Abstract

This study examines the factors influencing green energy investment in China from 2015 to 2022 using macroeconomic and financial data. Fully Modified Ordinary Least Squares (FMOLS) regression analysis identifies a strong positive relationship between green bond issuance—used as a proxy for green finance—and renewable energy investment, underscoring its critical role in the energy transition. However, private investment in public equity (PIPE) negatively correlates with renewable investment, suggesting a misalignment with equitable climate goals. Economic distress, measured by the misery index, is associated with increased renewable investment, likely reflecting a preference for stable, socially responsible assets during downturns. In contrast, rising income levels correspond to a decline in green investment, indicating that wealthier individuals may prioritize energy-intensive consumption. Policy recommendations to promote equitable green finance include aligning green bond standards, expanding RMB-denominated issuance domestically and internationally, and enhancing transparency to attract responsible investors. Strengthening these measures can help ensure the equitable distribution of benefits from renewable energy investments, supporting China’s transition to a sustainable and just energy system.

Similar content being viewed by others

Introduction and literature review

China, responsible for 27% of global carbon dioxide emissions and a third of the world’s greenhouse gases, has set ambitious “dual carbon” targets to combat climate change. Announced by President Xi Jinping at the 75th United Nations General Assembly in September 2020, these goals aim to peak carbon emissions before 2030 and achieve carbon neutrality by 2060. (Hong et al. 2024; Wang et al. 2024). Given China’s significant role in global emissions, these targets are crucial for international climate efforts. Reaching these goals will necessitate major changes in energy production, industrial operations, and national policies, focusing on renewable energy, energy efficiency, and technological advancements (Jiang and Raza 2023). Through these measures, as mentioned by Zhang et al. (2024) and Chaobo and Qi (2024), China aims to align its economic development with environmental sustainability, playing a critical part in the worldwide initiative to mitigate climate change effects.

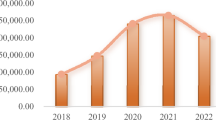

China is accelerating its renewable energy investments as a crucial strategy to achieve its carbon neutrality goals. In 2023, China invested a staggering $890 billion in clean energy sectors, almost equivalent to the total global investments in fossil fuel supply for the same year. These investments contributed 11.4 trillion yuan ($1.6 trillion) to the Chinese economy in 2023, demonstrating the economic significance of the clean energy sector (Xu et al. 2024). China’s commitment is evident as it accounted for one-third of the world’s clean energy investments. Notably, investment in solar power generation saw a remarkable increase of 232.7% in 2022 (Li et al. 2022), reaching 286.6 billion yuan. By 2030, China aims to source approximately 33% of its power from renewable sources, showcasing its dedication to transforming its energy landscape and meeting its ambitious carbon neutrality targets (Zhao et al. 2022).

Green finance plays a crucial role in accelerating the transition to sustainable energy. Among its key instruments, green bonds have emerged as a pivotal tool for financing renewable energy projects (Minh and Naderi 2022; Wang and Taghizadeh-Hesary, 2023; Liu et al. 2024). In 2023, China cemented its position as the world’s leading issuer of green bonds, raising $131.3 billion across domestic and international markets—nearly double Germany’s $67.5 billion issuance during the same period (The Asset 2024). This growth reflects China’s strong policy support and the expanding role of its green finance system in advancing clean energy. Additionally, alignment with global standards has improved, with over 98% of Chinese green bond issuances in 2023 adhering to the China Green Bond Principles, signaling a commitment to high-quality green financing. These developments underscore China’s efforts to strengthen its green finance infrastructure, contributing to global climate goals and sustainable economic growth (Wang et al. 2023; Li et al. 2024; Liu et al. 2024).

While green bonds are widely recognized as an effective mechanism for funding renewable energy projects (Taghizadeh-Hesary et al. 2023), their impact depends on several intermediary factors. Corporate climate strategies, regulatory oversight, and financial incentives play critical roles in determining their effectiveness. Tuhkanen and Vulturius (2022) highlight that although green bonds can enhance corporate climate commitments, their impact is often weakened by misalignment between bond proceeds and long-term decarbonization targets. Long et al. (2024) emphasize the need for robust financial mechanisms, risk mitigation tools, and transparent governance frameworks to ensure capital is effectively mobilized. Cheng and Wu (2024) illustrate how green bond issuance in China facilitates corporate green transformation, particularly for state-owned enterprises, by integrating sustainability mandates into financial decision-making. However, challenges such as geopolitical risks, greenwashing, and market uncertainties persist. Liu et al. (2024) note that external shocks—such as trade disruptions and policy volatility—can either stimulate or hinder green bond market development, depending on investor sentiment and regulatory responses. Ikevuje et al. (2024) further argue that for green bonds to finance a just energy transition effectively, post-issuance monitoring and compliance enforcement must be strengthened to ensure equitable fund allocation. This literature highlights that while green bonds are a valuable tool, their potential remains constrained without clear regulatory standards, financial oversight, and mechanisms for corporate accountability.

This paper examines how green bonds as a proxy of green finance have influenced the volume of renewable energy investment in China. To address this question, we selected quarterly data from the Quarterly National Accounts of the National Bureau of Statistics of China, covering the period from 2015 to 2022. 2015 was chosen because it marks the issuance of the first green bond in the People’s Republic of China (PRC), which has since become a significant player in the global green bond market. The motivation for studying the relationship between green bonds and renewable energy investment in China stems from the country’s pivotal role in global climate change mitigation efforts. As China continues to invest heavily in clean energy, understanding the impact of green bonds on these investments is crucial for policymakers, investors, and stakeholders. This research aims to provide insights into the effectiveness of green bonds as a financial instrument for promoting sustainable energy projects, thereby contributing to the broader goal of achieving carbon neutrality and combating climate change.

Earlier studies have extensively focused on China’s renewable energy development and green bonds. The literature underscores the rapid expansion of China’s renewable energy sector, driven by substantial investments and supportive policies. According to Wang et al. (2023) and Dong and Yu (2024), China’s renewable energy capacity has grown significantly over the past decade, particularly in solar and wind power, positioning the country as a global leader in renewable energy production. Kong et al. (2023) and Chen and Bian (2023) highlight that government initiatives, such as subsidies and favorable regulatory frameworks, have been pivotal in accelerating the deployment of renewable energy technologies. Additionally, Ye and Rasoulinezhad (2023) emphasize the role of green finance, particularly green bonds, in mobilizing the necessary capital for large-scale renewable energy projects. The issuance of green bonds in China has seen remarkable growth, as Zhou et al. (2024) noted, reflecting the strong policy support and increasing attractiveness of green investments.

Earlier research has also explored the development and impact of green bonds in China. Green bonds, intended to finance environmentally beneficial projects, have experienced rapid growth in the Chinese market. Liu et al. (2022) and Lin (2023) note that the issuance of green bonds in China has significantly increased, reflecting strong policy support and a rising commitment to sustainable finance. Kong et al. (2023) point out that the Chinese government has introduced various initiatives to encourage green bond issuance, including regulatory frameworks and financial incentives, which have been key in attracting domestic and international investors. Moreover, Xu and Li (2023) and Khurram et al. (2023) highlight the importance of green bonds in funding large-scale renewable energy projects, essential for China’s shift to a low-carbon economy.

It is important to recognize that while China has rapidly expanded its green bond market, similar efforts are underway in other emerging economies, shedding light on regulatory frameworks, financial mechanisms, and related challenges. For instance, green bond issuance in India has gained momentum since 2015. According to Tanwar and Qureshi (2023), this issuance was bolstered by government incentives and regulatory frameworks to boost investor confidence. However, studies have indicated that challenges such as transparency issues and regulatory fragmentation hinder large-scale adoption, emphasizing the need for clearer reporting mechanisms (Kodiyatt et al. 2024). Furthermore, Islamic green bonds (green sukuk) emerged as a suitable instrument for financing green projects (Ali et al. 2024). Indonesia has experienced success with green sukuk issuance. Indonesia’s distinctive issuance of green sukuk highlights the role of alternative financial instruments in broadening access to green finance, particularly in emerging economies with diverse investor bases (Adzimatinur et al. 2024). These international examples underscore the significance of harmonized green bond regulations, tailored financial instruments, and investor transparency in ensuring that green finance contributes to a just and equitable energy transition.

Previous research has thoroughly examined China’s pursuit of carbon neutrality. Studies by Evro et al. (2024) highlight China’s strategic measures to reduce carbon emissions, including transitioning to renewable energy sources, implementing energy efficiency standards, and promoting electric vehicles. According to Wen et al. (2023), China’s policy frameworks and substantial investments in green technologies have been pivotal in driving progress towards these goals. Additionally, Zhao et al. (2022) emphasize the importance of international cooperation and innovation in helping China meet its carbon neutrality targets. As confirmed by Li et al. (2022), Yang and Liu (2023), and Xu et al. (2023), the nation’s efforts, supported by a robust policy environment and significant financial investments, underscore its commitment to leading global climate action.

The energy justice principles must be reviewed to provide an appropriate framework for assessing the equity dimensions of green bond investments in China’s energy transition. According to Belaïd and Unger (2024), energy justice is typically divided into three dimensions: distributive justice, which concerns the fair allocation of financial resources and renewable energy benefits; procedural justice, which emphasizes inclusivity in decision-making processes; and recognition justice, which focuses on acknowledging and addressing the needs of marginalized communities. Understanding these dimensions allows for proportional benefits for affluent regions and corporate stakeholders while mitigating the neglect of lower-income or rural populations. Furthermore, a ‘just transition’ framework underscores the socio-economic implications of decarbonization policies. This emphasizes that climate actions must incorporate equitable considerations to alleviate inequalities among marginalized groups (Belaïd 2022). Therefore, green bonds are critical in mobilizing capital for renewable energy, and their distributional impacts and accessibility must be explored further in the context of low-income and marginalized groups.

This should be emphasized because equitable energy access is a crucial factor in promoting large-scale renewable energy investments and green bonds has significant role in funding these renewable energy projects. However, challenges burden low-income households, such as high issuance costs, regulatory complexities, limited direct benefits, lack of standardization, needs to be considered (Anjanappa, 2024). Therefore, tailored policy measures must be implemented to increase the inclusivity of green bond investments. Policies such as designated allocations for community renewable projects, tax incentives for social impact-driven green bonds, and mandatory impact assessments on social equity may be developed to facilitate the incorporation of energy justice objectives. Furthermore, the UNDP (2024) emphasized that sustainability-linked financing models can be leveraged to drive investments that directly improve energy affordability and employment opportunities for vulnerable populations and communities.

Despite the extensive research on renewable energy development and green bonds in China, there remains a significant gap in understanding the specific impact of green bonds on renewable energy investments within the country. Previous studies have predominantly concentrated on the overall expansion and governmental support for green bonds and renewable energy individually. However, there exists limited empirical evidence on how the financing provided by green bonds directly influences both the quantity and effectiveness of renewable energy projects in China. This study aims to address this gap by investigating the correlation between the issuance of green bonds and investments in renewable energy from 2015 to 2022. The central hypothesis of this research asserts that green bonds play a crucial role in substantially increasing the level of investment in renewable energy projects across China.

This study makes several significant contributions to the literature on green bonds and renewable energy investments in China. Firstly, it analyzes quarterly data on Chinese green bonds and their impact on green investments. Previous studies have often relied on annual or less frequent data. In contrast, this research uses quarterly data from 2015 to 2022, allowing for a more detailed and dynamic analysis of the relationship between green bond issuance and green investments. Secondly, this study examines green bonds’ short-term and long-term impacts on green investments in China. While some studies have explored the immediate effects of green bond issuance, there is a lack of research into how these effects evolve over longer periods.

The structure of this paper is organized as follows: Section 2 provides a theoretical background, focusing on the conceptual framework underpinning the relationship between green bonds and green investments in China. Section 3 elaborates on empirical data sources and outlines the model conceptualization used to analyze the data. In Section 4, empirical analysis results are presented and discussed, highlighting the findings regarding the impact of green bonds on green investments over the period studied. Section 5 concludes the study by summarizing key insights and discussing their implications for policy and practice. Finally, Section 6 outlines avenues for further research and expands on policy recommendations

Theoretical background

Several transmission channels influence private participation, financial development, economic risk reduction, and income levels, allowing us to understand the impact of green bond issuance on renewable energy investment.

Firstly, green bonds encourage private participation in renewable energy projects by providing dedicated financing options for sustainable initiatives. These bonds appeal to private investors who increasingly prioritize environmental, social, and governance factors in their investment decisions. By offering a structured and transparent investment opportunity, green bonds help reduce perceived risks associated with renewable energy investments, such as technological uncertainty and regulatory changes. This makes them more attractive to private investors, who are drawn to the potential for stable returns and the alignment of their portfolios with long-term sustainability goals. Additionally, green bonds often undergo certification or verification processes that assure investors of the environmental benefits and impact of the projects they finance, thereby boosting investor confidence and attracting a broader range of institutional and retail investors.

Green bonds also contribute significantly to financial development, mainly by enhancing market liquidity and transparency. These bonds lower financing costs by attracting a diverse pool of investors interested in sustainable projects, thus reducing the overall cost of capital for green initiatives. Moreover, the transparency inherent in green bonds—through their stringent reporting and verification requirements—provides clarity and confidence to investors regarding the environmental impact and financial viability of the projects they fund. This transparency helps attract more capital and improves the efficiency of capital allocation within the renewable energy sector. As a result, financial institutions and markets become better equipped to evaluate and price environmental risks, fostering a robust ecosystem for sustainable finance.

Furthermore, expanding access to capital for green initiatives allows smaller and newer players in the renewable energy market to secure funding, thereby accelerating innovation and deploying cutting-edge technologies that drive the transition to a low-carbon economy. By mitigating economic risks associated with conventional energy investments, such as volatility and environmental harm, green bonds attract risk-averse investors and diversify funding sources for renewable energy.

Finally, as income levels rise due to economic growth driven by green investments, there is a corresponding increase in demand for cleaner energy solutions. This creates a positive feedback loop between the issuance of green bonds and sustainable economic development. As economies expand through investments in renewable energy, job creation and economic opportunities follow, leading to higher disposable incomes for individuals and businesses alike. With greater disposable income, there is a heightened capacity and willingness to invest in and adopt cleaner energy alternatives, such as solar, wind, and hydroelectric power. This increased demand incentivizes issuing more green bonds to finance additional renewable energy projects, perpetuating the cycle of sustainable economic growth. Moreover, as more households and industries transition to cleaner energy sources, broader environmental and health benefits, such as reduced pollution and improved air quality, contribute positively to overall societal well-being.

To define the energy investment maximization function f(×1, ×2), where ×1 represents renewable energy investments and ×2 represents fossil fuel investments, under the constraint (Capital shortage) g(×1, ×2) = c, Eq. 1 can be expressed as follows:

The Lagrangian function for maximization can be defined as Eq. 2:

The partial derivatives concerning the three variables ×1, ×2, and λ, along with the first-order conditions of the optimization problem, can be expressed as Eqs. 3, 4, and 5:

Solving Eqs. 3 through 5 yields the optimal solutions ×1*, ×2*, and \({\lambda }^{* }\).

Assuming the investment function is ×1×2, and the capital constraint for investment is given by p1 × 1 + p2 × 2 = m, the optimal solutions can be calculated as Eqs. 6, 7, and 8.

It should be noted that \({\lambda }^{* }\) represents the marginal utility, indicating how much the investor’s utility would increase at the optimal values ×1* and ×2* if the investor’s income were increased marginally.

In summary, an investor’s intention to invest in renewable or fossil fuel energy resources depends on the investor’s income and investment cost. This conclusion aligns with our theoretical discussion, which emphasized the importance of private participation, financial development, economic risk reduction, and income levels in influencing the impact of green bonds on renewable investment volume.

Empirical data and model conceptualization

From 2015 to 2022, quarterly data from China has been collected to analyse the relationship between green energy investment and various influencing factors. The dependent variable in this study is green energy investment, while the primary explanatory variable is the amount of green bonds issued by the PRC. To understand the dynamics further, several mediating variables are considered: private participation, measured by private investment in public equity (PIPE); financial development, represented by China’s market capitalization as a percentage of GDP; economic risk reduction, approximated by the misery composite index which includes inflation and unemployment rates due to the lack of direct quarterly data; and income levels, measured by GDP per capita. Detailed information on these variables is provided in Table 1.

The issuance of green bonds by the PRC is expected to significantly impact green energy investment, as these bonds provide dedicated funding for sustainable projects. Green bonds are specifically designed to raise capital for projects with environmental benefits, making them an ideal financial instrument for supporting the development and expansion of green energy initiatives. By channelling funds directly into renewable energy projects, energy efficiency improvements, and other environmentally friendly activities, green bonds help to lower the cost of capital for these projects, making them more economically viable. Additionally, the issuance of green bonds can attract a wide range of investors interested in sustainable and responsible investment opportunities, thereby increasing the pool of available capital. This increased investment can accelerate the growth of the green energy sector, fostering innovation and technological advancements. Private participation, measured by PIPE, is also anticipated to boost green energy investment by bringing in additional capital and expertise from the private sector. PIPE transactions allow private investors to inject substantial funds into public companies, including those operating within the green energy sector. This influx of capital can be critical for funding large-scale renewable energy projects, such as wind farms, solar power plants, and other sustainable energy initiatives that require significant investment. Moreover, private investors often bring specialized knowledge, innovative strategies, and advanced technologies to the table, which can enhance the operational efficiency and effectiveness of green energy projects. The involvement of private entities can also foster a more competitive and dynamic market environment, driving continuous improvement and cost reductions in green energy technologies.

Furthermore, private participation can increase public awareness and acceptance of green energy solutions, as private investors and companies often have extensive networks and influence. Financial development, represented by market capitalization as a percentage of GDP, is likely to enhance green energy investment further, as a more developed financial market can provide better access to financing and investment opportunities. Conversely, the misery index, which includes inflation and unemployment rates, might negatively impact green energy investment by increasing economic uncertainty and reducing available capital for new projects. A high misery index indicates a struggling economy where inflation erodes the purchasing power of consumers and businesses, making it more expensive to fund and operate green energy projects. Rising unemployment rates compound this issue by decreasing household incomes and reducing consumer spending, leading to lower overall economic activity. In such an environment, private and public investors may become more risk-averse, preferring to allocate their limited resources to more immediate and less risky needs rather than long-term green energy investments. Economic uncertainty can also increase the cost of borrowing, as lenders demand higher interest rates to compensate for the higher risk, making it more challenging for green energy projects to secure affordable financing.

Additionally, governments facing high inflation and unemployment might prioritize short-term economic relief measures over long-term investments in sustainability, diverting funds away from green energy initiatives. Lastly, higher income levels, measured by GDP per capita, are expected to positively influence green energy investment, as increased wealth generally leads to greater demand for clean and sustainable energy solutions. As individuals’ income levels rise, they tend to prioritize and afford higher living standards, which often includes a greater emphasis on environmental quality and sustainability. Wealthier populations are more likely to support and invest in green energy initiatives, as they can better appreciate the long-term benefits of reducing pollution and combating climate change. Additionally, higher income levels usually correspond to increased government revenues, which can be allocated towards subsidies, incentives, and research and development in the green energy sector. This can further stimulate investment and innovation in renewable energy technologies. Furthermore, with higher incomes, consumers are more inclined to adopt green energy solutions in their homes and businesses, such as solar panels, energy-efficient appliances, and electric vehicles, creating a robust market demand that encourages further investment.

The econometric equation for this paper, structured as a time series analysis, can be expressed as follows:

To analyse the coefficients of the variables, we first conduct the Augmented Dickey-Fuller (ADF) unit root test to check for stationarity. Following this, we perform the Johansen cointegration test to examine the long-term relationships between the variables. Subsequently, we use the Fully Modified Ordinary Least Squares (FMOLS) technique to determine the long-term coefficients of the independent variables. Finally, we perform a robustness check to ensure the credibility of our findings.

The FMOLS technique significantly benefits time series analysis, especially when working with cointegrated variables. FMOLS addresses the issues of endogeneity and serial correlation, which frequently occur in time series data, by incorporating adjustments that account for feedback effects and the long-term covariance structure of the error term. This method is deemed suitable for analyzing the relationship between green finance and renewable energy investment because these variables have long-term interdependencies and are affected by various macroeconomic and financial factors. FMOLS allows for a more accurate estimation of long-run equilibrium relationships, ensuring that the policy implications derived from the research rest on solid statistical facts. Therefore, considering the potential structural changes and uncertainties in financial markets from 2015 to 2022, FMOLS was chosen to offer a robust framework for this study.

Empirical results

Before conducting the empirical study, data analysis must first be performed. To check for the presence of a unit root, the ADF test is applied. The null hypothesis of this test states that the time series has a unit root. The test results in Table 2 show that we can reject the null hypothesis, indicating that the time series is stationary.

Next, the Johansen cointegration test is applied, as shown in Table 3. The results suggest that the independent variables are cointegrated in the long term.

As the time series are cointegrated, we proceed with the Fully Modified OLS approach, which is a widely used method for cointegrating estimation. Table 4 presents the estimation results.

The estimation results confirm that a 1% increase in issued green bonds leads to a 0.94% increase in renewable energy investment in China. This strong positive relationship can be attributed to several primary reasons. Firstly, green bonds provide targeted funding for environmentally sustainable projects, reducing financial barriers to renewable energy initiatives. This dedicated stream of capital lowers the cost of financing for such projects, making them more attractive to investors. Secondly, the issuance of green bonds signals the government’s commitment to supporting and promoting renewable energy, which can boost investor confidence and attract further investments from domestic and international sources. Additionally, green bonds often come with tax incentives or subsidies, further enhancing their appeal and effectiveness in driving investment into renewable energy.

The estimation results indicate that a 1% increase in PIPE corresponds to a 0.30% reduction in green energy investment in China. This inverse relationship may be due to several key factors. Firstly, PIPE investments might divert capital from green energy projects, as investors may prefer sectors with higher short-term returns. Secondly, the influx of private investment into other public equities could increase competition for funding, making it harder for green energy projects to secure necessary resources. Additionally, private investors in public equity might prioritize immediate financial gains over long-term sustainability goals, resulting in less focus and fewer funds allocated to green energy initiatives.

The estimation results indicate that financial development, as measured by market capitalization as a percentage of GDP, does not significantly impact renewable energy investment in China. Several factors could explain this lack of significant effect. Firstly, while a developed financial market might provide better access to capital, it does not necessarily ensure that funds are directed toward green energy projects. Investment decisions are often influenced by factors such as perceived profitability and risk, and renewable energy projects might still be viewed as less attractive compared to other opportunities. Secondly, structural issues within the financial system, such as limited financial instruments tailored for green investments or insufficient policy incentives, could impede the flow of capital into renewable energy. Additionally, the presence of state-owned enterprises and government funding programs in China might overshadow the influence of market capitalization, as these entities play a more direct role in financing green energy projects.

Moreover, an increase in the misery index, which indicates economic uncertainty, leads to an increase in renewable energy investment in China. This counterintuitive relationship can be understood through several plausible reasons. Firstly, during periods of economic uncertainty characterized by high inflation and unemployment rates, policymakers and investors often prioritize investments that offer stability and long-term sustainability, such as renewable energy projects. These investments are perceived as less volatile and more resilient to economic fluctuations, making them attractive safe havens for capital deployment. Secondly, government responses to economic distress, such as fiscal stimulus packages or incentives for green technologies, may increase during uncertain times, fostering a favorable environment for renewable energy development. Additionally, global pressures and commitments towards reducing carbon emissions could drive increased investments in renewable energy despite economic uncertainties, aligning with China’s broader environmental goals and international obligations.

Lastly, an improvement in income levels leads to a reduction in green energy investment in China. This inverse relationship can be interpreted through several primary reasons. Firstly, as income levels rise, there may be a corresponding increase in overall energy consumption and demand for conventional energy sources, which can compete with investments in renewable energy. Higher incomes also lead to a preference for more luxurious or energy-intensive lifestyles, reducing the prioritization of environmentally friendly alternatives. Moreover, higher income levels may influence consumer behavior towards more energy-intensive goods and services, further straining natural resources and environmental sustainability efforts. Additionally, increased disposable income could shift investment preferences towards sectors with perceived higher returns or immediate benefits, potentially overlooking longer-term environmental concerns.

The estimation findings confirm the positive impact of the PRC issuing green bonds on renewable energy investment. However, they also suggest that macro variables such as PIPE and income levels deserve more attention from the Chinese government. While green bonds effectively channel funds into sustainable projects, the influence of private sector participation through PIPE and the broader economic implications of income levels on renewable energy investment highlight areas where targeted policies and incentives could further enhance investment flows.

To ensure robustness, we employ two approaches. Firstly, we substitute the dependent variable with investment in renewable power generation and re-estimate the coefficients. The results presented in Table 5 corroborate earlier findings and validate the positive influence of issued green bonds on renewable power generation in China. Secondly, as part of our robustness checks, we utilize the alternative Dynamic OLS method for estimation. Table 6 outlines the results, demonstrating the favorable impact of issued green bonds on renewable energy investment. Taken together, the credibility of the estimation findings is reinforced by these two robustness analyses.

Conclusion

The analysis from 2015 to 2022 provides valuable insights into the dynamics of green energy investment in China and its relationship with key influencing factors. The application of the FMOLS technique confirms a robust positive association between issued green bonds and renewable energy investment, illustrating their pivotal role in providing dedicated funding for environmentally sustainable projects. This funding stream reduces financial barriers and signals governmental commitment, enhancing investor confidence and attracting additional domestic and international investments. Conversely, the study reveals an inverse relationship between PIPE and green energy investment, suggesting that competing sectoral preferences and increased funding competition may divert resources away from renewable energy initiatives. The misaligned results reveal how often PIPE investors are more favorable toward industries with immediate profitability over long-term green investments. This situation arises from market failures such as information asymmetry, where investors lack adequate sustainability disclosures, and the preference for short-term returns, contributing to this phenomenon. Furthermore, capital flow into the sector may be restricted due to the limited availability of financial instruments tailored for PIPE participation in renewable energy.

The analysis results also indicate that the market capitalization measured as a percentage of GDP does not significantly influence renewable energy investment in China. This phenomenon may stem from structural constraints and competing investment opportunities within the financial system. It is essential to recognize the barriers in the renewable sector, which include high-risk perception among investors, underdeveloped secondary green bond markets, and limited access to credit for small and medium-sized enterprises. To address these barriers, policy interventions must focus on credit enhancement mechanisms, green financial guarantees, and government-backed de-risking initiatives. Alternatively, indicators such as credit to the private sector, financial inclusion indices, and the development of green financial instruments could provide a more comprehensive assessment of how financial systems mobilize capital for renewables investments.

Surprisingly, an increase in the misery index, which reflects economic uncertainty, correlates with higher levels of renewable energy investment. This unexpected finding highlights the appeal of stable and sustainable investments during economic volatility, driven by policy incentives and global environmental commitments. However, this relationship may also be affected by increased government stimulus packages during economic downturns, changes in investor risk appetite, or a flight-to-safety effect, where capital shifts from high-risk assets to long-term infrastructure projects. Furthermore, the study emphasizes that rising income levels correspond with decreased green energy investment in China. This relationship indicates a shift in consumption patterns towards more energy-intensive lifestyles and sectors, potentially overshadowing long-term sustainability goals without targeted policy interventions.

While this study offers valuable insights into the relationship between green bond issuance and renewable energy investment in China, several limitations should be acknowledged. Firstly, the analysis relies on quarterly data from 2015 to 2022, providing a detailed perspective that may not fully capture long-term structural changes or short-term market volatility. Secondly, the study focuses on macroeconomic and financial factors, potentially overlooking other elements such as technological advancements, policy interventions, and geopolitical risks that may influence green energy investment. Furthermore, while the FMOLS methodology ensures robustness in estimating long-run relationships, it does not adequately address endogeneity concerns or establish direct causality, highlighting the need for alternative econometric approaches in future research. Additionally, this study demonstrates that green bonds effectively mobilize renewable energy investment, but it does not assess their impact on marginalized communities. More research is needed to confirm that green finance supports an inclusive energy transition. Finally, this study emphasizes quantitative analysis while lacking qualitative insights from issuers, investors, or policymakers. Future research should address this gap through interviews or case studies.

Policy recommendations and points for future studies

China and other developing and emerging economies can adopt several practical policies to promote green energy investment through the green bond market.

First, harmonizing green bond regulations across regions and sectors will create a unified framework, boosting investor confidence and simplifying issuance processes. Aligning domestic standards with international frameworks like the Climate Bonds Standard and the EU Green Bond Standard will ensure consistency in eligibility, reporting, and verification. While this approach strengthens market integrity, harmonizing regulatory capacity across diverse regions remains challenging.

Second, leveraging AI to monitor compliance and assess real-time environmental impact can enhance regulatory efficiency and reduce inconsistencies in green bond verification. AI-driven verification systems can ensure transparency and adherence to sustainability criteria. However, a flexible framework is needed to accommodate sector-specific needs and foster innovation in green financing.

Third, expanding green bond issuance in domestic markets can significantly increase funding for renewable energy projects. Incentivizing both public and private entities to issue green bonds can ensure a steady capital flow into sustainable initiatives. Government interventions, such as tax incentives and interest subsidies, can lower financing costs and encourage market participation. However, strict impact verification and post-issuance reporting are essential to avoid greenwashing.

Fourth, developing international green bond markets, such as RMB-denominated bonds, can attract global investors and diversify funding sources for green projects. Collaborating with financial hubs like Hong Kong, Singapore, Tokyo or others could facilitate cross-border issuance. Blockchain technology can further enhance transparency, reduce costs, and enable real-time fund tracking. To ensure that internationalization aligns with domestic sustainability goals, part of the foreign capital should be allocated to local renewable initiatives.

Finally, addressing challenges in data gathering and reporting transparency is crucial. Implementing robust data collection and reporting standards will enhance accountability and attract socially responsible investors. Standardized impact assessment metrics and third-party verification can also strengthen credibility and trust. AI and blockchain technology can further ensure transparency and reduce greenwashing risks, though a balance must be struck to avoid burdening smaller issuers.

Recent literature highlights two emerging areas: the impact of AI on green investment and the growth of the digital green bond market. AI technologies, such as machine learning, are optimizing resource allocation, improving efficiency, and enhancing risk management in renewable energy projects. Meanwhile, digital green bonds, enabled by blockchain technology, are revolutionizing how green bonds are issued, traded, and monitored, offering increased transparency and lower transaction costs.

Future research should explore other green finance instruments, such as green loans and transition bonds, to deepen understanding of sustainable financing. Additionally, further studies should examine how AI and digital green bonds impact investment transparency and risk assessment. It is also important to assess the distributional impacts of green bond investments to ensure a just energy transition and equitable access to clean energy and economic opportunities, particularly for low-income and marginalized communities in developing and emerging economies.

Inclusion and diversity

While citing references scientifically relevant to this work, we also actively worked to promote gender balance in our reference list. The authors list of this paper includes contributors from the location where the research was conducted who participated in the data collection, design, analysis, and/or interpretation of the work.

Data availability

Data is provided within the supplementary information files.

References

Adzimatinur F, Olii R, Japal DFT (2024) The evolution of green sukuk in Indonesia. In: Proceeding international conference on islamic economics and business (ICIEB), 3(1), 160–173

Anjanappa, J Role of Private Sector in Driving the Green Bond Market in India (September 17, 2024). Available at SSRN: https://ssrn.com/abstract=4959091 or https://doi.org/10.2139/ssrn.4959091 (Accessed on Feb 10, 2025)

Ali Q, Rusgianto S, Parveen S, Yaacob H, Zin RM (2024) An empirical study of the effects of green Sukuk spur on economic growth, social development, and financial performance in Indonesia. Environ Dev Sustain 26(8):21097–21123

Belaïd F (2022) Implications of poorly designed climate policy on energy poverty: global reflections on the current surge in energy prices. Energy Res Soc Sci 92:102790

Belaïd F, Unger C (2024) Crafting effective climate, energy, and environmental policy: time for action Humanit Soc Sci Commun 11(1):1–5

Chaobo Z, Qi S (2024) Can carbon emission trading policy break China’s urban carbon lock-in? J Environ Manag 353:120129. https://doi.org/10.1016/j.jenvman.2024.120129

Chen K, Bian R (2023) Green financing and renewable resources for China’s sustainable growth: assessing macroeconomic industry impact. Resour Policy 85(Part A):103927. https://doi.org/10.1016/j.resourpol.2023.103927

Cheng Z, Wu Y (2024) Can the issuance of green bonds promote corporate green transformation? J Clean Prod 443:141071

Dong X, Yu M (2024) Green bond issuance and green innovation: evidence from China’s energy industry. Int Rev Finan Anal 94:103281. https://doi.org/10.1016/j.irfa.2024.103281

Evro S, Oni B, Tomomewo O (2024) Global strategies for a low-carbon future: lessons from the US, China, and EU’s pursuit of carbon neutrality. J Clean Prod 461:142635. https://doi.org/10.1016/j.jclepro.2024.142635

Hong Y, Jiang X, Xu H, Yu C (2024) The impacts of China’s dual carbon policy on green innovation: evidence from Chinese heavy-polluting enterprises. J Environ Manag 350:119620. https://doi.org/10.1016/j.jenvman.2023.119620

Ikevuje AH, Anaba D, Iheanyichukwu U (2024) Exploring sustainable finance mechanisms for green energy transition: a comprehensive review and analysis. Financ Account Res J. 6. 1224–1247. https://doi.org/10.51594/farj.v6i7.1314

Jiang B, Raza M (2023) Research on China’s renewable energy policies under the dual carbon goals: a political discourse analysis. Energy Strategy Rev 48:101118. https://doi.org/10.1016/j.esr.2023.101118

Khurram M, Xie W, Mirza S, Tong H (2023) Green bonds issuance, innovation performance, and corporate value: empirical evidence from China. Heliyon 9(4):e14895. https://doi.org/10.1016/j.heliyon.2023.e14895

Kodiyatt SJ, Nair BAV, Jacob MS, Reddy K (2024) Does green bond issuance enhance market return of equity shares in the indian stock market? Asia-Pac J Financ Stud 53:390–409. https://doi.org/10.1111/ajfs.12459

Kong F, Gao Z, Oprean- Stan C (2023) Green bond in China: an effective hedge against global supply chain pressure. Energy Econ 128:107167. https://doi.org/10.1016/j.eneco.2023.107167

Li J, Ho M, Xie C, Stern N (2022) China’s flexibility challenge in achieving carbon neutrality by 2060. Renew Sustain Energy Rev 158:112112. https://doi.org/10.1016/j.rser.2022.112112

Li R, Xu L, Hui J, Cai W, Zhang S (2022) China’s investments in renewable energy through the belt and road initiative stimulated local economy and employment: A case study of Pakistan. Sci Total Environ 835:155308. https://doi.org/10.1016/j.scitotenv.2022.155308

Li R, Liu Z, Gan K (2024) Impact of cities’ issuance of green bonds on local firm performance: evidence from China. Oper Res, 24, https://doi.org/10.1007/s12351-024-00846-5

Lin J (2023) Explaining the quality of green bonds in China. J Clean Prod 406:136893. https://doi.org/10.1016/j.jclepro.2023.136893

Liu F, Qin C, Qin M, Stefea P, Norena-Chavez D (2024) Geopolitical risk: an opportunity or a threat to the green bond market? Energy Econ 131:107391

Liu S, Qi H, Wan Y (2022) Driving factors behind the development of China’s green bond market. J Clean Prod 354:131705. https://doi.org/10.1016/j.jclepro.2022.131705

Liu Y, Dong K, Wang K, Fu X, Taghizadeh-Hesary F (2024) How do green bonds promote common prosperity? Evidence from Chinese prefecture-level cities. J Risk Financ 25:705–722. https://doi.org/10.1108/JRF-02-2024-0048

Liu Y, Huang H, Mbanyele W, Wang F, Liu H (2024) Does the issuance of green bonds nudge environmental responsibility engagements? Evidence from the Chinese green bond market. Finan Innov 10:92. https://doi.org/10.1186/s40854-024-00620-8

Long PD, Tram NHM, Ngoc PTB (2024) Financial mechanisms for energy transitions: a review article. Fulbright Rev Econ Policy 4(2):126–153

Minh TC, Naderi N (2022) Unleashing the role of green finance, clean energy, and environmental responsibility in emission reduction. J Environ Assess Policy Manag 24:2250033. https://doi.org/10.1142/S1464333222500338

Taghizadeh-Hesary F, Phoumin H, Rasoulinezhad H (2023) Assessment of role of green bond in renewable energy resource development in Japan. Resour Policy 80:103272. https://doi.org/10.1016/j.resourpol.2022.103272

Tanwar MD, Qureshi M (2023) A study on green bond framework and indian government initiative for green bond market. Int J Trade Commer-IIARTC 12:303–313. https://doi.org/10.46333/ijtc/12/2/4

The Asset (2024) China solidifies global green bond leadership. https://www.theasset.com/article/51516/-china-solidifies-global-green-bond-leadership. Accessed 10 Feb 2025

Tuhkanen H, Vulturius G (2022) Are green bonds funding the transition? Investigating the link between companies’ climate targets and green debt financing. J Sustain Financ Invest 12(4):1194–1216. https://doi.org/10.1080/20430795.2020.1857634

UNDP (2024) Feasibility Study on Sustainability-Linked Financing. United Nations Development Programme (UNDP) Indonesia: Jakarta

Wang H, Duan L, Zeng H (2023) Green bond financing, environmental regulation, and long-term value orientation: evidence from Chinese-listed companies. Environ Sci Pollut Res 30:123335–123350

Wang J, Jia L, Wang Y, Wang P, Huang L (2024) Diffusion of “dual carbon” policies among Chinese cities: a network evolution analysis. Energy 300:131514. https://doi.org/10.1016/j.energy.2024.131514

Wang Y, Taghizadeh-Hesary F (2023) Green bonds markets and renewable energy development: policy integration for achieving carbon neutrality. Energy Econ 123:106725. https://doi.org/10.1016/j.eneco.2023.106725

Wen H, Liang W, Lee C (2023) China’s progress toward sustainable development in pursuit of carbon neutrality: regional differences and dynamic evolution. Environ Impact Assess Rev 98:106959. https://doi.org/10.1016/j.eiar.2022.106959

Xu G, Zang L, Schwarz P, Yang H (2023) Achieving Chinaʼs carbon neutrality goal by economic growth rate adjustment and low-carbon energy structure. Energy Policy 183:113817. https://doi.org/10.1016/j.enpol.2023.113817

Xu G, Yang M, Li S, Jiang M, Rehman H (2024) Evaluating the effect of renewable energy investment on renewable energy development in China with panel threshold model Energy Policy 187:114029. https://doi.org/10.1016/j.enpol.2024.114029

Xu X, Li J (2023) Can green bonds reduce the carbon emissions of cities in China? Econ Lett 226:111099. https://doi.org/10.1016/j.econlet.2023.111099

Yang M, Liu Y (2023) Research on the potential for China to achieve carbon neutrality: a hybrid prediction model integrated with elman neural network and sparrow search algorithm. J Environ Manag 329:117081. https://doi.org/10.1016/j.jenvman.2022.117081

Ye X, Rasoulinezhad E (2023) Assessment of impacts of green bonds on renewable energy utilization efficiency. Renew Energy 202:626–633. https://doi.org/10.1016/j.renene.2022.11.124

Zhang X, Cheng X, Yang K, Zhao Z (2024) Evaluation of China’s double-carbon energy policy based on the policy modeling consistency index. Uti Policy 90:101783. https://doi.org/10.1016/j.jup.2024.101783

Zhao L, Liu J, Li D, Yang Y, Wang C (2022) China’s green energy investment risks in countries along the Belt and Road. J Clean Prod 380(Part 2):134938. https://doi.org/10.1016/j.jclepro.2022.134938

Zhao X, Ma X, Chen B, Shang Y, Song M (2022) Challenges toward carbon neutrality in China: strategies and countermeasures. Resour Conserv Recycl 176:105959. https://doi.org/10.1016/j.resconrec.2021.105959

Zhou F, Pan Y, Wu J, Xu C, Li X (2024) The impact of green finance on renewable energy development efficiency in the context of energy security: evidence from China. Econ Anal Policy 82:803–816. https://doi.org/10.1016/j.eap.2024.04.012

Acknowledgements

This research was funded by the Grant-in-Aid for the Excellent Young Researcher from the Ministry of Education, Culture, Sports, Science and Technology of Japan (MEXT); the Grant-in-Aid for Young Scientists (No. 22K13432) from the Japan Society for the Promotion of Science (JSPS); and the Grant-in-Aid for Scientific Research (B) (No. 22H03816) from JSPS. We are grateful to Tokai University for covering the article processing charge to make this paper open access.

Author information

Authors and Affiliations

Contributions

Wei Lou: Conceptualization; Data curation; Writing and Reviewing, Shibao Lu: Data Analysis; Writing and Reviewing; Meng Li: Validation; Writing and Reviewing; Reviewing and Editing Farhad Taghizadeh-Hesary: Modeling; Funding; Supervision; Reviewing and Editing.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed Consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Lou, W., Lu, S., Li, M. et al. Determinants of green energy investment—financial drivers and equitable transition. Humanit Soc Sci Commun 12, 489 (2025). https://doi.org/10.1057/s41599-025-04760-9

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-04760-9