Abstract

In an era marked by escalating uncertainty in the external environment, enhancing enterprise resilience is a top research priority. Although the business environment exerts a considerable influence on enterprise activities, the academic community has paid scant attention to how it impacts enterprise resilience. Based on the data of China’s urban business environment and sample data of listed companies from 2013 to 2021, this study examined the long-term value of the business environment from the perspective of enterprise resilience and explores its underlying mechanisms. It found that the business environment is crucial in improving the enterprise resilience. The human resource, financial, market and innovation environments are the main factors that contribute to enterprise resilience. Mechanism tests revealed that the business environment fosters enterprise resilience by propelling digital innovation. Furthermore, entrepreneurial spirit can amplify the positive effects of the business environment on digital innovation, thereby strengthening enterprise resilience. Heterogeneity analysis suggested that upgrading the business environment exhibits a more salient improvement in resilience for private enterprises, small and medium-sized enterprises and high-tech industries compared to state-owned, large-sized and traditional industries. This study investigates the important theoretical and practical value of understanding how to enhance enterprise resilience through optimising the business environment, driving digital innovation and fostering entrepreneurial spirit.

Similar content being viewed by others

Introduction

In the current business landscape, the global market is undergoing fast and unpredictable changes, and technological advancements are happening at an unprecedented speed. As a result, enterprises face increasingly turbulent external environments. Therefore, enhancing enterprises’ ability to turn adversities into opportunities has become a pressing and crucial issue (Van Der Vegt et al., 2015).

The concept of ‘resilience’ emerged from physics and refers to how materials can bounce back to their original shape after facing outside pressures. It gained popularity in the field of business management when Meyer (1982) introduced it into this area. Currently, the academic community primarily defines the concept of enterprise resilience from two perspectives: narrow and broad. From a narrow perspective, enterprise resilience pertains to the enterprise’s capability to withstand impacts, recover quickly and rebound in unexpected and rare events (Beuren and Santos, 2019; Herbane, 2019). From a broad perspective, enterprise resilience refers to the power to maintain long-term development when faced with ongoing uncertain events and environmental changes (Andersson et al., 2019; Ma et al., 2018). High levels of resilience enable enterprises to effectively respond to critical events and facilitate long-term growth (Zhang et al., 2023). How to improve the resilience of enterprises is an important practical problem that enterprises urgently need to solve.

The business environment is a comprehensive system encompassing the external conditions that enterprises face at every stage, from establishment to cessation (World Bank Group, 2019). Its quality directly influences the aggregation and dispersion of various factors, the fluctuation in the number of market participants and the strength of development momentum. Recently, the Chinese government has placed considerable emphasis on establishing an environment conducive to business growth, considering it as a crucial measure to promote the dynamism of market participants.

How does business environment optimisation affect enterprise resilience? From a narrow perspective of enterprise resilience, the existing literature has examined the impact of business environment on the degree of performance loss and recovery speed of private enterprises amid the COVID-19 epidemic. The study indicates that improving the business environment can mitigate the impact of the pandemic on the performance of private enterprises. This is achieved by providing timely and effective policy support, as well as a dependable supply of production factors, and by easing financing constraints (Fu et al., 2023). However, as the external environmental uncertainty continues to grow, research on enterprise resilience should not only focus on unexpected and catastrophic events but also encompass a broader dynamic environment (Duchek, 2020). Scholarship on enterprise resilience has shifted from a narrow perspective to a broader perspective. Nevertheless, scarce research has examined the role of the business environment from a broader perspective of enterprise resilience, with insufficient attention paid to the underlying mechanisms.

Digital innovation is when enterprises use new technologies such as big data, cloud computing and the Internet of Things to create new products, improve processes and establish innovative business models (Yoo et al., 2010). It is a crucial factor in driving enterprises’ digital transformation. While the existing literature has mostly examined the impetus of digital transformation for enterprise resilience (Abidi et al., 2023; Browder et al., 2024; Li et al., 2022; Ye et al., 2024), limited research addressed the association between digital innovation and enterprise resilience. Furthermore, the current research has primarily concentrated on the economic outcomes of digital innovation, exploring its impact on firm-level total factor productivity (Lo et al., 2023), firm performance (Liu et al., 2023; Huang et al., 2023) and ESG performance (Huang et al., 2023). When it comes to driving digital innovation within enterprises, a comprehensive approach that includes the characteristics of top management team (Firk et al., 2022), digital acquisitions (Hanelt et al., 2021), market position (Liu et al., 2021), external intellectual property protection systems (Zheng et al., 2023) and government digital initiatives (Wang et al., 2023) should be taken into consideration.

As digital innovation is an emerging form of innovation, projects have longer investment return cycles and higher uncertainties (Firk et al., 2022). Digital innovation places high demands on enterprises’ finance, technology and human capital, as well as on other resources (Tumbas et al., 2018). Many enterprises face the dilemma of being ‘unwilling’ or ‘afraid’ to innovate owing to the high barriers, costs and uncertainties involved in digital innovation (Huang et al., 2023). Enhancing the business environment encourages the free movement of factors by limiting administrative monopolies and increasing market competition, thus decreasing resource misallocation (Niu et al., 2023). This provides convenience for enterprises to acquire critical external resources such as funding, talent and technology. It helps drive businesses to enhance digital innovation and promote the improvement of enterprise resilience. Entrepreneurial spirit is a concentrated embodiment of entrepreneurs’ comprehensive abilities in establishing and managing businesses. The innovative, risk-taking spirit and long-term orientation contained within it have profound influences on strategic decision-making and resource allocation within enterprises (Shao and Wang, 2023). Entrepreneurial spirit plays an important role in promoting innovation, alleviating financial constraints and allocating production factors (Erken et al., 2018). Therefore, it may affect the mechanism by which the business environment affects enterprise resilience.

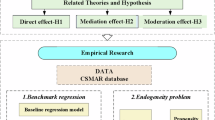

Building on the preceding analysis, the study utilises Chinese urban and listed company data from 2013 to 2021 and takes a broad perspective, with enterprise resilience as the outcome variable. From the perspectives of digital innovation and entrepreneurial spirit, it explores the underlying mechanisms through which the business environment influences enterprise resilience. Compared with existing research, the theoretical contributions of this study are reflected in the following. First, it expands the research on factors influencing enterprise resilience. Most existing research has primarily investigated the internal factors driving enterprise resilience, with relatively few studies delving into the interconnection between the external environment and enterprise resilience. This study adopts an institutional-based perspective and further expands the examination of factors affecting enterprise resilience at the institutional level. It offers empirical evidence on how to enhance enterprise resilience. Second, it reveals the mechanism by which the business environment affects enterprises resilience. This study focuses on the important factors affecting enterprise survival in the era of digitalisation. It integrates ‘business environment – digital innovation – enterprise resilience’ into the same research framework, expanding the research on the factors influencing enterprise digital innovation and its economic outcomes. Third, it proposes the crucial role of entrepreneurial spirit in enhancing the positive effects of the business environment. Digital innovation is a high-risk activity, and only enterprises with strong entrepreneurial spirit can invest limited resources into digital innovation. This study provides theoretical references on how to further amplify the positive impact of the business environment.

The structure of this study can be described as follows: Section 2 is a literature review. Section 3 offers a theoretical analysis of how the business environment impacts enterprise resilience. Section 4 provides an overview of the research methods, introducing the data source, variable definition and model of this study. Section 5 delivers the findings. Section 6 is the discussion, which includes the theoretical contributions of this study, practical implications and research limitations and future directions. The final section summarises the conclusions.

Literature review

In recent years, as external environmental uncertainties have increased, the academic focus on enterprise resilience has grown. Current research on the topic of ‘how to enhance enterprise resilience’ has developed extensively, covering the following three main areas.

First, research has concentrated on firms’ internal characteristics, exploring pathways to resilience from the perspectives of resources and capabilities. In terms of material resources, financial and technological resources contribute to enhancing enterprise resilience (Pal et al., 2014). Regarding human resources, managers’ abilities and psychological traits, as well as employee resilience, play a crucial role in forming enterprise resilience (Barasa et al., 2018). Organisational, innovation, dynamic and governance capabilities all serve to promote enterprise resilience (Williams and Anyanwu, 2017; Ozanne et al., 2022). With the rise of a new wave of technological revolution, recent studies have highlighted the value of digital transformation in enhancing enterprise resilience (Abidi et al., 2023; He et al., 2023). Second, research has examined the value of environmental and social practices in enhancing enterprise resilience from the perspective of interactions between firms and their stakeholders. For instance, Ortiz‐de‐Mandojana and Bansal, 2016 found that engaging in environmental and social practices contributes to long-term performance growth, reduces financial volatility and improves survival rates. DesJardine et al. (2019) investigated the impact of social responsibility during financial crises, revealing that firms fulfilling social responsibilities experienced reduced stock price losses and shorter recovery times during crises. Furthermore, strategic social responsibility has a more significant positive effect on enterprise resilience compared to tactical social responsibility. Broadstock et al. (2021) employed event analysis and found that the positive impact of ESG ratings on enterprise performance was stronger during the COVID-19 pandemic, demonstrating the incremental value of ESG performance during crises. Last, from the perspective of firms’ external environment, social trust as an informal institution has a positive effect on enterprise resilience (Lins et al., 2017). Additionally, there is literature confirming the role of digital finance in enhancing enterprise resilience (Xia et al., 2022).

The business environment is a comprehensive system encompassing the external conditions that enterprises face at every stage, from establishment to cessation (World Bank Group, 2019). On a macro level, enhancing the business environment enables to support the upgrading of the structure of human capital (He and Yao, 2022), improve informal employment (Estevão et al., 2022), enhance regional technological innovation levels (Zhong and Chen, 2023) promote regional economic growth (Gillanders and Whelan, 2014) and overall economic development (He and Yao, 2022; Zhong and Chen, 2023). On a micro level, a favourable business environment can facilitate individual entrepreneurship and the establishment of new enterprises (Yu et al., 2023; Canare, 2018), enhancing corporate innovation capabilities (Gogokhia and Berulava, 2021), facilitating firm exports (Hien et al., 2014; Reçica et al., 2019), increasing firm productivity (Gogokhia and Berulava, 2021), improving firm performance (Commander and Svejnar, 2011) and driving firm growth (Haschka et al., 2022). Regarding the impact of the business environment on enterprise resilience, existing research has used the COVID-19 pandemic as a case study to illustrate the critical role of the business environment in enhancing performance recovery during crises (Fu et al., 2023).

The literature review above shows that studies on the factors affecting enterprise resilience have primarily focused on internal resources and capabilities, as well as relationships with stakeholders. Research on external institutional environments has mainly concentrated on social trust as an informal institution. However, the role of the business environment in improving enterprise resilience has been examined mainly during crises, with insufficient attention given to its effects and mechanisms under normal conditions and the boundary conditions of such effects. Therefore, this paper employs an institutional perspective to theoretically analyse the relationship between business environment and corporate resilience as well as the mediating role of digital innovation and the moderating role of entrepreneurial spirit. This approach aims to reveal the underlying mechanisms by which the business environment affects corporate resilience. The following sections present the theoretical analysis and research hypotheses of this study.

Theoretical analysis and research hypotheses

Business environment and enterprise resilience

As this study examines enterprise resilience from a broad perspective, enterprise resilience is defined as a company’s ability to withstand external risks and achieve long-term growth in an uncertain environment. According to the perspective of resource dependence theory, organisations cannot produce all the necessary resources for their survival on their own. They need to interact with the environment to acquire key resources for sustaining their existence (Pfeffer, 1987). Improving the business environment has created a unified, open and competitively regulated modern market system. This helps reduce inappropriate and excessive intervention by local governments in businesses within their jurisdictions and lowers institutional transaction costs. It also facilitates the free flow of production factors through market mechanisms (Chen et al., 2023). Moreover, it provides a platform for enterprises to equally access external resources, thereby enhancing internal resource reserves and improving enterprise resilience.

First, optimising the business environment can increase enterprises’ financial resources, which serve as the foundation for investment activities. Optimising the business environment not only helps broaden enterprise financing channels, but it also reduces the cost of financing. This improves the difficulties and high costs faced by enterprises in obtaining financing, thus increasing their internal financial resources (Chen et al., 2023; Ganter and Hecker, 2013). On one hand, sufficient financial resources can solve the issue of not enough investment due to a lack of funds, encouraging companies to invest more in research and development. This improves enterprises’ innovation and market competitiveness, making them better at handling risks and enhancing enterprise resilience. On the other hand, having ample financial reserves enables enterprises to seize new investment opportunities, facilitating rapid recovery and long-term growth of performance after crisis events (Williams and Anyanwu, 2017). This helps promote the enhancement of enterprise resilience.

Second, optimising the business environment can improve enterprise human resources. Human resources are the driving force for achieving strategic goals, and the quality of human capital is a core element in strengthening enterprise resilience. A high-level business environment can attract outstanding talents and optimise the reserve of enterprise human resources (Luo et al., 2023). Highly qualified talents possess strong knowledge and management abilities. They can take measures to predict risks that enterprises may face and implement a series of preventive measures, thereby enhancing the enterprise’s ability to withstand external risks. Additionally, highly qualified talents have strong innovative capabilities. They can help enterprises discover new market opportunities and increase the probability of research and development success. This helps the enterprise to achieve long-term growth in performance, empowering the enhancement of enterprise resilience.

Third, optimising the business environment can expand enterprise technological resources. The favourable commercial credit environment created by optimising the business environment can strengthen communication and cooperation among enterprises; this increases enterprise technological resource reserves through knowledge spillover effects (Nam, Bao Tram (2021)). On one hand, with the support of technological resources, enterprises can introduce advanced technologies into the entire process of risk prediction, assessment and management, thereby enhancing their risk-defence capabilities, reducing the volatility of enterprise performance and enhancing enterprise resilience. On the other hand, rich technological resources can support enterprise research and development innovation activities, increasing the probability of research and development success. This can facilitate long-term growth for the enterprise and enhance its resilience. Thus, the following research hypothesis is proposed:

Hypothesis 1: A favourable business environment positively influences enterprise resilience.

The mediating role of digital innovation

With the rise of emerging economies, the institutional environment becomes a crucial endogenous variable affecting enterprise development (Hoskisson et al., 2000). In addition to industry conditions and resources mentioned in the industrial- and resource-based views, corporate strategic choices are also influenced by the institutional environment (Oliver, 1991). Peng (2002) introduced the institutional-based view and research paradigm of ‘institutional environment-strategic behaviour-corporate performance’. The business environment encompasses various external conditions that enterprises encounter throughout their lifecycle (World Bank Group, 2019). According to the institutional-based view, optimising the business environment affects corporate strategic choices and thus influences corporate behaviour. In China, where market mechanisms are still developing, the government continues to play a substantial role in resource allocation. Enterprises’ production and operational activities are influenced by the institutional environment established by government policies. Therefore, the institutional perspective provides a sound theoretical framework for explaining how the business environment impacts enterprise resilience through its effect on digital innovation in the Chinese context.

Digital innovation is when enterprises use new technologies such as big data, cloud computing and the Internet of Things to create new products, improve processes and establish innovative business models (Yoo et al., 2010). Digital innovation is a key strategic choice for enterprises to gain competitive advantage in the digital age. As a long-term, complex and systemic endeavour, digital innovation requires support from resources such as funding, talent and technology (Tumbas et al., 2018). To optimise the business environment, government agencies have established institutional measures to encourage enterprises to undergo digital transformation and drive innovation. Simultaneously, optimising the business environment equips enterprises with the talent, technology and financial support needed for digital innovation, thereby facilitating enterprise digital innovation.

First, digital innovation requires enterprises to introduce several hardware and software devices, which requires financial support. Improving the business environment boosts enterprises’ financial resources by broadening external financing options and lowering financing expenses, which helps alleviate the funding shortage dilemma for enterprises, allowing them to participate in digital innovation (Luo et al., 2023). This, in turn, encourages enterprises to actively promote digital innovation. Second, digital innovation requires high-quality talent – especially with digital literacy – to provide support. The emphasis on talent created by optimising the business environment helps attract talent with digital literacy to join enterprises (Luo et al., 2023), thereby promoting digital innovation in enterprises. Last, digital innovation requires specific technical support. By optimising the business environment, an open and inclusive social atmosphere is created, allowing enterprises to build platforms for cooperation and communication. This promotes collaborative innovation among enterprises and other market entities. Through knowledge spillover effects, this improves enterprise technological capabilities and promotes digital innovation in enterprises.

Digital innovation has a productive effect on the enterprise resilience. The inherent nature of digital technology allows for rapid iteration and upgrading of digital products and services. Digital innovation helps enterprise create automated, digitalised and intelligent business processes (Boland et al., 2007), which enhance operational efficiency and flexibility. Additionally, digital innovation can improve communication within an organisation’s various departments and with external entities, boosting the efficiency of information gathering, processing and decision-making (Philipp and Fritzscheb, 2017). This allows enterprises to more precisely predict risks across different areas and helps in formulating corresponding measures to strengthen the enterprise’s risk-defence capabilities. At the same time, digital innovation permits market analysis and integration, assisting enterprises in rapidly identifying new market demands and establishing reliable decision-making strategies (Philipp and Fritzscheb, 2017; Tanaka et al., 2020; Wamba et al., 2019). This facilitates the creation of personalised products that meet customer needs, thereby enhancing customer satisfaction and loyalty (Balci, 2021). This expansion of market share promotes sustainable growth in uncertain environments (Yoo et al., 2010), improving businesses’ long-term survival capabilities and enhancing enterprise resilience.

The analysis presented above suggests that optimising the business environment can provide crucial support to enterprises in obtaining external capital, talent and technological resources, thus aiding their involvement in digital innovation. Consequently, digital innovation has a substantial impact on enhancing the enterprise’s risk-defence capabilities and achieving long-term growth, thus promoting its overall resilience. Building upon these findings, the following hypothesis is proposed:

Hypothesis 2: The business environment improves enterprise resilience by promoting digital innovation.

The moderating role of entrepreneurial spirit

From the institutional-based view, the institutional environment, together with institutional and organisational resources, influences enterprise strategic choices and ultimately affects corporate performance (Peng, 2002). Entrepreneurial spirit refers to the qualities possessed by entrepreneurs, such as a propensity for innovation, proactive behaviour, willingness to take risks and long-term orientation (Gartner, 1988; Hayton and Kelley, 2006). As a critical resource within enterprises, entrepreneurial spirit serves as a substantial force shaping strategic decision-making (Shao and Wang, 2023). Digital innovation is a high-risk activity characterised by high input and uncertain returns (Firk et al., 2022). It necessitates strong innovative, adventurous and long-term value pursuit, aligning with the essence of entrepreneurial spirit.

On one hand, enterprises with stronger entrepreneurial spirit focus more on innovative activities. Such enterprises possess more innovative talents enabling them to deepen their understanding of the details of digital innovation technology. This helps to increase the probability of success in digital innovation and enhances confidence in conducting digital innovation activities. This prompts enterprises to allocate financial, human, technological, and other resources obtained from optimising the business environment to digital innovation activities, thereby strengthening the promoting effect of business environment optimisation on digital innovation. On the other hand, entrepreneurial spirit drives businesses to pursue high-risk activities (Drucker and Noel, 1986). Enterprises with a strong spirit of adventure can accept the risk of losses from failed digital technology innovations. They can allocate resources obtained from optimising the business environment to digital technology innovation activities. This helps to enhance the positive impact of business environment optimisation on digital innovation in enterprises. Therefore, relative to businesses with lower entrepreneurial spirit, businesses with higher entrepreneurial spirit have a higher degree of digital innovation and can enhance the productive consequence of optimising the business environment on digital innovation. Hence, this study posits the following research hypothesis:

Hypothesis 3a: Entrepreneurial spirit magnifies the favourable consequence of optimising the business environment on digital innovation within enterprises.

As analysed earlier, digital innovation can enhance a company’s ability to defend against risks and facilitate swift recovery following a crisis event, thereby contributing to enhancing enterprise resilience. Entrepreneurial spirit can enhance the positive effects of streamlining the business environment on digital innovation, thereby improving enterprise resilience as digital innovation acts as a mediator between business environment optimisation and enterprise resilience. Drawing from these arguments, the following hypothesis is proposed:

Hypothesis 3b: Entrepreneurial spirit enhances the profits of advancing the business environment on digital innovation, thereby strengthening the positive effect on enterprise resilience.

Figure 1 exhibits the conceptual structure used in this study.

Methods

Sample and data

Previous studies have utilised questionnaire survey methods to measure the relationship between business environment and enterprise resilience (Fu et al., 2023). However, owing to the considerable impact of the respondents’ subjective biases, the research conclusions may be biased. Additionally, the questionnaire survey method measures enterprise resilience at a specific point in time, which makes it difficult to reflect the long-term changes in enterprise resilience from a broader perspective. To overcome these issues, the data utilised in this study for constructing the city business environment were sourced from the China City Database, China Urban and Rural Construction Database and ‘Research Report on Fiscal Transparency of Chinese Municipal Governments’. As the data on fiscal transparency of Chinese municipal governments presented in the report began in 2013, and the China City Database used in this study was updated to 2021, the study period was set from 2013 to 2021. In line with this, the micro-level sample for empirical testing comprised non-financial listed companies in China from 2013 to 2021. This enables to reflect the changing trends in enterprise resilience, aligning with the study’s broader perspective on examining enterprise resilience. The data were sourced from the Database CSMAR and CNRDS. After processing, this study obtained 21,142 observations for empirical analysis. To address the outliers, all continuous variables underwent a dual-direction 1% removal. By eliminating observations falling within the top and bottom 1% range, this method successfully mitigated the adverse effects of outliers.

Measures

Dependent variable: enterprise resilience

At present, the primary approaches for quantifying enterprise resilience in the academic community are two: direct and indirect measurement. Direct measurement involves designing corresponding test items based on the definition and features of enterprise resilience, forming a multidimensional measurement scale and using questionnaire surveys to measure the level of enterprise resilience (Kantur and Say, 2015). Indirect measurement is based on sample data from listed companies and infers enterprise resilience through performance indicators such as the degree of stock price decline during crisis periods (DesJardine et al., 2019), long-term performance growth, performance volatility and corporate survival time (Ortiz‐de‐Mandojana and Bansal, 2016). Existing research has acknowledged indirect measurement methods for their objective and accurate data, as well as their capability to conduct long-term tracking analysis, owing to the challenges associated with tracking sample data using questionnaire survey methods and the substantial impact of respondents’ subjective psychological biases.

As this study defined enterprise resilience from a broad perspective, it followed the approach of Ortiz‐de‐Mandojana and Bansal (2016), starting from the dual perspectives of long-term performance growth and performance volatility. The three-year cumulative growth of operating income and stock return standard deviation was normalised and assigned using the entropy method to calculate the enterprise resilience score. The higher the three-year cumulative growth of operating income, the stronger the enterprise resilience; thus, three-year cumulative growth was subjected to positive normalisation processing. The larger the stock return standard deviation, the higher performance volatility and the lower enterprise resilience; thus, stock return standard deviation was subjected to reverse normalisation processing.

Explanatory variables: business environment

The urban business environment index calculated by Li et al. is considered authoritative. However, directly using their evaluation data or regression results may lead to biases due to changes in the evaluation indicators between 2018 and 2020 (Niu et al., 2023). Additionally, owing to the relatively short calculation period, for their index, reflecting long-term trends in the urban business environment is difficult. Therefore, this study learnt from the evaluation indicator system of Li et al.’s ‘Research Report on China’s Urban Business Environment 2019’. Based on data availability, this study built an assessment index framework for urban business environment, as shown in Table 1. After each indicator was standardised, the objective entropy method was used to assign weights to each indicator. Finally, the scores of the urban business environment were summed up. A higher value denoted a superior business environment for companies in the respective cities.

Figure 2 depicts the trend of the calculated business environment index over time. It shows that, in recent years, the urban business environment index in China has been rising annually, indicating a sustained improvement in the Chinese business environment. Figure 3 shows the trend of each primary indicators of the business environment. As for values, the government environment performs the best, followed by human resources and public services. In terms of trends, all primary indicators of the business environment have shown a sustained upward trend.

Mediator variable: digital innovation

Patents represent the ultimate manifestation of a firm’s investment in and efficiency of utilising innovative resources. They are the most widely used metrics in innovation-related research, especially in studies focusing on publicly traded companies (He et al., 2018; Huang and Li, 2019). Patent data typically encompass both patent applications and granted patents. Since patent grants can be influenced by external factors, while patent applications capture the timing of innovation by a firm, they serve as a crucial indicator of its innovation level (Hirshleifer et al., 2018). Therefore, following the approach of Liu et al. (2023) and Yang (2022), this study adopted the number of patent applications related to digital innovation as a measure of digital innovation. We followed the methods used in the existing literature to identify digital patents at the firm level by utilising patent text information (Liu et al., 2023; Huang et al., 2023). Specifically, we conducted keyword text analysis on the abstracts and descriptions of patent applications filed by publicly listed companies to determine the number of invention patents and utility model patents related to digital technologies. Subsequently, we aggregated the number of digital technology patents at the firm level and applied a logarithmic transformation to construct an indicator for digital innovation within the organisation. Among them, the digital innovation text information feature words were derived from Wu et al. (2021).

Moderating variable: entrepreneurial spirit

This study measured the proportion of research and development (R&D) personnel in enterprises. We believe that having R&D personnel is fundamental for a company’s innovation activities. A higher proportion of R&D personnel indicates stronger entrepreneurial spirit within the company.

Control variables

The variables controlled for in this study encompass firm size (Size), asset-liability ratio (Lev), corporate ownership (SOE), corporate age (Age), inventory ratio (INV), dual appointment of executives (Dual), board size (Board), shareholding proportion of the largest shareholder (TOP1), shareholding proportion of institutional investors (INST), return on assets (ROA), and book-to-market ratio (BM). Table 2 describes the aforementioned variables.

Models

Baseline Regression Model

The baseline regression model within this study is depicted as Eq. (1). In the equation, Re siliencei, t indicates the degree of enterprise resilience; BEi, t represents the business environment index of the city where company is located, and Σ Xi, t indicates a series of control variables. λj and μt denote industry and year-fixed effects, respectively, while εi, t represents the error term.

Mediation test model

Utilising the mediation effect testing framework suggested by Baron and Kenny (1986), we employed a stepwise regression coefficient testing approach to examine the mediating mechanism of digital innovation between business environment and enterprise resilience. The mediation test model constructed in this study is presented as Eqs. (2–4), where Digiti,t represents the firm’s digital innovation, and other variables remain consistent with the previous description. If both coefficients δ1 and δ2 are significant and the value of δ1 is less than α1, it indicates the presence of partial mediation. If δ1 is not significant, it indicates that the mediating variable fully mediates the influence of the business environment on enterprise resilience.

A Moderated Mediation Test Model

We constructed the model as Eqs. (5, 6) to test the moderating effect. Here, Entrei, t represents the entrepreneurial spirit, and other variables remain consistent with the previous description. First, we employed Eq. (5) to test the moderating effect of entrepreneurial spirit on the significance of the business environment on digital innovation. If a3 exhibits a statistically significant positive relationship, it signifies that entrepreneurial spirit enhances the consequences of optimising the business environment on digital innovation promotion. Second, we employed Eq. (6) to evaluate the moderating effect of entrepreneurial spirit on the process through which business environment optimisation affects enterprise resilience via digital innovation. If b3 is significantly positive, entrepreneurial spirit operates as a moderator in the first half of the process, where business environment optimisation influences enterprise resilience through digital innovation. In other words, the moderated mediation model is established.

Results

Descriptive statistics

The descriptive statistics are displayed in Table 3. The mean of enterprise resilience is 0.540. The business environment ranges from 0.052 to 0.630. The 50th percentile value of digital innovation is 0.000, which indicates that at least half of the listed companies in China have not conducted any digital innovation activities. The average value of entrepreneurial spirit is 0.130, and the standard deviation is 0.138.

Baseline estimation results

We conducted regression analysis on the sample data using Eq. (1) and clustered the standard errors at the company level. Table 4 lists the regression results. The business environment has a favourable effect on enterprise resilience, with a significance level of 1%; thus, Hypothesis 1 is confirmed. By improving the business environment, substantial cuts in institutional transaction costs for businesses have been made, creating opportunities for enterprises to participate in market competition and access external resources equally. This increases the reserves of financial, human and technological resources within the enterprise, which, in turn, enhances its ability to withstand risks, promotes rapid recovery of business performance, achieves sustainable growth and ultimately improves enterprise resilience.

Endogeneity test

Highly resilient firms tend to drive the economic development of their host cities, thereby improving the business environment. Therefore, a reverse causality issue may exist between enterprise resilience and the business environment. Additionally, owing to the challenges of fully controlling all factors that influence enterprise resilience, estimation results may be subject to errors. To address this concern, this study employed instrumental variable (IV) analysis. The Instrumental Variable Method (IV) is a statistical approach used to estimate causal relationships in economic models, particularly in the presence of endogeneity issues. The fundamental idea behind the IV method is to identify one or more exogenous variables, known as instrumental variables, which are correlated with the endogenous independent variable but uncorrelated with the error term of the dependent variable. By employing these instrumental variables, researchers can substitute for the endogenous independent variable, which leads to more accurate estimates. The use of the IV method can address challenges in causal inference in various economics and social science studies, thereby enhancing the reliability of parameter estimates. Specifically, following the approach used by Shen et al. (2021), we selected the topography variation of each city as an instrument for the business environment. This is because topography variation is a natural geographical condition that affects the ease of trade in different regions. Regions with higher topography variation have more mountains, which results in a more restricted business environment for their host cities. Therefore, a negative correlation exists between topography variation and a city’s business environment (Shen et al., 2021). Topographic variation, as a natural geographic factor, may not have a direct relationship with the strategic choices and behavioural performance of micro-enterprises within a region. Moreover, in modern society, with the continuous improvement of transportation infrastructure, the impact of topographic variation on business decision-making has diminished. This meets the exclusion restriction of instrumental variables. The weak instrument test, using the Kleibergen-Paap rk LM statistic, yielded a value of 2235.243 with a p-value of < 0.001, indicating no weak instrument problem. The Cragg-Donald Wald F statistic for weak instrument testing was 2488.154, exceeding the critical value for the 10% significance level as per the Stock-Yogo weak identification test. This indicates the absence of weak instrument issues. Table 5 shows the findings of the regression analysis. Topography variation negatively influences the business environment with a significance level of 1%, which indicates that higher topography variation is associated with a lower level of the business environment in a region. After instrumental variable concerns are accounted for, improving the business environment significantly enhances enterprise resilience at the 1% significance level.

Robustness check

One-period lag of explanatory variable

As highly resilient firms tend to drive the economic development of their host cities, thereby improving the business environment, a reverse causality issue may exist between enterprise resilience and the business environment. To mitigate this concern, this study introduced a lagged one-period business environment as an explanatory variable to address the potential reverse causality. The first column of Table 6 shows that after reverse causality is accounted for, optimising the business environment significantly promotes enterprise resilience.

Controlling for city-fixed effects

To overcome the consequence of the geographic location on enterprise resilience, this study further controlled for city-fixed effects. The second column of Table 6 presents the estimation results, which show that improving the business environment significantly enhances enterprise resilience at a significance level of 1%, even after the effects of different cities are accounted for; thus, the previous research findings remain valid.

Change the measurement method of explanatory variables

Entropy weighting was previously used to assign weights to indicators in the calculation of the business environment. Here, we switched to equal weighting to measure the business environment (BE2). The findings from column (3) of Table 6 suggest that the business environment is statistically significant, which confirms the accuracy of the previous research findings.

Testing the mediating role of digital innovation

Theoretical analysis in the previous section suggested that a conducive business environment can strengthen enterprise resilience by promoting digital innovation. This section empirically tests the mediating role of digital innovation. Regression analysis was conducted on the sample data using Eqs. (2–4), and Table 7 illustrates the results. We observe that the business environment enhances digital innovation at a 5% significance level. Furthermore, the regression results, considering both the business environment and digital innovation, indicate that digital innovation significantly improves enterprise resilience with a level of significance set at 1%. However, the estimated coefficient of the business environment has decreased, and its significance has also declined. This implies that digital innovation partly mediates the linkage between business environment and enterprise resilience. Additionally, a Bootstrap (1,000 iterations) sampling test was conducted, and the results reveal a 95% confidence interval for the indirect effect of [0.0141, 0.0269]. This leads to the inference that the mediating role of digital innovation is significant, and Hypothesis 2 is supported. This can be attributed to the fact that optimising the business environment expands firms’ avenues for acquiring resources, such as financial, human and technological resources, thus providing opportunities for firms to engage in digital innovation activities. Moreover, digital innovation contributes to enhancing firms’ risk-defence capabilities, performance recovery abilities and sustainable growth, in turn improving enterprise resilience. Additionally, enterprises with stronger entrepreneurial spirit can allocate their available resources towards digital innovation activities, thereby enhancing the positive impact of the business environment on enterprise resilience.

Examination of the moderating effect of entrepreneurial spirit

To assess the moderating effect of entrepreneurial spirit in relation to the link between business environment and enterprise resilience, regression analysis was performed on the sample data using Eqs. (5, 6). Table 8 shows the results. Column (1) shows that the interaction term is positively correlated with digital innovation with a level of significance set at 1%, and the estimated coefficient of digital innovation in column (2) with a level of significance set at 1%. This signifies that the moderating mediating effect of entrepreneurial spirit in the context of the association between business environment optimisation and enterprise resilience is established. Figure 4 is the diagram of the moderating effect of entrepreneurship. Entrepreneurial spirit can enhance the promotion consequence of the business environment optimisation on digital innovation in enterprises, thereby strengthening the promotion effect on enterprise resilience. Hypothesis 3a and 3b are thus supported.

Further analysis

Effects of Primary Indicators of Business Environment

Prior studies have established the significant positive impact of optimising the business environment on enterprise resilience from a holistic standpoint. We further decomposed the business environment into primary indicators in the evaluation index system to explore which primary dimensions of the business environment are more conducive to improving enterprise resilience. Specifically, we used each primary indicator in the business environment evaluation index system as an explanatory variable and regressed it on enterprise resilience. The results are presented in Table 9. As shown, both human resources and financial environment display a significant positive effect on enterprise resilience at the 1% significance level. The market environment significantly increases enterprise resilience with a level of significance set at 5%, while the innovation environment has a significant coefficient at the 10% significance level. However, the coefficients of public services and government environment fail to pass the significance test. These results suggest that human resources and financial resources are the most direct factors in enhancing enterprise resilience. The market and innovation environments also play important roles in promoting enterprise resilience by providing effective market assurance and innovation support for firms. Public services and the governmental environment, reflecting the fundamental level of public services in a region, cannot directly offer the most immediate support for enterprise development. Therefore, their direct impact on enterprise resilience is not significant.

Heterogeneity analysis

-

(1)

Property Rights Heterogeneity. Based on the enterprises’ ownership nature, we divided the entire sample into two sub-samples: state-owned and private enterprises. Regression analyses were separately conducted for these two groups, with the results presented in the first and second columns of Table 10. The results indicate that the impact of the business environment on the resilience of state-owned enterprises did not demonstrate statistical significance in the test, while the regression coefficient of the business environment on the resilience of private enterprises is significantly positive at the 1% level. This suggests that, in comparison with state-owned enterprises, the enhancing effect of the business environment on enterprise resilience is stronger among private enterprises. This is due to the influence of China’s unique property rights system, where government administrative authority intervenes in the market. As a result, resources among different ownership enterprises show a mismatch. State-owned enterprises are privileged in financing and operational activities, while private enterprises are at a disadvantage in accessing resources such as funds, talents and technology (She et al., 2022). The optimisation of the business environment helps broaden external resource channels for private enterprises and alleviates their resource acquisition difficulties (Chen et al., 2023; Du et al., 2023), thereby exerting a stronger promotion effect on the resilience of private enterprises. From practical experience, Qingdao is a coastal port city in eastern China, and in recent years, the business environment in the city has gradually improved. Sailun Group, a private enterprise in Qingdao, has seen an increase in the proportion of employees with a bachelor’s degree or higher from 14% in 2015 to 17%. Additionally, its total borrowings have risen from 4.6 billion to 7 billion yuan, and the number of patent applications has grown from 40 to 253. In contrast, the state-owned enterprise Aokema, also located in Qingdao, has seen the proportion of employees with a bachelor’s degree or higher increase from 18.3% to 19.5%, total borrowings rise from 400 million to 900 million yuan and patent applications increase from 90 to 130. This indicates that the optimisation of the business environment has a more substantial impact on the enhancement of human resources, financial resources and technological resources in private enterprises.

Table 10 Heterogeneity regression results. -

(2)

Size Heterogeneity. This study defined samples with a scale larger than the annual industry median as large-sized enterprises, while the rest were considered small and medium-sized enterprises (SMEs). Regression analyses were separately conducted for these two groups, with the results presented in columns (3) and (4) of Table 10. The regression coefficient of the business environment on enterprise resilience is not significant in the sample of large-scale enterprises, whereas it significantly enhances the resilience of SMEs at the 1% significance level. This suggests that the promoting effect of optimising the business environment on enterprise resilience is stronger among SMEs because they face greater disadvantages in resource acquisition compared to large-scale enterprises. Optimising the business environment helps broaden external resource channels for SMEs and alleviates their resource acquisition challenges. This leads to increased resource reserves for SMEs (Shao and Wang, 2023), exerting a significant promoting effect on enterprise resilience. For instance, Hangzhou is an important economic centre on the southeastern coast of China, and the city’s business environment ranks among the best in the country. Southeast Network Frame is a small-scale enterprise in Hangzhou. From 2013 to 2021, the proportion of employees with a bachelor’s degree or higher at this company increased from 11.9% to 15.4%. During the same period, the total amount of loans rose from 1.4 billion yuan to 3.3 billion yuan, and the number of patent applications increased from around 10 annually to over 60. In contrast, the large-scale enterprise Xiangmin Co., located in Changsha, saw the proportion of employees with a bachelor’s degree or higher increase from 2.4% to 3.2%, while the total borrowings rose from 39 million yuan to 150 million yuan, with patent applications remaining stable at about 15 to 20 per year. Thus, optimising the business environment has a more pronounced effect on enhancing human resources, financial resources and technological resources in small-scale enterprises.

-

(3)

Industry Heterogeneity. This study categorised the entire sample into two types: high-tech industries and traditional industries, based on the industry classification method provided by the National Bureau of StatisticsFootnote 1. Regression analyses were then conducted separately for each category, with the findings outlined in the fifth and sixth columns of Table 10. The business environment substantially strengthens enterprise resilience in high-tech industries at the 1% significance level, whereas its effect on the enterprise resilience in traditional industries is not significant. This indicates that the enhancement effect of optimising the business environment on enterprise resilience is more evident in high-tech industries than in traditional industries. This is because, relative to traditional industries, high-tech industries enterprises require more financial, human and technological resources. By reducing resource misallocation, optimising the business environment alleviates the resource scarcity experienced by high-tech enterprises (Luo et al., 2023), thus promoting the enhancement of enterprise resilience. For example, Shanghai is the leading city in China’s Yangtze River Economic Belt, known for its outstanding business environment. Shanghai Electric is a manufacturing equipment company that operates within the high-tech industry. In recent years, the proportion of employees with a bachelor’s degree or higher at this company increased from 38.4% to 52.3%, while the total borrowing amount rose from 5.7 billion yuan to 35.6 billion yuan, and the number of patent applications surged from around 50 annually to over 200. In contrast, Bright Dairy, located in the same city and belonging to the traditional food manufacturing industry, has maintained a proportion of employees with a bachelor’s degree or higher at around 21%, with total borrowings fluctuating around 2 billion yuan and annual patent applications remaining stable at approximately 100. This indicates that optimising the business environment has a more significant impact on enhancing human, financial and technological resources in high-tech industry enterprises.

Discussion

In the current context of unprecedented change, the external environment for business operations is becoming increasingly complex and volatile. Enhancing enterprise resilience is a vital source of driving sustained and healthy economic growth in China. The central and local governments have instituted a range of policy measures to maximise improvements in the business environment, striving to create a favourable operating environment for enterprises. Against this backdrop, exploring the value of the business environment from the perspective of enterprise resilience and its underlying mechanisms has key theoretical insights and practical applications. The study found that the business environment is crucial in improving enterprise resilience. The human resources, financial, market and innovation environments are the main factors that contribute to enterprise resilience. To some extent, this finding supports the conclusions of Fu et al. (2023), while also extending the research context from crisis periods to a broader perspective of enterprise development. Additionally, mechanism tests revealed that the business environment fosters enterprise resilience through propelling digital innovation. This enriches the mechanism through which the business environment influences enterprise resilience (Fu et al., 2023) and supplements the existing literature on the driving factors and consequences of digital innovation (Huang et al., 2023; Liu et al., 2023; Liu et al., 2021; Zheng et al., 2023). Furthermore, our findings suggest that entrepreneurial spirit can amplify the positive effects of the business environment on digital innovation, thereby strengthening enterprise resilience.

Theoretical contribution

This research makes a substantial theoretical contribution. First, a large portion of the literature has paid attention to the ramifications of internal characteristics on enterprise resilience, such as resources and capabilities (Barasa et al., 2018). This study enhances the current body of research results on factors influencing enterprise resilience from an institutional perspective, which helps expand the academic understanding of resilience-driving factors. In the digital era, driving digital innovation and understanding its impact on firms have become critical topics in the theoretical field. However, the current academic attention on these aspects is relatively little. This study expands research on the determinants of digital innovation from the perspective of the business environment and confirms the beneficial impact of digital innovation on enterprise resilience, thus adding to the literature on digital innovation. Furthermore, it expands the boundary conditions of the business environment’s impact on enterprise resilience from an entrepreneurial spirit perspective. It fills a research gap in the existing literature by paying insufficient attention to boundary conditions when exploring the role of the business environment (Gogokhia and Berulava, 2021; Hien et al., 2014; Reçica et al., 2019). Finally, most existing research has explored the role of the business environment from a holistic perspective (Chen et al., 2023; Commander and Svejnar, 2011). This study examines how different primary indicators of the business environment affect enterprise resilience differently, improving our understanding of the predictive role of the business environment on enterprise resilience.

Practical implications

This study also has considerable practical implications. For the government, further improving the business environment and providing resource support for enterprise development is essential. First, government departments should optimise the talent cultivation system, offering opportunities for learning, growth and promotion to high-skilled personnel. Second, government departments should provide enterprises with broader and more convenient channels to access financial resources. The government can encourage commercial banks to establish partnerships with businesses, offering special loans and increasing support for project financing. Last, government departments can support enterprise innovation activities through methods such as R&D subsidies, technical training and adoption of an inclusive attitude towards failure. For enterprises, first and foremost, they should vigorously promote entrepreneurial spirit and leverage the resource advantages brought about by an improved business environment to actively drive digital innovation. Specifically, enterprises can enhance their level of digital innovation by implementing digital investment plans, recruiting digital professionals and providing digital skills training. Second, enterprises should strengthen talent welfare and protection to attract outstanding talent and optimise the structure of human capital. By fully leveraging the value creation effects of human capital, enterprises can enhance their resilience.

Limitations and future directions

This study explored the impact of optimising the business environment on enterprise resilience, utilising a sample of China’s listed firms and urban business environment data. However, it is subject to certain limitations. We use textual analysis to measure digital innovation, with the number of patent applications related to digital innovation serving as the metric. Given the rapid evolution of digital technology and the expanding scope of digital innovation across various domains, the keyword spectrum utilised in this study may still fall short of encompassing all relevant terms. Future research can expand the range of keywords used to measure digital innovation according to the trends in digital technology development. This can more accurately present the situation of enterprise digital innovation. Furthermore, patents capture only a portion of a company’s digital innovation activities. Future research could further explore suitable metrics by examining aspects such as the digital innovation assets owned by the enterprise. Additionally, this study is based on the institutional-based view, investigating the mediating role of digital innovation and the moderating effect of entrepreneurial spirit. This only provides one mechanism for how the business environment influences enterprise resilience. Future research can explore more pathways between the two to further enrich the existing research findings. Finally, based on the sample of Chinese listed companies, to determine the applicability of our conclusions to regions outside China, further verification is required.

Conclusion

Based on the data of China’s urban business environment and sample data of listed companies from 2013 to 2021, this study examined the long-term value of the business environment from the perspective of enterprise resilience and explored its underlying mechanisms. It found that the business environment is crucial in improving enterprise resilience. The human resources, financial, market and innovation environments are the main factors contributing to enterprise resilience. Mechanism tests revealed that the business environment fosters enterprise resilience through propelling digital innovation. Furthermore, entrepreneurial spirit can amplify the positive effects of the business environment on digital innovation, thereby strengthening enterprise resilience. Heterogeneity analysis suggested that upgrading the business environment exhibits a more salient improvement in resilience for private enterprises, SMEs and high-tech industries compared to state-owned, large-sized and traditional industries. These results confirm the critical role of optimising the business environment in enhancing enterprise resilience. The findings have important theoretical and practical implications for understanding how improvements in the business environment, coupled with increased digital innovation and entrepreneurial spirit, can further bolster enterprise resilience.

Data availability

Data on the company’s enterprise resilience, entrepreneurial spirit, size, asset-liability ratio, ownership, age, inventory ratio, dual appointment of executives, board size, shareholding proportion of the largest shareholder, shareholding proportion of institutional investors, return on assets, and book-to-market ratio can be obtained by accessing the China Stock Market &Accounting Research (http://www.gtarsc.com/). The business environment can be obtained from EPS Database(https://www.epsnet.com.cn/) and The official website of School of Public Administration, Tsinghua University (https://www.sppm.tsinghua.edu.cn/). Due to the fact that the data on digital innovation were manually collected and organized by the authors from the annual reports of publicly listed companies, it will not be publicly disclosed at this time in consideration of privacy concerns and the need for ongoing future research. Nevertheless, interested individuals can acquire them by contacting the corresponding author and making a reasonable request.

Notes

High-tech industries encompass 19 sub-industry codes: C25, C26, C27, C28, C29, C31, C32, C34, C35, C36, C37, C38, C39, C40, C41, I63, I64, I65, and M73. All other industries are defined as traditional industries.

References

Abidi N, El Herradi M, Sakha S (2023) Digitalization and resilience during the COVID-19 pandemic. Telecommunications Policy 47(4):102522

Andersson T, Cäker M, Tengblad S, Wickelgren M (2019) Building traits for organizational resilience through balancing organizational structures. Scandinavian Journal Management 35(1):36–45

Balci G (2021) Digitalization in container shipping: Do perception and satisfaction regarding digital products in a non-technology industry affect overall customer loyalty? Technological Forecasting Social Change 172:121016

Barasa E, Mbau R, Gilson L (2018) What is resilience and how can it be nurtured? A systematic review of empirical literature on organizational resilience. International Journal Health Policy Management 7(6):491–503

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal Personality Social Psychology 51(6):1173–1182

Beuren IM, Santos VD (2019) Enabling and coercive management control systems and organizational resilience. Revista Contabilidade Finanç 30:307–323

Boland RJ, Lyytinen K, Yoo Y (2007) Wakes of innovation in project networks: The case of digital 3-D representations in architecture, engineering, and construction. Organization Science 18(4):631–647

Broadstock DC, Chan K, Cheng LT, Wang X (2021) The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Finance research letters 38:101716

Browder RE, Dwyer SM, Koch H (2024) Upgrading adaptation: How digital transformation promotes organizational resilience. Strategic Entrepreneurship Journal 18(1):128–164

Canare T (2018) The effect of ease of doing business on firm creation. Annals Economics Finance 19(2):555–584

Chen Z, Li Y, Lin Y, Pan J (2023) Business environment and corporate financing decisions: From the perspective of dynamic adjustment of capital structure. Finance Research Letters 58:104461

Commander S, Svejnar J (2011) Business environment, exports, ownership, and firm performance. Review Economics Statistics 93(1):309–337

DesJardine M, Bansal P, Yang Y (2019) Bouncing back: Building resilience through social and environmental practices in the context of the 2008 global financial crisis. Journal Management 45(4):1434–1460

Drucker PF, Noel JL (1986) Innovation and entrepreneurship: Practices and principles. Journal Continuing Higher Education 34(1):22–23

Du, Z, Zheng, X, Zhang, C, & Zhou, R (2023). Does the online interaction between retail investors and firm management affect capital structure?. Finance Research Letters, 103835

Duchek S (2020) Organizational resilience: a capability-based conceptualization. Business Research 13(1):215–246

Erken H, Donselaar P, Thurik R (2018) Total factor productivity and the role of entrepreneurship. Journal Technology Transfer 43:1493–1521

Estevão J, Lopes JD, Penela D (2022) The importance of the business environment for the informal economy: Evidence from the Doing Business ranking. Technological Forecasting Social Change 174:121288

Firk S, Gehrke Y, Hanelt A, Wolff M (2022) Top management team characteristics and digital innovation: Exploring digital knowledge and TMT interfaces. Long Range Planning 55(3):102166

Fu L, Shi Y, Yang X, Zhang W (2023) Enterprise resilience to the COVID-19 pandemic: The role of business environment. Plos One 18(8):e0288722

Ganter A, Hecker A (2013) Persistence of innovation: Discriminating between types of innovation and sources of state dependence. Research Policy 42(8):1431–1445

Gartner WB (1988) “Who is an entrepreneur?” is the wrong question. American Journal Small Business 12(4):11–32

Gillanders R, Whelan K (2014) Open for business? Institutions, business environment and economic development. Kyklos 67(4):535–558

Gogokhia T, Berulava G (2021) Business environment reforms, innovation and firm productivity in transition economies. Eurasian Business Review 11(2):221–245

Hanelt A, Firk S, Hildebrandt B, Kolbe LM (2021) Digital M&A, digital innovation, and firm performance: an empirical investigation. European Journal Information Systems 30(1):3–26

Haschka RE, Herwartz H, Struthmann P, Tran VT, Walle YM (2022) The joint effects of financial development and the business environment on firm growth: Evidence from Vietnam. Journal Comparative Economics 50(2):486–506

Hayton JC, Kelley DJ (2006) A competency‐based framework for promoting corporate entrepreneurship. Human Resource Management 45(3):407–427

He S, Yao H (2022) Business environment, human capital structural upgrading, and economic development quality. Frontiers Environmental Science 10:964922

He Z, Huang H, Choi H, Bilgihan A (2023) Building organizational resilience with digital transformation. Journal Service Management 34(1):147–171

He ZL, Tong TW, Zhang Y, He W (2018) Constructing a Chinese patent database of listed firms in China: Descriptions, lessons, and insights. Journal Economics Management Strategy 27(3):579–606

Herbane B (2019) Rethinking organizational resilience and strategic renewal in SMEs. Entrepreneurship Regional Development 31(5-6):476–495

Hien N, Laporte G, Roy J (2014) Business environment factors, incoterms selection and export performance. Operations Supply Chain Management: International Journal 2(2):63–78

Hirshleifer D, Hsu PH, Li D (2018) Innovative originality, profitability, and stock returns. Review Financial Studies 31(7):2553–2605

Hoskisson RE, Eden L, Lau CM, Wright M (2000) Strategy in emerging economies. Academy management journal 43(3):249–267

Huang KG, Li J (2019) Adopting knowledge from reverse innovations? Transnational patents and signaling from an emerging economy. Journal International Business Studies 50:1078–1102

Huang Q, Fang J, Xue X, Gao H (2023) Does digital innovation cause better ESG performance? an empirical test of a-listed firms in China. Research International Business Finance 66:102049

Huang Q, Xu C, Xue X, Zhu H (2023) Can digital innovation improves firm performance: Evidence from digital patents of Chinese listed firms. International Review Financial Analysis 89:102810

Kantur D, Say AI (2015) Measuring organizational resilience: A scale development. Journal Business Economics Finance 4(3):456–472

Li L, Wang Z, Ye F, Chen L, Zhan Y (2022) Digital technology deployment and firm resilience: Evidence from the COVID-19 pandemic. Industrial Marketing Management 105:190–199

Li, Z (2019). Evaluation of China’s Urban Business Environment. China Development Press. (in Chinese)

Lins KV, Servaes H, Tamayo A (2017) Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. Journal Finance 72(4):1785–1824

Liu Y, Dong J, Mei L, Shen R (2023) Digital innovation and performance of manufacturing firms: An affordance perspective. Technovation 119:102458

Liu Y, Dong J, Ying Y, Jiao H (2021) Status and digital innovation: A middle-status conformity perspective. Technological Forecasting Social Change 168:120781

Lo KL, Zhang J, Xia F (2023) Does digital technology innovation work better for industrial upgrading? An empirical analysis of listed Chinese manufacturing firms. Applied Economics Letters 30(18):2504–2509

Luo Y, Cui H, Zhong H, Wei C (2023) Business environment and enterprise digital transformation. Finance Research Letters 57:104250

Ma Z, Xiao L, Yin J (2018) Toward a dynamic model of organizational resilience. Nankai Business Review International 9(3):246–263

Meyer AD (1982).Adapting to environmental jolts. Administrative Science Quarterly, 515-537

Nam VH, Bao Tram H (2021) Business environment and innovation persistence: The case of small-and medium-sized enterprises in Vietnam. Economics Innovation New Technology 30(3):239–261

Niu Z, Xu C, Wu Y (2023) Optimization of Business Environment, Human Capital Effect, and Enterprise Labor Productivity. Journal Management World 39(2):83–100

Oliver C (1991) Strategic responses to institutional processes. Academy management review 16(1):145–179

Ortiz‐de‐Mandojana N, Bansal P (2016) The long‐term benefits of organizational resilience through sustainable business practices. Strategic Management Journal 37(8):1615–1631

Ozanne LK, Chowdhury M, Prayag G, Mollenkopf DA (2022) SMEs navigating COVID-19: The influence of social capital and dynamic capabilities on organizational resilience. Industrial Marketing Management 104:116–135

Pal R, Torstensson H, Mattila H (2014) Antecedents of organizational resilience in economic crises—an empirical study of Swedish textile and clothing SMEs. International Journal Production Economics 147:410–428

Peng MW (2002) Towards an institution-based view of business strategy. Asia Pacific journal management 19:251–267

Pfeffer J (1987) A resource dependence perspective on intercorporate relations. Intercorporate relations: Structural Analysis Business 1(1):25–55

Philipp G, Fritzscheb A (2017) Data-driven operations management: Organizational complications of the digital transformation in industrial practice. Production Planning Control 28(16):1332–1343

Reçica F, Hashi I, Jackson I, Krasniqi BA (2019) Innovation and the export performance of firms in transition economies: The relevance of the business environment and the stage of transition. International Journal Entrepreneurship Small Business 38(4):476–506

Shao K, Wang X (2023) Do government subsidies promote enterprise innovation?—Evidence from Chinese listed companies. Journal Innovation Knowledge 8(4):100436

She M, Hu D, Qiu L (2022) Peer effects in government R&D subsidies: evidence from the awareness-motivation-capability perspective. Asian Journal Technology Innovation 30(3):601–625

Shen S, Li X, Dang L (2021) Business environment and total factor productivity of enterprises. Economic Management Research 42(06):124–144

Tanaka M, Bloom N, David JM, Koga M (2020) Firm performance and macro forecast accuracy. Journal Monetary Economics 114:26–41

Tumbas S, Berente N, Vom Brocke J (2018) Digital innovation and institutional entrepreneurship: Chief Digital Officer perspectives of their emerging role. Journal Information Technology 33:188–202

Van Der Vegt GS, Essens P, Wahlström M, George G (2015) Managing risk and resilience. Academy Management Journal 58(4):971–980

Wamba SF, Akter S, Trinchera L, De Bourmont M (2019) Turning information quality into firm performance in the big data economy. Management Decision 57(8):1756–1783

Wang X, Li Y, Tian L, Hou Y (2023) Government digital initiatives and firm digital innovation: Evidence from China. Technovation 119:102545

Williams A, Anyanwu SA (2017) Innovation and organizational resilience: A study of selected food and beverage firms in Port Harcourt. Innovation 3(6):1–15

World Bank Group. (2019). Doing Business 2020.The World Bank

Wu F, Hu H, Lin H, Ren X (2021) Corporate Digital Transformation and Capital Market Performance: Evidence from Stock Liquidity. Journal Management World 37(7):130–144+10

Xia Y, Qiao Z, Xie G (2022) Corporate resilience to the COVID-19 pandemic: The role of digital finance. Pacific-Basin Finance Journal 74:101791

Yang CH (2022) How artificial intelligence technology affects productivity and employment: firm-level evidence from Taiwan. Research Policy 51(6):104536

Ye F, Ke M, Ouyang Y, Li Y, Li L, Zhan Y, Zhang M (2024) Impact of digital technology usage on firm resilience: a dynamic capability perspective. Supply Chain Management: International Journal 29(1):162–175

Yoo Y, Henfridsson O, Lyytinen K (2010) Research commentary—the new organizing logic of digital innovation: an agenda for information systems research. Information Systems Research 21(4):724–735

Yu L, Tang X, Huang X (2023) Does the business environment promote entrepreneurship?—Evidence from the China Household Finance Survey. China Economic Review 79:101977

Zhang S, Sun Q, Dai L, Wang X (2023) Turn calamities into blessings: the impact of resource reconfiguration and firm resilience on the company’s recovery and growth in the COVID-19 times. Journal Organizational Change Management 36(2):257–272

Zheng P, Li Z, Zhuang Z (2023) The impact of judicial protection of intellectual property on digital innovation: Evidence from China. Finance Research Letters 58:104257

Zhong Z, Chen Z (2023) Business environment, technological innovation and government intervention: influences on high-quality economic development. Management Decision 61(8):2413–2441

Acknowledgements

This research is supported by the Key Project of the National Social Science Fund (No.21AZD044) and Major Project of the National Social Science Fund (No.21&ZD090).

Author information

Authors and Affiliations

Contributions

Ideas and design: RW and GZ; Methodology and data analysis: RW; Original draft preparation: RW; Review and editing: RW and GZ.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This study did not require ethical approval, as it did not involve the use of human or animal subjects.

Informed consent

The authors did not perform any studies involving human participants in this article.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Wang, R., Zhang, G. Does optimising the business environment enhance enterprise resilience? The role of digital innovation and entrepreneurial spirit. Humanit Soc Sci Commun 12, 469 (2025). https://doi.org/10.1057/s41599-025-04704-3

Received: