Abstract

This study specifically focuses on the factors contributing to start-up failures in the SME sector in Sri Lanka, with particular emphasis on the educational, socio-cultural, economic, and psychological variables that affect entrepreneurial outcomes. The primary objective is to identify and analyse the factors contributing to these failures. Data collection involved interviews, telephone surveys, and online questionnaires. Given that the dependent variable categorises outcomes as either success or failure, a Probit regression model, was deemed the most appropriate analytical method. The findings reveal significant impacts of educational and economic factors on start-up failures in the SME sector. Additionally, psychological, and socio-cultural factors were found to influence these failures. Most participants recommended integrating entrepreneurship and skill development topics into the O/Level and A/Level curricula. Based on these insights, this study proposes several policy recommendations. It suggests that policymakers improve the education system to meet the country’s educational needs more effectively. It also recommends that family members, society, and religious leaders receive education pertaining to start-up development. Furthermore, it advises policymakers and financial institutions to align more closely with entrepreneurial needs to prevent business failures. Lastly, the study emphasises the importance of educating entrepreneurs on maintaining a motivated and positive attitude, addressing the fear of loss, and understanding the psychological aspects of business management. Building upon the brief overview in the abstract, the following introduction lays the foundation for our study, elaborating on the economic concepts and contextual background.

Similar content being viewed by others

Introduction

This research aims to analyse the factors contributing to start-up failures among SME entrepreneurs in Sri Lanka, specifically examining how educational, socio-cultural, economic, and psychological factors influence these failures through a random sampling of 387 entrepreneurs who have experienced business failures. Data were collected via a mixed-method approach. Utilising face-to-face interviews, telephone conversations, and online surveys to capture both quantitative and qualitative insights. Probit regression analysis was employed to assess the impact of educational, socio-cultural, economic, and psychological factors on the likelihood of start-up failure. By identifying these factors, the study intends to offer actionable suggestions to entrepreneurs aiming for business success and to provide informed recommendations to relevant stakeholders, including government bodies and policymakers.

SMEs are pivotal in the Sri Lankan economy, contributing to 75% of total enterprises and accounting for more than 45% of employment (Ministry of Industry and Commerce, 2017). These enterprises generate approximately 55% of the country’s Gross Domestic Product (GDP), highlighting their critical role in economic sustainability and growth. Given this backdrop, understanding the dynamics of SMEs is vital for deriving insights that can foster economic development. SME entrepreneurs are frequently recognised as catalysts for private sector investment and critical drivers of high-growth sectors. This role is well-supported by research, including (Acs et al. 2018) study on the Global Entrepreneurship and Development Index, which highlights the significant impact SMEs have on job creation and economic growth

This research focuses on exploring the factors that influence SME success and failure, particularly during their formative years. It aims to bridge the existing research gap within both the Sri Lankan context and internationally. The study has identified a significant correlation between entrepreneurial failures and an education system that does not directly support entrepreneurial skill development, shedding light on the multifaceted challenges faced by SME entrepreneurs.

Addressing macroeconomic challenges, this research emphasises the importance of investigating key variables such as educational, socio-cultural, economic, and psychological factors that influence SME success. Understanding these variables is essential for formulating strategies that enhance entrepreneurs’ contribution to the national economy, aligning with objectives such as maximising stakeholder value.

Furthermore, this research will examine the economic contribution of SMEs to GDP, aiming to provide clear statistics on the current state and categorisation of SMEs. This comprehensive analysis empowers entrepreneurs to assess and optimise their business strategies effectively, offering insights into potential pitfalls and guiding them towards successful outcomes.

Finally, this research endeavours to deepen the understanding of SME dynamics, addressing a critical research gap and providing insights that can inform strategic decision-making to foster the sustained growth of SMEs at the national level. By elucidating the factors influencing success and failures, this study contributes to the broader knowledge base, assisting stakeholders in making decisions that bolster the nation’s economy.

Literature Review

Small and medium enterprises (SMEs) are frequently heralded as the backbone of economies worldwide, driving economic growth and innovation. Entrepreneurs, the vanguard of this sector, play a pivotal role in advancing their nations’ economic development. In the context of developing countries, including Sri Lanka, scholarly investigations have largely focused on the socio-cultural and economic variables influencing SME success, while educational and psychological aspects have received comparatively less attention. For example, the socio-cultural and economic influences on SME success in Sri Lanka were emphasised, but there is the limited exploration of educational and psychological factors (Lussier et al. 2016). Similarly, Farrukh et al. (2019) highlighted various determinants of entrepreneurial intentions but noted a lack of focus on educational aspects (Farrukh et al. 2019). The psychological aspects of entrepreneurship have been reviewed, showing that much existing research emphasises socio-economic factors (Frese and Gielnik 2014). This literature survey aims to fill this gap systematically reviewing extant research on these lesser-studied factors.

The necessity of this endeavour is underscored by findings that identify critical determinants of business success or failure in Sri Lanka, including foundational business practices, financial acumen, and marketing expertise. These elements are crucial for understanding the broader landscape of SME operational dynamics and outcomes. Therefore, the current literature survey extends beyond these conventional areas to explore how educational and psychological factors influence entrepreneurial efficacy and business sustainability (Lussier et al. 2016).

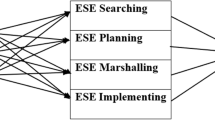

Utilising digital libraries such as SAGE Journals, ResearchGate, ScienceDirect, and Emerald Insight, this study embarked on a systematic exploration of literature, employing search terms like “Entrepreneurship,” “Start-up failures,” “Small and Medium Enterprises,” “Business start-ups,” and “Business failures.” This search was limited to content in English to maintain focus and relevance. The initial query resulted in retrieved over 100,000 articles, significantly exceeding expectations and underscoring the prolific nature of research in this field. From this extensive database, a curated selection of 100 research articles was made, categorised into five critical areas: Educational Factors, Socio-cultural Influences, and Economic Factors, including Financial and Government Institutions and Country-specific Economic Conditions and Psychological Factors. This categorisation facilitated a targeted analysis, enhancing the survey’s comprehensiveness. The method, illustrated in Fig. 1, shows the search strategy. Research into the reasons for small business failures employed several academic databases, including SAGE Journals, ResearchGate, ScienceDirect, and Emerald Insight, focusing on articles published in English from January 2010 to January 2024. According to the literature flow diagram, only 85 research papers were critically evaluated for this study.

This literature survey aims to illuminate the well-documented socio-economic impacts on SMEs and highlight the significant yet understudied educational and psychological dimensions that contribute to entrepreneurial success. By expanding the scope of investigation, this study seeks to provide a more holistic understanding of the factors influencing SME outcomes, thereby contributing valuable insights into the complexities of entrepreneurship.

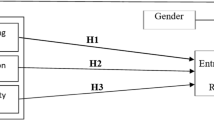

Figure 2 provides a visual overview of the conceptual framework, illustrating the connections between the key variables examined in this study. This framework underpins the analysis, aiming to dissect how educational, socio-cultural, economic, and psychological factors influence the success or failure of start-ups in the SME sector in Sri Lanka. To collect the data informing this analysis, a detailed questionnaire was developed and is available in S1 Appendix. This questionnaire is essential for capturing the nuances of these factors and their interactions, which are crucial to understanding the broader landscape of entrepreneurship within the region.

Educational factor

Researchers examined empirical evidence on the role of education, discussing the direct relationship between entrepreneurial education and venture growth, and emphasising the adaptability and innovation skills imparted through such education (Bogatyreva et al. 2019; Farrukh et al. 2019). Research into educational content and entrepreneurial skills remains a critical area of focus. Critics of Sri Lanka’s educational system note its emphasis on rote learning rather than critical thinking, with broader literature suggesting a global shift towards education that fosters creativity and problem-solving skills vital for entrepreneurship (Farrukh et al. 2019). By improving access to quality education, this research aims to address socio-economic disparities, empowering underrepresented groups and enhancing their entrepreneurial success. Entrepreneurial education is particularly beneficial for women and minorities, providing access to networks and knowledge otherwise less accessible (Baker and Welter 2020; Dana et al. 2021).

Researchers advocate for targeted interventions, proposing that specifically designed educational programmes can significantly level the playing field for disadvantaged groups in developing economies (Maritz et al. 2021). Integrating entrepreneurship into education from a young age is essential, equipping future entrepreneurs with the skills and knowledge necessary to overcome the challenges of starting and managing a business, thereby improving their chances of success (Crammond 2020). The gap between entrepreneurship education and entrepreneurial intent highlights a need for policy focus on creating more direct pathways from education to enterprise creation (Thurik et al. 2010)

It is important to discuss the success of experiential learning models, which are used in the US, and Europe It helps people solve real-world problems using simulations. At the same time, it also provides simulations for entrepreneurs. (Velinov et al. 2021). Simulation and real-world problem-solving form core components of the curriculum, providing a template that could be adapted for Sri Lanka. This is a very good suggestion for the Sri Lankan governing body of education as well.

The inadequate provision of entrepreneurial education and training has been linked to higher failure rates among start-ups, with research indicating that entrepreneurs lacking formal education or business management training face greater challenges in navigating business complexities, leading to an increased likelihood of failure (Lussier and Pfeifer 2001).

Socio-Cultural Factor

Exploring the socio-cultural dynamics that influence entrepreneurship in Sri Lanka offers valuable insights into the foundational elements of start-up success and failure within the SME sector. Family support, community values, religious beliefs, and cultural attitudes toward risk and failure are key factors shaping entrepreneurial behaviour and decision-making. For example, strong family networks often provide essential emotional and financial support, while community values may either encourage or inhibit entrepreneurial initiatives. Similarly, societal attitudes towards failure impact risk-taking behaviour, with cultural norms often determining the level of encouragement or stigma attached to business failure. This review incorporates historical and contemporary research to evaluate how ethnic values, family structures, religious influences, and social attitudes shape entrepreneurial activity.

Historical contexts provide insight into how social relations shape entrepreneurial tendencies (Aldrich 1989). Further research supports the idea that entrepreneurial behaviour is frequently a product of cultural conditioning (Frese and Gielnik 2014). Family dynamics also significantly affect entrepreneurial success and failure (Chhokar 2013), with family support playing a critical role in Sri Lanka by providing both emotional and financial resources that assist entrepreneurs in overcoming business challenges. Researchers highlight that family support varies across cultural backgrounds (Jovanovic M 2018; Maritz et al. 2021). The influence of religious leaders on start-ups is also explored, suggesting that spiritual guidance can significantly impact entrepreneurial decisions (Dawson et al. 2015).

Several research papers discuss the role of religious leaders and their influence on the entrepreneurial ventures of start-ups. Religious leaders can shape and explore the impact of religious affiliations on business ethics, positive thinking, and financial support, corroborating the idea that spiritual guidance significantly affects entrepreneurial decisions (Henley 2022; Giorgi et al. 2015) Research has highlighted how cultural norms influence risk-taking (Welter 2011). It further examines how societal attitudes towards failure impact entrepreneurial innovation, particularly in high-risk ventures (Zahra 2021). Additionally, cultural attitudes and business strategies may share common connections (Moriano et al. 2012). Some researchers explore how cultural alignment enhances organisational resilience and market adaptability (Spencer and Gomez 2011).

This research also considers two distinct factors—education and socio-cultural aspects—both of which are interconnected. Integrating cultural values and education significantly contributes to entrepreneurial success (Marina et al. 2014). Moreover, diverse educational skills are often accompanied by a culturally responsive pedagogy (Mueller and Thomas 2001). Researchers should explore the distinctions between modern and traditional cultural values for further investigation. It is crucial to bridge traditional and modern cultures (Wennberg et al. 2013) and to study cultural reorientation in business practices. Analysing how these socio-cultural characteristics align with technological and global market trends can have a positive influence on start-up success (Liñán and Fernández-Serrano 2014). To accommodate modern cultural changes, policies should be implemented to empower individuals to start more businesses in Sri Lanka. For instance, while patriarchal structures may prevail in certain Muslim cultures, many Muslim women actively participate in business and entrepreneurship, making significant contributions to their families and communities. Therefore, policies should support frameworks that encourage diverse entrepreneurial paths (Amorós et al. 2013). Community-based educational programmes should also be implemented to build entrepreneurial capabilities (Honig and Samuelsson 2012).

Socio-cultural factors, including family support and community networks, play a critical role in entrepreneurial success or failure. The absence of these supportive structures can heighten the risks entrepreneurs face, particularly in culturally conservative societies where business operations may conflict with traditional values, thereby increasing failure rates (Welter 2011).

Economic Condition – Financial Institution

In examining the literature on obstacles facing financial institutions, numerous scholars have provided recommendations and insights to the global community. The role of regulatory bodies and financial institutions is essential for entrepreneurial success (Olawale and Garwe 2009; Demirguc-kunt 2020; McCarthy et al. 2015). Furthermore, the banking sector can enhance financial support to SMEs by offering low-interest loans, thereby increasing credit availability to this sector (Udell and Berger 2002; Bruhn and Love 2014). Micro-financing services have also been shown to significantly improve business outcomes for SMEs (Rigol et al. 2013). Other research highlights that limited access to finance is a major barrier to growth for SMEs. Findings suggest that economic instability and insufficient financial support from banks contribute to high failure rates among start-ups, as entrepreneurs struggle to secure the necessary capital to sustain operations and expand their businesses (Beck 2006).

The impact of business-friendly policies on SME growth indicates that simply having policies in place is inadequate if they are not effectively implemented or accessible to the target population. For more effective banking and microfinancing support systems, policymakers should establish a robust policy framework (Mahmud et al. 2022; Aterido et al. 2013). Enhanced coordination among stakeholders—fostering collaboration between policymakers, financial institutions, and development agencies—is essential to creating a supportive environment for SME development, as argued by Nizaeva and Coskun (2018). Once a financial support mechanism is implemented, government institutions should conduct regular evaluations to enhance SME resilience and reduce financial barriers and administrative burdens (Yap et al. 2023). Finally, financial and government institutions should develop innovative financial strategies that meet the developmental needs of entrepreneurs (Craig et al. 2008).

Economic Condition – Country and Entrepreneur

Understanding the influence of a country’s economic conditions on entrepreneurs is essential to comprehending the success and failure rates of start-ups. The literature critically evaluates how both macroeconomic conditions and individual entrepreneurial circumstances affect new ventures. Stable GDP growth and low inflation are fundamental indicators of a country’s economic health, as noted by Wyrwich et al. (2016). Such research contributes to the literature on economic stability, demonstrating that a stable economic environment bolsters entrepreneurial confidence, encouraging investment and risk-taking behaviours conducive to business initiation and growth (Acs et al. 2018; Fairlie and Fossen 2018). The role of government in shaping economic conditions, facilitating access to finance, and providing supportive institutions is also crucial for entrepreneurial success. Further, proactive economic policies can remove barriers to entrepreneurship, such as bureaucratic red tape and financial constraints (Davidsson 2017; Kerr et al. 2016).

Policies must align with global and local trends to ensure their effectiveness in fostering entrepreneurship (Szirmai et al. 2011). Additionally, access to and utilisation of resources are critical for entrepreneurs. When a country’s economy is stable, resources, human capital, technological infrastructure, and institutional support are more readily available to entrepreneurs. Research highlights that human capital, technology, and institutional support are essential factors influencing entrepreneurial success (Urbano et al. 2019). This is corroborated by studies demonstrating how investments in technology and skills development can boost SME performance (Gries 2020)

Financial access and market opportunities can lead to improved resource allocation among entrepreneurs aiming to start their own businesses. When entrepreneurs operate in favourable economic conditions, they tend to be more confident, competitive, and sustainable in their business practices (Levine and Rubinstein 2017). To assess the economic impact on SMEs effectively, comprehensive, tailor-made research is required, as each entrepreneur’s needs are unique (Hall et al. 2010). Future research should focus on developing strategies that enhance economic resilience among entrepreneurs, including financial literacy programmes and innovation incentives, as discussed by Brown and Rocha (2020).

Psychological Factor

This literature review explores the impact of psychological factors on the success and failure of start-ups, focusing on how key characteristics—such as overconfidence, optimism, fear of loss, and cognitive biases—correlate with entrepreneurial performance in Sri Lanka and globally. Historical evidence indicates that psychological traits minimally influence entrepreneurial success (Aldrich and Wiedenmayer 1993; Baum and Locke 2004). However, recent studies using advanced methodologies demonstrate a correlation between psychological constraints and the challenges of starting a business (Baum et al. 2011). Research highlighting psychological traits like grit and perseverance underscores their importance in ensuring long-term entrepreneurial success (Qudus et al. 2022; Yan et al. 2023). Traits such as optimism, resilience, and self-efficacy impact entrepreneurial activities and help entrepreneurs overcome various challenges (Tsai et al. 2020). Further research reinforces the positive effects of optimism and resilience on entrepreneurial activities (Frese and Gielnik 2014).

Cross-cultural studies also reveal variations in entrepreneurial motivations, suggesting that psychological factors are influenced by cultural contexts, which in turn affect entrepreneurial outcomes (Soomro and Honglin 2015). The correlation between education and psychological factors is especially relevant in the Sri Lankan context, as the local education system plays a role in promoting entrepreneurial motivation and positive thinking. Studies examine whether the regional education system supports or inhibits the development of these psychological traits (Paul Vincent and Devi N 2018; Younggeun Lee and Herrmann 2021).

The influence of psychological characteristics on entrepreneurial intention and performance has been explored, with findings indicating that self-confidence and risk tolerance not only shape entrepreneurial intentions but also impact actual performance, which is further influenced by external factors (Maydiantoro et al. 2021). Psychological resilience and adaptability, including traits such as emotional stability and the ability to recover quickly, enable entrepreneurs to manage and adapt to change, enhancing their capacity to navigate business uncertainties (Ali et al. 2023). Passion for innovation also fosters resilience; entrepreneurs with a strong drive for innovation often experience reduced fear of failure, which ultimately supports start-up success (Cardon et al. 2009).

There is a notable relationship between an entrepreneur’s psychological traits and well-being, with research examining how characteristics like self-assurance and resilience impact entrepreneurial well-being and success (Keith M.Hmieleski 2009). Further, the relationship between entrepreneurial education and national economic growth suggests that psychological characteristics can predict entrepreneurial intentions and actions (Kautonen et al. 2015). Drawing from this comprehensive literature review, the research framework and proposed hypotheses aim to address existing gaps and extend the current understanding of psychological factors affecting entrepreneurship.

Psychological traits, particularly resilience and self-efficacy, play a crucial role in reducing start-up failure rates. Entrepreneurs exhibiting higher levels of confidence and stress tolerance are better equipped to manage setbacks, whereas those lacking these traits may be more prone to failure (Frese and Gielnik 2014).

A review of the literature highlights the importance of understanding how education, socio-cultural norms, economic conditions, and psychological factors collectively influence entrepreneurial success and failure. Research indicates that entrepreneurs who possess a balanced combination of these factors experience lower failure rates, underscoring the need for a holistic approach in entrepreneurship education and support (Ceresia 2018).

Research Framework and Hypothesis

Research Framework

Figure 2 presents the conceptual framework designed according to the research questionnaire, which includes multiple sections. The framework comprises a demographic section and other sections aimed at identifying the factors contributing to business failures in the SME sector.

Hypothesis

Hypothesis 1

H0 – There is no significant impact on start-up failures of entrepreneurs in Sri Lanka due to the education system.

HA – There is a significant impact on start-up failures of entrepreneurs in Sri Lanka due to the education system.

Hypothesis 2

H0 – There is no significant impact on start-up failures of entrepreneurs in Sri Lanka due to social impact and cultural influence.

HA - There is a significant impact on start-up failures in Sri Lanka due to social impact and cultural influence.

Hypothesis 3

H0 – There is no significant impact on start-up failures of entrepreneurs in Sri Lanka due to economic conditions related to financial and government institutions.

HA – There is a significant impact on start-up failures of entrepreneurs in Sri Lanka due to economic conditions related to financial and government institutions.

Hypothesis 4

H0 – There is no significant impact on start-up failures of entrepreneurs in Sri Lanka due to economic conditions related to the country and entrepreneurs.

HA – There is a significant impact on start-up failures of entrepreneurs in Sri Lanka due to economic conditions related to the country and entrepreneurs.

Hypothesis 5

H0 – There is no significant impact on start-up failures of entrepreneurs in Sri Lanka due to psychological constraints.

HA – There is a significant impact on start-up failures of entrepreneurs in Sri Lanka due to psychological constraints.

Methodology

To measure the internal reliability of the data, Cronbach’s alpha was employed to assess the internal consistency of the questionnaire, with satisfactory results indicating the reliability of the measurement scales. Additionally, content validity was ensured by designing the questionnaire based on existing literature and input from subject matter experts. The Cronbach method was used to obtain the alpha value for each variable in the research (Cronbach 1951). Given that the research is based on binary outcomes of success or failure, the Probit regression model was deemed appropriate for understanding the relationship between predictor variables and calculating the results. First, we obtained initial Probit regression results to facilitate an initial consultation of the findings. You can refer to the S2 Appendix for the initial results discussed. The researchers did a commendable job finalising the Probit model, providing crucial insights for future research (Bliss 1934; Fisher 1935). In statistics, the Probit model is used for regression when there is a binary outcome for the dependent variable. In this research, success or failure is the binary outcome, denoted by 1 and 0.

The general Probit regression model estimates the probability P (Y = 1 | X), where the Y is the dependent variable and the short terms represent the independent variables (Edu, Socl, Inst, Cntry, Psy) as follows:

The equation for the Probit regression in this research is as follows:

With the methodology firmly established, the research examined the outcomes, revealing significant insights into the economic patterns and implications of our study.

Results

The research questionnaire is based on one dependent variable, which is a binary outcome, while a Likert scale from 1 to 5 was used for the independent variables. Table 1 presents the descriptions of the variables and their expected signs. According to the table, five variables are expected to have a positive sign.

Initially, the research included one dependent variable and four independent variables. However, during the research process, it became clear that economic factors should be divided into two segments: those related to financial institutions and those pertaining to the economic conditions of the country and entrepreneurs. Since the data are primary, it is essential to check for internal consistency to further investigate the research. Any study based on measurements using primary data should assess the reliability of the measurement scales (Cronbach 1951). Therefore, by utilising Cronbach’s alpha, we can measure internal consistency using the same measurements.

It is clear from Table 2 that the data from the research exhibit acceptable internal consistency. The “Scss” item-test correlation of 0.8777 indicates a strong positive correlation with the total test score, while an alpha of 0.7210 suggests good internal consistency reliability. The “Edu” item-test correlation of 0.8456 also indicates a strong positive correlation with the total test score, with an alpha of 0.7014 indicating acceptable internal consistency reliability. The “Socl” item-test correlation of 0.6337 suggests a moderate positive correlation with the total test score, and an alpha of 0.7758 indicates good internal consistency reliability. For the “Inst” item, the item-test correlation of 0.6232 suggests a moderate positive correlation with the total test score, while an alpha of 0.7807 indicates good internal consistency reliability. The “Cntry” item-test correlation of 0.8288 indicates a strong positive correlation with the total test score, and an alpha of 0.7308 suggests good internal consistency reliability. Finally, the “Psy” item-test correlation of 0.4460 suggests a moderate positive correlation with the total test score, with an alpha of 0.8034 indicating good internal consistency reliability.

The total scale alpha of 0.7878 suggests good overall internal consistency reliability for the entire scale.

All items exhibit positive correlations with the total test score, indicating that higher scores on individual items tend to be associated with higher scores on the total scale. The Cronbach’s alpha values for individual items and the total scale are generally above 0.7, which is considered acceptable for good internal consistency reliability. In summary, based on these results, the items in the scale or questionnaire demonstrate acceptable internal consistency reliability and contribute positively to the total scale score. This suggests that the items consistently measure the intended construct for the next analysis.

After calculating the measurement’s alpha value, the research can proceed with the primary data analysis using STATA with Probit regression.

Table 3 illustrates the results of the Probit analysis and marginal effects. The education factor was a significant predictor of success, with a coefficient of 5.3852 and a robust standard error of 1.7039 (p = 0.002). The positive coefficient suggests that higher education levels significantly increase the probability of success. The marginal effect of a one-unit increase in education is substantial, enhancing the likelihood of success by 6.10%. This underscores the critical role of educational attainment in equipping individuals with the necessary skills and knowledge for success.

The socio-cultural factor has a positive coefficient of 0.9098, with marginal statistical significance (p = 0.066) and a robust standard error of 0.4950. The marginal effect of 1.03% indicates that social environments and networks have a positive but modest influence on success, highlighting the importance of supportive social structures in facilitating successful outcomes.

The economic condition—financial and governmental institutional support—showed a positive effect with a coefficient of 0.9839, which was statistically significant (p = 0.045). However, the marginal effect was only 0.05%, suggesting that while institutional frameworks and support systems positively impact success, their practical effect is relatively small compared to other factors. This finding may indicate that the quality or type of institutional support is as critical as its mere presence.

The economic condition—country and entrepreneur—showed a strong positive impact with a coefficient of 3.8726 (p = 0.001) and a robust standard error of 1.1154. The marginal effect of 4.39% indicates that country-specific conditions, such as economic, legal, and cultural environments, significantly influence success rates. This underscores the importance of context-specific strategies for enhancing entrepreneurial success and other forms of achievement.

The coefficient for psychological factors was negative at −0.5733, although this was not statistically significant (p = 0.171), with a robust standard error of 0.4184. The negative marginal effect of -0.65% suggests a potential detriment to success when negative psychological traits or conditions are prevalent, but further investigation is needed to clarify this relationship.

The intercept has a significant constant of −32.7900 (p = 0.001), implying that when all explanatory variables are zero, the likelihood of success is extremely low, highlighting the essential role these factors play in achieving successful outcomes.

In summary, the education factors, socio-cultural influences, economic conditions of institutions, and the economic conditions of entrepreneurs are statistically significant outcome variables based on their p-values. Furthermore, the education factor and the economic factor related to country and entrepreneurs have the most significant impact on the predicted probability of success among the predictors. Psychological factors exhibit a negative but not statistically significant effect on the probability of success. Having presented these findings, we will finally explore their implications and integrate them into the existing body of knowledge in the ensuing discussion.

Discussion

In line with global research, such as Farrukh et al. (2019) and Crammond (2020), the findings from the Probit model confirm that educational attainment plays a pivotal role in entrepreneurial success within Sri Lanka’s SME sector. However, while these studies affirm the importance of education in fostering entrepreneurial capabilities, the unique context of Sri Lanka necessitates specific educational reforms, particularly in entrepreneurial skill development, to align with broader global trends. The analysis revealed that educational attainment significantly increases the probability of entrepreneurial success.

Regarding socio-cultural influences, the findings highlight the impact of family and religious leaders on entrepreneurship, consistent with the work of Chhokar (2013) and Dawson et al. (2015). Unique cultural factors specific to Sri Lanka, such as the role of the extended family in business decisions, provide additional insights into start-up failures. This outcome, however, diverges from findings in regions like Europe, where psychological factors, such as resilience and self-efficacy (Frese and Gielnik 2014), play a more prominent role. The lack of significance for psychological factors in Sri Lanka suggests a cultural divergence that warrants further exploration. This aligns with global research highlighting education’s critical role in fostering entrepreneurial capabilities (Cantner et al. 2021a).

The analysis reveals that socio-cultural and economic factors significantly influence SME failure rates, as evidenced by global and local studies (Chhokar 2013; Dawson et al. 2015). Specifically, the influence of family support, religious leaders, and access to financial institutions was found to be pivotal in determining business outcomes. Additionally, this study’s findings corroborate the work of Farrukh et al. (2019), which highlights the importance of entrepreneurial education while uncovering unique socio-cultural dynamics present in Sri Lanka.

While these results offer valuable insights into SME entrepreneurial success in Sri Lanka, it is essential to recognise the study’s contextual specificity. Given the unique socio-cultural and economic landscape of Sri Lanka, the findings may not be entirely generalisable to other regions. However, key factors, such as the role of education and socio-cultural support, may provide transferable insights for other developing countries with similar economic conditions. Furthermore, the mixed-method data collection approach allowed for a more comprehensive understanding of the factors influencing failure. The Probit regression analysis provided a robust statistical framework for evaluating the binary outcome of start-up success or failure, with the assumptions of the model thoroughly tested and met.

Further examination reveals that individuals with specific entrepreneurial and skills-based education exhibit a higher likelihood of business success. This impact spans from secondary education levels (O/L and A/L) to tertiary education, reflecting a broader trend that underscores the importance of adapting educational systems to better prepare individuals for economic transitions from developing to developed statuses (Kulasekara et al. 2016). Sri Lanka has a relatively high literacy rate compared to other South Asian nations, with significant literacy rates among both genders. The education system primarily focuses on rigorous examinations that are knowledge centric. However, this study underlines the critical need for incorporating job-oriented and entrepreneurial subjects at various levels of education to better prepare students for future economic challenges and opportunities (Central Bank of Sri Lanka, 2019). Feedback from research participants suggests integrating entrepreneurial and skills education from the school stage (O/L and A/L) through to university (Diploma or Degree). Such early exposure is believed to be foundational in reducing business failures by equipping individuals with essential entrepreneurial capabilities. Furthermore, a significant number of respondents acknowledged receiving education related to entrepreneurship during their school years, which likely aids in cultivating an entrepreneurial mindset early on (Premaratna and Jayasundara 2016).

The Sri Lankan government should recognise the strategic importance of entrepreneurship and skills development as a solution for youth unemployment and fostering economic growth. Despite the introduction of entrepreneurship courses at university levels, there is still limited research on the impact of these educational interventions on entrepreneurial intentions among students (Premaratna and Jayasundara 2016). It is acknowledged that introducing entrepreneurial studies into the academic curriculum from an early age is crucial for the development of entrepreneurial thinking and skills. Such educational strategies prepare students for future entrepreneurial activities and play a vital role in enhancing their career development relative to their fields of study (Cantner et al. 2021a). The relationship between education and entrepreneurial success is complex, with significant implications for economic growth, innovation, and job creation. Higher education levels correlate with improved entrepreneurial activity and business sustainability (Farrukh et al. 2019). Education also provides critical access to financial resources, markets, and networks, which are essential for navigating business challenges and seizing opportunities (Baker and Welter 2020).

Promoting entrepreneurship education is crucial to addressing socioeconomic disparities that affect access to quality education and entrepreneurial opportunities. Targeted financial support, positive thinking programmes, and community-based support are necessary to ensure comprehensive growth and development (Wurth et al. 2021). In summary, the importance of education as a determinant of entrepreneurial success in the SME sector is evidenced by empirical research and reinforced by stakeholder feedback. The findings emphasise the need for the systematic integration of entrepreneurship education across all educational levels in Sri Lanka. By incorporating both entrepreneurial and psychological skill development, in line with global best practices (Cantner et al. 2021b), such initiatives could significantly enhance entrepreneurial success and drive sustainable economic growth. However, further research is needed to determine the adaptability of these educational strategies to regions with differing socioeconomic conditions, along with support for business start-ups.

Socio-cultural parameters determine the societal and cultural factors that affect how individuals understand, think, and act. These influences, including child-rearing approaches and cross-cultural differences, play a significant role in shaping entrepreneurial behaviour. Socio-cultural factors such as ethnic values, cultural change, family structure, kinship systems, and regional diversity significantly impact entrepreneurial endeavours (Aldrich 1989).

Family support is considered an essential determinant of entrepreneurial success, providing emotional backing and valuable resources that facilitate business start-ups and resource mobilisation (Tuazon et al. 2018). In Sri Lanka, where family units are crucial to social norms, support from the family unit is vital. However, it is essential to recognise that family support and trust can vary widely across different cultures and social backgrounds, affecting entrepreneurial experiences in diverse ways (Daspit et al. 2021).

Furthermore, religious leaders and related communities worldwide provide significant support and guidance, influencing entrepreneurs’ values, ethics, and risk-taking propensities (Henley 2022). The cultural perception of entrepreneurship, deeply embedded within Sri Lankan society, significantly influences individuals’ attitudes towards risk, innovation, and business ownership (Welter 2011). In the absence of support from religious leaders, unsuccessful business start-ups may occur, as such guidance is essential. Additionally, religious leaders within the Muslim community provide substantial support for individuals to start and sustain their own businesses. This is a general observation we have derived from the research itself.

Sociocultural factors not only influence start-up success but also provide essential insights into various aspects of business, including strategies, decision-making processes, and market interactions (Moriano et al. 2012). These cultural factors are significant for understanding the entrepreneurial landscape and developing strategies that align with local cultural and social contexts. Socio-cultural factors intersect with other dimensions of the entrepreneurial ecosystem, such as access to finance, regulatory frameworks, and educational opportunities (Yoowoo Lee et al. 2023). Cultural attitudes towards risk and failure can impact entrepreneurs’ willingness to seek external funding or engage in innovative ventures. Integrating cultural values into entrepreneurship education programmes can enhance the development of an entrepreneurial mindset and foster creativity and resilience among aspiring entrepreneurs (Marina et al. 2014).

Financial barriers are significantly connected to business start-ups, with major issues including insufficient support from government institutions such as the Ministry of Finance or the Department of SME Development. Consequently, this leads to an inability to secure sufficient capital, a lack of government support, difficulties in obtaining business loans from banks, inadequate collateral for disadvantaged individuals, and insufficient cash flow to sustain operations (Olawale and Garwe 2009). These challenges highlight the critical need for supportive financial infrastructure to enable business expansion.

In Sri Lanka, most successful entrepreneurs receive assistance from the Sri Lankan banking system to support business start-ups in the SME sector or benefit from Micro Finance Systems, along with support from government initiatives. After engaging with economic development officers in Sri Lanka, it is evident that they strengthen the foundation for entrepreneurs. They tend to categorise the field and facilitate connections for their development. Many unsuccessful entrepreneurs did not receive adequate support from such institutions or personnel. These perceptions underscore the pivotal role that financial institutions play in providing essential support to nascent businesses, significantly influencing the start-up success rate (Udell and Berger 2002).

Furthermore, financial institutions provide more than just loans; they also offer advisory services, technical assistance, and networking opportunities with similar groups of entrepreneurs, which are crucial for the resilience and competitiveness of start-ups (group 2019). These mechanisms enhance the development of entrepreneurs by reducing the likelihood of failure and promoting sustainable development. Effective government policies and interventions are essential for developing the SME sector. Regulatory frameworks, credit guarantee schemes, and targeted funding initiatives have been shown to significantly improve entrepreneurs’ access to finance, particularly those in underserved markets (Mahmud et al. 2022).

In addition to the significant role of financial institutions, structural barriers persist, such as stringent collateral requirements, high interest rates, and bureaucratic procedures, which hinder SMEs’ ability to access formal financial services (Demirguc-kunt 2020). Therefore, it is essential to coordinate and communicate effectively with policymakers, financial regulators, and development agencies to promote inclusive financial systems that cater to the diverse needs of entrepreneurs in the SME sector.

The analysis confirms the significant influence of the economic conditions of the country and entrepreneurs on the success and failure rates of start-ups in the SME sector in Sri Lanka. Policymakers and stakeholders must consider these factors when designing strategies and policies to reduce start-up failures and promote sustainable entrepreneurial activity. This research elaborates on the idea that when economic conditions are favourable, customers may experience an increase in their purchasing power. Consequently, they will buy more from sellers, ultimately benefiting retail sellers, wholesale sellers, and manufacturers.

The results from the Probit model also highlight the significant impact of the economic conditions of both the country and entrepreneurs on start-up failures within the SME sector in Sri Lanka. Recent research underscores the influence of macroeconomic indicators on entrepreneurship. Favourable economic conditions, such as low inflation and stable GDP growth, positively affect entrepreneurial activity by reducing uncertainty and enhancing market opportunities (Wyrwich et al. 2016). These conditions create a conducive environment for start-ups by providing predictability and potential for growth.

The economic stability of the country and its entrepreneurs, coupled with supportive policies, is critical for nurturing entrepreneurial ecosystems that foster start-up success. Stable economic conditions ensure that entrepreneurs have access to necessary resources and a favourable market environment (Acs et al. 2018). The results of the Probit model align with comprehensive studies that emphasise the importance of access to finance, market demand, and a supportive regulatory environment as fundamental drivers influencing entrepreneurial behaviour and venture performance (Davidsson 2017). A robust economic framework facilitates better access to capital and market opportunities, which is essential for the sustainability of business start-ups for entrepreneurs in Sri Lanka.

The significant impact of start-ups is influenced by the economic conditions of the country and the entrepreneurs themselves. Therefore, policymakers and political groups within the governing body should aim to enhance the country’s economic conditions, improve access to finance, reduce bureaucratic barriers, and foster an innovation ecosystem. Additionally, governments can create an enabling environment for entrepreneurial ventures (Kerr et al. 2016). Such policies would support SMEs in achieving profitability and long-term growth, ultimately benefiting the entire country.

While economic conditions and stability are important, other contextual variables—such as the availability of human capital, technological infrastructure, and institutional support—also play crucial roles in determining entrepreneurial success (Urbano et al. 2019). These elements contribute to the overall development of the country’s economic conditions and those of entrepreneurs. When entrepreneurs have access to capital, they are more likely to invest in human capital and technological infrastructure, increasing their chances of success rather than failure. This unique study provides valuable insights into the interplay between the country’s economic conditions and start-up failures in the SME sector of Sri Lanka. By understanding the multidimensional nature of entrepreneurship and its dependence on macroeconomic factors, responsible institutions and personnel can be developed to support SMEs and enhance overall economic growth and development (Bubnovskaia et al. 2024).

Finally, this analysis of the dependent variable confirms that the economic conditions of the country and the entrepreneurs themselves significantly influence the success and failure rates of start-ups in the SME sector in Sri Lanka. As mentioned earlier, responsible government institutions and private entities must consider these factors when designing strategies and policies aimed at reducing start-up failures and promoting sustainable entrepreneurial activity.

Research has been conducted on the psychological factors influencing start-up entrepreneurship in Sri Lanka and other countries. However, findings suggest that factors such as overconfidence, optimism, fear of loss, negative attitudes, and cognitive biases play significant roles in start-up outcomes. Early studies on entrepreneurial traits from 1961 to 1990 showed minimal effects, which was unexpected given that venture capitalists and entrepreneurs often cite personal characteristics as major drivers of success (Aldrich and Wiedenmayer 1993; Baum and Locke 2004). Psychological factors, such as the fear of failure, were not statistically significant in this study, while the significant influence of psychological traits like resilience was noted (Frese and Gielnik 2014). The divergence in findings might reflect differences in the cultural or economic pressures facing entrepreneurs in Sri Lanka.

Recent research focusing on competence, motivation, cognition, and behaviour highlights a growing interest in psychology-based investigations into how these factors correlate with entrepreneurial success. The use of more intricate models and improved research methods has facilitated a deeper understanding of the impact of these traits on performance (Baum et al. 2011; Baum and Locke 2004; Mitchell et al. 2000).

Research conducted by Qudus et al. (2022) shows how psychological factors affect and influence entrepreneurs’ start-ups. Similarly, another study by Yan et al. (2023) found that while grit and perseverance are important for the survival of technology start-ups, these traits alone do not guarantee long-term success, indicating the importance of external factors in entrepreneurial outcomes. Further insights into psychological factors and entrepreneurship have been explored by Paul Vincent and Devi N (2018), who examined the relationship between psychological constraints, such as risk-taking propensity and self-efficacy among Indian entrepreneurs, noting their positive influence on entrepreneurial intentions but limited impact on actual start-up performance. While entrepreneurial passion and vision are crucial for the success of start-ups in Bangladesh, they are often hindered by institutional barriers and market conditions. This challenge in protecting the nation’s interests was also highlighted by Younggeun Lee and Herrmann (2021). In Sri Lanka, the education system also influences the motivation and positive thinking of entrepreneurs.

Comparative studies and meta-analyses conducted by Soomro and Honglin (2015) highlighted cross-cultural differences in entrepreneurial motivations between Chinese and American students, emphasising the significance of contextual factors. Tsai et al. (2020) provided evidence supporting the positive impact of psychological indicators such as optimism, resilience, and self-efficacy on entrepreneurial outcomes. They referenced a review by Frese and Gielnik (2014) that offered insights for both psychology and entrepreneurship research, suggesting theoretical frameworks for understanding entrepreneurial success. This integrative research indicates the need to consider psychological dimensions comprehensively within entrepreneurship research and practice.

Maydiantoro et al. (2021) examined the influence of self-assurance, overconfidence, and risk attitudes on entrepreneurial intention and performance in the UK, noting that while these factors shape intentions, their translation into performance is influenced by external variables. Rauch et al. (2009) demonstrated the importance of entrepreneurial orientation and its impact on business performance, highlighting the need for a combination of psychological attributes and strategic capabilities. Ali et al. (2023) explored how emotional stability and conscientiousness moderate the relationship between entrepreneurial failures and dynamic managerial capabilities, underscoring the role of psychological factors in fostering resilience and adapting to change. While the discussion has highlighted the strengths and implications of our findings, it is also crucial to consider the limitations of our study, which are addressed in the following section to provide a balanced view of our research scope and impact. Although the findings offer valuable insights into SME failures in Sri Lanka, the results may not be fully generalisable to other contexts due to the unique socio-cultural, economic, and educational environments. However, the role of entrepreneurial education and family support highlighted in this study may offer transferable insights for other developing countries with similar SME ecosystems.

Limitations

This study’s limitations include the sample size and geographic focus, which may restrict the generalisability of the findings. Future research should incorporate a more diverse sample spanning various regions of Sri Lanka to bolster the robustness and applicability of the results. Additionally, potential biases in data collection should be considered when interpreting the outcomes, particularly regarding underrepresented demographics in this study. Future research should explore a more diverse sample to enhance the robustness of these findings and their potential relevance to other contexts. Furthermore, some external factors may not have been considered in this research, such as packaging, managerial competencies, customer perspectives, product quality, and product availability. Despite these limitations, the insights garnered from our analysis hold significant implications for the field, as encapsulated in the following concluding remarks.

Conclusion

This study has identified several pivotal factors contributing to start-up success within the SME sector in Sri Lanka, underscoring the multifaceted nature of entrepreneurial ecosystems. Among these, educational initiatives—particularly those incorporating entrepreneurial education at various stages, from primary through higher education—emerge as critical in cultivating the requisite skills and mindset for entrepreneurial success. Integrating entrepreneurial subjects and skills development from early educational stages to university significantly enhances the likelihood of start-up viability, supporting the necessity for ongoing investment in curriculum development that fosters entrepreneurial capabilities.

Socio-cultural dynamics also play a significant role in shaping entrepreneurial outcomes. The evidence suggests a marginally significant but clearly positive relationship between socio-cultural support and start-up success. Specifically, strong family support, spiritual guidance from religious leaders, and a cultural perception that favours business endeavours contribute positively to the entrepreneurial landscape. Promoting these supportive networks can mitigate start-up failures and enhance success rates, highlighting the need for community and policy-level interventions to nurture these elements.

Financial support emerges as another crucial determinant of entrepreneurial success. The facilitative roles of financial institutions, including banks and microfinance systems, are evident in their provision of essential capital and advisory services, which are instrumental in navigating financial challenges. It is imperative that government bodies and financial institutions continue to refine and implement policies that enhance access to financial resources, ensuring the sustainability and growth of start-ups.

Moreover, the country’s economic stability significantly influences entrepreneurial activity. Improvements in the macroeconomic environment can enhance the financial stability of individual entrepreneurs, thereby creating a conducive backdrop for business operations. Policymakers are urged to enact economic policies that foster such an environment, which is crucial for reducing start-up failures and supporting entrepreneurial endeavours.

Lastly, the psychological attributes of entrepreneurs—such as optimism, resilience, and self-efficacy—are foundational to their success. However, the impact of these traits is often moderated by broader socio-economic and cultural contexts. Thus, entrepreneurs should be encouraged to develop these psychological strengths and supported through educational programmes that integrate comprehensive entrepreneurial education and skills training, particularly at critical stages of educational development.

In synthesising these findings, enhancing the entrepreneurial ecosystem in Sri Lanka requires a holistic approach. By addressing educational needs, socio-cultural support systems, financial accessibility, economic stability, and psychological resilience, a collaborative effort between government, financial institutions, educational bodies, and community leaders is essential. Such a comprehensive strategy will lead to a higher rate of entrepreneurial success and a reduction in start-up failures, ultimately contributing to the robust economic growth of Sri Lanka.

Policy Implication

This study has illustrated several important factors contributing to start-up success within the SME sector in Sri Lanka, offering critical information for policymaking to enhance entrepreneurial success. Research demonstrates a significant correlation between educational factors and entrepreneurial success. The enhancement of individuals’ skills and knowledge through entrepreneurial education was highlighted by Farrukh et al. (2019), thereby improving their chances of business success. Similarly, Kolvereid (1996) and Pruett et al. (2009) discuss how education positively influences entrepreneurial intentions, with subsequent success in business ventures being examined (McNally et al. 2014; Pruett et al. 2009). There is a clear need for curricular changes incorporating entrepreneurship education from early stages through to higher education. In Sri Lanka, O/L, A/L, Diploma, and Undergraduate programmes can make a significant difference in entrepreneurial success. Policy initiatives should focus on integrating entrepreneurial subjects and skills development into the educational system to prepare students for practical economic engagements and innovations. This can be achieved through partnerships between educational institutions and industry leaders to provide hands-on learning experiences and mentorship. While not all students will become entrepreneurs, entrepreneurship education can equip them with essential skills to navigate real-life challenges, whether they pursue entrepreneurial ventures or other professional paths.

The findings suggest that socio-cultural support, including strong family networks and spiritual guidance, can positively impact entrepreneurial success. Policies that foster community support systems through workshops, networking events, and community centres could further strengthen these ties. Promoting an entrepreneurial culture through media and public campaigns can enhance social perceptions and attitudes towards entrepreneurship.

While financial institutions play a critical role in supporting start-ups, there is a need for more accessible financial services, including loans and grants tailored to new entrepreneurs. Government policy could incentivise banks to lower barriers to financing for SMEs. Enhancing the functionality of government support programmes, such as those offered by the Ministry of Finance or SME Development Departments, will ensure that entrepreneurs receive the necessary guidance and resources to navigate the initial stages of business development. Improving macroeconomic conditions, such as GDP growth and inflation control, can provide a stable environment that nurtures business growth. Policies aimed at economic stability and growth should focus on creating favourable conditions for entrepreneurship. Developing infrastructure, reducing bureaucratic barriers, and fostering an innovation ecosystem will further support entrepreneurs and attract foreign investment.

Psychological factors like optimism and resilience are critical for entrepreneurial success. Educational programmes incorporating training in these areas can help build a more robust entrepreneurial mindset. Initiatives to raise awareness about the psychological challenges of entrepreneurship and provide support systems, such as counselling and positive thinking programmes, can mitigate the impact of negative psychological characteristics.

In conclusion, a multi-faceted approach involving educational reforms, socio-cultural enhancements, strategic financial support, and stable economic policies will be essential in reducing start-up failures and creating a strong entrepreneurial ecosystem in Sri Lanka. Through these policy implementations, the government and other stakeholders can ensure sustainable growth and robust economic development, benefiting individual entrepreneurs and the broader society.

Data availability

The datasets generated during and analysed during the current study are not publicly available due to containing information that could compromise the privacy of research participants but are available from the corresponding author on reasonable request.

References

Acs Z, Szerb, L, Lafuente, E, Lloyd, A (2018) The Entrepreneurial Ecosystem. In Global Entrepreneurship and Development Index 2018 (pp. 1–9). Switzerland AG: Springer imprint

Aldrich H (1989) Networking among Women Entrepreneurs. In Hagan O, Rivchum C, Sexton D (Eds.), (pp. 103–132). New York: Praeger

Aldrich H, Wiedenmayer, G (1993) From Traits to Rates: An Ecological Perspective on Organizational Foundings. In Seminal ideas for the next twenty-five years of advances (Vol. 21, pp. 61–97): Emerald Publishing Limited

Ali M, Yaqub, M, Aftab, M, Bokhari, SAA, Malik, A (2023) Entrepreneurs’ Dynamic Managerial Capabilities as a Source of Sustained Competitive Advantage for Small and Medium Enterprises. International Journal of Business Performance Management, 1:1. https://doi.org/10.1504/IJBPM.2023.10051534

Amorós J, Bosma N, Levie J (2013) Ten years of Global Entrepreneurship Monitor: Accomplishments and prospects. International Journal of Entrepreneurial Venturing 5:120–152. https://doi.org/10.1504/IJEV.2013.053591

Aterido R, Beck T, Iacovone L (2013) Access to Finance in Sub-Saharan Africa: Is There a Gender Gap? World Development 47:102–120. https://doi.org/10.1016/j.worlddev.2013.02.013

Baker T, Welter, F (2020) Contextualizing Entrepreneurship Theory. New York: Routledge

Baum JR, Bird B, Singh S (2011) The practical intelligence of entrepreneurs: Antecedents and a link with new venture growth. Personnel Psychology 64:397–425. https://doi.org/10.1111/j.1744-6570.2011.01214.x

Baum JR, Locke E (2004) The Relationship of Entrepreneurial Traits, Skill, and Motivation to Subsequent Venture Growth. Journal of Applied Psychology 89:587–598. https://doi.org/10.1037/0021-9010.89.4.587

Beck T, Demirguc-Kunt, A (2006) Small and Medium Enterprises: Access to Finance as a Growth Constraint. Journal of Banking & Finance, 30

Bliss CI (1934) The Method of Probits. 79(2037): 38-39. https://doi.org/10.1126/science.79.2037.38

Bogatyreva K, Edelman L, Manolova T, Osiyevskyy O, Shirokova G (2019) When do entrepreneurial intentions lead to actions? The role of national culture. Journal of Business Research 96:309–321. https://doi.org/10.1016/j.jbusres.2018.11.034

Brown R, Rocha A (2020) Entrepreneurial uncertainty during the Covid-19 crisis: Mapping the temporal dynamics of entrepreneurial finance. Journal of Business Venturing Insights 14:e00174. https://doi.org/10.1016/j.jbvi.2020.e00174

Bruhn M, Love, I (2014) The Real Impact of Improved Access to Finance: Evidence from Mexico. The Journal of Finance, 69. https://doi.org/10.1111/jofi.12091

Bubnovskaia O, Tam D, Gafforova E, Salamzadeh A (2024) Exploring the relationship between entrepreneurship and economic growth in selected countries. World Review of Entrepreneurship, Management and Sustainable Development 20:272–289. https://doi.org/10.1504/WREMSD.2024.137124

Cantner U, Cunningham, J, Lehmann, E, Menter, M (2021a) Entrepreneurial ecosystems: a dynamic lifecycle model. Small Business Economics, 57. https://doi.org/10.1007/s11187-020-00316-0

Cantner U, Cunningham JA, Lehmann EE, Menter M (2021b) Entrepreneurial ecosystems: a dynamic lifecycle model. Small Business Economics 57(1):407–423. https://doi.org/10.1007/s11187-020-00316-0

Cardon M, Wincent J, Drnovsek M (2009) The Nature and Experience of Entrepreneurial Passion. The Academy of Management Review 34:511–532. https://doi.org/10.5465/AMR.2009.40633190

Central Bank of Sri Lanka (2019) Central Bank Annual Report – 2019. Colombo: Central Bank of Sri Lanka. https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports/annual-reports/annual-report-2019

Ceresia F (2018) The Role of Entrepreneurship Education in Fostering Entrepreneurial Intentions and Performances: A Review of 30 Years of Research. Equidad y Desarrollo: 47–66. https://doi.org/10.19052/ed.4380

Chhokar JS, Brodbeck, FC, House, RJ (Eds.). (2013) Culture and Leadership across the world. The GLOBE Book of the In-Depth Studies of 25 Societies: Lawrance Erlbaum Associates

Craig R, Dettmann-Busch, I, Gomes, E, Greubel, G, Liebig, K, Lui, K, Marino, R, Mminele, D, et al. (2008) Financial Innovation and Emerging Markets: Opportunities for Growth vs. Risks for Financial Stability (Proceedings)

Crammond R (2020) Advancing Entrepreneurship Education in Universities: Concepts and Practices for Teaching and Support

Cronbach LJ (1951) Cofficient alpha and the internal structure of tests (16, No 3)

Dana L-P, Tajpour M, Salamzadeh A, Hosseini E, Zolfaghari M (2021) The Impact of Entrepreneurial Education on Technology-Based Enterprises Development: The Mediating Role of Motivation. Administrative Sciences 11:105. https://doi.org/10.3390/admsci11040105

Daspit J, Chrisman J, Ashton T, Evangelopoulos N (2021) Family Firm Heterogeneity: A Definition, Common Themes, Scholarly Progress, and Directions Forward. Family Business Review 34:296–322. https://doi.org/10.1177/08944865211008350

Davidsson P (2017) A Future of Entrepreneurship Research. In (pp. 1–23)

Dawson A, Sharma P, Irving PG, Marcus J, Chirico F (2015) Predictors of Later–Generation Family Members’ Commitment to Family Enterprises. Entrepreneurship Theory and Practice 39(3):545–569. https://doi.org/10.1111/etap.12052

Demirguc-kunt A, et al. (2020) The Global Findex Database 2017: Measuring finacial inclusion and the fintec revolution. (8310): World Bank Policy Reserach Working Paper

Fairlie R, Fossen, F (2018) Defining Opportunity Versus Necessity Entrepreneurship: Two Components of Business Creation. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3132357

Farrukh M, Lee J, Sajid M, Waheed A (2019) Entrepreneurial intentions: The role of individualism and collectivism in perspective of theory of planned behaviour. Education and Training 61:984–1000. https://doi.org/10.1108/ET-09-2018-0194

Fisher RA (1935) The Case of Zero Suvivors in Probit Assays

Frese M, Gielnik M (2014) The Psychology of Entrepreneurship. Annual Review of Organizational Psychology and Organizational Behavior 1:413–438. https://doi.org/10.1146/annurev-orgpsych-031413-091326

Giorgi S, Lockwood C, Glynn M (2015) The Many Faces of Culture: Making Sense of 30 Years of Research on Culture in Organization Studies. The Academy of Management Annals 9:1–54. https://doi.org/10.1080/19416520.2015.1007645

Gries T, Naude, W (2020) Entrepreneurship and regional development: On the interplay between agency and context. Regional Studies

group Wb (2019) Financing Solutions for Micro, Small and Medium scale ntrepreises in Bangladesh

Hall J, Daneke G, Lenox M (2010) Sustainable development and entrepreneurship: Past contributions and future directions. Journal of Business Venturing 25:439–448. https://doi.org/10.1016/j.jbusvent.2010.01.002

Henley A (2022) Religion and Entrepreneurship. In Zimmermann KF (Ed.), Handbook of Labor, Human Resources and Population Economics (pp. 1–27): Springer International Publishing

Honig B, Samuelsson M (2012) Planning and the Entrepreneur: A Longitudinal Examination of Nascent Entrepreneurs in Sweden. Journal of Small Business Management, 50. https://doi.org/10.1111/j.1540-627X.2012.00357.x

Jovanovic M JM, Petkovic J (2018) The Role of Cuturae in Entrepreneurial Ecosystem: What Matters Most?. Doing Business in the Digital Age: Challenges, Approaches and Solutions: 1-9

Kautonen T, Gelderen M, Fink M (2015) Robustness of the Theory of Planned Behavior in Predicting Entrepreneurial Intentions and Actions. Entrepreneurship Theory and Practice 39:655–674. https://doi.org/10.1111/etap.12056

Keith M, Hmieleski JCC (2009) The Relationship Between Entrepreneur Psychological Capital and New Venture Performance. SSRN Electronic Journal

Kerr S, Kerr W, Ozden C, Parsons C (2016) Global Talent Flows. Journal of Economic Perspectives 30:83–106. https://doi.org/10.1257/jep.30.4.83

Kolvereid L (1996) Prediction of Employment Status Choice Intentions. Entrepreneurship Theory and Practice 21(1):47–58. https://doi.org/10.1177/104225879602100104

Kulasekara C, Lekamge, D, Talagala, I, Yapa, SR (2016) Study on Development of leaarning Environment in General Education in Sri Lanka

Lee Y, Herrmann, P (2021) Entrepreneurial Passion: A Systematic Review and Research Opportunities. 31: 122-147. https://doi.org/10.53703/001c.29740

Lee Y, Kim, J, Mah, S, Karr, A (2023) Entrepreneurship in Times of Crisis: A Comprehensive Review with Future Directions. Entrepreneurship Research Journal. https://doi.org/10.1515/erj-2022-0366

Levine R, Rubinstein Y (2017) Smart and Illicit: Who Becomes an Entrepreneur and Do They Earn More? Quarterly Journal of Economics 132:963–1018. https://doi.org/10.1093/qje/qjw044

Liñán F, Fernández-Serrano J (2014) National culture, entrepreneurship and economic development: Different patterns across the European Union. Small Business Economics 42:685–701. https://doi.org/10.1007/s11187-013-9520-x

Lussier R, Pfeifer S (2001) A Cross-National Prediction Model for Business Success. Journal of Small Business Management 39:228–239. https://doi.org/10.1111/0447-2778.00021

Lussier RN, Bandara, C, Marom, S (2016) Entrepreneurship success factors: an empirical investigation in Sri Lanka. World Journal of Entrepreneurship, Management and Sustainable Development, 12(2). https://doi.org/10.1108/WJEMSD-10-2015-0047

Mahmud K, Joarder M, Muheymin-Us-Sakib K (2022) Adoption Factors of FinTech: Evidence from an Emerging Economy Country-Wide Representative Sample. International Journal of Financial Studies 11:9. https://doi.org/10.3390/ijfs11010009

Marina S, Westhead P, Matlay H (2014) Cultural factors and entrepreneurial intention: The role of entrepreneurship education. Education and Training 56:680–696. https://doi.org/10.1108/ET-07-2014-0075

Maritz A, Jones, C, Foley, D, De Klerk, S, Eager, B, Nguyen, Q (2021) Entrepreneurship education in Australia. In (pp. 208-226)

Maydiantoro A, Jaya T, Basri M, Yulianti D, Sinaga R, Arif S (2021) The influence of entrepreneurial attitudes, subjective norms and self-efficacy on entrepreneurial intentions. International Journal of Information and Decision Sciences 24:1–12

McCarthy S, Oliver B, Verreynne M-L (2015) Bank financing and credit rationing of Australian SMEs. Australian Journal of Management 42(1):58–85. https://doi.org/10.1177/0312896215587316

McNally JJ, Martin, B, Honig, B, Bergmann, H, Piperopoulos, P (2014) Assessing Kolvereid’s (1996) Measure of Entrepreneurial Attitudes (2014)

Ministry of Industry and Commerce (2017) National Policy Framework for SME Development. Colombo: Ministry of Industry and Commerce. http://www.sed.gov.lk/sedweb/en/wp-content/uploads/2017/03/SME-fram-work_eng.pdf

Mitchell R, Smith, J, Seawright, KW, Morse, E (2000) Cross-Cultural Cognitions and the Venture Creation Decision. The Academy of Management Journal, 43. https://doi.org/10.2307/1556422

Moriano J, Gorgievski M, Laguna M, Stephan U, Zarafshani K (2012) A Cross-Cultural Approach to Understanding Entrepreneurial Intention. Journal of Career Development 39:162–185. https://doi.org/10.1177/0894845310384481

Mueller S, Thomas A (2001) Culture and Entrepreneurial Potential: A Nine Country Study of Locus of Control and Innovativeness. Journal of Business Venturing 16:51–75

Nizaeva M, Coskun, A (2018) Determinants of the Financing Obstacles Faced by SMEs: An Empirical Study of Emerging Economies. Journal of Economic and Social Studies, 7. https://doi.org/10.14706/JECOSS17725

Olawale F, Garwe, D (2009) Obstacles to the growth of new SMEs in South Africa: A principal component analysis approach. Afr. J. Bus. Manag., 4

Paul Vincent MT, Devi NU (2018) Exploring the Relationship between Psychological Capital and Entrepreneurial Success. International Journal of Pure and Applied Mathematics 119:2987–2999

Premaratna S, Jayasundara, C (2016) Impact of Entrepreneurship Education on Entrepreneurial Intentions among Sri Lankan Undergraduates

Pruett M, Shinnar R, Toney B, Llopis F, Fox J (2009) Explaining entrepreneurial intentions of university students: A cross-cultural study. International Journal of Entrepreneurial Behaviour & Research 15:571–594. https://doi.org/10.1108/13552550910995443

Qudus A, Mazhar M, Tabassum M, Saggu A (2022) The Role of Psychological Factors on Entrepreneurial Intentions among Business Students

Rauch A, Wiklund J, Lumpkin G, Frese M (2009) Entrepreneurial Orientation and Business Performance: An Assessment of Past Research and Suggestions for the Future. Entrepreneurship Theory and Practice 33:761–787. https://doi.org/10.1111/j.1540-6520.2009.00308.x

Rigol N, Pande R, Papp J, Field E (2013) Does the classic microfinance model discourage entrepreneurship among the poor? Experimental evidence from India. American Economic Review 103:2196–2226. https://doi.org/10.1257/aer.103.6.2196

Soomro RB, Honglin Y (2015) Analyzing the impact of the psychological characteristics on entrepreneurial intentions among university students. Advances in Economics and Business 3:215–224. https://doi.org/10.13189/aeb.2015.030603

Spencer J, Gomez C (2011) MNEs and corruption: the impact of national institutions and subsidiary strategy. Strategic Management Journal 32:280–300. https://doi.org/10.1002/smj.874

Szirmai A, Naudé, W, Goedhuys, M (2011) Entrepreneurship, Innovation, and Economic Development: An Overview. Entrepreneurship, Innovation, and Economic Development. https://doi.org/10.1093/acprof:oso/9780199596515.003.0001

Thurik R, Verheul, I, Hessels, J, Zwan, P (2010) Factors Influencing the Entrepreneurial Engagement of Opportunity and Necessity Entrepreneurs. EIM Business and Policy Research, Scales Research Reports, 6. https://doi.org/10.1007/s40821-016-0065-1

Tsai F-S, Leonard K, Srivastava S (2020) Editorial: the role of psychological capital in entrepreneurial contexts. Frontiers in Psychology 11:582133. https://doi.org/10.3389/fpsyg.2020.582133

Tuazon G, Bellavitis C, Filatotchev I (2018) Nascent Entrepreneurship Research: Theoretical Challenges and Opportunities. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3112511

Udell G, Berger A (2002) Small business credit availability and relationship lending: the importance of bank organization structure. Economic Journal 112:32–32. https://doi.org/10.2139/ssrn.285937

Urbano D, Aparicio S, Audretsch D (2019) Twenty-five years of research on institutions, entrepreneurship, and economic growth: what has been learned? Small Business Economics, 49: 21–49. https://doi.org/10.1007/s11187-018-0038-0

Velinov EE, Ashmarina S, Zotova A (2021) Importance of International Entrepreneurship Skills Among MBA Students: Global Comparative Study. In (pp. 78–84)

Welter F (2011) Contextualizing Entrepreneurship - Conceptual Challenges and Ways Forward. Entrepreneurship Theory and Practice 35:165–184. https://doi.org/10.1111/j.1540-6520.2010.00427.x

Wennberg K, Pathak, S, Autio, E (2013) How culture moulds the effects of self-efficacy and fear of failure on entrepreneurship. Entrepreneurship and Regional Development, 25. https://doi.org/10.1080/08985626.2013.862975