Abstract

The digital reform of tax administration occupies a pivotal role due in enhancing governmental governance capabilities in the digital era. We consider China’s “Golden Tax Phase III” project (GTP3P) as a representative digital reform of tax administration. Utilizing a multi-phase DID model, we analyze the impact of GTP3P on the stock market, with a particular focus on corporate stock price crash risk (SPCR). Our findings reveal a significant reduction in SPCR subsequent to the GTP3P implementation. After performing parallel trend test, dealing with endogeneity concerns, and estimating the double machine learning model, we confirm baseline findings again. Heterogeneity analysis indicates that the influences of GTP3P on SPCR is asymmetrical. In the mechanism analysis, we verified that tax administration reform significantly enhances information disclosure, which guarantees a reduction of SPCR. Finally, we perform a further analysis examining investors’ holding preferences. Contrary to expectations, we observed a decrease in stock liquidity and the shareholding of long-term and fund investors, attributed to the escalated tax burden and diminishing business benefits post-reform. This study presents an innovative perspective on the corporate implications of digitization.

Similar content being viewed by others

Introduction

The stock market, often regarded as the “barometer” of economic activity, constitutes a fundamental component of the financial systems in economies worldwide. It performs critical functions, including optimizing the allocation of capital and risk, transmitting and reflecting market information, and addressing the financing needs of enterprises while catering to the investment demands of individuals (Arestis et al. 2001; Chen et al. 2023b). Traditional financial development theory posits that financial development serves as a catalyst for economic growth. However, global financial development practices have increasingly revealed vulnerabilities in financial systems, accompanied by a notable rise in the frequency and intensity of financial market shocks (Wang et al. 2023).

Over the past decade, abnormal stock market fluctuations have become more frequent (Chen et al. 2023a; Jiang et al. 2022b; Fan and Zhang, 2024). For instance, consider the case of Meta, a leading U.S. technology company. On February 3, 2022, Meta experienced a historic 26.39% decline in market capitalization, representing the largest single-day loss in U.S. market history. Later that year, on October 27, Meta’s market value plummeted by another 24.56%. These substantial declines in the share prices of major corporations have heightened public and governmental awareness of stock price crash risk (SPCR). SPCR refers to the sudden, dramatic, and unpredictable collapse of stock market indices or individual stock prices (Fan and Zhang, 2024).

The efficient functioning of capital markets is critical, as they mobilize, aggregate, and allocate financial resources, thereby serving as a powerful driver of economic development (Afghahi et al. 2024). However, stock price crashes, characterized by their abruptness, speed, and potential for contagion, have far-reaching consequences. Such crashes erode corporate shareholder wealth, reduce social welfare (Chen et al. 2023a), and trigger widespread investor panic and withdrawals. This, in turn, escalates corporate capital costs, disrupts market confidence, and ultimately leads to the misallocation of economic resources. Frequent stock price crashes also amplify the risk of systemic market collapse through cross-contagion, threaten the stability of financial systems, and exacerbate financial risk (Hong and Stein, 2003; Piotroski et al. 2015). Consequently, mitigating SPCR has become an increasingly important area of academic inquiry in recent years (Jiang et al. 2022b; Eugster and Wang, 2023; Pham and Nguyen, 2023). Addressing SPCR is not only essential for safeguarding financial stability but also for ensuring the efficient operation of capital markets and fostering sustainable economic development.

The concentrated release of adverse news has been widely identified as a direct catalyst for corporate SPCR (Jin and Myers, 2006; Hutton et al. 2009; Jiang et al. 2022b). Drawing on agency theory and information asymmetry theory, prior research highlights that managerial hoarding of negative information and financial manipulation are key drivers of extreme stock price risks (Kim et al. 2011; Kim et al. 2014; Hutton et al. 2009). Consequently, efforts to mitigate SPCR have primarily focused on enhancing the quality of information disclosure, curbing managerial opportunistic behavior, and improving the availability and accessibility of information for investors (Afghahi et al. 2024; Yuan et al. 2024).

Scholars have devoted significant attention to accounting-related determinants of SPCR (e.g., Robin and Zhang, 2015; Kim et al. 2022; Richardson et al. 2022; Au et al. 2023; Cho et al. 2023; Liu et al. 2024a), as well as internal governance factors, such as executive characteristics (e.g., Pham and Nguyen, 2023; Choi et al. 2022; Kumar and Mohnot, 2024; Liu et al. 2024b), board characteristics (e.g., Cao et al. 2019; Hu et al. 2020), and internal control mechanisms (e.g., Lobo et al. 2020; Chen et al. 2017; Lee et al. 2024; Zhang et al. 2024). Additionally, an emerging body of literature has underscored the significance of external governance-related determinants (e.g., Lu and Qiu, 2023; Chen et al. 2022a; Wang and Qiu, 2023; Chen et al. 2023a; Sun, 2023; Gan et al. 2024). Among these external factors, government intervention has been recognized as a particularly effective mechanism for mitigating SPCR (e.g., Chen et al. 2022a; Sun, 2023; Chen and Chen, 2024; Shi et al. 2024). The jurisdictional authority of governments enables regulatory bodies to influence economic incentives and restrict firms’ ability to conceal unfavorable information, thereby reducing extreme stock price risks.

Among government-related factors, the role of tax authorities is especially critical. Tax administration is directly linked to tax revenue, a vital economic resource for governments (Desai et al. 2007; Chen et al. 2022a; Ye et al. 2023). Tax authorities maintain access to detailed corporate tax-related information and, due to the coercive nature of tax regulation, possess a unique ability to influence corporate behavior. Transformations within tax authorities, particularly in terms of digitalization and oversight capabilities, have the potential to reduce information asymmetry at the corporate level. By enhancing the transparency of corporate financial practices, such transformations can serve as a mechanism to mitigate SPCR. Exploring the impact of tax authority reforms on corporate SPCR is therefore of significant academic and practical relevance. It offers critical insights into how government-led initiatives can stabilize capital markets through readily implementable and enforceable measures. Such measures not only contribute to reducing SPCR but also strengthen the broader financial system by fostering transparency and accountability within the corporate sector.

This study aims to investigate corporate SPCR through the lens of the digitization of tax administration. On one hand, the digital economy is increasingly recognized as a key driver of global economic growth (Goldfarb and Tucker, 2019; Verhoef et al. 2021; Jiang et al. 2022b; Zhou et al. 2023). Leveraging digital technologies to enhance governmental governance capabilities has become a central focus of government transformation in the digital era. In the realm of tax collection and administration, governments across the globe are progressively adopting digital technologies to collect and process tax-related information and to monitor taxpayer compliance (Slemrod et al. 2017; Bassey et al. 2022; Almunia and Lopez-Rodriguez, 2018; Okunogbe and Santoro, 2022). Examining digital tax administration provides valuable insights into the governance effectiveness of digital government initiatives. On the other hand, while existing research has explored the economic implications of digital tax administration, it has predominantly focused on areas such as tax compliance (Slemrod et al. 2017; Li et al. 2020; Almunia and Lopez-Rodriguez, 2018; Mascagni et al. 2021; Bellon et al. 2022; Bellon et al. 2023), financial performance (He and Yi, 2023), tax burdens (Okunogbe and Pouliquen, 2022), and investment efficiency (Zhang et al. 2023). However, limited attention has been given to how capital markets respond to digital tax administration reforms. This study seeks to address this gap by exploring the impact of digital tax administration on stock market dynamics, particularly focusing on SPCR and stock liquidity. By examining how digitalization in tax administration influences corporate stock behavior, this research provides new insights into the intersection of digital governance and capital markets, thereby contributing to the broader understanding of the economic effects of digital government initiatives.

This study leverages the implementation of China’s “Golden Tax Phase III” project (GTP3P) as a proxy for the digitization of tax administration and examines its impact on corporate SPCR among Chinese public enterprises. Several factors support the suitability of GTP3P as both a research focus and an empirical instrument. First, China has made substantial efforts to digitize its tax system, with GTP3P representing a major milestone in this transformation. GTP3P integrates advanced technologies, such as Internet-based platforms, cloud computing, and big data analytics, enabling the comprehensive integration and analysis of tax-related data. This upgrade marks a significant leap in the digital modernization of China’s tax administration, making GTP3P an ideal proxy for studying the effects of tax digitization. Second, the phased rollout of GTP3P across various provinces and cities since 2013 offers a unique quasi-experimental setting. This staggered implementation allows for the construction of a multi-phase DID model to evaluate the causal effects of tax digitization on SPCR. Third, while digital tax systems have been established in developed economies for some time (Bassey et al. 2022; Almunia and Lopez-Rodriguez, 2018), the digital transformation of taxation in developing countries remains in its early stages (He and Yi, 2023). As the largest developing country, China’s experience provides a critical case for understanding the implications of tax digitization in similar emerging market contexts. Fourth, the dominance of individual investors has exacerbated the volatility of the Chinese stock market (Wan et al. 2024), making it particularly susceptible to SPCR. For example, between July and September 2015, the Shanghai Composite Index experienced a sharp decline of 28.63%. Other notable instances, such as the dramatic stock price collapse of Zhangzidao in 2018 and the more than 300 listed companies that saw declines exceeding 30% in 2021, underscore the prevalence of SPCR among Chinese firms. These events highlight the relevance of the Chinese market as a suitable setting for exploring how tax digitization influences SPCR.

Theoretically, the digitization of tax administration holds significant potential to enhance corporate transparency and reduce SPCR. On one hand, digital tax systems employ advanced technologies, such as electronic invoicing and big data analytics, enabling the direct, accurate, and timely transfer of tax-related data from firms to tax authorities. This reduces the ability of companies to engage in tax evasion or financial manipulation. On the other hand, digital tax systems incorporate features such as risk early-warning modules and strengthened internal risk monitoring mechanisms. These capabilities not only improve tax authorities’ oversight but also enhance internal corporate governance, thereby increasing the difficulty for managers to hoard negative information or engage in opportunistic behavior. According to information asymmetry theory and agency theory (Jin and Myers, 2006; Hutton et al. 2009; Jiang et al. 2022b), reducing information asymmetry and curbing managerial opportunism are critical factors in mitigating SPCR. By increasing the transparency and accountability of corporate financial practices, the digitization of tax administration systems has the potential to significantly lower the risk of stock price crashes. Thus, this study contributes to the literature by investigating how digital tax reforms influence SPCR, offering new insights into the intersection of tax policy, corporate governance, and financial market stability.

The results of the multi-period DID model strongly support our hypothesis. To ensure the robustness of these findings, we conducted a series of validation tests, including parallel trend tests, the substitution of dependent and independent variables, addressing potential endogeneity concerns, and other complementary analyses. Additionally, we employed the double machine learning model (DMLM) to strengthen causal inference. The observed negative association between digital tax administration and corporate SPCR remains robust across these tests. Moreover, heterogeneity analysis reveals significant asymmetries in the baseline effects, highlighting the differentiated impacts of digital tax reforms across firms. In exploring the underlying mechanisms, we confirm the mediating role of information asymmetry, demonstrating that tax administration reforms significantly enhance the quality of corporate information disclosure. Finally, we extend our analysis to investor behavior, finding that digital tax reforms reduce stock liquidity and decrease the proportion of long-term investors. This outcome suggests a general aversion among investors to digital tax reforms, offering important insights into how such initiatives are perceived in capital markets.

This study expands the scope of research on the digitization of tax administration by offering novel insights into the economic implications of digital tax regulation. While previous studies have predominantly focused on the relationship between digital taxation and corporate behavior, this research leverages the phased implementation of China’s GTP3P as a natural experiment to examine the effects of digital tax administration on stock market dynamics, with a particular emphasis on extreme SPCR and stock liquidity. Importantly, the study not only validates the mediating role of information asymmetry but also conducts a comprehensive heterogeneity analysis, considering key factors such as ownership structure, firm size, institutional investor participation, internal control mechanisms, and financing dependence. This multifaceted approach allows for the derivation of nuanced conclusions and the formulation of refined policy recommendations that address the diverse impacts of digital tax administration across varying corporate contexts. In addition, the integration of machine learning techniques enhances the analytical rigor of this study, offering both methodological innovations and a benchmark for future research on digital tax administration. By doing so, this study makes significant contributions to the growing body of literature on government digitization, while simultaneously providing actionable insights for policymakers seeking to balance the advantages of digital tax reforms against their potential repercussions on capital market stability and investor behavior.

This research also contributes meaningfully to the broader literature on the digital economy. While prior studies have largely focused on enterprise digitization (e.g., Jiang et al. 2022b; Zhou et al. 2023) and industry-level digitization (e.g., Ouyang et al. 2023; Jiang et al. 2022a), this study enriches the empirical evidence on the interaction between capital markets and the digital economy from a digital government perspective. Furthermore, while a substantial body of research suggests that the digital economy fosters value creation, this study provides a counterpoint by demonstrating that the digitization of tax administration can negatively influence stock liquidity and overall financial performance.

Moreover, this research extends the discourse on the relationship between government actions and extreme risks associated with corporate stock prices. The existing literature has primarily explored this relationship through the lenses of policy implementation and equity control. However, the evolution of digital technology and the digital economy necessitates a reevaluation of government digitization, an area that has been underexplored in discussions about the determinants of SPCR. By addressing this gap, this study sheds light on investor sentiment towards digital reforms in governmental functions and provides a critical assessment of how such reforms influence corporate stock price risks and capital market behavior.

The structure of the document is organized in the subsequent manner: The second section encompasses a review of relevant literature, foundational background, and theoretical analysis. The third section delineates the model, outlining its variables and the data utilized. The fourth section details the empirical process, while the final section offers conclusions and policy recommendations.

Literature review, background and theoretical analysis

Researches on the determinants of stock price crash risk

The sudden and severe decline in a company’s stock price, commonly referred to as SPCR, has been extensively examined in the academic literature (Chen et al. 2001; Jin and Myers, 2006; Hutton et al. 2009; Jiang et al. 2022b). Existing studies predominantly investigate the determinants of SPCR at the firm level through the theoretical frameworks of agency theory and information asymmetry theory (Jin and Myers, 2006; Hutton et al. 2009). Agency problems often drive managers to withhold unfavorable information for personal or self-serving reasons, while the opaque environment created by information asymmetry enables and exacerbates such concealment. The prolonged suppression of negative information inflates stock prices, which are prone to sharp corrections when adverse information is disclosed in aggregate (Hong and Stein, 2003). These theoretical perspectives form the foundation for much of the existing research on the causes of and potential strategies to mitigate SPCR.

A significant portion of the literature focuses on corporate governance factors, including managerial traits, board composition, and ownership structures. Corporate governance influences agency conflicts, shaping managerial incentives to withhold negative news and impacting internal risk management. The board of directors, for instance, plays a critical role in supervising managerial behavior, while ownership structures determine the alignment of stakeholder interests and the motivation for oversight. Recent studies confirm that specific governance attributes can constrain managerial tendencies to hoard bad news and reduce information asymmetry, thereby affecting SPCR. For example, evidence suggests that internally promoted CEOs (Choi et al. 2022), executives with legal backgrounds (Huang and Ho, 2023), CEO stock gifts (Pham and Nguyen, 2023), CEOs with weaker decision-making power (Al Mamun et al. 2020), academic independent directors (Jin et al. 2022), board feature (Yuan et al. 2024) and financial audit experts (Cho et al. 2023) contribute to mitigating SPCR. Similarly, minority shareholder activism (Wang and Qiu, 2023), institutional cross-ownership (Hou and Liu, 2023) and organization capital (Chen et al. 2024) and controlling shareholders’ stock pledges (Ren et al. 2024) have been linked to improved transparency and reduced crash risk.

Operational strategies can also reshape the information environment of firms, alleviating information asymmetry and reducing SPCR. For instance, corporate social responsibility initiatives (Kim et al. 2014; Dumitrescu and Zakriya, 2021), ESG disclosures (Zaman et al. 2021; Yu et al. 2023; Chebbi, 2024; Zhou et al. 2024), human capital quality (Si and Xia, 2023), digitalization (Jiang et al. 2022b), online interactions (Li et al. 2023), customer concentration (Afghahi et al. 2024), supply chain transparency (Zhong et al. 2024) and diversification strategies (Wang et al. 2023) have been found to enhance transparency and mitigate crash risk. The social-ecological characteristics of a firm’s headquarters location can trigger strategic choices that affect SPCR, such as local speculative culture (Zuo et al. 2023), local gambling attitudes (Yu et al. 2024) and terrorist attacks (Liu et al. 2024c).

Beyond firm-level factors, government regulation plays a critical role in shaping SPCR by influencing corporate incentives and determining the extent to which negative information can be concealed. Governments, particularly those holding equity stakes in corporations, often act as stakeholders by monitoring or directly influencing internal governance mechanisms. Recent studies underscore the impact of government intervention in enhancing corporate governance and mitigating SPCR. For instance, Sun (2023) found that government-controlled firms in China exhibit stronger governance practices and reduced financial opacity, thereby decreasing the likelihood of stock price crashes. Similarly, Zhang et al. (2023) demonstrated that the involvement of Chinese party and government entities strengthens governance structures and mitigates SPCR. Policy implementation can also function as a signaling mechanism. Chen et al. (2023a) showed that the enforcement of green credit policies heightened external oversight over highly polluting firms, leading to a reduction in SPCR. Using the issuance of inquiry letters by stock exchanges as a proxy for non-punitive supervision, Lu and Qiu (2023) revealed that such oversight compels firms to disclose more information, alleviating information asymmetry and lowering SPCR. Xu et al. (2023) documented that the consolidation of China’s State Administration of Taxation and local tax bureaus significantly reduced SPCR by enhancing tax enforcement. Similarly, Sun et al. (2024) analyzed panel data from Chinese A-share listed firms (2010–2022) and found that government green subsidies reduced SPCR by alleviating financing constraints and improving investor sentiment. Supporting these findings, Li and Huang (2024) reported that the New Asset Management Regulations reduced SPCR by enhancing financial stability.

However, not all government initiatives have a mitigating effect on SPCR. Shi et al. (2024) observed that participation in China’s Targeted Poverty Alleviation program increased SPCR, as firms engaged in higher earnings management to maintain favorable reputations. Makrychoriti and Pyrgiotakis (2024), using Brexit as a quasi-natural experiment, identified a positive association between firm-level political risk and SPCR. In contrast, Dong et al. (2024) showed that the centralization of regulated information through national databases effectively reduced SPCR in European Union countries.

While the existing literature provides detailed insights into the relationship between government actions and SPCR, it primarily focuses on policy implementation and equity control. With the advent of digital technology, government oversight has increasingly transitioned from traditional offline methods to big data-driven monitoring. The impact of government digitization on firm behavior has become an unavoidable topic, yet the role of digital tools in addressing SPCR remains underexplored. This study seeks to fill this gap by examining how the digitization of tax collection and administration influences SPCR. Specifically, we investigate whether digital tax reforms reduce SPCR and explore how investors perceive and react to these technological advancements in government oversight. By expanding the discussion on the intersection of government digitization and SPCR, this paper offers new insights into the implications of digital governance for corporate transparency and risk management.

Background

Tax revenue constitutes a vital financial pillar for governments (Pomeranz and Vila-Belda, 2019). Reforms in tax collection and administration are primarily driven by the objective of enhancing efficiency and simplifying compliance, thereby fostering the dual advancement of fiscal revenues and economic development. In China, issues such as tax evasion and avoidance have been particularly pervasive. According to the Chinese State Administration of Taxation, in 2015 alone, 250 anti-tax avoidance investigations were launched, resulting in a substantial increase of nearly 60 billion yuan in tax revenue. To address these challenges, Chinese authorities have significantly augmented investments in human resources for tax enforcement. Between 1994 and 2013, the tax workforce expanded by approximately 150,000 employees. Nonetheless, this growth has struggled to keep pace with the rapid proliferation of enterprises amid China’s fast-evolving economy. Consequently, a strategic pivot toward integrating advanced information technology into tax collection and administration has emerged as a critical imperative for enhancing operational capacity.

In this context, the Chinese government initiated the “Golden Tax Project” (GTP) in 1994, aiming to progressively modernize the IT infrastructure supporting its tax system. Officially termed the China Tax Management Information System, the GTP has undergone four developmental phases since its inception. The first phase, implemented between 1994 and 1998 across 50 Chinese cities, prioritized the establishment of systems such as the value-added tax (VAT) anti-counterfeiting tax control system and the VAT special invoice cross-checking system. These measures were instrumental in reinforcing the broader reforms of the industrial and commercial tax framework, particularly in addressing issues like the forgery and fraudulent issuance of VAT invoices.

The subsequent phase, “Golden Tax Phase II,” launched in 1998, sought to rectify limitations in data accuracy, omissions, and inefficiencies identified during the first phase. This phase introduced four core modules: the VAT anti-counterfeiting tax control invoicing subsystem, certification subsystem, VAT audit subsystem, and invoice information management subsystem. While these enhancements improved VAT administration efficiency, they fell short of addressing the increasingly complex demands of tax audits and the comprehensive coverage of tax entities. The escalating intricacies of tax-related data and the expanding scope of tax collection highlighted the limitations of Phase II’s technology and operational framework. To address these challenges, the Chinese government introduced the “Golden Tax Phase III Project” (GTP3P), which represents a transformative leap in tax administration. This phase leverages cutting-edge digital technologies such as big data analytics and cloud computing to optimize the collection, processing, and verification of tax-related data. GTP3P is grounded in three strategic objectives. First, it aims to establish a centralized technical infrastructure integrating network hardware and foundational software to standardize and enhance the quality of national tax data. This unified system facilitates seamless interconnectivity among various tax departments, enabling robust cross-verification, procedural oversight, and centralized data management within both national and local tax agencies. Consequently, the project delivers a consolidated, nationwide perspective on tax data. Second, GTP3P addresses informational asymmetries between central and local government entities by fostering data sharing across diverse institutions, including tax bureaus, statistics agencies, financial institutions, commercial administrations, and social security offices. Third, through automated data verification, matching, and analysis, GTP3P significantly enhances the precision and efficiency of tax risk assessments conducted by tax authorities, thereby improving the effectiveness of tax inspections. By integrating internet technology, big data, and cloud computing, GTP3P achieves comprehensive data synthesis and analysis across the National Tax Bureau, local tax bureaus, and third-party sources. This phase signals a profound digital transformation of China’s tax administration, setting a new benchmark for leveraging technology to streamline and secure fiscal processes.

The implementation of GTP3P has established a unified national tax platform, integrating tax departments across the country through a phased rollout of pilot programs and systematic deployment. Specific timelines for these initiatives will be discussed in subsequent sections. Recent studies have examined the economic ramifications of GTP3P (Ye et al. 2023; He and Yi, 2023; Zhang et al. 2023; Li et al. 2020). Recent studies have extensively explored the economic impacts of the GTP3P, revealing its multifaceted effects on corporate behavior and market outcomes. A significant body of research suggests positive effects: the digital tax administration has enhanced corporate information disclosure quality (Ye et al. 2023), improved ESG performance (Hai et al. 2024), reduced R&D manipulation (Pang and Hua, 2024), and mitigated inefficient investment (Guo et al. 2024). The system has also shown broader social impacts by narrowing corporate salary disparities (Wei et al. 2024) and promoting job creation (Cheng et al. 2024). However, some studies highlight adverse effects, indicating that the digital overhaul has increased corporate tax burdens (Li et al. 2020) and negatively impacted corporate performance and investment levels (He and Yi, 2023).

While the intersection of the digital economy and capital markets has garnered attention, the specific responses of capital markets to the digitization of China’s tax system remain underexplored. This study seeks to bridge this gap by providing a comprehensive investigation into the implications of tax system digitization on capital market dynamics, thereby contributing to a nuanced understanding of the broader economic impacts of digital tax reforms.

Theoretical analysis: Digital tax administration and stock price crash risk

This paper argues that the transition to digital tax systems transforms corporate information transparency, which subsequently influences financial practices, corporate governance, and the information asymmetry faced by investors.

Digital tax systems enhance financial oversight and curtail tax evasion. First, the adoption of digital tools in tax collection and administration, leveraging technologies such as online invoicing and advanced data analytics, facilitates the seamless transmission of tax-related data from corporations to tax authorities. This enables real-time monitoring of corporate operations and production activities, effectively addressing the deficiencies of traditional manual tax processes. Second, the “Golden Tax Phase III” (GTP3P) system empowers the State Administration of Taxation to centrally manage and archive tax-related data, encompassing detailed records of purchases, production, and sales across diverse industries and regions. Third, utilizing big data technology, tax authorities can precisely identify and monitor electronic invoices by tracking amounts and tax numbers, while cross-referencing discrepancies between VAT input and output invoices through taxpayer identification numbers. Fourth, the GTP3P system enhances commodity tracking using barcode technology, enabling tax authorities to more accurately assess business inventory and financial standing. Collectively, digital tax administration ensures the immediacy, integration, and digitization of tax-related data. By consolidating information from multiple sources, the GTP3P significantly raises barriers for corporations attempting financial manipulation and tax evasion.

Digital tax administration strengthens financial compliance and fortifies corporate governance. The GTP3P system incorporates an early-warning risk module, which employs big data analytics to flag high-risk entities and regions. By benchmarking financial metrics against tax data within similar industries, the system swiftly identifies enterprises with irregularities, compelling them to clarify, report, and rectify questionable practices. Moreover, digital tax administration eliminates the reliance on manual verification by local tax officials. By centralizing tax processing across provincial and national levels, the GTP3P minimizes opportunities for collusion, curbing exploitative behaviors and fraudulent practices. Consequently, the digitization of tax management intensifies internal risk surveillance, reduces financial opportunism, and enhances the overall integrity of corporate governance, making it increasingly difficult for managers to conceal adverse information.

Digital tax administration also improves the quality of information disclosure and mitigates information asymmetry for investors. First, the GTP3P facilitates data integration and interdepartmental information sharing, enabling tax authorities to comprehensively collect corporate information from diverse sources. This cross-verification capability significantly enhances tax oversight, bolsters corporate transparency, and discourages financial manipulation, thereby improving the authenticity and timeliness of corporate disclosures. Second, the introduction of the “Trial Measures for the Administration of Tax Credit Rating Assessment” in 2002 allows tax authorities to evaluate enterprises based on criteria such as tax compliance, payment history, and avoidance behaviors, assigning ratings (A, B, C, D) accordingly. Publicizing the list of A-rated enterprises under GTP3P enables investors to better assess corporate performance and operational health. Conversely, enterprises with lower ratings or flagged by tax authorities are more likely to be scrutinized, allowing investors to conduct timely and informed analyses of their conditions.

As previously noted, information opacity is a significant driver of extreme SPCR. From an investor’s perspective, opacity impedes access to timely and accurate information on corporate performance, leading to decisions based on incomplete or distorted data. From a corporate perspective, transparency deficits allow managers to obscure negative developments, misleading stakeholders about the true financial health of the firm. Additionally, opacity exacerbates agency problems in poorly governed firms, as executives may intentionally withhold adverse information for personal gain. When such information eventually surfaces, it can result in significant stock price volatility. Furthermore, opacity reduces oversight, fostering behaviors such as tax avoidance, which may initially appear beneficial by preserving internal funds for reinvestment. However, when uncovered, such practices can trigger severe financial penalties and reputational harm.

From the lens of principal-agent theory, tax avoidance represents a risky yet ostensibly profitable strategy that management may pursue to increase after-tax cash flows, often at odds with shareholder interests. This behavior typically requires a veil of secrecy, further deepening firm-level information asymmetry. Over time, undisclosed negative information accumulates, reaching a tipping point that can precipitate sudden and severe stock price crashes. Under robust and digitally enforced tax administration, however, the opportunity costs of tax avoidance rise significantly, diminishing its appeal and mitigating principal-agent conflicts over tax-related decisions. This regulatory shift incentivizes more timely disclosure of adverse information, curbing the risk of extreme stock price collapses. Consequently, digital tax systems not only enhance corporate transparency but also align managerial behaviors more closely with shareholder and societal interests.

In sum, digital tax administration reduces information opacity, thereby improving corporate financial practices, strengthening internal governance mechanisms, and enhancing the accessibility of information for investors. Ultimately, these improvements contribute to a reduction in SPCR, fostering greater stability within financial markets.

Methodology, variables, and data

Methodology

We generate a multi-period difference-in-difference model to assess the association between tax administration reform and corporate SPCR. The multi-period DID model is as follows:

where i, c, t, and j denote the enterprise, city, and year, respectively. \({{Crash}}_{{cit}}\) represents the SPCR of a corporation. \({{GT}}_{c,t}\) refers to the implementation of tax collection and management reform. \({X}_{{cit}}\) are vectors of firm-level control variables, respectively. To mitigate possible endogeneity, we include \({\gamma }_{t}\), \({\delta }_{i}\), and \({\tau }_{c}\) denoting the year, firm, and city fixed effects, respectively. \({\varepsilon }_{{it}}\) is the error term. The coefficient \({\beta }_{1}\) measures the effect of tax administration reform on corporate SPCR. A negative and significant \({\beta }_{1}\) implies that tax administration reform alleviates corporate SPCR. Moreover, our analysis adopts the PSM, placebo test, and DMLM to address endogeneity concerns.

Variable setting

Stock price crash risk

SPCR represents an unexpected extreme decline in stock prices (Jiang et al. 2022b; Hutton et al. 2009; Afghahi et al. 2024). This extreme risk differs from a decline in market indices. This extreme risk is different from the decline in market indices, as it is caused by heterogeneous fluctuations due to the concentrated release of negative news from the company. Therefore, the key to measuring SPCR is to measure the company’s idiosyncratic returns independent of market fluctuations. We run the following model:

\({r}_{i,w}\) is the stock return of corporation i at week w; rm,w is the market return of corporation \(i\) at week \(w\); \({\varepsilon }_{i,w}\) is the error term, indicating the portion of stock returns that cannot be correlated with market returns. This study sets the firm-specific weekly return \({W}_{i,w}\).

he calculation method of market return includes market value weighted average and equal weighted average. The main risk indicator for SPCR in this article is the upper-lower volatility calculated by market value weighted market returns.

\({D}_{{up}}\) and \({D}_{{down}}\) refer to the number of weeks when the weekly stock returns of corporation \(i\) are larger and smaller, respectively, than the annual average return. A larger \({Crash}\) implies the greater SPCR. In the robustness checks, we attempt to use the alternative risk indicators.

Tax administration reform

Building on existing research (Ye et al. 2023; Zhang et al. 2023; Li et al. 2020), this investigation utilizes the “Golden Tax Phase III” project (GT) as a proxy for assessing the digitization of tax collection and administration. Since 2013, the GT project has been incrementally introduced in different provinces and cities. Initially, in 2013, it was deployed in Chongqing, Shanxi, and Shandong. The following year, 2014, saw the rollout in Guangdong (Shenzhen not included), Henan, and Inner Mongolia. By 2015, the project was operational in an additional 14 provinces, including Hainan, and by 2016, it extended to encompass the entire nation. Table 14 details the specific launch dates of the GT project across various regions. The GT serves as a binary indicator; it is set to 1 following the project’s implementation in the enterprise’s region, and 0 otherwise.

Control variables

We include a series of corporate-level control variables, as indicated in previous research (Kim et al. 2011; Jiang et al. 2022b), to account for potential missing variables. We add variables reflecting corporates’ fundamentals, containing the firm-level gross profit margin (Mar), sales revenue growth rate (Saleg), the corporate scale (Size) and financial leverage (Lev). Regarding that internal governance is related to corporate’s SPCR (Andreou et al. 2016; Hu et al. 2020), we include two variables, the percentage of independent directors (Du) and the shareholding of the largest shareholder (Top). Following previous researches (e.g., Jiang et al. 2022b), we controlled for the average return on stocks (StockM) and the standard deviation of stock prices (StockV) to absorb interference from market changes. Definitions of these variables are provided in Table 13.

Data and description

The dataset employed in this research encompasses annual records from A-share listed corporations in both Shanghai and Shenzhen, China, covering the years from 2009 to 2020. To enhance data integrity, we excluded data points associated with ST and *ST companies as well as those from the financial sector. Furthermore, to reduce the effect of statistical anomalies, all continuous variables were winsorized at the 1% threshold. Verification of the implementation dates for the GTP3P was conducted through direct consultations with the tax bureau. Corporate financial metrics were sourced from the CSMAR database, whereas city-specific data were obtained from local statistical annuals and official governmental reports. Descriptive statistics for the studied variables are delineated in Table 1. The mean indicator for GT stands at 0.501, suggesting that about half of the enterprises in our sample were impacted by the GTP3P during the analysis timeframe. The average value for Crash is registered at −0.222, with a standard deviation of 0.486, indicating a considerable divergence in SPCR among the observed firms. A comparative analysis of core variables such as Saleg, Mar, Lev, and Size with those documented in previous research (e.g., Jiang et al. 2022b; Zhou et al. 2023) shows negligible discrepancies, thereby affirming the robustness, reliability, and representativeness of our research sample relative to existing studies.

Empirical results

Baseline findings

Based on Eq. (1), we explore the effect of tax administration reform on the SPCR. Table 2 reports benchmark regression results. We have controlled year, firm, and city fixed effects in all columns. In column (1), excluding the firm-level controls, we find that tax administration reform significantly reduces the level of SPCR by 0.037. In columns (2)-(5), we perform similar regression with gradually adding variables that represent corporate business operation, corporate governance, and stock returns. We find the negative effects of tax administration reform on corporate SPCR remains. As revealed as column (5), the negative relationship between GT and Crash remains significant, and the coefficient estimate is 0.042, taking about 18% of the mean level of all enterprises. Our findings coincide with those of Kim et al. (2011), they confirm that corporate tax avoidance raises the SPCR. In this case, our administration reform as a coercive tax governance policy is expected to combat corporate tax evasion, which in turn reduces corporate SPCR. As for the controls, the large scale of cooperate assets and good stock returns are benefit for the reduction of SPCRs.

Robustness tests

We then conducted a battery of robustness tests to convince our baseline findings. This subsection includes three parts: parallel trend test, replace explained variables, replace explanatory variables, deal with endogeneity concern, and other complementary tests.

Parallel trend test

As Li et al. (2016) noted, an important prerequisite for quasi-natural experimental analysis of policies using DID model is “parallel trends,” which means that the treatment and control groups should exhibit similarity until the time of policy onset, i.e., they should have a common trend, or there should be absence of notable discrepancies in the explanatory variables (Crash) between the two groups. However, if the Crash of the two groups have significantly different development trends before the tax administration reform, it will lead to the deviation of the estimation of the treatment effect.

Here, we perform parallel trend test to exclude such concern. Following previous studies (Li et al. 2016; Jiang et al. 2021; Chen et al. 2022b), we perform the event study analysis based on the following model:

Here, \({T}_{{cit}}^{n}\) is a series of year dummy variables, it takes the value of 1 if the time period between the fiscal year and the establishment year of tax administration is n, where −8 = < n < = +5. It should be noted that n = +5 comprises the time period large than 5 to save space. We employ these dummy variables as explanatory variables for the regression, and drop the one year before tax administration reform to reduce collinearity. The coefficients of \({T}_{{cit}}^{n}\) reflect the differences between the treatment and control groups in a given year, that is, the differential trends between these two groups before and after the tax administration reform. \({X}_{{it}}\) is a series of control variables. \({\gamma }_{t}\), \({\delta }_{i}\) and \({\tau }_{c}\) are year, enterprise, and city fixed effects, respectively. \({\varepsilon }_{{it}}\) is the random error as above.

Table 3 reports the estimated coefficients of the \({T}_{{cit}}^{n}\), showing the dynamic effects of tax administration reform in different years. These coefficients are not significantly different from 0 before the tax administration reform although a positive estimate in three before this policy, indicating that no significant difference exists between treat and control groups before the policy point, that is, to meet the hypothesis of the parallel trend. The evidence also illustrates the continuing impact of tax administration reform on SPCR.

Replace variables

In this subsection, we replace the explained and explanatory variable to exclude the concerns about variables definition.

Following Jiang et al. (2022b), we use two alternative indicators (Crash2 and Crash3) to measure corporate SPCR. Crash2 is the risk of corporate SPCR calculated by negative return skewness coefficient according to the equal-weighted average method of submarkets, and Crash3 is the SPCR indicator calculated by negative return skewness coefficient using the average method of total market capitalization of the combined market. They are both collected from the CSMAR database. We perform similar regressions as Table 2 and report results in columns (1) and (2) of Table 4. Consistent with the findings in Table 2, we observe a notable mitigating influence of tax administration reform on corporate SPCR. The estimated coefficient is similar to the estimate in our baseline regression.

In the previous section, we defined the policy timing of tax administration by defining the implementation time in the second half of the year (later than June 30) as the next year’s implementation. For example, in Shanxi Province, the tax administration policy was implemented in October 2013, and considering that the time is very close to the next year, we take the implementation time of the tax policy as 2014 in baseline analysis. However, there may be some man-made errors in this practice. Here, we do not adjust the year anymore, and the tax administration implemented in that year is regarded as a policy shock in that year. Thus, the policy time for Shanxi province is 2013 at this point. In this case, we similarly adjust for the timing of tax administration reform in other areas and define a new policy effect variable GT2. The robustness result is shown in Column (3) of Table 4. It is evident that the negative effect of tax collection on the SPCR remains.

Endogeneity concerns

In this subsection, we discuss possible endogeneity issues because of omitted variables and model-setting problems. Here, regarding omitted variables, we try to control for the interference from potential omitted socioeconomic factors, conducting tests such as adjustment of control variables and change the fixed effects. Regarding model setting, we conducted placebo tests such as PSM, policy randomness, and adjustment of clustering standard errors.

Studies noted that the deterioration of audit quality aggravates the SPCR (Robin and Zhang, 2015; Fan and Xu, 2022). The independence, scale, expertise, and number of meetings of the audit committee will reduce the earnings management of enterprises. In this case, the audit quality assumes the role of external governance (Abbott et al. 2007), and we anticipate that it may mitigate SPCR to a certain degree. Therefore, our baseline model suffers from omitted variable problems. To cater this concern, we add audit quality (Audit) in Eq. (1) and re-perform regression. The coefficient estimate reported in Column (1) of Table 5 reveals a negative association between tax administration reform and SPCR, and a negative effect of audit quality as expected, though statistically insignificant.

In addition, the political connection of directors should also affect SPCR. Previous works like Lee and Wang (2017) found that appointing local government officials as corporate directors would help listed private holding enterprises reduce SPCR. Here, we exclude the omitted variables concerned owned to political connections. We define a dummy variable (Polground) based on the political background of the executives, which is defined as 1 when the executive has a history of political office (former and current) and 0 when the executive has no political history. A new baseline regression with Polground is conducted and the related result is reported in Column (2) of Table 5. Consistent with Table 2, the negative effects of tax administration reform on SPCR remain significant.

Given that we are using regional-level policy factors as the subject, then regional socioeconomic factors should also influence our interest in tax collection as well as SPCR. After all, firm behavior is influenced by the external macro environment and the industry environment. First, regional economic upswing periods are characterized by more active stock markets and are less likely to experience negative events such as stock price crashes. Second, the government’s relationship with the market inevitably affects its tax collection efforts and the performance of corporate behavior. Moreover, the government’s aggressiveness in tax collection is also related to its fiscal surplus, and when local finances are tight, officials are more likely to want to alleviate their financial woes through taxation, which may also affect corporate stock price performance in such cases. Therefore, we exclude this contextual factor by adding region GDP calculated as the logarithm of real GDP, marketability Index (Market), and the level of fiscal deficit (Deficit) based on the difference between fiscal revenue and expenditure. Related results are reported in Columns (3)-(5) respectively. We find the negative effects of tax administration reform on SPCR remain after excluding these factors.

In fact, it is difficult to quantify and exclude all contextual factors. However, considering that the majority of the confounding factors are either at the industry level or at the regional level, we can exclude them by controlling additional fixed effects. Here, apart from the baseline fixed effects specification, the two-way fixed effects by year and industry are also concluded in Eq. (1). Column (1) of Table 6 reveals a negative relationship between tax administration reform and SPCR, consistent with baseline findings.

As Li et al. (2016) pointed out, the use of quasi-natural experimental methods requires that the setting of the treatment object of the policy is random. In other words, the treatment group and the control group need to remain similar in other aspects except for the factor of policy variable, so that the final difference between the two is only caused by the policy object. In the benchmark analysis, we distinguish the treatment group and the control group based on whether the enterprise is subject to tax collection and management in the place of registration. However, the treatment enterprises and control enterprises are not necessarily similar in other aspects. To this end, we conducted an annual propensity score matching method (PSM) to find most similar control enterprises for the treatment enterprises and then carry on PSM-DID analysis. Following Deng et al. (2020), the proximity 1:3 matching method is employed and result is reported in Column (2) of Table 6. We find the tax administration reform significantly reduces corporate SPCRs. We also replace the explained variable with Crash2, Crash3 and perform another test. The result in Column (3)-(4) supports our baseline findings.

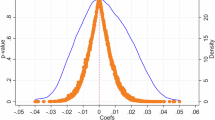

To address any lingering doubts regarding the assignment of entities into treatment and control groups and to mitigate the impact of latent variables, we conducted placebo tests as outlined by Li et al. (2016). In these tests, we randomly designated firms for treatment, introduced a fictitious treatment variable, Falsetreat, and recalculated our primary model using this artificially generated explanatory variable. This procedure was replicated 500 times. Figure 1 illustrates the distribution of Falsetreat’s regression coefficients across these simulations, along with the associated P-values on the vertical axis for each model iteration. The coefficients of Falsetreat appear to follow a standard normal distribution, with the majority of P-values exceeding 0.1, affirming that our initial results are robust against hidden variable bias and validating the group assignments. Additionally, we assessed the robustness of our findings through a random sample analysis concerning policy implementation dates, creating a hypothetical policy variable, Falsepolicy, and applying the same methodological approach. Figure 2 displays the estimated coefficients and P-values for 500 random policy simulations, where the coefficients predominantly cluster around zero, significantly below the actual observed effect of −0.041. This analysis lends further credence to our baseline assertions.

Moreover, we adjusted the standard errors in the baseline model. Regarding that the research subject of the article is company-level variables, the joint industry-year and the corporate clustering robust standard errors replace the use of city-year clustering standard errors. Findings in Columns (5) and (6) confirm that tax administration reform reduces SPCR remains significant.

Other robust tests

In this subsection, we conduct other robust checks to support our baseline findings. We eliminate the influence of synchronization interference, sample tests, and the impact of control variable changes.

First, although we have eliminated the problem of omitted variables due to social variables in the previous section, there remains the influence of other important factors. In particular, other tax policies in addition to tax administration reform bring disturbances. Essentially, different tax policies will all affect the tax burden of firms and thus their behavior. If this is the case, then our benchmark results are likely to be biased. To rule out this problem, we need to eliminate the effects of other tax policies over the same period. We find that in addition to the tax administration reform, firms are also affected by the VAT reformFootnote 1. Therefore, we need to exclude the role of VAT reform. We use the ratio of total VAT plus business tax to business revenue as a proxy for the VAT policy. We re-run the regression of Eq. (1) with the inclusion of VAT. The relevant results are reported in Column (1) of Table 7. This significant negative estimate of GT indicates that the baseline results remain.

Second, considering that tax administration reform fully implemented in China from 2017. At this time, all enterprises will be impacted by policies. There is no policy effect difference between the treatment and the control group. In this case, in order to accurately estimate the policy effect, we reserved the data from 2009 to 2017 for regression analysis. As Column (2) of Table 7 revealed, the negative effects of tax administration reform on SPCR remain significant, consistent with the estimate in Table 2.

Third, in addition to affect the SPCR, our control variables may also be affected by tax administration reform. For example, the Mar may be affected by tax administration reform. When the enterprise is faced with strict tax collection and management, it is difficult for the enterprise to evade taxes, and the increase of tax burden will correspondingly reduce the income of the enterprise, thereby reducing the Mar. Therefore, we will multiply the control variables and tax administration policies, replace the original control variables X in Eq. (1), and conduct analysis again. The estimate in Column (3) of Table 7 support our baseline findings. Here, we also multiply the control variables and year variables to further exclude potential interference. Then, we use these new control variables in Eq. (1). The last column of Table 7 also supports our baseline findings that tax administration reform reduces SPCR.

As previously mentioned, the digital economy affects various sectors including production, governance, and consumption (Verhoef et al. 2021; Wang et al. 2024). It involves the digitization of traditional industries as well as purely digital sectors. The adoption of digital technologies is not limited to government entities; enterprises are a significant force in the economic transition to digital (Du et al. 2024). The digitization of means of production helps businesses to timely understand, analyze, and visualize internal operational conditions, thereby reducing information asymmetry (Chen and Jiang, 2024). Consequently, digital transformation has a substantial direct impact on stock price fluctuations. In the digital economy era, it is common and logical for multiple sectors to develop their digital capabilities concurrently. The similar upward trends in both tax digitization and corporate digitization can undermine the reliability of baseline conclusions. This paper seeks to eliminate this uncertainty by incorporating the variable of corporate digitization into the baseline regression model. Following contemporary scholarly practices (Jiang et al. 2025), we utilized textual analysis to depict the extent of enterprises’ digital transformation. Column (5) of Table 7 displays the corresponding results. It is encouraging that the estimated coefficient for GT remains significant, and the change in its absolute value provides further corroboration of our concerns.

Finally, stock volatility is easily influenced by the market. The emergence of a financial crisis can temporarily disrupt the supply-demand dynamics that determine stock prices, leading to a significant impact on the stability of financial markets (Jiang et al. 2024). Considering that the dependent variable in this study is extreme stock price volatility, which is susceptible to the effects of financial crises, we have excluded samples from financial crises in our regression analysis. Column (6) of Table 7 shows that the stock price effect of GT still holds.

Double machine learning

This section introduces the DMLM as a robust methodological approach for enhancing predictive accuracy in causal inference. Traditional techniques, such as difference-in-differences and regression discontinuity, rely heavily on rigid theoretical assumptions and predefined linear relationships between independent and dependent variables. These limitations constrain their practical applicability, particularly in empirical predictions. Accurate estimation of policy effects requires minimizing the influence of extraneous variables on SPCR; however, addressing high-dimensional control variables poses challenges for conventional regression methods, often resulting in the “curse of dimensionality.” To overcome these limitations, Chernozhukov et al. (2018) developed the DMLM, which accommodates high-dimensional covariates and relaxes the restrictive linearity assumptions inherent in traditional models. This approach enables precise estimation of treatment effects without explicitly specifying the functional relationships among covariates, between covariates and primary explanatory variables, or between these and the outcome variable. By leveraging “instrumental variables,” DML corrects for the biases commonly associated with machine learning algorithms while mitigating the dimensionality issues of linear models. DMLM has increasingly been applied in causal inference across various domains (Yang et al. 2020; Bodory et al. 2022; Farbmacher et al. 2022). Following the methodologies proposed by Chernozhukov et al. (2018), this investigation employs both the partial linear model and the interactive model to assess the impact of event shocks on SPCR. Detailed descriptions of the models and their configurations are available in Chernozhukov et al. (2018).

Table 8, columns (1)–(4), displays predictions from the partial linear model. Regardless of covariate combinations, it consistently forecasts a significant reduction in SPCR by GT. Moreover, the interactive model corroborates this effect. Thus, the robustness of the foundational conclusions is confirmed.

Heterogeneous effects

Having established the negative relationship between tax administration reform and SPCR, we now investigate whether this effect varies across corporate ownership structures, industry characteristics, and regional features.

We begin by examining the heterogeneity of corporate ownership. Huang and Liu (2021) observe that SOEs are generally larger than non-SOEs, showing that SOEs are better equipped to withstand SPCR during periods of crisis. Similar findings are reported by Jiang et al. (2022b), who argue that SOEs exhibit greater resilience to risk due to their closer alignment with government oversight and the policy incentives they receive. In contrast, non-SOEs face lower levels of government intervention and protection, making them more vulnerable to SPCR. Consequently, if tax administration reform mitigates the risk of stock price crashes, this positive effect is expected to be more pronounced in non-SOEs. To test this hypothesis, we categorize the sample into state-owned and non-state-owned firms based on the effective controller of each enterprise and conduct subsample regressions using Eq. (1). The coefficient estimates for the tax administration reform variable (GT) are presented in Fig. 3. The results align with our conjecture, showing that tax administration reform significantly reduces SPCR among non-state-owned firms, while the effect on SOEs is less pronounced.

We next discuss whether the relationship between tax administration and SPCR varies across enterprises of different sizes. Large enterprises are usually well-capitalized and have more management experience to balance the returns and risks of the enterprise. Consistent with our benchmark analysis, we find that firm size is negatively correlated with SPCR. To investigate this further, we divide the sample into large-scale and small-scale firms based on the mean value of total assets across all enterprises and conduct a subsample analysis using Eq. (1). As illustrated in Fig. 3, the effect of tax administration reform on reducing SPCR is more pronounced among small-scale firms, suggesting that smaller enterprises benefit disproportionately from the reform’s stabilizing effects.

We also discuss if there is a heterogeneous response in industry attributes, such as whether it is a high-tech firm. Prior research indicates that firms in high-tech industries tend to invest heavily in R&D and are more engaged in the development of innovative technologies (Stam and Wennberg, 2009). These activities enhance productivity and R&D intensity, which have been linked to lower SPCR (Bai et al. 2022). In contrast, firms in non-high-tech industries face higher SPCR due to their relatively lower innovation capacities, suggesting that the effects of tax reform should be more pronounced for these firms. To test this hypothesis, we categorize the sample into high-tech and non-high-tech firms based on industry classification and conduct a subsample analysis. As shown in Fig. 3, the results reveal that the significant reduction in SPCR is concentrated among non-high-tech firms, while the effect is less pronounced in high-tech enterprises.

We investigate the variability attributed to internal control mechanisms. Chen et al. (2017) present empirical findings demonstrating a significant inverse relationship between the strength of internal controls and the probability of future stock price declines. Utilizing the average scores of internal control from a collective dataset of corporations, we divide the sample into two categories: those with robust internal controls and those with weak internal controls. The outcomes from our segmented regression analysis are detailed in Table 9. Columns (1) and (2) contrast firms based on their internal control capacities. The analysis indicates a more pronounced adverse effect of tax administration reforms on SPCR in companies with less stringent internal controls, underscoring the essential influence of governance quality in reducing the likelihood of stock price crashes.

Lamont et al. (2001) established that companies facing financial constraints tend to have lower stock returns and exhibit greater vulnerability to external economic disturbances, thereby highlighting the significant influence of financial limitations on stock market volatility. In a similar vein, Bae et al. (2021) explored how ESG factors intersect with SPCR, particularly focusing on the mediating effect of financial constraints. Their research suggests that although elevated ESG scores generally diminish SPCR, this positive impact is notably diminished in entities burdened by more substantial financial constraints. In our research, we categorize companies according to their financial constraint index (SA), as sourced from the CSMAR database. Entities with SA scores surpassing the mean are deemed highly constrained, whereas those below are considered less constrained. Columns (3) and (4) of Table 9 delineate the comparative analysis of SPCR among firms with different levels of financial constraints. The findings reveal that the marked negative influence of tax enforcement policies on SPCR predominantly affects firms with lower financial constraints, with no significant impact observed within highly constrained firms.

Institutional investors play a pivotal role in corporate governance by performing a crucial oversight function (Ni et al. 2020). Their significant stock ownership and extended investment duration provide them with a strong incentive to oversee company operations. This monitoring by institutions helps curb the accumulation of undisclosed negative information by management, which, when eventually disclosed, can lead to sudden and severe price corrections (SPCR). To investigate this further, we categorize our sample into two groups: one with institutional holdings above or equal to the average across all firms, and another with holdings below this threshold. We then apply the initial model separately to each group. Figure 4’s upper section highlights how tax administration reforms impact SPCR more distinctly in companies with fewer institutional investors.

There is no shortage of scholars discussing the response of investor sentiment in the stock market and finding that such sentiment does affect SPCR (Qadan and Nama, 2018), and there are also studies finding that investor sentiment affects stock returns (Paudel et al. 2022). In general, both high and low investment sentiment affect stock market performance. For the purposes of our analysis, we classify firms into two groups based on investor sentiment—high and low—using the average score of the CSMAR investor sentiment index as the benchmark. The lower section of Fig. 4 highlights the differences in coefficients between these groups. Our results reveal that the negative effects of tax administration reform on the likelihood of corporate SPCR are more pronounced among firms characterized by low investor sentiment, suggesting that sentiment plays a critical role in moderating the relationship between tax reforms and SPCR.

A robust rule of law environment is crucial in curbing managerial opportunism, safeguarding investor interests, and fostering the development of capital markets (La Porta et al. 1997). The regional rule of law environment exerts a binding influence on the comparability of corporate accounting information. In regions with stronger rule of law, firms exhibit lower levels of discretionary earnings management, and the quality of information disclosure for locally listed firms is significantly enhanced. Consequently, a favorable rule of law environment reduces the extent of earnings manipulation, ensures that stock prices more accurately reflect a firm’s true operational performance, and mitigates the risk of future stock price crashes. To empirically test this relationship, we adopt the marketization index employed by Liu et al. (2023) as a proxy for the regional rule of law environment, dividing the sample into two groups: high-marketization and low-marketization regions. Firms in the high-marketization group operate in regions where the legal system level meets or exceeds the national average. Subsample coefficient estimates are presented in Fig. 5. The results indicate that tax administration reform significantly reduces SPCR for enterprises located in low-marketization regions, suggesting that the reform’s impact is more pronounced in areas with weaker institutional frameworks.

Vo (2020) examines the relationship between international equity holdings and SPCR, employing various panel data analysis techniques. The study identifies a positive correlation between foreign investments and the likelihood of future SPCR. Similarly, Huang et al. (2020) explore the impact of international investors on firm-specific crash risk within the Chinese market, finding that foreign investments significantly increase SPCR. Building on these insights, our research investigates whether the effect of tax administration reforms on firm-specific SPCR varies with differing levels of reliance on foreign capital. To test this, we classify firms into two groups—high and low reliance on foreign capital—based on the average level of foreign capital dependence. Subsample analyses are conducted to evaluate the heterogeneity in effects. As illustrated in Fig. 5, our results reveal that tax administration reforms significantly reduce SPCR for firms with high dependency on foreign investments. This finding suggests that the stabilizing effects of tax reforms are particularly impactful for companies with greater exposure to international capital flows.

Potential channels of Tax administration on stock price crash risk

Having found the negative effects of tax administration on SPCR, we now aim to investigate the potential channels between them. According to the theoretical discussion in Section 2, we will analyze the mechanism from the perspective of information asymmetry.

Within the framework where ownership is distinct from management, it is observed that company executives, serving as agents, tend to conceal adverse details rather than disclose them, driven by personal gain or other benefits. Furthermore, to preserve the value of the company, these managers often accumulate unfavorable news to maintain stability in the stock market, especially when the company’s results are unsatisfactory or fall short of expectations. Managers have a potent incentive to suppress information that they believe would be disadvantageous for investors to discover. This creates a disparity in information between investors and the corporation. Though these practices might seem inconsequential in the short run, they can lead to severe repercussions over time. Accumulating too much hidden negative information can eventually lead to a crisis point where a sudden release of this accumulated bad news can cause a drastic plummet in the company’s stock prices, or in extreme cases, lead to a complete market collapse. Based on information asymmetry theory, it has been found in the literature that the lower the information transparency of a firm and the higher the degree of surplus management, the higher the risk of a firm’s stock price crash. To this end, we discuss whether tax administration reform is beneficial in mitigating the degree of information asymmetry and thus reducing SPCR.

Here, we use the quality of information disclosure of enterprises to reflect the degree of information asymmetry. With reference to Kim and Verrecchia (2001), the calculation method is as follows:

We take KV as the proxy variable of information disclosure quality, in which the higher KV value represents the lower information disclosure quality. As shown in Columns (1) and (2) of Table 10, we find that tax administration reform significantly reduces KV, which indicates an improvement in information asymmetry and a high level of information transparency. We also provide the estimates of the parallel trend test. We re-run Eq. (5) by replacing Crash with KV. T+5 had been dropped because of collinearity. Column (3) of Table 10 reports the estimated coefficients of the \({T}_{{cit}}^{n}\), showing the dynamic effects of tax administration reform on KV in different years. These coefficients are not significantly different from 0 before the tax administration reform, indicating that no significant difference exists between treat and control groups before the policy point, that is, to meet the hypothesis of the parallel trend.

We next run a mediation effects model to verify the pivotal role played by information asymmetry in the tax reform’s impact on stock price risk. We perform the following designs.

Tables 2 and 10 have shown the estimates of Eq. (8) and Eq. (9), respectively. Based on the theoretical analysis, information asymmetry increases SPCR, which predicts that the coefficient \(\rho\) will be positive. If the mediating effect of information asymmetry KV holds, then the absolute value of the coefficient \({\beta }_{2}\) will be less than the absolute value of the coefficient \({\beta }_{1}\). Table 11 displays findings in accordance with our expectations. In this case, the increased information transparency can mitigate information asymmetry and thus reduces the SPCR (Hutton et al. 2009).

Further analyses: Is tax administration reform good news for investors?

The above discussion centers on the relationship between tax administration reform and corporate SPCR. Indeed, the information environment does not fully determine investors’ holding preferences. Whether improvements in the information environment can enhance stock liquidity depends critically on investor returns (Chen et al. 2023b). As mentioned earlier, tax administration reforms reduce corporate information asymmetries and further curb corporate tax avoidance and financial manipulation. Other things being equal, tax administration reforms have instead resulted in firms losing some of their earnings (He and Yi, 2023), which can be derived from legal tax avoidance and financial manipulation. Thus, while tax administration reform reduces information asymmetry, it undermines investors’ returns to ownership. Tax administration reform may be bad news for investor. We test the above scenario.

We use the following variables to characterize investor concerns and holdings: LQ, LI, and FI. LQ is a variable measuring stock liquidity. We use the illiquidity indices proposed by Amihud (2002). FI is the shareholding of fund investors. LI is the shareholding of long-term investors.

Building on prior research (Jiang et al. 2024), this study classifies institutional investors based on their turnover rates. The analysis primarily centers on the trading activities of equity funds and hybrid funds, given the availability and reliability of relevant data. Specifically, the study aggregates the total stock assets purchased and sold by each institutional investor over the period from 2007 to 2020, providing a comprehensive view of institutional trading behavior. The following are the calculation formulae for the institutional investor \(s\)’s total assets of equities purchased and sold each half year:

In the model, the investor index and the semi-annual index are represented by the letters s and h. The overall number of shares is N. \({{Buy}}_{s,h}\) and \({{Short}}_{s,h}\) refer to the total market value of stocks that investor s has purchased or sold during the period \(h\), respectively. \({{SN}}_{s,h,i}\) and \({{SN}}_{s,h-1,i}\) indicate the number of shares of corporate \(i\) held by investor \(s\) in the period \(h\) and the previous period \(h-1\), respectively. \({P}_{h,i}\) and \({P}_{h-1,i}\) is the stock price of firm \(i\) in the period \(h\) or in the period \(h-1\), respectively. Then, the turnover rate of investor \(s\) during the period \(h\) is defined as:

\({{SN}}_{s}\) is the share number that the investor \(s\) hold. \({{TR}}_{s,h}\) is the metric used to gauge the turnover rate of investor \(s\) during the period \(h\). Then, to compute the average turnover rate of institutional investor \(s\) over the past two years, the following calculation is undertaken:

An institutional investor is generally associated with long-term investments when exhibiting a lower average turnover rate, while a higher average turnover rate often signals a propensity for short-term investment strategies. Contrary to general expectations, a cohort of investors characterized by a high turnover rate is classified as long-term investors for the purposes of this study. Institutional investors are segmented into three distinct categories based on their average turnover rate. Subsequently, for each stock i in year t, the shareholding ratio of long-term investors (LI) is calculated according to the type of investor.

We replace Crash of Eq. (1) with LQ, LI, and FI, respectively. Columns (1)-(2) of Table 12 confirm that tax reform decreases stock liquidity and the percentage of investors who own shares, showing that investors do not prefer GT.

Additionally, we looked at whether tax reform actually hurts the company’s financial performance. We generate three variables: TA, RT, and ROA. We use the difference between the nominal income tax rate minus the effective income tax rate (RT) to capture the degree of corporate tax avoidance (TA). ROA is the return on assets. We use themes to replace the explanatory variable in Eq. (1) and perform a regression analysis. Obviously, from Table 12, we find the implementation of tax administration significantly decreases the level of tax avoidance, as expected. Furthermore, following the tax management reform, the tax burden and benefits for businesses have dramatically deteriorated.