Abstract

Geopolitics events have a significant impact on financial markets in the process of global economic integration and financial liberalization. Focusing on the 2022 Russia-Ukraine conflict, this paper utilizes the TVP-VAR network connectedness approach to investigate its specific impacts on the connectedness of major global financial markets. It examines the dynamic evolution of high-frequency and low-frequency shocks on market correlations during the pre-conflict, initial, and stalemate stages, revealing the changes in risk transmission paths. Findings show that the conflict led to increased market interconnectedness. Low-frequency became a major part of the total spillover, signaling long-term structural changes. The stock and foreign exchange market initially responded swiftly, serving as starting points for risk diffusion. The commodity market has been risk receivers throughout the conflict period. Intra-market and cross-market linkages have also changed. The German stock market was the main source of risk spillovers in the conflict, influencing international market linkages. In the global financial market network, several stock markets were the primary risk transmitters in the early stage of the conflict, while foreign exchange markets took on this role during the stalemate period. In addition, gold continues to play a safe-haven role. Furthermore, the TVP-VAR model is used to quantitatively assess the extent of the impact of the conflict on the spillover effects of major global financial markets at different time points and lags. Based on these findings, this paper constructs diversified portfolios and proposes a series of targeted risk management recommendations, which provide a theoretical basis for future policy formulation under similar crises.

Similar content being viewed by others

Introduction

Financial security is an important component of national security. With the continuous advancement of economic globalization and financial liberalization, the financial markets of various countries are deeply integrated. Especially during a global crisis event, the connectedness among global financial markets experiences a substantial increase (Zaremba et al., 2019; Spierdijk and Umar, 2014; Elsayed and Helmi, 2021; Naeem et al., 2020). The heightened connectedness enables turbulence in one national or regional market to spread rapidly to others, triggering a cross-market resonance effect. This effect can severely disrupt normal operations within financial markets and pose significant threats to a country’s financial security.

In particular, the sudden outbreak of the Russia-Ukraine conflict brought great challenges to the global economy and financial system on February 24, 2022. The outbreak of the conflict triggered widespread economic panic, causing major global stock markets to plummet. On the day of the conflict, the IRTS plummeted by more than 50%, the N225 fell below 26,000, and European stock markets fell collectively. Exchange rates in several countries depreciated sharply, with the Russian exchange rate falling to 90 rubles to the dollar. As Russia and Ukraine are important exporters of commodities, their conflict has led to a decline in the production of some commodities, such as energy, food and rare metals. It has also seriously interfered with the global supply of commodities and exacerbated global inflationary pressures, accompanied by an increase in export controls. In the initial three-week period after the outbreak of the conflict, Organization for Economic Cooperation and Development (OECD) data shows that global wheat prices rose by 80% compared to January 2022. Concurrently, fertilizer and nickel prices increased by over 60% during this timeframe. Additionally, the prices of numerous other important metal products experienced considerable growth, with most rising by more than 20% in the same period. The conflict has significantly exacerbated volatility in major global financial markets, amplifying market risks. Simultaneously, it has led to a trend of resonance among financial risks across multiple markets.

To date, the conflict has lasted almost two years while it continues to escalate. The United States and other European countries have continued to impose all-round economic sanctions and export controls on Russia, thereby creating new global trade barriers. These actions have exacerbated the uncertainty within global financial markets and accelerated the worldwide diffusion of risks. It is thus clear that the Russia-Ukraine conflict poses a great threat to global financial stability. In order to maintain financial security and effectively respond to global systemic financial risks, it is essential to gain a comprehensive understanding of the connectedness among financial markets. Our objective is to delve into the risk transmission and spillover effects among major global financial markets during the Russia-Ukraine conflict. Through this analysis, we aim to provide key information and feasible recommendations for risk management.

In order to deeply study the connectedness among major global financial markets during the Russia-Ukraine conflict, this paper proposes and analyzes three questions. First, did the interactions between various financial markets change as a result of the conflict? Second, did the role of markets change during the period of turmoil? Finally, are the linkages between markets in a given period driven primarily by short-term or long-term shock? Under this background, we focus on the changes in connectedness and the evolution of relationships within their respective sub-markets between stock, foreign exchange and commodity markets. Specifically, these markets include the stock and foreign exchange markets of China, Japan, the United States, the United Kingdom, France, Germany, Brazil and India, as well as the primary export commodities from Russia and Ukraine, which consist of oil, natural gas, nickel, wheat, and the widely traded commodity gold. Ultimately, we will use the results of these analyses to guide the construction of cross-market, multi-asset class portfolios designed to achieve better diversification of risk and maximize potential returns and to help investors find opportunities for stable growth amid global macroeconomic volatility.

Methodologically, we use the TVP-VAR network connectedness approach (Antonakakis et al., 2020), considering both high and low frequency bands. This method permits to identify the periods when changes in the financial markets may have a deeper impact, thereby facilitating an examination of the new connectedness that emerge within specific periods. Then, we investigate the impact of the geopolitics risk (GPR) triggered by the Russia-Ukraine conflict on the stock, foreign exchange, and commodity markets using TVP-VAR with stochastic volatility (Primiceri, 2005; Nakajima, 2011). The TVP-VAR model provides insights into the impact of specific Geopolitics events on various financial markets at different time points and lags. Additionally, we use the minimum connectedness portfolio (MCoP) to construct the optimal portfolios for different stages (Broadstock et al., 2022; Wu et al., 2023; Bai et al., 2023). This methodology ensures our investment strategies dynamically adapt to the evolving interdependencies and volatilities within and across the global financial markets.

The study finds that the global financial markets were affected by the Russia–Ukraine conflict during the conflict. The spillover effect of global financial markets increased significantly, especially in the commodity, stock and foreign exchange markets. The commodity market experienced the most substantial increase in risk, mainly due to the status of Russia and Ukraine’s energy resources and the changes in their production levels and exports. The low-frequency volatility component dominates the total spillovers, suggesting long-term structural changes.

Then, we divide the time range from January 01, 2021 to October 31, 2023 into three stages: pre-conflict (January 01, 2021 to February 23, 2022), initial (February 24, 2022 to December 30, 2022) and stalemate (January 02, 2023 to October 31, 2023), to observe a dynamic evolution of financial market connectedness. In the pre-conflict period, the stock and commodity markets were primary risk transmitters, with commodities notably influencing the foreign exchange market. The conflict’s outbreak changed direction of risk transmission, reflecting geopolitical tensions’ profound impact. Our study reveals this shift: initially, the stock and foreign exchange markets, sensitive to global economic shifts, rapidly released risk due to sanctions, playing pivotal risk-dissemination roles. Meanwhile, the commodity market adapted, absorbing spillovers and adjusting risks from the foreign exchange and stock markets, highlighting the dynamic interdependence and adaptability of these financial sectors amidst turmoil. Our study not only deepens the understanding of how GPR specifically affects the functioning of international financial markets but also provides a valuable theoretical foundation and practical guidance for future policymaking under similar crises.

Furthermore, we examine changes in within-market and cross-market connectedness to understand how financial relationships and market dynamics are reshaped during the conflict. In the stock markets, the German and British stock markets became main sources of risk transmission. In the foreign exchange markets, the European foreign exchange markets became the primary sources of risk transmission. Nickel and wheat were the most affected in commodity markets due to the disruptions in the global supply chain caused by the Russia-Ukraine conflict. They turned into major risk transmitters. Gold, on the other hand, continued to play the role of a risk absorber throughout the conflict. Additionally, a study of the connectedness between various types of markets finds that in the initial stage of the conflict, the German stock market became the main source of risk spillovers, which were transmitted to the energy, stock, and foreign exchange markets of other countries.

Constructing a robust diversified portfolio is particularly critical in the face of significantly increased market volatility. Therefore, we construct different diversified portfolios based on the principle of minimum connectedness according to the market characteristics and risk profile of each specific period. During periods of market calm, the portfolio may be biased towards growth assets such as equities and commodities. And in the early stages of increased market uncertainty, the proportion of safe-haven assets such as currency pairs may be increased. Through these dynamic strategies, our diversified portfolios are designed to optimize the balance of risk and return, helping investors to secure returns in a volatile market environment.

This study is expected to provide new insights and contributions to the existing literatures in several ways. First, previous literature focuses only on the impact of the Russia-Ukraine conflict on a single type of market and does not provide a macro view of the evolution of the overall financial market connectedness. However, we examine the changes in connectedness among stock, foreign exchange and commodity markets before and after the Russia-Ukraine conflict, and capture the evolution of connectedness within each submarket.

Second, existing literature only examines the impact of the initial stage (within six months) of the Russia-Ukraine conflict on financial markets. But the initial market reaction is not necessarily representative of market performance throughout the conflict period. As the Russia-Ukraine conflict continues to escalate and the conflict normalizes, ignoring the subsequent evolution of the conflict may lead to an incomplete understanding of the market impact. So, we analyze the changes in financial market connectedness before and after the conflict, examining these shifts at the initial and stalemate of the conflict in a staged manner.

Third, we have examined how to construct an optimal portfolio strategy that can effectively withstand external shocks and achieve solid asset growth during the conflict. This research covers in-depth analysis of stock, foreign exchange and commodities. It seeks to explore diversified investment opportunities in a highly uncertain market environment.

This paper is organized as follows. Section 2 provides a literature review. Section 3 provides a brief overview of the models. Section 4 shows preliminary descriptions of data. Then, Section 5 presents the empirical results. Finally, we present the conclusions and suggestions in the last section.

Literature review

In this section, we review the valuable studies related to the topic of this paper. We categorize the previous literatures into three groups. Firstly, studies have shown the impact of the Russia-Ukraine conflict on the global financial economy. Secondly, studies have shown the connectedness of financial markets. Thirdly, studies have shown connectedness measuring methodology.

Literatures on the impact of the Russia-Ukraine conflict

The Russia-Ukraine conflict may lead to volatility in global financial markets, especially in conflict-related regions and in countries with economic ties to Russia and Ukraine. Recent literatures have examined the impact of the Russia-Ukraine conflict on the global financial economy from a variety of perspectives, including various types of financial markets and systemic financial risks. Most of the literatures study the effects of the Russia-Ukraine conflict on stock markets. Sun and Zhang (2022) investigated the effects of the Russia-Ukraine conflict on global stock markets. They showed that the Russia-Ukraine conflict negatively impacts the stock return and volatility. Gaio et al. (2022) studied the effects of the conflict on the efficiency of stock markets in six developed countries, including USA, UK, Germany, France, Italy and Spain. Tajaddini and Gholipour (2023) analyzed stock market data across 83 countries and found that countries with more connectedness (in terms of exports and imports) with Russia and Ukraine had greater declines in stock market index values in the conflict. Ahmed et al. (2023) examined the impact of the conflict on European stock markets, which experienced significant negative abnormal returns. Kamal et al. (2023) delved into the impact of conflict on Australian stock market using event study method. Umar et al. (2022) studied the impact of geopolitical risks on asset returns from bonds, stocks and commodity markets.

A small portion of the literatures focus on the impact of the Russia-Ukraine conflict on the foreign exchange market. Aliu et al. (2022) explored the impact of the conflict on five Euro exchange rates, with the Russian ruble playing a significant role in the depreciation of the euro. Hossain et al. (2024) examined the impact of GPR due to the conflict on the foreign exchange market of 39 countries and found that the foreign exchange rates of all these countries declined against the US dollar.

Due to the importance of Russia and Ukraine in commodities such as energy and food, the conflict has led to volatility in the prices of these commodities. Fang and Shao (2022) investigated the extent to which and the channels through which the conflict affects the volatility risk of commodity markets. There are also some literatures devoted to the impact of the Russia-Ukraine conflict on the price of crude oil (Zhang et al., 2024; Zhang et al., 2023; Meng and Yu, 2023). Volatility in financial markets often brings about systemic financial risks. Qureshi et al. (2022) studied the systemic risk impacts of the Russia-Ukraine conflict on Russia, Ukraine, France, Germany, Italy, the United Kingdom, the United States, and China. They showed that the sanctions caused systemic risk spillovers to European countries and the United States.

Literatures on the connectedness between financial markets

In the research on the transmission of financial market risks, the connectedness is a critical issue. Many scholars have focused on the connectedness among financial markets. Yoon et al. (2019) explored the correlations and spillovers among stock, bond, currency and commodity markets. Zhang and Broadstock (2020) studied the connectedness among major global commodities after the 2008 global crisis. Umar et al. (2022) measured the dynamic connectedness among Russian and European financial markets, as well as global commodity markets. Just and Echaust, (2022) examined the spillover transmission among agricultural commodities during the Russia-Ukraine conflict. Wu et al. (2023) compared the volatility spillovers between fossil energy and agricultural commodities caused by COVID-19 pandemic and Russia-Ukraine conflict. Okhrin et al. (2023) investigated the asymmetric and nonlinear connectedness between crude oil and financial markets during the Russia-Ukraine conflict. Shahzad et al. (2023) employed TVP-VAR and wavelet coherence to analyze the dynamic connectedness of economic instability and GPR on traditional non-renewable energy sources and precious metals markets over the period ranging from June 11, 2012 to May 23, 2022. El Khoury et al. (2023) investigated the connectedness and spillover dynamics of Financial Technology (FinTech), Environmental, Social and Governance (ESG), renewable energy, gold and Morgan Stanley Capital International (MSCI) indices in developed and emerging countries.

Literatures on volatility spillovers and connectedness method

At present, most literatures on volatility spillovers and connectedness are based on two types of models. The first is based on GARCH model. GARCH models are used to quantify the volatility of financial assets and capture dynamic changes in conditional heteroscedasticity of markets. Tian and Ji (2022) proposed a new CoVaR model based on GARCH copula quantile regression to study the risk spillovers between four developed financial markets. Zhao et al. (2023) used the binary VAR-BEKK-GARCH model to study the income spillover effect and volatility spillover effect of the Nordic electricity market and the carbon market. The second is based on Diebold & Yilmaz model (Diebold and Yilmaz, 2014). Diebold & Yilmaz (DY) model effectively measure and analyze volatility spillover effects and risk transmission intensity across different financial markets. Li et al. (2023) explored the spillover effect of Economic Policy Uncertainty (EPU) on the stock market based on the DY model and network analysis. Xia et al. (2022) studied the static and dynamic risk spillover relationship between China’s carbon and stock market from the perspective of the entire market and different industry levels, using the DY model.

Besides, another important approach is the time-varying parameter structural vector auto-regression (TVP-VAR) network connectedness approach (Antonakakis et al., 2020). It incorporates time-varying parameters into a VAR framework and employs DY model analysis, thereby adapting to market changes and precisely depicting cross-market risk spillover effects. This approach has also been widely used (e.g., Jiang et al. 2019, Antonakakis et al. 2020, Aharon and Demir 2022, Urom et al. 2022). The TVP-VAR connectedness approach can capture the dynamic evolution of the connectedness of markets over time, enabling a deeper understanding of how market linkages evolve as conflicts unfold.

However, existing research have not yet comprehensively and systematically explored the impact of the Russia-Ukraine conflict on the connectedness of major global financial markets, including the stock, foreign exchange and commodity markets. Moreover, these studies have not differentiated between different stages before and after the conflict for in-depth comparative analysis. Based on this, this paper aims to fill this research gap by expanding the sample range and employing the TVP-VAR connectedness approach to comparatively study the connectedness of major global financial markets during the pre-conflict period, post-conflict period, the initial and stalemate stages of the Russia-Ukraine conflict.

Methodologies

In the empirical research, we use the TVP-VAR model and the TVP-VAR connectedness approach to analyze volatility spillovers among financial markets. We first briefly introduce these two models.

TVP-VAR model time-varying spillovers

We employ the TVP-VAR model to explore the time-varying spillovers among financial markets. This model is an extension of the traditional VAR model. It can dynamically adjust to changing market conditions, eliminating the need for a fixed window size, thus guaranteeing the inclusion of all relevant observations. In particular, the TVP-VAR model’s the coefficient and variance covariance change with time. The TVP-VAR model can be represented as:

where \({y}_{t}\) is the observed k × 1 order dependent variable vector; \({\beta }_{t}\), \({A}_{t}\) and \(\sum t\) are time-varying.

\({A}_{t}\) is a lower triangular matrix:

\(\sum t\) is a diagonal matrix:

It is assumed that these time-varying parameters follow the random walk process:

where \({h}_{t}={({h}_{1t},\ldots ,{h}_{{kt}})}^{{\prime} }\), \({h}_{{it}}={\log }_{{\sigma }_{{it}}}^{2}\), i = 1, …, k, t = s + 1, …, n.

\({\mu }_{\beta t}\), \({\mu }_{\alpha t}\), \({\mu }_{{ht}}\) is described as follows:

To prevent potential parameter estimation bias, we use the method of Markov Chain Monte Carlo (MCMC) to perform Bayesian estimation of parameters, and then further calculates the impulse response impact between each variable.

TVP-VAR network connectedness

The directional connectedness approach (Diebold and Yilmaz, 2014) was proposed to quantify the intensity and direction of spillover effect between financial markets. To overcome the defects of the VAR model, Antonakakis et al. (2020) presented a TVP-VAR connectedness methodology, which both combines the TVP-VAR method and the directional connectedness approach.

According to Section 2.1, the TVP-VAR model can be transformed to TVP-VMA model by using the following function:

where \({\Theta }_{{jt}}\) is an N × N dimensional matrix.

Next, we use the generalized impulse response function to estimate the responses of all variables following a shock in variable i. Following this, the elements of the dynamic H-step generalized variance decomposition matrix can be defined as

where \({\varphi }_{{ij},t}^{g}\) represents the forecast error of j’s shock to i at time t.

The H-step ahead generalized forecast error variance decomposition (GFEVD) from Koop et al. (1996) and Pesaran and Shin (1998), can be calculated as follows:

where \({\sum }_{j=1}^{N}{\widetilde{\Phi }}_{{ij},t}^{g}(h)=1\), and \({\sum }_{i,j=1}^{N}{\widetilde{\Phi }}_{{ij},t}^{g}(h)=N\).

The total connectedness index (TCI) can be obtained as follows:

The spillovers of the variable i to all other variables j can be defined as follows:

The spillovers received by the variable i from all other variables j can be defined as follows:

The net total directional connectedness (NET) is given as:

The net pairwise directional connectedness index (NPDC):

If \({{\rm{NPDC}}}_{{ij}}\left(h\right)\)>0, it means that variable i dominates j; conversely, variable j dominates variable i.

In addition, we measure the connectedness in the frequency domain. Baruník and Křehlík (2018) use spectral representation of variance decompositions based on frequency responses to shocks.

The scaled generalized variance decomposition is:

where frequency band d = (a, b): a, b\(\in\) (-π, π), a < b; \({\varGamma }_{i}(\omega )\) is frequency share of the variance of the j variable; \({(f(\omega ))}_{i,j}\) is generalized causation spectrum over frequencies ω.

Through the change of frequency band d, the high-frequency and low-frequency connectedness can be defined as:

MCoP for portfolio selection

Finally, we will construct a portfolio based on the above research and adopt the method of MCoP based on pairwise connectedness index (PCI) advised by Broadstock et al. (2022). PCI is a measure of the interaction between two assets. The primary objective of the MCoP is to minimize the interdependencies among its constituent assets, thereby reducing the spillover effects that can propagate risks across the portfolio. By doing so, the MCoP aims to bolster the portfolio’s resilience—its capacity to withstand or mitigate systemic shocks and market disruptions. Therefore, investment instruments that exhibit independence—neither influencing nor being influenced by other variables—will be assigned higher weights within the portfolio composition. It can be defined as follows:

where \({\omega }_{t}\) is an n × 1 vector of portfolio wights, PCIt is the matrix of pairwise connectedness index in period t and I is an n × 1 vector of ones.

For the constructed portfolio, we evaluate its performance using the criteria of the Sharpe ratio and hedge effectiveness.

The Sharpe Ratio, a recognized metric introduced by Sharpe in 1966, serves as a pivotal benchmark for fund managers in evaluating the overall performance of investment portfolios by balancing risk and return. It can be defined as follows:

where \({R}_{p}\) is the returns on the portfolio and \({\bar{R}}_{p}\) is the average return on the portfolio. A higher Sharpe Ratio signifies a portfolio’s superior ability to generate returns in proportion to the risk assumed.

The hedge effectiveness of the Ederington (1979) is utilized to quantify the degree of risk mitigation achieved in a single asset through various portfolio allocation strategies. It can be defined as:

where \(\mathrm{var}({R}_{p})\) is the return variance of the portfolio and \(\mathrm{var}({R}_{i})\) is the return variance of the unhedged asset. A higher HE denotes a better hedging effect of a portfolio and vice versa.

Data description

In the empirical research, we incorporate daily data from a diverse array of markets, ensuring coverage of at least one major economy from each continent. This includes economies with substantial market capitalization and global influence, such as the US, the UK, France, Germany, China, Japan, Brazil and India. Due to the additional risks and uncertainties stemming from Russia’s direct involvement in the conflict, we have decided to exclude Russian data to prevent distortion in our analyses and to avoid unnecessary complexity. Specifically, the Russian stock market was suspended for a period during the Russia–Ukraine conflict and was subsequently removed from the MSCI index, leading to a lack of stock market data. Additionally, sanctions imposed by Western countries have significantly affected the stability and liquidity of the ruble, resulting in irregularities in the Russian foreign exchange market. By omitting Russian data, we ensure a more accurate representation of the financial relationships and market dynamics of the remaining markets under the study. Furthermore, we include major commodities primarily exported by Russia such as oil, natural gas, nickel and wheat, as well as gold, which is one of the most widely traded commodities. We take MSCI indices of China, Japan, Brazil, India, US, UK, France and Germany as proxies of the stock markets, USDX, CNY/USD, JPY/USD, GBP/USD, EUR/USD, BRL/USD, INR/USD exchange rate as proxies of the currencies markets, WTI crude oil, natural gas, nickel, wheat and gold futures prices as proxies of the commodity markets. The data is sourced from Wind database and MSCI ranging from January 2021 to October 2023. All price data are transformed into logarithmic returns through the first-order difference of the logarithmic prices. The descriptive statistics are reported in Table 1. The results of ADF test show stationarity of all series.

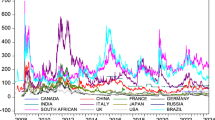

Due to the presence of conditional heteroskedasticity in financial market data, we employ GARCH family models to calculate volatilities of these series. In order to ensure that the applied volatility models are highly compatible with the specific characteristics of each dataset, we select the respective volatility models for different time series. Based on the results of the model selection, we adopt the conventional GARCH (1,1) model for volatility estimation of sequences including US, UK, FR, WTI, Gold, Natural Gas, Wheat, and BRL/USD. We choose the EGARCH (1,1) model to compute volatility for sequences JPY/USD, USDX, GBP/USD, EUR/USD, CNY/USD and JP. For the Nickel series, the GJR-GARCH (1,1) model is more suited due to its capacity to handle the series’ complex volatility structures, including jumps and heavy tails. Table 2 presents the descriptive statistics of the volatilities. Figure 1 illustrates the series of volatility. All volatility series exhibit noticeable changes in response to the outbreak of the Russia-Ukraine conflict.

Empirical results

In order to analyze the impact of the Russia-Ukraine conflict on the connectedness among major global financial markets, we study the total volatility spillovers of the global financial system. We further investigate the dynamic relationships between different types of markets during the entire sample period, focusing on changes in connectedness before and after the conflict. Subsequently, to gain a deeper understanding, we employ the TVP-VAR model to investigate the impulse responses of GPR on various types of markets. By doing so, we can systematically explore the extent to which specific geopolitical events, such as the Russia-Ukraine conflict, influence these markets at different time points and lags.

Total spillovers analysis

In this section, we examine total volatility spillovers in major global financial markets and volatility spillovers in various types of detailed markets. Figures 2–5 present the total volatility spillovers in the major financial markets: the stock, foreign exchange and commodity markets, respectively. We can see that the volatility spillover in each type of market increased dramatically at the outbreak of the Russia-Ukraine conflict. The commodity market experienced the largest increase in risk, followed by the stock and foreign exchange markets. The pronounced surge in commodity market risk can be attributed to the pivotal roles of both Russia and Ukraine as global commodity exporters. Amidst the conflict, reduced production levels and increased export controls have led to substantial price fluctuations, which in turn amplified the risk exposure within this market. Moreover, the heightened risk observed in stocks is reasonable considering their typical vulnerability to crises and uncertainty.

Furthermore, we examine the volatility spillovers during the conflict at different frequencies. We adopt a similar approach proposed by Baruník and Křehlík (2018) to differentiate between short-term and long-term market phenomena. We define a one-week period (comprising five consecutive trading days) as an indicator of short-term market dynamics. This timeframe is particularly suitable for capturing the immediate reactions of financial markets to new information, transient sentiment swings and short-term speculative activities. It serves as a practical timescale for analyzing high-frequency data, where volatility and correlations can exhibit pronounced fluctuations due to daily market events. Data classified as longer-term, or low-frequency, which includes periods extending beyond one week, is instrumental in revealing deeper market trends, macroeconomic influences, and strategic investment patterns. Our decision to utilize these specific frequency bands is thus anchored in empirical evidence and theoretical frameworks that underscore the differential behavior of financial markets across varying time horizons.

The result reveals that these fluctuations are predominantly driven by the low-frequency component (more than 5 days). When the low-frequency band determines the total spillovers in the system, it is likely to suffer structural changes and become obvious as time goes on. A possible explanation might be that the Russia-Ukraine conflict led to deeper changes in major global financial markets and more prolonged effects. These changes can be attributed to various factors, such as shifts in long-term trends, structural changes and slow-moving systemic factors like persistent macroeconomic conditions, policy adjustments, or deep-seated institutional reforms. As a result, the connectedness and volatility transmission among different financial assets are significantly influenced by these evolving structural elements, ultimately shaping the overall risk profile and stability of the global financial landscape.

The connectedness of three types of financial markets

In this section, we explore the changes in connectedness of financial markets before and after the onset of the Russia-Ukraine conflict. Unlike previous literature, we divide the period into three stages. The first stage is the pre-conflict stage (January 4, 2021–February 23, 2022). The second stage is the initial stage of the conflict (February 24, 2022–December 30, 2022). The third stage is the stalemate stage (January 2, 2023–October 31, 2023). We reveal the changes in inter-market connectedness during the different stages, based on dynamic volatility spillovers between major global financial markets.

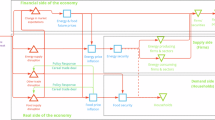

First, we categorize the major financial markets into three distinct types: stock, foreign exchange and commodity markets. Figure 6 shows the dynamic volatility spillovers among the three markets over the entire sample period. Subsequently, we examine how the dynamic connectedness among these different market types evolves over time. Figure 7 presents the connectedness among the three types of markets in different time stages (the pre-conflict period, post-conflict period, the initial and stalemate stages of the conflict) respectively. In the connectedness figure, the size of each node represents the magnitude of risk that the respective market (stock, foreign exchange, or commodity) either transmits or receives. Larger nodes indicate a greater volume of risk being handled by that market. Meanwhile, the thickness of the lines connecting the nodes signifies the strength or amount of risk being transferred between markets. Thicker lines imply a more substantial flow of risk from one market to another.

At the pre-conflict stage, the stock market and commodity market assumed central positions as principal transmitters of risk. Specifically, the commodity market imparted substantial risk to the foreign exchange market. With the outbreak of conflict, the dynamics shifted, making the stock and foreign exchange markets the primary channels for risk transmission. This shift led to these markets passing risk on to the commodity market. This change shows that geopolitical tensions had a big effect on how risk moved between these financial markets.

To understand this change, we further investigate the change in connectedness in initial and stalemate stages of the Russia-Ukraine conflict. In the initial stage of the conflict, the stock market became a central part of the rapid risk release. As tensions escalated into actual conflict, global stock markets plummeted sharply, intensifying panic and instigating broad sell-offs. This immediate reaction in the stock market promptly cascaded into the commodity market. Additionally, the foreign exchange market emerged as a key component in the rapid release of risk. The foreign exchange market acts as a global economic integrator. It is highly sensitive to changes in international trade and capital movements. Currencies tied to the conflict faced notable selling. Such risk-averse actions were quickly shown in exchange rate changes, which increased foreign exchange market volatility. Subsequently imposed economic sanctions by Europe and the United States against Russia augmented this instability. Consequently, the stock and foreign exchange markets have played pivotal roles in this geopolitical turmoil, serving as the main channels for transmitting risk.

As the conflict enters a prolonged stalemate, investors’ mounting worries over the economic future of regions impacted by the conflict led to a hastened flight of capital. This accelerated capital outflow exerted downward pressure on the currencies of the affected nations, thereby driving heightened volatility in the foreign exchange market as their currencies depreciated sharply. Volatility in foreign exchange markets has also affected commodities, particularly those dependent on international trade. Fluctuations in exchange rates had a direct impact on the cost of imports and, consequently, on commodity prices. In this dynamic evolution, commodity markets have played a key risk-adjusting role, absorbing risk spillovers from foreign exchange and stock markets.

Subsequently, we investigate the changes in connectedness within each individual type of market. This allows us to identify how different type markets respond to external shocks and interact with one another, which complements our broader analysis of cross-market interactions.

The connectedness of stock markets

Figure 8 provides an overview of the dynamic volatility spillovers across all stock markets throughout the entire sampling period. Following this, Fig. 9 presents the connectedness between stock markets during the pre-conflict period, post-conflict period, the initial and stalemate stages of the Russia-Ukraine conflict, respectively. Before the outbreak of the conflict, the stock markets of Germany, France, India and Brazil were risk transmitters. In the post-conflict period, the UK stock market also became important source of risk transmission. This shift suggests that the conflict has altered risk transmission dynamics, broadening the role of various markets in spreading financial instability. It demonstrates the increased interconnectedness and interdependence of global financial markets while facing a significant increase in uncertainty.

Next, we examine the connectedness of stock markets at various stages of the conflict. At the beginning of the war, the main spillovers of risk were the German, UK, Indian and Brazilian stock markets. Compared to the pre-conflict period, Germany, India, and Brazil continued to be sources of risk spillover, with Germany remaining the primary transmitter of risk. As Europe’s largest economy, Germany boasts a robust manufacturing sector that plays a crucial role in global supply chains. The country’s significant reliance on Russian energy, particularly natural gas, has made it highly vulnerable to the rising energy prices triggered by the Russia-Ukraine conflict. These increased energy costs have directly impacted Germany’s industrial competitiveness and stock market performance. Additionally, Germany’s heavy reliance on exports means that global trade tensions and uncertainties stemming from the conflict have negatively affected German exporters, further influencing the performance of the German stock market.

Also, the UK shifted from being a risk receiver to a risk transmitter. As a member of NATO and a country with significant international influence, the UK is militarily likely to be involved in the conflict, either directly or indirectly. Its economy, finances and national security would be directly affected by conflict. This has contributed to the UK stock market becoming a risk transmitter.

As the conflict enters its later stage and evolves into a prolonged stalemate, the Chinese stock market has evolved from risk-taker to risk-transmitter. Increased global economic uncertainty has resulted in greater volatility in the Chinese stock market. As the world’s second-largest economy, China is a major trading partner for many countries, especially for those goods and services affected by conflict, such as energy and food. Consequently, the volatility in China’s stock market can spread to other global markets.

The connectedness of foreign exchange markets

Figure 10 presents the dynamic volatility spillovers across all foreign exchange markets throughout the entire sampling period. Subsequently, Fig. 11 shows the connectedness between foreign exchange markets during the pre-conflict period, post-conflict period, the initial and stalemate stages of the Russia-Ukraine conflict, respectively. Comparing the state of interconnectedness before and after the onset of the Russia-Ukraine conflict, a significant shift occurred in the UK’s foreign exchange market, transitioning from being a risk receiver to a risk transmitter. This transformation can be attributed primarily to the unprecedented economic and financial sanctions imposed by Western countries on Russia. The measures included freezing Russian assets, placing restrictions on currency transactions involving major currencies like the US dollar, Euro, and Ruble, and excluding Russia’s banking system from SWIFT. These sanctions not only had a direct impact on Russia’s economy and financial markets but also caused indirect repercussions on the global flow of capital and the stability of supply chains, with the UK and Eurozone countries experiencing the most immediate effects. Additionally, the conflict has caused considerable volatility in energy prices, presenting a significant economic risk to countries reliant on Russian energy, especially the UK and Eurozone countries. As a result of these actions, foreign exchange market of the UK and Eurozone countries have become major transmitters of risk.

Then, we examine how the roles of different markets have evolved during the conflict. Compared to pre-conflict period, the US dollar has transitioned from being a risk transmitter to a risk absorber. With the outbreak of the conflict, the market uncertainty surged and investors became more risk-averse. Given that the US dollar is widely regarded as a reliable safe-haven currency, substantial capital flowed into US dollar assets as a hedge against risk. This shift in investor behavior led to the US dollar taking on a new role as a risk absorber rather than merely transmitting risk. In addition, the Brazilian foreign exchange market has transitioned from a risk-absorbing to a risk-transmitting market. This shift is primarily attributable to Brazil’s status as a major global commodity exporter. The conflict has resulted in heightened volatility in global commodity prices, particularly for energy and food. As commodity exports are a crucial source of economic growth and foreign exchange earnings for Brazil, the rise in commodity prices has led to a temporary boost in export revenues. However, this situation has also created volatility in capital flows, pressure for exchange rate appreciation and fluctuations in macroeconomic indicators, collectively positioning the Brazilian foreign exchange market as a risk transmitter.

During the stalemate stage of the Russia-Ukraine conflict, the foreign exchange markets of the UK, the Eurozone countries, and the United States had become transmitters of risk, while other markets had become receivers of risk. The Eurozone countries and the UK had direct economic links to the conflict, particularly regarding energy supply. They therefore remained the primary transmitters of risk. Additionally, as the conflict had entered a stalemate, investors had begun to reassess risks and returns, safe-haven demand had declined and factors such as the policy stance and economic performance in the United States had started to influence the dollar. As a result, the US dollar gradually shifted from being a risk receiver to a risk transmitter.

The connectedness of commodity markets

Figure 12 shows the dynamic volatility spillovers across all commodity markets throughout the entire sampling period. Figure 13 presents the connectedness between commodities during the pre-conflict period, post-conflict period, the initial and stalemate stages of the Russia-Ukraine conflict, respectively. After the outbreak of the conflict, a marked escalation in Geopolitical risks took place, coupled with severe sanctions targeting Russia’s energy exports (e.g., crude oil and natural gas). This development significantly altered the landscape for commodity prices. Instead of being primarily governed by traditional supply-demand dynamics, these key commodities’ price volatility became increasingly influenced by non-economic factors. Specifically, GPR and unilateral sanctions played a more decisive role in shaping their fluctuations. Consequently, this shift led to a weakening of the economic connectedness among commodities.

In addition, gold shifted after the conflict. Before the conflict, gold was the only risk transmitter. After the conflict, gold became a risk taker. This means that it becomes the choice of investors seeking a safe haven in turbulent times. Gold is often thought to hold its value during economic crises or geopolitical tensions. This is because it is scarce, globally recognized and not directly affected by the monetary policies of a single country. As a result, its price tends to be supported or increase during and after conflicts as investors buy gold in large quantities for preservation and hedging purposes, reflecting the increased market demand for gold as a safe asset that receives transfers from other risky assets.

Next, we observe the changes that have occurred in the connectedness of commodity markets during the conflict. In the initial stage of the conflict, nickel and wheat were the main risk spillovers. This is because Russia is one of the world’s major nickel producers. The conflict and subsequent sanctions led to market concerns about disruptions in nickel supply. It directly pushed up nickel prices and triggered unprecedented volatility in the London Metal Exchange nickel market. This affected the stability of the global metal market, which in turn spilled over into other related commodity markets. The wheat market was even more affected by the conflict. Russia and Ukraine together account for nearly 30% of global wheat exports, and the disruption to exports caused by the conflict had a direct impact on global grain markets. It pushed up wheat prices, raising food security and inflation concerns. The wheat market has thus become an important source of risk spillovers. And by the time the conflict reached a stalemate, the nickel market changed. Over time, market concerns about nickel supply shortages eased. The gradual return of nickel price volatility to fundamentals has transformed the nickel market from a risk spillover to a risk receiver, with increased exposure to volatility of other markets.

The connectedness of all financial markets

Finally, we examine changes of connectedness among major financial markets. Figure 14 presents the dynamic volatility spillovers across all markets throughout the entire sampling period. Figure 15 shows the connectedness among global financial markets during the pre-conflict period, post-conflict period, the initial and stalemate stages of the Russia-Ukraine conflict, respectively. Before the Russia-Ukraine conflict, there was strong connectedness among global financial markets. However, this strong connectedness took a significant hit following the outbreak of the conflict, particularly after Western-imposed economic sanctions against Russia. As the German economy is highly dependent on imports of energy and raw materials, the outbreak of the conflict severely affected Germany due to shortages of raw materials and the risk of price increases. Additionally, given Germany’s central position in the global financial network, risks in the German stock market impacted multiple financial markets. This makes the German stock market a crucial factor in the transmission of risk.

In the initial stage of the conflict, stock markets were the primary risk transmitters in the global financial network. This is because stock markets quickly reflect market sentiment and uncertainty. Consequently, the stock markets in European countries closely tied to the conflict became major risk transmitters. Moreover, in the currency market, only the euro acted as a risk transmitter. Nickel, a crucial industrial metal with limited alternatives, was also significantly affected. Russia controls most of the nickel supply and the outbreak of the conflict led to increased volatility in nickel prices due to concerns over the supply chain. Sanctions against Russia heightened expectations of nickel supply shortages, making nickel the sole risk spreader in the commodity markets during the initial stage of the conflict.

When the conflict reached a stalemate, foreign exchange markets became key risk transmitters. As markets adjusted to ongoing uncertainty and investors reassessed risks and returns, foreign exchange markets reflected variations in economic health and policies. Notably, natural gas emerged as the largest risk transmitter in the global financial network. As the conflict settled into a stalemate, overall risk in global financial markets decreased. However, natural gas, a crucial energy commodity, remained highly volatile due to supply constraints and price fluctuations. This volatility not only affected the countries directly involved in the conflict but also had a ripple effect on global financial markets.

Impulse response of GRP to financial markets

This paper provides a complementary study of the impulse responses of GPR to various types of markets. To optimally model these relationships, we constructed a TVP-VAR model with 1-period lag, based on the Akaike Information Criterion (AIC) and other relevant statistical information criteria. This model design enables us to effectively capture the evolving connectedness between variables and their time-varying attributes. In order to estimate the time-varying parameters in the model, the study employed the MCMC method with 10,000 iterations to obtain valid sample estimates of the parameters. The results of the study are displayed in Figs. 16 and 17. These figures illustrate the impulse response curves of GPR on three different types of markets at different lags as well as at specific points in time, respectively.

From these graphs, we can observe that all three types of markets are positively affected by geopolitical risk events in the short term. This indicates that geopolitical conflicts increase markets’ risk. However, over time, while the intensity of these positive impacts lessens, they do not fully dissipate. Thus, the impact of geopolitical risks on financial markets is to some extent persistent. Further results emphasize that geopolitical events differ in the strength of shocks to various markets at different points in time. Notably, during critical junctures related to the Russia-Ukraine conflict, the shock effects on all markets are uniformly positive and more pronounced, thereby highlighting the substantial impact that geopolitical crises can have on the stability and dynamics of financial markets.

Portfolio selection

In this section, we use the method of MCoP to construct portfolios for different stages. Since we have a total of 20 assets, it is rare for an investor to allocate to all of them. Given that portfolio construction requires potential return, we select assets at each stage based on their average return rankings to ensure that the selected portfolios maintain a certain level of return expectation. Specifically, we calculate the average return of all assets over time. The top five highest-returning assets are then screened for each period to construct the portfolio. Table 3 shows the weights, HE and SR of the portfolios at different stages. In the pre-conflict stage, we construct portfolios for WTI, Nickel, Natural Gas, Wheat, and IND. At the initial stage of the conflict, we construct portfolios on JPY/USD, USDX, GBP/USD, Nickel, INR/USD. During the stalemate period of the conflict, we construct portfolios on JP, BRA, US, WTI, Gold. The portfolios we construct have positive HE. It indicates that they are less risky than allocating to a single asset, which serves as a risk mitigation. Therefore, investors can learn from this way of constructing investment portfolios and adjust the asset allocation at the right time according to the market environment in different periods.

Conclusions and suggestions

Conclusions

This paper conducts a thorough analysis of total volatility spillovers and the shifts in inter-market connectedness among major global financial markets, comparing their status before and after the Russia-Ukraine conflict. This examination aims to reveal the specific mechanisms and transmission paths by which GPR influence financial markets. The findings indicate that since the onset of the conflict, global financial markets have exhibited a notable increase in interconnectedness. The commodity market experienced the most significant rise in risk due to Russia and Ukraine’s pivotal roles in energy and resource exports, as well as production declines and export controls resulting from the conflict. It is noteworthy that low-frequency volatility components dominated total spillovers throughout the conflict, potentially indicating structural changes brought about by the conflict in the long run.

Building upon these findings, the study further delves into the dynamic evolution of financial market connectedness by dividing it into three distinct stages, including pre-conflict, initial and stalemate stages. Before the conflict, the stock and commodity markets led risk transmission, with the commodity market notably affecting the foreign exchange market. The conflict shifted inter-market risk pathways, mirroring geopolitics’ impact. Our analysis suggests that the initial surge in the stock and foreign exchange market-driven risk as a result of sanctions underscores its importance. The commodity market evolved to absorb shocks from the foreign exchange and stock markets, illustrating the markets’ adaptive interconnectedness in times of crisis.

Additionally, the research highlighted changes in both within-market and cross-market connectedness after the conflict. The German stock market was the largest risk transmitter in the stock markets. Throughout the conflict, the German stock market transmitted greater risk to the remaining national stock markets. This is mainly due to the fact that the German economy is highly dependent on energy and raw material imports, which have been severely affected by commodity supply bottlenecks and the risk of price increases resulting from the Russia–Ukraine conflict. In the foreign exchange market, the UK and Eurozone countries emerged as the largest risk transmitters. This shift indicates that countries closely associated with the conflict faced heightened risk. It reflects the complex interplay of international sanctions, economic coping strategies and market hedging behavior, which collectively reshaped the risk-transmission landscape in the global foreign exchange market. Because of the disruption to the global supply chain caused by the Russia-Ukraine conflict, two of the major markets in commodities, nickel and wheat, were the most affected. They became the main transmitters of risk. On the other hand, gold continued to assume the role of risk absorber throughout the conflict. This further cemented its position as a safe-haven asset, attracting investors seeking to preserve the value of their assets and hedge against financial market turmoil.

Furthermore, the study of the connectedness between various types of markets finds that in the initial stage of the conflict, the German stock market became the main source of risk spillovers, which were transmitted to the commodity, stock, and foreign exchange markets of other countries. In the early stage of the conflict, several stock markets were the primary risk transmitters. However, during the stalemate period, foreign exchange markets took on this role. This shift reflects how markets adapt to the evolving dynamics of the conflict and the associated economic uncertainties.

In summary, while the Russia-Ukraine conflict initially induced higher volatility and structural shifts in global financial market connections, the system demonstrated resilience and adaptability over the long term, gradually restoring the original risk transmission dynamics. This research enhances our understanding of how GPR affects international financial markets and provides policymakers valuable theoretical frameworks and practical guidance for addressing similar crises.

Suggestions

For investors, we suggest using the MCoP methodology detailed in this study to construct more efficient and scientifically diversified portfolios. MCoP focuses on allocating assets in accordance with lower correlations and higher yields across different market cycles and economic environments, thereby constructing portfolios that can be robust in the face of volatility. The approach is significantly superior to the traditional approach, such as Minimum Variance Portfolio and Minimum Correlation Portfolio (Broadstock et al., 2022; Bai et al., 2023).

In practice, it is recommended that the composition of the portfolio be adjusted periodically based on real-time market dynamics, such as geopolitical situations, economic policy changes and industry trends. During periods of market calm, the portfolio may be biased towards growth assets such as equities and commodities. In the early stages of increased market uncertainty, the proportion of safe-haven assets such as currency pairs may be increased. This dynamic adjustment strategy ensures that the portfolio can flexibly respond to various market environments and effectively capitalize on market opportunities while controlling potential risks. And by utilizing this approach, investors can dynamically adjust their asset allocation weightings over time. This allows investors to grow wealth consistently and steadily in a complex and volatile financial market.

The roles of regulators and policymakers are equally crucial. Regulators should enhance the construction of monitoring and early warning systems to gauge the impact of GPR on financial markets. Improving the ability to identify and respond to crises promptly is imperative. Timely intervention measures should be implemented to curb the escalation of volatility triggered by speculative behaviors. Close monitoring of the gold market, as well as other markets prone to exacerbating systemic risks, is necessary. Furthermore, strengthening investor education is vital to foster a rational understanding of the complexities and risks associated with geopolitical events. Encouraging a long-term investment perspective helps prevent panic buying, which could drive up gold prices and escalate systemic risk.

Policy makers play a pivotal role in stabilizing financial markets through international cooperation. A pivotal aspect of their role involves adeptly managing and regulating cross-border capital flows. They aim at mitigating adverse market effects, forestalling the subsequent market upheavals, and preventing accretion of systemic risks. To achieve these objectives, policy makers should implement monetary and fiscal policies in a timely manner, especially in the early stage of a crisis. These approaches help stabilize market sentiment and maintain the basic stability of financial markets. From a long-term perspective, policy makers should focus on optimizing the structure of financial markets to enhance overall resilience. Promoting balanced development across different asset classes strengthens cross-market buffer mechanisms. Encouraging product innovation and diversification in financial markets provides investors with a broader array of risk management tools, thereby reducing excessive reliance on any single safe-haven asset and effectively controlling potential systemic risks.

Data availability

The datasets analyzed during the current study are available in the Harvard Dataverse, https://doi.org/10.7910/DVN/ESUNEA.

References

Aharon DY, Demir E (2022) NFTs and asset class spillovers: Lessons from the period around the COVID-19 pandemic. Financ Res Lett 47:102515

Ahmed S, Hasan MM, Kamal MR (2023) Russia–Ukraine crisis: the effects on the European stock market. Eur Financ Manag 29(4):1078–1118

Aliu F, Hašková S, Bajra UQ (2022) Consequences of Russian invasion on Ukraine: evidence from foreign exchange rates. J Risk Financ 24(1):40–58

Antonakakis N, Chatziantoniou I, Gabauer D (2020) Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. J Risk Financ Manag 13(4):84

Bai L, Wei Y, Zhang J, Wang Y, Lucey BM (2023) Diversification effects of China’s carbon neutral bond on renewable energy stock markets: A minimum connectedness portfolio approach. Energy Econ 123:106727

Baruník J, Křehlík T (2018) Measuring the frequency dynamics of financial connectedness and systemic risk. J Financ Econ 16(2):271–296

Broadstock DC, Chatziantoniou I, Gabauer D (2022) Minimum connectedness portfolios and the market for green bonds: advocating socially responsible investment (SRI) Activity. In: Floros, C, Chatziantoniou, I (eds), Applications in energy finance. Palgrave Macmillan, Cham

Diebold FX, Yilmaz K (2014) On the network topology of variance decompositions: Measuring the connectedness of financial firms. J Econ 182(1):119–134

Elsayed AH, Helmi MH (2021) Volatility transmission and spillover dynamics across financial markets: the role of geopolitical risk. Ann Oper Res 305(1-2):1–22

Ederington LH (1979) The Hedging Performance of the New Futures Markets J Financ 34(1):157–170

El Khoury R, Nasrallah N, Hussainey K, Assaf R (2023) Spillover analysis across FinTech, ESG, and renewable energy indices before and during the Russia–Ukraine war: International evidence. J Int Financ Manag Account 34(2):279–317

Fang Y, Shao Z (2022) The Russia-Ukraine conflict and volatility risk of commodity markets. Financ Res Lett 50:103264

Gaio LE, Stefanelli NO, Pimenta T, Bonacim CAG, Gatsios RC (2022) The impact of the Russia-Ukraine conflict on market efficiency: Evidence for the developed stock market. Financ Res Lett 50:103302

Hossain AT, Masum AA, Saadi S (2024) The impact of geopolitical risks on foreign exchange markets: Evidence from the Russia–Ukraine war. Financ Res Lett 59:104750

Jiang Y et al (2019) Determinants of within and cross-country economic policy uncertainty spillovers: Evidence from US and China. Financ Res Lett 31:195–206

Just M, Echaust K (2022) Dynamic spillover transmission in agricultural commodity markets: What has changed after the COVID-19 threat? Econ Lett. 217:110671

Kamal MR, Ahmed S, Hasan MM (2023) The impact of the Russia-Ukraine crisis on the stock market: Evidence from Australia. Pac -Basin Financ J 79:102036

Koop G, Pesaran MH, Potter SM (1996) Impulse response analysis in nonlinear multivariate models. Econ 74:119–147

Li R, Li S, Yuan D, Chen H, Xiang S (2023) Spillover effect of economic policy uncertainty on the stock market in the post-epidemic era. N Am J Econ Financ 64:101846

Meng X, Yu Y (2023) Does the Russia-Ukraine conflict affect gasoline prices? Energy Econ. 128:107113

Naeem M, Umar Z, Ahmed S, Ferrouhi EM (2020) Dynamic dependence between ETFs and crude oil prices by using EGARCH-Copula approach. Phys A Stat Mech Appl 557:124885

Nakajima J (2011) Time-varying parameter VAR model with stochastic volatility: an overview of methodology and empirical applications. Monet. Econ Stud 29:107–142

Okhrin Y, Uddin GS, Yahya M (2023) Nonlinear and asymmetric interconnectedness of crude oil with financial and commodity markets. Energy Econ 125:106853

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58:17–29

Primiceri GE (2005) Time varying structural vector autoregressions and monetary policy. Rev Economic Stud 72(3):821–852

Qureshi A, Rizwan MS, Ahmad G, Ashraf D (2022) Russia–Ukraine war and systemic risk: Who is taking the heat? Financ Res Lett. 48:103036

Shahzad U, Mohammed KS, Tiwari S, Nakonieczny J, Nesterowicz R (2023) Connectedness between geopolitical risk, financial instability indices and precious metals markets: Novel findings from Russia Ukraine conflict perspective. Resour Policy 80:103190

Spierdijk L, Umar Z (2014) Stocks for the long run? Evidence from emerging markets. J Int Money Financ 47:217–238

Sun M, Zhang C (2022) Comprehensive analysis of global stock market reactions to the Russia-Ukraine war. Appl Econ Lett 30:2673–2680

Tajaddini R, Gholipour HF (2023) Trade dependence and stock market reaction to the Russia-Ukraine war. Int Rev Financ 23(3):680–691

Tian M, Ji H (2022) GARCH copula quantile regression model for risk spillover analysis. Financ Res Lett 44:102104

Umar Z, Bossman A, Choi SY, Teplova T (2022) Does geopolitical risk matter for global asset returns? Evidence from quantile-on-quantile regression. Financ Res Lett 48:102991

Urom C, Ndubuisi G, Guesmi K (2022) How do financial and commodity markets volatility react to real economic activity? Financ Res Lett 47:102733

Umar Z, Polat O, Choi SY, Teplova T (2022) The impact of the Russia-Ukraine conflict on the connectedness of financial markets. Financ Res Lett 48:102976

Wu Y, Ren W, Wan J, Liu X (2023) Time-frequency volatility connectedness between fossil energy and agricultural commodities: Comparing the COVID-19 pandemic with the Russia-Ukraine conflict. Financ Res Lett 55:103866

Xia M, Chen ZH, Wang P (2022) Dynamic risk spillover effect between the carbon and stock markets under the shocks from exogenous events. Energies 16(1):97

Yoon SM, Al Mamun M, Uddin GS, Kang SH (2019) Network connectedness and net spillover between financial and commodity markets. N Am J Econ Financ 48:801–818

Zaremba A, Umar Z, Mikutowski M (2019) Inflation hedging with commodities: A wavelet analysis of seven centuries worth of data. Econ Lett 181:90–94

Zhang D, Broadstock DC (2020) Global financial crisis and rising connectedness in the international commodity markets. Int. Rev. Financ. Anal 68:101239

Zhao Y, Zhou Z, Zhang K et al. (2023) Research on spillover effect between carbon market and electricity market: Evidence from Northern Europe. Energy 263:126107

Zhang Q, Hu Y, Jiao J, Wang S (2024) The impact of Russia–Ukraine war on crude oil prices: an EMC framework. Human Soc Sci Commun 11(1):1–12

Zhang Q, Yang K, Hu Y, Jiao J, Wang S (2023) Unveiling the impact of geopolitical conflict on oil prices: A case study of the Russia-Ukraine War and its channels. Energy Econ 126:106956

Acknowledgements

This work is supported by the National Natural Science Foundation of China (No. 72033001, 72021001, 72301124, 72432005), and the Fundamental Research Funds for the Central Universities (JKF-20240176).

Author information

Authors and Affiliations

Contributions

Conceptualization: LP, ZP; Methodology & data curation: LP, ZP, GY, and LJ; Data analysis: ZP, LJ; Writing, review, and editing: ZP, LP, GY, and LJ; Supervision: LP.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human and or animal participants performed by the authors.

Informed consent

Informed consent is not applicable. The study used secondary data. The authors did not directly engage any participants.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Li, P., Zhang, P., Guo, Y. et al. How has the relationship between major financial markets changed during the Russia–Ukraine conflict?. Humanit Soc Sci Commun 11, 1731 (2024). https://doi.org/10.1057/s41599-024-04231-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-04231-7