Abstract

This paper introduces a contingent claim analysis to examine sustainable insurance practices. It investigates how life insurers participate in sustainable lending by financing borrowing firms committed to environmentally friendly practices for cleaner production. We establish a capped call option model, where the capped function explicitly considers credit risks associated with borrowing firms in a supply chain engaged in the cap-and-trade mechanism regulated by environmental policies. Our findings reveal that tightening the cap within the cap-and-trade system and reducing green loans can enhance insurer’s interest margins. Conversely, an escalation in the green input ratio across the supply chain may reduce these margins for the insurer. However, reducing low-margin insurance offerings could jeopardize the stability of insurance. The insurer faces financial challenges while supporting borrowing firms in their efforts toward carbon reduction and sustainable production. Notably, the substantial impact of climate change fueled by carbon emissions significantly influences the underwriting of life insurance policies related to human health. Policymakers need to navigate these intricacies to establish a careful balance between environmental objectives and the financial stability of sustainable insurance.

Similar content being viewed by others

Introduction

The advancement of a green environment, heavily reliant on green finance, faces challenges within the framework of the Global Green Agreement, which aligns with the Paris Agreement (Zhang and Wilson 2022). Cap-and-trade regulations, designed to mitigate carbon emissions, provide a platform for trading carbon allowances, fostering cleaner production in sustainable development. Hong and Guo (2019) and Yang et al. (2021) support this trading approach and emphasize the critical role of government subsidies as essential incentives for curbing carbon emissions. Production firms are increasingly motivated to adopt cleaner production methods, driven by a surge in environmental awareness among consumers (Hong and Guo, 2019) and a growing demand for reduced carbon footprints (Li et al. 2021). The motivations behind this transition reflect both a response to consumer preferences for environmentally conscious products and a strategic alignment given the rising global emphasis on sustainable practices.

Through this paper, we step into an underexplored realm. Our research underscores the crucial link between the willingness to transition toward sustainability and the acquisition of sustainable financing by borrowing firms’ production efforts for environmental improvements. Chiaramonte et al. (2020) highlight the scarcity of studies that delve into sustainability practices in the insurance industry despite its pivotal role as an institutional fund provider and risk mitigator in pursuing sustainability.

Our objective is to address the gap in the sustainable finance literature by examining how the sustainability practices of borrowing firms in a supply chain influence insurers’ decisions regarding green finance and, subsequently, their financial stability. This investigation seeks to illuminate the intricate connections between sustainable practices, financial decisions, and overall stability given the sustainability landscape of the insurance sector.

The significance of our paper’s objective becomes evident when considering the pressing consequences of environmental degradation and the imperative for a shift toward more sustainable environmental development. Life insurers, as significant institutional fund providers, have a substantial influence on steering the transition to a greener economy. Despite not being primary polluters such as production firms, insurers play a pivotal role in promoting ecological sustainability through their green finance initiatives.

Our focus is on understanding how life insurers, given their considerable lending capabilities, can strategically allocate funds to green borrowing firms in a supply chain. By doing so, insurers empower these manufacturers to engage in cleaner production methods, contributing to environmental improvements. The effectiveness of this contribution hinges on the borrowing firm’s adept implementation of sustainable strategies, including participation in cap-and-trade systems and thoughtful consideration of carbon footprints within the supply chain. In essence, our research underscores the paramount importance of insurers’ green fund-providing endeavors in fostering sustainable sustainability and recognizing the symbiotic relationship between insurers and borrowing firms in advancing cleaner production practices.

Many studies have argued that government subsidies are essential incentives for mitigating carbon emissions (e.g., Tsao et al. 2021; Zhang et al. 2022) and that the cap-and-trade system significantly impacts production firms’ planning of emission reduction strategies (Wang et al. 2018). These studies have commonly overlooked the significance of green finance in environmental improvements. Madaleno et al. (2022) demonstrate that the interconnection of ecological responsibility, green technology, sustainable energy, and green finance represents progress in sustainability. Thus, Golnaraghi (2018) argues that financial institutions may play a pivotal role in facilitating the scaling of socioeconomic resilience against physical risk and the shift toward a sustainable economy. Moreover, the government may intervene in cap-and-trade mechanisms with subsidies to curb carbon emissions (Yang et al. 2021). Regulatory pressure on green lending positively influences reductions in corporate carbon emissions (Wang et al. 2019). Green finance is also essential for achieving sustainable energy development goals through green innovation (Huang et al. 2022), funding technology (Madaleno et al. 2022), carbon taxes (Tong et al. 2022), and internal carbon pricing (Zhu et al. 2022).

Our research focuses on insurer green finance and considers the explicitly capped credit from borrowing firms, which employs the cap-and-trade mechanism and the green production supply chain to contribute to the green finance literature. Moreover, we contribute to the cap-and-trade literature by examining the capped credit risks associated with supply chain borrowing firms engaging in the trading of carbon permits through sustainable finance. This investigation is particularly relevant in a life insurance policy market that is imperfectly competitive and closely tied to human health. The rationale of this study is grounded in the observation that borrowing firms, characterized by an upstream–downstream technological structure, are subject to notable regulations for their involvement in the cap-and-trade mechanism. This involvement is aligned with sustainable insurance practices, contributing to the achievement of a net-zero objective.

In light of the previous work, we aim to develop a contingent claim option model to evaluate the equity value of the insurer. The contingent claim option captures the features of explicit credit treatment from the green borrowing firm through supply chain production. The insurer’s green finance also considers the impact of the green loan subsidy, the regulatory cap of the cap-and-trade mechanism, and the supply chain in the output production of borrowing firms on the insurer’s financial decisions and policyholder protection. Moreover, we assume that the life insurance policy market encountered by a large-scale insurer is characterized by imperfect competition, whereby the insurer acts as a guaranteed rate-setter (Hong and Seog 2018). The insurer aims to establish the optimal guaranteed rate to maximize the market value of equity. Therefore, the insurer’s lending function generates the greenness needed to model equity as a capped call option, in accordance with the framework established by Dermine and Lajeri (2001). This paper is the first to introduce green loan risk associated with borrowing-firm green practices in supply chain sustainability.

The primary contribution of the research is to model a capped call option to capture borrowing firms’ carbon reduction operations within a supply chain. The capped call values the fund-providing insurer’s equity. The optimal guaranteed rate determination considering the borrowing-firm features of green lending becomes crucial in the management of asset–liability matching. In this research, we bridge the manufacturing and financial sectors through green borrowing-lending in a supply chain when analyzing carbon emissions reductions for sustainability. Furthermore, a distinctive feature of this study is its exploration of a climate change policy involving regulatory carbon trading within the context of sustainable insurance. Consequently, the implicit enhancement in human health is considered through cap-and-trade policies integrated with sustainable finance.

Remarkably, one finding is that the diminishing regulatory cap of the cap-and-trade increases the insurer’s interest margin and contributes to policyholder protection. One immediate implication is that the insurer may be inclined to provide green funding to manufacturing firms because the stringent regulatory cap of green trading helps the insurer’s profitability and thus encourages green lending. We propose that the government subsidize insurers’ green financing to reduce borrowing-firm carbon emissions in the production process and achieve sustainable development. Moreover, recognizing implicit improvements in human health through cap-and-trade policies linked with sustainable finance suggests that policymakers should consider the broader implications of such frameworks. The findings highlight an opportunity for designing and implementing policies that not only address environmental concerns through carbon trading but also contribute to individuals’ well-being by aligning with sustainable insurance practices. Policymakers may benefit from exploring and promoting the synergy between environmental and health-related initiatives within regulatory frameworks to create more holistic and impactful policies.

The following is the structure of this paper. The subsequent part provides a literature review to establish the theoretical foundation for this study. Section “Research methods” introduces the assumptions and models of the fund-providing insurer’s objective via the valuation of the capped call option and considers the green operations of the borrowing firm. We further formulate the policyholder protection function to address the issue of insurance stability in light of the borrowing-firm’s modifications to its green sustainable development processes. Sections “Data”, “Empirical results”, and “Discussion” present the collected data, the empirical findings, and a commentary, respectively. The last part concludes the crucial results and suggests further research directions.

Literature review and theoretical background

We mainly review the related research strands, namely, green subsidies, cap-and-trade mechanisms, green supply chain production, and green finance, which pave the way for the development of the research model.

The first strand is the literature on green subsidies. Wang et al. (2014) show that mixed-subsidy policies (i.e., initial subsidies, research and development subsidies, production subsidies, and recycling subsidies) have stronger positive impacts on the promotion of remanufacturing compared to a single subsidy policy, although involve higher costs. Shi and Min (2015) demonstrate that a production subsidy is adequate for stimulating a more extended period of a remanufacturing system. Government green subsidies are effective at reducing carbon emissions (Yang et al. 2021). Li et al. (2021) indicate that the government typically subsidizes manufacturing firms to encourage green technology investments and carbon emissions reductions. Chen et al. (2022a, 2022b, 2022c) develop a two-sided market model to estimate the size of the green market for green subsidies with alternative goals. Chen et al. (2023) demonstrate that hybrid subsidies effectively balance the trade-offs between food quantity and quality. We indicate that the design of a green subsidy program may effectively and adaptably support food security and safety. Sun et al. (2024) find that green subsidies in China can reduce stock price crash risk by easing financing restrictions and improving investor sentiment, with effects varying based on firm characteristics. The above literature discusses government subsidies for manufacturing firms or investors but does not address the financial institution perspective.

The second strand is the cap-and-trade mechanism literature. Du et al. (2016) explore the influence of the carbon footprint and low-carbon preferences on the production choices of emission-dependent firms under cap-and-trade frameworks. Lin and Jia (2019) argue that the cap-and-trade system is an effective method for diminishing carbon emissions. Li et al. (2020) use the coal supply chain network and carbon emission policies as research objects. Hussain et al. (2020) focus on pricing behavior in a monopoly market and treat government subsidies as financial incentives for firms under the cap-and-trade system for reducing carbon emissions. Ding (2022) explores the correlation between wholesale electricity market prices and the carbon costs associated with nine areas in Japan, using the carbon cost pass-through rate as a critical metric. The discoveries from this investigation play a pivotal role in providing essential support for adjustments to carbon trading policies. Chen et al. (2022a, 2022b, 2022c) apply a difference-in-difference method to study the environmental and financial impacts of pilot policies. Ivanov et al. (2024) show that cap-and-trade policies lead banks to offer shorter loan maturities, less long-term financing, and higher interest rates to affected firms, primarily impacting private companies. Banks quickly adjust their exposure to climate policy risks through loan renegotiation. Xu et al. (2024) highlight several research deficiencies and prospective avenues in the field, including the need to consider uncertain factors, explore new coordination contracts, incorporate emerging technologies, and employ more diverse research methodologies beyond mathematical modeling.

The third strand of the recent literature concerns the supply chain. Recently, the literature has paid considerable attention to supply chain coordination with government financial subsidies (e.g., Li et al. 2018; Safarzadeh and Rasti-Barzoki 2019; Li et al. 2021). Li et al. (2021) examine the impact of government subsidies on the coordination of green markets and the investment of green technologies in a supply chain that operates under a cap-and-trade system. Winkler et al. (2022) find that high uncertainty disrupts the decommissioning of the planning and preparation supply chain. Sarfraz et al. (2023) explore the impact of sustainable supply chain strategies affect competitive advantages by considering the adoption of blockchain technology and the roles of digital transformation and sustainable practices. Their findings highlight the importance of firms adopting sustainability, advanced technology, and transformative practices for maintaining competitiveness in dynamic markets. Herrador-Alcaide et al. (2023) connect barriers to green supply chain development with empirical green banking research and its core themes. Forghani et al. (2023) develop a multiperiod hydrogen supply chain model using pipeline transportation and test the trade-off between costs and carbon emissions. Terlouw et al. (2024) analyze large-scale hydrogen economies, finding that renewable electrolytic production has lower emissions but still significant environmental impacts. It identifies mismatches between production and demand across continents and potential resource limitations.

The fourth strand of the recent literature involves green finance in facilitating sustainable development. Qian et al. (2023) find that a preference for green bonds significantly influences sustainable investments in exhibition industry companies. Sun et al. (2023) suggest tailored policies for a cleaner environment and emphasize the impact of green financing in the eastern and western provinces. Policymakers should incentivize the East and adopt a balanced approach in the central region for faster sustainable development in China. Ulpiani et al. (2023) highlight cities’ crucial role in emission-free futures but identify financial constraints as a hurdle. They stress the need to address diverse financial readiness levels and institutional maturity for effective climate financing at the city level. Li et al. (2024) reveal a non-linear correlation between digital inclusive finance and agricultural greenhouse gas output in China, identifying depth of usage and digitization as critical determinants in mitigating emissions. Another research shows green finance positively impacts regional green innovation in China, particularly in certain technologies, with effects influenced by environmental supervision levels and exhibiting spatial spill-over effects (Li et al. 2024). The literature reviewed consistently explores the impact of green financing preferences on sustainable investments, addressing challenges and opportunities in fostering a cleaner environment. Notably, discussions on the topic of sustainable insurance are lacking.

The literature commonly overlooks financial behavior when analyzing environmental policies. We aim to address this gap by delving into insurers’ guaranteed rate-setting behavior concerning sustainable insurance. Specifically, the credit risk of borrowing firms is capped explicitly and intertwined with the determination of the guaranteed rate when engaging in green lending to achieve a net-zero emission target. What sets our model apart from previous studies is our focus on green initiatives within an insurer-borrowing firm dynamic, where the insurer acts as a provider of green funds supported by government subsidies. In our research, we investigate the impact of green lending subsidies, cap-and-trade schemes, the production supply chain, and green finance on insurers’ interest margins and policyholder protection. The goal is to make meaningful contributions to sustainable finance in the realms of climate, energy conservation, and environmental policies.

Research methods

Conceptual framework

In a one-period sustainable insurance model for contingent claim analysis, three firms play distinct roles. The input-providing firm exclusively meets the derived demand for output production from the borrowing firm. Important to note is that the input-providing firm operates independently of the funds provided by the insurer, whereas the output-providing firm relies on such funds. Together, the borrowing firm and its input provider form a simple supply chain echelon.Footnote 1 Life insurance policyholders mainly finance the insurer’s investment.

The insurer manages a loan portfolio comprising both green and conventional loans for sustainable insurance purposes. Green loans involve government subsidies aimed at reducing carbon emissions. To qualify for a green loan, the borrowing firm and its input provider must act as carbon allowance suppliers in the cap-and-trade mechanism. This requirement underscores a commitment to reducing the carbon footprint and aligning with the objective of attaining net-zero emissions for human health in the context of climate change.

An insurer’s coordination with the supply chain in green finance contributes significantly to carbon emissions reductions, as highlighted by Yang et al. (2021). This finance coordination establishes a carbon footprint structure essential for the development of sustainable insurance. The contractual advantage of green loans may incentivize firms that are otherwise hesitant to invest effort and costs in environmentally friendly practices, particularly those not typically subject to emission control regulations (Hong and Guo 2019).

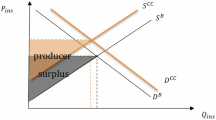

Overall, the one-period sustainable insurance model involves three firms: an input-providing firm supplying the borrowing firm’s derived demand and an insurer offering green and conventional loans. While the input provider operates independently, the borrowing firm relies on insurer funds. With government subsidies, green loans require firms to act as carbon allowance suppliers, aligning with net-zero emission goals. Insurer-supply chain coordination enhances carbon emissions reductions, establishing a crucial carbon footprint structure for sustainable insurance. Figure 1 shows the conceptual theoretical structure as follows.

Theoretical structure

Consider a one-period model (\(t\in [0,1]\)). At t = 0, the balance sheets are:

The insurer’s balance sheet in Eq. (1) represents life insurance policies (\(L=\alpha ({A}_{G}+{A}_{C}+B)\) where 0 < α < 1 = leverage) and capital (\(K=(1-\alpha )({A}_{G}+{A}_{C}+B)\)) to finance green loans (\({A}_{G}\)), conventional loans (\({A}_{C}\)), and liquid assets (B). The insurer’s asset portfolio comprises three assets to reflect a more realistic market for green finance. For simplicity, the leverage ratio applies to all investments equally. In Eq. (2), the output production firm uses green loans borrowed from the insurer and its capital (\({K}_{O}\)) to fund the output production investment (\({A}_{O}\)). Let the output production consist of materials purchased from the green input provider (\(\beta ({A}_{G}+{K}_{O})\)) and the operative costs for the output production (\((1-\beta )({A}_{G}+{K}_{O})\)). In Eq. (3), the input-providing firm uses its liabilities (\({L}_{I}=\beta {A}_{O}=\beta ({A}_{G}+{K}_{O})\)) and capital (\({K}_{I}\)) to fund material production (\({A}_{I}\)). The balance sheet of the output production borrowing firm includes an item for eco-friendly loans obtained from the insurer. The balance sheet of the input provider also consists of the output production firm’s cost distribution choices (β), capital (\({K}_{O}\)), and green loans (\({A}_{G}\)). Thus, the three linked balance sheets pave the way for this research.

In this article, we employ a capped call option framework to evaluate the insurer’s equity (Dermine and Lajeri 2001). The “capped” feature captures directly the definitive treatment of credit risk from the output production firm and indirectly from the input-providing firms due to green loan contract constraints. A green contract requires that both firms, constituting a simple supply chain echelon, play the role of carbon allowance sellers within the emissions trading framework (Jiang et al. 2019). The government regulates the cap to mitigate carbon emissions for sustainable energy and enhance environmental quality. Then, we can first describe the expected investment returns of the borrowing firm and its input provider:

Equation (4) demonstrates the expected returns from the output production borrowing-firm’s investments (\({V}_{O}\)). The returns include two sources: the expected repayments from the investment (\((1+{R}_{O}){A}_{O}=(1+{R}_{O})({A}_{G}+{K}_{O})\), where RO is the market rate of returns) and the selling allowance revenues in the cap-and-trade system (\((g-{g}_{O})({A}_{G}+{K}_{O})\), where the regulatory cap (g) is greater than the output production firm’s marginal cost of carbon emissions (\({g}_{O}\))). The same pattern as Eq. (4) applies to Eq. (5), where AI = expected returns from the input provider, RI = market rate of return, gI = input provider’s marginal cost of carbon emissions, and \(g\, > \,{g}_{I}\). The term \(\beta ({A}_{G}+{K}_{O})\) explains that the input is only a portion of the output production.

Objective function: equity valuation

Here, the research models the insurer’s equity, which consists of a capped call option to meet the green lending contract requirements and one standard call for the rest, as shown in the balance sheets. First, the capped call option (\(CC({V}_{I},\theta Z)\)) is the value of a call on the input provider’s assets (\({V}_{I}\)) at a strike price (\(\theta Z\)) of the insurer’s obligations net of the call given to the same \({V}_{I}\) at a strike price (\(\beta (1+{R}_{G}){A}_{G}\), where RG = green loan rate) of the insurer’s green investment returns. The net call option denotes the loss in value from the cap. The market value of the input provider’s underlying assets are subject to a geometric Brownian motion:

where the underlying assets (\({V}_{I}\)) are associated with an instantaneous drift (\({\mu }_{I}\)) and instantaneous volatility (\({\sigma }_{I}\)). The standard Wiener process is \({W}_{I}\). The strike price is:

where

and where \({R}_{G}={R}_{C}-{R}_{S}=\) green loan rate, RC = conventional loan rate, RS = subsidy rate for green lending, RB = liquid-asset interest rate, R = guaranteed rate of the profit-sharing life insurance policy, and Z = guaranteed payoffs to policyholders net of the repayments from liquid-asset investments. Moreover, we assume that the insurer faces an imperfectly competitive life insurance market (Hong and Seog 2018). The determination of the guaranteed rate becomes crucial for equity maximization. Thus, we have:

where

and where δ = participation level of the life insurance policy, and \(N(\cdot )=\) cumulative density function of the standard normal distribution. The second and last terms \([\cdot ]\) represent the loss in value from the cap.

Next, we apply Merton (1974) and view equity as an asset-based call option. The option’s strike price corresponds to the liability book value. When asset value falls below the strike price, equity value equals zero. The call option is:

where

and where the underlying assets (V) have an instantaneous drift (μ), volatility (σ), and a standard Wiener process (W).

Accordingly, we have the market value of the insurer’s equity value:

In Eq. (10), the first term on the right-hand side is the equity value from investment returns based on the green lending contract. The second term is the equity value from convention-loan and liquid-asset investment returns.

Liability function: policyholder protection

Given information on the insurer’s equity in Eq. (10), the policyholder protection consists of liabilities from \(CC({V}_{I},\theta Z)\) and \(C(V,Z)\). We apply Dermine and Lajeri (2001) to state the policyholder protection for the former term as follows:

The value of the liabilities resembles put options in existing literature, with the exception that the underlying asset is one of the input providers rather than the insurer. The policyholder protection for the latter term is as follows:

The value of the liabilities is similar to the put options based on Eq. (9). Thus, we have total liabilities as follows:

The first term on the right-hand side is the policyholder protection from the insurer’s lending required by the green lending contract. The second term of policyholder protection comes from conventional and liquid-asset investments.

Solution and comparative statistics

Partially differentiating Eq. (10) concerning the guaranteed rate, the first-order condition is as follows:

where the second-order condition is required, i.e., \({\partial }^{2}S/\partial {R}^{2} < 0\). We obtain the optimal guaranteed rate, where the marginal equity return of the guaranteed rate equals zero.

We consider the impact on the guaranteed rate (and thus on the insurer’s interest margin, i.e., the spread between the market liquidity rate (\({R}_{B}\)) and the optimal guaranteed rate (\(R\))) from changes in the regulatory cap (\(g\)), the subsidy rate for green loans (\({R}_{S}\)), green loans (\({A}_{G}\)), and the green input ratio (\(\beta\)). An implicit differentiation of Eq. (14) concerning i = g, \({R}_{S}\), \({A}_{G}\), and \(\beta\) yields:

Furthermore, we can differentiate the policyholder protection with changes in the four parameters above evaluated at the optimal guaranteed rate as follows:

Let the term \(dP/di\) be the total effect. The equation’s first right-hand term represents the direct effect, assuming a fixed optimal guaranteed rate. The subsequent term captures the indirect effect, reflecting how parameter changes influence policyholder protection through adjustments in the optimal guaranteed rate.

In the methodology section, we formulate a theoretical model that incorporates the insurer’s equity and liability functions through a capped call option. To maximize equity, we derive two sets of comparative static outcomes. These theoretical outcomes illustrate the effects on the guaranteed rate (Eq. 15) and policyholder protection (Eq. 16) resulting from changes in the regulatory cap, government green subsidies, green lending, and green input ratio within a supply chain. Furthermore, we subject the comparative static results related to the regulatory cap issue to a robustness test. The ensuing section provides an exposition of the underlying rationale.

Data

The data are collected from the literature, websites, imputations, and assumptions when conducting the numerical exercises. We define a set of baselines as follows:

(i) The insurer encounters a supply curve for life insurance policies that is upward-sloping. The insurer offers a 3.25% guaranteed rate, according to Holsboer (2000). Here, we assume the supply locus from (R(%), L) = (2.50, 307), (2.75, 323), (3.00, 334), (3.25, 341), (3.50, 345), (3.75, 347), to (4.00, 348).

(ii) The participation rate is δ = 0.85, and the leverage is α = 0.70 (Briys and De Varenne 1994).

(iii) Cui et al. (2018) report that the mean ratio of green loans to total loans in China was 2.30% in 2009 and 4.80% in 2015. China’s State Council reports that green loans rapidly grow in 2021, jumping 33% from 2020.Footnote 2 We assume that the average growth ratio of green loans to total loans per year from 2015 to 2021 is 33%. Thus, we obtain a percentage equal to 26.57 in 2021. Accordingly, we assume that \({A}_{G}=341\times 26.57 \% =90.60\) and \({A}_{C}=341\times (1-26.57 \% )=250.40\) when \(R( \% )=3.25\). Wyman and Insurance Europe (2013) report that the ratio of government bonds to insurers’ total assets in 2011 was ~8%. We have \(B/(341+B)=28 \%\); hence, \(B=132.61\).

(iv) Chou and Wang (2007) report that the riskless rate (\({R}_{B}\)) ranges from a minimum of 1.32% to a maximum of 7.37%. The model assumes \({R}_{B}=(1.32 \% +7.37 \% )/2=4.35 \%\). The interest rate on the conventional loan is \({R}_{C}=4.75 \%\). The green loan rate is \({R}_{G}={R}_{C}-{R}_{S}=4.75 \% -0.45 \% =4.30 \%\), which is \({R}_{S}=0.45 \%\) (Li et al. 2021). Tan et al. (2020) report investment return rates ranging from −0.98% to 8.30%, with a 1.60% standard deviation. For our analysis, we posit that the investment return rate from the output production borrowing firm is \({R}_{O}=8.30 \% -2\times 1.60 \% =5.10 \%\). For simplicity, the investment return rate for the input provider is \({R}_{I}={R}_{O}=5.10 \%\).

(v) We have mentioned \({A}_{G}=90.60\). The average leverage ratio of productive firms is ~26.10%, with a standard deviation of 16.06%. Manufacturing companies exhibit an average leverage ratio of about 26.10%, with a 16.06% standard deviation (Trinks et al. 2020). We have \({K}_{O}=32.00\); hence, we obtain \({A}_{O}=122.60\). In addition, we assume \({L}_{I}=\beta {A}_{O}=61.30\) with \(\beta =0.50\). This assumption demonstrates that the ratio of the materials used relative to the output production is 0.50. Given the leverage ratio, \({K}_{I}=21.65\); thus, we can obtain \({A}_{I}=82.95\).

(vi) Research by Narassimhan et al. (2018) reveals cap-and-trade compliance costs of $72,440 per installation, with $2750 in administrative expenses. They note an annual cap stringency reduction of 2.20%. The rate (2750/72,440 = 3.80%) implies that carbon emission allowances are purchased for production permission with a regulatory cap of g = 2.20%. In the model, we assume a carbon-neutral case of the cap-and-trade scheme. Thus, we can express \({g}_{O}=0.60 \% =2.20 \% -(3.80 \% -2.20 \% )\). Since the supply chain is green, we use the term \({g}_{O}={g}_{I}=0.60 \%\) for simplicity.

(vii) Brockman and Turtle (2003) estimate asset volatility using 40-quarter market valuations. Their findings show a mean volatility of 29.04%, with a 26.08% standard deviation. In our model, we assume that \(\sigma ={\sigma }_{O}={\sigma }_{I}=24.10 \%\).

We summarize the data baseline in Table 1.

Empirical results

The literature has embraced numerical exercises as an analytical tool. This approach’s main advantage is its explicit handling of numerical complexity, facilitating the resolution of problems. In our study, we employ a numerical method to assess the empirical results for the impacts on guaranteed rates and policyholder protection. These findings can contribute to the evaluation of environmental policies through the lens of insurance sustainability.

Effect on an optimal guaranteed rate

First, we analyze the effect of the stringent regulatory cap of the cap-and-trade system on the optimal guaranteed rate at various green input ratio values.

Table 2 illustrates that reducing the regulatory cap decreases the optimal guaranteed rate. Consequently, this enhances the insurer’s interest margin, representing the difference between the market rate of investment returns and the optimal guaranteed rate. The significance of this increased margin becomes more pronounced as the utilization of green input in comparison to green output production increases. The results are explained as follows.

As the regulatory authority imposes stricter caps within the cap-and-trade system, the firm engaged in output production and borrowing must align with a more cost-oriented approach to ensure environmental sustainability. This heightened level of regulatory enforcement translates into an increased financial burden for the firm. To counterbalance this, the insurer may seek to enhance the revenue stream by reallocating investments from riskier asset portfolios to more liquid assets. This strategic shift led to reduced life policy offerings with a lower guaranteed rate. This decrease in liabilities enhances insurers’ optimal interest margins, facilitating more effective asset–liability management. A stringent regulatory cap can dissuade borrowing firms from actively participating in initiatives to promote cleaner production for sustainable development when supported by green insurer finance. However, worth noting is that green finance strategies can increase the insurer’s interest margin, ceteris paribus.

Furthermore, when the green production supply chain experiences higher demand, signified by a substantial use of green input in the production process, the previously mentioned increase in margin becomes less pronounced. This observation leads us to propose that strict emissions limits and a robust eco-friendly production supply chain are mutually reinforcing factors when viewed from the insurer’s profitability standpoint. This proposition adds value to the existing literature on cleaner production for sustainable energy development by establishing a pivotal connection between insurer-driven green finance initiatives and the operational dynamics of the green production supply chain.

Government green subsidies promote insurer-based green financing and indirectly bolster green borrowers by amplifying input demand through insurer intermediation, thereby supporting subsidized output production firms. The relationship between higher government incentive rates and optimal assured returns adds complexity to our findings. This nuanced interaction requires careful consideration in policy analysis. This uncertainty stems from the prospect that insurers might strategically adjust their asset allocation to optimize returns without always necessitating an increase in funding sources, such as life insurance policies. This dynamic nature renders the behavior of guaranteed rate setting less straightforward. To provide a more compelling analysis, additional considerations specific to the intricacies of green finance are imperative, expanding our understanding beyond the confines of the current model (Table 3).

Table 4 highlights a pivotal discovery: as insurers augment their allocation toward green loans, there is a simultaneous escalation in the guaranteed rate provided by life insurance policies. In essence, while the insurer contributes to curbing carbon emissions by expanding green loans, this sustainability commitment results in decreased profit margins. The reduction in profits acts as a tangible consequence of a spill-over effect stemming from the actions of the insurer’s borrowing firms. This argument signifies a complex trade-off wherein the pursuit of environmentally beneficial practices intersects with the financial landscape, potentially impacting the insurer’s bottom line.

A high green input ratio, as indicated by Table 5, signifies that the insurer’s green loan contracts involve a substantial commitment to green production by the borrowing firm. Such contracts could be aptly characterized as “robust green finance,” given their emphasis on bolstering green production through the increased utilization of green inputs. Notably, the data reveal that the pursuit of robust green finance incentivizes insurers to extend life insurance policies at a higher guaranteed rate. However, this expansion leads to narrower interest margins for insurance providers.

This finding underscores a pivotal dynamic: while insurer green finance significantly advances environmental protection through fostering robust green finance contracts, it simultaneously imposes a financial burden on the insurer. The intersection of environmental responsibility and financial viability is evident, posing challenges that demand strategic consideration for insurers navigating the complexities of green finance.

Effect on policyholder protection

We investigate the effect of the stringent regulatory cap on policyholder protection by considering various green input ratio values in a supply chain.

Delving into liability is essential, particularly policyholder protection, as presented in Tables 6 and 7. Two aspects must be considered. First, the regulatory cap directly influences policyholder protection, assuming that the optimal guaranteed rate fixed. This direct impact is negative, indicating that stricter emissions limits diminishes policyholder protection. This decrease is intuitive, as a lower cap discourages carbon emission reductions by both the output production borrowing firm and the input-providing firm within the supply chain, as outlined in the insurer’s green loan contracts. These reductions run counter to the intended goals of green loan contracts, consequently diminishing policyholder protection. Second, an indirect effect considers how regulations affect policyholder safeguards while considering potential modifications to the optimal guaranteed rate. This indirect effect proves positive. As noted earlier, reduced emissions caps drive higher guaranteed rate, resulting in enhanced returns from investments in green lending, ultimately bolstering revenues. These increased revenues contribute positively to policyholder protection. A positive indirect effect effectively counterbalances the negative direct impact, leading to a net beneficial outcome. In summary, we conclude that stricter emissions trading limits enhance policyholder protection. Our research findings support the argument proposed by Lin and Jia (2019), affirming the efficacy of the cap-and-trade scheme as a regulatory mechanism for carbon emissions.

As highlighted in Table 7, the consequences of adjusting environmental subsidy on optimal guaranteed rate are not straightforward to discern. This complexity extends to the qualitative assessment of its effects on policyholder protection, making the overall impact somewhat elusive. In this context, it is important to note that policyholder protection is closely tied to the insurer’s liabilities. The insurer’s capacity to fulfill its obligations to policyholders relies on several factors, including the amount of premiums collected, investment returns, and the guaranteed rates offered. However, due to the uncertainty surrounding the effects of changes in the green subsidy, the insurer lacks a clear and consistent strategy for setting these guaranteed rates. This ambiguity in guaranteed rate-setting decisions creates a challenge in issuing life insurance policies. Policyholders and potential customers may find it difficult to assess the terms and benefits of these policies, given the lack of a predictable pattern in rate adjustments. In turn, this result can affect the insurer’s reputation and competitiveness in the market.

Insurer involvement in green lending is a pivotal aspect of green finance. Tables 8 offers insights into the effects of insurer-designed green loan contracts on policyholder protection. First, the direct effect reveals that increasing green loans while holding the guaranteed rate constant contributes positively to policyholder protection. This result indicates that green finance is crucial for providing financial resources to borrowing firms, facilitating their effective reduction of carbon emissions in production processes. Second, the indirect effect further strengthens this positive impact. As green loans increase, they also result in a higher guaranteed rate, as mentioned previously. This elevated guaranteed rate translates into increased life insurance policies and higher total liabilities. This alignment between assets and liabilities enhances policyholder protection.

The direct and indirect effects create a comprehensive and positive overall impact. Green loans safeguard policyholders, promoting stability within the insurance industry. Our findings underscore the importance of well-designed green lending contracts in facilitating carbon emission reductions by borrowing firms while ensuring insurance stability. However, this comes at the cost of reducing narrower interest margins for insurers. These findings correspond with observations documented by Chiaramonte et al. (2020), affirming the compatibility of our findings with their comprehensive analysis.

In the scenario described, the output production firm secures green loans from the insurer to support its production activities. Subsequently, the output production firm opts to incorporate more green inputs into its production processes. It is crucial to note that increased green input utilization negatively affects policyholder protection when the optimal guaranteed rate stays fixed (termed the “direct effect” in our model). As shown in Table 9, the insurer allocates its green loans to a production firm that, due to the increased use of green inputs, exhibits a less favorable input portfolio allocation in terms of feasibility. This unfavorable allocation ultimately compromises policyholder protection within efficient asset–liability matching management.

On a positive note, as previously mentioned, an increase in the green input ratio contributes positively to the optimal guaranteed rate. This, in turn, results in stronger policyholder protection. In a broader context, the insurer’s strategic approach involves designing green loan contracts that encourage output production borrowing firms to employ green inputs for more efficient carbon emission reductions. This form of green finance, facilitated by the insurer, actively promotes efforts to reduce carbon emissions. Hence, policyholders derive substantial protection from the effective asset–liability management employed in green finance investments, enhancing insurance sector stability. These findings align with and receive validation from research presented by Chen et al. (2022b).

Discussion

Expanding on the environmental policy issue is imperative in light of the results uncovered in the preceding section, outlined as follows.

Our analysis shows that stricter emissions trading caps lead to lower assured returns (thus widening interest margins) while initially reducing policyholder protection. While the heightened interest margin supports a rigorous cap for attaining carbon emission reduction goals, the diminished policyholder protection (and subsequent decrease in insurance stability) acts as a deterrent to the stringent cap. Consequently, the environmental policy of enforcing strict emissions limits poses a dilemma, balancing insurance sector profitability against operational stability. A crucial policy implication is the importance of balancing a stringent cap for carbon emissions reductions with adequate policyholder protection and insurance stability. Policymakers should carefully consider this interplay to avoid dilemmas in insurance profitability or stability, emphasizing the need for comprehensive policy designs that reconcile environmental objectives with the stability of sustainable insurance mechanisms.

Second, the impact of government-issued green loan subsidies on the insurer’s interest margin and insurance stability remains uncertain. The impact hinges on the net position of subsidies and liabilities, which is essential for effective asset–liability matching management. Consequently, the environmental policy surrounding green loan subsidies may not necessarily foster sustainable insurance. We suggest that balancing subsidies and liabilities is crucial for sustainable insurance, and a cautious, well-informed policy stance can promote environmentally conscious financial practices without jeopardizing insurance sector stability.

Third, we demonstrate that the escalation of green loans in support of sustainable insurance leads to a reduction in the interest margin while concurrently enhancing insurance stability. A management implication is that insurance companies should integrate green loans strategically for sustainability despite a potential reduction in the interest margin. This implication necessitates proactive risk management and innovative financial strategies to ensure long-term stability in the evolving landscape of sustainable finance.

Finally, our findings indicate that increasing the green input ratio within a supply chain to enhance environmental sustainability has a dual effect: it negatively impacts the insurer’s interest margin and simultaneously bolsters insurance stability. A key managerial implication is that companies should cautiously manage the transition to a higher green input ratio in the supply chain. Although this move enhances environmental sustainability and insurance stability, managers must navigate potential negative effects on the insurer’s interest margin. A striking balance between environmental responsibility and financial considerations requires innovative strategies and robust risk management practices for a resilient business model.

Conclusions

We introduce a capped call option model for sustainable insurance aimed at fostering environmental enhancements. Key insights into insurer-driven green finance hold significance for investors, managers, and regulators. Notably, we reveal that the diminishing regulatory cap within the cap-and-trade system amplifies the insurer’s interest margin while strengthening safeguards for policyholders. Nevertheless, insurers may exhibit reluctance to offer green financing, potentially impeding carbon emission reduction efforts, as this reluctance could increase guaranteed rates. Furthermore, the efficient operation of asset–liability management for green finance investments benefits life insurance policyholders by ensuring robust protection, thereby reinforcing overall insurance stability.

Building upon these insights, we propose the following policy recommendations to further integrate sustainable insurance practices that strengthen sustainable insurance and improve green financing effectiveness. While our results suggest that reducing the regulatory cap in the cap-and-trade system can increase the insurer’s interest margin and enhance policyholder protection, it may also discourage insurers from offering green financing. Therefore, regulators should design a nuanced subsidy framework for green loans that incentivizes insurers to engage in sustainable lending practices without compromising their financial stability. This framework should aim to offset potential reductions in profitability that insurers may face when increasing their green loan portfolios. By integrating sustainability criteria into the subsidy structure, regulators can encourage insurers to actively participate in financing projects that contribute to carbon emission reductions, such as supporting borrowing firms in adopting cleaner production methods. The incentive mechanism should be designed to reward insurers for their contributions to a carbon-neutral economy.

To guide future research, the next logical progression for the model could involve integrating the concept of a carbon tax, an aspect not addressed in this paper. Implementing carbon taxes presents an effective option for advancing sustainable energy adoption and mitigating carbon emissions. The incorporation of carbon taxes into sustainable insurance holds the potential to broaden the research landscape in the realms of climate, energy, and environmental policy.

Notes

Li et al. (2021) also model a two-echelon supply chain under the cap-and-trade mechanism.

References

Briys E, De Varenne F (1994) Life insurance in a contingent claim framework: pricing and regulatory implications. Geneva Pap Risk Insur Theory 19:53–72. https://doi.org/10.1007/BF01112014

Brockman P, Turtle HJ (2003) A barrier option framework for corporate security valuation. J Financ Econ 67:511–529. https://doi.org/10.1016/S0304-405X(02)00260-X

Chen M, Xue W, Chen J (2022a) Platform subsidy policy design for green product diffusion. J Clean Prod 359:132039. https://doi.org/10.1016/j.jclepro.2022.132039

Chen S, Huang FW, Lin JH (2022b) Life insurance policyholder protection, government green subsidy, and cap-and-trade transactions in a black swan environment. Energy Econ 115:106333. https://doi.org/10.1016/j.eneco.2022.106333

Chen Y, Xu Z, Zhang Z, Ye W, Yang Y, Gong Z (2022c) Does the carbon emission trading scheme boost corporate environmental and financial performance in China? J Clean Prod 368:133151. https://doi.org/10.1016/j.jclepro.2022.133151

Chen Y, Zhang Z, Mishra AK (2023) A flexible and efficient hybrid agricultural subsidy design for promoting food security and safety. Humanit Soc Sci Commun. 10:1–8. https://doi.org/10.1057/s41599-023-01874-w

Chiaramonte L, Dreassi A, Paltrinieri A, Piserà S (2020) Sustainability practices and stability in the insurance industry. Sustainability 12:5530. https://doi.org/10.3390/su12145530

Chou H-C, Wang D (2007) Performance of default risk model with barrier option framework and maximum likelihood estimation: evidence from Taiwan. Phys A Stat Mech Appl 385:270–280. https://doi.org/10.1016/j.physa.2007.06.044

Cui Y, Geobey S, Weber O, Lin H (2018) The impact of green lending on credit risk in China. Sustainability 10:2008. https://doi.org/10.3390/su10062008

Dermine J, Lajeri F (2001) Credit risk and the deposit insurance premium: a note. J Econ Bus 53:497–508. https://doi.org/10.1016/s0148-6195(01)00045-5

Ding D (2022) The impacts of carbon pricing on the electricity market in Japan. Humanit Soc Sci Commun 9:1–8. https://doi.org/10.1057/s41599-022-01360-9

Du S, Hu L, Song M (2016) Production optimization considering environmental performance and preference in the cap-and-trade system. J Clean Prod 112:1600–1607. https://doi.org/10.1016/j.jclepro.2014.08.086

Forghani K, Kia R, Nejatbakhsh Y (2023) A multi-period sustainable hydrogen supply chain model considering pipeline routing and carbon emissions: the case study of Oman. Renew Sustain Energy Rev 173:113051. https://doi.org/10.1016/J.RSER.2022.113051

Golnaraghi M (2018) Climate change and the insurance industry: taking action as risk managers and investors. The Geneva Association, pp 1–48

Herrador-Alcaide TC, Hernández-Solís M, Cortés Rodríguez S (2023) Mapping barriers to green supply chains in empirical research on green banking. Humanit Soc Sci Commun 10:1–16. https://doi.org/10.1057/s41599-023-01900-x

Holsboer JH (2000) The impact of low interest rates on insurers. Geneva Pap Risk Insur Issues Pract 25:38–58. https://doi.org/10.1111/1468-0440.00047

Hong J, Seog SH (2018) Life insurance settlement and the monopolistic insurance market. Insur Math Econ 81:36–50. https://doi.org/10.1016/j.insmatheco.2017.12.003

Hong Z, Guo X (2019) Green product supply chain contracts considering environmental responsibilities. Omega 83:155–166. https://doi.org/10.1016/j.omega.2018.02.010

Huang Y, Chen C, Lei L, Zhang Y (2022) Impacts of green finance on green innovation: a spatial and nonlinear perspective. J Clean Prod 365:132548. https://doi.org/10.1016/j.jclepro.2022.132548

Hussain J, Pan Y, Ali G, Xiaofang Y (2020) Pricing behavior of monopoly market with the implementation of green technology decision under emission reduction subsidy policy. Sci Total Environ 709:136110. https://doi.org/10.1016/j.scitotenv.2019.136110

Ivanov IT, Kruttli MS, Watugala SW (2024) Banking on carbon: corporate lending and cap-and-trade policy. Rev Financ Stud 37(5):1640–1684. https://doi.org/10.1093/rfs/hhad085

Jiang W, Lu W, Xu Q (2019) Profit distribution model for construction supply chain with cap-and-trade policy. Sustainability 11(4):1215. https://doi.org/10.3390/SU11041215

Li B, Chen W, Xu C, Hou P (2018) Impacts of government subsidies for environmental-friendly products in a dual-channel supply chain. J Clean Prod 171:1558–1576. https://doi.org/10.1016/j.jclepro.2017.10.056

Li H, Tian H, Liu X, You J (2024) Transitioning to low-carbon agriculture: the non-linear role of digital inclusive finance in China’s agricultural carbon emissions. Humanit Soc Sci Commun 11(1):818. https://doi.org/10.1057/s41599-024-03354-1

Li J, Wang L, Tan X (2020) Sustainable design and optimization of coal supply chain network under different carbon emission policies. J Clean Prod 250:119548. https://doi.org/10.1016/j.jclepro.2019.119548

Li L, Ma X, Ma S, Gao F (2024) Role of green finance in regional heterogeneous green innovation: evidence from China. Humanit Soc Sci Commun 11(1):1011. https://doi.org/10.1057/s41599-024-03517-0

Li Z, Pan Y, Yang W, Ma J, Zhou M (2021) Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energy Econ 101:105426. https://doi.org/10.1016/j.eneco.2021.105426

Lin B, Jia Z (2019) What will China’s carbon emission trading market affect with only electricity sector involvement? A CGE based study. Energy Econ 78:301–311. https://doi.org/10.1016/j.eneco.2018.11.030

Madaleno M, Dogan E, Taskin D (2022) A step forward on sustainability: the nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ 109:105945. https://doi.org/10.1016/j.eneco.2022.105945

Merton RC (1974) On the pricing of corporate debt: the risk structure of interest rates. J Financ 29:449. https://doi.org/10.2307/2978814

Narassimhan E, Gallagher KS, Koester S, Alejo JR (2018) Carbon pricing in practice: a review of existing emissions trading systems. Clim Policy 18:967–991. https://doi.org/10.1080/14693062.2018.1467827

Qian F, Pu Y, Shang Y (2023) Financing preferences and practices for developing sustainable exhibitions in Chinese companies. Humanit Soc Sci Commun 10:938. https://doi.org/10.1057/s41599-023-02467-3

Safarzadeh S, Rasti-Barzoki M (2019) A game theoretic approach for pricing policies in a duopolistic supply chain considering energy productivity, industrial rebound effect, and government policies. Energy 167:92–105. https://doi.org/10.1016/j.energy.2018.10.190

Sarfraz M, Khawaja KF, Han H, Ariza-Montes A, Arjona-Fuentes JM (2023) Sustainable supply chain, digital transformation, and blockchain technology adoption in the tourism sector. Humanit Soc Sci Commun 10:1–13. https://doi.org/10.1057/s41599-023-02051-9

Shi W, Min KJ (2015) Remanufacturing decisions and implications under material cost uncertainty. Int J Prod Res 53:6421–6435. https://doi.org/10.1080/00207543.2014.932933

Sun G, Wang J, Ai Y (2024) The impact of government green subsidies on stock price crash risk. Energy Econ 134:107573. https://doi.org/10.1016/j.eneco.2024.107573

Sun Y, Bao Q, Taghizadeh-Hesary F (2023) Green finance, renewable energy development, and climate change: evidence from regions of China. Humanit Soc Sci Commun 10:107. https://doi.org/10.1057/s41599-023-01595-0

Tan X, Sirichand K, Vivian A, Wang X (2020) How connected is the carbon market to energy and financial markets? A systematic analysis of spillovers and dynamics. Energy Econ 90:104870. https://doi.org/10.1016/j.eneco.2020.104870

Terlouw T, Rosa L, Bauer C, McKenna R (2024) Future hydrogen economies imply environmental trade-offs and a supply-demand mismatch. Nat Commun 15(1):7043. https://doi.org/10.1038/s41467-024-51251-7

Tong J, Yue T, Xue J (2022) Carbon taxes and a guidance-oriented green finance approach in China: path to carbon peak. J Clean Prod 367:133050. https://doi.org/10.1016/j.jclepro.2022.133050

Trinks A, Mulder M, Scholtens B (2020) An efficiency perspective on carbon emissions and financial performance. Ecol Econ 175:106632. https://doi.org/10.1016/j.ecolecon.2020.106632

Tsao YC, Thanh VVan, Chang YY, Wei HH (2021) COVID-19: government subsidy models for sustainable energy supply with disruption risks. Renew Sustain Energy Rev 150:111425. https://doi.org/10.1016/J.RSER.2021.111425

Ulpiani G, Rebolledo E, Vetters N, Florio P, Bertoldi P (2023) Funding and financing the zero emissions journey: urban visions from the 100 Climate-Neutral and Smart Cities Mission. Humanit Soc Sci Commun 10:647. https://doi.org/10.1057/s41599-023-02055-5

Wang F, Sun J, Liu YS (2019) Institutional pressure, ultimate ownership, and corporate carbon reduction engagement: evidence from China. J Bus Res 104:14–26. https://doi.org/10.1016/J.JBUSRES.2019.07.003

Wang S, Wan L, Li T, Luo B, Wang C (2018) Exploring the effect of cap-and-trade mechanism on firm’s production planning and emission reduction strategy. J Clean Prod 172:591–601. https://doi.org/10.1016/j.jclepro.2017.10.217

Wang Y, Chang X, Chen Z, Zhong Y, Fan T (2014) Impact of subsidy policies on recycling and remanufacturing using system dynamics methodology: a case of auto parts in China. J Clean Prod 74:161–171. https://doi.org/10.1016/j.jclepro.2014.03.023

Winkler L, Kilic O, Veldman J (2022) Collaboration in the offshore wind farm decommissioning supply chain. Renew Sustain Energy Rev 167:112797. https://doi.org/10.1016/J.RSER.2022.112797

Wyman O, Insurance Europe (2013) Funding the future: Insurers’ role as institutional investors. https://www.oliverwyman.com/our-expertise/insights/2013/jun/funding-the-future.html. Accessed 10 Sept 2017

Xu S, Govindan K, Wang W, Yang W (2024) Supply chain management under cap-and-trade regulation: a literature review and research opportunities. Int J Prod Econ 271:109199. https://doi.org/10.1016/j.ijpe.2024.109199

Yang J, Hao Y, Feng C (2021) A race between economic growth and carbon emissions: What play important roles towards global low-carbon development? Energy Econ 100:105327. https://doi.org/10.1016/j.eneco.2021.105327

Zhang W, Chiu YB, Hsiao CYL (2022) Effects of country risks and government subsidies on renewable energy firms’ performance: evidence from China. Renew Sustain Energy Rev 158:112164. https://doi.org/10.1016/J.RSER.2022.112164

Zhang X, Wilson C (2022) Transition from brown to green: analyst optimism, investor discount, and Paris Agreement. Energy Econ 116:106391. https://doi.org/10.1016/j.eneco.2022.106391

Zhu B, Xu C, Wang P, Zhang L (2022) How does internal carbon pricing affect corporate environmental performance? J Bus Res 145:65–77. https://doi.org/10.1016/J.JBUSRES.2022.02.071

Acknowledgements

This paper is financially supported by the General Program of National Natural Science Foundation of China (No. 72473115); Ministry of Education Humanities and Social Sciences Fund (No.21YJA790031); Major Special Project of Philosophy and Social Sciences Fund of Sichuan Province in 2024 (No. SCJJ24ZD13); Guanghua Talent Project of Southwestern University of Finance and Economics; Annual project of the “Special Fund for basic scientific research and business expenses of the Central University” in 2024 (No. 2024060037).

Author information

Authors and Affiliations

Contributions

Author 1: conceptualization, data curation, formal analysis, writing—review and editing, funding acquisition; Author 2: data curation, investigation, software; Author 3: conceptualization, methodology, writing—original draft preparation, supervision; Author 4: resources, investigation.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Li, X., Lu, T., Lin, JH. et al. Insurer green financing for a supply chain under cap-and-trade regulation: a capped call contingent claim analysis. Humanit Soc Sci Commun 11, 1545 (2024). https://doi.org/10.1057/s41599-024-04033-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-04033-x