Abstract

The distributed power (DP) trading market plays a pivotal role in promoting renewable energy and driving the global economy’s low-carbon transition. However, the DP market worldwide is still in its infancy and faces problems such as immature market mechanisms and fluctuating power generation. To address these challenges, this paper introduces an innovative Hybrid Transaction Model (HTM) designed to optimize DP market mechanisms and refine “grid fee” structures. HTM operates through two structured transaction markets: (1) the aggregation transaction market, which manages trades between aggregators and distributed users; (2) the terminal transaction market, which facilitates exchanges between aggregators and industrial and commercial users. Additionally, HTM integrates a shared energy storage market to support expanding energy storage systems. Using China as a case study, this paper examines the barriers to DP trade market development and offers actionable policy implications for the further development of DP markets in China and comparable regions.

Similar content being viewed by others

Introduction

As the problem of climate change caused by the economic development of human society receives more and more attention, many countries are committed to reducing greenhouse gas emissions and thereby mitigating the associated environmental and climate risks (Yin and Zhao, 2024). Reducing emissions in the power industry represents a crucial step toward reducing greenhouse gas emissions (Ding, 2022), and distributed renewable energy has emerged as a pivotal direction for the future low-carbon transformation of the power sector (Mao et al. 2022). The distributed power (DP) trading market plays a pivotal role in promoting the adoption of renewable energy and curbing greenhouse gas emissions in today’s society (Zia et al. 2018). This market brings innovation to the energy sector and creates the basis for achieving sustainable development goals through the use of clean energy technologies. The DP trading market offers an efficient platform for integrating small-scale, distributed energy resources, such as solar and wind energy, overcoming the limitations of traditional centralized energy models (Guerrero et al. 2020). Through the DP market, individuals and small-scale energy providers can integrate their clean energy production, promoting widespread adoption and augmenting the overall efficiency of the energy network. Furthermore, the operation of the market facilitates the establishment of a resilient and intelligent energy system (Gilani et al. 2020), managing the equilibrium between energy supply and demand-side response through smart grid applications, electricity generation, and storage technologies, as well as end-user interactions (Roldán-Blay et al. 2019). This flexibility enhances the stability and resilience of the energy system while moving the entire energy industry toward greater sustainability and intelligence. The DP trading market promotes the reduction of greenhouse gas emissions. Its innovative contributions accelerate the transition towards clean energy, leading to greater societal emphasis on sustainable development. With the ongoing advancement of technology and the escalating societal demand for renewable energy, the DP trading market is anticipated to play an increasingly crucial role in constructing a sustainable and intelligent energy system.

According to the US Department of Energy plan, between 2010 and 2020, the installed capacity of distributed energy in the United States increased by 9.5 × 107 kW, accounting for 29% of the total installed capacity. In Germany, the installed capacity of distributed energy resources amounts to 7.5 × 107 kW, representing, ~47% of the total installed capacity. In Japan, distributed power generation relies on combined heat and power and solar photovoltaic systems, with a total installed capacity of approximately 3.6 × 107 kW, constituting 13.4% of the national power generation installation capacity. However, the development of the DP trading market in many emerging economies is still in its nascent stages, primarily attributed to the increasingly rational market mechanisms and the heightened regulatory demands that accompany the rising renewable energy penetration rate (Eid et al. 2016). Considering China as a case study, by October 2017, China’s National Development and Reform Commission (NDRC) and National Energy Administration (NEA) had jointly issued the “Notice on Launching a Pilot Distributed Power Trading Market”, promoting the DP trading market nationally. However, challenges such as unreasonable trading mechanisms, inadequate economic incentives, and the intrinsic characteristics of distributed power continue to hinder the progression of the DP trading market in China, keeping it in its nascent stage of development. There is an urgent need to optimize the mechanisms underlying the DP trading market and to promote the development of DP resources. The use of new technologies, such as blockchain, promises to address the challenges in the DP trading market to some extent. These advancements are anticipated to play a crucial role in optimizing the evolution of the DP trading market.

This paper aims to propose a novel mechanism for the DP trading market, termed the Hybrid Trading Model (HTM), which integrates blockchain technology to optimize DP transaction mechanisms in developing countries. The paper then conducts a case study on China to analyze the obstacles faced by the DP trading market, including transmission and distribution fees, regional administrative barriers, and other relevant factors. This study supplements existing research and offers robust policy implications for optimizing the DP markets in China and other countries. The potential contributions of this paper are as follows:

Firstly, this paper innovatively conceives the Hybrid Transaction Model (HTM) for a distributed power trading system, comprehensively accounting for the characteristics of distributed power generation, including high uncertainty, small-scale power generation, and limited trading incentives. This model serves as a foundation for promoting distributed power generation and introduces a novel paradigm and concept for transactions within the electric power market.

Secondly, the HTM’s distributed power generation trading mechanism integrates energy storage systems and establishes models for energy storage power trading. This study not only addresses gaps in existing research but also contributes significantly to the commercial development of energy storage technologies.

Thirdly, this paper examines China as a case study to analyze the impediments to developing distributed power markets, including unreasonable transmission and distribution costs, market segmentation, and other factors, while exploring possible solutions. The research findings offer policy insights and theoretical underpinning for the establishment of a scientific and rational distributed power trading market mechanism, as well as the construction of a unified power market.

The remainder of this paper is organized as follows: the section “Literature review and background” presents a literature review and background on the DP trading market. Section “The design of hybrid transaction model” delineates the model design of the HTM for DP resources. Section “Simulation results” furnishes simulation results of the DP trading utilizing the HTM. Section “Further study” delves into further analysis, using China as a case study to analyze the DP market’s obstacles and discuss potential improvements to “grid fees”. Section “Conclusion and policy implications” summarizes the main conclusions and policy implications of this study.

Literature review and background

The International Energy Agency (IEA), World Alliance for Decentralized Energy (WADE), and United States Department of Energy (DOE) have each provided summaries of the concept of distributed energy. Specifically, the IEA defines the following definition of distributed generation (DG) and distributed power (DP): DG refers to power stations that cater to local users or local grids, encompassing a variety of technologies such as internal combustion engines, small or micro gas turbines, fuel cells, and photovoltaic power generation systems (excluding wind power). DP, in turn, broadens this scope to include energy storage systems alongside DG. According to these definitions, the DP trading market inherently includes both decentralized electricity transactions and energy storage systems. However, there is a notable dearth of literature that concurrently investigates the DP trading market and energy storage. Research in this domain primarily focuses on models such as microgrids, virtual power plant (VPP) models, and peer-to-peer (P2P) transactions.

Microgrids model

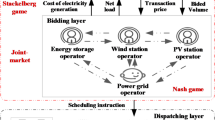

A Microgrid represents an autonomous power system, integrating multiple users and distributed energy sources to establish a closed-loop system encompassing “generation, grid, load, and storage”. Through the mediation of a microgrid aggregator, various microgrids engage in mutual transactions, offering compensated power services. Emerging as a novel organizational paradigm for power systems, microgrids consist of loads and distributed generation (DG), including renewable distributed energy sources, energy storage devices, residential consumers, and electric vehicle loads. When there is a surplus or deficit of electrical energy within a microgrid, direct trading with the distribution network is bypassed, and energy transactions are instead facilitated with neighboring microgrids, creating localized clusters of microgrid energy markets. By integrating a blockchain network as a communication channel for transaction entities, secure, transparent, and economically efficient distributed transactions can be achieved. Figure 1 illustrates the microgrid transaction mechanism, with the central icon depicting microgrid aggregators and the marginal icons representing DP consumers.

The concept of microgrids was initially introduced by the United States, which now holds a prominent position in microgrid research boasting over 200 demonstration projects. These US demonstration microgrids exhibit diversity in terms of investment entities, structural compositions, geographical distribution, and application scenarios, primarily aiming to enhance power supply reliability and provide grid support (Feng et al. 2018; Shi et al. 2022). Europe has also been an early pioneer in microgrid research and demonstration, with a strong practical orientation. Key directions in Europe encompass the large-scale integration of renewable energy sources, reducing pollutant emissions, and the development of smart grids (IqtiyaniIlham et al. 2017). Various demonstration microgrid projects have been implemented, including a 40-kW photovoltaic-powered grid-connected microgrid in central Berlin that supplies household electricity (Quitzow, 2023), and a Danish demonstration microgrid that provides power to island residents through a combination of wind power, diesel generators, and micro gas turbines.

VPP model

A virtual power plant (VPP) is essentially an intelligent operating system. Leveraging communication and control technologies, it integrates distributed energy sources, controllable loads, battery storage systems, and other components distributed in different geographical locations within the power system. By modulating the logical relationships between distributed energy sources and smart grids, the VPP efficiently transports electrical energy to end-users, thereby creating a comprehensive power plant with significant economic value. Notably, the VPP does not alter the grid connection of individual distributed energy sources but rather uses advanced software control and information communication technologies to unify distributed generators, controllable loads, battery storage systems, electric vehicles, and other devices. Its operational processes mirror traditional power plants. The transaction mechanism of the VPP model is shown in Fig. 2. The central icon denotes the information and communication integration center of the VPP model, and the marginal icons encompass electricity vehicles, storage systems, energy consumers, factories, and other entities (see Fig. 2).

Currently, research and implementation efforts in VPPs are focused on the United States and Europe. In the United States, VPP research focuses primarily on demand response plans and the optimal utilization of renewable energy. Conversely, European VPP research revolves around the reliable integration of decentralized generators and the functioning of electricity markets, where decentralized generators play a pivotal role as components of decentralized energy resources. The development of VPPs in European countries exhibits distinct characteristics (Moreno and Díaz, 2019). For example, the VPP developed by the Energy Centre of the Netherlands (ECN) uses electricity matching technology and determines market clearing prices through auctioneers acting as agents (Van Summeren et al. 2020). The Flexible Electricity Network to Integrate the Expected Energy Solution (FENIX) project, developed jointly by 20 research institutions in eight countries, including the UK, France, and Spain, aggregates substantial amounts of distributed power into a large-scale virtual power plant. To enhance the granularity and responsiveness of distributed power transactions, it adopts a hierarchical management mechanism (Tian et al. 2020). The Professional VPP project, a collaboration between Siemens and the RWE Group in Germany, aggregates small-scale distributed generators into a unified entity, exhibiting characteristics akin to a traditional power plant and creating new energy supply points for existing power companies. Furthermore, the EDISON (Electric Vehicles in a Distributed and Integrated Market Using Sustainable Energy and Open Networks) project, developed by seven research institutions from Denmark, Germany, and other countries, proposes two distinct VPP management architectures independent and integrated to address the grid connection challenges associated with electric vehicles.

Peer-to-peer model

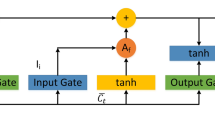

The peer-to-peer (P2P) model of DP resources represents a fully decentralized electricity market model. This P2P model creates a competitive energy market that circumvents monopolization by a few utility companies, benefiting small-scale energy producers and consumers (Mengelkamp et al. 2018). Several studies have delved into the P2P model of DP transactions. However, the development of this model requires addressing numerous technical challenges (Pressmair et al. 2021), including privacy and security issues arising from the bidirectional communication network, which can undermine the stability and reliability of the DP trading system. Blockchain technology is considered a promising solution for ensuring security and privacy in DP transactions (Swan, 2015), as it facilitates public contracts and transactions without compromising user security and privacy (Shahzad et al. 2024). The transaction mechanism of the P2P model with blockchain technology is illustrated in Fig. 3. Transactions among entities are conducted through blockchain accounts (see Fig. 3).

The American company LO3 Energy has developed the Exergy peer-to-peer energy trading platformFootnote 1, which is grounded in blockchain technology and has transitioned into commercial operation. On the prosumer user side, a smart meter uploads power supply and consumption data as tokens to the user’s blockchain account, enabling energy transactions on the Energy platform. Meanwhile, Tata Energy, an energy distribution company, has collaborated with technology firm company Power Ledger to initiate a P2P solar trading project in New DelhiFootnote 2.

Summary and comparison

Despite extensive exploration in the distributed power trading market through practice and research, several challenges remain: (1) inadequate consideration of the synchronization between trading and dispatching poses a problem. Distributed power trading and dispatching must adhere to the physical constraints of various power networks, optimizing dispatch while rigorously accounting for physical and energy flow limitations. Consequently, in practical scenarios, trading parties are constrained by energy transmission lines or pipelines, often resulting in a mismatch between actual trading contracts and secure dispatch. Therefore, the design of the energy trading system must incorporate interactions with dispatching. (2) the hierarchical grid access fee issue lacks sufficient attention, particularly in developing countries such as China. Grid companies can play a pivotal role in power transmission and distribution during trading. The collection of grid access fees should be determined based on the voltage level and power transmission distance of the transaction, encouraging distributed power trading to occur within smaller, more localized ranges, thereby promoting aggregator participation and enhancing market competitiveness. (3) the significant fluctuations, small generation capacity, and large quantities of distributed generation are not adequately addressed, posing obstacles to the widespread marketization of distributed power. Stimulating market vitality and encouraging greater participation in market-based trading by distributed generation represent critical issues that trading models must address.

Compared to existing transaction models, the HTM proposed in this paper offers four primary advantages. Firstly, HTM incorporates two layers of transaction markets, utilizing an aggregated transaction approach to mitigate the uncertainty risks associated with power generation. This approach addresses the impact of distributed power volatility on market-based transactions. Secondly, in contrast to traditional aggregators, which typically fulfill either a transaction facilitation or resource pooling role, this paper assigns them a dual function, incorporating both perspectives. This dual role not only enhances the market participation of small-scale users but also boosts market transaction efficiency. Thirdly, HTM integrates shared energy storage transactions into the DP trading market, considering the shared energy storage model. Users driven by their interests are likely to actively develop shared energy storage facilities actively, promoting the emergence of a shared energy storage trading model. Fourthly, HTM introduces an improved continuous double auction mechanism and a matching mechanism based on “credit priority, price priority, and time priority”. This ensures Pareto-optimal transaction outcomes while reducing the risk of transaction defaults.

The design of hybrid transaction model (HTM)

Model framework

Participants in the HTM market include residential users (and other small-scale consumers), aggregator companies, industrial and commercial users (including other large-scale consumers), and power companies. Both small consumers, such as residential users, and large consumers, such as factories, can have electricity generation and energy storage systems simultaneously. Aggregators primarily consolidate the transaction needs of distributed users and provide energy storage services.

Residential users

Residential users refer to individuals or families residing in residential areas. In the HTM model, they represent small distributed resource prosumers, as they are the primary generators and consumers of distributed power. In the general electricity market, residential users typically engage in transactions involving small-scale electricity demands. They are characterized by a large user base, relatively low individual load elasticity, and low electricity efficiency (Andersen et al. 2021). Consequently, residential users do not directly participate in power transactions; instead, they engage indirectly through aggregators.

Aggregator companies

Aggregator companies (referred to as “aggregators”) are entities that function as intermediary agents with a broader scope than traditional aggregators. While traditional aggregators are typically viewed as facilitators of transactions or poolers of resources. This paper assigns them a dual role encompassing both functions. On one hand, aggregators facilitate electricity trading by targeting numerous small private customers. Especially those with energy storage systems that can participate in short-term spot market transactions in the decentralized electricity market. Conversely, aggregators enter into shared energy storage agreements with other users by renting out their energy storage facilities to generate rental income, thereby establishing a business model focused on shared energy storage.

Industrial and commercial users

Industrial and commercial users refer to enterprises or institutions that operate commercially or industrially and require significant amounts of electricity. Their electricity demand typically exceeds those of residential users, making them important players in the electricity market due to the need to purchase larger quantities. To reduce electricity procurement costs, industrial and commercial users can participate in spot bidding transactions in the distributed power market or engage in shared energy storage business models. Their involvement in electricity transactions is essential for the smooth operation and development of the electricity market, positioning them as key participants.

Power companies

Power companies play a crucial role in the HTM by ensuring effective power transmission, maintaining a stable power supply, acting as a backstop for the market, and operating the trading platform. They are responsible for the efficient transmission of electricity in every transaction in the decentralized electricity market, as well as for monitoring and managing the power supply and promptly resolving any disruptions to ensure stability. As a backstop to the market, utilities can help meet unmet electricity needs or manage unsold power sources. Additionally, although the HTM focuses on distributed power trading, the trading platform maintained by power companies is essential, as it facilitates operations such as publishing transaction information, pricing, and verifying grid security, ensuring efficiency and security.

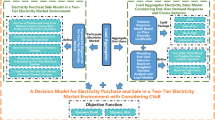

The HTM framework consists of two market layers (see Fig. 4). The first level layer includes the aggregation process, in which aggregator companies consolidate small distributed energy generation entities, such as residential distributed generation users. The second layer includes the power trading process involving aggregators and large power users, including factories, schools, and other large-scale consumers. The first-layer market underpins the second layer, while the second-layer market is the realization of the first. Aggregators acquire small-scale distributed power in the first tier, forming a large-scale power supply, that reduces barriers for small-scale distributed generators to participate in market transactions and prepares the ground for the second layer. In the second layer, transactions take place primarily between aggregators and large-scale power users, with the trading power of aggregators derived mainly from the first layer.

Transaction process of HTM

The first layer of transaction markets

The first layer of the HTM framework is the aggregation transaction market, which focuses on interactions between residential users and aggregators. Residential users generate electricity via distributed power systems, and initially cover their own energy needs (see Fig. 5). If this self-generated electricity is not enough, they have Choice 1: to either buy electricity from aggregators or use stored electricity from their energy storage facilities.

When residential users have surplus electricity after covering their consumption, they are faced with Choice 2: they can either store the excess in personal energy storage or sell it to aggregators. Prioritizing storage has the advantage of avoiding costly repurchases from aggregators during peak demand periods, thereby mitigating the financial impact of price differences between peak and trough prices. Although personal energy storage involves significant upfront costs, it optimizes load scheduling, reducing the long-term economic burden on residents, and improving overall grid stability.

Blockchain is intended to improve both the efficiency and reliability of electricity trading within the first layer of the HTM. Upon joining the power trading network, each residential user and aggregator undergo identity authentication, and details of their power generation and storage devices are securely uploaded to the blockchain. This process ensures the authenticity and traceability of data and creates a solid foundation for reliable transactions. Additionally, smart contracts automate transaction execution through predefined rules. For instance, when storage devices reach a certain capacity, any excess electricity is automatically sold to aggregators at a preset price, reducing the need for manual intervention and increasing transaction efficiency while ensuring fair pricing and trading conditions. Once the transaction is completed, blockchain technology immediately triggers settlement and securely transfers payments to residential users’ digital wallets. This enables fast, transparent, and secure financial flows with reduced transaction costs.

In the power trading process, the electricity purchased and sold by aggregators must be transmitted and distributed through power companies, with aggregators paying network fees based on voltage levels. The specific calculation of these fees varies depending on the region and is based on local regulations or power exchange guidelines. With their comprehensive power system design, construction, operation, and maintenance of energy systems as well as extensive technical expertise, power companies can efficiently manage transmission and distribution networks, ensuring stable and reliable power supply services. Since network charges are positively correlated with transmission distance, aggregators often choose to purchase electricity from nearby residential users to minimize transaction costs, following the “local transactions” principle.

The second layer of transaction markets

The second layer of the HTM is the terminal transaction market, which includes power transactions between industrial and commercial users and aggregators (see Fig. 6). Given the impact of cross-subsidies and similar factors, the price of electricity purchased by industrial and commercial consumers on the commercial market is expected to be lower than the price from power companies, as is the case in some developing countries such as China. Consequently, industrial and commercial users prioritize purchasing electricity from the distributed power market.

Industrial and commercial users have three choices. Choice 1: Industrial and commercial users can trade with aggregators in the DP market, and purchase electricity at a higher price during “peak demand periods” and at a lower price during the “valley demand period”. Choice 2: When storage capacity is insufficient, industrial and commercial users can store surplus power in aggregators’ storage devices. Choice 3: Industrial and commercial users can trade directly with each other within this market.

The distributed power trading model between industrial and commercial users (Choice 3) works similarly to peer-to-peer (P2P) trading within a microgrid. Buyers and sellers conduct power spot transactions via a blockchain-based smart contract system. Once a transaction is complete, power companies enable transmission and distribution services. In a balanced market, there is neither surplus power nor unmet demand. However, in cases of imbalance, power companies step in to either purchase untraded power or supply additional power to market participants. Industrial and commercial users can also earn dividends by investing in aggregators’ shared energy storage facilities.

In this model, smart contracts automate transactions instantly executing trades when predefined conditions are met, thereby reducing manual intervention and ensuring fairness. Blockchain technology further strengthens the trust of participants by ensuring the traceability and authenticity of each transaction. Additionally, it also streamlines the settlement process by recording transactions on a decentralized ledger, minimizing transaction costs and speeding up payments.

The energy storage transaction in HTM

Energy storage equipment is crucial for advancing renewable energy and significantly reducing carbon emissions (Jafari et al. 2020; De Sisternes et al. 2016). It improves the efficiency of distributed power generation, for example, solar home systems (Mallapragada et al. 2020; Charles et al. 2019). In distributed power markets, energy storage not only provides essential storage services but also helps address the grid challenges arising from large-scale renewable energy integration (Meng et al. 2024). However, energy storage operation is constrained by certain physical limitations and a high technical threshold. Therefore, the HTM framework includes energy storage transactions to support distributed power trading.

The energy storage transactions in HTM include two distinct models: the “investment and co-construction” model and the “storage leasing” model.

Investment and co-construction model

This model allows market participants to invest in the construction of large-scale energy storage facilities managed by aggregators. The main advantage is that investors receive ownership and usage rights, allowing them to store excess self-generated electricity when needed. However, the model requires a significant investment, which creates a higher entry threshold.

Storage leasing model

This model allows participants to enter into short or long-term contracts with owners of energy storage facilities, thereby providing access to storage without significant upfront costs, as participants only pay a rental fee. While this model lowers initial financial barriers, it limits usage flexibility and introduces risks due to price fluctuations in response to market supply and demand dynamics, particularly given the uncertainties in the distributed power market.

Price mechanism of HTM

Given the characteristics of the distributed power spot trading market—such as a large number of participants, small transaction volumes, and short trading cycles, resulting from the widespread adoption of distributed power sources. This paper proposes a mechanism tailored to distributed power spot trading, building on the existing medium—to long-term trading framework. Since grid stability requires a steady supply to meet demand in real-time, and the key challenges for renewable energy lie in quantification and price volatility (Boretti and Castelletto, 2021; Foley et al. 2020), spot power trading is proving to be a viable option as an optimal mechanism.

Firstly, acknowledging the similarities between distributed power spot trading and securities trading such as multiple participants, small transaction volumes, and short trading cycles. This paper introduces an innovative adaptation of the “continuous double auction (CDA)” mechanism from securities trading into the distributed power spot market. Building on the principle of simultaneous bidding by buyers and sellers, this improved CDA approach is proposed (see Fig. 7).

Secondly, this paper proposes a “credit priority, price priority, time priority” trading rule to address credit risk in distributed power trading. Participant creditworthiness will become a key factor in determining transaction matching as well as improving and expanding traditional double auction mechanisms. This approach aims to standardize trading behavior and thereby reduce risks in the distributed power spot market. Additionally, prioritizing price helps transactions achieve Pareto optimality, ensuring more efficient and balanced outcomes.

Transaction rules of DP spot trading mechanism

Transaction declaration rules

Buyers and sellers can change their offers at any time during the trading cycle. Before transactions are executed, utilities assess the risk of potential transaction blockages by analyzing power consumption and output on each branch. For branches where blockages may occur, they calculate the impact of each transaction and assign blockage prices accordingly, allowing users to adjust their offer information accordingly. At the same time, buyers and sellers specify the acceptable credit rating range of their potential trading partners to reflect their risk tolerance. Credit ratings, evaluated based on historical transaction data, are updated in real-time for each transaction.

Transaction matching rules

The matching of buyers \(i\) and sellers \(j\) must satisfy two conditions: the buyer price \({p}_{{\rm {b}}}^{i}\) must not be lower than the seller price \({p}_{{\rm {a}}}^{j}\) (\({p}_{{\rm {b}}}^{i}\ge {p}_{{\rm {a}}}^{j}\)), and the credit rating \({C}_{i}\) and \({C}_{j}\) must be mutually acceptable. Transaction matching then follows the order of credit priority, price priority, and time priority. Credit priority dictates that buyers with higher credit rating (\({C}_{i} > {C}_{k}\)) are matched before lower-rated buyers. If credit ratings are equal (\({C}_{i}={C}_{k}\)), price priority applies: the buyer with the higher bid price (\({p}_{{\rm {b}}}^{i}\ge {p}_{{\rm {b}}}^{k}\)) or the seller with the lower ask price (\({p}_{{\rm {a}}}^{j}\ge {p}_{{\rm {a}}}^{m}\)) takes precedence. If credit and price are identical, time priority applies, and the earlier bid or ask (based on submission time \(t\)) is prioritized (\({t}_{i} < {t}_{k}\)). Finally, the trading platform conducts a safety check to ensure that the auction results meet power flow constraints, (\({P}_{{{\rm {flow}}}}({V}_{i})\le {P}_{\max }\)). If these constraints are not satisfied, the transaction volume \({V}_{i}\) is adjusted, and the auction is rerun until the conditions are met.

Determination of transaction price rules

If the bid price for buying matches the asking price for selling, that price becomes the transaction price. If the bid price differs from the asking price, the transaction price will be set at the bid price favoring the higher-rated bidder. In cases where the bid and ask prices differ and both parties have the same credit rating, the transaction price will be determined by the bid of the party who submitted their quote first. The trading platform operated by power companies publishes buyers’ and sellers’ quotation information in real-time and updates the quotation sequence accordingly.

Distributed power transaction matching process

Both buyers and sellers submit their quotes, supply and demand quantities, and credit ratings for their intended trading partners to the power company’s trading platform. The platform then ranks the buyers’ quotes from highest to lowest and the sellers’ quotes from lowest to highest. Based on the input and output power of each branch, the platform assesses the potential for transaction blockages. For lines with potential blockages, it calculates the impact of each transaction and assigns blockage prices to the relevant users, who may then adjust their quotes accordingly.

During the trading period, the transaction conditions are deemed met if the highest bid price exceeds or equals the lowest ask price. Once these conditions are satisfied, the platform matches buyers and sellers according to their acceptable credit ranges, following the principles of credit priority, price priority, and time priority. Higher credit bidders are prioritized; if credit ratings are equal, the higher bid price for buying or the lower ask price for selling takes precedence. If both credit and price are identical, the platform prioritizes the earlier quote.

The transaction price is determined based on specific rules: if the highest bid price matches the lowest ask price, this price becomes the transaction price. If the bid and ask prices differ, the price favoring the higher credit bidder is selected. When credit ratings are equal and the bid and ask prices still differ, the transaction price is based on the party who submitted their quote first. After each round of transactions, the platform records the results, updating the remaining power supply and demand for the next trading round. If the supply still falls short of meeting demand after all power has been sold, buyers will purchase the deficit from the power company. Conversely, if sellers have surplus power after the round, they will sell the remaining electricity to the power company.

Simulation results

This section presents a case study of the price mechanism, assuming four levels of transaction credit: A–D (with A > B > C > D), involving 18 participants consisting of 9 buyers and 9 sellers. The transaction information for buyers and sellers is organized according to the “credit priority, price priority, time priority” rule (see Figs. 8 and 9).

The credit ratings of various participants and their intended trading credit ratings are summarized in Table 1. For instance, Buyer 1 has a credit rating of A and intends to trade with sellers who have a credit rating of either A or B. Consequently, the matched participants for Buyer 1 are Sellers 1 through 6.

The specific trading matching and price determination process is outlined as follows:

Step 1: Determine the matching parties

Based on the intended trading credit ratings submitted by users, matching begins according to the credit priority principle. Buyers are prioritized as Buyer 1 and Buyer 2, both of which have an A credit rating, while the prioritized sellers are Seller 1, Seller 2, and Seller 3, all with an A rating. Since multiple buyers and sellers have the same credit rating, the next criterion is price priority. Buyer 1 has a higher bid price than Buyer 2, so Buyer 1 takes precedence. Among sellers, Seller 1 and Seller 2 have lower ask prices than Seller 3, but both offer the same price. Therefore, the time priority principle comes into play: since Seller 1 submitted its declaration earlier than Seller 2, Seller 1 receives priority. Consequently, in the first round of trading matching, Buyer 1 is matched with Seller 1.

Step 2: Determine the transaction price

First, the platform checks whether the bid and ask prices of both parties are identical. It was found that the bid and ask prices for Buyer 1 and Seller 1 are not the same, so a direct transaction price determination is not possible. The credit priority principle is then applied: Buyer 1 and Seller 1 have the same credit rating, so the transaction price remains undetermined. Considering the time priority principle, since Buyer 1 submitted a declaration before Seller 1, the transaction is finalized for 0.87 yuan/kWh. As a result, Buyer 1 purchases 4000 kWh from Seller 1 at 0.87 Yuan/kWh, leaving Seller 1 with a surplus of 1000 kWh.

Step 3: Update transaction information and continue matching

The platform updates the transaction data and proceeds to the next round of trading matching. Using the same analytical approach, the results of the second round reveal that Buyer 2 purchases 1000 kWh of electricity from Seller 1 at 0.83 yuan/kWh. Following this, Buyer 2 buys an additional 2000 kWh from Seller 2 at the same price. Consequently, Seller 1 sells all their electricity, while Seller 2 retains a surplus of 1000 kWh.

Step 4: Update and continue matching

The platform again updates the transaction information and moves to the next round. There are currently no buyers in the market that fit Seller 2’s requirement that only buyers with an A credit rating trade with them. As a result, the trading platform matches Buyer 3 with Seller 3 for the third round. The outcome is that Buyer 3 purchases 2000 kWh of electricity from Seller 3 for 0.84 yuan/kWh, leaving Seller 3 with a surplus of 2000 kWh.

Step 5: Update and continue matching

After updating the transaction information, the platform moves to the fourth round of trading. Using the same analysis method, the results indicate that Buyer 4 purchases 2000 kWh from Seller 3 at 0.83 yuan/kWh. Buyer 4 proceeds by paying the same price to Seller 4 for 3000 kWh. Following these transactions, Seller 3 sells all of their electricity, while Seller 4 keeps the 2000 kWh that is left over.

Step 6: Update and continue matching

In the fifth round of trading, the platform updates the transaction information once more. Using the same analysis method, it is concluded that Buyer 5 pays 0.86 yuan/kWh to Seller 6 for 6000 kWh. After this transaction, Seller 6 has a remaining surplus of 1000 kWh.

The transaction results are summarized in Table 2, while Table 3 details any unmatched transaction demands. Even though some participants have bid prices below the lowest ask price, trade matching ends at this point because there are no market quotes that satisfy both price and credit criteria. Compared to other trading mechanisms, the distributed electricity spot trading mechanism is tailored to align with the diverse participant base, low transaction volumes, and short trading cycles characteristic of the distributed trading market. The mechanism offers four major advantages:

Enhanced information symmetry

Unlike the single-direction auction mechanism, the distributed electricity trading mechanism based on the improved continuous double auction (CDA) addresses the market information asymmetry between buyers and sellers. This improvement helps standardize quoting behaviors and reduce problems such as “speculation” and “malicious quoting” that often occur in one-sided auctions.

Reduced transaction costs

Compared to long-term electricity trading approaches, such as bilateral negotiations and centralized trading, the CDA-based mechanism reduces monopolistic power and lowers transaction costs, thereby meeting the different transaction needs of both parties.

Real-time market adaptability

The CDA mechanism enables real-time quote adjustments and allows participants to flexibly adapt to changes in market equilibrium prices. Transactions are executed instantly when matching quotes appear, improving transaction efficiency by bypassing time restrictions.

Enhanced risk control through credit assessment

Unlike standard bidirectional auction models, this paper’s mechanism integrates credit risk into transaction matching. By extending the “price priority, time priority” rules to “credit priority, price priority, time priority,” the proposed mechanism enforces credit assessment as a key matching criterion, helping to mitigate risks in distributed electricity trading and standardize participant behavior more effectively.

Further study

The obstacle to DP trading market development

This paper uses China as a case study to analyze the obstacles hindering the development of the DP trading market. The NDRC and the NEA of China have issued the “Notice on Launching a Pilot Distributed Power Trading Market”, to foster a nationwide DP trading market. However, despite these initiatives, the development of the DP trading market in China remains in its nascent stages due to several challenges:

Inadequate deviation assessment system

The current deviation assessment system in China is inadequate for market-based trading of distributed resources. According to existing standards, distributed power generation projects must tolerate deviations in their output of ~3% and compensate for any such discrepancies. With a monthly trading cycle, generators must anticipate and submit production plans well in advance. However, distributed photovoltaic power is highly susceptible to weather conditions (Feron et al. 2021), rendering medium- to long-term forecasts challenging and potentially resulting in economic losses for producers.

Unreasonable grid fee

In China, electricity companies are responsible for transmission and distribution tasks, for which they charge a fee known as the “grid fee”. In the realm of distributed power trading, numerous transactions take place within the same region and at lower voltage levels, which leads to grid fees that are not sufficient to cover the operational costs of grid companies. In addition, grid fee standards vary across regions, with some lacking transparency, which results from inconsistent cost burdens for distributed power systems in different areas.

Production constraints

From a production perspective, while energy storage devices can reduce the volatility of distributed power sources, their development is hampered by high costs and limited revenue models. Although storage can help stabilize generation and improve system stability, the significant capital and operating costs, along with a single source of revenue, pose significant challenges to market-based support.

Insufficient consumer incentives and undefined green power attributes

Renewable energy certificates (RECs), also known as “green certificates”, are crucial for promoting the development and use of renewable energy and increasing the market value of green power (Zhu et al. 2022). The pursuit of net-zero emissions depends on the growth of green energy market trading (Tiwari et al. 2024). Ensuring that distributed generation projects are appropriately endowed with green certificates and their environmental characteristics are described would not only facilitate increased consumption of renewable energy but also promote market-based trade. However, in China, the issuance of green certificates is currently restricted to centralized wind and solar projects, except electricity generated by distributed projects.

The improvement method of “grid fees”

Theoretically, grid fees should primarily cover the related costs associated with distribution facilities and cover the operational and maintenance expenditures incurred in market-based transactions in the area of distributed power generation. China has launched several concrete initiatives to address the problem of excessive network fees associated with decentralized electricity trading, particularly in Zhejiang and Jiangsu provinces. In Zhejiang, a pilot initiative is promoting the pooling of distributed energy resources, including solar and wind power, for participation in green electricity tradingFootnote 3. This strategy optimizes local energy utilization and diminishes grid fees. Conversely, Jiangsu has introduced market-oriented trading regulations aimed at strengthing transparency and equity, rationalizing over-grid fees, and incentivizing small-scale distributed power generationFootnote 4. These efforts support local energy consumption, increase efficiency, and reduce grid congestion.

In actual operation, the temporary assessment method for grid charges encounters several challenges: power grid transmission and distribution prices contain policy-driven cross-subsidies (including high-voltage to low-voltage electricity subsidies, as well as general industrial and commercial subsidies for agriculture and residential electricity). When the transmission and distribution prices of the two voltage levels are directly subtracted, these subsidies may be fully or even excessively offset (owing to the higher cross-subsidy burden at the high-voltage level is higher). Such a method of assessing grid fees hinders power grid companies from achieving their authorized revenue and impedes the progress of market-based transactions in distributed power. In evaluating power transmission and distribution prices, the objective should not be the complete elimination of cross-subsidies, but rather the gradual retention of only “effective cross-subsidies” (Lin and Liu, 2016). Consequently, this paper initiatives from the accounting mechanism of electricity transmission and distribution prices and proposes an optimization approach that involves “retaining reasonable electricity price cross-subsidies, withdrawing and reallocating unreasonable electricity price cross-subsidies”, thereby refining the grid fee assessment framework.

Step 1

The prevalent approach to quantifying cross-subsidization in electricity prices across regions, voltage levels, and consumption types is the price difference method. This method revolves around the benchmark price to calculate the magnitude and extent of cross-subsidies. The specific formula is outlined below:

Among Eqs. (1) and (2), \({{\rm{BT}}}_{i}\) is the subsidy amount of energy commodities, \({P}_{{{\rm {b}}i}}\) is the calculation base price, \({P}_{{{\rm {f}}i}}\) is the consumer price of terminal energy, \({E}_{i}\) is the energy consumption, \({D}_{i}\) is the degree of subsidy for electricity prices, and \(i\) is a specific energy source.

Step 2

Taking into account the regional context, electricity price cross-subsidies are categorized into reasonable electricity price cross-subsidies (such as subsidies for low-income groups and agricultural electricity) and unreasonable electricity price cross-subsidies (e.g., subsidies for high-income individuals). The reasonable cross-subsidies will be retained, and the unreasonable ones will be redistributed. The withdrawn unreasonable cross-subsidies will prioritize repayment to industrial and commercial users in underdeveloped areas of the province. At the same time, this process requires the fulfillment of the marginal criteria for the reimbursement of electricity price cross-subsidies to industrial and commercial users in these underdeveloped areas. Upon fulfilling these criteria, the remaining funds will be allocated to industrial and commercial users in developed areas of the province.

Step 3

Adjust the transmission and distribution prices, as well as the grid fees. After the elimination of inappropriate cross-subsidies for electricity prices, the transmission and distribution prices must be recalculated or adjusted by the actual remaining cross-subsidies. Subsequently, the collection of grid-connected fees should be optimized, adhering to the nationally approved power transmission and distribution prices, as outlined in Eq. (3).

In Eq. (3), \({{\rm {Fee}}}1\) denotes the transmission and distribution price corresponding to the voltage level that power users access. \({{\rm {Fee}}}2\) represents the highest voltage level transmission and distribution price involved in distributed power generation market transactions. \({{\rm{Grid}}{\rm{Fee}}}_{i}\) denotes the corrected grid fees.

Conclusion and policy implications

This paper proposes the Hybrid Trading Model (HTM) to enhance the efficiency of distributed power trading markets, accounting for the significant volatility, limited generation capacity, and vast number of distributed power sources. In this way, HTM aims to increase transaction efficiency and promote greater user engagement in the distributed electricity market. Additionally, the paper examines China as a case study to analyze the barrier to the DP market and then proposes improvements to the “grid fees”. Based on the key findings of this paper, the following policy implications are suggested:

Firstly, promote aggregator involvement in market transactions for distributed resources. Enable distributed resources to participate in transactions through aggregators, providing a risk-hedging mechanism against uncontrollable factors, such as natural phenomena. Establish a credit assessment framework based on power transactions to mitigate default risks during the trading process. Moreover, make use of technologies like blockchain and smart contracts to enable on-chain certification and transaction verification, which will improve the efficiency and security of market operations.

Secondly, establish shared energy storage systems to promote the participation of distributed energy storage in market transactions. These systems interconnect distributed power generation sources with energy storage devices, including both large-scale and decentralized storage facilities. This creates a platform on which storage units can provide market services.

Thirdly, expedite green certificate verification for distributed power sources by developing a robust data monitoring system. This system should accurately track the power generation of distributed power projects, and ensure accurate verification of green certificates by recording information, including power generation volume, generation time, and power source type. Furthermore, utilize blockchain technology to store pertinent data on-chain, to enhance the transparency of the green certificate verification process.

Data availability

Data will be made available on reasonable request.

Notes

References

Andersen FM, Gunkel PA, Jacobsen HK et al. (2021) Residential electricity consumption and household characteristics: an econometric analysis of Danish smart-meter data[J]. Energy Econ 100:105341

Boretti A, Castelletto S (2021) Techno-economic performances of future concentrating solar power plants in Australia [J]. Humanit Soc Sci Commun 8(1):1–10

Charles RG, Davies ML, Douglas P et al. (2019) Sustainable energy storage for solar home systems in rural sub-Saharan Africa—a comparative examination of lifecycle aspects of battery technologies for circular economy, with emphasis on the South African context[J]. Energy 166:1207–1215

Ding D (2022) The impacts of carbon pricing on the electricity market in Japan[J]. Humanit Soc Sci Commun 9(1):1–8

De Sisternes FJ, Jenkins JD, Botterud A (2016) The value of energy storage in decarbonizing the electricity sector[J]. Appl Energy 175:368–379

Eid C, Codani P, Perez Y et al. (2016) Managing electric flexibility from distributed energy resources: a review of incentives for market design[J]. Renew Sustain Energy Rev 64:237–247

Foley AM, McIlwaine N, Morrow DJ et al. (2020) A critical evaluation of grid stability and codes, energy storage and smart loads in power systems with wind generation[J]. Energy 205:117671

Feron S, Cordero RR, Damiani A et al. (2021) Climate change extremes and photovoltaic power output[J]. Nat Sustain 4(3):270–276

Feng W, Jin M, Liu X et al. (2018) A review of microgrid development in the United States—a decade of progress on policies, demonstrations, controls, and software tools[J]. Appl Energy 228:1656–1668

Guerrero J, Gebbran D, Mhanna S et al. (2020) Towards a transactive energy system for integration of distributed energy resources: home energy management, distributed optimal power flow, and peer-to-peer energy trading[J]. Renew Sustain Energy Rev 132:110000

Gilani MA, Kazemi A, Ghasemi M (2020) Distribution system resilience enhancement by microgrid formation considering distributed energy resources[J]. Energy 191:116442

IqtiyaniIlham N, Hasanuzzaman M, Hosenuzzaman M (2017) European smart grid prospects, policies, and challenges[J]. Renew Sustain Energy Rev 67:776–790

Jafari M, Korpås M, Botterud A (2020) Power system decarbonization: impacts of energy storage duration and interannual renewables variability[J]. Renew Energy 156:1171–1185

Lin B, Liu C(2016) China’s energy subsidy reform and effective energy subsidies J. Chin. Soc. Sci. 10:52–71 [In Chinese]

Mallapragada DS, Sepulveda NA, Jenkins JD (2020) Long-run system value of battery energy storage in future grids with increasing wind and solar generation[J]. Appl Energy 275:115390

Meng H, Jia H, Xu T et al. (2024) Trading mechanism of distributed shared energy storage system considering voltage regulation[J]. Appl Energy 374:123904

Moreno B, Díaz G (2019) The impact of virtual power plant technology composition on wholesale electricity prices: a comparative study of some European Union electricity markets[J]. Renew Sustain Energy Rev 99:100–108

Mengelkamp E, Gärttner J, Rock K et al. (2018) Designing microgrid energy markets: a case study: the Brooklyn microgrid[J]. Appl Energy 210:870–880

Mao J, Jafari M, Botterud A (2022) Planning low-carbon distributed power systems: evaluating the role of energy storage[J]. Energy 238:121668

Pressmair G, Kapassa E, Casado-Mansilla D et al. (2021) Overcoming barriers for the adoption of local energy and flexibility markets: a user-centric and hybrid model[J]. J Clean Prod 317:128323

Quitzow L (2023) Smart grids, smart households, smart neighborhoods–contested narratives of prosumage and decentralization in Berlin’s urban Energiewende[J]. Innovation 36(1):107–122

Roldán-Blay C, Escrivá-Escrivá G, Roldán-Porta C (2019) Improving the benefits of demand response participation in facilities with distributed energy resources[J]. Energy 169:710–718

Shahzad MF, Xu S, Lim WM et al. (2024) Cryptocurrency awareness, acceptance, and adoption: the role of trust as a cornerstone[J]. Humanit Soc Sci Commun 11(1):1–14

Swan M (2015) Blockchain: blueprint for a new economy. O’Reilly Media, Inc

Shi J, Ma L, Li C et al. (2022) A comprehensive review of standards for distributed energy resource grid-integration and microgrid[J]. Renew Sustain Energy Rev 170:112957

Tiwari S, Bashir S, Sarker T et al. (2024) Sustainable pathways for attaining net zero emissions in selected South Asian countries: role of green energy market and pricing[J]. Humanit Soc Sci Commun 11(1):1–13

Tian L, Cheng L, Guo J et al. (2020) A review of research on the management and interaction mechanism of virtual power plants for distributed energy [J]. Power Grid Technol 44(06):2097–2108. [In Chinese]

Van Summeren LFM, Wieczorek AJ, Bombaerts GJT et al. (2020) Community energy meets smart grids: reviewing goals, structure, and roles in Virtual Power Plants in Ireland, Belgium and the Netherlands[J]. Energy Res Soc Sci 63:101415

Yin S, Zhao Y (2024) An agent-based evolutionary system model of the transformation from building material industry (BMI) to green intelligent BMI under supply chain management[J]. Humanit Soc Sci Commun 11(1):1–15

Zia MF, Elbouchikhi E, Benbouzid M (2018) Microgrids energy management systems: a critical review on methods, solutions, and prospects[J]. Appl. Energy 222:1033–1055

Zhu Q, Chen X, Song M et al. (2022) Impacts of renewable electricity standard and Renewable Energy Certificates on renewable energy investments and carbon emissions[J]. J Environ Manag 306:114495

Acknowledgements

This work is supported by the Major Program of the National Fund of Philosophy and Social Science of China (No. 21&ZD109), National Natural Science Foundation of China (Nos. 72204098 and 72074186), the Major Project of Philosophy and Social Science Research in Colleges and Universities in Jiangsu Province (No. 2022SJZD147), the Youth Project of Social Science Foundation of Jiangsu Province (No. 22GLC018), Basic Scientific Center Project of National Science Foundation of China (No. 71988101), the Fundamental Research Funds for the Central Universities concerned Chinese modernization (No. 20720231061).

Author information

Authors and Affiliations

Contributions

Qianwen Li: Writing draft, formal analysis, methodology, revision, funding. Zhilong Chen: Writing draft, formal analysis, methodology, revision, supervision. Jialin Min: Writing—review and editing, revise. Mengjie Xu: Formal analysis, methodology, revision. Yanhong Zhan: Formal analysis, methodology, revision. Wenyue Zhang: Writing—review and editing, conceptualization. Chuanwang Sun: Funding, formal analysis, methodology, supervision.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Li, Q., Chen, Z., Min, J. et al. Hybrid transaction model for optimizing the distributed power trading market. Humanit Soc Sci Commun 11, 1473 (2024). https://doi.org/10.1057/s41599-024-04012-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-04012-2