Abstract

The income gap stemming from disparities in asset ownership is a significant contributor to economic inequality and social polarization. Asset income is derived from the growth and realization of these assets, with financial investment serving as the key mechanism for transforming household assets into asset-generated income. Institutionalized wealth accumulation mechanisms play a vital role in facilitating household asset growth through the influence of risk preferences.The Housing Provident Fund (HPF), an integral component of China’s social welfare and security system, is one such policy aimed at promoting asset building. This study employs linear regression and ordered logit regression, using cross-sectional data from the 2019 China Household Finance Survey (CHFS), to investigate the relationship between HPF possession, risk attitude, and financial investment engagement. To ensure robustness, a bootstrap mediation analysis is conducted to evaluate the mediating role of household heads’ risk attitudes in this relationship. The results indicate that HPF possession is positively associated with financial investment engagement (β = 0.091, p < 0.001) and the risk preferences of household heads (β = 0.130, p < 0.01). Moreover, household heads’ risk preferences partially mediate the relationship between HPF possession and financial investment engagement, with an indirect effect of 0.011 (10.3%, p < 0.05).

Similar content being viewed by others

Introduction

The income gap can be primarily decomposed into two major components: the wage income gap, stemming from labor market disparities, and the asset income gap, which arises from disparities in asset ownership. Notably, the latter significantly contributes to deepening social polarization between affluent and less affluent groups (Fräßdorf et al. 2011; Ning et al. 2016; Saez and Zucman, 2016; Yang and Zhang, 2022). The proportion of income derived from human capital (i.e., labor) has shown a declining trend, whereas income sourced from financial capital and assets has been on the rise (Autor, 2014; Cynamon and Fazzari, 2014; Karabarbounis and Neiman, 2014; Piketty, 2014; Wolff, 2017). Consequently, enhancing household asset income is essential for individuals and families seeking to build wealth and mitigate wealth disparities.

The Chinese government has recognized this imperative and is actively promoting policies aimed at “enhancing urban and rural residents’ asset-based income through various channels,” including reforms in income distribution, improvements in the financial system, and social policies that encourage asset accumulation (Central Committee of the Communist Party of China, 2021; Ministry of Finance of the People’s Republic of China, 2021; National Development and Reform Commission, 2021). These initiatives seek to elevate the income levels of low-income households, optimize income structures, and progressively reduce income inequalities.

Asset-based income includes various returns from assets, such as interest, dividends, and rent (Saez and Zucman, 2016; Wolff, 2017). Assets and asset-based income are interconvertible, individuals and households accumulate assets, which in turn generate asset-based income. This income promotes further asset expansion, leading to continuous accumulation of wealth (Carroll and Samwick, 1997; Wolff, 2017). This process enhances the financial stability and security of individuals and households.

The generation of asset-based income highlights the crucial role of financial market participation in transforming household assets into income streams (Ning, 2014). However, in China, only about 15% of households invest in stocks, 4% in mutual funds, and an even smaller percentage in high-risk instruments such as bonds (China Household Finance Survey and Research Center, 2019). Empirical evidence indicates that Chinese households have limited engagement in risky investments, with minimal allocation to such assets and a predominantly homogenous asset structure. Compared to developed economies, the depth and breadth of Chinese households’ participation in financial markets remain low, impeding the growth of household asset income (Yin et al. 2015).

Given this pervasive under-engagement, understanding the factors that influence financial investment participation becomes paramount. This issue has drawn considerable attention from both domestic and international scholars in recent years. Existing studies have identified various determinants of investment participation, including age, educational attainment, household wealth, income (He and Dai,2007), property ownership (Cocco et al. 2005), life cycle considerations (Wu et al. 2010), health status (Atella et al. 2012), financial literacy (Yin et al. 2014), household composition (Wang and Lu, 2017), religious beliefs (Wang et al. 2017), and marital status (Liao, 2017). Additionally, research has examined the role of social networks and interactions in shaping investment behaviors (Weber and Morris, 2010; Guiso et al. 2008; Guiso and Jappelli, 2020).

Increasingly, studies have also focused on the influence of social security and welfare systems on financial investment participation. For instance, Gormley et al. (2010) demonstrated that social security provisions can substantially enhance stock market participation. Similarly, Goldman and Maestas (2013) utilized data from the HRS survey (1998–2000) and found a significant relationship between the extent of social security coverage and the likelihood of households participating in risky financial investments.Additionally, according to the asset-building theory, the sustained accumulation of assets—facilitated through specialized savings mechanisms—enables households to develop a forward-looking perspective that supports long-term investment engagement (Sherraden, 1991).

This paper posits that household financial investment engagement is influenced not only by individual and household financial circumstances but also by institutionalized savings mechanisms embedded within social policies. Such institutionalized savings can shape individuals’ attitudes and foster confidence in future financial security, thereby impacting household participation in financial markets. The Housing Provident Fund (HPF) is a form of an institutionalized social savings policy that can play a pivotal role in this context.

Asset building theory

In Assets and the Poor: A New American Welfare Policy, Michael Sherraden (1991) introduced the fundamental concept of asset-building theory, encapsulated in the phrase, “Those who have will have more, those who have none will have no more.” This theory contends that welfare policies should move beyond providing immediate support to fostering long-term empowerment and security for individuals. While income-based welfare measures offer short-term relief, they do not contribute to sustainable personal development or financial independence. In contrast, asset ownership can fundamentally reshape individuals’ perspectives and interactions within society by prompting them to think beyond present needs and focus on long-term planning and goals (Sherraden, 1991).

Sherraden argued that assets enhance household stability and cultivate a forward-looking mindset that facilitates effective planning for the future. And assets empower individuals to establish long-term objectives, formulate growth strategies, and take calculated risks (Sherraden, 1991). He further emphasized the importance of institutional factors—such as structured savings mechanisms, targeted financial education, attractive savings incentives, and accessible savings opportunities—in influencing both individual and family savings behaviors and asset accumulation (Beverly and Sherraden, 1999). Institutionalized savings systems highlight the necessity and benefits of saving (Cagan, 1965; Carroll and Summers, 1987), creating an environment conducive to consistent saving practices that foster long-term financial stability and wealth accumulation.

The Housing Provident Fund (HPF)

In China, housing is not only essential for meeting basic living needs but also serves as a key vehicle for wealth accumulation. Disparities in housing ownership have become a key factor contributing to socio-economic inequality(DiPasquale and Glaeser, 1999; Gyourko and Molloy, 2015; McKee et al. 2020; Yang et al. 2018). During the planned economy era, China operated a welfare-oriented housing allocation system characterized by low rents, in-kind distribution, and government-exclusive investment, which proved unsustainable for meeting the population’s housing demands. To address these challenges and mitigate housing disparities brought about by marketization, China introduced the Housing Provident Fund (HPF).

The “Interim Provisions on the Establishment of a Housing Provident Fund System” in 1994 laid the groundwork for the HPF, outlining five key characteristics: mandatory participation, mutual assistance, welfare orientation, targeted use, and long-term sustainability. These principles have remained consistent throughout subsequent policy iterations. The monetization of housing allocations in 1998 marked the beginning of the HPF era and ended physical housing distribution. A major regulatory update in 2002 by the State Council cemented the HPF’s framework, reinforcing its mandatory nature, mutual assistance, welfare orientation, targeted use, and long-term housing security goals.

The mandatory nature of the HPF requires employers to register and contribute on behalf of their employees, with penalties for non-compliance including fines and enforced payments (State Council of the People’s Republic of China, 1999; Ministry of Housing and Urban-Rural Development of the People’s Republic of China, 2002). Both employers and employees must contribute a percentage of the employee’s salary to the HPF, which is used for housing-related expenses, such as purchases, construction, renovation, loan repayment, and rent (Ministry of Housing and Urban-Rural Development of the People’s Republic of China, 2002). The HPF’s welfare orientation mandates that contributions are directed toward improving urban residents’ living conditions and are safeguarded against misuse (State Council of the People’s Republic of China, 1999). The long-term nature of the HPF ensures that it functions as a sustainable housing savings system that enhances living standards (Ministry of Housing and Urban-Rural Development of the People’s Republic of China, 2002).

The “Opinions on Accelerating the Improvement of the Socialist Market Economic System in the New Era” issued by the State Council in 2020 emphasized the HPF’s role in fostering a comprehensive social security system and facilitating diverse housing supply channels. This underscores the HPF’s integration into China’s broader social security framework.

The HPF as an institutionalized social policy facilitating asset building

The HPF operates as an institutionalized social policy designed to foster asset building by deducting a fixed percentage from employees’ wages, matched by employer contributions, and depositing these funds into designated accounts. This mechanism promotes the accumulation of housing assets while providing low-interest housing loans to employees for purchasing homes (State Council of the People’s Republic of China, 2002). The Housing Provident Fund (HPF) operates as an institutionalized social policy designed to foster asset building by deducting a fixed percentage from employees’ wages, matched by employer contributions, and depositing these funds into designated accounts. This mechanism promotes the accumulation of housing assets while providing low-interest housing loans to employees for purchasing homes (State Council of the People’s Republic of China, 2002).

Firstly, the HPF functions as a long-term, compulsory, and specialized savings plan. Employees can withdraw the entire balance, including both principal and interest, upon retirement (State Council of the People’s Republic of China, 2002). In 2022, approximately 8.96 million people withdrew their HPF funds for retirement or other reasons, amounting to a total of 4,446 billion yuan (approximately 700 billion USD) (Ministry of Housing and Urban-Rural Development of the People’s Republic of China, 2022). This acts as an important financial supplement to pension income, easing the financial burdens faced by retirees and enhancing their resilience against future financial uncertainties.

Secondly, the HPF is a significant tool for families in acquiring housing assets (Ministry of Housing and Urban-Rural Development of the People’s Republic of China, 2022). Housing is considered one of the most valuable and enduring assets for families in China (Zhang, 2020; Li and Wang, 2018; Zhang et al. 2015) and is commonly viewed as a hedge against inflation and a means of long-term financial growth (Chen, 2017). Studies have demonstrated that access to the HPF can increase homeownership rates and contribute to the financial stability of families (Liu et al. 2019). Thus, the HPF represents a crucial asset accumulation mechanism that spans the entire lifecycle of a family.

Thirdly, the HPF is a component of China’s social welfare and security system that promotes investment behavior of individuals. Research has indicated that social security systems can provide a safety net against economic risks and uncertainties, shaping individuals’ risk preferences and fostering a greater inclination towards asset accumulation and investment in higher-risk financial assets (Delavande and Rohwedder, 2011; Kerkhofs et al. 1998; Zhang, 2013). For instance, Lin et al. (2017) asserted that social security systems can reduce household income and expenditure uncertainties, subsequently lowering precautionary savings and enhancing the depth and diversity of household investment in financial markets.

Theoretical framework

The HPF represents a key institutionalized social policy that facilitates asset accumulation among urban residents in China. By mandating savings, providing low-interest loans, enhancing financial security, promoting homeownership, and encouraging risk-taking, the HPF contributes significantly to long-term wealth accumulation and financial stability of individuals and households.

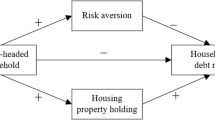

This study develops a theoretical framework (Fig. 1) based on asset-building theory, proposing that the HPF, as an institutionalized saving mechanism, enhances individuals’ and families’ future orientation and risk attitude, thus fostering greater participation in financial investments.

Based on the theoretical framework, the study proposes the following hypotheses:

-

(1)

Possession of a HPF is positively correlated with household financial investment engagement.

-

(2)

Possession of a HPF is positively correlated with the risk preference of the household head.

-

(3)

The risk preference of the household head partially mediates the relationship between HPF possession and household financial investment engagement.

Methods

Data and sample

The study utilized cross-sectional data from the China Household Finance Survey Project (CHFS, 2019). It is a nationwide survey conducted by the China Household Finance Survey and Research Center of Southwest University of Finance and Economics in 2017. This dataset covers 29 provinces (regions), 343 counties, and 1,360 village (residential) committees across China, offering detailed micro-level information on demographic attributes, household assets and liabilities, insurance coverage, and income and expenditure structures. It offers a comprehensive depiction of household fundamentals. The dataset contains 34,643 samples, derived from 34,643 households with 107,001 residents. The CHFS baseline survey is a nationwide sampling program in China that uses face-to-face household interviews to collect information. The data are nationally and provincially representative.

We selected household heads aged between 16 and 80 at the time of the interview, with urban household registration. This age range is chosen because individuals aged 16 or older who primarily rely on their own labor income are regarded as having full civil capacity to serve as household heads, while those above 80 years old are often limited in their ability to perform civil functions.We select household heads with urban household registration because the HPF is only available to individuals with urban household registration. The initial sample size consisted of 21,900 observations. We applied the Multivariate Imputation by Chained Equations (MICE) method to address missing data, resulting in 20,800 complete cases.

Measurement

Dependent variable

Financial investment engagement is measured by the number of household financial investment products, including internet finance, stocks, funds, and bonds. Each type of financial investment product owned contributes one point to the score, resulting in a variable that ranges from 0 to 4. This variable is treated as continuous in our analysis.

Independent variables

The HPF is represented as a binary variable indicating whether the head of the household currently holds an HPF account. A value of 1 is assigned for ‘yes’ and 0 for ‘no’.

Mediation variable

Risk attitude serves as the mediating variable in this study. It is assessed through the question: ‘If you had money to invest, which type of investment project would you prefer?’ Respondents who choose ‘high-risk, high-return projects’ or ‘slightly high-risk, slightly high-return projects’ are classified as risk-appetite and assigned a value of 2. Those who opt for ‘average-risk, average-return projects’ are categorized as risk-neutral and assigned a value of 1. Participants selecting ‘slightly low-risk, slightly low-return projects’ or ‘unwilling to take any risk’ are deemed risk-averse and assigned a value of 0. For this study, risk attitude is treated as an ordinal variable.

Control variables

This study incorporates ten control variables: the age of the household head, gender of the household head (male = 1, female = 0), education level of the household head (below high school = 1, high school = 2, above high school = 3), employment status of the household head (unemployed = 1, temporary employment = 2, formal employment = 3, employer = 4), marital status (married = 1, not married = 0), health status of the household head (poor = 0, fair = 1, good = 2), city classification (first-tier cities = 1, non-first-tier cities = 0), and residence type (rural = 1, urban = 0), per capita household income, and the balance of income and expenditure (balanced = 1, unbalanced = 0).

Methods of analysis

To mitigate potential sample bias, we used MICE methods to address missing data. Descriptive and bivariate analyses, including t-tests and χ² tests, were performed to outline and compare sample characteristics according to HPF possession. Linear regression models were employed to examine the association between HPF, risk attitude, and financial investment engagement, Additionally, ordered logistic regression (ologit) model was applied to assess the association between risk attitude and financial investment engagement. To ensure the robustness of the mediation effect results, we employed bootstrap tests to assess the mediating role of risk attitude in the relationship between HPF possession and financial investment engagement (MacKinnon, 2006; Davidson and Flachaire, 2008; Wehrens et al. 2000).

For linear regression models, heteroskedasticity-robust standard errors were used to adjust standard errors, ensuring reliable estimates in the presence of heteroskedasticity. Multicollinearity was assessed by calculating the variance inflation factor (VIF) for each independent variable, with overall VIF values of 1.76 and 1.71, both well below the commonly accepted threshold of 10, indicating no significant multicollinearity issues (O’Brien, 2007). In the ordered logistic regression models, we conducted a series of parallel assumption test, including Wolfe-Gould, Brant, score, likelihood ratio, and Wald tests. Results indicated no violations of the parallel assumption (all p-values > 0.05). To confirm the reliability and generalizability of our research findings, we conducted robustness tests by reanalyzing the models using listwise deletion after the removal of outliers.

Results

Sample characteristics

Table 1 presents the socio-demographic and financial differences between individuals participating in the HPF program and those not participating. Households with HPF have a significantly higher mean number of financial investment products (M = 1.16) compared to non-participants (M = 0.65; t = 41.59, p < 0.001). There was a significant association between HPF participation and risk attitudes (χ² = 714.99, p < 0.001). Participants were less likely to be risk-averse (59.23%) and more likely to exhibit fair (26.83%) or risk-appetite attitudes (13.95%) than non-participants. On average, HPF participants were younger (M = 44.52) than non-participants (M = 56.29; t = −47.67, p < 0.001).Household heads participating in the HPF program were more likely to be male (76.56%) compared to non-participants (69.13%; χ² = 81.72, p < 0.001). Participants also had higher educational attainment, with 40.51% having completed education above high school compared to 4.62% of non-participants (χ² = 5200, p < 0.001). Formal employment was predominant among participants (87.08%), whereas non-participants had higher rates of unemployment (48.37%; χ² = 5600, p < 0.001). A greater proportion of participants were married (87.85%) compared to non-participants (84.63%; χ² = 25.35, p < 0.001). Participants reported better health, with 59.48% indicating good health, compared to 40.39% among non-participants (χ² = 609.52, p < 0.001). Additionally, HPF participants were more likely to reside in first-tier cities (44.65%) than non-participants (34.22%; χ² = 145.38, p < 0.001). HPF participants had a significantly higher annual per capita income (M = 6.95) compared to non-participants (M = 3.34; t = 21.33, p < 0.001). However, HPF participants were also more likely to report an unbalanced financial state (41.30%) compared to non-participants (27.59%; χ² = 275.00, p < 0.001). One possible explanation for this finding is that, although HPF participants had higher annual per capita income, a substantial portion of this income may be allocated to increased expenditures or investments, such as housing loan repayments, which could contribute to an imbalance between income and expenditures.

Regression analysis and mediation effect test

Table 2 presents the results of linear regression and ordered logistic regression models analyzing the association between HPF possession, risk attitude, and financial investment engagement. Model 1 examines the association between financial investment engagement and HPF possession, Model 2 examines the association between HPF possession, and risk attitude, and Model 3 examines the association between financial investment engagement, HPF possession and risk attitude.

In Model 1, the results show that HPF possession has a significant positive association with financial investment products (β = 0.091, p < 0.001). Therefore, Hypothesis 1 is validated at the 99% confidence interval. In Model 2, household heads possess HPF exhibit a higher risk preference (β = 0.130, p < 0.01). Therefore, Hypothesis 2 is validated at the 99% confidence interval.

Model 3 demonstrates that HPF possession (β = 0.081, p < 0.001) and risk attitude (β = 0.209, p < 0.001 for “fair”; β = 0.353, p < 0.001 for “risk appetite”) are both positively and significantly associated with financial investment products. Model 3 also reveals additional factors influencing financial investment engagement. Specifically, age (β = −0.116, p < 0.001) and gender (β = −0.050, p < 0.001) have significant negative associations, indicating that older and males household heads are less likely to engage in financial investments (This finding may be associated with that female-headed households have higher per capita household income). Conversely, married individuals are more likely to participate in financial investments compared to their unmarried counterparts (β = 0.107, p < 0.001).

Educational attainment is positively associated with financial investment engagement. Individuals with a high school education (β = 0.182, p < 0.001) and those with education above high school (β = 0.225, p < 0.001) show significant positive associations compared to those with less than a high school education (reference group). Employment status is another critical factor. Formal employment (β = 0.105, p < 0.001) and being an employer (β = 0.145, p < 0.001) are positively associated with financial investment, whereas temporary employment shows a negative association (β = −0.048, p < 0.001). Health status significantly impacts financial investment engagement. Individuals reporting fair health (β = 0.085, p < 0.001) or good health (β = 0.111, p < 0.001) are more likely to invest than those reporting poor health. Living in a first-tier city is associated with a slight positive effect on financial investment (β = 0.006, p < 0.001), and higher annual per capita income is positively correlated with financial investment (β = 0.005, p < 0.001). Lastly, individuals with a balanced income and expenditure are less likely to engage in financial investment (β = −0.093, p < 0.001) compared to those with an unbalanced financial status.

Mediation effect test

Table 3 presents the results of the mediation analysis examining the role of risk attitude in the relationship between HPF possession and financial investment engagement. The mediation effect was assessed using the bootstrap method. The findings indicate that the direct effect of HPF on financial investment is 9.4%, while the indirect effect mediated by risk attitude is 1.1%. The total contribution rate of the mediation effect is 10.3%, which is statistically significant within the 95% confidence interval. These results suggest that risk attitude serves as a partial mediator in the relationship between HPF possession and financial investment engagement. Therefore, Hypothesis 3 is supported at the 95% confidence level.

Robustness test

To confirm the reliability of our research findings, we conducted robustness tests using listwise deletion after removing outliers. Four methods—standardized residuals, studentized residuals, Cook’s distance, and Welch distance—were employed to identify outliers. Samples identified as outliers by at least two of these methods were excluded from the analysis. In total, 83 outliers were removed, and after excluding samples with missing values, 7,177 samples were retained for the final analysis.

Linear regression models and ordered logistic regression (ologit) models were subsequently used to examine the associations between HPF possession, risk attitude, and financial investment engagement. To ensure the robustness of the results, we employed bootstrap tests to evaluate the mediating effect of risk attitude on the relationship between HPF possession and financial investment engagement.Table 4 presents the results of the correlation analysis between HPF possession, risk attitude, and financial investment engagement. Table 5 shows the mediation analysis results. Tables 4 and 5 indicate that the robustness test results are consistent with the results of the primary analysis models.

Discussion

This study contributes to the existing literature by examining the link between asset building and household financial investment engagement, while also exploring the mechanism through which asset accumulation impacts participation in financial investments. We posit that HPF, as an institutional asset-building tool, enhances financial market engagement by increasing the risk preferences of household heads (Cagan, 1965; Carroll and Summers, 1987; Carroll and Samwick, 1997).

The findings provide several significant insights. Firstly, possession of an HPF is positively correlated with the risk preference of household heads. Existing research highlights that more robust social security systems increase individuals’ propensity to take risks in investment (Eling et al. 2021; Cavapozzi et al. 2013). For instance, Gruber and Yelowitz (1999) found that public health insurance programs significantly reduce private savings among eligible households, suggesting that the availability of social insurance diminishes the necessity for precautionary savings. Similarly, Cavapozzi et al. (2013) observed that individuals who purchase life insurance are more inclined to invest in stocks and mutual funds at a later stage. This phenomenon can be attributed to the financial stability provided by social security systems, which mitigate risks associated with unemployment, severe illness, or retirement, thus encouraging higher-risk and potentially higher-return investments. Conversely, higher healthcare policy uncertainty correlates with increased absolute risk aversion (Fleck and Monninger, 2020; Wiemann and Lumsdaine, 2020).

From a behavioral economics perspective, social security systems foster psychological safety. Prospect theory posits that individuals weigh potential losses more heavily than gains when making decisions, but the presence of social security as a protective mechanism lessens the degree of loss aversion (Tversky and Kahneman, 1992; Thaler and Sunstein, 2008). Consequently, individuals are more inclined to engage in risk-taking behaviors related to financial planning and investment, as potential losses are buffered by the safety net provided by social security systems. This finding aligns with asset-building theory, which states that possessing assets enhances individuals’ confidence in their financial future and encourages greater risk-taking (Sherraden, 1991; Kerkhofs et al. 1998; Delavande and Rohwedder, 2011; Zhang, 2013; Zhang and Geng, 2017).

Secondly, our findings reveal that risk preferences significantly influence financial market participation, corroborating previous research. For instance, Guiso and Paiella (2001) demonstrated that risk attitudes strongly predict household decisions related to occupation, portfolio choice, relocation, and health status. Barasinska et al. (2012) found that more risk-averse households typically maintain incomplete portfolios composed predominantly of low-risk assets. They also noted that the propensity to acquire additional assets heavily depends on whether liquidity and safety needs are satisfied.

Participation in financial markets through investments in stocks, bonds, or mutual funds allows households to potentially achieve higher returns than traditional savings methods (Campbell and Viceira, 2002; Guiso et al. 2002). This can augment asset-based income and reduce dependence on wage income alone, contributing to wealth distribution equity and addressing socio-economic disparities (Saez and Zucman, 2016; Wolff, 2017). To promote broader participation in financial markets, it is essential to create an inclusive environment that facilitates and supports widespread engagement.

Household asset building is a cornerstone of financial market participation, as it strengthens risk tolerance and investment capacity. Institutional factors are key in promoting asset accumulation. Beverly and Sherraden (1999) argued that institutionalized opportunities for asset building draw attention to the importance and benefits of saving, prompting proactive asset-building behaviors among individuals and families. Establishing a comprehensive institutional framework involves not only awareness-raising but also the provision of practical pathways and efficient tools to facilitate asset accumulation.

Institutional mechanisms, such as mandatory retirement savings plans and housing provident funds, provide individuals and families with stable, long-term savings channels. These mechanisms help households manage financial uncertainty and risks, laying a foundation for sustainable asset growth and enhancing financial resilience (Engelhardt and Gruber, 2004; Kotlikoff, 1987). Additionally, accessible asset-saving measures like automated transfers and online financial management platforms mitigate operational challenges, reduce cognitive and decision-making burdens, and enable broader and more sustained participation (Beverly et al. 2008; Beshears et al. 2005; Thaler and Sunstein, 2008).

Furthermore, targeted financial education is also essential for increasing market engagement (Lusardi and Mitchell, 2014; Kaiser and Menkhoff, 2017). By providing financial knowledge and training, individuals can develop a comprehensive understanding of financial products and investment strategies, which boosts their confidence and willingness to participate (Brown and Graf, 2012). Improved financial literacy also enhances risk awareness and decision-making skills, enabling individuals to make well-informed choices in complex market environments (Lusardi and Messy, 2023; Hastings, et al. 2013).

Limitations

Several limitations of this study must be acknowledged. First, this research employs cross-sectional data from China to explore the correlation between the HPF participation, risk attitudes, and household financial investment engagement. However, it does not establish causality between these variables. Future studies should prioritize the use of longitudinal data to better determine causal relationships between these variables over time, thereby enhancing the theoretical and practical contributions of the research. Additionally, conducting comparative analyses of different social welfare policies within China or across countries could provide deeper insights into the role of institutionalized savings in financial market participation. Second, the study’s focus on urban areas in China, where the HPF is available, restricts its scope and prevents it from capturing the nationwide situation, particularly in rural areas. This limitation means that the findings do not comprehensively reflect the experiences of all households across urban and rural regions. Future research should consider including rural household data to provide a more holistic view of financial market participation in relation to institutionalized savings mechanisms.

Data availability

The data that support the findings of this study are available from https://chfser.swufe.edu.cn/datasso/Home/Login?5228714360447555497, but restrictions apply to the availability of these data, which were used under licence for the current study, and so are not publicly available. Data are however available from the authors upon reasonable request and with permission of Survey and Research Center for China Household Finance.

References

Atella V, Brunetti M, Maestas N (2012) Household portfolio choices, health status and health care systems: A cross-country analysis based on SHARE. J Bank Financ 36(5):1320–1335. https://doi.org/10.1016/j.jbankfin.2011.11.025

Autor DH (2014) Skills, education, and the rise of earnings inequality among the “other 99 percent”. Science 344(6186):843–851

Barasinska N, Schäfer D, Stephan A (2012) Individual risk attitudes and the composition of financial portfolios: Evidence from German household portfolios. Q Rev Econ Financ 52(1):1–17. https://doi.org/10.1016/j.qref.2011.10.001

Beshears, J, Choi, JJ, Laibson, D, Madrian, BC (2005) The importance of default options for retirement saving outcomes: Evidence from the United States. In E McCaffrey & J Slemrod (Eds.), Behavioral public finance (pp. 167–195). Russell Sage Foundation. https://doi.org/10.1093/acprof:oso/9780199226801.003.0004

Beverly SG, Sherraden M (1999) Institutional determinants of saving: Implications for low-income households and public policy. J Socio-Econ 28(4):457–473. https://doi.org/10.1016/S1053-5357(99)00046-3

Beverly, SG, Sherraden, M, Cramer, R, Shanks, TRW, Nam, Y, Zhan, M (2008) Determinants of asset building. In M Sherraden (Ed.), Asset building and low-income families (pp. 89–151). Russell Sage Foundation. https://www.urban.org/sites/default/files/publication/31641/411650-determinants-of-asset-building.pdf

Brown, M, Graf, R (2012) Financial Literacy, Household Investment and Household Debt: Evidence from Switzerland. Research Papers in Economics. https://www.semanticscholar.org/paper/Financial-Literacy%2C-Household-Investment-and-Debt%3A-Brown-Graf/78df07196105530e2ff893be6c32cc1dd94260d1

Cagan P (1965) The Effect of Pension Plans on Aggregate Savings: Evidence from a Sample Survey (Occasional Paper No. 95). National Bureau of Economic Research, New York

Campbell, JY, Viceira, LM (2002) Strategic Asset Allocation: Portfolio Choice for Long-Term Investors. Oxford University Press. https://doiorg.ezp.slu.edu/10.1093/0198296940.001.0001

Carroll C, Summers LH (1987) Why have private savings rates in the United States and Canada diverged? J Monetary Econ 20:249–279

Carroll CD, Samwick AA (1997) The nature of precautionary wealth. J Monetary Econ 40(1):41–71

Cavapozzi D, Trevisan E, Weber G (2013) Life insurance investment and stock market participation in Europe. J Econ Ageing 1-2:32–44. https://doi.org/10.1016/j.alcr.2012.10.007

Central Committee of the Communist Party of China. (2021) The 14th Five-Year Plan for National Economic and Social Development of the People’s Republic of China and the Long-Range Objectives Through the Year 2035

Chen L (2017) Housing as a Hedge Against Inflation in China. Econ Perspect 35(2):78–89

China Household Finance Survey and Research Center (2019) China Household Finance Survey Report 2019. Southwest University of Finance and Economics

Cocco JF, Gomes FJ, Maenhout PJ (2005) Consumption and portfolio choice over the life cycle. Rev Financial Stud 18(2):491–533. https://doi.org/10.1093/rfs/hhi017

Cynamon, BZ, Fazzari, SM (2014, October 24) Inequality, the Great Recession, and slow recovery. https://doi.org/10.2139/ssrn.2205524

Davidson R, Flachaire E (2008) The wild Bootstrap, tamed at last. J Econ 146(1):162–169

Delavande A, Rohwedder S (2011) Individuals’ uncertainty about future social security benefits and portfolio choice. J Appl Econ 26(3):498–519

DiPasquale D, Glaeser EL (1999) Incentives and social capital: Are homeowners better citizens? J Urban Econ 45(2):354–384

Eling, M, Ghavibazoo, O, Hanewald, K (2021) Willingness to take financial risks and insurance holdings: A European survey. ARC Centre of Excellence in Population Ageing Research (CEPAR) Working Paper No. 2021/04. https://doi.org/10.2139/ssrn.3790782

Engelhardt, GV, Gruber, J (2004) Social Security and the evolution of elderly poverty (NBER Working Paper No. 10466). National Bureau of Economic Research. https://doi.org/10.3386/w10466

Fräßdorf A, Grabka M, Schwarze J (2011) The impact of household capital income on income inequality—a factor decomposition analysis for the UK, Germany and the USA. J Economic Inequal 9(1):35–56. https://doi.org/10.1007/s10888-009-9125-4

Fleck, J, Monninger, A (2020) Culture and portfolios: Trust, precautionary savings and home ownership. ECB Working Paper No. 20202457. https://doi.org/10.2139/ssrn.3676330

Gormley TA, Liu H, Zhou G (2010) Limited participation and consumption-saving puzzles: a simple explanation and the role of insurance. Soc Sci Electron Publ 96(2):331–344

Goldman D, Maestas N (2013) Medical expenditure risk and household portfolio choice. J Appl Econ 28(4):527–550. https://doi.org/10.1002/jae.2278

Gruber J, Yelowitz A (1999) Public health insurance and private savings. J Political Econ 107(6):1249–1274. https://doi.org/10.1086/250096

Guiso L, Jappelli T (2020) Investment in financial information and portfolio performance. Economica 87:1133–1170

Guiso L, Sapienza P, Zingales L (2008) Trusting the stock market. J Financ 63:2557–2600

Guiso, L, Haliassos, M, Jappelli, T (2002) Household Portfolios. MIT Press. https://doi.org/10.7551/mitpress/3568.001.0001

Guiso L, Paiella M (2001) Risk aversion, wealth and background risk. J Eur Econ Assoc 6(6):1109–1150. https://doi.org/10.2139/ssrn.262958 2008

Gyourko J, Molloy R (2015) Regulation and housing supply. Handb Regional Urban Econ 5:1289–1337

Hastings JS, Madrian BC, Skimmyhorn WL (2013) Financial literacy, financial education, and economic outcomes. Annu Rev Econ 5(1):347–373. https://doi.org/10.1146/annurev-economics-082312-125807

He, X, Dai, G (2007) Empirical research on household financial asset selection under the constraints of income and liquidity risks. Southern Economy, (10), 58–69

Kaiser T, Menkhoff L (2017) Does financial education impact financial literacy and financial behavior, and if so, when? World Bank Econ Rev 31(3):611–630. https://doi.org/10.1093/wber/lhx018

Karabarbounis L, Neiman B (2014) The global decline of the labor share. Q J Econ 129(1):61–103

Kerkhofs M, Lindeboom M, Theeuwes J (1998) Retirement, financial incentives and health. Labour Econ 6(2):203–227

Kotlikoff LJ (1987) Justifying public provision of social security. J Policy Anal Manag 6(4):674–689. https://doi.org/10.2307/3323524

Lin J, Zhou M, Dong Z (2017) Social insurance and household financial risk asset investment. J Manag Sci 2:94–107

Liao, J (2017) Marital status and household financial investment preferences. Southern Finance, (11), 23–32

Li J, Wang Y (2018) The Importance of Housing in Family Wealth in China. China Econ Rev 50:42–56

Liu H, Zhang J, Zhao Z (2019) The Impact of Housing Provident Fund on Homeownership and Financial Stability in China. J Urban Econ 110:45–60

Lusardi A, Mitchell OS (2014) The economic importance of financial literacy: Theory and evidence. J Econ Lit 52(1):5–44. https://doi.org/10.2139/ssrn.2243635

Lusardi A, Messy F-A (2023) The importance of financial literacy and its impact on financial wellbeing. J Financial Lit Wellbeing 1(1):1–11. https://doi.org/10.1017/flw.2023.8

MacKinnon JG (2006) Bootstrap methods in econometrics. Econ Rec 82:S2–S18

McKee M, Kearns A, Ellaway A (2020) Housing, home and health: Review of evidence. Glasgow Centre for Population Health

Ministry of Housing and Urban-Rural Development of the People’s Republic of China. (2002) Regulations on the Administration of Housing Provident Fund. Beijing, China

Ministry of Finance of the People’s Republic of China. (2021) Fiscal Policy Implementation Report

Ministry of Housing and Urban-Rural Development of the People’s Republic of China. (2022) 2022 Annual Report on China’s Housing Provident Fund. http://www.mohurd.gov.cn/

National Development and Reform Commission. (2021) Guidelines for Improving Income Distribution Mechanism

Ning, G (2014) Residential Property Income Gap: Differences in Ability or Institutional Obstacles? Evidence from China’s Household Finance Survey. Econ Research, (S1), 102-115

Ning, G, Luo, L, Qi, W (2016) Analysis of the Causes of Inequality in Residents’ Property Income during China’s Transition Period. Econ Research, (4), 116-128

O’Brien RM (2007) A caution regarding rules of thumb for variance inflation factors. Qual Quant 41(5):673–690. https://doi.org/10.1007/s11135-006-9018-6

Piketty T (2014) Capital in the Twenty-First Century. Harvard University Press

Saez E, Zucman G (2016) Wealth Inequality in the United States since 1913: Evidence from Capitalized Income Tax Data. Q J Econ 131(2):519–578

Sherraden M (1991) Assets and the poor: A new American welfare policy. M. E. Sharpe, Armonk, NY

State Council of the People’s Republic of China. (1999) Interim Provisions on the Establishment of a Housing Provident Fund System. Beijing, China

State Council of the People’s Republic of China. (2002) Regulations on the administration of housing provident fund. https://www.gov.cn/gongbao/content/2019/content_5468861.htm

Thaler RH, Sunstein CR (2008) Nudge: Improving decisions about health, wealth, and happiness. Yale University Press

Tversky A, Kahneman D (1992) Advances in prospect theory: Cumulative representation of uncertainty. J Risk Uncertain 5(4):297–323

Wang, M, Lu, E (2017) Household Registration Status, Social Capital, and Household Financial Investment: A Micro Study Based on Intermediary Effects and Interaction Effects. Southern Finance, (8), 11-20

Wang, Y, Wang, S, Zang, R, Chen, W (2017) Does Religious Belief Influence Household Financial Investment Behavior? Financial Theory and Practice, (07), 57-63

Weber E, Morris M (2010) Culture and judgment and decision making: the constructivist turn. Perspect Psychological Sci 5:410–419

Wehrens R, Putter H, Buydens L (2000) The Bootstrap: A tutorial. Chemometrics Intell Lab Syst 54(1):35–52

Wiemann, TT, Lumsdaine, RL (2020) The effect of health care policy uncertainty on households’ consumption and portfolio choice. https://doi.org/10.2139/ssrn.3418411

Wolff EN (2017) A Century of Wealth in America. Harvard University Press

Wu W, Yi J, Zheng J (2010) Empirical analysis of chinese urban residents’ household investment structure: based on lifecycle, wealth, and housing. Econ Res 45(S1):72–82

Yang C, Zhang H (2022) Accumulated advantage, financialization effect, and housing asset inequality. Sociol J Renmin Univ China 2022(3):1–28

Yang Q, Chen C, Zhang K (2018) Income gap, housing conditions, and residents’ well-being: empirical evidence from CGSS2003 and CGSS2013. Northwest Popul 39(5):11–20. 29

Yin Z, Song Q, Wu Y (2014) Financial knowledge, investment experience, and household asset selection. Econ Res 49(04):62–75

Yin, Z, Wu, Y, Gan, L (2015) Financial accessibility, participation in financial markets, and household asset selection. Econ Res (3), 87–99

Zhang, X, Li, L, Chai, C, Ma, S (2015) Does Housing Increase Happiness: An Investment Attribute or a Living Attribute? Financial Res (10), 17-31

Zhang X (2013) Risk Attitude and Household Financial Asset Allocation. Southwest University of Finance and Economics

Zhang, H, Geng, G (2017) Life Satisfaction and Household Financial Asset Selection. Journal of Central University of Finance and Economics, (03), 48-58

Zhang X (2020) Homeownership and Financial Stability in China. J Hous Stud 25(3):123–145

Zhang J (2013) Social security reform in China: Issues and prospects. J Comp Econ 41(3):821–841

Author information

Authors and Affiliations

Contributions

Y. Y. Z planned and conceptualized the study, conducted data analyses, and prepared the reports. S.F contributed to the theoretical framework. Both Y. Y. Z and S.F wrote the original draft and were involved in the review and editing process. All authors reviewed and approved the final version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical statements

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

Informed consent was not required as this study did not involve human participants.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Zhang, Y., Fang, S. Housing Provident Fund, risk attitude, and household financial investment engagement: an asset-building perspective. Humanit Soc Sci Commun 12, 354 (2025). https://doi.org/10.1057/s41599-025-04692-4

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-04692-4