Abstract

The threat posed by climate deterioration are gradually expanding, and excessive carbon emissions resulting from corporate production are one of the main reasons for global warming. Therefore, how to curb corporate carbon emissions has become an urgent issue that needs to be addressed. The “Green Finance Reform and Innovation Pilot Zone” policy serves as a quasi-natural experiment to examine the impact of green finance policy on corporate carbon emissions with difference-in-differences and double/debiased machine learning methods. Results show that green finance policy can inhibit corporate carbon emissions, particularly direct carbon emissions. It is more significant for firms that are high-energy-efficiency, located in financially developed areas and highly competitive industries. Moreover, the reduction of managerial myopia and the alleviation of information asymmetry are identified as key mediating mechanisms, with stronger mediation effects observed for direct carbon emissions compared to indirect carbon emissions. Additionally, environmental regulation and intellectual property protection positively moderate these relationships. The former predominantly influences indirect carbon emissions, while the latter has a more substantial impact on direct carbon emissions. Overall, the carbon reduction can significantly decrease the operating fee as well as increase corporate value.

Similar content being viewed by others

Introduction

Recently, climate issues are getting serious. The extensive use of fossil energy during industrialization has resulted in excess carbon emissions, negatively impacting global average temperatures (Allen et al. 2009). State of the Global Climate 2023Footnote 1 released by the World Meteorological Organization, stated that 2023 has been the hottest year on record since the beginning of meteorological measurements, with global average temperature increasing by 1.4 °C since the industrial age. This warming trend has led to frequent disasters, posing serious threats to human health (Huisingh et al. 2015). For instance, in January 2023, heavy rains in California, USA caused billions of dollars in damage to crops. Eight months later, flooding resulted in over 3900 deaths and left more than 9000 missing in Libya. As global temperatures rise, China is also suffering from challenges such as degradation permafrost and frequent urban heatwaves. It is widely accepted that reducing carbon emissions is essential to address global climate challenges and safeguard human survival (Zeebe et al. 2008). This sense of urgency is echoed in China’s commitment to emission reductions. Firms, as key economic actors, play a crucial role in achieving this goal by curbing their carbon emissions. However, finding effective strategies for reducing corporate carbon emissions remains an urgent and pressing issue.

Green finance policy involves a series of measures that integrate environmental costs and benefits into financial services. This policy steers economic resources towards green industries and encourages financial institutions to increase green credit, thus reducing industrial emissions (Muganyi et al. 2021). Recently, the Chinese government has launched numerous green finance policies, like Notice on Carbon Emissions Trading Pilot WorkFootnote 2 and Green Credit GuidelinesFootnote 3. These policies aim to stimulate environmental dividends and play an important role in air quality improvement by providing green finance services for the real economy (Dong et al. 2019; Tian et al. 2022). However, the current green finance system is still imperfect and does not fully meet the requirements needed to curb carbon emissions effectively. For example, there are not enough green finance products out there to fund all the green projects, leaving a big funding gap (Hafner et al. 2020).

To improve the green finance system, the Chinese government has embarked on new explorations of green finance policies. In June 2017, the State Council approved to implement the policy of “green finance Reform and Innovation Pilot Zone (GFRIPZ)” in five provinces, namely, Zhejiang, Guangdong, Jiangxi, Guizhou, and Xinjiang. The pilot zones are set up to get firms to share more about their environmental impact, give them financial incentives, and put rules in place to make sure they follow through. The financial sector uses these zones to test out new ways to allocate financial resources wisely and bolster green finance business. But there are still some critical questions. Has the GFRIPZ policy effectively curbed carbon emissions in these zones? How does it work to affect corporate carbon emissions? And what economic benefits does it bring? Answering these questions is helpful to scientifically assess the impact of the GFRIPZ policy.

Existing literature predominantly supports the notion that green finance policy inhibits the carbon emissions. First, green bond issuance is crucial for funding the renewable energy industry and contributes significantly to the global economy’s decarbonization (Al Mamun et al. 2022). Moreover, carbon emissions trading, particularly in the energy sector, optimizes resource allocation through price signals, reducing energy consumption and carbon emissions (Lin and Jia, 2019; Dong et al. 2019). Final, green investments expand the scope and efficiency of renewable energy, promoting low-carbon development (Adams and Acheampong, 2019; Huang et al. 2021). However, dissenting viewpoints exist. Lan et al. (2023) argue that there is an inverted N-shaped relationship between green finance and pollution emissions, meaning the excessive growth of green finance may have negative influences on the climate and the environment conditions. Additionally, some scholars argue that carbon finance brings additional credit costs to firms and fails to reduce carbon emissions, limiting its effectiveness in protecting environment (Tariq and Hassan, 2023).

While existing literature has provided valuable insights, several areas still need further exploration. First, much literature has concentrated on how green finance policy affects firms’ decarbonization efforts, with limited studies on distinction between direct and indirect carbon emissions. Firms generate direct carbon emissions from internal production activities and highly control them. Green financial policy can directly incentivize firms to improve their production processes, thereby affecting direct carbon emissions. In contrast, indirect ones arise from external electricity and heat that firms consume or utilize in their production activities, involving multiple intermediate links. Green financial policy influence indirect carbon emissions by fostering cooperation among upstream and downstream firms and through supply chain finance, resulting in slower effects. Therefore, distinguishing between different sources of carbon emissions is crucial. Second, existing literature has largely focused on the mediating roles of financing costs and industrial structure (Zhao et al. 2024), neglecting such roles of managerial myopia and information asymmetry. Managerial myopia may lead to short-sighted behaviors, ignoring the long-term interests of firms and reducing the efficiency of green fund allocation. Meanwhile, information asymmetry can distort information flow, leading to a situation where high-cost compliant firms are edged out by low-cost firms that engage in greenwashing, thereby affecting the long-term effectiveness of green financial policy. Both of these factors ultimately impact the mediation of green financial policy to corporate carbon emissions. Third, existing literature has predominantly looked at the moderating role of financial supervision (Zhen and Lu, 2024), overlooking the impacts of environmental regulation and intellectual property protection. Environmental regulation can influence firm’s operating costs by putting pressure on them to be more eco-friendly. Intellectual property protection encourages firms to introduce green equipment and increase expected earnings. These factors may produce different moderating effects. Fourth, although some literature has conducted preliminary research on the decarbonization effect of green financial policy, they have not gone far enough to see how this benefits companies financially. Favorable economic benefit, one of the driving forces for firms’ green transformation, can propel them grow in the long run and keep green investments going. Therefore, this study further explores the potential economic benefits of decarbonization.

The remainder of this study is organized as follows. Theoretical background and relevant research hypotheses are presented in section “Theoretical analysis and hypotheses”. The model construction and variable selection are introduced in section “Methodology and variables”. Sections “Main analysis” and “Mechanism analysis” derives the empirical results. Section “Further analysis: Economic benefits” presents the economic benefits of green finance policy’s decarbonization effect. The conclusions and recommendations are summarized in section “Conclusions and policy recommendation”.

Theoretical analysis and hypotheses

Institutional background

To address climate issues and promote global sustainability and carbon reduction, China and other countries have tied environmental protection to financial policies. On June 23, 2017, seven Chinese ministries and commissions issued the overall plan for green financial reform and innovation pilot zones. These zones, including Zhejiang, Guangdong, Jiangxi, Guizhou, and Xinjiang, vary in economic level, industrial structure, resources, and environmental capacity, showcasing their diversity and representativeness.

Zhejiang and Guangdong, both financially developed, emphasize different aspects. The former is all about innovating green finance to transform and upgrade the traditional industries and offering green services to small and medium-sized cities. The latter is developing the green financial market, creating new carbon-related financial products, and constructing a new model that integrates green financial reform with economic growth. Specifically, Zhejiang has introduced a green inclusive development index for counties and established a green financial dispute mediation center, which has significantly reduced the non-performing loan ratio of green loans.

Guangdong supports pig farming through green finance, using a collaborative insurance, futures, and banking model to stabilize pork supplies. It also innovates green supply chain finance in the automotive industry to alleviate financing difficulties for small and medium-sized firms within the industry chain.

Although Jiangxi and Guizhou are less financially developed, they are rich in green resources. They can leverage green finance to prioritize support for organic modern agriculture, urban farming, and agricultural waste treatment, while encouraging the projects of energy-saving and emission-reduction. Jiangxi has launched a carbon neutrality fund, investing more than 2800 million dollars in the carbon offset market, and introduced more than 10 green lifestyle service projects and a network technology supervision platform to monitor local financial institutions in real time. Guizhou has established the first green finance court, set up a poverty alleviation investment fund for green industries, and continuously increased the rural incomes. Xinjiang, a key Silk Road Economic Belt region, supports clean energy resources and solar power-related high-end manufacturing by green finance, promoting green development from point to area. It also proposes a new cotton insurance and futures model to stabilize market prices.

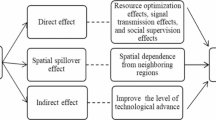

Green finance policy and corporate carbon emissions

The direct impact of green finance policy on corporate carbon emissions shows up in several ways. First, green finance policy can require banks to adopt punitive interest rates to heavily polluting firms and redirecting societal funds towards eco-friendly ones (Shi et al. 2022; Bakry et al. 2023). The heavily polluting firms may suffer from industrial difficulties and change their production mode to reduce carbon emissions. Moreover, firms may face green premium for low-carbon production due to the cost differences between clean and fossil energy sources (Yoo and Kwak, 2009). In contrast, green investments can boost more funds for clean energy technology, lowering costs for firms (Sharif et al. 2023). The reduction of green premium can motivate more and more firms to switch to clean energy and further realize low-carbon production. Final, green consumer credit can meet the demand of eco-conscious buyers (Wang et al. 2018). Their willingness and ability to pay for low-carbon products encourage firms to offer more such products (Bleda and Valente, 2009).

Considering that direct carbon emissions of firms originate from their own production activities, they are easier to track and measure. Indirect ones are influenced by numerous external factors, making data collection and management more challenging (Huang et al. 2018). Consequently, green financial policy may have differing intervention effects on direct and indirect carbon emissions. For one thing, firm can control the carbon emissions generated from fuel combustion and industrial processes during their operation processes (Labaran et al. 2021), so that they can directly adopt eco-friendly and clean renewable energy and utilize green funds to improve production processes, thereby reducing direct carbon emissions. For another, indirect carbon emissions involve multiple supply chain links (Hong et al. 2015), and firms, as intermediaries, may face responsibility shifting (Balogun et al. 2003). Moreover, supply chain emission reduction requires coordination among multiple stakeholders and takes time to see benefits (Co and Barro, 2009). It is difficult to oversee upstream and downstream firms by green financial policy, potentially leading them prefer greenwashing over substantive emission reductions (Wang and Shen, 2024). In light of the aforementioned, the following hypothesis is suggested.

H1: Green finance policy can inhibit corporate carbon emissions, particularly direct carbon emissions.

Mediation effect

Managerial myopia

Green finance policy can inhibit corporate carbon emissions by decreasing managerial myopia. First, while green technologies used in production processes often come with high cost and poor performance (Iravani et al. 2017), managers may opt for non-green technologies with immediate benefits to pursue personal performance (Stein, 1988). This can reduce the long-term profits of firms. Shareholders are also affected by this issue. Green finance policy can highlight potential environmental risks, forcing managers to weigh between short-term benefits and long-term risks (Zhang et al. 2023) and reduce carbon emissions by using green technologies. Second, based on signaling theory and stakeholder theory, the environmental orientation of green finance policy can help firms establish a green reputation and attract eco-conscious investors (Pimonenko et al. 2019). This prompts managers to focus on long-term development rather than short-term gains. To further safeguard the benefits derived from the green reputation, managers will actively work on reducing carbon emissions (Komarek et al. 2013). Final, green finance policy can improve carbon accounting standards and clarify support for green transition projects (Ng et al. 2018). In this context, firms may face higher costs of carbon reduction if managers excessively pursue short-term profits. To keep these costs down, firms will strictly adhere to the standards and realize carbon reduction. In light of the aforementioned, the following hypothesis is suggested.

H2: Green finance policy can inhibit corporate carbon emissions through decreasing managerial myopia.

Information asymmetry

Green finance policy can inhibit corporate carbon emissions by alleviating information asymmetry. First, without third-party verification, disclosure of green information remains overly formalized (Frankel and Li, 2004). Green finance policy urges firms to actively disclose green information and reduces the problems of adverse selection and moral hazard arising from information asymmetry in capital markets. This can increase stock liquidity and enhance corporate value (Kim and Verrecchia, 2001), further encouraging firms to provide low-carbon services. Second, stakeholders may regard the lack of green information as an unfavorable signal and shift the high cost of information search to firms (Almazan et al. 2009). To prevent this, firms voluntarily disclose green information, showing stakeholders that they are actively fulfilling environmental obligations, which can curb carbon emissions (Matisoff, 2013). Final, environmental issues deeply affect daily lives of the public. As green finance policy is implemented, public awareness of environmental issues is increasing (Dikau and Volz, 2019). More public voluntarily collect the green information to decrease the information asymmetry between market and firms based on the public choice theory (Macey, 1988). With this, the government can focus on monitoring the firms with environmental problems reflected by the public, thus improving decarbonization. In light of the aforementioned, the following hypothesis is suggested.

H3: Green finance policy can inhibit corporate carbon emissions through alleviating information asymmetry.

Moderation effect

Environmental regulation

Environmental regulation plays a positive role between green finance policy and corporate carbon emissions. First, green finance policy provides firms with access to sufficient green funds. Strengthened environmental regulation can give well-funded firms a competitive edge in terms of cost and differentiation (Yang et al. 2017). This can increase the decarbonization effect of green finance policy by using these advantages to optimize green projects such as carbon dioxide capture, utilization and storage, as well as cleaner heating in rural areas (Omer, 2008). Second, Green finance policy guides fund flows via market mechanisms, while environmental regulation sends clear policy signals, addressing gaps in the green finance market (Yu et al. 2021; Liu et al. 2024). This boosts policy effectiveness and prompts financial institutions to offer green services, thereby effectively controlling their carbon emissions (Lemos and Agrawal, 2006; Li et al. 2024). Meanwhile, stringent environmental regulation hikes non-compliance costs for high-carbon firms, forcing them to cut energy use in the production process (Qi et al. 2023), increasing the decarbonization effect. Final, environmental regulation supports microfinance institutions to join in green finance activities, attracting domestic and foreign capital for green investments and reducing the financing threshold (Chang, 2019). This leads to more high-quality financial services promoting decarbonization projects. In light of the aforementioned, the following hypothesis is suggested.

H4: The higher the environmental regulation, the greater the inhibition effect of green finance policy on corporate carbon emissions.

Intellectual property protection

Intellectual property protection plays a positive role between green finance policy and corporate carbon emissions. First, a robust modern property rights system can support the integration of patented technology of artificial intelligence into green finance, driving the industrialization and commercialization of green patents (Forero-Pineda, 2006). This can enhance the inhibition effect of green finance policy on corporate carbon emissions by enabling firms to optimize their production processes (Afni et al. 2018). Second, regions with stronger intellectual property protection can proactively adapt to green finance development model and effectively combat the intellectual property rights illegal activities. By minimizing infringement, these regions can minimize the risk of green investments and guarantee stable returns (Stjepandić and Trappey, 2015), reducing the climate impact of corporate profit-seeking. This further improves the carbon-reducing effect of green finance policy. Final, high-carbon industries typically face high energy consumption and carbon emission costs, prompting them to focus on developing energy-saving and emission-reduction technologies (Wang et al. 2012; Liston-Heyes and Vazquez Brust, 2016). Intellectual property protection further increases the costs of imitation and plagiarism. Meanwhile, firms can share R&D risks via green insurance or seek support from green funds, thereby cutting their carbon emissions. In light of the aforementioned, the following hypothesis is suggested.

H5: The stronger intellectual property protection, the greater the inhibition effect of green finance policy on corporate carbon emissions.

In summary, these research hypotheses are shown in Fig. 1.

Methodology and variables

Methodology

DID model

In view of the GFRIPZ policy, this study identifies H1 with the difference-in-differences (DID) model.

where i represents firm, t represents time. \({\rm {c{e}}}_{it}\) represent corporate carbon emissions, including total (\({\rm {tc{e}}}_{it}\)), direct (\({\rm {dc{e}}}_{it}\)) and indirect carbon emissions (\({\rm {ic{e}}}_{it}\)). \({\rm {gf{p}}}_{it}\) denotes the GFRIPZ policy. \({x}_{it}\) represents primary of the control variable. \({\rm {f{e}}}_{it}\) include industry, firm, year and province fixed effect. α is the constant term. \({\varepsilon }_{it}\) is the random error term. \({\alpha }_{0}\) is the estimated coefficient of green finance policy on corporate carbon emissions.

DML model

The DID model assumes that the treatment and control groups meet the parallel trend before the policy shock, and the traditional multiple linear model has limitations in model setting and covariate selection. Furthermore, estimation bias may occur if there is a nonlinear relationship between the variables, and too many covariates also produce multicollinearity. To avoid these problems, according to Chernozhukov et al. (2018) and Yang et al. (2020), this study also constructs a partial linear model with the double/debiased machine learning (DML) method to verify H1.

Equation (2) is the main regression model and Eq. (3) is an auxiliary regression model introduced to reduce the regularity bias. \({\bar{x}}_{it}\) is a series of the control variables, including the primary (\({x}_{it}\)) and higher dimensional terms (\({x}_{it}^{n}\)) of the control variables. \({x}_{it}^{n}\) include primary interaction, secondary and tertiary terms of the control variables. The exact form of \(g({\bar{x}}_{it})\), \(f({\bar{x}}_{it})\) is unknown and can be further estimated by a machine learning algorithm (Lassocv) to find \(\hat{g}({\bar{x}}_{it})\),\(\hat{f}({\bar{x}}_{it})\). \({u}_{it}\), \({v}_{it}\) is the error term with a conditional mean of 0. The other symbols are the same as Eq. (1). To avoid the overfitting problem, the sample inside and outside cross (K-fold) validation is considered. The split ratio is determined as 1:4 (i.e., five samples are randomly selected, and four of them are taken as the training data, and one of them is used as the validation data).

Mediation model

To further explore H3 and H4, this study constructs the DID model as shown from Eqs. (4) and (5) and the DML models as shown from Eqs. (6)–(9) separately.

From Eq. (4) to (9), \({m}_{it}\) denote the mediating variables, including managerial myopia and information asymmetry. \({\beta }_{0}\) are the estimated coefficients of green finance policy on managerial myopia and information asymmetry, respectively. \(\gamma {m}_{it}\) characterize \(-({\beta }_{0}{\rm {gf{p}}}_{it})\), representing the reduced managerial myopia and alleviated information asymmetry after implementing green finance policy, respectively. \({\beta }_{1}\) are the estimated coefficients of the reduced managerial myopia and alleviated information asymmetry after implementing green finance policy on corporate carbon emissions, respectively. The other symbols have the same meaning as in Eqs. (1)–(3).

Moderation model

To further explore H4 and H5, this study refers to Brockner et al. (1997) and constructs the DID model as shown in Eq. (10) and the DML models as shown from Eqs. (11) to (12) separately.

From Eq. (10) to (12), \({t}_{it}\) denote the moderating variables, including environmental regulation and intellectual property protection. \({\rm {gf{p}}}_{it}\times {t}_{it}\) denotes the interaction constructed based on the median of the moderating variables and green finance policy. \({\theta }_{0}\) are the estimated coefficients of green finance policy on corporate carbon emissions after considering environmental regulation and intellectual property protection, respectively. \({\widehat{x}}_{it}\), \({\widehat{\overline{x}}}_{it}\) include control variables, \({t}_{it}\) and \({\rm {gf{p}}}_{it}\). The other symbols have the same meaning as in Eqs. (1)–(3).

Variables

Dependent variable

Corporate carbon emissions (\(ce\)). Referring to Lewandowski et al. (2017), \({\rm {tce}}\) is divided into \({\rm {dce}}\) and \({\rm {ice}}\). \({\rm {dce}}\) are the greenhouse gases (GHGs) generated from emission sources directly controlled or owned by the firms (Scope 1) according to GHG ProtocolFootnote 4. \({\rm {ice}}\) refer to the GHGs generated by the firms’ purchased electricity, heat, or others (Scope 2), as well as the GHGs generated by the firms’ production activities but controlled or owned by other firms (Scope 3). \({\rm {dce}}\) and \({\rm {ice}}\) are summed to \({\rm {tce}}\). Many firms disclose the above data directly, but some firms only disclose different types of fossil energy, electricity, and heat consumption. For such firms, \(ce\) is calculated according to the IPCC Guidelines for National GHGs inventoriesFootnote 5

where \({\rm {a{d}}}_{it}\) is the product of the fossil fuel consumption and the average low-level heat production for fossil energy consumption. \({\rm {e{f}}}_{it}\) is the emission factor for that fossil fuel. For electricity consumption, \({\rm {a{d}}}_{it}\) is the amount of electricity purchased by firm, and \({\rm {e{f}}}_{it}\) is the average emission factor of the power grid in the region where the firm is located. For heat consumption, the emission factor is the nationally standardized 0.11 t CO2/GJ. GHGs from different types of fossil energy consumption are \({\rm {dce}}\), and GHGs from electricity and heat consumption are \({\rm {ice}}\).

Core independent variable

The GFRIPZ Policy (\({\rm {gfp}}\)). Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang were approved as pilot regions for reforming and innovating green finance in June 2017. Referring to Zhang et al. (2023), if the registration place of firm is located in the pilot regions, and the observation time is after implementing this policy, \({\rm {gfp}}\) is 1, otherwise, it is 0.

Mechanism variables

-

(1)

Managerial myopia

Referring to Brochet et al. (2015), text analytics and machine learning are used to construct managerial myopia. We screened the seed words of myopia vision in the managerial discussion and analysis of the annual financial reports, including day (days or daily), week (weeks or weekly), month (months or monthly), quarter (quarters or quarterly), latter half (latter half of the year), short-term and short-run. They contain several days, with days, within a day, several months, several weeks, with the month, with years, during the current year, within the year, at the latest, at once, immediately, right away, opportunity, chance, imminent, as soon as possible, in a difficult situation, at the time, on the eve of, coincide with, pressure, severe test, at the time of, and so on.

The CBOW model constructed in Word2Vec is used to train the corpus.

$${\rm{Max}}\mathop{\sum}\limits_{w\in C}\log p(w|{{context}}(w))$$(14)where \(C\) denotes the corpus, \(w\) denotes the center word, and \({{context}}(w)\) denotes the context of the center word, based on which the similar words of the center word can be obtained from the model. After that, the final indicator word is based on the lexicon method, and managerial myopia (\({{mm}}\)) is measured by taking the logarithm of the total word frequency. The larger \({\rm {mm}}\), the more serious the managerial myopic behavior.

-

(2)

Information asymmetry

Referring to Bharath et al. (2009), the information asymmetry (asy) is constructed by using principal component analysis on three indicators, including liquidity ratio (\({\rm {l{r}}}_{it}\)), illiquidity ratio (\({\rm {il{l}}}_{it}\)), and yield inversion (\({\rm {ga{m}}}_{it}\)). The larger asy, the higher the information asymmetry.

$${{l{r}}}_{it}=-\frac{\mathop{\sum }\nolimits_{k=1}^{{d}_{it}}\sqrt{{v}_{it}(k)/|{r}_{it}(k)|}}{{d}_{it}},\,{{il{l}}}_{it}=\frac{\mathop{\sum }\nolimits_{k=1}^{{d}_{it}}\sqrt{|{r}_{it}(k)|/{v}_{it}(k)}}{{d}_{it}},\,{{ga{m}}}_{it}=|{\gamma }_{it}|$$(15)where \({r}_{it}(k)\) denotes the stock return on the k trading day, \({v}_{it}(k)\) denotes the daily turnover, \({d}_{it}\) denotes the number of trading days in the year.

$${r}_{it}^{e}(k)={\omega }_{it}+{\zeta }_{it}{r}_{it}(k-1)+{\gamma }_{it}{v}_{it}(k-1){{sign}}|{r}_{it}^{e}(k-1)|+{\sigma }_{it}(k)$$(16)$${r}_{it}^{e}(k)={r}_{it}(k)-{r}_{mt}(k)$$(17)From Eqs. (16) to (17), \({r}_{it}^{e}(k)\) is the excess return, \({r}_{{\rm {mt}}}(k)\) represents the market return weighted by market capitalization, \(k-1\) represents previous trading day.

Moderator variables

-

(1)

Environmental regulation

The number of environmental administrative penalties in the region is used to measure environmental regulation (er). The larger er, the higher the intensity of environmental regulation.

-

(2)

Intellectual property protection

The explicit comparative advantage indicator is adopted to measure intellectual property protection (ipp). The larger ipp, the stronger the intellectual property protection. The model is constructed as follows:

where \({\rm {ipp}}{c}_{it}\) represents the number of intellectual property trial settlements in the region where the firm is located. \({\rm {gd{p}}}_{it}\) represents the regional gross domestic product (GDP). \({\rm {IPP}}{A}_{t}\) represents the total number of intellectual property trial settlements in the whole country. \({\rm {gd{p}}}_{t}\) represents the national GDP.

Control variables

Referring to the existing studies, the growth rate of operating income (growth), fixed assets ratio (fixed), total assets turnover (ato), inventory ratio (inv), net profitability of total assets (\({\rm {roa}}\)), debt-to-assets ratio (\({\rm {lev}}\)), size of the firm (size), cash flow ratio (cash flow), and accounts receivable ratio (rec) are selected as control variables. growth is measured as the ratio of operating income growth to previous year’s operating income. fixed is measured as the ratio of net fixed assets to total assets. ato is measured as the ratio of operating income to average total assets. inv is measured as the ratio of net inventory to total assets. roa is measured as the average balance of net profit and total assets. lev is measured as the ratio of total liabilities to total assets. size is measured as the natural logarithm of total assets. cash flow is measured as the ratio of net cash flows from operating activities to total assets. rec is measured as the ratio of net accounts receivable to total assets.

Data sources

Considering the availability of data on corporate carbon emission, the sample period is from 2011 to 2021. Chinese A-share listed firms are taken as the research samples. All the original data are obtained from CSMAR, Wind, CNRDS, China Tax Yearbook, China Environmental Yearbook, Peking University Law Judicial Cases, Social Responsibility Report, Sustainable Development Report and Financial Report. Considering the data validity, firms that have massive missing data, have exceptional financial statements (i.e., industry code J, ST and *ST warnings) and have been listed after 2010 are excluded. To control the potential influence of outliers, all constant variables are shrink-tailed. Table 1 reports the statistical description.

Main analysis

Parallel trend test

This study uses 2017 as the starting year for implementing GFRIPZ policy. Set the dummy variables for each of the five years before, the start of, and the two years following the policy implementation and be multiplied by dummy variables for the treatment group. If the policy is implemented in the 1st year, the dummy variable current takes 1, and if not, it takes 0. The dummy variables before1 to before5 indicate that 1 is taken in the 1st, 2nd, 3rd, 4th, and 5th years before implementing GFRIPZ policy respectively, and 0 otherwise. The dummy variables after1 to after4 indicate that 1 is taken in the 1st, 2nd, 3rd, and 4th years following the policy implementation respectively, and 0 otherwise. The other control variables are consistent with Eq. (1). The result of the parallel trend test is drawn in Fig. 2. The estimated coefficients of the above dummy variables are plotted with 95% confidence intervals, as shown in Fig. 2a–c. The estimated coefficients of current to before5 are insignificant, indicating that there is no significant difference between the treatment group and the control group. The estimated coefficients of after1 to after4 are significantly negative at the 10% level, indicating that gfp has a significant impact on tce, dce and ice, but with a certain lag.

a represents the difference in total, corporate carbon emissions between treatment and control groups if the GFRIPZ policy is implemented or not. b denotes the difference in direct corporate carbon emissions between treatment and control groups if the GFRIPZ policy is implemented or not. c indicates the difference in indirect corporate carbon emissions between treatment and control groups if the GFRIPZ policy is implemented or not. The vertical axis represents the regression coefficients, while the horizontal axis represents the dummy variables. Estimate refers to the regression coefficients of the above dummy variables. The 95% CI denotes the 95% confidence interval.

Baseline results

Table 2, columns (1)–(3) are the results without adding high-dimensional control variables, and columns (4)–(6) are the results with adding high-dimensional control variables. gfp is significantly negative at the 1% level, which suggests that green finance policy can inhibit corporate carbon emissions. H1 is verified. Furthermore, the absolute value of gfp on total and direct carbon emissions is larger than that of indirect carbon emissions, which indicates that this indirect decarbonation effect is smaller than direct. Fossil energy consumption and solid waste incineration are the main sources of direct carbon emissions. In China, energy consumption structure is still dominated by such high-carbon energy. Green finance policy optimizes the allocation of financial resources between different industries, making high-carbon energy dominated firms face the dilemma of insufficient funds. These firms must downsize their production scales and consume less fossil energy. Additionally, green premium of using clean energy has been decreasing, carrying out low-carbon production.

Potential endogeneity

Although the inclusion of control variables can mitigate the part of exogenous factors, the results may still suffer from sample selection bias, bi-directional causation and omitted variables. Because the pilot areas are not randomly, and factors such as economic development and financial development may affect the selection of pilot zones. Although green finance policy can inhibit corporate carbon emissions, this decarbonation effect may also expand green investments and change green bond support programs, so that there may be a bidirectional causal relationship between them. Moreover, corporate carbon emissions are affected by a variety of factors. The unobserved factors may affect the results. To address these problems, this study adopts the propensity score matching (PSM) method and instrumental variable (IV) method to identify the corporate decarbonation effect of green finance policy.

The propensity score values are estimated using Logit model with control variables primary and high-dimensional terms as covariates. The new samples of treatment and control groups are drawn based on the one-to-one matching principle. Moreover, referring to Xue et al. (2023) and Nunn and Qian (2014), the interaction between the number of pawns in the Qing dynasty in 1812 and the time cross-multiplier term is adopted as an instrumental variable for gfp. Pawn, as one of the primary institutions in the traditional Chinese financial industry, is characterized by simple credit procedures and a wide range of pledges, which can offer loans through mortgaging movable and immovable property or property rights. Concurrently, financial development is long-term and sustainable. The historical financial institution count and contemporary green finance policy are positively correlated (Pascali, 2016). The historical number of pawns does not directly affect current corporate carbon emissions, satisfying the exogenous requirement.

The results of the balance test after propensity score matching can be found in Appendix (see Tables A1 and A2). Moreover, Table 3, Panels A and B report that gfp are significantly negative at least at the 5% level, and the absolute value of gfp on total and direct carbon emissions is larger than that of indirect carbon emissions. This indicates that the decarbonization effect of green finance policy is exist after solving endogenous problems.

Robustness check

The robustness check is carried out as follows: (1) Delete the special samples. The samples affected by COVID-19 and the year of policy implementation are deleted and regressed respectively. (2) Consider macro control variables. The macro control variables, including economic development, industrial structure upgrading, urbanization, R&D investment intensity, clean energy development, and infrastructure construction, are further added to regress. (3) Replace the dependent variables. To avoid the influence of calculation method, the ratio of corporate carbon emissions and corporate revenue is applied to measure the dependent variable. (4) Reset the DDML model. The sample partition ratio is changed from 1:4 to 1:2 (K-folds = 3) and 1:7 (K-folds = 8), the machine learning algorithm is changed from lasso to neural network (NNET) and support vector machine (SVM), and a general interaction model as shown in Eqs. (19) and (20) replace the partial linear model.

Table 4, Panels A–C show that gfp is significantly negative at the 1% level, and the absolute value of gfp on total and direct carbon emissions is larger than that of indirect carbon emissions. This indicates that the decarbonization effect of green finance policy is robust.

Analysis of heterogeneity

Corporate energy efficiency

The ratio of total energy consumption and operating revenue is adopted to measure corporate energy efficiency, and the sample is divided into high- and low-energy-efficiency firms according to the median. Table 5, Panel A shows that gfp for high-energy-efficiency firms is significantly negative at the 1% level, while gfp is insignificant and its absolute values is smaller for low-energy-efficiency firms. This indicates that the green finance policy significantly inhibits the high-energy-efficiency corporate total, direct and indirect carbon emissions. Because firms with higher energy efficiency have advanced production equipment and consume less energy (Greening et al. 2000). The GFRIPZ policy also enables these firms to obtain green subsidies and encourages low-carbon development. Low-energy-efficiency firms may waste massive energy, making their demand for energy consumption higher (Kostka et al. 2013). It is difficult for green finance policy to curb the carbon emissions of these firms in a short period.

Regional financial development

The ratio of deposit and loan balances of financial institutions and GDP of cities is adopted to measure financial development, and the sample is divided into firms that are located in financially developed and underdeveloped regions according to the median. Table 5, Panel B reports that gfp is significantly negative at the 1% level for two types of firms. The absolute values of gfp of firms located in financially developed regions is greater than that in financially underdeveloped regions. Moreover, the results of the Seemingly Unrelated Regression test (suest) indicate that the coefficients of inter-group differences are statistically significant.This suggests that green finance policy have a greater inhibitory effect on corporate total, direct and indirect carbon emissions located in financially developed regions. Because regional financial development affects the financing costs (Love, 2003). In financially developed regions, green finance can pool financial resources into the green industry, reducing the marginal costs of firms’ access to these resources (Qu et al. 2020). This can reduce environmental degradation. In financially undeveloped regions, financial resources are dispersed and it is difficult to acquire them (Rosenthal and Strange, 2001), so the decarbonization effect of green finance policy is smaller.

Industrial competitiveness

The sample is divided into highly and lowly competitive industries based on the median of the Herfindahl index. Table 5, Panel C shows that \({\rm{gfp}}\) in highly competitive industries is significantly negative at the 1% level, while gfp is insignificant and its absolute values is smaller for firms in lowly competitive industries. This suggests that in highly competitive industries, the inhibitory effect of green finance policy on total, direct and indirect carbon emissions of firms is larger and more obvious. Because in highly competitive industries, firms reacting favorably to the GFRIPZ policy is helpful in obtaining government financial support. They can use these funds to improve industrial waste gas treatment power (Guan et al. 2015), which will reduce emissions. In contrast, in lowly competitive industries, the costs of external technologies may be higher (Ceccagnoli and Jiang, 2013). Due to the lack of competition, firms are less motivated to make internal technological breakthroughs (Tsinopoulos et al. 2018), which makes the inhibitory effect smaller.

Mechanism analysis

Based on the above analysis, the excess carbon emissions make the global climate deteriorate continuously, which brings drought, floods and other disasters. The green finance policy can increase the investment in green industry and improve the use of clean energy to promote the green low-carbon transformation of firms. However, what is the mechanism of this policy to inhibit corporate carbon emissions? This study further investigates their mediation effect from the aspects of managerial myopia and information asymmetry, and tests the moderation effect from the perspectives of environmental regulation and intellectual property rights protection, respectively.

Mediation effect

Managerial myopia

Table 6, columns (1) and (5) indicate that gfp is significantly negative at least at the 10% level, indicating that green finance policy can decrease managerial myopia. Columns (2)–(4) and (6)–(8) indicate that \(\gamma {\rm {mm}}\) is still significantly negative at the 1% level after considering the mediator variables, and the absolute value of \(\gamma {\rm {mm}}\) on total and direct carbon emissions are larger than that on indirect carbon emissions. This indicates that the more managerial myopia reduced, the more obvious inhibition effect on corporate total, direct and indirect carbon emissions, and this inhibition effect is mainly reflected in direct carbon emissions. Specifically, green finance policy increases pollutant emission standards, increasing environmental costs for firms, which forces managers to further weigh the trade-offs between benefits and risks, reduce short-sighted behavior, and ultimately decrease pollutant emissions. Consequently, it can be concluded that green finance policy can inhibit corporate carbon emissions by decreasing managerial myopia, thus verifying H2.

Information asymmetry

Table 7, columns (1) and (5) indicate that gfp is significantly negative at least at the 5% level, suggesting that the green finance policy can alleviate information asymmetry. Columns (2)–(4) and (6)–(8) indicate that \(\gamma {\rm {asy}}\) on the corporate total, direct and indirect carbon emissions is significantly negative at the 1% level after considering the mediator variables, and the absolute value of \(\gamma {\rm {asy}}\) on the corporate total and direct carbon emissions is greater than indirect carbon emissions. This indicates that the more information asymmetry is reduced, the more obvious the inhibition effect on the total, direct and indirect carbon emissions is, and that this inhibition effect is mainly reflected in direct carbon emissions. Because the green finance policy can urge firms to actively disclose green information. This can alleviate the information asymmetry between the capital market, stakeholders and firms to protect environment. Consequently, it can be concluded that green finance policy can inhibit corporate carbon emissions by alleviating information asymmetry. H3 is verified.

Moderation effect

Environmental regulation

Table 8, Panel A shows that \({{gfp}}\times {{er}}\) on total and direct carbon emission is significantly negative at the 10% level, and \({{gfp}}\times {{er}}\) on indirect carbon emission are significantly negative at the 5% level, which indicates that environmental regulation can strengthen the inhibitory effect of green finance policy on the total, direct and indirect carbon emissions, and this effect is mainly reflected in indirect carbon emissions. Specifically, environmental regulation can enhance the fund-guiding role of green financial policy and lower the problem of insufficient green finance market mechanism. This can improve the efficiency of environmental governance, ultimately strengthening the inhibition effect of green finance policy on corporate carbon emissions. H4 is verified.

Intellectual property protection

Table 8, Panel B shows that \({\rm {gfp}}\times {\rm {ipp}}\) is significantly negative at least at the 10% level, and the absolute value of \({\rm {gfp}}\times {\rm {ipp}}\) on total and direct carbon emissions is larger than indirect carbon emissions. This shows that intellectual property protection can strengthen the inhibitory effect of green finance policy on the total, direct and indirect carbon emissions, and this effect is mainly reflected in direct carbon emissions. Specifically, a perfect modern property rights system can reduce the risk of infringement and enhance the application of new knowledge, technologies, and equipment in environmental protection. This may incentivize firms to increase investment in research and development of energy-saving and emission-reduction, strengthening the inhibition effect of green finance policy on corporate carbon emissions, thus confirming H5.

Further analysis: Economic benefits

As a result, green finance policy can significantly inhibit corporate carbon emissions, ultimately promoting the green development of the economy. To explore the economic benefits of green finance policy to inhibit corporate carbon emissions, this study constructs the DID model as shown in Eq. (21) and the DML model as shown from Eqs. (22) to (23) separately.

From Eqs. (21) to (23), \({\rm {eco{n}}}_{it+1}\) represent the next period economic benefits of green finance policy to inhibit corporate carbon emissions, including operating fee as well as corporate value. The former is measured by the sum of administrative expenses and selling expenses divided by operating revenue (\({\rm {ofe{e}}}_{it+1}\)). The latter is measured by the ratio of book value to market value (\({\rm {b{m}}}_{it+1}\)). \(\gamma {\rm {c{e}}}_{it}\) represents \(-({\beta }_{0}{\rm {gf{p}}}_{it})\) according to Eqs. (1) and (2), representing the total, direct and indirect carbon emissions inhibited by green finance policy. \({\varphi }_{0}\) denote the estimated coefficients of the reduced total, direct and indirect carbon emissions after implementing green finance policy on economic benefits. The other symbols have the same meaning as in Eqs. (1)–(3).

In Table 9, Panels A and Panel B represent that \(\gamma {\rm {tce}}\), \(\gamma {\rm {dce}}\) and \(\gamma {\rm {ice}}\) are significantly negative at the 1% level, indicating that the commitment of firm to reducing carbon emissions can dcrease operating fee and improve corporate value. Corporate participation in carbon reduction can reduce waste disposal costs and decrease raw material procurement costs through recycling and reuse, thereby lowering operational expenses. Furthermore, by adopting more efficient and eco-friendly business practices, firms can attract more investors and customers who are concerned about social and environmental conditions (Provan et al. 1980). This is conducive to promoting corporate value growth.

Conclusions and policy recommendation

Corporate carbon emission is a major contributor to the rise in global temperatures, and the threat that climate change poses to human health is steadily growing. It is clear that reducing corporate carbon emissions is crucial to protect the survival of human beings. This study shows that green finance policy can inhibit corporate carbon emissions, compared with indirect carbon emissions, this inhibition effect is greater for direct carbon emissions. It can be found in the three aspects of heterogeneity, including the corporate energy efficiency, the regional financial development and the industrial competitiveness. Additionally, green finance policy can inhibit corporate carbon emissions by decreasing managerial myopia and alleviating information asymmetry, and this mediation effect is mainly reflected in direct carbon emissions. Environmental regulation and intellectual property protection play the negative regulatory roles in this decarbonation effect, with the former playing a major role in indirect carbon emissions and the latter playing a major role in direct carbon emissions. Final, the carbon reduction can significantly decrease the operating fee as well as increase corporate value.

Based on the above conclusions, the following recommendations are made.

First, advance green finance development by expanding policy scope and intensity under controllable risks. The government can offer interest subsidies and leverage financial markets. By guiding financial institutions to differentiate interest rates and raise thresholds for energy-intensive firms, these firms can be motivated to cut down on carbon emissions to promote green transformation. Meanwhlie, promoting green finance innovation can enhance service quality and strengthen risk control, paving the way for better low-carbon development. Equally important is improving supporting facilities and cultivate talent in green finance through training and industry-academia-research collaboration.

Second, formulate targeted green finance policies considering different features. For firms with high energy efficiency, located in financially developed areas, and in highly competitive industries, they can further use the environmental protection advantages of green finance policies. For others, it is necessary to reduce discrimination against low energy efficiency firms for energy optimization to access green funds. Meanwhile, policy guidance should be strengthened in less developed areas to foster local finance aimed at reducing resource costs. Also, credit distortions in less competitive industries should be minimized to encourage technological advancements.

Third, smooth the mechanisms of green finance policy on corporate carbon emissions. Enhancing corporate long-term interests and prompting emission standard raises are vital to reducing short-sighted behaviors. Firms should actively disclose green information, and the public should be encouraged to voluntarily participate in collecting corporate green information, thereby increasing information transparency. It is necessary to strengthen environmental regulations and intellectual property protection to improve fund allocation efficiency and accelerate technology iteration, promoting low-carbon transformation.

Fourth, establish a unified and clear global framework to strengthen international cooperation. Carbon emission accounting and disclosure standards need to be internationally unified to assist international investors in identifying and assessing the environmental benefits of green projects. Moreover, it is feasible to draw on the successful experiences of other countries in green finance policies and formulate suitable policies based on national conditions. Some countries can actively engage in international green finance cooperation mechanisms, elevate certification standards for green financial products, and promote interconnection among international green financial markets.

Data availability

No datasets were generated or analysed during the current study.

Notes

References

Adams S, Acheampong AO (2019) Reducing carbon emissions: the role of renewable energy and democracy. J Clean Prod 240:118245

Afni Z, Gani L, Djakman CD, Sauki E (2018) The effect of green strategy and green investment toward carbon emission disclosure. Int J Bus Rev (Jobs Rev) 1(2):93–108

Al Mamun M, Boubaker S, Nguyen DK (2022) Green finance and decarbonization: evidence from around the world. Financ Res Lett 46:102807

Allen MR, Frame DJ, Huntingford C, Jones CD, Lowe JA, Meinshausen M, Meinshausen N (2009) Warming caused by cumulative carbon emissions towards the trillionth tonne. Nature 458(7242):1163–1166

Almazan A, Suarez J, Titman S (2009) Firms’ stakeholders and the costs of transparency. J Econ Manag Strategy 18(3):871–900

Bakry W, Mallik G, Nghiem XH, Sinha A, Vo XV (2023) Is green finance really “green”? Examining the long-run relationship between green finance, renewable energy and environmental performance in developing countries. Renew Energy 208:341–355

Balogun J (2003) From blaming the middle to harnessing its potential: Creating change intermediaries. Br J Manag 14(1):69–83

Bharath ST, Pasquariello P, Wu G (2009) Does asymmetric information drive capital structure decisions? Rev Financ Stud 22(8):3211–3243

Bleda M, Valente M (2009) Graded eco-labels: a demand-oriented approach to reduce pollution. Technol Forecast Soc Change 76(4):512–524

Brochet F, Loumioti M, Serafeim G (2015) Speaking of the short-term: disclosure horizon and managerial myopia. Rev Account Stud 20:1122–1163

Brockner J, Siegel PA, Daly JP, Tyler T, Martin C (1997) When trust matters: the moderating effect of outcome favorability. Adm Sci Q 42(3):558–583

Ceccagnoli M, Jiang LIN (2013) The cost of integrating external technologies: supply and demand drivers of value creation in the markets for technology. Strateg Manag J 34(4):404–425

Chang Y (2019) Green finance in Singapore: barriers and solutions. SSRN Electron J. https://doi.org/10.2139/ssrn.3326287

Chernozhukov V, Chetverikov D, Demirer M, Duflo E, Hansen C, Newey W, Robins J (2018) Double/debiased machine learning for treatment and structural parameters. Econ J 21(1):C1–C68

Co HC, Barro F (2009) Stakeholder theory and dynamics in supply chain collaboration. Int J Oper Prod Manag 29(6):591–611

Dikau S, Volz U (2019) Central banking, climate change and green finance. Springer, Singapore, pp 81-102

Dong F, Dai Y, Zhang S, Zhang X, Long R (2019) Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci Total Environ 653:565–577

Forero-Pineda C (2006) The impact of stronger intellectual property rights on science and technology in developing countries. Res Policy 35(6):808–824

Frankel R, Li X (2004) Characteristics of a firm’s information environment and the information asymmetry between insiders and outsiders. J Account Econ 37(2):229–259

Greening LA, Greene D, Difiglio C (2000) Energy efficiency and consumption—the rebound effect—a survey. Energy Policy 28(67):389–401

Guan J, Yam RC (2015) Effects of government financial incentives on firms’ innovation performance in China: evidences from Beijing in the 1990s. Res Policy 44(1):273–282

Hafner S, Jones A, Anger-Kraavi A, Pohl J (2020) Closing the green finance gap—a systems perspective. Environ Innov Soc Transit 34:26–60

Hong J, Shen GQ, Feng Y, Lau WST, Mao C (2015) Greenhouse gas emissions during the construction phase of a building: a case study in China. J Clean Prod 103:249–259

Huang L, Krigsvoll G, Johansen F, Liu Y, Zhang X (2018) Carbon emission of global construction sector. Renew Sustain Energy Rev 81:1906–1916

Huang Y, Xue L, Khan Z (2021) What abates carbon emissions in China: examining the impact of renewable energy and green investment. Sustain Dev 29(5):823–834

Huisingh D, Zhang Z, Moore JC, Qiao Q, Li Q (2015) Recent advances in carbon emissions reduction: policies, technologies, monitoring, assessment and modeling. J Clean Prod 103:1–12

Iravani A, Akbari MH, Zohoori M (2017) Advantages and disadvantages of green technology: goals, challenges and strengths. Int J Sci Eng Appl 6(9):272–284

Kim O, Verrecchia RE (2001) The relation among disclosure, returns, and trading volume information. Account Rev 76(4):633–654

Komarek TM, Lupi F, Kaplowitz MD, Thorp L (2013) Influence of energy alternatives and carbon emissions on an institution’s green reputation. J Environ Manag 128:335–344

Kostka G, Moslener U, Andreas J (2013) Barriers to increasing energy efficiency: evidence from small-and medium-sized enterprises in China. J Clean Prod 57:59–68

Labaran YH, Mathur VS, Farouq MM (2021) The carbon footprint of construction industry: a review of direct and indirect emission. J Sustain Constr Mater Technol 6(3):101–115

Lan J, Wei Y, Guo J, Li Q, Liu Z (2023) The effect of green finance on industrial pollution emissions: evidence from China. Resour Policy 80:103156

Lemos MC, Agrawal A (2006) Environmental Governance. Annu Rev Environ Resour 31(1):297-325

Lewandowski S (2017) Corporate carbon and financial performance: the role of emission reductions. Bus Strategy Environ 26(8):1196–1211

Li Z, Wang X, Wu Z (2024) Can Green Finance Reform and innovation policies promote corporate carbon performance? Financ Res Lett 62:105203

Lin B, Jia Z (2019) Impacts of carbon price level in carbon emission trading market. Appl Energy 239:157–170

Liston-Heyes C, Vazquez Brust DA (2016) Environmental protection in environmentally reactive firms: lessons from corporate Argentina. J Bus Ethics 135:361–379

Liu X, Cifuentes-Faura J, Wang CA, Wang L (2024) Can green finance policy reduce corporate carbon emissions? Evidence from a quasi-natural experiment in China. Br Account Rev 134:101540

Love I (2003) Financial development and financing constraints: international evidence from the structural investment model. Rev Financ Stud 16(3):765–791

Macey JR (1988) Public choice: the theory of the firm and the theory of market exchange. Cornell Law Rev 74:43

Matisoff DC (2013) Different rays of sunlight: understanding information disclosure and carbon transparency. Energy Policy 55:579–592

Muganyi T, Yan L, Sun H (2021) Green finance, fintech and environmental protection: evidence from China. Environ Sci Ecotechnol 7:100107

Ng AW (2018) From sustainability accounting to a green financing system: institutional legitimacy and market heterogeneity in a global financial centre. J Clean Prod 195:585–592

Nunn N, Qian N (2014) US food aid and civil conflict. Am Econ Rev 104(6):1630–1666

Omer AM (2008) Focus on low carbon technologies: The positive solution. Renew Sustain Energy Rev 12(9):2331-2357

Pascali L (2016) Banks and development: jewish communities in the Italian Renaissance and current economic performance. Rev Econ Stat 98(1):140–158

Pimonenko T, Chygryn O, Lyulyov O (2019) Green branding as a driver to boost the development of green investment market. Bull Cherkasy Bohdan Khmelnytsky Natl Univ Econ Sci 1:144–150

Provan KG, Beyer JM, Kruytbosch C (1980) Environmental linkages and power in resource-dependence relations between organizations. Adm Sci Q 26(3):496

Qi Y, Zhang J, Chen J (2023) Tax incentives, environmental regulation and firms’ emission reduction strategies: evidence from China. J Environ Econ Manag 117:102750

Qu C, Shao J, Shi Z (2020) Does financial agglomeration promote the increase of energy efficiency in China? Energy Policy 146:111810

Rosenthal SS, Strange WC (2001) The determinants of agglomeration. J Urban Econ 50(2):191–229

Sharif A, Kocak S, Khan HHA, Uzuner G, Tiwari S (2023) Demystifying the links between green technology innovation, economic growth, and environmental tax in ASEAN-6 countries: the dynamic role of green energy and green investment. Gondwana Res 115:98–106

Shi J, Yu C, Li Y, Wang T (2022) Does green financial policy affect debt-financing cost of heavy-polluting enterprises? An empirical evidence based on Chinese pilot zones for green finance reform and innovations. Technol Forecast Soc Change 179:121678

Stein JC (1988) Takeover threats and managerial myopia. J Polit Econ 96(1):61–80

Stjepandić J, Liese H, Trappey AJ (2015) Intellectual property protection. Concurrent Engineering in the 21st century: Foundations, developments and challenges. Cham: Springer International Publishing, pp 521-551

Tariq A, Hassan A (2023) Role of green finance, environmental regulations, and economic development in the transition towards a sustainable environment. J Clean Prod 413:137425

Tian C, Li X, Xiao L, Zhu B (2022) Exploring the impact of green credit policy on green transformation of heavy polluting industries. J Clean Prod 335:130257

Tsinopoulos C, Sousa CM, Yan J (2018) Process innovation: open innovation and the moderating role of the motivation to achieve legitimacy. J Prod Innov Manag 35(1):27–48

Wang H, Shen H (2024) Self-restraint or external supervision: green bond issuance and greenwashing. Res Int Bus Financ 70:102402

Wang K, Zhao R, Chen H (2018) Optimal credit period and green consumption policies with cash-credit payments under asymmetric information. J Clean Prod 205:706–720

Wang Z, Yang Z, Zhang Y, Yin J (2012) Energy technology patents—CO2 emissions nexus: an empirical analysis from China. Energy Policy 42:248–260

Xue Y, Hu D, Irfan M, Wu H, Hao Y (2023) Natural resources policy making through finance? The role of green finance on energy resources poverty. Resour Policy 85:104023

Yang H, Luo J, Wang H (2017) The role of revenue sharing and first-mover advantage in emission abatement with carbon tax and consumer environmental awareness. Int J Prod Econ 193:691–702

Yang JC, Chuang HC, Kuan CM (2020) Double machine learning with gradient boosting and its application to the Big N audit quality effect. J Econ 216(1):268–283

Yoo SH, Kwak SY (2009) Willingness to pay for green electricity in Korea: a contingent valuation study. Energy policy 37(12):5408–5416

Yu CH, Wu X, Zhang D, Chen S, Zhao J (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:112255

Zeebe RE, Zachos JC, Caldeira K, Tyrrell T (2008) Carbon emissions and acidification. Science 321(5885):51–52

Zhang X, Jiang F, Liu H, Liu R (2023) Green finance, managerial myopia and corporate green innovation: evidence from Chinese manufacturing listed companies. Financ Res Lett 58:104383

Zhang Z, Wang J, Feng C, Chen X (2023) Do pilot zones for green finance reform and innovation promote energy savings? Evidence from China. Energy Econ 124:106763

Zhao X, Benkraiem R, Abedin MZ, Zhou S (2024) The charm of green finance: can green finance reduce corporate carbon emissions? Energy Econ 134:107574

Zhen Z, Lu B (2024) The impact of green finance on corporate carbon disclosure: financial regulation as a moderator. Financ Res Lett 63:105273

Acknowledgements

This study is supported by the National Social Science Foundation of China (20BJL032), the Philosophy and Social Science Young Talent Team Foundation of Shandong Province (2024-QNRC-81), the Social Science Foundation of Shandong Province (24BGLJ04).

Author information

Authors and Affiliations

Contributions

Yanwei Lyu: Conceptualization, methodology, funding acquisition, supervision. Xuan Xiao: Conceptualization, methodology, software, visualization, writing—original draft, writing—review and editing, formal analysis. Jinning Zhang: Writing—review and editing, supervision.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Lyu, Y., Xiao, X. & Zhang, J. Green finance policy and corporate carbon emissions: advancing corporate sustainability. Humanit Soc Sci Commun 12, 1143 (2025). https://doi.org/10.1057/s41599-025-05197-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-025-05197-w