Abstract

Stimulating green technology innovation in agricultural enterprises through appropriate environmental policies is of great significance for achieving green agricultural development. Based on the data of listed agribusinesses from 2007 to 2020, this paper analyzes the incentive effects of traditional environmental regulatory tools, carbon trading, and policy synergies using the SDM-SDID model. It was found that: (1) Although both traditional environmental regulatory tools and carbon trading provide incentive effects, the former tends to exhibit more pronounced direct effects, making it more suitable for adoption by local governments, while the latter demonstrates stronger spatial spillover effects, making it more appropriate for application in a national market context. (2) Command-and-control environmental regulatory instruments and carbon trading are complementary policy mixes, and other environmental policy mixes are to be used as appropriate in the context of the actual situation. (3) The incentive effects of environmental policies are more significant in eastern regions, non-heavily polluting, and state-owned agribusinesses, but not in the basic agricultural sector. Based on the above research, this paper reveals the differentiated effects of different types of environmental policies and policy combinations on the green technology innovation of agribusinesses. This contributes to the deepening of research on environmental policy selection and provides theoretical support and practical references for precise policy implementation and collaborative governance.

Similar content being viewed by others

Introduction

In China, greenhouse gas emissions from agricultural activities account for 24% of the total emissions (Huang et al. 2022). In September 2020, the Chinese government set two major goals: “carbon peak” and “carbon neutrality.” The aim is to achieve carbon peak around 2030 and carbon neutrality by 2060, reducing carbon emissions to zero or negative values (Li et al. 2023b). Green and sustainable development has become the inevitable direction for China’s agricultural production (Yu et al. 2022). Green technological innovation is a technological innovation in energy conservation and pollution prevention, which has the dual positive externalities of innovation knowledge spillover and environmental protection (Huang et al. 2019; Wang et al. 2019). During China’s 13th Five-Year Plan period, the adoption of green innovation technologies led to an 8.5% increase in output across 13 major grain-producing regions and a 30% reduction in pollution load across 109 agricultural demonstration zones (Xiao et al. 2022). Consequently, green technological innovation is emerging as a pivotal catalyst for green agricultural growth (Zheng and Zhang, 2023). Agricultural enterprises are significant contributors to both pollution emissions and active innovation. The efficacy of green technological innovations within these enterprises directly influences the success of the nation’s green development strategy in agriculture.

To incentivize innovation in green technology, the Chinese government has implemented a range of environmental policies. These include the “Management Measures for the Collection and Use of Pollutant Surcharge (2003)” and the “Management Measures for the Use of China Environmental Label (2008)” (Ren et al. 2018). Through the establishment of pollution emission standards, the imposition of sewage charges, and the promotion of independent environmental information disclosures, China has essentially established a multifaceted system of environmental regulation that integrates government, market, and societal elements. In recent years, to achieve the strategic goals of carbon neutrality, the Chinese government initiated a Carbon Emission Trading (CET) pilot project in 2011. This project was launched in eight regions, namely Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong, Shenzhen, and Fujian, with the aim of accumulating experience for establishing a unified national carbon emission trading market (National Development and Reform Commission, 2011). Unlike traditional environmental regulatory tools such as pollution permits and fees, which are characterized by single constraints, carbon trading operates on a dual mechanism of both penalties and incentives. This approach is more effective in addressing the dual externalities of green technology innovation, thereby enhancing the motivation for enterprise innovation (Xie and Teo, 2022; Pu and Ouyang, 2023). Additionally, it leverages the advantage of facilitating cross-regional resource flow (Zhao et al. 2022). As a foundational industry of the national economy, agriculture requires effective environmental policies from the government to fully support green technology innovation (Lybbert and Sumner, 2012). However, single environmental policies may have significant limitations (Goulder and Parry, 2008). For instance, command-and-control regulations can be highly reliable when strictly enforced but are often proven to be inflexible and inefficient (Gunningham, 1996). Conversely, multiple policy combinations do not necessarily outperform single policies (Lehmann, 2012; Bahn-Walkowiak and Wilts, 2017). Policy combinations can reduce flexibility, increase transaction costs, and potentially lead to negative impacts due to conflicts (Schader et al. 2014). Therefore, to effectively incentivize green technology innovation in agricultural enterprises and provide theoretical references for precise policy implementation, it is necessary to explore the impacts of environmental policies and identify suitable policies and their combinations.

This paper aims to identify suitable policies that effectively incentivize green technology innovation in agribusinesses by comparing the impacts of various environmental policies. It seeks to address three critical questions: (1) What are the differences in the incentivizing effects and applicable contexts between traditional environmental regulatory tools and carbon trading? (2) What synergistic effects arise when traditional environmental regulations and carbon trading are combined? Which policy combinations are complementary and effective, and which might have adverse impacts? (3) How do the incentivizing effects of environmental policies vary across different regions, industries, and firm characteristics within the sample?

This paper makes three primary contributions. First, by comparing the differences in incentivizing effects and applicable contexts between traditional environmental regulatory tools and carbon trading, it identifies effective and applicable policy tools and complementary combinations. This enriches the research on environmental policies and provides quantitatively practical data for policy-making. Second, by using micro-level data from agribusinesses, the study expands the research scope in the agricultural sector, helping to explore the unique performance of environmental policies within agriculture. Third, building on the traditional Spatial Difference-in-Differences (SDID) model, this paper refines the average spillover effects into two parts: within pilot agricultural enterprises and between pilot and non-agricultural enterprises. This enriches the research methodology for environmental policies. This study deepens the comprehensive understanding of the effects of current environmental regulations on green technology innovation in Chinese agribusinesses, providing empirical data for the formulation of realistic environmental policies and collaborative governance. Additionally, the research on heterogeneity offers valuable insights for developing countries to tailor policy choices according to their specific agricultural contexts.

The remainder of this article is structured as follows. Section “Literature review and research hypotheses” sets out the theoretical basis and research hypotheses. Section “Research design” details the research hypotheses, variables, and research methodology. Section “Results and discussion” discusses the empirical results. Section “Conclusions, policy implications and limitations” summarizes the main findings, and recommends possible policies and future research. Subsequently, this paper will undertake a comprehensive literature review encompassing three key areas: green technology innovation, environmental regulation, and the influence of environmental regulation on green technology innovation. This will establish a theoretical foundation for empirical research.

Next, this paper presents a comprehensive literature review on the relationship between environmental policy and green technology innovation, and environmental policy comparison and applicability. This will establish a theoretical foundation for empirical research.

Literature review and research hypotheses

This section reviews the literature on two key questions: whether environmental policies have incentive effects and which types of environmental policies may be more effective. The first question examines the relationship between environmental policies and green technological innovation, while the second compares the effectiveness and applicability of different environmental policies.

Environmental policy and green technology innovation

Green technology innovation encompasses technological advancements in processes, products, production methods, and management systems (Saunila et al. 2018). The primary objective is to enhance resource utilization while mitigating adverse environmental impacts (Wang et al. 2019). Numerous studies explore how to incentivize green technology innovation. Shen et al. (2021) through a study of government work reports of 244 prefecture-level cities in China from 2004 to 2016, argue that economic target-setting inhibits green technology innovation. Using data on listed real estate firms in China, Lin and Xie (2023) find that government subsidies promote green technology innovation by influencing R&D investment. Using Spanish manufacturing firms as a study sample, Opazo-Basáez et al. (2024) reveal that there is a prevalent positive correlation between organizational performance and green innovation. Xu et al. (2023e) employing fixed effects and mediation effect models to analyze a sample of non-financial listed companies in China, demonstrate that digital transformation in enterprises has a greater impact on the quantity of green technology innovation than on its quality. Some research focus on the impact effects of green technology innovations. Shao et al. (2021), studying carbon emissions in N-11 countries, find that green technology innovation has an insignificant impact on carbon emissions in the short term but significantly reduces emissions in the long run. Ramzan et al. (2023), using the method of moment quantile regression, show that green innovation significantly reduces carbon emissions and ecological footprints in the world’s 10 most green economies from 1980 to 2019.

Environmental policy serves as a tool to enhance environmental quality through both direct intervention and indirect influence. Direct intervention is reflected in forcing enterprises to reduce pollution by raising the cost of pollution control to achieve the protection of the environment. Indirect influence is often manifested in the form of increased capacity to control pollution by stimulating firms to innovate with green technologies (Song et al. 2020b). Many studies focus on the impact effect of environmental regulation. Xu et al. (2023a), through a study of G20 countries from 2000–2020, conclude that green technology innovation and environmental regulation are the most effective ways to achieve the net-zero emissions target. He et al. (2023) evaluate the Chinese environmental law using the DID model and find that it significantly improves the ESG performance of heavily polluting firms. Carbon trading pilot policies significantly weaken carbon emissions (Li et al. 2022a), favoring the enhancement of regional green development performance (Xiao et al. 2023b) and enterprise total factor productivity (Cheng et al. 2017; Bai et al. 2023). Nevertheless, there are still negative implications. Xiao et al. (2023a) examine provincial panel data spanning 2000–2018 in China and discover that environmental regulations intensify energy poverty. A study by Neves et al. (2024) shows that environmental taxes drive e-waste exports from the EU region. Although this is favorable to the ecological environment, it is not conducive to the recycling of resources. In addition, several studies also focus on agriculture. For example, environmental regulation significantly promotes farmers’ adoption of green production technologies (Guo et al. 2022), reduces agricultural carbon emissions (Li et al. 2023a), and enhances the quality of employment for migrant workers (Huang and Cheng, 2023).

The correlation between environmental regulations and green technology innovation is extensively explored, yielding a plethora of research findings. These primarily fall into three categories. Firstly, the phenomenon known as the “compliance cost” effect is addressed. Environmental regulations can increase additional investment costs for firms (Cai and Ye, 2020) and crowd out R&D funds (Hottenrott and Rexhäuser, 2015), thus inhibiting green technology innovation (Albrizio et al., 2017; Yang and Wang, 2023). The second perspective pertains to the “innovation compensation” effect. Appropriate environmental regulations can induce this effect, which effectively offsets compliance costs and consequently incentivizes green technology innovation (Porter and Linde, 1995; Jaffe et al. 1997; Jin et al. 2022). The third perspective is an uncertain relationship. Liu et al. (2022a), based on panel data from Chinese cities, find an inverted U-shaped relationship between command-and-control environmental regulation and green innovation, whereas a positive U-shaped relationship is found between market-based and voluntary environmental regulation. Xu et al. (2023d) argue that the U-shaped relationship explains different stages of responses to environmental regulation and that Porter’s hypothesis and the cost of compliance effect are not actually in conflict. China is now close to the “inflection point” but still in the “inhibition stage” (Song et al. 2020a). Other studies focus on heterogeneity effects. Du et al. (2022), using data from listed companies in China from 2006 to 2020, argue that environmental regulation is more effective for green technology innovation in non-state-owned, heavily polluting firms. Wang et al. (2022) find that environmental regulations are more effective for eastern, capital-intensive, and technology-intensive firms.

The above theoretical basis provides a diverse conclusion on the relationship between environmental policy and green technology innovation. Building on this foundation and referencing Xu et al. (2012), this study proposes Research Hypothesis 1 by constructing a production cost function. By establishing two scenarios—carbon emission fees and carbon trading—the paper derives the respective impacts of traditional environmental regulatory tools and carbon trading on green technological innovation (Appendix 1). The conceptual framework is shown in Fig. 1.

Hypothesis 1: Both conventional environmental regulatory instruments and carbon trading policies have the potential to incentivize green technological innovation within agricultural enterprises.

Environmental policy comparison and applicability

Environmental regulation tools can be typically categorized into three distinct types: command & control, market-based, and voluntary (Liu et al. 2022a). Early environmental regulations are primarily command & control measures, such as emission standards and permits (Long and Zhang, 2012). However, due to the excessive controls that inhibit enterprise initiatives, market-based environmental regulation is gradually been adopted, including pollution charges, emissions taxes, and emissions trading (Zou and Wang, 2024). As the emphasis on green production and consumption increases, voluntary environmental regulations, such as environmental certification labels and disclosures of environmental information, are increasingly recognized as vital supplements to command & control and market-based environmental regulation (Ren et al. 2018). In the context of carbon reduction targets, carbon trading policies progressively transition from localized pilot programs to the establishment of a cohesive national market. This evolution underscores a significant shift in China’s environmental regulatory framework from regional oversight to centralized supervision (Zou and Wang, 2024). Therefore, carbon trading policy has a special significance different from other market-based environmental regulations.

Comparing the effects of different types of environmental regulation is an important area of research. Liu et al. (2022a) study urban green innovation in China from 2008 to 2019 and find that commanded environmental regulation has an inverted U-shaped relationship with it, while market-based and voluntary environmental regulation exhibit a positive U-shaped relationship. Xie and Teo (2022) argue that market-based environmental policies tend to be more effective than command-and-control policies through a study of green productivity in Chinese provinces. Environmental taxes are the best choice when economic efficiency is prioritized (Xu et al. 2023b). Emission trading is not suitable for small firms due to high costs (Tietenberg, 1990). Voluntary environmental regulation usually works only when command-and-control and market-based environmental regulation are effective (Blackman, 2008). Emission standards inhibit green technological innovation, but cleaner production standards have an incentive effect (Xu et al. 2023c). It is also argued that the effectiveness of environmental regulation depends largely on the design features rather than the type of instrument (Kemp and Pontoglio, 2011). The synergistic effects of multiple environmental regulations also receive widespread attention. Wang et al. (2023) based on a global over-adjusted epsilon measure, argue that the interactive effects of formal and informal regulations strongly contribute to the green transition in Chinese steel companies. Multiple types of environmental regulation implemented together can have a stacking effect (Liu et al. 2022c). Therefore, a joint regulatory approach is more advantageous (Taylor et al. 2015) and can enhance the effectiveness and implementation of environmental policies to varying degrees (Liu et al. 2022b).

Some scholars also study the applicability of environmental policies. Elmagrhi et al. (2019), after investigating 383 A-share listed companies in China from 2011 to 2015, argue that higher female board member participation is more conducive to environmental policy playing a role in corporate environmental governance. Wu et al. (2020) based on the provincial panel data of China from 2005–2016, find that environmental administrative decentralization alleviates the constraint effect of environmental regulation on green total factor energy efficiency. Li et al. (2021), through a global case study using the keywords “sustainability” and “sustainable development,” found that the successful implementation of environmental regulations requires a shift in moral values. He and Qi (2021), analyzing data from Chinese listed companies from 2004 to 2016, concluded that environmental policies only achieve their intended protective effects when they reach the judicial level. Assunção et al. (2023), using forest area data from the Amazon region (2006–2016), demonstrated that the implementation of environmental monitoring technologies, such as remote sensing, significantly enhances policy enforcement efficiency.

Currently, from a policy practice perspective, the fundamental issue of selecting appropriate environmental policies and their combinations for different application scenarios remains underexplored. As far as the effects of traditional environmental regulatory instruments are concerned, several studies argue that traditional environmental regulation has a fairly significant policy effect on the place where the policy is implemented (Khurshid et al. 2024; Zheng et al. 2023). In contrast, the impact of traditional tools is more limited for those areas where the policy is not implemented (Zhang et al. 2022). The “pollution paradise” hypothesis suggests that firms, driven primarily by short-term profit objectives, migrate from regions with heightened environmental regulatory intensity to areas of reduced regulation. This migration often results in increased pollution or elevated levels of green innovation in adjacent non-policy zones (Walter and Ugelow, 1979; Jiang et al. 2022). The “technology spillover effect” suggests that after environmental regulations have facilitated local green technological advances, the diffusion of technology enhances the level of green technology in other regions (Liu et al. 2023; Yang and Ding, 2023). However, these phenomena take a longer time to manifest. From the perspective of specific implementation of traditional instruments, local governments in China can formulate emission standards that are stricter than national emission standards (The State Council, 2017a; 2017b) or adjust the tax rates for environmental protection taxes (The State Council, 2018). The efficacy of environmental policies, however, is often contingent upon local circumstances and the specific design of the policy (Kemp and Pontoglio, 2011; Xu et al. 2023d). Local governments, as the direct duty bearers, are in a better position to adapt and implement traditional tools according to local realities. Therefore, traditional environmental regulatory instruments are suitable for local governments because of their significant direct effects and greater flexibility in policy formulation. Carbon trading policies vary significantly. Carbon emission rights possess distinct property rights, leading to their autonomous trading (Jia et al. 2023) that are not constrained by geographical or administrative limitations. This system of carbon trading not only generates supplementary revenue, thereby encouraging agribusinesses to innovate with green technologies (Song et al. 2023) but also enhances the independent allocation of resources and expedites the cross-regional mobility of factors (Yang and Ding, 2023). This process fosters a strong spatial spillover effect, which transcends regional boundaries as the trading market expands. Therefore, the carbon trading policy exhibits a pronounced spillover effect, making it more suitable for implementation on a broader regional scale. Hence, the following hypothesis is proposed.

Hypothesis 2: Traditional environmental regulatory instruments, characterized by their significant direct effects, are aptly suited for implementation by local governments. Conversely, Carbon trading policies have significant spillover effects and are more effective on a larger regional scale.

Overall, although existing literature provides a wealth of theoretical and empirical research on the relationship between environmental policies and green technology innovation, it typically focuses more on individual rather than comparative studies, with less attention to selection criteria and application contexts (Gunningham and Sinclair, 2019; Greco et al. 2022). Additionally, most studies discuss policy impacts from a macro perspective (Hu et al. 2023a) or focus on industrial enterprises (Liu and Liu, 2023), lacking sufficient attention to the agricultural sector. Therefore, this paper, based on micro-level data from agribusinesses and using a spatial DID model, delves into the incentivizing effects and heterogeneity of traditional environmental regulations, carbon trading, and their combinations. By identifying suitable environmental policies, this study aims to further unleash the potential for green technology innovation in agricultural enterprises.

Research design

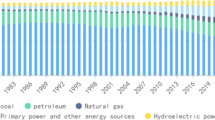

Sample selection and data sources

This study utilizes the panel data of publicly listed agricultural companies in China, spanning from 2007 to 2020, as the initial sample. The sample is then expanded to include the year 2021 for robustness testing. Based on the industry classification standards for listed companies published by the China Securities Regulatory Commission and the 2021 agricultural and related industry statistical classification released by the National Bureau of Statistics, a sample of 225 companies was formed after excluding ST-related companies and those with severe data gaps. The data sources for specific variables are listed in Tables A2 and A3 (Appendix 2).

Variables measurement

Green Technology Innovation in Agricultural Enterprises (AGTI)

Green patent data, which can reflect both the innovative output of enterprises and is relatively easy to obtain, serves as a common indicator for measuring green technology innovation (Griliches, 1998; Haščič and Migotto, 2015). This study employs the logarithm of the quantity of green patent authorizations granted to enterprises as a metric for evaluating green technological innovation in agricultural firms (Liu et al. 2021; Ma and Xue, 2023).

Traditional environmental regulation (TER)

Refer to Kemp and Pontoglio (2011); and Ren et al. (2018), this paper categorizes traditional environmental regulation into three distinct types: command-control, market-based, and voluntary. Command-control environmental regulation (CER): The occurrence frequency of environmental protection terminology in the work reports of prefecture-level municipal governments was utilized as a metric (Zhang et al. 2020). Market-based environmental regulation (MER): The sewage discharge fee is used as a measurement index (Ren et al. 2018). Voluntary environmental regulation (VER): This paper employs the attainment of ISO14001 environmental management certification as a measurement index (Bu et al. 2020). The year in which the certification was obtained is designated as 1, while all other years are marked as 0. The larger the value of the aforementioned index, the more intensive the environmental regulation.

Carbon emission trading (CET)

Referring to Liu et al. (2023), the year 2011 is designated as the inflection point for unified pilot policy implementation. Consequently, years before 2011 are categorized as 0, while those post-2011 (inclusive of 2011) are assigned a value of 1. Agricultural enterprises in pilot provinces are denoted as 1, whereas those in non-pilot provinces are labeled as 0. The cities where the pilot and non-pilot agricultural enterprises are located are shown in Fig. 2.

Control variables

As in previous research (Cai and Ye, 2020; Li et al. 2022c; He et al. 2023), some determinants were controlled. SIZE. Utilizing the natural logarithm of total assets as a metric. AGE. Companies with extended operational longevity tend to leverage innovative experiences more frequently, whereas their younger counterparts exhibit greater creativity. ALR. The asset-liability ratio is frequently employed as a metric to gauge a company’s debt position. ROA. This measured the profitability of total assets. ROE. This measured the profitability of net assets. R&D. Sufficient R&D investment is essential for fostering corporate innovation. R&D investment was divided by revenue to measure the variable.

The descriptive statistics of the main variables are presented in Table A1(Appendix 2).

Methodology

There are typical spatial spillover effects in technology diffusion (Wu, 2006). When environmental regulations encourage the innovation of local green technologies, the proliferation of these new technologies can elevate the level of green technological innovation in other regions (Yang and Ding, 2023). Therefore, overlooking the correlation of space may underestimate the impact of environmental regulation on green technology innovation in agricultural enterprises (Liu et al. 2023). Compared to the traditional econometric linear regression model, the spatial econometric model offers superior handling of spatial correlation and heterogeneity (Partridge et al. 2012). Therefore, this paper constructs three econometric models within the framework of spatial econometric modeling, using traditional environmental regulatory instruments, carbon trading policies, and environmental policy portfolios as units of analysis. The research framework is shown in Fig. 3.

Traditional environmental regulatory instruments

The Spatial Durbin Model (SDM), a prevalent model in spatial econometric modeling, is constructed by incorporating the spatial lag term of the independent variable and the spatial autocorrelation coefficient into the conventional panel model (Allers and Elhorst, 2005). Since all the sample agribusinesses were exposed to traditional environmental regulatory instruments throughout the sample period, the SDM model was constructed as shown below:

where \(AGT{I}_{it}\) is the agribusiness green technology innovation \(i\) and \(t\) respectively denote the units and year. \(TE{R}_{it}\) represents the traditional environmental regulations. \(contro{l}_{it}\) indexes the control variables, \({\phi }_{i}\) indexes the individual fixed effects, and \({\theta }_{t}\) indexes the time fixed effects. \(W\) denotes the spatial weight matrix, which quantifies the degree of spatial correlation. The green technology innovation of agribusinesses may be mainly affected by three aspects. The specific explanation of this model can be found in Appendix 3.

Carbon trading policy

To assess the incentive effect of the carbon trading pilot policy, which affects only certain agribusinesses during part of the sample period, this study adopts a spatial difference-in-differences model (SDID) following Chagas et al. (2016) (see Appendix 4 for details).

where \(CE{T}_{it}\) denotes the pilot situation of carbon trading policy, \(\alpha\) denotes the direct impact of carbon trading policies on the green technological innovation of agribusinesses, \({W}_{P,P}\) denotes the spatial relationship between pilot agribusinesses, \({W}_{NP,P}\) denotes the spatial relationship between pilot and non-pilot agribusinesses.

Environmental policy mix

To examine the synergistic effects of traditional environmental regulatory tools and carbon trading policies on green technology innovation, this paper integrates Eqs. (1) and (2). Thus, the spatial econometric modeling of the environmental policy mix is shown below:

where \(CE{T}_{it}\ast TE{R}_{it}\) represents the policy mixes of traditional instruments and carbon trading. The coefficient \(\alpha\) represents the direct effect of the policy mixes on the green technology innovation of agribusinesses. \({\delta }_{1}{W}_{P,P}\) represents the spillover effect within the carbon trading pilot agribusinesses. \({\delta }_{2}{W}_{NP,P}\) represents the spillover effect between the carbon trading pilot agribusinesses and non-pilot agribusinesses.

Results and discussion

The results and discussion are reported as follows: descriptive statistics and spatiotemporal features, comparison of environmental policies, robustness test, policy synergies, and heterogeneity analysis.

Spatiotemporal features

Referring to Du et al. (2018), this research uses sample data sources to depict the spatial distribution characteristics and temporal evolution attributes of explanatory and dependent variables, in order to illustrate the specific changes in each variable before and after the implementation of the carbon trading pilot policy (see Appendix 5). During the sample period, the level of green technological innovation in agricultural enterprises shows an upward trend, with enterprises exhibiting high levels of green innovation primarily concentrated in Zhuzhou, Beijing, and Chengdu, and focused on the rubber and plastic products, agricultural product processing, and paper products industries. The average intensity of command-and-control traditional environmental regulation shows no significant change, although coastal areas tend to have stricter environmental standards. Regarding market-based environmental regulation, agricultural enterprises with the highest average pollution discharge fees are located in Yibin, Zunyi, Hohhot, and Jining, mainly operating in the wine, dairy, and paper industries. In terms of voluntary environmental regulation, most agricultural enterprises obtained environmental certification only after the initiation of the carbon trading pilot.

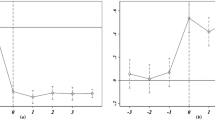

Benchmark regression: comparison of environmental policies

This paper ensures the validity of the SDID model through a series of tests (Appendix 6). The results of the baseline regression are shown in Table 1. This paper employs the fixed effects model as a benchmark for comparison with the SDM-SDID model. In this study, the fixed effects model serves as a benchmark for comparing the SDM-SDID model. The regression outcomes from both models align, suggesting that the SDM-SDID model not only yields reliable direct effects but also offers the added advantage of estimating spatial spillover effects. Therefore, we compare traditional environmental regulatory tools and carbon trading policies in terms of their direct effects and spillover effects.

Comparison of direct effects

The regression coefficients for all environmental policies are significantly positive, except for command-and-control traditional environmental regulation, which has a significantly negative regression coefficient. Specifically, command-and-control environmental regulations have an inhibitory effect on green technological innovation in agribusinesses, while market-based environmental regulations, voluntary environmental regulations, and carbon trading policies have an incentivizing effect. This implies that the phenomenon of the “Compliance cost effect” coexists with the “Porter hypothesis”.

The regression coefficient for \(CER\) is −0.278, which is statistically significant at the 1% level. The Command-control environmental regulation exhibits a discernible inhibitory impact on green technology innovation, aligning with the findings of numerous extant studies (Cai and Ye, 2020; Du et al. 2021; Yang and Wang, 2023). The reasons for this negative correlation are multifaceted. Under rigorous emission regulations, agribusiness may face increased fines due to non-compliance with emission standards (Gollop and Roberts, 1983). The acquisition of environmental protection facilities leads to the crowding out of R&D funds (Zhao and Sun, 2016). Compensatory benefits from innovative activities do not compensate for the costs of mandatory penalties for environmental non-compliance, making it difficult to effectively incentivize green technological innovation (Tao et al. 2021). In addition, the prevalence of more diverse regulatory tools has brought about a downward trend in the intensity of command-control environmental regulation (Cheng et al. 2017).

The regression coefficient for \(MER\) is 0.8702, which is statistically significant at the 1% level. At the same time, the regression coefficient value of \(MER\) is the largest, which is the most effective type of tool to incentivize green technology innovation in agribusiness. This is similar to the results of numerous studies (Jin et al. 2022; Liu et al. 2022a). On one hand, market-based environmental regulations incentivize agribusinesses to augment their existing innovation activities with new investments, thereby generating a ‘leverage effect’(Liu and Xiao, 2022). On the other hand, it forces agribusinesses to overcome organizational inertia, reduce their dependence on polluting production methods through green technological innovations, and effectively avoid environmental regulatory costs. This phenomenon is referred to as a ‘push-back effect’ (Li and Xiao, 2020).

The regression coefficient of \(VER\) is 0.0961, which is significant at the 1% level. Meanwhile, the regression coefficients for \(VER\) are significantly smaller than those for other environmental policies. This observation aligns with the majority of studies that suggest a limited incentive effect of voluntary environmental regulation (Hu et al. 2023b; Xiong et al. 2023). This is even though the stringent demands of the ISO have encouraged businesses to implement standardized environmental management systems and enhance the efficacy of green technology innovation (Jiang et al. 2021). At the same time, it engenders a reputational advantage that mitigates or circumvents price competition, thereby offering a distinctive market edge and consequently incentivizing innovation in green technology (Lyon and Maxwell, 2014). However, as a supplementary policy and self-incentive mechanism (Bu et al. 2020), its efficacy is constrained, typically only manifesting when both command-and-control and market-based environmental regulations are effective (Blackman, 2008; Tian and Feng, 2022).

The regression coefficient of \(CET\) is 0.123, which is significant at a 5% level. Carbon trading effectively promotes green technology innovation in agribusiness, which is consistent with the general findings (Liu et al. 2023; Xiao et al. 2023b). As sellers in the carbon trading market, agribusiness can generate additional revenue by selling surplus emission allowances (Calel and Dechezleprêtre, 2016). Simultaneously, government incentives such as tax reductions for low-pollution, high-innovation firms further stimulate their willingness and performance in green technological innovation (Cui and Cao, 2023). As a buyer of carbon, the “push effect” of cost pressure also incentivizes green technological innovation. When the cost of purchasing carbon emission rights exceeds the cost of green innovation, agribusinesses will adopt green innovation (Li and Gao, 2022). While both carbon trading policy and emissions charges represent market-oriented environmental policies, carbon trading exhibits significantly less incentive compared to emissions charges. As the study by Kemp and Pontoglio (2011) points out, the impact of carbon trading on innovation is much weaker than assumed. However, it has been posited that the incentive effect of carbon trading exhibits a significant positive correlation with the duration of policy implementation (Shi et al. 2022) and the extent of the market being addressed (Jia and Lin, 2020). China’s carbon trading policy was piloted in 2011. Due to the relatively short period of implementation of the policy and the small number of pilot samples, the true effects of carbon trading may not have been fully realized.

In summary, apart from command-control traditional environmental regulation, other environmental policies can incentivize green technology innovation among agricultural enterprises. Despite the current disincentive effect of command-and-control environmental regulation, numerous studies have consistently shown that it can ultimately foster sustainable technological innovation in the long term (Ouyang et al. 2020; Song et al. 2020a). Therefore, H1 was verified.

Comparison of spillover effects

In the context of this paper, spatial spillover effects refer to the impacts of the implementation of environmental policies in one region on agricultural enterprises in other regions. The results in Table 1 show that \(CER\) and \(CET\) have significant spatial spillover effects, while \(MER\) and \(VER\) have insignificant spatial spillover effects.

The spillover effect of \(CER\) is 0.559, which is significant at the 5% level. Similar to Dong and Wang (2019); He and Zhou (2023), command-control traditional environmental regulations have a facilitative effect on green technology innovation among neighboring agricultural enterprises. There are two potential explanations for this phenomenon. One is the “pollution paradise hypothesis”. Stringent environmental standards force polluting agribusinesses to relocate in the vicinity (Walter and Ugelow, 1979; Dong and Wang, 2019). As the total number of firms located in regions hosting polluting firms increases, so does the average number of green patents. This creates a scenario where the average level of \(AGTI\) is raised over a short period. The second is the warning effect. The imposition of stringent environmental standards results in a substantial escalation in costs, a reduction in profitability, and a decrease in green innovation activities within local agribusinesses. Consequently, this has a perceivable warning effect on agribusinesses in adjacent regions. These agribusinesses proactively incorporated innovative green technologies to preemptively mitigate potential future costs associated with environmental infractions.

The study reveals that \(CET\) exhibits a negative spillover effect within the pilot agribusinesses while demonstrating no spillover effect between these pilot agribusinesses and non-pilot agribusinesses. The coefficient for \(CE{T}_{P-P}\) is −0.252, which is significant at the 10% level. In contrast to the results presented by Liu et al. (2023), there exists a moderate inhibitory effect of environmental regulations on green technology innovation in pilot agribusinesses in adjacent regions. As a result of autonomous trading between pilot agribusinesses, many prioritize the purchase of carbon emission rights over the development of green innovations due to comparative cost considerations (Cui and Cao, 2023). Meanwhile, the incentives for carbon trading price signals are not sufficient (Yang et al. 2016). Low carbon prices cannot provide enough impetus for innovation. When carbon prices rise, it is also likely to aggravate the burden on enterprises. Therefore, green technology innovation is inhibited. The coefficient for \(CE{T}_{NP-P}\) is insignificant. The reason for this is that there is no trading of emission rights between pilot and non-pilot agribusinesses, so there are no spillover effects caused by the carbon trading policy.

There are no spillover effects from other traditional environmental regulatory instruments. This is in contrast to Dong et al. (2020), who conclude that environmental regulation inhibits technological progress in neighboring regions. The reason is that the regulatory intensity of both emission charges and environmental certification labeling is lower than that of emissions standards, which provides greater autonomy to firms (Li and Xiao, 2020). Therefore, the impact on other agribusinesses is considerably limited. Furthermore, the agricultural sector often becomes more reliant on public R&D outcomes due to a lack of adequate R&D investment across the board (Huang et al. 2021). The high barrier to entry and complexity associated with many green technologies restrict imitation and competition among agribusinesses (Liang et al. 2023). This also has implications for the diffusion of green technologies to some extent.

In summary, although both traditional environmental regulatory tools and carbon trading policies provide certain incentive effects, the direct effects of traditional regulatory tools are generally more pronounced, making them more suitable for adoption by local governments. On the other hand, carbon trading policies have a comparative advantage in terms of spillover effects, making them more appropriate for implementation in a national market context. This is similar to the findings of Zhang et al. (2022) and Qi et al. (2021). Although many studies have found that traditional regulatory instruments have certain spillover effects (He and Zhou, 2023). However, it is important to note that the spillover effect operates as an indirect influence, necessitating a longer duration for its generation. Therefore, the spillover effect of traditional instruments is generally not significant enough. However, traditional instruments exhibit a pronounced direct incentive effect and possess significant flexibility in policy formulation. At the same time, the actual effects of environmental policies often depend on local circumstances and the specific design of the policy (Kemp and Pontoglio, 2011; Xu et al. 2023d). Therefore, traditional environmental regulatory tools are well suited for adoption by local governments. The comparative advantage of carbon trading is the capacity for enterprises to engage in direct transactions without geographical constraints. This greatly facilitates the interoperability of resources and factor flows, which in turn generates spatial spillover benefits and promotes the level of green technological innovation of agribusinesses within the coverage of the carbon market (Yang and Ding, 2023). Despite the current negative spillover effects of carbon trading, the marginal returns to agribusinesses purchasing carbon emission rights will diminish. This gradual decline will incentivize agribusinesses to innovate and adopt green technologies (Hu and Ding, 2020; Yang, 2023). In addition, several studies show a positive correlation between the incentive effects of carbon trading and the extent of the market covered by the policy (Jia and Lin, 2020). Therefore, the carbon trading policy is suitable for use in regions at a larger scale. H2 was verified.

Robustness tests

The results of the benchmark regression show the differential effects of the two types of environmental policies on green technology innovation in agribusiness. This section conducts a series of robustness checks to verify the reliability and robustness of the baseline results (Appendix 7).

Further analysis: policy synergies

Given that environmental regulatory tools are often applied in combination, this section analyzes the interaction terms of variables to further examine policy synergies. The results in Table 2 reveal two main categories of policy combinations: complementary and those requiring careful consideration.

Complementary policy mix: command-and-control environmental regulation and carbon trading

The combined policy of command-control traditional environmental regulation and carbon trading (\(CER\times CET\))demonstrates significantly positive coefficients for both direct effects and spillover effects. Carbon trading has reversed the negative direct effect of command-control environmental regulation on green technological innovation in agribusiness. The primary explanation may be that the policy dividend brought about by carbon trading nullifies the “crowding-out effect” of environmental regulations on R&D funding (Liu et al. 2022c), thereby bolstering both the willingness and performance of agribusiness innovation. At the same time, command-control environmental regulation also induces a shift of carbon trading’s spillover effects among pilot agricultural enterprises from negative to positive. Dual regulation creates double pressure to comply with emission standards and purchase carbon credits. This cost exceeds the cost of innovation, thus incentivizing agribusinesses to embark on green technological innovations (Hu and Ding, 2020; Yang, 2023).

Discretionary policy mix: market-based environmental regulation, voluntary traditional environmental regulation and carbon trading

The combination of market-based traditional environmental regulation and carbon trading policy(\(MER\times CET\)), the voluntary traditional environmental regulations tool combined with carbon trading(\(VER\times CET\)), as well as the combination of command-control, market-based, voluntary, and carbon trading policy(\(TER\times CET\)), all yield significantly positive direct effects and significantly negative spillover effects. Compared to the coefficients in the benchmark regression, the direct effect coefficients for the aforementioned policy combinations are markedly lower. The imposition of multiple regulations imposes a cost pressure that can induce a certain degree of reduction in the green technology innovation activities of local agribusinesses (Cai and Ye, 2020). However, it still generally exerts a substantial incentive effect. In terms of spillover effects, the negative effects are not only found only between pilot agribusinesses but also between pilot and non-pilot agribusinesses. The reason may be that some pilot agri-businesses have developed competitive advantages due to the policy mix, which has strengthened the siphoning effect on neighboring resources (Liu et al. 2023). This results in a reduction of R&D resources for neighboring non-pilot agribusinesses and thus weakens their level of green technology innovation. Therefore, these policy mixes need to be used as appropriate.

In summary, traditional regulations provide a foundation of compliance, while carbon trading offers additional incentives for green technological innovation that exceeds the baseline. Specifically, the synergies observed in environmental policy offer two primary benefits. On the one hand, Carbon trading offers agribusinesses the opportunity to purchase emission rights. This prevents them from engaging in production cuts if they fail to meet stringent environmental standards (Zhao and Sun, 2016). When the expense associated with green technology innovation is prohibitively high, acquiring carbon emission rights can serve as an effective strategy for cost reduction (Liao et al. 2020). This approach also alleviates financial strain and facilitates capital accumulation. In the long term, these benefits bolster green technological innovation. On the other hand, traditional environmental regulatory instruments exert a “push effect” on buyers in carbon trading. The increased environmental costs have induced them to alter their initial trajectory of dependence and implement green technological innovations (Li and Xiao, 2020). Furthermore, the establishment of a unified national carbon trading market will facilitate a more rational distribution of resources on a broader scale, thereby alleviating the current detrimental effects on non-pilot agribusinesses. Therefore, the choice of environmental policy mix should be aimed at maximizing long-term green performance and be fully contextualized to better leverage the incentives.

Heterogeneity analysis: regional, industry, and enterprise characteristics

The heterogeneous effects of environmental regulations have been well demonstrated (Liu et al. 2022c). Heterogeneity, stemming from regional, industrial, and firm-specific characteristics, significantly influences firms’ green technology innovation (Cai et al. 2020; Li et al. 2022b). Consequently, this study examines heterogeneity across these three dimensions to gain a deeper understanding of selecting appropriate environmental policies.

Regional characteristics

Given the influence of regional development disparities on the integrity and rationality of environmental regulations (Yang and Xu, 2023; Yin et al. 2023), this study categorizes the sample into three distinct sub-samples: eastern agribusiness, central agribusiness, and western agribusiness. The regression results are shown in Table A11 (Appendix 8). Since there is no pilot agribusiness in the Western region, only the results of traditional environmental regulation instruments are disclosed.

The results were similar to the findings of Qi et al. (2021). For eastern agribusinesses, most environmental policies and combinations have some incentive effect. Of these, command-and-control instruments and carbon trading are complementary combinations, while other policy mixes need to be used as appropriate. Voluntary and market-based environmental regulations have been more effective for central agribusinesses. However, spillover effects have not yet developed. For western agribusinesses, only command-control and market-based environmental regulations are effective. The aforementioned regional disparities can likely be attributed to the eastern region’s superior economic development, more dynamic market mechanisms, and more comprehensive and rational environmental policies (Lin and Li, 2023). In addition, the eastern agribusinesses were found to have the largest sample size, which inevitably influences the outcomes to a certain degree.

Consequently, it is imperative to implement the development of a unified national carbon trading market. The successful experience of the eastern region should be actively promoted. There is a need to bolster regional exchanges and collaborations, thereby enhancing the circulation of factors and resources on a more expansive regional scale.

Industry characteristics

Industry types

Variations within the agricultural sector, specifically in production methods and means of execution, can influence the efficacy of environmental regulations. In this paper, the sample is divided into three categories: agriculture, forestry, animal husbandry and fisheries, edible agricultural product processing and manufacturing, and non-edible agricultural product processing and manufacturing. The results of the classification regression are shown in Table A12 (Appendix 8).

The incentive effects of environmental policies are most evident in the non-edible agricultural product processing industry, while the edible agricultural product processing industry benefits more from market-based policy combinations. In contrast, green technological innovation in agriculture, forestry, animal husbandry, and fisheries is largely unaffected by environmental policies, likely due to lower profit margins. Non-edible and edible agricultural product industries, with relatively higher profitability, can allocate a portion of their profits toward green innovation, whereas the primary agricultural sector lacks such capacity. Therefore, public and cooperative research and development in the agricultural sector should be valued, with green subsidies and tax exemptions serving as supplementary measures for environmental policy.

Pollution intensity

From the standpoint of the market price mechanism, it is generally observed that environmental regulations exert a more pronounced impact on high-polluting industries than on low-polluting ones (Yang and Xu, 2023). Therefore, this paper divided the sample agricultural enterprises into two categories: heavy pollution industries and non-heavy pollution industries, and performed regression on them respectively. The results are shown in Table A13 (Appendix 8).

Environmental policies and policy combinations exhibit stronger incentive effects on green technological innovation in non-heavy polluting agricultural firms, differing from Yang and Xu’s (2023) view that environmental regulations primarily impact heavy polluters. For heavily polluting agricultural firms, the lag in green innovation exacerbates the pressure from high environmental costs, reducing their willingness to innovate. The only positive spillover effect occurs between pilot and non-pilot agricultural firms. Non-pilot heavy polluters, facing high emission costs without carbon trading support, are incentivized to collaborate with pilot firms, enhancing their green innovation levels. Collaboration among agricultural firms in green innovation should be strengthened to share risks and benefits (Chesbrough and Schwartz, 2007). Additionally, governments could consider tax exemptions and subsidies beyond environmental regulations to support green innovation in heavily polluting firms.

Enterprise characteristics

The nature of property rights of firms leads to significant differences in access to resources, which in turn affects sensitivity to environmental regulation (Luo et al. 2023; Meng et al. 2023). The sample is divided into state-owned and non-state-owned enterprises, with regression results presented in Table A14 (Appendix 8).

State-owned agribusinesses apply to the vast majority of environmental policies and combinations. Non-state-owned agribusinesses exhibit greater sensitivity to environmental policies that are more market-competitive. This is consistent with the findings of Hu et al. (2020). The state-owned agribusiness leaders are usually appointed by the government and are more responsive to national policies. With stronger capabilities and government support, state-owned agribusiness are better positioned to bear the environmental costs and risks associated with green innovation (Cai and Ye, 2020; Cai et al. 2020). In contrast, overly stringent environmental regulations hinder green innovation in non-state-owned agribusiness (Luo et al. 2023). However, market-based environmental policy combinations demonstrate stronger incentive effects (Calel and Dechezleprêtre, 2016), particularly through voluntary regulations that foster healthy competition and imitation, generating positive spillover effects for neighboring firms (Lyon and Maxwell, 2014). Therefore, the government should fully consider these differences. Building on policy support, it should actively promote healthy market competition to enhance the incentive for green technology innovation in agricultural enterprises.

Conclusions, policy implications and limitations

Conclusions

This paper aims to compare the incentivizing effects of traditional environmental regulation methods and carbon trading policies on green technological innovation within agribusinesses. The objective is to identify suitable environmental policies and their combinations. To achieve this, the study utilizes data from Chinese-listed agribusinesses spanning 2017 to 2020, employing the SDM-SDID model for analysis. It is found that (1) both traditional regulatory instruments and carbon trading demonstrate sufficient efficacy to stimulate green technological innovation within the agribusiness sector. Traditional regulatory instruments, characterized by their significant direct effects, are apt for flexible implementation by local governments. Conversely, carbon trading offers superior spillover effects and is more suitable for application on a broader regional scale. (2) Command-and-control environmental regulatory instruments and carbon trading are complementary policy mixes. Carbon trading has the potential to mitigate the negative direct effects of command-and-control regulations on green technological innovation, while command-and-control regulations help shift the spillover effects of carbon trading among pilot agribusinesses from negative to positive. Other environmental policy mixes should be used in context and as appropriate to ensure the sustainability of green technological innovation in agribusinesses. (3) Environmental policy incentive effects are heterogeneous. The incentive effects of environmental policies and synergies are more significant in eastern, non-polluting, and state-owned agribusinesses, but not in basic agriculture. Non-state-owned agribusinesses are more sensitive to market-based environmental policies. This offers a more pragmatic benchmark for other nations in analogous circumstances, enabling them to formulate and execute environmental policies that are more congruent with the agricultural sector. This study enriches existing comparative research on environmental policy, which has been relatively unexplored in the agricultural microcosm. It provides reliable data to support the development of specific environmental policies and policy mixes, as well as the establishment of national carbon trading markets. In addition, it provides practical policy references that are of great relevance to other countries globally facing similar situations.

Policy implications

Based on the above findings, the following policy recommendations are given.

-

(1)

Flexibly Utilize Traditional Environmental Regulatory Tools. Local governments should flexibly employ traditional environmental regulations based on their specific environmental and economic characteristics, aiming to maximize long-term green performance. This requires careful consideration of the region’s environmental carrying capacity and the realities of agricultural industry development to ensure the effectiveness and enforceability of policies. Additionally, local governments can establish special funds for green technology innovation, providing financial support and technical guidance to help agribusinesses reduce the cost of green technology innovation and enhance policy implementation and sustainability. Furthermore, it is crucial to build a broad societal consensus on green development and fully leverage self-regulation by agricultural enterprises and public supervision.

-

(2)

Vigorously Promote Carbon Trading Policies. By summarizing the successes and lessons from pilot projects, best practice models suitable for different regions should be distilled to support the construction of a nationwide carbon trading market. Depending on the specific circumstances and agricultural industry structures of different regions, a diverse combination of environmental policies should be flexibly selected to form an integrated governance system. Additionally, the effectiveness of the environmental policy system can be improved through various means such as policy incentives, technical support, and financial subsidies, promoting the positive spillover of green innovative technologies across regions, industries, and enterprises.

-

(3)

Develop Differentiated Environmental Policies. It is essential to fully consider the heterogeneity of incentive effects and develop differentiated policies for different types of agribusinesses. Green technology innovation is not the only option for enterprises facing environmental regulations, which may limit the effectiveness of environmental policies. Therefore, for eastern regions, non-heavily polluting, and state-owned agribusinesses, the government can adopt stricter environmental regulatory measures to fully exploit their potential for green technology innovation. In the basic agricultural sector, the motivation for green technology innovation should be strengthened through technical guidance and financial subsidies. Given the market sensitivity of non-state-owned agribusinesses, the government should primarily use market-based environmental policies to incentivize their green technology innovation. Moreover, the government should enhance promotion and training to increase agribusinesses’ awareness and participation in environmental policies, ensuring effective incentives from these policies.

Research limitations

The limitations of this study are mainly in three aspects. First, the sample limitation. Given the availability of data, this paper only selected listed agribusinesses for sample analysis. Future research should broaden the sample to include non-listed agribusinesses to more accurately reflect the impact of environmental policies on green technology innovation within agricultural businesses. Secondly, the limitation of content. The present study has not yet examined the influence of public scrutiny on the existence of environmental policy implementation. Future research could further integrate the public perspective into the policy evaluation system. Finally, methodological limitations. The SDID method adopted in this paper still has a certain degree of selectivity bias. Future research might consider implementing the PSM method on the SDID model for enhanced analysis.

Data availability

All data generated or analyzed during this study is submitted as a supplementary file.

References

Albrizio S, Kozluk T, Zipperer V (2017) Environmental policies and productivity growth: Evidence across industries and firms. J. Environ. Econ. Manag. 81:209–226

Allers MA, Elhorst JP (2005) Tax mimicking and yardstick competition among local governments in the Netherlands. Int. tax. public Financ. 12:493–513

Assunção J, Gandour C, Rocha R (2023) DETER-ing deforestation in the Amazon: environmental monitoring and law enforcement. Am. Economic J.: Appl. Econ. 15:125–156

Bahn-Walkowiak B, Wilts H (2017) The institutional dimension of resource efficiency in a multi-level governance system—Implications for policy mix design. Energy Res. Soc. Sci. 33:163–172

Bai C, Liu H, Zhang R, Feng C (2023) Blessing or curse? Market-driven environmental regulation and enterprises’ total factor productivity: Evidence from China’s carbon market pilots. Energy Econ. 117:106432

Blackman A (2008) Can voluntary environmental regulation work in developing countries? Lessons from case studies. Policy Stud. J. 36:119–141

Bu M, Qiao Z, Liu B (2020) Voluntary environmental regulation and firm innovation in China. Economic Model. 89:10–18

Cai W, Ye P (2020) How does environmental regulation influence enterprises’ total factor productivity? A quasi-natural experiment based on China’s new environmental protection law. J. Clean. Prod. 276:124105

Cai X, Zhu B, Zhang H, Li L, Xie M (2020) Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Sci. Total Environ. 746:140810

Calel R, Dechezleprêtre A (2016) Environmental policy and directed technological change: evidence from the European carbon market. Rev. Econ. Stat. 98:173–191

Chagas AL, Azzoni CR, Almeida AN (2016) A spatial difference-in-differences analysis of the impact of sugarcane production on respiratory diseases. Regional Sci. Urban Econ. 59:24–36

Cheng Z, Li L, Liu J (2017) The emissions reduction effect and technical progress effect of environmental regulation policy tools. J. Clean. Prod. 149:191–205

Chesbrough H, Schwartz K (2007) Innovating business models with co-development partnerships. Res.-Technol. Manag. 50:55–59

Cui H, Cao Y (2023) How can market-oriented environmental regulation improve urban energy efficiency? Evidence from quasi-experiment in China’s SO2 trading emissions system. Energy 278:127660

Dong Z, He Y, Wang H, Wang L (2020) Is there a ripple effect in environmental regulation in China?–Evidence from the local-neighborhood green technology innovation perspective. Ecol. Indic. 118:106773

Dong, Z, Wang, H, 2019. Local-Neighborhood Effect of Green Technology of Environmental Regulation. China Industrial Economics, 100–118

Du H, Chen Z, Mao G, Li RYM, Chai L (2018) A spatio-temporal analysis of low carbon development in China’s 30 provinces: A perspective on the maximum flux principle. Ecol. Indic. 90:54–64

Du K, Cheng Y, Yao X (2021) Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 98:105247

Du L, Lin W, Du J, Jin M, Fan M (2022) Can vertical environmental regulation induce enterprise green innovation? A new perspective from automatic air quality monitoring station in China. J. Environ. Manag. 317:115349

Elmagrhi MH, Ntim CG, Elamer AA, Zhang Q (2019) A study of environmental policies and regulations, governance structures, and environmental performance: The role of female directors. Bus. strategy Environ. 28:206–220

Gollop FM, Roberts MJ (1983) Environmental regulations and productivity growth: The case of fossil-fueled electric power generation. J. political Econ. 91:654–674

Goulder LH, Parry IW (2008) Instrument choice in environmental policy. Rev. Environ. Econ. policy 2:152–174. https://doi.org/10.2139/ssrn.1117566

Greco M, Germani F, Grimaldi M, Radicic D (2022) Policy mix or policy mess? Effects of cross-instrumental policy mix on eco-innovation in German firms. Technovation 117:102194

Griliches, Z, 1998. Patent statistics as economic indicators: a survey, R&D and productivity: the econometric evidence. University of Chicago Press, 287–343

Gunningham N (1996) From compliance to best practice in OHS: the roles of specification, performance and systems-based standards. Aust. J. Labour Law 9:221–246

Gunningham, N, Sinclair, D, 2019. Regulatory pluralism: Designing policy mixes for environmental protection, Environmental Law. Routledge, 463–490

Guo Z, Chen X, Zhang Y (2022) Impact of environmental regulation perception on farmers’ agricultural green production technology adoption: a new perspective of social capital. Technol. Soc. 71:102085

Haščič I, Migotto M (2015) Measuring environmental innovation using patent data. OECD Environment Working Papers, No. 89, OECD Publishing, Paris, 10.1787/5js009kf48xw-en

He L, Qi X (2021) Environmental Courts, Environment and Employment: Evidence from China. Sustainability 13:6248

He S, Zhou R (2023) Governance efficiency analysis of heterogeneous environmental regulation——Based on spatial Durbin model and mediating effect. Resour. Dev. Mark. 39:1106–1115

He X, Jing Q, Chen H (2023) The impact of environmental tax laws on heavy-polluting enterprise ESG performance: A stakeholder behavior perspective. J. Environ. Manag. 344:118578

Hottenrott H, Rexhäuser S (2015) Policy-induced environmental technology and inventive efforts: is there a crowding out? Ind. Innov. 22:375–401

Hu H, Qi S, Chen Y (2023a) Using green technology for a better tomorrow: How enterprises and government utilize the carbon trading system and incentive policies. China Economic Rev. 78:101933

Hu J, Pan X, Huang Q (2020) Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol. Forecast. Soc. Change 158:120122

Hu S, Wang M, Wu M, Wang AR (2023b) Voluntary environmental regulations, greenwashing and green innovation: Empirical study of China’s ISO14001 certification. Environ. Impact Assess. Rev. 102:107224

Hu Y, Ding Y (2020) Can carbon emission permit trade mechanism bring both business benefits and green efficiency? China Population. Resour. Environ. 30:56–64

Huang L, Liu L, Xiao H, Liu X (2021) Scientific and Technological Innovation, Technical Efficiency and Economic Development of Agricultural: Empirical Analysis Based on VAR Model. Sci. Technol. Manag. Res. 41:107–113

Huang W, Wu F, Han W, Li Q, Han Y, Wang G, Feng L, Li X, Yang B, Lei Y (2022) Carbon footprint of cotton production in China: Composition, spatiotemporal changes and driving factors. Sci. Total Environ. 821:153407

Huang Z, Cheng X (2023) Environmental regulation and rural migrant workers’ job quality: Evidence from China migrants dynamic surveys. Economic Anal. Policy 78:845–858

Huang Z, Liao G, Li Z (2019) Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Change 144:148–156

Jaffe AB, Palmer, K.J.R.o.e., statistics (1997) Environmental regulation and innovation: a panel data study. Rev. Econ. Stat. 79:610–619

Jia Z, Lin B (2020) Rethinking the choice of carbon tax and carbon trading in China. Technol. Forecast. Soc. Change 159:120187

Jia, Z, Lin, B, Wen, S, 2023. Carbon Trading Pilots and Total Factor Productivity——With Discussions on Porter Hypothesis, Technology Diffusion and Pollution Paradise. Economic Perspectives, 66–86

Jiang W, Cole M, Sun J, Wang S (2022) Innovation, carbon emissions and the pollution haven hypothesis: Climate capitalism and global re-interpretations. J. Environ. Manag. 307:114465

Jiang Z, Wang Z, Lan X (2021) How environmental regulations affect corporate innovation? The coupling mechanism of mandatory rules and voluntary management. Technol. Soc. 65:101575

Jin H, Yang J, Chen Y (2022) Energy saving and emission reduction fiscal policy and corporate green technology innovation. Front. Psychol. 13:1056038

Kemp R, Pontoglio S (2011) The innovation effects of environmental policy instruments—A typical case of the blind men and the elephant? Ecol. Econ. 72:28–36

Khurshid A, Huang Y, Cifuentes-Faura J, Khan K (2024) Beyond borders: Assessing the transboundary effects of environmental regulation on technological development in Europe. Technol. Forecast. Soc. Change 200:123212

Lehmann P (2012) Justifying a policy mix for pollution control: a review of economic literature. J. Economic Surv. 26:71–97

Li L, Han J, Zhu Y (2023a) Does environmental regulation in the form of resource agglomeration decrease agricultural carbon emissions? Quasi-natural experimental on high-standard farmland construction policy. J. Clean. Prod. 420:138342

Li M, Gao X (2022) Implementation of enterprises’ green technology innovation under market-based environmental regulation: An evolutionary game approach. J. Environ. Manag. 308:114570

Li Q, Xiao Z (2020) Heterogeneous Environmental Regulation Tools and Green Innovation lncentives: Evidence from Green Patents of Listed Companies. Economic Res. J. 55:192–208

Li RYM, Li YL, Crabbe MJC, Manta O, Shoaib M (2021) The impact of sustainability awareness and moral values on environmental laws. Sustainability 13:5882

Li RYM, Wang Q, Zeng L, Chen H (2023b) A study on public perceptions of carbon neutrality in China: Has the idea of ESG been encompassed? Front. Environ. Sci. 10:949959

Li S, Liu J, Wu J, Hu X (2022a) Spatial spillover effect of carbon emission trading policy on carbon emission reduction: Empirical data from transport industry in China. J. Clean. Prod. 371:133529

Li X, Du K, Ouyang X, Liu L (2022b) Does more stringent environmental regulation induce firms’ innovation? Evidence from the 11th Five-year plan in China. Energy Econ. 112:106110

Li X, Guo D, Feng C (2022c) The carbon emissions trading policy of China: Does it really promote the enterprises’ green technology innovations? Int. J. Environ. Researc Public Health 19:14325

Liang C, Du G, Hao J (2023) Spatial-temporal pattern and inducement of agricultural technology innovation in China. Arid Land Geogr. 46:667–677

Liao, W, Dong, X, Weng, M, Chen, X, 2020. Economic Effect of Market-oriented Environmental Regulation: Carbon Emission Trading, Green Innovation and Green Economic Growth. China Soft Science, 159–173

Lin, B, Xie, Y, 2023. Positive or negative? R&D subsidies and green technology innovation: Evidence from China’s renewable energy industry. Renewable Energy

Lin, Y, Li, C, 2023. The Impact of Agricultural Digitalization on the Green Growth of Agriculture. Chinese Journal of Agricultural Resources and Regional Planning, 1–16

Liu B, Wang J, Li RYM, Peng L, Mi L (2022a) Achieving carbon neutrality–the role of heterogeneous environmental regulations on urban green innovation. Front. Ecol. Evolution 10:923354

Liu J, Liu X (2023) Effects of carbon emission trading schemes on green technological innovation by industrial enterprises: Evidence from a quasi-natural experiment in China. J. Innov. Knowl. 8:100410

Liu J, Xiao Y (2022) China’s Environmental Protection Tax and Green Innovation: Incentive Effect or Crowding-out Effect? Economic Res. J. 57:72–88

Liu, S, Peng, Y, She, Y, Liu, Y, 2023. Grasp the nettle or retreat: Dynamic effects decomposition of carbon trading policies from a spatial perspective. Journal of Cleaner Production, 137788

Liu X, Ren T, Ge J, Liao S, Pang L (2022b) Heterogeneous and synergistic effects of environmental regulations: theoretical and empirical research on the collaborative governance of China’s haze pollution. J. Clean. Prod. 350:131473

Liu Y, Ji D, Zhang L, An J, Sun W (2021) Rural financial development impacts on agricultural technology innovation: evidence from China. Int. J. Environ. Res. Public Health 18:1110

Liu Y, She Y, Liu S, Lan H (2022c) Supply-shock, demand-induced or superposition effect? The impacts of formal and informal environmental regulations on total factor productivity of Chinese agricultural enterprises. J. Clean. Prod. 380:135052

Long C, Zhang X (2012) Patterns of China’s industrialization: Concentration, specialization, and clustering. China Economic Rev. 23:593–612

Luo G, Guo J, Yang F, Wang C (2023) Environmental regulation, green innovation and high-quality development of enterprise: Evidence from China. J. Clean. Prod. 418:138112

Lybbert TJ, Sumner DA (2012) Agricultural technologies for climate change in developing countries: Policy options for innovation and technology diffusion. Food policy 37:114–123

Lyon, TP, Maxwell JW (2014) ‘Voluntary’ Approaches to Environmental Regulation: A Survey. SSRN

Ma X, Xue Y (2023) How does carbon emission trading scheme affect enterprise green technology innovation: evidence from China’s A-share non-financial listed companies. Environ. Sci. Pollut. Res. 30:35588–35601

Meng, X, Zhang, M, Zhao Y (2023) Environmental regulation and green transition: Quasi-natural experiment from China’s efforts in sulfur dioxide emissions control. Journal of Cleaner Production, 139741

National Development and Reform Commission, 2011. General Office of the National Development and Reform Commission on Carbon Emission Right Trading Pilot Work Trading Pilot Work. Beijing. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/201201/t20120113_964370.html

Neves SA, Marques AC, de Sá Lopes LB (2024) Is environmental regulation keeping e-waste under control? Evidence from e-waste exports in the European Union. Ecol. Econ. 216:108031

Opazo-Basáez M, Monroy-Osorio JC, Marić J (2024) Evaluating the effect of green technological innovations on organizational and environmental performance: A treble innovation approach. Technovation 129:102885

Ouyang X, Li Q, Du K (2020) How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Policy 139:111310

Partridge MD, Boarnet M, Brakman S, Ottaviano G (2012) Introduction: whither spatial econometrics? J. Regional Sci. 52:167–171

Porter ME, Linde CVD (1995) Toward a new conception of the environment-competitiveness relationship. J. economic Perspect. 9:97–118

Pu S, Ouyang Y (2023) Can carbon emission trading policy promote green innovation? The perspective of corporate operating difficulties. J. Clean. Prod. 420:138473

Qi S-Z, Zhou C-B, Li K, Tang S-Y (2021) Influence of a pilot carbon trading policy on enterprises’ low-carbon innovation in China. Clim. Policy 21:318–336

Ramzan M, Abbasi KR, Salman A, Dagar V, Alvarado R, Kagzi M (2023) Towards the dream of go green: An empirical importance of green innovation and financial depth for environmental neutrality in world’s top 10 greenest economies. Technol. Forecast. Soc. Change 189:122370

Ren S, Li X, Yuan B, Li D, Chen X (2018) The effects of three types of environmental regulation on eco-efficiency: A cross-region analysis in China. J. Clean. Prod. 173:245–255

Saunila M, Ukko J, Rantala T (2018) Sustainability as a driver of green innovation investment and exploitation. J. Clean. Prod. 179:631–641

Schader C, Lampkin N, Muller A, Stolze M (2014) The role of multi-target policy instruments in agri-environmental policy mixes. J. Environ. Manag. 145:180–190

Shao X, Zhong Y, Liu W, Li RYM (2021) Modeling the effect of green technology innovation and renewable energy on carbon neutrality in N-11 countries? Evidence from advance panel estimations. J. Environ. Manag. 296:113189