Abstract

Housing price dispersion highlights the individual differences in capital gains by capturing the varying prices among comparable properties. We examine the impact of investors’ activities on housing price dispersion within the Hong Kong private housing market, based on micro-level transactions. Our results indicate that investors’ activities can significantly lower price dispersion in housing markets, even after accounting for trading volumes. The reduction effect of investment activities on price dispersion varies across boom-bust cycles, being more pronounced in cooler markets. We address the roles of housing investors in facilitating the price discovery process and reducing price dispersion by providing liquidity and mitigating information asymmetry. This suggests that well-informed investors can play a welfare-enhancing role by improving information efficiency. We also demonstrate that nearby investment activities can indirectly influence local price dispersion through information spillover effects. Our findings have profound implications for facilitating information efficiency and the potential for reducing price dispersion.

Similar content being viewed by others

Introduction

Price dispersion refers to the variation in prices among homogeneous goods at a given point in time. In the housing market, this concept highlights the situation where properties within the same area, sharing similar characteristics, are sold at different prices over the same time period. (Leung et al. 2006; Lisi, 2019; He et al. 2020). This variability gives rise to a critical financial concept: the idiosyncratic aspect of capital gains (Giacoletti 2021). Unlike market-wide trends, these gains are unique to individual properties and are not easily predictable due to a myriad of specific factors that influence each transaction. Investigating the potential channels in affecting house price dispersion has welfare implications for understanding the idiosyncratic risk associated with households’ investments in residential housingFootnote 1.

Housing market is decentralized, segmented, illiquid, and involved with high transaction costs in the searching-and-matching process (Piazzesi and Schneider 2009; Genesove and Han 2012; Piazzesi et al. 2020; Han and Strange 2014; Turnbull and van der Vlist 2022). The predominant source of price dispersion could be the uncertainty in pricing during transactions, attributable to scarce trading opportunities. Upon deciding to sell, a homeowner encounters potential buyers with varied valuations, influenced by heterogeneous preferences and asymmetric information. However, due to high transaction costs, sellers often interact with a limited subset of buyers, potentially selling to the buyer with the highest offer within this group. The smaller the pool of active buyers that engage with each seller, the more pronounced the influence of buyers’ individual assessments on the variability of housing prices. Thus, this “matching uncertainty” results in price dispersion and contributes to the variance in individual property prices and capital gains (Giacoletti 2021).

Another significant source of housing price dispersion is imperfect price information (Li and Chau 2024; Siebert and Seiler 2022). Informational efficiency facilitates asset pricing and reduces search frictions. When market agents are well informed, they can trade optimally and seize arbitrage opportunities to eliminate price differentiation. In contrast, uninformed agents are more likely to pay higher housing prices and sell at a discount compared to better-informed sellers (Chinco and Mayer 2016; Fan et al. 2023). Thus, the availability and quality of price information can largely explain housing price dispersion.

Given the prevalence and salience of housing price dispersion, we examine the impact of investor activities on housing price dispersion. Housing investment involves the strategic purchase and retention of residential properties, aiming to sell them for a profit once their market value increases. The purpose of these investment activities is to achieve capital gains rather than rental income from residential services. Housing investors strategically purchase properties at lower prices and sell them at higher prices, thereby providing liquidity to the market (Bayer et al. 2020). Thus, investors reduce “matching uncertainty” arising from limited trading opportunities by increasing market liquidity and facilitating price discovery. Specifically, investors create a more dynamic market and offer sellers a quicker and more certain path to liquidate their assets while avoiding the idiosyncratic risks associated with housing markets.

Recent investment activities increase the number of comparable trades in both temporal and spatial proximity, which can endogenously reveal how attributes are capitalized in the local market. In this context, investors facilitate price discovery by providing price information that reflects the willingness-to-pay (WTP) in current market conditions. Specifically, the prevalence of misinformed agents or “fire sales” creates arbitrage opportunities for investors to gain excess returns by targeting properties and negotiating transaction prices with specific trading partnersFootnote 2. In this way, well-informed investors can identify and exploit mispricing in the market, leading to a narrowing of the price disagreement between similar properties. As a result, investors may mitigate price dispersion by providing price information from comparable trades.

In an ideal efficient market, investors are well-informed, face no transaction costs or entry barriers, and can immediately identify and act on arbitrage opportunities, which allows for rational decision-making. In reality, however, agents often lack perfect information, particularly in housing investment, and tend to rely on peers’ opinions as informational clues, albeit that such information is misleading. In this context, investors may act as noise-driven traders, irrationally amplifying and propagating biased information through self-reinforce mechanisms (Gao et al. 2021). Noise-driven traders are broadly defined as investors who trade based on factors unrelated to fundamentals, leading to price deviations from intrinsic values and increased volatility (Cutler et al. 1991; De Long et al. 1990). Research shows that even a tiny fraction of housing investors can significantly affect the entire market by spreading biased expectations (Anenberg and Kung 2014; Piazzesi and Schneider 2009; De Stefani 2021). Such noise-driven trading may distort available information and lead to more dispersed housing prices (Glaeser and Nathanson 2017). Overall, whether housing investors mitigate or exacerbate price dispersion remains unclear. Despite the abundant literature on the investors’ behaviors and consequences, little is known about the role of housing investors in influencing price dispersion.

We empirically investigate the role of housing investors in affecting price dispersion. After removing price differentials driven by market fluctuations and inherent differences in ex-ante heterogeneous housing attributes, the residual variation in pricing is a proxy for the housing price dispersion (Li and Chau 2019). We construct novel measures of investment activities at the housing estateFootnote 3 level by using property-level transactions in the Hong Kong private residential market between 1994Q1 and 2019Q4. The microdata enables us to establish a remarkably detailed holding profile for each individual for identifying investors. Exploiting the temporal and spatial variation in investor activities, we aim to address the issues: First, how do investor activities affect housing price dispersion? Second, how does the impact of investor activities on the price dispersion vary with the boom-bust cycle? Third, what are the main mechanisms through which investor activities influences housing price dispersion?

We first systematically document the presence and several stylized facts regarding housing price dispersion based on micro-level transactions in Hong Kong’s private housing markets. We reveal that housing price dispersion exhibits a counter-cyclical pattern relative to boom-bust market cycles. Secondly, we find that investment activities can significantly reduce the housing price dispersion. Thirdly, we find that the reduction effect of investor activities on housing price dispersion is stronger during market downturns than during market booms. Last but not least, we find that nearby investment activities can affect local housing price dispersion through information spillover mechanisms. Our study contributes to understanding the informational role of housing investors in asset pricing and housing price dispersion.

This research contributes to several strands of the literature. Firstly, it adds to the understanding of the existence and sources of housing price dispersion. First demonstrated by Case and Robert (1988), individual house prices change more volatilely than city-wide average prices. Some studies relate the existence of housing price dispersion with liquidity available on the market. Kotova and Zhang (2024) argue that idiosyncratic price dispersion is the equilibrium outcome driven by the supply and demand of liquidityFootnote 4. Giacoletti (2021) suggests most idiosyncratic house price volatility is due to liquidity risk. Likewise, Zheng and Hui (2016) argue that selling housing property in illiquid markets commands a high liquidity risk premium. Yiu et al. (2008) find a negative relationship between transaction volume and price dispersion. Moreover, some reveal that individual-level transaction frictions can also cause price dispersion, including heterogeneous preferences (Zhou et al. 2015), bargaining power (Harding et al. 2003), neighborhood attributesFootnote 5 (Peng and Thibodeau 2017), and differences in search costs and ability to obtain information (Leung and Zhang 2011). We contribute to this strand of literature by systematically documenting the stylized facts of housing price dispersion using more granular transaction-level data.

Secondly, we further contribute by highlighting housing investors’ informational role in explaining price dispersion (Kotova and Zhang 2024; Giacoletti 2021; Peng and Thibodeau 2017; Leung et al. 2006; Ben-Shahar and Golan 2019). The role of information efficiency in explaining price dispersion has gained increasing popularity in recent years (Lisi 2019; Maury and Tripier 2014). Ben-Shahar and Golan (2019) find that improved information shock leads to a decline in the standard deviation of quality-adjusted prices. We contribute to this literature by examining investors’ informational role in price dispersion, highlighting their welfare-enhancing impact on reducing dispersion and improving information efficiency (Bayer et al. 2020; Bayer et al. 2021; K. K. Deng et al. 2022; Fu et al. 2016; Freybote and Seagraves 2017; H. Zheng et al. 2023; Broxterman and Zhou 2023). We further contribute to the literature on the price information spillovers through social learning within nearby neighborhoods (De Stefani 2021; Singh et al. 2023; Bayer et al. 2021). We extend this literature by offering evidence of price information spillovers in the price discovery process in the housing markets.

Thirdly, this study connects to the literature on the market consequences of housing investors’ behaviors and strategies in local markets. In perfectly efficient markets, where rational participants have complete information, prices would align closely with market fundamentals (Fama 1965). However, the coexistence of rational agents and noise-driven traders creates a more complex and less predictable market dynamic. Despite the long-standing theoretical and practical research on the market performance and welfare implications of investors (e.g., irrational housing bubble, short-term momentum, pricing anomalies, market efficiency, etc.), the existing empirical evidence on the impact of investors on price dispersion has been minimal and infinitive. We contribute to this literature by analyzing how informed versus noise-driven traders exert heterogeneous effects on housing price dispersion.

The rest of this paper is organized as follows: Section “Theoretical Analysis and Hypotheses Development” develops the theoretical analysis and hypotheses; Section “Data and Key Variables” describes the dataset and presents our analysis of descriptive statistics; Section “Identification Strategies” presents identification strategies; Section “Empirical Results” reports empirical results and implications; Section “Conclusion” concludes.

Theoretical Analysis and Hypotheses Development

We theoretically examine the role of investors in the housing price formation process: (i) they provide liquidity and increase comparable sales with spatial proximity, immediacy, and similarity in housing characteristics; (ii) their trading behaviors serve as price signals for other market participants. Friedman (1996) suggests that rational investors play a role in stabilizing prices, particularly through informed traders who enhance informational efficiency and maintain market stability. As new information becomes available, market participants adjust and update asset valuations. Frequent investment activities enable agents to access accurate and immediate information revealed by comparable transactions. This improved information facilitates price discovery and reduces price divergence for homogenous properties. If price dispersion arises from asymmetric information between trading parties, the availability of high-quality information may help reduce the ask-bid spread and facilitate price discovery (Stein 1995; Wu and Deng 2015; Zhou et al. 2015).

Housing investors aim to buy low and sell high to profit, playing a key role in maintaining market activity, particularly during periods of low demand (Bayer et al. 2020). Unlike credit-constrained homebuyers, investors often have better access to financing and stronger bargaining power, which allows them to acquire multiple properties at relatively lower opportunity costs. These advantages also enable investors to make quick purchases and reduce market friction. Experienced investors are skilled at targeting underpriced properties and negotiating favorable terms. They may also use networks or platforms to identify motivated sellers, streamlining the transaction process. In this scenario, investors provide liquidity to homeowners needing to sell quickly, facilitate more comparable transactions, improve information efficiency, and reduce price dispersion.

However, the impact of investor activities on price dispersion depends heavily on the quality of revealed price information. Noise-driven trading can distort price information and exacerbate price dispersion through a self-reinforcing positive feedback mechanism. Additionally, investors may learn biased expectations about market fundamentals from others’ trading behaviors. Shiller (2011) argues that an irrational exuberance could spread spatially due to psychological contagion. Glaeser and Nathanson (2017) propose a biased learning model to rationalize housing price anomalies. Gao et al. (2021) find noises in household learning could spread to local economy and cause price distortion. Consequently, noise-driven information creates price distortions and inhibits price discovery, significantly increasing price dispersion. Overall, the relative presence of informed and noise-driven investors modifies trading composition and further affects informational efficiency, thereby impacting housing price dispersion.

Informed housing investors can enhance the aggregation of high-quality price information and improve information efficiency, thereby reducing price dispersion. As more price information becomes available, housing prices for similar properties tend to converge, reducing price dispersion. This process contributes to welfare enhancement by facilitating more accurate price discovery, ensuring that market transactions reflect underlying property values. Conversely, noise-driven investors may amplify biased information. This can drive prices away from market fundamentals. It also distorts price informativeness and leads to an increase in price dispersion. These varied theoretical predictions suggest that the effect of investor activities on price dispersion is an empirical matter. Overall, the relationship between investment activity and housing price dispersion remains inconclusive due to the trading composition of informed and noise-driven investors. Therefore, we formulate the first hypothesis as follows:

Hypothesis 1: Housing investment activities help reduce price dispersion, ceteris paribus.

It is well-established that market participants respond asymmetrically in bull and bear markets, driven by overreactions to positive news (Fu and Qian 2014) and loss aversion (Genesove and Mayer 2001). This asymmetry is widespread and persistent in capital markets, particularly in real estate markets characterized by boom-bust cycles (Bolt et al. 2019; Burnside et al. 2016). The composition of informed versus noise-driven investors varies across these cycles. Consequently, it is essential to examine whether the impact of investor activities on price dispersion displays asymmetric behavior in growing versus declining housing markets.

During housing booms, informed investors provide liquidity and price information derived from recent comparable sales. However, noise-driven investors, lacking rational expectations and expertise, are drawn to the market by contagion effects. These investors typically underperform in capital returns and struggle with timing their entry and exit (Bayer et al. 2020; Li and Chau 2024), leading to irrational trading that amplifies and spreads biased information. This distorts price expectations, attracting more optimistic noise-driven investors and creating a feedback loop that drives prices away from their intrinsic value. Restrictions on short selling further weaken the mean reversion process in price discovery. As a result, informed arbitrageurs face risks and costs when attempting to correct price overreactions. This leads to prolonged mispricing. In other words, noise-driven traders crowd out rational investors, preventing transactions from accurately reflecting their fundamental value. As a result, while informed investors help to stabilize the market and improve liquidity, the influx of noise-driven investors alters the market composition, dampening the impact of informed trading.

In a declining housing market with lower turnover and transaction volumes, participants often lack up-to-date information due to limited comparable transactions. With reduced demand and increased supply, buyers become more price-sensitive and adopt a wait-and-see attitude, resulting in longer time on market (TOM). Sellers face a smaller pool of bidders. As a result, they may hesitate to accept lower offers due to the disposition effect. This makes transactions more difficult. In the sluggish market, informed investors absorb risks that homeowners may avoid, thereby facilitating transactions. For example, investors may target and purchase undervalued properties, particularly in “fire sale” scenarios, acting as a counterparty to sellers eager to sell quickly. Additionally, buyers hold more bargaining power in a declining market, which allows investors to leverage this advantage to negotiate and narrow sellers’ reservation prices. As expectations decline, informed investors may exit to limit losses, while noise-driven investors become less active due to short-selling restrictions.

Although informed investors can identify temporarily over- and underpriced properties, short-selling constraints make it difficult for them to act on overpriced ones. As a result, they tend to target underpriced properties instead. The strategic trading of housing investors, combined with their ability to absorb risks that homeowners may avoid, plays a welfare-enhancing role by providing liquidity and improving price efficiency. The trading composition between informed and noise-driven investors varies across boom-and-bust cycles; specifically, noise-driven investors are more prevalent during booms than during downturns. This disparity leads to a more pronounced reduction in price dispersion during downturns, thereby explaining the observed asymmetric patterns. Therefore, we posit the following hypothesis:

Hypothesis 2: The impact of housing investment activities on price dispersion manifests as an asymmetric pattern in a cool and hot market, ceteris paribus.

Beyond broad market signals, the spatial correlation of housing price dynamics provides localized information for nearby neighborhoods (Bailey et al. 2018; Gao et al. 2021). The aggregation, sharing, and learning of local information significantly shape investment decisions. New investors often adopt strategies, beliefs, and insights from peers in their immediate vicinity. As a result, investors may adjust their beliefs about market fundamentals or learn practical investing strategies from surrounding comparable sales (Seru et al. 2009). Consequently, housing market participants’ asset valuations and expectations are often shaped by local information, making them more vulnerable to the behaviors of those in their immediate neighborhoods (Miao et al. 2011; Zhu et al. 2013). For example, Pirinsky and Wang (2006) argue that local investors may interact and influence each other’s decision-making, often mimicking the trading behaviors of nearby investors. Bayer et al. (2021) further find that homeowners are more likely to invest in real estate after witnessing profitable housing transactions in nearby metropolitan areas. Bailey et al. (2018) also suggest that individual recent housing purchases can directly affect others’ expectations and behaviors through geographically distant social networks.

In this context, price information spillovers through social learning within nearby neighborhoods play a crucial role in the price discovery process. Thus, the impacts of investor activities on housing price dispersion could spill over to surrounding locations as a result of such information spillovers. Consequently, we advance the following hypothesis:

Hypothesis 3: The investment activities in the immediate neighborhood can indirectly affect local housing price dispersion.

Data and Key Variables

Data and preliminary description

Three essential characteristics of Hong Kong’s private housing market (HKPHM) make it a compelling and appropriate setting for studying the relationship between investor activities and housing price dispersion. First, HKPHM is mature, active, and relatively liquidFootnote 6 (X. Zheng and Hui 2016). There were plenty of speculative activities in the HKPHM during the booms. Second, the housing transaction records with detailed asset-level information have been registered with the Hong Kong Land Registry at the time of purchase. This highly frequent and reliable micro-transaction data enables us to construct various trading indicators at more granular level. Third, the transaction records include detailed geographic information, allowing us to capture spatial dynamics and within-market interactions arising from information spillovers.

We use housing transaction records obtained from the Hong Kong Economic Property Research Centre (EPRC) in the HKPHM between 1994 and 2019. Each transaction record includes information on transaction date and price, name of buyer and seller, housing type, address (district, street, building name, floor level, unit number), saleable floor area (SFA), gross floor area (GFA), number of bedrooms, year built, and facilities (e.g., swimming pool and club). Besides, each housing estate is geo-coded based on Google’s map.

We employ the following criteria to construct the sample for empirical analysis. First, we only focus on the residential resale properties based on the sale and purchase agreement where individual buyers and sellers negotiate the transaction prices. Any transactions purchased by institutional agents are excludedFootnote 7. Second, we exclude the non-arm’s length transactions (e.g., gift deeds, special deals, name changes, or data entry error), which deviate largely from market pricesFootnote 8. We also drop transactions with incomplete details in transaction date, price, or floor. Third, we additionally drop the top and bottom 1 percent of transaction prices and saleable floor area to avoid biased resulting from outliers, as they are either uncommon properties (e.g., extremely poor or luxury units) or merely reflect recording errors. Fourth, we primarily concentrate on the major large housing estates to rule out the estimation bias from outliers.

Measuring price dispersion

The primary goal of this research is to examine the impact of investment activity on housing price dispersion. In this section, we describe how we measure price dispersion. First, we have to decompose housing prices into several components based on the following specifications. Omitted variables bias is a potential concern with the pure hedonic price model (Rosen 1974). Unobserved quality factors (e.g., views, natural light) can also significantly affect market prices. For instance, Mak et al. (2010) find that better views and symbology (unlucky numbers) affect property prices in Hong Kong. To address these concerns, we follow Kotova and Zhang (2024)Footnote 9 to combines the repeat sales model (which removes time-invariant property characteristics and isolates price impacts) and the hedonic price model (which captures time-varying price effects of observable characteristics). Price dispersion is measured using the residual term from the combined model in Eq. (1). The combined model is specified as follows:

\({P}_{p,i,t}\) denote the log unit priceFootnote 10 of housing property p in housing estate i traded in period t. \({x}_{p}\) represents a set of time-invariant observable attributes of housing flat p, including building age, floor level, saleable floor area, and dummy indicators for features such as duplexes, roofs, balconies, parking spaces, gardens, bay windows, and bay window area. γp denotes the housing property-level fixed effect, capturing all time-invariant observable and unobservable housing attributes. \({\eta }_{i,t}\) represents the estate-year-quarter fixed effects, which captures parallel trends in log prices within a specified housing estate over time.

In the absence of the \(f({x}_{p},t)\) term, Eq. (1) resembles a pure repeat-sales modelFootnote 11, where the housing property-level fixed effects \({\gamma }_{p}\) control for time-invariant characteristics specific to each property, leaving only estate-specific time effects \({\eta }_{i,t}\). The pure repeat-sales model assumes that, after differencing out property-level features, all houses within a specified area (in this case, a housing estate) follow parallel trends in their price changes.

However, houses in different geographic locations or with varying characteristics, such as size or age, may appreciate at different rates. To capture idiosyncratic house price variation, we add the term \(f({x}_{p},t)\) to allow the conditional mean of \({P}_{p,i,t}\) to change as a smooth function of observable attributes \({x}_{p}\) and time \(t\). It enables observable housing attributes to exert a time-varying effect on the housing price. Thus, Eq. (1) serves as a hedonic model for the changes in relative prices of houses with varying observable characteristics. \({\varepsilon }_{p,i,t}\) is the error term. Standard errors are clustered at the estate level to allow for the correlation of errors between observations in the same housing estate.

After we have removed the price components deriving from time-invariant housing attributes (\({\gamma }_{p}\)), the time-varying impact of observable characteristics (\(f({x}_{p},t)\)), time-varying impacts from the housing estate (\({\eta }_{i,t}\)), the residual (\({\hat{\varepsilon }}_{p,i,t}\)) can be interpreted as the de-trended and quality-adjusted housing price. This residual represents the portion of the housing price that cannot be explained by the aforementioned factors, and it reflects the price variation after adjusting for both quality and time trends. While it is not directly an observed or predicted price, it serves as a measure of price variation that accounts for these factors.

Price dispersion is defined as the cross-sectional variation in transaction prices for homogeneous properties within a specific period. Most studies use standard deviation as a scale-neutral metric to measure housing price dispersion across regions and time. A larger standard deviation indicates a higher degree of dispersion. For example, Deng et al. (2012) use the standard deviation of transaction prices to proxy price dispersion. Peng and Thibodeau (2017) measure price dispersion using the standard deviation of the pricing error—regression residual of the hedonic price model. Ben-Shahar and Golan (2019) also employ the 6-month standard deviation of quality-adjusted housing prices to quantify price dispersion. In our analysis, we calculate the quarterly standard deviation of these residuals in Eq. (1) within each housing estate to measure housing price dispersion. Therefore, housing price dispersion varies across both quarters and housing estates.

Measuring liquidity

Liquidity in the real estate market reflects how quickly a housing property can be traded at its current market price. In a perfectly liquid market, assets can be traded quickly without any price discount or premium. In an illiquid market, sellers have to trade-off between increasing time to market (TOM) and selling at a discount; buyers have to trade-off between increasing searching effort and paying a premium (Anglin et al. 2003; Merlo and Ortalo-Magne 2004).

Trading volume and turnover rates are commonly used proxies for liquidity in the housing market. Trading volumes denote the number of properties traded in each period, while the turnover rate refers to the volume standardized by the total stock of properties within a specified housing estate. We use turnover rate as our liquidity proxy because it provides a more consistent measure of liquidity, allowing us to assess how quickly properties are traded relative to the total number of available properties.

Figure 1 illustrates the dynamics of housing price dispersion and the housing price index in the Hong Kong housing market during our study period. We highlight the stylized facts regarding the temporal variation in price dispersion, which exhibits a counter-cyclical pattern relative to boom-bust market cycles. Specifically, price dispersion increases significantly during real estate downturns and decreases during housing booms and subsequent recovery periods.

Figure 1 illustrates the quarterly dynamics of housing price dispersion and the repeat sales price index in the Hong Kong housing market throughout our study period. The main stylized facts regarding temporal variations in price dispersion reveal a counter-cyclical relationship with boom-bust market cycles.

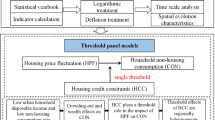

Designating of housing investors

Another challenge in testing our hypothesis is to construct an appropriate measure of investment activities. First, we aim to identify whether a homebuyer is an investor and when they were drawn into investing. The processing flowchart is illustrated in Fig. 2. Second, we need to distinguish properties for investment and primary residences for each identified investorFootnote 12. The processing flowchart is presented in Fig. 3.

This flowchart illustrates the process for distinguishing investors from homebuyers with residential purposes. Individuals are classified as investors if they hold multiple properties with overlapping tenures, excluding transitional periods associated with moving. Those with single-property holdings are classified as non-investors.

Following the identification of investors in Step 1, this flowchart focuses on distinguishing investment properties within the investors’ portfolios. The definition of an investment property in this paper is based on the property’s role in the investor’s portfolio. If an individual owns multiple properties and holds them simultaneously (i.e., there is an overlap in the holding period), these are likely to be classified as investment properties. However, the primary residence of an investor may be excluded from this classification if it can be identified through our conservative procedures.

First, we follow Bayer, et al. (2021) to build a homeownership profile over time for each homebuyer based on nameFootnote 13 and transaction date. We then examine whether the holding period of a property overlaps with another for each homeowner. Thus, we designate homeowners as investors once they acquire overlapping properties (i.e., simultaneously holding two or more properties). Given the search frictions in the housing market, we allow for multiple holdings within a very brief period as a transition to moving house. If the homeowner sells the previous property within the six months before purchasing the second property, then this homeowner is not classified as an investor. This method is conservative to avoid classifying overlapping holdings deriving from market frictions as investors.

Second, we identify the “primary residence” for each investor in their portfolios of properties. For non-investors, the sole property held is designated as the “primary residence”. For investors, we designate the property purchased before acquiring multiple holdings as the “primary residence”. To avoid misclassifying an investment property as a “primary residence”, the property before overlapping holding is not assigned as a “primary residence” if at least one of the following conditions is met: (i) buying multiple properties within one year or from the same seller, (ii) the property that should have been identified as a “primary residence” was held less than two years, (iii) the property that should have been identified as a “primary residence” overlaps with investment properties less than one year if investors only have one investment property.

We assign all remaining overlapping properties held by investors (i.e., those not classified as “primary residences”) as “investment properties”. The investor’s entry date is the purchase date of a first investment property (a second house except for the “primary residence”).

Within the category of investment properties, we further specify whether the property has been “flipped,” meaning resold after a short holding period. The flipper’s (short-term investor’s) entry date is the purchase date of their first flipped property. We focus on this subgroup of investors because the Hong Kong SAR government implemented a Special Stamp Duty (SSD) to curb short-term speculation in the housing market. Effective from 20 November 2010, any residential property acquired on or after that date and resold within 24 or 36 months is subject to SSDFootnote 14.

Responding to skepticism regarding the construction of individual housing holding profiles over time, where the potential for identical names to represent different individuals (homonyms) could arise, it is true that such instances may occur. However, the threat to our results is mitigated for several reasons. First, we have excluded individuals with extremely common names that are likely to result in a high incidence of homonyms, reducing the risk of misidentification. Second, the majority of the names in our database are recorded using the Hong Kong Pinyin system, accompanied by the individual’s English name. This bilingual naming convention significantly reduces the likelihood of homonymic matches, as the combination of local and English names provides a more unique identifier. Third, we have conducted robustness checks by comparing our results with alternative methods of identifying flippers based on holding tenure. The consistency of our findings across different identification methods reinforces the reliability of our conclusions.

Figure 4 visualizes the trends and trading proportions of investment activities in Hong Kong between 1994Q1 and 2019Q4, based on micro-level transaction data. Figure 5 illustrates the trends and trading proportions of flipped properties (holding periods of less than two years) over the same period. Their time-varying patterns are highly similar, which peaks at around 1998Q4, 2007Q4, and 2010Q3. It shows an apparent decline during the 1997 Asian Financial Crisis, the 2008 Global Financial Crisis, and the introduction of Special Stamp Duty (SSD)Footnote 15 in 2010. Generally, our overall measure of investment activities closely tracks the market trends and external shocks, further supporting our measures of investment activities.

Identification Strategies

Baseline model

To investigate the impacts of investment activities on housing price dispersion, we measure investor activity using the turnover index. This method helps convince that changes in housing price dispersion are driven by investor behavior, rather than simply an increase in market participants. We first measure investor activity using the number of new investor entries within a specific period, normalized by the total property stock in a housing estate, referred to as the variable “new investor entry turnover.” This measure reflects the count of new investors entering the market, marked by the purchase of their first investment property, which subsequently results in multiple holdings. Additionally, we distinguish investment properties within investors’ portfolios. The number of investment properties purchased by investors within a given period, normalized by the total property stock, is used to measure investor activity through the variable “investment property purchase turnover.” This variable indicates the count of properties bought by investors during the period. Thus, “new investor entry turnover” and “investment property purchase turnover” represent investor activities from the perspectives of “people” and “properties,” respectively. The baseline model is specified as follows:

where the dependent variable \(P{D}_{i,d,t}\) is the log-transformed housing price dispersion of estate i, district d during period t. \({{Inv}}_{i,t}\) denotes the proxy variables for investment activity in estate i in period t, expressed in log form. Our primary explanatory variables of interest are “new investor entry turnover” and “investment property purchase turnover” within the specified housing estate i during period t. A higher turnover of investor entries or investment purchases indicates a greater level of local investment activity.

\({\tau }_{d,t}\) represents the district-year-quarter fixed effects, which capture the trends in log-transformed price dispersion specific to each district. \({\epsilon }_{i,d,{t}}\) is the error term. \({\boldsymbol{X}}\) includes the trading volume in the specified housing estate for the current period \(t\), along with a vector of lagged controls. This vector comprises the estate-specific time-varying residential price index derived from the coefficients of \({\eta }_{i,t}\) in Eq. (1), as well as liquidity, subregional market yields, and supply in the private residential market.

The descriptive statistics of major variables in baseline specifications are presented in Table 1.

Information spillover effects

To investigate how the information spillover effects of real estate investment influence price dispersion in nearby housing estates, we adopt the specification specified in Eq. (4). This framework examines both direct and indirect impacts of local investment activities on housing price dispersion.

where subscripts \(i\) and \(t\) represent housing estate and period, respectively, and subscript \(j\) represents other near estates \(j\) (excluding estate \(i\)). \({\overline{{Inv}}}_{j,t}\) denotes the average neighborhood investment activity in housing estate \(i\mbox{'}s\) surrounding housing estates (other housing estates within the specified distance). Average neighborhood investment activity is proxied by the proportion of investment purchases in surrounding housing estates relative to all traded properties within a given period. These trading activities can serve as a source of localized signals for investors in adjacent real estate markets. Our null hypothesis is that \({\rm{\delta }}=\,0\); that is, local housing price dispersion is unaffected by the investment activities of their immediate neighborhood.

Empirical Results

Benchmark results

The baseline regression results, reported in Panel A of Table 2, demonstrate a negative and statistically significant impact of investment activities on housing price dispersion. The coefficient on the variable of interests remains stable and highly significant after including control variables, as reported in column (2). Specifically, a one percent increase in investor entry turnover is associated with a 0.58 percent decrease in housing price dispersion. Further analysis in columns (3) and (4) incorporates lagged investor entry turnover from the past and previous two quarters, respectively. The results consistently indicate a statistically significant reduction in housing price dispersion attributable to investment activities. These findings suggest that the liquidity provided by investors, along with enhanced information efficiency, outweighs any potential “noisy information effect,” thereby contributing to a decrease in price dispersion. Overall, our empirical findings support Hypothesis 1, indicating that housing investment activities contribute to a reduction in price dispersion, even after controlling for trading volume and lagged estate-level variables.

Furthermore, we apply the same specification presented in Panel B of Table 2 to investigate the role of housing flippers, a subset of investors who speculate for short-term returns by reselling investment properties within two years. In Panel B, housing flippers exhibit a significant negative effect on price dispersion, albeit with a slightly smaller magnitude compared to all investors in Panel A.

Table 3 examines how investment property purchase turnover affects housing price dispersion. The empirical results reveal a significant negative relationship between investment properties and housing price dispersion. Specifically, a one percent increase in investment property purchase turnover corresponds to a 1.07 percent reduction in housing price dispersion. These findings support Hypothesis 1, which asserts that investment activities significantly reduce housing price dispersion. Besides, potential downward measurement errors in investment activities may lead to an underestimation of their actual impacts, resulting in a more conservative estimation in this paper.

Results of asymmetric effects

To further examine whether the impacts of investor activities exert heterogeneous effects on housing price dispersion across boom-bust cycles, we incorporate a series of year dummy variables that interact with either new investor entry turnover or investment property purchase turnover. This approach allows us to intuitively observe how the effects of investment activities evolve over time, providing insights into the asymmetric impacts of these activities on housing price dispersion under varying market conditions. Both subfigures reveal a similar pattern: the effects of investment activities on housing price dispersion are more pronounced during declining periods, particularly in the two bust phases (1998–2003 and 2008) and the transitional recovery period (2004–2007). In contrast, the estimated effects during the two boom periods (prior to 1997 and post-2009) are insignificant, as the 95% confidence intervals encompass the zero line. This suggests that investment activities play a pivotal role in influencing housing price dispersion primarily during downturns, reinforcing the notion that investors are crucial in enhancing market liquidity and information efficiency in such contexts. This finding is consistent with the predictions of Hypothesis 2, which states that the impact of housing investment activities on price dispersion manifests as an asymmetric pattern in cool and hot markets Fig. 6.

Figure employs a series of year dummy variables interacting with both new investor entry turnover and investment property purchase turnover. a, b The impact of investor activities on price dispersion. a Measures investor activity using “new investor entry turnover,” defined as the number of new investors—those purchasing their first investment property—normalized by total housing stock. b Uses “investment property purchase turnover,” the number of investment properties acquired by investors in a given period, also normalized by housing stock. Both panels reveal consistent results supporting the presence of asymmetric effects. This methodology enables an intuitive observation of how the effects of investment activities on housing price dispersion evolve over time. The analysis reveals the asymmetric impacts of these activities under varying market conditions, illustrating how fluctuations in investment behavior correspond with shifts in price dispersion throughout boom and bust cycles. The shaded blue areas indicate two major downturns (the 1998–2003 bust and the 2008 financial crisis), where a more pronounced reduction in price dispersion underscores these asymmetric effects.

Results of information spillover effects

The geographic nature of the housing market provides a natural mechanism for information spillover effects among investors, as potential housing investors can use information from nearby investors to shape their perception and trading behaviors (Bailey et al. 2019). Comparable sales within the local neighborhood offer more informative insights for potential buyers with a narrow search scope focused on specific local submarkets than those in hyper-local districts. In this context, information spillover effects are stronger in closer proximity and tend to diminish with distance. Conversely, buyers with a broader search scope can benefit from surrounding information, as it helps them gather more relevant data, regardless of local or hyper-local distinctions. In this case, information spillover effects may remain strong or even increase with distance, as broader searches allow buyers to integrate a wider range of data sources, enhancing their understanding of market dynamics.

The results of the information spillover effects are presented in Table 4. The average investment activity in nearby neighborhoods within a one-mile radius is statistically significant and negatively impacts housing price dispersion, as shown in columns (1) and (2). Similarly, columns (3) and (4) demonstrate that average investment activity within a two-mile radius also has significant negative effects. Specifically, a one-percent increase in average neighborhood investment activities (within one mile) leads to a 0.01 percent decrease in housing price dispersion, while a one-percent increase within two miles results in a 0.05 percent decrease. This suggests that the information spillover effects do not decline significantly when the distance increases from one mile to two miles, as hyper-local areas serve as substitutes for broader searchers who are indifferent to specific locations. For these broader searchers, increased investment activities in wider neighborhoods provide more relevant price information for reference, thereby enhancing their decision-making process and contributing to a more efficient market (Bayer et al. 2021; Gao et al. 2021).

Conclusion

While there is an argument that housing investors can destabilize markets, our findings highlight the informational roles of housing investors in reducing housing price dispersion by providing liquidity and facilitating price discovery. Further analysis reveals an asymmetric impact of investment activities on housing price dispersion in cool and hot markets, with effects being more pronounced during cooler periods. This implies that housing investors can play a welfare-enhancing role in facilitating information efficiency and the price discovery process, especially in declining markets characterized by higher matching uncertainties and limited price information.

Moreover, information spillover effects manifest geographically during within-market analyses, as submarkets act as substitutes for broader searchers in segmented housing markets. The prevalence of broad searchers facilitates the spillover of price information across various submarkets, reshaping the market’s response to localized demand and supply shocks. In the presence of information spillover effects, investors with a broad search scope help enhance market efficiency and reduce price dispersion over a wider range. This analysis underscores the mechanisms through which information circulates and influences the price discovery process across different submarkets.

Our findings contribute to the debate about the role of investors in the housing market by emphasizing their welfare-enhancing functions in promoting liquidity and price information efficiency. While a common narrative suggests that housing investors contribute to bubbles, leading policymakers to implement restrictions such as transaction taxes to curb speculation and volatility, it is essential to recognize the value of informed investors. These investors serve as intermediaries, enhancing welfare in markets with informational frictions. However, government interventions aimed at curbing speculative fervor can be a double-edged sword. These measures to deter speculative investment activities can partially undermine the welfare-enhancing roles of investors by discouraging both informed and uninformed investors. Our study provides evidence that investor activities are significant in reducing price dispersion, even amidst noise-driven investors. Therefore, policymakers should carefully evaluate the diverse functions of investors and tailor restrictions to avoid unintended consequences, ensuring that interventions do not hinder the beneficial roles of informed investors.

Our results provide potential policy implications regarding information efficiency in the housing market, particularly in the context of big data and the impacts of the digital economy. The land registry of the Hong Kong SAR government provides access to historical and current information on properties with chargesFootnote 16. As a result, potential home buyers incur transaction costs when obtaining price information for comparable trades, which can hinder the overall efficiency of property transactions. One potential solution is to establish an open-access post-trade information system that allows investors to access local demand-side data, thereby enhancing information efficiency within the segmented housing market. Furthermore, leveraging big data analytics could improve the accuracy of price assessments and market predictions, ultimately fostering a more transparent and efficient housing market. Policymakers should consider these strategies to mitigate information asymmetries and support informed decision-making among market participants.

The limitations of this study and suggestions for future research encompass two key aspects. First, future research could leverage policy interventions and causal identification strategies to generate more compelling evidence on how investor activities affect housing price dispersion. While this paper primarily focuses on the effects of investor activities on housing price dispersion, an important area for future research involves the causal identification of such effects through policy-induced changes. The Special Stamp Duty (SSD), implemented in Hong Kong in November 2010, imposed a tax on properties resold within 24 or 36 months after purchase. This policy unexpectedly curbed investor activities, creating a discontinuity in investment patterns that can be leveraged to assess its effects on housing markets. Future research will investigate the causal effects of the SSD policy on housing price dispersion using more in-depth analyses, such as regression discontinuity (RD) design, to exploit the sharp timing of the policy implementation. These findings will contribute to a deeper understanding of the long-term causal effects of policy interventions on housing price dispersion. Second, our current lack of individual-level data restricts our ability to categorize market participants clearly. However, this presents an interesting avenue for future research focused on the trading composition among different types of investors. Future studies could examine how various market segments, such as presale and spot markets, with differing proportions of experienced versus first-time investors, influence housing price dynamics.

Data availability

The data that support the findings of this study are subject to EPRC (https://www.eprc.com.hk/index.htm) license, which restricts public sharing. As a result, the full dataset cannot be made publicly available.

Notes

From a household perspective, a typical household usually owns one single house rather than a diversified housing property portfolio, each property transaction is exposed to idiosyncratic risk due to price dispersion.

For example, financially distressed buyers seek to sell their assets quickly, resulting in transaction prices that fall below their fair value (Shleifer and Vishny 1992). Besides, uninformed non-local agents are more likely to pay higher transaction housing prices (Chinco and Mayer 2016; Siebert and Seiler 2022). Deng et al. (2012) find the time-on-market of less well-informed sellers is longer, and they sell at nearly a three-percentage point discount relative to better-informed sellers.

Housing estate is a housing development project consisting of at least two building towers, which covers approximately two-thirds of private housing transactions in Hong Kong. The housing properties within the same estate are relatively homogenous.

Liquidity supply is purchasing pressure: the inflow level of buyers, determining how tight the equilibrium market is. Liquidity demand is the average impatience of sellers to sell their housing properties.

Peng and Thibodeau (2017) document the correlation between idiosyncratic house price dispersion and neighborhood attributes (e.g., average income) at the zip code level.

There are several housing types in Hong Kong residential market, including private housing estate, private single building, village house and public housing. Housing estate indicate a housing project consisting of at least two building towers. Single buildings are both smaller in size and number of units than estates. Housing estates and single buildings are the major component of HKPHM.

We identify institutional agents based on name cleaning algorithm.

We drop records if transaction prices were less than HK$1 or more than HK$ 100 million. We also drop the records in which transaction date is earlier than completion year of building. Although we exclude these transactions from our empirical analysis of investment activities, we still use these records to flag investors and investment properties.

This reference provides additional context for the combined methods used to measure housing price dispersion.

Housing unit price (Hong Kong Dollars/ m2) is the total transaction prices divided by saleable floor area.

The repeat sales model requires two transactions of the same property to eliminate the impact of unobservable characteristics. In its simplest form, the model is expressed as: \(\mathrm{ln}\left(\frac{{p}_{{it}}}{{p}_{{is}}}\right)=\mathop{\sum }\nolimits_{t=0}^{T}{\delta }_{t}{D}_{{it}}+{\varepsilon }_{{it}}\) Where pit is the price of property i in period t and Dit is a dummy that takes the value of one in the period of the property sale. By differencing the prices of the same property and assuming constant property attributes, we eliminate the need to measure these characteristics. The pure repeat sale model assumes that property attributes remain constant over time, and this differencing method is analogous to the fixed effects approach in econometrics (the γp term in Eq. (1)), both aiming to eliminate time-invariant property-level characteristics and isolate price differences.

Different motivations for purchase may affect searching efforts and strategies for homebuyers. Although some home buyers consider their primary residence as “an investment”, we only focus on those who purchase additional properties for capital gains rather than consumption of housing services.

We treat buyers’ name under joint ownership as separate when establish one’s homeownership profile. To avoid assigning different homebuyers with the same common name to one investor, we exclude homeowners with more than 50 transactions during our sample period. The results are robust to this threshold value.

In late 2010, the Hong Kong Government levied a Special Stamp Duty (SSD) on individual and institutional buyers who purchase a residential property resell it within 36 months in Hong Kong. If they resell the house within 6 months since purchase, they have to pay an SSD equivalent to 20% of the transaction price. If the property is sold within 12 to 36 months, the SSD will be reduced to 10%.

References

Anenberg E, Kung E (2014) Estimates of the Size and Source of Price Declines Due to Nearby Foreclosures. Am Econ Rev 104(8):2527–2551

Anglin PM, Rutherford R, Springer TM (2003) The Trade-off Between the Selling Price of Residential Properties and Time-on-the-Market: The Impact of Price Setting. J Real Estate Financ Econ 26(1):95–111

Bailey M, Cao R, Kuchler T, Stroebel J (2018) The Economic Effects of Social Networks: Evidence from the Housing Market. J Political Econ 126(6):2224–2276

Bailey M, Dávila E, Kuchler T, Stroebel J (2019) House Price Beliefs and Mortgage Leverage Choice. Rev Econ Stud 86(6):2403–2452

Bayer P, Geissler C, Mangum K, Roberts JW (2020) Speculators and Middlemen: The Strategy and Performance of Investors in the Housing Market. Rev Financ Stud 33(11):5212–5247

Bayer P, Mangum K, Roberts JW (2021) Speculative Fever: Investor Contagion in the Housing Bubble. Am Econ Rev 111(2):609–651

Ben-Shahar D, Golan R (2019) Improved Information Shock and Price Dispersion: A Natural Experiment in the Housing Market. J Urban Econ 112(July):70–84

Bolt W, Demertzis M, Diks C, Hommes C, van der Leij M (2019) Identifying Booms and Busts in House Prices under Heterogeneous Expectations. J Econ Dyn Control 103(June):234–259

Broxterman D, Zhou T (2023) Information Frictions in Real Estate Markets: Recent Evidence and Issues. J Real Estate Financ Econ 66(2):203–298

Burnside C, Eichenbaum M, Rebelo S (2016) Understanding Booms and Busts in Housing Markets. J Political Econ 124(4):1088–1147

Case, KE, and Robert JS. 1988. The Efficiency of the Market for Single-Family Homes. Working Paper Series. National Bureau of Economic Research. https://doi.org/10.3386/w2506

Chinco A, Mayer C (2016) Misinformed Speculators and Mispricing in the Housing Market. Rev Financ Stud 29(2):486–522

Cutler DM, Poterba JM, Summers LH (1991) Speculative Dynamics. Rev Econ Stud 58(3):529

De Long JB, Shleifer A, Summers LH, Waldmann RJ (1990) Noise Trader Risk in Financial Markets. J Political Econ 98(4):703–738

De Stefani A (2021) House Price History, Biased Expectations, and Credit Cycles: The Role of Housing Investors. Real Estate Econ 49(4):1238–1266

Deng KK, Chen J, Lin Z, Yang X (2022) Differential Selling Strategies between Investors and Consumers: Evidence from the Chinese Housing Market. J Real Estate Res 44(1):80–105

Deng Y, Gabriel SA, Nishimura KG, Zheng D(della)(2012) Optimal Pricing Strategy in the Case of Price Dispersion: New Evidence from the Tokyo Housing Market Real Estate Econ 40(s1):S234–S272

Fama EF (1965) The Behavior of Stock-Market Prices. J Bus 38(1):34

Fan Y, Hu MR, Wan WX, Wang Z (2023) A Tale of Two Cities: Mainland Chinese Buyers in the Hong Kong Housing Market. Rev Financ 27(6):2205–2232

Freybote J, Seagraves PA (2017) Heterogeneous Investor Sentiment and Institutional Real Estate Investments. Real Estate Econ 45(1):154–176

Friedman M (1996) The Case for Flexible Exchange Rates. In International Political Economy, 236–246. London: Macmillan Education UK

Fu Y, Qian W (2014) Speculators and Price Overreaction in the Housing Market. Real Estate Econ 42(4):977–1007

Fu Y, Qian W, Yeung B (2016) Speculative Investors and Transactions Tax: Evidence from the Housing Market. Manag Sci 62(11):3254–3270

Gao Z, Sockin M, Xiong W (2021) Learning about the Neighborhood. Rev Financ Stud 34(9):4323–4372

Genesove D, Han L (2012) Search and Matching in the Housing Market. J Urban Econ 72(1):31–45

Genesove D, Mayer C (2001) Loss Aversion and Seller Behavior: Evidence from the Housing Market*. Q J Econ 116(4):1233–1260

Giacoletti M (2021) Idiosyncratic Risk in Housing Markets. Rev Financ Stud 34(8):3695–3741

Glaeser EL, Nathanson CG (2017) An Extrapolative Model of House Price Dynamics. J Financ Econ 126(1):147–170

Han L, Strange WC (2014) Bidding Wars for Houses. Real Estate Econ 42(1):1–32

Harding JP, Knight JR, Sirmans CF (2003) Estimating Bargaining Effects in Hedonic Models: Evidence from the Housing Market. Real Estate Econ 31(4):601–622

He X, Lin Z, Liu Y, Seiler MJ (2020) Search Benefit in Housing Markets: An Inverted U‐shaped Price and TOM Relation. Real Estate Econ 48(3):772–807

Kotova N, Zhang AL (2024) Search Frictions and Idiosyncratic Price Dispersion in the US Housing Market. SSRN Electronic J. https://doi.org/10.2139/ssrn.3386353

Leung CKY, Leong YCF, Wong SK (2006) Housing Price Dispersion: An Empirical Investigation. J Real Estate Financ Econ 32(3):357–385

Leung CKY, Zhang J (2011) ‘Fire Sales’ in Housing Market: Is the House-Searching Process Similar to a Theme Park Visit? https://mpra.ub.uni-muenchen.de/id/eprint/29127

Li L, Chau KW (2019) What Motivates a Developer to Sell before Completion? J Real Estate Financ Econ 59(2):209–232

Li L, Chau KW (2024) Information Asymmetry with Heterogeneous Buyers and Sellers in the Housing Market. J Real Estate Financ Econ 68(1):138–159

Lisi G (2019) The Search and Matching Process in the Housing Market: Explaining the Phenomenon of the House Price Dispersion. J Eur Real Estate Res 12(3):380–391

Mak S, Choy L, Ho W (2010) Quantile Regression Estimates of Hong Kong Real Estate Prices. Urban Stud 47(11):2461–2472

Maury T-P, Tripier F (2014) Search Strategies on the Housing Market and Their Implications on Price Dispersion. J Hous Econ 26(December):55–80

Merlo A, Ortalo-Magne F (2004) Bargaining over Residential Real Estate: Evidence from England. J Urban Econ 56(2):192–216

Miao, H, S Ramchander, and JK Zumwalt. 2011. Information Driven Price Jumps and Trading Strategy: Evidence from Stock Index Futures. SSRN ELibrary. https://www.academia.edu/download/39892077/Information_Driven_Price_Jumps_and_Tradi20151111-15931-kr96dz.pdf

Peng L, Thibodeau TG (2017) Idiosyncratic Risk of House Prices: Evidence from 26 Million Home Sales. Real Estate Econ 45(2):340–375

Piazzesi M, Schneider M (2009) Momentum Traders in the Housing Market: Survey Evidence and a Search Model. Am Econ Rev 99(2):406–411

Piazzesi M, Schneider M, Stroebel J (2020) Segmented Housing Search. Am Econ Rev 110(3):720–759

Pirinsky C, Wang Q (2006) Does Corporate Headquarters Location Matter for Stock Returns? J Financ 61(4):1991–2015

Rosen S (1974) Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J Political Econ 82(1):34–55

Seru A, Shumway T, Stoffman N (2009) Learning by Trading. Rev Financ Stud 23(2):705–739

Shiller RJ (2011) 33. Long- Term Perspectives on the Current Boom in Home Prices. In The Economists’ Voice, 269–287. Columbia University Press

Shleifer A, Vishny RW (1992) Liquidation Values and Debt Capacity: A Market Equilibrium Approach. J Financ 47(4):1343

Siebert RB, Seiler MJ (2022) Why Do Buyers Pay Different Prices for Comparable Products? A Structural Approach on the Housing Market. J Real Estate Financ Econ 65(2):261–292

Singh A, Kumar S, Goel U, Johri A (2023) Behavioural Biases in Real Estate Investment: A Literature Review and Future Research Agenda. Humanit Soc Sci Commun 10 (1). https://doi.org/10.1057/s41599-023-02366-7

Stein JC (1995) Prices and Trading Volume in the Housing Market: A Model with down-Payment Effects. Q J Econ 110(2):379–406

Turnbull GK, van der Vlist AJ (2022) Bargaining Power and Segmented Markets: Evidence from Rental and Owner‐occupied Housing. Real Estate Econ 50(5):1307–1333

Wu J, Deng Y (2015) Intercity Information Diffusion and Price Discovery in Housing Markets: Evidence from Google Searches. J Real Estate Financ Econ 50(3):289–306

Yiu CY, Man KF, Wong SK (2008) Trading Volume and Price Dispersion in Housing Markets. J Prop Res 25(3):203–219

Zheng H, Qian J, Liu G, Wu Y, Delang CO, He H (2023) Housing Prices and Household Consumption: A Threshold Effect Model Analysis in Central and Western China. Humanities Soc Sci Commun 10(1):1–16

Zheng X, Hui ECM (2016) Does Liquidity Affect Housing Market Performance? An Empirical Study with Spatial Panel Approach. Land Use Policy 56(November):189–196

Zhou X, Gibler K, Zahirovic-Herbert V (2015) Asymmetric Buyer Information Influence on Price in a Homogeneous Housing Market. Urban Stud (Edinb, Scotl) 52(5):891–905

Zhu B, Füss R, Rottke NB (2013) Spatial Linkages in Returns and Volatilities among U.S. Regional Housing Markets. Real Estate Econ 41(1):29–64

Acknowledgements

This research was supported by the National Natural Science Foundation of China (Grant No. 72074097); the Fundamental Research Funds for the Central Universities (Jinan University) (Grant No. 23NJYH05); the Pujiang Program of the Shanghai Magnolia Talent Plan (Grant No. 24PJC038); the Youth Project of the Shanghai Philosophy and Social Science Planning Program (Grant No. 2024ECK001); and the Youth Research Fund of the Shanghai University of International Business and Economics (Grant No. 24QN020). The authors gratefully acknowledge the generous financial support from these funding bodies.

Author information

Authors and Affiliations

Contributions

Dr. Ziqing Yuan: Data Curation; Formal Analysis; Methodology; Writing - Original Draft Preparation. Prof. KW Chau: Conceptualization; Resources; Supervision. Prof. Xian Zheng (Corresponding Author): Conceptualization; Project Administration; Writing - Review & Editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Yuan, Z., Chau, K.W. & Zheng, X. Investors matter when prices are dispersed: the effects of investor activities on housing price dispersion. Humanit Soc Sci Commun 12, 878 (2025). https://doi.org/10.1057/s41599-025-05260-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-025-05260-6