Abstract

Over the past two decades, digital banking has undergone significant advancement. However, numerous studies have not investigated this subject thoroughly. This study seeks to address this gap by following a systematic literature review (SPAR-4-SLR) method to analyze 1959 research papers on digital banking published between 1983 and 2020. Methodologies such as bibliometric analysis, science mapping, network analysis, and Multidimensional Scaling are utilized. This study examined the patterns and interconnections within the research. Furthermore, the machine learning analysis of the selected literature offers novel insights and identifies key relationships in the field. This study presents five principal findings and their implications from this extensive review, highlighting areas for future research. It is distinguished by its comprehensive examination of such a vast collection of studies and efforts to propose a forward-looking research framework. Science mapping through network analysis of keyword co-occurrence reveals seven major themes that define the body of knowledge or intellectual structure of digital banking research: ATM banking, Internet banking, mobile banking, peer-to-peer financing, cryptocurrency, digital payments, and fintech. Five of these seven major themes pertain to digital banking types, with digital payments being a distinct theme. A review of these articles and reflection on the existing gaps in each major theme led to the identification of several underexplored or underrepresented issues that future research could address to enrich the major themes in digital banking research. These include digital payments to customers without smartphones, expanding the reach of digital banking, mitigating the risks involved in digital banking, fintech sustainability, and the commercialization of cryptocurrency. This study proposes future directions and prominent research questions in the digital banking core field and subthemes, including e-wallets, mobile banking, and a Unified Payment Interface.

Similar content being viewed by others

Introduction

The expansion of the Internet has enabled organizations and customers to discover unique ways of communicating, significantly impacting the banking industry (Ganguli and Roy, 2011). Mobile, telephone, and Internet services are three digital banking (DB) channels that offer customers convenience of anytime and anywhere access, compelling banks to provide services through these channels to remain competitive (Sundarraj and Wu, 2005). Consequently, banks have shifted their focus from physical branches to digital channels (Groenfeldt, 2014). DB reduce the costs associated with mailing printed statements and eliminate the need for in-person interactions at branches; however, customers still expect the same level of engagement through DB and social media networks (Dootson et al. 2016). Customers no longer need to wait for bank hours or endure long telephone queues to reach a bank representative (Zook and Smith, 2016). A 2015 study by Accenture highlighted that modern customers desire flexibility to conduct transactions from anywhere while also seeking a deeper personal connection with their bank relationship officers. DB have introduced new avenues for customer relationships that were previously unavailable (Barney and Ray, 2012). Traditionally, cash, debit, or credit cards are the only payment options; however, today, a variety of choices exist: cash, debit cards, credit cards, mobile wallets, e-wallets, and direct debits (Harasim and Klimontowicz, 2013). Consumers in both advanced and developing nations are transitioning from cash to cashless payments (Flood et al. 2013). Given the expansive nature of DB, numerous scholars have conducted research to gain a deeper understanding of its various sub-topics. A recent review by Alkhowaiter (2020) focuses on the factors driving the adoption of DB and payments, examining 46 articles focusing on Gulf countries. However, this field is much broader, as demonstrated by the review of 1959 articles. Notably, to date, no review has attempted to analyze the rapidly growing field of DB without imposing excessively stringent criteria to reduce the corpus to a manageable size.

This study offers a cutting-edge perspective on DB research, acknowledging every aspect and associated research in this field. Our research encompasses the entire spectrum of DB, considering all dimensions of the concept, as seen in previous studies, such as fintech (Milian et al. 2019), mobile banking (Tam and Oliveira, 2017), internet banking (Yousafzai, 2012), and research in developing countries (Alkhowaiter, 2020). Furthermore, this research employs an unbiased and robust analytical approach, specifically bibliometric methods, which are well-suited for evaluating extensive collections of articles using quantitative measures (Donthu et al. 2021; Paul et al. 2021; Pattnaik et al. 2020). In particular, bibliometric analysis demonstrates the application of big data analytics by utilizing machine-learning techniques to study scholarly research in two major ways: (1) this study employs bibliometric analysis, leveraging artificial intelligence-powered databases such as Scopus to extract relevant bibliometric data on DB articles; and (2) big data analysis (bibliometrics), which is intricate (e.g., journal, author, institution, country, and keywords) and extensive (e.g., thousands of data points across multiple facets of 1959 articles), is supported by unsupervised machine learning, an additional subset of artificial intelligence, to uncover latent relationships (e.g., interrelated keywords) and comparable groupings of these relationships (e.g., major themes).

This study focuses on analyzing the performance and mapping of the scientific landscape of the entire DB research corpus using bibliometric analysis. Performance analysis examines publication trends, top articles, authors, journals, institutions, and countries, whereas science mapping reveals the core themes and topics shaping the field’s intellectual structure. Through this study, we aim to provide valuable insights that address six key research questions, ideally revealed through bibliometric reviews (Kumar et al. 2021; Rao et al. 2021; Donthu, Kumar, Pattnaik et al. 2021; Kumar, Pandey et al. 2021; Kumar, Sureka et al. 2021; Donthu, Kumar, Pandey et al. 2021; Kumar, Lim et al. 2021).

-

1.

What are the publication trends in DB research?

-

2.

What are the most influential articles and top contributing journals in DB research?

-

3.

What are the top contributing authors, institutions, and countries for DB research?

-

4.

What methodological choices and research context exist in DB research?

-

5.

What are the major themes and topics in DB research?

-

6.

What are the future research directions for DB ?

The remainder of this paper is organized as follows. This study begins by summarizing DB. Next, we discuss the methodology used in this review and report the findings. In closing, this paper provides a future research agenda and outlines the research questions related to each major theme. These insights will serve as valuable references for aspiring researchers seeking to advance the DB field.

Digital banking

The expansion of the Internet has helped organizations and customers find unique ways to communicate with each other, which has had a deep impact on the banking industry (Ganguli and Roy, 2011). This study focused on the impact of service quality on customer satisfaction and loyalty but did not examine the technology acceptance model or theory of planned behavior to study the factors that impact the usage of such new technology. Mobile banking, telephone banking, and Internet banking are three DB (DB) service channels that provide convenience, anytime, and anyplace services to customers; therefore, banks have to provide services on these channels to endure (Sundarraj and Wu, 2005; Daniel, 1999; Mols, 2001). These factors did impact the decision to use online services, but customers still feared losing money, which led to a push in the adoption of these services to a later period. Banks have started to focus less on branches and more on the use of digital channels (Groenfeldt, 2014). Indian banks did not shift their focus from branch banks. They focus equally on branch and online banking. DB helps cut costs related to sending printed statements by postal exchange and avoids in-person interactions with customers in branches; however, customers expect to have comparable levels of interactions on DB and social media platforms (Dootson et al. 2016). Customers need not wait for the bank to open or spend time waiting in telephone queues to contact their bank customer executives (Zook and Smith, 2016). One study pointed out that today’s customers expect the freedom to conduct business from anywhere but also require a deeper personal connection with their bank relationship officers (Accenture 2015). This is true, but regulations were not in place to secure the rights of customers in the case of online fraud. DB have also opened new options for customer relationships that were not available earlier (Barney and Ray, 2012). Cash payments, debit card payments, and credit card payments are the only few means of payment; however, multiple options are currently available: cash payments, debit card payments, credit card payments, mobile wallet payments, e-wallet payments, and direct debits (Harasim and Klimontowicz, 2013). Consumers from developed and emerging nations are migrating from cash to cashless payment modes (Flood et al. 2013; Demirgüc-Kunt et al. 2018). Internet banking and mobile banking are the two channels of DB that customers use for their banking needs other than visiting the branch (Garzaro et al. 2021). The major difference between the two channels is the way banking services are accessed: internet banking is accessed via a web browser, and mobile banking is accessed by downloading the bank’s application or any third-party application that connects with the bank’s application (Berger, 2002). Banks with physical branches integrate DB by implementing a multichannel strategy that combines the Internet and/or mobile banking with their physical branch services (Scornavacca and Hoehle, 2007). Banks employ an omni-channel strategy to seamlessly, personally, and consistently deliver DB services by integrating Internet and mobile banking (Verhoef et al. 2021). Additionally, banks invest in artificial intelligence to gather, interpret, and respond to customer queries and issues (Fares et al. 2023). Banks have been able to provide unique and recognizable customer experiences through technological advancements (Srivastava et al. 2021). DB has its own challenges. Perceived risk is a factor that has been analyzed in many studies and proven to negatively impact the adoption and usage of DB services (Elhajjar and Ouaida, 2020). Perceived risk pertains to the risk of losing money, the fear of losing data, and security threats. Lower levels of digital literacy also hinder acceptance of DB. This was proven in various studies, and Medhi et al. (2009) advocated the study of this variable whenever the use of DB is studied by researchers, as it negatively impacts the adoption of technology.

Figure 1 illustrates the evolution of research in the DB field. The journey started in 1983, with a focus on relationship marketing, virtual banking, and e-commerce until 2000. The 20th century marked a significant moment in the DB journey, where theories such as the technology acceptance model (TAM), theory of planned behavior (TPB), and Decomposed theory of planned behavior were analyzed to understand the adoption of internet banking in developed nations. In 2005, internet banking was introduced to developing nations. Many studies were conducted in 2005 to understand the factors affecting the usage of Internet banking. They also analyzed the impact of perceived risk on hinderance to internet banking usage. In the second decade of the 20th century, fintech companies entered the financial market and provided services similar to banks. Mobile banking has also begun making inroads in the DB domain. Many researchers studied the adoption and continuous usage of mobile banking in the second decade. Indian banking saw a drastic shift after the introduction of demonetization. Consumers began to use mobile wallets in the second half of the second decade of the 20th century. This half of the 20th century saw researchers studying blockchain technology, the impact of artificial intelligence on DB, and the use of mobile payments in developing countries. After COVID-19, the digital payment space received a huge impetus.

Methodology

This study utilized Scientific Procedures and Rationales for Systematic Literature Reviews (SPAR-4-SLR) to assemble, arrange, and assess the literature accumulated for this research. Performance analysis was devised to understand the latest research trends and identify the most influential articles, publication trends, and a few other analysis-like top contributing journals and authors. Science mapping was performed to study the temporal and network analyses. Multidimensional scaling was then applied to understand the similarities in the research in a cluster. Figure 2 shows a diagrammatic representation of the methodology used in this study.

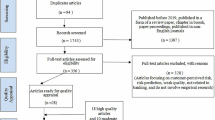

This study gathered bibliometric data related to DB research for review. To achieve this, the research follows the Scientific Procedures and Rationales for Systematic Literature Reviews (SPAR-4-SLR) protocol instead of the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) or Theories, Contexts, Characteristics, and Methodologies (TCMM) because PRISMA focuses on reporting; TCMM is theory driven but SPAR-4-SLR emphasizes the entire review process, making it suitable for diverse and emerging disciplines. SPAR-4-SLR involves three key stages: article collection, organization, and evaluation (Paul et al. 2021). Figure 3 provides an overview of the review process.

Assembling

Relevant search keywords were extracted from the initial literature review to compile a comprehensive collection of articles on DB. In addition, consultations with five experts confirmed the suitability of these keywords. The outcome was an array of 11 keywords, which were then structured into the following search string. “Digital Banking” OR “Digital Payments” OR “Fintech” OR “Internet Banking” OR “Unified Payments Interface” OR “Online Payment” OR “Mobile Banking” OR “Smartphone Payments” OR “Open Banking” OR “Mobile Wallet” OR “Digital Wallet.” Following the identification of search keywords, this study performed a comprehensive search for articles using the specified search string within the “article title, abstract, and keywords” section of Scopus, the premier scientific database for scholarly articles, and the largest abstract and citation database of peer-reviewed literature (Norris and Oppenheim, 2007; Comerio and Strozzi, 2019). The Scopus database was used owing to its global reach, ease of access, citation analysis, credibility, and comprehensive coverage. The search yielded 3229 documents.

Arranging

To organize a corpus of 3229 articles collected during the assembly stage, this study utilized the Scopus category (code) function. The search results were reviewed based on criteria such as year, subject area, document type, publication stage, source type, and language. Specifically, the results were filtered and restricted to articles from 2021 related to business, management, and accounting, categorized as ‘article,’ in the final publication stages, from journals, and written in English. Following the recommendations of Paul et al. (2021), specific filters were applied to the dataset. First, the search was limited to articles published up to the year 2020. Post COVID, there was an unprecedented increase in the usage of DB, which led to extensive research. This study attempts to exclude the impact of COVID by focusing on article till 2020–21. Second, this study focused on articles related to business, management, and accounting. Third, the study excluded non-article formats such as editorials and notes, as they might lack peer review. Fourth, this study avoided reviews because they provided conflicting insights. Fifth, the press articles were omitted because of their provisional status. Sixth, we excluded non-journal sources (e.g., books, book chapters, and conference proceedings) to ensure rigorous peer review. Finally, non-English articles were excluded owing to language limitations. The final corpus comprised 2254 articles. Subsequently, we retrieved and thoroughly reviewed each article. We identified 295 articles that mentioned search keywords, but were not directly relevant to DB. Consequently, these studies were excluded from analysis. The final dataset comprised 1959 articles. To ensure rigor, we conducted an additional cross-check across various databases, including Google Scholar and publisher platforms such as Elsevier, Emerald, Sage, Springer, Taylor, and Francis. This step was taken to prevent inadvertent omission of pertinent studies within the field (Harari et al. 2020; Goyal et al. 2021; Lim et al. 2021).

Assessing

This study employed a bibliometric analysis methodology to evaluate an extensive dataset of 1959 articles. A Biblioshiny 4.0 a web application using R was used for bibliometric analysis. In essence, bibliometric analysis utilizes quantitative techniques to extract valuable scientific insights from scholarly articles (Donthu et al. 2021). Indeed, systematic reviews employing bibliometric techniques have become commonplace (Ellegaard and Wallin, 2015), companies (Zupic and Čater, 2015; Baker et al. 2020; Donthu et al. 2021), banking (Durisin and Puzone, 2009; Linnenluecke et al. 2020; Xu et al. 2019), As bibliometric analysis employs quantitative tools, it effectively mitigates the inherent bias often present in manual and qualitative reviews (Broadus, 1987; Burton et al. 2020), particularly in the case of extensive review compilations when there are more than 1000 articles (Donthu et al. 2021). Following the footsteps of earlier reviews (Cobo et al. 2011; Donthu et al. 2021; Khan et al. 2021), this research employs bibliometric analysis, incorporating performance metrics to depict publication trends, identify top articles, contributing journals, authors, institutions, and countries, and explore methodological choices and research contexts. Furthermore, it employs science mapping techniques, including temporal analysis visualized through word clouds (Van Eck and Waltman, 2017) and network analysis based on keyword co-occurrence (Callon et al. 1983; Newman and Girvan, 2004; Pesta et al. 2018; Castriotta et al. 2019; Donthu et al. 2021) in VOSviewer (Van Eck and Waltman, 2017), to elucidate the central themes and underlying intellectual framework of the research. To enhance understanding in this domain, this study constructs a prospective research itinerary by synthesizing the existing literature and identifying gaps within each primary thematic area.

MDS: Metric multidimensional scaling

Multidimensional scaling (MDS) is a statistical technique that helps to understand the similarities or differences between a set of objects. MDS helps reduce multiple dimensions in the datasets to three dimensions. This technique can also be used for dimension reduction. This technique helps sketch 2D or 3D scatter plots for complex datasets (Van der Klis and Tellings, 2022). MDS is a prominent quantitative technique for elucidating underlying interconnections within the knowledge framework of a research field. In addition, MDS assesses the stability of relational data by examining the likelihood of model instability (Chabowski et al. 2013). This study employs multidimensional scaling (MDS) to construct a spatial representation of objects based on their similarities, proximities, and interrelationships within a multidimensional domain. (Cox and Cox, 2001; Wilkinson, 2002; Yang et al. 2023; Zupic and Čater, 2015). MDS facilitates the visualization of the scholarly network within a specific research topic by analyzing similarities, dissimilarities, and distances among authors. The MDS identifies key dimensions within a defined research domain (White and McCain, 1998; Nerur et al. 2008; Yang et al. 2023). Articles related to DB from 1983 to 2020 were collected, and highly cited documents were used for the MDS analysis after completing the co-citation matrix. In this analysis, the co-citation value was used to determine the proximity between studies. Documents with high cocitation metrics can be interpreted as having more shared topics. Similarly, lower values indicated distinctness in this study. Previous studies (Ramos-Rodríguez and Ruiz-Navarro, 2004) used stress values to study the goodness of fit or closeness between MDS clusters. A stress value of 0 indicates that research papers or topics in that cluster are closely related, while values between 0.10 and 0.20 are indicative of a good fit and the research papers in that cluster are related to each other. The MDS Analysis was performed using IBM SPSS for Windows v24 software. The subsequent sections present the review outcomes accompanied by descriptive visualizations in the form of figures and tables.

Findings

Performance analysis

Performance analysis, as a bibliometric method, elucidates the dynamics and effectiveness of a given research domain (Donthu et al. 2021), and in this scenario, the field of DB. This examination bears resemblance to participant profiling in empirical studies, albeit conducted with greater rigor through the application of bibliometric metrics (Donthu et al. 2021). In this study, we have undertaken a performance analysis to unveil the following insights: (1) publication trend; (2) most influential articles; (3) top contributing journals; (4) top contributing authors; (5) top contributing institutions; (6) top contributing countries; and (7) methodological choices and research contexts.

Publication trend for research

Figure 4 illustrates the chronological progression of research publications in the DB. Notably, the inaugural DB article indexed in Scopus emerged in 1983 (Galitz, 1983). Over the subsequent 38 years (1983–2020), the field has witnessed substantial growth. While the early years saw minimal contributions, the past two decades have seen remarkable expansion, culminating in unprecedented 487 publications by 2020. The surge in publications, particularly from 2013 onward, aligns with the widespread adoption of smartphones and internet connectivity worldwide.

A comprehensive analysis revealed that more than 78% of articles were published between 2013 and 2020, solidifying 2013 as a pivotal year for DB research.

Most influential articles for research

Table 1 presents the pivotal articles within the research domain, ranked by citation impact. Notably, Lee’s (2009) work has emerged as the most frequently cited, averaging 53.57 citations annually and accumulating 750 citations since its 2009 publication. Following are Sathye (1999) and Luo et al.’s (2010) contributions, cited 496 and 484 times, respectively. Intriguingly, the top three highly cited articles delve into internet banking and mobile banking, reflecting recent scholarly emphasis on these topics. Collectively, the top 25 articles command an impressive number of 9078 citations, underscoring their substantial influence on the scientific community.

Top contributing journals for research

The compilation comprises 1959 scholarly articles related to DB, disseminated across 702 distinct journals. Table 2 highlights the top 24 contributing journals, each featuring a minimum of five articles within the DB domain. Collectively, these journals accounted for 654 publications (33.38% of the total). Notably, the three most prolific journals are the International Journal of Bank Marketing, Journal of Internet Banking and Commerce, and International Journal of Scientific and Technology Research with 115, 97, and 34 articles, respectively. In terms of scholarly impact, the International Journal of Bank Marketing had 7174 citations, followed by the International Journal of Information Management with 2922. Remarkably, most of these top-contributing journals boast impact factors above one and receive favorable ratings (3 and 4) in the Academic Journal Guide by the Chartered Association of Business Schools, underscoring the prominence of DB research within esteemed academic outlets.

Top contributing authors for research

Table 3 highlights the key contributors to the DB research. Notably, Karjaluoto H. (University of Jyväskylä, Finland) and Rahi S. (University of Punjab, Pakistan) were the most prolific authors, each having authored 11 articles each. Following closely are Laukkanen T. (University of Eastern Finland, Finland) and Shaikh A.A. (University of Jyväskylä, Finland) with ten and nine articles, respectively. However, in terms of scholarly impact, Laukkanen T. (University of Eastern Finland) and Oliveira T. (New University of Lisbon, Portugal) lead the way, with 1258 and 902 citations, respectively. Notably, Oliveira achieved a higher average citation return per year (TC/TP = 150.33) than did Laukkanen et al. (TC/TP = 125.8). Collectively, the top 25 authors contributed 147 (7.50%) articles, with 7077 citations in the DB field.

Top contributing institutions for research

Table 4 provides an overview of the leading institutions that have contributed to DB research. Notably, the University of Regensburg (Germany) has emerged as the most prolific, having authored 15 articles. Following closely are The University of Oxford (United Kingdom), University of British Columbia (Australia), and University of California (United States), each with 13 articles. However, in terms of scholarly impact, Tilburg University (the Netherlands) took the lead, boasting 1050 citations. This was followed by the University of Minho (Portugal) and Maastricht University (the Netherlands), with 846 and 698 citations, respectively. Collectively, the top 25 contributing institutions contributed 211 articles (22.54% of the total), amassing 6439 citations in the DB field.

An intriguing observation is that research efforts extend beyond developed nations, and developing countries also make substantial contributions. Furthermore, representation spans across continents, enriching the DB field.

Science mapping

Science mapping constitutes an analytical approach that reveals the existing knowledge landscape within a specific domain and visually depicts its interrelationships (Donthu et al. 2021) within the context of DB research in this scenario. The science mapping of DB research employs two bibliometric analysis techniques within the VOSviewer. First, temporal analysis utilizes word clouds to elucidate the predominant topics characterizing DB research across distinct time periods. Second, a network analysis based on keyword co-occurrence reveals the fundamental themes shaping the intellectual structure of DB research over the past 38 years (1983–2020).

Temporal analysis using word clouds for digital banking research

The DB research corpus is partitioned into four distinct time intervals: 1983–2002, 2003–2012, 2013–2018, and 2019–2020. Employing temporal analysis, we identified key thematic areas within each period, visually represented through word clouds in Figs. 5–9. Figure 5 specifically captures the emergence of terms such as “deposit insurance,” “contact card,” “bank notes,” “internet,” and “internet banking” and Internet banking during the initial years (1983–2002). Notably, this period also witnessed exploration of topics related to “customer service,” “customer trust,” “costs,” and “consumer behavior,” often grounded in theories like the theory of planned behavior (Liao et al. 1999).

Figure 6 highlights the continuous growth of “virtual banking,” “internet banking,” and “electronic commerce” between 2003 and 2012 by venturing into uncharted territories that include “service quality,” “satisfaction,” “security,” “perceived risk,” “innovation,” and “loyalty” for the “adoption” and “usage” of “internet banking” and “electronic commerce.” During this decade, the field also gradually shifted from “card payments” to “internet banking.” Various theories were used to study the “adoption” of “internet banking,” such as “UTAUT,” “Decomposed Theory of Planned Behavior,” and “Innovation Diffusion Theory,” but the “Technology Acceptance Model” was widely used.

Figure 7 illustrates the shift from “internet banking” to “fintech,” “financial inclusion,” and “blockchain” between 2012 and 2018, including the impact of “demonetization” demonetization on the banking industry. “Fintech” started to compete with banks and introduced a fresh wave of innovativeness in the banking industry. “Perceived innovativeness,” “perceived ease of use,” “perceived usefulness,” “attitude,” “satisfaction,” “perceived risk,” and “security” were the various factors used to understand the adoption and usage of fintech and e-banking, as well as the impact of demonetization on them. This era also saw the use of various theories, such as the Technology Acceptance Model, UTAUT, UTAUT 2, Decomposed Theory of Planned Behavior, and various research papers that used more than one theory to understand the adoption of fintech, blockchain, Internet banking, and e-commerce.

Figure 8 indicates that “fintech,” “mobile banking,” “blockchain,” “financial technology,” and “internet banking” occupied significant position between 2018 and 2020, post the demonetization event that took place in 2016 in India. During this specific two-year period, the examination of DB has focused on exploring new areas and uncovering fresh insights like “blockchain,” “cryptocurrency,” “peer-to-peer lending,” and the regulations that are supporting or hindering the growth of these areas. “Mobile banking” has picked up pace in the research arena as more and more people are adopting the use of smartphones. “Fintech” has again taken center stage in this era as it is growing at a fast pace. “Digital payments,” “mobile payments,” “digital banking,” and “financial technology” are picking up speed in countries like India and China.

Figure 9 shows the research area that was predominantly highlighted from 1983 to 2020. Mobile banking, Fintech, and the Technology Acceptance Model were frequently used from 1983 to 2020.

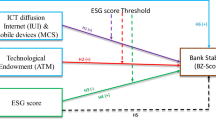

Network analysis

Figure 10 shows the keyword network of digital research over the years, which has evolved from a prime focus on Technology, Banking, and e-commerce to mobile banking, digital payments, and fintech. The period from 1983 to 2022 was a phase during which mobiles were not used by the population. It was a phase in which branch and telephone banking were used. In this period, researchers focused on introducing technology for core banking and identifying the factors that influence the usage of telephone banking. Towards the beginning of the 20th century, banks began introducing Internet banking. Various researchers have studied the adoption of Internet banking using theories such as TAM and UTAUT 2. As we moved towards the second decade of this century, the Internet and mobile devices were vastly used in developing as well as developed nations. There was a gradual shift from Internet banking to wallets as well as mobile banking. Research has focused on the usage of mobile banking along with other factors such as loyalty, trust, and the risk of continuous usage of this new technology. In the second half of the second decade of the 20th century, many fintech companies started banking services that challenged traditional banking. DB was pushed into India due to demonetization in 2016 and the introduction of the UPI. Developing countries also started moving towards DB as they understood the advantages of DB, while issues such as security, fraud, and technical challenges could be addressed in a timely manner. After COVID-19, DB banking saw a huge push throughout the world. Researchers are now focusing on areas such as Artificial Intelligence, Machine Learning, and the advantages and disadvantages of Central Bank Digital Currency.

Metric multi-dimensional scaling (MDS)

Following data collection from the most highly cited documents spanning 1982 to 2020 and the subsequent construction of the co-citation matrix, MDS was applied to discern subfields within the specified research domain (Cobo et al. 2011). In MDS analysis, the co-citation value serves as a proxy for the proximity between highly cited works. This approach reveals both commonalities and distinct themes among documents. Documents with higher co-citation metrics indicate stronger shared topics and closer conceptual proximity. Conversely, lower scores indicate distinctiveness within or between topics (Ramos-Rodríguez and Ruíz-Navarro, 2004). It is important to highlight that the MDS analysis was conducted using IBM SPSS for Windows v24 to assess the goodness of fit for the data model. To evaluate the model fit, Ramos-Rodrigues and Ruiz-Navarro (2004) recommend examining the stress value. The MDS considers that there is a moderate difference among objects in a constant dimension. This was used to categorize the data and identify the closeness matrix of the co-citation matrices. These data were passed through IBM SPSS software to obtain the stress values and analyze the goodness of fit. A stress value of 0 indicates a perfect fit, while values between 0.10 and 0.20 are indicative of a good fit. The stress value found was.00926 for the corpus collected from 1983 to 2002. The stress value was 0.005557 for research data from 2003 to 2012. The stress value was 0.0236 for research papers published from 2013 to 2018. The stress value was found to be 0.01579 for research papers published from 2019 to 2020. All the stress values were much <0.1 and near zero in most cases, which shows a near-perfect fit. MDS analysis utilized a standardized distance of 0.25.

MDS analysis for 1983 to 2002

Figure 11 shows the multidimensional scaling for research papers from 1983 to 2002. Internet banking has been widely studied from 1983 to 2002. Two groups have been identified: one related to factors impacting Internet banking usage, and the second related to the service quality of Internet banking. The first group comprised V4, V6, and V16, and the second group comprised V5, V15, and V16. The first group studies the acceptance of internet banking in various countries, whereas the second group studies the service factors impacting DB. Both groups were interconnected via the V16. The V16 study focuses on factors affecting the usage of internet banking as well as the service quality element in internet banking. The Planned Behavior was extensively used in this era to study IB adoption of internet banking.

Source: Authors’ analysis using Biblioshiny 4.0. V1 = Sathye (1999); V2 = Suh and Han (2002); V3 = Torkzadeh et al. (2002); V4 = Polatoglu and Ekin (2001); V5 = Jun et al. (2001); V6 = Jayawardhena et al. (2000); V7 = Karjaluoto et al. (2002); V8 = Liao et al. (1999); V9 = Daniel et al. (2002); V10 = Kenny et al. (2000); V11 = Lockett et al. (1997); V12 = Furst et al. (2002); V13 = Broderick et al. (2002); V14 = Thornton and White (2001); V15 = Bradley et al. (2002); V16 = Mols (2000); V17 = Mols (1999); V18 = Fernández et al. (2000); V19 = Flohr et al. (2002); V20 = Guraău (2002); V21 = Bürk et al. (1990); V22 = Mols (1999); V23 = Courchane et al. (2002); V24 = Stamoulis et al. (2002); V25 = Pahl (2000); V26 = Hone et al. (2001); V27 = Giannakoudi (1999); V28 = Bürk et al. (1989); V29 = Li (2001); V30 = Mols (1998); V31 = Melewar and Bains (2002); V32 = Kane (2000); V33 = Hsieh (2001); V34 = Buck (1996); V35 = Hone and Baber (1999); V36 = Sannes (2001); V37 = Wright and Ralston (2002); V38 = Peffers and Tuunainen (1998); V39 = Li (2002); V40 = Gavrilenkov (1999); V41 = Galitz (1983); V42 = Hobbs et al. (2002); V43 = Pollitt (1999); V44 = Perrodo (1993); V45 = Petersburg et al. (2002); V46 = Tonglet and Johnstone (2001); V47 = Maree (2002); V48 = Bryant (2002); V49 = Zinski (2000); V50 = Murphy (1998);.

MDS analysis for 2003 to 2011

Figure 12 shows the multidimensional scaling for research papers from 2003 to 2011. Although there have been studies related to internet banking, mobile banking research started gaining momentum between 2003 and 2011. One group, consisting of V1, V3, and V12, focuses on mobile banking adoption research. Another group, formed by V75, V76, and V80 due to their close proximity, studied innovation resistance and consumer attitudes toward internet banking. This was an era where Internet banking usage started to pick up and theories such as the theory of planned behavior, decomposed theory of planned behavior and technology acceptance were used to study consumer behavior/adoption of Internet banking.

Source: Authors’ analysis using Biblioshiny 4.0. V1 = Yu (2012); V3 = Al-Jabri et al. (2012); V12 = Akturan et al. (2012); V18 = Zhou (2012); V34 = Lin (2011); V35 = Zhou (2011); V43 = Riquelme and Rios (2010); V47 = Luo et al. (2010); V49 = Püschel et al. (2010); V50 = Laukkanen et al. (2010); V52 = Cruz et al. (2010); V54 = Koenig-Lewis et al. (2010); V68 = Donner et al. (2008); V75 = Laukkanen (2007); V76 = Laukkanen et al. (2007); V80 = Laforet et al. (2005); V83 = Lee et al. (2003); V122 = Nasri et al. (2012); V128 = Kesharwani et al. (2012); V171 = Im et al. (2011); V179 = Alsajjan et al. (2010); V212 = Yousafzai et al. (2009); V219 = Lee (2009); V229 = Al-Somali et al. (2009); V237 = Aldas-Manzano et al. (2009); V263 = Poon (2008); V271 = Grabner-Kräuter et al. (2008); V282 = Shamdasani et al. (2008); V294 = DeYoung et al. (2007); V296 = Mauro et al. (2007); V301 = Kuisma et al. (2007); V303 = Yiu et al. (2007); V310 = Cheng et al. (2006); V312 = Van et al. (2006); V313 = Littler et al. (2006); V321 = Gerrard et al. (2006); V329 = Oly and Sinti (2006); V336 = Flavián et al. (2005); V338 = Jaruwachirathanakul et al. (2005); V343 = Eriksson et al. (2005); V346 = Lai et al. (2005); V353 = Shih and Fang (2004); V354 = Kim et al. (2004); V355 = Akinci et al. (2004); V357 = Chan et al. (2004); V367 = Rotchanakitumnuai and Speece (2003); V372 = Mattila et al. (2003); V379 = Gerrard et al. (2003); V383 = Suh and Han (2003); V386 = Brown et al. (2003).

MDS analysis for 2012 to 2018

Figure 13 shows the multidimensional scaling for research papers from 2012 to 2018. During this period, there were studies related to Fintech, Financial Inclusion, mobile banking, and Internet banking. Two groups of research papers were identified in close proximity. One group, consisting of V10, V305, and V92, focuses on Financial Inclusion and Fintech. The other group, consisting of V244, V333, and V354, focuses on the continuous intention to use mobile banking. A plethora of theories were used in this period, but the TAM model was mostly utilized by researchers to understand the adoption of mobile banking.

Source: Authors’ analysis using Biblioshiny 4.0. V5 = Buchak et al. (2018); V10 = Ozili (2018); V57 = Shareef et al. (2018); V92 = Marsal-Llacuna (2018); V97 = Gomber et al. (2018); V117 = Lee et al. (2019); V191 = Gabor et al. (2017); V193 = Gomber et al. (2017); V198 = Alalwan et al. (2017); V206 = Leong et al. (2017); V213 = Munoz-Leiva et al. (2017); V244 = Baptista et al. (2017); V260 = Tam et al. (2017); V300 = Laukkanen (2016); V305 = Zins and Weill (2016); V306 = Koksal (2016); V308 = Susanto et al. (2016); V316 = Shim and Shin (2016); V319 = Alalwan et al. (2016); V333 = Yuan et al. (2016); V347 = Lu et al. (2015); V354 = Mortimer et al. (2015); V383 = Montazemi and Qahri-Saremi (2015); V393 = Thakur (2014); V396 = Lin et al. (2014); V410 = Oliveira et al. (2014); V411 = Van et al. (2014); V416 = Allen et al. (2014); V429 = Chen (2013); V432 = Mishra and Singh Bisht (2013); V435 = Goyal et al. (2013); V437 = Lin (2013); V479 = Zhang et al. (2018); V515 = Alalwan et al. (2018); V518 = Cao et al. (2018); V595 = Rouibah et al. (2016); V603 = Amin (2016); V618 = Chaouali et al. (2016); V631 = Tarhini et al. (2016); V639 = Pham and Ho (2015); V649 = Van et al. (2014); V652 = Yu et al. (2015); V671 = Arenas-Gaitán et al. (2015); V691 = Polasik et al. (2015); V703 = Shaw (2014); V709 = Martins et al. (2014); V740 = Al-Qeisi et al. (2014); V747 = Gomez-Herrera et al. (2014); V775 = Akhlaq et al. (2013); V790 = Hong et al. (2013).

MDS analysis for 2019 to 2020

Figure 14 shows the Multidimensional Scaling for research papers from 2019 to 2020. Many research papers were published during this period, focusing on blockchain, fintech, and the adoption of DB as a whole. Various theories have been used to understand the usage and adoption of DB, but researchers have predominantly used UTAUT and UTAUT 2. V538, V516, and V619 formed one group because of their close proximity and focus on acceptance of DB. Another group, consisting of V134, V205, and V206, focuses on blockchain technology.

Source: Authors’ analysis using Biblioshiny 4.0. V12 = De et al. (2020); V134 = Chen et al. (2019); V181 = Grover and Kar (2020); V185 = Nguyen (2020); V204 = Myovella et al. (2020); V205 = Perera et al. (2020); V206 = Fosso et al. (2020); V213 = Palmié et al. (2020); V266 = Thakor (2020); V310 = Shankar et al. (2020); ; V402 = Xu et al. (2019); V417 = Merhi et al. (2019); V421 = Haberly et al. (2019); V426 = Chawla et al. (2019); V445 = Bernards et al. (2019); V447 = Chaouali et al. (2019); V460 = Belanche et al. (2019); V464 = Karjaluoto et al. (2019); V481 = Haddad et al. (2019); V482 = Lim et al. (2011); V490 = Boonsiritomachai et al. (2019); V491 = Goldstein et al. (2019); V492 = Fuster et al. (2019); V493 = Chen et al. (2020); V495 = Lee et al. (2009); V506 = Baabdullah et al. (2019); V516 = Sivathanu (2019); V517 = Raza et al. (2019); V520 = Asongu et al. (2019); V522 = Zhao et al. (2019); V523 = Milian et al. (2019); V526 = V531 = Owusu Kwateng et al. (2019); V536 = Malaquias et al. (2016); V538 = Sharma and Sharma (2019); V539 = Baabdullah et al. (2019); V586 = Brummer et al. (2019); V614 = Kandpal et al. (2019); V619 = Leong et al. (2020); V648 = Kaul et al. (2019); V676 = Talwar et al. (2020); V701 = Singh et al. (2020); V710 = Singh et al. (2020); V757 = Rahi et al. (2019); V759 = Rahi et al. (2019); V782 = Fiore et al. (2019); V789 = Chauhan et al. (2019); V812 = Almaqtari et al. (2019).

Utilizing a standardized distance of 0.25, the MDS analysis revealed the spatial arrangement of highly cited research within the context of DB co-citation data. Items exhibiting greater similarities were positioned closer to one another on the MDS map, indicating relatedness. Based on these MDS findings, this study delineates eight distinct research clusters, offering researchers a comprehensive perspective of the DB landscape. “For grouping, based on the recommendations of Chabowski et al. (2018, 2013), Chabowski, Hult, Kiyak, and Mena (2010), and Wilden et al. (2017 JSR), the group names are as follows:

-

Group 1 (V4, V5, and V6): Study of Internet Banking

-

Group 2 (V5, V15, and V16): Service Factors Impact on Internet Banking

-

Group 3 (V1, V3, and V12): Factors Impacting Mobile Banking Usage

-

Group 4 (V75, V76, and V80): Innovation Resistance and Customer Attitude

-

Group 5 (V10, V305, and V92): Financial Inclusion and Fintech

-

Group 6 (V244, V333, and V354): Continuous Intention of Usage of Mobile Banking

-

Group 7 (V538, V516, and V619): DB Acceptance

-

Group 8 (V134, V205, and V206): Blockchain Technology Acceptance

Future work

DB maintains relevance across management schools, financial markets, and regulatory bodies. This study focuses on research done in DB in the pre-COVID era. Remarkably, DB usage has considerably increased after the COVID-19 pandemic and is likely to have a drastic shift in usage, impacting all aspects of work and life (De et al. 2020). Financial technology is altering the future of banking and the way banks position themselves in the financial market; however, trust will still be on core banking (Broby, 2021). Banks and fintech are attempting to use this technology to provide financial services in an efficient, accessible, and customer-centric manner (Almomani and Alomari, 2021). Artificial Intelligence, blockchain, and mobile computing are fueling banks and financial service providers to attempt to introduce innovative solutions across financial industry segments (Iyelolu and Paul, 2024). This disruption is evident in various aspects of banking, such as regulatory compliance, payments, wealth banking, and lending (Igbinenikaro and Adewusi, 2024). Adding fuel to fire is changing consumer behavior and expectations, in which they expect to avail any banking facility anytime, anywhere, and from any device (Iyelolu and Paul, 2024). In addition, financial markets actively seek novel sustainable financial instruments that they can strategically utilize to address economic needs, while significantly advancing sustainability and sustainable development. This focus particularly extends to achieving the sustainable development goals (SDGs) and reducing carbon emissions in alignment with the Paris Agreement (Muganyi et al. 2021; Yu et al. 2021). Central Bank digital currencies (CBDCs) exhibit varying degrees of environmental sustainability based on factors such as a country’s electricity costs, renewable energy capacity, carbon emissions, and specific design features of the CBDC (Serdarušić H. et al. 2024). Collectively, an ongoing flow of novel insights is essential to fuel and meet evolving demands within the DB landscape. As the body of knowledge expands and data becomes increasingly available for DB research, future scholars will find themselves in a more advantageous position than their predecessors. They can delve into the direct and indirect factors influencing various facets of DB, particularly in relation to consumer demand and innovation (Kasturi, 2023; Serdarušić et al., 2024). Undoubtedly, the surge in interest in DB is evident from this comprehensive review, which highlights a substantial growth in the volume of research articles over time. Equally significant, our analysis of these articles and the identification of gaps within each major theme have yielded valuable recommendations. These suggestions serve as a roadmap for future research, allowing the field of DB to be enriched in meaningful and impactful ways. Notably, the prevailing themes in the literature predominantly focus on various technological aspects of DB (e.g., blockchain in DB, artificial intelligence and machine learning in DB, and cybersecurity in DB). While technology remains the focus of DB, regulatory compliance while providing these services could be another focus area for future research, as central banks are looking to increase their vigil on DB considering the threat to vulnerable customers. Furthermore, we acknowledge the interconnectedness of the major themes, recognizing their potential mutual influence. Drawing from our deep understanding of the field’s structure and evolution, we intentionally crafted a prospective research agenda. This agenda is informed by our analysis of the shared gaps in the existing literature and promising research directions that have received relatively less attention within the past five years (2020–2024).

Impact on Digital Banking due to changing customer behaviour and expectations

Past research has explored consumer acceptance of mobile banking, e-wallets, internet banking, and mobile payments (Yousafzai, 2012; Alalwan A.A. et al. 2017). Consumers are getting accustomed to anytime and anywhere banking and expecting banks to introduce more and more such products (Almomani and Alomari, 2021). Banks also employ and invest in artificial intelligence to study customer behavior and expectations (Fares et al. 2023). Changing customer behaviors and increased expectations are also quite evident from the new features introduced by fintech companies and banks. Therefore, future research needs to study changing consumer behavior and increasing expectations, which would help banks manage these expectations and introduce long-lasting products, captured through the following research questions:

-

How will customer expectations shape the offerings of DB ?

-

How will changing customer behaviors force banks to continue evolving in the DB space?

-

How does innovation in DB impact customer experience and eventually customer expectations, and in turn, result in changing customer behavior?

-

Will the use of artificial intelligence help DB meet changing customer behavior and expectations?

Financial inclusion through Digital Banking

Earlier research has found that financial inclusion is differentiated by age and country; however, COVID-19 has shown that the gap has widened and governments have not been able to find a solution for the same (Vasile et al. 2021). The COVID-19 pandemic was responsible for many customers not making their loan payments, but it also helped in financial inclusion, as vendors encouraged digital mode of payments due to social distancing needs (Barajas, A. et al. 2020). Demonetization also caused trouble to many people during its initial phases, as cash was not available at will, and people had to switch to digital payment modes of payments (Sivathanu 2019). Recent research has also found that the infusion of DB is not uniform, and the following research questions can be explored to determine if DB can work as an agent to increase financial inclusion in a country:

-

How penetration of DB will help countries achieve their Financial Inclusion targets?

-

Will financial literacy among individuals improve through usage of DB ?

-

How can banks leverage technology to helps banking reach the downtrodden for inclusive growth?

-

Will DB help emerging economies to reduce the widening gaps and inequalities?

-

How non-uniform diffusion of DB impacts financial inclusion?

Sustainable and green banking practices

DB has helped customers to do anywhere and anytime banking, which helps customers save a lot of time and bank as per convenience, and banks are also able to cross-sell products to customers. Corporate Sustainability can be achieved via digitalization, and it is not just a corporate issue but also an issue for the country across the globe (Indayani et al. 2023). Digital transformation and corporate sustainability have helped banks improve their financial performance (Forcadell et al. 2021). Digital Finance has also helped institutions reduce banks’ carbon footprints for the bank (Yang, G. et al., 2023). Earlier researchers have studied the impact of one type of DB, such as digital finance, on sustainability or the impact of digital transformation on banks’ financial performance, but researchers have not focused on the impact of DB as a whole on sustainable performance. Researchers can explore the following research questions to understand the relationship between DB and sustainable performance:

-

How does DB usage help improve the sustainable performance of banks and impact banks’ financial performance?

-

Will Green Finance help to improve the sustainable performance of banks?

-

How will fintech adoption with banks’ core banking facilities help in the sustainable performance of the banking industry?

Regulatory and compliance challenges in Digital Banking

The advent of DB has reshaped the way banks interact with customers and has influenced customer behavior, business models, and the regulatory landscape, but it also has risks, such as cybersecurity risks associated with it (Ofo et al. 2024). A regulatory framework is required to address security issues and ensure transaction simplicity. Regulators also imply penalties for banks to safeguard their customer interests. Additionally, researchers can focus on the following research questions to explore the impact of regulatory challenges on the infusion of DB :

-

How will regulatory requirements affect the DB product offering?

-

How will regulatory requirements motivate customers to use DB ?

-

Will penalties work as an efficient tool to safeguard customer interests in DB ?

-

How will regulatory compliance help banks to share innovative DB products?

-

How will regulatory landscape help in mitigation of cyber fraud in DB ?

Blockchain integration with Digital Banking

Blockchain integration with DB remains an unexplored area of research. Digital bank guarantees can be issued with the help of blockchain quickly as compared to issuing a traditional bank guarantee, which also helps to apply higher security and keeps the identity of the customers hidden (Singh and Hiremath, 2023; Mikheeva, 2020). The number of frauds in digital payments is increasing day by day; researchers can explore whether using blockchain in DB will help bring fraud at standstill. The following research questions can be studied to understand the fusion of blockchain and DB :

-

How can blockchains enhance the efficiency, security, and cost-effectiveness of remittance services across borders?

-

How can smart contracts automate and streamline claim processing, improve transparency, and reduce fraud?

-

How are DeFi protocols reshaping financial services, including lending, borrowing, and trading, and how do they impact traditional banking systems?

Leveraging the power of emerging technologies in Digital Banking

More than banking, technology is the backbone of DB. Cash withdrawal via ATM was possible due to ATM kiosks, Internet banking using the Internet and core banking technology, mobile banking using apps, the Internet, and banking software. The usage of internet banking, mobile payments, and mobile banking has been studied by various researchers (Yousafzai, 2012; Alkhowaiter, 2020) but researchers can now focus on how artificial intelligence and machine learning can help continue the usage of DB. Studies have also focused on the risks involved in DB (Chauhan et al., 2019) but going forward, researchers can gauge the impact of integrating cybersecurity protocols and machine-learning techniques to establish a secure and reliable environment for DB. Having personal connections with customers is becoming increasingly difficult as customers’ footsteps in banks have reduced, but researchers can focus on the use of new age technologies to achieve operational excellence in DB. Researchers can explore the following research questions to understand how emerging technologies impact the usage of DB.

-

How can artificial intelligence and machine learning be applied to DB to increase the continuance of DB usage?

-

How can big data analytics and machine learning be applied to acquire knowledge of public sentiments about DB ?

-

How can cybersecurity and machine learning be applied to create a safe, secure, and trusted place in DB ?

-

How can new technologies such as artificial intelligence, big data analytics, cloud computing, and machine learning be integrated in tandem with cybersecurity to achieve operational and impact excellence for DB ?

-

How can banks and fintech leverage new technologies, such as artificial intelligence, big data analytics, cloud computing, and machine learning, to develop or adapt DB operations in innovative, smart, and agile ways?

Impact of CBDC on Digital Banking

Many countries have shifted from cash banking to internet banking to walking to mobile banking. Some countries, such as India, are exploring the use of Central Bank Digital Currency (CBDC). Cryptocurrencies, such as Bitcoin, are not regulated by the central bank of any country, but Digital Currency is regulated by the central bank of each country. Central banks want to provide efficiency and convenience for digital payments and the security of traditional currencies to transactions made by digital currency. UPI started in 2015–16, picked up some pace post-demonetization, and has been on exponential growth post COVID-19. CBDC is an area of research that can help regulators and banks take the right steps to make digital currency usage a success. The following research questions can be explored by researchers to understand how CBDC impacts banking space in the future:

-

Will central bank digital currency impact the usage of DB in a country?

-

How can central bank digital currency usage be made fool-proof using artificial intelligence and machine learning?

-

Will a central bank digital currency lead to zero cash payments in states where literacy is high?

-

Will circulation of the central bank digital currency lead to the central bank printing less cash annually?

Conclusion

This study follows a systematic literature review approach using bibliometric analysis to shed light on DB. This approach, which exemplifies the use of big data analytics through machine learning in scholarly research, is especially noteworthy given the astonishing absence of the application and discussion of new technologies in DB research. In doing so, this study contributes in a novel way by leveraging the power of big data analytics through machine learning and providing greater visibility to it in the process, to uncover the most influential articles and top contributing journals, authors, institutions, and countries, as well as the methodological choices and research contexts. It also reveals the temporal evolution of topics and major themes underpinning the intellectual structure of DB research. To this end, we summarize five key takeaways and their equivalent implications from this state-of-the-art review of 1959 articles on DB over the past 37 years (1983–2020).

First, the performance analysis indicates a consistent growth in publications in the field following the introduction of internet banking. Most publications come from authors and institutions in India, the United States, and the United Kingdom, as these countries have been introducing newer methods of DB. In this regard, DB research should expand to underrepresented countries where DB is gaining momentum (e.g., Africa, Malaysia, and Singapore).

Second, the performance analysis also reveals that qualitative research was most prominent in DB in earlier years, but quantitative research is currently almost twice that of qualitative research. This is because, in earlier years, there were talks about introducing DB, but in the last two decades, people have been using DB in one form or another.

Third, the performance analysis also shows that most studies before 2000 were application-oriented, but post-2000, the percentage of studies testing theories has increased significantly. Very few studies have focused on building theories in DB. Most studies focus on single-country data, with earlier studies concentrating on developed economies such as Europe, the United States, and the United Kingdom, and more recent studies on emerging economies such as Asia, Africa, and China. Most studies are inclined toward the adoption of mobile banking or internet banking. Therefore, we encourage prospective researchers to proactively view these gaps as opportunities to make new and novel contributions to enrich and extend the understanding of DB.

Fourth, science mapping through a temporal analysis reveals that DB research has contributed to myriad insights over time, starting with a focus on ATM banking (1990 onwards) and branching out progressively to other areas such as Internet banking and telephone banking (1995 onwards), fintech (2007 onwards), and more recently, mobile banking and cryptocurrency (2015 onwards). Notably, the field of DB will grow larger in the future, with new innovative modes of DB being developed over time, as seen through the rise of digital payments across the world.

Fifth, science mapping through a network analysis of keyword co-occurrence reveals seven major themes that characterize the body of knowledge or intellectual structure of DB research, namely ATM banking, Internet banking, mobile banking, peer-to-peer financing, cryptocurrency, digital payments, and fintech. We observe that five out of seven major themes relate to the types of DB, with digital payments being a unique theme. Notably, our reading of the articles and reflection on the extant gaps in each major theme brought us to several underexplored or underrepresented issues that future research can address to enrich the major themes in DB research. These include digital payments to customers without smartphones, increasing the reach of DB, mitigating the risks involved in DB, fintech sustainability, and the commercialization of cryptocurrency.

Implications for Bankers, Fintech and Regulators

This study provides insights into the progress in DB since 1983 and highlights how DB has made huge inroads in the lives of customers and bank employees. With time, the factors impacting the use of DB have changed. Every bank is at a different stage in terms of technology, as the focus of each bank is different. Central banks ensure that customer experience is similar across banks by introducing platforms such as UPI, where all banks have to make infrastructure compatible with such platforms. Banks can see the factors that influence the usage of DB and improve its continuous usage, which in turn would help cross-sell various banking products. They can focus on these factors to ensure that DB is widely used by customers. While doing so, they also need to ensure that they provide substantial support in the case of any challenges faced by customers while using DB. Fintech firms play a key role in providing banking services to end-customers. They can also refer to this study and focus on features that need to be improved for the safety of customers while customers continue the usage of these DB services. Regulators in each country aim to increase the digital footprint without compromising customer security. Regulators can refer to the factors that hinder the usage of these services and modify the regulations in such a manner that customers feel safe to use these services, and banks provide support in case of any concerns that customers face.

Limitations

Notwithstanding the extant contributions of this seminal state-of-the-art review of DB research, we concede that our review remains limited in several ways. First, our review was limited to the accuracy and completeness of the articles made available through the Scopus database. Nonetheless, we have taken due diligence to correct erroneous entries and crosscheck publisher websites and other databases to mitigate this limitation. Second, our review provides only a broad overview of the performance and intellectual structure of DB. Although this is in line with the goal and value of systematic literature reviews using bibliometric analysis, wherein large-scale reviews become pragmatically possible, we concede that this approach falls short of providing fine-grained insights into other deserving and interesting peculiarities, such as the factors (independent, mediating, moderating, dependent) and relationships (positive, negative, linear, curvilinear) that may be involved in DB. In this regard, we encourage future reviews using alternative approaches such as a framework- or theory-based review of DB. Such reviews do not necessarily need to be large-scale; they can be pursued on a smaller scale (e.g., tens to hundreds of articles), so that the review remains pragmatic and manageable.

Data availability

The data as been extracted from Scopus database. Raw data files have been uploaded in form of Spreadsheet in the additional supplementary files.

References

Akhlaq A, Ahmed E (2013) The effect of motivation on trust in the acceptance of internet banking in a low income country. Int J Bank Mark 31(2):115–125

Akinci S, Aksoy Åž, Atilgan E (2004) Adoption of Internet banking among sophisticated consumer segments in an advanced developing country. Int J Bank Mark 22(3):212–232

Akturan U, Tezcan N (2012) Mobile banking adoption of the youth market: perceptions and intentions. Mark Intell Plan 30(4):444–459

Alalwan AA, Dwivedi YK, Rana NP (2017) Factors influencing adoption of mobile banking by Jordanian bank customers: extending UTAUT2 with trust. Int J Inf Manag 37(3):99–110

Alalwan AA, Dwivedi YK, Rana NPP, Williams MD (2016) Consumer adoption of mobile banking in Jordan: examining the role of usefulness, ease of use, perceived risk and self-efficacy. J Enterp Inf Manag 29(1):118–139

Alalwan AA, Dwivedi YK, Rana NP, Algharabat R (2018) Examining factors influencing Jordanian customers’ intentions and adoption of internet banking: extending UTAUT2 with risk. J Retail Consum Serv 40:125–138

Aldas Manzano J, Lassala Navarr C, Ruiz Mafe C, Sanz-Blas S (2009) The role of consumer innovativeness and perceived risk in online banking usage. Int J Bank Mark 27(1):53–75

Al-Jabri IM, Sohail MS (2012) Mobile banking adoption: application of diffusion of innovation theory. J Electron Commer Res 13(4):379–391

Alkhowaiter WA (2020) Digital payment and banking adoption research in Gulf countries: a systematic literature review. Int J Inf Manag 53:102102

Allen F, Carletti E, Cull R, Qian JQJ, Senbet L, Valenzuela P (2014) The African financial development and financial inclusion gaps. J Afr Econ 23(5):614–642

Almaqtari FA, Al-Homaidi EA, Tabash MI, Farhan NH (2019) The determinants of profitability of Indian commercial banks: a panel data approach. Int J Financ Econ 24(1):168–185

AlMomani AA, Alomari KF (2021) Financial Technology (FinTech) and its Role in Supporting the Financial and Banking Services Sector. Int J of Academic Research in Business and Social Sciences, 11(8):1793–1802

Al-Qeisi K, Dennis C, Alamanos E, Jayawardhena C (2014) Website design quality and usage behavior: unified theory of acceptance and use of technology. J Bus Res 67(11):2282–2290

Alsajjan B, Dennis C (2010) Internet banking acceptance model: cross-market examination. J Bus Res 63(45179):957–963

Al-Somali SA, Gholami R, Clegg B (2009) An investigation into the acceptance of online banking in Saudi Arabia. Technovation 29(2):130–141

Amin M (2016) Internet banking service quality and its implication on e-customer satisfaction and e-customer loyalty. Int J Bank Mark 34(3):280–306

Arenas GJ, Peral PB, Ramón Jerónimo MA (2015) Elderly and internet banking: an application of UTAUT2. J Internet Bank Commer 20:1-23

Asongu SA, Odhiambo NM (2019) Mobile banking usage, quality of growth, inequality and poverty in developing countries. Inf Dev 35(2):303–318

Baabdullah AM, Alalwan AA, Rana NP, Kizgin H, Patil P (2019) Consumer use of mobile banking (M-Banking) in Saudi Arabia: towards an integrated model. Int J Inf Manag 44:38–52

Baabdullah AM, Alalwan AA, Rana NP, Patil P, Dwivedi YK (2019) An integrated model for m-banking adoption in Saudi Arabia. Int J Bank Mark 37(2):452–478

Baker HK, Pandey N, Kumar S, Haldar A (2020) A bibliometric analysis of board diversity: current status, development, and future research directions. J Bus Res 108:232–246

Baptista G, Oliveira T (2017) Why so serious? Gamification impact in the acceptance of mobile banking services. Internet Res 27(1):118–139

Barney JB, Ray G (2012) How information technology resources can provide a competitive advantage in customer service. In: King WR (ed) Planning for information systems. Routledge, New York, NY, pp 444–453

Belanche D, Casal LV, Flavi C (2019) Artificial Intelligence in FinTech: understanding robo-advisors adoption among customers. Ind Manag Data Syst 119(7):1411–1430

Berger AN (2002) The economic effects of technological progress: evidence from the Banking Industry. J Money Credit Bank 35:141–176

Bernards N, Campbell-Verduyn M (2019) Understanding technological change in global finance through infrastructures: Introduction to Review of International Political Economy Special Issue “The Changing Technological Infrastructures of Global Finance™”. Rev Int Polit Econ 26(5):773–789

Van Birgelen M, de Jong A, de Ruyter K (2006) Multi-channel service retailing: the effects of channel performance satisfaction on behavioral intentions. J Retail 82(4):367–377

Boonsiritomachai W, Pitchayadejanant K (2019) Determinants affecting mobile banking adoption by generation Y based on the unified theory of acceptance and use of technology model modified by the technology acceptance model concept. Kasetsart J Soc Sci 40(2):349–358

Van Der Boor P, Oliveira P, Veloso F (2014) Users as innovators in developing countries: The global sources of innovation and diffusion in mobile banking services. Res Policy 43(9):1594–1607

Bradley L, Stewart K (2002) A Delphi study of the drivers and inhibitors of Internet banking. Int J Bank Mark 20(6):250–260

Broadus RN (1987) Toward a definition of “bibliometrics. Scientometrics 12(5–6):373–379

Broby D (2021) Financial technology and the future of banking. Financ Innov 7:47. https://doi.org/10.1186/s40854-021-00264-y

Broderick AJ, Vachirapornpuk S (2002) Service quality in Internet banking: the importance of customer role. Mark Intell Plan 20(6):327–335

Brown I, Cajee Z, Davies D, Stroebel S (2003) Cell phone banking: predictors of adoption in South Africa—an exploratory study. Int J Inf Manag 23(5):381–394

Brummer C, Yadav Y (2019) Fintech and the innovation trilemma. Georget Law J 107(2):235–307

Bryant J (2002) Trade, credit and systemic fragility. J Bank Financ 26(44960):475–489

Buchak G, Matvos G, Piskorski T, Seru A (2018) Fintech, regulatory arbitrage, and the rise of shadow banks. J Financ Econ 130(3):453–483

Buck SP (1996) Electronic commerce—would, could and should you use current Internet payment mechanisms? Internet Res 6(44960):5–18

Bürk H, Pfitzmann A (1989) Digital payment systems enabling security and unobservability. Comput Secur 8(5):399–416

Bürk H, Pfitzmann A (1990) Value exchange systems enabling security and unobservability. Comput Secur 9(8):715–721

Burton B, Kumar S, Pandey N (2020) Twenty-five years of the European Journal of Finance (EJF): a retrospective analysis. Eur J Financ 26(18):1817–1841

Callon M, Courtial J-P, Turner WA, Bauin S (1983) From transaction to problematic networks: an introduction to co-word analysis. Soc Sci Inf 22(2):191–235

Cao X, Yu L, Liu Z, Gong M, Adeel L (2018) Understanding mobile payment users’ continuance intention: a trust transfer perspective,. Internet Res 28(2):456–476

Castriotta M, Loi M, Marku E, Naitana L (2019) What’s in a name? Exploring the conceptual structure of emerging organizations. Scientometrics 118(2):407–437

Chabowski B, Kekec P, Morgan NA, Hult GTM, Walkowiak T, Runnalls B (2018) An assessment of the exporting literature: using theory and data to identify future research directions. J Int Mark 26(1):118–143

Chabowski BR, Samiee S, Hult GTM (2013) A bibliometric analysis of the global branding literature and a research agenda. J Int Bus Stud 44(6):622–634

Chabowski BR, Hult GTM, Kiyak T, Mena JA (2010) The structure of JIBS’s social network and the relevance of intra-country variation: a typology for future research. J Int Bus Stud 41(5):925–934

Chan S-C, Lu M-T (2004) Understanding Internet Banking adoption and use behavior: a Hong Kong perspective. J Glob Inf Manag 12(3):21–43

Chaouali W, Souiden N (2019) The role of cognitive age in explaining mobile banking resistance among elderly people. J Retail Consum Serv 50:342–350

Chaouali W, Ben Yahia I, Souiden N (2016) The interplay of counter-conformity motivation, social influence, and trust in customers’ intention to adopt Internet banking services: The case of an emerging country. J Retail Consum Serv 28:209–218

Chauhan V, Yadav R, Choudhary V (2019) Analyzing the impact of consumer innovativeness and perceived risk in internet banking adoption: a study of Indian consumers. Int J Bank Mark 37(1):323–339

Chawla D, Joshi H (2019) Consumer attitude and intention to adopt mobile wallet in India – an empirical study. Int J Bank Mark 37(7):1590–1618

Chen CS (2013) Perceived risk, usage frequency of mobile banking services. Manag Serv Qual 23(5):410–436

Chen MA, Wu Q, Yang B (2019) How valuable is FinTech innovation? Rev Financ Stud 32(5):2062–2106

Chen Y, Bellavitis C (2020) Blockchain disruption and decentralized finance: The rise of decentralized business models. J Bus Ventur Insights 13:e00151. https://doi.org/10.1016/j.jbvi.2019.e00151

Cheng TCE, Lam DYC, Yeung ACL (2006) Adoption of internet banking: an empirical study in Hong Kong. Decis Support Syst 42(3):1558–1572

Cobo MJ, López‐Herrera AG, Herrera‐Viedma E, Herrera F (2011) Science mapping software tools: review, analysis, and cooperative study among tools. J Am Soc Inf Sci Technol 62(7):1382–1402

Comerio N, Strozzi F (2019) Tourism and its economic impact: a literature review using bibliometric tools. Tour Econ 25(1):109–131

Courchane M, Nickerson D, Sullivan R (2002) Investment in internet banking as a real option: theory and tests. J Multinatl Financ Manag 12(45021):347–363

Cox T, Cox M (2001) Multidimensional scaling, 2nd edn. Chapman & Hall

Cruz P, Neto LBF, Muñoz-Gallego P, Laukkanen T (2010) Mobile banking rollout in emerging markets: evidence from Brazil. Int J Bank Mark 28(5):342–371

Daniel E (1999) Provision of electronic banking in the UK and the Republic of Ireland. Int J Bank Mark 17(2):72–83. https://doi.org/10.1108/02652329910258934

Daniel E, Wilson H, Myers A (2002) Adoption of E-commerce by SMEs in the UK: towards a stage model. Int Small Bus J 20(3):253–270

De R, Pandey N, Pal A (2020) Impact of digital surge during Covid-19 pandemic: A viewpoint on research and practice. Int J Inf Manage 55:102171. https://doi.org/10.1016/j.ijinfomgt.2020.102171

DemirgüCô-Kunt A, Klapper L, Singer D, Ansar S, Hess JR (2018) The global findex database 2017—measuring financial inclusion and the Fintech revolution. https://globalfindex.worldbank.org/. Accessed 19 Jan 2019

DeYoung R, Lang WW, Nolle DL (2007) How the Internet affects output and performance at community banks. J Bank Financ 31(4):1033–1060

Donner J, Tellez CA (2008) Mobile banking and economic development: linking adoption, impact, and use. Asian J Commun 18(4):318–332

Donthu N, Kumar S, Pattnaik D, Lim WM (2021) A bibliometric retrospection of marketing from the lens of psychology: insights from Psychology & Marketing. Psychol Mark 38(5):834–865

Donthu N, Kumar S, Mukherjee D, Pandey N, Lim WM (2021) How to conduct a bibliometric analysis: an overview and guidelines. J Bus Res 133:285–296

Dootson P, Beatson A, Drennan J (2016) Financial institutions using social media—do consumers perceive value? Int J Bank Mark 34(No. 1):9–36

Durisin B, Puzone F (2009) Maturation of corporate governance research, 1993–2007: an assessment. Corp Gov: Int Rev 17(3):266–291

Van Eck NJ, Waltman L (2017) Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics 111(2):1053–1070

Elhajjar S, Ouaida F (2020) An analysis of factors affecting mobile banking adoption. Int J Bank Mark 38(2):352–367. https://doi.org/10.1108/ijbm-02-2019-0055

Ellegaard O, Wallin JA (2015) The bibliometric analysis of scholarly production: how great is the impact? Scientometrics 105(3):1809–1831

Eriksson K, Kerem K, Nilsson D (2005) Customer acceptance of internet banking in Estonia. Int J Bank Mark 23(2):200–216

Fares OH, Butt I, Lee SHM (2003) Utilization of artificial intelligence in the banking sector: a systematic literature review. J Financ Serv Mark 28:835–852. https://doi.org/10.1057/s41264-022-00176-7

Fernández C, Koop G, Steel M (2000) A Bayesian analysis of multiple-output production frontiers. J Econ 98(1):47–79

Fiore U, De Santis A, Perla F, Zanetti P, Palmieri F (2019) Using generative adversarial networks for improving classification effectiveness in credit card fraud detection. Inf Sci 479:448–455

Flavián C, GuinalÃu M, Torres E (2005) The influence of corporate image on consumer trust: a comparative analysis in traditional versus internet banking. Internet Res 15(4):447–470

Flohr Nielsen J (2002) Internet technology and customer linking in Nordic banking. Int J Serv Ind Manag 13(5):475–495

Flood D, West T, Wheadon D (2013) Trends in mobile payments in developing and advanced economies. RBA Bull 1:71–80

Forcadell FJ, Úbeda F, Aracil E (2021) Effects of environmental corporate social responsibility on innovativeness of spanish industrial SMEs. Technol Forecast Soc Change 162:120355. ISSN 0040-1625

Fosso Wamba S, Kala Kamdjoug JR, Epie Bawack R, Keogh JG (2020) Bitcoin, Blockchain and Fintech: a systematic review and case studies in the supply chain. Prod Plan Control 31(44960):115–142

Furst K, Lang WW, Nolle DE (2002) Internet banking. J Financ Serv Res 22(44928):95–117

Fuster A, Plosser M, Schnabl P, Vickery J (2019) The role of technology in mortgage lending. Rev Financ Stud 32(5):1854–1899

Gabor D, Brooks S (2017) The digital revolution in financial inclusion: international development in the fintech era. N Polit Econ 22(4):423–436

Galitz LC (1983) Consumer credit analysis. Manag Financ 9(3–4):27–33. https://doi.org/10.1108/eb013527

Galitz LC (1983) Interbank. A bank management simulation exercise. J Bank Financ 7(3):355–382

Ganguli S, Roy SK (2011) Generic technology‐based service quality dimensions in banking: impact on customer satisfaction and loyalty. Int J Bank Mark 29(2):168–189. https://doi.org/10.1108/02652321111107648

Garzaro DM, Varotto LF, Pedro SDC(2021) Internet and mobile banking: the role of engagement and experience on satisfaction and loyalty Int J Bank Mark 39(1):1–23. https://doi.org/10.1108/IJBM-08-2020-0457

Gavrilenkov E (1999) Permanent crisis in Russia: selected problems of macroeconomic performance. Hitotsubashi J Econ 40(1):41–57

Gerrard P, Barton Cunningham J (2003) The diffusion of Internet banking among Singapore consumers. Int J Bank Mark 21(1):16–28

Gerrard P, Cunningham JB, Devlin JF (2006) Why consumers are not using internet banking: a qualitative study. J Serv Mark 20(3):160–168

Giannakoudi S (1999) Internet banking: the digital voyage of banking and money in cyberspace. Inf Commun Technol Law 8(3):205–243

Goldstein I, Jiang W, Karolyi GA (2019) To FinTech and beyond. Rev Financ Stud 32(5):1647–1661

Gomber P, Koch J-A, Siering M (2017) Digital Finance and FinTech: current research and future research directions. J Bus Econ 87(5):537–580