Abstract

This study utilizes version 6 of the regression analysis of time series (RATS) software package to implement the estimation of the bivariate diagonal generalized autoregressive conditional heteroscedasticity (GARCH) model combined with a composite asset selection approach including two hybrid performance measures to solve ‘the trade-off problem between return and risk’ and ‘the inconsistent results from different performance measures’ in the problem of asset allocation within a group of minimum variance portfolios during the pre-COVID-19 and COVID-19 periods. Empirical results show that the optimal portfolios obtained from this approach and the assets added to a portfolio to achieve better performance differ between the pre-COVID-19 and COVID-19 periods. For instance, the optimal portfolios are the Chinese yuan-Ethereum and Bitcoin-Ethereum for the pre-COVID-19 period, but the WTI-Ethereum for the COVID-19 period. To achieve better performance, we added Ethereum to our portfolio during the pre-COVID-19 period, while WTI and Bitcoin were added during the COVID-19 period. Thus, the COVID-19 pandemic had a significant impact on the performance of asset allocation in the three markets. The proposed approaches in this study can be embedded in a computer as an asset allocation algorithm of Robo-advisers.

Similar content being viewed by others

Introduction

To achieve risk diversification, fund managers should select multiple assets within a group of assets to construct a portfolio according to an optimal strategy, such as the minimum variance in this study (see Akhtaruzzaman et al. 2021, among others). They face two key problems in establishing the portfolio. Firstly, among numerous assets (for example, seven assets), how can one select a subset of assets, such as two assets, to construct an optimal portfolio? Secondly, how to allocate the capital to the assets selected above. This indicates that there are 21 bi-asset portfolios in total, which are all possible portfolios. Then, we first use the minimum variance optimal strategy to forecast the weights of the component assets for each of the 21 bi-asset portfolios, and 21 minimum variance portfolios (MVPs) are obtained. This is the step of capital allocation. Second, based on some performance measures, we must execute a series of performance comparisons among 21 MVPs to find the MVP with the best performance. The component assets of this MVP are the most suitable assets to construct an optimal portfolio based on the minimum variance strategy. This is the step of asset selection. The two things mentioned above are collectively called asset allocation (see Su, 2020).

As everyone knows, risk and return are the two key factors that investors must consider in the investment process (Markowitz, 1952, 1959). Further, the high return is accompanied by high risk in all real investment cases. If we individually use the risk or return to execute the performance comparisons within 21 bi-asset portfolios. We face the problem of ‘the trade-off between return and risk’ (see Bodnar et al. 2017). That is, if the investors choose a portfolio with the largest return based on the return, they will bear the greater risk. Conversely, if they select a portfolio with the smallest risk based on the volatility, they will lose the greater return. Additionally, investors face the question of ‘the inconsistent results from different performance measures’ (see Lv et al. 2020).

The above phenomena motivate us to propose a composite asset selection approach with two hybrid performance measures to solve ‘the trade-off problem between return and risk’ and ‘the inconsistent results from different performance measures’ in the asset allocation problem. The two-hybrid performance measures are the compound ranks of return and volatility measures (RV) and coefficient of variance (CV), which consider risk and return simultaneously. Moreover, this approach can get compromising and convergent results, which past literature has never solved (Bodnar et al. 2017; Lv et al. 2020; among others).

Thus, this study uses a bivariate diagonal BEKK-generalized autoregressive conditional heteroscedasticity (GARCH) model proposed by Su (2014) to estimate the conditional variance and covariance for each of the 21 bi-asset portfolios, and the ‘BEKK’ in the BEKK-GARCH model is named after Baba et al. (1990). Subsequently, this work utilizes the four capital allocation approaches (CAAs) of Su (2020), based on the minimum variance strategy, to forecast the weights of component assets of MVP corresponding to each bi-asset portfolio. The first step of asset allocation in this study is capital allocation. This study proposes a minimum volatility criterion to assess the performance of the weights forecast of MVP for the four CAAs. This criterion, designed by the definition of the efficient frontier, can efficiently evaluate the weights forecast performance of the four CAAs of Su (2020).

According to the return and risk of 21 MVPs obtained by a CAA with the best weights forecast performance, this study utilizes a composite asset selection approach with two hybrid performance measures to assess this group of MVPs. Then, for the pre-COVID-19 and COVID-19 periods, we select an optimal portfolio among 21 bi-asset portfolios. The second step of asset allocation in this study is asset selection. Based on the above results, this study investigates the following two questions. First, for two subperiods, which capital allocation approach has the best performance of weight forecasts of MVP among the four CAAs in Su (2020)? Second, is the asset allocation performance in the pre-COVID-19 and COVID-19 periods unlike? To the best of my knowledge, this study is the first to explore the issue of asset allocation for the pre-COVID-19 and COVID-19 subperiods and examine the influence of the COVID-19 pandemic on asset allocation performance. Subsequently, we apply the following two hypotheses to examine the second question.

Hypothesis 1 (H1): For the composite asset selection approach and each of the four performance measures (the return, volatility, RV, and CV), the optimal portfolios from the two subperiods are different

Hypothesis 2 (H2): To get a better (or worse) performance in a portfolio, the assets added for the two subperiods are different.

Empirical results show that, firstly, for the pre-COVID-19 and COVID-19 periods, the weights forecast performance of MVPs for the Constant Weight during the In-sample period (CWI) approach is the best among all four CAAs. Secondly, for two subperiods, we meet two problems in the process of asset allocation: ‘the trade-off problem between return and risk’ and ‘the inconsistent results from different performance measures’. The problem of ‘the inconsistent results from different performance measures such as return and volatility’ happens in the asset allocation procedure because most assets are dispersedly located along the upper-right direction on a risk-return space. Hence, the portfolios based on the return and volatility performance measures are almost situated in the top-right and bottom-left corners of a risk-return space, and the distance between these two portfolios is very far. This results in seriously inconsistent results from the return and volatility performance measures. Thirdly, through the final performance comparison check in the two subperiods, the result that ‘the composite asset selection approach can get a convergent result in asset allocation’ is robust. Finally, regarding the composite asset selection approach and the four performance measures, the obtained optimal portfolios for the two subperiods are all different. Moreover, to get a better (or worse) performance, the assets added to the portfolio for the two subperiods are different. This implies that the asset allocation performance in the commodity, cryptocurrency, and currency markets is significantly different in the pre-COVID-19 and COVID-19 periods. From the above results, we can presume that the COVID-19 pandemic significantly impacted asset allocation performance.

The rest of this paper is organized as follows. Section “Literature review” illustrates the literature review about asset allocation. Section “Methodology” presents the specification of the bivariate BEKK-GARCH model, the theory of four CAAs in Su (2020), and their assessment methods. Section “Data's descriptive statistics and the mean equation's lag setting” reports the data and their descriptive statistics. Section “Empirical results” analyzes the empirical results of the asset allocation for the bivariate BEKK-GARCH model coupled with the minimum variance optimal strategy and further investigates the two questions proposed in this work. Section “Conclusion and discussion” draws some conclusions and gives several policy implications for fund managers and investors.

Literature review

In this section, we review the literature related to asset allocation to find the problems that past literature has never solved or needs to improve. For example, Aziz et al. (2019), Paolella et al. (2021), and Rezaei et al. (2021) utilized a group of econometric models combined with an optimal strategy to establish a group of portfolios composed of all given assets and explore which model can achieve better portfolio performance. Paolella et al. (2021) found that an orthogonal GARCH model with a multivariate generalized hyperbolic distribution obtained the best performance. Aziz et al. (2019) found that the copula-GARCH model was not better than the dynamic conditional correlation (DCC)-GARCH model. Rezaei et al. (2021) found that a model with complete ensemble empirical mode decomposition, a convolutional neural network, and long short-term memory, the most generalized model, obtained the best performance.

Lv et al. (2020) and Bessler et al. (2021) utilized one model combined with an optimal strategy to construct a group of portfolios composed of part of the given assets and explore which type of asset included can get better portfolio performance. Lv et al. (2020) found that the portfolios containing Shanghai International Energy Exchange (INE) crude oil futures performed best under volatility. Conversely, the portfolios that added Brent crude oil futures performed best under the return, Sharpe, and Treynor ratios. Bessler et al. (2021) found that the industry-based portfolio was superior to the country-based portfolios.

Bodnar et al. (2017) used several weight forecast approaches, which are based on a minimum variance strategy or equally weighted, to execute the capital allocation for a multi-asset portfolio and then explore which weight forecast approach can get better performance. They found that the equally weighted approach performed best under return but worst under volatility. Conversely, the conjugate approach performed best under volatility but worst under return. In addition, Akhtaruzzaman et al. (2021), Aziz et al. (2024), Bekiros et al. (2016), Hadhri (2021), Iglesias-Casal et al. (2020, 2025), Tsuji (2018), and Yousaf and Ali (2020) used a bivariate GARCH model combined with a CAA approach of Kroner and Ng (1998) to execute the capital allocation for a specific group of bi-asset portfolios. Then, they explore the optimal weights of gold in gold-commodities paired assets (Akhtaruzzaman et al. 2021) or S&P500 in S&P500-commodities paired assets (Bekiros et al. 2016) to get the minimum risk for this group of bi-asset portfolios.

Hence, the literature on asset allocation always uses at least one empirical model combined with at least one optimal strategy to allocate the existing capital into a given set of assets to construct a group of multi-asset portfolios. Then, they utilized several performance measures (such as return, volatility, and Sharpe ratio) to evaluate this group of portfolios to explore which econometric model (see, Aziz et al. 2019; Paolella et al. 2021; Rezaei et al. 2021), which type of optimal strategy (see, Carroll et al. 2017; Rezaei et al. 2021), which asset included (see, Akhtaruzzaman et al. 2021; Bekiros et al. 2016; Bessler et al. 2021; Hadhri, 2021; Li et al. 2021; Lv et al. 2020; Mensi et al. 2013; Ngene et al. 2018), and which weights forecast approach (Bodnar et al. 2017) can get better portfolio performance.

The optimal strategies include minimum variance (see, Akhtaruzzaman et al. 2021; Aziz et al. 2019; Bekiros et al. 2016; Bernardo and Campani, 2019; Bessler et al. 2021; Bodnar et al. 2017; Carroll et al. 2017; di Tollo and Filograsso, 2025; Hadhri, 2021; Iglesias-Casal et al. 2020; Jebabli and Roubaud, 2018; Li et al. 2025; Lv et al. 2020; Mensi et al. 2013; Ngene et al. 2018; Paolella et al. 2021; Qi, 2021; Su, 2020; Tsuji, 2018; Yousaf and Ali, 2020), mean-variance (see, Aziz et al. 2019; Bessler et al. 2021; Paolella et al. 2021; Rezaei et al. 2021), equal-weighted (see, Bessler et al. 2021; di Tollo and Filograsso, 2025; Paolella et al. 2021; Rezaei et al. 2021), maximum Sharpe ratio (see, Aziz et al. 2019), maximum Sortino ratio (see, Aziz et al. 2019), mean-CVAR (see, Aziz et al. 2019), Black-Litterman (see, Bessler et al. 2021; Rezaei et al. 2021), and minimum expected shortfall (see, Paolella et al. 2021).

To summarize, we found the following drawbacks from the above literature review. Firstly, most literature forecasted the weights of component assets of a portfolio composed of a given set of assets, but did not execute the performance comparison of all possible portfolios constructed by the above set of assets to find suitable component assets. That is, they almost focused on capital allocation but omitted the question of asset selection (see Aziz et al. 2019; Paolella et al. 2021; Rezaei et al. 2021; Bodnar et al. 2017; Akhtaruzzaman et al. 2021; Bekiros et al. 2016; Hadhri, 2021; among others). The consequence of omitting the asset selection problem is that we may not get an optimal portfolio because the assets within this given set of assets may not be the best assets to establish the optimal portfolio. Secondly, most researchers always individually used the return, volatility, and Sharpe ratios to assess the performance of a group of portfolios. However, they ignore the inconsistent results obtained from the different performance measures that appeared in Bodnar et al. (2017) and Lv et al. (2020). The consequence of ignoring the inconsistent results from different performance measures, such as return and volatility, is that we cannot get a compromise portfolio in performance and may get an extreme portfolio situated in the top-right or bottom-left corner of a risk-return space. Thirdly, most literature always used the weight forecast approach of Kroner and Ng (1998) to predict the weights of the component assets in a bi-asset portfolio based on a minimum variance strategy (Akhtaruzzaman et al. 2021; Bekiros et al. 2016; among others). The consequence of always using the weight forecast approach of Kroner and Ng (1998) to predict the weights of the component assets in an MVP is that we may give up on finding another capital allocation approach having a better weight forecasting performance than the CAA of Kroner and Ng (1998).

To fill the gap in the literature discussed above, we apply the four CAAs of Su (2020), the more extensive capital allocation approaches than that of Kroner and Ng (1998), to forecast the weights of component assets of MVP, and to allocate the existing capital into component assets of a portfolio under the minimum variance optimal strategy. A minimum volatility criterion is proposed to assess the weight forecast performance of MVP for the four CAAs and to investigate whether there exists another capital allocation approach having a better weight forecasting performance than the CAA of Kroner and Ng (1998), which usually appears in the literature. This is the step of capital allocation. Subsequently, to solve ‘the trade-off problem between return and risk’ and ‘the inconsistent results from different performance measures’ usually appearing in the problem of asset allocation (see, Bodnar et al. 2017; Lv et al. 2020), this work proposes a composite asset selection approach with two hybrid performance measures to execute the asset selection within a group of minimum variance portfolios to get a compromise portfolio in performance during the pre-COVID-19 and COVID-19 periods. This is the step of asset selection. To sum up, this study gives a comprehensive illustration of the implementation of the process of asset allocation, including capital allocation and asset selection.

Methodology

In this section, to estimate the conditional variance and covariance for each of the 21 paired data sets, this work first illustrates the specification of a bivariate diagonal BEKK-GARCH model of Su (2014) (hereafter, the B-GARCH model). This variance-covariance specification of this B-GARCH model satisfies the positive-definite matrix condition and owns the parsimonious parameter estimates (see Su, 2014). Thus, it is easy to interpret the parameters estimated compared to the BEKK model proposed by Engle and Kroner (1995).

Subsequently, this work utilizes the theory of the four CAAs of Su (2020), which is based on the minimum variance strategy, to forecast the weights of component assets of MVP for each of the 21 bi-asset portfolios. The minimum variance optimal strategy of the four CAAs has the following two advantages. First, compared to the other optimal strategy, it is easier to implement (see Qi, 2021). Second, it can find the nose of the efficient frontier, the minimum variance portfolio (MVP) (see Su, 2020). Hence, the minimum variance optimal strategy is popularly used in the literature (see, Akhtaruzzaman et al. 2021; Aziz et al. 2019; Bekiros et al. 2016, among others). Then, we depict the minimum volatility criterion to assess the weights forecast performance of the four CAAs and a composite asset selection approach with two hybrid performance measures to solve the two problems: ‘the trade-off between return and risk’ and ‘the inconsistent results found from the two different performance measures’ in the asset allocation.

The bivariate econometric model to construct the bi-asset portfolio

In this section, we use the B-GARCH model to construct the return and variance of a bi-asset portfolio. The B-GARCH model is composed of a two-dimensional mean equation (\({{\bf{r}}}_{{\bf{t}}}\)) and a variance–covariance equation (\({{\bf{H}}}_{{\bf{t}}}\)) combined with the normal distribution. Based on the Akaike information criterion (AIC), the mean equation, \({{\bf{r}}}_{{\bf{t}}}\), is shown in the form of a bivariate vector autoregressive with lag one period (hereafter, VAR (1)), and it is expressed below.

where \({{\bf{r}}}_{{\bf{t}}}={\left({{r}}_{1,{t}},{{r}}_{2,{t}}\right)}^{{\prime} }\) is a column vector of log returns \({{r}}_{{i},{t}}=\left(\mathrm{ln}{{P}}_{{i},{t}}-\mathrm{ln}{{P}}_{{i},{t}-1}\right)\times 100\) for \({i}=1,2\). \({{P}}_{{i},{t}}\) and \({{r}}_{{i},{t}}\), respectively, are the closing price and its return of the \({{i}}{{th}}\) component asset of a bi-asset portfolio at time t. ‘\({{\upphi}}_{10},{{\upphi}}_{11},\,{\rm{and}}\,{{\upphi}}_{12}\)’ and ‘\({{\upphi}}_{20},{{\upphi}}_{21},\,{\rm{and}}\,{{\upphi}}_{22}\)’ are the parameters of the mean equations \({{r}}_{1,{t}}\) and \({{r}}_{2,{t}}\), respectively. \({{\boldsymbol{\varepsilon }}}_{{t}}={\left({{\varepsilon }}_{1,{t}},{{\varepsilon }}_{2,{t}}\right)}^{{\prime} }\) is a column vector of error terms and its conditional distribution is assumed to follow the bivariate normal distribution with \({\rm{E}}\left({{\boldsymbol{\varepsilon }}}_{{\bf{t}}}\right)={\bf{0}}\) and \({\rm{E}}\left({{\boldsymbol{\varepsilon }}}_{{\bf{t}}}{{\boldsymbol{\varepsilon }}}_{{\bf{t}}}^{{\boldsymbol{{\prime} }}}\right)={{\bf{H}}}_{{\bf{t}}}\). That is, \({{\boldsymbol{\varepsilon }}}_{{\bf{t}}}\left|{{\mathbf{\Omega }}}_{{\bf{t}}-{\bf{1}}} \sim {\rm{N}}\left({\bf{0}},{{\bf{H}}}_{{\bf{t}}}\right)\right.\) or the variance of the error term of the VAR model (\({{\bf{H}}}_{{\bf{t}}}\)) is not a constant, varies with time, and follows a bivariate diagonal BEKK-GARCH (1,1) specification shown below.

Subsequently, the variance–covariance equation, \({{\bf{H}}}_{{\bf{t}}}\), is shown in the form of a bivariate diagonal BEKK-GARCH(1,1) model, and it is listed as follows:

where vech (\({{\bf{H}}}_{{\bf{t}}}\)) denotes the vech operator that stacks the ‘upper triangular’ portion of a two-dimensional matrix \({{\bf{H}}}_{{\bf{t}}}\) into a vector with a single column. \({{h}}_{11,{t}}\) and \({{h}}_{22,{t}}\) are the variances of the first and second component assets of a bi-asset portfolio at time t, respectively. ‘\({{\omega }}_{1},\,{{\alpha }}_{1},{\rm{and}}\,{{\beta }}_{1}\)’ and ‘\({{\omega }}_{2},\,{{\alpha }}_{2},{\rm{and}}\,{{\beta }}_{2}\)’ are the parameters of the variance equations \({{h}}_{11,{t}}\) and \({{h}}_{22,{t}}\), respectively. \({{\rm{h}}}_{12,{\rm{t}}}\) denotes the covariance between two assets’ returns at time t mentioned above. \({{\omega }}_{12},\,{{\alpha }}_{12},{\rm{and}}\,{{\beta }}_{12}\) are the parameters of the covariance equation. Additionally, via the maximum likelihood (ML) optimizing procedure, the parameters in this bivariate GARCH model are estimated by the following bivariate log-likelihood function with normal density.

where \({\mathbf{\Psi }}=[{{\upphi}}_{10},{{\upphi}}_{11},\,{{\upphi}}_{12},\,{{\upphi}}_{20},{{\upphi }}_{21},{{\upphi}}_{22},{{\omega }}_{1},{{\alpha }}_{1},{{\beta }}_{1},{{\omega }}_{12}{,{\alpha }}_{12},\,{{\beta }}_{12},{{\omega }}_{2},{{\alpha }}_{2},{{\beta }}_{2}]\) is the vector of parameters of this model. \({\Omega }_{{t}-1}\) represents the information set of all observed returns up to time \({t}-1\) and \({f}\left(\cdot \right)\) represents the bivariate normal density. In addition, n is the sample size in the estimation period. \({{\bf{r}}}_{{\bf{t}}}\), \({{\bf{H}}}_{{\bf{t}}},\) and \({{\boldsymbol{\varepsilon }}}_{{\rm{t}}}\) are shown in Eqs. (1)–(6).

Finally, the return and variance of a bi-asset portfolio at time t, \({{r}}_{{\rm{P}},{t}}\) and \({{h}}_{{\rm{P}},{t}}\), are calculated by the following equations:

where \({\bf{w}}={\left({{w}}_{1},{{w}}_{2}\right)}^{{\prime} }\) is a column vector of weights of the first and second component assets of a bi-asset portfolio, \({{w}}_{1}\) and \({{w}}_{2}\). \({{\bf{r}}}_{{\bf{t}}},{{\bf{H}}}_{{\bf{t}}},{{r}}_{1,{t}},{{r}}_{2,{t}},{{h}}_{11,{t}},{{h}}_{22,{t}},{\rm{and}}\,{{h}}_{12,{t}}\) are described as in Eqs. (1)–(6).

The theory of capital allocation approaches based on the minimum variance strategy

In this section, we utilize the four CAAs of Su (2020) to forecast the weights of component assets of MVP for each of the 21 bi-asset portfolios. Then, we allocate the capital to each component asset of a portfolio according to the weights obtained above. This is the first step of asset allocation in this study, capital allocation based on the minimum variance strategy. Through this step, we can get 21 MVPs corresponding to the above 21 bi-asset portfolios, which are all possible portfolios set in this study. The four CAAs have the same weight constraints \({{w}}_{1}+{{w}}_{2}=1\) and \(-0.4\le {{w}}_{1},\,{{w}}_{2}\le 1.4\). The first CAA is called the constant weight (CW) approach because, during the entire in-sample period, the weight of each component asset of a bi-asset portfolio is constant. In addition, the size of the weight increment for both \({{w}}_{1}\) and \({{w}}_{2}\) is set to 0.1, indicating that we can get 19 weight combinations \(({{w}}_{1},{{w}}_{2})\) and further obtain 19 weighted portfolios via Eqs. (8)–(9). In a specified bi-asset portfolio, the weight forecasts of the MVP are the weight combination of a portfolio with the smallest value of volatility among the 19 weighted portfolios. Because the MVP is the leftmost portfolio among all possible weighted portfolios on a two-dimensional risk-return space.

The other three CAAs use the mathematical programming technique to calculate the weights of MVP. For example, as shown in the following CAA, we substitute a weight constraint such as \({{w}}_{2,{t}}=1-{{w}}_{1,{t}}\) into the objective function related to \({{h}}_{{\rm{P}},{t}}\) and solve a partial derivatives equation of this objective function, such as \(\partial {{h}}_{{\rm{p}},{t}}/\partial {{w}}_{1,{t}}=0\). The second CAA is called the Dynamic Weight approach during the In-sample period (DWI) because, for the entire in-sample period, the weight of each component asset of a bi-asset portfolio, \({{w}}_{1,{t}}\) or \({{w}}_{2,{t}}\), changes with time. Therefore, \({{w}}_{1,{t}}\) and \({{w}}_{2,{t}}\) are calculated by minimizing an objective function: the portfolio’s variance at any time t (\({{h}}_{{\rm{P}},{t}}\)).

Therefore, the weight forecasts of the MVP for the DWI approach are the last observations in the two in-sample weight forecast series (\({{\rm{w}}}_{1,{\rm{t}}}\) and \({{w}}_{2,{t}}\)) and they are expressed as follows:

where \({{w}}_{1}^{{\rm{MVP}}}\) and \({{w}}_{2}^{{\rm{MVP}}}\) are the first and second component assets’ weights forecasts in the MVP, respectively. n is the size of the in-sample period, which is set to 1441 in this study. \({{w}}_{1,{n}}\,{\rm{and}}\,{{w}}_{2,{n}}\) are the last observations of the in-sample weight forecast series of the first and second component assets of MVP, respectively. \({{h}}_{11,{n}},{{h}}_{22,{n}},{\rm{and}}\,{{h}}_{12,{n}}\), respectively, are the last observations of the two variances’ forecast series and their corresponding covariance forecast series during the in-sample period.

The third CAA is called the mean of dynamic weight approach during the In-sample period (MDWI) because the weight forecasts of the MVP are the mean of the two in-sample weight forecast series obtained by the DWI approach. Hence, they are expressed as follows:

where \({{w}}_{1}^{{\rm{MVP}}},\,{{w}}_{2}^{{\rm{MVP}}},{n},\,{{h}}_{11,{t}},{{h}}_{22,{t}},\,{\rm{and}}\,{{h}}_{12,{t}}\) are defined above. Notably, the formulas for the weight forecasts of MVP obtained from the DWI and MDWI approaches are similar to those obtained from Kroner and Ng (1998).

The fourth CAA is called the Constant Weight approach during the In-sample period (CWI) because, for the entire in-sample period, the weight of each component asset of a bi-asset portfolio, \({{w}}_{1}\) or \({{w}}_{2}\), is set to a constant. Therefore, \({{w}}_{1}\) and \({{w}}_{2}\) are determined by minimizing an objective function: the total portfolio’s variance for the entire in-sample period (\(\mathop{\sum}\limits_{{t}=1}^{{n}}{{h}}_{{\rm{P}},{t}}\)).

Therefore, the weight forecasts of the MVP for the CWI approach are shown as follows:

where \({{w}}_{1}^{{\rm{MVP}}},\,{{w}}_{2}^{{\rm{MVP}}},{n},\,{{h}}_{11,{t}},{{h}}_{22,{t}},\,{\rm{and}}\,{{h}}_{12,{t}}\) are defined above.

To sum up, the purpose of the four CAAs (CW, DWI, MDWI, and CWI) in this study is to determine the weight forecasts of the MVP for each of the 21 bi-asset portfolios. Notably, the MVP is the leftmost portfolio among all possible weighted portfolios on a two-dimensional risk-return space. Thus, this study proposes a minimum volatility criterion to assess the weight forecast performance of MVPs for four CAAs. That is, if a specific CAA has the best weight forecast performance on MVP, then the value of the variance of MVP predicted by this CAA is the smallest among those predicted by the four CAAs.

The principle of asset selection based on a composite asset selection approach

In this section, we develop a composite asset selection approach with two hybrid performance measures to assess the performance of a group of minimum variance portfolios (MVPs), such as 21 MVPs in this study. Then, we choose the optimal MVP within this group of MVPs. The component assets of this MVP are the optimal assets in the given set of assets to satisfy the condition of the minimum variance. This is the second step of asset allocation in this study: asset selection. The process of asset selection based on the composite asset selection approach is divided into four steps and is depicted in Fig. 1.

Step 1: The asset selection is based on two basic performance measures: return and volatility. In this step, we give a rank order Rr for each MVP within a group of MVPs according to the ranking rule of the values of \({{r}}_{{\rm{P}}}\) (portfolio return) from the greatest to the smallest for this group of MVPs. Conversely, we give a rank order Rv for each MVP within a group of MVPs according to the ranking rule of the values of \({{\sigma }}_{{\rm{P}}}\) (portfolio volatility) from the smallest to the greatest for this group of MVPs. The optimal portfolio based on the return (volatility) is a portfolio with \({{R}}_{{\rm{r}}}=1\) (\({{R}}_{{\rm{v}}}=1\)).

Step 2: The asset selection is based on two hybrid performance measures: RV and CV. The hybrid performance measures are used to solve ‘the trade-off problem between return and risk’ in the asset allocation problem. The first hybrid performance measure is called the compound ranks of Return and Volatility measures (hereafter, the RV). The value of RV is the summation of the two rank orders based on return and volatility, Rr and Rv. The core concept of this measure, RV, is that the greater a portfolio’s return or the lower a portfolio’s risk, the smaller the value of Rr and Rv of this portfolio. This further indicates that the smaller the value of RV on a portfolio and the better the performance of this portfolio. The second hybrid performance measure is the coefficient of variance (hereafter, the CV), defined as the ratio of the volatility to the return for a portfolio (i.e., the risk per unit return). Hence, it is also another hybrid performance measure because it simultaneously considers the volatility and return when the performance of a portfolio is assessed. The lower a portfolio’s CV, the better the performance of this portfolio. Hence, we give a rank order Rk1 (Rk2) for each MVP within a group of MVPs according to the ranking rule of the values of the portfolio’s RV (CV) from the smallest to the greatest for this group of MVPs. Thus, the smaller the rank order of a portfolio, Rk1 or Rk2, the better the performance of this portfolio. The optimal portfolio based on the RV (CV) is a portfolio with \({{\rm{Rk}}}_{1}=1\) (\({{\rm{Rk}}}_{2}=1\)).

Step 3: The asset selection is based on a composite asset selection approach. The composite asset selection approach is built to solve the inconsistent results obtained from the two different measures in the asset allocation problem. Regardless of using the first or the second hybrid performance measure, the smaller the rank order of a portfolio, the better the performance of this portfolio. This indicates that the smaller the ‘sum’ (s) or ‘difference’ (d) of the two rank-order numbers Rk1 and Rk2 of a portfolio, the better the performance of this portfolio, where \({s}={{\rm{Rk}}}_{1}+{{\rm{Rk}}}_{2}\) and \({d}=\left|{{\rm{Rk}}}_{1}-{{\rm{Rk}}}_{2}\right|\). The above rules can further infer that the smaller the value of the summation of the above ‘difference’ and ‘sum’ of a portfolio, SUM, owns, the better the performance this portfolio has. Notably, \({\rm{SUM}}={d}+{s}\). Hence, among a group of portfolios, I give a rank order for each portfolio, Rk3, according to the values of the portfolio’s SUM from the smallest to the greatest. The optimal portfolio obtained from this approach is a portfolio with \({{\rm{Rk}}}_{3}=1\).

Step 4: The asset selection is based on the final performance comparison check. In this step, if the optimal portfolio obtained from this check, a portfolio with \({\rm{RK}}=1\), is consistent with the optimal portfolio based on the composite asset selection approach, a portfolio with \({{\rm{Rk}}}_{3}=1\), then the result obtained from the composite asset selection approach is convergent. Notably, RK denotes, among a group of portfolios, the rank order according to the value of ‘the summation of three rank orders (Rk1, Rk2, and Rk3)’ from the smallest to the greatest.

Data’s descriptive statistics and the mean equation’s lag setting

The seven assets in this study include the gold and West Texas Intermediate (WTI) crude oil in the commodity market; the euro (USEU) and Chinese yuan (CHUS) in the currency market; and Bitcoin, Ethereum, and Litecoin in the cryptocurrency market. The daily close price data of seven assets covers the period from August 12, 2015, to July 30, 2021, obtained from the Yahoo Finance website. According to the World Health Organization (WHO), the COVID-19 pandemic occurred on March 11, 2020. Hence, the study period is partitioned into the pre-COVID-19 and COVID-19 periods because this extreme event, the COVID-19 pandemic, may make a structural break in the above markets.

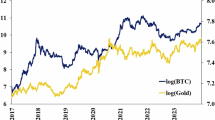

Table 1 lists basic descriptive statistics of the daily return of seven assets during the pre-COVID-19 period (see panel A) and the COVID-19 period (see panel B). As reported in the data in the columns ‘Mean’, ‘SD’, and ‘CV’ in Table 1, we find the following phenomena. Regardless of the pre-COVID-19 or the COVID-19 period, Ethereum owns the largest mean return and the greatest standard deviation, but the euro has the smallest mean return and the lowest standard deviation. This indicates that we can’t compare the performance of assets by using the return and standard deviation representing the risk. However, the coefficient of variation (CV) may solve the above question from the view of risk per unit return. Thus, we find the following phenomena based on the CV. Bitcoin and WTI had the best and worst performance during the pre-COVID-19 period, respectively. However, Ethereum and CHUS had the best and worst performance during the COVID-19 period, respectively. Hence, we can presume that, owing to this pandemic, a structural break occurred in the return series of the seven assets of this study. The reason is that, among seven assets, the asset owning the best (worst) performance is different for the pre-COVID-19 and COVID-19 periods.

The other descriptive statistics have the same features as those for most financial return series. For instance, the return series isn’t normally distributed because the distribution of returns is left- or right-skewed and has a larger and thicker tail than the normal distribution. The above results are shown by the coefficient of skewness, excess kurtosis, and the J–B normality test statistics (Jarque and Bera, 1987). Additionally, as reported by the Ljung-Box \({{Q}}^{2}(24)\) statistics for the squared returns, the return series exhibits linear dependence and a strong AutoRegressive Conditional Heteroscedasticity (ARCH) effect. The results found above are consistent with those found by Su and Hung (2011). The above findings indicate that the GARCH family models are favorable to capture the features of ‘the fat tails and time-varying volatility’ found before. Figure 2 illustrates the trend of price levels and the variation of returns for seven assets during the study period. From Fig. 2, I find that near the date of the COVID-19 pandemic, the price of assets underwent a severe decline and then a rapid rise. Moreover, its return also exhibited a significant variation, especially for the WTI. This indicates that this pandemic may produce a structural break in the return series of the above assets.

Owing to the length of the lag in VAR in Eqs. (1) and (2) in the section “The bivariate econometric model to construct the bi-asset portfolio” being sensitive to the estimation results, this study follows the Su (2016) to use the Akaike information criterion (AIC) and Schwarz’s Bayesian Criterion (SBC) to determine the optimal lag in the VAR type of mean equation of the B-GARCH model in this study. Table 2 lists the AIC and SBC values of alternative lags for 21 paired data sets. In column ‘SUM’ at the last panel in Table 2, I find that based on AIC, the optimal lag number is one. The reason is that 8 is the greatest value of the total number of paired data that owns the maximum AIC value in absolute value among lags 1–6. This number appears in lag 1. On the other hand, the optimal lag number is two for SBC since the total number of pairs of data that own the maximum SBC value in absolute value among lags 1–6, equals 21 for lag 2. Moreover, 21 is the greatest among all numbers in the same column. Hence, based on the AIC, we set the lag number in this study’s VAR type of mean equation as 1.

Empirical results

In this section, we first use the minimum volatility criterion to assess the weight forecast performance of the MVP of the four CAAs. According to the volatility and return of MVPs obtained by a CAA with the best weight forecasts performance, a composite asset selection approach with two hybrid performance measures is used to select an optimal portfolio among 21 bi-asset portfolios for two subperiods. Based on the above results, we discuss two questions addressed in this study.

The implementation of asset allocation for the pre-COVID-19 period

The selection of capital allocation approaches based on the minimum variance strategy

Table 3 lists the weight forecast, return, and volatility of MVPs of 21 bi-asset portfolios obtained by the four CAAs during the pre-COVID-19 period. In Table 3, we find that the ‘\({{w}}_{1}=0.1\)’ is the weighted forecast of the first component asset (WTI) of MVP of the WTI-gold (wt-go) portfolio for the CW approach. The reason is that the volatility corresponding to this weight (0.8152) is the smallest among the 19 weighted portfolios’ volatilities. Subsequently, we use the minimum volatility criterion to assess the weight forecast performance of the MVP of the four CAAs. In Table 3, the volatility of MVP obtained from the CWI approach is the smallest for all cases when the values of the volatility of MVPs for the four CAAs are compared. This indicates that the CWI approach has the best weight forecast performance of MVP among the four CAAs during the pre-COVID-19 period.

Then, for each bi-asset portfolio like the WTI-gold, we can get one similarly parabolic line in a risk-return space of Fig. 3a using the data of 19 weighted portfolios obtained from the CW approach. Notably, the upper part of this parabolic line in Fig. 3a represents the efficient frontier of the WTI-gold bi-asset portfolio. Hence, Fig. 3 shows, during the pre-COVID-19 period, 21 parabolic lines correspond to the 21 bi-asset portfolios. In Fig. 3, we find that the MVP predicted by the CWI approach is near the nose of the efficient frontier for all cases.

a WTI-Gold, b WTI-CHUS, c WTI-USEU, d WTI-Bitcoin, e WTI-Ethereum, f WTI-Litecoin, g Gold-CHUS, h Gold-USEU, i Gold-Bitcoin, j Gold-Ethereum, k Gold-Litecoin, l CHUS-USEU, m CHUS-Bitcoin, n CHUS-Ethereum, o CHUS-Litecoin, p USEU-Bitcoin, q USEU-Ethereum, r USEU-Litecoin, s Bitcoin-Ethereum, t Bitcoin-Litecoin, and u Ethereum-Litecoin.

The asset selection based on a composite asset selection approach

Subsequently, we summarize the information of MVPs of 21 bi-asset portfolios obtained by the CWI approach in Table 3 into the left-hand side of Table 4 to select the optimal portfolio by using a composite asset selection approach with two hybrid performance measures. The obtained results are listed on the right-hand side of Table 4. To clearly illustrate the process of selecting an optimal portfolio based on the return and volatility of MVPs during the pre-COVID-19 period, the 21 MVPs corresponding to the 21 bi-asset portfolios are plotted in a risk-return space in Fig. 4a. In Fig. 4a, six bi-asset portfolios (ch-bi, ch-et, ch-li, bi-et, bi-li, and et-li) are located on the upper-right side of this figure. Conversely, the other 15 bi-asset portfolios are closely located in a small region with a value of ‘\({{\sigma }}_{{\rm{P}}}\)’ <2.5 and a value of ‘\({{r}}_{{\rm{P}}}\)’ <0.06. Moreover, this small region is located on the bottom-left side of Fig. 4a. Hence, it is hard to differentiate them. Then, in Fig. 4b, we enlarge the above small region.

a All 21 bi-asset portfolios. b The enlarged part of the bottom left of (a). 1. wt, go, ch, eu, bi, et, and li denote the abbreviations of WTI, gold, CHUS, USEU, Bitcoin, Ethereum, and Litecoin, respectively. 2. The number inside the parentheses ‘[)’ or ‘[]’ beside a bi-asset portfolio denotes the rank orders of performance comparison within 21 portfolios based on the composite asset selection approach. On the other hand, the symbols ‘R’, ‘V’, ‘RV’, and ‘CV’ beside the abovementioned number denote that this portfolio is also the optimal portfolio based on the return, volatility, RV, and CV measures, respectively. 3. Figure (b) is the enlarged part of the bottom left of Figure (a).

Then, we follow the asset selection procedure in Fig. 1 and utilize the data of the rank orders in columns Rv, Rr, Rk1, Rk2, Rk3, and RK in Table 4 to execute the performance comparison of 21 MVPs corresponding to 21 bi-asset portfolios based on the volatility, return, RV, CV, composite asset selection approach, and a final performance comparison check. The results of the asset selection procedure are summarized in Fig. 5. In Fig. 5, we follow the four steps in Fig. 1 to illustrate the results of each step during the asset selection process.

Step 1: The asset selection is based on basic performance measures: return and volatility. From the rank order in columns ‘\({{\sigma }}_{{\rm{P}}}\)’ and ‘\({{r}}_{{\rm{P}}}\)’ in Table 4, we find that the optimal portfolios based on volatility and return, respectively, are the gold-euro (go-eu) and bitcoin-ethereum (bi-et) because \({{R}}_{{\rm{v}}}=1\) for go-eu and \({{R}}_{{\rm{r}}}=1\) for bi-et. Notably, the go-eu and bi-et are, respectively, the leftmost and uppermost portfolios in Fig. 4a. This indicates that investors face a trade-off problem between return and risk. That is, if investors choose the bi-et portfolio with the largest return, then they will bear the greater risk. Conversely, if investors select the go-eu portfolio with the smallest risk, then they will lose the greater return. The above phenomena are also found in Bodnar et al. (2017). Bodnar et al. (2017) found that the portfolio obtained from the equally weighted approach performed best under return but worst under volatility. Conversely, the portfolio obtained from the conjugate approach performed best under volatility but worst under return. Thus, in the next step, we utilize two hybrid performance measures, RV and CV, to solve the trade-off question between return and risk.

Step 2: The asset selection is based on hybrid performance measures: RV and CV. From the rank orders in column ‘Rk1’ in Table 4, we find that the optimal portfolios based on the RV measure are gold-Chinese yuan (go-ch), gold-euro (go-eu), and gold-bitcoin (go-bi) because \({{\rm{Rk}}}_{1}=1\) for these portfolios. Notably, these three portfolios are located in the bottom-left corner of Fig. 4. Moreover, from the rank orders in column ‘Rk2’ in Table 4, we find that the optimal portfolio based on the CV measure is the Chinese yuan-bitcoin (ch-bi) because \({{\rm{Rk}}}_{2}=1\) for this portfolio. Notably, as shown in Fig. 4a, the ch-bi is located on a line with the steepest slope among all 21 lines, which are connected by the origin and 21 points corresponding to 21 MVPs in this system. The above results indicate that the optimal portfolios obtained from the first and second hybrid performance measures are unlike, which is similar to the phenomenon found by Lv et al. (2020). Lv et al. (2020) found that the portfolios containing INE crude oil futures performed best under volatility. Conversely, the portfolios that added Brent crude oil futures performed best in the return, Sharpe ratio, and Treynor ratio. Thus, in the next step, we develop a composite asset selection approach to solve the question of the inconsistent results from these two performance measures.

Step 3: The asset selection is based on a composite asset selection approach. From the rank orders in column ‘Rk3’ in Table 4, we find that the optimal portfolios obtained from the composite asset selection approach are Chinese yuan-ethereum (ch-et) and bitcoin-ethereum (bi-et) because \({{\rm{Rk}}}_{3}=1\) for these portfolios. These results are unlike those obtained from the first and second hybrid performance measures. Thus, we aren’t sure these results are credible. Hence, in the next step, we utilize a final performance comparison check to examine whether the results obtained from this approach are convergent.

Step 4: The asset selection is based on the final performance comparison check. From the rank orders in column ‘RK’ in Table 4, we find that the optimal portfolio obtained from this check is ch-et because \({\rm{RK}}=1\) for this portfolio. This result ‘ch-et’ is consistent with the optimal portfolio based on the composite asset selection approach, indicating that we can get a convergent result through the composite asset selection approach. Hence, the optimal portfolio for the composite asset selection approach is the Chinese yuan-ethereum. Moreover, the weights in the Chinese yuan and Ethereum are equal to 64.28% and 35.72%, respectively.

To sum up, the above inconsistent results from different performance measures, such as return and volatility, are similar to those found in the selection of an econometric model (Aziz et al. 2019; Paolella et al. 2021), asset (Lv et al. 2020; Ngene et al. 2018), and capital allocation approach (Bodnar et al. 2017) in the asset allocation procedure. In the problem of econometric model selection, Aziz et al. (2019) found that, within 26 models, the multivariate Asymmetric Dynamic Conditional Correlation with the Normal (aDCC-MVT) model got the best performance based on the return and Sharpe ratio, whereas the vector autoregressive and generalized orthogonal GARCH with normal (VAR-GG-MVN) model based on the risk. Paolella et al. (2021) found that equal-weighted, CCC-GARCH with asymmetric normal inverse Gaussian distribution (NIG-CCC), and CCC-GARCH with symmetric Student-t distribution (Mt-CCC) models get the best performance based on the return, volatility, and Sharpe ratio, respectively. In the problem of asset selection, Ngene et al. (2018) found that the portfolio including the Mauritius stock market gets the best performance based on the return, whereas containing Tunisia owns the best performance based on the volatility.

Notably, the reason for the inconsistent results from different performance measures, such as return and risk, happening in the asset allocation procedure is that most assets are dispersedly along the upper-right direction on a risk-return space, as shown in Fig. 4. Owing to the above fact, the portfolios based on the return and volatility performance measures are situated in the top-right and bottom-left corners of a risk-return space. Thus, the distance between these two optimal portfolios is very far in this risk-return space. This results in seriously inconsistent results from the return and volatility performance measures. This also indicates that high return is always accompanied by high risk.

In addition, the results for the pre-COVID-19 period will be used to test Hypothesis 1 in the second question of this study. Additionally, Fig. 4 also depicts the distribution of 21 portfolios, including the top 3 portfolios in performance obtained by the composite asset selection approach: ch-et [1], bi-et [1; R), ch-bi [2; CV), go-bi [3; RV), and Chinese yuan-Litecoin (ch-li) [3]. Notably, the ch-et, bi-et, ch-bi, and ch-li are located at the upper-right side of Fig. 4, whereas the go-bi is at the bottom-left corner. Moreover, the bi-et and ch-bi are also the optimal portfolios based on the return and CV measures, respectively. However, the go-bi is also the optimal portfolio based on the RV measure.

Finally, I explored, for the pre-COVID-19 sub-period, which assets to be included in a portfolio can get a better (or worse) performance. As shown by the rank orders in column ‘Rk3’ in Table 4, the first two best-performing portfolios are ch-et [1] and bi-et [1], whereas the last two worst-performing portfolios are wt-li [16] and wt-eu [17]. Notably, the Ethereum and WTI assets simultaneously appear twice in the first two best-performance portfolios and the last two worst-performance portfolios, respectively. This result indicates that, during the pre-COVID-19 period, adding Ethereum and WTI to a portfolio can get better and worse portfolio performance, respectively. The above results for the pre-COVID-19 period will be used to test Hypothesis 2 in the second question of this study.

The implementation of asset allocation for the COVID-19 period

The selection of capital allocation approaches based on the minimum variance strategy

In this section, we follow the asset selection procedure in Fig. 1 and imitate the process of the implementation of asset allocation in the previous subsection to execute the performance comparison of 21 MVPs based on the return, volatility, RV, and CV measures, as well as a composite asset selection approach. The obtained results are compared with those for the pre-COVID-19 period to examine the impact of the COVID-19 pandemic on asset allocation performance. Firstly, we use the data in Table 5 to explore, during the COVID-19 period, which capital allocation approach has the best weight forecast performance of MVP among the four CAAs. Table 5 lists, during the COVID-19 period, the results of weight forecasts of MVPs of 21 bi-asset portfolios obtained by four CAAs. In Table 5, the volatility of MVP obtained from the CWI approach is the smallest for all cases when the values of the volatility of MVPs for the four CAA are compared. This indicates that, during the COVID-19 period, the CWI approach had the best weight forecast performance on MVP among the four CAAs according to the minimum volatility criterion. The above result is consistent with that found in the pre-COVID-19 period, implying that the COVID-19 pandemic cannot influence the weight forecast performance of MVP for the CWI approach. Further, the CWI approach proposed by Su (2020) has a better MVP weight forecast performance than the MDWI approach of Kroner and Ng (1998), which is popularly used in the literature on capital allocation.

The asset selection based on a composite asset selection approach

Subsequently, we summarize the information of MVPs of 21 bi-asset portfolios obtained by the CWI approach in Table 5 into the left-hand side of Table 6 to select the optimal portfolio by using a composite asset selection approach with two hybrid performance measures. The obtained results are listed on the right-hand side of Table 6. As reported in the rank orders in columns Rv, Rr, Rk1, Rk2, Rk3, and RK in Table 6, we get the optimal portfolios based on the volatility, return, RV, CV, composite asset selection approach, and a final performance comparison check. The obtained results are summarized in Fig. 6. Moreover, the 21 MVPs corresponding to the 21 bi-asset portfolios are plotted in a risk-return space in Fig. 7 to aid the illustration of the asset selection process. In Fig. 6, we follow the four steps in Fig. 1 to illustrate the results of each step during the asset selection process.

a All 21 bi-asset portfolios. b The enlarged part of the bottom left of (a). 1. wt, go, ch, eu, bi, et, and li denote the abbreviations of WTI, gold, CHUS, USEU, Bitcoin, Ethereum, and Litecoin, respectively. 2. The number inside the parentheses ‘[)’ or ‘[]’ beside a bi-asset portfolio denotes the rank orders of performance comparison within 21 portfolios based on the composite asset selection approach. On the other hand, the symbols ‘R’, ‘V’, ‘RV’, and ‘CV’ beside the abovementioned number denote that this portfolio is also the optimal portfolio based on the return, volatility, RV, and CV measures, respectively. 3. Figure (b) is the enlarged part of the bottom left of Figure (a).

Step 1: The asset selection is based on basic performance measures: return and volatility. We find that the wt-eu and wt-et are the optimal portfolios based on the volatility and return performance measures, respectively. These results are unlike those found in the pre-COVID-19 period, such as the go-eu and the bi-et for the volatility and return performance measures, respectively. The wt-eu and wt-et are located on the bottom-left and upper-right sides of Fig. 7, respectively. That is, investors also must face the trade-off problem between return and risk found in the previous subsection. Thus, in step 2, we utilize two hybrid performance measures, RV and CV, to solve the trade-off question between return and risk.

Step 2: The asset selection is based on hybrid performance measures: RV and CV. We find that the eu-bi and wt-et are the optimal portfolios based on the RV and CV measures, respectively. These results are different from the results, the go-ch, go-eu, and go-bi for the RV measure and the ch-bi for the CV measure, found in the pre-COVID-19 period. Moreover, the eu-bi for the RV measure and the wt-et for the CV measure aren’t the same. That is, we again meet the question of the inconsistent results obtained from different performance measures that appeared in the pre-COVID-19 period. Thus, in step 3, we utilize a composite asset selection approach to solve the above inconsistent results and obtain the compromise result.

Step 3: The asset selection is based on a composite asset selection approach. We find that the wt-et is the optimal portfolio based on this approach. This result is different from the results found in the pre-COVID-19 period, the ch-et and bi-et. Notably, the wt-et is also the optimal portfolio based on the return and the CV measures. However, we aren’t sure this result is credible. Hence, in step 4, we utilize the final performance comparison check to examine whether the result obtained from this approach is convergent.

Step 4: The asset selection is based on the final performance comparison check. We find that the wt-et is the optimal portfolio based on the final performance comparison check. This result is consistent with the optimal portfolio based on the composite asset selection approach. These results indicate that we can get a convergent result through the composite asset selection approach. This conclusion is consistent with that in the pre-COVID-19 period, indicating that the result of ‘the composite asset selection approach can get a convergent result in asset allocation’ is robust, and the results found from this approach are credible. Hence, the optimal portfolio for the composite asset selection approach is the wt-et (WTI-Ethereum). Moreover, the weights in the WTI and Ethereum are equal to 45.8% and 54.2%, respectively.

To sum up, based on the composite asset selection approach and each performance measure, the return, volatility, RV, and CV, the obtained optimal portfolios for the pre-COVID-19 and COVID-19 periods are all different. This implies that Hypothesis 1 in the second question of this study is not rejected. In addition, Fig. 7 also depicts the distribution of 21 portfolios where wt-et [1; R, CV), wt-bi [2], bi-li [2], and ch-bi [3] are the top 3 portfolios in performance obtained by the composite asset selection approach. The top 3 portfolios are located on the upper-right side of Fig. 7. Moreover, wt-et is also the optimal portfolio based on the return and CV performance measures.

In addition, we use the rank orders in column ‘Rk3’ in Table 6 to investigate which assets to be included in a portfolio can get a better (or worse) performance during the COVID-19 period. As shown by the rank orders in column ‘Rk3’, the first two best-performing portfolios are wt-et [1], wt-bi [2], and bi-li [2], whereas the last two worst-performing portfolios are wt-go [17] and go-li [18]. Notably, the WTI and Bitcoin assets simultaneously appear twice in the first two best-performing portfolios. Conversely, the gold asset simultaneously appears in the last two worst-performing portfolios. This result implies that, during the COVID-19 period, adding WTI and Bitcoin to a portfolio can get better performance. Conversely, including gold in a portfolio can result in worse performance. These results are different from those found in the pre-COVID-19 period. That is, to get a better (or worse) performance, the assets added to the portfolio for the pre-COVID-19 and COVID-19 periods are different. This implies that Hypothesis 2 in the second question of this study isn’t rejected. Because Hypothesis 1 and Hypothesis 2 in the second question of this study aren’t rejected, the asset allocation performance in the commodity, cryptocurrency, and currency markets is different in the pre-COVID-19 and COVID-19 periods.

Thus, the COVID-19 pandemic impacted the asset allocation performance in the above three markets. The reason for the above finding may be that, to rescue the weakened economy during this crisis period, fiscal and monetary stimulus packages were implemented and increased the asset allocation performance in this period, as reported by the CV values in Table 6 for the COVID-19 period, smaller than those in Table 4 for the pre-COVID-19 period for most cases. This indicates that fiscal and monetary stimulus packages from the COVID-19 pandemic significantly improved the asset allocation performance in the above three markets. This result is similar to that in Akhtaruzzaman et al. (2021). Akhtaruzzaman et al. (2021) calculated the optimal weight of gold in a minimum variance portfolio composed of gold with a stock index, WTI crude oil, or exchange rate and found that the optimal weights of gold in S&P 500, Euro Stoxx 50, Nikkei 225, China FTSE A50 stock indices, and WTI crude oil portfolios significantly increased during Phase II of the COVID-19 pandemic crisis (March 17–April 24, 2020). This indicates that investors increased the optimal weights of gold as a “flight-to-safety asset” during the crisis period, and the COVID-19 pandemic significantly changed or impacted the optimal portfolio structure in asset allocation.

Robustness analysis

In the previous subsections “The implementation of asset allocation for the pre-COVID-19 period” and “The implementation of asset allocation for the COVID-19 period”, the pre-COVID-19 period started from August 12, 2015, to March 11, 2020, whereas the COVID-19 period began from March 12, 2020, to July 30, 2021. The sample size of the pre-COVID-19 period is far greater than that of the COVID-19 period. Then, to keep the sample size of the pre-COVID-19 and COVID-19 periods the same, in this subsection, we regulate the pre-COVID-19 period starting from one year before 2020/3/11 and the COVID-19 period ending one year after 2020/3/11 to investigate the same topics or two questions addressed in this study. If the results are similar to those found in the previous subsections, then the model is deemed stable. Or, the results found in the subsections “The implementation of asset allocation for the pre-COVID-19 period” and “The implementation of asset allocation for the COVID-19 period” are robust.

Which capital allocation approach has the best weight forecast performance?

Tables 7 and 8 list the results of weight forecasts of MVPs of 21 bi-asset portfolios obtained by four CAAs in the pre-COVID-19 and COVID-19 periods, respectively. In Tables 7 and 8, the volatility of MVP obtained from the CWI approach is the smallest for all cases when the values of the volatility of MVPs for the four CAA are compared. This indicates that, during the pre-COVID-19 and COVID-19 periods, the CWI approach had the best weight forecast performance on MVP among the four CAAs according to the minimum volatility criterion. Certainly, the CWI approach proposed by Su (2020) has a better MVP weight forecast performance than the MDWI approach of Kroner and Ng (1998), and the COVID-19 pandemic cannot influence the weight forecast performance of MVP for the CWI approach. The above results answer the first question of this study.

Is the asset allocation performance in the pre-COVID-19 and COVID-19 periods different?

Subsequently, we summarize the information of MVPs of 21 bi-asset portfolios obtained by the CWI approach in Table 7 (Table 8) into the left-hand side of Table 9 (Table 10) to select the optimal portfolio by using a composite asset selection approach with two hybrid performance measures according to the procedure in Fig. 1. The obtained results are listed on the right-hand side of Tables 9 and 10. As reported in the rank orders in columns Rv, Rr, Rk1, Rk2, Rk3, and RK in Table 9 (Table 10), we get the optimal portfolios based on the volatility, return, RV, CV, composite asset selection approach, and a final performance comparison check and the obtained results are also summarized in Fig. 8 (Fig. 9).

Step 1: The asset selection is based on basic performance measures: return and volatility. As reported in the rank orders in columns Rv and Rr in Tables 9 and 10, we find that, during the pre-COVID-19 period, the wt-eu and bi-et are the optimal portfolios based on the volatility and return performance measures, respectively. Moreover, the wt-eu for the volatility measure and the bi-et for the return measure are not the same. In the COVID-19 period, the go-eu and bi-et are the optimal portfolios based on the volatility and return performance measures, respectively. Furthermore, the go-eu for the volatility measure and the bi-et for the return measure are not the same. Notably, the optimal portfolios for the volatility measure in the pre-COVID-19 and COVID-19 periods are unlike because those are the wt-eu for the pre-COVID-19 period and the go-eu for the COVID-19 period.

Step 2: The asset selection is based on hybrid performance measures: RV and CV. As reported in the rank orders in columns Rk1 and Rk2 in Tables 9 and 10, we find that, during the pre-COVID-19 period, the eu-li and go-bi are the optimal portfolios based on the RV and CV measures, respectively. Moreover, the eu-li for the RV measure and the go-bi for the CV measure are not the same. In the COVID-19 period, the eu-bi and wt-bi are the optimal portfolios based on the RV and CV measures, respectively. Furthermore, the eu-bi for the RV measure and the wt-bi for the CV measure are not the same. Notably, the optimal portfolios for the RV (CV) measure in the pre-COVID-19 and COVID-19 periods are dissimilar because those are the eu-li (go-bi) for the pre-COVID-19 period and the eu-bi (wt-bi) for the COVID-19 period.

Step 3: The asset selection is based on a composite asset selection approach. As reported in the rank orders in column Rk3 in Tables 9 and 10, we find that the go-bi and wt-bi are the optimal portfolios based on this approach during the pre-COVID-19 and COVID-19 periods, respectively. Hence, the optimal portfolios for this approach in the pre-COVID-19 and COVID-19 periods are different. The go-bi (wt-bi) is also the optimal portfolio based on the CV measure in the pre-COVID-19 (COVID-19) period. However, we aren’t sure this result is credible. Hence, in step 4, we utilize the final performance comparison check to examine whether the result obtained from this approach is convergent.

Step 4: The asset selection is based on the final performance comparison check. As reported in the rank orders in column RK in Tables 9 and 10, we find that the go-bi and wt-bi are the optimal portfolios based on the final performance comparison check in the pre-COVID-19 and COVID-19 periods, respectively. Hence, the optimal portfolios for this approach in the pre-COVID-19 and COVID-19 periods are unlike. The go-bi (wt-bi) is consistent with the optimal portfolio based on the CV measure and the composite asset selection approach in the pre-COVID-19 (COVID-19) period. These results indicate that we can get a convergent result through the composite asset selection approach in these two periods.

Hence, the optimal portfolio for the composite asset selection approach in the pre-COVID-19 and COVID-19 periods is the go-bi and wt-bi, respectively. Thus, in the pre-COVID-19 period, we allocated 98.7% and 1.3% of capital, respectively, into gold and bitcoin to construct an optimal bi-asset portfolio, whereas 23.9% and 76.1% of capital, respectively, into WTI and bitcoin in the COVID-19 period. Moreover, based on the composite asset selection approach and each performance measure, the return, volatility, RV, and CV, the obtained optimal portfolios for the pre-COVID-19 and COVID-19 periods are different, except for the return measure. This implies that Hypothesis 1 in the second question of this study isn’t rejected.

In addition, we use the rank orders in column ‘Rk3’ in Tables 9 and 10 to investigate which assets to be included in a portfolio can get a better (or worse) performance during the pre-COVID-19 and COVID-19 periods. In Table 9, we find that the first two best-performing portfolios are go-bi [1], go-ch [2], and go-li [2], whereas the last two worst-performing portfolios are go-eu [16] and eu-li [17]. Notably, gold (euro) simultaneously appears in the first two best-performing (the last two worst-performing) portfolios, indicating that, during the pre-COVID-19 period, adding gold (euros) to a portfolio can result in better (worse) performance. Conversely, during the COVID-19 period, adding bitcoin (gold) to a portfolio can get better (worse) performance. The reasons are that, in Table 10, the first two best-performing portfolios are wt-bi [1], ch-bi [2], and bi-li [2], whereas the last two worst-performing portfolios are go-li [18] and wt-go [19]. Moreover, bitcoin (gold) simultaneously appears in the first two best-performing (the last two worst-performing) portfolios. Thus, to get a better (or worse) performance, the assets added to the portfolio for the pre-COVID-19 and COVID-19 periods are different. This implies that Hypothesis 2 in the second question of this study is not rejected. Because Hypothesis 1 and Hypothesis 2 in the second question of this study are not rejected, the asset allocation performance in the commodity, cryptocurrency, and currency markets is different in the pre-COVID-19 and COVID-19 periods. Thus, the COVID-19 pandemic impacted the asset allocation performance in the above three markets. The above results answer the second question of this study.

To sum up, irrespective of the first or second question investigated in this study, we get the same conclusions in this subsection as compared with subsections “The implementation of asset allocation for the pre-COVID-19 period” and “The implementation of asset allocation for the COVID-19 period”. Hence, the model applied in this study is deemed stable. Or, the results found in the subsections “The implementation of asset allocation for the pre-COVID-19 period” and “The implementation of asset allocation for the COVID-19 period” are robust.

Conclusion and discussion

This work proposes a composite asset selection approach with two hybrid performance measures to implement the asset allocation based on the minimum variance optimal strategy in the commodity, currency, and cryptocurrency markets for the pre-COVID-19 and COVID-19 periods. We use the results to investigate does the COVID-19 pandemic influences allocation performance in the above three markets.

The empirical results can be outlined below. Firstly, for the pre-COVID-19 and COVID-19 periods, the weights forecast performance of MVP for the CWI approach is the best among all four CAAs. This implies that the weights forecast performance of MVP for the CWI approach is not influenced by the COVID-19 pandemic. Moreover, the CWI approach proposed by Su (2020) has better MVP weights forecast performance than the MDWI approach of Kroner and Ng (1998) popularly used in the literature on capital allocation. Secondly, for two subperiods, the optimal portfolios obtained from the volatility and return performance measures are located near the bottom-left and top-right sides in the risk-return space in a system, respectively. This indicates that investors face a trade-off problem between return and risk. Then, the two hybrid performance measures considering simultaneously the return and volatility are suggested in this study to assess the portfolio performance. Thirdly, for two subperiods, the optimal portfolios obtained from the two-hybrid performance measures, the RV and CV, are unlike. This implies that we meet the question of the inconsistent results from different performance measures, and a composite asset selection approach is developed in this study to solve the above question and obtain a convergent compromise result. Fourthly, through the final performance comparison check in the two subperiods, the result of ‘the composite asset selection approach can get a convergent result in asset allocation’ is robust.

Finally, based on the composite asset selection approach for each of the four performance measures (the return, volatility, RV, and CV), the obtained optimal portfolios for the two subperiods are all different. For example, the optimal portfolio obtained by the composite asset selection approach is the Chinese yuan-Ethereum and Bitcoin-Ethereum for the pre-COVID-19 period, but the WTI-Ethereum for the COVID-19 period. Moreover, to get a better (or worse) performance, the assets added to the portfolio for the two subperiods are not the same. For instance, to get a better performance, we added Ethereum to a portfolio during the pre-COVID-19 period, but WTI and Bitcoin during the COVID-19 period. This implies that Hypothesis 1 and Hypothesis 2 in the second question of this study are not rejected, indicating that the asset allocation performance in the commodity, cryptocurrency, and currency markets is significantly different in the pre-COVID-19 and COVID-19 periods. Thus, the COVID-19 pandemic affected the asset allocation performance in the three markets. This phenomenon may be attributed to a structural break occurring in these three markets owing to this pandemic.

Based on the above findings, I give the following policy implications for fund managers, investors, and the setting of Robo-advisers of asset allocation. Firstly, based on the minimum variance strategy, investors should apply the CWI approach to execute the capital allocation and then forecast the weights of MVP for each bi-asset portfolio. Subsequently, they use the composite asset selection approach with two hybrid performance measures to execute the asset selection. Secondly, based on the minimum variance optimal strategy, investors should choose the Chinese yuan (64.28%) and Ethereum (35.72%) to construct a portfolio for the pre-COVID-19 period, but the WTI (45.87%) and Ethereum (54.13%) for the COVID-19 period to solve the problems of ‘the trade-off problem between return and risk’ and ‘the inconsistent results from different performance measures’. Thirdly, to get better performance, the fund managers can include Ethereum in their portfolios in the pre-COVID-19 period, but WTI in the COVID-19 period.

Even if this work has provided a comprehensive analysis of the impact of the COVID-19 pandemic on the asset allocation performance in the commodity, currency, and cryptocurrency markets. However, the portfolio is always composed of more than two assets. Thus, in future research, we will execute the asset allocation on the portfolio constructed by more than two component assets and then discuss the same topic of this study.

Data availability

The datasets generated and analyzed in the current study are available from the corresponding author upon reasonable request.

References

Akhtaruzzaman M, Boubaker S, Lucey BM, Sensoy A (2021) Is gold a hedge or a safe-haven asset in the COVID–19 crisis? Econ Model 102:105588. https://doi.org/10.1016/j.econmod.2021.105588

Aziz G, Sarwar S, Yuan Q, Waheed R, Morales L (2024) Reinvestigating the role of oil and gold for portfolio optimization in view of COVID-19 and structural breaks: empirical evidence of BEKK, DCC and wavelet quantile based estimations. Resour Policy 92:104957. https://doi.org/10.1016/j.resourpol.2024.104957

Aziz NSA, Vrontos S, Hasim HM (2019) Evaluation of multivariate GARCH models in an optimal asset allocation framework. N Am J Econ Financ 47:568–596. https://doi.org/10.1016/j.najef.2018.06.012

Baba Y, Engle RF, Kraft DK, Kroner K (1990) Multivariate simultaneous generalized ARCH. University of California, Unpublished Manuscript

Bekiros S, Nguyen DK, Uddin GS, Sjö B (2016) On the time scale behavior of equity-commodity links: implications for portfolio management. J Int Financ Mark Inst Money 41:30–46. https://doi.org/10.1016/j.intfin.2015.12.003

Bernardo MR, Campani CH (2019) Liability driven investment with alternative assets: evidence from Brazil. Emerg Mark Rev 41:100653. https://doi.org/10.1016/j.ememar.2019.100653

Bessler W, Taushanov G, Wolff D (2021) Optimal asset allocation strategies for international equity portfolios: a comparison of country versus industry optimization. J Int Financ Mark Inst Money 72:101343. https://doi.org/10.1016/j.intfin.2021.101343

Bodnar T, Mazur S, Okhrin Y (2017) Bayesian estimation of the global minimum variance portfolio. Eur J Oper Res 256(1):292–307. https://doi.org/10.1016/j.ejor.2016.05.044

Carroll R, Conlon T, Cotter J, Salvador E (2017) Asset allocation with correlation: a composite trade-off. Eur J Oper Res 262:1164–1180. https://doi.org/10.1016/j.ejor.2017.04.015

di Tollo G, Filograsso G (2025) Asset allocation with portfolio immunization strategies based on community detection. Ann Oper Res 1–30. https://doi.org/10.1007/s10479-025-06532-9

Engle RF, Kroner KF (1995) Multivariate simultaneous GARCH. Econ Theory 11:122–150. https://doi.org/10.1017/S0266466600009063

Hadhri S (2021) The nexus, downside risk and asset allocation between oil and Islamic stock markets: a cross-country analysis. Energy Econ 101:105448. https://doi.org/10.1016/j.eneco.2021.105448

Iglesias-Casal A, Lopez-Penabad MC, Lopez-Andion C, Maside-Sanfiz JM (2020) Diversification and optimal Hedges for socially responsible investment in Brazil. Econ Model 85:106–118. https://doi.org/10.1016/j.econmod.2019.05.010

Iglesias-Casal A, Lopez-Andion C, Lopez-Penabad MC, Maside-Sanfiz JM (2025) Dynamic correlations and portfolio optimization in socially responsible investments: evidence from Indonesia and South Korea. Humanit Soc Sci Commun 12:452. https://doi.org/10.1057/s41599-025-04753-8

Jarque CM, Bera AK (1987) A test for normality of observations and regression residuals. Int Stat Rev/Rev Int Stat 55(2):163–172. https://doi.org/10.2307/1403192

Jebabli I, Roubaud D (2018) Time-varying efficiency in food and energy markets: evidence and implications. Econ Model 70:97–114. https://doi.org/10.1016/j.econmod.2017.10.013

Kroner KF, Ng VK (1998) Modeling asymmetric comovements of asset returns. Rev Financ Stud 11:817–844. https://doi.org/10.1093/rfs/11.4.817

Li XU, Liviu MM, Juan FEC, Rui D, Codruta-Daniela P (2025) Utilizing the real estate investment trusts for portfolio optimisation by application of genetic algorithm. Humanit Soc Sci Commun 12:476. https://doi.org/10.1057/s41599-025-04715-0

Li Y, Jiang S, Wei Y, Wang S (2021) Take Bitcoin into your portfolio: a novel ensemble portfolio optimization framework for broad commodity assets. Financ Innov 7:63. https://doi.org/10.1186/s40854-021-00281-x

Lv F, Yang C, Fang L (2020) Do the crude oil futures of the Shanghai International Energy Exchange improve asset allocation of Chinese petrochemical-related stocks? Int Rev Financ Anal 71:101537. https://doi.org/10.1016/j.irfa.2020.101537

Markowitz HM (1952) Portfolio selection. J Financ 7:77–91. https://doi.org/10.1111/j.1540-6261.1952.tb01525.x

Markowitz HM (1959) Portfolio selection: efficient diversification of investments. John Wiley & Sons, New York, USA

Mensi W, Beljid M, Boubaker A, Managi S (2013) Correlations and volatility spillovers across commodity and stock markets: linking energies, food, and gold. Econ Model 32:15–22. https://doi.org/10.1016/j.econmod.2013.01.023

Ngene G, Post JA, Mungai AN (2018) Volatility and shock interactions and risk management implications: evidence from the U.S. and frontier markets. Emerg Mark Rev 37:181–198. https://doi.org/10.1016/j.ememar.2018.09.001

Paolella MS, Polak P, Walker PS (2021) A non-elliptical orthogonal GARCH model for portfolio selection under transaction costs. J Bank Financ 125:106046. https://doi.org/10.1016/j.jbankfin.2021.106046

Qi HD (2021) On the long-only minimum variance portfolio under single factor model. Oper Res Lett 49:795–801. https://doi.org/10.1016/j.orl.2021.08.014

Rezaei H, Faaljou H, Mansourfar G (2021) Intelligent asset allocation using predictions of deep frequency decomposition. Expert Syst Appl 186:115715. https://doi.org/10.1016/j.eswa.2021.115715

Su JB (2014) The interrelation of stock markets in China, Taiwan and Hong Kong and their constructional portfolio’s value-at-risk estimate. J Risk Model Valid 8(4):69–127. https://doi.org/10.21314/JRMV.2014.130

Su JB (2016) How the quantitative easing affect the spillover effects between the metal market and United States dollar index? J Rev Glob Econ 5:254–272. https://doi.org/10.6000/1929-7092.2016.05.22

Su JB (2020) The implementation of asset allocation approaches: theory and evidence. Sustainability 12(17):7162. https://doi.org/10.3390/su12177162

Su JB, Hung JC (2011) Empirical analysis of jump dynamics, heavy-tails and skewness on value-at-risk estimation. Econ Model 28(3):1117–1130. https://doi.org/10.1016/j.econmod.2010.11.016

Tsuji C (2018) Return transmission and asymmetric volatility spillovers between oil futures and oil equities: new DCC-MEGARCH analyses. Econ Model 74:167–185. https://doi.org/10.1016/j.econmod.2018.05.007

Yousaf I, Ali S (2020) The COVID-19 outbreak and high frequency information transmission between major cryptocurrencies: evidence from the VAR-DCC-GARCH approach. Borsa Istanb Rev 20:S1–S10. https://doi.org/10.1016/j.bir.2020.10.003

Acknowledgements

The author is grateful to the editor and anonymous reviewers for providing suggestions that helped in improving the quality of the manuscript.

Author information

Authors and Affiliations

Contributions

Jung-Bin Su: Conceptualization, data curation, formal analysis, funding acquisition, investigation, methodology, project administration, resources, software, supervision, validation, visualization, writing—original draft, and writing—review and editing.

Corresponding author

Ethics declarations

Competing interests

The author declares no competing interests.

Ethical approval

Ethical approval was not required as the study did not involve human participants.

Informed consent

This study did not involve human participants.

Additional information