Abstract

In recent years, global crisis events have become increasingly common. Gold, recognized as a safe asset, and crude oil, an essential industrial commodity, have attracted the attention of many scholars seeking to understand the impact of such crises on both. On the basis of a Markov regime-switching (MRS) model, copula function, and conditional value at risk (CoVaR) model, this paper proposes an MRS copula CoVaR model to investigate the changes in the level of dependence between these two assets and examine the risk spillover effects between them. This study obtains the following conclusions. (1) From 2018 to 2023, there are two distinct dependence regimes between the two assets. The tranquil regime is characterized by positive dependence, whereas the crisis regime is characterized by negative dependence. (2) In the crisis regime, there is downside risk spillover between the two assets, whereas in the tranquil regime, there is an upside risk spillover. These findings contribute to theoretical research and offer valuable insights for policymakers and investors in making informed decisions and developing appropriate investment strategies.

Similar content being viewed by others

Introduction

In recent years, international crises have emerged one after another and have widely affected the development of the world economy. As a result, investigating the impact of crises on financial markets has become a prominent area of contemporary financial research.

There is evidence that crises have indeed impacted financial markets. For example, Ali et al. (2020) and Ullah (2023) suggest that COVID-19 had a negative effect on returns in financial markets, but it is worth noting that some government interventions have helped restore financial market returns. Yousaf et al. (2022) indicate that stock markets have been significantly and adversely affected by the Russia–Ukraine conflict. Additionally, Nerlinger and Utz (2022) find that energy companies have outperformed the stock market since the onset of this conflict. As such global crises intensify, a growing proportion of scholars have become interested in the impact of these crises on financial markets.

Once widely circulated in the human world, gold continues to have a substantial influence on the global economy (see Starr and Tran, 2008). Crude oil plays an essential role in human economic activities, and fluctuations in its price significantly impact economic development (see Mo et al. 2019; Wen et al. 2019). Evidence indicates that gold can be regarded as a secure refuge against both inflation and political instability (see Blose, 2010; Chua and Woodward, 1982; Ghosh et al. 2004; Tully and Lucey, 2007; Worthington and Pahlavani, 2007). Similarly, crude oil has the ability to mitigate risk to some extent (see Garbade and Silber, 1983).

Gold and crude oil, as two key financial markets, have attracted significant scholarly interest in the study of the impact of crises on them (see Junttila et al. 2018). However, traditional time-series methods are not efficient to capture the complex changes between gold and crude oil. Although the recently popular copula method features a more flexible structure and can effectively address some inherent challenges, it is not able to capture the extreme changes caused by crises effectively.

Ang and Timmermann (2012) believe that the regime-switching model proposed by Hamilton (1989) can effectively account for the frequent and sudden changes in financial markets. Therefore, in this work, we combine the regime-switching model with the copula function to develop a Markov regime-switching (MRS) copula model. Next, we discuss the impact of the crisis on gold and crude oil from the following two perspectives: changes in dependence and risk spillovers.

The main contributions of this paper are as follows. First, while most literature focuses on examining the effects of individual major crises on financial markets, this study incorporates several major crises into its research framework. Second, unlike Mo et al. (2023), which suggests a downside risk spillover effect between gold and crude oil, our findings align with those of Dai et al. (2020), indicating that both upside and downside risk spillovers between these two assets exist. Third, we further investigate the factors that influence changes in upside and downside risk spillovers and examine the conditions under which these spillovers occur. Finally, whereas Baur and Lucey (2010) and Baur and McDermott (2010) argue that both gold and crude oil have safe haven properties and can serve as substitutes for one another during crises, our results indicate that in the context of risk spillovers, gold is viewed as a safer asset than is crude oil in times of crisis.

The remainder of this paper is organized as follows. Section “Literature review” surveys the literature. Section “Data and preliminary analysis” presents descriptive statistics and a preliminary analysis of the data. Section “Methodology” introduces the model approach. Section “Empirical analysis” presents the empirical results of the model and discusses further analyses. Finally, Section “Conclusions” concludes the paper and provides suggestions.

Literature review

There is substantial evidence that the relationship between gold and crude oil is intricate and multifaceted. Soytas et al. (2009) observe that higher oil prices have a positive effect on gold prices in the short term. Sari et al. (2010), Narayan et al. (2010), and Gokmenoglu and Fazlollahi (2015) point to a long-term relationship between gold and crude oil prices.

Moreover, various methods, such as cointegration methods (see Šimáková, 2011), threshold cointegration methods (see Wang and Chueh, 2013), generalized autoregressive conditional heteroskedasticity (GARCH) models, nonlinear Granger causality tests, and nonlinear autoregressive distributed lags, have been used to study the relationship between gold and crude oil.

However, economic globalization has contributed to heightened complexity in terms of the dependence between the gold and crude oil markets. As a result, traditional analytical models have become inadequate in meeting evolving research requirements. Concurrently, the emergence and advancement of the copula model have presented researchers with new avenues for exploration.

Teetranont et al. (2018) propose various GARCH- and copula-based methods to investigate the relationship between gold and crude oil prices. Elie et al. (2019) examine the role of gold and crude oil as safe haven assets to combat extreme declines in clean energy stock indices using single and mixed copula and tail dependence measures.

As research has advanced, an increasing amount of evidence suggests that in times of crisis, the dependence between gold and crude oil has changed. Bedoui et al. (2018) employ a subperiod-based comparative framework to capture the comovement of gold and crude oil during both normal and crisis periods.

A review of the literature reveals that the complex dependence between gold and crude oil changes with the impact of crises. However, classical research methods are not sufficient for studying these changes effectively. Some scholars have proposed new models, among which the combination of MRS and copula models has attracted much attention. The MRS copula model combines the advantages of both MRS and copula models, offering greater flexibility in handling complex realities (see Boubaker and Sghaier, 2016; da Silva Filho et al. 2012; Gong et al. 2020; Luo et al. 2015; Okimoto, 2008; Wang and Ding, 2024; Wang et al. 2013).

Tiwari et al. (2020) employ the MRS copula model to examine how geopolitical risk influences the relationship between gold and crude oil, demonstrating the model’s superior performance. However, the dependence between gold and crude oil is influenced by not only geopolitical risks but also other factors, such as pandemics and trade disputes. To account for these influences, we utilize the MRS copula model to capture the variations in the dependence between gold and crude oil and to further explore the risk spillover between them.

Data and preliminary analysis

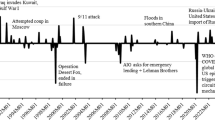

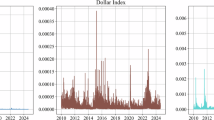

To examine the impact of crises on gold and crude oil, we select the daily closing prices of gold futures and Brent crude oil futures from 2018 to 2023 as experimental data.Footnote 1 The daily closing prices of gold and crude oil are shown in Fig. 1, and Fig. 2 presents their respective returns. Table 1 presents statistical descriptions of the data.Footnote 2

Note: Data are from [https://fred.stlouisfed.org/].

The above figure shows that gold and crude oil prices appear to rise and fall at the same time in a certain period, whereas in other periods, one of them appears to rise while the other falls. To better visualize the alterations in their dependence structure, we present the cross-correlation function (CCF) diagram between them in Fig. 3. Different dependence structures are presented at varying lag orders. Therefore, we tentatively determine that the structure of the dependence between gold and crude oil changes during periods of crisis.

Following the analysis, we opt to develop an autoregressive integrated moving average (ARIMA)-GARCH MRS copula model to further investigate the impact of crises on gold and crude oil.

Methodology

Marginal model specification

The GARCH family of models, a cornerstone of financial econometrics, originated from the pioneering ARCH model introduced by Engle (1982).

The Glosten–Jagannathan–Runkle (GJR)-GARCH model can not only address the volatility aggregation phenomenon but also consider the asymmetric effects of market shocks on volatility. The GJR-GARCH function can be written as follows:

where vt ~ IID(0, 1); α0 > 0; αi ≥ 0, i = 1, 2, 3, …, q − 1, αq > 0; βi ≥ 0, i = 1, 2, 3, …, p − 1, βp > 0; and \(\mathop{\sum }\nolimits_{i = 1}^{q}{\alpha }_{i}+\mathop{\sum }\nolimits_{i = 1}^{p}{\beta }_{i}+0.5\mathop{\sum }\nolimits_{i = 1}^{q}{\gamma }_{i} < 1\). Nt−i is the schematic function indicating that εt−i < 0, which can be written as follows:

The asymmetric power ARCH (APARCH) model is a highly nonlinear volatility model for situations such as those involving asymmetric effects, thick-tailed distributions, and volatility aggregation phenomena. The APARCH function can be written as follows:

where vt ~ IID(0, 1); α0 > 0; αi≥0, i = 1, 2, 3, …, q − 1, αq > 0; βi≥0, i = 1, 2, 3, …, p − 1, βp > 0; and \(\mathop{\sum }\nolimits_{i = 1}^{q}{\alpha }_{i}{\left(| {h}_{t-i}^{2}| -{\gamma }_{i}{h}_{t-i}^{2}\right)}^{\delta }+\mathop{\sum }\nolimits_{i = 1}^{p}{\beta }_{i} < 1\).

In this paper, we choose suitable GARCH models to fit the marginal distribution. The detailed procedure is described in Section “Results of marginal models”.

Specification of MRS copula models

Let X and Y represent two random variables. H denotes the joint distribution function of X and Y with marginal distribution functions F1 and F2, respectively. Then, according to Sklar’s theorem, a copula function, C, such that

exists, and Eq. (3) can be alternatively expressed as follows:

where u = F1(x1), v = F2(x2), u and v follow a standard uniform distribution.

In this work, we construct an MRS copula that is a mixture of two static copulas, with its dynamic properties being entirely governed by state variables. As the state variables change, the copula function adjusts accordingly. The two-regime Markov process is effective in capturing the variations present in most financial datasets. We assume that St ∈ {0, 1} follows a Markov process. The transition probabilities can be formulated as follows:

The matrix of transition probabilities can be articulated as follows:

where pij represents the likelihood of transitioning from state i at time t to state j at time t + 1. According to the properties of the copula function, the MRS copula can be formulated as follows:

We assemble the optimal MRS copula from the copula mentioned in Table 2 and their deformations (survival Clayton (S.Clayton) copula and survival Gumbel (S.Gumbel) copulaFootnote 3).

Parameter estimation

Maximum likelihood (ML) is the most widely used method for estimating parameters in copula models. In this work, we continue to apply ML to estimate the parameters of the MRS copula. By applying logarithms to both sides of Eq. (3), we deduce the logarithmic likelihood function, which is articulated as follows:

where h denotes the joint probability density function of X1t and X2t, fi represents the marginal probability density function of Xit (i = 1, 2), c signifies the copula density, Ωt−1 refers to the information set accessible after time t − 1, and ut = F1(x1t), vt = F2(x2t).

By leveraging the properties of the copula function, this study employs a two-stage approach to the parameter estimation of the MRS copula model. During the initial phase, the marginal density parameters are ascertained as follows:

In the subsequent phase, the copula parameters are determined using the following:

\({\hat{\theta }}_{c}\) contains an unknown variable, St, and thus, Hamilton’s filter proposed by Hamilton (1994) is used in this paper for specific estimation.

Copula correlation indicators

The correlation indices (such as Kendall’s τ, Spearman’s ρ, and tail dependence coefficients) between two variables can be derived from their copula function. The specific indicators relevant to this paper are outlined as follows:

Kendall’s τ between random variables X and Y can be derived from their copula function C as follows:

where u = F1(x1), v = F2(x2), u, v ∈ [0, 1], and τ ∈ [− 1, 1]. When τ = 0, the correlation between X and Y cannot be determined.

Tail dependence coefficients are widely used in extreme value theory to indicate the probability of an extreme value in one observed variable being followed by an extreme value in another variable. The tail dependence between random variables X and Y can also be derived from their copula function C, and the upper tail correlation coefficient (λU) and the lower tail correlation coefficient (λL) can be written as follows:

Risk spillover

Value at risk (VaR) is a metric used by professionals to measure risk issues. The definition of VaR is as follows:

where \({{\rm{VaR}}}_{i,t}^{\alpha }\) and \({{\rm{VaR}}}_{i,t}^{1-\alpha }\) represent the downside and upside VaRs of financial market i, respectively.

Adrian and Brunnermeier (2011) introduced the concept of conditional VaR (CoVaR), building on VaR, to study risk transmission from a single financial institution to another financial institution or the broader financial system as a whole.

Definition of CoVaR

According to Adrian and Brunnermeier (2011), the downside CoVaR and upside CoVaR values are as follows:

Adrian and Brunnermeier set the distress event condition in which institution j reaches the exact VaR. Girardi and Ergün (2013) modify the CoVaR by assuming that the condition for financial distress events is that institution j reaches, at most, its VaR. On the basis of Girardi and Ergün (2013), Eq. (14) can be written as follows:

where i and j represent different financial markets. \({{\rm{CoVaR}}}_{j,t}^{\beta }\) and \({{\rm{CoVaR}}}_{j,t}^{1-\beta }\) represent the downside and upside CoVaRs, respectively.

Calculation of CoVaR

In this paper, we use the methods proposed by Reboredo and Ugolini (2015) and Mensi et al. (2017) to calculate the CoVaR. From Eq. (15), the following can be derived:

In conjunction with Eq. (13), Eq. (16) can also be written as follows:

The joint distribution of Eq. (17) can be written as follows:

According to the above equations, α, βFootnote 4 and \({{\rm{VaR}}}_{i,t}^{\alpha }\) (or \({{\rm{VaR}}}_{i,t}^{1-\alpha }\)) are first used to compute \({F}_{{r}_{i,t}}({{\rm{CoVaR}}}_{j,t}^{\beta })\) (or \({F}_{{r}_{i,t}}({{\rm{CoVaR}}}_{j,t}^{1-\beta })\)) via the corresponding copula function. Then, the marginal distribution function of ri,t is inversely solved to obtain the CoVaR value.

Test of CoVaR

In Reboredo and Ugolini (2016), a method to determine whether financial risk spillovers occur by testing the consistency of the VaR and CoVaR is proposed. The original hypothesis is as follows:

If the above assumptions are not rejected, then CoVaR and VaR are considered consistent, and no risk contagion is considered to have occurred. If the original hypothesis is rejected, then risk contagion is considered to have occurred. In this paper, we use the bootstrap Kolmogorov–Smirnov (KS) test proposed by Abadie (2002) to compare the VaR and CoVaR as follows:

where Fm(x) and Fn(x) are the CDFs of CoVaR and VaR, respectively. m and n are the number of samples for CoVaR and VaR, respectively.

Empirical analysis

Results of marginal models

The first step in the copula approach is to estimate the marginal model for the univariate data. In constructing the marginal model, we consider several conditional mean models (ARIMA(p, q), p, q = 0, 1, 2, 3), five conditional variance models (GARCH(1,1), exponential GARCH (EGARCH)(1,1), integrated GARCH (IGARCH)(1,1), GJR-GARCH(1,1) and APARCH(1,1) Footnote 5) and five distributions for standardized disturbances (standard normal, skewed normal, Student’s t, skewed t, and generalized error distributions). We then proceed with the below steps to determine the optimal marginal model from these alternatives.

First, in the established model, a candidate for the best marginal model is chosen on the basis of the Akaike information criterion (AIC). Second, the autocorrelation and heteroskedasticity of the candidate model’s residuals are evaluated. This approach involves applying the weighted Ljung–Box test and the weighted ARCH-LM testFootnote 6 to the residuals \({\hat{z}}_{it}\) and their squares \({\hat{z}}_{it}^{2}\). If these tests are passed, then the model is deemed free of autocorrelation and heteroskedasticity effects. Third, we apply the KS test to \({\hat{u}}_{it}\), which is obtained from the residual probability integral transformation. If these tests pass, then the marginal distribution is well specified, and \({\hat{u}}_{it}\) can be assumed to be independently generated from a standard uniform distribution.

If all tests yield satisfactory results, then the marginal model that successfully passes these criteria is deemed optimal. However, if either the second or third step fails, then the process reverts to the first step, and model selection begins anew.

Table 3 reports the estimation results of the quasi-optimal marginal model.Footnote 7 The results in Table 3 indicate that the selected quasi-optimal model passes all of the abovementioned tests. Ultimately, we opt for the ARMA (3,3)-EGARCH (1,1) marginal model with a generalized error distribution for gold returns and the ARMA (1,2)-APARCH (1,1) marginal model with a skewed t distribution for crude oil returns.

Results of MRS copula models

On the basis of the observations \({\hat{u}}_{it}\) obtained in the first step, we proceed to estimate the MRS copula model. First, we consider 6 different copulas (Gaussian copula, t copula, Clayton copula, Gumbel copula, S.Clayton copula, and S.Gumbel copula) to compose the MRS copula. Next, we test the significance of the parameters in each of the 36 MRS copula models at the 5% significance level. Finally, we compare the AIC values of the MRS copula models that pass the parametric significance test to select the best MRS copula.Footnote 8

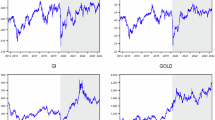

Tables 4, 5 present the estimation results for 36 MRS copula models. On the basis of the results of these tables, we ultimately decide to employ the Gaussian–t MRS copula to investigate the dynamic dependence structure between gold and crude oil during the period 2018–2023. Table 6 reports the dependence indicators between the two markets under different regimes. On the basis of experience, we refer to the regime where the two assets are negatively correlated as a crisis regime and to the regime where they are positively correlated as a tranquil regime. Figure 4 depicts the likelihood of various regimes occurring at distinct temporal intervals and shows that the occurrence of these crises has enhanced the emergence of crisis regimes.

Note: When the economy is stable and market conditions are steady, positive dependence between gold and crude oil exists. Therefore, we refer to the regime where gold and oil exhibit positive dependence as the tranquil regime, while the regime reflecting negative dependence is termed the crisis regime.

Results of the CoVaR model

Tables 7 –8 report the VaR and CoVaR values for gold and crude oil under crisis and tranquil regimes, respectively. The results of the table show that the regime change does not affect the VaR values of gold and crude oil but does cause a change in their CoVaR values. Figures 5–6 show the changes in the mean values for the VaR and CoVaR of gold and crude oil over time for different regimes. The results show that the volatility of both the VaR and CoVaR of crude oil is greater than that of gold, which indicates that gold is safer than crude oil.

These figures and tables illustrate that during tranquil periods, the CoVaR values for gold and crude oil exceed their respective VaR values. In contrast, during crisis periods, the VaR values for both commodities surpass the CoVaR values. However, it is essential to determine whether risk spillovers between gold and crude oil occur under different regimes. Table 9 presents the results of the risk spillover test, the findings of which indicate an upside risk spillover between the two in a tranquil regime, whereas a downside risk spillover occurs in a crisis regime.

Analysis of the impact of the crisis

According to Tables 4–6, there are two distinct dependence structures between gold and crude oil. In the crisis regime, gold and oil are linked by a Gaussian copula, whereas in the tranquil regime, they are connected by a t copula. Switching between the different regimes follows a Markov process. The variables connected by the Gaussian copula are tail-independent, whereas those linked by the t copula exhibit tail dependence. This finding indicates that this switch involves not only changes in positive and negative dependence structures but also variations in the degree of tail dependence. According to tail dependence theory, diversifying investments across the gold and crude oil markets can help mitigate risk during crises.

As mentioned in Section “Results of MRS copula models“, the occurrence of a crisis increases the probability of entering a crisis regime. However, Fig. 4 shows that when a crisis occurs, the probability of entering a crisis regime does not rise immediately but, instead, gradually increases over time. This delay can be attributed to the lagged impact of a crisis on financial markets. Figure 4 also illustrates that the probability of entering a crisis regime does not continuously rise after a crisis occurs. This outcome can be linked to the timely and proactive policies implemented by governments to address crises, which help stabilize market dynamics and support economic recovery. For example, at the beginning of the COVID-19 pandemic, as the first country affected by the pandemic, in China, the government swiftly implemented management and economic support policies, which played crucial roles in stabilizing financial markets and promoting global economic recovery.

After examining the impact of a crisis on the dependence between gold and crude oil, we further analyse its effect on the risk spillovers between them by exploring these spillovers under different regimes.

According to the results in Tables 7–8 and Figs. 5–6, the VaR values are the same, whereas the CoVaR values are different in different regimes. This finding indicates that a crisis does not affect the risk within gold and crude oil markets but affects the risk spillover between them. The CoVaR values across different regimes are further compared. Under a crisis regime, the CoVaR values for gold and crude oil are lower than those observed under a tranquil regime. This finding indicates that when the regime shifts from tranquil to crisis, the likelihood of risk spillover diminishes, which is consistent with the view that gold and crude oil can be regarded as safe assets.

We further analyse the risk spillovers between gold and crude oil during crises. In the tranquil regime, there is an upwards risk spillover between gold and crude oil; however, in a crisis regime, the spillover shifts downwards. This pattern aligns with the decline in financial market returns typically observed during economic downturns.

The previous analysis shows that crises trigger regime switching, and these regime changes alter the dependence between gold and crude oil, as well as risk spillovers. Therefore, it can be concluded that crises influence both the dependence and risk spillovers between gold and crude oil.

Conclusions

This work analyses the change in the dependence structure of gold and crude oil during 2018–2023 using the Gaussian–t MRS copula model and further discusses the risk spillover between them.

The conclusions of this study are twofold. First, this work examines the impact of crises on the dependence between gold and crude oil. Between 2018 and 2023, two distinct regimes for gold and crude oil are identified. During the tranquil regime, there is a positive dependence between the two markets, whereas during the crisis regime, this dependence becomes negative. Crises also increase the likelihood of transitioning to a crisis regime. Second, this study analyses the effect of crises on risk spillovers between these two assets. Crises alter both the intensity and the nature of risk spillovers when transitioning from a tranquil regime to a crisis regime. Notably, as a tranquil regime shifts to a crisis regime, the CoVaR value decreases, and the direction of risk spillovers shifts from upwards to downwards.

In light of the above research, this work proposes the below recommendations.

Concerning financial markets, given the frequency of crises today, it is essential to enhance the research on the impact of crises on financial markets. With the deepening of global economic integration, financial markets have become increasingly sensitive to crises. In the wake of these events, the connections between financial markets have grown more complex. The findings of this study can help fill the gaps in the existing theoretical framework.

In terms of methods and models, research has demonstrated that the interdependence among financial markets is highly complex, and traditional statistical methods, such as multivariate time-series methods, cannot fully capture these dependency structures. Thus, the development of more efficient and accurate models remains both fascinating and challenging. The model presented in this paper is an exploration of this endeavour.

Regarding policymakers and governments, crises disrupt the economic environment and dampen market sentiment. However, this work also demonstrates that active government intervention can effectively stabilize market dynamics during crises. Therefore, in the face of sudden crises, timely and active intervention by governments and policymakers is crucial for stabilizing market operations and supporting economic growth.

Regarding investors and practitioners, gold and crude oil have traditionally been regarded as safe assets, offering protection by reallocating investments to these markets during times of crisis. However, this study highlights that crude oil, although considered a safe haven, is more volatile than is gold. Additionally, the internal risks within both markets during crisis periods are greater than are those caused by spillovers, with the potential for downside risk contagion. Investors and practitioners can use the model presented in this study to better understand and manage these risks, thus enabling more effective risk mitigation strategies.

The results of this work provide evidence of how crises affect the dependence structure between gold and crude oil, as well as risk spillovers. Nevertheless, importantly, the dependence structure between gold and crude oil is highly intricate. This paper is limited by the models and data used and cannot fully capture the entire dependence structure between these assets. However, this limitation offers valuable insights for future research. In subsequent studies, we aim to leverage a broader dataset and explore more complex copula combinations.Footnote 9 Another potential research direction is to consider a multiregime Markov process (with three or more regimes) between gold and crude oil, which could more accurately depict changes in the dependency structure between these assets.Footnote 10

Data availability

The datasets analysed during the current study are available in the [https://cn.investing.com/].

Notes

This period is characterized by a series of crises, such as the trade friction between China and the US, the COVID-19 pandemic, and the Russia–Ukraine conflict.

The data analysis in this paper is conducted using R.

The relationship between these two copula functions is \(\overline{C}(u,v)=u+v-1+C(1-u,1-v)\).

In this paper, the values of α and β are set to 5%.

For further details on GARCH model variants, see Ali et al. (2013).

Compared with the Ljung–Box and ARCH-LM tests, Fisher and Gallagher (2012) introduce the weighted versions of these tests, which offer a more accurate representation of the statistical distribution of median values within the model estimations.

Given space constraints, we do not report the marginal model selection process or the estimation results of the other models. However, these details can be obtained from the authors upon request.

Nasri et al. (2020) note that the AIC can be used to determine the optimal MRS copula model.

Tiwari et al. (2020) employed a time-varying MRS copula to investigate the influence of geopolitical risks on the relationship between gold and crude oil.

Zhou and Zhang (2022) examined the impact of Brazil, Russia, India, and China (BRIC) and Canada, the European Union, Japan, and the US (G4) liquidity on real oil prices using a single-state VaR model and a multistate VaR (MSVaR) model. The results show that the latter provides a more nuanced description of how the liquidity of the four BRIC countries affects actual oil prices. Chen et al. (2023) used the MRS model to test the regime states of the series.

References

Abadie A (2002) Bootstrap tests for distributional treatment effects in instrumental variable models. J. Am. Stat. Assoc. 97:284–292

Adrian, T., Brunnermeier, M.K. CoVaR. Technical Report. National Bureau of Economic Research, (2011)

Ali G (2013) EGARCH, GJR-GARCH, TGARCH, AVGARCH, NGARCH, IGARCH and APARCH models for pathogens at marine recreational sites. J. Stat. Econom. Methods 2:57–73

Ali M, Alam N, Rizvi SAR (2020) Coronavirus (COVID-19)–An epidemic or pandemic for financial markets. J. Behav. Exp. Financ. 27:100341

Ang A, Timmermann A (2012) Regime changes and financial markets. Annu. Rev. Financ. Econ. 4:313–337

Baur DG, Lucey BM (2010) Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financ. Rev. 45:217–229

Baur DG, McDermott TK (2010) Is gold a safe haven? International evidence. J. Bank. Financ. 34:1886–1898

Bedoui R, Braeik S, Goutte S, Guesmi K (2018) On the study of conditional dependence structure between oil, gold and usd exchange rates. Int. Rev. Financ. Anal. 59:134–146

Blose LE (2010) Gold prices, cost of carry, and expected inflation. J. Econ. Bus. 62:35–47

Boubaker H, Sghaier N (2016) Markov-switching time-varying copula modeling of dependence structure between oil and GCC stock markets. Open J. Stat. 6:565–589

Chen X, Shan Z, Tang D, Zhou B, Boamah V (2023) Interest rate risk of Chinese commercial banks based on the GARCH-EVT model. Humanit. Soc. Sci. Commun. 10:1–11

Chua J, Woodward RS (1982) Gold as an inflation hedge: a comparative study of six major industrial countries. J. Bus. Financ. Account. 9:191–197

da Silva Filho OC, Ziegelmann FA, Dueker MJ (2012) Modeling dependence dynamics through copulas with regime switching. Insurance: Math. Econ. 50:346–356

Dai X, Wang Q, Zha D, Zhou D (2020) Multi-scale dependence structure and risk contagion between oil, gold, and US exchange rate: A wavelet-based vine-copula approach. Energy Econ. 88:104774

Elie B, Naji J, Dutta A, Uddin GS (2019) Gold and crude oil as safe-haven assets for clean energy stock indices: Blended copulas approach. Energy 178:544–553

Engle RF (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50:987–1007

Fisher TJ, Gallagher CM (2012) New weighted portmanteau statistics for time series goodness of fit testing. J. Am. Stat. Assoc. 107:777–787

Garbade KD, Silber WL (1983) Price movements and price discovery in futures and cash markets. Rev. Econ. Stat. 65:289–297

Ghosh D, Levin EJ, Macmillan P, Wright RE (2004) Gold as an inflation hedge? Stud. Econ. Financ. 22:1–25

Girardi G, Ergün AT (2013) Systemic risk measurement: Multivariate GARCH estimation of CoVaR. J. Bank. Financ. 37:3169–3180

Gokmenoglu KK, Fazlollahi N (2015) The interactions among gold, oil, and stock market: Evidence from S&P500. Procedia Econ. Financ. 25:478–488

Gong Y, Li KX, Chen SL, Shi W (2020) Contagion risk between the shipping freight and stock markets: Evidence from the recent US-China trade war. Transport. Res. Part E: Logist. Transport. Rev. 136:101900

Hamilton, J. Time series econometrics. Princeton University Press, (1994)

Hamilton JD (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica: J. Econom. Soc. 57:357–384

Junttila J, Pesonen J, Raatikainen J (2018) Commodity market based hedging against stock market risk in times of financial crisis: The case of crude oil and gold. J. Int. Financ. Mark., Inst. Money 56:255–280

Luo CQ, Xie C, Yu C, Xu Y (2015) Measuring financial market risk contagion using dynamic MRS-Copula models: The case of Chinese and other international stock markets. Econ. Model. 51:657–671

Mensi W, Hammoudeh S, Shahzad SJH, Shahbaz M (2017) Modeling systemic risk and dependence structure between oil and stock markets using a variational mode decomposition-based copula method. J. Bank. Financ. 75:258–279

Mo B, Chen C, Nie H, Jiang Y (2019) Visiting effects of crude oil price on economic growth in BRICS countries: fresh evidence from wavelet-based quantile-on-quantile tests. Energy 178:234–251

Mo B, Meng J, Wang G (2023) Risk dependence and risk spillovers effect from crude oil on the Chinese stock market and gold market: implications on portfolio management. Energies 16:2141

Narayan PK, Narayan S, Zheng X (2010) Gold and oil futures markets: Are markets efficient? Appl. energy 87:3299–3303

Nasri BR, Remillard BN, Thioub MY (2020) Goodness-of-fit for regime-switching copula models with application to option pricing. Can. J. Stat. 48:79–96

Nerlinger M, Utz S (2022) The impact of the Russia-Ukraine conflict on energy firms: A capital market perspective. Financ. Res. Lett. 50:103243

Okimoto T (2008) New evidence of asymmetric dependence structures in international equity markets. J. Financ. Quant. Anal. 43:787–815

Reboredo JC, Ugolini A (2015) Systemic risk in European sovereign debt markets: A CoVaR-copula approach. J. Int. Money Financ. 51:214–244

Reboredo JC, Ugolini A (2016) Quantile dependence of oil price movements and stock returns. Energy Econ. 54:33–49

Sari R, Hammoudeh S, Soytas U (2010) Dynamics of oil price, precious metal prices, and exchange rate. Energy Econ. 32:351–362

Šimáková J (2011) Analysis of the relationship between oil and gold prices. J. Financ. 51:651–662

Soytas U, Sari R, Hammoudeh S, Hacihasanoglu E (2009) World oil prices, precious metal prices and macroeconomy in Turkey. Energy Policy 37:5557–5566

Starr M, Tran K (2008) Determinants of the physical demand for gold: Evidence from panel data. World Econ. 31:416–436

Teetranont, T., Chanaim, S., Yamaka, W., Sriboonchitta, S. Investigating relationship between gold price and crude oil price using interval data with copula based GARCH, in: Predictive Econometrics and Big Data TES2018, Springer. pp. 656–669, (2018)

Tiwari AK, Aye GC, Gupta R, Gkillas K (2020) Gold-oil dependence dynamics and the role of geopolitical risks: Evidence from a Markov-switching time-varying copula model. Energy Econ. 88:104748

Tully E, Lucey BM (2007) A power GARCH examination of the gold market. Res. Int. Bus. Financ. 21:316–325

Ullah S (2023) Impact of COVID-19 pandemic on financial markets: A global perspective. J. Knowl. Econ. 14:982–1003

Wang YK, Ding XQ (2024) Dependence Structure of the US Dollar Index and Crude Oil Prices: A Regime-Switching Copula Approach. J. Math. Financ. 14:172–189

Wang YC, Wu JL, Lai YH (2013) A revisit to the dependence structure between the stock and foreign exchange markets: A dependence-switching copula approach. J. Bank. Financ. 37:1706–1719

Wang YS, Chueh YL (2013) Dynamic transmission effects between the interest rate, the US dollar, and gold and crude oil prices. Econ. Model. 30:792–798

Wen F, Min F, Zhang YJ, Yang C (2019) Crude oil price shocks, monetary policy, and China’s economy. Int. J. Financ. Econ. 24:812–827

Worthington AC, Pahlavani M (2007) Gold investment as an inflationary hedge: Cointegration evidence with allowance for endogenous structural breaks. Appl. Financ. Econ. Lett. 3:259–262

Yousaf I, Patel R, Yarovaya L (2022) The reaction of G20+ stock markets to the Russia–Ukraine conflict “black-swan” event: Evidence from event study approach. J. Behav. Exp. Financ. 35:100723

Zhou Z, Zhang X (2022) Quantifying nonlinear effects of BRIC and G4 liquidity on oil prices. Humanit. Soc. Sci. Commun. 9:1–13

Author information

Authors and Affiliations

Contributions

Y. Wang: Conceptualization; Methodology; Software; Investigation; Writing - original draft, review & editing. X. Ding: Conceptualization; Methodology; Writing - review & editing P. Wang: Resources; Writing - review & editing. Z. Huang: Software; Writing - review & editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Wang, Y., Ding, X., Wang, P. et al. Impact of global crisis events on the dependence and risk spillover between gold and crude oil: a regime-switching copula approach. Humanit Soc Sci Commun 11, 1751 (2024). https://doi.org/10.1057/s41599-024-04329-y

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-04329-y