Abstract

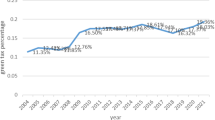

Achieving green economic growth requires enterprises to develop and promote green products that balance environmental protection, intensive resource utilization, and sustainable development. However, under the externality assumption, the green market is often faced with the challenge of insufficient supply. Based on 2004–2018 panel data covering regional industrial enterprises in 30 provinces in China, this study empirically tests the composite driving mechanism of the effect of an increase in the regional green production capacity, organizational factors, and environmental policies on the green product innovation (GPI) of regional export-oriented industrial enterprises (REIEs). This study finds that the increase in regional green production capacity directly drives an improvement in REIEs’ GPI level, that the regional green technology level and degree of human capital accumulation are indirect driving channels between capacity increases and product innovation, and that environmental regulations and green credit have a positive moderating effect on the influence of increasing green production capacity on GPI. Further threshold regression analysis reveals that increasing green production capacity, foreign direct investment, digitization, and trade openness have an inverted U-shaped promoting effect on GPI and that the proportion of local government expenditure shows a diminishing marginal utility effect on GPI.

Similar content being viewed by others

Introduction

The core of economic green growth is to decouple human economic activities from carbon emissions through the development of green industrial sectors, which involves managing and promoting the green transformation of traditional industries and supporting the development of emerging green industries. The activity in which enterprises consume a large amount of resources to introduce new green products in a specific field (Otto et al. 2023), i.e., develop and promote green products that balance environmental protection, resource intensity, and sustainable development (Rennings, 2000; UNEP, 2004; OECD, 2009; UNEP, 2011), can be understood as green product innovation (GPI). In this context, China aims to integrate the Sustainable Development Goals (SDGs) with industry, trade, and international competitiveness (Shahzad et al. 2022; Hu et al. 2024b). By incentivizing green innovation, developing high-quality and high-value-added trade in green productsFootnote 1, increasing China’s international market share in the green sector, and promoting the economic transition to high-quality growth in China. Thus, one of the core elements of China’s green transformation strategy is to gain new competitive advantages for export-oriented manufacturing enterprises through GPI. However, that is a hard and complicated challenge. On the one hand, GPI is usually costly due to the high degree of uncertainty (Peters and Buijs, 2022), and firms need to overcome the high initial costs. On the other hand, compliance costs are further exacerbated by stricter domestic and international environmental regulations that accompany the implementation of green policies and targets (Goerzen et al. 2021). In practice, firms usually fail to show initiative in exporting green products (Wang et al. 2024), while the driving mechanism for GPI remains unclear.

Currently, there is an extensive discussion on the antecedents of green innovation in enterprises, which can be summarized into two dimensions: the internal influences of the organization based on the natural resource-based view (NRBV) and the external environment based on the institutional theory and stakeholder theory. Some studies on the internal drivers of green innovation show that an enterprise’s future strategic and competitive advantage depends on its resources and abilities to promote environmentally sustainable development (Albort-Morant et al. 2018), among which absorptive capacity, i.e., the ability of an enterprise to absorb, understand, and apply internal and external green knowledge, is one of the core factors that affects enterprises’ green innovation performance as well as its competitiveness (Ben Arfi et al. 2018; Xu and Hu, 2024).

In addition, the implementation of GPI by enterprises is constrained by many external drivers, of which environmental regulation and green finance are the major institutional factors affecting green innovation activities. Environmental regulation is a public means through which to constrain the behavior of industrial enterprises with environmental protection objectives (Li and Gao, 2022), however, opposing views exist on its impact on green innovation (Zhang et al. 2024). Given that green innovation requires stable and sufficient funding (Zhang et al. 2021), traditional finance has many deficiencies in terms of its ability to improve the level of green technology innovation (Feng et al. 2022; Qiu et al. 2023). Enterprise green innovation not only relies on the support of the market mechanism but also needs corresponding fiscal and policy support, such as tax reductions, tax rebates, and government-led equity investment, to guide the flow of funds to enterprises (Cao et al. 2021; Sun et al. 2023). In summary, while existing studies provide a basis for understanding the drivers of enterprises to engage in GPI, several knowledge gaps remain. In terms of internal drivers, the regional characteristics of GPI carried out on enterprises are not clearly expressed, and in terms of external drivers, as the main actor in the coordination of insufficient green supply and low-level allocation efficiency in the market, there is a gap between the theoretical insights and the actual implementation of green growth policies.

Different from previous studies, we note that the principle of relatedness and the complexity perspective in product space (PS) theory provide a research paradigm and analytical framework to help us coordinate the internal and external drivers for enterprises to engage in GPI and implement green growth into management practices. Against the background of PS theory, we regard the achievement of international comparative advantage for newly produced and exported green products as a successful GPI. On the one hand, the principle of relatedness combines the concepts of enterprise absorptive capacity and knowledge diffusion (Hidalgo, 2021), which believes that the export externality of an enterprise depends on the degree of relatedness between the products produced by the enterprise and the local export products (Hazir et al. 2019). The higher the degree of production relatedness of this product is, the more similar the needed production capacities, the easier the transfer of comparative advantage (Hidalgo et al. 2007), and finally the GPI can be realized. On the other hand, regional green complexity represents the level of complexity of the green complex knowledge base and productivity accumulated in the production process of the enterprises in the specified region (Hidalgo and Hausmann, 2009; Nguyen et al. 2021). The findings of the existing PS theory indicate that high-complexity regions tend to be able to export technologically advanced products competitively, therefore those regions with higher complexity of green production capacity may have enough available resources for GPI to implement SDGs.

Based on the above analysis, we take regional export-oriented industrial enterprises (REIEs) in 30 provinces in China from 2004 to 2018 as the research objects as the research object to discuss the GPI driving mechanism from the PS perspective. The objectives of this study are aimed at revealing the composite driving mechanism that drives REIEs’ GPI, specifically: (1) Will endogenous production capacity improvement be a direct driver for enterprises to implement GPI to gain sustainability opportunities? (2) How should the government coordinate with the development and innovation activities of the green products of enterprises and adjust this policy? To this end, it is critical to effectively identify the multiple driving conditions and synergic mechanisms affecting GPI and to find more scientific and specific decision-making designs to support and promote the development of green products and green industries. In this study, three dynamic mechanisms driving GPI, namely, the direct drive of the increasing green production capacity, the indirect push of the observable knowledge capital at the provincial level, and the regulatory pull of the environmental policy are investigated, empirical testing by means of panel fixed effects regression, an instrumental variable-two-stage least squares (IV-2SLS) regression model, a three-stage least squares (3SLS) regression model, and threshold regression to address the above knowledge gap.

Compared with the existing research, the marginal contributions of this paper are as follows. On the one hand, we emphasize the improvement of green production capacity as the direct driving force of GPI to make some contributions to the research on PS theory in the field of sustainable development. Based on the discussion of green complexity by Mealy and Teytelboym (2022) and Wang and Yang (2022), our study is the first to include the accumulation and evolution of regional enterprise production capacity from the PS perspective in an antecedent study of GPI. Although existing studies have discussed the relationship between China’s economic complexity and the degree of green growth at the national level (Wang et al. 2023) and that the increase in green complexity can reduce CO2 emissions (Wang and Yang, 2022), investigations of GPI diversification from the perspectives of green complexity and green product-related density are still lacking. Our research can provide insights into the diversification of the green product innovation of enterprises in the region. On the other hand, we respond to the call of Mealy and Teytelboym (2022) for an exploration of green complexity at the regional level. Green export product trade data on REIEs in 30 Chinese provinces are used to measure regional enterprises’ green product-related density and regional green complexity, and the complexity of the study is expanded to the sub-national level to provide quantitative support for this PS study.

The remainder of this paper is organized as follows. In Section 2, we discuss the theoretical driving mechanism of enterprise GPI from the PS perspective and propose relevant hypotheses; Section 3 introduces the research methods, data sources, and regression analysis; the empirical results are presented, and a further discussion is carried out in Sections 4 and 5, respectively; and the conclusions are given in Section 6.

Theoretical basis and research hypotheses

Increasing green production capacity and GPI

According to PS theory, an enterprise implements its product innovation strategy along the shortest path in the PS network according to its own production capabilities. Either the enterprise carries out diversified incremental innovation along the shortest distance in the PS through capacity restructuring based on capacity accumulation or, led by external forces, the accumulation of production capacity of the enterprise undergoes qualitative changes, and the enterprise takes a step toward related products with more complex PSs and higher value-added, achieving breakthrough innovation (Balland et al. 2019). The above conclusions have been applied to specific industries such as high-tech industries (Boschma et al. 2014), blue industry (Qi, 2022), as well as to some national and regional organizations’ industrial strategy studies like Europe’s Smart Specialization Strategy (Balland et al. 2019), Mexico’s Special Economic Zones (Gómez Zaldívar et al. 2019) and China’s export processing zones (Chen et al. 2017). Therefore, the degree of technical relatedness between products and the complexity of product knowledge and technology are both important factors affecting an enterprise’s product innovation.

The principle of relatedness

The relatedness principle of PS theory follows path dependence theory and holds that economic agents tend to carry out economic diversification activities on the basis of the original related economic activities (Hidalgo et al. 2007). The concept of relatedness also combines the concepts of enterprise absorptive capacity and knowledge dissemination (Hidalgo, 2021) and suggests that the export externality of an enterprise depends on the degree of relatedness between the products produced by the enterprise and local export products (Hazir et al. 2019). Hidalgo (2021) placed a special emphasis on product heterogeneity. The spillover effect generated by knowledge-based relatedness in the PS is different from the internal short-term spillover effect of Marshall-Arrow-Romer and the long-term external spillover effect of Jacobs; the spillover effect generated by relatedness occurs in production inputs. In innovation activities with similar processes but heterogeneous products, only when innovation is heterogeneous can it avoid competition and provide a limited number of learning opportunities (Boschma and Frenken, 2011). As the main bodies of green product production, green export enterprises also follow the principles of profit maximization and relatedness and inevitably choose heterogeneous green products with stronger correlations and higher profits within a certain geographic range to carry out production innovation activities to secure their places in green competition. Therefore, the product innovation activities of an enterprise are closely related to the relatedness of the products within the geographic scope of the enterprise.

Complexity perspective

According to PS theory and its derivative research and related concepts in the green economy, the complexity of a regional green economy measures the green knowledge stocks accumulated by the economic actors in the local production structure in the production process (Hidalgo and Hausmann, 2009; Nguyen et al. 2021) and represents the current overall green production capacity of regional enterprises. If regional enterprises want to obtain sustainable competitiveness, then they inevitably try to increase the degree of complexity of production products to encourage entrepreneurs to carry out product innovation (Ajide, 2022). To maintain a first-mover advantage and obtain a sustainable green competitive advantage, leading enterprises inevitably choose to continue to develop more complex green products because the more complex the green production structure is, the higher the value of embedded knowledge and the stronger the exclusivity, making it more difficult for other enterprises to imitate in their own production activities. Due to the self-stabilization characteristics of the PS, a late-comer enterprise can imitate the export product portfolio of the technology-related leading enterprise in that location and take advantage of inter-organizational learning and labor cost advantage to follow up the innovation, eventually leading to the increase in the complexity of product technology as a whole in that location and promoting the full-scale development of innovation activities, which eventually have a positive impact on the improvement of GPI in enterprises.

In summary, regional enterprises with higher degrees of complexity of green technology have embedded enough knowledge needed for green production in the production process to help them enhance their technology absorptive capacity and enable their green knowledge input to be better turned into output, ultimately providing them with green innovation opportunities.

H1: The increase in green production capacity is the direct driving force of GPI.

Promotion of knowledge capital as a driving channel

In investigating economic complexity and China’s green development efficiency, Wang et al. (2023) argue that technological innovation and human capital levels are the indirect mechanisms through which economic complexity promotes the improvement of green efficiency. We refer to human capital and technological innovation collectively as intellectual capital. Intellectual capital includes the collection of the personal knowledge, skills, and expertise of employees (human capital), as well as the collection of technological progress, innovation, and intellectual property rights within an organization or society (technology innovation). Since economic complexity is a production function that links economic input and output, with the increase in the degree of economic complexity, human capital and production knowledge consisting of green production technologies increase, which is naturally accompanied by an increase in green output. With reference to the theoretical intuition of green PS, the increase in regional enterprises’ green production capacity, as measured by the complexity of the green economy, may also drive the level of enterprise GPI by improving the regional green technology and human capital levels.

Green technology

The increase in the green production capacity of regional enterprises implies that the region has a variety of industries that match green and sustainable development, and cross-industrial cooperation is conducive to knowledge transfer between industries (Balland et al. 2019). For example, experts in one field of green industry cooperate with experts in other fields to develop new green technologies. In addition, regions with highly complex green economies usually benefit from knowledge spillover and collaboration networks, and the diversified networks of regional enterprises enable the transfer and flow of knowledge between networks (Christopherson and Clark, 2007; Hu et al. 2024a). Moreover, enterprises acquire more secret and decentralized technologies and knowledge (Antonelli, 2000) to accelerate the improvement of the overall level of regional green technology. At the same time, the active adoption of green technology and the implementation of a green development strategy help enterprises develop new market opportunities and increase their degree of green competitiveness, as is specifically demonstrated in the effect of “reducing cost and improving quality” of the innovation of green production technology in the green product innovation of enterprises (Yacob et al. 2019). This situation helps enterprises increase their green market share of export products, gives regional green products a new competitive advantage in the international market, helps enterprises gain a comparative advantage in green products, and ultimately allows enterprises to achieve successful export product innovation.

H2a: An increase in green production capacity drives green technology innovation, which in turn promotes GPI.

Human capital level

As an input factor in the production of final and technology products, human capital plays a key role in promoting enterprises to develop green and sustainable products (Seeck and Diehl, 2017). From the PS capacity perspective, human capital can be understood as the set of production knowledge mastered by the labor force carrying out production activities. The accumulation of production capacity of regional enterprises is inseparable from the accumulation of the number of abilities of the labor force as the main body of production activities; the more complex the accumulation of production capacity by regional enterprises is, the more diversified their engagement in economic activities and the more diversified economic activities create diversified employment opportunities for individuals and enterprises (Adam et al. 2023), which in turn promote the accumulation of professional knowledge and skills and improve the level of human capital. In addition, the increase in production capacity places greater demands on all sectors of the green industry for professional knowledge and skills, including a higher demand for skilled labor. To meet such labor demand, individuals are encouraged to receive higher education and training and thus accumulate human capital. A higher level of human capital represents a set of skilled and more educated labor capabilities. Compared with other labor forces, this more educated and skilled labor force is more likely to have environmental awareness, making it easier for enterprises to identify and implement opportunities for GPI; green human capital with green knowledge and experience in environmental protection (Chen, 2008) can help enterprises comply with GPI in the face of complex environmental regulations, thereby improving the chances of their success in GPI.

H2b: Increasing green production capacity increases the level of human capital, which in turn promotes GPI.

Moderating effect of environmental regulation and green credit

The production of products, the continuous improvement of product quality, and the implementation of diversified production by the enterprise can all promote it in obtaining a sustainable competitive advantage. However, the implementation of GPI by enterprises is faced with the unfavorable situation of uncertain innovation results and the threat of imitation by peers; thus, there is often a lack of sufficient incentives for GPI. Therefore, a good institutional environment is needed to guide the internalization of the abovementioned externalities to promote the GPI of enterprises.

Environmental regulation

Environmental regulation plays an important role in promoting the export of green products by encouraging enterprises to produce such products. According to the “Porter hypothesis”, it is recognized that appropriate environmental regulation can stimulate technological innovation and increase firm productivity, which to a certain extent offsets the reverse effect of increased costs brought about by environmental regulation (Porter and Linde, 1995), and creates an innovation compensation effect (Herman and Xiang, 2019; Zhao et al. 2022). Although the innovation compensating effect of environmental regulation can promote green innovation and exports, it may also bring about challenges for enterprises, especially small and medium-sized enterprises (SMEs), due to the dynamic environment involving compliance costs, administrative burden, and constant adaptation to changing regulations (Skare et al. 2023). It is noted that China’s environmental regulatory performance has improved significantly in recent years (Zhong and Peng, 2022). On the one hand, environmental regulation can serve as a powerful incentive for enterprises to invest in green production technologies and implement sustainable development strategies, producing an incentive effect (Cai et al. 2020). For example, strict environmental regulations require manufacturing enterprises to reduce emissions, improve energy efficiency, adopt clean production processes to slow down the environmental damage caused by production, force enterprises to innovate in terms of green products and technologies and enable enterprises to develop and export green products with environmental protection benefits. On the other hand, strict environmental regulation meets the requirements of enterprises for market access and legitimacy (Liu et al. 2021). Many countries and regions have strict environmental standards and laws. To enter these markets, the development of green products and compliance with environmental standards can open up new markets and export opportunities for enterprises (Wang and Tao, 2023). Based on the above analysis, we believe that, both in the Chinese context and from a long-term perspective, environmental regulation creates opportunities for innovation, market access, and competitive advantage in the growing global market for environmentally sustainable products and services.

H3a: Environmental regulation enhances the promoting effect of increasing green production capacity on REIEs’ GPI.

Green credit

Compared with environmental regulation, green credit is used to reduce the costs and risks associated with green innovation activities and effectively improve the efficiency of green technological innovation, which is considered an effective tool to actively stimulate green innovation (Sun et al. 2023; Li and Gao, 2022). From the perspectives of cost savings and competitive advantage, green credits can help enterprises implement cost-saving measures, such as energy-efficient production methods or waste reduction measures. These cost savings can enhance the market competitiveness of green products, making them more attractive to consumers and the export market as a whole. Green credit can also improve enterprise innovation output and innovation efficiency (Li et al. 2022) to promote the expansion of green production capacity and drive the green product innovation of the enterprise. Enterprises can expand their business and increase the number of green products they produce and export. This scalability is critical for enterprises in meeting the growing demand for environmentally sustainable goods and services (Sdiri, 2023). In addition, enterprises usually need to meet international environmental standards and certifications when exporting green products (Nguyen et al. 2023). Green credit can help enterprises meet these requirements by providing funds for necessary adjustments and certifications. Therefore, obtaining green credits can also enable enterprises to enter the international market while prioritizing sustainable development and participating in competition (Zhou et al. 2023).

H3b: Green credit enhances the promoting effect of increasing green production capacity on REIEs’ GPI.

Data and methodology

Data sources and variable selection

The data of this study consist of 2004–2018 panel data covering the green exports of REIEs in 30 provinces across China (the Tibet Autonomous Region, Hong Kong, Macao, and Taiwan are excluded from the present study due to a considerable amount of missing data). Firstly, consistent with previous research (Qiu et al. 2024), we use the Comprehensive List of Environmental Goods (CLEG) compiled by Sauvage (2014) as the list of green productsFootnote 2. Secondly, we matched the China Customs Database and the China Industrial Enterprises Database based on the EPS microenterprise export databaseFootnote 3, and aggregated to the regional level to obtain the sample of Chinese REIEs. Finally, the China Customs Database provides comprehensive import and export data at the enterprise product level with 8-digit HS codes (Hu et al. 2024c), from which we identify the REIEs that engage in the export trade of green products based on the green product list, which provides data support for this study. The rest of the research data are from the China Stock Market and Accounting Research (CSMAR) Database, the national and provincial statistical yearbooks, the China Industrial Statistical Yearbook, and the Statistical Yearbook on Science and Technology Activities of Industrial Enterprises.

Explained variable: GPI

Based on the definition of Schumpeter’s innovation theory that new products enter the market as innovations, we consider the international comparative advantage gained by the newly produced green products of export enterprises as a proxy variable for enterprise GPI. With reference to Xuan and Jun (2022), GPI is represented by the total amount of green product exports that REIEs newly acquire to gain regional comparative advantage each year. Moreover, the comparative advantage gained by new products when they enter the international market can be reflected not only in the increase in export value but also in the degree of product diversification. Therefore, for the robustness tests, the present study uses the export volume of green products that REIEs newly acquire to gain regional comparative advantage each year as a substitute for the explained variable.

Explanatory variable: Increase in green production capacity

The increase in green production capacity is a microscopic manifestation of the promotion of macroscopic green economy development in the increase in enterprise production capacity. We believe that the increase in green production capacity involves not only the arrangement and reorganization of existing production knowledge by enterprises to obtain diverse production portfolios but also, more importantly, the accumulation of capacity for the production of more complex products and the shift to production activities with higher productivity levels and rates of return. Therefore, the proxy variable of production capacity in two dimensions in PS theory is considered at the same time.

We collate the export trade data of 137 countries and regions around the world in the CEPII-BACI databaseFootnote 4 and calculate and obtain the comparative advantage of the product in different years \({{RCA}}_{{cp}}=\frac{{X}_{{cp}}/{\sum }_{c}{X}_{{cp}}}{{\sum }_{p}{X}_{{cp}}/{\sum }_{c}{\sum }_{p}{X}_{{cp}}}\), and the product complexity index (PCI) is the PS index. Since this paper investigates the production capacity of each province in China, to avoid the situation in which developed provinces and cities have a comparative advantage in terms of every product when measuring the comparative advantage of the provinces and cities by using national exports as the denominator, according to the recommendation of the OECFootnote 5, we revise the calculation of product comparative advantage as the comparison of the production share of local units (such as regions and provinces) and the overall world production share; \({{RCA}}_{{sp}}=\frac{{X}_{{sp}}^{s}/{\sum }_{s}{X}_{{sp}}^{s}}{{\sum }_{p}{X}_{{cp}}/{\sum }_{c}{\sum }_{p}{X}_{{cp}}}\). The calculation approaches for the other PS indices are the same.

Green product-related density

With reference to Ferrarini and Scaramozzino (2016) for the understanding of national average product-related density, green product-related density measures the degree of association between the products produced by the regional enterprises and the surrounding products, which, when summed and averaged at the regional level, can represent the magnitude of the improvement in regional green production capacity.

where \({\rm{s}}\) represents the province where the enterprise is located, \({p}^{{\prime} }\) represents all exported products, and g represents green export products. The threshold of the degree of product specialization by province in China is\({M}_{{sp}}=\left\{\begin{array}{c}1\,{{RCA}}_{{sp}}\ge 1\\ 0{otherwise}\end{array}\right.\);\(\,{{\Phi }_{p{p}^{{\prime} }}}_{p={g}_{1},{g}_{2}\ldots {g}_{246}}\) represents the association between green products and other products, \({\Phi }_{p{p}^{{\prime} }}=\frac{\sum _{c}{M}_{{cp}}{M}_{c{p}^{{\prime} }}}{\max \left({k}_{p,0},{k}_{{p}^{{\prime} },0}\right)}\) calculates the global association between export products, \({M}_{{cp}}\) binarizes the comparative advantage of export products \(\left({\rm{that}}\, {\rm{is}},\,{M}_{{cp}}=\left\{\begin{array}{c}1\,{{RCA}}_{{cp}}\ge 1\\ 0\,{otherwise}\end{array}\right.\right)\)), \({k}_{p,0}=\sum _{c}{M}_{{cp}}\) is the number of countries that have an export product p with a comparative advantage, and \({k}_{{p}^{{\prime} },0}\) is defined in a similar manner.

Green complexity index (GCI)

With reference to a study on the green PS (Mealy and Teytelboym, 2022), the complexity of the regional green economy measures the complex green knowledge stocks accumulated by the economic actors in the local production structure in the production process, which can effectively evaluate the accumulated green production capacity of local enterprises.

where \({\rm{s}}\) represents the province where the enterprise is located, \({M}_{{sg}}\) is the specialization level of green products in each province, and \({\widetilde{{PCI}}}_{g}\) is the degree of green product complexity obtained after the normalization of \({{PCI}}_{g}\).

Driving channel: green technology and human capital

Green technology. The number of patent applications is generally used as a proxy variable for technological innovation output (Li, 2011), reflecting the overall technological innovation level of the region. Green technologies are identified based on the International Patent Classification Green List, and the number of local green patents granted is used as the measure of the regional green technology level.

Human capital. We measure the level of human capital by the present value of an individual’s lifetime income during his or her expected lifetime. Human capital is calculated by the China Center for Human Capital and Labor Market Research (CHLR) at the Central University of Finance and Economics based on the lifetime income method and the improved Jorgenson-Fraumeni method.

Moderating variables: green credit and environmental regulation

Green credit. The ratio of interest expenditures of each province in China, except for the six high-energy-consuming industries (chemical, petroleum, electric power and heat, ferrous metals, nonferrous metals, and nonmetals), to the total interest expenditures of industrial industries is used to measure green credit.

Environmental regulation. First, the levels of industrial wastewater discharge, industrial SO2 emissions, and industrial soot emissions in each province are standardized; second, the corresponding weights are obtained for the three pollutants; and finally, the comprehensive environmental regulation index is obtained through the product of the weights and the standardized values.

Control variables

Regional enterprise size is expressed as the ratio of the total output value of industrial enterprises above the designated size to the number of enterprises, while the regional enterprise innovation climate is expressed as the proportion of industrial enterprises conducting R&D activities in the total number of industrial enterprises. The logistics level is expressed by cargo turnover (hundred million ton-km), the degree of FDI technology spillover is expressed by direct investment outside the province, the scale of local government expenditure is expressed by the ratio of the total fiscal expenditure to regional GDP, and the degree of trade openness is expressed as the proportion of the total import and export trade amount in the region in terms of the regional GDP. The regional digitization is considered to have a significant impact on China’s green economic transition and green growth (Ma and Lin, 2023; Hu et al. 2024b). Referring to Gao et al. (2022) and Wang et al. (2022), the evaluation of digital indices considers the connotation of the following three aspects: (1) The digital infrastructure is measured mainly from two indices, broadband and mobile internet foundations, which are characterized by the length of long-distance optical cable lines (10,000 kilometers) and the capacity of mobile phone exchanges (10,000 households), respectively. (2) The application of digital technology, the broadband internet, and the mobile internet in the corresponding infrastructure is characterized by the internet penetration rate (%) and the mobile phone penetration rate (parts/100 people), respectively. (3) The development of the digital industry is characterized by the number of websites owned by the enterprise, the amount of e-business sales (100 million yuan), information technology service revenue (10,000 yuan), and the number of employees in telecommunications and other information transmission services. The comprehensive digital index is evaluated by using the entropy method to calculate the weight of each secondary index. The above data come from the China High-tech Industry Statistical Yearbook and the CSMAR database. The descriptive statistics of the variables are shown in Table 1.

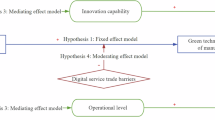

Mathematical model

This study uses three models to discuss the driving forces of the GPI of REIEs, namely, the direct drive model of the promotion of green capacity, the indirect push model of structural transformation, and the regulatory pull model of the external environment, which is used to test H1, H2, and H3, respectively, to reveal their direct or indirect impacts on the GPI of REIEs.

Direct drive model

To test the direct driving effect of the increasing green production capacity on GPI, a benchmark regression model is constructed. This model is estimated using panel fixed effects regression to remove the influence of those time trends and regional characteristics that cannot be observed.

where \({\log {NGPExport}}_{{st}}\) represents the GPI of REIEs in region s in year t; \({{GCI}{{\_}}{stdv}}_{{st}}\) represents the green complexity in region s in year t, measuring the overall green production capacity of regional enterprises; \({{Controls}}_{{st}}\) represents the control variables; \({u}_{s}\) and \({v}_{t}\) are the provincial/region and time-fixed effects, respectively; and \({\varepsilon }_{{st}}\) is a potential random error term.

To further isolate the effect of REIEs’ accumulation of more complex product-related capabilities, we construct an IV-2SLS model to analyze the impact of the increasing green production capacity of REIEs on GPI from the PS perspective. The specific method is as follows: in the first stage of IV regression, green product-related density is used as an IV to perform regression on the GCI. The purpose is to separate the part of the effect on regional enterprises’ accumulation of production capacity for more complex products from the various effects of green product-related density on the accumulation of the green production capacity of enterprises. The second-stage regression uses this part of the increase in green production capacity as the core explanatory variable to regress GPI and observe its impact on GPI. Based on Eq. (1), the IV-2SLS model incorporates IV regression:

where\(\,{\log {Gdensity}}_{{st}}\) represents the green product-related density of enterprises in region s in year t.

Indirect push model

Considering the channel effect of increasing green production capacity on structural transformation in GPI and with reference to Lee et al. (2020), the IV-2SLS model is extended to the 3SLS model to study the upgrading effect of technology and human capital brought about by the increase in green production capacity. On the basis of Eq. (2), Eq. (1) is adjusted for the 3SLS model as follows:

where \({{Adj}}_{{st}}\) is a driving channel proxy variable including green technology and human capital.

Regulatory pull model

Considering the impact of environmental regulation and green credit, as two external environmental variables, on the promotion of GPI through the increase in green production capacity, the interaction term between the two external environmental variables and GCI is included in Eq. (1):

where \({{Eenvir}}_{{st}}\) includes environmental regulation (\({\log {ER}}_{{st}}\)) and green credit (\({\log {GreenLoan}}_{{st}}\)) as two moderating variables.

Results

Test of the composite driving mechanism

Benchmark regression: direct drive model

First, we conducted a multi-collinearity analysis by the variance inflation factor (VIF) test. The results showed that the average value of the VIF is 3.54 and the maximum value is 5.69 for model (1), both of which are lower than the threshold value of 10, hence the research model does not suffer from the problem of multi-collinearity. Second, we conduct an endogeneity test on the assumed endogenous variable, GCI. The p value of Chi-sq(1) is 0.0093, and the null hypothesis is rejected at the 1% level. The core explained variables are considered endogenous variables, and the IVs can thus be used. Next, green product-related density is tested as an IV. The Kleibergen‒Paap rk Lagrange multiplier (LM) statistic value in the underidentification test is 11.703, and the null hypothesis of “underidentification of the IV” is rejected at the 1% significance level; in the weak instrumental variable test, first, the regression coefficient of the IVs in the first-stage regression is 0.359, which is significantly positive at the 1% level. Green product density and GCI are positively correlated. Second, the F value of the first-stage regression is 92.57 > 10. The Kleibergen‒Paap rk Wald F-statistic value of 92.568 is greater than the 10% bias in the Stock–Yogo weak ID test critical values; that is, the null hypothesis that the IV is a weak instrumental variable is rejected.

Table 2 reports the benchmark regression results that increasing green production capacity affects REIEs’ GPI, in which Model (1) is the result of general fixed effects regression. Model (2) is obtained by introducing IVs into Model (1), and the IV-2SLS regression results are shown. Models (1) and (2) both show that the regression coefficient of the effect of the increasing green production capacity of REIEs on GPI is positive and significant at the 1% level, indicating that this increasing green production capacity is a factor that directly drives REIEs’ GPI, thus validating H1.

Indirect push test

The test results of the driving channel effect are shown in Models (1)–(3) in Table 3. According to Models (1) and (2), the estimation coefficients of the core explanatory variables, green production capacity, and green technology, are both positive at the 1% significance level, indicating that the increase in green production capacity can significantly improve the regional green technology level, which in turn promotes the innovation level of REIEs to exert a significant “technology-driven” effect, thus supporting H2a. Models (4)–(6) show the test of the driving channel effect of human capital improvement. Models (5) and (6) show that the core explanatory variable, increasing green production capacity, can significantly improve the level of human capital. The estimation coefficients of the human capital variables in Model (4) are all positive at the 1% significance level, indicating that the accumulation of human capital further promotes the level of GPI of local enterprises, thus validating H2b.

Regulatory pull test

To avoid the influence of multi-collinearity, when generating the interaction terms, the core explanatory variables and moderating variables are centered. Table 4 reports the moderating effects of the environmental variables, focusing mainly on the estimation coefficients of the interaction terms between the core explanatory and moderating variables.

The main effects show that the core explanatory variable is significantly positive at the 1% level; that is, the increase in the green production capacity of REIEs promotes GPI. Second, after the introduction of the environmental regulation variable and the interaction term between it and the increase in green production capacity, the interaction term coefficient is found to be significantly positive at the 10% level, indicating that environmental regulation has strengthened the effect of the increasing green production capacity of REIEs on GPI, with a significant positive moderating effect, thus validating H3a. Finally, after the introduction of green credit and the interaction term with the core explanatory variables, it is found that the interaction term coefficient is significantly positive at the 1% level, indicating that green credit has a significant promoting effect on the increase in the green production capacity of regional enterprises and the promotion of GPI. Thus, H3b is validated.

Figure 1 shows the moderating role of environmental regulation and green credit in the relationship between the increase in the green production capacity and green product innovation of REIEs. The horizontal axis represents the difference in the increase in REIEs’ green capacity, and the vertical axis represents GPI. High levels of environmental regulation and green credit are obtained by adding one standard deviation to the mean value; low levels of environmental regulation and green credit are obtained by subtracting one standard deviation from the mean value. As can be seen in Fig. 1, environmental regulation and green credit have different moderating effects on the relationship between the increase in REIEs’ green capacity and GPI. Under a high level of environmental regulation, the impact of the increasing green capacity of REIEs on their GPI is stronger than the direct driving effect of green production capacity under a low level of environmental regulation. Similarly, regional enterprises’ increasing green capacity has a stronger impact on the GPI of REIEs with a high level of green credit and a weaker impact on that of REIEs with a low level of green credit.

Robustness test

(1) Replacing the explained variable. The total amount of green product exports that regional export enterprises newly acquire to gain regional comparative advantage each year is used as the explained variable. To avoid measurement error that may be caused by the measurement of a single index, the export volume of green products that REIEs newly acquire to gain regional comparative advantage each year is used as the surrogate index for the explained variable to perform a robustness test. As shown in Table 5, the regression results show that after the proxy variable of the explained variable is used, the estimation result of the increase in the green production capacity of regional enterprises on GPI remains unchanged, and GCI is still shown to positively promote enterprise GPI at the 1% significance level, indicating that the selection of the explained variable does not affect the conclusions of this study.

(2) Adding control variables. On the basis of the original control variables, we continue to add control variables at the enterprise, industry, and regional levels to avoid the potential omitted variables from affecting the conclusions. At the enterprise level, the transaction amount in the enterprise technology market is generally considered a proxy variable for the commercialization of the enterprise’s technological innovation outcomes. The larger the scale of technology market transactions is, the higher the level of enterprise innovation. At the industry level, industrial agglomeration cannot only generate a cluster spillover effect but also get caught in imitative competition and technological lock-in as the agglomeration expands, exerting a two-way impact on the innovation level of the enterprises in the cluster. At the regional level, per capita GDP often acts as a proxy variable for the regional economic development level. In general, the higher the regional economic development level is, the higher the enterprise innovation level. As shown by the regression results in Table 6, after the replacement of the proxy variables of the explained variables, the estimates of the effects of the core explanatory variables on REIEs’ GPI remain unchanged, proving that the conclusions are robust.

(3) Removing outliers. The lower multi-collinearity somehow circumvents over-fitting of the model, however, further testing of the effect of outliers on regression results is still required (Qu, 2021). We use the winsorization to eliminate possible outliers in the variables. In this paper, all variables are subjected to different levels of two-sided winsorization, and the results are shown in Table 7. Model (1) reports the regression results after 1% two-sided winsorization treatment to eliminate outliers, showing that the regression coefficients of the explanatory variables are all significantly positive at the 1% level, consistent with the findings of the benchmark regression. Model (2) reports the regression results after performing 5% two-sided winsorization, and similarly, the significance and direction of the sign of the regression coefficients remain unchanged. Therefore, after different degrees of two-sided winsorization of the variables, the impact of the rise in regional green production capacity on the GPI remains robust.

(4) Discussing endogenous reciprocal causation. Considering the calculation method with which to measure green production capacity, the relatedness density and GCI of green products are calculated from microscopic data on the green product exports of exporting enterprises. The potential problem is that when the GPI behavior of enterprises leads to industrial upgrading and restructuring, it affects the green production capacity of enterprises at the regional level; that is, GPI may reversely promote an increase in the green production capacity of enterprises. Referring to Lv and Ji (2021), to alleviate the problems caused by reciprocal causation, the mean value of GCI in the same economic and geographic region in the same year is introduced as the IV for the increase in the green production capacity of regional enterprises.

Before observing the regression results and considering the rationality of the selection of IVs, we first conduct an endogeneity test on the assumed endogenous variables. The p value of Chi-sq(1) is 0.0206, the null hypothesis is rejected at the 5% level, and the IVs can be used. The Kleibergen‒Paap rk LM statistic value is 14.490, the null hypothesis of “insufficient IV identification” is rejected at the 1% significance level, the Hansen J statistic value is 0.851, and the Chi-sq(1) p value is not significant at 0.3564. For the null hypothesis that “all IVs are exogenous”, the F-statistic value of the Kleibergen‒Paap rk Wald test for the first-stage regression is 44.257, which is greater than the 10% error threshold in the Stock–Yogo weak ID test, the null hypothesis that “the IVs are weak” is rejected; thus, the selection of IVs is valid. Based on the endogenous reciprocal causation test results in Table 8, the regression result of the effect of the increase in green production capacity on GPI is still significantly positive, indicating the robustness of the results.

Heterogeneity test

The benchmark regression results show that the increase in REIEs’ green production capacity has a positive promoting effect on GPI. If the differences in regional characteristics are taken into account and the entire sample is decomposed into several subsamples for regression, can the same conclusion be obtained? To answer this question, we use a threshold regression model to identify and determine the threshold value and endogenously include the core explanatory variable, i.e., the increase in green production capacity, as well as control variables representing the regional level, including the logistics level, FDI, digitization, local government expenditure, and trade openness as the threshold variables for different regional characteristics, and we estimate the different impacts of increasing green production capacity on GPI in each interval.

Before running the threshold regression model, it is first necessary to examine and determine whether the above threshold variables have a threshold effect. The bootstrap method of Hansen (1999) is used for the sampling test, and the specific settings are as follows: the number of bootstrap times is 300, the proportion of outlier removal in the threshold group is 0.01, and the number of grids for sample grid calculation is 100. Table 9 reports the results of the threshold existence test. Except for the logistics level, all other variables pass the threshold existence test.

As seen in Table 10, the coefficients of the interaction term between the threshold variable and the core explained variable are significantly positive at the 1% level. The estimation coefficients change as the threshold variable crosses a certain threshold, but regardless of whether the threshold variable crosses this threshold, the increase in green production capacity has a positive promoting effect on GPI, and the influence coefficient decreases as the threshold variable crosses a certain threshold.

Specifically, before GCI crosses the second threshold of −1.2243, the promoting effect of GCI on GPI is constantly increasing (from 1.823 units to 2.335 units). Then, when GCI crosses the second threshold, the promoting effect weakens to 1.031, showing an inverted U-shaped promoting effect. The dual-threshold estimation results of the logarithmic value of FDI, the logarithmic value of the digitization level, and the triple threshold estimation results of trade openness show a similar inverted U-shaped promoting effect. When the logarithmic value of the local government expenditure proportion is less than −1.6332, it has a promoting effect of 1.963 on GPI. When the value exceeds −1.6332, the promoting effect on GPI decreases to 1.301, indicating that the influence of the proportion of local government expenditure on GPI is not constant but shows a diminishing marginal utility effect.

Discussion

We focus the deconstruction of the innovation drivers of REIEs at the provincial level of China’s green product space. Taking the increasing green production capacity of REIEs to promote GPI as the direct driving factor, we also focus on the indirect driving role played by observable knowledge capital and the regulatory pull of the environmental policy.

The empirical research results support the hypothesis (H1) that the increase in the green production capacity of REIEs directly drives the increase in the level of GPI. The reorganization and dynamic accumulation of complex knowledge needed by enterprises lead to the technological differentiation of GPI, while innovative green knowledge and green technologies continuously establish new green capacity location advantages under the regional green innovation system, eventually causing enterprises to acquire such knowledge to create a continuous source of internal innovation motivation. The findings also support the fact that GPI plays a pivotal role in the sustainable development of export-oriented enterprises. At the horizontal level, competitive advantage is gained by upgrading products through the adoption of green technologies that meet market demands, and are novel or characterized by green attributes (Becker and Egger, 2013), while at the vertical level, the enterprise tends to reorganize resources, knowledge, and technology based on the original relevant green production activities (Mealy and Teytelboym, 2022; Mai et al. 2022; Romero and Gramkow, 2021) to carry out the innovation and diversification of green products and thus the implementation of the SDGs.

The knowledge capital-based driving channel test holds that there are two ways in which to enhance the green production capacity of REIEs to promote the innovation level of enterprises’ green products: one way is to enhance the overall green technology level of the region (H2a), and the other way is to enhance the regional human capital level of the region (H2b). The two driving paths are originally inspired by the intuition of the green complexity of the PS. The economic complexity index (ECI) has demonstrated that it is closely related to economic structural transformation and is directly related to the skill and knowledge levels of workers, the technical capabilities embedded in production, and technological progress (Zheng et al. 2021). Countries with more complex green production capacities are able to provide better conditions for the development of more environmentally friendly products than those countries with less such capacity (Mealy and Teytelboym, 2022).

The test of the moderating effect of environmental regulation and green credit shows that both have a positive promoting effect on the increase in green production capacity and green product innovation. The moderating effect of green credit can be considered a type of incentive-based government subsidy to compensate for the crowding out of enterprise innovation by punitive environmental regulation. The moderating effect of environmental regulation between enterprise production capacity and green innovation behavior comes from the study of enterprise dynamic capacity intuition (Xing et al. 2022). A considerable amount of research suggests that a series of laws and policies enacted by the government to protect the environment, such as strict regulations on the environment, are the direct driving force of enterprise green innovation. This conclusion is based on the following intuition of innovation externality: enterprises do not directly carry out green innovation activities. However, this intuition ignores the fact that the decision-making in terms of innovation behavior, given the internal resources of an organization, is constrained by the external environment. Similar to the conclusions of Xing et al. (2022), under strict environmental regulation, regional enterprises with more green production capacity measured by PS are more likely to achieve green innovation through technology and knowledge reorganization compared to regional enterprises with less of such capacity.

Conclusion, implications, and limitations

Conclusions

Based on 2004–2018 empirical panel data covering REIEs in 30 Chinese provinces, we discuss the GPI driving mechanism and test the effect of increasing green production capacity, organizational factors, and environmental policies on the GPI of REIEs from the PS perspective. Our results are presented below.

The first research objective reveals the improvement of endogenous production capacity is a direct driver for enterprises to implement GPI. The conclusion still holds while we further isolate the effect of REIEs’ accumulation of more complex product-related capabilities by constructing an IV-2SLS model. With this base, we further tested the driving channel effect of knowledge capital through 3SLS regression and found that there are two channels to promote the level of GPI of enterprises by increasing the green production capacity of REIEs, which are to enhance the green technology and human capital in the region, respectively.

The second research objective provides data and methodological support for the government to coordinate with the development and innovation activities of the green products of enterprises. We find that both environmental regulations and green credit positively contribute to GPI as a result of green productive capacity growth. In addition, taking into account the differences in the characteristics of REIEs, we find that increasing green production capacity, FDI, digitization, and trade openness have an inverted U-shaped effect on GPI, while the proportion of local government expenditure shows a diminishing marginal utility effect on GPI and no threshold effect on the level of logistics.

Theoretical contributions

This study deconstructs the complex composite mechanism of the innovation motivation of the GPI of REIEs from the PS perspective to study the prerequisites for GPI, especially concerning how the accumulation and evolution of the production capacity of regional enterprises from the PS perspective affect GPI. Thus, the knowledge base of existing research is beneficially supplemented.

Our first objective reveals the impact of the accumulation and evolution of enterprises’ productive capacity on GPI. For the first time, we consider the accumulation and evolution of regional enterprise production capacity from the PS perspective in our antecedent study of GPI. Most studies that explore the impact of enterprise capabilities on GPI from the perspective of capabilities start mostly from the NRBV (Hart, 1995), arguing that the natural environment inevitably constrains the enterprise’s advantage in creating sustainable competition (Aboelmaged and Hashem, 2019); therefore, enterprises need to have the resources and capabilities to promote environmentally sustainable development (Albort-Morant et al. 2018). On this basis, we demonstrate that the idea of green PS provides a new way of thinking and new methods for improving enterprise green production capacity. In addition, through the connection of PS and the research on enterprise green innovation, we hope to make some contributions to the research on PS in the field of sustainable development. Our study is based on the discussion of green complexity by Mealy and Teytelboym (2022) and Wang and Yang (2022), and can also be considered a further refinement of the study by Wang et al. (2023). Compared to the economic complexity indices that represent the overall production level, our study can provide insights into the diversified green product innovation of the enterprises in the region.

Our second objective provides theoretical support for the government to develop a positive external environment to cooperate with enterprises to implement GPI. As mentioned in the introduction, enterprises usually lack the initiative to export green products (Wang et al. 2024), and at this point, external motivations are particularly important because the decision-making on innovation behavior by internal resources of the organization is constrained by the external environment. As discussed in our literature review, there are opposing views on the effects of government environmental regulatory behavior. The findings in this paper further support the “Porter hypothesis” that the benefits of innovation exceed the costs of environmental regulation and that enterprises carry out green innovation through the innovation compensation effect (Herman and Xiang, 2019), which also supports the context of China’s significant improvement in environmental regulatory performance (Zhong and Peng, 2022).

Methodologically, we respond to the call of Mealy and Teytelboym (2022) for the exploration of green complexity at the regional level. Green export product trade data on export industrial enterprises in 30 Chinese provinces are used to measure regional enterprises’ green product-related density and the degree of regional green complexity, expanding the application of the sample dimension of complexity study at the subnational level and providing quantitative support for PS research at the subnational level.

Practical implications

The results of this study are of great significance to enterprise managers and policy-makers.

Enterprise managers must sense environmental changes and grasp market trends in a timely manner, seize market opportunities, cultivate enterprise-specific green capabilities, and implement a correct GPI strategy to help their enterprises continuously develop more diversified and greener products, gain a competitive advantage, and achieve successful product innovation. For example, enterprises with leading green production capacity levels choose high-complexity products with the smallest jump distance in the green PS for production, and the accumulation of a larger amount of green complexity knowledge is conducive to the evolution of the enterprise to the core-dense area of the PS and the realization of higher-efficiency innovation. Moreover, imitation enterprises can give priority to the production and export of green products with local comparative advantage to enrich the diversity of their own exports. In addition, as another way of indirectly gathering knowledge capital, human capital suggests that enterprise managers pay attention to the accumulation of advanced human capital and local human capital levels and carry out the continuous training of talent in the field of green production management to support green manufacturing enterprises in improving their green production processes to achieve GPI.

The government and policy-makers should implement various incentive measures, including fiscal and nonfiscal measures, to provide a good business environment for enterprises to participate in GPI. Our test of the moderating effects of environmental regulation and green credit shows that both have a positive promoting effect on the increase in green production capacity and GPI. In the future, China can continue to strengthen environmental regulation and improve industrial financing standards to give full play to the promoting effect of incentives measures on enterprise GPI activities. At the same time, it should be noted that the effect of the proportion of local government expenditure on GPI exhibits a diminishing marginal utility effect. At the regional level, the examination of heterogeneity focuses on the results of local government policies tailored to specific regions. Therefore, the government should consider the characteristics of different provinces and formulate differentiated environmental fiscal policies to support GPI to fully mobilize market enthusiasm and avoid policy distortions.

Limitations and future recommendations

The best way to construct a country or region’s PS is to use the production data of each country or region. Due to data availability, most existing studies use the export data of each country to construct the PS. The microenterprise data in this paper are obtained from the EPS database, which has cleaned the data of the China Industrial Enterprise and China Customs databases. Affected by these data sources, the identification of microenterprises is carried out only by considering the customs enterprise code or industrial enterprise code and cannot be implemented in specific enterprises. This situation has caused certain problems for the further expansion of the scope of our future research samples and sample data and placed certain restrictions on our selection of enterprise-level variables. In addition, the China Customs database ceased to provide specific customs enterprise product trade information after 2016, which may challenge the applicability of the conclusions drawn from this paper at the enterprise level. Therefore, it is necessary to pay close attention to the updating of PS methodology to eliminate the reliance of the PS method on product trade data.

Data availability

The datasets generated and/or analyzed for this study are available on the Access website at https://github.com/open-data-code/GPS.git.

Notes

State Council of the People’s Republic of China: Guiding Opinions on Accelerating the Establishment of a Green Low-Carbon Circular Developing Economic System: https://www.gov.cn/zhengce/zhengceku/2021-02/22/content_5588274.htm Accessed: June 20th, 2024.

For a detailed list of green products, we refer to the Organization for Economic Co-operation and Development’s (OECD’s) Trade and Environment Working Papers by Sauvage (2014): “Stringency of environmental regulations and trade in environmental goods,” pp. 51-56. The green product list provided by Sauvage contains 248 green products with HS2007 version codes, which is actually 246 after conversion to HS1996 version.

The data before 2016 provide specific export information for local enterprises, while the data after 2017 provide only export information for the province where the enterprises are located. Therefore, this study consolidates the data to those provinces where customs enterprises export. Regarding data selection, export data for enterprises using the general trade method between 2004 and 2018 are chosen. This was done to eliminate the impact of low value-added trades, such as processing and service trades, on the calculation of export comparative advantages. Additionally, abnormal observations such as unusual HS codes, missing province codes, and export values that are missing or less than 0 are excluded. For records lacking information on the province where the enterprise is located, provincial information is obtained based on the enterprise address. HS 6-digit monthly enterprise export data are merged with HS 6-digit annual provincial export data, and HS codes are uniformly adjusted to the 1996 versions.

According to the suggestion of the Growth Lab of Harvard University regarding data screening for the construction of economic complexity maps, we conduct preliminary data screening of the CEPII-BACI database as follows. Between 1996 and 2020, a total of 238 countries or regions engage in export activities, with continuous export information available for 218 countries or regions in the past two decades. After excluding countries or regions with populations of less than one million and those with average trade volumes below one billion US dollars over the 20-year period, a final set of 137 countries or regions is included in the scope of this study.

Observatory of Economic Complexity (OEC): https://oec.world/en/resources/methods. Accessed: June 20th, 2024.

References

Aboelmaged M, Hashem G (2019) Absorptive capacity and green innovation adoption in SMEs: the mediating effects of sustainable organisational capabilities. J Clean Prod 220:853–863. https://doi.org/10.1016/j.jclepro.2019.02.150

Adam A, Garas A, Katsaiti M-S, Lapatinas A (2023) Economic complexity and jobs: an empirical analysis. Econ Innov N Tech 32(1):25–52. https://doi.org/10.1080/10438599.2020.1859751

Ajide FM (2022) Economic complexity and entrepreneurship: insights from Africa. Int J Dev Issues 21(3):367–388. https://doi.org/10.1108/IJDI-03-2022-0047

Albort-Morant G, Leal-Rodríguez AL, De Marchi V (2018) Absorptive capacity and relationship learning mechanisms as complementary drivers of green innovation performance. J Knowl Manag 22(2):432–452. https://doi.org/10.1108/JKM-07-2017-0310

Antonelli C (2000) Collective knowledge communication and innovation: the evidence of technological districts. Reg Stud 34(6):535–547. https://doi.org/10.1080/00343400050085657

Balland P-A, Boschma R, Crespo J, Rigby DL (2019) Smart specialization policy in the European Union: relatedness, knowledge complexity and regional diversification. Reg Stud 53(9):1252–1268. https://doi.org/10.1080/00343404.2018.1437900

Becker SO, Egger PH (2013) Endogenous product versus process innovation and a firm’s propensity to export. Empir Econ 44:329–354. https://doi.org/10.1007/s00181-009-0322-6

Ben Arfi W, Hikkerova L, Sahut J-M (2018) External knowledge sources, green innovation and performance. Technol Forecast Soc Change 129:210–220. https://doi.org/10.1016/j.techfore.2017.09.017

Boschma, R, & Frenken, K (2011). Technological relatedness, related variety and economic geography. In: Handbook of Regional Innovation and Growth: Edward Elgar Publishing

Boschma R, Heimeriks G, Balland P-A (2014) Scientific knowledge dynamics and relatedness in biotech cities. Res Pol 43(1):107–114. https://doi.org/10.1016/j.respol.2013.07.009

Cai X, Zhu B, Zhang H, Li L, Xie M (2020) Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Sci Total Environ 746:140810. https://doi.org/10.1016/j.scitotenv.2020.140810

Cao S, Nie L, Sun H, Sun W, Taghizadeh-Hesary F (2021) Digital finance, green technological innovation and energy-environmental performance: evidence from China’s regional economies. J Clean Prod 327:129458. https://doi.org/10.1016/j.jclepro.2021.129458

Chen Y-S (2008) The positive effect of green intellectual capital on competitive advantages of firms. J Bus Ethics 77:271–286. https://doi.org/10.1007/s10551-006-9349-1

Chen Z, Poncet S, Xiong R (2017) Inter-industry relatedness and industrial-policy efficiency: evidence from China’s export processing zones. J Compar Econ 45(4):809–826. https://doi.org/10.1016/j.jce.2016.01.003

Christopherson S, Clark J (2007) Power in firm networks: what it means for regional innovation systems. Reg Stud 41(9):1223–1236. https://doi.org/10.1080/00343400701543330

Feng S, Zhang R, Li G (2022) Environmental decentralization, digital finance and green technology innovation. Struct Chang Econ Dyn 61:70–83. https://doi.org/10.1016/j.strueco.2022.02.008

Ferrarini B, Scaramozzino P (2016) Production complexity, adaptability and economic growth. Struct Chang Econ Dyn 37:52–61. https://doi.org/10.1016/j.strueco.2015.12.001

Gao D, Li G, Yu J (2022) Does digitization improve green total factor energy efficiency? Evidence from Chinese 213 cities. Energy 247:123395. https://doi.org/10.1016/j.energy.2022.123395

Goerzen A, Iskander SP, Hofstetter J (2021) The effect of institutional pressures on business-led interventions to improve social compliance among emerging market suppliers in global value chains. J Int Bus Policy 4(3):347–367. https://doi.org/10.1057/s42214-020-00064-8

Gómez Zaldívar F, Molina E, Flores M, Gómez Zaldívar MdJ (2019) Economic complexity of the special economic zones in Mexico: opportunities for diversification and industrial sophistication. Ens Rev Econ 38(1):1–40. https://doi.org/10.29105/ensayos38.1-1

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econ 93(2):345–368. https://doi.org/10.1016/s0304-4076(99)00025-1

Hart SL (1995) A natural-resource-based view of the firm. Acad Manag Rev 20(4):986–1014. https://doi.org/10.5465/amr.1995.9512280033

Hazir CS, Bellone F, Gaglio C (2019) Local product space and firm-level churning in exported products. Ind Corp Change 28(6):1473–1496. https://doi.org/10.1093/icc/dtz021

Herman KS, Xiang J (2019) Induced innovation in clean energy technologies from foreign environmental policy stringency? Technol Forecast Soc Change 147:198–207. https://doi.org/10.1016/j.techfore.2019.07.006

Hidalgo CA (2021) Economic complexity theory and applications. Nat Rev Phys 3(2):92–113. https://doi.org/10.1038/s42254-020-00275-1

Hidalgo CA, Hausmann R (2009) The building blocks of economic complexity. PNAS 106(26):10570–10575. https://doi.org/10.2307/40483593

Hidalgo CA, Klinger B, Barabási A-L, Hausmann R (2007) The product space conditions the development of nations. Science 317(5837):482–487. https://doi.org/10.1126/science.1144581

Hu F, Qiu L, Wei S, Zhou H, Bathuure IA, Hu H (2024a) The spatiotemporal evolution of global innovation networks and the changing position of China: a social network analysis based on cooperative patents. RD Manag 54(3):574–589. https://doi.org/10.1111/radm.12662

Hu, F, Zhang, S, Gao, J, Tang, Z, Chen, X, Qiu, L, Hu, H, Jiang, L, Wei, S, & Guo, B (2024b). Digitalization empowerment for green economic growth: the impact of green complexity. Environ Eng Manage J, 23(3). https://doi.org/10.30638/eemj.2024.040

Hu Y, Liu P, Xia J (2024c) The impact of environmental decentralization on the export domestic value-added rate of enterprises in China. Humanit Soc Sci Commun 11(1):654. https://doi.org/10.1057/s41599-024-02996-5

Lee H, Shin K, Lee J-D (2020) Demand-side policy for emergence and diffusion of eco-innovation: the mediating role of production. J Clean Prod 259:120839. https://doi.org/10.1016/j.jclepro.2020.120839

Li M, Gao X (2022) Implementation of enterprises’ green technology innovation under market-based environmental regulation: an evolutionary game approach. J Environ Manag 308:114570. https://doi.org/10.1016/j.jenvman.2022.114570

Li S, Zhang W, Zhao J (2022) Does green credit policy promote the green innovation efficiency of heavy polluting industries?—Empirical evidence from China’s industries. Environ Sci Pollut Res 29(31):46721–46736. https://doi.org/10.1007/s11356-022-19055-8

Li X (2011) Sources of external technology, absorptive capacity, and innovation capability in Chinese state-owned high-tech enterprises. World Dev 39(7):1240–1248. https://doi.org/10.1016/j.worlddev.2010.05.011

Liu Y, Wang A, Wu Y (2021) Environmental regulation and green innovation: evidence from China’s new environmental protection law. J Clean Prod 297:126698. https://doi.org/10.1016/j.jclepro.2021.126698

Lv Y, Ji Y (2021) Economic policy uncertainty, regional economic complexity and corporate innovation behavior (in chinese). Sci Technol Prog Countermeasures 38(1):71–78. https://doi.org/10.6049/kjjbydc.2020050304

Ma R, Lin B (2023) Digital infrastructure construction drives green economic transformation: evidence from Chinese cities. Humanit Soc Sci Commun 10(1):460. https://doi.org/10.1057/s41599-023-01839-z

Mai NT, Ha LT, Hoa TTM, Huyen NTT (2022) Effects of digitalization on natural resource use in european countries: does economic complexity matter? Int J Energy Econ Policy 12(3):77–92. https://doi.org/10.32479/ijeep.12748

Mealy P, Teytelboym A (2022) Economic complexity and the green economy. Res Pol 51(8):103948. https://doi.org/10.1016/j.respol.2020.103948

Nguyen CP, Nguyen B, Duy Tung B, Dinh Su T (2021) Economic complexity and entrepreneurship density: a non-linear effect study. Technol Forecast Soc Change 173:121107. https://doi.org/10.1016/j.techfore.2021.121107

Nguyen H, Onofrei G, Yang Y, Pham H, Wiengarten F, Nkhoma M (2023) Handling customer green pressures: the mediating role of process innovation among export‐oriented manufacturing industries. Bus Strateg Environ 32(4):2312–2326. https://doi.org/10.1002/bse.3250

OECD. (2009). Declaration on green growth adopted at the meeting of the council at ministerial level on 25 June 2009

Otto GA, Driessen PH, Hillebrand B, Prasad R (2023) Antecedents and performance implications of stakeholder understanding in green product innovation. J Clean Prod 420:138174. https://doi.org/10.1016/j.jclepro.2023.138174

Peters K, Buijs P (2022) Strategic ambidexterity in green product innovation: obstacles and implications. Bus Strateg Environ 31(1):173–193. https://doi.org/10.1002/bse.2881

Porter ME, Linde CVD (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(4):97–118. https://doi.org/10.1257/jep.9.4.97

Qi X (2022) Building a bridge between economic complexity and the blue economy. Ocean Coast Manage 216:105987. https://doi.org/10.1016/j.ocecoaman.2021.105987

Qiu L, Xia W, Wei S, Hu H, Yang L, Chen Y, Zhou H, Hu F (2024) Collaborative management of environmental pollution and carbon emissions drives local green growth: An analysis based on spatial effects. Environ Res 259:119546. https://doi.org/10.1016/j.envres.2024.119546

Qiu L, Yu R, Hu F, Zhou H, Hu H (2023) How can China’s medical manufacturing listed firms improve their technological innovation efficiency? An analysis based on a three-stage DEA model and corporate governance configurations. Technol Forecast Soc Change 194:122684. https://doi.org/10.1016/j.techfore.2023.122684

Qu L (2021) A new approach to estimating earnings forecasting models: robust regression MM-estimation. Int J Forecast 37(2):1011–1030. https://doi.org/10.1016/j.ijforecast.2020.11.003

Rennings K (2000) Redefining innovation—eco-innovation research and the contribution from ecological economics. Ecol Econ 32(2):319–332. https://doi.org/10.1016/s0921-8009(99)00112-3

Romero JP, Gramkow C (2021) Economic complexity and greenhouse gas emissions. World Dev 139:105317. https://doi.org/10.1016/j.worlddev.2020.105317

Sauvage, J (2014) The stringency of environmental regulations and trade in environmental goods (OECD Trade and Environment Working Papers, Issue

Sdiri, H (2023). Do environmental commitment and innovation influence export intensity? Firm-level evidence from Tunisia. Int J Innov Manage, 2350026. https://doi.org/10.1142/s1363919623500263

Seeck H, Diehl M-R (2017) A literature review on HRM and innovation–taking stock and future directions. Int J Hum Resour Manag 28(6):913–944. https://doi.org/10.1080/09585192.2016.1143862