Abstract

The information relationship between real estate investment trusts and stock markets has garnered significant interest in finance; however, the time-varying information flow between the two can vary due to different market conditions. This study scrutinizes the information-leading roles between the real estate investment trust sector and overall stock markets under various market conditions. Shannonian transfer entropy, used for identifying information-leading roles, can reveal nonlinear interactions between two markets; however, the results can be hindered by rare events, such as sporadically occurring episodes. Therefore, this study introduces Rényian transfer entropy to examine the role of rare events in the information flow between the two markets. This conjecture is confirmed using the COVID-19 pandemic as a natural experiment setting of rare events. The results reveal notable findings. (i) Rényian transfer entropy can accurately capture the impact of rare events regardless of the sample period, including the changes in information-leading roles when volatility clustering strengthens. Furthermore, (ii) the significance of liquidity and market efficiency produces different information flows depending on market status. The findings suggest that investors can use Rényian transfer entropy to accurately identify information-leading roles between assets under various market conditions, facilitating optimal portfolio allocation. Moreover, policymakers can benchmark this approach to identify financial risk contagion paths, enabling regulators to implement timely policy actions to mitigate market risks.

Similar content being viewed by others

Introduction

The REIT sector has experienced significant market capitalization growth over several decades (Topuz and Isik, 2009), underscoring its importance in the market and its advantages against physical assets, such as higher liquidity and ease of trading (Jain et al., 2017; Akinsomi, 2021; Ryu et al., 2021).Footnote 1 Financial liberalization and improved trading systems have facilitated the globalization of real estate and financial markets, which has been a primary driver of market growth in REIT (Lesame et al., 2021). The increasing expansion of the REIT market has fostered considerable interest in the price dynamics of the stock and REIT markets (Li et al., 2017). Specifically, investors and scholars are interested in the association between REIT and stock markets as a potential market diversification approach (Chandrashekaran, 1999) and a safe haven against systemic risk (Damianov and Elsayed, 2018). Therefore, previous research has intensively investigated the information flow in terms of spillover risks (Chiang et al., 2017), long-term relationships (Glascock et al., 2000), and market integration (Liu et al., 1990) between the two markets.

REITs and stock markets are significant components of the financial system, and the existing literature has extensively studied their interactions (Xu and Yin, 2017; Gokmenoglu and Hesami, 2019; Bustos and Pomares-Quimbaya, 2020; Mazur et al., 2021; Boungou and Yatié, 2022); however, the direction of information flow between these markets remain mixed. For example, previous studies have tested linear and nonlinear causal relationshipsFootnote 2 and documented the bidirectional information flow between REITs and overall stocks (Luchtenberg and Seiler, 2014; Lee and Chen, 2022). Furthermore, Hoesli and Oikarinen (2012) employed forecast error variance decomposition, revealing unilateral information flow in which office REIT shocks notably affect general stock market volatility. In contrast, Okunev et al. (2000) and Subrahmanyam (2007) used the GC testFootnote 3 to determine that stock market returns can influence REIT market returns. This conflicting evidence may be attributed to specific market status depending on the sample period; therefore, this study considers various market conditions and generalizes the exploration of information flow between REITs and stock markets.

Previous studies used Shannonian TE as an instrument rather than the GC test, which can be constrained by several assumptionsFootnote 4 (Yi et al., 2021; Lee et al., 2022). Shannonian TE can capture linear and nonlinear interactions between two markets as a model-free measure, providing a more comprehensive assessment of market dynamics (He and Shang, 2017; Baboukani et al., 2020). Notably, Shannonian TE cannot capture specific aspects of a distribution, such as the impact of rare events (Assaf et al., 2022). This study introduces Rényian TE to address this challenge; this approach quantifies the diversity and uncertainty of rare events to capture information flow in various market conditions (Będowska-Sójka et al., 2021; Bossman, 2021; Aslanidis et al., 2022).

By answering the following two inquiries, this study explores the potential of Rényian TE to address the ongoing debate regarding the information flow between REITs and overall stock markets. (1) Can Rényian TE accurately capture the time-varying information flow between REITs and overall stock markets by considering the influence of rare events?Footnote 5 (2) If so, what are the underlying factors for the shift in the information-leading role? This study’s findings have implications for investors and policymakers. First, investors can benchmark the approach to identify the information-leading role between REITs and overall stock markets; for example, such investors can consider market status to allocate optimal weights for each asset (Peralta and Zareei, 2016; Aromi and Clements, 2019). Second, policymakers can use Rényian TE to identify the contagion paths of systemic risk considering entropy-based networks (Kuang, 2021) to establish strategically targeted financial regulations.

Methodologically, this research advances the ongoing debate on the informational relationship between REITs and broader stock markets. This study clarifies TE’s applicability for identifying the information-leading role between REITs and overall stock markets by incorporating nonlinear characteristics of financial time series. This study also provides new insights into the applicability of Rényian TE for accurately assessing information flow in financial markets that consider tail regions in return distributions. Regarding rare events, Rényian TE can capture the variability in information flow across different market conditions—an aspect that traditional Shannonian TE cannot address. This outcome implies that Rényian TE can be benchmarked to identify information flows between financial markets when various market statuses are mixed. Furthermore, the research framework employs a natural experiment setting based on COVID-19 to ensure the consistency of the Rényian TE results and enhance the robustness of conclusions.

The remainder of this study is organized as follows. Section 2 investigates existing literature concerning information flow, and Section 3 describes the data and methodology. Sections 4 and 5 present and discuss the results. Section 6 concludes this study by providing relevant implications. Abbreviations denoted in this study are summarized in Table 1.

Literature review

Measuring information flow

Investigating information flows between financial assets is a substantially debated topic in finance research. Tang et al. (2019) applied the commonly used GC test to construct a directed network, revealing the information flow between global stock markets beyond simple correlations. Similarly, Al-Yahyaee et al. (2019) conducted the GC test between the US stock market and those in GIPSI, revealing significant causal relationships. Nonetheless, the GC test is limited by its reliance on strict assumptions, including the linearity of time series and normality of residuals in the VAR process (Schreiber, 2000; Dimpfl and Peter, 2013; Jang et al., 2019; Joo et al., 2021; Yi et al., 2021; Lee et al., 2022; Jo et al., 2023). Furthermore, the nonlinear GC test often oversimplifies the complex nature of data series (Li et al., 2022).

In contrast, Shannonian TE captures linear and nonlinear market interactions, offering a broader assessment of market dynamics (He and Shang, 2017; Baboukani et al., 2020); however, Shannonian TE cannot capture rare events or specific aspects of distribution (Assaf et al., 2022). Therefore, several studies adopted Rényian TE, which can effectively capture the impacts of rare events on financial markets (Będowska-Sójka et al., 2021; Bossman, 2021; Aslanidis et al., 2022). Jizba et al. (2021) highlighted the importance of Rényian TE during turbulent periods, such as spikes or sharp rises, for a deeper understanding of directional information transfer. Furthermore, He and Shang (2017) contended that Rényian TE methods could advance analyzing informational relationships between assets’ return series.

This study adopts the Rényian TE to analyze information flow between REITs and overall stock markets across varying market conditions and confirms its robustness through a natural experiment. Therefore, the research framework of this study can provide additional insight into existing studies regarding information flow between REITs and overall stock markets.

Information flow between REITs and stock markets

REITs can make investment in real estate assets easier and mitigate liquidity issues by separating ownership rights, likened to stocks (Simon and Ng, 2009); thus, previous studies examined whether REITs exhibit an information-leading role against stocks. For example, Glascock et al. (2000) found that REITs shared no common information with the stock market from 1972 to 1991; however, a long-term relationship emerged from 1992 to 1996. Furthermore, Laopodis (2009) reported a reciprocal linkage between equity REITs and stocks and asymmetric information flows from mortgage REITs to stocks from 1971 to 2007. These findings highlight that the information flows between REITs and stocks have evolved, with the presence of information transmission between the two assets remaining inconclusive.

The varying market conditions during the sample period may be one reason for the mixed evidence on information flows; however, the existing literature primarily focused on the information flow between REITs and stocks under typical market conditions. The tail regions of return distributions arising from macroeconomic events have received little attention. Numerous studies utilized the COVID-19 pandemic as a proxy for volatile market conditions and explored the dynamics between various financial assets (Kartal et al., 2020; Depren et al., 2021; Kartal et al., 2021; Kartal et al., 2022; Kartal et al., 2024). Nonetheless, the relationship between REITs and the stock market during this period remains largely overlooked.

This study uncovers the relationship between REITs and stocks concerning the varying information flows between these assets across different market dynamics to address these apparent gaps. This study applies the Rényian TE and verifies the robustness of its results through a natural experiment using the COVID-19 pandemic. This approach allows to examine how information flow varies considering time-varying market conditions.

Research method

Data

The SPDR S&P 500 ETF (SPY) and iShares US Real Estate ETF (IYR) are widely used as proxies for overall stock markets and REITs, respectively (Bae and Kim, 2020; Kownatzki et al., 2023). Table 2 presents the specification of each variable. As the oldest and most respected ETF in the US, SPY accurately tracks the US stock market (Bae and Kim, 2020). IYR is the first traditional ETF in the US real estate sector. It serves as the representative for the US REIT market (Curcio et al., 2012; Kownatzki et al., 2023), benchmarking the Dow Jones US Real Estate Index, which tracks the performance of US REITs (Ryu et al., 2021; Ahn et al., 2024). This study obtains daily SPY and IYR closing prices from Barchart.com. The sample period covers from December 1, 2018, to June 30, 2021, including when the World Health Organization declared the COVID-19 pandemic (Ciotti et al., 2020). This period allows to investigate the relationship between REITs and the overall stock market, considering the exogenous shock caused by the pandemic (Onali and Mascia, 2022; Yang et al., 2023).

This study examines the descriptive statistics of two return series to understand the underlying patterns and distributions of SPY and IYR (Yi et al., 2021; Choi et al., 2023). Table 3 presents the descriptive statistics of the SPY and IYR return series, revealing that IYR has a more volatile return distribution than SPY regarding the minimum–maximum range and standard deviation. Both return distributions are negatively skewed, indicating investors’ risk-averse attitudes (Wen and Yang, 2009; Yi et al., 2022) in the marketplace. The highly leptokurtic return distributionsFootnote 6 for SPY and IYR indicate that the frequency of extreme returns is higher and more contingent in the distribution tails than in the normal distribution.

In summary, the two assets’ return distributions are far from the Gaussian distribution; hence, a traditional approach for analyzing two return series may suffer from an embedded normality assumption (Wu et al., 2011). Additionally, this study performs normality tests on both return series to examine whether each follows a Gaussian distribution. The null hypotheses of the normality tests for SPY and IYR are rejected at a 1% significance level. The Jarque–Bera, skewness, and kurtosis test results are 5.636, −1.029, and 17.312 for SPY and 16.039, −2.130, and 27.017 for IYR, respectively. This outcome shows that the return distributions of the two assets deviate significantly from a Gaussian distribution.

Figure 1 illustrates the return series of SPY and IYR, revealing the comovement of the two returns. According to Hoesli and Oikarinen (2012), REITs and overall stock markets move together in the short term with a less than three-year horizon because both markets share the noise from the equity market. The shaded area in Fig. 1 indicates that both assets were severely affected by the COVID-19 pandemic (NBER),Footnote 7 with strong volatility clustering, demonstrating heteroskedasticity in both return series.

Methodology

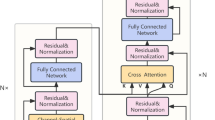

Figure 2 graphically summarizes the methodologies employed in this study. First, this study utilizes the VRT to test the weak-form efficient market hypothesis for REITs and the overall stock market. The TE approach captures nonlinear information flows between two assets. TE is further divided into two parts, i.e., the Shannonian TE for general market conditions and the Rényian TE for reflecting the impacts of rare events on information flows. Then, this study applies the AMIM method to identify the time-varying market (in)efficiency across the whole data period.

Variance ratio test

The VRT has been widely used to investigate the weak-form EMHFootnote 8 (Aumeboonsuke and Dryver, 2014; Ryu et al., 2021) and can examine whether the natural logarithm of a price series (\({Y}_{t}\)) follows a random walkFootnote 9 (Choi et al., 2023; Jeong et al., 2023). In the VRT, the variance of the random walk increments increases linearly with the sampling interval. Accordingly, if the log price series follows a random walk, the variance of its \(d^{\rm{th}}\) difference should grow proportionally with the number of differences (\(d\)). The log price series, \({Y}_{t}\), is as follows:

where \(\mu\) is constant and \({\varepsilon }_{t}\) is an \(i.i.d.\) random variable following a normal distribution with a zero mean and finite variance. The variance ratio \({VR}(d)\) is defined as follows:

where \({\hat{\sigma }}^{2}\) corresponds to the maximum likelihood estimator of \({\sigma }^{2}\). \({\hat{\sigma }}^{2}\left(1\right)\) and \({\hat{\sigma }}^{2}\left(d\right)\) are variances of the first and \(d^{\rm{th}}\) differences, respectively, referencing Lo and MacKinlay (1988):

and

with

where \({Y}_{0}\) and \({Y}_{{nd}}\) are the first and last observations of the log price series, respectively.

The test acknowledges heteroskedasticity due to the observed time-varying conditional volatilities of the two markets. Under heteroskedasticity, the asymptotic variance is expressed as follows:

with

The \(Z\)-statistics under heteroskedasticity specification (\(Z\left(d\right)\)) can be expressed as follows:

The null hypothesis of the VRT is that the log price series, \({Y}_{t}\), follows a random walk (i.e., \({VR}\left(d\right)=1\)). If \({VR}\left(d\right)\,>\,1\), then the increment of the log price series is positively serially correlated, implying that the price series has long-term memory. Conversely, if \({VR}\left(d\,\right)\, <\, 1\), then the increment of the log price series is negatively serially correlated, and the price series is a mean-reverting process (Ryu et al., 2021).

Transfer entropy

This study employs TEFootnote 10 using Shannonian and Rényian TE measures. First, Shannonian TE is a widely utilized methodology for analyzing information flow (Yi et al., 2021; Jo et al., 2023). Shannonian TE measures the cause–effect relationships between dynamic events hidden behind the correlation (Liang, 2013) and can also capture asymmetric interactions between two systems, serving as a nonlinear causality measure (Jo et al., 2023); thus, it provides a valuable alternative when the assumptions of the GC test do not hold (Yi et al., 2021). First, the average amount of information, \(H\), leads to the general formula of Shannon entropy (Shannon, 1948), such that (Dimpfl and Peter, 2013):

where \(J\) denotes a discrete variable that takes the probability distribution \(p\left(j\right)\); thus, \(j\) indicates each value that \(J\) can hold. Accordingly, the mathematical formula for Shannonian TE is as follows:

Suppose \({A}_{t}^{\left(k\right)}=\left({A}_{t},\cdots ,{A}_{t-k+1}\right)\) and \({B}_{t}^{\left(l\right)}=\left({B}_{t},\cdots ,{B}_{t-l+1}\right)\) are two distinct random processes of lengths \(k\) and \(l\), respectively. In this case, the conventional TE is as follows:

where \(T{E}_{B\to A}\left(k,l\right)\) is the effect of \({B}_{t}^{\left(l\right)}\) on predicting \({A}_{t+1}\). \(H\left({A}_{t+1}|{A}_{t}^{\left(k\right)}\right)\) is a conditional entropy that denotes the degree of uncertainty in predicting \({A}_{t+1}\) for a given \({A}_{t}^{\left(k\right)}\). \(H\left({A}_{t+1}|{A}_{t}^{\left(k\right)},{B}_{t}^{\left(l\right)}\right)\) is a conditional entropy that represents the degree of uncertainty in predicting \({A}_{t+1}\), simultaneously considering \({A}_{t}^{\left(k\right)}\) and \({B}_{t}^{\left(l\right)}\) (Choi et al., 2023; Jeong et al., 2023).

Rényian TE can be benchmarked against Shannonian TE when a rare event arises in a financial time series in investigating information flow (Assaf et al., 2022). Rare events that occur at the edges or in the extreme portions of a distribution (often referred to as the “tail ends”), as well as various regions across the entire range of the distribution, can be accentuated by controlling the weighting parameter (Jizba et al., 2012). Therefore, this approach is preferable when the sample period depends on varying market conditions, such as the COVID-19 pandemic. Rényian TE is based on Rényi entropy, an extension of Shannon entropy that introduces an additional parameter (\(q\)).

Rényi entropy considers a distinct random variable (\(J\)) with probability distribution \(p(j)\), where \(j\) is the possible outcomes of \(J\). The Rényi entropy (\({H}_{J}^{q}\)) is as follows:

where \(p\) denotes the event probability, and \(q\) is a positive number. For \(0 <\, q \,<\, 1\), rare events with low probabilities are weighted more heavily as \(q\) approaches zero. If \(q \,>\, 1\), central events with high probabilities receive more weight; however, as \(q\to 1\), Rényi entropy converges to Shannon entropy (Będowska-Sójka et al., 2021; Bossman, 2021; Aslanidis et al., 2022).

Adjusted market inefficiency magnitude

Le Tran and Leirvik (2019) proposed AMIM, which captures the time-varying properties of market efficiency across different asset classes. AMIM can directly measure the significance of efficiency in a market over time using autocorrelation coefficients and associated confidence intervals.

This study first considers the AR processFootnote 11 (\({AR}\left(m\right)\)) of returns (\({r}_{t}\)) as follows:

where \(m\) is the number of lags in the AR model. \({\beta }_{m}\) is the AR coefficient with a lag of \(m\), \(\alpha\) is the constant, and \({\varepsilon }_{t}\) is the error term. \(\hat{\beta }\) is an \((m\times 1)\) vector that includes the estimated AR coefficients \({\left({\hat{\beta }}_{1},{\hat{\beta }}_{2},\cdots ,{\hat{\beta }}_{m}\right)}^{{\prime} }\). \(\hat{\beta }\) is asymptotically distributed as given by \(\hat{\beta } \sim N(\beta, {\Sigma})\), where β is the \(\left(m\times 1\right)\) vector of true AR coefficients, and \({\Sigma}\) is the \(\left(m\times m\right)\) asymptotic covariance matrix of the estimated \(\hat{\beta }\) vector. Through the Cholesky decomposition, \({\Sigma}\) can be decomposed into two triangular matrices, \({\Sigma} =L{L}^{{\prime} }\). After multiplying \(\hat{\beta }\) into the inverse of triangular matrix \(L\), the standardized \(\hat{\beta }\) is obtained as follows:

where each component in \({\hat{\beta }}^{{\rm{standard}}}\) is independent.

The EMH requires that past and current returns do not predict future returns; therefore, if the market is efficient, all the coefficients \(\left({\beta }_{1},{\beta }_{2},\cdots ,{\beta }_{m}\right)\) in Equation (1) should be close to zero. Meanwhile, \({\hat{\beta }}^{{\rm{standard}}}\) is normally distributed with a covariance matrix, an identity matrix under the null hypothesis that the EMH holds in the market. Therefore, MIM, which indicates the degree of inefficiency within the market, can be defined as follows:

where \({{\hat{\beta }}_{i}}^{{\rm{standard}}}\) is the \({i}^{{th}}\) term of the standardized AR coefficient matrix \({\hat{\beta }}^{{\rm{standard}}}\), and MIM falls between 0 and 1.

This study uses an overlapping window of the daily return series to compute MIM measures for each time interval. Specifically, MIM is calculated at time \(t\) using a moving window with \({r}_{t-m+1}\), where \(1\le m\le w\) with \(w\) window size. The optimal lag order of each moving window is determined using AIC.

The MIM value can lead to a false alarm regarding market efficiency as MIM and the number of lags in \({AR}\left(m\right)\) would be positively correlated. This study uses the AMIM value and a 95% confidence interval of MIM under the null hypothesis to avoid this undesirable outcome: \({{\hat{\beta }}_{i}}^{{\rm{standard}}}=0\). This study computes the confidence interval (\({R}_{{CI}}\)) for each of the lag numbers with simulated \({{\hat{\beta }}_{i}}^{{\rm{standard}}}\) values that follow the standard normal distribution. Finally, the AMIM is given as follows:

The denominator in Equation (2) enables comparison across different periods and assets. Specifically, \({AMIM}\,\le\, 0\) indicates that a market is efficient. In contrast, \({AMIM}\, >\, 0\) implies inefficiency within the market (Le Tran and Leirvik, 2019; Okoroafor and Leirvik, 2022).

Results

Market efficiency

Efficient markets have been well documented as having an information-leading role against inefficient markets (Lu et al., 2018; Choi et al., 2023; Jeong et al., 2023); that is, more information flows from the market with a fair price to the market with a price anomaly. In this context, this study first investigates whether the VRT can support the random walk hypothesis of SPY and IYR.

This study considers the VRT under the heteroskedasticity specification due to observed time-varying conditional volatilities that can be supported by testing whether each return series’ residuals are homoscedastic (Box and Pierce, 1970; Ljung and Box, 1978; Breusch and Pagan, 1979). Considering the return series in the form of \({r}_{t}=\mu +{\varepsilon }_{t}\), the null hypothesis of each test is that residual, \({\varepsilon }_{t}\), is independently distributed (i.e., the series is homoscedastic). Table 4 shows that the null hypothesis is rejected for SPY and IYR at the 1% significance level, regardless of the testing methods, confirming heteroskedasticity in the two return series.

This study conducts the VRT under this specification based on heteroskedasticity in the return series. Table 5 reveals that the SPY does not follow a random walk at a 5% significance level; thus, the SPY market is inefficient in the weak form. In contrast, we cannot reject the random walk hypothesis for the IYR as the IYR market is efficient in the weak form; therefore, we hypothesize that the IYR market has an information-leading role over the SPY market.

Information flow

This study determines the information flow between SPY and IYR markets by estimating the Shannonian TE, a conventional approach for investigating information flow between two interacting systems. Table 6 demonstrates unilateral information flow from IYR to SPY, confirming the conjecture based on the VRT results that the IYR market has an information-leading role over the SPY market. Consistent with previous studies (Lu et al., 2018; Choi et al., 2023; Jeong et al., 2023), the findings indicate that the IYR market (which has fair prices) transfers information unilaterally to the SPY market (which contains price anomalies).

Notably, financial markets lose market efficiency when a negative externality is eminent (Le Tran and Leirvik, 2019; Choi, 2021; Wang and Wang, 2021), implying that the information-leading role between the REITs and overall stock markets during a period of turmoil could change (Huang et al., 1996). Therefore, this study investigates the change in information-leading role using Rényian TE based on its capability of capturing the effect of rare events (i.e., extreme market conditions).Footnote 12

Figure 3 presents the estimated Rényian TE values and standard errors. When \(q=1\), the result is consistent with the Shannonian TE findings in Table 5;Footnote 13 however, when \(q < 1\), significant bidirectional information flows are evident, and information-leading role shifts from IYR to SPY. Moreover, the net information flow from the SPY to IYR rises as \(q\) approaches zero. Therefore, this study contends that the information-leading role shifts from the REIT market to the overall stock market as negative externalities are imminent.

Natural experiment

This study uses a natural experiment (the COVID-19 pandemic) to confirm the results of the Rényian TE (Choi et al., 2023), revealing that the information flow between SPY and IYR changes across different market phases (Onali and Mascia, 2022; Yang et al., 2023). Considering the conditional volatility in the marketplace, this study divides the sample period into pre-turmoil, turmoil, and post-turmoil periods of the COVID-19 pandemic. This study employs the GARCH model, specifically the GARCH(1,1) model (Zolfaghari et al., 2020), as shown in Fig. 4.Footnote 14 The findings indicate heteroskedasticity in the conditional variance of daily returns of the SPY and IYR. Furthermore, strong volatility clustering occurred in the early stage of the COVID-19 pandemic. In the shaded period of Fig. 4, most conditional volatilities in each asset deviate above the trendFootnote 15 by more than one standard deviation; therefore, this study contends that the pandemic turmoil period (Period 2) ranges from February 2020 to April 2020. This result aligns with previous studies (Onali, 2020; John and Li, 2021; Joo et al., 2021; Jeong et al., 2023) and largely overlaps with the US recession period announced by the NBER.

Panels A and B indicate the conditional volatilities, trends, and thresholds for SPY and IYR, respectively. The shaded area is the turmoil period caused by the COVID-19 pandemic from February 2020 to April 2020. The data represent the conditional volatilities of SPY and IYR estimated using the GARCH(1,1) model. This study estimates the trend of conditional volatilities using the HP filter, with a smoothing parameter value of \(\mathrm{13,322,500}\) for daily frequency data. Each threshold is one standard deviation above the trend.

This study uses Shannonian TE to investigate the information flow between SPY and IYR in the three subsample periods. Table 7 shows that information flow is only evident from IYR to SPY during the pre-turmoil period, which is congruent with information flow for the entire sample period reported in Table 6. Conversely, when volatility clustering strengthens during the turmoil period, the SPY exerts an information-leading role over the IYR, which is consistent with the Rényian TEs with a low value of parameter \(q\) (i.e., assigning high weight to rare events). In the post-turmoil period, symmetric and bidirectional information flows are revealed between SPY and IYR. This outcome could be attributable to the relieved effect of the externality a few months after the pandemic since market return and volatility for both real estate and stock began to rebound after April 2020 (Hasan et al., 2021; Kuk et al., 2021).

This study next employs the t-test to determine whether a statistically significant difference is present between groups (Chernozhukov et al., 2018; Yao et al., 2022). This approach validates the findings of symmetric and asymmetric information flow between SPY and IYR in each subsample period. Table 8 shows that the \(t\)-test result can reject the null hypotheses for Periods 1 and 2, implying that the information flow from IYR to SPY (from SPY to IYR) dominated that from the opposite direction in the pre-turmoil (turmoil) period. Conversely, the null hypothesis cannot be rejected in Period 3, even at the 10% significance level, indicating bidirectional and symmetric information flow between SPY and IYR. In summary, the information-leading role immediately shifts from IYR to SPY after the external shock; however, both markets ultimately share equivalent information until the shock stabilizes. These results from the natural experiment align well with those of the Rényian TE per the different weights for rare events.

Discussion

This study first identifies the unilateral information flow from IYR to SPY over the entire sample period, which can be explained in terms of market efficiency. According to Ryu et al. (2021), the REIT market is efficient in the weak form due to high institutional ownership. Institutional investors have risen consistently, with the proportion of shares exceeding 60% on average from 1993 to 2020 (Aroul et al., 2023). Furthermore, for over two decades, the number of institutional investors in the REIT market has consistently surpassed that in the common stock market (Ryu et al., 2021; Bond et al., 2022). These institutional investors intensely monitor the REIT market; thus, information in the REIT market is effectively incorporated, lowering information asymmetry and enhancing market efficiency (Boone and White, 2015; Chen et al., 2020). Therefore, IYR has an information-leading role over SPY during the overall sample period because of the REIT market’s price fairness.

Nonetheless, both markets are inefficient during and after the turmoil period, and IYR loses its information-leading role against the SPY (Le Tran and Leirvik, 2019; Choi, 2021; Wang and Wang, 2021). Figure 5 illustrates the (in)efficiency of SPY and IYR in the time-varying form of AMIM values. A positive measure indicates market price inefficiency (Le Tran and Leirvik, 2019); thus, the SPY and IYR were inefficient during the turmoil period. This instability continued for several months in the post-turmoil period, maintaining the pandemic-related inefficiency in the REIT and overall stock market (\({\rm{AMIM}}\, >\, 0\)); therefore, the IYR’s efficiency no longer held an information-leading role.

Focusing on rare events shows that liquidity can be a primary factor (Chordia et al., 2008; Chung and Hrazdil, 2010) influencing the reversed information flow from SPY to IYR during the COVID-19 pandemic. Therefore, this study uses Amihud’s (2002) illiquidity measure, which is the ratio of the absolute value of daily returns to trading volume in dollars, to compare the liquidity of SPY and IYR for the entire sample period. Figure 6 reveals that SPY’s liquidity continuously exceeded IYR’s during the entire period. Chebbi et al. (2021) found that liquidity is crucial for investors, and its significance increases when the market suffers from high uncertainty, such as during financial crises. Ahn et al. (2019) and Lee et al. (2022) demonstrated that markets based on massive liquidity could include most information and subsequently act as information transmitters to less liquid markets. In this context, liquidity can be crucial in determining the role of information discovery between REITs and overall stock markets, in which both markets are inefficient. The SPY market is more liquid than the IYR market and unilaterally transfers information to the IYR during the turmoil period.

This study presents the logarithmic scaled values of illiquidity. The shaded area indicates the turmoil period caused by COVID-19 from February 2020 to April 2020. The dotted lines indicate each subsample period’s average illiquidity: Period 1 (pre-turmoil: December 2018–January 2020), Period 2 (turmoil: February 2020–April 2020), and Period 3 (post-turmoil: May 2020–June 2021).

Concluding remarks

Conclusion

This study explores Rényian TE’s potential as a promising instrument for investigating information flows between two financial assets under different market status periods. While Shannonian TE suffers from rare events, such as sporadically occurring episodes, this study demonstrates that Rényian TE can successfully detect changes in information-leading role across the sample period by effectively capturing the impact of rare events. Specifically, IYR holds an information-leading role over SPY during the overall sample period because IYR has weak-form market efficiency (as revealed by the VRT), unlike SPY; however, when volatility clustering is prominent, the information-leading role transfers to SPY over IYR. While both markets lose market efficiency as volatility clustering strengthens, liquidity can be a primary driver for explaining the information-leading role.

Implications

This study’s findings have managerial and policy implications for investors and regulators. First, the Rényian TE can help investors precisely identify the information-leading role between assets for various market conditions, allowing them to obtain valuable insights for allocating optimal weights to their portfolios. Furthermore, policymakers can employ the analytical approach to discern the contagion paths of financial risk captured by entropy-based networks, which may help regulators establish timely strategic policy actions to relieve market risks.

Limitations and future works

This study mainly focuses on daily returns, suggesting that future studies can use high-frequency data to benchmark the research framework in exploring market microstructure. In addition to return series, the information flow between markets based on volatility can deliver additional insights using intra-day prices. This study’s Rényian TE approach can be a desirable instrument in this procedure because a distribution’s tail regions are closely related to the extent of volatility. This study concentrated on ETFs; however, future studies can consider the research framework (including Rényian TE and the natural experiment setting) in unveiling dynamic information flows between futures and spot markets for the underlying assets.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author upon reasonable request.

Notes

This has been fueled by investors’ interest in properties that offer superior liquidity (Hulchanski, 1995; Hoesli and Oikarinen, 2012) and substantial dividends (Andrew and Glenn, 2003; Topuz and Isik, 2009), requiring REIT firms to distribute at least 90% of their profits to investors (NAREIT, https://www.reit.com/what-reit).

The causal relationship can be the information flow between two dynamical systems (Liang, 2015).

The GC test evaluates whether one-time series can contribute to predicting another, indicating a directional causal relationship and information connection between financial time series (Jeong et al., 2023; Sparacino et al., 2024). The GC test is widely used in finance studies to assess causal relationships and information flows (Papana et al., 2017; Tang et al., 2019).

The GC test is generally based on strict assumptions, including the linearity of time series and normality of the residuals of the VAR process (Schreiber, 2000; Dimpfl and Peter, 2013). Nonlinear GC tests also depend on oversimplified properties of complex data series (Li et al., 2022). These limitations prompt the use of TE for a more comprehensive analysis of market dynamics (He and Shang, 2017; Baboukani et al., 2020).

Rare events refer to rare and unlikely occurrences, often triggered by macroeconomic shocks manifesting at the extreme ends of financial data distribution. These events, such as abrupt spikes or jumps, can significantly affect market behavior and information flows between markets (Jizba et al., 2012).

A leptokurtic return distribution refers to a return distribution with fatter tails than a normal distribution, indicating a higher probability of extreme values or large price swings (Scherer et al., 2012).

The Business Cycle Dating Committee of the US NBER (n.d.) declared February 2020 as the peak and April 2020 as the trough in the US economic activity.

EMH posits that asset prices fully reflect all available information, making it impossible to consistently outperform the market on a risk-adjusted basis (Fama, 1970).

The random walk is a probabilistic process that performs a series of random steps. It is frequently used in various research fields to model real-world scenarios involving uncertainty and random events (Zhang and Zhang, 2023). This process is closely related to the EMH (Dias et al., 2020; Palamalai et al., 2021), suggesting that if markets are truly efficient, price changes should be random and unpredictable (Ehiedu and Obi, 2022).

This study utilizes the R software statistical package for employing TE measures. Specifically, for Shannonian and Rényian TE, this study employs the RTransferEntropy library introduced by Behrendt et al. (2019).

An AR process is a conventional time series model where current values are determined by their past values, incorporating a degree of random error.

This study estimates the conditional volatilities of SPY and IYR using the GARCH model referencing Bollerslev (1986). Specifically, this study employs the GARCH(1,1) process, which fits well in financial studies (Kola and Kodongo, 2017; Lahmiri et al., 2018). Considering the return series \({r}_{t}=\mu +{\epsilon }_{t}\), where \(t\), \(\mu\), and \({\epsilon }_{t}\) respectively denote the time index, conditional mean, and error term, the conditional volatility (\({h}_{t}\)) is obtained by \({h}_{t}=\omega +\pi {\epsilon }_{t-1}^{2}+\gamma {h}_{t-1}\). Here, \(\pi\) and \(\gamma\) are the coefficients of the error term and conditional volatility at time \(t-1\), and \({\epsilon }_{t}={\phi }_{t}{\epsilon }_{t-1}+\,{\eta }_{t}\) with standardized residual \({\eta }_{t}\) (Zolfaghari et al., 2020).

The Hodrick–Prescott (HP) filter yields an optimal decomposition of the time series data into trend and cycle components (Hodrick and Prescott, 1997). Hodrick and Prescott (1997) first proposed the smoothing parameter of the HP filter as 1,600 for quarterly data. It was subsequently adjusted for data with different time frequencies (Backus and Kehoe, 1992). Therefore, the smoothing parameter is determined using 100 times the square of the number of observations in a year (Backus and Kehoe, 1992; Mise et al., 2005). This study uses daily frequency data; thus, the corresponding value of the smoothing parameter is set to \({365}^{2}\times 100=\mathrm{13,322,500}\) (Malafeyev et al., 2019; Dragoe and Oprean-Stan, 2020).

References

Ahn K, Bi Y, Sohn S (2019) Price discovery among SSE 50 index-based spot, futures, and options markets. J Futures Mark 39(2):238–259

Ahn K, Jang H, Kim J, Ryu I (2024) COVID-19 and REITs crash: Predictability and market conditions. Comput Econ 63:1159–1172

Akinsomi O (2021) How resilient are REITs to a pandemic? The COVID-19 effect. J Prop Invest Financ 39(1):19–24

Al-Yahyaee KH, Mensi W, Al-Jarrah IMW, Tiwari AK (2019) Testing for the Granger-causality between returns in the US and GIPSI stock markets. Phys A 531:120950

Amihud Y (2002) Illiquidity and stock returns: Cross-section and time-series effects. J Financ Mark 5(1):31–56

Andrew M, Glenn M (2003) Public and private real estate in a mixed-asset portfolio. J Real Estate Portf Manag 9(3):193–203

Aromi D, Clements A (2019) Spillovers between the oil sector and the S&P500: The impact of information flow about crude oil. Energy Econ 81:187–196

Aroul R, Freybote J, Nguyen A (2023) Do informed REIT market participants respond to property sector mispricing? J Prop Res 40(4):311–332

Aslanidis N, Bariviera AF, López ÓG (2022) The link between cryptocurrencies and Google trends attention. Financ Res Lett 47:102654

Assaf A, Bilgin MH, Demir E (2022) Using transfer entropy to measure information flows between cryptocurrencies. Phys A 586:126484

Aumeboonsuke V, Dryver AL (2014) The importance of using a test of weak-form market efficiency that does not require investigating the data first. Int Rev Econ Financ 33:350–357

Baboukani PS, Graversen C, Alickovic E, Østergaard J (2020) Estimating conditional transfer entropy in time series using mutual information and nonlinear prediction. Entropy 22(10):1124

Backus DK, Kehoe PJ (1992) International evidence on the historical properties of business cycles. Am Econ Rev 82(4):864–888

Bae K, Kim D (2020) Liquidity risk and exchange-traded fund returns, variances, and tracking errors. J Financ Econ 138(1):222–253

Będowska-Sójka B, Kliber A, Rutkowska A (2021) Is Bitcoin still a king? Relationships between prices, volatility and liquidity of cryptocurrencies during the pandemic. Entropy 23(11):1386

Behrendt S, Dimpfl T, Peter FJ, Zimmermann DJ (2019) RTransferEntropy—Quantifying information flow between different time series using effective transfer entropy. SoftwareX 10:100265

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econ 31(3):307–327

Bond S, Guo H, Yang C (2022) Systematic mispricing: Evidence from real estate markets. J Real Estate Financ 1–33

Boone AL, White JT (2015) The effect of institutional ownership on firm transparency and information production. J Financ Econ 117(3):508–533

Bossman A (2021) Information flow from COVID-19 pandemic to Islamic and conventional equities: An ICEEMDAN-induced transfer entropy analysis. Complexity 2021:1–20

Boungou W, Yatié A (2022) The impact of the Ukraine–Russia war on world stock market returns. Econ Lett 215:110516

Box GEP, Pierce DA (1970) Distribution of residual autocorrelations in autoregressive-integrated moving average time series models. J Am Stat Assoc 65(332):1509–1526

Breusch TS, Pagan AR (1979) A simple test for heteroscedasticity and random coefficient variation. Econometrica 47(5):1287–1294

Bustos O, Pomares-Quimbaya A (2020) Stock market movement forecast: A systematic review. Expert Syst Appl 156:113464

Chandrashekaran V (1999) Time-series properties and diversification benefits of REIT returns. J Real Estate Res 17(1):91–112

Chebbi K, Ammer MA, Hameed A (2021) The COVID-19 pandemic and stock liquidity: Evidence from S&P 500. Q Rev Econ Financ 81:134–142

Chen Y, Kelly B, Wu W (2020) Sophisticated investors and market efficiency: Evidence from a natural experiment. J Financ Econ 138:316–341

Chernozhukov V, Wuthrich K, Zhu Y (2018) A t-test for synthetic controls. Preprint at https://doi.org/10.48550/arXiv.1812.10820

Chiang MC, Sing TF, Tsai IC (2017) Spillover risks in REITs and other asset markets. J Real Estate Financ 54(4):579–604

Choi G, Park K, Yi E, Ahn K (2023) Price fairness: Clean energy stocks and the overall market. Chaos Soliton Fract 168:113049

Choi SY (2021) Analysis of stock market efficiency during crisis periods in the US stock market: Differences between the global financial crisis and COVID-19 pandemic. Phys A 574:125988

Chordia T, Roll R, Subrahmanyam A (2008) Liquidity and market efficiency. J Financ Econ 87(2):249–268

Chung D, Hrazdil K (2010) Liquidity and market efficiency: A large sample study. J Bank Financ 34(10):2346–2357

Ciotti M, Ciccozzi M, Terrinoni A, Jiang WC, Wang CB, Bernardini S (2020) The COVID-19 pandemic. Crit Rev Cl Lab Sci 57(6):365–388

Curcio RJ, Anderson RI, Guirguis H, Boney V (2012) Have leveraged and traditional ETFs impacted the volatility of real estate stock prices? Appl Financ Econ 22(9):709–722

Damianov DS, Elsayed AH (2018) On the transmission of spillover risks between the housing market, the mortgage and equity REITs markets, and the stock market. Financ Res Lett 27:193–200

Depren Ö, Kartal MT, Depren SK (2021) Changes of gold prices in COVID-19 pandemic: Daily evidence from Turkey’s monetary policy measures with selected determinants. Technol Forecast Soc 170:120884

Dias R, Teixeira N, Machova V, Pardal P, Horak J, Vochozka M (2020) Random walks and market efficiency tests: Evidence on US, Chinese and European capital markets within the context of the global Covid-19 pandemic. Oecon Copernic 11:585–608

Dimpfl T, Peter FJ (2013) Using transfer entropy to measure information flows between financial markets. Stud Nonlinear Dyn E 17(1):85–102

Dragoe SI, Oprean-Stan C (2020) Bitcoin, the mother of all bubbles or the future of money? Int Conf Knowl Based Organ 26(2):13–18

Ehiedu V, Obi C (2022) Efficient market hypothesis (EMH) and the Nigerian stock exchange in the midst of global financial crises. Int J Acad Manag Sci Res 6(8):263–273

Fama E (1970) Efficient capital markets. J Fin 25(2):383–417

Glascock JL, Lu C, So RW (2000) Further evidence on the integration of REIT, bond, and stock returns. J Real Estate Financ 20(2):177–194

Gokmenoglu K, Hesami S (2019) Real estate prices and stock market in Germany: Analysis based on hedonic price index. Int J Hous Mark Anal 12:687–707

Hasan MB, Mahi M, Sarker T, Amin MR (2021) Spillovers of the COVID-19 pandemic: Impact on global economic activity, the stock market, and the energy sector. J Risk Financ Manag 14:200

He J, Shang P (2017) Comparison of transfer entropy methods for financial time series. Phys A 482:772–785

Hodrick RJ, Prescott EC (1997) Postwar U.S. business cycles: An empirical investigation. J Money Credit Bank 29:1–16

Hoesli M, Oikarinen E (2012) Are REITs real estate? Evidence from international sector level data. J Int Money Financ 31(7):1823–1850

Huang RD, Masulis RW, Stoll HR (1996) Energy shocks and financial markets. J Futures Mark 16(1):1–27

Hulchanski JD (1995) The concept of housing affordability: Six contemporary uses of the housing expenditure‐to‐income ratio. Hous Stud 10:471–491

Jain P, Sunderman M, Westby-Gibson KJ (2017) REITs and market microstructure: A comprehensive analysis of market quality. J Real Estate Res 39:65–98

Jang SM, Yi E, Kim WC, Ahn K (2019) Information flow between bitcoin and other investment assets. Entropy 21(11):1116

Jeong M, Kim S, Yi E, Ahn K (2023) Market efficiency and information flow between the crude palm oil and crude oil futures markets. Energy Strategy Rev 45:101008

Jizba P, Kleinert H, Shefaat M (2012) Rényi’s information transfer between financial time series. Phys A 391(10):2971–2989

Jizba P, Lavička H, Tabachová Z (2021) Rényi transfer entropy estimators for financial time series. Eng Proc 5(1):33

Jo K, Choi G, Jeong J, Ahn K (2023) Information flow among stocks, bonds, and convertible bonds. PLOS ONE 18(3):e0282964

John K, Li J (2021) COVID-19, volatility dynamics, and sentiment trading. J Bank Financ 133:106162

Joo K, Jeong M, Seo Y, Suh JH, Ahn K (2021) Shanghai crude oil futures: Flagship or burst? Energy Rep 7:4197–4204

Kartal M, Ayhan F, Kirikkaleli D (2024) Regime-switching effect of COVID-19 pandemic on stock market index: Evidence from Turkey as an emerging market example. Macroecon Financ EME 17(1):189–206

Kartal M, Depren Ö, Depren S (2020) The determinants of main stock exchange index changes in emerging countries: Evidence from Turkey in COVID-19 pandemic age. Quant Finance Econ 4:526–541

Kartal M, Ertuğrul H, Ulussever T (2022) The impacts of foreign portfolio flows and monetary policy responses on stock markets by considering COVID-19 pandemic: Evidence from Turkey. Borsa Istanb Rev 22:12–19

Kartal M, Kiliç Depren S, Depren Ö (2021) How main stock exchange indices react to Covid-19 pandemic: Daily evidence from East Asian countries. Glob Econ Rev 50:54–71

Kola K, Kodongo O (2017) Macroeconomic risks and REITs returns: A comparative analysis. Res Int Bus Financ 42:1228–1243

Kownatzki C, Kim D, Park A, Kwon S (2023) REIT sector implied volatility index: Liquidity and information of option trading. J Real Estate Portf Manag 29(1):43–60

Kuang PC (2021) Measuring information flow among international stock markets: An approach of entropy-based networks on multi time-scales. Phys A 577:126068

Kuk J, Schachter A, Faber JW, Besbris M (2021) The COVID-19 pandemic and the rental market: Evidence from Craigslist. Am Behav Sci 65:1623–1648

Lahmiri S, Bekiros S, Salvi A (2018) Long-range memory, distributional variation and randomness of bitcoin volatility. Chaos Soliton Fract 107:43–48

Laopodis N (2009) REITs, the stock market and economic activity. J Prop Invest Financ 27(6):563–578

Le Tran VL, Leirvik T (2019) A simple but powerful measure of market efficiency. Financ Res Lett 29:141–151

Lee CW, Chen WJ (2022) Nonlinear short-run adjustments between REITs and stock markets in the USA and Australia. J Appl Financ Bank 12(1):47–68

Lee S, Yi E, Cho Y, Ahn K (2022) The path to a sustainable palm oil futures market. Energy Rep 8:6543–6550

Lesame K, Bouri E, Gabauer D, Gupta R (2021) On the dynamics of international real-estate-investment trust-propagation mechanisms: Evidence from time-varying return and volatility connectedness measures. Entropy 23:1048

Li R, Fong S, Chong K (2017) Forecasting the REITs and stock indices: Group method of data handling neural network approach. Pac Rim Prop Res J 23:123–160

Li S, Tu D, Zeng Y, Gong C, Yuan D (2022) Does geopolitical risk matter in crude oil and stock markets? Evidence from disaggregated data. Energy Econ 113:106191

Liang XS (2013) The Liang-Kleeman information flow: Theory and applications. Entropy 15:327–360

Liang XS (2015) Normalizing the causality between time series. Phys Rev E 92(2):022126

Liu C, Hartzell DJ, Greig W, Grissom TV (1990) The integration of the real estate market and the stock market: Some preliminary evidence. J Real Estate Financ 3:261–282

Ljung GM, Box GEP (1978) On a measure of lack of fit in time series models. Biometrika 65(2):297–303

Lo AW, MacKinlay AC (1988) Stock market prices do not follow random walks: Evidence from a simple specification test. Rev Financ Stud 1:41–66

Lu J, Chen X, Liu X (2018) Stock market information flow: Explanations from market status and information-related behavior. Phys A 512:837–848

Luchtenberg K, Seiler M (2014) Did the recent financial crisis impact integration between the real estate and stock markets? J Real Estate Portf Manag 20(1):1–20

Malafeyev O, Awasthi A, Kambekar KS, Kupinskaya A (2019) Random walks and market efficiency in Chinese and Indian equity markets. Stat Optim Inf Comput 7(1):1–25

Mazur M, Dang M, Vega M (2021) COVID-19 and the March 2020 stock market crash. Evidence from S&P1500. Financ Res Lett 38:101690

Mise E, Kim TH, Newbold P (2005) On suboptimality of the Hodrick–Prescott filter at time series endpoints. J Macroecon 27(1):53–67

National Bureau of Economic Research (n.d.) Business cycle dating committee announcements. https://www.nber.org/research/business-cycle-dating/business-cycle-dating-committee-announcements. Accessed 14 Aug 2023

Okoroafor UC, Leirvik T (2022) Time varying market efficiency in the Brent and WTI crude market. Financ Res Lett 45:102191

Okunev J, Wilson P, Zurbruegg R (2000) The causal relationship between real estate and stock markets. J Real Estate Financ 21(3):251–261

Onali E (2020) COVID-19 and stock market volatility. https://papers.ssrn.com/sol3/Papers.cfm?abstract_id=3571453. Accessed 14 Aug 2023

Onali E, Mascia DV (2022) Corporate diversification and stock risk: Evidence from a global shock. J Corp Financ 72:102150

Palamalai S, Kumar K, Maity B (2021) Testing the random walk hypothesis for leading cryptocurrencies. Borsa Istanb Rev 21(3):256–268

Papana A, Kyrtsou C, Kugiumtzis D, Diks C (2017) Financial networks based on Granger causality: A case study. Phys A 482:65–73

Peralta G, Zareei A (2016) A network approach to portfolio selection. J Empir Financ 38:157–180

Ryu I, Jang H, Kim D, Ahn K (2021) Market efficiency of US REITs: A revisit. Chaos Soliton Fract 150:111070

Scherer M, Rachev ST, Kim YS, Fabozzi FJ (2012) Approximation of skewed and leptokurtic return distributions. Appl Financ Econ 22(16):1305–1316

Schreiber T (2000) Measuring information transfer. Phys Rev Lett 85(2):461–464

Shannon CE (1948) A mathematical theory of communication. Bell Syst Tech J 27(3):379–423

Simon S, Ng WL (2009) The effect of the real estate downturn on the link between REITs and the stock market. J Real Estate Portf Manag 15(3):211–219

Sparacino L, Antonacci Y, Barà C, Valenti A, Porta A, Faes L (2024) A method to assess Granger causality, isolation and autonomy in the time and frequency domains: Theory and application to cerebrovascular variability. IEEE Trans Biomed Eng 71(5):1454–1465

Subrahmanyam A (2007) Liquidity, return and order‐flow linkages between REITs and the stock market. Real Estate Econ 35(3):383–408

Tang Y, Xiong J, Luo Y, Zhang Y (2019) How do the global stock markets influence one another? Evidence from finance big data and Granger causality directed network. Int J Electron Comm 23(1):85–109

Topuz JC, Isik I (2009) Structural changes, market growth and productivity gains of the US real estate investment trusts in the 1990s. J Econ Financ 33(3):288–315

Wang J, Wang X (2021) COVID-19 and financial market efficiency: Evidence from an entropy-based analysis. Financ Res Lett 42:101888

Wen F, Yang X (2009) Skewness of return distribution and coefficient of risk premium. J Syst Sci Complex 22(3):360–371

Wu PS, Huang CM, Chiu CL (2011) Effects of structural changes on the risk characteristics of REIT returns. Int Rev Econ Financ 20(4):645–653

Xu L, Yin X (2017) Does ETF trading affect the efficiency of the underlying index? Int Rev Financ Anal 51:82–101

Yang MY, Chen Z, Liang Z, Li SP (2023) Dynamic and asymmetric connectedness in the global “Carbon-Energy-Stock” system under shocks from exogenous events. J Commod Mark 32:100366

Yao Q, Li R, Song L (2022) Carbon neutrality vs. neutralité carbone: A comparative study on French and English users’ perceptions and social capital on Twitter. Front Environ Sci 10:969039

Yi E, Ahn K, Choi MY (2022) Cryptocurrency: Not far from equilibrium. Technol Forecast Soc 177:121424

Yi E, Cho Y, Sohn S, Ahn K (2021) After the splits: Information flow between Bitcoin and Bitcoin family. Chaos Soliton Fract 142:110464

Zhang Y, Zhang H (2023) Application of random walks in data processing. Highlights Sci Eng Technol 31:263–267

Zolfaghari M, Ghoddusi H, Faghihian F (2020) Volatility spillovers for energy prices: A diagonal BEKK approach. Energy Econ 92:104965

Acknowledgements

This work was supported by the National Research Foundation of Korea (NRF) grant funded by the Korean government (MSIT) (No. 2022R1A2C1004258, Kwangwon Ahn).

Author information

Authors and Affiliations

Contributions

Sihyun An: Writing the original draft, data analysis, and result interpretation; Jihae Kim: Writing the original draft, data analysis, and result interpretation; Gahyun Choi: Data curation, data analysis, and visualization; Hanwool Jang: Reviewing, revising the original draft, and editing; Kwangwon Ahn: Supervising, conceptualization, and approval of the final manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

An, S., Kim, J., Choi, G. et al. The effect of rare events on information-leading role: evidence from real estate investment trusts and overall stock markets. Humanit Soc Sci Commun 11, 1628 (2024). https://doi.org/10.1057/s41599-024-04146-3

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-04146-3