIs—a systematic review through the lens of the business science literature. Int J Manag Educ 22(1):100904. https://doi.org/10.1016/j.ijme.2023.100904

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

Xiong Y, Dai L (2023) Does green finance investment impact on sustainable development: Role of technological innovation and renewable energy. Renew Energy 214:342–349

Ye X, Rasoulinezhad E (2023) Assessment of impacts of green bonds on renewable energy utilization efficiency. Renew Energy 202:626–633

Yoshino N, Rasoulinezhad E, Taghizadeh-Hesary F (2021) Economic impacts of carbon tax in a general equilibrium framework: empirical study of Japan. J Environ Assess Policy Manag 23(01):2250014. https://doi.org/10.1142/S1464333222500144

Zhao L, Rasoulinezhad E (2023) Role of natural resources utilization efficiency in achieving green economic recovery: evidence from BRICS countries. Resour Policy 80:103164. https://doi.org/10.1016/j.resourpol.2022.103164

Acknowledgements

Bingfeng Meng: Conceptualization, supervision, resources, writing review and editing, Data curation, writing original draft preparation; Zhihao Hao: Competing interests, supervision.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not encompass studies involving human participants conducted by any of the authors.

Informed consent

This article does not include any studies involving human participants conducted by the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Meng, B., Hao, Z. Role of green finance and higher education in fostering the sustainability and energy transition practices. Humanit Soc Sci Commun 11, 1298 (2024). https://doi.org/10.1057/s41599-024-03843-3

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-03843-3