Abstract

The inclusiveness and “fragmentation” of digital trade have created new possibilities for enterprises that used to face disadvantages in traditional trade, which may reshape the income pattern of enterprises. The increase in digital trade exports positively affects the equalization of inter-firm and intra-industry wages, which exacerbates inter-industry wage inequality. Digital trade exports push the median wage upward and reduce the number of low-wage enterprises. However, it is difficult for high-yield export companies to escape the fate of “the top being cut”. Furthermore, digital trade exports improve the margin of export density and inhibit the marginal category of goods and the market margin, thereby promoting wage equalization among enterprises. Furthermore, there are certain heterogeneity effects on various categories of digital trade, varying levels of intensity of Internet use, different types of enterprises, different locations of industrial chains, and the regional pattern in eastern, central, and western areas.

Similar content being viewed by others

Introduction

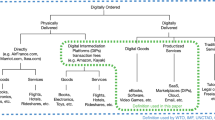

According to Deardorff (2017), digital trade refers to business involving multiple countries that have digital products or products that at least partially deal with the Internet or similar digital technologies for advertising, ordering, deliveries, payments, or services. Therefore, this study defines “the export of digital trade” as a form of export trade wherein digital technology plays an indispensable role, including the export of digital products and the digitization of export mode. These components of digital trade exports have experienced rapid growth in recent years (USITC, 2017). In particular, the development momentum of China’s foreign trade has slowed down in recent times, while the digital trade represented by cross-border e-commerce has performed against the trend and become a hot spot in international trade. According to the data from the General Administration of Customs of China, China’s cross-border e-commerce exports totaled 1.83 trillion yuan in 2023, which accounts for a year-on-year increase of 19.6%. Due to the push of the digital revolution, the proportion of digital trade is rising, the export threshold is declining, consumer demand is becoming fragmented, and borderization is reducing. Then these may empower small and medium-sized enterprises (SMEs) and private enterprises, thereby promoting the participation of disadvantaged companies in the world’s value chain and reducing the income disparity among enterprises (Pomfret, 2021).

The scientific and technological revolution and industrial revolution that occurred in the past century are reshaping the world economy and trade patterns (Bernhofen et al., 2021; Lacka et al., 2020). However, in the new trade pattern, digital trade may become an important means for multinational corporations to enhance their monopolistic competitive advantage, and it is difficult to change the jungle law that relies on competitive advantage and the approach that the weaker is the prey of the stronger in the world market. Moreover, in the era of the digital economy, “digital inequality,” negative external effects of networks, and the substitution effect of digital technology are common problems that partially hinder income equalization among enterprises. Thus, the study of digital trade exports is helpful for examining in-depth the impact mechanism of income distribution, promoting improvements to the export trade environment for disadvantaged enterprises under digital changes, thereby contributing to the alleviation of the problem of unbalanced and insufficient economic development among enterprises in China.

This figure illustrates how digital trade exports impact wage inequality among firms through both direct and indirect channels. This figure is not covered by the Creative Commons Attribution 4.0 International License. Reproduced with permission of Liping Zhou; copyright © Liping Zhou, all rights reserved.

Therefore, this study focuses on three issues that have not been deeply explored in the extant literature. First, do digital trade exports affect inter-firm wage inequality? If so, is the overall effect positive or negative? Second, what are the key mechanisms of digital trade exports affecting inter-firm wage inequality? Third, what are the heterogeneous effects on wage inequality among companies of different “digital”, firms, industries, and regions that conduct digital trade exports? To investigate these problems, we first discuss the core model of the impact of digital trade exports on inter-firm wage inequality based on micro-enterprise data (China Industrial Enterprise Database and China Customs Trade Database) and macroeconomic data (China Urban Statistical Yearbook and World Bank Database). The results of the empirical analysis show that digital trade exports promote wage equality among enterprises and within industries, but they also exacerbate wage inequality across industries. Although it has the potential to increase wages in enterprises with low- and middle-income levels, it can also force once-high-yield exporters to reduce profits, that is, “cut off the top” by the market. Thus, with the help of the mediating effect model, this paper explores whether digital trade exports affect wage inequality among Chinese enterprises through the export “quadruple margin.” Mechanism analysis shows that digital trade exports, compared with non-digital trade exports, are capable of improving export density margin while inhibiting the growth of categories and market margins, thereby promoting wage equalization among enterprises. The empirical results on heterogeneity indicate that the impact of various factors, including different types of digital trade, varying levels of Internet usage, diverse ownership structures of enterprises, differing capital intensity, distinct financing constraints, varied positions in the value chain, and regional variations among enterprises engaged in digital trade exports, exhibit non-uniform effects on wage equalization.

The remaining sections are organized as follows. Section “Literature review” presents the literature review and possible contributions of this paper. Section “Theoretical analysis and research hypothesis” examines the relationship between digital trade exports and inter-firm wage equalization, elucidates the underlying mechanisms, and formulates theoretical hypotheses. Section “Research design and data” constructs the econometric model and explains the variables and data in detail. Section “Empirical results and analysis” presents the empirical test and analyzes the result. The section “Conclusion and policy implications” discusses the conclusions and policy recommendations.

Literature review

Controversy regarding the impact of international trade on income inequality is common. Beginning with the theory of absolute advantage and comparative advantage, economists explored whether the international division of labor and trade gains caused by competitive advantage could reduce income inequality. Some economists emphasize that free trade itself benefits countries. Ricardian trade theory suggests that although relative differences in technology lead to trade, as long as there exists demand for the relative differences, countries would benefit from trade (Matsuyama, 2008). From the perspective of competitive advantage, most scholars have underlined that the division of labor and profitable sectors from trade may increase inter-country and domestic wage inequalities (UNCTAD, 2019). The absolute advantage and comparative advantage theories do not clearly explain the impact of international trade on income inequality. The theory that confronts this problem directly is the Stolper–Samuelson theorem (hereafter SS theorem), which inherited the concept of “relative” from the comparative advantage theory, but its conclusion departs from the comparative advantage theory (Chipman, 1969). It points out that international trade is not suitable for every country because it changes the pattern of a country’s factor income distribution. Thus, there is also an extensive body of opinion that supports trade barriers. The SS theorem is a pivotal theory that studies the impact of international trade on income inequality based on different factor endowments, and it has its clout in related studies. However, this theoretical model is relatively simple and thus unsuitable for today’s increasingly complex international economic situation.

In recent years, there have been research breakthroughs in terms of the mechanism of international trade and income inequality. The major channels posed by international trade for income distribution include the three “bridges”: productivity, institutions, and education (i.e., Furusawa et al. 2020; Dorn et al. 2022; Nam et al. 2024; Yang, 2024). Some scholars have conducted in-depth analyses of these three mechanisms from the vertical perspective, including enterprise (Helpman et al. 2010), urban (Hornbeck and Moretti, 2018), and national productivity (Basco and Mestieri, 2014). Although productivity affects the relationship between trade and inequality, as economist Robert Solow pointed out in his theory of the “productivity paradox,” there is a lack of Internet technology (IT) content in productivity statistics, so productivity has little effect. With regards to the impact mechanism at the institutional level, the result is relatively inclusive and includes politics, economics and trade, such as the taxation system (i.e., Dodson, 2020) and institutional quality (i.e., Nam et al. 2024). Finally, there are relatively few in-depth studies from the perspective of education. Khalifa (2016) verifies that over-education is used as an intermediate mechanism, and evidence shows that trade liberalization impacts skill premiums in developing countries, which depends on the degree of over-education. Yang (2024) discovered that education can mitigate roughly 50% of the inequality caused by trade in the long run. Many scholars have extended the study of this impact mechanism from a horizontal perspective to various directions; they fall into the following four dimensions: products (such as product quality), workers [such as observable characteristics of laborers (Helpman et al. 2017)], enterprises [such as technology (Borrs and Knauth, 2021)], and finance [such as financial openness (Zhang et al. 2015)]. In addition, some scholars argue that the trade mechanism of wage inequality typically does not follow a single channel but rather involves complex multidimensional impact channels (Pavcnik, 2017). Although some of them have been supported by empirical evidence, most studies (Grossman and Helpman, 2018; Dix-Carneiro and Traiberman, 2023) tend to overlook the critical reality that digital trade has gradually become an extensive mode of international trade with associated consequences on the evolution of income patterns.

So far, the extant research has focused on traditional international trade and neglected the research on the income inequality effect of digital trade. There are several data sources for the research of traditional international trade, but the relevant data on digital trade are mainly restricted to the macro level. Many institutions and scholars use the United Nations Trade and Development Conference’s digital service trade transnational data (such as the data provided by the Ministry of Commerce of the People’s Republic of China and the US Department of Commerce) and per capita e-commerce transaction volume of each province as an indicator of the growth rate of cross-border e-commerce (Nugent and Lu, 2021; Wang et al. 2017). Some scholars use self-related indicators; for instance, Ye et al. (2020) used the digital trade feature map method to evaluate the development of digital trade between China and the USA, while Wang et al. (2023) employed the entropy weight approach to construct a metric for the development level of digital trade across China’s provinces. A few scholars still investigate digital product trade using micro-measurement (Aguiar and Waldfogel, 2018). In indirect evaluation, digital trade is measured using communication technology indicators and several other methods. The main indicators for indirect evaluation include information and communication technology (ICT) infrastructure (Francois and Manchin, 2013), commercial Internet usage index (Vemuri and Siddiqi, 2009), comprehensive ICT development index and its three sub-indexes (Nath and Liu, 2017), and B2B and B2C Internet usage in importing and exporting countries (Asare et al. 2012), but the above-mentioned data cover a short time span. In addition, some scholars combine differential methods to indirectly measure rural e-commerce (Couture et al. 2021). However, due to the difficulties in collecting relevant data at the micro-level of digital trade exports, it is difficult to match the time of impact and reality, and the treatment group is prone to errors at that time (Gomez-Herrera et al. 2014). The micro-empirical analysis of digital trade exports requires further exploration.

Over the recent years, a growing body of research has emerged, investigating the repercussions of digital transformation (Li et al. 2023), big data (Bu et al. 2024), digital finance (Adugna, 2024; de Moraes et al. 2023), and e-commerce (Liu et al. 2024) on diverse manifestations of inequality. Predominantly, qualitative or descriptive statistical methods have been used to explore the impact of digital trade on income inequality, but the results are widely divided. In reality, the digital revolution is fundamentally changing the pattern of international trade (López González and Jouanjean, 2017). In his book, Mankiw suggested that the Internet and mobile phones might be able to solve the problem of inequality. Zwass (2003) further comments from the perspective of supply chain research that the trade benefits of the Internet extend to people and businesses that have traditionally been marginalized at international levels in terms of innovation and competitiveness. Following this idea, Fefer et al. (2017) believe that digital trade creates opportunities for new participants through e-commerce, social media, and cloud computing. Janow and Mavroidis (2019) comment that digital trade has changed the main micro-global value chain. They test whether digital connectivity, as reflected by the existence of a firm’s website, facilitates the participation of manufacturing SMEs from developing countries in global value chains. In contrast, MacLeod (2018) points out four worrying issues: the phenomenon of the “digital divide” the high concentration of trade resulting from network external effects, distortions in tax burden due to transfer pricing, and suppression of demand for labor-intensive manufacturing firms. For empirical analysis, the Internet is usually used as a separate indicator to examine the relationship between international trade and income distribution. For example, Chen and Ye (2021) and Lin et al. (2017) adopt a spatial quantile regression model for estimation. The results show that Internet usage and trade have a significant impact on income inequality, but the impacts of trade on high and low quantile income distributions are in opposite directions. Although this result indicates a link between digital trade and income inequality, this method fails to adequately demonstrate the impact of digital trade on income inequality. Thus, this paper focuses on uncovering the “black box” of the impact of digital trade exports on the equalization of labor income distribution at the enterprise level.

This study makes several contributions to the existing research. First, most studies analyze regional income inequality from the perspective of traditional international trade. In contrast, this paper focuses on digital trade exports and enterprise wage inequality. Second, from an empirical perspective, Lin et al. (2017), which is relatively similar to the analysis in this paper, only examines the effects of Internet usage and trade on income inequality in isolation. However, in this study, the bilateral continuous difference model is constructed to evaluate the micro-level effect of digital trade exports on wage inequality while accounting for the lack of empirical data, reverse causality, self-worth, and synergistic value of bilateral Internet usage. In sub-sample regression, this study also draws on the relative deviation and quantile method to create the upper and lower relative deviations for different quantile intervals to measure inequality, which is conducive to illustrating the relative gap and direction of labor income in different quantile intervals. This paper includes not only macro-level data, such as those provided by the China City Statistical Yearbook and World Bank Development Indicators, but also product information from Alibaba international station, micro-data from the China Customs Trade Database (2000–2013), and the Industrial Enterprise Database (1998–2013)Footnote 1 to carry out empirical testing at the micro-level.

Theoretical analysis and research hypothesis

Digital trade exports serve as both an accelerator for the formation of a new trade pattern and a catalyst for the formation of a new wage income pattern among enterprises. A significant number of enterprises employ digital trade channels and platforms to facilitate the digital transformation of their export operations and implement adaptive innovations. This approach has led to the streamlining of trade processes, enhanced trade efficiency, and optimized logistics efficiency. These collectively contribute to the formation of a high-quality, dynamic equilibrium characterized by flexible supply meeting demand and demand network externalities stimulating supply. Concurrently, it is not a given that the average wage at the enterprise level will increase as a result of productivity improvements. It may be assumed that an increase in the expected wage level will result in enhanced productivity. However, it is also likely that wage differentials will rise concurrently. Consequently, the two forces exert opposing influences on the average logarithmic wage. When productivity reaches a sufficient level, the average logarithmic wage will decline. The advent of digital trade has the effect of reducing marginal costs and trade barriers, as well as increasing the threshold marginal costs due to the increased willingness to substitute differentiated products for homogeneous products. This leads to an increase in the overall average logarithmic wage, which often serves to reduce the differences between enterprises following digital trade. Moreover, the advent of digital trade has facilitated the deepening of digital technology and the rapid dissemination of digital products, which has promoted improvements in artificial intelligence and workers’ qualifications. Consequently, the proportion of productivity that is lower or equal to the wages of hired workers in the enterprise has been reduced, thereby widening the wage gap between enterprises. It is, therefore, not possible to determine the relationship between digital trade and inter-firm wage inequality on the basis of a mere qualitative inference.

In view of this, we put forward the following pair of opposite research hypotheses.

Research hypothesis 1a: The growth in digital trade exports is more conducive to wage equalization across enterprises.

Research hypothesis 1b: The rise in digital trade exports has a more deleterious impact on wage equality across enterprises.

While the precise causal relationship remains elusive, it is evident that digital trade patterns exert a discernible influence on the characteristics of international commerce. Moreover, in light of the well-established correlation between international trade and inter-firm wage inequality, as evidenced in a substantial body of literature, the anticipated relationship between digital trade and inter-firm wage inequality is not a difficult prospect to envisage. In essence, the impact of digital trade exports on inter-firm wage inequality is primarily driven by alterations in the export value of diverse types of firms. However, changes in export trade value encompass a multitude of additional elements. A number of studies (e.g., Muûls, 2015) subdivide the value of export trade into quadratic margins. These include the margin of the number of export destinations (the geographic margin), the margin of the number of categories of exported goods (the category margin), the margin of the average value of exports (the average-value margin), and the margin of the density of exports (the density margin).

In the quaternary margin of export, the first is the market margin (MM). From one perspective, digital trade exports reduce barriers posed by export distance, potentially leading to an expansion of export destinations. This is influenced by various factors, including enterprise productivity and scale. This, in turn, leads to a further increase in the income of enterprises with an export advantage and widens the labor income gap. Conversely, digital trade is affected by digital infrastructure, “virtuality,” and cyber security. As a result, the potential for an increase in the number of export destinations under this emerging model is limited, leading to increased competition in digital trade exports and equalizing labor prices.

The second is the category margin (CM). Digital trade can facilitate the role of the “Long-Tail EconomyFootnote 2,” which is advantageous for the export of niche goods. Consequently, this can contribute to a reduction in the labor income gap by enhancing the income of niche goods enterprises. Furthermore, the unsuitability of certain products for cross-border online sales, the challenges in establishing a reliable mechanism for digital trade, and the deficiencies in network platform security and functionality have collectively hindered the growth of product categories. This results in a certain degree of compression with regard to the revenue generated by digital trade, while simultaneously promoting a more balanced development of labor income among companies.

The third is the average-value margin (AM). While digital trade has a relatively low entry threshold, the regulatory system is not without imperfections. The phenomenon of “inferior goods driving out good ones” presents a challenge to the objective of increasing the average actual value of goods and services, which in turn impedes the development of digital trade. Consequently, small businesses with low customer loyalty are susceptible to being compelled to exit the international market, which tends to exacerbate the wage disparity between enterprises. Nevertheless, the exponential expansion of digital trade has captured the attention of governments and businesses alike. The digital trade credit and evaluation system is undergoing a process of continuous improvement. The inhibitory effect of the aforementioned average actual value is also gradually decreasing, which may prove beneficial to cross-border transactions of small and medium-sized enterprises and other vulnerable enterprises with serious financing constraints.

The last is the density margin (DM). In the context of digital trade, the limitations of the geographical and category margins, along with the reduction of trade costs and the optimization of logistics systems, have contributed to an increase in export density. This not only provides a novel avenue for underperforming enterprises to generate revenue through exports, but it also curtails the market dominance of some export enterprises, thereby fostering income equality across diverse business entities (Fig. 1).

Research design and data

Measurement model

The traditional differences-in-differences model estimates the effects of policies or shocks by using the interaction of two-valued variables. However, in this paper, this method was limited by the lack of relevant data for the period before the beginning of China’s digital trade exports; consequently, this model cannot capture the real effect of China’s digital trade exports. Therefore, based on the evaluation methods suggested by Couture et al. (2021) and the evaluation of interaction terms, in order to solve the difficulty of measuring the micro-index of digital trade exports, we establish the bilateral continuous difference model. The design ideas of the model are as follows. First, to circumvent the aforementioned period of insufficient data, the related variables that change over time were employed to describe the impact subsequent to the shock, as opposed to utilizing dummy variables representing policies preceding and succeeding the shock. Second, treatment and control groups can be filtered with additional data that are relevant and time series sufficient. Third, digital trade exports were considered to involve Internet usage in both trading countries (including countries in which trade flows in and out) (Elsig and Klotz, 2021). Therefore, to reflect the self-worth and synergy value of Internet usage on both sides of the trade, the product of the indicators of bilateral Internet usage was adopted in our model to measure network value. Fourth, the coexistence of interaction terms and their separate control variables in the model can lead to multicollinearity problems. To avoid this multicollinearity and analyze the mediating effect, the variables of the multiplication term with treat are standardized by z-score, min–max method, or log-logistic model. Thus, we construct the following bilateral continuous difference model:

Here, e and m represent the country of export (China) and destination, respectively. Meanwhile, t, h, s, and f stand for the year, HS6 code (2017), city, and enterprise, correspondingly. inequality is the dependent variable (wage inequality index), and treat is an indicator variable used to distinguish between the treatment and control groups. If treat is 1, it indicates that the digital trade exports experienced significant changes in trade volume around 1999 (when Alibaba Group was founded) and belong to the treatment group. If treat is 0, it means that non-digital trade exports experienced relatively small changes in the trade volume around 1999 and belong to the control groupFootnote 3. lInternet represents the lag period of Internet usage density following Wang (2021) and Gnangnon and Iyer (2018); CX represents other control variables, Fe represents the city, industry (2-digit code), and fixed effects of the import country; and ε represents the random disturbance term.

Variable description

Wage inequality indicators

Because different indicators have different focuses, they may lead to incomplete or even distorted conclusions. Therefore, this article not only includes Jenkins’ (2008) commonly used measure of income inequality—the Gini coefficient (gini) and Theil index (ge1)—but also draws on the relative deviation and quantile method to create wage inequality measures. The upper and lower relative deviations of the digit interval are used to measure inequality, as shown in Eq. (2). The inequality index measures the wage gap between the upper and lower ends of the p-quantile using the relative deviation between the firm and p-quantile for different wage quantiles, which gives us a clearer picture of the direction of the relative wage gap. In addition, all the wage inequality indicators that we construct are calculated from gross wages payable and the number of employees at the firm level, which helps assess the extent of labor income equalization among enterprises. The Gini coefficient and Theil index are relatively common indicators of inequality, so we omit their description here. Our self-constructed upper- and lower-side inequality indicators are as follows:

Here, mwagefit is the value around the p percentile; if \({\rm {mwag{e}}}_{it}^{p}\) >fit, u = 0, otherwise u = 1. Among them, inequality represents the inequality index; mwage represents the per capita wage, that is, total wages/number of employees; subscript f, i, and t are the identifiers of enterprise, industry, and year, respectively; superscript p represents the income quantile; and u is used to distinguish between the upper and lower relative dispersion. If u is 0, it indicates relative lower dispersion (called the “lower inequality index”), and if u is 1, it indicates relative upper dispersion (called the “upper inequality index”). For example, inequality25,0 is the lower inequality index of the 25th percentile, which is used to indicate the relative wage gap between enterprises with average wage lower than the 25th percentile of the industry and those with average wage equal to the 25th percentile.

Indicators related to digital trade exports

As indicated above, this paper mainly uses the bilateral continuous difference model to measure the impact of digital trade exports. This model constructs a dummy variable (treateht) and two continuous variables (Internetest and Internetmt).

Regarding the setting of treateht dummy variables, when treateht as equal to 1, it indicates that the commodity is a digital trade export item (i.e., the experimental group), while a value of 0 indicates that it is a non-digital trade export item (i.e., the control group). Specifically, this paper has chosen Alibaba.com, a cross-border e-commerce platform with great influence in China, as the object of investigation. We used Excel to automatically or manuallyFootnote 4 match the commodities collected from Alibaba.com with the product category of the HS code query websiteFootnote 5. Then, to ensure an effective comparison between the treatment and control groups, data from the CEPII BACI database for the 1995–2017 period were used to measure the post-indicator variable. The post of Alibaba.com is denoted with 0 before it was established in 1999 and with 1 after it was established. Then, according to the HS 6-digit code, the following models were used for regression analyses. Finally, the products with significant post coefficients and belonging to Alibaba.com were classified as the treatment group, and the commodities with neither significant post coefficients nor belonging to Alibaba.com were classified as the control group.

In the above equation, the dependent variable trade is the export trade volume, ν is the fixed effect of the destination country, and μ is the residual term.

To measure the Internet usage intensity indicators, this study considers the method suggested by Pastpipatkul and Saeor (2018) as well as other methods. However, the pairwise correlations among Internet usage, independent variables, and economic scale control variables are relatively high; this can easily lead to endogeneity and serious multicollinearity problems. Therefore, this paper adopted the Internet usage intensity index with a lag period. However, there are slight differences in the indicators constructed by bilateral Internet usage intensity. The intensity of Internet usage in the destination country is measured by dividing the personal Internet usage rate by per capita GDP (current RMB price). Because this study focuses on China’s digital trade exports, the lagged intensity of Internet usage in the exporting country (China) is measured by dividing the number of lagged Internet users at the city level by the local GDP (current RMB price). Therefore, the bilateral Internet usage intensity indicators need to be standardized to achieve consistency in indicator units.

For the robustness test, we use the entropy weight and TOPSIS methods to measure city-level digital trade (DTst) and multiply it with the dummy variable treateht to measure digital trade exports. The comprehensive score of city-level digital trade is measured using 11 secondary indicators across 5 dimensions: digital infrastructure, digital technology, digital industrialization scale and trade volume, digital industrialization trade, and dependence on foreign trade (Table 1).

Other variables

Following Ge et al. (2019), enterprise-level control variables include the following: lagged enterprise size (llnemployment), measured by the natural logarithm of the number of employees at the end of the year with a lag period; firm age (age), measured by the difference between the year in which it was operated and the year in which it was established; the lagged capital intensity (lKL), estimated by a one-period lag in the ratio of the original value of fixed assets to the number of employees at the end of the year; lagged total factor productivity (lTFP), measured by the ACF (Ackerberg et al. 2006) method using total factor productivity estimated from the production function of the industrial value added, the capital stock, and intermediate input proxy variables with one-period lag; and indicators of various types of ownership capital to total capital ratios, such as state (state_share), collective (collective_share), legal person (legalp_share), individual (individual_share), and foreign capital ratios (foreign_share).

Control variables at the macro level mainly include the following: lagged education investment (ledu_GDPest), evaluated by the lagged share of urban education expenditure in the GDP (Sylwester, 2000), and lagged urban and rural residents’ savings rate (lS_GDPest), measured by dividing the lagged year-end savings of urban and rural residents by the lagged GDP (Dickens, 2015). Similar to the gravity model, this study controls for the size of the regional economies on both sides of the trade and the economic scale of China’s cities (lnrGDPest). It chooses the logarithm of each city’s adjusted GDP per capita in 2000 as a baseline measure to capture differences in the economic conditions of various cities. The economic scale of the destination country (lnrGDPmt) is the natural logarithm of the real GDP per capita at the national level, and the fixed effects of cities, industries, and destination countries are controlled.

Because this paper discusses the indirect effect of digital trade exports on wage inequality by decomposing trade value into quaternary margin, the relevant variables of mechanism test are as follows. According to the method by Muûls (2015), the export trade volume was subdivided into quaternary margins as the enterprise(f)–year(t)–HS2 bit code(h2). In Eq. (4), cnum represents the number of countries to which exports are destined, hnum represents the number of categories of export commodities, u represents the average value of exports, and td represents export density. Export density is a measure of the ratio of the number of destination country–commodity combinations with positive exports (o) to the number of all possible combinations (cnum × hnum).

The relevant indicators for heterogeneity testing include the following. Firstly, the pertinent indicators for heterogeneity testing at the “digital” level. A regression on digital services exports is conducted using the BaTIS dataset to calculate the digital services exports indicator (lnDSE), which is the sum of six service exports (logarithmized): “insurance and pension services”, “financial services”, “charges for the use of intellectual property”, “telecommunications, computer, and information services”, “other business services” and “personal, cultural, and recreational services”. The variable for cross-border e-commerce exports uses the treat measure. The empirical analysis is conducted separately based on the different Internet usage intensity of exporting cities in China and importing countries, using the median as the dividing standard, resulting in two binary virtual variables hlInternetest and hlInternetmt, where 1 indicates a high level of Internet usage and 0 indicates a low level of Internet usage.

Secondly, the indicators of the heterogeneity test mainly include four types of firm-level heterogeneity indicators. The dummy variables for different ownership structures are based on the ratio of various types of registered capital to the total capital of enterprises >50%. The types of enterprise ownership were divided into state (state), collective (collective), legal person (legalp), private (private), HMT (HMT), and foreign ownership (foreign). Moreover, to avoid severe multicollinearity, the state dummy variable is omitted; this omission implies that the estimated coefficients of other enterprise ownership variables are relative to those of state-owned enterprises. The enterprise sizes were classified as large, medium, small, and micro-enterprises in the “statistical classification of large, medium and small micro-enterprises (2017)” issued by the Chinese Bureau of Statistics (Table 2). Accordingly, this study divided the enterprises into large (bc), medium (mc), and small (sc) enterprises and omitted the dummy variable for the large enterprise variable (bc). The dummy variable for high capital intensity (KLh) is 1 if the value exceeds median capital intensity and 0 otherwise. The dummy variable for high financing constraint (lnFCh) is set to 1 if the value is below the median of the reverse index of financing constraint and 0 otherwise, and the logarithm of the ratio of logarithmic interest expense to fixed assets is taken as the reverse index of financing constraint.

Thirdly, the relevant indicators of the heterogeneity test at the industry and regional levels are included. Following Li et al. (2015), the dummy variable (ui) for upstream industry is 1 if the company is upstream (front end of the industrial chain), and it is 0 if the company is located downstream (back end of the industrial chain). Similarly, the dummy variables for regional locations include the eastern region variable (Eregion), central region (Cregion), and western region (Wregion); we set the eastern region dummy to 0 to avoid multicollinearityFootnote 6.

Data selection

The data in this study cover macro and micro measures, involving several large databases and manually collected commodity information from Alibaba.com (June 2019). First, the enterprise-level data for the 2000–2013 period were derived from the China Customs database and China Industrial Enterprise Database. This paper used the method of Brandt et al. (2012) and collected GB4754-2011 standard to adjust for industry codes, and it created a new enterprise unique identification code. Furthermore, it used the method of Dai et al. (2018) to match customs data with industrial enterprise data (which matched 108,839 enterprises). Moreover, to improve information utilization, this paper replaces inconsistent data (such as a negative value and an export delivery value greater than the total industrial sales value) with a null value and uses interpolation to replace them with a positive value. Second, the treatment and control groups were differentiated according to the commodity information from Alibaba.com, the HS code query website, and the trade data of the CEPII BACI database from 1995 to 2017. Third, the data for China’s urban GDP, year-end total population, education expenditure, and year-end savings balance of urban and rural residents were collected from the China City Statistical Yearbook, whereas the CPI for each province was taken from the China Statistical Yearbook. Fourth, at the national level, the data on individual Internet usage in destination countries were collected from the World Development Indicators of the World Bank, while the data for the GDP, total population, CPI, and exchange rates in destination countries were collected from the World Bank database. In addition, to alleviate the problem of outliers in the regression results, we winsorize the data for the continuous variables using (0.05, 0.95) criteria.

Empirical results and analysis

Core estimate results

Benchmark test for the impact of digital trade exports on wage inequality

Table 3 shows the regression results of the baseline model. Models (1) and (2) are constructed by considering the Gini coefficient (gini), Theil index (ge1), inter-industry Theil index (between_ge1), and intra-industry Theil index (within_ge1) as dependent variables. The estimate results of models (1) and (2) show that the coefficients of treat × lInternetest × lInternetmt are all significantly negative at 1%, thereby indicating that digital trade exports have significantly reduced wage inequality across enterprises, which in turn means that the impact of corporate network externalities and overall export benefits on wage inequality exceeds the positive effects of digital inequality and consumer network externalities. Furthermore, it confirms the views that previously non-exporting firms may be affected by changes in costs, information communication, and global value chains, thereby enabling them to become important participants in international trade. The variables treat × lInternetest and treat × lInternetmt, which control for the exposure of digitally traded exports to the unilateral Internet, exhibit a significantly negative coefficient for the former, while the coefficients on the latter are not statistically significant. This suggests that the exposure of digitally traded exports to the unilateral Internet at home is a contributing factor to inter-firm wage inequality. With regard to non-digital trade exports, there is a positive correlation between bilateral Internet usage intensity and domestic Internet usage intensity in China and wage inequality. Conversely, Internet usage intensity in destination countries has been found to reduce wage inequality. The possible explanations are as follows. On the one hand, non-digital exports do not sufficiently use the information “bridge” of the Internet, the entry threshold, and convenience in time and space. However, labor income inequality is aggravated by consumer network externalities, the substitution effect of digital technology, and digital inequality. On the other hand, the increasing intensity of Internet usage in the destination country acts as a catalyst that pushes the growth of local e-commerce enterprises, thereby increasing the degree of competition in the destination market and leading to the equalization of profits and wages of non-digital trade enterprises.

The dependent variables in models (3) and (4) are intra-industry and inter-industry wage inequalities, respectively. The results show that digital trade exports accelerate the equalization of intra-industry wages but deteriorate inter-industry wage inequality. In addition, within industries, digital trade products are influenced by both domestic and foreign Internet penetration, which negatively and positively affect wage inequality, respectively. Whereas non-digital trade exports, which are subject to bilateral and source-area Internet technologies, increase wage inequality. Nevertheless, unilateral IT in the destination country reduces such inequality. Among industries, except for the insignificant inequality effects of digital trade products caused by the domestic Internet of the exporting country, the non-equilibrium phenomena between industries caused by other Internet-related indicators are exactly the opposite of those within industries.

How can we explain this divergence between intra-industry and inter-industry inequalities? First, the overall wage inequality largely results in intra-industry rather than inter-industry (Helpman et al. 2017), so the effects of digital trade exports and IT on intra-industry inequality are similar to those of overall inequality. Second, with the penetration of digital technology in different industries, digital trade exports have brought more unprecedented opportunities than non-digital trade exports for some industries (such as IT, music, and food). However, certain industries have still lost competitiveness or are stagnant due to the characteristics of their products and the lack of material, manpower, or relevant experience. Moreover, the professional skills of the workforce vary widely across industries; therefore, the changes in labor force structure make it difficult to adapt to digital trade exports. Thus, in the export sector, network externalities of users and differences in the labor force structure amplify wage inequalities across industries. Third, most digital trade products are sold on the domestic digital trade platforms of the source countries. Domestic digital trade provides more possibilities to marginalized enterprises in the same industry because the network of enterprises expands. In contrast, the increase in digital trade in destination countries dampens the export of digital trade from source countries, which aggravates wage inequality in the industry. In terms of inter-industry inequality, high-profit industries attract more competition from enterprises in destination countries. As a result, the increase in digital trade in destination countries influences the digital trade exports of high-income industries in source countries, thereby reducing inter-industry wage inequality. Finally, among industries, even though the penetration of digital technology is ineffective in bringing some industries into the ranks of digital trade exports, it facilitates once-vulnerable industries to import intermediate goods, carry out investment and financing, and conduct smart manufacturing and distance training. However, these industries may also be affected by increased Internet usage in foreign countries, thereby leading to loss of competitive advantage and withdrawal from foreign markets and further aggravating the inequality of labor income across industries.

The results of models (1) and (2) demonstrate that, when other variables are held constant, an increase in firm age, capital intensity, and savings rates, as well as a rise in the proportion of all types of capital except for collective capital, will result in an expansion of wage inequality. This suggests that capital accumulation and a mixed economic structure serve to exacerbate and mitigate inequality, respectively (Piketty et al. 2019). In contrast, the larger or more productive the firm, the more rapid the region’s economic growth, or the higher the investment in education, the lower the degree of wage inequality between firms. This result is consistent with Sylwester (2000) that investment in education leads to a transmission mechanism for a negative correlation between economic growth and income inequality. Nevertheless, the effects of firm scale and productivity are unclear. There is a strong positive correlation between enterprises’ growth in developed countries and wage inequality (Mueller et al. 2017), but China, as a socialist market economy, has a tight grip on income distribution among large firms, and trade unions play a more egalitarian role in large enterprises. In addition, the negative effect of productivity on wage inequality is due to the fact that its positive effect is partially diluted by Internet technology-related indicators. However, the results of models (3) and (4) show that the effects of control variables on intra-industry and inter-industry wage inequalities are heterogeneous. For example, investment in education is positively and negatively correlated with future intra-industry and inter-industry wage inequalities, respectively.

Testing the impact of digital trade exports on upper and lower wage inequality

In general, some degree of wage inequality is inevitable in a complex economy with numerous businesses and workers. Aggregate inequality cannot measure the shocks caused by digital trade exports to firms with different revenues. Therefore, four different quantile intervals of the upper and lower wage inequality were constructed in this paper. The results are reported in Table 4. With the exception of the interquartile range below the first quartile, digital trade exports exert a negative influence on inequality across all other interquartile wage ranges. However, the magnitude of this negative effect exhibits considerable variability, with the higher interquartile ranges exhibiting the more pronounced negative effectFootnote 7. The result shows that inequality among enterprises with medium and high wage levels has been significantly alleviated by digital trade exports. On the one hand, most middle- and upper-income companies possess the human capital, physical capital, and technology required for digital trade. Therefore, they are more significantly affected by digital trade exports. On the other hand, the emergence of digital trade enables an increase in median wages. Nevertheless, the prices of commodities and factors are becoming increasingly transparent, and the asymmetry in information is gradually diminishing, which has resulted in homogeneous competition among peer companies with middle- and upper-wage levels and more flexible labor mobility. Therefore, the equilibrium wage level of the labor market in the middle- and upper-wage groups tends to approach the median.

Analysis of the mechanism of digital trade exports affecting wage inequality

This section employs the stepwise test method for mediating effects. In order to facilitate comparison, the continuous variables have been standardized, and empirical tests have been conducted on Eqs. (6) through (8). The results of Eq. (6) are presented in Table 3. The specification and analysis of Eqs. (7) and (8) are as follows:

In this context, β′ is the direct effect, α × λ is the indirect effect, and β = β′ + α × λ is the total effect. X is the explanatory variable, and M is the intermediate variable.

Export trade growth can be subdivided into quaternary margins: market, category, export density, and average real value margins. This is illustrated in Eq. (4). Then, how do digital trade exports indirectly affect wage inequality through the quaternary margins that are closely related to trading? Table 5 shows the results. The estimated coefficient of treat × lInternetest × lInternetmt in the odd-numbered column shows that compared with non-digital trade exports, digital trade exports constrain the marginal growth of the number of destination countries and product categories but increase the export density margin and its relationship with the average real value margin relatively weak. The even-numbered column further illustrates the α × λ mediating effect. As shown in the regression results, the market, category, and export density margins serve as promoting mechanisms for the negative correlation between digital trade exports and wage inequality, among which the indirect effect of the export density margin is the largest, followed by the category margin and the quantity margin in destination countries (i.e. the market margin).

Why does this happen? The possible reasons are as follows. On the one hand, the geographic scope of sales is constrained by the “digital divide,” which impedes the ability of certain countries to engage in digital trade due to the lack of human and material resources to support the adoption of digital technologies. This market limitation puts downward pressure on both export intensity and category demand. While digital trade capitalizes on the potential of the long-tail economy, certain product categories remain unsuitable for cross-border online sales. This is due to the intrinsic nature of the products, the lack of trust between buyers and sellers, and the absence of adequate security and experience on the online platform. These factors collectively impede the expansion of these categories. Coupled with the constant optimization of the logistics system and reduction in trade costs, export density continues to rise. However, restrictions on export regions, categories, and increased export density have led the international market to approach perfectly competitive market conditions, thereby resulting in wage equalization among different companies. On the other hand, due to the lower entry threshold and the insufficient digital trade supervision system, there has been a phenomenon of inferior goods driving out superior goods, thereby this has led digital trade exports to inhibit the increase in average real value. However, with the improvement in digital trade credit and evaluation systems, this inhibition effect is gradually declining. Therefore, changes in average real value have not been significantly affected by digital trade exports, and this mediating effect is also relatively small.

Heterogeneity effect of digital trade exports on wage inequality

This study aims to explore the diverse impacts of digital trade on inter-firm wage inequality arising from variations in the “digital” dimension. It investigates the heterogeneous effects of different categories of digital trade exports and the level of Internet usage in both exporting and importing countries on inter-firm wage inequality. This paper conducts regression analyses on digital service exports and cross-border e-commerce exports and performs empirical analysis based on varying levels of Internet use in export cities and importing countries. However, due to the involvement of multiple variables related to Internet use intensity in the measurement model, heterogeneity effect tests using Eq. (9) are not conducted here; instead, regression analyses are performed by dividing the sample.

In addition, the heterogeneity effect of digital trade exports on inter-firm wage inequality may result from the differences related to firms, industries, and regions, which can be easily masked by the aggregate regression results. However, if the sub-sample regression is adopted, comparing and estimating the coefficients becomes difficult owing to the sample differences. Therefore, the heterogeneity effect model is constructed to evaluate the heterogeneity results caused by various sample differences. The specific model is as follows:

where Het denotes the heterogeneity variable, the subscript j is used to distinguish among different heterogeneity variables of the same classification, and the estimated coefficient β8j is relative to the estimated coefficient β1 of the reference variable.

Heterogeneous effects at the “digital” Level

Conducting heterogeneity tests based on the categories of digital trade. As shown in Table 6, Columns (1) and (2) of the regression results, the regression coefficients of both exports of services that can be delivered digitally and cross-border e-commerce exports are significantly negative. Compared with cross-border e-commerce exports, the regression coefficient (negative) and P-value of the export of digital services are larger, indicating that the positive effect of the export of digital services on inter-firm wage equalization is smaller than that of cross-border e-commerce exports. The paper suggests that the main reason for this is as follows: First, for cross-border e-commerce exports involving more industries, cross-border e-commerce exports based on the first and second industries will also affect the income of enterprises in the tertiary industry, such as logistics services and digital financial services. Second, the trade volume and transaction volume of cross-border e-commerce exports are much larger than those of digital services that can be delivered, which can not only attract more enterprises to participate in cross-border e-commerce transactions, but also with the narrowing of the digital divide and the improvement of international logistics systems, the entry threshold is lowered, information transparency is improved, and long-distance trade costs are reduced, which is conducive to traditional trade disadvantaged enterprises, reduce inter-firm wage inequality through the expansion of trade markets and improve trade income. Finally, the fact that average wages are generally higher in the industries involved in the trade of digital services makes it difficult for wages to rise significantly again as a result of digital service exports, and it is even less likely that wages will fall in the opposite direction. The main function of the digital service export model is to reverse the previously “non-tradable” service sector and promote the development of international business and trade. Its role in reducing inter-firm wage inequality is somewhat smaller.

Additionally, this paper employs a heterogeneity test based on the intensity of Internet usage at the locations of import and export. As illustrated in Table 6, the regression coefficients of treat × lInternetest × lInternetmt in Columns (3), (4), and (6) are all significantly negative, with their absolute values in descending order in Columns (3), (4), and (6). In contrast, the coefficient of treat × lInternetest × lInternetmt in Column (5) is significantly positive. This suggests that digital trade exports have the potential to serve as a crucial catalyst for inter-firm wage equalization in the source country, regardless of the level of Internet usage in the product’s source city. In instances where Internet usage intensity in the destination country is relatively low, the likelihood of digital trade exports contributing to an exacerbation of wage inequality among firms in the source country is increased. Conversely, when the intensity of Internet usage in the importing country is high, digital trade exports can also markedly diminish wage inequality among firms in the exporting country. However, the mitigating effect is less pronounced than that brought about by Internet usage intensity in the exporting city being high or low.

The reasons for this outcome are complex and can be attributed to a number of factors, the primary ones of which are as follows: Firstly, export cities with low Internet penetration rates are predominantly economically underdeveloped. Digital trade exports have the potential to enhance the revenue of local enterprises, thereby narrowing the wage gap between local enterprises and those in economically developed areas. Secondly, regions with higher Internet coverage tend to exhibit higher levels of economic development and more diversified sources of income. However, despite these advantages, wage inequality can still be mitigated to a certain extent due to the constraints imposed by the scope for wage upgrading in these regions and the assistance provided by digital trade in micro, small, and medium-sized enterprises (MSMEs). Thirdly, importers in countries with low Internet usage are constrained by economic factors and tend to source cost-effective products through digital trade platforms. This results in relatively limited profit margins for micro, small, and medium-sized enterprises (MSMEs). In contrast, only large enterprises with economies of scale are typically able to export high-quality goods at low cost. Consequently, in such instances, digital trade can exacerbate wage inequality among firms in exporting countries. Fourthly, when the intensity of Internet use in importing countries is high, the products they pursue are no longer solely price-oriented. Instead, different factors, such as product categories, quality, logistics, after-sales service, and added value, are considered. Consequently, an increase in the number of exporting firms utilizing digital trade would lead to a reduction in wage inequality among firms in the exporting country. Nevertheless, this is, in essence, the development of the Internet in the importing country, and thus the impact is not as significant as the impact of Internet coverage in the exporting country on the distribution of income in the exporting country.

Heterogeneous effects at the enterprise level

This paper examines four types of heterogeneity in the impact of digital trade exports on inter-firm wage inequality at the firm level, that is, we focus on attribution of enterprise ownership, enterprise size, capital-intensive versus labor-intensive, and enterprise financing constraints. The details are as follows.

In terms of enterprise ownership, as shown in Column (1) of Table 7, the increase in digital trade exports of enterprises under different ownership has a nonuniform effect on wage inequality among enterprises. Compared with state-owned enterprises, the negative effects of collective-owned enterprises are more significant, that of Individual-owned and Hong Kong, Macao and Taiwan-owned enterprises are smaller, and the difference in the negative effect among legal person-owned enterprises, foreign-owned enterprises, and state-owned enterprises is not significant. In other words, with digital trade exports, collective-owned enterprises show the greatest income equalization effects, followed by state-owned, legal person-owned, and foreign-owned enterprises; individual-owned enterprises and enterprises owned by Hong Kong, Macao and Taiwan have the least effect.

In terms of the difference in enterprise scale, Column (2) of Table 7 indicates that large enterprises have the ability to amplify the negative impact of digital trade exports on wage inequality, while the role of SMEs is not significantly different from that of large enterprises. As explained above, the equalization effect of large firms can be attributed to government supervision and labor unions, and digital trade exports provide a more fiercely competitive market for goods and labor for large firms. Thus, wage inequality has been significantly reduced by digital trade exports. Due to the lower threshold for international trade caused by digital technologies, some previously small enterprises have joined the ranks of medium-sized enterprises, thereby reducing wage inequality among enterprises. However, they may face problems such as insufficient economy of scale effect, financing constraints, and talent-related bottlenecks. Therefore, their ability to promote wage equalization is not greater than that of large enterprises. Similarly, although small and micro-enterprises have benefited considerably from digital trade exports, wage inequality has been alleviated. However, due to their small workforce and lack of labor unions, the labor force’s bargaining power in these enterprises is quite heterogeneous. It is difficult for small and micro-enterprises to form a consensus on wages, so their negative effect on wage inequality is modest.

In terms of differences in capital intensity, it can be observed from Column (3) of Table 7 that high capital intensity has a certain promoting effect on the negative correlation between digital trade exports and wage inequality, which is the inverse of the relationship between capital intensity and wage inequality noted earlier. This implies that, relative to labor-intensive enterprises, capital-intensive enterprises have leveraged the potency of capital reproduction to enter and augment their digital trade exports. Moreover, the majority of capital-intensive enterprises commonly employ low-price strategies to secure a greater market share, thereby bringing average profits and wages closer to those of their peers.

As for the heterogeneity of firms’ financing constraints, the results in Column (4) of Table 7 show that enterprises with high financing constraints can significantly expand the negative effect of digital trade exports on wage inequality, while relatively speaking, enterprises with low financing constraints have less power to reverse wage inequality in the process of digital trade exports. Most likely, firms with high financial constraints struggle to move up along the value chain, and they often lack the capital to hire high-quality talent, thereby making it difficult for them to gain a foothold in traditional international trade. However, as the capital and talent requirements of digital trade are progressively diminished, enterprises with severe financing constraints can also export with lower costs and less human capital. Therefore, overall labor income inequality gradually fades away.

Heterogeneity effect in other aspects

In addition to the aforementioned firm-level heterogeneity effect, industrial and regional differences may exert an influence on wage equalization. Indeed, the regression results of this study substantiate this assertion.

As depicted in Column (5) of Table 7, digital trade exports within downstream industries alleviate inter-firm wage inequality compared to non-digital trade exports, whereas those in upstream sectors tend to exacerbate wage disparities. Digital trade is transforming the basic structure of global value chains. Moreover, the development of blockchain can narrow the “trust” gap between upstream and downstream enterprises in the supply chain. The development of digital trade has enabled downstream enterprises to obtain the intermediate goods they need at a more transparent price. Then, by using the digital trading platform, they can sell the products they manufacture at a price that is slightly lower than the market price. The compression of cost and price leads to the reduction of wage inequality. Furthermore, enterprises located upstream in the industrial chain often possess unique resources or technologies, which typically lead to increased barriers to entry. The adoption of digital trade modes for exports will further expand their market share and revenue sources, thereby exacerbating income inequality among them.

As can be seen from Column (6) of Table 7, a negative correlation exists between digital trade exports and inter-firm wage inequality in all three regions of China: the eastern, central, and western. The effect shows certain differences depending on the region, which are manifested in descending order as follows: western, central, and eastern regions. In other words, the poverty alleviation effect of digital trade exports is relatively significant. The western region of China is abundant in natural resources; however, it faces a shortage of talent and adverse geographical conditions, which have contributed to the relative underdevelopment of the overall economy in this area. Nevertheless, digital trade has opened up new opportunities for the conversion of natural resources into revenue in the western region. Moreover, with government backing for education, transportation, and digital infrastructure in the western region, combined with the close proximity of many western cities to other countries, certain cities in the west are well-positioned to participate in digital trade. In the underdeveloped western regions, when digital trade exports appear, they increase income in poverty-stricken areas and positive feedback effects, such as increased consumption and investment expenditures, follow. Positive feedback promotes the wage levels of local enterprises and is sufficient to reverse the deterioration in overall wage inequality. Similarly, the revenue of previously non-export companies in the central and eastern regions benefit from digital trade, which mitigates overall wage inequality. However, compared with the western region, the economic foundation of the central and eastern regions is generally stronger, and digital trade export is only a small part of their revenue source; thus, the impact of digital trade exports on wage inequality in these regions is comparatively weaker.

Robustness test

This section substantiates the previous results by adjusting the models, variables, and sample sizes. Firstly, the model estimation method underwent revision. Due to the substantial lack of micro-level data and the presence of significant heteroscedasticity as indicated by testing, this study utilized maximum likelihood and two-step consistent estimation methods for further validation. The results are presented in Table 8, Columns (1) and (2), demonstrating robustness. Secondly, we substitute the key explanatory variables. In this section, we employ the entropy weight and TOPSIS methods to assess the interaction term between the digital trade of city’s (lagged one-period indicator) and treat, serving as an additional measurement indicator for digital trade exports. The regression results are reported in Column (3) of Table 8, which align closely with the benchmark test results. Moreover, determining the lag order in empirical studies is often challenging; therefore, this study employs two-period and three-period lags in the Internet usage intensity to examine variations in the results. As indicated in Table 8, Columns (4) and (5), the results of the abovementioned benchmark regression are robust, evidenced by the significant negative impact exerted by both two- and three-period lagged digital trade exports, which have a significantly negative effect on wage inequality. However, the results suggest that in comparison to the one-period lag, the two-period lagged indicator exhibits greater significance and a larger absolute coefficient value, whereas the significance of the three-period lagged indicator is diminished. Thirdly, increase the sample size. To achieve this, the study adjusts the treatment and control groups by dividing them based on the products collected from Alibaba.com station. A value of 1 for alibb index signifies that exported products fall under Alibaba.com station’s commodities category - representing the treatment group; whereas a value of 0 indicates that these exported products do not belong to any commodity category on Alibaba.com - representing instead as part of control group. The results show that the negative correlation between digital trade exports and wage inequality remains statistically significant, albeit with a slightly reduced absolute value of the estimated coefficient compared to the benchmark regression result. Fourthly, we apply the quadratic term model to examine whether inter-firm wage equalization caused by digital trade export will change. In the field of economics, the effects of several shocks may be constantly diluted or even reversed by certain forces. Therefore, this paper introduces the quadratic term to detect any changes. The results in Column (7) of Table 8 indicate that the estimated coefficient of (treat × lInternetest × lInternetmt)2 is not statistically significant, while the linear term remains significantly negative.

In general, the adverse impacts of digital trade exports on wage inequality, as determined through various estimation methods, city-level digital trade analysis, multi-period lagged Internet usage intensity indicators, expanded sample size, or inclusion of the quadratic term, align closely with the findings of the benchmark regression. This underscores the robustness and reliability of the benchmark regression results.

Conclusions and policy implications

This paper empirically investigates the impact of digital trade exports on wage inequality using a matched sample of Chinese industrial enterprises and customs goods classified under 6-digit HS Code. The aim is to investigate whether traditional export trade or digital trade exports are more effective in mitigating wage inequality among enterprises and to comprehend the mechanisms by which digital trade exports impact wage inequality. Empirical evidence suggests that digital trade exports are capable of promoting wage equality across firms and within industries while exacerbating wage inequality across industries. In terms of different wage groups, digital trade exports by firms at lower to middle-range wage levels increase median wages and decrease low wages. However, among the middle- and high-wage level groups, high-income exporters cannot escape the fate of being “cut off the top.” Regarding the mechanism, compared to non-digital trade exports, digital trade exports increase the export density margin, inhibit the growth of regional and category margins, and promote wage equalization.

This paper also investigates the heterogeneity impacts of digital trade exports on wage inequality from the vantage points of “digital,” enterprises, industries, and regions. The findings indicate that cross-border e-commerce exports exert a more pronounced influence on reducing inter-firm wage inequality, while the impact of digital services exports is comparatively less pronounced. Under the influence of digital trade exports, the negative effect of inter-firm wage inequality in the exporting region is greater when Internet usage intensity is lower, the effect is next when Internet usage intensity is higher in the exporting city, the effect is smaller when Internet usage intensity is higher in the importing country, and the effect of digital trade on inter-firm wage inequality in the exporting country is promotional when Internet usage intensity is lower in the importing country. In the process of digital trade exports, collectively-owned enterprises have the largest income equalization effect; state-owned, legal person-owned and foreign-owned enterprises rank second; and individual-owned and Hong Kong, Macao and Taiwan-based enterprises have the smallest wage equalization effect. In comparison to large enterprises, the positive effects of digital trade exports of SMEs on wage equalization are not significantly different. In contrast to labor-intensive enterprises, capital-intensive enterprises that develop and increase digital trade exports witness their average profits and wage levels approaching that of their peers. Compared with low-financially constrained companies, the digital trade exports of high-financially constrained companies have a greater impact on reversing wage inequality. Digital trade exports in upstream and downstream industries worsen and contribute to the equalization of wages among firms, respectively. The negative correlation between digital trade exports and wage inequality varies across the Eastern, Central, and Western regions. The magnitude of the adverse effect decreases in the order of the Western, Central, and Eastern regions.

In conclusion, with the continuous growth of international trade empowered by digital technology, previously disadvantaged companies and poor areas will greatly benefit from digital trade exports; however, wage polarization between industries that are supported and those that are constrained may be exacerbated by digital trade. Therefore, while strengthening the export of digital trade, the government needs to particularly focus on low-value-added enterprises in non-digital trade. The policy implications of our findings are significant, and it is imperative to consider the following recommendations.

The first is top-down coordination. The government should support disadvantaged enterprises in entering and increasing digital trade exports through multiple incentive mechanisms; for example, the government can introduce subsidies, export tax rebates, and personnel training for digital trade exports according to the region, industrial chain, and financing constraints.

The second is bottom-up adjustment. Companies that suffer losses can switch to different categories of digital trade exports or search in a wider range to choose their destination countries.

The third is inside-outside matching. Corporate personnel should constantly update their knowledge regarding digital technology and digital trade to align with relevant positions, so as to avoid the aggravation of wage inequality caused by the adverse impact of digital trade on some industries or enterprises.

Data availability

Data used in this study are available from the corresponding author at reasonable request.

Notes

Because many indicators of industrial enterprises are based on one- and two-period data, the data of industrial enterprises from 1998 to 1999 are retained in this study.

The Long-Tail Economic Theory posits that the aggregate demand and sales of niche, “cold” goods is the overlooked Long Tail.

Apart from the treatment and control groups selected in this study, other samples are eliminated because other samples are in a “neither black nor white gray sensitive area,” and thus, they cannot be used to compare digital export with traditional export. The selection of the dummy variable treat is explained in Eq. (3).

The items collected from Alibaba.com were matched automatically with the HS-code of the product categories using MS Excel, and then the remaining items were matched manually.

HS Code Queries site: https://www.hsbianma.com/

The eastern region includes Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan; the central region includes Shanxi, Inner Mongolia, Jilin, Heilongjiang, Henan, Hubei, Hunan, Jiangxi, and Anhui; and the western region includes Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Guangxi, Tibet, and Xinjiang.

The distinction here is based on an overall evaluation of the significance level and estimation coefficient.

References

Ackerberg D, Caves K, Frazer G (2006) Structural identification of production functions, MPRA Paper No. 38349, posted 25 Apr 2012 00:44 UTC. https://mpra.ub.uni-muenchen.de/38349/

Adugna H (2024) Fintech dividend: How would digital financial services impact income inequality across countries? Technol Soc 77:102485. https://doi.org/10.1016/j.techsoc.2024.102485

Aguiar L, Waldfogel J (2018) Netflix: global hegemon or facilitator of frictionless digital trade? J Cult Econ 42(3):419–445. https://doi.org/10.1007/s10824-017-9315-z

Asare SD, Gopolang B, Mogotlhwane O (2012) Challenges facing SMEs in the adoption of ICT in B2B and B2C E‐commerce: a comparative case study of Botswana and Ghana. Int J Commer Manag 22(4):272–285. https://doi.org/10.1108/10569211211284485

Basco S, Mestieri M (2014) The world income distribution: the effects of international unbundlingof production. TSE Working Paper, n. 14-531,Toulouse. http://publications.ut-capitole.fr/16604/

Bernhofen DM, El‐Sahli Z, Kneller R (2021) The impact of technological change on new trade: evidence from the container revolution. Can J Econ/Rev Can Econ 54(2):923–943. https://doi.org/10.1111/caje.12517

Borrs L, Knauth F (2021) Trade, technology, and the channels of wage inequality. Eur Econ Rev 131:103607. https://doi.org/10.1016/j.euroecorev.2020.103607

Brandt L, Van Biesebroeck J, Zhang Y (2012) Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. J Dev Econ 97(2):339–351. https://doi.org/10.1016/j.jdeveco.2011.02.002

Bu H, Xun Z, Cai S (2024) Big data and inter-firm wage disparities: theory and evidence from China. Econ Change Restruct 57(4):147. https://doi.org/10.1007/s10644-024-09729-3

Chen C, Ye A (2021) Heterogeneous effects of ICT across multiple economic development in Chinese cities: a spatial quantile regression model. Sustainability 13(2):954. https://doi.org/10.3390/su13020954

Chipman JS (1969) Factor price equalization and the Stolper–Samuelson theorem. Int Econ Rev 10(3):399–406. https://www.jstor.org/stable/2525651?seq=1#metadata_info_tab_contents

Couture V, Faber B, Gu Y, Liu L (2021) Connecting the countryside via e-commerce: evidence from China. Am Econ Rev: Insights 3(1):35–50. https://www.aeaweb.org/articles?id=10.1257/aeri.20190382

Dai M, Yu M, Zhao C (2018) Export tightening, competition, and firm innovation: evidence from the renminbi appreciation. Rev Dev Econ 22(1):263–286. https://doi.org/10.1111/rode.12340