Abstract

Tungsten plays an irreplaceable role in industrial development and high technology and is vital for national security and economic development. Supply and demand imbalances, and geopolitical and social health events, among other factors, lead to supply risks for tungsten resources in different economies. The existing studies have focused on modeling supply risk in the upstream mineral trade and lack a quantitative analysis of supply risk propagation in tungsten product trade networks from an industry chain perspective. Therefore, this paper uses trade data from 2009 to 2020 to construct an international trade network for tungsten products and applies a cascading failure model to simulate the risk propagation process in the trade network of the industry chain. The results show that China, Germany, and the US have the greatest impact ranges. The influence of economies is related to the trade export value, number of trade partners, and location. The influence of economies on the trade of midstream and downstream products is significantly related to intermediary capacity, the level of economic development, and trade closeness, with technological factors becoming increasingly important as the chain extends downward. Supply risk in upstream and midstream products is propagated mainly through indirect routes, whereas risk in downstream products is propagated mainly through direct trade relationships. The number of affected economies increases substantially when there is a small decline in the export value of tungsten products from core economies. The results can provide reference and decision support for different economies to secure the supply security and sustainability of tungsten resources.

Similar content being viewed by others

Introduction

Widely used in aerospace, new energy vehicles, equipment manufacturing, telecommunications, and mining, tungsten is vital to industrial development, national defense-security, and high-tech industries (Huang et al. 2021; Li et al. 2020; Zhu et al. 2019; Tang et al. 2020; Tkaczyk et al. 2018). Economies such as Japan, the European Union, the United States, and China have listed it as a critical mineral (An and Li, 2022; Wang et al. 2020). Globally tungsten resources are unevenly distributed, with China’s tungsten reserves and production ranking first in the world. The global supply of tungsten resources is produced mainly in China. Despite restrictive measures by China, its tungsten concentrate production is still greater than 80% of the world’s production (USGS, 2022). For China, tungsten is the dominant mineral but has not achieved a matching market position. Downstream products in the industry chain show a pattern of detachment from resource endowment constraints because of their strong technological dependence (Li et al. 2020; Tang et al. 2023). For economies other than China, because of the scarcity of resources and the irreplaceable nature of tungsten, most economies rely on trade imports to meet their development needs. As the potential of tungsten is explored in various fields, the demand for tungsten will continue to grow, and economies will become increasingly dependent on foreign economies. The competition among economies has exacerbated the supply crisis of tungsten resources, exposing global tungsten resources to serious supply risks. We should focus not only on the sustainable supply of a single tungsten product but also on the stability and sustainability of the overall systemic supply of the tungsten industry chain from upstream supply to downstream industrial demand (An and Li, 2022). Natural disasters, geopolitical events, major social hygiene events, and other unexpected events, can all affect the tungsten industry chain to varying degrees, triggering supply risks; thus, ensuring the supply security of the tungsten industry chain is vital. The existence of international trade helps economies alleviate the tungsten resource gap and counteract supply risks (Guan and An, 2017). The supply risk of one economy may also spread to other economies or even globally through trade relations. Considering trade as the main mode of tungsten product supply and the complex role of trade in supply, it is necessary to study the process of supply risk propagation in the tungsten industry chain on the basis of international trade.

A cutting-edge approach to analyzing the impact of external shocks focuses on the complexity of the system (Liu et al. 2023). International trade in mineral products is a key source of complexity in the whole mineral chain supply system. Applying the complex network approach helps in understanding the interrelationships between different economies and the structural characteristics of the overall mineral industry chain supply system. Research on the supply risk propagation process from the perspective of trade networks has been widely recognized by scholars. From the perspective of the research object, the existing research can be divided into single mineral and multiple minerals studies. In terms of a single mineral, scholars have analyzed the trade networks of iron and steel (Guo et al. 2019), tungsten (Li et al. 2020), cobalt (Sun et al. 2022), copper (Hu et al. 2020), lithium (Hu et al. 2021b), and nickel (Dong et al. 2021) from different perspectives. Some scholars have also conducted research on multiple minerals at the same time. Liu et al. (2021) proposed a new method for calculating trade dependence indicators and identified high-risk countries in the lithium, cobalt, and nickel trade dependence networks. Guan and An (2017) constructed trade networks for oil, coal, natural gas, and solar photovoltaics to predict future cooperation between countries on the basis of cooperation preferences and link forecasts. For research purposes, studies on the trade of critical minerals have focused mainly on structural characteristics (Huang et al. 2021; Li et al. 2020; Hu et al. 2020; Dong et al. 2021), evolutionary trends (Huang et al. 2021; Hu et al. 2021b), material flows (Leal-Ayala et al. 2015; Sun et al. 2017; Liang et al. 2022), resource dependence (Liu et al. 2021), competition patterns (Li et al. 2020; Zhu et al. 2020), spillover risk (Zhang et al. 2020), and price transmission (Guo et al. 2019; Qi et al. 2020). Shi et al. (2022) and Huang et al. (2021) studied the structural characteristics of the trade networks of upstream, midstream, and downstream products in the mineral resources industry chain. Wang et al. (2022a) used the point mutual information method to quantify the trade dependence of coal, crude oil, and natural gas and analyzed the structure of associations in the trade dependence network. Liu et al. (2022b) constructed a material flow model of the cobalt industry chain based on the production and trade data, and used the Herfindahl‒Hirschman index to measure the concentration of the import and export markets at each stage, and measured the resource dependence of countries. From the perspective of the supply security of mineral resources, Li et al. (2021) assessed the comprehensive trade risk of major importing countries in the industrial chain on the global trade network of copper products in terms of both supply risk and vulnerability.

Risk is the possibility of a hazard or disaster occurring. From the perspective of mineral resources, scholars have studied the risk propagation process in various mineral resource networks, including copper (Hu et al. 2020), lithium (Tian et al. 2021), cobalt (Sun et al. 2022), nickel (Wang et al. 2022b), steel (Guo et al. 2019), natural graphite (Wang et al. 2018a), oil (Wei et al. 2022), and rubber (Zhou et al. 2022), from the perspective of the entire industry chain, upstream products, and downstream products. From the perspective of the entire industry chain, Hu et al. (2020) divided copper products into copper raw materials and copper waste and studied the interdependence between copper raw materials and copper waste trade networks, as well as how China’s policy of restricting the import of copper waste will affect the trade of copper raw materials and copper waste. From the perspective of upstream products, Sun et al. (2022) used a cascading failure model to study the risk propagation process and structural characteristics of avalanches in the cobalt ore trade network. Wei et al. (2022) constructed a risk propagation model based on the oil trade network, verified the impact of different indicators on network robustness, and improved the oil trade risk assessment framework. From the perspective of downstream products, Hu et al. (2021b) used a cascading failure model to study the risk transmission mechanism under two supply shortage scenarios, node interruption and edge interruption in the trade network of lithium batteries. Tian et al. (2021) used a bootstrap percolation model to study the influence of core countries in the trade of lithium batteries. Zhou et al. (2022) studied waste rubber and analyzed the direct and indirect impacts of waste rubber regulatory policies in China, India, and Thailand on trade. Some scholars have also modeled risk propagation in multiple mineral waste trade networks (Hu et al. 2021a; Petridis et al. 2020). Scholars have focused only on a particular type or stage of mineral products, ignoring the heterogeneity between products in different stages of the industrial chain. Studies analyzing risk propagation in the trade of products at different stages from the perspective of the whole industry chain have yet to be supplemented.

Tungsten has a high risk of resource supply because of its resource endowment characteristics and the possibility of major events or contingencies, such as natural disasters affecting its supply. Further research on supply risks in the tungsten industry chain is needed. The risks involved in this paper are mainly tungsten resource supply risks. Commonly used methods for complex network risk propagation simulations include epidemic models (Wang et al. 2021; Wang and Zhang, 2022; Lei et al. 2021), percolation models (Chen et al. 2018; Tian et al. 2021; Wang et al. 2018b) and cascading failure models (Wang et al. 2018a; Sun et al. 2022; Tie et al. 2018; Zhang and Yang, 2018a; Ren et al. 2022; Wei et al. 2022; Zhang and Yang, 2018b; Liu et al. 2019). Wang et al. (2021) used the trade data of PV cells and the improved SI model to simulate the potential impact of COVID-19 on the trade of PV cells. Lei et al. (2021) improved the traditional SIS model to simulate the risk propagation process in cross-border supply chains, explored the impact of supplier relationships and the supply structure on risk propagation, and conducted an empirical examination with data from the Japanese earthquake and tsunami. Chen et al. (2018) applied a bootstrap percolation model on the trade network of natural gas to simulate the propagation of risk and to discuss the impacts of different countries. Tian et al. (2021) constructed a trade network and a trade competition network of key resources for lithium batteries; applied percolation theory to simulate the propagation of four levels of risk, namely, low, medium, high, and extreme risk; and identified the dominant countries in different resources. Differences between individuals (Tie et al. 2018) and the gradual accumulation of risk (Tie et al. 2018; Zhang and Yang, 2018a) are ignored in the epidemic model and the percolation model. Individuals in cascading failure models can have different propagation probabilities due to their respective characteristics, thus more accurately reflecting the risk propagation process. Ren et al. (2022) used a cascading failure model to simulate the propagation of supply risk in a nested implicit mineral supply chain network and identified important economies by avalanche size. Zhang and Yang (2018b) constructed a two-layer interdependent enterprise R&D network to analyze the effects of different dependencies and attack sizes on the vulnerability of the R&D network based on cascading failure. Liu et al. (2019) extended the cooperative network between firms to a dichotomous network containing firms and projects. Wang et al. (2018a) and Sun et al. (2022) constructed natural graphite trade networks and cobalt ore trade networks, respectively, to investigate the supply risk propagation mechanisms and characteristics through cascade failure models. In a tungsten product trade network, supply risk in one economy affects economies that import tungsten products from that economy, which in turn may affect all the economies involved in the trade. Therefore, the cascading failure model can be applied to study the propagation process of supply risk in tungsten product trade networks (Lee et al. 2011).

The impact range can characterize the extent of the impact of the risk from an economy. Many scholars have analyzed the factors influencing trade competition, including GDP, geographical distance, consumption, level of technological development (Wang et al. 2019), export political risk (Zhang et al. 2018), and Sino-US trade frictions (Huang et al. 2021). However, few studies have explored which factors affect the impact range. Clarifying the factors influencing the impact range can help to determine the reasons why economies are at risk so that solutions can be proposed in a targeted manner. As the application of tungsten in high-tech industries continues to expand, the impact of technological development on the impact range cannot be ignored. Wang et al. (2018a) mainly explored the effects of factors such as GDP and consumption, ignoring the impact of network structural characteristics. Liu et al. (2023) explored the relationship between structural characteristics, national vulnerability, and the spread of the Russia–Ukraine conflict and reported that diversity of import sources and low import dependence help mitigate supply shocks. In this work, the external factors and internal network structure characteristics are selected to study the factors influencing the impact range.

In summary, this paper constructs a multiplex tungsten trade network based on trade data for the tungsten industry chain from 2009 to 2020. The propagation process of supply risk is simulated in multiplex networks to understand the influence of different economies when they act as risk sources. The contributions are summarized as follows: (1) Applying the cascading failure model to the tungsten industry chain can better identify the risk propagation process in the tungsten product trade network at different stages. (2) The exogenous factors and network structure characteristics are integrated and selected to explore the factors influencing the impact range. The results can help different types of economies secure their tungsten resource supply.

Data and methods

Data description

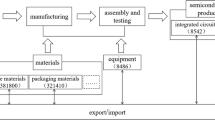

To analyze the trade pattern of the tungsten industry chain, international trade data from 2009 to 2020 on tungsten products including tungsten ores and tungsten concentrates (referred to as tungsten ores, HS code: 2611), tungstates (HS code: 284180), ferrotungsten (HS code: 720280) and tungsten final products (HS code: 8101), are obtained from UN Comtrade. Tungsten ore is processed mainly for the production of ferrotungsten and ammonium paratungstate, which is the most commonly used raw material for the formation of tungsten compounds, tungsten metal powder, and tungsten carbide powder (Tang et al. 2020). Therefore, tungstate and ferrotungsten are chosen as representative products in the midstream of the tungsten industry chain. Considering the comparability and completeness of the data, the trade value (US dollar) is chosen to characterize the trade relationship. To eliminate the effect of inflation, the trade value is deflated via the US Consumer Price Index (CPI) (Hu et al. 2020).

Network construction

A multiplex network for tungsten products was constructed (Fig. 1). There are five layers in the trade network, each of which is an independent directed weighted network, namely, the tungsten ore trade network (L1), tungstate trade network (L2), ferrotungsten trade network (L3), tungsten final product trade network (L4), and tungsten-related product trade network (L5).

The tungsten ore trade network is constructed as GL1 = (NL1, EL1, WL1) by using nodes to denote economies and edges to represent trade relationships. NL1 = {na: a = 1, 2, 3, …, m}, where m is the number of economies involved in the trade. EL1 is the set of edges eabL1, na exports tungsten ores to nb when eabL1 = 1, and nb does not import tungsten ores from na when eabL1 = 0. The direction of the edge is the same as the direction of the material flow. The weight of edge wabL1 is the total value exports from na to nb. Other layer networks are constructed in the same way. The tungsten industry chain trade network is defined as GL = (NL, EL, WL), where NL = [NL1, NL2, NL3, NL4, NL5], EL = [EL1, EL2, EL3, EL4, EL5], and WL = [WL1, WL2, WL3, WL4, WL5].

Construction of the risk propagation model

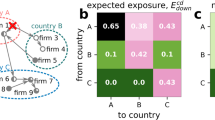

To simulate the cascading effect of supply risk from different economies, we apply a cascading failure model to construct a risk propagation model for the tungsten industry chain. The cascading failure model requires a load, capacity, load redistribution strategy (Duan et al. 2013) and a safety threshold (Wang et al. 2018a). When a node in the network fails, the load of each node in the whole network is recalculated according to the load redistribution strategy. When the load of the other nodes exceeds the safety threshold they can withstand, the node will fail, resulting in a new round of load redistribution (Wang et al. 2018a). This process iterates, and the affected area gradually expands. Referring to Wang et al. (2018a), taking the tungsten ore as an example, the propagation process is described as follows:

(1) Figure 2a shows the initial state, with all economies trading normally. The initial loads of the edges are defined as their weights. Both import and export trade will affect the domestic supply. Therefore, the capacity of the economy, which refers to its ability to cope with supply risks, is defined as the total amount of import and export trade. Economy A has been hit suddenly by external shocks.

(2) In Fig. 2b, Economy A is in a supply crisis. The export value of Economy A has decreased by α. The trade value in all export relationships of the economy is reduced to (1−α) times the original trade value. The risk tolerance coefficient β is introduced. If the total decrease in the import value exceeds the risk tolerance range, the economy will fall into a crisis. The total decrease in the import value of B exceeds the risk tolerance range (ΔwbL1 > βTbL1, where ΔwbL1 represents the total reduction imported by Economy B after the occurrence of risk; TbL1 represents Economy B’s ability to cope with supply risks), whereas the total decrease of C does not exceed the risk tolerance range (ΔwcL1 < βTcL1). Therefore, in Fig. 2c, B is in a supply crisis, whereas C is not.

(3) Similarly, after Economy B falls into a supply crisis, as shown in Fig. 2c, its export value decreased by an α reduction in proportion. For Economy D, the total decrease in the import value exceeds the risk tolerance, corresponding to the supply crisis in Economy D in Fig. 2d.

(4) In Fig. 2e, the above process is repeated until no new economy falls into crisis, and then the propagation ends.

To quantify the impact of supply risk on the industrial chain, we introduce the impact cycle (T), impact range (A), and infection proportion (P). The impact cycle is the number of steps in which the supply risk spreads. The impact range is quantified by the avalanche size, which refers to the number of other affected economies caused by the risk source. The infection proportion is the ratio of the avalanche size to the number of participating trading economies outside the risk source.

In addition, correlation analysis was conducted to better reveal the relationship between the impact range in the tungsten industry chain trade network and the exogenous attributes and network structure. The influencing factors and data sources are shown in Table 1.

In papers exploring the factors affecting the avalanche size, the general indicators chosen are the export trade value (Wang et al. 2018a) and gross domestic product (GDP) (Shuai et al. 2020). In this paper, we add five new indicators: level of technological development, number of export partners, closeness centrality, betweenness centrality, and PageRank. A higher level of technological development and innovation with better product quality and lower costs will lead to positive externalities and a greater range of influence. Because mid- and high-end technology development is important for the production of tungsten products, the value added in medium- and high-technology industries as a proportion of total manufacturing value added is used to quantify the level of technological development (Wang et al. 2019). The greater the number of export partners is, the greater the range of economies that may be affected. The influence of nodes in a complex network can be quantified via global information about the network, and the most commonly used methods include the shortest path method (betweenness centrality and closeness centrality) and the random wandering method (PageRank) (Wei et al. 2022). Therefore, the three network indicators are also included in the impact factor indicators.

Results and discussion

Impact ranges of different economies and identification of the core economies

The avalanche size is an important quantitative indicator in the risk cascade propagation process and can be used to assess the potential impact of a given economy. The distribution of avalanche sizes for all economies depends on the value of α/β. There is a critical value where the distribution of avalanche sizes for all economies follows a power law distribution. First, we attempt to find the core economies with the largest potential impacts according to the avalanche size. At a critical value consistent with a power law distribution, the avalanche sizes in the system can cover the largest range. The avalanche sizes are the most dispersed, which helps to distinguish the potential impact differences among economies. Second, power law distributions exist in various fields as typical distributions (Yu and Deng, 2022; Pinto et al. 2012). Many economic phenomena, such as wealth distribution (Pinto et al. 2012), stock price and trading volume (Gabaix et al. 2003), city size distribution (Hsu, 2012), and firm size distribution (Heinrich and Dai, 2016), obey power law distributions. Like supply risk, the forest fire size distribution (Song et al. 2007), the spread of epidemics (Beare and Toda, 2020), and the size of outages in the power grid (Odor and Hartmann, 2020) obey power law distributions. Finally, many researchers take the power law distribution as an important parameter-taking criterion (Lee et al. 2011; Wang et al. 2018a). Therefore, we choose the critical value of α/β according to the power law distribution.

In the trade network of the tungsten industry chain, assuming that each economy is a risk source, the critical point of each layer is found by adjusting α/β (Fig. 3). From L1 to L5, the critical values of α/β are 8, 5, 4, 4, 5. At the critical point, we traverse the participating economies as risk sources to obtain the impact range. Then, we obtain the top 10 core economies with impact ranges in each layer (Table 2), including the region of risk source (R), impact cycle (T), impact range (A), infection proportion (P), and number of infections in each period (T1–T7).

a Tungsten ore. b Tungstate. c Ferrotungsten. d Tungsten final product. e Tungsten-related product. The horizontal axis represents avalanche size (impact range, A), and the vertical axis represents the number of economies whose avalanche size is ≥A. The horizontal axis has been offset by one to plot the economies with A = 0 on a logarithmic scale.

The influence range of the economies in the tungsten ore trade network is limited by resource endowments. The economy with the largest range is Canada. Among the top 10 economies, Canada, Russia, Bolivia, China, and the United States are all economies with tungsten resource reserves. As the economy with the highest tungsten resource reserves in the world, China’s influence range is ranked seventh. As the strategic position of tungsten continues to grow, China has made a series of policy and strategic adjustments to guide and regulate tungsten mining for its development and national security reasons. For example, the total amount of tungsten exploration and mining has been limited, and a tungsten export quota system has been implemented (Zhu et al. 2019).

The global supply of tungstate is largely dependent on Asia. The top economy in terms of influence range is China, which has long been a dominant player in tungsten ore and primary processing. The second-largest economy is Vietnam. Vietnam has relatively rich tungsten resources. Vietnam ranked second in the world in terms of mineral extraction in 2023 (USGS, 2023). However, Vietnam’s mineral production is still not enough to meet its domestic tungsten smelting capacity, so it also needs to import tungsten ore from other economies. Vietnam primarily processes tungsten ore before it is exported in the form of tungstate. For technical and financial reasons, Masan Group cannot develop the Nui Phao mine completely independently, which is the main source of tungsten ore in Vietnam. American and European investors are rapidly occupying the tungsten ore mining market in Vietnam. In the future, Vietnam’s output of tungsten ore products and tungstate products will continue to grow, and its influence will further expand.

The economy with the largest impact cycle and impact range in the ferrotungsten trade is China. The supply risk from China will propagate six rounds, affecting a total of 102 economies, with an impact ratio of 83.6%. When α/β = 4, if China falls into a supply crisis, basically all economies involved in the trade will also fall into a supply crisis. The influence range of China is nearly three times greater than that of the second-ranked economy (the Netherlands). China exports ferrotungsten mainly to Japan, the Netherlands and Germany. The Netherlands and Germany, with the second and third largest influence range, respectively, play important roles as trade intermediaries.

China still occupies an important position in the tungsten final product trade. If China had a supply problem, 90% of the economies involved in the trade would be in a supply crisis. Three of the top five economies are located in Europe. This indicates that the European and American markets are more competitive. Since 2016, the US stopped producing primary processed products of tungsten (Case et al. 2022). Germany, France and the UK do not have advantages in terms of raw materials. However, they still have a high influence, mainly due to a strong level of technology and processing capabilities. These economies import upstream raw materials and midstream primary products and then export high-value-added final products after refining. As China’s tungsten trade unit price is high in imports and low in exports (Li et al. 2020), China needs to identify the sources of raw materials or intermediate products for processing final products in the other core economies to avoid exporting raw materials at a low price and importing final products at a high price.

The results in tungsten-related products are similar to those for final products. The economies with the greatest influence range are China, Germany and the United States. Half of the top ten economies are located in Europe, which is an important processing and manufacturing location for tungsten products. Among the top ten economies, only China and the United States have some resource advantages, and the United States does not mine tungsten. This shows that for economies to have high influence, they not only rely on their resource endowment but also need to have advanced processing technology. There is a need to develop key technologies and products that are compatible with the characteristics of the resources and capable of meeting the demands of the international market.

The model involves mainly the parameter α/β, which may affect the propagation process. Although the rankings may be slightly different, the top 10 economies are similar (Table S1) under different parameters (Hu et al. 2023). Therefore, the parameter settings do not affect the main findings.

Correlation analysis of the factors affecting the impact range

To further reveal the factors influencing the impact range, the correlations between the impact range (A) and impact cycle (T), export value (EV), number of trade export partners (NEP), GDP, closeness centrality (CC), betweenness centrality (BC), PageRank (PR), and technological development level (TECH) are explored in different product trade networks (Fig. 4).

a Tungsten ore. b Tungstate. c Ferrotungsten. d Tungsten final product. e Tungsten-related product. *p < 0.05, **p < 0.01, ***p < 0.001. The horizontal and vertical coordinates represent different influencing factors, which are reflected in the diagonal positions. The value below the diagonal corresponds to the size and color of the circle above the diagonal.

Only three factors have a significant impact on upstream products, and the number of factors with a significant impact gradually increases for mid- and downstream products. For all products, there is a significant positive correlation between the import range and the export value, the impact cycle, and the number of export partners. The number of export trading partners, the export value, and the period of impact correspond to the channel of propagation, the intensity of propagation, and the time of propagation, respectively, and an increase in all three factors contribute to a wider impact. From the industry chain perspective, the impact range in the midstream products is also closely related to the betweenness centrality. Increasing the mediating capacity in the trade of midstream products helps to increase the influence of trade. The influence range in the final product is related to the level of economic development and closeness centrality. Increasing trade relationships with different economies helps to increase the influence. The influence factors in tungsten-related products and the final products are basically the same. In the downstream, economies with higher levels of economic development invest more in product processing and manufacturing, which helps improve the competitiveness of export products. The greater the competitiveness of the product is, the higher the export value and the greater the impact on the global supply. In addition, tungsten final products are widely embedded in strategic emerging industries such as photovoltaics, lithium batteries, and semiconductors. With economic development, the competition for tungsten final products will continue to intensify, which may accelerate the restructuring of the trade pattern of tungsten products.

The findings of Sohail and Din (2024) and Ruan et al. (2024) validate our findings that economic development can positively promote mineral resource trade and increase the influence of economies. Shao et al. (2021) showed that betweenness centrality significantly contributes to the intensity of competition in the lithium trade. The greater the betweenness centrality is, the better the ability to control resources and the greater the potential influence on trade. Wang et al. (2018a) found that the avalanche size in the upstream natural graphite trade is related to GDP and export value. In this study, the significant effect of GDP on the avalanche size occurred mainly in the downstream. The downstream products are more technologically sensitive. Economic development drives the increase in research and development investment for industrial upgrading and technological innovation. Economies produce higher-quality final products that are more competitive. The influence of the economy will also be greater.

The correlation between the influence range and the technical factors is not significant. However, the indirect correlation gradually increases as the chain extends downward. There is no relationship between these two factors in the upstream. For midstream products, the technology factor is significantly correlated with the number of export trading partners, which is significantly correlated with the influence range. For downstream products, the technology factor is significantly correlated with the number of export trading partners, PageRank, betweenness centrality, and closeness centrality. All four are significantly correlated with the influence range. Technological progress can promote industrial restructuring, enhance product total factor productivity (Liang et al. 2023), and increase product output. In the tungsten industry chain, there is strong technological dependence on upstream ore dressing, midstream smelting and purification, and downstream processing and manufacturing. Ruan et al. (2024) found that technological factors significantly affect the trade of basic lithium products in economies along the Belt and Road. As the production of midstream lithium products needs processing and refining technology, the level of technology will greatly affect the production, which in turn affects the influence of economies. Therefore, technological progress helps to improve the influence range of economies in the midstream and downstream.

Spatial aggregation and indirectness of supply risk propagation

Risk propagation is a gradual process. We start by finding three economies with the largest avalanches in different regions. Then, the proportions of the directly affected economies located in the same region as the risk sources are calculated to assess the degree of spatial clustering of risk propagation (Table 3).

As shown in Table 3 and Fig. 5, when the economy with the largest influence range serves as the risk, the proportions of the directly affected economies located in the same region as the risk sources are relatively low. However, when the remaining economies act as sources of risk, the proportions are relatively high, suggesting spatial aggregation in the propagation of supply risk. From the perspective of economies, South Africa has the strongest spatial aggregation of propagation when it is the risk source of tungsten ferroalloy, and Canada has the weakest when it is the risk source of tungsten ore. From a product perspective, the spatial aggregation of risk propagation is strongest for trade in ferrotungsten and weakest for trade in tungsten ore. The degree of spatial aggregation of supply risks indirectly indicates whether there are regional effects on product production. Tungsten mineral products are limited by resource endowment, and economies in different regions all need to import minerals from core economies, so the spatial aggregation is weak. As the industrial chain extends downward, the restriction of resources on product production gradually decreases, and the regional effects of product production and exports gradually strengthen. Considering transport costs and safety, economies prefer to import products from economies closer to them. Therefore, the spread of supply risk shows spatial aggregation. Economies that rely on tungsten imports need to pay close attention to the supply status of core economies located in the same region to make timely adjustments when risks occur.

A comparison of the trade relationships and risk propagation pathways reveals that the failed economies are not exclusively those that have trade relationships with risk sources. Even if they do not directly import products from the risk source, they are still affected. To analyze the role of indirect contagion in risk propagation, the three economies with the largest avalanches from each tungsten product are selected as the objects of study. There are three types of avalanches: one-step direct avalanches, multistep direct avalanches, and indirect avalanches (Fig. 6). In the upstream and midstream, the proportions of indirect avalanches from most economies are above 56%. In contrast, in downstream products and overall tungsten product trade, direct avalanches predominate. The main reason is that the selected core economies have trade relationships with most of the economies involved in trade, so direct avalanches are mainly dominant. Compared with previous studies (Sun et al. 2022; Lee et al. 2011), there is a difference in the results, mainly because the study by Sun et al. (2022) focused mainly on upstream cobalt mining products, whereas this study focuses on products at all stages. The risk transmission in tungsten ores is also mainly based on indirect propagation. However, the results for downstream products and tungsten-related products are the opposite, reflecting the heterogeneity of products at different stages (Lee et al., 2011). In addition, the avalanche size is still relatively small in the first propagation cycle, and the range gradually increases mainly in the subsequent propagation process. Therefore, it is important to pay close attention to the supply situation in the core economies so that timely measures can be taken to minimize the losses.

Influence of core economies

Canada has the largest impact on L1, whereas China has the largest impact on the other layers. The influence range depends largely on α/β (Wang et al. 2018a). To further analyze the influence of Canada and China, we simulate the change in avalanche size when there are different decreases in tungsten product trade exports from Canada and China by adjusting α/β (Fig. 7).

a The risk propagation range of Canada as a risk source for different α/β values in the tungsten ore trade network. b–e The risk propagation range of China as a risk source for different α/β values in the corresponding tungsten trading network. γ = α/β. The variation in avalanche size is reflected in the line charts.

The results when Canada is the risk source of tungsten ore trade are shown in Fig. 7a. When α/β ≤ 2, no economy is affected. When 2 < α/β ≤ 5, up to three economies are affected, namely, the Netherlands, Curaçao and Egypt. These three economies are heavily dependent on Canada for tungsten ore. When 5 < α/β < 7.5, the affected economies are mainly Asian and European economies, including Vietnam, China, Indonesia, Laos, Italy, Serbia, and Croatia. From 2020, with the implementation of a quota system for tungsten ore exports, the export value of China declined. Moreover, because of the gradual expansion of China’s capacity for intermediate products, China is also producing intermediate products for other economies in the form of processing raw materials (Tang et al. 2022). Vietnam also needs to import minerals from other economies, as tungsten ore production within the economy cannot meet demand because of the expansion of midstream product capacity. Canada is the main source of mineral products for China and Vietnam. When 7.5 ≤ α/β < 16, Canada begins to impact African and American economies. When 16 ≤ α/β ≤ 40, a crisis in Canada has the greatest impact on Asia and Europe, followed by the Americas, where Canada is located. Fifty-three percent of African economies are affected. When α/β > 40, essentially all economies involved would be affected.

The results of the risk propagation simulation when China is the risk source in tungstate trade are shown in Fig. 7b. When α/β = 1, only Timor–Leste will be affected. Because Timor–Leste imports tungstate only from China. When 1 < α/β < 1.5, the affected economies are mainly Asian and European. In addition to Timor–Leste, there are four Asian economies, namely, Brunei, Iran, Japan and Korea. Resource-poor economies such as Japan and South Korea compete to import from China. Japan has advanced technology and exceptional production and processing capacity. Japan imports midstream products from China and transforms them into high-value-added final products. China relies on Japan for tungsten metal products. A tungstate crisis from China may affect the final product supply in China by affecting the tungstate supply in Japan. When 1.5 ≤ α/β ≤ 5, African and American economies start to be affected. When 5 < α/β ≤ 9, the other affected economies are located mainly in Asia, Africa, and Europe. When α/β > 9, essentially all of the economies are affected.

The variation and distribution of the impact range when China is the risk source in the trade of ferrotungsten are shown in Fig. 7c. When α/β < 1.25, no economy is affected. When 1.25 ≤ α/β ≤ 2.5, all four economies involved in the trade in Oceania would be affected. Other affected economies are located in Asia and the Americas. These include Japan, Iran, Singapore, the US, Peru and Bolivia. Developed economies, such as the United States and Japan have a high demand for tungsten products and, therefore, need to import large quantities of intermediate products from China. Similar to the case of tungstates, developed economies import intermediate products and then export highly profitable final products after they are finished. When 2.5 < α/β < 3.75, economies in Europe and Africa begin to be affected. No European or African economies were affected before. Europe is an important producer of intermediate products, and the European economies tend to choose their import sources from Europe because of transport costs. Therefore, European economies will not be affected by a small export restructuring in China. The economic development in Africa is slower, and the demand for tungsten products is lower, so it is not easily affected. When α/β ≥ 3.75, basically all participating economies will be affected. When α/β is ~3.57, the avalanche size is only 35, but when α/β is 3.75, the avalanche size increases directly to 102, indicating that the ferrotungsten trade is less robust.

The results for the final products are shown in Fig. 7d. When α/β ≤ 1, no economy is affected. When 1 < α/β < 3.5, if a tungsten final product supply crisis occurs in China, the affected economies are mainly Asian and African. These economies are relatively weak in tungsten product finishing and rely only on imports to meet their development needs. A small decline in exports from core economies will cause these economies to fall into a supply crisis. When 3.5 ≤ α/β ≤ 3.75, the economies of Europe, the Americas, and Oceania begin to suffer, including Canada and the United States. Canada’s raw material advantage slows the rate at which Canada is affected. The United States, with higher tungsten exports, was affected later because it can produce and process tungsten products. When α/β > 3.75, essentially all of the economies involved will be affected. This reflects China’s important role in the final product trade.

The results when China is the risk source in the trade of tungsten-related products are shown in Fig. 7e. When α/β ≤ 1, no economy is affected. When 1 < α/β ≤ 2.5, the affected economies are mainly Asian economies. These economies are highly dependent on China. When 2.5 < α/β ≤ 3, European economies, in addition to Asian economies, begin to be affected. The affected economies include the Netherlands, South Korea, Malaysia, and Ukraine. Among them, the Netherlands is an important intermediate economy, and the risk will spread further through it. When 3 < α/β ≤ 3.57, the risk spreads widely within this range and may be affected by the intermediate economies falling into supply risk in the previous period. These include the United States and India, which play important roles in the trade. The impact range in the next period is further extended through these economies. When 3.57 < α/β < 5, the additional economies are mainly in Africa and Europe. When α/β ≥ 5, essentially all economies are affected.

The critical values in tungsten ore products are much larger than those in the trade of other products. All economies import minerals in one direction from a few resource-advantaged economies; thus, the trade relationship is relatively sparse, and the supply system is relatively stable. The critical value of tungsten ferroalloys and final products is the smallest. Trade in the final tungsten products and ferrotungsten is highly globalized, with close relationships between economies. Small export restructuring in the core economies will affect most of the economies involved in trade.

We further analyze the evolution of the infection proportion of core economies, and extend the core economies from those with the largest avalanche size to those ranked in the top three in avalanche size (Fig. 8). The evolution of the core economies can be classified into three categories. For the first category, the dominant position was reflected mainly in the previous period, including tungsten ore. The main influence of Canada is reflected in the pre-2016 period. In 2016, the infection proportion in Canada declined significantly. In 2015, the tungsten ore market was oversupplied, tungsten prices were low (USGS, 2016), and many economies reduced production. One of the major tungsten mines in Canada, the Cantung mine, was shut down for maintenance in 2015 (USGS, 2016), severely affecting the production and export of Canadian tungsten. The impact proportions of Russia and Bolivia were relatively stable, and by 2020, the impact proportions of both economies were essentially the same.

The second category, in which the infection proportion of the core economies fluctuates in ranking, consists of tungstate and ferrotungsten. The influence of China was lower than that of Vietnam only in 2016 and 2020. The influence of Vietnam was lower than that of China and Germany until 2014 when it exceeded that of Germany. The influence of Vietnam exceeded that of China in 2020, making Vietnam the economy with the largest infection proportion. The growth in global demand for high-quality tungstates led to an overall strengthening of the global tungstate trade in 2014, with the core economies all increasing their infection proportions, with Vietnam experiencing the largest increase. The largest tungsten mine in Vietnam, which is the second-largest mine in the world, the Nui Phao mine (Ha et al. 2019), was officially put into full production (Bradshaw, 2023), leading to a significant increase in tungsten exports in 2014. Masang Resources, the operating company of the Nui Phao mine, has further upgraded its processing capacity to start producing tungstate with high added value. Compared to 2019, the production of midstream products in 2020 increased by 67.5% (Masan High-Tech Materials, 2021).

The impact of China on the trade of ferrotungsten was greater than that of the Netherlands and Germany until 2012. In 2013 and 2014, the impact of China was lower than that of the Netherlands and Germany. China reduced its export quota in 2013 to protect resources and the environment and to better promote a sustainable supply of tungsten products. In 2015, the proportion of China significantly increased again, and it has remained the absolute leader since then. The World Trade Organization ruled that the restrictive export measures taken were inconsistent with WTO obligations in 2014. China canceled the export quota system and export tariffs on tungsten products in 2015 (USGS, 2016). This significantly increased Chinese tungsten exports, further expanding China’s influence on the tungsten trade.

The third category, in which the core economies have largely maintained their absolute leadership, consists of tungsten final products and tungsten-related products. The influence of China and the United States on the tungsten final product trade was essentially the same in the first two years. The infection proportion of China increased significantly in 2011 and has remained the absolute leader since then. The global economy gradually recovered from the financial crisis, leading to an increase in the global demand for tungsten final products in 2011. Chinese products are more competitively priced because of their lower labor and raw material costs. The infection proportions of the United States and Germany are relatively stable. For tungsten-related products, the infection proportion of China is maintained at 0.8, which is significantly greater than that of Germany and the United States.

Conclusions

This paper uses actual data from the UN Comtrade database to construct an international trade network for tungsten products. By simulating the risk propagation process of different economies as risk sources in the tungsten product trade network, the core economies with the largest impact ranges are identified, and the influence of the core economies and the factors influencing the impact range are analyzed. The main findings are as follows:

(1) China, Germany, and the US occupy a central position in the trade of tungsten products. From the upstream to the downstream tungsten industry chain, the economies with greater influence gradually shift from those with higher resource endowments to those with higher production and processing levels and consumption. In the upstream, Canada’s original centrality is replaced later by Russia and Bolivia. In the midstream and downstream, the influence of the core economies fluctuates, but China largely maintains its centrality.

(2) The impact range in the products at each stage is significantly and positively related to the export value, the number of export trading partners, and the impact cycle. The impact range in the midstream product is related to intermediary capacity, whereas in the downstream product, it is significantly related to the level of economic development and trade closeness. As the chain extends downstream, the influence of technological factors becomes stronger.

(3) Supply risk propagation is spatially clustered. The supply risk in the upstream and midstream products is propagated mainly through indirect routes, whereas the supply risk in the downstream products is propagated mainly through direct trade relationships. Risks affect fewer economies in the first round and expand mainly through subsequent processes.

(4) The influence of the core economies in different product trade networks varies, and network robustness gradually decreases as the chain extends downward. At various stages of the chain, a small reduction in exports from the core economies would affect multiple economies involved in the trade.

Considering the differences in products at different stages of the tungsten industry chain and the differences in resource endowment, economic strength, and technological level between different economies, this paper proposes the following recommendations:

(1) To ensure a stable supply of global tungsten products, core tungsten-supplying economies need to pay attention to developing and utilizing tungsten ores and can take measures such as improving the mineral exploration ability and efficiency (Liu et al. 2022a), raising the industry access threshold and strictly approving mining licenses. The core supplying economies will have a large amount of tungsten slag due to the processing and production process, which contains not only important elements such as tungsten but also toxic elements such as lead and mercury (Liu et al. 2020). The treatment process of tungsten slag can be improved by encouraging cooperation among industry, universities, and research institutes to avoid wasting resources and environmental pollution. The problem of environmental pollution caused by the production process should be shared by the producing and consuming economies. At present, China helps other tungsten-consuming economies take responsibility for environmental protection, so other tungsten product-consuming economies should provide China with more profit space for environmental treatment.

(2) Economies that rely on imports need to pay close attention to the tungsten export policies of the core supplying economies and the stability of the tungsten product supply from other economies in the same region. For example, tungsten ore import-dependent economies in the Americas need to pay close attention to the tungsten ore export policies of Canada and Bolivia. And strengthen trade connections with economies in different regions.

(3) To improve the position in the midstream and downstream of the tungsten industry chain, economies need to have a stable supply of raw materials at reasonable prices on the one hand, and on the other hand, they need to increase investment in processing technology R&D, encourage technological innovation, and promote cooperation between R&D institutions and industrial production to produce more competitive products in the future. Advantageous economies need to strengthen the monitoring of market trends and clarify the sources of raw materials in other advantageous economies to prevent a situation where raw materials are exported at low prices and products are imported at high prices.

Because of differences in the reported trade value of the importing and exporting economies due to different statistical guidelines, the maximum value reported is taken uniformly as the trade value between the two economies in the study, which may introduce some uncertainty but does not affect the main conclusions. In addition, the simulation of the risk propagation process considers only propagation in the trade of a single product and does not consider the interaction between products at different stages of the industry chain. In the future, we will simulate the propagation of risk across the whole chain.

Data availability

The datasets generated and analyzed during the current study are included in this published article and its supplementary information and supplementary data files.

References

An H, Li H (2022) Theory and research advances in whole industrial chain of strategic mineral resources. Resour Ind 24(1):8–14. (in Chinese)

Beare BK, Toda AA (2020) On the emergence of a power law in the distribution of COVID-19 cases. Physica D 412:132649

Bradshaw C (2023) Leveraging modern technology, facilitating key industry sectors globally. https://masanhightechmaterials.com/leveraging-modern-technology-facilitating-key-industry-sectors-globally/

Case GND, Graham GE, Marsh EE, Taylor RD, Green CJ, Brown PJ, Labay KA (2022) Tungsten skarn potential of the Yukon-Tanana Upland, eastern Alaska, USA—a mineral resource assessment. J Geochem Explor 232:106700. https://doi.org/10.1016/j.gexplo.2020.106700

Chen Z, An H, An F, Guan Q, Hao X (2018) Structural risk evaluation of global gas trade by a network-based dynamics simulation model. Energy 159:457–471. https://doi.org/10.1016/j.energy.2018.06.166

Dong X, An F, Dong Z, Wang Z, Jiang M, Yang P, An H (2021) Optimization of the international nickel ore trade network. Resour Policy 70(7):101978. https://doi.org/10.1016/j.resourpol.2020.101978

Duan D, Wu J, Deng H, Sha F, Wu X, Tan Y (2013) Cascading failure model of complex networks based on tunable load redistribution. Syst Eng—Theory Pract 33(01):203–208. (in Chinese)

Gabaix X, Gopikrishnan P, Plerou V, Stanley HE (2003) A theory of power-law distributions in financial market fluctuations. Nature 423(6937):267–270. https://doi.org/10.1038/nature01624

Guan Q, An H (2017) The exploration on the trade preferences of cooperation partners in four energy commodities’ international trade: crude oil, coal, natural gas and photovoltaic. Appl Energy 203:154–163

Guo S, Li H, An H, Sun Q, Hao X, Liu Y (2019) Steel product prices transmission activities in the midstream industrial chain and global markets. Resour Policy 60:56–71

Ha NTH, Ha NT, Nga TTH, Minh NN, Anh BTK, Hang NTA, Duc NA, Nhuan MT, Kim KW (2019) Uptake of arsenic and heavy metals by native plants growing near Nui Phao multi-metal mine, northern Vietnam. Appl Geochem 108:104368

Heinrich T, Dai SP (2016) Diversity of firm sizes, complexity, and industry structure in the Chinese economy. Struct Change Econ Dyn 37:90–106. https://doi.org/10.1016/j.strueco.2016.01.001

Hu X, Wang C, Lim MK, Chen W (2020) Characteristics of the global copper raw materials and scrap trade systems and the policy impacts of China’s import ban. Ecol Econ 172. https://doi.org/10.1016/j.ecolecon.2020.106626

Hu X, Wang C, Lim MK, Bai X, Yao C (2021a) Evaluating waste and scrap trade risks in Belt and Road initiative countries. Resour Conserv Recycl 173:105728. https://doi.org/10.1016/j.resconrec.2021.105728

Hu X, Wang C, Zhu X, Yao C, Ghadimi P (2021b) Trade structure and risk transmission in the international automotive Li-ion batteries trade. Resour Conserv Recycl 170:105591. https://doi.org/10.1016/j.resconrec.2021.105591

Hu X, Wang C, Lim MK, Chen W, Teng L, Wang P, Wang H, Zhang C, Yao C, Ghadimi P (2023) Critical systemic risk sources in global lithium-ion battery supply networks: Static and dynamic network perspectives. Renew Sustain Energy Rev 173:113083. https://doi.org/10.1016/j.rser.2022.113083

Huang J, Ding Q, Wang Y, Hong H, Zhang H (2021) The evolution and influencing factors of international tungsten competition from the industrial chain perspective. Resour Policy 73:102185. https://doi.org/10.1016/j.resourpol.2021.102185

Hsu WT (2012) Central place theory and city size distribution. Econ J 122(563):903–932. https://doi.org/10.1111/j.1468-0297.2012.02518.x

Leal-Ayala DR, Allwood JM, Petavratzi E, Brown TJ, Gunn G (2015) Mapping the global flow of tungsten to identify key material efficiency and supply security opportunities. Resour Conserv Recycl 103:19–28. https://doi.org/10.1016/j.resconrec.2015.07.003

Lee KM, Yang JS, Kim G, Lee J, Goh KI, Kim IM (2011) Impact of the topology of global macroeconomic network on the spreading of economic crises. PLoS ONE 6(3). https://doi.org/10.1371/journal.pone.0018443

Lei Z, Lim MK, Cui L, Wang Y (2021) Modelling of risk transmission and control strategy in the transnational supply chain. Int J Prod Res 59(1):148–167. https://doi.org/10.1080/00207543.2019.1698782

Li B, Li H, Dong Z, Liu Y, Liu N, Hao X (2021) The global copper material trade network and risk evaluation: a industry chain perspective. Resour Policy 74:102275. https://doi.org/10.1016/j.resourpol.2021.102275

Li H, An H, Qi Y, Liu H (2020) Trade and competitiveness structure of China’s advantageous mineral resources based on the international trade network of industrial chain: a case study of Tungsten. Resour Sci 42(8):1504–1514. (in Chinese)

Liang J, Geng Y, Zeng X, Gao Z, Tian X (2022) Toward sustainable utilization of tungsten: Evidence from dynamic substance flow analysis from 2001 to 2019 in China. Resour Conserv Recycl 182:106307. https://doi.org/10.1016/j.resconrec.2022.106307

Liang S, Zhong Q, Zhou H, Liao Y, You J, Meng J, Feng C, Lin C(2023) Double-edged sword of technological progress to climate change depends on positioning in global value chains PNAS Nexus 2(9):288. https://doi.org/10.1093/pnasnexus/pgad288

Liu H, Li H, Qi Y, An P, Shi J, Liu Y (2021) Identification of high-risk agents and relationships in nickel, cobalt, and lithium trade based on resource-dependent networks. Resour Policy 74:102370. https://doi.org/10.1016/j.resourpol.2021.102370

Liu H, Liu H, Nie C, Zhang J, Steenari BM, Ekberg C (2020) Comprehensive treatments of tungsten slags in China: a critical review. J Environ Manag 270:110927. https://doi.org/10.1016/j.jenvman.2020.110927

Liu H, Yang N, Yang Z, Zhang Y, Lin J (2019) Modeling and simulations of the cascading failure of multiple interdependent R&D networks under risk propagation. Phys Lett A 383(21):2443–2450. https://doi.org/10.1016/j.physleta.2019.05.012

Liu L, Lu J, Tao C, Liao S, Su C, Huang N, Xu X (2022a) Fuzzy forest machine learning predictive model for mineral prospectivity: a case study on Southwest Indian Ridge 48.7°E–50.5°E. Nat Resour Res 31:99–116. https://doi.org/10.1007/s11053-021-09996-1

Liu L, Wang W, Yan X, Shen M, Chen H (2023) The cascade influence of grain trade shocks on countries in the context of the Russia–Ukraine conflict. Humanit Soc Sci Commun 10:449. https://doi.org/10.1057/s41599-023-01944-z

Liu M, Li H, Zhou J, Feng S, Wang Y, Wang X (2022b) Analysis of material flow among multiple phases of cobalt industrial chain based on a complex network. Resour Policy 77:102691. https://doi.org/10.1016/j.resourpol.2022.102691

Masan High-Tech Materials (2021) Vietnamese mining business affirms its brand on international arena. https://masanhightechmaterials.com/vietnamese-mining-business-affirms-its-brand-on-international-arena/

Odor G, Hartmann B (2020) Power-law distributions of dynamic cascade failures in power-grid models. Entropy 22(6):666. https://doi.org/10.3390/e22060666

Petridis NE, Petridis K, Stiakakis E (2020) Global e-waste trade network analysis. Resour Conserv Recycl 158:104742. https://doi.org/10.1016/j.resconrec.2020.104742

Pinto CMA, Lopes AM, Machado JAT (2012) A review of power laws in real life phenomena. Commun Nonlinear Sci Numer Simul 17(9):3558–3578. https://doi.org/10.1016/j.cnsns.2012.01.013

Qi Y, Li H, Liu Y, Feng S, Li Y, Guo S (2020) Granger causality transmission mechanism of steel product prices under multiple scales—the industrial chain perspective. Resour Policy 67:101674. https://doi.org/10.1016/j.resourpol.2020.101674

Ren B, Li H, Wang X, Shi J, Ma N, Qi Y (2022) The flow of embodied minerals between China’s provinces and the world: a nested supply chain network perspective. Resour Policy 78:102853. https://doi.org/10.1016/j.resourpol.2022.102853

Ruan Z, Du P, Jiao Y (2024) Analysis of lithium trade patterns and influencing factors in the regions along the “Belt and Road”. PLoS ONE 19(8):e0307321. https://doi.org/10.1371/journal.pone.0307321

Shao L, Hu J, Zhang H (2021) Evolution of global lithium competition network pattern and its influence factors. Resour Policy 74:102353. https://doi.org/10.1016/j.resourpol.2021.102353

Shi Q, Sun X, Xu M, Wang M (2022) The multiplex network structure of global cobalt industry chain. Resour Policy 76:102555. https://doi.org/10.1016/j.resourpol.2022.102555

Shuai J, Leng Z, Cheng J, Shi Z (2020) China’s renewable energy trade potential in the “Belt-and-Road” countries: a gravity model analysis. Renew Energy 161:1025–1035. https://doi.org/10.1016/j.renene.2020.06.134

Sohail MT, Din NM (2024) How do digital inclusion and energy security risks affect mineral resources trade? Evidence from world-leading mineral trading countries. Resour Policy 89:104528. https://doi.org/10.1016/j.resourpol.2023.104528

Song W, Zheng H, Wang J, Ma J, Satoh K(2007) Weather-driven model indicative of spatiotemporal power laws Phys Rev E 75(1):2. https://doi.org/10.1103/PhysRevE.75.016109

Sun X, Shi Q, Hao X (2022) Supply crisis propagation in the global cobalt trade network. Resour Conserv Recycl 179:106035. https://doi.org/10.1016/j.resconrec.2021.106035

Sun X, Hao H, Zhao F, Liu Z (2017) Tracing global lithium flow: a trade-linked material flow analysis. Resour Conserv Recycl 124:50–61. https://doi.org/10.1016/j.resconrec.2017.04.012

Tang L, Wang P, Chen W (2022) Evolution of China’s tungsten trade pattern and its implications based on the perspectives of material flow and valcce flow. Sci Technol Rev 40(8):70–77. (in Chinese)

Tang L, Wang P, Graedel TE, Pauliuk S, Xiang K, Ren Y, Chen W (2020) Refining the understanding of China’s tungsten dominance with dynamic material cycle analysis. Resour Conserv Recycl 158:104829. https://doi.org/10.1016/j.resconrec.2020.104829

Tang L, Wang P, Ma Z, Pauliuk S, Chen W, Dai T, Lin Z (2023) Exploring the global trade networks of the tungsten supply chain: Insights into the physical and monetary mismatch among countries. J Ind Ecol 27:323–335. https://doi.org/10.1111/jiec.13333

Tian X, Geng Y, Sarkis J, Gao C, Sun X, Micic T, Hao H, Wang X (2021) Features of critical resource trade networks of lithium-ion batteries. Resour Policy 73(2):102177. https://doi.org/10.1016/j.resourpol.2021.102177

Tie R, Yang N, Zhang Y, Hou W (2018) Modeling and simulation of technical risk propagation in R&D network. J Ind Eng Eng Manag 32(3):188–194. (in Chinese)

Tkaczyk AH, Bartl A, Amato A, Lapkovskis V, Petranikova M (2018) Sustainability evaluation of essential critical raw materials: cobalt, niobium, tungsten and rare earth elements. J Phys D-Appl Phys 51(20):203001. https://doi.org/10.1088/1361-6463/aaba99

U.S. Geological Survey (2016) Mineral commodity summaries 2016. U.S. Geological Survey, 202pp

U.S. Geological Survey (2022) Mineral commodity summaries 2022. U.S. Geological Survey, 202pp

U.S. Geological Survey (2023) Mineral commodity summaries 2023. U.S. Geological Survey, 210pp

Wang C, Huang X, Hu X, Zhao L, Liu C, Ghadimi P (2021) Trade characteristics, competition patterns and COVID-19 related shock propagation in the global solar photovoltaic cell trade. Appl Energy 290:116744

Wang H, Zhang X (2022) Research on supply chain risk transmission mechanism based on improved SIRS model. Math Probl Eng 2022:9502793

Wang J, Yang L, Lin J, Bentley Y (2020) The availability of critical minerals for China’s renewable energy development: an analysis of physical supply. Nat Resour Res 29:2291–2306. https://doi.org/10.1007/s11053-020-09615-5

Wang W, Fan L, Zhou P (2022a) Evolution of global fossil fuel trade dependencies. Energy 238:121924. https://doi.org/10.1016/j.energy.2021.121924

Wang X, Li H, Yao H, Chen Z, Guan Q (2019) Network feature and influence factors of global nature graphite trade competition. Resour Policy 60:153–161. https://doi.org/10.1016/j.resourpol.2018.12.012

Wang X, Li H, Yao H, Zhu D, Liu N (2018a) Simulation analysis of the spread of a supply crisis based on the global natural graphite trade network. Resour Policy 59:200–209. https://doi.org/10.1016/j.resourpol.2018.07.002

Wang X, Wang A, Zhu D (2022b) Simulation analysis of supply crisis propagation based on global nickel industry chain. Front Energy Res 10:919510. https://doi.org/10.3389/fenrg.2022.919510

Wang Z, Zhou D, Hu Y (2018b) Group percolation in interdependent networks. Phys. Rev E 97(3). https://doi.org/10.1103/PhysRevE.97.032306

Wei N, Xie W, Zhou W (2022) Robustness of the international oil trade network under targeted attacks to economies. Energy 251:123939. https://doi.org/10.1016/j.energy.2022.123939

Yu Z, Deng Y (2022) Derive power law distribution with maximum Deng entropy Chaos Solitons Fractals 165(2):112877. https://doi.org/10.1016/j.chaos.2022.112877

Zhang H, Xi W, Ji Q, Zhang Q (2018) Exploring the driving factors of global LNG trade flows using gravity modelling. J Clean Prod 172:508–515. https://doi.org/10.1016/j.jclepro.2017.10.244

Zhang W, Fan X, Liu Y, Wang S, Chen B (2020) Spillover risk analysis of virtual water trade based on multi-regional input–output model—a case study. J Environ Manag 275:111242. https://doi.org/10.1016/j.jenvman.2020.111242

Zhang Y, Yang N (2018a) Modeling and simulation of the control method against risk propagation in research and development network. J Syst Manag 27(3):500–511. (in Chinese)

Zhang Y, Yang N (2018b) Vulnerability analysis of interdependent R&D networks under risk cascading propagation. Physica A 505:1056–1068. https://doi.org/10.1016/j.physa.2018.04.063

Zhou W, Feng R, Han M, Chen M (2022) Evolution characters and regulation impacts within the global scrap rubber trade network. Resour Conserv Recycl 181:106201. https://doi.org/10.1016/j.resconrec.2022.106201

Zhu X, Li X, Zhang H, Huang J (2019) International market power analysis of China’s tungsten export market—from the perspective of tungsten export policies. Resour Policy 61:643–652. https://doi.org/10.1016/j.resourpol.2018.11.005

Zhu Z, Dong Z, Zhang Y, Suo G, Liu S (2020) Strategic mineral resource competition: strategies of the dominator and nondominator. Resour Policy 69:101835. https://doi.org/10.1016/j.resourpol.2020.101835

Acknowledgements

This research is supported by grants from the National Natural Science Foundation of China (Grant Nos. 72173119, 71991481, and 71991480), the Fundamental Research Funds for the Central Universities (Grant Nos. 2652019087 and 2652019241), the Key Projects of Beijing Social Science Foundation (Grant No. 22JCB051) and the National Social Science Fund of China (Grant No. 23STA012). In translating the manuscript from Chinese to English, the authors used DeepL Translate for assistance with sentence expressions. After using this tool, the authors reviewed and edited the content as needed and took full responsibility for the content of the publication.

Author information

Authors and Affiliations

Contributions

Xinxin Zheng: Methodology, data curation, writing—original draft. Huajiao Li: Conceptualization, writing—review and editing, supervision. Xiaojie Liu: Writing—review and editing. Xingxing Wang: Methodology, writing—review and editing. Yuqi Zhang: Writing—review and editing. Qianyong Tang: Writing—review and editing. Bo Ren: Writing—review and editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Zheng, X., Li, H., Liu, X. et al. Supply risk propagation in international trade networks of the tungsten industry chain. Humanit Soc Sci Commun 12, 54 (2025). https://doi.org/10.1057/s41599-024-04301-w

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-04301-w