Abstract

Based on the annual reports and input–output table data of Chinese listed companies from 2008 to 2020, this paper measures the level of digital transformation of enterprises by using the keyword word frequency index in the annual reports of listed companies and reveals the impact and mechanism of digital transformation of enterprises on industry chain elasticity by using a panel data model. Additionally, it provides a theoretical explanation of how the digital revolution of businesses affects industrial chain resilience. The outcome shows that improving industrial chain resilience can be facilitated by businesses undergoing a digital transition. Moreover, factor mismatch can be reduced by corporate digital transformation, which enhances industrial chain resilience. Furthermore, the beneficial effects of the digital revolution on industrial chain resilience will be enhanced by politically linked businesses. The main conclusions contribute to our understanding of the relationship between industrial chain resilience and enterprises’ digital transformation. It also offers crucial policy recommendations and guidance that the government can use to create sensible digital economy policies and successfully direct businesses’ digital transformations in order to strengthen the industrial chain resilience.

Similar content being viewed by others

Introduction

The report of the 20th National Congress of the Communist Party of China emphasized the need to build a modern economic system more quickly, concentrate on raising total factor productivity, and work to make supply linkages and industrial chains more robust and safe (Liu et al. 2024). The “blockages”, “breakpoints”, and “short boards” in the industry chain and supply chain are the key structural problems that have long constrained the efficiency of China’s industrial development and the smooth flow of the national economic cycle (Zeng et al. 2017). Moreover, developed nations led by the United States encounter these as the “choke points” of China’s industries (Pournader et al. 2016). Additionally, these are the primary domains where China’s industries have come into contact with the “necklace” of industrialized nations headed by the United States (Zhang et al. 2023). Therefore, it is an important task to promote supply-side structural reform and build a modernized industrial system at present and in the long term future to improve the resilience of the industrial chain supply chain by opening up the obstacles (Pournader et al. 2016). The management literature is where the term “resilience” is most frequently used (Zhang et al. 2024). In particular, studies pertaining to resilience within supply chains have yielded numerous important findings. Brandon–Jones makes a distinction between supply chain resilience, which is defined as “the capacity of a supply chain to get back to its normal operational efficiency within a reasonable time period following disturbance”, and resilience, which is defined as “the ability of a supply chain to keep up its function despite either external or internal disruptions” (Brandon-Jones, 2014). Building on a multi-perspective and multidisciplinary examination of resilience, define it as “the capacity of a supply chain to avert unforeseen circumstances, adapt to disturbances, and sustain operations at the optimal degree of connection and function control” (Ponomarov and Holcomb, 2009). In summary and in combination with previous literature, when a supply chain is affected by market volatility, its resilience primarily relates to its capacity to bounce back to its previous state or even surpass it (Christopher and Peck, 2004; Soni et al. 2014). The strategy for improving supply chain resilience emphasizes capacity building in three aspects, incorporating the capacity of the supply chain to be ready to handle any unforeseen threats, the rapid response ability when the chain is interrupted, and the recovery and reconstruction ability (Ponomarov and Holcomb, 2009). Previous literature has paid particular attention to the study of preparation to deal with risks, such as suitable supplier selection, supplier diversity, supply chain flexibility, etc. (Futtner and Maklan, 2011)). However, the current study on “resilience” focuses on the perspective of management and lacks the perspective of economics. Industrial chain division of labor is an important research area of industrial economics. As a result, in order to further understand the mechanism and implications of the resilience of the supply chain and industrial chain, empirical testing must be done using the theory of industrial economics.

As digital technologies continue to spread, new business possibilities, creative goods and services, and successful company models appear (Ling et al. 2023; Verhoef et al. 2021). It was noted that nearly every modern organization has been significantly impacted by digital technology and that data is a crucial part of the digital economy and a new driver of economic growth (Bhimani, 2015). Digitization can also help enterprises improve data analysis capabilities, induce processes, and diversify restructuring innovation (Wu et al. 2019). The average digital transformation index of Chinese businesses, according to the most current figures, is 54 points in the year 2021, 50 points in the year 2020, 45 points in the year 2019, and 37 points in the year 2018, indicating a steady advancement in the digital transformation of Chinese businesses (Jiang et al. 2022). Businesses may increase their capacity for innovation, boost the effectiveness of factor allocation, increase R&D investment, and optimize supply chain structure (Wang et al. 2023; Wu et al. 2024). However, the prevalent phenomena of “island” and “fragmentation” pose a significant challenge to the current digital transformation at the industry level (Alvarenga et al. 2023), and many businesses prioritize the internal development of digital technology while ignoring its outward effects. In particular, due to the industrial chain supply chain’s lack of toughness, poor upstream and downstream transmission, and insufficient coordination (Tortorella et al. 2023), the effect of digital transformation at the industrial chain supply chain level often appears “1 + 1 < 2 “phenomenon (Van et al. 2022). In this context, it is necessary to learn the influence of the digital economy level of enterprises on the resilience of the industrial chain (Pournader et al. 2016) and then point out the direction for promoting policy optimization and guiding enterprise behavior (Nikookar and Yanadori, 2022). In addition, businesses all throughout the world have had to change as the COVID-19 pandemic started in order to withstand the economic crisis (Jin et al. 2022; Liu et al. 2024). A serious pandemic emphasizes how urgently businesses need to embrace digital transformation, forcing enterprises to reconsider digital transformation (Jiang et al., 2022). In order to enhance business performance and acquire an ongoing competitive edge (Vial, 2019; Verhoef et al. 2021), the majority of organizations use digital platforms and technologies in response to the dramatic changes in the market environment and technology that accompany the digital age (Feng et al. 2024; Li et al. 2016). The research of digitization has been extended to micro firms by the current literature (Jiang et al. 2022), which employs the microdata to empirically support the beneficial effects of organization digital technology adoption on enterprise performance.

The digital economy is experiencing rapid growth, and new information technology has aided in this process (Van et al. 2022). Data is now a crucial component of production that drives economic development, and new business models and scenarios are continuously emerging, and the digital economy leads industrial transformation with new connotations, which will accelerate the restructuring of the global value chain (Antràs and Gortari, 2020), and the layout of China’s industrial chain is facing major changes. A fresh approach to industrial cooperation is progressively emerging. The digital economy is growing rapidly, and new information technology has aided in this process. Data is now a crucial component of production that drives economic development, and new business models and scenarios are continuously being developed (Tortorella et al. 2023), and the digital economy leads industrial transformation with new connotations, which will accelerate the restructuring of the global value chain, and China’s industrial chain’s design is undergoing significant adjustments. The next wave of economic expansion will be significantly fueled by the digital economy (Falk and Biagi, 2016) and it will bring all-round changes in all links of the industrial chain (Baz and Ruel, 2021). In the new wave of global change, the digital economy has shown unprecedented vitality (Sultana et al. 2021), bringing a large number of new elements and new industries to the chain of the manufacturing sector, promoting the chain of the manufacturing sector gradually to the “new blue ocean”, and accelerating the improvement of the resilience of the chain of the manufacturing sector. With emerging technologies like big data and artificial intelligence serving as the foundational underpinning for new sectors, the digital economy can continuously give birth to digital emerging industries in the field of manufacturing industry chain (Guo et al. 2023) and give a new impetus to the resilience of the chain of the manufacturing industry. It is significant to highlight that the advancement and application of digital technology have made it possible to build supply and industrial chains, increase company efficiency, and foster favorable conditions. In the opinion of some scholars, the digital economy can deconstruct and reconstruct the industrial chain from both software and hardware levels through services and infrastructure, so as to enhance the strength. And the growth can enhance the resilience of China’s industrial chain and increase its capacity to fend off threats (Wang et al. 2023).

Nevertheless, there are still a lot of unanswered questions in the present body of research about the connection between industrial chain resilience and business digital transformation, mainly in the following two aspects: In the first place, the system and method of measurement of enterprise digital transformation level need to be further improved. Some scholars use text analysis to evaluate enterprise digitization (Du et al. 2022), discuss the impact of an organization's digital transition on productivity, and find that there is a promoting effect between technological innovation and productivity at the firm level. Second, more research is required to determine how the industrial chain’s resilience is impacted by digital transformation. There is much work to be done on the theoretical framework of industrial chain resilience and digital transformation. Whether enterprises’ digital transformation has an impact on the industrial chain correlation, what kind of impact it has, and through what dimensions and ways, this study offers empirical evidence for the influence of digital transformation on industrial chain resilience.

On the basis of enhancing the system for measuring both industrial chain toughness and enterprise digital transformation, this study investigates the impact and mechanism of the latter on the former. The key ways that this work differs from earlier research are as follows: First, from a research standpoint, there is a wealth of pertinent study results because academics have been concentrating on digital transformation in recent years. Under such a severe situation of the market economic environment, the industry chain toughness as a comprehensive embodiment of the resistance, resilience, and enhancement of the enterprise in the face of external shocks, to enhance the industry chain toughness has also become particularly important, but at present, there is not a lot of research on combining the digital transformation with the industry chain toughness. In order to fill in the gaps in the existing research and improve the pertinent research findings, this paper begins with an examination of the relationship between industry chain resilience and digital transformation and then delves into that relationship at the enterprise micro level. Secondly, on the measurement of core indicators, the existing rich research results also provide great reference value for this paper. By comparing and analyzing the measurement methods of different scholars on digital transformation and industry chain resilience, we draw on their measurement ideas and improve them, and ultimately determine the specific measurement methods suitable for this paper. For example, this paper makes full use of and mines the effective information in the annual reports of enterprises and counts the word frequency of keywords of digital transformation, so as to measure digital transformation. Third, in terms of research content, it constructs a mathematical economic model for the relationship between enterprise digital transformation, factor mismatch, political affiliation, and industry chain resilience, analyzes the impact of enterprise digital transformation on industry chain resilience, and supplements the research content in related fields.

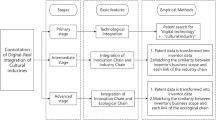

The remainder of the study is structured in this manner. After studying the mechanism of digital transformation on industrial chain resilience and the relationship between factor allocation, digital transformation, and political link in the second part of the research, three hypotheses are put forth. In addition, the third part is model construction, index selection, and data source. Then, the analysis of the empirical findings is the fourth section, and after that, the endogeneity test, the robustness test, and the heterogeneity analysis of different industries and different periods are provided. Finally, the conclusions and policy suggestions of this paper are delivered. To illustrate the outline of the research framework clearly, we draw Fig. 1.

Theory and hypothesis

The powerful technology, high levels of synergy, and widespread penetration of the digital economy have transformed the traditional industrial chain (Zhang et al. 2022, 2024). On the one hand, the industrial chain has gained new life due to the quick growth of digital technologies like the Internet of Things, big data, and artificial intelligence, enterprises have begun to transform and upgrade to intelligent manufacturing, and technology enables the industrial chain, promotes the formation of a triple positive feedback loop of business, manufacturing and R&D innovation, realizes a new economic structure with increasing returns to scale, and improves the resilience of the industrial chain. On the other hand, the growth of the digital economy has significantly increased the effectiveness and openness of information sharing (Ding et al. 2021), accomplished the industrial chain’s upstream and downstream separation of labor and collaboration, and reduced the risk of information asymmetry. The intervention of digital technology can connect and reorganize elements in a short period, screen and sort out production and management resources for the operation of the industrial chain from massive information data, reduce production costs, improve the efficiency of reasonable allocation of resource elements, and thus improve the industrial chains toughness (Spieske and Birkel, 2021).

The great coordination and permeability of the digital economy also lead to more precise and efficient factor matching, which optimizes the distribution of resources and raises the standard and efficiency of manufacturing growth (Wang et al. 2024). First of all, during the period of the digital economy, even more knowledge-intensive elements such as data and information have the characteristics of high permeability and high collaboration (Lu et al. 2024). With the increase in the input of high-end elements such as data and information, the organic ratio of factor input has changed, and the productivity of conventional factors has increased because of their deep integration with labor, capital, and other components. The application of digital technology triggers the substitution of capital for labor (Zhang et al. 2022), and while replacing simple labor, it also drives the demand for complex labor that cannot be automated, raises the need for skilled workers, and boosts output effectiveness. Secondly, the traits of a network industry apply to the digital economy (Niu et al. 2024). The highly interconnected network framework that the digital economy has created, along with its positive externality effect and scale effect, makes it easy for different factors to be created, aggregated, transferred, and applied. It also achieves precise matching between the supply and demand of factors, which alters the terms under which traditional financial institutions can lend money. In addition, as the digital economy grows, monopolistic industry reform will be supported, rivalry in the market will be bolstered, sensible flow and the best possible combination of production elements will be accelerated, and the input–output ratio will be improved. Moreover, the digital economy develops the change of enterprise organization form, business process and coordination mechanism, the transformation of enterprise organization mode to network, flat and flexible, and the optimization of production factor allocation. Enterprise information asymmetry can be lessened through digital transformation. The process of digital transformation has the potential to expedite the shift in internal production and operation modes, enhance internal operation intelligence, mitigate the issue of information asymmetry in industrial operations, optimize internal resource allocation, and boost resource utilization efficiency. Furthermore, digital transformation can achieve the synergistic development of internal production and operation of the enterprise and supply chain management, as well as increase the efficiency of inter-enterprise collaboration (Cheng and Cui, 2024). Digital technology can realize supply chain business scenarios, optimize supply chain resource allocation and improve production efficiency under the condition of ensuring smooth and effective logistics, capital flow and information flow. Enterprises may face resource mismatch problems in production and operation, which not only increases operating costs but also reduces production efficiency, thus failing to better cope with various risks. Therefore, improving resource allocation efficiency among enterprises will be conducive to enhancing the level of industry chain resilience, while digital transformation can lessen resource mismatch by improving synergistic effects and decreasing the information asymmetry issue (Fig. 2).

In recent years, the issue of the political connection of enterprises has been an important research topic in the academic circle. Political connections can be considered a special kind of human relation and powerful guanxi in China (Gu et al. 2013; Ye et al. 2024). The political affiliation of business refers to the many ways in which companies establish good relations with the government. This phenomenon is widespread in many countries around the globe (Chen et al. 2024). And political linkage is not only a static and informal relationship but also a dynamic and changing mechanism of interaction between the government and enterprises; political linkage connects government work and enterprise behavior, which will have an impact on the development of enterprises, and then affect the resilience of the industrial chain. In the context of China’s economic transformation, as a non-market factor, political connection is a crucial component of business functioning and growth that cannot be disregarded. Enterprise operation, enterprise financing, and enterprise value are all significantly impacted by the connection between government and business (Shen et al. 2023; Feng et al. 2024). On the one hand, political connection plays the role of a “supporting hand”. For example, through political connections, enterprises can obtain more bank loans, obtain tax incentives, ease financing constraints, and enter industries with high barriers. What’s more, political connections can also act as a “predatory hand” by decreasing the effectiveness of business mergers and acquisitions, increasing the burden of social responsibility, and decreasing the accuracy of credit distribution of resources (Wang et al. 2023). Some studies have found there is an indirect relationship between political resources and a direct negative association between corporate efficiency and political connections (Li et al. 2019). These could all turn into roadblocks in the way of businesses undergoing digital transformation, which would affect how resilient the industrial chain is. It is generally believed that Chinese government officials have a strong sense of social responsibility, and politically connected entrepreneurs represent both their economic and political identities, the latter indicating to some extent that politically connected entrepreneurs have passed the test of their values by governmental organizations and have a keen sense of insight, so when formulating enterprise development strategies, such executives, under the intrinsic driving force of their values, will respond positively to national policies, anticipate industry winds, and improve their own competitiveness and ability to cope with risks. The analysis shown above leads to the following hypothesis being put forth:

H1: The industrial chain’s resilience will increase as a result of enterprise digital transformation.

H2: Enterprise digital transformation promotes the resilience of the industrial chain by reducing factor mismatch.

H3: The digital transformation of businesses is accelerated by political ties, thereby strengthening the industrial chain’s resilience.

Research methodology and data description

Model design

Benchmark regression model

The effect of the enterprise digital economy level on the industrial chain’s resilience is the main subject of this study, and the following are the precise parameters of its benchmark regression model.

where Resilience is the level of industry chain resilience, DL is the enterprise digital economy development level, and Control is a collection of control variables, Firm, Industry, Province, and Year stand for fixed effects, correspondingly. The term for random error is εit. the industrial chain resilience is greatly enhanced by DL if α0 is significantly positive.

Mediating effect model

Simultaneously, this article establishes the following model and uses the intermediary effect model to investigate the mechanism via which the enterprise digital economy’s growth level influences the industrial chain’s toughness through factor mismatch:

where FES expresses the factor mismatch variable and other variables are consistent with model (1).

Specific index selection

Dependent variable

The measurement methods of industry chain toughness include input–output method and value-adding method. The input–output method is the basis of the input–output table. Among them, the length of production segmentation can not only reflect the degree of specialization, but also measure the correlation and then measure the toughness level of the industrial chain. The longer the length of production segments, the higher the level of industry chain linkage, indicating that each unit of final product produced requires the support of more products from other industries and industry chains. The degree of industry chain association, i.e. the degree of interdependence and collaboration among the links in the chain, is a key factor characterizing the resilience of the industry chain. A close industry chain connection can promote the rapid flow of information and resources. When the risk comes, each link can respond quickly to adjust the production plan and reduce the loss. Moreover, diversified industry chain linkages can help diversify risks. By establishing multiple supply chains, enterprises can reduce their dependence on a single supplier or market and improve their risk resistance. In addition, the industry chain association also promotes technological innovation and synergistic development. In the net-like structure of the industry chain, through technology sharing and joint research and development, enterprises jointly attack the“neck” technology to enhance the overall competitiveness, so the industry chain connection not only improves the allocation efficiency of resources but also enhances the overall industry chain’s ability to resist risks and innovation, which is an important symbol of the industry chain’s resilience. Therefore, this article is improved on the basis of predecessor research. Table and the number of production stages to calculate the length of production segmentation of various industries, the specific calculation formula is:

where PSLj represents the number of production stages of industry j, and amj represents the industry m that needs to be invested to produce one unit of industry j product. The number of products, if no intermediate input is required in the production process, the number of production stages is set to one. Next, combine formula (7) rewrite in matrix form:

where PSL is the number of production stages of order n × 1, I represent the n × 1 order matrix with all elements of 1, A represents the direct consumption coefficient matrix, and n is the number of industries examined.

It is not difficult to find that the prerequisite for calculating the number of production stages in various industries is to obtain the direct consumption system of the input–output table in different years. As mentioned earlier and released by the National Bureau of Statistics has a long time interval, which will cause certain obstacles to the subsequent analysis. This article takes the input-output tables from 2011 and 2016 as a source, based on the research findings (Zheng et al. 2018). Based on the matrix transformation technique, the time-series input-output table from 2011 to 2020 is obtained.

In addition, the value increment rule reflects the degree of specialization of the enterprise through micro-data, and the degree of specialization of the enterprise is higher. The higher it is, the stronger the correlation between the industrial chain. This paper refers to the research and adopts the revised value increment method. The specific calculation formula is

Because the industrial chain is a product chain formed by input–output link, upper and lower connections, interlocking and close contact, involving two levels of enterprises and industries. Therefore, this paper takes the product of the above two indicators as an indicator to measure the toughness level. The industrial chain toughness of enterprise i in industry j can be expressed as

Independent variable

At present, the National Bureau of Statistics and various authoritative databases do not yet have specific public information and relevant data on the digital transformation of each enterprise, and the existing literature on the measurement of digital transformation is inconclusive, some studies have used information technology assets or information technology personnel to measure it, but the data obtained by such methods only reflect the level of informationization of the enterprise, and it is difficult to get a glimpse of the whole picture of the digital transformation, so how to effectively measure digital transformation is still a difficult task. Therefore, how to effectively measure digital transformation remains a challenge.

Text analytics provides the possibility of transforming qualitative information into quantitative data. As an important source of corporate textual information, in recent years, more and more scholars have successively mined digital transformation-related information from annual reports of listed enterprises and transformed it into quantitative data for measuring digital transformation (Ren et al. 2024; Dou et al. 2023). Enterprises’ digital transformation is in line with national strategic orientation and policy requirements and is a manifestation of actively responding to national policy calls and guidelines. For listed enterprises, they are obliged to proactively disclose “material matters”, and their regular annual reports are the management’s analyses of the current stage of the enterprise’s operating conditions and its outlook for the future, which is of the nature of summarizing and guiding, so the annual reports have a summary and guidance nature. Its regular annual report is the management’s analysis of the current stage of the enterprise’s business situation and its outlook for the future, which is of a summarizing and guiding nature, so the vocabulary in the annual report can reflect the situation of the enterprise’s digital transformation to a certain extent. In view of this, this paper utilizes the text analysis method to construct the digital transformation index, and the specific operation steps are as follows:

The first step is to obtain the annual reports of enterprises. By using the crawler function in Python, we batch collect all the annual reports of Chinese A-share listed manufacturing enterprises in the period of 2009–2021, and convert them into txt pure paper format.

The second step is to build a lexicon of enterprise digital transformation. Collect, read, and analyze relevant policy documents and reports on the digital economy and digital transformation to get the initial keyword thesaurus, and then refer to relevant literature to remove and supplement some keywords by manual screening, and count 99 digitization-related word frequencies in four dimensions: digital technology application, Internet business model, intelligent manufacturing, and current agent information system, and finally form the digital transformation thesaurus of this paper (see Table 1).

Control variable

In order to obtain the net impact of an enterprise’s digital economy development level on the resilience of the industrial chain, it is also necessary to add control variables to the model. The control variables chosen in this study include enterprise size, enterprise age, current ratio, return on assets, asset-liability ratio, cash flow intensity, equity concentration, book-to-market ratio, etc.

Mediating variable

This study employs the fixed asset-to-employee ratio to characterize the effect of the digital economy’s growth level on the industrial chain’s resilience from the standpoint of factor mismatch.

Data source description

Considering the availability of data, this study uses samples of China’s A-share listed firms from 2008 to 2020 and applies the following concepts to data processing: ST, PT, and samples from the financial sector are not included; Only samples with complete data should be kept for a minimum of five years; 1% and 99% indentation for all continuous variables. A total of 35,539 company-year observations were obtained. All data is from the CSMAR database.

Data test and result

Baseline regression result

This study examines the association between industrial chain resilience and enterprise digital economy level using the panel data model. Table 2 displays the expected outcomes of the benchmark regression model. Table 2’s Column (1) solely investigates how the enterprise digital economy level affects the industrial chain’s toughness as a variable of explanation. It is not difficult to see that the regression coefficient of enterprise digital transformation is positive and passes the significance test at 10%, that is, the development level of the enterprise digital economy can promote the improvement of the toughness of the industrial chain. Consistent with the expected results of hypothesis 1. Control variables were continued to be added to the baseline regression model, while province, industry and year-fixed effects were also considered. As can be seen in column (2) of Table 2, the regression findings exhibited some resilience even if the regression coefficient’s sign and significance remained the same. The model’s goodness of fit was greater. It also verifies the research hypothesis that the level of enterprise digital economy development can promote chain elasticity. Column (3) of Table 2 adopts the lag of the first stage of enterprise digital economy as an explanatory variable, and the sign of the regression coefficient is also positive and still significant at the 1% level. Further observation shows that the development level of the enterprise digital economy can have a sustained impact on the enhancement of industry chain resilience level in a longer period of time, i.e., there is a certain lag effect, which again verifies the hypothesis of this paper. Hypothesis H1 is verified.

Mediation effect analysis

Test findings for the mediating role of factor mismatch in enhancing the industrial chain’s resilience at the enterprise digital economy’s growth stage are listed in Table 3. The direct effect of the baseline regression is 0.013 and is statistically positive at the 10% level, as can be seen in Table 3’s column (1). Column (2), on the other hand, depicts the relationship between factor mismatch and the enterprise digital economy’s development level. The coefficient, which is statistically negative at the 1% level, indicates a negative correlation between the two variables and a relationship where the higher the enterprise digital economy’s development level, the lower the factor mismatch. At the 5% level, the visualization coefficients in column (3) are substantial. The intermediate effect model’s guiding concept leads one to the conclusion that, by lowering factor mismatch, the business digital economy may strengthen the industrial chain’s resilience. It is confirmed that hypothesis H2.

Endogenous problem

Instrumental variable method

Regression analysis was conducted using the instrumental variable approach (IV) and the two-stage least-square method (2SLS) to reduce the endogeneity issues brought on by reverse causality and missing variables. According to the previous practice, the mean value of the degree of digital transformation of other enterprises in the same industry and in the same year is used as an instrumental variable for the digital transformation of enterprises (Dou et al. 2023). It satisfies the constraints of relevance and exogeneity: The mean value of the degree of digital transformation of the same industry reflects the overall situation of the degree of digital transformation of the whole industry to a certain extent. Generally speaking, the higher the degree of digital transformation of other enterprises in the industry, the higher the degree of digital transformation of this enterprise, and there is a correlation between the two. However, the mean value of the degree of digital transformation of other enterprises and the other behaviors of this enterprise does not have a direct correlation, is exogenous for industry chain resilience, and passes the under-identification and weak instrumental variable tests. The pertinent outcomes of the two-stage regression are displayed in Table 4. Table 5’s Kleibergen-Paap rk LM test statistic value of 564.903 indicates that the null hypothesis regarding the insufficient determination of instrumental factors has been rejected, as it is significantly higher than its critical value at the 1% level. The null hypothesis is also rejected by the Cragg–Donald Wald F statistic, which has a value of 578.066 and is far higher than its critical value at the 1% level. As a result, the instrumental variables used in this study make sense. The first stage’s regression findings are displayed in Table 4 (1). There is a 1% significant positive association between the instrumental elements and the enterprise digital economy’s growth level, which is consistent with the expected results. The enterprise digital transformation has a certain promoting effect on the industrial chain correlation, as can be seen from the second stage’s regression results (see column (2) of Table 4). The regression coefficient of the company's digital economy development level is also significantly positive at the 1% level, and when compared to the benchmark regression result, the value is higher, suggesting that the corporation's digital transformation can improve the industrial chain correlation before the endogenous problem is resolved. From the perspective of the digital economy, the role of the development level in improving the industrial chain has been underestimated. The test results of the endogeneity problem are still consistent with the previous research conclusions, which enhances the reliability of the research conclusions.

Propensity score matching method

Propensity matching method can effectively reduce the endogenous bias caused by sample selection problems. Depending on how far the organizations had gone toward digital transformation, the samples were divided into two groups: the treatment group, whose digital transformation score was higher than the sample average, and the control group. Otherwise, they served as the control group, and propensity score matching was applied to the control variables accordingly. The accuracy of the results is ensured by the balance test, which requires that the control variables have no obvious difference in different degrees of digital transformation after matching. If the data bias is reduced, it means that the matching degree of the data after PSM is increased, and the sample balance is also improved accordingly. According to the results of the sample balance test, firm size, firm age, cash flow strength, equity concentration, and other variables were all significant before matching, but not significant after PSM, indicating that after the tendency rating matches, the standard deviation of these variables is significantly reduced, and the T value does not refuse the original assumption that there is no systemic bias between the treatment group and the control group. It shows that the matching results are good, the endowment characteristics of different levels of the digital economy are eliminated, and the results pass the balance test on the whole.

Robustness test

Replacement core variable

The outcomes of the benchmark regression demonstrate that the industrial chain’s resilience is significantly influenced by the enterprise digital economy’s degree of development. The process of substituting fundamental variables is further validated to guarantee the validity of the study findings. In order to reassess the industrial chain’s resilience and the corporate digital economy’s development, this research uses the following methodologies: First, based on the value-added method, that is, using the proportion of procurement in the main business income to recalculate the correlation degree of the industrial chain; The second is to set the value-added tax rate to 0, that is, to recalculate the toughness level of the industrial chain without considering the value-added tax; The third is to standardize the subdivision indicators of five dimensions, namely artificial intelligence, big data, cloud computing, digitization, and informatization, and then sum them linearly according to equal weights to obtain a new digital transformation index; The fourth is to carry out principal component analysis of five different dimensions of subdivision indicators in the digital terminology dictionary and extract the first principal component as an alternative indicator of development level. Regardless of the test method, the projected coefficient of organizational digital change is substantially positive at the level of at least 10%, which also proves the validity of the benchmark regression result.

Replacement sample data

This paper further adopts the method of replacing sample data for testing: First, since most entrepreneurial enterprises are related to digitization, this paper removes the samples of listed companies on GEM and conducts a regression test again. Secondly, considering the strong economic and political particularity of the municipality directly under the Central Government, the distinctive features of the company digital economy’s growth level and the resilience of the industrial chain are also quite different, this article conducts a regression test again without the samples of listed companies in the municipality. Finally, since the outbreak of the epidemic, online education, digital entertainment, collaborative offices, and other industries have continued to be hot, which also brings opportunities for development. Ignoring the impact of the epidemic is easy to cause certain endogenous interference. This research does a second regression test using samples of public firms from 2011 to 2019 in an effort to reduce the epidemic’s impact. The findings demonstrate that all of the corporate digital transformation regression coefficients are positive and pass the significance test at the 1% level. Thus, all of the aforementioned regression outcomes validate the robustness of the benchmark regression results and lend support to the research hypothesis that corporate digital transformation fosters industrial chain correlation.

Mediation effect test

This research supplements the Sobel test and Bootstrap test to demonstrate the mediating function of resource mismatch between industry chain resilience and corporate digital transformation. The test results are displayed in Tables 5 and 6.

According to Table 5, Sobel’s Z-value is 4.064, and the P-value is <0.05, the original hypothesis is rejected. According to Table 6, it passed the Bootstrap method robustness test, and the test results are in line with the original regression analysis results. Overall, the mediation effect was tested, further indicating that the conclusions drawn on the basis of the empirical evidence in this paper have a certain degree of robustness and reliability.

Exogenous shocks

Based on the strategy of “Broadband China”, this article adopts the multi-period differential model (DID) to test the relationship between the industrial chain’s toughness and the business digital economy’s degree of development. The specific setting form of the model is as follows:

where subscript i and t, respectively, represent enterprise and year. Resilienceit is resilienceit of industrial chain. DIDit is a multi-phase differential variable, and DIDit = treati × postit, where treat i indicates whether it is a processing group. If enterprise i is located in the demonstration city of “Broadband China”, treati = 1, and otherwise 0. postit indicates that the approval time of “Broadband China” demonstration city is the same as formula (1). Column (2) of Table 7 further introduces into the model the interaction term of multi-period differential variables and the extent of digital change within the organization. The results show that, at the 1% significance level, the interaction term between the enterprise digital economy level and the multi-period differential variables is still positive, suggesting that the impact of the “broadband China” strategy on the industrial chain correlation varies depending on the level of digital transformation. In particular, from the perspective of time series, column (3) of Table 7 investigates the trend characteristics of the influence of the “Broadband China” strategy on the correlation level of the industrial chain. It is not difficult to see that the regression coefficients from one to six years prior to the “Broadband China” strategy’s adoption did not meet the statistical significance threshold. It demonstrates that the parallel trend hypothesis is satisfied by the difference in the industrial chain’s toughness level between the treatment and control groups. In addition, after the implementation of the “Broadband China” strategy, the regression coefficient is significantly positive at the level of at least 10%, and the regression coefficient gradually increases, indicating that the “broadband China” strategy has a continuous role in promoting the toughness of the industrial chain, which is consistent with the previous research results. It can be seen that the main finding of this paper remains true even after taking into account the external effects of the “broadband China” approach.

Heterogeneity test

Heterogeneity test of political correlation

This paper further investigates whether political factors play a role in the impact of the level of enterprise digital economy development on the elasticity of the industry chain by setting political association as a dummy variable, which is denoted by PC. If the chairman or general manager of an enterprise has served in the government at central and local levels, courts and procuratorates at all levels, or has served as a representative of the People’s Congress or a member of the Chinese People’s Political Consultative Conference at all levels, the value of PC is 1; otherwise, it is 0. Based on this, this paper conducts regressions on the subsamples with or without political affiliation, respectively, and the relevant results are shown in columns (1) and (2) of Table 8.

When PC = 1, i.e., when the top management of the enterprise has served as representatives of people’s congresses and members of the Chinese People’s Political Consultative Conference (CPPCC) at all levels, the digital transformation obviously has a positive contributing effect on improving the resilience of the industrial chain and passes the significance test at the 10% level, while the opposite is not significant. The possible explanation is that political affiliation plays an important role in enterprise digital transformation. First, the government encourages enterprises to upgrade digitally through policy guidance and financial support. Policy support helps firms clarify the direction of transformation and reduce the risk of transformation. Second, political connections help enterprises acquire key resources, such as data and technology, to promote the depth of digital transformation. As data is a new production factor, enterprises with strong political connections can better integrate and analyze data, thus optimizing the decision-making process. In addition, political connections can facilitate cooperation between enterprises and governments, promote the application of digital technology in a wider range of fields, and enhance overall industrial efficiency. For example, by cooperating with the government in smart city construction, enterprises can further expand their business scope and realize industrial upgrading and political affiliation helps them grasp market dynamics and anticipate policy directions so that they can respond more flexibly to changes in the market and also plays a key role in enhancing the resilience of the industrial chain. As digital transformation requires big data and cloud computing technology to enable enterprises to more accurately grasp market dynamics and supply chain conditions, thereby optimizing resource allocation and reducing operating costs, politically connected enterprises tend to have a wider network of resources, and the application of digital technology can further amplify the synergistic effect of these resources and improve the overall industry chain’s risk-resistant ability. In addition, digital technology can also promote information sharing and synergistic cooperation between enterprises, the government and other stakeholders. In the context of politically connected enterprises, such cooperation tends to be closer, and the digital platform provides an efficient information exchange channel, which helps to form a more solid industry chain ecosystem. In summary, politically connected enterprises can not only enhance their own competitiveness in the process of digital transformation but also effectively improve the overall resilience of the industry chain by strengthening cooperation with all parties, so as to maintain their advantages in the complex and changing market environment. In summary, H3 is proven.

Industry-level heterogeneity test

In this paper, the sub-samples of the service industry and manufacturing industry are respectively regression, and the pertinent findings are given in columns (1) and (2) of Table 9. It is easy to see that the digital transformation of manufacturing enterprises has a positive significance for improving the level of industry chain toughness, and through the significance test at the 1% level, the impact of the digital transformation of service-oriented enterprises on the toughness of the industry chain is significantly worse than that of the manufacturing industry. The possible explanation is that the comprehensive digital upgrade provides an application scenario for the digital economy’s current stage of development in the manufacturing industry, and the traditional manufacturing industry can be comprehensively and systematically transformed with the aid of technique, and the superposition and multiplication of digital technology on new formats can be continuously played. When the product production and sales process involves a number of technically separable stages, corporation production and operation are becoming more and more substantively integrated with digital technology, and each stage can be completed by enterprises independently or in cooperation with other enterprises, and the impact of digitization on internal and external costs of enterprises is gradually prominent, and ultimately promote the improvement of the correlation level of the industrial chain. In other words, manufacturing enterprises have certain leading advantages as the digital economy develops. By combining online and offline methods, the platform approach has the potential to broaden the industrial digital economy’s reach, promote the digitization of the manufacturing industry in all channels and multiple scenarios, release huge industrial dividends, adjust the boundaries of manufacturing enterprises, and improve their sensitivity to the environment. In order for the evolution of the industrial chain pattern to more obviously take advantage of the growth of the digital economy, the industrial division of labor and cooperation is more in line with the features of the industrial chain.

Fierce industry competition means greater price and resource pressure for enterprises, and there are more alternative trading objects to choose from. Innovation in manufacturing and product technology brought about by the growth of the corporate digital economy can enhance an organization’s ability to survive and grow in a competitive environment and serve as its primary source of competitive advantage. In addition, digitization reduces external transaction costs, helps to broaden the scope of business, and enterprises will deploy more value-creation links to extend the industrial chain. Due to the fierce market competition, in order to maintain competitive advantages, enterprises may further broaden the industrial chain links, realize the extension to the upstream of the industrial chain, and implement differentiated management to avoid the competitive final product links, so as to obtain more profits. It is evident that the level of industry competitiveness will have an impact on the promotion effect of the development of the company's digital economy on the modernization of the industrial chain. Based on the earlier practice, the sample is generally divided into two categories: regulatory and competitive industries. Columns (3) and (4) of Table 9 demonstrate that the development from the standpoint of the digital economy has little bearing on the industrial chain’s resilience when it comes to regulated industries. For competitive industries, at the 1% level, the enterprise digital economy development level’s regression coefficient is positive and still significant. Compared with regulated industries, the development mentioned in competitive industries has a more obvious effect on the resilience of the industrial chain. This is because enterprises in competitive industries face higher external transaction costs, and the development of the business digital economy has led to a more significant decline in external transaction costs, which strengthens the industrial chain resilience.

Heterogeneity test of policy characteristics

This article serves as a reference to investigate if there are variations in the promotion effect of corporate digital change on industrialized link correlation in different periods. In the approach, the development process of enterprise digital transition is divided into science and technology policy stages (2012–2014), industrial policy stages (2015–2016), and innovation policy stages (2017–2020). Table 10 shows the correlation regression results. Column (1) of Table 10 shows the regression results of the science and technology policy stage. It is not difficult to find that the regression coefficient of the development level of the enterprise digital economy is not significant, which may be explained by the impact of a variety of factors such as lack of talent, technical constraints, high cost, and lack of understanding. The development of an enterprise digital economy is usually difficult to achieve results, especially since most small and medium-sized enterprises are faced with the dilemma of “not turning, unwilling to turn, afraid to turn”. The continuous investment in the early stage is easy to become a burden for enterprises. As can be seen from Table 10 (2), in the stage of industrial policy, the regression coefficient of the enterprise digital economy development level is still not significant. The possible explanation is that the key direction of digital economy development of some enterprises is not clear, the correlation with business development is weak, and the lack of digital talents makes it difficult to expand business deeply. Moreover, the development of the digital economy has the characteristics of a long investment cycle and a slow effect. As can be seen from column (3) of Table 10, in the innovation policy stage, digital technology and enterprise production and operation activities have substantial integration, and with the advancement of digitization, the integration degree is continuously improved, which is conducive to business process re-engineering.

Conclusions and policy recommendations

Based on the annual reports and input-output table data of Chinese listed companies from 2008 to 2020, the article calculates the degree of enterprise digital transformation and the resilience of the industrial chain. Furthermore, the panel data model is further used to reveal the relationship between enterprise digital transformation and industrial chain resilience, and empirically test the impact effect and mechanism of enterprise digital transformation on industrial chain resilience. The main research conclusions are as follows: First, the digital transformation of enterprises promotes the improvement of the toughness of the industrial chain, and the conclusion is still valid after the robustness test by replacing core variables, replacing sample data, and considering exogenous shocks. Second, the promotion effect of enterprise digital transformation on the human resilience of the industrial chain is significantly different in different enterprises, different industries, different dimensions and different times, and the effect of technology-intensive enterprises and competitive industries is relatively more obvious. Third, corporate digital transition can affect the toughness of the industrial chain by reducing factor mismatch, and ultimately improve the toughness relationship of the industrial chain, which has passed the Sobel test and Bootstrap test. Fourth, firms with political affiliation enhance the positive impact of firms’ digital transformation on industry chain resilience, which may be explained by the fact that in the context of politically affiliated firms, information sharing and synergistic cooperation between firms and the government and other stakeholders will be closer, and the digitization platform also provides an efficient channel for information exchange, which contributes to the formation of a more solid industry chain ecosystem. Politically connected companies have a wider network of resources, and the application of digitization technology can further amplify the synergistic effect of these resources, improve the risk-resistant ability of the overall industry chain, and thus enhance the resilience of the industry chain.

Combined with the previous research, this paper puts forward the following policy recommendations. First, accelerate the digital transformation of enterprises and enhance the resilience of industrial chains. Talent shortage, high cost, technical constraints and other factors will affect digital transformation and further development, improvement, and implementation of policies pertaining to the digital economy are essential. For the shortage of talent, it is necessary to cultivate a group of professionals who master digital technology and are familiar with business processes, so as to provide the necessary conditions for digital industrialization and industrial digitization. For the problem of high cost, it is urgent to increase investment in intangible assets such as patents, technology, software, and data, especially to speed up the deep integration of data elements and various industries. For the problem of technical constraints, digital technology should be deeply embedded in the enterprise's organizational structure, decision-making system and production process, and the competitive advantage should be continuously shaped through scientific and technological research and development and technology accumulation to achieve the goal of cost reduction and efficiency increase.

Second, digital enables resilience of the industrial chain and expands digital application scenarios. Through the platform to empower the industrial chain, deepen the new model and new business mode of online and offline integrated development, encourage the complete integration of corporate manufacturing resources with the internet platform, minimize the gap between businesses and customers, enhance the correlation structure, cut down on intermediary links; minimize transaction costs; streamline business procedures, and encourage the shift from conventional manufacturing to highly automated, intelligent production. Accelerate the upgrading of products and technologies, and form the whole industrial chain fully connected production and manufacturing and intelligent service system. We will maximize the impact of factor allocation in the emerging digital economy, enhance market-based measure allocation, encourage efficient labor and capital allocation within the domestic market, lessen factor allocation distortion, and boost factor allocation efficiency. In addition, the government should implement differentiated policies according to the geographical advantages of different regions, the basic conditions of different industries, the technical characteristics of different enterprises, and the key directions of different periods: vigorously develop the “East number and west calculation” project to promote the efficient transmission and sharing of data across the country, targeted to ease the various difficulties faced by organizations in the throes of digital transition, and resolve the potential risks that may exist in the transformation process; Flexibly adjust the digital transformation strategy of enterprises, and promote the substantive integration of digital technology and enterprise production and operation activities.

Third, continue to improve the level of marketization, and give play to the role of leading enterprises. The government needs to formulate relevant systems for the circulation and transaction of data resources to create a good external business environment for enterprises to implement digital transformation. It also needs to further improve the system and mechanism of the market economy, reshape enterprise organizations and processes, stimulate the vitality of the digital economy, alleviate the upward pressure of transaction costs, and give full play to the allocation role of the market competition mechanism. Promote the deep integration of digital technology and service elements such as finance, consulting, management, and human capital, and escort the digital transformation of enterprises. In addition, it is necessary to reform the government-led allocation of scientific and technological resources, establish a sound, market-oriented mechanism for technological innovation, break administrative dominance and departmental segmentation, and let the market decide the allocation of technological innovation projects and funds. Due to the technical advantages and resource characteristics of leading enterprises, it is urgently necessary to promote leading enterprises to become the “chain master” of the industrial chain and integrate into the global industrial network, accelerate the formation of a good industrial ecology with associated enterprises, and gradually optimize the industrial chain association relationship, which may develop the digital scale impact of the entire company and scene, in addition to fostering the integrated development of large-scale industrial clusters and the industrial chain. In addition, it can facilitate the deep integration of the digital and real economies, integrate the resources of all links in the industrial chain, and create a more dynamic and unique industrial chain as well as a more efficient coordination mechanism. Supporting “chain master” businesses is essential if they are to investigate building different kinds of digital empowerment platforms, successfully spread and propel small and medium-sized businesses’ digitization, and increase the overall robustness of the supply and industrial chains. In particular, to fully utilize the guidance and support role of tax breaks, financial aid, and other policies, as well as to ease the challenges that private companies face in the process of digital transformation—namely, “do not want to turn”, “dare not to turn”, and “will not turn”—the policy on digital growth should concentrate on helping private companies in the supply chain. It is important to focus on highlighting the unique benefits of state-owned businesses in enhancing the fundamental capabilities of the industrial sector and the robustness of the supply and industrial chains, to encourage the establishment of “core hubs” that are completely integrated with all components, including the supply, industrial, and value chains, and to propel the coordinated growth of private businesses.

Finally, based on the study of the impact of corporate digital transformation on industrial chain resilience, this paper acknowledges its limitations, which are inherent due to the author’s cognitive level and understanding ability during the research process. The study primarily employs empirical analysis, while the shortcomings in theoretical analysis are overlooked. Moreover, the constraints in the measurement methods of indicators should be highlighted. For example, when evaluating the process of corporate digital transformation, frequency measurement often focuses merely on superficial phenomena, neglecting the significance of context and practical application. It is challenging to assess the sustainability and long-term impact of digital transformation, indicating that over-reliance on frequency measurement methods has its clear limitations. Furthermore, beyond the mediating mechanism examined in this study, advanced technologies such as fsQCA could be beneficial for further research. To address the shortcomings of this study, future research directions are proposed as follows. First, expand the sample size, accurately target the research objects of the sample, conduct more in-depth research, and ensure the objectivity of data collection as much as possible to make the research results more realistic. Second, explore more comprehensive and scientific indicator measurement methods. Third, increase related path analysis and mechanism research, using more mechanism analysis to explore how corporate digital transformation affects industrial chain resilience.

Data availability

The datasets generated during and/or analyzed during the current study are not publicly available because they are subject to third-party restrictions.

References

Antràs P, Gortari AD (2020) On the geography of global value chains. Econometrica 88(4):1553–1598. https://doi.org/10.3982/ECTA15362

Alvarenga MZ, de Oliveira MPV, de Oliveira T (2023) The impact of using digital technologies on supply chain resilience and robustness: the role of memory under the covid-19 outbreak. Supply Chain Manag-Int J 28(5):825–842. https://doi.org/10.1108/scm-06-2022-0217

Baz JE, Ruel S(2021) Can supply chain risk management practices mitigate the disruption impacts on supply chains’ resilience and robustness? Evidence from an empirical survey in a COVID-19 outbreak era Int J Prod Econ 233(4):107972. https://doi.org/10.1016/j.ijpe.2020.107972

Bhimani A (2015) Exploring big data’s strategic consequences. J Inf Technol 30:66–69. https://doi.org/10.1057/jit.2014.29

Brandon-Jones (2014) A contingent resource‐based perspective of supply chain resilience and robustness. J Supply Chain Manag 50(3):55–73. https://doi.org/10.1111/jscm.12050

Cheng C, Cui HF (2024) Combining digital and legacy technologies: firm digital transformation strategies—evidence from Chinese manufacturing companies. Humanit Soc Sci Commun 11(1). https://doi.org/10.1057/s41599-024-03498-0

Chen XY, Wan P, Ma ZF, Yang Y (2024) Does corporate digital transformation restrain ESG decoupling? Evidence from China. Humanit Soc Sci Commun 11(1). https://doi.org/10.1057/s41599-024-02921-w

Christopher M, Peck H (2004) Building the resilient supply chain. Int J Logist Manag. 15(2):1–13

Ding YB, Zhang HY, Tang ST (2021) How does the digital economy affect the domestic value-added rate of Chinese exports? J Glob Inf Manag 29(5):71–85. https://doi.org/10.4018/JGIM.20210901.oa5

Dou X, Guo SL, Chang XC, Wang Y (2023) Corporate digital transformation and labor structure upgrading. Int Financ Anal Rev 90. https://doi.org/10.1016/j.irfa.2023.102904

Du X, Jiang K (2022) Promoting enterprise productivity: the role of digital transformation. Borsa Istanb Rev 22(6):1165–1181. https://doi.org/10.1016/j.bir.2022.08.005

Falk M, Biagi F (2016) Relative demand for highly skilled workers and use of different ICT technologies. Appl Econ 49(9):1–12. https://doi.org/10.1080/00036846.2016.1208357

Feng YC, Gao Y, Xia XQ, Shi K, Zhang C, Yang L, …, Cifuentes-Faura J (2024) Identifying the path choice of digital economy to crack the “resource curse” in China from the perspective of configuration. Resour Policy 91. https://doi.org/10.1016/j.resourpol.2024.104912

Feng YC, Pan YX, Lu S, Shi JX (2024) Identifying the multiple nexus between geopolitical risk, energy resilience, and carbon emissions: evidence from global data. Technol Forecast Soc Change 208. https://doi.org/10.1016/j.techfore.2024.123661

Futtner U, Maklan S (2011) Supply chain resilience in the global financial crisis: an empirical study. Supply Chain Manag: Int J 16(4):246–259. https://doi.org/10.1108/13598541111139062

Gu H, Ryan C, Bin L, Wei G (2013) Political connections, guanxi and adoption of CSR policies in the Chinese hotel industry: is there a link? Tour Manag 34:231–235. https://doi.org/10.1016/j.tourman.2012.01.017

Guo BN, Wang Y, Zhang H, Liang CY, Feng Y, Hu F (2023) Impact of the digital economy on high-quality urban economic development: evidence from Chinese cities. Econ Model 120:106194. https://doi.org/10.1016/j.econmod.2023.106194

Jiang K, Du X, Chen Z (2022) Firms’ digitization and stock price crash risk Int Rev Financ Anal 82(3):102196. https://doi.org/10.1016/j.irfa.2022.102196

Jin X, Zhang M, Sun G, Cui L (2022) The impact of COVID-19 on firm innovation: evidence from Chinese listed companies. Finance Res Lett 45(30):102133. https://doi.org/10.1016/j.frl.2021.102133

Ling X, Luo ZW, Feng YC, Liu X, Gao Y (2023) How does digital transformation relieve the employment pressure in China? Empirical evidence from the national smart city pilot policy. Humanit Soc Sci Commun 10(1). https://doi.org/10.1057/s41599-023-02131-w

Li MS, Sun XH, Wang Y, Song-Turner H (2019) The impact of political connections on the efficiency of China’s renewable energy firms. Energy Econ. 83:467–474. https://doi.org/10.1016/j.eneco.2019.06.014

Liu FK, Liu GX, Wang XH, Feng YC (2024) Whether the construction of digital government alleviate resource curse? Empirical evidence from Chinese cities. Resour Policy 90. https://doi.org/10.1016/j.resourpol.2024.104811

Liu YC, Dong YG, Qian WW (2024) The impact of digital transformation on the quality and safety level of agricultural exports: evidence from Chinese listed companies. Humanit Soc Sci Commun 11(1). https://doi.org/10.1057/s41599-024-03321-w

Li W, Liu K, Belitski M, Ghobadian A, O’Regan N (2016) e-Leadership through strategic alignment: an empirical study of small- and medium sized enterprises in the digital age. J Inf Technol 31(2):185–206. https://doi.org/10.1057/jit.2016.10

Lu S, Peng S, Shi J, Zhang C, Feng Y (2024) How does digital transformation affect the total factor productivity of China’s A-share listed enterprises in the mineral resource-based sector? Resour Policy 94:105146–105146. https://doi.org/10.1016/j.resourpol.2024.105146

Nikookar E, Yanadori Y (2022) Preparing supply chain for the next disruption beyond COVID-19: managerial antecedents of supply chain resilience. Int J Oper Prod Manag 42(1):59–90. https://doi.org/10.1108/ijopm-04-2021-0272

Niu SH, Zhang KX, Zhang J, Feng YC (2024) How does industrial upgrading affect urban ecological efficiency? New evidence from China. Emerg Mark Financ Trade 60(5):899–920. https://doi.org/10.1080/1540496x.2023.2260544

Ponomarov, Holcomb (2009) Understanding the concept of supply chain resilience. Int J Logist 20(1):124–143. https://doi.org/10.1108/09574090910954873

Pournader M, Rotaru K, Kach AP, Hajiagha SHR (2016) An analytical model for system-wide and tier-specific assessment of resilience to supply chain risks. Supply Chain Manag-Int J 21(5):589–609. https://doi.org/10.1108/scm-11-2015-0430

Ren CM, Lin XX (2024) Digital transformation, competitive strategy choices and firm value: evidence from China. Ind Manag Data Syst 124(4):1656–1676. https://doi.org/10.1108/imds-03-2023-0172

Shen Q, Pan YX, Wu R, Feng YC (2023) Peer effects of environmental regulation on sulfur dioxide emission intensity: empirical evidence from China. Energy Environ. https://doi.org/10.1177/0958305x231201232

Soni U, Jain V, Kumar S (2014) Measuring supply chain resilience using a deterministic modeling approach. Comput Ind Eng 74:11–25. https://doi.org/10.1016/j.cie.2014.04.019

Spieske A, Birkel H (2021) Improving supply chain resilience through industry 4.0: a systematic literature review under the impressions of the COVID-19 pandemic. Comput Ind Eng 158:107452. https://doi.org/10.1016/j.cie.2021.107452

Sultana S, Akter S, Kyriazis E, Wamba SF (2021) Architecting and developing big data-driven innovation (DDI) in the digital economy. J Glob Inf Manag 29(3):165–187. https://doi.org/10.4018/jgim.2021050107

Tortorella G, Prashar A, Samson D, Kurnia S, Fogliatto FS, Capurro D, Antony J (2023) Resilience development and digitalization of the healthcare supply chain: an exploratory study in emerging economies. Int J Logist Manag 34(1):130–163. https://doi.org/10.1108/ijlm-09-2021-0438

Van Veldhoven Z, Vanthienen J (2022) Digital transformation as an interaction-driven perspective between business, society, and technology. Electron Mark 32(2):629–644. https://doi.org/10.1007/s12525-021-00464-5

Verhoef PC, Broekhuizen T, Bart Y, Bhattacharya A, Dong JQ, Fabian N, Haenlein M (2021) Digital transformation: a multidisciplinary reflection and research agenda. J Bus Res 122:889–901. https://doi.org/10.1016/j.jbusres.2019.09.022

Vial G (2019) Understanding digital transformation: a review and a research agenda. J Strateg Inf Syst 28:118–144. https://doi.org/10.1016/j.jsis.2019.01.003

Wang CL, Chen XJ, Yu T, Liu YD, Jing YH (2024) Education reform and change driven by digital technology: a bibliometric study from a global perspective. Humanit Soc Sci Commun 11(1). https://doi.org/10.1057/s41599-024-02717-y

Wang D, Shao XF, Song Y, Shao HL, Wang LQ (2023) The effect of digital transformation on manufacturing enterprise performance. Amfiteatru Econ 25(63):593–608. https://doi.org/10.24818/ea/2023/63/593

Wang S, Zhang R, Yang Y, Chen J, Yang S (2023) Has enterprise digital transformation facilitated the carbon performance in Industry 4.0 era? Evidence from Chinese industrial enterprises. Comput Ind Eng 184:109576. https://doi.org/10.1016/j.cie.2023.109576

Wang XY, Chen J (2023) An empirical study on the indirect empowerment of economic development by the digital economy-based on the perspective of China’s domestic economic cycle. J Knowl Econ. https://doi.org/10.1007/s13132-023-01445-z

Wu L, Hitt L, Lou B (2019) Data analytics, innovation, and firm productivity. Manag Sci 1–23. https://doi.org/10.1287/mnsc.2018.3281

Wu Y, Li Z (2024) Digital transformation, entrepreneurship, and disruptive innovation: evidence of corporate digitalization in China from 2010 to 2021. Humanit Soc Sci Commun 11(1). https://doi.org/10.1057/s41599-023-02378-3

Ye D, Xu B, Wei BL, Zheng LL, Wu YJ (2024) Employee work engagement in the digital transformation of enterprises: a fuzzy-set qualitative comparative analysis. Humanit Soc Sci Commun 11(1). https://doi.org/10.1057/s41599-023-02418-y

Zeng HX, Chen XH, Xiao X, Zhou ZF (2017) Institutional pressures, sustainable supply chain management, and circular economy capability: empirical evidence from Chinese eco-industrial park firms. J Clean Prod 155:54–65. https://doi.org/10.1016/j.jclepro.2016.10.093

Zhang SJ, Dong R, Jiang JX, Yang SY, Cifuentes-Faura J, Peng SH, Feng YC (2024) Whether the green credit policy effectively promote green transition of enterprises in China? Empirical analysis and mechanism verification. Environ Res 244. https://doi.org/10.1016/j.envres.2023.117910

Zhang W, Zhang T, Li HY, Zhang H (2022) Dynamic spillover capacity of R&D and digital investments in China’s manufacturing industry under long-term technological progress based on the industry chain perspective. Technol Soc 71:102129. https://doi.org/10.1016/j.techsoc.2022.102129

Zhang XF, Li Y, Shi K, Feng YC (2022) How do environmental technology standards affect the green transformation? New evidence from China. Int J Environ Res Public Health 19(10). https://doi.org/10.3390/ijerph19105883

Zhang ZH, Shi K, Gao Y, Feng YC (2023) How does environmental regulation promote green technology innovation in enterprises? A policy simulation approach with an evolutionary game. J Environ Plan Manag. https://doi.org/10.1080/09640568.2023.2276064

Zhang ZH, Wu HB, Zhang YP, Hu SL, Pan YX, Feng YC (2024) Does digital global value chain participation reduce energy resilience? Evidence from 49 countries worldwide. Technol Forecast Soc Change, 208. https://doi.org/10.1016/j.techfore.2024.123712

Zheng H, Fang Q, Wang C, Jiang Y, Ren R (2018) Updating China’s input–output tables series using MTT method and its comparison. Econ Model 74:186–193. https://doi.org/10.1016/j.econmod.2018.05.011

Acknowledgements

We acknowledge the financial support from the National Social Science Foundation of China (21AZD109).

Author information

Authors and Affiliations

Contributions

Conceptualization, Haijie Wang; Methodology, Le Yang; Software, Haijie Wang; Validation, Le Yang; Formal analysis, Le Yang and Yanchao Feng; Data curation, Le Yang; Writing—original draft preparation, Le Yang; Writing—review and editing, Yanchao Feng; Visualization, Haijie Wang; Supervision, Yanchao Feng; Funding acquisition, Haijie Wang.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Wang, H., Yang, L. & Feng, Y. How does digital economy affect the industry chain resilience in China?. Humanit Soc Sci Commun 11, 1529 (2024). https://doi.org/10.1057/s41599-024-04077-z

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-04077-z

This article is cited by

-

Investigating corporate entrepreneurship strategy through digital transformation: a dynamic capabilities perspective

Journal of Innovation and Entrepreneurship (2025)

-

Driving role of digital finance on economic resilience: threshold effects of industrial structure upgrading and social security

Economic Change and Restructuring (2025)