Abstract

This research investigates how changes in public discourse on social media (particularly Twitter, now X) influence financial performance of companies listed on the e-commerce XTCRT index of Borsa Istanbul amid the COVID-19 pandemic. Utilising a unique 4-layer network structure, the study integrates daily closing prices, highest and lowest values, and trading volume data of these companies with Twitter discussions on six categories: culture, economy, health, politics, technology, world affairs. By using advanced computational methods such as multilayer network analysis, long short-term memory architecture, nonlinear autoregressive distributed lag analysis, we find a high responsiveness of the e-commerce index to social media content, particularly in discussions related to health, technology, world affairs. The study underscores that social media discussions significantly shape index composition, resulting in noticeable shifts in market dynamics, including fluctuations in stock prices, trading volumes, and market sentiment. Our study advocates for a more advanced approach to market analysis that incorporates the dynamics of online public discussions.

Similar content being viewed by others

Introduction

Studies on structural aspects of trade companies, particularly those with e-commerce counterparts in Borsa Istanbul, hold paramount significance for diverse reasons. The importance is derived from fundamental business and network analysis concepts, offering valuable insights into market trends, investment opportunities and overall economic stability (Basole et al., 2015; Felch and Sucky, 2023). The inclusion of e-commerce competitors adds a crucial dimension, revealing how traditional commerce adapts or merges with digital platforms in the contemporary economy. This adaptation addresses the expanding digital consumer base and showcases advancements in technology, supply chain management and customer engagement techniques (Choi et al., 2023; He and Liu, 2024; Zennaro et al., 2022). By using conventional and digital business models, organisations create distinctive ecosystems providing insights into future transformations. Additionally, examining the connection between these entities and online counterparts sheds light on challenges and opportunities arising from digital disruption (Faccia et al., 2023; Fuerst et al., 2023). Analyses on how these organisations employ technology to enhance productivity, expand customer base and generate additional income deepen the understanding of changing dynamics in international trade, with particular significance for investors and policymakers operating in an evolving digital landscape.

Multilayer networks offer a comprehensive framework for grasping intricate interconnections and interdependencies within a system. The analysis of multilayer networks considers various types of interactions and it is more efficient than examining combined single-layer networks. This approach elucidates distinctive structural characteristics and dynamics that might otherwise remain hidden. For instance, it reveals interactions and influences among different layers, enhancing comprehension of the entire system (Aleta and Moreno, 2019; Chen et al., 2023; Gani et al., 2020; Sugiki et al., 2021, van Dorsser and Taneja, 2020).

A multifaceted viewpoint is essential for discerning emerging behaviour patterns and systemic weaknesses. In complex networks involving economic and social aspects, disturbances in the economic component may substantially affect the social component, influencing community structures, behaviours and norms (Boss et al., 2004; Stella et al., 2020). The examination of multilayer networks fosters multidisciplinary collaboration, integrating information and methodologies from physics, sociology, biology and computer science (Boccaletti et al., 2014; Du et al., 2016; Falegnami et al., 2020; Ibrahim et al., 2021; Milano et al., 2023). Furthermore, it opens avenues to apply network theory in practical situations such as urban planning, infrastructure resilience, ecological management and public health (Alessandretti et al., 2023; Hutchinson et al., 2019; Pianese and Belfiore, 2021; Ulak et al., 2021; Xie et al., 2023), improving capacities to create, forecast, control interconnected systems in an increasingly interconnected world.

This analytical technique can be a useful instrument for policymakers to comprehend and exert influence over public sentiment, assess the efficacy of communication tactics and enhance crisis management capabilities. Policymakers can gain insights into public discourse by analysing the dissemination of information and attitudes through different social and communication networks. This understanding is crucial for influencing public health communication, economic strategies and social interventions. Moreover, the analysis can assist in identifying and deterring misinformation and disinformation operations that might harm public health initiatives and incite societal turmoil. Especially during a pandemic, it is crucial to retain public trust and ensure adherence to health rules.

Comprehending the emotional tone and prevailing views in online discussions can aid in formulating empathic and impactful public messages, which are crucial for efficient administration. Additionally, it can assist in forecasting and alleviating the societal consequences of policy choices by offering insights into public reception and potential responses. Overall, examining structural characteristics of online discourse networks during significant events such as the COVID-19 pandemic provides a valuable method for monitoring public discourse, creating well-informed interventions and promoting a governance approach that is more responsive and adaptable. This can ultimately result in enhanced policy outcomes and a more knowledgeable public.

Our study focuses on companies that are included in the commerce index (i.e., XTCRT index) of Borsa Istanbul. A 4-layer network architecture is constructed by using daily closing prices, highest and lowest values and trading volume values of companies throughout the COVID-19 period. We investigated the impact of changes in discourse topics on the main structural and topological metrics of the multilayer network, that is stock performance metrics. The network in question is comprised of individuals who posted various topics on Twitter (now referred to as X). We used deep learning and natural language processing techniques to analyse Twitter topics across six distinct categories: culture, economy, health, politics, technology and world affairs. Identifying the six categories is crucial for various reasons. It facilitates comprehension of the current issues and interests of a society or group. This classification also facilitates focused policy formulation, marketing tactics and other decision-making procedures that necessitate comprehension of public interest and sentiment across different areas.

The novelty of our study is that it uses multilayer financial network analysis to offer a broader perspective on the numerous financial relationships and correlations generated by listed companies. For instance, while two company stocks may move in tandem, their reactions to economic indicators or global events might diverge. Furthermore, our approach facilitates an understanding of the interconnectedness of different market segments and how fluctuations in one area can ripple through to others. By analysing interconnections across various market types, financial analysts can identify systemic risks and hidden vulnerabilities that span across multiple market segments. It is crucial for developing effective risk mitigation strategies and understanding the complex structure of financial contagion.

Results showed that public discourse on social media has an impact on short- and long-term company performance. Hence, public policies should be designed while considering public view and trust in financial markets. In this context, authorities could support public awareness initiatives for increasing levels of financial literacy and market dynamics among citizens, which could yield a knowledgeable public discourse. In addition, our results suggested that specific conversations about health, technology and world events are of interest and concern for citizens. Considering this reality, authorities are called to implement cross-sectoral policy approaches to better serve public interest and market realities.

This study is structured as follows: “Literature review” provides an extensive analysis of the impact of social media posts on economies. “Methodology” details the methodology employed in the study. “Results” presents the outcomes of multiplex analysis and topic classification. “Results based on NARDL” focuses on the results using Nonlinear Autoregressive Distributed Lag (NARDL) analysis. “Conclusions” provides concluding remarks and future research directions.

Literature review

The COVID-19 pandemic has been named by the International Monetary Fund as the biggest economic disaster since the Great Depression. It has resulted into significant economic ramifications, such as the disruption of global stock and financial markets (Baboukardos et al., 2021). Furthermore, it has exerted a significant influence on diverse facets of life on a global scale (Naseem et al., 2021). The COVID-19 pandemic has caused unprecedented challenges for global financial markets, with significant volatility observed across various indices. Previous studies have documented how economic uncertainty driven by the pandemic has led to drastic fluctuations in stock prices and trading volumes (Ali and Ramlan, 2020; Baker et al., 2020). For instance, research has shown that Borsa Istanbul, like many global markets, experienced sharp declines in response to the pandemic, particularly in sectors highly sensitive to changes in consumer behaviour, such as e-commerce (Çelik and Gökmen, 2020; Yılmaz, 2021). However, these studies often rely on traditional financial metrics and do not consider the influence of external factors (such as social media discourse) on market dynamics. This gap underscores the necessity for more comprehensive analytical frameworks that integrate both financial and non-financial data sources (Eren and Özbekler, 2020).

Social media platforms, particularly Twitter (now X), have become increasingly important in shaping public discourse and influencing investor behaviour. Existing research demonstrates that sentiment and discussions on social media can lead to significant shifts in stock prices and trading volumes, sometimes even predicting market movements (Bollen et al., 2011; Fiala et al., 2015; Nyakuruwa and Seetharam, 2023; Piñeiro-Chousa et al., 2017; Smales, 2021; Wang et al., 2022; Wang and Vergeer, 2024; Wu et al., 2017; Zhang et al., 2022; Zhang et al., 2020). Lazzini et al. (2022) classify the COVID-19 pandemic as the inaugural social media pandemic, emphasising its impact on the economy and social media. According to this perspective, social media has significantly changed how information is shared and digested. It empowers anyone to create and share content instantly on a worldwide scale, without filtering or restrictions. Therefore, social media serves as an expansive virtual platform where users may discuss and exchange ideas, information, news, feelings, aspirations, concerns, uneasiness regarding various economic, cultural, social issues at local and global levels.

Despite these findings, most studies focus on general market trends rather than specific sectors like e-commerce (Ahmed and Ullah, 2022). Moreover, the predominant use of linear models to analyse social media sentiment may not fully capture the complex and nonlinear nature of online discussions and their impact on financial performance. This limitation suggests the need for more advanced computational methods to better assess the role of social media in market behaviour (Aramonte et al., 2021; Fang and Peress, 2021).

Investor behaviour is influenced by a combination of market fundamentals and external factors such as news and social media. During the COVID-19 pandemic, the increased uncertainty led to a greater reliance on social media for real-time information, which further amplified its impact on financial markets (Alfaro et al., 2020; Guan et al., 2021; Smales, 2021). While previous studies have explored the relationship between market sentiment and investor behaviour (Da et al., 2011; Garcia, 2013), they fail to account for the multidimensional nature of market dynamics during crisis periods. Notably, the interaction between social media discourse and specific market sectors remains underexplored, particularly in the context of e-commerce companies listed on Borsa Istanbul (Gunay, 2022). Our study addresses this gap by employing a multilayer network structure that integrates market data with social media discussions, providing a more nuanced understanding of investor behaviour (Armanious et al., 2020). Based on an extensive study from the Kepios Research Group, the global user base of social media platforms surpassed an astonishing 4.95 billion individuals as of October 2023. This represents around 61.4% of the entire worldwide population. The main social media platforms are Facebook, X, Snapchat, Instagram. The use of social media platforms for corporate operations has become a growing concern for both academic and industrial research in recent years (Kaplan and Haenlein, 2010).

Social media platforms offer a unique opportunity for commercial companies to engage with consumers, advertise products, gain insights into the industry (Ismail et al., 2018; Smith et al., 2012). These analyses facilitate the understanding of the intricate link between social media activity and commercial enterprises business decisions. In this context, studies examine content, engagement, sentiment and network dynamics.

Kadous et al. (2017) investigate the intricacies of contemporary investment techniques and emphasise the influential role of social media on moulding investor behaviour. When companies disseminate information regarding financial statements on social media, individual investment trajectory can be altered. Singh Chauhan et al. (2023) argue that individuals’ emotions and thoughts have a substantial impact on price changes in financial markets. Hence, market analysts perceive social media and microblogging platforms as prospective means for acquiring insights into future stock market developments. According to Valle-Cruz et al. (2022), information shared on social media triggers emotional responses and reactions among investors. These emotional responses then impact their choices to buy or sell financial assets (especially in stock markets) and eventually result in observable behaviours. Moreover, the spread of news on social media (regardless of their truthfulness) can change the trends of international or national stock market indicators.

Biswas et al. (2020) state that investors’ ideas and behaviours, along with public opinion and news, are significant factors that influence capital markets. Das et al. (2022) analyse stock market variations during a lockdown situation caused by the COVID-19 pandemic, using sentiment ratings. Results indicate that the combination of society mood, news headlines/articles and stock data improves the accuracy of stock price predictions. Lazzini et al. (2022) show that stock market is affected by the dominant sentiment, discourse in news or media outlets and that new content can predict changes in market values. Moreover, it indicates that investors’ perceptions on risk may have a stronger impact on their actions than concrete facts.

The COVID-19 pandemic has provided investors and policymakers with a clear understanding of the significant influence that global calamities can exert on the global economy and financial markets (Singh Chauhan et al., 2023). Domalewska (2021) asserts that worldwide stock and foreign exchange markets have been perceived as increasingly perilous for international investors since the pandemic onset. The author highlights the importance of establishing consistent regulations worldwide to prevent market participants from mitigating risk-taking capacity and to ensure the availability of liquidity in global markets.

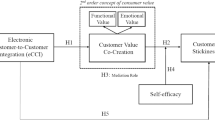

Despite the established link between social media activity and financial market performance (Zhang et al., 2020), existing studies often lack a sector-specific focus and do not incorporate advanced computational techniques. Additionally, much of the research overlooks the multilayered impact of social media discussions on various aspects of financial performance, such as stock prices, trading volumes and market sentiment (Wu and Liu, 2020). Our research addresses these gaps by utilising a unique 4-layer network structure that integrates daily financial data with social media discourse across six thematic categories: culture, economy, health, politics, technology and world affairs (Cui et al., 2020). By applying advanced methods such as multilayer network analysis (De Domenico et al., 2015), long short-term memory (LSTM) architecture (Hochreiter and Schmidhuber, 1997) and NARDL analysis (Shin et al., 2014), we offer a comprehensive examination of how social media influences the financial performance of e-commerce companies during the COVID-19 pandemic. By addressing gaps through advanced computational methods and a sector-specific focus, our study significantly contributes to the understanding of how social media discourse shapes financial market dynamics, particularly for e-commerce companies listed on Borsa Istanbul.

Methodology

Multilayer network analysis

Multilayer network analysis allows for a nuanced exploration of various levels of interaction among companies, offering insights into their interconnections within complex financial systems (Batrancea et al., 2022, 2023; Gao, 2022; Li et al., 2022). In the context of Borsa Istanbul, this approach is vital for understanding intricate networks where companies are linked not just through direct trading ties but also through shared stakeholders, market influences and sectoral dependencies.

This analysis is crucial for identifying underlying patterns and potential systemic risks that might be overlooked in conventional single-layer network analysis (Batrancea et al., 2022; Korol, 2019). By examining multiple layers of linkages, researchers can better comprehend market dynamics, risk propagation and inform investment strategies (Korbel et al., 2019; Yan et al., 2015; You et al., 2015).

In Borsa Istanbul, financial correlation networks help visualise the complex interrelationships among assets, highlighting how price movements of one asset can influence others. Understanding these connections is essential for improving risk assessment and devising resilient portfolio strategies (Akgüller et al., 2023; Balcı et al., 2022).

Using graph theory (Liang et al., 2020), where nodes represent assets and edges represent relationships, a weighted graph \(G=(V,E,\omega )\) is constructed. Here, edge weights are derived from correlation distances, where stronger correlations correspond to lower weights, facilitating effective filtering techniques. Methods like Minimum Spanning Trees (Mantegna, 1999) and Planar Maximally Filtered Graphs (PMFG) (Tumminello et al., 2005) are employed to distil network topology, retaining significant connections while simplifying overall structure.

To analyse multilayer networks, we assume companies are interconnected within a complete correlation distance, applying PMFG filtration to enhance the network’s topological structure. A multilayer network is defined as a quadruplet \(M=({V}_{M},{E}_{M},V,L)\), where \({V}_{M}\) represents the node-layer combinations and \({E}_{M}\) the filtered edge set. The multilayer network enables a more comprehensive view of financial relationships across different layers, each representing a distinct aspect of the market.

The strength of a node, denoted as \({s}_{i}^{\alpha }\), is calculated by summing the weights of adjacent edges within a layer. The node’s weighted edge overlapped degree \({o}_{i}\) across all layers is given by

Additionally, the multilayer participation coefficient \(P(i)\) measures a node’s involvement across layers, with higher values indicating more balanced participation

Nodes are categorised based on \(P(i)\): ‘focused’ (\(0 \,<\, P(i) \,<\, 1/3\)), ‘mixed’ (\(1/3\le P(i) \,<\, 2/3\)) and ‘truly multilayer’ (\(P\left(i\right)\ge 2/3\)). This classification aids in understanding the roles of different nodes within the network. The Z-score \(z({o}_{i})\) standardises the overlapping strength, distinguishing ‘hubs’ from ordinary nodes

Lastly, we calculate the entropy \(H\) of the multilayer network to measure its complexity

where \({p}_{i,\alpha }\) is the probability of a specific state involving node \(i\) in layer \(\alpha\). This metric assesses the unpredictability and information distribution across the multilayer network.

By applying this methodology, we gain deeper insights into the interconnected dynamics of Borsa Istanbul financial entities, revealing how various layers of interaction contribute to the overall market structure. This comprehensive understanding enables analysts and investors to identify critical nodes and connections that may pose systemic risks or offer strategic opportunities. Consequently, it facilitates more informed decision-making, allowing for the development of robust investment strategies and resilient financial models that can better withstand market shocks and uncertainties. Moreover, the ability to dissect and analyse these multilayered networks equips stakeholders with the tools needed to anticipate and mitigate potential contagion effects, ultimately contributing to a more stable and secure financial environment.

Topic classification

The classification of social media posts by topic is becoming increasingly important for commerce enterprises operating in stock markets, as it provides valuable data for making strategic decisions and conducting market analysis (Cavalcante et al., 2016; Chang et al., 2022; Yono et al., 2019). Social media platforms offer real-time data on customer mood and trends. By accurately classifying and analysing data, useful insights can be gained about consumer behaviour, preferences and perceptions. Companies can enhance their ability to monitor and analyse important discussions and comments by systematically organising social media content into specified subjects. This methodology empowers them to customise marketing tactics, product advancement, customer support to effectively fulfil the requirements and anticipations of intended demographic. Moreover, topic classification facilitates the identification of emerging market trends and possible hazards, enabling organisations to promptly adjust to evolving market conditions. The strategic advantage plays a vital role in the dynamic and competitive setting of Borsa Istanbul, where prompt and well-informed decisions can have a substantial impact on company performance and stock value. This study employs the method proposed by Batrancea et al. (2023) to classify topics.

The technique of text classification, a critical task in Natural Language Processing (NLP), is gaining popularity in numerous disciplines (Gasparetto et al., 2022; Khadhraoui et al., 2022; Kesiku et al., 2022).

An obstacle in text classification is the handling of unprocessed data acquired via internet, which frequently lacks uniformity. Online news articles may contain foreign letters, punctuation, numerals, and special symbols. While these elements are not crucial to phrase interpretation, they can add noise and distortions into the dataset. To solve this issue and enhance data quality, such characters were eliminated. Turkish, as an agglutinative language, allows word changes through the inclusion of numerous affixes or conjugations, leading to the creation of multiple derivatives from a single root within a sentence. Our study utilises the Zemberek NLP library, a popular tool specifically designed for processing Turkish language (Akın and Akın, 2007). Zemberek analyses Turkish words based on fundamental components and rectifies incorrectly spelled terms. The library is employed for the processes of tokenization, stop-word removal and stemming.

Machine learning algorithms often exhibit poorer performance while processing a substantial amount of data points. Deep learning approaches are favoured in such instances due to their superior efficiency and improved outcomes. An inherent advantage of deep learning compared to classical machine learning is its ability to bypass the requirement for feature extraction. Deep learning employs an artificial neural network architecture that relies on word embedding, a technique that converts words or phrases into vectors of real numbers. At first, every word is shown as a vector with randomly assigned values. This study specifically utilises the GloVe (Global Vectors for Word Representation) word embedding paradigm. The vector matrices are subsequently incorporated into the embedding layer of the classification model.

GloVe, created by the Stanford NLP group (Pennington et al., 2014), is an unsupervised model that uses co-occurrence probabilities to represent words. It evaluates word similarity by analysing the proportion of times they appear together in different contexts. The GloVe model employs a weighted least-squares regression equation that places greater emphasis on ratios rather than probabilities to denote associations between words. Word frequencies are determined by analysing a co-occurrence matrix, and a particular weighting function is utilised in the model.

For our research, Turkish news and tweets are classified using LSTMs. Loops interconnection gives the Recurrent Neural Networks (RNNs) their characteristic dynamic temporal patterns and allows them to analyse inputs by drawing on their internal memory. However, RNNs can only hold on to data for so long before it becomes useless. To solve this problem, LSTM learns about long-term associations, which allows it to draw on past learning to generate new findings. LSTMs are unique among RNNs since they have four separate layers: input, output, forget and memory cell. An embedding layer, a hidden layer, a dense layer and an output layer make up the classification model used in this study. Word embedding vector matrices are received by the input layer and sent to the hidden layer, which contains LSTM parameters activated with a sigmoid function. Overfitting risk can be reduced via dropout. The activation function of the Rectified Linear Unit is used by the dense layer to improve learning and guarantee consistent output. Using SoftMax as its activation function, seven neurons make up the output layer, which produces a probabilistic output for various news categories.

Nonlinear autoregressive distributed lag model

The NARDL model is particularly advantageous for analysing financial data due to its ability to capture both short- and long-term relationships between variables while accounting for asymmetric effects of positive and negative changes in the independent variables (Ahmed et al., 2023; Jiang et al., 2022; Menegaki, 2019; Song and Ma, 2023). Financial data often exhibit nonlinear patterns and asymmetrical responses to various inputs, making NARDL an appropriate choice for modelling such complexities (Ahmed et al., 2020; Allen and McAleer, 2021; Alharbi, 2022; Milin et al., 2023).

Mathematically, the NARDL model is represented as

where \({y}_{t}\) is the dependent variable (e.g., stock market index), \({x}_{t-j}^{+}\) and \({x}_{t-k}^{-}\) represent the positive and negative components of the independent variable \({x}_{t}\) (e.g., Twitter sentiment or news impact) at time \(t\), decomposed into positive\(\,{x}_{t-j}^{+}\) and negative \({x}_{t-k}^{-}\) changes, \({\alpha }_{i}\) captures the autoregressive effect of the dependent variable, \({\beta }_{j}^{+}\) and \({\beta }_{k}^{-}\) are the coefficients that measure the impact of positive and negative changes in \({x}_{t}\) on \({y}_{t}\) and \({\epsilon }_{t}\) is the error term.

This model allows for the distinct measurement of how positive and negative shocks in social media sentiment (or other independent variables) affect the stock market differently, capturing potential asymmetries in investor responses. Additionally, the lagged variables in the model, represented by \({y}_{t-i}\), \({x}_{t-j}^{+}\) and \({x}_{t-k}^{-}\), enable the analysis of the delayed effects of these shocks, crucial in financial markets where responses may not be immediate.

The NARDL approach is particularly useful for exploring both long-term cointegration and short-term dynamics within financial data. It allows for the assessment of a stable, long-term relationship between Twitter topic series and multilayer network measurements, indicated by the presence of cointegration among variables. This capability is essential for understanding the enduring connections between social media trends and financial market behaviour. Additionally, the model effectively captures the immediate adjustments that occur when there are deviations from this long-term equilibrium, providing insights into how quickly and to what extent the stock market responds to new information arising from social media discussions. This dual focus on both long-term and short-term dynamics makes the NARDL model a powerful tool for analysing the complex interactions within financial systems.

Given the multilayer nature of the network analysis, where different layers might exhibit nonlinear interactions and interdependence, the NARDL model can accommodate these complexities by allowing distinct layers to respond differently to changes in the independent variables, such as variations in Twitter sentiment.

Results

Data sets

The BIST TICARET index (XTCRT) is one of several indices listed on the Istanbul Stock Exchange, specifically encompassing companies within the commerce sector. For this study, we focused on companies listed in the XTCRT index that operate in the sphere of electronic commerce. The e-commerce sector was chosen due to its rapid growth and significant influence on the modern economy, particularly during the COVID-19 pandemic, when online shopping and digital transactions surged. Analysing this sector provides valuable insights into how digital businesses respond to market conditions and social media discourse, which is especially relevant in understanding investor behaviour and market dynamics in the digital age.

The nine companies selected from the XTCRT index—BIMAS, BIZIM, CRFSA, DOAS, DOHOL, MEPET, MGROS, SOKM, TKNSA—were chosen based on their active involvement in the e-commerce sector. These companies represent a cross-section of the industry, ranging from retail giants like BIMAS (BIM Birleşik Mağazalar) and MGROS (Migros Ticaret) to diversified holdings with significant e-commerce operations such as DOHOL (Doğan Holding). Each company plays a vital role in the Turkish e-commerce landscape, contributing to the sector’s overall market dynamics.

The selected companies from the XTCRT index represent a diverse range of sectors within the e-commerce landscape. BIMAS is a leading supermarket chain known for its expanding online presence, particularly in grocery delivery. BIZIM operates as a wholesaler catering to both retail customers and businesses, with a growing emphasis on digital sales channels. CRFSA is engaged in diversified services, including retail, and has established a notable footprint in e-commerce. DOAS is active in the automotive sector, offering digital sales platforms. DOHOL, a conglomerate, has a strong digital media presence and is actively pursuing e-commerce initiatives. MEPET operates within the fuel retail sector and is developing its digital commerce capabilities. MGROS, another prominent supermarket chain, boasts a robust online shopping platform. SOKM, a discount retailer, has seen significant growth in its e-commerce activities. Finally, TKNSA is a leading electronics retailer with extensive online sales operations, making it a key player in the digital marketplace. These companies collectively provide a comprehensive view of the e-commerce sector within the XTCRT index, each contributing uniquely to the sector’s overall dynamics.

The financial performance data, encompassing daily closing prices, highest and lowest values, and trading volume for each company, was used to construct multilevel networks. These networks consist of four layers, each containing the nine selected companies as nodes. The choice of a 5-day sliding window to extract financial correlation networks was made due to its alignment with a standard trading week, providing an appropriate timeframe for capturing short-term market trends. This window balances the need for sufficient data points to establish meaningful correlations while retaining sensitivity to rapid market changes.

The social media data used in this study was sourced from Batrancea et al. (2023). It spans the period from March 9, 2020 to November 1, 2020, capturing Turkish tweets related to COVID-19. These tweets were identified using keywords such as ‘Covid,’ ‘Corona,’ ‘Kovid’ and ‘Korona,’ reflecting the Turkish adaptations of these terms. Despite some interruptions in data collection, the dataset remains robust, with regular intervals every 15 min ensuring comprehensive coverage. Duplicate tweets were removed to maintain data integrity.

While the study’s social media discourse data comprises 4,900 posts, financial data refer to only nine listed companies. Although sample size is limited, the nine entities were carefully chosen for their prominence and representativeness within the Turkish e-commerce sector. This selection ensures that the research sample adequately reflects the broader dynamics of the sector, allowing for meaningful analysis of the interplay between social media discourse and financial performance.

The dataset utilised during the deep learning training phase consists of news articles sourced from Turkish websites. It was constructed by selecting six prominent news categories: culture, economy, health, politics, technology and world affairs. There are 700 news entries in each category, for a total of 4900 articles. The number of tweets is presented in Fig. 1.

Missing data gaps were filled using the autoregressive integrated moving average model, which generates predictions for the corresponding number of blank sections. Furthermore, while considering the days when Borsa Istanbul is closed, the time series are synchronised on the same days, and the logarithmic differences of the post numbers acquired from Twitter are calculated. 161 observations were collected in this case, consisting of time series data for both multilayer network measurements and subject classes. Logarithmic regressions decrease the time series to 160 observations.

To assess measurement changes of the multilayer network, we additionally employ the 5-length sliding window approach on the time series derived from subject classification of social media postings. In this scenario, the median of the number of postings on topics with a length of 5 is calculated. The distributions for each window in the topic series exhibit skewness. Therefore, we used the median rather than the mean in multilayer measurements. As a result, we compared 156-entry series with 5-length sliding windows.

Results of multiplex analysis

This section presents the data acquired from the topological measurements of the 4-layer network of the selected businesses.

Equation 2 defines the multilayer participation coefficient value for each node. To treat this as a metric in a network with four layers, the mean value is utilised at each individual layer. In Fig. 2, we present the mean multilayer participation coefficients of the 4-layered network.

Figure 2 displays a spectrum of average participation coefficients ranging from 0.7 to 1.0, which signifies different degrees of interconnectedness among enterprises. Data distribution indicates that there are certain periods where the average participation coefficient is significantly high, approaching a value of 1.0. This demonstrates a robust interconnectedness between the stock actions of companies across all network layers during those specific periods. In contrast, there are substantial declines in the mean coefficient that indicate reduced interconnectedness over specific periods. The fluctuations observed may be associated with particular events or market stages, presumably influenced by the economic repercussions of the COVID-19 epidemic during the relevant period. Lower participation coefficients may indicate periods of market stress or volatility, during which stock prices tend to exhibit more segregation and less interconnection. Conversely, larger values may suggest more stable periods characterised by equities moving in a synchronised manner across all parameters under consideration.

Equation 3 defines the z-score for every node. Again, the mean value is employed at each layer separately. In Fig. 3, we display the average z-scores of the 4-layered network.

Figure 3 indicates that mean z-scores exhibit periodic variations around zero. Most data points are concentrated within a narrow range, showing that the attributes of nodes are generally near the overall mean of the network. Nevertheless, there are occasions when average z-scores exhibit noteworthy surges that surpass positive and negative values. Positive spikes represent intervals during which node attributes were higher than the mean, whereas negative spikes indicate intervals for which attributes were lower. Spikes can signify instances of atypical activity or departure from typical behaviour patterns. Furthermore, fluctuations in the average z-scores throughout the sliding windows can indicate dynamic shifts in the stock market, potentially affected by external occurrences or the intrinsic instability during initial phases of the pandemic. Negative z-scores indicate instances when specific stock properties were underperforming relative to the average, whereas positive scores correspond to above-average performance.

Equation 6 provides a definition of the entropy of a multilayer network. Entropy values are shown in Fig. 4, calculated using Eq. 3.

Figure 4 reveals a range of entropy values spanning from 0.5 to 2.5. Most data points appear to concentrate towards the upper limit of this range, indicating a generally elevated degree of complexity or diversity in the interconnections among network levels. This suggests a market characterised by numerous influential factors and a significant level of interconnectedness across components of stock performance, including closing prices, daily highs and lows and trading volumes. Nevertheless, there are specific time intervals during which entropy decreases to lower levels, signifying periods of decreased complexity or heightened predictability in the market. These instances may indicate periods when the market exhibited greater homogeneity or when specific layers exerted significant impacts on the entire system, resulting in a more organised state.

Results on topic classification

Our classification model was initially applied to the training data set. In the data set comprising 700 news articles for each of the six topics, 80% of data was allocated for training, while the rest was set aside for testing purposes. The training was conducted over 50 iterations, and results were stabilised after the 40th iteration. The Categorical Cross-Entropy loss function was employed to calculate loss and accuracy. Given that most measurement results exceed 90%, it suggests that the classification technique used is effective (Batrancea et al., 2023).

The graphs shown in Fig. 5 illustrate changes in the average logarithmic returns of tweet volume for each topic.

The culture graph depicts oscillations within a limited scope, indicating that cultural discussions on Twitter were shielded from significant changes caused by market or global occurrences. Hence, culture-related discussions remain consistent and unaffected by economic fluctuations. Nevertheless, if there are distinct high or low points in the graph, it would be worth exploring whether they coincide with cultural events or releases that could quickly captivate the public’s attention, thus offering a temporary diversion from current economic circumstances.

The economy graph displays substantial changes since economic discourse is typically responsive to market situations. If peaks in economic discussions are correlated with falls in the mean multilayer participation coefficients from stock market analysis, greater economic discourse could be either a reaction to or an indicator of decreased market stability. Moreover, one should investigate whether increases in the number of economic tweets are associated with notable changes in the market, which may be observed through the analysis of multilayer entropy and z-scores.

Considering the period, it is likely that conversations about health are mostly focused on the COVID-19 outbreak. Surges in health-related tweets may align with the timing of lockdown announcements, infection rates and other news relevant to the epidemic. These peaks may represent moments of elevated market volatility, characterised by low participation coefficients or high z-scores, as the market reacts aggressively to health-related news. An analysis of health data in relation to the entropy graph may indicate a correlation between heightened discourse on health matters and periods of elevated uncertainty in the stock market.

Political discourse can significantly influence market attitudes, especially during times of policy shifts, elections and geopolitical concerns. The political graph may exhibit relationships with market data, wherein noteworthy political events result in heightened market interconnection, as indicated by greater participation coefficients, or market strain, as indicated by extreme z-scores or entropy values.

The technology category is expected to have direct significance for the e-commerce enterprises included in the XTCRT index. Surges in technology-related discourse may align with significant advancements in technology, introduction of new products and changes in regulations that impact electronic commerce. These events may result in greater consistency in the market performance of these enterprises, which could be observed as higher average participation coefficients or reduced entropy within specified time periods.

Global events can significantly influence financial markets, particularly when they have economic consequences. The global graph can exhibit surges in Twitter engagement in reaction to global occurrences such as elections, trade pacts and worldwide economic assessments. These spikes may correspond to notable shifts in market behaviour, as companies in the XTCRT index respond to global dynamics.

Results based on NARDL

Besides the graphical representations illustrating the relationships between the series of topics, we conduct NARDL analysis to obtain more comprehensive results.

We represent series of average multilayer participation coefficients as \({T}_{{mp}}\) and series of multilayer network entropy as \({T}_{{en}}\). Due to small values and high variations in the series derived from z-scores, they would not adhere to the linearity assumptions in NARDL testing. Consequently, tests are exclusively conducted on the \({T}_{{mp}}\) and \({T}_{{en}}\) series. The study solely presents the mean z-score series in a graphical format. Topics are represented by the series indicated as \({T}_{{topic}}\). We used the Akaike Information Criterion and Bayesian Information Criterion to ascertain the optimal lags. In this situation, a latency of 4 has been selected as the maximum value. For model diagnostics, we employed the Jarque-Bera, Lagrange Multiplier and ARCH tests for each model. In addition, we employed the Pesaran, Shin and Smith test for conducting the cointegration test (Pesaran et al., 2001).

Tests for culture topic

The NARDL test results for \({T}_{{mp}}\sim {T}_{{culture}}\) are presented in Table 1.

The coefficients for \({T}_{m{p}_{1}}\), \({T}_{{cultur}{e}_{p}}\) (positive changes in cultural tweets) and \({T}_{{cultur}{e}_{n}}\) (negative changes in cultural tweets) are particularly significant in the short term. The substantial negative coefficient for \({T}_{m{p}_{1}}\) implies that as the average multilayer participation coefficient increases, the response variable decreases. This suggests a negative correlation between the multilayer network dynamics and the cultural discourse on Twitter. The coefficients for \({T}_{{cultur}{e}_{p}}\) and \({T}_{{cultur}{e}_{n}}\) are positive but not statistically significant. This suggests that both positive and negative changes in cultural tweets positively correlate with the response variable. However, the relationship is not strong enough to be considered conclusive based on conventional significance levels. Over time, the coefficients for \({T}_{{cultur}{e}_{p}}\) and \({T}_{{cultur}{e}_{n}}\) are positive, suggesting both positive and negative changes in cultural discourse on Twitter may be related to the response variable. However, these coefficients lack statistical significance at conventional thresholds, indicating a possible yet inconclusive long-term association. The model diagnostics suggest a strong fit with a relatively low residual standard error and a statistically significant F-statistic, which supports the general validity of the model. The JB test reveals non-normal distribution of residuals, a common problem in time series models. Cointegration test indicates that the F-statistic exceeds critical values at conventional significance levels, implying the presence of a long-term link between variables. The results of the Short Run Asymmetry test and Long Run Asymmetry test are particularly interesting. The Short Run Asymmetry test does not demonstrate any substantial asymmetry in the relationship, implying that both positive and negative alterations in cultural discourse have an equivalent effect in the immediate period. Nevertheless, the Long Run Asymmetry test (with a p-value near the standard significance level) suggests the presence of asymmetry in the long-term effects of positive and negative cultural discourse modifications.

The NARDL analysis indicates an intricate correlation between the multilayer network dynamics of enterprises in the Borsa Istanbul and cultural discourse on Twitter. Although there are signs of both temporary and lasting connections, they lack sufficient strength to be considered definitive.

The NARDL test results for \({T}_{{en}}\sim {T}_{{culture}}\) are presented in Table 2.

The coefficient for \({T}_{e{n}_{1}}\) exhibits a significant negative value, suggesting a robust inverse correlation between past values of multilayer network entropy and the response variable in the near future. This implies that an increase in entropy inside the network, which may signify greater complexity or unpredictability, is linked to a decreasing outcome variable. The coefficients for \({T}_{{cultur}{e}_{p}}\) and \({T}_{{cultur}{e}_{n}}\) exhibit negative values, but they do not demonstrate statistical significance. This suggests that fluctuations in cultural communication on Twitter do not exert a substantial immediate influence on the complexity of the interconnected network. The model demonstrates a strong correlation. The residual standard error is of a moderate magnitude, indicating that the model can capture a significant portion of the variability present in the data. The results of diagnostic tests, such as the JB test for normality of residuals, LM test for serial correlation and ARCH test for autoregressive conditional heteroskedasticity, indicate that there are no significant problems with the model specification, suggesting that it is well-defined. Cointegration indicates that \({T}_{{en}}\) and \({T}_{{culture}}\) exhibit a long-term relationship, where any divergence from this relationship is transient and variables will eventually return to their equilibrium state. The results of both the Short Run and Long Run Asymmetry tests indicate that there is no substantial asymmetry in the impact of positive and negative changes in cultural discourse on the response variable, as evidenced by the high p-values. This suggests that multilayer network entropy is not influenced differently by the direction of change (positive or negative) in cultural tweets.

In conclusion, the NARDL analysis shows that multilayer network entropy has a strong negative correlation with its previous values. However, changes in cultural discourse on Twitter, whether positive or negative, do not have a significant effect on the multilayer network entropy in the short or long term. The existence of cointegration validates a solid and enduring connection between variables, albeit the impact of cultural discussion is not statistically significant. These findings indicate that the level of complexity or unpredictability in the network, as quantified by entropy, is not significantly affected by the cultural conversations taking place on social media during the investigated period.

Tests for economy topic

The NARDL test results for \({T}_{{mp}}\sim {T}_{{economy}}\) are presented in Table 3.

The presence of a negative coefficient for \({T}_{m{p}_{1}}\) indicates a substantial inverse correlation between preceding values of \({T}_{{mp}}\) and the dependent variable in the near future. On the other hand, \({T}_{m{p}_{2}}\) exhibits a positive coefficient, but it is not statistically significant. The coefficients for \({T}_{{econom}{y}_{p}}\) and its lagged effects exhibit a combination of results and do not demonstrate statistical significance. This suggests that temporary fluctuations in economic discussion, whether they occur immediately or with a delay, do not significantly affect \({T}_{{mp}}\). The model demonstrates a satisfactory level of fit, as indicated by an acceptable residual standard error and a statistically significant F-statistic. The diagnostic tests (JB test, LM test and ARCH test) reveal that there are no significant problems with model specification. However, the JB test indicates the presence of non-normality in the residuals, which is a typical issue in time series analysis. Based on the cointegration test, there is cointegration among variables, as the F-statistic exceeds critical values. This suggests a stable and consistent relationship between variables over time, even though there may not be significant immediate effects. The Short Run Asymmetry test does not show any significant asymmetry in the relationship. Nevertheless, the Long Run Asymmetry test yields a noteworthy outcome, indicating that the long-term influence of positive and negative shifts in economic discourse on \({T}_{{mp}}\) may exhibit asymmetry.

The analysis of the NARDL model indicates that the average multilayer participation coefficients show a significant short-term inverse relationship with previous values. Moreover, the impact of economic discourse is significant, both in the short term and long term. Especially the noteworthy outcome of the Long Run Asymmetry test suggests the necessity for additional study into the distinct impacts of positive and negative attitudes in economic discourse on long-term financial market dynamics.

The NARDL test results for \({T}_{{en}}\sim {T}_{{economy}}\) are presented in Table 4.

The substantial negative coefficient for \({T}_{e{n}_{1}}\) signifies a robust inverse correlation between its previous values and the dependent variable in the near future. This suggests that an increase in entropy within the network, which signifies greater complexity or unpredictability, is linked to a reduction in the response variable. The coefficients for positive (\({T}_{{econom}{y}_{p}}\)) and negative (\({T}_{{econom}{y}_{n}}\)) changes in economic tweets exhibit both a very small magnitude and a lack of statistical significance. This implies that fluctuations in economic discussions on Twitter do not exert a substantial influence on the complexity of the multilayer network in the immediate period. Over time, the coefficients for \({T}_{{econom}{y}_{p}}\) and \({T}_{{econom}{y}_{n}}\) remain small, suggesting that there is no robust and conclusive long-term connection between the economic tweets and \({T}_{{en}}\). The model has a strong fit, as shown by a high R-squared value and a statistically significant overall F-statistic. The residual standard error is of considerable magnitude, indicating that the model effectively captures a significant portion of the variability present in the data. It is observed that the complexity of financial market networks and economic discourse on social media, captured through \({T}_{{economy}}\), tend to move together over time. Any deviation from this long-term path is temporary, and they will eventually converge back to this equilibrium relationship. The results of Short Run and Long Run Asymmetry tests indicate that there is no significant difference in the impact of positive and negative changes in economic discourse on the response variable. This conclusion is supported by the high p-values obtained.

NARDL analysis indicates that there is a strong negative correlation between multilayer network entropy and its previous values. However, changes in economic discourse do not have a significant effect on the entropy of the network, both in the short and long term. This suggests that the level of complexity or unpredictability of the network, as quantified by entropy, is not significantly affected by economic debates on social media. Hence, complexities of market behaviour may not be immediately affected by public economic discussions on platforms such as Twitter.

Tests for health topic

The NARDL test results for \({T}_{{mp}}\sim {T}_{{health}}\) are presented in Table 5.

The coefficients for \({T}_{{healt}{h}_{p}}\) and \({T}_{{healt}{h}_{n}}\) are both positive but do not have statistical significance. This suggests that, in the immediate period, alterations in health-related discussions on Twitter do not significantly influence \({T}_{{mp}}\). Over time, the coefficients for \({T}_{{healt}{h}_{p}}\) and \({T}_{{healt}{h}_{n}}\) consistently show positive values yet non-significant. There is no strong and conclusive long-term association between health-related tweets and \({T}_{{mp}}\). Both Short Run and Long Run Asymmetry tests produce high p-values, suggesting that there is no substantial asymmetry in the influence of positive versus negative changes in health discourse on the response variable.

The analysis of the NARDL model indicates that the average multilayer participation coefficients exhibit a significant negative correlation with their previous values. However, changes in health-related discourse on Twitter do not have a significant impact on \({T}_{{mp}}\) in either the short or long term. This suggests that the intricacy or fluctuations of the network, as quantified by the participation coefficients, are not significantly affected by public health conversations on social media. These data emphasise the possible lack of connection or autonomy between commercial trends in the e-commerce industry and public health attitudes, especially during the crucial phase of the COVID-19 pandemic.

The NARDL test results for \({T}_{{en}}\sim {T}_{{health}}\) are presented in Table 6.

The coefficients for \({T}_{{healt}{h}_{p}}\), \({T}_{{healt}{h}_{n}}\) and \({T}_{{healt}{h}_{n1}}\) are not statistically significant, indicating no significant relationship between positive changes in health tweets, negative changes, and lagged negative changes. Fluctuations in health-related discussions on Twitter do not significantly affect the overall network complexity. The coefficients for \({T}_{{healt}{h}_{p}}\), \({T}_{{healt}{h}_{n}}\) and \({T}_{{healt}{h}_{n1}}\) in the long run remain insignificant. Hence, there is no clear and lasting connection between the health-related tweets and the entropy of multilayer network. The results of Short Run and Long Run Asymmetry tests suggest no significant difference in the impact of positive and negative changes in health discourse on the response variable.

Multilayer network entropy is primarily influenced by its own past values rather than changes in health-related discourse on Twitter, both in the short and long term. Public health discussions on social media have minimal impact on the complexity or unpredictability of the network within the observed timeframe. This might indicate the distinctiveness of health-related discussions, which may not directly impact intricacies of financial market behaviours.

Tests for politics topic

The NARDL test results for \({T}_{{mp}}\sim {T}_{{politics}}\) are presented in Table 7.

There is a significant and positive relationship between positive political discourse on Twitter and the response variable. Nevertheless, the coefficients for lagged effects of positive and negative political tweets do not show statistical significance, suggesting that their short-term impact is relatively small. Over time, the coefficients for \({T}_{{politics}}\) variables show a combination of positive and negative values, but they are not statistically significant. This indicates that there is no strong, conclusive long-term relationship between political tweets and \({T}_{{mp}}\), except for a slightly significant coefficient for \({T}_{{politic}{s}_{p}}\). Diagnostic tests suggest that there are no significant problems with model specification. The Short Run Asymmetry test does not show any significant asymmetry in the relationship. The cointegration test reveals that there is evidence of cointegration between \({T}_{{mp}}\) and \({T}_{{politics}}\), as F-statistic exceeds critical values. This implies a long-term equilibrium connection. Nevertheless, the Long Run Asymmetry test reveals a significant outcome, indicating a potential asymmetry in the long-term effects of positive and negative changes in political discourse on \({T}_{{mp}}\).

According to the NARDL model analysis, the average multilayer participation coefficients show a notable short-term inverse relationship with past values. However, the impact of changes in political discourse is more varied. The observed correlation between positive tweets and short-term financial market dynamics suggests a possible impact of positive political discourse. The significant result in the Long Run Asymmetry test suggests the importance of delving deeper into potential impact of positive and negative sentiments in political discourse on long-term financial market dynamics. The findings shed light on the intricate relationship between market behaviour and political discourse, particularly in relation to the impact of social media on public perception and market movements.

The NARDL test results for \({T}_{{en}}\sim {T}_{{politics}}\) are presented in Table 8.

The coefficients for \({T}_{{politic}{s}_{p}}\) and \({T}_{{politic}{s}_{n}}\) show positive changes in political tweets, but their statistical significance is not established. It appears that changes in political discourse on Twitter, whether positive or negative, do not have a substantial immediate effect on the multilayer network entropy. The coefficients for \({T}_{{politic}{s}_{p}}\) and \({T}_{{politic}{s}_{n}}\) in the long run are positive but not significant. There is no significant long-term relationship, suggesting that the discourses of political tweets do not have a substantial impact on the entropy of the multilayer network. The residual standard error indicates that the model effectively captures a significant amount of variability in the data. Diagnostic tests show that there are no significant problems with model specification. However, residuals do not follow a normal distribution. Short Run and Long Run Asymmetry tests show high p-values, hence there are no significant difference in the impact of positive and negative changes in political discourse on the response variable. The cointegration test indicates the presence of cointegration among variables. The F-statistic obtained is significantly higher than critical values, providing evidence for the existence of a long-term relationship between variables.

Multilayer network entropy \({T}_{{en}}\) is greatly impacted by previous values. The presence of cointegration indicates a stable long-term relationship among variables, even though the impact of political discourse is not statistically significant. Hence, political discussions on social media have minimal impact on the complexity or unpredictability of financial market networks.

Tests for technology topic

The NARDL test results for \({T}_{{mp}}\sim {T}_{{technology}}\) are presented in Table 9.

The coefficients for \({T}_{{technolog}{y}_{p}}\) and \({T}_{{technolog}{y}_{n}}\) are positive but not significant. In the short term, fluctuations in technology-related discussions on Twitter do not significantly affect \({T}_{{mp}}\). Over time, coefficients also show positive non-significant values. Hence, the sentiment of technology-related tweets does not have an impact on the entropy of the multilayer network in the long run. Short Run and Long Run Asymmetry tests show high p-values, hence we found no significant differences in the impact of positive and negative changes in technology discourse. The cointegration test indicates the presence of cointegration among variables, as the F-statistic exceeds critical values. This suggests a long-term balance between variables, even though individual long-term coefficients do not show significance.

Multilayer network entropy is mainly affected by its previous values rather than changes in technology-related discourse on Twitter. The presence of cointegration indicates a stable long-term relationship among variables, despite the lack of significant influence from technology sentiment. Discussions about technology on social media do not have a significant impact on the complexity or unpredictability of financial market networks. Results emphasise the potential disparity between the dynamics of financial market networks and public technology discourse, which is crucial for comprehending the wider effects of social media discourse on financial markets.

The NARDL test results for \({T}_{{en}}\sim {T}_{{technology}}\) are presented in Table 10.

The coefficients for \({T}_{{technolog}{y}_{p}}\) and \({T}_{{technolog}{y}_{n}}\), together with their corresponding delayed effects, indicate a combination of positive and negative influences. It is worth mentioning that \({T}_{{technolog}{y}_{p1}}\) has a substantial positive influence, indicating that the delayed effect of optimistic technology-related discussions has a discernible impact on the outcome. The long-term coefficients exhibit a comparable trend, with \({T}_{{technolog}{y}_{p1}}\) demonstrating a substantial positive influence, whilst the remaining coefficients lack statistical significance. This suggests a complex and enduring relationship where the delayed favourable discourse about technology has a stronger impact. The Short Run Asymmetry test indicates a p-value that is near the significance level, suggesting asymmetry in the immediate effects of positive and negative changes in technological discourse. The Long Run Asymmetry test, although lacking statistical significance, suggests the possibility of asymmetry in the long-term effects. The cointegration test indicates the presence of cointegration among variables, as the F-statistic exceeds critical values. This implies the existence of a stable relationship between variables in the long run, even though certain long-run coefficients may not be significant.

The NARDL model indicates that multilayer network entropy is affected by previous values and has an intricate association with technology-related discussions on Twitter. The notable effect of the delayed favourable technology tweets in both the immediate and extended periods underscores the potential sway of technology discussions on the intricacy or unpredictability of financial market networks. Cointegration validates a consistent and enduring connection between variables, albeit with varying effects from technology sentiment. These findings highlight the subtle and potentially significant influence of technology-related social media debates on altering financial market behaviour.

Tests for world topic

The NARDL test results for \({T}_{{mp}}\sim {T}_{{world}}\) are presented in Table 11.

The coefficients for \({T}_{{worl}{d}_{p}}\) and \({T}_{{worl}{d}_{n}}\) are positive but not statistically significant. This implies that in the short term, changes in global discourse on Twitter do not have a substantial impact on \({T}_{{mp}}\). In the long run, the coefficients for \({T}_{{worl}{d}_{p}}\) and \({T}_{{worl}{d}_{n}}\) are positive but non-significant. Therefore, in the long run, world-related tweets do not influence the participation of multilayer network. The Short Run and Long Run Asymmetry tests both yield high p-values, suggesting no significant asymmetry in the impact of positive versus negative changes in world discourse on the response variable. The cointegration test indicates the presence of cointegration among variables.

According to the NARDL analysis, multilayer network means that the participation coefficient is significantly influenced by past values but not by changes in world-related discourse in either short or long term. The presence of cointegration confirms a stable long-term relationship among variables, although the specific influence of global sentiment is not significant. This finding implies that participation coefficients are not strongly affected by global discussions on social media. Results underscore the potential independence or disconnect between the dynamics of financial market networks and public global sentiment, highlighting the unique characteristics of financial markets in relation to social media discourse.

The NARDL test results for \({T}_{{en}}\sim {T}_{{world}}\) are presented in Table 12.

The statistical analysis indicates that the coefficients for \({T}_{{worl}{d}_{p}}\), \({T}_{{worl}{d}_{n}}\) and \({T}_{{worl}{d}_{n1}}\) are not significant. Rapid and delayed shifts in world-related conversation do not influence short-term complexity of multilayer networks. The long-term coefficients for \({T}_{{worl}{d}_{p}}\), \({T}_{{worl}{d}_{n}}\) and \({T}_{{worl}{d}_{n1}}\) are not significant. The absence of a notable enduring correlation suggests that tweets on world affairs do not exert a meaningful influence on the complexity of the multilayer network in the long run.

Asymmetry tests indicate no significant difference between the impact of positive and negative changes in world discourse on the response variable. The cointegration test shows the presence of cointegration among variables, as the F-statistic exceeds critical values. Hence, a link between variables in the long term may not be statistically significant.

Study results reveal that, while multilayer network entropy in financial markets is substantially influenced by prior values of the network, it remains unaffected by fluctuations in world-related discourse, whether observed over the short term or extended periods. Cointegration analysis validates the presence of a consistent and enduring connection between network entropy and historical data. However, the precise impact of global mood, including cultural topics discussed on social media, does not emerge as statistically significant. This underscores that the complexity of financial market networks operates independently of social media conversations, revealing a disconnection between the behaviour of these networks and the shifting nature of global mood.

From a cultural perspective, our findings carry significant implications. Despite the proliferation of online discourse on various cultural and societal topics, such discussions do not seem to translate into measurable changes in the structure or complexity of financial market networks. This points to a fundamental characteristic of financial systems, which appear to function autonomously from the influence of social sentiment, especially as expressed on global platforms like social media.

Nevertheless, the study has certain limitations. The analysis predominantly focuses on global mood and cultural topics without delving into specific themes or sectors that might have more direct relevance to financial markets. For example, discussions surrounding economic policy, market regulation, or geopolitical events could potentially exhibit a stronger connection to financial network behaviour. Future research could benefit from a more granular examination of these themes, exploring their distinct impact on market dynamics. Additionally, refining the modelling techniques to capture more subtle variations in global discourse could improve the accuracy and predictive power of such analyses. In conclusion, while results might suggest a lack of correlation between global social media conversations and financial network complexity, further investigation into other topics and refined methodologies may yield more nuanced insights into the intricate relationship between social discourse and financial markets.

Conclusions

This study provides valuable insights into the dynamics of financial markets, particularly in relation to social media discourse, within the specific context of the e-commerce sector in Türkiye. Using NARDL analysis, we discovered significant short-term and long-term relationships between social media discussions and market behaviour. A critical finding is the significant short-term inverse relationship between the average multilayer participation coefficients and their previous values, suggesting that market participants in the e-commerce sector may react dynamically and often inversely to recent past performance. This reactivity is particularly evident in how economic discourse significantly influences market dynamics, underscoring the strong impact of public sentiment on financial behaviours in both the short and long term.

Furthermore, the analysis reveals a strong negative correlation between multilayer network entropy and its past values, indicating that the complexity and unpredictability of network structures are largely shaped by historical data rather than current market fluctuations. This finding is crucial for understanding the behaviour patterns specific to the e-commerce sector and predicting future trends within this context. In terms of political discourse, the impact on financial markets appears more nuanced. We observed that positive political sentiment can have a tangible, albeit short-lived, effect on market behaviour, again emphasising the sensitivity of the e-commerce sector to public discourse.

Technology-related discussions on Twitter also exhibit a mixed influence. While network entropy is predominantly determined by historical values, the analysis indicates that technology-related discourse can have a delayed yet significant impact on market behaviour in the e-commerce sector. This suggests that technology is increasingly becoming a key factor in shaping market dynamics within this specific sector.

Overall, our NARDL analysis paints a complex picture of financial market dynamics in the e-commerce sector, where public discourse on economic, political and technological topics exerts varying degrees of influence. Empirical evidence from Borsa Istanbul shows that companies in the XTCRT index are responsive to social media content related to economic and political matters. Specifically, discussions surrounding technology and economic issues impact the topological configuration of the XTCRT index, leading to observable shifts in stock prices, trading volumes and overall market sentiment.

Our study’s focus on the e-commerce sector of Borsa Istanbul, particularly the nine companies within the XTCRT index, provides valuable insights into the specific interactions between social media discourse and financial market performance in this sector. The significant interconnectivity among these companies highlights the need for public policies that strengthen market resilience, particularly during periods of global challenges like the COVID-19 pandemic. Policymakers should consider establishing resilient financial safety nets and contingency plans to manage periods of heightened market volatility and stress, specifically within sectors that are highly reactive to public sentiment.

The variations in average z-scores and network entropy within the e-commerce sector underscore the market’s susceptibility to external disturbances and information transmission. To mitigate speculative trading and disinformation, policymakers should enhance the regulatory framework related to information transmission and market transparency, ensuring that these regulations are tailored to the specific dynamics of the e-commerce sector.

From a research perspective, our study contributes to the literature examining the impact of social media on the stock market, particularly in the context of the e-commerce sector during the pandemic period. Unlike other studies that may generalise findings across entire stock exchanges, our research is specifically targeted at the e-commerce sector, revealing how public discourse on certain topics influences market behaviour in both the short and long term.

However, it is important to acknowledge the limitations of our study. First, our analysis is based on a sample of nine companies in the e-commerce sector included in the XTCRT index. Second, our network analysis focuses on an eight-month period following the onset of the COVID-19 pandemic in Türkiye. Third, the social media discourse was retrieved only from one platform (Twitter, now called X). These limitations suggest that findings are most applicable to the e-commerce sector within Borsa Istanbul and should not be generalised to all companies listed on the Istanbul Stock Exchange.

Nevertheless, the insights gained from this study open several avenues for future research. One potential area is exploring the causal links between financial market activities and social media discourse, particularly within specific sectors. Future studies could use more detailed data and advanced analytical tools, such as machine learning algorithms and sentiment analysis, to further investigate these relationships. Expanding the analysis to include other social media platforms and different forms of digital communication could offer a broader perspective on public opinion and its impact on financial markets.

In conclusion, while our research is focused on the e-commerce sector within Borsa Istanbul, it highlights the broader need for sophisticated analytical techniques and social media monitoring to enhance the stability, resilience and responsiveness of financial markets. Policymakers and regulators should consider these findings in the context of specific sectors, ensuring that regulations and public policies are appropriately tailored to the unique dynamics of each sector. By doing so, they can better manage the complex interplay between public sentiment and financial market performance, ultimately contributing to a more stable and resilient economic environment.

Data availability

The datasets generated and/or analysed during the current study are available from the corresponding author on reasonable request.

References

Ahmed F, Kousar S, Pervaiz A, Ramos-Requena JP (2020) Financial development, institutional quality, and environmental degradation nexus: new evidence from asymmetric ARDL co-integration approach. Sustainability 12(18):7812. https://doi.org/10.3390/su12187812

Ahmed M, Huan W, Ali N, Shafi A, Ehsan M, Abdelrahman K, Khan AA, Abbasi SS, Fnais MS (2023) The effect of energy consumption, income, and population growth on co2 emissions: evidence from NARDL and machine learning models. Sustainability 15(15):11956. https://doi.org/10.3390/su151511956

Ahmed A, Ullah S (2022) Impact of social media on the performance of listed companies. J Bus Socio-Econ Dev 2(3):312–330. https://doi.org/10.1108/JBSED-09-2021-0112

Akgüller Ö, Balcı MA, Batrancea LM, Gaban L (2023) Path-based visibility graph kernel and application for the Borsa Istanbul stock network. Mathematics 11(6):1528. https://doi.org/10.3390/math11061528

Akın AA, Akın MD (2007) Zemberek, an open source NLP framework for Turkic languages. Structure 10(2007):1–5. https://doi.org/10.21105/joss.01241

Alessandretti L, Natera-Orozco LG, Saberi M, Szell M, Battiston F (2023) Multimodal urban mobility and multilayer transport networks. Environ Plan B Urban Anal City Sci 50(8):2038–2070. https://doi.org/10.1177/23998083231164732

Alfaro L, Chari A, Greenland AN, Schott PK (2020) COVID-19 and corporate investment: evidence from past pandemics. National Bureau of Economic Research Working Paper Series, No. 27117. https://doi.org/10.3386/w27117

Aleta A, Moreno Y (2019) Multilayer networks in a nutshell. Annu Rev Condens Matter Phys 10:45–62. https://doi.org/10.1146/annurev-conmatphys-031218-013259

Ali SS, Ramlan H (2020) Stock market forecasting using artificial intelligence during the COVID-19 pandemic. Proceedings of the 3rd International Conference on Communication, Computing, and Digital Systems (C-CODE). https://doi.org/10.1109/ICCCA49749.2020.9259162

Alharbi FM (2022) How do the remittance outflows react to economic development in Saudi Arabia? Evidence from NARDL. Economies 10(5):105. https://doi.org/10.3390/economies10050105

Allen DE, McAleer M (2021) A nonlinear autoregressive distributed lag (NARDL) analysis of the FTSE and S&P500 indexes. Risks 9(11):195. https://doi.org/10.3390/risks9110195

Aramonte S, Avalos F, Xia D (2021) How does COVID-19 revolution affect the financial market? SSRN Electron J. https://doi.org/10.2139/ssrn.3722115

Armanious M, El-Nahas N, Farag A (2020) Using social media data to model stock market movements. Proceedings of the 2020 IEEE International Conference on Industrial Cyber-Physical Systems (ICPS), pp 940–945. https://doi.org/10.1109/ICICS49469.2020.9406630

Baboukardos D, Gaia S, She C (2021) Social performance and social media activity in times of pandemic: evidence from covid-19-related Twitter activity. Corp Gov Int J Bus Soc 21(6):1271–1289. https://doi.org/10.1108/CG-11-2020-0482

Balcı MA, Batrancea LM, Akgüller Ö (2022) Network-induced soft sets and stock market applications. Mathematics 10(21):3964. https://doi.org/10.3390/math10213964