Abstract

This study employs quarterly data and the ARDL approach to explore how the growth of the green finance market influences China’s carbon neutralization capacity from 1995Q1 to 2021Q4. Findings indicate that a 1% rise in green finance market value is associated with a 0.25% increase in short-term and a 0.31% increase in long-term carbon sequestration capacity. Similarly, a 1% improvement in Environmental, Social, and Governance (ESG) investment boosts carbon neutralization capacity by 0.19% in the short term and 0.26% in the long term, demonstrating the role of ESG practices in reducing emissions. Additionally, a 1% increase in green energy production enhances carbon neutralization capacity by 0.24% in the short term and 0.17% in the long term, emphasizing the importance of renewable energy sources. However, the analysis also reveals that GDP per capita and trade liberalization negatively impact carbon sequestration, highlighting the need for sustainable development approaches. Policy recommendations include fostering carbon-neutral bonds, standardizing green bonds, supporting ESG investments, prioritizing green growth strategies, and advancing green trade policies.

Similar content being viewed by others

Introduction

Understanding the carbon neutralization capacity is paramount for the development of effective policies aimed at mitigating emissions and combating climate change. This capacity refers to the Earth’s ability to absorb and neutralize carbon dioxide, primarily through natural processes such as photosynthesis, oceanic absorption, and carbon sequestration in forests and soils (Zhao and Rasoulinezhad, 2023; Bai et al., 2023). Quantifying this capacity provides policymakers with crucial insights into how much carbon emissions can be safely absorbed without leading to further climate destabilization. By leveraging this knowledge, policymakers can design strategies to regulate emissions, promote carbon offset initiatives, and protect ecosystems that play a pivotal role in carbon sequestration (Yoshino et al., 2021; Hussain et al., 2023). Additionally, it underscores the importance of preserving biodiversity and ecosystems, which are essential for maintaining the planet’s carbon balance.

Instruments within the green finance market have emerged as efficient tools for promoting carbon neutralization goals. One notable instrument is green bonds, which enable investors to finance projects with environmental benefits, such as renewable energy infrastructure and carbon capture initiatives (Alharbi et al., 2023). These bonds channel capital towards projects that reduce greenhouse gas emissions or enhance carbon sequestration, thus contributing to carbon neutralization efforts. Another key instrument is carbon offset credits, which allow organizations to compensate for their emissions by investing in projects that reduce or remove carbon from the atmosphere (Yang, 2023; Gafoor et al., 2024). According to Chi and Yang (2023), and Hua et al. (2024), by creating financial incentives for carbon reduction activities, these instruments stimulate innovation and investment in sustainable solutions while aligning economic interests with environmental objectives, as shown in Table 1.

The global green finance market has experienced significant growth in recent years, with the market size reaching USD 4.18 trillion in 2023 and projected to grow at a compound annual growth rate (CAGR) of 21.25% from 2023 to 2033, ultimately reaching USD 28.71 trillion by 2033. This growth reflects a growing recognition of the importance of sustainable investing and the increasing demand for financial products and services that align with environmental objectives. However, despite the promising trajectory, the expansion of the green finance market is not without its challenges. One major obstacle is the difficulty in pricing green finance products, stemming from both the lack of standardization and data availability. This hampers transparency and comparability, hindering market efficiency. Additionally, investors may exhibit hesitancy towards green finance due to uncertainties surrounding its financial performance, particularly concerning differences between traditional and green finance.

The alignment of green finance with China’s carbon neutrality goals is crucial, particularly in light of the nation’s extraordinary economic expansion since the 1978 reforms. With an average annual GDP growth of over 10% for more than thirty years, China’s rapid industrialization and urbanization have posed significant environmental challenges. The rise in waste disposal, reaching around 244.5 million tons by 2022, highlights the urgent need for sustainable practices. As the world’s most populous nation, China generates over 15% of global municipal solid waste, despite comprising only 18% of the global population. Additionally, China’s CO2 emissions have surged, averaging 3.8% growth annually from 2021 to 2023, up from 0.9% between 2016 and 2020, even as GDP growth has slightly decreased from 5.7% to 5.4%. These challenges emphasize the critical role of the green finance market in promoting investments in carbon neutrality, supporting sustainable development, reducing environmental impacts, cutting carbon emissions, and paving the way for a greener, more resilient economy for future generations.

The central research question driving this paper is “what is the impact of green finance market development on carbon neutralization capacity in China?” This inquiry seeks to understand the relationship between the evolution of the green finance market and the enhancement of carbon neutralization efforts within China’s environmental landscape. The primary research hypothesis posits that the advancement of the green finance market positively correlates with an increase in carbon neutralization capacity in China. This hypothesis is founded on the premise that the availability of financial resources and incentives through the green finance market can catalyze investments in carbon reduction initiatives, such as renewable energy projects, afforestation programs, and carbon capture technologies, thus bolstering the country’s overall capacity to neutralize carbon emissions.

The paper adopts a structured approach to examine the research question and hypothesis. Initially, “Introduction” introduces the research topic and emphasizes the importance of studying how the development of the green finance market influences carbon neutralization capacity in China. Following this, “Literature review” conducts an in-depth review of existing literature, encompassing pertinent studies, theories, and empirical evidence concerning green finance, carbon neutralization, and their interconnectedness in the Chinese context. In “Theoretical discussion”, the theoretical framework and conceptual foundations guiding the analysis are established, drawing from established economic and environmental theories to formulate hypotheses and analytical frameworks. Subsequently, “Analysis and results” elucidates the research methodology, elucidating the data sources, variables, and analytical methods utilized to empirically investigate the research question. “Empirical interpretations and discussions” then presents the primary findings derived from the analysis, shedding light on the correlation between the development of the green finance market and carbon neutralization capacity in China, and discussing the implications of these findings. Lastly, “Conclusions and practical policies” offers a comprehensive summary of the paper’s key points, providing a synthesis of the research outcomes and their broader implications.

Literature review

The issues of carbon neutralization and the utilization of sustainable finance tools have garnered significant attention from a vast array of scholars. Across various academic disciplines, researchers have recognized the pressing need to address climate change and environmental degradation through innovative financial mechanisms and carbon reduction strategies. Scholars from fields such as economics, finance, environmental science, and policy analysis have contributed to the discourse surrounding carbon neutralization and sustainable finance, exploring diverse perspectives and proposing multifaceted solutions to mitigate carbon emissions and promote environmental sustainability.

A group of scholars has focused on the realization of carbon neutrality goals. The realization of carbon neutrality goals has been a central focus of scholarly research, reflecting the imperative to address climate change and its associated challenges. Numerous studies have examined various aspects of carbon neutrality, ranging from the development of policy frameworks to the implementation of mitigation strategies. For instance, Wu et al. (2022) conducted a comprehensive review of carbon neutrality pathways, emphasizing the importance of policy integration and technology innovation in achieving ambitious emission reduction targets. Building on this, Huovila et al. (2022), and Rasoulinezhad and Eksi (2024) explored the role of renewable energy sources in advancing carbon neutrality, highlighting the potential for wind and solar power to drive decarbonization efforts. Additionally, research by Becker et al. (2020) focused on the economic implications of carbon neutrality, assessing the costs and benefits associated with transitioning to a low-carbon economy. Furthermore, studies such as Wei et al. (2022) have investigated the role of international cooperation and multilateral agreements in facilitating the global transition to carbon neutrality.

The body of literature surrounding sustainable financing and green projects highlights the essential function of financial mechanisms in advancing environmentally friendly initiatives and encouraging sustainable development. Research conducted by Agrawal et al. (2023) analyzes the effectiveness of green bonds in attracting capital for renewable energy projects, demonstrating their potential to draw investors and expedite the shift toward a low-carbon economy. Similarly, studies by Chen et al. (2021), Gafoor et al. (2024), and Ahmed et al. (2024) examine how sustainable financing practices influence the execution of green infrastructure projects, stressing the need to incorporate environmental factors into investment decision-making processes. Furthermore, Rasoulinezhad and Tahghizadeh-Hesary (2022), and Zhang et al. (2023) investigate the role of financial institutions in furthering sustainable development goals by offering green loans and investment options. Additionally, Yang, (2023) discusses the challenges and opportunities related to sustainable financing in emerging markets, providing valuable insights into strategies for overcoming obstacles to financing green projects.

The greening of the Chinese economy has emerged as a central theme in academic research, reflecting the country’s crucial position in global environmental sustainability efforts. Scholars have explored various dimensions of this transition, including policy frameworks, technological advancements, and economic consequences. For example, Ma et al. (2024) analyzed China’s renewable energy policies and their effects on the shift toward a low-carbon economy, underscoring the significance of government intervention in facilitating green development. Similarly, research by Lin and Zhou (2022) investigated the role of technological innovation in greening China’s industrial sectors, highlighting the potential of advanced manufacturing and clean energy technologies to reduce carbon emissions while improving productivity. Additionally, studies by Guo et al. (2023) assessed the economic impacts of greening the Chinese economy, evaluating the costs and benefits associated with environmental regulations and sustainable development initiatives. Furthermore, Xiong et al. (2023) examined the importance of international collaboration and global supply chains in fostering green growth in China, stressing the necessity for cross-border cooperation to tackle transboundary environmental challenges.

While the existing literature provides valuable insights into various aspects of carbon neutrality, sustainable financing, and the greening of the Chinese economy, several gaps remain to be addressed. Generally, there is a need for more research focusing on the integration of carbon neutrality goals with sustainable finance practices, particularly within the context of emerging economies like China. While studies have explored the impact of green financing on environmental projects, there is limited research on how financial mechanisms can specifically facilitate the achievement of carbon neutrality targets.

Theoretical discussion

The sustainable finance market in China has experienced rapid growth, driven by the government’s green finance policies aimed at fostering investment in environmentally friendly projects. These policies incentivize funding for a diverse array of assets, including renewable energy projects, water treatment plants, and recycling facilities. Notably, green financing in China, predominantly through bank loans, leasing project financing, and bonds such as asset-backed securities, has surged at a compound annual growth rate (CAGR) of around 30% from 2019 to the first half of 2023 (Forbes, 2023). However, despite this remarkable expansion, challenges persist in the development of green finance in the country. Chief among these challenges is the need to reconcile diverse interests between central and local governments and between state and market players, which can impede the effective implementation of green finance policies and initiatives. Additionally, the lack of sufficient incentives for green over brown finance presents a significant hurdle, potentially hindering the transition to a more sustainable financial system in China.

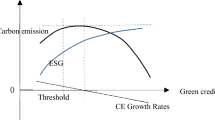

Sustainable finance plays a critical role in promoting carbon neutralization capacity in a country through various transmission channels. Sustainable finance serves as a conduit for directing capital towards environmentally friendly projects, encompassing a diverse array of initiatives aimed at mitigating climate change and enhancing ecological resilience. This includes investments in renewable energy infrastructure, such as solar, wind, and hydroelectric power generation, which facilitate the transition away from fossil fuels and significantly reduce carbon emissions associated with electricity generation. Moreover, sustainable finance supports afforestation and reforestation initiatives, which play a crucial role in sequestering carbon dioxide from the atmosphere through the absorption and storage of carbon in trees and forest ecosystems. By financing the restoration and preservation of forests, sustainable finance contributes to the expansion of carbon sinks, thus offsetting emissions from various sources. Additionally, sustainable finance promotes investments in energy-efficient technologies and infrastructure, spanning sectors such as transportation, construction, and manufacturing. These investments enable the deployment of cleaner and more efficient technologies, leading to substantial reductions in energy consumption and greenhouse gas emissions. Sustainable finance mechanisms play a pivotal role in incentivizing businesses and industries to embrace sustainable practices, thereby catalyzing the transition towards low-carbon business models and fostering innovation in clean technologies. These mechanisms operate through a combination of financial rewards for carbon reduction efforts and penalties for carbon-intensive activities, effectively aligning economic incentives with environmental objectives. By offering financial incentives, such as preferential loan terms, grants, or subsidies, for initiatives that reduce carbon emissions and enhance environmental performance, sustainable finance encourages businesses to prioritize sustainability in their operations and investment decisions. Conversely, sustainable finance imposes penalties, such as higher borrowing costs or regulatory fines, on activities that generate significant carbon emissions or environmental harm, thereby discouraging carbon-intensive practices and promoting the adoption of cleaner alternatives. This incentivization framework not only drives immediate reductions in carbon emissions but also stimulates long-term investments in research, development, and deployment of clean technologies. Thirdly, Sustainable finance plays a crucial role in shaping institutional and regulatory frameworks that are conducive to achieving carbon neutrality goals. By fostering the development of green finance policies, standards, and reporting mechanisms, sustainable finance helps establish a robust infrastructure to support and facilitate carbon neutralization efforts across various sectors of the economy. This involves creating policies that encourage investments in low-carbon technologies, renewable energy, and sustainable infrastructure, along with establishing regulatory frameworks that foster transparency, accountability, and best practices in environmental finance. Sustainable finance further aids in developing standardized methodologies for measuring, reporting, and verifying the environmental impacts of financial activities, which enhances both transparency and the comparability of sustainability performance among organizations. Moreover, sustainable finance enhances transparency and accountability in carbon management by incorporating environmental, social, and governance (ESG) considerations into investment decision-making processes. This helps investors assess and mitigate carbon-related risks while promoting investments in sustainable assets.

Analysis and results

This study aims to explore the primary research question: “How does the development of the green finance market influence carbon neutralization capacity in China?” By analyzing the connection between the growth of the green finance market and improvements in carbon neutralization efforts within China’s environmental context, the research covers the period from 1995Q1 to 2021Q4. To empirically examine this relationship, the study utilizes the logarithmic form of the variables, with China’s carbon neutralization capacity serving as the dependent variable, calculated using the method outlined by Bai et al. (2023). The green finance market value is used as the explanatory variable in the model. Furthermore, control variables such as ESG investment, green energy generation, GDP per capita, and trade liberalization are included to address potential confounding factors. Table 2 presents the information related to these variables, providing a detailed overview of the factors considered in the empirical analysis.

The expected explanations of each variable on carbon neutralization capacity are as follows:

A greater green finance market value is expected to exert a positive influence on carbon neutralization capacity by facilitating increased investment in environmentally friendly projects. As the value of the green finance market rises, so too does the availability of capital allocated towards initiatives aimed at mitigating carbon emissions and promoting environmental sustainability. Specifically, this entails directing financial resources towards projects such as renewable energy infrastructure development and carbon reduction initiatives. By channeling capital into these areas, green finance mechanisms enable the implementation of carbon-neutralizing projects on a larger scale, thereby enhancing the country’s overall capacity to mitigate carbon emissions and achieve environmental sustainability goals. Moreover, the provision of financial incentives, such as preferential loan terms or grants, further incentivizes the adoption of sustainable practices and the deployment of clean technologies.

Moreover, Environmental, Social, and Governance (ESG) investment is anticipated to exert a positive influence on carbon neutralization capacity. This stems from the rationale that directing funds towards companies and projects that prioritize ESG criteria fosters a culture of sustainability and responsible corporate behavior. By aligning investments with ESG principles, stakeholders incentivize firms to adopt environmentally friendly practices and embrace strategies geared towards carbon reduction. Consequently, heightened ESG investment not only supports the adoption of sustainable initiatives but also facilitates the implementation of carbon mitigation measures. This, in turn, leads to a tangible reduction in carbon emissions and an amplification of carbon sequestration efforts.

Greater investment in and utilization of green energy generation infrastructure are expected to yield significant benefits for carbon neutralization capacity. By augmenting the proportion of electricity derived from renewable sources like solar, wind, and hydroelectric power, countries can substantially reduce their reliance on fossil fuels, which are major contributors to carbon emissions. As renewable energy sources produce electricity with minimal or zero greenhouse gas emissions during operation, the expansion of green energy generation plays a pivotal role in mitigating carbon emissions associated with electricity generation. Additionally, the deployment of green energy technologies facilitates the transition towards a more sustainable and resilient energy system, characterized by lower carbon intensity and greater environmental compatibility. Consequently, a heightened contribution of green energy to the overall energy mix serves as a cornerstone of carbon neutrality efforts, aligning with global objectives to reduce carbon footprints and combat climate change.

The relationship between GDP per capita and carbon neutralization capacity is nuanced and multifaceted. On one hand, higher GDP per capita typically corresponds with increased industrialization and energy consumption, which are often associated with higher carbon emissions. The expansion of industrial activities and the consumption of energy-intensive goods and services can contribute to elevated levels of greenhouse gas emissions, thereby potentially undermining efforts towards carbon neutralization. However, it is crucial to recognize that higher GDP per capita also signifies greater economic prosperity and financial resources within a country. This can provide the means to invest in carbon reduction technologies, renewable energy infrastructure, and environmental protection measures. As such, the relationship between GDP per capita and carbon neutralization capacity is contingent upon the extent to which economic growth is decoupled from carbon emissions. Sustainable development practices and green investments play a crucial role in this decoupling process by promoting resource efficiency, renewable energy adoption, and emission reduction initiatives.

The impact of trade liberalization on carbon neutralization capacity is complex and multifaceted. On one hand, increased trade openness may stimulate economic growth, industrialization, and energy consumption, potentially leading to higher carbon emissions. On the other hand, trade liberalization can facilitate the transfer of clean technologies, promote the adoption of environmental standards, and encourage international cooperation on climate issues. Therefore, the effect of trade liberalization on carbon neutralization capacity may vary depending on factors such as the composition of trade, the stringency of environmental regulations, and the extent of technological transfer and knowledge exchange.

The estimation strategy outlined in this paper consists of several essential components. First, collinearity is evaluated by examining the correlation matrix of the variables. Next, the stationary properties of the data are analyzed using the Phillips-Perron method, which tests the null hypothesis that a unit root is present, along with the ADF-GLS test to determine whether the time series behaves like a random walk, possibly with drift. Following this, the analysis advances to investigate cointegration through Johansen’s maximum eigenvalue and trace tests. This process is further enhanced by applying the Autoregressive Distributed Lag (ARDL) technique, provided there is a long-term equilibrium relationship among the series and their integration orders match.

Empirical interpretations and discussions

In this section, we present the empirical findings derived from our analysis. We begin by computing the correlation matrix to investigate the presence of multicollinearity among the variables. The results are detailed in Table 3, which summarizes our findings and indicates that multicollinearity is not a significant issue among the variables under consideration

Continuing our analysis, we employ two tests of stationary evaluation to ascertain the order of integration of the variables under study. The results of these tests are presented in Tables 4 and 5, which confirm that the variables exhibit a first-order integration.

Continuing our sequential analysis, we proceed to conduct Johansen’s maximum eigenvalue and trace tests to examine the presence of cointegration among the variables. The results of these tests, outlined in Table 6, unequivocally confirm that the variables are indeed integrated in the long term.

To assess the long-term coefficients of the independent variables, we utilize the time series Autoregressive Distributed Lag (ARDL) technique. This method allows us to effectively capture the relationship between the variables across an extended time frame while addressing potential issues of endogeneity and serial correlation. The results of this estimation for both short- and long-term effects are displayed in Table 7.

The results of our analysis reveal a significant correlation between the growth of the green finance market value and China’s carbon sequestration capacity. Specifically, our findings show that a 1% increase in the green finance market value leads to a 0.25% and 0.31% rise in carbon sequestration capacity in the short and long term, respectively. This empirical relationship highlights the crucial role that investments in green finance initiatives play in enhancing the country’s ability to sequester carbon. Several key factors may explain this observed effect, including the channeling of funds into sustainable projects such as renewable energy infrastructure, afforestation initiatives, and technological innovations aimed at reducing carbon emissions. Furthermore, increased investment in green finance may encourage industries to adopt cleaner production techniques and comply with stricter environmental regulations, thereby further improving China’s carbon sequestration capabilities.

Additionally, our analysis indicates that a 1% increase in Environmental, Social, and Governance (ESG) investment corresponds to a 0.19% rise in carbon neutralization capacity in the short term and a 0.26% increase in the long term. This finding highlights the essential role of ESG investment practices in fostering positive environmental outcomes. The observed relationship implies that directing investments toward companies and projects with strong ESG credentials aids in reducing carbon emissions and advancing sustainability initiatives. One possible explanation for this outcome is that firms with high ESG ratings are more inclined to prioritize environmentally sustainable practices, such as minimizing energy consumption, adopting cleaner technologies, and implementing sustainable supply chain management. By channeling capital into ESG-focused investments, stakeholders can encourage companies to embrace more responsible and eco-friendly business practices, thereby bolstering China’s overall carbon neutralization capacity.

Additionally, our estimation reveals that a 1% increase in green energy generation is linked to a significant rise of 0.24% in carbon neutralization capacity in the short term and 0.17% in the long term for China. This finding highlights the critical importance of green energy in promoting carbon reduction efforts and achieving sustainability objectives. Several key factors can explain this observed relationship. First, investments in green energy infrastructure, such as wind, solar, and hydropower facilities, support the shift away from fossil fuels, which are major sources of carbon emissions. By utilizing renewable energy sources, China can considerably decrease its carbon footprint and enhance its carbon neutralization capabilities. Moreover, the growth of green energy generation provides opportunities for job creation, economic development, and technological advancement, further encouraging the adoption of sustainable energy practices. Additionally, investments in green energy projects typically lead to enhancements in energy efficiency and modernization of the grid, optimizing the use of renewable resources and reducing waste.

Additionally, the findings reveal the adverse impact of GDP per capita and trade liberalization on the enhancement of China’s carbon sequestration capacity. This negative relationship suggests that as GDP per capita increases or trade liberalization policies are implemented, there is a corresponding decrease in the country’s capacity for carbon neutralization. The negative association between GDP per capita and carbon sequestration capacity implies that as economic prosperity grows, there is a tendency for increased consumption and industrial activity, leading to higher carbon emissions. This finding reflects the challenge of decoupling economic growth from environmental degradation and highlights the need for sustainable development strategies that prioritize environmental conservation alongside economic prosperity. The adverse impact of trade liberalization on carbon neutralization capacity suggests that increased international trade may lead to higher levels of carbon emissions associated with transportation, manufacturing, and energy-intensive industries. Trade liberalization policies, while fostering economic integration and growth, may inadvertently exacerbate environmental pressures if not accompanied by stringent environmental regulations and sustainable trade practices.

Conclusions and practical policies

This paper examines the critical relationship between the growth of the green finance market and China’s carbon sequestration capacity. Our analysis reveals a significant correlation, indicating that a 1% increase in green finance market value corresponds to a rise of 0.25% in the short term and 0.31% in the long term in China’s carbon sequestration capacity. This relationship underscores the vital role that investments in green finance initiatives play in enhancing carbon sequestration efforts, facilitated by funding directed towards renewable energy projects, afforestation, and technological advancements aimed at reducing carbon emissions. Furthermore, the findings indicate that a 1% increase in Environmental, Social, and Governance (ESG) investments is associated with a 0.19% increase in carbon neutralization capacity in the short term and a 0.26% increase in the long term. This highlights the importance of ESG practices in promoting sustainable outcomes, as firms with strong ESG credentials are more likely to prioritize eco-friendly practices. Additionally, our study shows that a 1% rise in green energy generation results in a significant increase of 0.24% in carbon neutralization capacity in the short term and 0.17% in the long term, reinforcing the importance of renewable energy in reducing carbon emissions and achieving sustainability goals. However, the analysis also identifies challenges, noting that increases in GDP per capita and trade liberalization negatively impact carbon sequestration capacity. As economic prosperity grows, so does consumption and industrial activity, leading to higher emissions. This finding highlights the difficulty of decoupling economic growth from environmental degradation, emphasizing the necessity for sustainable development strategies that balance economic and environmental objectives.

To improve its carbon neutralization capacity by expanding green finance tools, China could adopt several effective policies. First, it could promote the issuance of carbon-neutrality bonds and sustainable development-linked bonds, which would provide targeted funding for projects designed to lower carbon emissions and support sustainable development initiatives. Additionally, clarifying the standards for green bonds issued by non-financial corporations would enhance transparency and credibility within the green finance market, encouraging companies to embrace environmentally friendly practices. Promoting Environmental, Social, and Governance (ESG) investment practices would also facilitate the allocation of capital to companies with strong sustainability credentials, cultivating a culture of responsible investment and yielding positive environmental results. Focusing on green growth strategies, including investments in renewable energy infrastructure and sustainable urban development, would further advance China’s transition to a low-carbon economy. Finally, encouraging green trade policies and initiatives that promote environmentally sustainable practices in international trade would help reduce carbon emissions related to global supply chains.

To further contribute to the research in this area, future studies could focus on two key aspects. Firstly, an in-depth examination of the green bonds market in China would provide valuable insights into the dynamics of sustainable finance and its impact on carbon neutralization efforts. By analyzing trends in green bond issuance, investor preferences, and the allocation of funds to environmentally beneficial projects, researchers can better understand the role of financial markets in driving sustainability initiatives. Additionally, exploring the relationship between the carbon taxation system and carbon neutralization capacity in China would offer important insights into the effectiveness of policy measures in reducing carbon emissions. By assessing the impact of carbon taxes on industrial practices, energy consumption patterns, and investment decisions, researchers can evaluate the potential for taxation policies to incentivize emissions reduction and promote carbon neutrality.

Data availability

For inquiries regarding access to the datasets generated or analyzed in the current study, please do not hesitate to reach out to the corresponding author.

References

Agrawal R, Agrawal S, Samadhiya A, Kumar A, Luthra S, Jain V (2025) Adoption of green finance and green innovation for achieving circularity: An exploratory review and future directions. Geosci Front 15(4):101669. https://doi.org/10.1016/j.gsf.2023.101669

Ahmed D, Hua H, Bhutta U (2024) Innovation through Green Finance: a thematic review. Curr Opin Environ Sustain 66:101402. https://doi.org/10.1016/j.cosust.2023.101402

Alharbi S, Mamun A, Boubaker S, Rizvi S (2023) Green finance and renewable energy: a worldwide evidence. Energy Econ 118:106499. https://doi.org/10.1016/j.eneco.2022.106499

Bai X, Zhang S, Li C, Xiong L, Song F, Du C, Li M, Luo Q, Xue Y, Wang S (2023) A carbon-neutrality-capacity index for evaluating carbon sink contributions. Environ Sci Pollut Res 15:100237. https://doi.org/10.1016/j.ese.2023.100237

Becker S, Bouzdine-Chameeva T, Jaegler A (2020) The carbon neutrality principle: a case study in the French spirits sector. J Clean Prod 274:122739. https://doi.org/10.1016/j.jclepro.2020.122739

Chi Y, Yang Y (2023) Green finance and green transition by enterprises: an exploration of market-oriented governance mechanisms. Borsa Istanb Rev 23(3):628–646

Forbes (2023) China aims to become a leader in green Finance. https://www.forbes.com/sites/zennonkapron/2023/04/19/china-aims-to-become-a-leader-in-green-finance/?sh=351c26777d49 [data retrieved on 12.11.2023]

Gafoor C, Perumbalath S, Daimari P, Noheem K (2024) Trends and patterns in green finance research: a bibliometric study. Innov Green Dev 3(2):100119. https://doi.org/10.1016/j.igd.2023.100119

Guo Y, Rosland A, Ishak S, Senan M (2023) Public spending and natural resources development: a way toward green economic growth in China. Resour Policy 86(Part B):104078. https://doi.org/10.1016/j.resourpol.2023.104078

Houvila A, Siikavirta H, Rozado C, Rokman J, Tuominen P, Paiho S, Hedman A, Yien P (2022) Carbon-neutral cities: critical review of theory and practice. J Clean Prod 341:130912. https://doi.org/10.1016/j.jclepro.2022.130912

Hua M, Li Z, Zhang Y, Wei X (2024) Does green finance promote green transformation of the real economy? Res Int Bus Financ 67(Part B):102090. https://doi.org/10.1016/j.ribaf.2023.102090

Hussain J, Lee C, Hu D (2023) Maximizing load capacity factor through a carbon-neutral environment via a simulation of carbon peak. Econ Anal Policy 79:746–764

Lin B, Zhou Y (2022) Measuring the green economic growth in China: influencing factors and policy perspectives. Energy 241:122518. https://doi.org/10.1016/j.energy.2021.122518

Ma Z, Tian Y, See K (2025) The driving force behind the growth of China’s green economic efficiency: provincial efficiency influence analysis for a sustainable future. J Clean Prod 460:142205. https://doi.org/10.1016/j.jclepro.2024.142205

Rasoulinezhad E, Eksi I (2024) The economic development of the Russian Federation. Ctries Stud 2(2):279–289

Rasoulinezhad E, Taghizadeh-Hesary F (2022) Role of green finance in improving energy efficiency and renewable energy development. Energy Effic 15:14. https://doi.org/10.1007/s12053-022-10021-4

Wei Y, Chen K, Kang J, Chen W, Wang X, Zhang X (2022) Policy and management of carbon peaking and carbon neutrality: a literature review. Engineering 14:52–63

Wu X, Tian Z, Guo J (2022) A review of the theoretical research and practical progress of carbon neutrality. Sustain Oper Comput 3:54–66

Xiong W, Jiang M, Tashkhodjaev M, Pashayev Z (2023) Greening the economic recovery: natural resource market efficiency as a key driver. Resour Policy 86(Part B):104268. https://doi.org/10.1016/j.resourpol.2023.104268

Yang X (2023) Role of green finance and investment in sustainable resource development in China. Resour Policy 86(Part A):104219. https://doi.org/10.1016/j.resourpol.2023.104219

Yoshino N, Rasoulinezhad E, Taghizadeh-Hesary F (2021) Economic impacts of carbon tax in a general equilibrium framework: empirical study of Japan. J Environ Assess Policy Manag 23(01):2250014. https://doi.org/10.1142/S1464333222500144

Zhang D, Guo Y, Taghizadeh-Hesary F (2023) Green finance and energy transition to achieve net-zero emission target. Energy Econ 126:106936. https://doi.org/10.1016/j.eneco.2023.106936

Zhao L, Rasoulinezhad E (2023) Role of natural resources utilization efficiency in achieving green economic recovery: evidence from BRICS countries. Resour Policy 80:103164. https://doi.org/10.1016/j.resourpol.2022.103164

Acknowledgements

This study is supported by 2024 Anhui Province Youth Teacher Training Action Project (NO.YQYB2024058); 2023 Anhui Province Quality Engineering Project Phase Achievement (No. 2023sxzz068).

Author information

Authors and Affiliations

Contributions

Yanqiang Lou: Conceptualization, supervision, resources, writing review and editing; Data curation, writing original draft preparation.

Corresponding author

Ethics declarations

Competing interests

The author declares no competing interests.

Ethical approval

This article does not encompass studies involving human participants conducted by any of the authors.

Informed consent

This article does not include any studies involving human participants conducted by the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Lou, Y. Green finance market and carbon neutralization capacity in China. Humanit Soc Sci Commun 12, 261 (2025). https://doi.org/10.1057/s41599-025-04429-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-025-04429-3