Abstract

This study explores the relationship between the overseas experience of Chief Financial Officers (CFOs) and digital transformation in Chinese listed companies, using data from 2009 to 2022. Grounded in upper echelons theory, the research examines how CFOs’ international experience influences corporate strategy and digital innovation. The results demonstrate that CFOs with overseas experience significantly drive digital transformation within firms. This finding is robust, surviving multiple tests, including instrumental variable analysis to address endogeneity and various robustness checks. Further analysis reveals that while CFOs’ overseas work experience has a strong positive impact on digital transformation, their overseas education experience has an insignificant effect. The study also identifies research and development (R&D) intensity and environmental, social, and governance (ESG) practices as key mediators that enhance the relationship between CFOs’ overseas experience and digital transformation. These findings suggest that CFOs with international experience contribute strategic vision and a global perspective, fostering innovation and sustainability within the firm. By linking CFOs’ overseas experience with innovation and sustainable development strategies, this research contributes to the theoretical understanding of how strategic leadership impacts digital transformation. The study recommends that companies prioritize the overseas experience of CFOs to gain competitive advantages and create long-term value.

Similar content being viewed by others

Introduction

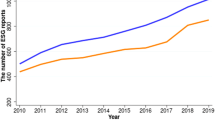

In the era of digital transformation, the roles of corporate management have undergone profound changes, compelling leaders to reconsider their responsibilities, skills, and decision-making processes. As companies progressively transition to digital operations and decision-making, not only have the demands for talent shifted, but the expectations for management to embrace these changes have also increased. To enhance their competitiveness, senior management must cultivate and recruit talent with digital skills to meet this challenge (Banciu et al., 2023). Senior executives, including Chief Executive Officers (CEOs), Chief Information Officers (CIOs), and Chief Financial Officers (CFOs), need to acquire new skills and adapt to these changes (Nadkarni and Prügl, 2021). Successful digital transformation requires management to be proficient in technology and capable of leading cross-departmental collaboration, fostering a culture of data-driven decision-making (Kraus et al., 2022). For example, CEOs and CFOs must evaluate and leverage the impact of digital technologies on business models and understand how these technologies support the company’s long-term strategic goals (Zoppelletto et al., 2023). Furthermore, digitalization has altered the demand for talent, necessitating that senior management embrace this change by developing and recruiting individuals with digital skills to strengthen the company’s competitive edge (Kane et al., 2015; Nissen et al., 2018). The growing prominence of the digital economy reflects these transformative trends. Figure 1 illustrates the proportion of the digital economy in China’s GDP over recent years, underscoring that digital transformation is a crucial strategy for enterprises seeking sustainable growth. This highlights how digitalization has become an inevitable trend in corporate operations and governance.

Specifically, in the era of digital transformation, the role of the CFO has evolved beyond traditional financial stewardship to become a pivotal bridge between conventional business operations and a digital future. According to a study by Frankiewicz and Chamorro-Premuzic (2020), CFOs are increasingly seen as key drivers of digital transformation, leveraging their strategic financial leadership to integrate digital technologies and facilitate corporate growth and transformation. As digital transformation deepens, the responsibilities of CFOs expand, making them indispensable to successful corporate transitions. CFOs must navigate the complexities of digital transformation by aligning financial strategies with technological advancements, thereby enhancing organizational performance (Sandner et al., 2020). Figure 2 presents the findings of a survey targeting CFOs: 65.1% of respondents believe that a digital value management system should be established; 54.4% consider it necessary to leverage digital technology to enhance organizational efficiency; and 49.5% highlight the importance of achieving digital and intelligent transformation in finance.

Furthermore, the influence of technology, strategy, and external environments on digital transformation is significant. Bharadwaj et al. (2013) emphasized the critical role of the financial function in adapting to and influencing digital transformation strategies, ensuring that financial goals are met while embracing innovative technologies. For CFOs with international experience, their global perspective and diverse experiences play a particularly significant role in digital transformation. As highlighted by Gerth and Peppard (2016), these CFOs utilize their international expertise to provide informed decision-making for digital investments, facilitating a successful transition to a digitalized organization. Thus, CFOs are not only key figures in financial and strategic decision-making but also central to driving and implementing digital transformation.

Digital transformation has become a key driver of business success, and existing studies have highlighted the pivotal role of the CFO in this context. However, while the literature acknowledges the increasing importance of CFOs in navigating digital change, there has been limited focus on how the CFOs’ role influences digital transformation in emerging markets, particularly in China. This gap is significant, as both developed and emerging economies are undergoing rapid digitalization. Therefore, this study aims to explore the strategic role of the CFO in the digital transformation process, with a particular emphasis on how international experience shapes the development of digital transformation strategies.

This study focuses on Chinese A-share listed companies and explores the relationship between CFOs’ overseas experience and corporate digital transformation (CDT). Using quantitative analysis methods and innovative data collection techniques, this research aims to shed light on how the international background of CFOs facilitates internal digital transformation within organizations. The study first examines the evolution of the CFO role from a traditional financial manager to a strategic leader of digital transformation by analyzing annual reports and the frequency of terms related to digital transformation. It then investigates the specific impacts of overseas education and international work experience on digital transformation. In terms of methodology, the research addresses endogeneity issues by using 1919 Chinese statistical data as an instrumental variable to resolve potential causal relationship concerns. Empirical analysis reveals that CFOs’ overseas experience drives digital transformation through influencing R&D investments and Environmental, Social, and Governance (ESG) strategies. These innovations not only enrich theoretical research in the academic field but also provide valuable insights for business practice.

This study makes several key contributions to the existing literature. First, it focuses on the evolving role of CFOs in the digital transformation process, emphasizing their growing importance in strategic leadership beyond traditional financial management functions. The analysis shows that CFOs have shifted from financial overseers to strategic leaders, effectively bridging traditional business practices with future-oriented digital strategies. Second, the study explores the significance of CFOs’ overseas experience, analyzing the different impacts of international education and work experience on digital transformation outcomes. It argues that a global perspective equips CFOs with stronger decision-making abilities and a better understanding of international technological and regulatory trends, thereby aligning financial resources more effectively with digital goals. Third, the research employs innovative methods, using historical data as an instrumental variable to address endogeneity, enhancing the causal inference of the empirical results. Finally, the study reveals how CFOs’ overseas experience drives digital transformation outcomes through mechanisms such as increased R&D investments and improved ESG performance. These mediating pathways provide deeper insights into how CFOs’ international experience is translated into tangible corporate outcomes in the context of digital transformation.

The paper is organized as follows. In the next section, a comprehensive literature review is presented, followed by the formulation of the hypotheses based on theoretical analysis. Section three outlines the research design and data inputs used in this study. Section four presents the empirical results, while section five discusses the mechanisms identified in the analysis. Finally, section six concludes the paper, highlighting its limitations and suggesting potential directions for future research.

Literature review and hypothesis development

Literature review

In recent years, digital transformation (DT) has emerged as a critical driver of innovation and environmental sustainability, gaining significant attention in academic research. Studies have demonstrated that digital transformation plays a pivotal role in enhancing corporate innovation and promoting green practices. For instance, Akhtar et al. (2024) and H. Zhang et al. (2024) emphasized that digital transformation can boost innovation performance and drive green innovation, underlining the importance of incorporating digital strategies into corporate operations with a focus on both innovation and environmental objectives. In terms of green technological innovation, Deyong et al. (2022), Hao et al. (2023), Hao et al. (2024) and Luo et al. (2023) explored how digitalization aids in achieving green transformation, particularly in the manufacturing and financial sectors. Their findings suggest that digital optimization and collaborative green R&D enhance firms’ environmental innovation capabilities. Liu et al. (2023) further provided empirical evidence that digital transformation significantly contributes to green innovation output.

The role of digital transformation in driving organizational efficiency and competitive advantage has also been widely explored. Heavin and Power (2018) argued that the introduction of digital technologies such as machine learning and analytics creates vast opportunities for organizations to enhance their internal efficiency and problem-solving capabilities. In the context of mergers and acquisitions (M&A), Tu and He (2023) examined how digital transformation reduces organizational costs and facilitates strategic growth, particularly within Chinese listed companies. Additionally, Ghosh et al. (2021) highlighted the transformative effects of DT on business models, operational structures, and corporate cultures. Organizations must, therefore, remain adaptable to align existing processes with digital advancements, fostering a culture of risk acceptance and continuous change (Benjamin and Potts, 2018; Horváth and Szabó, 2019). Kane et al. (2015) further emphasized that digital transformation requires organizations to embrace new technologies, cultivate new mindsets, and adjust their leadership structures to remain competitive.

In the context of corporate management, the role of leadership in driving digital transformation has garnered increasing attention. C. Zhang et al. (2024) explored the relationship between a CEO’s green experience and a company’s digital transformation, while Firk et al. (2024) examined how CEOs with digital transformation experience influence the overall digitalization of organizations. AlNuaimi et al. (2022) investigated the nexus between organizational agility, digital strategy, and leadership, underscoring the pivotal role of management in steering digital transformation through strategic agility and effective leadership. In the context of leadership, Prince (2018) underscored the critical role of digital leadership for Australian CEOs, highlighting its importance in navigating the digital era and leading fundamental transformations. Similarly, Sandner et al. (2020) examined the impact of blockchain technology on industrial company CFOs, emphasizing the necessity for role-specific understanding in the adoption of new technologies. Zhang et al. (2023) provided insights into the digital transformation of public services, stressing the crucial role of top management in the digital era. Furthermore, Cheng and Masron (2023) and Zhao et al. (2024) analyzed how factors such as economic policy uncertainty (EPU) and market competition influence the digital strategies of Chinese A-share listed companies, showing the substantial impact of both market dynamics and policy environments on CDT.

While much of the research focuses on the technological and environmental benefits of digital transformation, its successful implementation depends on several factors, particularly corporate governance, leadership, and managerial characteristics (Ding et al., 2022; Nadkarni and Prügl, 2021). Among these factors, the role of CFOs has garnered increasing academic attention due to their strategic influence on financial resource allocation, risk management, and long-term corporate planning. CFOs with international experience are particularly positioned to drive digital transformation through two key mechanisms: R&D intensity and ESG performance. Their exposure to global best practices enhances their managerial ability, allowing them to make informed strategic decisions, optimize resource allocation, and effectively integrate international insights into corporate strategies (Dai et al., 2021). Additionally, CFOs’ global exposure often leads to a stronger emphasis on ESG performance, aligning corporate operations with international sustainability standards. This emphasis enhances stakeholder trust, reduces information asymmetry, and fosters an environment conducive to long-term digital strategy implementation (Ding et al., 2022; Wang and Fung, 2022).

Despite the growing body of literature examining the relationship between digitalization, innovation, green transition, and mergers, and the significant role of top executives, there remains a notable gap in the research regarding the specific role of CFOs in the digital transformation process. Particularly, few studies have focused on how CFOs, especially those with overseas experience, influence digital transformation outcomes within the unique context of China’s business environment. Furthermore, as corporate governance and strategies evolve in the globalized economy, the increasing importance of the CFOs’ role in digital transformation has yet to be fully addressed in existing research. This gap presents an opportunity to explore how CFOs with international experience can contribute to digital transformation efforts in Chinese companies, particularly in light of China’s distinct cultural and economic context.

In conclusion, while the literature highlights the significant role of leadership and management in driving digital transformation, further research is needed to specifically examine how CFOs with overseas experience contribute to this process. This study aims to fill this gap by exploring the influence of CFOs’ international exposure on the digital transformation of Chinese companies, offering valuable insights into how global perspectives can enhance corporate strategies and performance in the digital era.

Hypothesis development

CFOs with international backgrounds bring invaluable perspectives and strategic guidance to corporate transformation. Their deep understanding and practical experience in cross-cultural management, international financial standards, and global market dynamics enable them to make more precise decisions when managing global resources and operations (Chatpibal et al., 2023; Yu et al., 2022). These experiences enhance the organization’s adaptability and innovation capability in response to external environmental changes. Furthermore, internationally experienced CFOs play a critical role in driving digital transformation within enterprises. Leveraging their global perspectives and expertise, they guide the optimization and innovation of financial and technological processes, thereby enhancing the company’s competitiveness and market responsiveness (Diugwu, 2011). In the digital transformation process, such CFOs focus on the strategic use of data, promoting transparency in decision-making and data-driven decision-making, which has long-term positive impacts on the overall efficiency and performance of the organization (Elsa and Halil, 2024).

Through precise data analysis and financial insights, CFOs can provide scientific decision support for digital investments, with their overseas education and work experience being recognized as a potential catalyst for driving organizational change towards digitalization (Chen et al., 2022). The impact of CFOs’ international exposure on CDT has become a subject of increasing interest and importance in the business world. Understanding how CFO overseas experience influences digital transformation strategies and outcomes is crucial for companies seeking to thrive in the digital age.

To better understand the role of CFOs in CDT, we can examine the relationship between CFOs’ international experience and the effectiveness of digital transformation efforts. According to the Upper Echelons Theory, top executives’ experiences, values, and cognitive biases significantly shape strategic decisions and organizational outcomes. In the context of CDT, this theory suggests that CFOs with international experience are likely to bring a broader worldview, a higher tolerance for risk, and a deeper understanding of digital financial tools, all of which can facilitate more effective digital transformation strategies.

Based on this theoretical framework, we propose the following hypothesis:

Hypotheses H1: CFOs’ overseas experience can have a positive impact on CDT.

R&D intensity is widely recognized as a critical indicator of a firm’s innovation capability and its level of technological investment. Increased R&D intensity not only enhances a firm’s competitiveness but also builds essential technological reserves, providing the innovative resources necessary for successful digital transformation(Cohen and Levinthal, 1990; Teece, 2010). In the context of digitalization, R&D intensity reflects a firm’s technological absorptive capacity, which influences its ability to adopt, integrate, and optimize digital technologies. Furthermore, it highlights the firm’s capability to identify and collaborate with high-quality partners within the innovation ecosystem (García‐Romanos & Martínez‐Ros, 2024; Martínez-Noya and García-Canal, 2021).

Top executives, particularly CFOs with international experience, play a pivotal role in shaping R&D investment decisions. Their global exposure enables them to bring diverse cognitive insights and a broader strategic perspective, allowing them to better identify emerging technological trends and global market demands(Herrmann and Datta, 2005). Additionally, their experience enhances their ability to allocate financial resources strategically toward R&D initiatives that drive long-term innovation. CFOs with overseas experience are also more adept at evaluating technological collaborations, selecting high-value innovation projects, and establishing partnerships that focus on technological advancement. These capabilities reinforce the firm’s technological absorptive capacity and innovation resilience.

Building on this theoretical framework, we propose the following hypothesis:

Hypotheses H2: R&D intensity mediates the relationship between CFOs’ overseas experience and CDT outcomes.

ESG reflects a firm’s comprehensive performance in environmental protection, social responsibility, and corporate governance. It not only enhances the firm’s reputation and competitiveness but also provides critical resources and momentum for digital transformation. Firms with strong sustainability capabilities are more likely to establish stakeholder engagement mechanisms and focus on creating and fostering long-term value (Eccles et al., 2014). Research suggests that effective ESG practices can further stimulate internal drivers, such as the application of green technologies and the optimization of stakeholder relationships, accelerating technological advancements and the digital transformation process(Friede et al., 2015; Wang and Chang, 2024).

CFOs with international experience often bring heightened awareness of sustainability, prompting firms to place greater emphasis on social responsibility and invest in ESG-related initiatives(Khalid et al., 2022). Their global perspective allows them to better understand green development trends, ensuring compliance with international sustainability standards while minimizing the risks associated with ESG shortcomings. Furthermore, improved ESG practices foster trust among stakeholders, reduce information asymmetry, and create a stable foundation for CDT.

Based on this theoretical framework, we propose the following hypothesis:

Hypotheses H3: ESG performance mediates the relationship between CFOs’ overseas experience and CDT outcomes.

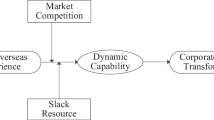

Figure 3 illustrates the research framework of this study. By offering novel perspectives on the role of CFOs in digital transformation, particularly in the context of their overseas experience, this research enriches the existing literature and provides valuable insights for enterprises navigating digital transformation in a globalized business environment.

Research design

Sample selection and data sources

This study utilizes data from Chinese A-share listed firms in Shanghai and Shenzhen between 2009 and 2022, comprising an initial sample of 33,032 observations from 3697 companies. The data was processed as follows: first, financial institutions were excluded to prevent potential distortions in the analysis due to their distinct financial structures. Second, firms designated as ST, PT, and *ST were removed because their financial conditions are not representative of the general market. Third, to minimize the influence of outliers, continuous variables at the firm level were winsorized at the 1st and 99th percentiles. This procedure involves capping extreme values, with those above the 99th percentile set to the 99th percentile value and those below the 1st percentile adjusted to the 1st percentile value. The raw data were sourced from the China Stock Market and Accounting Research database (CSMAR), the Chinese Research Data Services (CNRDS), and Wind database, while annual report data for the firms were collected from the official websites of the Shenzhen Stock Exchange and Shanghai Stock Exchange.

Definition of variables

Explained variable: Corporate digital transformation (CDT) and its five dimensions

CDT is a leading subject in both academic study and practical implementation. In today’s economy, data is often regarded as the “new energy.” However, CDT goes beyond the simple digitization of corporate information and data. It involves the strategic deployment of cutting-edge digital technologies and hardware systems to digitize key production factors and operational processes, with the overarching aim of improving overall quality and efficiency.

In the early stages of CDT, companies primarily rely on “digital technology-driven” methods to enhance the digitization of their existing technological systems and production processes. This transformation is centered on the adoption and advancement of key core technologies. Foundational technologies such as Artificial Intelligence (AI), blockchain, cloud computing, and big data form the essential architecture supporting CDT. During this phase, the focus is on the integration of digital technologies, with an emphasis on digitizing, transforming, and optimizing internal production operations, management models, and supporting technologies.

The ultimate objective of CDT is to generate innovative outputs and market applications that drive business growth. At more advanced stages, this innovation gradually influences a company’s core market operations by connecting and integrating specific behavioral scenarios from both economic and social contexts, creating new opportunities for business expansion. At this point, digital transformation focuses more on the integration and innovation of digital technologies within complex business ecosystems, evolving beyond initial technological upgrades to more profound changes in business practices. This shift starts by strengthening backend operations and empowering corporate technologies, eventually extending to frontend market applications.

In summary, this article categorizes CDT into two structural levels: “bottom-up technology applications” and “technology practice applications”. The bottom-up technology applications encompass four major mainstream technological directions, while technology practice applications emphasize specific digital business scenarios. Most current research on CDT is qualitative and theoretical, with limited quantitative analysis. To empirically evaluate the economic impact of CDT, a precise definition of the “digital transformation” variable is essential. Some scholars have explored quantitative approaches, for instance, utilized a binary “0–1” dummy variable to indicate whether digital transformation occurred in a given year. However, this method may not accurately capture the intensity of CDT, potentially leading to erroneous assessments of its scope.

This study proposes that as a key strategic initiative for high-quality development in the new era, the characteristics of CDT are better reflected in the language and guidance provided in annual reports. The terminology in these reports often conveys a company’s strategic direction and future vision, representing the management’s concepts and the developmental paths they endorse. Therefore, analyzing the frequency of CDT-related terms in listed companies’ annual reports offers a viable and scientifically sound method for measuring the extent of transformation. Similar approaches have been used in previous research to quantify the number of industrial policy documents across provinces and cities to indicate policy strength using keyword pairing and selection. This provides a logical basis for this study’s method of using the frequency of relevant keywords in annual reports as a proxy for measuring CDT.

From a technical standpoint, this study employed Python web scraping to gather and compile the annual reports of all A-share listed companies from the Shanghai and Shenzhen Stock Exchanges. Following this, the Java PDFBox library was utilized to extract the full text from these reports, forming the foundation for identifying relevant feature words. When selecting feature words for CDT, the study approached the task by addressing both academic and industrial perspectives separately. In the literature review, classic works on digital transformation were examined to extract specific keywords associated with the concept. Additionally, the study incorporated key Chinese policy documents and research reports, such as the “Special Action Plan for Empowering Digitalization of Small, Medium, and Micro Corporates”, “Action Plan to Promote Cloud Computing and Big Data Driving New Economic Development”, the “2020 Digital Transformation Trends Report,” and the recent “Government Work Report”. These sources were used to expand the keyword library related to digital transformation.

Based on the structural classification established in the analysis, which separates digital transformation into the two levels of “bottom-up technology applications” and “technology practice applications”, the study developed a feature word map to guide the analysis.

The study then refined the analysis by removing expressions starting with negations (such as “no”, “not”, or “non”) and excluding keywords related to “digital transformation” that were irrelevant to the company itself, such as references to shareholders, customers, suppliers, or introductions of company executives. Finally, using Python, the study conducted a search and matching process, calculating word frequencies based on the feature words listed in Table 1. This allowed for the categorization and summarization of word frequencies tied to key technological directions, ultimately producing an overall word frequency count.

This process led to the construction of an index system for CDT across five dimensions: artificial intelligence, big data, cloud computing, blockchain, and digital technology applications. Given that data distributions tend to be right-skewed, the study applied a logarithmic transformation to provide a more balanced and comprehensive measure of the composite index for CDT.

This approach to measuring digital transformation aligns with China’s growing emphasis on leveraging cutting-edge technologies to fuel economic development, particularly in key regions like the Guangdong-Hong Kong-Macao Greater Bay Area and cities such as Beijing, which are known for their digital innovation. The analysis methodology reflects the broader national focus on harnessing AI, big data, and cloud computing to drive corporate efficiency and economic growth, as seen in government initiatives and strategic policy frameworks guiding companies’ digital transformations.

In the robustness test, based on Zhao et al. (2021), which reconstructed a CDT metric based on the vocabulary in Table 2 and re-run the regression test based on differences in technology composition and application scenarios.

Main explanatory variable: CFOs’ overseas experience (COE), CFOs’ overseas work experience (COWE) and CFOs’ overseas education experience (COEE)

The article introduced a dummy variable, COE, which is assigned a value of 1 if a Chinese CFO has studied or worked abroad, and 0 otherwise. In line with previous research, both study and work experiences abroad are considered as overseas experiences (Zhang et al. (2024)). In the analysis, the article distinguishes between COWE (CFOs with overseas work experience) and COEE (CFOs with overseas educational experience) to explore how different types of overseas experiences impact a firm’s digital transformation.

Access to the overseas experiences of Chinese CFOs is seen as vital, serving as a virtual channel through which these experiences can influence a company’s digital transformation. The argument is made that individuals with overseas experience are more likely to develop and enhance their understanding of digitization, thereby enabling them to incorporate this awareness into corporate management strategies effectively.

Control variables

To strengthen the reliability of the empirical findings in this paper concerning the effects of CDT, several factors are taken into account, including a firm’s financial condition, operational status, and governance level. Building on prior research, this paper incorporates 13 control variables. The control variables identified are as follows:

-

1.

Corporate size (ln_Size): Larger companies, typically measured by the natural logarithm of total corporate assets, are generally more capable of undergoing digital transformation.

-

2.

Financial leverage (Lev): Recognized as a significant driver of CDT.

-

3.

Age: The number of years a company has been listed is represented by the natural logarithm of the total years listed plus one.

-

4.

Cash: The ratio of cash and cash equivalents to total assets at the end of the period.

-

5.

TobinQ: Firm value is commonly represented by Tobin’s Q ratio.

-

6.

Growth: Firm revenue growth rate.

-

7.

TOP1: Equity concentration is indicated by the shareholding ratio of the company’s largest shareholder.

-

8.

Ins: Institutional investor shareholding, measured by the percentage of institutional investor holdings.

-

9.

Ind_Direct: Percentage of independent directors on the board.

-

10.

Mngmhldn: Management shareholding, represented by the proportion of shares held by company directors, supervisors, and senior management.

-

11.

SOE: State ownership of the corporation is represented by a dummy variable, where 1 indicates that the firm is state-owned and 0 indicates otherwise.

-

12.

Dua: The dual role of the board chairman is represented by a dummy variable, where 1 indicates that the chairman and the general manager are the same individual, and 0 indicates otherwise.

-

13.

CFO Age: The age of the CFO in the current year.

These control variables are detailed in Table 3 for reference.

Model setting and empirical strategy

In order to verify the research hypothesis 1, this paper adopts the multiple regression model for benchmarking empirical analysis, where \({\alpha }_{1}\) and \({\beta }_{1}\) is the correlation coefficient of interest in this paper. The specific empirical model is as follows:

Where i, t represent firms and years respectively; \({y}_{i,t}\) are a series of metrics that measure the digital transformation of a corporate, including CDT and CAIT, CBDT, CCCT, CBCT, CDTA five dimensions; \({x}_{i,t-1}\) are the main explanatory variables, including COE, COWE and COEE; \({\alpha }_{1}\) and \({\beta }_{1}\) are the coefficients of our concern; \({{CV}}_{i,t}\) is the control variable matrix; \({\varepsilon }_{i,t}\) is the random error. In Eq. (2), this paper uses the fixed effects model by including firm fixed effects \({{Firm}}_{i}\) and year fixed effects \({{Year}}_{t}\).

Using lagged explanatory variables addresses several key issues in regression analysis. First, it helps mitigate endogeneity concerns by reducing the risk of reverse causality, as the explanatory variable (such as COE) is less likely to be simultaneously determined with the dependent variable in the same period. Second, many relationships in fields like economics, finance, and business unfold over time, and using lagged variables allows for a more accurate reflection of delayed effects, as impacts may not be immediate but become evident in subsequent periods. Third, lagged variables improve model specification by capturing the dynamic relationship between variables over time, ensuring the model better aligns with real-world processes where certain influences (like leadership traits or strategies) have a delayed impact. Finally, lagged explanatory variables help control for autocorrelation in time-series data, enhancing the robustness of the results. Together, these advantages make lagged variables essential for accurately modeling causal relationships and improving the reliability of regression analysis.

The primary reason for selecting the fixed effects model as the benchmark regression is its ability to control for unobservable heterogeneity at the firm level, such as management quality, organizational culture, or strategic priorities, which may influence digital transformation processes but cannot be directly observed. These firm-specific characteristics remain constant over time, and by using firm fixed effects, we can account for them, ensuring that the relationship between independent variables (e.g., CFOs’ characteristics) and dependent variables (e.g., digital transformation outcomes) is not confounded by persistent differences between firms. Additionally, macro-economic and industry-wide factors, such as economic cycles, regulatory changes, technological advancements, and market conditions, may affect all companies over time. To address this, we include year fixed effects, which control for time-varying factors that impact all firms in a given period, such as the global disruptions caused by the COVID-19 pandemic. Year fixed effects allow us to isolate the impact of CFOs’ characteristics on digital transformation by eliminating the influence of common shocks or trends. Ultimately, the fixed effects model enhances the consistency and robustness of regression estimates, addressing omitted variable bias and ensuring that our results accurately reflect the true relationship between CFOs’ characteristics and digital transformation, free from the interference of unobserved confounding factors.

Regression results

Descriptive statistics

Table 4 presents the descriptive statistics of the sample variables. Following the logarithmic transformation, the disparity in digital transformation levels among companies has been reduced, resulting in a more concentrated dataset. The average value of the CDT level indicator is 1.45, while the median is 1.1, indicating a relatively close overall level of digital transformation. Among the five-dimension indicators, the average value of CDTA is 1, with a median of 0.69, showing closer proximity compared to the other four indicators. However, the median of the remaining four indicators is 0, suggesting that a significant number of corporates have relatively low levels of digital transformation in these dimensions. It is noteworthy that the average value of CBCT is only 0.04, indicating a low level of attention to block chain technology among Chinese listed companies. The proportion of CFOs with overseas experience in the sample is only 4%, indicating a relatively low level.

Additionally, the average and median values of control variables—such as company size, financial leverage, years since listing, cash asset ratio, company value, growth rate, equity concentration, institutional investor shareholding proportion, and independent director proportion—are relatively close, indicating a fairly even distribution. However, notable discrepancies exist between the average and median values for control variables like management ownership, the dual role of the company’s board chairman, and ownership structure. To further explore the relationships among these variables, this paper will conduct multiple regression analysis.

Benchmark regression results

Table 5 presents the regression results for Eqs. (1) and (2). Columns (1) to (3) utilize CDT as the dependent variable, while columns (4) to (8) use CDT’s five dimensions as the dependent variables. Specifically, column (1) presents the regression results of Eq. (1) with control variables, column (2) shows the results without control variables, and column (3) includes control variables.

Examining Table 5 from column (1) to column (3), it is evident that the core explanatory variable, CFOs’ overseas experience (COE), is statistically significant at the 5% level. The positive regression coefficients indicate that CFOs’ overseas experience has a significant positive impact on CDT. When control variables, firm fixed effects, and year fixed effects are included, the regression coefficient for COE is 0.07, statistically significant at the 5% level. This finding suggests that CFOs’ overseas experience, on average, contributes to a 7% increase in the degree of CDT. The economic effect of enhancing CDT is notably significant.

In Table 5, columns (4) through (8) present the regression results of Eq. (2) with corporate artificial intelligence technology (CAIT), corporate big data technology (CBDT), corporate cloud computing technology (CCCT), corporate block chain technology (CBCT), and corporate digital technology applications (CDTA) as the explained variables. The analysis reveals that in column (4, the regression coefficient is 0.09, statistically significant at the 1% level, indicating a significant facilitating effect of CFOs’ overseas experience (COE) on CAIT. This implies that CFOs’ overseas experience contributes to a notable 9% increase, on average, in corporate artificial intelligence technology.

However, in column (5), the regression results for CBDT show a coefficient of 0.04, which is statistically insignificant, suggesting a lack of significant facilitation effect of COE on CBDT. Moving to column (6), the regression coefficient for CCCT is 0.06, statistically significant at the 5% level, indicating a substantial facilitating effect of COE on CCCT. This suggests that CFOs’ overseas experience contributes to a 6% increase, on average, in corporate cloud computing technology.

In column (7), the regression results for CBCT display a coefficient of 0.03, statistically significant at the 1% level, indicating a significant facilitating effect of COE on CBCT. This implies that CFOs’ overseas experience contributes to a 3% increase, on average, in corporate block chain technology. Lastly, in column (8), the regression coefficient for CDTA is 0.06, statistically significant at the 10% level, demonstrating a significant facilitating effect of COE on CDTA. CFOs’ overseas experience contributes to a 6% increase, on average, in corporate digital technology applications.

In summary, CFOs’ overseas experience significantly contributes to CDT, particularly through facilitating corporate artificial intelligence technology, corporate digital technology applications, corporate cloud computing technology, and corporate block chain technology, while its impact on corporate big data technology is found to be not significant. Hypothesis H1 of this paper is verified.

Discussion on endogeneity

Firms with higher levels of digital transformation may exhibit a preference for recruiting CFOs with overseas experience, raising concerns about reverse causality endogeneity in the regressions presented in this paper. Additionally, despite the inclusion of numerous control variables, the possibility of omitted variables remains, further contributing to the endogeneity issue and potentially undermining the credibility of the findings.

To address the challenges posed by endogeneity, this paper aims to mitigate these concerns by identifying instrumental variables and conducting 2SLS regression. By employing instrumental variables and 2SLS regression, this study seeks to enhance the robustness of its findings and provide more credible insights into the relationship between CFOs’ characteristics, digital transformation, and firm performance.

Instrumental variable

The instrumental variables approach is often used in empirical economics to solve endogeneity problems. Drawing on Ang et al. (2014) and Fang and Zhao (2011), this paper adopts an instrumental variable approach to address the endogeneity issue. The instrumental variable selected for this study is the ratio of Christian church elementary school enrollment to the local population in different provinces of China as of 1919. There are several compelling reasons for choosing this particular instrumental variable.

Firstly, the instrumental variable meets the exogeneity requirement as it has no direct influence on current business management or CDT, and is unrelated to contemporary factors. This means that the variable is not influenced by the modern factors under study, thereby reducing the risk of endogeneity. Additionally, prior studies, such as Fang and Zhao (2011), have shown that there is no significant correlation between Christian missionary activities and the distance from each place to the coast in China during that time, nor is there a significant correlation between the location of church schools and the level of economic development of each province. Therefore, the instrumental variable satisfies the exogeneity requirement, further ensuring its effectiveness in addressing endogeneity issues.

Secondly, the selected variable measures the impact of Western institutions or values on different regions of China. Specifically, it reflects the degree of penetration of Western ideas in local communities: the more prevalent Western-style elementary schools established by Christian institutions, the greater the exposure of the local population to Western culture. Consequently, people in these areas may be more inclined to seek opportunities for studying or working abroad. After completing their study or accumulating resources, these individuals are more likely to return to work for hometown corporates (at least within the same province) due to traditional Chinese notions of family and country. They bring back advanced corporate management ideas from overseas as well as concepts of digitalization for hometown corporates, thereby facilitating the digital transformation of these corporates. This indicates that the instrumental variable influences the number of Chinese returnees incorporates and meets the correlation requirement of the instrumental variable.

By utilizing this instrumental variable, the study aims to effectively address endogeneity concerns and provide more robust and credible insights into the relationship between CFOs’ characteristics and CDT.

2SLS regression results

In order to standardize the data for comparison purposes, the number of Christian church pupils in each province of China in 1919 was standardized by calculating the number of Christian church pupils per 10,000 people, which was then used as the instrumental variable in this paper. To address skewness in the data, the density of Christian church pupils was transformed by taking the natural logarithm. Additionally, to prevent the loss of observations with zero values, a constant of 1 was added to the number of incoming students. The transformed variable is represented as ln (1 + (Christian church elementary school students/population * 10,000)).

The study initially tested the endogeneity of the COE variable, with the test yielding a p value of 0, rejecting the null hypothesis and confirming that COE is indeed an endogenous variable. Subsequently, a weak instrumental variable test was conducted, resulting in a Cragg-Donald Wald F statistic of 35.52, which surpasses the threshold of 10 and exceeds the critical value of 16.38 for the 10% maximal IV size, indicating that the instrumental variable is not weak. Furthermore, robust inference tests performed to validate the instrumental variable’s strength. Therefore, the instrumental variables in this study satisfy the necessary statistical criteria.

Building upon the aforementioned results, this paper utilizes the concentration of Christian elementary school students in each province as an instrumental variable to test the research findings. The outcomes of the two-stage regression using instrumental variables are presented in Table 6.

The first stage of the instrumental variables test reveals a positive and statistically significant coefficient for the instrumental variable, indicating that in regions with a higher concentration of Christian Western elementary school students, local firm CFOs tend to possess more overseas education and work experiences, aligning with our initial expectations. In the second stage, the coefficient of Modified CFOs’ Overseas Experience remains significantly positive, even after addressing potential endogeneity issues. This suggests that the positive impact of CFOs’ overseas experience on CDT persists after mitigating potential endogeneity concerns, reinforcing the robustness of our findings.

The results indicate that even after addressing potential endogeneity, the conclusions drawn in this paper remain significant. Thus, Hypothesis H1 is further tested.

Robustness tests

In the preceding section, the reliability of our research findings was confirmed through a thorough discussion of endogeneity. To further bolster the robustness of our conclusions, this paper will undertake the following additional robustness tests.

Replacement of corporate digital transformation measurement metrics

In this study, the CDT indicator was derived from the word frequencies associated with key technology directions outlined in Table 2 of the previous section, serving as a proxy for the explained variables. The new indicators encompass Digital Technology Applications, Internet Business Models, Intelligent Manufacturing, and Modern Information Systems to provide a comprehensive representation of CDT Zhao et al. (2021). Recognizing the right-skewed nature of the data, a logarithmic transformation was applied to ensure a more balanced distribution of the composite index.

Regression analysis of the CFOs’ overseas experience (COE) against the new CDT indicator yielded a coefficient of 0.084, demonstrating statistical significance at the 1% level. This result closely aligns with the findings of previous research within this paper, further affirming the robustness of the analysis.

Clustering standard errors of regression results

To account for the potential influence of region or industry factors on CDT, this paper conducted a robustness test by clustering the standard errors of the regression equation in Eq. (2) based on province and industry categories. The regression analysis revealed that when clustering the standard errors by province, the estimated coefficients remained consistent with those presented in column (3) of Table 5, yielding a p-value of 0.035, which is statistically significant at the 5% level. Likewise, when clustering the standard errors by industry, the estimated coefficient remained steady, producing a p-value of 0.059, which retains significance at the 10% level. Consequently, the regression estimates in this study have effectively passed the robustness test, underscoring the resilience and reliability of the research findings.

Fixed industry effects and province effects

On the basis of the standard errors clustered into industries or provinces above, in order to further exclude the influence of provinces and industries on the regression results, this paper further fixes the province and industry effects in the regression. the specific equations are as follows:

In the context where c, j, i, t represent provinces, industries, firms and years respectively; \({{CDT}}_{c,j,i,t}\) denotes the extent of CDT in province c, industry j, firm i in year t; \({{COE}}_{c,j,i,t-1}\) is the main explanatory variable; \({\gamma }_{1}\), \({\delta }_{1}\) and \({\mu }_{1}\) are the coefficients of our concern; \({{CV}}_{i,t}\) is the control variable matrix; \({\varepsilon }_{c,j,i,t}\) is the random error. In Eqs. (3) and (5), to capture the differences between provinces that do not change over time, this paper uses province fixed effects \({{Province}}_{c}\); in Eqs. (4) and (5), to capture the differences between industries that do not change over time, this paper uses industry fixed effects \({{Industry}}_{j}\); to capture the differences between firms that do not change over time, this paper uses firm fixed effects \({{\rm{Firm}}}_{i}\); and year fixed effects \({{Year}}_{t}\) are included to address omitted variables that may change over time, such as economic cycles and macroeconomic changes.

Table 7 displays the regression results for Eqs. (3–5).

As can be seen from Table 7, the regression coefficients are still significant at the 5% level after adding the province fixed effects and industry fixed effects, and the regression coefficients are not too different from the results of previous studies, which makes the findings of this paper more robust.

Further analysis

According to Conyon et al. (2019) and Dai (2019), individuals’ overseas experiences vary in their effects, with different types of experiences yielding distinct outcomes. Long-term, in-depth exposure to Western culture through overseas educational experiences primarily impacts individuals’ values and behavioral patterns, shaping aspects such as leadership behavior. On the other hand, overseas work experiences deepen individuals’ technical competencies. It is evident that both overseas educational experiences and overseas work experiences possess the potential to incentivize CFOs to bolster the extent of CDT. Such experiences can broaden their perspectives, enhance their understanding of global trends, and foster a mindset conducive to embracing digital innovation within the corporate realm.

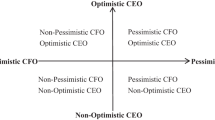

Based on the above background, this study will subdivide CFOs’ overseas experience into two categories: overseas work experience and overseas education experience. In order to explore whether there is a difference in the impact of these two different types of CFOs’ overseas experience on the digital transformation of corporates, this study carries out the following treatment: firstly, CFOs’ overseas experience is divided into two groups with overseas work experience and with overseas education experience by type. Subsequently, the sample of CFOs with overseas work experience and the sample of CFOs without overseas experience were combined to form the overseas work experience subgroup. The CFOs sample with overseas education experience was merged with the CFOs sample without overseas experience to form the overseas education experience subgroup. Finally, the impact of CFOs’ overseas experience on the pay gap and digital transformation within the corporate is analyzed in the above two data groups. The specific results are detailed in Table 8.

The results presented in the regression analysis of CDT on CFOs’ overseas education experience (COEE) under the double fixed effects of year and firm in column (1) of Table 8 indicate that COEE does not have a statistically significant effect on CDT. However, in column (2), the regression results of firms’ digital transformation on CFOs’ overseas work experience (COWE) with year and firm double fixed effects show a significant impact at the 1% level, suggesting that COWE leads to an average increase of 12% in the degree of firms’ digital transformation.

In columns (3) and (4), additional fixed effects are introduced (industry fixed effects and province fixed effects), and in column (5), standard errors clustered into industries based on column (4) are shown. All the regression coefficients in these columns are significant at the 5% level, indicating the robustness of the results from column (2). As a result, this study concludes that CFOs’ overseas work experience (COWE) significantly contributes to CDT, while CFOs’ overseas education experience (COEE) does not have a significant effect on it.

To further explore the influence of CFOs’ overseas work experience (COWE) on the digital transformation of corporates, the paper conducts regressions of COWE with each of the five dimensions of CDT. The regression results are displayed in columns (6) to (10) of Table 8. The findings suggest that COWE significantly contributes to CDT, especially by enhancing corporate artificial intelligence technology, digital technology applications, cloud computing technology, and big data technology within the company. However, its impact on corporate block chain technology is deemed not significant.

Identification of mechanism pathways

The aforementioned study provides rich empirical data to deeply understand the effect of COE on CDT. However, it is important to note that the previous paper only portrayed the overall picture of “CFOs’ overseas experience - CDT”, and has not yet examined the black box of the mechanism. In this section, we focus on identifying the channel mechanism of the impact between the two. Referring to the works of MacKinnon et al. (2002) and Taylor et al. (2008), the mediation effect test model is constructed as follows:

\({M}_{i,t}\) is the mediating variable, and the meanings of the other variables are consistent with the previous section.

Corporate research and development (R&D) intensity

CFOs’ overseas experience may bring in not only direct knowledge and skills related to digital transformation but also broader strategic perspectives and innovative insights gained from exposure to diverse international business environments (Herrmann and Datta, 2005). Concurrently, higher corporate R&D intensity signifies a greater investment in innovation and technological advancement within the company, which can potentially harness and leverage the knowledge and strategic input brought in by CFOs with overseas experience, thereby influencing the overall digital transformation efforts of the organization (Martínez-Noya and García-Canal, 2021; García‐Romanos and Martínez‐Ros, 2024).

In light of this theoretical framework, the significant coefficients observed in the mediated effects regression model underscore the importance of corporate R&D intensity as a channeling mechanism through which the impact of CFOs’ overseas experience on CDT is manifested. This suggests that the interplay between CFOs’ overseas experience, corporate R&D intensity, and digital transformation represents a complex and dynamic process, where R&D efforts act as a conduit for translating the insights and expertise derived from CFOs’ overseas experiences into tangible advancements in digital capabilities within the organization.

To further explore the mediating role of corporate R&D intensity in the relationship between CFOs’ overseas experience (COE) and CDT, this study employs a mediated effects regression model. The results, presented in columns (1), (2), and (3) of Table 9, show that the regression coefficients of interest are all statistically significant at the 5% level. This suggests that corporate R&D intensity acts as a mediating factor in the effect of COE on CDT. Hypothesis H2 of this paper is tested.

Additionally, after conducting bootstrap tests with 500 repetitions, both the indirect and direct effect coefficients were found to be significantly positive, with their 95% confidence intervals not including zero. This provides further evidence that the mediating effect of corporate R&D intensity is statistically significant, with partial mediation confirmed through the bootstrap tests. These results are consistent with the findings reported above.

By elucidating the mediating role of corporate R&D intensity, this analysis contributes to a more nuanced understanding of how CFOs’ overseas experience influences CDT, shedding light on the mechanisms through which such influence is transmitted and highlighting the interconnected nature of strategic leadership, innovation investment, and digital evolution within modern enterprises.

Corporate environmental, social, governance (ESG)

ESG represents a set of business practices that focus on environmental stewardship, social responsibility, and good governance in corporate operations. Increasingly, research indicates that effective ESG management not only enhances a company’s sustainable development and long-term value creation capabilities but also plays a positive role in driving corporate innovation and digital transformation (Friede et al., 2015; Wang and Chang, 2024).

Theoretically, strong performance in corporate ESG often reflects a firm’s commitment to sustainable operations and social responsibility, while also implying higher levels of risk management, transparency, and governance standards. These factors interact with the strategic vision and innovative insights brought by CFOs’ overseas experience, collectively influencing the company’s digital transformation process. By integrating CFOs’ overseas experience and corporate ESG practices, companies can better leverage the ESG framework to drive digital transformation, enhancing innovation capabilities and competitiveness.

The results of the mediated effects regression model presented in columns (1), (4), and (5) of Table 9 show that the regression coefficients of interest are all statistically significant at the 5% level. This indicates that corporate ESG plays a mediating role in the relationship between CFOs’ overseas experience (COE) and CDT. Hypothesis H3 of this paper is tested. Specifically, corporate ESG practices not only have a direct impact on digital transformation but also serve as a crucial intermediary linking CFOs’ overseas experience to digital transformation. This, in turn, contributes to the advancement of sustainability, innovation, and digitalization within firms.

Furthermore, after performing 500 repetitions of the bootstrap test, the coefficients for both the indirect and direct effects were significantly positive, and the 95% confidence intervals for these coefficients did not include zero. This provides further evidence that the mediating effects of corporate ESG are statistically significant, with the bootstrap tests confirming some of these effects. These findings are consistent with the results previously reported.

By delving into the role of corporate ESG as a channel, we can gain a more comprehensive understanding of how CFOs’ overseas experience influences CDT through ESG practices, providing more specific guidance and recommendations for corporate decision-makers to achieve synergies between sustainable growth and strategic objectives.

Discussion and conclusions

Results discussion

The findings of this study provide strong evidence that CFOs’ overseas work experience significantly enhances CDT efforts in the Chinese context. This supports the upper echelons theory, which posits that top executives’ experiences and cognitive frameworks shape firm-level outcomes. However, our study extends this theory by demonstrating the differentiated impact of overseas work versus education experience—an underexplored distinction in the literature.

Contrary to expectations that any form of international exposure would benefit digital transformation, our empirical results suggest that only CFOs with international work experience—not education—significantly drive digital transformation. This finding highlights the importance of practical, organizational learning in foreign settings over purely academic exposure. In doing so, the study responds to recent calls to disaggregate forms of international experience in strategic leadership research (Conyon et al., 2019; Dai, 2019).

The mediation analysis further refines our understanding of the mechanism: CFOs with international experience appear to leverage their exposure to global business environments to enhance R&D investment and promote ESG practices. These findings echo prior research linking returnee managers to innovation outcomes but go further in demonstrating a dual-channel mechanism rooted in both technical capacity (R&D) and institutional alignment (ESG). This dual-path insight contributes to the broader literature on how managerial traits foster both innovation and sustainability—a synergy increasingly emphasized in digital era strategy research (Akhtar et al., 2024; Friede et al., 2015).

Moreover, the evidence also implies that international CFOs act as institutional entrepreneurs in emerging markets. By importing norms and practices from developed financial and regulatory systems, they catalyze internal reform and digital capability-building in firms that may otherwise be constrained by legacy governance or risk aversion (Firk et al., 2024).

Importantly, these findings must be interpreted in light of China’s specific institutional and cultural setting, where state ownership, guanxi, and hierarchical governance may interact with leadership traits differently than in Western markets. As such, the results enrich context-sensitive leadership theories and invite future research to explore boundary conditions such as ownership structure, political connections, or regional digital policy environments.

Conclusions and implications

This study makes a substantial contribution to the existing literature by investigating the complex relationship between CFOs’ overseas experience, corporate ESG practices, and CDT. By highlighting the role of CFOs with international experience in driving digital transformation, the findings offer significant theoretical insights into how strategic leadership influences organizational change. Specifically, the study demonstrates that CFOs’ overseas work experience plays a pivotal role in facilitating digital transformation, whereas the impact of overseas educational experience appears to be less pronounced. This distinction provides a nuanced understanding of the different types of international experience and their varying effects on organizational dynamics.

Additionally, this study identifies corporate ESG practices and research and development (R&D) intensity as key mediators that link CFOs’ overseas experience to digital innovation. These mediators not only foster sustainability but also catalyze innovation and digitalization, reinforcing the importance of integrating sustainability practices into digital transformation strategies. This insight contributes to the growing body of research on the interdependence of sustainability and digitalization, showing how CFOs can drive both simultaneously through their international exposure.

The methodological rigor of this study, including discussions of endogeneity and robustness checks, strengthens the reliability of the findings and ensures the validity of the observed relationships. In contrast to prior studies, such as C. Zhang et al. (2024), which suggested that CEOs’ green experience hinders digital transformation, this study presents compelling evidence that international experience among top executives positively influences digital outcomes. This aligns with the work of Conyon et al. (2019), who found that executives’ international experience has a beneficial impact on organizational performance, offering a clearer picture of how global perspectives can drive digital and sustainable innovation.

Moreover, by extending the research of Yao et al. (2024), which focused on CFOs’ narcissism, this study broadens the understanding of CFOs’ traits that influence digital transformation. It underscores that beyond personality traits, the CFOs’ international exposure significantly shapes their approach to digital and sustainable initiatives, marking an important contribution to the literature on strategic leadership and organizational development.

In practical terms, the findings underscore the strategic importance of CFOs with overseas experience for companies seeking to enhance their competitive edge in an increasingly globalized and digitalized business environment. The insights suggest that organizations should prioritize recruiting or developing CFOs with international experience to drive both digital transformation and ESG initiatives effectively. By recognizing the synergy between CFOs’ characteristics, ESG practices, and digital innovation, companies can position themselves for long-term success, fostering not only financial growth but also positive environmental and societal impact.

However, there are certain limitations that should be acknowledged. Firstly, the study’s reliance on textual analysis to gauge the degree of digital transformation, while validated through robustness checks, may raise concerns regarding the exogeneity of the indicators used. Secondly, the sample drawn from China, although offering valuable insights into the context of developing economies, may limit the generalizability of the findings to more developed markets. Future research could address these limitations by incorporating diverse methodologies and expanding the sample to include organizations from different regions and industries, enhancing the external validity of the results.

In conclusion, this study enriches the theoretical understanding of the interplay between CFOs’ characteristics, corporate governance, and digital transformation, while also providing practical recommendations for organizations aiming to leverage strategic leadership for sustainable growth and innovation.

Data availability

Data will be made available on request.

References

Akhtar S, Tian H, Alsedrah IT, Anwar A, Bashir S (2024) Green mining in China: Fintech’s contribution to enhancing innovation performance aimed at sustainable and digital transformation in the mining sector. Resour Policy 92:104968

AlNuaimi BK, Singh SK, Ren S, Budhwar P, Vorobyev D (2022) Mastering digital transformation: the nexus between leadership, agility, and digital strategy. J Bus Res 145:636–648

Ang JS, Cheng Y, Wu C (2014) Does enforcement of intellectual property rights matter in China? Evidence from financing and investment choices in the high-tech industry. Rev Econ Stat 96(2):332–348

Banciu D, Vevera AV, Popa I (2023) Digital transformation impact on organization management and several necessary protective actions. Stud Inform Control 32(1):49–56

Benjamin K, Potts HW (2018) Digital transformation in government: Lessons for digital health? SAGE Publications Sage UK: London, England, p. 2055207618759168

Bharadwaj A, El Sawy OA, Pavlou PA, Venkatraman NV (2013) Digital business strategy: toward a next generation of insights. MIS Q 37:471–482

Chatpibal M, Chaiyasoonthorn W, Chaveesuk S (2023) Driving financial results is not the only priority! An exploration of the future role of chief financial officer: a grounded theory approach. Meditari Account. Res 32(3):857–887

Chen XH, Tee K, Chang V (2022) Accelerating innovation efficiency through agile leadership: the CEO network effects in China. Technol Forecast Soc Change 179:121602

Cheng Z, Masron TA (2023) Economic policy uncertainty and corporate digital transformation: evidence from China. Appl Econ 55(40):4625–4641

Cohen WM, Levinthal DA (1990) Absorptive capacity: a new perspective on learning and innovation. Adm Sci Q 35(1):128–152

Conyon MJ, Haß LH, Vergauwe S, Zhang Z (2019) Foreign experience and CEO compensation. J Corp Financ 57:102–121

Dai Y (2019) Taking your company global: the effect of returnee managers on overseas customers. China Financ Rev Int 9(1):51–72

Dai Y, Chao Y, Wang L (2021) The brain gain of CFOs in China: the case of analyst forecasts. Int Rev Financial Anal 75:101744

Deyong S, Wenbo Z, Hai D (2022) Can firm digitalization promote green technological innovation? An examination based on listed companies in heavy pollution industries. J Financ Econ 48(04):34–48

Ding N, Ullah I, Jebran K (2022) Foreign experienced CEOs’ and financial statement comparability. Emerg Mark Financ Trade 58(13):3751–3769

Diugwu IA (2011) Building Competitive advantage of small and medium sized enterprises through knowledge acquisition and sharing. KCA J Bus Manag 3(3):102-120

Eccles RG, Ioannou I, Serafeim G (2014) The impact of corporate sustainability on organizational processes and performance. Manag Sci 60(11):2835–2857

Elsa, J, & Halil, H (2024). Digital Transformation in Finance: the Role of Accounting Technology

Fang Y, Zhao Y (2011) Searching for instrumental variables of institutions: Estimating the contribution of property rights protection to China’s economic growth (in Chinese). Econ Res. J. 5:138–148

Firk S, Hennig JC, Meier J, Wolff M (2024) Institutional entrepreneurship and digital transformation: the role of outsider CEOs. Strateg. Organ 19:14761270241242905

Frankiewicz B, Chamorro-Premuzic T (2020) Digital transformation is about talent, not technology. Harv Bus Rev 6(3):1–6

Friede G, Busch T, Bassen A (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J Sustain Financ Investig 5(4):210–233

García‐Romanos J, Martínez‐Ros E (2024) Digitalization and employment in Europe: the role of firm’s size and the complementarity of R&D. RD Manag 54(4):695–712

Gerth AB, Peppard J (2016) The dynamics of CIO derailment: how CIOs come undone and how to avoid it. Bus Horiz 59(1):61–70

Ghosh S, Hughes M, Hughes P, Hodgkinson I (2021) Corporate digital entrepreneurship: leveraging industrial internet of things and emerging technologies. Digital Entrepreneur 183:1–339

Hao X, Li Y, Ren S, Wu H, Hao Y (2023) The role of digitalization on green economic growth: does industrial structure optimization and green innovation matter? J Environ Manag 325:116504

Hao X, Liang Y, Yang C, Wu H, Hao Y (2024) Can industrial digitalization promote regional green technology innovation? J Innov Knowl 9(1):100463

Heavin C, Power DJ (2018) Challenges for digital transformation–towards a conceptual decision support guide for managers. J Decis Syst 27(sup1):38–45

Herrmann P, Datta DK (2005) Relationships between top management team characteristics and international diversification: an empirical investigation. Br J Manag 16(1):69–78

Horváth D, Szabó RZ (2019) Driving forces and barriers of Industry 4.0: do multinational and small and medium-sized companies have equal opportunities? Technol Forecast Soc Change 146:119–132

Kane GC, Palmer D, Phillips AN, Kiron D, Buckley, N (2015) Strategy, not technology, drives digital transformation. MIT Sloan Management Review and Deloitte University Press, 4:1-25

Khalid F, Naveed K, He X, Ye C (2022) Impact of chief financial officer’s experience on the assurance of corporate social responsibility reports in China. Soc Bus Rev 17(4):613–635

Kraus S, Durst S, Ferreira JJ, Veiga P, Kailer N, Weinmann A (2022) Digital transformation in business and management research: an overview of the current status quo. Int J Inf Manag 63:102466

Liu X, Liu F, Ren X (2023) Firms’ digitalization in manufacturing and the structure and direction of green innovation. J Environ Manag 335:117525

Luo S, Yimamu N, Li Y, Wu H, Irfan M, Hao Y (2023) Digitalization and sustainable development: how could digital economy development improve green innovation in China? Bus Strategy Environ 32(4):1847–1871

MacKinnon DP, Lockwood CM, Hoffman JM, West SG, Sheets V (2002) A comparison of methods to test mediation and other intervening variable effects. Psychol Methods 7(1):83

Martínez-Noya A, García-Canal E (2021) Innovation performance feedback and technological alliance portfolio diversity: the moderating role of firms’ R&D intensity. Res Policy 50(9):104321

Nadkarni S, Prügl R (2021) Digital transformation: a review, synthesis and opportunities for future research. Manag Rev Q 71:233–341

Nissen V, Lezina T, Saltan A (2018) The role of IT-management in the digital transformation of Russian companies. Форсайт 12(3 (eng)):53–61

Prince, KA (2018). Digital leadership: transitioning into the digital age. James Cook University

Sandner P, Lange A, Schulden P (2020) The role of the CFO of an industrial company: an analysis of the impact of blockchain technology. Future Internet 12(8):128

Taylor AB, MacKinnon DP, Tein J-Y (2008) Tests of the three-path mediated effect. Organ Res Methods 11(2):241–269

Teece DJ (2010) Business models, business strategy and innovation. Long. Range Plan. 43(2-3):172–194

Tu W, He J (2023) Can digital transformation facilitate firms’ M&A: empirical discovery based on machine learning. Emerg Mark Financ Trade 59(1):113–128

Wang L-H, Fung H-G (2022) The effect of female CEO and CFO on tail risk and firm value. Financ Res Lett 47:102693

Wang S, Chang Y (2024) A study on the impact of ESG rating on green technology innovation in enterprises: an empirical study based on informal environmental governance. J Environ Manag 358:120878

Yu H, Fletcher M, Buck T (2022) Managing digital transformation during re-internationalization: trajectories and implications for performance. J Int Manag 28(4):100947

Zhang C, Yu J, Bai Y, Ho K-C (2024) The impact of CEO’s green experience on digital transformation. Pacific-Basin Finance J 85:102397

Zhang H, Wu J, Mei Y, Hong X (2024) Exploring the relationship between digital transformation and green innovation: the mediating role of financing modes. J Environ Manag 356:120558

Zhang X, Xu YY, Ma L (2023) Information technology investment and digital transformation: the roles of digital transformation strategy and top management. Bus Process Manag J 29(2):528–549

Zhao C, Wang W, Li X (2021) How does digital transformation affect the total factor productivity of enterprises? (in Chinese). Financ Trade Econ 42(7):114–129

Zhao X, Chen Q-a, Zhang H, Chen P, Chen S (2024) A study on the influencing factors of corporate digital transformation: empirical evidence from Chinese listed companies. Sci Rep 14(1):6243

Zoppelletto A, Orlandi LB, Zardini A, Rossignoli C, Kraus S (2023) Organizational roles in the context of digital transformation: a micro-level perspective. J Bus Res 157:113563

Acknowledgements

The authors gratefully acknowledge the support of the Educational Science Research Project of Chongqing Higher Education Association (Project No. CQGJ21B145) and the Chongqing Vocational Education Teaching Reform Research Project (Project No. Z233016).

Author information

Authors and Affiliations

Contributions

LW and LQ wrote the main manuscript text, GC completed the visualization and analysis part of the article, and CX and JL reviewed and edited the manuscript and managed the project. All authors reviewed the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article